No one is forced to be a Christian. But no one should be forced to live according to the "new religion" as though it alone were definitive and obligatory for all mankind.

All

Low Time Preference Leads to Civilization

Economists use time preference to explain the existence of interest, but the ability of people to postpone some present consumption in order to save for the future has much broader social ramifications.

Why Are There So Many Americans That Can't Find A Job Even Though They Are Desperate To Be Hired?

Why Are There So Many Americans That Can't Find A Job Even Though They Are Desperate To Be Hired?

Tyler Durden

Fri, 04/26/2024 - 09:50

Authored by Michael Snyder via The Economic Collapse blog,

According to the absurd numbers that the government feeds us, the unemployment rate is very low and there are lots of jobs available. But if what they are telling us is true, why are so many Americans not able to find work? As you will see below, some people haven’t been hired even though they have literally applied for hundreds of jobs.

There seems to be an enormous disconnect between what is actually happening in the real economy and the economic narrative that they are constantly pushing. By the time you are done reading this article, I think that you will agree with me.

Earlier this week, I received an email from a reader that has not been able to find work after seven months of searching.

He gave me permission to share part of that email with you, and it is certainly quite heartbreaking…

Hi Michael,

I am a long-time reader of theeconomiccollapseblog.com, and your recent article comparing the economy to the movie “Weekend at Bernie’s” really stood out to me.

I’m really trying to figure out WHY it is so hard to find a job.

I was laid off from my job as a Custodial Foreman in September 2023, and have had ZERO results for my countless hours spent searching for comparable work.

I don’t know if you want to use any of this for an article or not, but if you do, please just keep doing what you normally do: Praising Jesus Christ. Without my faith in him I don’t know what I’d do.

When I wake up, I make coffee and turn on the computer and go through the state’s unemployment job search sites they provided me when I was laid off. I have been looking and also applying for jobs DAILY since September 2023. And these are not “rocket science” positions; I’m simply looking for Maintenance or Custodial or Groundskeeper type jobs. You know, “normal working class” type jobs.

But after ~300 applications (And these are all just to the jobs that I not only have experience for but also would actually want to do), I have had 1 interview. One interview in 7 months of applying and sending tailored cover letters with, daily!

If the economy is doing so “great”, why can’t he find employment?

Some of you may be tempted to think that he is just an isolated case.

Well, here is another example of an experienced worker that has applied for approximately 300 jobs without any success…

Royal Siu, who lives in Seattle and is trained as a pharmacist, likes to make his friends guess how many jobs he’s applied to. They’ll often toss out some number around 40, he told BI. He’ll tell them to keep going. Most give up by the time they reach 100. That’s when Siu drops that he’s applied to about 300 jobs. “It’s usually a shock factor to them,” he said.

Siu, who’s trying to use his pharmacy degree to work in other parts of healthcare, is finding it harder to land interviews than in a prior job search. The 28-year-old was getting more phone screenings and first and second interviews in the past. This time, it’s been a couple of months since he had a screening call. So he continues to turn to his network but also doesn’t stop applying.

What in the world is going on here?

I thought that there were “millions” of good jobs just waiting for someone to step into them.

Something definitely does not add up.

Even Americans with advanced degrees from top schools are increasingly finding themselves out of work.

If you doubt this, just check out these numbers…

Even at some top business schools, the number of recently minted M.B.A.s without jobs has roughly doubled from a couple of years ago, when U.S. companies were rushing to hire as many workers as they could, according to data from the schools.

At Harvard Business School, 20% of job-seeking 2023 M.B.A. graduates didn’t have one three months after graduation, up from 8% in 2021. At Stanford’s Graduate School of Business, 18% didn’t, compared with 9% in 2021. About 13% of those at the Massachusetts Institute of Technology’s Sloan School of Management didn’t have a job within three months, up from about 5% in 2021.

How are those numbers possible if the unemployment rate is hovering near “historic lows”?

Of course the truth is that we have been sold a lie.

If you do not have a job, you are classified by the U.S. government as either “unemployed” or “not in the labor force”.

In 2008 and 2009, the combined total of those two categories never even reached 90 million.

Today, the combined total of those two categories is over 106 million.

The Biden administration says that only 6,429,000 Americans are officially “unemployed”.

The other 99,989,000 Americans without a job are considered to be “not in the labor force”.

And more will be lumped into those two categories soon, because large employers all over the nation continue to conduct mass layoffs.

For example, thousands of Tesla workers in California and Texas were just notified that they will be losing their jobs…

The notifications in California and Texas, where the electric vehicle (EV) maker has large presences, came in the form of WARN notices, according to reports.

In California, the planned Tesla headcount reductions will hit approximately 3,300 workers, The San Francisco Standard reported Tuesday.

They will apparently occur at locations in a total of four different cities in the Golden State.

Meanwhile, Texas will see almost 2,700 employees in Austin lose their jobs, according to the Austin American-Statesman.

Sadly, the pace of layoffs is likely to increase during the months ahead, because business activity in the U.S. is declining…

The U.S. economy lost momentum in April, a pair of S&P surveys found, as businesses reported a decline in new orders and reduced employment for the first time since the pandemic.

The flash U.S. manufacturing purchasing managers index slipped to a four-month low of 49.9 in April from 51.9 in March.

The S&P flash U.S. services PMI fell to a five-month low of 50.9 this month from 51.7 in March.

The surveys are the first indicators of each month to give a sense of how the U.S. economy is performing.

Meanwhile, the cost of living crisis just continues to escalate.

Shockingly, at one station in California gasoline now costs $7.29 per gallon…

Soaring gas prices have skyrocketed to a whopping $7.29 per gallon in some parts of California – which is above the current the national hourly minimum wage.

While the average price for a gallon of gas varies from state to state – drivers in a certain Silicon Valley town are facing particularly extortionate rates that set them back almost $150 for a full tank.

The Chevron gas station in Menlo Park was exposed on Sunday by a bewildered customer who posted on X that the price per gallon was four cents ‘above the federal hourly minimum wage.’

If you think that this is bad, just wait until the war in the Middle East transforms into the apocalyptic conflict that I believe it will become.

I am entirely convinced that inflation will continue to be a major problem even as economic activity in the U.S. slows down even more.

We are already experiencing “stagflation”.

What is eventually coming will be so much worse than that.

Of course the economic pain that we are going through is just one of the factors that is systematically destroying our nation.

A Warning to America: 25 Ways the US is Being Destroyed | Explained in Under 2 Minutes pic.twitter.com/qwmBO8DmMt

— Western Lensman (@WesternLensman) April 22, 2024Just about all of our major institutions are crumbling, just about every sector of our society is in the process of melting down, and conditions are rapidly getting worse all around us.

And now we are heading into the most chaotic election season in the entire history of our country.

This is a recipe for disaster, but there is no turning back now.

* * *

Michael’s new book entitled “Chaos” is available in paperback and for the Kindle on Amazon.com, and you can check out his new Substack newsletter right here.

Tin Soldiers and Nixon Coming…

A version of this article first appeared as an exclusive update to RPI subscribers. Subscribe for free here.

Student action on university campuses against US involvement in Israel’s slaughter of Gaza has exploded across the country. Suddenly there is the distinct feel in the air of the anti-Vietnam war protests once they finally caught on in 1968 and soon thereafter changed the course of US history.

Both protest movements were fully demonized by the same forces of the mainstream Left/Right regime and what libertarian writer Jacob Hornberger rightly calls the “National Security State.” I would add the mainstream media from Fox to MSNBC. But these days there is relatively more freedom of expression available to Americans via some of the social media outlets. The US government war on one of these outlets – TikTok – may also be fueling protests, as this outlet is particularly popular among younger Americans and has become the platform for them to hear more objective and independent views on what is happening in Gaza. It should not be considered a coincidence that not long after Anti-Defamation League’s Jonathan Greenblat was caught on tape panicking over the shift in opinion away from fealty to Israel among the younger generation, a big PR operation about “Chinese infiltration” of the platform emerged as did calls to ban the popular application.

“We have a major, major, major generational (TikTok) problem,” Greenblat said. This past week both Houses of Congress voted to ban TikTok. Problem solved? Not exactly.

So back to the protests.

Tens of thousands of students from New York’s Columbia University to the University of Southern California have risen up to demand an end to US support for Israel’s 200 day – and counting – total demolition of Gaza in retribution for the October 7th Hamas bloody incursion into Israeli territory.

To date, more than 35,000 Palestinian civilians in Gaza have been killed including an estimated 15,000 children. Hamas, by contrast, is reportedly not significantly degraded and its massive tunnel system remains intact. Former Israeli Defense Forces General Yitzhak Brick told Israeli newspaper Maariv that Israel has already lost the war against Hamas and must admit it.

The wild disproportionality of the Israeli response has animated and ignited the sense of repulsion and demand for justice among the nation’s youth. Most recently the grisly details of Israel’s apparent mass slaughter of hundreds of patients at the Nasser Hospital in Gaza – many discovered with their hands and feet bound – may have been the last straw that led to mass student action across the country.

When the wave of student protests settled in the Lone Star State on Wednesday, Texas Governor Gregg Abbott wasted no time at all calling in the Texas State Troopers to smash the protest at the University of Texas. Heavily-armed Troopers – some on horseback – marched onto campus attempting to force the crowd of protesters to disburse. As might be expected, the situation very quickly got out of hand, with Troopers assaulting and arresting those participating in what began as a peaceful protest.

