In the name of tolerance, tolerance is being abolished; this is a real threat we face.

All

Chicago's Lori Lightfoot Lands $400 An Hour Job Investigating 'Worst Mayor In America'

Chicago's Lori Lightfoot Lands $400 An Hour Job Investigating 'Worst Mayor In America'

Tyler Durden

Tue, 04/09/2024 - 14:08

Former Chicago Mayor Lori Lightfoot has been appointed by the trustees of Dolton, Illinois as a special investigator to probe Dolton's embattled mayor, Tiffany Henyard - for $400 per hour.

Henyard is accused of mishandling funds. Last month she vetoed calls for an investigation into herself, which was overturned Monday night. A former city employee also accused Henyard of retaliation after she says a village trustee sexually assaulted her on a trip to Las Vegas last year, after which she was fired after speaking up.

During a Monday meeting which had roughly 150 community members in attendance - but Henyard and two village trustees skipped out on, the four remaining trustees present voted in favor of appointing Lightfoot, a former assistant US attorney, to investigate the mayor.

"This board specifically has made reaches to the state’s attorney, attorney general, governor’s office, and as we know, there are ongoing, well, it’s been reported that there are ongoing investigations from federal entities. Those entities as we know can take anywhere from two months to five years," said Trustee Jason House - mayor pro tempore for the meeting, Fox32 Chicago reports.

"We feel this option will give us an independent process," House continued.

Lightfoot will get to work right away, starting her new role as ‘special investigator’ for the Village of Dolton on Tuesday.

She will be launching a probe into Henyard's alleged mishandling of village funds, among other complaints.

"She has more authority to get what we're missing, to seal this deal and take our community back," said Belcher.

On Monday, Belcher stated that the Village of Dolton is more than $7 million in debt. -Fox32

Lightfoot, an objectively horrible mayor, lost her bid for re-election in Chicago last March, coming in third place. Her greatest hits include;

- "F**k Clarence Thomas!" Shouts Chicago Mayor Lori Lightfoot During Pride Parade

- Chicago Mayor Lori Lightfoot Granting Interviews "Only To Black Or Brown Journalists"

- Did Chicago Punish Car Dealership Rocked By $1 Million Theft After Lightfoot Called Owner An "Idiot"?

- Chicago's Ex-City Attorney Brands Mayor Lori Lightfoot A 'Disaster' After $2.9 Million Settlement Over Botched Police Raid

- Chicago Homicide Crisis Worsens As Mayor Lightfoot Fails To Quell Violence

- Illinois Sheriffs Reject Mayor Lightfoot's Urgent Plea To Cover Police Shortage In Crime-Hit Chicago

Henyard tries a lawyer trick!

In response to Lightfoot's appointment, a Dolton Township lawyer hired by Henyard to serve as the village's prosecutor, Michael del Galdo, said in a Monday letter to the legal team representing the trustees that if Lightfoot is appointed as "additional legislative counsel," Henyard will "not be approving any payments to Lightfoot," as her appointment would violate the law due to the trustees' existing attorney.

Burt Odelson, an attorney for the Trustees, hit back- saying that Lightfoot would serve not as "additional legislative counsel," but rather a "special investigator."

According to the report, Lightfoot's $400 per hour investigation will be capped at $30,000 for now - so she better wrap this up in 75 hours or less.

Henyard was called the "worst mayor in America" by an angry resident during a monthly board meeting earlier this month.

"You know what you’re doing. You’re violating our rights, and that’s a shame," one resident testified. "This is a disgrace what you have done to this village … They say that you’re the worst mayor in America. I agree."

"An Open-Minded Spirit No Longer Exists Within NPR" - NPR Veteran Excoriates Outlet Over Hunter, Russiagate Activism

"An Open-Minded Spirit No Longer Exists Within NPR" - NPR Veteran Excoriates Outlet Over Hunter, Russiagate Activism

Uri Berliner near his home in Washington, D.C., on April 5, 2024. (Photo by Pete Kiehart for The Free Press)

Tyler Durden

Tue, 04/09/2024 - 13:50

Uri Berliner near his home in Washington, D.C., on April 5, 2024. (Photo by Pete Kiehart for The Free Press)

Tyler Durden

Tue, 04/09/2024 - 13:50

Authored by Uri Berliner via The Free Press (emphasis ours),

You know the stereotype of the NPR listener: an EV-driving, Wordle-playing, tote bag–carrying coastal elite. It doesn’t precisely describe me, but it’s not far off. I’m Sarah Lawrence–educated, was raised by a lesbian peace activist mother, I drive a Subaru, and Spotify says my listening habits are most similar to people in Berkeley.

I fit the NPR mold. I’ll cop to that.

So when I got a job here 25 years ago, I never looked back. As a senior editor on the business desk where news is always breaking, we’ve covered upheavals in the workplace, supermarket prices, social media, and AI.

It’s true NPR has always had a liberal bent, but during most of my tenure here, an open-minded, curious culture prevailed. We were nerdy, but not knee-jerk, activist, or scolding.

In recent years, however, that has changed. Today, those who listen to NPR or read its coverage online find something different: the distilled worldview of a very small segment of the U.S. population.

If you are conservative, you will read this and say, duh, it’s always been this way.

But it hasn’t.

For decades, since its founding in 1970, a wide swath of America tuned in to NPR for reliable journalism and gorgeous audio pieces with birds singing in the Amazon. Millions came to us for conversations that exposed us to voices around the country and the world radically different from our own—engaging precisely because they were unguarded and unpredictable. No image generated more pride within NPR than the farmer listening to Morning Edition from his or her tractor at sunrise.

Back in 2011, although NPR’s audience tilted a bit to the left, it still bore a resemblance to America at large. Twenty-six percent of listeners described themselves as conservative, 23 percent as middle of the road, and 37 percent as liberal.

By 2023, the picture was completely different: only 11 percent described themselves as very or somewhat conservative, 21 percent as middle of the road, and 67 percent of listeners said they were very or somewhat liberal. We weren’t just losing conservatives; we were also losing moderates and traditional liberals.

An open-minded spirit no longer exists within NPR, and now, predictably, we don’t have an audience that reflects America.

That wouldn’t be a problem for an openly polemical news outlet serving a niche audience. But for NPR, which purports to consider all things, it’s devastating both for its journalism and its business model.

* * *

Like many unfortunate things, the rise of advocacy took off with Donald Trump. As in many newsrooms, his election in 2016 was greeted at NPR with a mixture of disbelief, anger, and despair. (Just to note, I eagerly voted against Trump twice but felt we were obliged to cover him fairly.) But what began as tough, straightforward coverage of a belligerent, truth-impaired president veered toward efforts to damage or topple Trump’s presidency.

Persistent rumors that the Trump campaign colluded with Russia over the election became the catnip that drove reporting. At NPR, we hitched our wagon to Trump’s most visible antagonist, Representative Adam Schiff.

Schiff, who was the top Democrat on the House Intelligence Committee, became NPR’s guiding hand, its ever-present muse. By my count, NPR hosts interviewed Schiff 25 times about Trump and Russia. During many of those conversations, Schiff alluded to purported evidence of collusion. The Schiff talking points became the drumbeat of NPR news reports.

But when the Mueller report found no credible evidence of collusion, NPR’s coverage was notably sparse. Russiagate quietly faded from our programming.

It is one thing to swing and miss on a major story. Unfortunately, it happens. You follow the wrong leads, you get misled by sources you trusted, you’re emotionally invested in a narrative, and bits of circumstantial evidence never add up. It’s bad to blow a big story.

What’s worse is to pretend it never happened, to move on with no mea culpas, no self-reflection. Especially when you expect high standards of transparency from public figures and institutions, but don’t practice those standards yourself. That’s what shatters trust and engenders cynicism about the media.

Russiagate was not NPR’s only miscue.

In October 2020, the New York Post published the explosive report about the laptop Hunter Biden abandoned at a Delaware computer shop containing emails about his sordid business dealings. With the election only weeks away, NPR turned a blind eye. Here’s how NPR’s managing editor for news at the time explained the thinking: “We don’t want to waste our time on stories that are not really stories, and we don’t want to waste the listeners’ and readers’ time on stories that are just pure distractions.”

But it wasn’t a pure distraction, or a product of Russian disinformation, as dozens of former and current intelligence officials suggested. The laptop did belong to Hunter Biden. Its contents revealed his connection to the corrupt world of multimillion-dollar influence peddling and its possible implications for his father.

The laptop was newsworthy. But the timeless journalistic instinct of following a hot story lead was being squelched. During a meeting with colleagues, I listened as one of NPR’s best and most fair-minded journalists said it was good we weren’t following the laptop story because it could help Trump.

When the essential facts of the Post’s reporting were confirmed and the emails verified independently about a year and a half later, we could have fessed up to our misjudgment. But, like Russia collusion, we didn’t make the hard choice of transparency.

Politics also intruded into NPR’s Covid coverage, most notably in reporting on the origin of the pandemic. One of the most dismal aspects of Covid journalism is how quickly it defaulted to ideological story lines. For example, there was Team Natural Origin—supporting the hypothesis that the virus came from a wild animal market in Wuhan, China. And on the other side, Team Lab Leak, leaning into the idea that the virus escaped from a Wuhan lab.

The lab leak theory came in for rough treatment almost immediately, dismissed as racist or a right-wing conspiracy theory. Anthony Fauci and former NIH head Francis Collins, representing the public health establishment, were its most notable critics. And that was enough for NPR. We became fervent members of Team Natural Origin, even declaring that the lab leak had been debunked by scientists.

But that wasn’t the case.

When word first broke of a mysterious virus in Wuhan, a number of leading virologists immediately suspected it could have leaked from a lab there conducting experiments on bat coronaviruses. This was in January 2020, during calmer moments before a global pandemic had been declared, and before fear spread and politics intruded.

Reporting on a possible lab leak soon became radioactive. Fauci and Collins apparently encouraged the March publication of an influential scientific paper known as “The Proximal Origin of SARS-CoV-2.” Its authors wrote they didn’t believe “any type of laboratory-based scenario is plausible.”

But the lab leak hypothesis wouldn’t die. And understandably so. In private, even some of the scientists who penned the article dismissing it sounded a different tune. One of the authors, Andrew Rambaut, an evolutionary biologist from Edinburgh University, wrote to his colleagues, “I literally swivel day by day thinking it is a lab escape or natural.”

Over the course of the pandemic, a number of investigative journalists made compelling, if not conclusive, cases for the lab leak. But at NPR, we weren’t about to swivel or even tiptoe away from the insistence with which we backed the natural origin story. We didn’t budge when the Energy Department—the federal agency with the most expertise about laboratories and biological research—concluded, albeit with low confidence, that a lab leak was the most likely explanation for the emergence of the virus.

Instead, we introduced our coverage of that development on February 28, 2023, by asserting confidently that “the scientific evidence overwhelmingly points to a natural origin for the virus.”

When a colleague on our science desk was asked why they were so dismissive of the lab leak theory, the response was odd. The colleague compared it to the Bush administration’s unfounded argument that Iraq possessed weapons of mass destruction, apparently meaning we won’t get fooled again. But these two events were not even remotely related. Again, politics were blotting out the curiosity and independence that ought to have been driving our work.

Uri Berliner near his home in Washington, D.C., on April 5, 2024. (Photo by Pete Kiehart for The Free Press)

Uri Berliner near his home in Washington, D.C., on April 5, 2024. (Photo by Pete Kiehart for The Free Press)

I’m offering three examples of widely followed stories where I believe we faltered. Our coverage is out there in the public domain. Anyone can read or listen for themselves and make their own judgment. But to truly understand how independent journalism suffered at NPR, you need to step inside the organization.

You need to start with former CEO John Lansing. Lansing came to NPR in 2019 from the federally funded agency that oversees Voice of America. Like others who have served in the top job at NPR, he was hired primarily to raise money and to ensure good working relations with hundreds of member stations that acquire NPR’s programming.

After working mostly behind the scenes, Lansing became a more visible and forceful figure after the killing of George Floyd in May 2020. It was an anguished time in the newsroom, personally and professionally so for NPR staffers. Floyd’s murder, captured on video, changed both the conversation and the daily operations at NPR.

Given the circumstances of Floyd’s death, it would have been an ideal moment to tackle a difficult question: Is America, as progressive activists claim, beset by systemic racism in the 2020s—in law enforcement, education, housing, and elsewhere? We happen to have a very powerful tool for answering such questions: journalism. Journalism that lets evidence lead the way.

But the message from the top was very different. America’s infestation with systemic racism was declared loud and clear: it was a given. Our mission was to change it.

“When it comes to identifying and ending systemic racism,” Lansing wrote in a companywide article, “we can be agents of change. Listening and deep reflection are necessary but not enough. They must be followed by constructive and meaningful steps forward. I will hold myself accountable for this.”

And we were told that NPR itself was part of the problem. In confessional language he said the leaders of public media, “starting with me—must be aware of how we ourselves have benefited from white privilege in our careers. We must understand the unconscious bias we bring to our work and interactions. And we must commit ourselves—body and soul—to profound changes in ourselves and our institutions.”

He declared that diversity—on our staff and in our audience—was the overriding mission, the “North Star” of the organization. Phrases like “that’s part of the North Star” became part of meetings and more casual conversation.

Race and identity became paramount in nearly every aspect of the workplace. Journalists were required to ask everyone we interviewed their race, gender, and ethnicity (among other questions), and had to enter it in a centralized tracking system. We were given unconscious bias training sessions. A growing DEI staff offered regular meetings imploring us to “start talking about race.” Monthly dialogues were offered for “women of color” and “men of color.” Nonbinary people of color were included, too.

These initiatives, bolstered by a $1 million grant from the NPR Foundation, came from management, from the top down. Crucially, they were in sync culturally with what was happening at the grassroots—among producers, reporters, and other staffers. Most visible was a burgeoning number of employee resource (or affinity) groups based on identity.

They included MGIPOC (Marginalized Genders and Intersex People of Color mentorship program); Mi Gente (Latinx employees at NPR); NPR Noir (black employees at NPR); Southwest Asians and North Africans at NPR; Ummah (for Muslim-identifying employees); Women, Gender-Expansive, and Transgender People in Technology Throughout Public Media; Khevre (Jewish heritage and culture at NPR); and NPR Pride (LGBTQIA employees at NPR).

All this reflected a broader movement in the culture of people clustering together based on ideology or a characteristic of birth. If, as NPR’s internal website suggested, the groups were simply a “great way to meet like-minded colleagues” and “help new employees feel included,” it would have been one thing.

But the role and standing of affinity groups, including those outside NPR, were more than that. They became a priority for NPR’s union, SAG-AFTRA—an item in collective bargaining. The current contract, in a section on DEI, requires NPR management to “keep up to date with current language and style guidance from journalism affinity groups” and to inform employees if language differs from the diktats of those groups. In such a case, the dispute could go before the DEI Accountability Committee.

In essence, this means the NPR union, of which I am a dues-paying member, has ensured that advocacy groups are given a seat at the table in determining the terms and vocabulary of our news coverage.

Conflicts between workers and bosses, between labor and management, are common in workplaces. NPR has had its share. But what’s notable is the extent to which people at every level of NPR have comfortably coalesced around the progressive worldview.

And this, I believe, is the most damaging development at NPR: the absence of viewpoint diversity.

* * *

There’s an unspoken consensus about the stories we should pursue and how they should be framed. It’s frictionless—one story after another about instances of supposed racism, transphobia, signs of the climate apocalypse, Israel doing something bad, and the dire threat of Republican policies. It’s almost like an assembly line.

The mindset prevails in choices about language. In a document called NPR Transgender Coverage Guidance—disseminated by news management—we’re asked to avoid the term biological sex. (The editorial guidance was prepared with the help of a former staffer of the National Center for Transgender Equality.) The mindset animates bizarre stories—on how The Beatles and bird names are racially problematic, and others that are alarmingly divisive; justifying looting, with claims that fears about crime are racist; and suggesting that Asian Americans who oppose affirmative action have been manipulated by white conservatives.

More recently, we have approached the Israel-Hamas war and its spillover onto streets and campuses through the “intersectional” lens that has jumped from the faculty lounge to newsrooms. Oppressor versus oppressed. That’s meant highlighting the suffering of Palestinians at almost every turn while downplaying the atrocities of October 7, overlooking how Hamas intentionally puts Palestinian civilians in peril, and giving little weight to the explosion of antisemitic hate around the world.

For nearly all my career, working at NPR has been a source of great pride. It’s a privilege to work in the newsroom at a crown jewel of American journalism. My colleagues are congenial and hardworking.

I can’t count the number of times I would meet someone, describe what I do, and they’d say, “I love NPR!”

And they wouldn’t stop there. They would mention their favorite host or one of those “driveway moments” where a story was so good you’d stay in your car until it finished.

It still happens, but often now the trajectory of the conversation is different. After the initial “I love NPR,” there’s a pause and a person will acknowledge, “I don’t listen as much as I used to.” Or, with some chagrin: “What’s happening there? Why is NPR telling me what to think?”

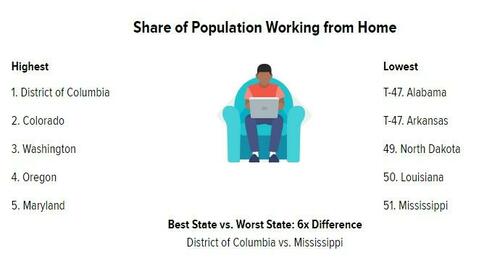

In recent years I’ve struggled to answer that question. Concerned by the lack of viewpoint diversity, I looked at voter registration for our newsroom. In D.C., where NPR is headquartered and many of us live, I found 87 registered Democrats working in editorial positions and zero Republicans. None.

So on May 3, 2021, I presented the findings at an all-hands editorial staff meeting. When I suggested we had a diversity problem with a score of 87 Democrats and zero Republicans, the response wasn’t hostile. It was worse. It was met with profound indifference. I got a few messages from surprised, curious colleagues. But the messages were of the “oh wow, that’s weird” variety, as if the lopsided tally was a random anomaly rather than a critical failure of our diversity North Star.

In a follow-up email exchange, a top NPR news executive told me that she had been “skewered” for bringing up diversity of thought when she arrived at NPR. So, she said, “I want to be careful how we discuss this publicly.”

For years, I have been persistent. When I believe our coverage has gone off the rails, I have written regular emails to top news leaders, sometimes even having one-on-one sessions with them. On March 10, 2022, I wrote to a top news executive about the numerous times we described the controversial education bill in Florida as the “Don’t Say Gay” bill when it didn’t even use the word gay. I pushed to set the record straight, and wrote another time to ask why we keep using that word that many Hispanics hate—Latinx. On March 31, 2022, I was invited to a managers’ meeting to present my observations.

Throughout these exchanges, no one has ever trashed me. That’s not the NPR way. People are polite. But nothing changes. So I’ve become a visible wrong-thinker at a place I love. It’s uncomfortable, sometimes heartbreaking.