Shortly after siccing the heavily armed state militia on student protestors, Abbot released this Tweet:

Arrests being made right now & will continue until the crowd disperses.

These protesters belong in jail.

Antisemitism will not be tolerated in Texas. Period.

Students joining in hate-filled, antisemitic protests at any public college or university in Texas should be expelled. https://t.co/XhLlQdvUl0

Abbott’s blanket accusation that these protests are prima facie anti-Semitic is belied by the fact that Jews across the country are participating in the mass action, including on university campuses.

There is clearly a major attempt being made to conflate legitimate concern over tens of thousands of Palestinian civilians being slaughtered – and hundreds of thousands facing starvation – with blanket hatred of Jewish people. But the youth are not buying it. So it’s time to send in the militarized police to shut down peaceful protest and the First Amendment.

In the case of Texas, one cheeky conservative Twitter/X user pointed out that, “Abbott sent more troops to shutdown peaceful protests at UT than he did to secure the border.”

Ouch – but revealing.

Other observers have similarly pointed out the hypocrisy of the massive deployment of militarized police to quell a peaceful political protest, commenting on a video montage of police beating and arresting American university students that, “imagine if this video was out of Tehran University in Iran, our politicians & media would have endless calls for regime change.”

Throughout the country, many “influencers” on the professional political Right are acting like the “woke snowflakes” they have derided, demanding that our fundamental liberty to freely assemble and speak our minds be amended in this particular instance due to the subject matter.

Many “professional right-wingers” have done their best to try and convince us that these protesters are identical to the BLM protesters of several years ago. Matt Walsh at the Daily Wire put out a podcast today claiming that, “The ‘Free Palestine’ Movement Is Just BLM Repackaged.”

The problem in his and the rest of their calculus is that the state and local authorities would not lift a finger to stop the BLM riots, yet they are cracking heads robustly among the Palestine protests.

Walsh even seemed to sense the inconsistency in his logic, questioning Governor Abbott’s move against the protesters by Tweeting, “Did Abbott ever arrest BLM protesters for antiwhiteism? Is antisemitism the only hateful ideology not permitted in Texas? Are you legally allowed to hate some groups but not others?”

He added, in a criticism of Abbot’s suggestion that the protesters were being arrested for “antisemitism,” that, “If you’re arresting them for an illegal encampment or for making threats then say that. But arresting people for ‘antisemitism’ is obviously a clear violation of the First Amendment. I can’t stand these protesters but you can’t arrest people simply for having ‘hateful’ views.”

He deserves credit for this observation.

As is often the case, action by state actors against this protest movement will only strengthen the movement. We have not even seen the beginning of what is in store

Polls clearly show that a considerable majority in America believes Israel has gone way too far in its reaction to October 7th. America for the first time in my lifetime is in the majority opposed to Israel, and that shift is more than anything else a generational shift. Hence Greenblat’s panic.

This movement is picking up steam and threatens to turn Biden’s big Democratic Convention coronation ceremony into the disastrous 1968 Democratic Convention in Chicago, where the Lyndon Johnson campaign went to die. Ironically the Democratic Party convention this year is to be held in…Chicago!

May 4th will be the 54th anniversary of Nixon’s National Guard killing four students at Ohio’s Kent state University for protesting our killing squads in Vietnam (My Lai massacre). Will soldiers in the US start cutting protesters down again?

The New ‘Texas Antisemitism Lottery’ Should Pay Out Big in Lawsuit Awards and Settlements

The Texas Lottery has paid out many millions of dollars to winners of its games of chance since voters in the state approved its creation in 1991. This week, Texas Governor Greg Abbott announced a new lottery of sorts — the “Texas Antisemitism Lottery” — that could rival and maybe even surpass the original Texas Lottery in cash payouts.

One of the more sure things in constitutional law is that a person subjected to punishment by government because of the content of his communication has had his free speech rights violated and, therefore, should be compensated for the harm. This is especially the case when that communication is centered on political matters, such as actions of the Israel government undertaken in its United States government funded and armed war effort. Thus, it is unusual to see government publicly declaring its intention to take action to wipe out the expression of a particular viewpoint.

Nonetheless, that is just what the governor of Texas did on Wednesday when he posted the following message at Twitter above another individual’s Twitter post including video of police in riot gear walking en masse down a street at the University of Texas at Austin (UT) — a Texas state school:

Arrests being made right now & will continue until the crowd disperses.

These protesters belong in jail.

Antisemitism will not be tolerated in Texas. Period.

Students joining in hate-filled, antisemitic protests at any public college or university in Texas should be expelled.

By the way, for Abbot the word “antisemitism” has a much broader meaning than it does for most people. Abbott even defines as antisemitism saying things critical of the government of Israel. Abbott made this clear in his March 27 executive order focused on countering “antisemitism” at Texas higher education institutions. That executive order directed all Texas higher education institutions, UT included, to, among other things, “Include the definition of antisemitism, adopted by the State of Texas in Section 448.001 of the Texas Government Code, in university free speech policies to guide university personnel and students on what constitutes antisemitic speech.”

The referenced Texas statutory provision’s definition of antisemitism includes the following: “Examples of antisemitism are included with the International Holocaust Remembrance Alliance’s ‘Working Definition of Antisemitism’ adopted on May 26, 2016.” Looking through those examples, one encounters several that concern criticizing the government of Israel. “Denying the Jewish people their right to self-determination, e.g., by claiming that the existence of a State of Israel is a racist endeavor” and “[d]rawing comparisons of contemporary Israeli policy to that of the Nazis” are two examples.

There may have been articulable reasons to shut down or at least impose some limits on the protest at UT that courts would find acceptable. But, Abbott managed to offer instead a reason that pretty much assures people roughed up, arrested, or jailed will come out of the experience in a strong position for asserting a claim for free speech violation. The same goes for people the state university expels at Abbott’s direction for taking part in the protest.

The police and Abbott have had their day at UT. And they may keep suppressing speech similarly at colleges across the state. Next should be their comeuppance. Lawyers are busy now communicating with victims of the speech content targeting crackdown and preparing court action.

Anglo American Rejects BHP's Takeover Deal, Calls It "Highly Unattractive"

Anglo American Rejects BHP's Takeover Deal, Calls It "Highly Unattractive"

Tyler Durden

Fri, 04/26/2024 - 09:35

The world's largest global diversified miner, BHP, is being forced to significantly raise its buyout offer of Anglo American or walk away from the proposed all-share deal valued at £31.1 billion ($38.9 billion).

"The BHP proposal is opportunistic and fails to value Anglo American's prospects, while significantly diluting the relative value upside participation of Anglo American's shareholders relative to BHP's shareholders," Anglo chairman Stuart Chambers wrote in a statement on Friday.

Chambers continued, "The proposed structure is also highly unattractive, creating substantial uncertainty and execution risk borne almost entirely by Anglo American, its shareholders and its other stakeholders."

The first indication that Anglo executives would reject the deal came Thursday afternoon when Reuters reported two sources familiar with talks with top Anglo investors who said the offer was 'unattractive.'

Anglo owns massive copper mines in South America. The miner has become an acquisition target of BHP solely to create the world's largest copper mining giant, with control of about 10% of the global copper mining supply. Copper mining supplies are dwindling, and demand is expected to soar as power grids worldwide are upgraded to support the green energy transition.

The Financial Review quoted hedge fund manager Rafi Lamm of Melbourne's L1 Capital as saying BHP would have to increase its bid for Anglo's assets, which have been underappreciated by the market and make strategic sense for BHP.

"We think it's a sensible move by BHP and we think they can afford to pay the proposed deal pricing and a lot more," Lamm said.

James Whiteside, head of mining and metals corporate research at consultancy Wood Mackenzie, said BHP will have to raise its offer to bring its value "closer to the share price in 2023 before operational issues emerged."

On Thursday, BHP proposed an all-share deal valued at £31.1 billion ($38.9 billion). The transaction depends on Anglo spinning off its South African iron ore and platinum businesses to its shareholders. The offer is conditional and non-binding at £25.08 a share, or about a 14% premium to Anglo's closing share price on Wednesday.

BHP investor Equity Trustees Asset Management told the Sydney Morning Herald that BHP's bid to buy Anglo American made sense strategically, "but much will depend on what BHP will eventually pay."

"Having a bit more copper in the portfolio is a positive. If copper can move up from here this will likely offset any errors made in its purchase price of Anglo," Equity Trustees head of equities Chris Haynes said.

Haynes added, "As we know, large acquisitions like this always have problems and will likely weigh on the BHP stock price in the short term."

Shares in BHP fell on Friday, ending the Australian session at 4.6% lower.

Meanwhile, copper prices hit $10,000 a ton for the first time in two years, fueled by speculation of dwindling supplies and robust demand from the green energy transition.

Copper bulls like BlackRock and Trafigura Group have said the base metal must move higher to spur new mine development.

BofA recently warned, "The copper supply crisis is here."

Let's not forget our note titled "The Next AI Trade," which explains the investment opportunities in upgrading America's grid as generative AI data centers increase power demand.

And Jefferies is on it: "Copper Demand in Data Centers."

Recall billionaire mining investor Robert Friedland, who explained last year on Bloomberg TV that "copper prices might explode ten times."

Watch: Drag Queen Makes Tiny Kids Chant "Free Palestine"

Watch: Drag Queen Makes Tiny Kids Chant "Free Palestine"

Tyler Durden

Fri, 04/26/2024 - 09:15

Authored by Steve Watson via Modernity.news,

Video has emerged of a drag queen leading children barely older than toddler age in chanting “Free Palestine” during a so called “Queer Storytime for Palestine” event in Massachusetts.

The event, featuring a drag queen going by the name of ‘Lil Miss Hot Mess’, took place earlier this month at the Northampton Center for the Arts.

The event was advertised by the organisers as “dancing, celebrating Palestine culture, learning about queer heroes and doing arts and crafts.”

According to the hosts, Valley Families for Palestine, profits from the event were donated to alQaws, a Palestinian organisation that is “working for queer liberation.”

Video captured at the event shows ‘Hot Mess’ reading her book titled “If You’re a Drag Queen and You Know It,” and ordering the kids “If you’re a drag queen and you know it shout ‘Free Palestine.'”

Video has emerged of a drag queen leading children barely older than toddler age in chanting “Free Palestine” during a so called “Queer Storytime for Palestine” event in Massachusetts. Full report here: https://t.co/RLzl7S1ZC2 pic.twitter.com/cbcnVkQh6I

— m o d e r n i t y (@ModernityNews) April 26, 2024First off, gay people are at best severely disrespected, and at worst murdered in Gaza and other Palestinian areas. In terms of how gay-friendly it is, The LGBT Equality Index ranks Palestine as 192 out of 197 countries. Syria, Somalia and Yemen are ranked as more open to homosexuality.

It’s safe to say that a drag queen encouraging American kindergarteners to say ‘free Palestine’ is not really going to shift the needle as far as that situation is concerned.

Amherst, MA - Valley Families for Palestine puts on ‘Queer Storytime for Palestine’ in which toddlers are recorded chanting “Free Palestine”.

The harsh reality? Members of the LGBTQ+ community are often murdered in Gaza and other Palestinian areas such as Ramallah. pic.twitter.com/b8qwU4ycR3

Secondly, these children are clearly being subjected to a double dose of ideological and political indoctrination.

What’s next? Queer Palestine vaccine furry Ukraine drag queen story time?

Who in their right minds are taking their kids to this kind of thing? What do they expect will come of it?

Some people don't deserve to be parents: pic.twitter.com/ALAGhKXHdw

— End Wokeness (@EndWokeness) April 25, 2024* * *

Your support is crucial in helping us defeat mass censorship. Please consider donating via Locals or check out our unique merch. Follow us on X @ModernityNews.

A FORETASTE OF HEAVEN…

I returned to the parish that I was pastor from 1991 to 2004, for a foretaste of heaven, the wedding liturgy and banquet following. I witnessed the marriage vows of the daughter of a very good friend of mine who I have known since 1991 before he married. I married him and his wife in June of 1996 and had to privilege of celebrating their daughter’s wedding this past Saturday in the very same church.

The Church of the Most Holy Trinity in Augusta, Georgia photographs very well as does the wedding party!

And if I do say so myself, this is how you renovate/restore a historic church as yours truly oversaw it. It was begun in 1857 and completed and consecrated in April of 1863 as the Civil War was raging. The tabernacle remained dead center, never placed on a side altar. Please note the altar—it is the original altar consecrated in 1863 and in continuous use until this day. In the late 1960’s the altar was separated from the reredos so Mass could be celebrated facing the nave. In the mid 1990’s I had the entire structure, altar and reredos, dismantled. The reredos was pushed closer to the back wall of the apse, the altar placed in its original place with supports beneath. When it was pulled forward, no supports were placed in the basement for the new location which cause the floor of the sanctuary to sag a bit. My reorientation of the altar-table also allowed for the celebration of the Mass ad orientem or facing the nave. I knew this would return even in 1996!!!! The previous set up did not allow for the Mass to be ad orientem as the altar was placed on the edge of the last step up to the altar.

The pipe organ, also historically restored during my reign, was delayed in arriving from New York due to the war. Father Abram Joseph Ryan, the priest-poet of the Confederacy became the parochial vicar of the Church of the Most Holy Trinity in 1866 and helped to raise funds to bring the Jardine Tracker Pipe Organ to the church from New York by giving recitals of his poetry.

Ukrainian Drone Strikes Target Russian Oil Refineries Again Despite White House Pleas

Ukrainian Drone Strikes Target Russian Oil Refineries Again Despite White House Pleas

Tyler Durden

Fri, 04/26/2024 - 08:55

Just days after the Biden administration signed a new military aid package worth billions of dollars to Ukraine, Kyiv launched a series of suicide drone attacks on Russian oil refineries. Biden's top officials have pleaded with Kyiv to stop attacks on Russia's energy infrastructure because of the fears that turmoil in crude markets would send pump prices in the US higher ahead of the presidential elections in November.

"Our region is again under attack by Ukrainian UAVs," Smolensk Governor Vasily Anokhin wrote in a post on Telegram on Wednesday. Kamikaze drones damaged oil facilities in western Russia.

Another drone attack hit the Lipetsk region further south, which is home to steel production plants and pharmaceutical sites, Governor Igor Artamonov said.

"The Kyiv criminal regime tried to hit infrastructure in Lipetsk industrial zone," Artamonov said.

The Moscow Times pointed out:

A source in the Ukrainian defense sector confirmed to AFP on Wednesday that drones in the service of the Security Service of Ukraine (SBU) had carried out the attacks.

The source made no mention of the attack on Lipetsk but claimed two oil depots were destroyed in the Smolensk region.

"Rosneft lost two storage and pumping bases for fuels and lubricants in the towns of Yartsevo and Rozdorovo," the source said, referring to the Russian state-controlled energy giant.

The Financial Times, citing unnamed US officials, recently said long-range drones have hit at least 20 energy facilities deep within Russia so far this year. Kyiv's drone attacks on Russia's energy complex have been frightening for the Biden administration, as Brent prices have risen to the $90/bbl level on higher war risk premiums. Higher energy costs feed into inflation as stagflation concerns mount in the US. Also, gasoline pump prices in the US are inching closer to the politically sensitive $4 level.

According to AAA data, the average cost of gas at the pump across the US was $3.66 as of Thursday, up from $3.10 in mid-January.

"The recent uptick in US consumer price inflation, driven by services, housing and fuel, is already of concern to the Biden administration, which is hoping to secure a second term in the November election," Markus Korhonen, senior associate at geopolitical risk consultancy S-RM, told Newsweek.

In recent weeks, Brent prices jumped to the $90bbl to $92bbl range on a higher war risk premium as Israel and Iran volleyed missiles and drones at each other. Prices sank to as low as the $85bbl handle as the market saw the Middle East conflict was just theatrics. However, prices have increased from $85bbl earlier this week, to $89.50 on Friday morning - perhaps on new fears of tighter Russia supplies.

The latest Bloomberg data shows Russian seaborne crude exports hit a multi-month high in the four weeks to April 21. Refineries in the country have struggled to be repaired from the series of drone attacks as oil processing sinks to lows last seen in May 2023 when floods forced the Orsk refinery offline.

So far, Ukraine has only attacked oil-processing facilities deep within Russia, avoiding crude and crude product export ports.

"Should Ukraine begin also targeting crude oil facilities, this could threaten Russia's overall production and exports and, more meaningfully, global oil prices would tick up, driving up inflation and cost-of-living pressures in the US and elsewhere," said Korhonen, adding, "It would also raise the prospects of Russia retaliating, for example, targeting energy infrastructure that the West relies on."

The ultimate goal of Ukraine's drone attacks is to reduce Moscow's oil revenues that finance the war. This means that Russia's crude export ports will be targeted at some point. And we're 100% sure the Biden administration is terrified about this ahead of the elections.

If that happens, "it would not only bring up the price of oil, it would put a lot of pressure on inflation because of the impact on prices," said O'Donnell.

The question becomes when does Kyiv begin hitting Russia's crude export terminals.

Now We Are Supposed to Cheer Government Surveillance?

They are wearing us down with shocking headlines and opinions. They come daily these days, with increasingly implausible claims that leave your jaw on the floor. The rest of the text is perfunctory. The headline is the takeaway, and the part designed to demoralize, deconstruct, and disorient.

A few weeks ago, the New York Times told us that “As It Turns Out, the Deep State Is Pretty Awesome.” These are the same people who claim that Trump is trying to get rid of democracy. The Deep State is the opposite of democracy, unelected and unaccountable in every way, impervious to elections and the will of the people. Now we have the NYT celebrating this.

And the latest bears notice too: “Government Surveillance Keeps Us Safe.” The authors are classic Deep Staters associated with Hillary Clinton and George W. Bush. They assure us that having an Orwellian state is good for us. You can trust them, promise. The rest of the content of the article doesn’t matter much. The message is in the headline.

Amazing isn’t it? You have to check your memory and your sanity. These are the people who have rightly warned about government infringements on privacy and free speech for many decades dating way back.

And now we have aggressive and open advocacy of exactly that, mainly because the Biden administration is in charge and has only months to put the final touches on the revolution in law and liberty that has come to America. They want to make it all permanent and are working furiously to make it so.

Along with routine warrantless surveillance, not only of possible bad guys but everyone, comes of course censorship. A few years ago, this seemed to be intermittent, like the biased and arbitrary actions of rogue executives. We objected and denounced but generally assumed that it was aberrant and going away over time.

Back then, we had no idea of the scale and the ambition of the censors. The more information that is coming out, the more the full goal is coming into view. The power elite want the Internet to operate like the controlled media of the 1970s. Any opinion that runs contrary to regime priorities will be blocked. Websites that distribute alternative outlooks will be lucky to survive at all.