Even so, out of frustration, on November 6, 2022, I wrote to the captain of ship North Star—CEO John Lansing—about the lack of viewpoint diversity and asked if we could have a conversation about it. I got no response, so I followed up four days later. He said he would appreciate hearing my perspective and copied his assistant to set up a meeting. On December 15, the morning of the meeting, Lansing’s assistant wrote back to cancel our conversation because he was under the weather. She said he was looking forward to chatting and a new meeting invitation would be sent. But it never came.

I won’t speculate about why our meeting never happened. Being CEO of NPR is a demanding job with lots of constituents and headaches to deal with. But what’s indisputable is that no one in a C-suite or upper management position has chosen to deal with the lack of viewpoint diversity at NPR and how that affects our journalism.

Which is a shame. Because for all the emphasis on our North Star, NPR’s news audience in recent years has become less diverse, not more so. Back in 2011, our audience leaned a bit to the left but roughly reflected America politically; now, the audience is cramped into a smaller, progressive silo.

Despite all the resources we’d devoted to building up our news audience among blacks and Hispanics, the numbers have barely budged. In 2023, according to our demographic research, 6 percent of our news audience was black, far short of the overall U.S. adult population, which is 14.4 percent black. And Hispanics were only 7 percent, compared to the overall Hispanic adult population, around 19 percent. Our news audience doesn’t come close to reflecting America. It’s overwhelmingly white and progressive, and clustered around coastal cities and college towns.

These are perilous times for news organizations. Last year, NPR laid off or bought out 10 percent of its staff and canceled four podcasts following a slump in advertising revenue. Our radio audience is dwindling and our podcast downloads are down from 2020. The digital stories on our website rarely have national impact. They aren’t conversation starters. Our competitive advantage in audio—where for years NPR had no peer—is vanishing. There are plenty of informative and entertaining podcasts to choose from.

Even within our diminished audience, there’s evidence of trouble at the most basic level: trust.

In February, our audience insights team sent an email proudly announcing that we had a higher trustworthy score than CNN or The New York Times. But the research from Harris Poll is hardly reassuring. It found that “3-in-10 audience members familiar with NPR said they associate NPR with the characteristic ‘trustworthy.’ ” Only in a world where media credibility has completely imploded would a 3-in-10 trustworthy score be something to boast about.

With declining ratings, sorry levels of trust, and an audience that has become less diverse over time, the trajectory for NPR is not promising. Two paths seem clear. We can keep doing what we’re doing, hoping it will all work out. Or we could start over, with the basic building blocks of journalism. We could face up to where we’ve gone wrong. News organizations don’t go in for that kind of reckoning. But there’s a good reason for NPR to be the first: we’re the ones with the word public in our name.

Despite our missteps at NPR, defunding isn’t the answer. As the country becomes more fractured, there’s still a need for a public institution where stories are told and viewpoints exchanged in good faith. Defunding, as a rebuke from Congress, wouldn’t change the journalism at NPR. That needs to come from within.

A few weeks ago, NPR welcomed a new CEO, Katherine Maher, who’s been a leader in tech. She doesn’t have a news background, which could be an asset given where things stand. I’ll be rooting for her. It’s a tough job. Her first rule could be simple enough: don’t tell people how to think. It could even be the new North Star.

Uri Berliner is a senior business editor and reporter at NPR. His work has been recognized with a Peabody Award, a Loeb Award, an Edward R. Murrow Award, and a Society of Professional Journalists New America Award, among others. Follow him on X (formerly Twitter) @uberliner.

And fast https://t.co/JwCLUrcTlz

— Elon Musk (@elonmusk) April 9, 2024Trafigura Gets Bullish On Power Markets As Wall Street Joins The 'Next Big Trade'

Trafigura Gets Bullish On Power Markets As Wall Street Joins The 'Next Big Trade'

Tyler Durden

Tue, 04/09/2024 - 13:35

It's becoming increasingly clear that cutting-edge chatbot providers and other AI and hyper-scaler businesses will require energy-intensive data centers to operate. This places a significant burden on an outdated electrical grid that desperately needs modernization.

In last week's note, "The Next AI Trade," we explained that soaring power demand is not just AI-related; there are multiple drivers, including onshoring trends, electrification of transportation and buildings, extreme weather, and, of course, data center demand. We also provided several investment ideas on how to capitalize on powering up America for the digital age.

"Every day, I'm surprised by how fast power consumption is growing," One River CIO Eric Peters wrote in a recent note, adding, "Take any application, add AI, and you need 7x-50x the compute power. AI is a black hole; it'll suck money out of everything else and into its vortex. The arms race between industry giants is a 20 on a scale of 1-10."

In addition to grid modernization efforts, we explained to readers in December 2020, "Buy Uranium: Is This The Beginning Of The Next ESG Craze." This is because nuclear power is clean and reliable compared to unreliable solar and wind. The latest sign that a nuclear renaissance is just beginning was a report last month from the federal government about the first-ever restart of a US nuclear power plant in southwestern Michigan.

Given all this, Wall Street is jumping on the bandwagon and seeing the same investment ideas as we see in the uranium industry and companies that will upgrade the power grid to handle EVs and AI data centers.

Richard Holtum, Trafigura's global head of gas, power, and renewables, is the most recent Wall Street analyst to recognize these emerging trends. On Tuesday, he told the audience at the Financial Times Commodities Global Summit in Lausanne, Switzerland, about his incredibly bullish views on power markets.

"Electrification of the vehicle fleet, AI — all these things are massively power-intensive," Holtum said.

Across the world, traders are building out power desks from the US to Japan as regulated electricity markets open up, allowing traders from overseas to buy and sell physical units, according to Bloomberg.

He said, "There's a growing realization that the one piece that binds the traditional fossil and the energy transition is the electron," adding, "As more and more grids get liberalized, the trading sphere gets even larger."

He also noted that the nuclear power industry in the US could tremendously benefit from soaring power demand.

Will there be an 80% growth in US power consumption in the next five years?

Richard Holtum, global head of gas, power and renewables @trafigura, says this increase could help the nuclear industry in the US. #FTCommodities pic.twitter.com/n1sVteaKEt

Last week, Patti Poppe, the chief executive officer of Pacific Gas & Electric, told a Stanford University forum that nuclear power should continue to be part of the state's power generation mix as efforts to decarbonize the grid move forward.

And Morgan Stanley analyst Carlos De Alba recently conveyed his optimistic outlook for the US metals and mining sector because investment levels in the industry have reached their lowest level in decades. He believes the sector is poised for massive investments as reshoring rare earth mineral supply chains goes into overdrive.

What's clear is that electrifying the economy will require an upgraded grid to handle the new electrical load - and the most reliable form of clean energy to power it all is nuclear.

Ugly 3Y Auction Tails The Most In Over A Year As Foreign Buyers Flee Ahead Of CPI

Ugly 3Y Auction Tails The Most In Over A Year As Foreign Buyers Flee Ahead Of CPI

Tyler Durden

Tue, 04/09/2024 - 13:29

The first coupon auction of the week and the month is in the history books and boy, was it ugly: maybe it was nerves ahead of tomorrow's CPI, maybe it was the realization that there is a lot more where this came from. A LOT more.

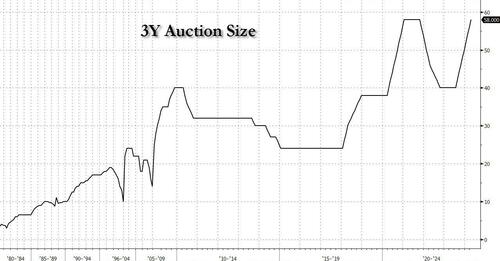

With $58 billion in 3Y paper for sale today, tied for the biggest amount on record for sale in the tenor...

... the reception was anything but warm.

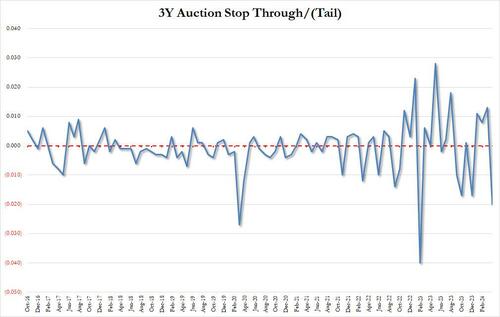

The high yield of today's auction was 4.548%, up markedly from last month's 4.256% and the highest since November's 4.701%, the auction tailed the When Issued 4.528% by 2.0bps, which was not only the first tail after 3 stopping though auction, but the biggest tail since February 2023.

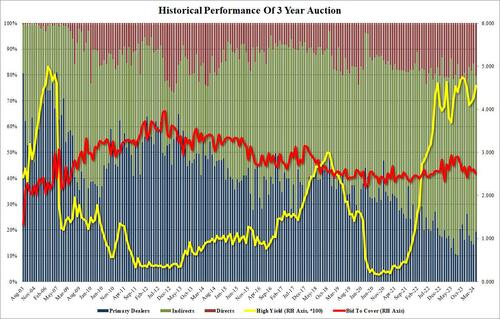

The bid to cover dropped to 2.50% from 2.60%; it was the lowest since December's 2.42 and well below the six-auction average of 2.584%.

The internals were also ugly, with foreign demand fading as Indirects took down just 60.3%, the lowest since December's 52.1 (and below the 62.3 recent average), leaving 20.4 to Directs, the most since December, and Dealers awarded 19.31T, the most since, you guessed it, December.

In response to the auction, yields - which were sliding all day in a flight to safety as stocks dumped - moved higher by about 2 bps although remained near session lows amid the general selling everywhere else.

That said, if tomorrow's CPI ends up being hot again, watch out below as all of today's buyers end up being deeply underwater in less than 24 hours.