To understand what’s going on, see the White House document called Declaration on the Future of the Internet. Freedom is barely a footnote, and free speech is not part of it. Instead it is to be a “rules-based digital economy” governed “through the multistakeholder approach, whereby governments and relevant authorities partner with academics, civil society, the private sector, technical community and others.”

This whole document is an Orwellian replacement of the Declaration of Internet Freedom from 2012, which was signed by Amnesty International, the ACLU, and major corporations and banks. The first principle of this Declaration was free speech: don’t censor the Internet. That was 12 years ago and the principle is long forgotten. Even the original website has been dead since 2018. It is now replaced with one word: “Forbidden.”

Yes, that’s chilling but it is also perfectly descriptive. In all mainline Internet venues, from search to shopping to social, freedom is no longer the practice. Censorship has been normalized. And it is taking place with the direct involvement of the federal government and third-party organizations and research centers paid for by tax dollars. This is very clearly a violation of the First Amendment but the new orthodoxy in elite circles is that the First Amendment simply does not apply to the Internet.

This issue is making its way through litigation. There was a time when the decision would not be in question. No more. Several or more Supreme Court Justices do not seem to understand even the meaning of free speech.

The Prime Minister of Australia made the new view clear in his statement in defense of fining Elon Musk. He said that social media has a “social responsibility.” In today’s parlance, this means they must obey the government, which is the only proper interpreter of the public interest. In this view, you simply cannot allow people to post and say things that are contrary to regime priorities.

If the regime cannot manage public culture, and manipulate the public mind, what’s it there for? If it cannot control the Internet, its managers believe, it will lose control of the whole of society.

The crackdown is intensifying by the day. Representative Thomas Massie shot a video after the Ukraine vote for a total foreign aid package of an astonishing $95 billion. Vast numbers of Democrats on the House floor waved Ukrainian flags, which you might suppose smacks of treason. The Sergeant-at-Arms wrote Massey directly to tell him to take down the video or get a $500 fine.

Instead of fining democrats for waving flags, the House Sergeant at Arms just called and said I will be fined $500 if I don’t delete this video post.

Mike Johnson really wants to memory hole this betrayal of America. https://t.co/5DPWoo4cLw

True, the rules say you cannot film in a way that “impairs decorum,” but he simply took out his phone. The decorum was disturbed by masses of lawmakers waving a foreign flag. So Massie refused. After all, the entire disgraceful scene was on C-SPAN but the presumption is that no one watches that but everyone reads X, which is probably true.

Clearly, GOP speaker Mike Johnson doesn’t want his perfidy this well-advertised. After all, it was he who shepherded the authorization of spying on the American people using Section 702 of FISA, which 99 percent of GOP voters opposed. Just who do these people think they are there to represent?

It’s actually astonishing to do a conjectural history in which Elon did not buy Twitter. The regime monopoly on social media today would be 99.5 percent. Then the handful of alternative venues could be shut down one by one, just as with Parler a few years ago. Under this scenario, closing the social end of the Internet would not be that difficult. The domains are another matter but those could be banned gradually over time.

But with X rising in a meteoric way since Elon’s takeover, that is now far more difficult. He has made it his mission to remind the world of core principles. This is why he told the boycotting advertisers to jump in a lake and why he refused to comply with every dictate by the despotic head of the Brazilian Supreme Court. Daily he is showing what it means to stand up for principle in extremely hard times.

Glenn Beck puts it well: “What Elon Musk is doing in both Brazil and Australia is this: He is simply standing where the Free world used to stand. They have moved, not him. They are the radicals not him. HAVE THE COURAGE to remain standing, unmovable in the truth that can never change and you will be targeted and eventually change the world.”

Censorship is not an end unto itself. The purpose is control of the people. That is also the purpose of surveillance. It is not, rather obviously, to protect the public. It is to protect the state and its industrial partners against the people. Of course, just as in every dystopian film, they always pretend otherwise.

Somehow – call me naive – I just didn’t expect the New York Times to be all-in on the immediate establishment of the surveillance state and universal censorship by the “awesome” Deep State. But think of this. If the NYT can be fully captured by this ideology, and probably captured by the money that goes with it, so can any other institution. You have probably noticed a similar editorial line being pushed by Wired, Mother Jones, Rolling Stone, Salon, Slate, and other venues, including the entire suite of publications owned by Conde Nast including Vogue and GQ magazine.

“Don’t bother me with your crazed conspiracy theory, Tucker.”

I get the point. What is your explanation?

Reprinted with permission from Brownstone Institute.

Fed's Favorite Inflation Indicator Prints Hotter-Than-Expected As Savings Rate Plunges

Fed's Favorite Inflation Indicator Prints Hotter-Than-Expected As Savings Rate Plunges

Tyler Durden

Fri, 04/26/2024 - 08:39

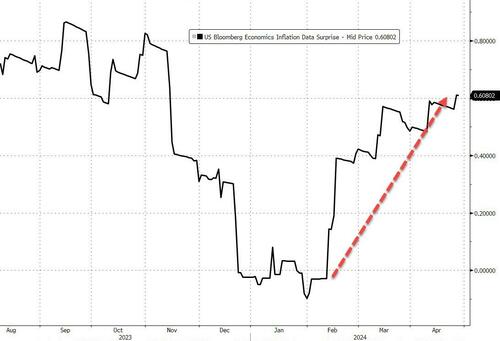

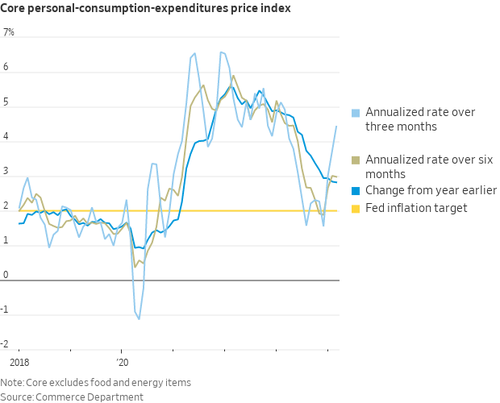

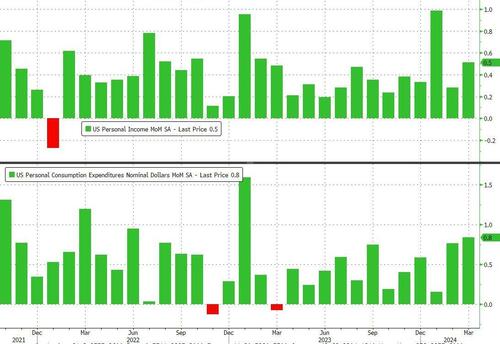

With inflation data surprising to the upside recently...

Source: Bloomberg

...the doves' last chance for sooner than later rate-cuts is today's Core PCE Deflator - often described as The Fed's favorite inflation signal. Last month saw an uptick in the headline deflator and following yesterday's core PCE rise for Q1, all eyes are on the March data released this morning.

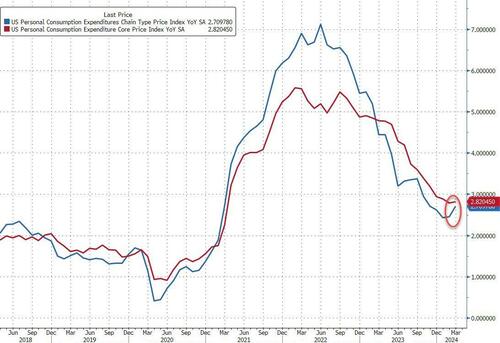

However, both the headline and core PCE Deflator data printed hotter than expected (+2.7% vs +2.6% exp vs +2.5% prior and +2.8% vs +2.7% exp vs +2.8% prior respectively)...

Source: Bloomberg

The silver lining is that this hot PCE print is 'dovish' relative to the GDP-based data we saw yesterday, with whisper numbers of +0.4 to +0.5% MoM (vs the +0.3% print).

But still - it's not good for the doves.

As WSJ Fed Whisperer Nick Timiraos notes, the 3-Month annualized core PCE jumped to 4.4%...

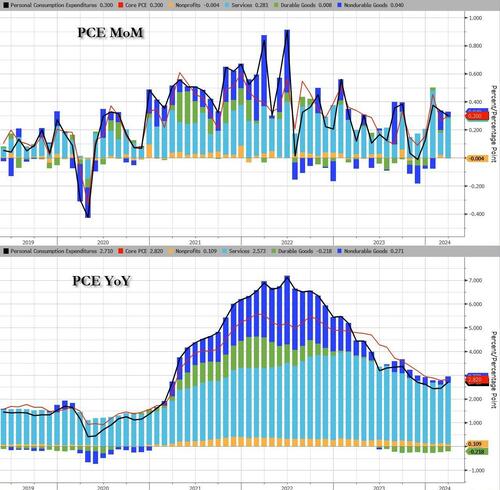

The Service sector led the MoM and YoY acceleration in headline PCE...

Source: Bloomberg

And for Core PCE, it was Services prices too that drove the acceleration...

Source: Bloomberg

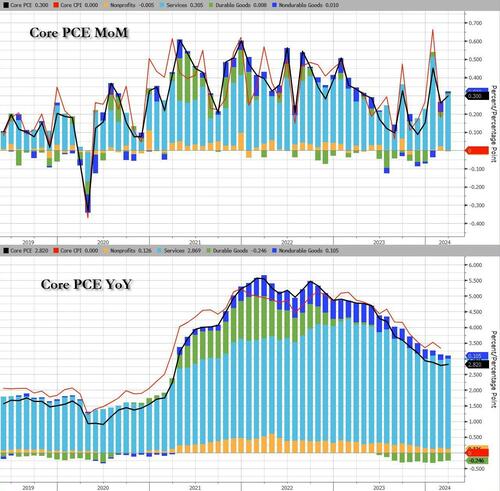

The so-called SuperCore - Services inflation ex-Shelter - rose once again, and was revised higher...

Source: Bloomberg

Stripping it back even further, Transportation Services and 'Other Services' were the biggest gainers in SuperCore...

Source: Bloomberg

Income and Spending both rose again on a MoM basis with spending outpacing income (again). The 0.8% MoM rise in spending was the highest since Jan 2023...

Source: Bloomberg

Spending is accelerating fast relative to incomes (on a YoY basis) - and remember this is all nominal...

Source: Bloomberg

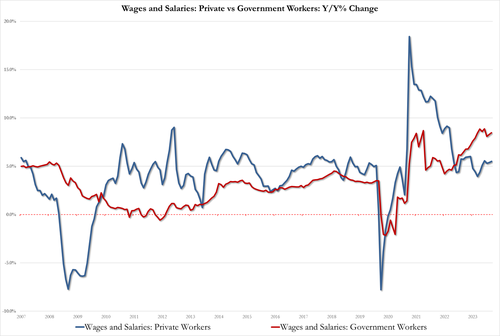

On the income side, government and private wage growth accelerated:

-

Govt wages rose to 8.5% YoY, from 8.3%, the highest Dec 22

-

Private wages rose to 5.5% YoY, from 5.4%, highest since Dec 22 as well

Source: Bloomberg

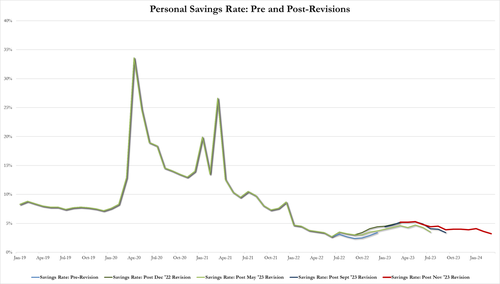

Which meant the personal savings rate plunged to 3.2% from 3.6% - its lowest since Nov 2022...

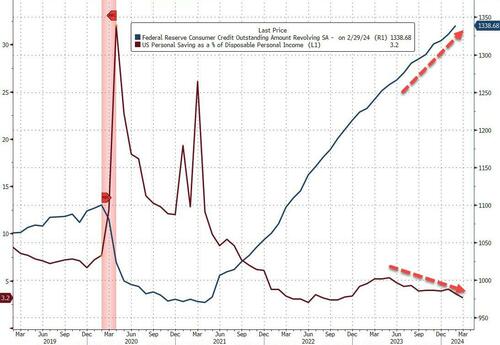

And the soaring credit card balance explains how people are getting by...

Source: Bloomberg

And all this amid the fourth straight month of government handouts...

Source: Bloomberg

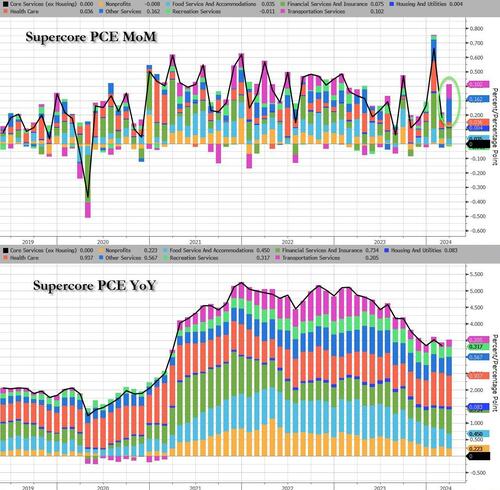

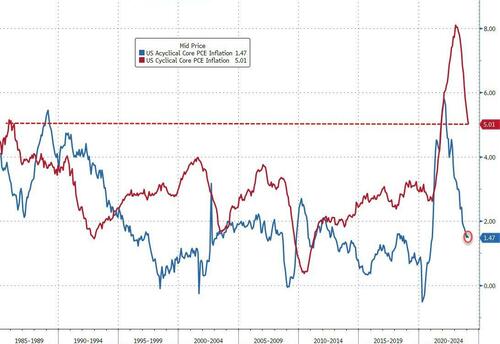

Finally, while the markets are exuberant at the survey-based disinflation, we do note that it's not all sunshine and unicorns. The vast majority of the reduction in inflation has been 'cyclical'...

Source: Bloomberg

Acyclical Core PCE inflation remains extremely high, although it has fallen from its highs.

Is The (apolitical) Fed going to be able to cut at all this year like Joe Biden said they would?

Genocide games: Srebrenica gambit and reigniting the Bosnian War

The UN General Assembly will soon be presented with a draft resolution declaring July 11 the “International Day of Remembrance for the victims of the Srebrenica genocide,” referring to events that allegedly took place in 1995.

Germany and Rwanda supposedly decided on their own to dredge up this episode from the Bosnian War at this particular time for no particular reason whatsoever. Considering that Rwanda is best known for a genocide that took place in 1994, while Germany’s conduct during WW2 caused the very term to be coined, the choice of sponsors seems strange – until one realizes that the ultimate source of “their” is the United States.

At first glance, the timing of this makes no sense. It’s not July, and even if it were, why the 29th anniversary in particular? One theory goes that the Globalist American Empire (GAE) and its vassals insist on the resolution now because of a recent actual milestone anniversary – of the NATO attack on then-Yugoslavia, now Serbia, in 1999; a clear-cut act of aggression that has underpinned the “rules-based world order” ever since.

The other possibility is that the US and its vassals are trying to deflect attention from Israel’s conduct in Gaza, while offering “proof” to the Muslim world of their virtue on the example of Bosnia – just as they originally intended in the 1990s.

Note that the original gambit backfired horribly, radicalizing tens of thousands of jihadists around the world who bought the story of how there was a genocide in Bosnia and how the West was too slow to intervene. Propaganda intended to shame the American public into giving up their Cold War “peace dividend” ended up escaping the control of its creators and delivered 9/11 and the War on Terror instead.

Genocide is about the worst thing anyone could be accused of. It’s an extraordinary claim, that one would think requires extraordinary evidence as well. In the case of Srebrenica, however, that rule has never been applied.

The facts of the case seem to matter not at all. The GAE never cared about the sectarian war launched by an Islamist fanatic and apologist for the Waffen-SS; or the 28th Division of the “Army of the Republic of Bosnia-Herzegovina,” stationed in the supposedly demilitarized “UN safe area” that had raided the nearby Serb villages for years. Or how many of its members actually died in July 1995, where, and under what circumstances.

All of those things were simply asserted by a sham “tribunal” – one the GAE and its vassals openly and repeatedly admitted to be an instrument of their power – and then accepted as a given by the International Court of Justice, without any examination whatsoever. That said, the ICJ unequivocally and completely rejected the lawsuit by “Bosnia-Herzegovina” accusing Serbia of genocide, including in Srebrenica.

Narratives never die if they are useful, though. Almost 30 years after the Bosnian War ended, it’s being revived for the same exact purpose: helping the GAE. In the minds of the narrative managers, the US gets to be the white knight, Germany and Rwanda get to launder their bloody past, Muslims of the world get to have a genocide of their own – just not Gaza! – and all of this gets to happen on the backs of the Serbs, whom the Empire designated “little Russians” back in the ‘90s and tagged them as the scapegoat on the altar of its ascension.

Bosnia is being sacrificed, as well. In the zeal to get the “Srebrenica genocide” resolution passed, the Bosnian Muslims unilaterally usurped the foreign ministry and the UN mission to claim it has official state support. This kind of running roughshod over the Serbs and Croats is precisely why the war broke out in 1992. The Dayton Peace Agreement, more or less imposed by the US in 1995, managed to keep the guns silent for almost 30 years. Now it’s being rapidly unraveled, with the full-throated support of the US, EU and a failed German politician Christian Schmidt, illegitimately styling himself the “high representative of the international community” and lording it over the supposedly independent state like a colonial viceroy.

The “Srebrenica genocide” gambit is so transparent, it has been called out by Simon Wiesenthal Center director Efraim Zuroff – as well as the Iranian ambassador to Serbia.

“The charge of genocide should not be made lightly nor without irrefutable evidence and broad agreement that reflects the gravity of such an accusation,” Zuroff wrote in the Jerusalem Post on April 17. Declaring Srebrenica a genocide at the UNGA “not only breaks from tradition but may also dilute the term’s significance,” he added.

Two days later, in an interview on Serbian TV, Ambassador Rashid Hassan Pour Baei argued that the resolution was “being used as a political instrument” to attack Serbia for being independent and sovereign, as well as to deflect attention from the carnage in Gaza. The ambassador also pointed out that if the UNGA can be used to label people as genocidal, that can – and will – be used against anyone.

The “rules-based order” the GAE insists on means that it and its vassals can never be held to even their own standards, while everyone else gets to be subjected to global anarcho-tyranny. The Serbs found this out in the 1990s. The rest of the world took a little longer, but has by and large arrived at the same conclusion by now.

If the Empire and its helpers manage to ram this cynical resolution through the UNGA, it would be poetic justice to see them hoisted by their own petard a few weeks or months later, as everyone with a grievance against Washington – or one of its allies – claims genocide. Sure, that’s not the kind of democracy the rulers of Our Democracy want or like, but they started the war – and in war, the other side also gets a vote.