Musk Says Starlink Will Be Free For Brazil Schools If Government Cancels Contract

Musk Says Starlink Will Be Free For Brazil Schools If Government Cancels Contract

Tyler Durden

Tue, 04/09/2024 - 13:15

Authored by Stephen Katte via The Epoch Times (emphasis ours),

SpaceX CEO Elon Musk has said he will provide Starlink services free of charge for schools in Brazil if the government chooses to follow through and cancel a contract for the service in the country.

Many schools in Brazil have reported using the company to provide internet access to their citizens. Starlink terminals connect to the company’s satellites in low Earth orbit and provide high-speed communications.

Brazil’s government has reportedly announced plans to suspend all contracts with Starlink. Prompting Mr. Musk to offer the service free of charge.

“Starlink will provide free Internet for schools in Brazil if the government won’t honor their contract,” he said in an April 8 social media post.

Starlink will provide free Internet for schools in Brazil if the government won’t honor their contract

— Elon Musk (@elonmusk) April 9, 2024The moves come amid a growing stoush between social media company X, also owned by Mr. Musk, and the Brazilian government.

According to an April 6 post on the platform, the global affairs team announced they were being “forced by court decisions to block certain popular accounts in Brazil.”

“We do not know the reasons these blocking orders have been issued. We do not know which posts are alleged to violate the law. We are prohibited from saying which court or judge issued the order, or on what grounds,” the post said.

The global affairs team claimed the company had been threatened with fines if they didn’t comply with the order. They also said they were unable to provide a list of which accounts were impacted.

“We believe that such orders are not in accordance with the Marco Civil da Internet or the Brazilian Federal Constitution, and we challenge the orders legally where possible,” the post from the global affairs team said.

“The people of Brazil, regardless of their political beliefs, are entitled to freedom of speech, due process, and transparency from their own authorities.”

The announcement came after a report by investigative journalist Michael Shellenberger and colleagues David Ágape and Eli Vieira, titled “Twitter Files Brazil.”

Mr. Shellenberger said that sitting members of Brazil’s Congress and journalists were among those named by Brazil’s highest court for censorship. He has shared his findings on X.

CONTEXT: Brazil’s Supreme Court and Superior Electoral Court

Seven justices comprise Brazil’s Superior Electoral Court (TSE).

Three of those justices are also members of the Supreme Court (STF).

One of them, Alexandre de Moraes, presides over the TSE.

Here's background on…

Mr. Musk announced soon after he had removed all content restrictions in Brazil in defiance of the order.

As a result, Brazilian Supreme Court Justice Alexandre de Moraes opened a probe into Mr. Musk for alleged obstruction of justice after he challenged a court order requiring the removal of certain X accounts.

In his decision on April 7, Justice de Moraes said Mr. Musk will be probed for alleged obstruction of justice, criminal organization, and incitement.

Mr. Musk has made serious allegations of corruption against Justice de Moraes and Brazilian President Luiz Inácio Lula da Silva. In a follow-up April 8 post, Mr. Musk claims that events have since escalated and all Twitter Brazil employees are in danger of arrest. Once safe, he will release the information proving his allegations.

“We need to get our employees in Brazil to a safe place or otherwise not in a position of responsibility, then we will do a full data dump,” he said.

“They have been told they will be arrested. Save the Brazilian X employees.”

We need to get our employees in Brazil to a safe place or otherwise not in a position of responsibility, then we will do a full data dump

— Elon Musk (@elonmusk) April 9, 2024Student Loan Inflation, Here It Goes Again

Student Loan Inflation, Here It Goes Again

Tyler Durden

Tue, 04/09/2024 - 12:25

As the Democratic Party has shifted away from its traditional base of working-class and middle-class Americans, to an increased reliance on college professors, students, and highly educated but low-paid professions, such as social workers, a new policy has risen to prominence: student loan forgiveness.

Borrowed money to advance your career or to study something you got pleasure from but don’t want to pay your loans back?

The new favorite argument by progressive policymakers is that you shouldn’t have to; the taxpayers can take the financial hit for you.

President Biden early in his term tried to deliver on that left-wing commitment by unilaterally canceling $400 billion in student loans. Biden claimed that the Higher Education Relief Opportunities For Students Act, which allowed the Secretary of Education to modify loans in response to national emergencies, combined with the pandemic coronavirus let him waive and modify student loans. The Supreme Court rejected his interpretation of that law.

Now, President Biden is back at it trying for another round of student loan forgiveness despite the mountains of criticism earlier actions took. Beyond the legal criticisms, policy experts have pointed out that student loan forgiveness is regressive because much of the debt is held by students who borrowed tens of thousands to go to graduate school, some of whom will go on to lucrative careers as doctors, dentists, lawyers, and more. Further, when debtors no longer devote part of their budget to repaying loans, this will free up their spending on other goods and services. The influx of new dollars chasing goods and services will make the prices increase in general. This is another inflation-pushing policy.

On Monday, April 8, Biden revealed the details of his new student loan forgiveness plan. It involves several planks. One plank would allow wiping away tens of thousands of accrued interest for borrowers and would extend forgiveness to relatively wealthy borrowers- couples making almost a quarter of a million dollars annually would be eligible. It would also reward borrowers who delayed paying back their loans, providing forgiveness to borrowers who still have not repaid their loans after 20 years for undergraduate students, or 25 years for undergraduate students.

The legal basis for this executive action is a law from the 1960s, the 1965 Higher Education Act, which as written allows the Secretary of Education to amend student loan terms.

When Senator Elizabeth Warren ran for president, she argued that this meant the Secretary of Education could be ordered by the president to forgive student loan borrowers en masse.

Perhaps the worst thing about these student loan forgiveness moves for the broader public is that even if courts limit or strike down some of these executive actions, student loan borrowers, to the extent that they are rational, should price in a now higher probability that at some point a Democratic president will try to bail out their loans, no matter how regressive such a policy might be.

These “rational expectations” that student loan borrowers now have an increased probability of a sudden windfall in the form of student loan forgiveness, should encourage them to save less, deprioritize paying off loans they voluntarily took, and increase their spending on consumption.

This increased consumption is rational already and encouraging additional dollars to chase the same supply of goods and services will drive inflation.

Another major downside of these student loan forgiveness plans is how they might encourage borrowers to run up higher tabs because they know there is some possibility that Biden or some other left-wing politician might waive their loans. While college students might reasonably borrow loans to pay for educational programs, each dollar borrowed with under market rates or forgiven by the federal government is fundamentally paid for by the rest of society. Students might also rationally borrow money they don’t strictly need for educational purposes to increase their standard of living, a practice that actually has sound economic logic and is known as consumption smoothing. However, to the extent this practice increases due to the risk of student loan forgiveness it will just be another factor propping up the painful Biden-esque levels of inflation we are already stuck with.

Until Congress changes the law to prevent unilateral executive action on student loan forgiveness or proponents of it pay a heavy political cost, inflation will be higher than it should be due to the specter of student loan forgiveness.

Jack Smith Urges Supreme Court To Reject Trump's Presidential Immunity Claim In Final Filing

Jack Smith Urges Supreme Court To Reject Trump's Presidential Immunity Claim In Final Filing

Tyler Durden

Tue, 04/09/2024 - 11:45

Authored by Stephen Katte via The Epoch Times,

Special counsel Jack Smith in his final filing before the hearing is urging the Supreme Court to reject former President Donald Trump’s presidential immunity claim and deny any motions to delay a trial on charges related to the 2020 federal election conspiracy case.

Prosecutors from the DOJ allege President Trump attempted to overturn the 2020 election result on Jan. 6, 2021, charging him with four counts of conspiracy and obstruction.

Former President Trump has denied he did anything wrong by calling for transparency and audits of the vote counts in swing states, and maintains presidential immunity for his actions on that day, which prevents prosecution for any actions he took while still in the top job.

In a fresh court brief on April 8, Mr. Smith pressed that President Trump’s argument for presidential immunity over official acts as president has no grounding in the Constitution, the nation’s history, or Americans’ understanding that presidents are not above the law.

“The President’s constitutional duty to take care that the laws be faithfully executed does not entail a general right to violate them,” Mr. Smith said in the brief.

“The Framers never endorsed criminal immunity for a former President, and all Presidents from the Founding to the modern era have known that after leaving office they faced potential criminal liability for official acts.”

According to Mr. Smith, former President Richard Nixon’s official conduct revealed during the Watergate scandal is the closest historical precedent for this situation.

Mr. Smith says President Nixon eventually accepted a pardon from his successor, former President Gerald Ford, and that “his acceptance of a pardon implied his and President Ford’s recognition that a former President was subject to prosecution.”

“Since Watergate, the Department of Justice has held the view that a former President may face criminal prosecution, and Independent and Special Counsels have operated from that same understanding,” he said.

Mr. Smith claims that despite President Trump’s claim of presidential immunity, all former presidents knew and wholly understood they were open to facing criminal charges for conduct while in the White House.

“The effective functioning of the presidency does not require that a former president be immune from accountability for these alleged violations of federal criminal law,” he said.

“To the contrary, a bedrock principle of our constitutional order is that no person is above the law, including the president.”

Trump Brief Argues Presidents Need Immunity to Function Effectively

Former President Trump has continued to argue that official acts by presidents should have immunity from criminal prosecution. Last month, he asked the Supreme Court to hold that he and other former presidents enjoy absolute criminal immunity from prosecution for official acts during their time in office.

According to him, from 1789 to 2023, no former or sitting president has faced criminal charges for their official acts, and for good reason.

“The President cannot function, and the Presidency itself cannot retain its vital independence if the President faces criminal prosecution for official acts once he leaves office,” President Trump’s brief to the Court says.