China Is Pivotal For US Inflation's Path

China Is Pivotal For US Inflation's Path

Tyler Durden

Fri, 04/26/2024 - 08:25

Authored by Simon White, Bloomberg macro strategist,

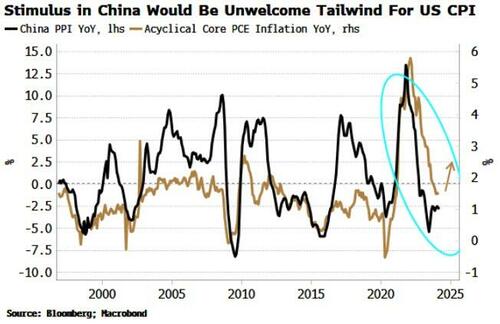

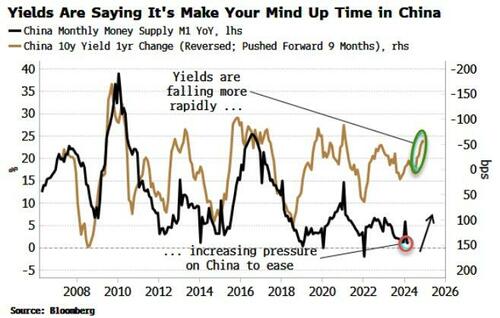

A more forthright response from China to its deflationary predicament would further support US inflation that is already proving sticky, adding to longer-term upwards pressure on term premium and thus yields.

There are upside risks to the US PCE release today after the higher-than-expected core-PCE price index released on Thursday.

Inflation is more stubborn than most expected.

That’s proven to be the case even without China so far managing to engineer robust recovery.

The San Francisco Fed separates out core PCE to a cyclical and an acyclical component, with the first being those inputs to PCE most correlated to Fed policy and acyclical is anything left over.

Most of the fall in core inflation has been driven by the acyclical component, while the cyclical has only fallen marginally, inferring that much of the disinflation was not directly down to Fed policy.

The acyclical component, though, is highly correlated to China PPI, i.e. China is a big driver of global inflation pressures. If the country had had stronger recovery, it is likely the US (and other countries) would be contending with a larger inflation problem than they currently have.

That’s why China’s next move is so important. Falling bond yields, in contrast to rising ones in almost every other country, signal the economy is nearing a crunch point. Typically, China has responded with much broader stimulus - reflected in rising M1 growth - when yields have seen such a fall.

If it responds similarly again, inflation pressures in the US will receive an unwelcome boost even as it is already dealing with price growth that is becoming embedded.

Futures Jump As Tech Giants Soar, Yen Plummets After BOJ Refuses To Prop Up Crashing Currency

Futures Jump As Tech Giants Soar, Yen Plummets After BOJ Refuses To Prop Up Crashing Currency

Tyler Durden

Fri, 04/26/2024 - 08:18

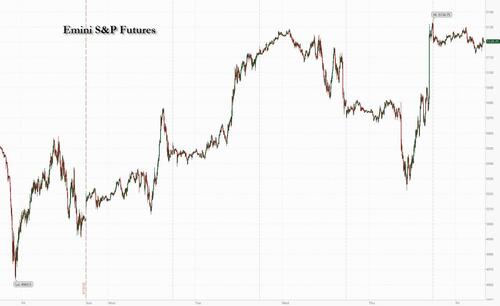

In a rollercoaster 48 hours to close the week, yesterday's early market slump (after the disappointing Meta guidance) has been fully reversed and stock futures are now pointing sharply higher after blockbuster earnings from Microsoft and Alphabet with attention now turning to the release of US personal consumption data - the Fed’s preferred measure of inflation, where a hotter-than-expected reading after Thursday’s weaker GDP figures may signal US rates will remain higher for longer. As of 7:40am, S&P futures are 0.7% higher while Nasdaq futures gain 1.1%. The positive sentiment carried into European trading, with tech stocks leading equity gains, with miners outperforming as copper hit $10,000 a ton for the first time in two years. Traders are also speculating as to whether Japan will intervene to support the Yen after the currency slid to a 34-year low before rebounding after the central bank kept rates on hold and Ueda said nothing to prop up the currency in what Deutsche Bank has called a policy of "benign neglect." Later in the day, attention will shift. Elsewhere, the USD is higher and bond yields are slightly lower. In commodities, oil and precious metals are higher; base metals and Ags are mixed. Today, key focus will be the March PCE release at 8.30am ET, where consensus expects headline PCE and core PCE to both rise +0.3% MoM.

In premarket trading, Google parent Alphabet surged as much as 12%, poised to add more than $230 billion to its market capitalization and exceed $2 trillion in valuation. Microsoft rose 4% after the software giant reported third-quarter results that beat expectations, a sign that AI is fueling growth and demand. The companies trounced Wall Street estimates with their latest quarterly results, fueled in part by demand for AI services. In other earnings-related moves, Exxon fell 1.2% after missing EPS but smashing revenue estimates, while Intel slumped more than 7% after providing weaker-than-anticipated guidance. Here are some other notable movers:

- Atlassian shares slide 5.3% after the application software company said co-founder Scott Farquhar is stepping down as co-CEO after 23 years.

- Boyd Gaming shares fall 14% after the regional casino operator reported adjusted earnings per share for the first quarter that missed the average analyst estimate.

- Chinese stocks listed in the US rise, reflecting a rally in Hong Kong as Asian big tech names get a boost following robust earnings from Alphabet and Microsoft. Alibaba +2.0%, Baidu +2.6%, PDD Holdings +2.5%, JD.com +5.0%, NetEase +1.7%, Trip.com +3.1%, KE Holdings +3.3%, Bilibili +5.4%

- Cloud software stocks rise following better-than-expected sales in Microsoft and Google’s cloud divisions. Datadog +4.9%, Snowflake +3.5%, MongoDB +3.8%, Cloudflare +2.3%

- Enphase Energy (ENPH US) shares rise 2.9% as Barclays upgrades its recommendation to overweight from equal-weight, saying the solar-equipment manufacturer is nearing an inflection point.

- Intel shares drop 7.3% after the chipmaker’s second-quarter outlook was weaker than anticipated, underlining the difficulties the company has had in executing a turnaround.

- KLA Corp shares rise TKTK after the semiconductor equipment supplier’s third-quarter earnings beat estimates and outlook for the fourth quarter was strong, prompting analysts to raise their price targets.

- Marathon Digital shares rise 3.3% after the company increases year-end hash rate target to 50 EH/s from 35-37 EH/s.

- Mobileye shares fall 3.0% after a downgrade to underweight at Morgan Stanley in the wake of the company’s results.

- Roku shares fall 4.8% as the streaming-video platform company said it expects adjusted Ebitda to moderate in the second half of the year, after reporting first-quarter results that beat expectations.

- Snap shares surge 24% after the social-media company reported first-quarter results that beat expectations and gave an outlook that is stronger than forecast, helping to ease concerns about its growth.

- T-Mobile shares waver after the carrier’s results received a mixed reception from analysts, who said that the earnings were overall solid, but were disappointed that the company didn’t raise its guidance for postpaid phone subscribers as it looks raise prices.

- Teladoc Health shares drop 4.4% after a second-quarter forecast missed estimates. The healthcare services company also reported a first-quarter gross margin that fell short of expectations.

While earnings remain center stage, the focus Friday will also be on US data, with the Fed's preferred measure of inflation of particular interest. Treasury yields dipped following yesterday’s bond-market losses when stagflationary GDP data pushed back expectations for policy easing. A gauge of the dollar was steady.

“We have a precarious situation where the earnings of a few big companies are driving sentiment on the entire market,” said Justin Onuekwusi, chief investment officer St James Place Management. “We have seen a bit of volatility driven by earnings as well as rate decreases being priced out and that’s likely to continue.”

Almost 80% of S&P 500 firms that have reported so far have beaten analysts’ earnings estimates, according to JPMorgan strategists. Still, stock price reactions have been underwhelming, with better-than-expected results seeing below average upside, while those missing estimates are being penalized by more than usual, the strategists wrote. More than 50% of S&P 500 companies have yet to report.

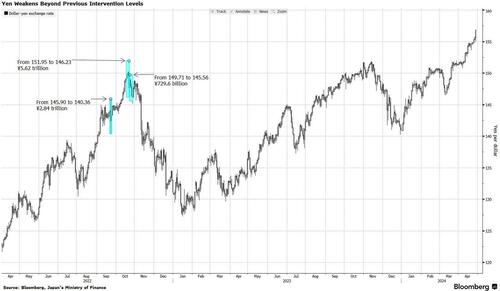

A big highliight of the overnight session was the latest collapse in the Japanese yen which fell to a fresh cycle low near 157 versus the dollar after the Bank of Japan stood pat on interest rates and Governor Ueda did little to push back against recent weakness in the press conference. The yen’s slump to a record low versus the dollar has left traders on guard for any hints of intervention from Japan. The yen swung sharply from the day’s low to near its high amid jittery trading in the wake of the Bank of Japan’s decision to keep monetary policy unchanged.

“Should the yen fall further from here, like after the BOJ decision in September 2022, the possibility of intervention will increase,” said Hirofumi Suzuki, chief currency strategist at Sumitomo Mitsui Banking Corp. “It is not the level but it’s the speed that will trigger the action.”

European stocks rose along with US equity futures: the Stoxx 600 is up 0.6%, with technology and construction sectors leading gains, while chemicals and insurance subgroups are the biggest losers. Thyssenkrupp shares jumped after Czech billionaire Daniel Kretinsky’s EP Corporate Group agreed to buy a fifth of the German manufacturer’s troubled steel unit. Miners outperformed as copper hit $10,000 a ton for the first time in two years. Here are the biggest movers Friday:

- Saint-Gobain shares gain as much as 6.3% after the French building-materials producer reported first-quarter sales that were slightly above expectations, according to Oddo. Separately, management is seeing signs of bottoming out for new build markets in Europe

- NatWest rises as much as 5.2% after net interest income and pretax operating profit for the first quarter beat the average analyst estimate

- Amundi soars 7%, most in two years, after the French asset manager reported net inflows for the first quarter that beat the average estimate. Citi analysts expect mid-single digit consensus upgrades. KBW called the results “solid.”

- Electrolux shares gain as much as 7%, the most since December, after first-quarter figures from the Swedish maker of domestic appliances weren’t as bad as feared, with an operating loss of SEK720 million, versus an expected SEK809 million

- Jeronimo Martins soars most in six months after Ebitda margin erosion in 1Q was smaller than analysts expected, showing that Portuguese retailer can withstand competition pressure in Poland as well as negative impact from slowing inflation

- Airbus shares fall as much as 3% to the lowest since early March after its first-quarter results were significantly below estimates, even as the planemaker reiterated its full-year targets

- IMCD’s shares sink as much as 10%, the most since March 2020, after the specialty chemicals and ingredients company reported first-quarter operating Ebita that missed estimates. ING says the story was “underlying quite weak.”

- Hexagon shares fall as much as 4.4% after the software firm reported sales and operating profit that missed estimates, while saying that demand will remain mixed in the near term

- ConvaTec Group shares decline as much as 7.2% after the medical equipment maker was downgraded to reduce by analysts at Peel Hunt, which has growing concerns about its wound care products in the US

- Yara shares fall as much as 6.9%, the lowest intraday since May 2020, after the Norwegian agricultural chemicals firm reported adjusted Ebitda below estimates

Earlier in the session, Asian stocks rose, headed for their best week since November, as investors cheered upbeat earnings from technology firms and sentiment on China continued to improve. Japanese stocks rose as the Bank of Japan left interest rates unchanged. The MSCI Asia Pacific Index rose 0.8%, with TSMC and Tencent among the biggest boosts. The gauge extended its weekly gains to more than 3%. Stocks rose in mainland China and Hong Kong, with the Hang Seng China Enterprises Index poised for its best week since April 2015. Signs of an improving Chinese economy, better corporate earnings and Bejing’s support measures have spurred inflows from global funds.

- Hang Seng and Shanghai Comp. were underpinned by strength in tech and property, while the constructive mood was also facilitated by a meeting between US Secretary of State Blinken and Chinese Foreign Minister Wang where it was stated that the US-China relationship has stabilised although negative factors are building.

- ASX 200 underperformed after the prior day's losses caught up with the index on return from holiday.

- Nikkei 225 was initially choppy and briefly dipped into negative territory as participants braced for the BoJ policy announcement and whether the central bank flags a reduction in bond buying, but then surged as the central bank kept policy settings unchanged and refrained from any major hawkish surprises.

In FX, the dollar was slightly lower, as all the action was in the Japanese yen which cratered to a fresh 34 year low near 157 versus the dollar after the Bank of Japan stood pat on interest rates and Governor Ueda did little to push back against recent weakness in the press conference. USD/JPY did swing sharply lower to sub-155 before swiftly rebounding in jittery trading amid heightened speculation that authorities may intervene in the market.

In rates, treasuries climbed, paring some of Thursday’s post-data drop. US yields are richer by up to 2bp across long-end of the curve with 5s30s spread around 8bp, tighter by around 1bp on the day; 10-year yields around 4.685%, down 1.5bp on the day with bunds outperforming by 1bp in the sector.

In commodities, oil prices advance, with WTI rising 0.4% to trade near $83.90 a barrel. Spot gold rises 0.7% to around $2,350/oz. Copper hit $10,000 a ton for the first time in two years.

Looking at today's calendar, the US session highlight is the March personal income/spending (8:30am); we algo get the April revised University of Michigan sentiment (10am) and April Kansas City Fed services activity (11am). Fed members are in self-imposed quiet period ahead of May 1 policy announcement

Market Snapshot

- S&P 500 futures up 0.8% to 5,121.00

- STOXX Europe 600 up 0.6% to 505.47

- MXAP up 0.7% to 172.65

- MXAPJ up 0.8% to 536.04

- Nikkei up 0.8% to 37,934.76

- Topix up 0.9% to 2,686.48

- Hang Seng Index up 2.1% to 17,651.15

- Shanghai Composite up 1.2% to 3,088.64

- Sensex down 0.7% to 73,833.99

- Australia S&P/ASX 200 down 1.4% to 7,575.91

- Kospi up 1.1% to 2,656.33

- German 10Y yield little changed at 2.60%

- Euro up 0.2% to $1.0748

- Brent Futures up 0.2% to $89.21/bbl

- Brent Futures up 0.2% to $89.21/bbl

- Gold spot up 0.6% to $2,347.56

- US Dollar Index down 0.10% to 105.49

Top Overnight News

- BOJ leaves rates unchanged, as expected, and retained its guidance from Mar about purchasing gov’t bonds (there had been some speculation of a taper or a hint of one). WSJ

- Japan’s Tokyo CPI for April cools far more than anticipated, coming in +1.8% ex-food/energy vs. the Street +2.7% and down from +2.9% in March. BBG

- China’s foreign minister says the relationship w/the US was starting to stabilize but that “negative factors” were increasing. NBC News

- Eurozone inflation expectations over the next 12 months ticked down to 3% (from 3.1%), hitting the lowest level since Dec 2021. ECB

- The ECB is likely to need extra interest rate cuts if global borrowing costs are pushed up by the US Federal Reserve maintaining its restrictive monetary policy stance, a top eurozone policymaker has said. Fabio Panetta, head of Italy’s central bank, said that if the Fed keeps rates on hold longer than markets expect, or even raises them, it would be “likely to reinforce the case for a rate cut [by the ECB] rather than weakening it”. FT

- Donald Trump’s allies are quietly drafting proposals that would attempt to erode the Federal Reserve’s independence if the former president wins a second term, in the midst of a deepening divide among his advisers over how aggressively to challenge the central bank’s authority. WSJ

- Walmart's CEO says inflation continues to cool: “At Walmart, we are now seeing prices that are in line with where they were 12 months ago. I haven’t been able to say that for a few years now. The last few weeks, we've taken even more prices down in areas like produce and meat and fresh food”. ABC News

- Annualized US core PCE inflation accelerated to 4.5% over the last three months, but underlying trends are less alarming. The Q1 acceleration mostly reflected one-off surprises in acyclical categories where costs pass-through with long lags, and forward-looking indicators are at target-consistent levels. Progress therefore appears delayed but not reversed, and we forecast that core PCE inflation will slow to 2.2% on a sequential annualized basis in 2024Q2-Q4. GIR

- Microsoft and Alphabet jumped premarket after stellar earnings and expectations for a surge in cloud revenue fueled by AI demand. Execs at both companies said they plan to spend more on AI. BBG

Earnings

- Alphabet Inc (GOOGL) Q1 2024 (USD): EPS 1.89 (exp. 1.51), Revenue 80.54bln (exp. 78.59bln); board authorised Co. to repurchase up to an additional 70bln and declared a cash dividend of 0.20/shr. Shares +11.5% in pre-market trade

- Microsoft Corp (MSFT) Q3 2024 (USD): EPS 2.94 (exp. 2.82), Revenue 61.86bln (exp. 60.8bln). Shares +4.1% in pre-market trade

- Intel Corp (INTC) Q1 2024 (USD): Adj. EPS 0.18 (exp. 0.14), Revenue 12.70bln (exp. 12.78bln). Shares -7.5% in pre-market trade

- Snap Inc (SNAP) Q1 2024 (USD): Adj. EPS 0.03 (exp. -0.05), Revenue 1.19bln (exp. 1.12bln). Shares +23.5% in pre-market trade

- TotalEnergies (TTE FP) Q1 (USD): Adj. Net 5.11bln (exp. 5bln). Adj. EBITDA 11.5bln (exp. 11.1bln). Plans a USD 2bln share buyback Q2; Cash flow from operating activities 2.2bln (prev. 5.1bln Y/Y); Dividend +7% Y/Y

- Airbus (AIR FP) Q1 24 (USD): Adj. EBIT 600mln (exp. 789mln), Revenue 12.80bln (exp. 12.87bln), Gross Orders 170 (prev. 156), Net Orders 170 (prev. 142), Deliveries 142. Reaffirms 2024 guidance.

A recap of overnight news courtesy of Newsquawk

APAC stocks were mostly higher as the region digested recent market themes including disappointing US data, strong big tech earnings and the BoJ policy announcement. ASX 200 underperformed after the prior day's losses caught up with the index on return from holiday. Nikkei 225 was initially choppy and briefly dipped into negative territory as participants braced for the BoJ policy announcement and whether the central bank flags a reduction in bond buying, but then surged as the central bank kept policy settings unchanged and refrained from any major hawkish surprises. Hang Seng and Shanghai Comp. were underpinned by strength in tech and property, while the constructive mood was also facilitated by a meeting between US Secretary of State Blinken and Chinese Foreign Minister Wang where it was stated that the US-China relationship has stabilised although negative factors are building.