“The threat of future prosecution and imprisonment would become a political cudgel to influence the most sensitive and controversial Presidential decisions, taking away the strength, authority, and decisiveness of the Presidency.”

The attorneys general from 18 Republican states have submitted an amicus brief in support of President Trump’s argument, saying Mr. Smith’s legal efforts against the presumed GOP 2024 presidential nominee is partisan in nature.

“Prosecutors purport to represent the People, but their approach toward President Trump suggests ulterior motives. The Court should take seriously the risk that exposing former Presidents to criminal liability will enable partisan abuse,” they wrote.

Attorneys for President Trump on March 19 argued that presidential immunity is necessary in the context of criminal prosecution to prevent cycles of recrimination and even political “blackmail” of sitting presidents.

The Supreme Court is set to hear oral arguments on April 25. It will examine what presidential immunity covers and how it should affect the nation’s separation of powers in future administrations.

...

The outcome for the case could impact President Trump’s other legal battles, in which he also argues presidential immunity as a defense.

What Do They Know: Goldman, Amex Quietly Cut Rates On Savings Accounts... Is The Fed Next?

What Do They Know: Goldman, Amex Quietly Cut Rates On Savings Accounts... Is The Fed Next?

Tyler Durden

Tue, 04/09/2024 - 11:30

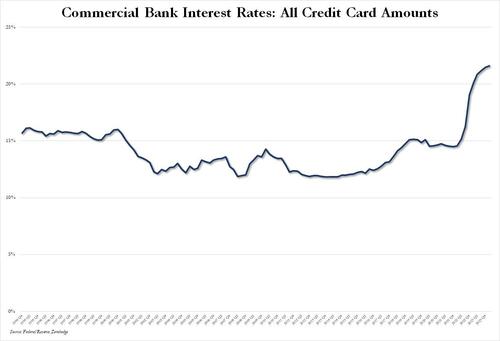

It is not a secret that the biggest market debate of 2024 is when - and even if - the Fed will cut rates: after all, with the US labor force adding hundreds of thousands of illegal immigrants, and core CPI bubbling along at a blistering hot ~4% pace, many - such as Larry Sanders and even Neel Kashkari - are warning that the Fed does not need to cut rates (in fact, a rate hike may be prudent). On the other hand, we have a growing roster of Democrat politicians (most notably Senator Elizabeth "Pokarenhontas" Warren) demanding Powell cuts rates to "help address the affordable housing crisis" and also reduce the record high credit card APRs for their voters.

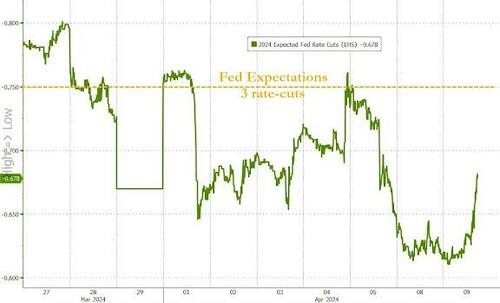

It's not just the politicians: the dovish Fed itself in its latest dot plot indicated that it still expects to cut rates 3 times in 2024, a schedule which - when accounting for the November elections - would mean the Fed has to start cutting in June if it wishes to avoid delaying the start of the easing cycle and also avoid the impression that it is hoping to influence the outcome of the presidential elections (much to the chagrin of Bill Dudley who wrote a 2019 op-ed demanding Powell do just that).

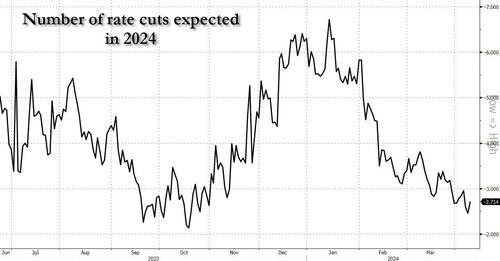

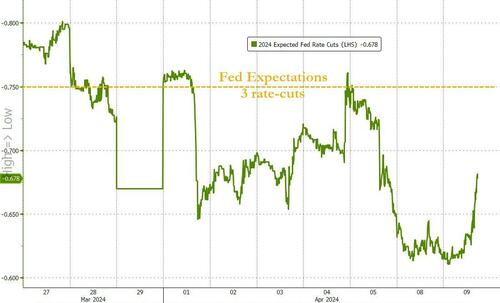

Yet even as the market has recently taken a machete to its own dovish expectations, and after pricing in more than 6 rate cuts in 2024 at the start of the year, has since trimmed its forecast to less than 3 full cuts...

... or even fewer than the Fed has telegraphed...

... suggesting that the market is convinced that the Fed is wrong, the economy will run hotter than expected, and Powell will be forced to delay, or even scrap, the easing cycle.

But maybe not, because while signs mounts - especially in the realm of higher commodity prices - that a June cut is a pipe dream, some financial institutions are aggressively taking matters into their own hands: consider that in the last week, not one but two financial giants, have quietly cut the interest rate they pay on their "high yield" savings accounts, a step that usually takes place just around the time they are dead certain the Fed will cut rates or right after.

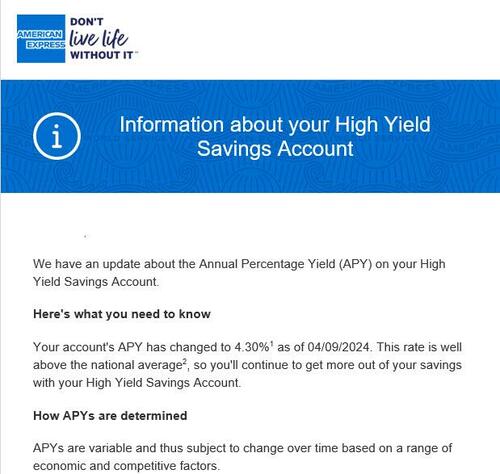

We are talking about Goldman and American Express: starting with the former, last Wednesday, Goldman’s consumer bank Marcus lowered the rate on its high-yield savings account for the first time in more than three years, trimming the APR on the bank’s flagship product to 4.4%, down from 4.5% in March. It was the first cut since November 2020, when Goldman lowered the rate from 0.6% to 0.5%.

“Our current rate places us ahead of the majority of our peers,” a Goldman spokesperson told Bloomberg in an email when asked to explain the rate cut. “We will continue to focus on providing value to our customers and growing our Marcus deposits business which is a priority for the firm.”

Well, you can only keep growing deposits if the rate cut does not lead to deposit outflows... which can only happen if Goldman knows that everyone else is also about to cut rates, following in the footsteps of the Fed

And then moments ago, doubling down on the clear dovish trend that is suddenly sweeping banks for "reasons unknown", American Express did the same, when it cut the rate on its High Yield Savings Account to 4.30% from 4.35%.

Or maybe the cuts are not for "reasons unknown": maybe the banks realize that they can start cutting rates because soon everyone else will do the same for one simple reason: the Fed will fire the starting pistol to an easing cycle so many believe will start momentarily.

As Bloomberg notes, the move signals that financial institutions are on alert for when they can lower interest rates for individuals, and the fact that not one but two of the biggest players in the game just did that, should be enough to raise a lot of eyebrows about the Fed's rate cutting plans...

One More Hot CPI Print Could Prove Existential Difference Between “Being And Nothingness” For Traders

One More Hot CPI Print Could Prove Existential Difference Between “Being And Nothingness” For Traders

Tyler Durden

Tue, 04/09/2024 - 11:05

By Michael Every of Rabobank

Being and Nothingness

With a solar eclipse as the epic backdrop, and 10-year US Treasury yields over 4.40% and testing towards 4.50% despite (or because of?) pledged Fed rate cuts, markets are focused on US CPI tomorrow. Without getting into omens or phenomenological ontology, or the workings of carry trades, one more hot CPI print could prove the existential difference between “being and nothingness” for some trades, especially if it’s seen as a harbinger of sustained inflation pressure rather than (yet another) ‘one off’. So, let’s try to focus on what matters.

Tellingly, as the Guardian notes, in August 1943, the French publisher of Jean-Paul Sartre’s new 700-page philosophical tome, ‘Being and Nothingness’, noticed it was selling unexpectedly well. Did his pretentious thoughts resonate with those enduring Nazi occupation? “Not quite. It sold well because the book weighed exactly one kilogram and so was a perfect substitute for copper weights, which had been sold on the black market or melted down for ammunition.” Today, we also don’t have time for pretentious sophistry: markets need to look at key weights and measures - and copper and ammunition.

Oil remains above $90; the Middle-East is on a knife-edge; Ukraine is striking Russian oil refineries, prompting the latter to ask Kazakhstan for energy; and Rabo’s Joe DeLaura has revised his Brent forecasts up to $89.5 for 2024, $93.5 for 2025, and $98.75 in 2026. Moreover, the cargo ship that brought down Baltimore’s Key Bridge *may* have suffered a power failure due to dirty fuel, as a similar containership tragedy was nearly just repeated at New York’s Verrazzano Bridge. If this is human error twice, it’s bad; but dirty fuel, it would suggest sabotage. In which case, things go from bad to much, much worse. One hopes that was not the case.

Russia claims the Tajiks who carried out the attack on the Crocus theatre were paid by Kyiv. Former president Medvedev blames the West. A Financial Times life & arts op-ed from Janan Ganesh, ‘The price of peace is stagnation’, zeitgeists, “I have no certainty that a war would be creative stimulus, just a nauseous feeling that we are due to find out.”