Top Asian News

- Chinese Foreign Minister Wang said in a meeting with US Secretary of State Blinken that the China-US relationship has stabilised but negative factors are building, while he added that sliding into conflict with the US would be a lose-lose situation that they ask the US not to interfere with China's internal affairs. Furthermore, Blinken said there is no substitute for face-to-face diplomacy and they need to avoid miscalculations, while he hopes the US and China can make progress on agreements, citing fentanyl, military-to-military ties and AI risks.

- US is pushing allies in Europe and Asia to tighten restrictions on exports of chip-related technology and tools to China amid rising concerns about Huawei's development of advanced semiconductors, according to FT sources. US wants Japan, South Korea, and the Netherlands to use existing export controls more aggressively, including stopping engineers from their countries servicing chipmaking tools at fabs in China.

- ByteDance reportedly prefers shutting down the app rather than a sale if it exhausts all legal options and the algorithms TikTok relies on are deemed core to ByteDance’s overall operations, making the sale of the app unlikely, according to Reuters sources.

European bourses, Stoxx 600 (+0.5%) are entirely in the green, though trade has been contained at session highs, as participants await March's US PCE at 13:30 BST. European sectors are almost entirely in the green, with the exception of Chemicals, following poor IMCD (-9.1%) results. Tech tops the pile, with optimism lifted following strong large-cap Tech earnings in the US. US Equity Futures (ES +0.7%, NQ +0.9%, RTY +0.1%) are entirely in the green, with the NQ outperforming, benefitting from significant pre-market strength in both Google (+11.1%) and Microsoft (+3.6%), after reporting strong earnings after-market.

Top European News

- ECB's Panetta said they must weigh the risk of monetary policy becoming too tight, while he added that timely and small rate cuts would counter weak demand and could be paused. Furthermore, he stated that hesitations in adjusting rates would hurt investment and productivity, while large rate cuts could create a credibility issue.

- ECB Consumer Inflation Expectations survey (Mar) - 12-months ahead 3.0% (prev. 3.1%); 3-year ahead 2.5% (prev. 2.5%). Economic growth expectations for the next 12 months 1.1% (prev. -1.1%)

- SNB Chair Jordan said SNB has been successful in fight against inflation; uncertainty remains elevated and shocks can occur at and time

BOJ

- BoJ kept its policy settings unchanged with the short-term interest rate target at 0.0%-0.1%, as expected, with the decision made unanimously, while it dropped the reference from the statement that it currently buys about JPY 6tln worth of JGBs per month but stated that it will conduct JGB, commercial paper and corporate bond buying in line with the decision in March. BoJ said it must be vigilant to FX and market moves and their impact on the economy and prices but noted no excessive behaviour is seen in Japan's asset market and financial institutions' practices. Furthermore, it stated that if trend inflation rises, the BoJ will likely adjust the degree of monetary easing but also added to expect accommodative monetary conditions to continue for the time being. In terms of the latest Outlook Report, Board Members' Real GDP median forecast for Fiscal 2024 was cut to 0.8% from 1.2% but the Fiscal 2025 median forecast was maintained at 1.0%, while the Core CPI Fiscal 2024 median forecast was raised to 2.8% from 2.4% and Fiscal 2025 median forecast was raised to 1.9% from 1.8%.

- PRESS CONFERENCE: BoJ Governor Ueda said easy financial conditions will be maintained for the time being; Weak JPY so far is not having a big impact on trend inflation. Difficult to gauge timing of future rate hikes. Weak JPY so far is not having a big impact on trend inflation. Reduction in JGB buying in the future is in sight. Will not comment on FX moves

FX

- USD is around flat, and holding within a 105.40-71 range. USD was initially being propped up by JPY softness post-BoJ, although that has abated somewhat, amid Yen intervention speculation.

- JPY is the clear laggard across the majors following the BoJ policy announcement overnight, which provided no hawkish surprise. USD/JPY took another leg higher amid BoJ Ueda's press conference, before being slapped down to sub-155 levels, a few hours later. Some will likely view the move as intervention but we are yet to see any official confirmation of this.

- EUR is flat vs. the USD and breached yesterday's 1.0740 best. If the pair ventures higher, 1.0756 from April 11th is the next potential target.

- Antipodeans are firmer vs. the USD and outmuscling peers alongside the favourable risk environment. AUD/USD has gained a firmer footing above its 200 and 50DMAs at 0.6526 and 0.6532 respectively with focus now on a potential approach of 0.66

- PBoC set USD/CNY mid-point at 7.1056 vs exp. 7.2449 (prev. 7.1058).

Fixed Income

- USTs are a touch firmer after yesterday's data induced losses, which sent the Jun'24 UST to a contract low of 107.04. Today's trade has been contained within a 107.04-108.01 range, with all eyes on March's US PCE metrics later.

- Bund price action has been following USTs and attempting to recoup recently lost ground which has been inspired this week by a combination of better data and speak from hawkish ECB members. Bunds are so far respecting yesterday's 129.53-130.38 range.

- Gilts are firmer and in-fitting with global peers in an attempt to claw back recent losses. However, with a lack of UK-specific drivers, UK paper will likely remain at the whim of global peers.

Commodities

- A relatively tame session thus far for the crude complex following Thursday's choppy trade, as participants await monthly US PCE metrics; Brent Jun'24 range between 89.08-69/bbl.

- Precious metals are firmer amid the softer Dollar and ahead of the US PCE data, with spot silver narrowly leading vs spot gold. XAU topped yesterday's peak (USD 2,344.93/oz) to trade in a current intraday range between USD 2,326.36-2,352.30/oz.

- Base metals are stronger across the board amid bullish momentum after copper crossed key levels, with the broader complex underpinned by the softer Dollar and broader risk appetite; 3M LME copper is posting gains of over USD 100/t at the time of writing after mounting the key USD 10,000/t mark to levels last seen in 2022.

- India Oil Minister said cartel of oil producers are responsible for current volatility in the market; oil producers are cutting down and holding back production, according to ETNow.

Geopolitics: Middle East

- "US Secretary of State Blinken to visit Israel on Tuesday", according to Sky News Arabia

- Hezbollah said it shelled an Israeli force with artillery at the site of Al-Malikiyah and achieved a direct hit, according to Al Jazeera.

Geopolitics: Other

- US official said the US could announce as soon as Friday USD 6bln in new weapon purchases for Ukraine.

- North Korean leader Kim supervised the test-firing of multiple launch rockets, according to KCNA.

- China's Defence Ministry said Chinese and French militaries established a dialogue mechanism for cooperation between theatre commands, according to Reuters.

US Event Calendar

- 08:30: March PCE Deflator MoM, est. 0.3%, prior 0.3%

- March PCE Core Deflator MoM, est. 0.3%, prior 0.3%

- March PCE Deflator YoY, est. 2.6%, prior 2.5%

- March PCE Core Deflator YoY, est. 2.7%, prior 2.8%

- 08:30: March Personal Income, est. 0.5%, prior 0.3%

- March Personal Spending, est. 0.6%, prior 0.8%

- March Real Personal Spending, est. 0.3%, prior 0.4%

- 10:00: April U. of Mich. Sentiment, est. 77.9, prior 77.9

- April U. of Mich. Current Conditions, prior 79.3

- April U. of Mich. Expectations, prior 77.0

- April U. of Mich. 1 Yr Inflation, prior 3.1%

- April U. of Mich. 5-10 Yr Inflation, est. 3.0%, prior 3.0%

- 11:00: April Kansas City Fed Services Activ, prior 7

DB's Jim Reid concludes the overnight wrap

It’s been a volatile 24 hours in markets, but in spite of a selloff yesterday, there’s increasing positivity this morning thanks to strong results from Microsoft and Alphabet after last night’s close. Both companies exceeded revenue and earnings expectations, with Alphabet seeing the larger beat on profitability, as their growth was boosted by demand for cloud computing and AI-related offerings. That’s seen Alphabet rise by over 11% in after-hours trading, while Microsoft is up more than -4%, having both been down in the main session yesterday. In turn, futures on the S&P 500 are currently up +0.81%, which is a significant turnaround from yesterday, as the index closed -0.46% lower, and that was only after recovering from initial losses that had pushed it down -1.60%.

That positivity has continued into Asian markets overnight, which comes as the Bank of Japan left their interest rates unchanged at their latest meeting. That’s seen the Japanese Yen weaken further, and it’s currently trading at 156.11 per dollar, which is its weakest level since 1990. Front-end government bond yields have also fallen overnight in Japan, with the 2yr yield down -0.7bps to 0.29%. And for equities, all the major indices have risen, including the Nikkei (+0.74%), the KOSPI (+1.10%), the Hang Seng (+1.98%), the CSI 300 (+1.03%) and the Shanghai Comp (+0.79%).

Before that overnight reversal, markets had struggled yesterday, as challenging data and poor earnings led to a notable selloff. That meant investors pushed back the timing of rate cuts yet again, and the 2yr Treasury yield (+7.1bps) closed at 4.998%, so almost at 5% for the first time since mid-November. That was mainly driven by the Q1 US GDP release, which had the unfortunate combination of a downside surprise on growth, and an upside surprise on inflation. As we found out in 2022, that stagflationary mix can potentially be a bad recipe for markets, so it wasn’t a surprise to see equities and bonds lose ground simultaneously even if equities have since been busy making up their initial losses.