Japan is being invited to join AUKUS, bringing that defence pact up to China’s doorstep, as the White House is about to warn China it stands behind the Philippines in the South China Sea. This is despite the US Navy running years behind on producing the nuclear submarines it had already promised Australia. And it’s as the CSIS warns, “China’s defence industrial base is operating on a wartime footing, while the US defence industrial base is largely operating on a peacetime footing… China has a shipbuilding capacity that is roughly 230 times larger than the US.”

With Canada also looking at joining AUKUS, can the EU see an Asia-Pacific-focused alliance that could leave Europe to do its own heavy lifting vs. Russia, at vast cost? The latest €7bn German order of two new frigates is a drop in the ocean given the Houthis now claim they can strike the Indian Ocean too, which means container shipping may not be safe trying to get to the EU round Africa either. The Financial Times is also warning that the EU cannot rely on Chinese cotton, a byproduct of which, nitrocellulose, is used in ammunition, as the price of copper soars.

US Treasury Secretary Yellen just returned from China, where Bloomberg suggests “warming ties” between the two economic giants: that author only needs to wear a T-shirt all next winter, as they are such a good judge of “warm” vs. cold. Indeed, Bloomberg also notes, ‘Yellen Threatens Sanctions for China Banks That Aid Russia War’, which is not very cuddly. Moreover, David Fickling says, ‘Yellen junks 200 years of economics to block China clean tech’. Cold once again though, sorry. Not about blocking, but 200 years of economic theory.

Free trade is only a few decades old and has always collapsed when tried. It started with the UK in 1846, at gunpoint; was never embraced by the US; and in Europe, reversed into imperialism in the 19th century, then WW1; it failed with communism/fascism and WW2; trade from 1945-1973 was hardly free under Bretton Woods, before that paradigm also collapsed; and only after the end of the Cold War did it get tried properly, by those who thought history was over. Yet it’s failing again due to mercantilism and national security concerns. There is nothing new under the solar eclipse.

China has offered bilateral discussions over what the US (and Europe) calls its over-production. However, immediate follow-up statements, the clear heuristic, and the domestic imperative argue nothing will change without Western action, i.e., tariffs, which would up-end markets even if they don’t flow through to geopolitics directly: recall 1985‘’s Plaza Accord, and the less well-known 1995 ‘Inverse Plaza’, where the US dollar soared, leading to the Asian Crisis in 1997?

Even Wall Street titan JP Morgan CEO Jamie Dimon just made the following public statement, which I won’t apologize for quoting at length given what he says:

“We may be entering one of the most treacherous geopolitical eras since World War II… We remain wary of economic prognosticating… Instead, we look at a range of potential outcomes for which we need to be prepared. Geopolitical and economic forces have an unpredictable timetable - they may unfold over months, or years, and are nearly impossible to put into a one-year forecast. They also have an unpredictable interplay: For example, the geopolitical situation may end up having virtually no effect on the world’s economy or it could potentially be its determinative factor.

Many key economic indicators today continue to be good and possibly improving, including inflation. But when looking ahead to tomorrow, conditions that will affect the future should be considered. For example, there seems to be a large number of persistent inflationary pressures, which may likely continue. All of the following factors appear to be inflationary: ongoing fiscal spending, remilitarization of the world, restructuring of global trade, capital needs of the new green economy, and possibly higher energy costs in the future (even though there currently is an oversupply of gas and plentiful spare capacity in oil) due to a lack of needed investment in the energy infrastructure.

In the past, fiscal deficits did not seem to be closely related to inflation. In the 1970s and early 1980s, there was a general understanding that inflation was driven by “guns and butter”; i.e., fiscal deficits and the increase to the money supply, both partially driven by the Vietnam War, led to increased inflation, which went over 10%. The deficits today are even larger and occurring in boom times - not as the result of a recession - and they have been supported by quantitative easing, which was never done before the great financial crisis...

Therefore, we are prepared for a very broad range of interest rates, from 2% to 8% or even more, with equally wide-ranging economic outcomes - from strong economic growth with moderate inflation (in this case, higher interest rates would result from higher demand for capital) to a recession with inflation; i.e., stagflation. Economically, the worst-case scenario would be stagflation, which would not only come with higher interest rates but also with higher credit losses, lower business volumes and more difficult markets. Under these many different scenarios, our company would continue to perform at least okay. Importantly, being prepared means we can continue to help our clients no matter what the future portends.”

So, it seems we are at an historic juncture on multiple, conflating fronts; and past history does not suggest this ends with Goldilocks scenarios for markets. Something is going to give. Indeed, the real risk is that this is about being or nothingness: NOT “who is rate cuts?”

Something's Breaking...

Something's Breaking...

Tyler Durden

Tue, 04/09/2024 - 10:55

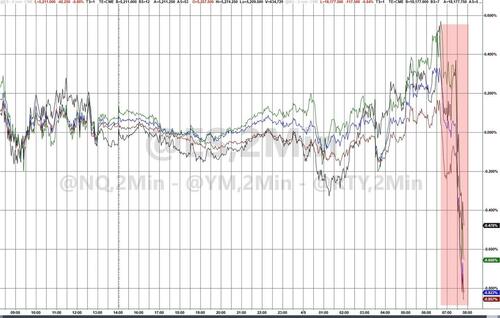

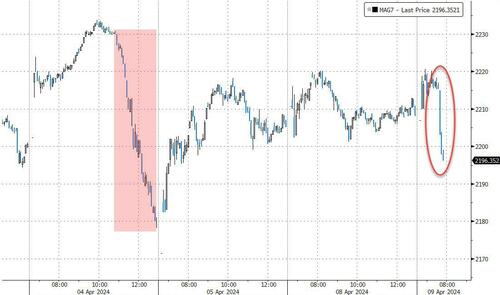

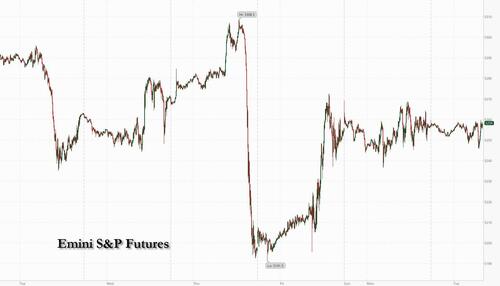

Last Thursday we got a 'glimpse'...

Is today another?

No FedSpeak. No Macro. No major geopol issues.

But, stocks suddenly puked...

Led my MAG7 stocks...

Source: Bloomberg

Notably, 0-DTE traders were buying puts aggressively out of the gate...

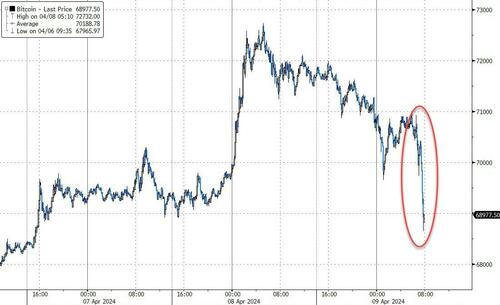

As Crypto was slammed...

Source: Bloomberg

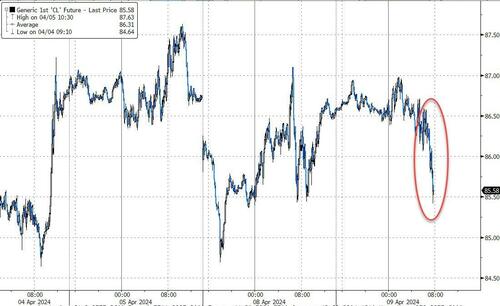

Oil prices tumbled...

Source: Bloomberg

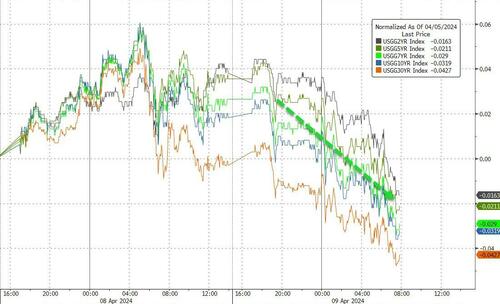

All as Treasury yields actually fell...

Source: Bloomberg

... and rate-cut expectations rose...

Source: Bloomberg

Anxiety ahead of tomorrow's CPI?

GM's Cruise Plans To Restart Robotaxi Operations Across Phoenix

GM's Cruise Plans To Restart Robotaxi Operations Across Phoenix

Tyler Durden

Tue, 04/09/2024 - 09:25

Cruise, the driverless car company owned by General Motors, is preparing to resume robotaxis operations in Phoenix, Arizona. This is a crucial step before resuming service nationwide following the grounding of the taxi fleet after a pedestrian in San Francisco in October was dragged under one of the vehicles.

Sources familiar with Cruise told Bloomberg that the company is planning to announce the resumption of robotaxi service in Phoenix sometime on Tuesday. They said Cruise officials have been talking with government leaders in dozens of US cities before the planned restart.

"We are in the process of meeting with officials in select markets to gather information, share updates and rebuild trust," Cruise spokesman Pat Morrissey wrote in an emailed statement, adding there was no timeline on when operations would begin.

What led to Cruise's nationwide grounding of robotaxis was an October incident when one of the vehicles ran over a pedestrian in San Francisco. California regulators immediately investigated the incident and found that the company withheld key video and details, which resulted in the suspension of Cruise's license in California. Shortly after, Cruise suspended all operations nationwide, reshuffled top management, and added a new chief safety officer.

Before last year's accident, the company had hundreds of robotaxis operating across San Fran, Austin, Houston, and Phoenix.

Meanwhile, crowds in downtown San Fran destroyed a Waymo self-driving car earlier this year.

BREAKING: An autonomous Waymo vehicle is intentionally set on fire in Chinatown, according to SF Fire. Firefighters said they got reports around 10 people were involved.

Waymo said “a crowd surrounded and vandalized the vehicle, breaking the window and throwing a firework … pic.twitter.com/6QN2jTppRu

Days ago, Elon Musk wrote on X, "Tesla Robotaxi unveil on 8/8."

Stocks Face Rug-Pull From Extreme Momentum Move

Stocks Face Rug-Pull From Extreme Momentum Move

Tyler Durden

Tue, 04/09/2024 - 09:05

Authored by Simon White, Bloomberg macro strategist,

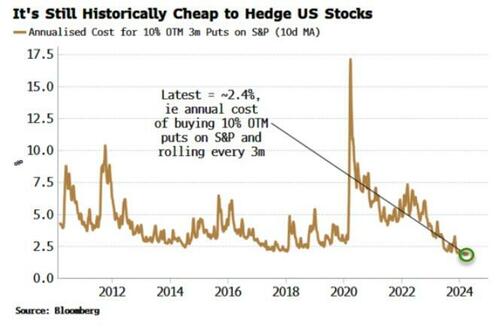

Momentum stocks are very stretched. A reversal exposes the equity market to the risk of a potentially sizable correction, with rising inflation a potential catalyst. Portfolios taking advantage of cheap hedges are better placed to weather any fall in prices.

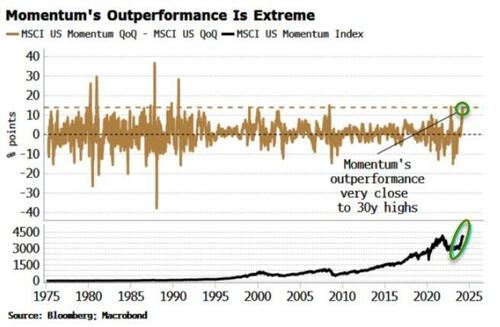

Momentum is leading the charge in the current rally, with it being the best performing of the most popular types of factor. But the trend is looking increasingly extended.

On a quarterly basis, you have to go back over 30 years before you decisively see more extreme outperformance in the factor.

The two most recent times showing a similar degree of relative upside were March 2022 and June 2008, neither of which were particularly propitious for the stock market.

That’s a risk that it would be folly to ignore, especially as — even if the market escapes unscathed — portfolio hedges remain cheap (although that is already changing as vol begins to rise — discussed here last month).

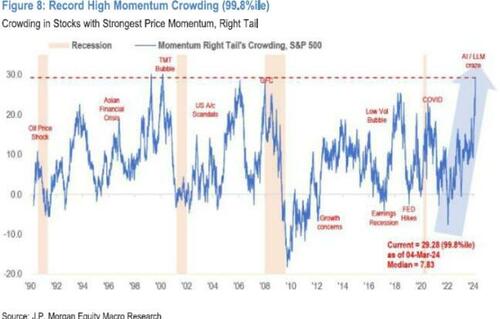

Momentum’s popularity means when the unwind comes, it has the potential to be severe. Hedge-fund portfolios carry a record tilt to momentum, according to Goldman Sachs.

Source: Goldman Sachs

Furthermore, JPMorgan sees record high crowding in momentum stocks (i.e. stocks that are part of momentum-factor portfolios).

Source: JP Morgan

Momentum’s blessing is also its curse. Momentum begets momentum, driving the market yet higher. But when the trend changes, momentum strategies can quickly go into reverse, selling stocks that are falling. In some cases, that can cause the market to correct, or worse. That risk is especially elevated when everybody’s in the same trade, as is the case today.

The prognosis is not good from a historical standpoint. The quarterly outperformance of MSCI’s momentum factor is at 13 percentage points. The forward return of the MSCI US is negative on a one and three-month basis when the quarterly outperformance is more than 10 percentage points, and it is well under the average on a six-month horizon. History is telling us too much momentum is a bad thing.

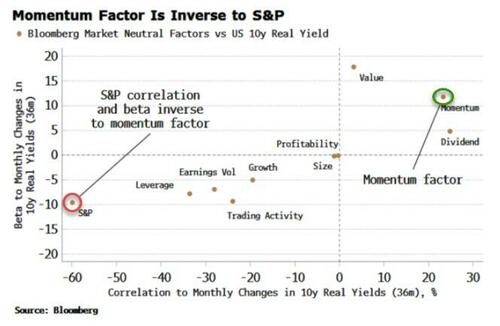

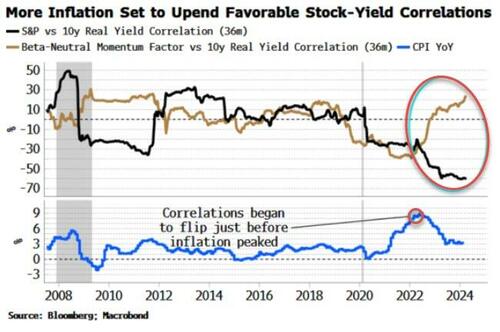

But it could be even worse given the current set up. Momentum is a key reason why the stock market has managed to rally despite elevated and rising yields. Of the most common factors (using the Bloomberg market-neutral factor indexes), momentum currently has the highest beta-and-correlation combination to changes in US 10-year real yields.

This is almost exactly inverse to the S&P, which has a very negative correlation and beta to 10-year real yield changes. It is unusual to have this combination. But it is a mix that has allowed stocks to continue rallying despite higher real yields.

Why? In the months when yields have risen, the index was down slightly, but the momentum factor was up strongly. In months when yields were down, the momentum factor fell by more than the index rose. But as yields increased in about twice as many rolling-month periods as they fell since the rally began in October 2022, overall the market has been able to rise — despite real yields rising over 150 bps.

The positive yield-versus-momentum correlation and the negative yield-versus-index correlation started to develop at the beginning of 2022, before inflation had topped, but around the time when the peak was soon anticipated. A re-acceleration in inflation would likely trigger a reversal in this trend, with elevated real yields quickly becoming a problem for stocks.

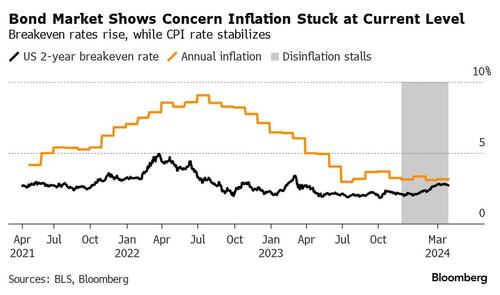

We will get March data for US CPI on Wednesday. Disinflation has already stalled, while leading indicators see a re-rise in inflation.

Assets are not priced for this eventuality. Among the biggest stocks in many momentum portfolios are tech firms, such as Nvidia, Meta and Broadcom, which have high duration and are therefore in the inflation headlights. With such extreme crowding in the momentum space, a re-increase in CPI has the potential to trigger a selloff that could develop into a nasty correction, or worse.

Top 10 Stocks in iShares MSCI US Momentum Factor ETF

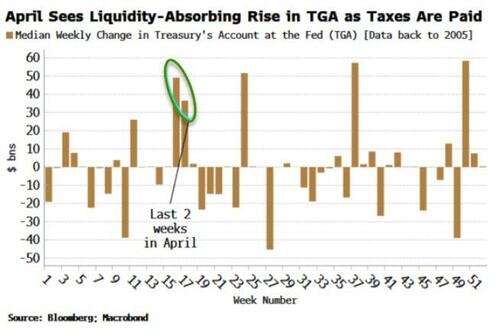

It comes at a time of potential short-term headwinds from liquidity as taxes are paid to the Treasury. The Treasury General Account at the Federal Reserve has its largest average two-week rise in the second half of April — leading to the removal of market liquidity, all other things equal — until the Treasury re-injects the money back into the system.

It’s probably not enough to derail the bull market as recession risk remains low and excess liquidity is supportive, but that doesn’t mean it won’t be uncomfortable.

Equity hedges, though, still remain cheap.

Other hedges include VIX call options (vol of vol remains low), short credit, and bond volatility.

Momentum signals for US stocks, such as Z scores of returns, look to have peaked and are rolling over. That brings forward the time when systematic strategies such as CTAs start to exit high-momentum and crowded stocks.

A trickle of selling could turn into a flood. Momentum begets momentum — until it doesn’t.

In The Next Several Weeks, We Could See $300 Billion Of Liquidity Leaving The System

In The Next Several Weeks, We Could See $300 Billion Of Liquidity Leaving The System

Tyler Durden

Tue, 04/09/2024 - 08:25

Submitted by Larry McDonald, creator of the Bear Traps Report and author of the newly published book "When Markets Speak" which has been #1 on Amazon over the last week across most non-fiction, finance categories.

What’s Under the Surface?

The heart of “conditioning bias” comes down to one sentence. The longer something works, the more players get drawn into playing the game. We know the junkies are on every street corner these days buying call options when the VIX is up 29% since late December with equities as measured by the S&P 500 – up just a touch more than 9% higher.

Over the last 30 years — most of the time, the CBOE Volatility Index has been supported by investors looking for downside protection in buying puts. But 2024 is much like 1999. For most of that year, the same thing occurred. Today, many players on the field say “greed is good” and they’re all buying upside.

They Love to Buy the 20 Day Moving Average

As the market grinds higher – more and more capital came into the hands of algos and quants buying the 20-day moving average. This is an important area to keep an eye on. There are so many players involved, that a violation of the 20-day moving average will likely come with a meaningful flush lower.

What Could Alter the Equation?

In the next several weeks, we could see about $300 billion of liquidity leaving the system. This is in large part due to the tax deadline on April 15 (see "$265 Billion In Capital Gains Tax Selling: Morgan Stanley Warns Momentum Mauling Is Coming, Thanks To The IRS"). We should expect large tax revenues, in part because taxpayers have significant capital gains from the 2023 equity bull run. Treasury bill issuance will flip negative in Q2 to the tune of about $150 billion as the government runs a budget surplus for a cup of coffee. Add to that the $95 billion in monthly QT (quantitative tightening, Fed balance sheet reduction) and we could see $250 billion of liquidity drain. On top of that, this month about $75 billion of the emergency bank lending facility (BTFP loans) expired and since the facility is now closed, they may not get renewed. This causes another contraction in bank reserves.

Keep in mind, that S&P 500 companies are still in the buyback blackout period, which means that they cannot buy back their stock until they have reported earnings. Stock buybacks are about $100BN per month, so this upward pressure on stocks is currently gone.

Equity Volatility is Cheap vs. Encroaching Risks

The combination of the cocktail ingredients listed above makes the market very vulnerable and at risk of a larger drawdown if any geopolitical risk comes to the surface. Each week, Iran and Israel look toward retaliation, and the probability of escalation is rising. Brent is up nearly 30% since December, putting significant pressure on higher bond yields. Over the same period, the yield on U.S. 10-year Treasuries has moved from 378bps (3.78%) to 440bps (4.40%).

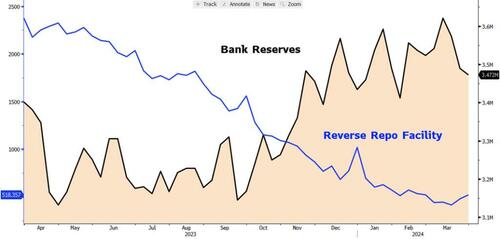

One of the biggest drivers of the stock market since early 2023, and especially since late October, has been liquidity. In an election year of course, Treasury Secretary Yellen and Fed Chair Powell have carefully rebuilt a big chunk of the excess liquidity that underpinned the stock market rally. The two main reasons for the liquidity boost have been to — a) stabilize the banking system after SVB (Silicon Valley Bank) blew up a year ago and — b) to suppress volatility in the election year. A large amount of that liquidity has come from the Reverse Repo Facility (RRP). This is a facility the Fed brought to life in 2020 to mop up some of the excess liquidity from all the Fed’s juicy new programs used to stabilize the financial system during the Covid Financial Panic.

Pick up our latest book “When Markets Speak“ which has been #1 on Amazon over the last week across most non-fiction, finance categories.

Remember, the Fed injected $3.3T of liquidity into the system that year. Fast forward to the end of 2022, and there was almost $2.5T in this RRP facility. Ever since, Treasury Secretary Yellen has been using this money in this honey pot, the RRP to finance her ~$2.5T of bill issuance. The way this works is that when the Treasury ramps up bill issuance, it will push up bill yields. At some point that yield we go above the rate on these reserve balances in the RRP. This is what the Fed pays investors, mostly money market funds, to keep money in the RRP. These investors get lured into the bills market with its higher rates and they take their money out of the RRP and buy bills with it. The money in the RRP is not considered to be part of overall liquidity, so if that money leaves the RRP and enters the bills market, it adds to the liquidity pool. Much of this money has ended up in a special component of the commercial banks’ balance sheet called the reserve balance held at the Fed. In the past, the Fed injected liquidity into the system via QE, which also increased these reserves. But in the last year, the bank reserves expanded primarily from the RRP depletion, and the Fed’s introduction of the Bank Term Funding Program in March of last year. This program allowed banks to borrow from the Fed and use their bonds at par as collateral. This was done to inject liquidity into the banking system to avoid a cash shortage at mainly regional banks following the blow-up of SVB.

Excess Liquidity, Bitcoin, and the S&P

Excess liquidity have surged higher in the last year, which has pushed up risk assets, such as bitcoin and equities.

Together with the introduction of the BTFP in March ’23, the Fed and Treasury pushed up bank reserves from $3T on Oct 22, to $3.6T by March ’24. What do these reserves do? These reserves cannot leave the banking system and therefore cannot enter the “real economy”. It’s a financial form of money only for banks. They can transact in reserves with each other and settle repo and reverse repo transactions. They account for high-quality liquid assets (HQLA) together with bonds and mortgage-backed securities (MBS). Most importantly, banks use the reserves to buy bonds from each other. In this way, they drive liquidity into the market and drive investors into riskier assets. We see that almost every time reserves go up, risk assets benefit.

Bank Reserves Go Up when RRP Goes Down and Vice Versa

As the Treasury pushed money out of the RRP, bank reserves held at the Fed have gone up simultaneously. This has been one of the biggest driver of stock market gains

In the next few weeks, we could see liquidity reverse for two reasons.

- 1) Treasury bill issuance will flip negative in Q2 to the tune of about $150bl. In Q1, 400bl of capital went from the RRP into the bills market, and in Q2 this will reverse. Add to that the 95bl in monthly QT and we could see 250bl of liquidity drain.

- 2) Expiration of the BTFP. In April about 75bl of BTFP loans expire and since the facility is now closed, they may not get renewed. This causes another contraction in bank reserves.

Overall we could see over $300bl of contraction if Yellen/Powell do not step in to offset. We think they will step in but it might take a month or so for them to react.

In the meantime, we are still in the buyback blackout window ($100bl of monthly buybacks do not start anew until after GOOG/AAPL report in late April/Early May) so we could fly into an air pocket.

In the next blog post, we will explain how Yellen and Powell can and will come up with a solution if they see liquidity plunge too far or stock market volatility surges higher.

Futures Flat In Cautious Trade Ahead Of CPI As Gold Roars To New Record High

Futures Flat In Cautious Trade Ahead Of CPI As Gold Roars To New Record High

Tyler Durden

Tue, 04/09/2024 - 08:10

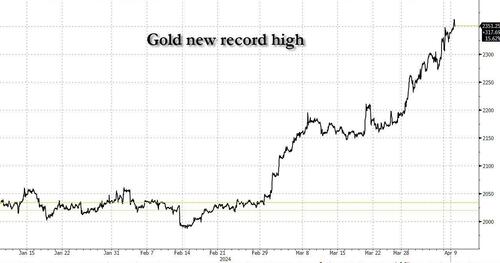

US equity futures are trading in a narrow range, swinging between gains and losses as bonds climbed, clawing back some of Monday’s slump which sent yields to the highest since last November in the buildup to US CPI print tomorrow that is crucial to the Fed's decision when it will start to cut interest rates; Government debt in the UK and Germany followed suit, with yields falling across the curve after a 20-year UK bond sale drew record demand from investors. As of 8:00am, S&P futures were up 0.1% but traded tightly around the unchanged line as they extended Monday’s flat close on Wall Street, when trading was the thinnest since Christmas. Nasdaq futures gained 0.2% while Europe's Estoxx 50 was down about 0.5%, with technology and industrials leading to the downside. Commodity markets are higher lead by Energy and Metals, with Gold hitting a new record high, rising as much as $25 to $2,365 before paring gains. The macro picture is light today but keep an eye on the 3Y auction, which may give some cues to investor positioning ahead of the CPI.

In premarket trading, Mag7 names are mixed with Semis up. Blackberry rose 6.9% after the Canadian software company announced a robotics collaboration with AMD. Here are some other notable premarket movers:

- ChargePoint shares fell 4.3% as Goldman Sachs downgraded the provider of electric vehicle charging solutions to sell from neutral, on expectations of a slower EV market in the US. Goldman also lowered its rating on sector peer Sensata to neutral from sell.

- Maxeon Solar shares dropped 16% after the solar-panel maker’s first-quarter revenue forecast missed estimates.

Caution dominates sentiment before Wednesday’s inflation report, which is forecast to show some further easing of price pressures but may surprise to the upside after the recent surge in oil prices. Traders are also preparing for the ECB's rates announcement on Thursday, which could support bets on earlier easing by the ECB than the Fed, and for the start of the first-quarter earnings season. While markets now favor just two US rate cuts this year, former Fed St. Louis President James Bullard said three reductions remain “the base case."

For Mohit Kumar, strategist and chief economist for Europe at Jefferies, the more important discussion should be over how the Fed would respond to any signs that resilience in the American economy is faltering. "The right question is whether the Fed is willing to cut rates if there is any sign of weakness,” Kumar wrote in a note to clients. “And on that we are reasonably confident that if the economy weakens, we will see easing from the Fed which would support risk sentiment.”

While economists surveyed by Bloomberg expect the consumer price index will show some cooling in inflation, the core gauge, which excludes food and energy costs, is forecast to be up 3.7% from a year earlier — above the Fed’s 2% target. Concerns, however, are for hotter prints in the future, which reflect the ongoing surge in gold, which rose as much as $25 to $2,365 this morning, a new record high, and up more 17% since mid-February. Copper traded near a 15-month high as supply tightens and global manufacturing picks up.

Marija Veitmane, head of equity markets research at State Street Global, said her firm’s measure of online inflation pointed to a potentially above-consensus read. “We have seen prices in every sector we track to grow at higher than average pace in March,” she said. As for corporate results, “we continue to worry about narrowness of earnings, where majority of growth comes from the tech/large-cap stocks, which majority of companies are showing signs of stress,” Veitmane said. “Falling margins are particular concerns as they tend to precede layoffs.”

European stocks fall with consumer products, construction and real estate underperforming. FTSE 100 outperforms peers, adding 0.2%, DAX lags, dropping 0.6%. In individual stock moves Tuesday, BP Plc rose to a five-month high after an update that analysts said showed a strong performance in oil and gas trading. Renault SA advanced after an upgrade from analysts at Barclays Plc. Mining stocks were a bright spot in Europe as iron ore headed for its biggest two-day rally in more than two years.