To live without faith, without a patrimony to defend, without a steady struggle for truth – that is not living, but existing.

All

Robeyns Peter to Pay Paul

Ingrid Robeyns doesn't want to abolish markets and replace them with central planning. However, as David Gordon points out, her ideas on reducing inequality reflect the belief that progressives can create a fantasy world, state control without the consequences.

Robeyns Peter to Pay Paul

Ingrid Robeyns doesn't want to abolish markets and replace them with central planning. However, as David Gordon points out, her ideas on reducing inequality reflect the belief that progressives can create a fantasy world, state control without the consequences.

Robeyns Peter to Pay Paul

Ingrid Robeyns doesn't want to abolish markets and replace them with central planning. However, as David Gordon points out, her ideas on reducing inequality reflect the belief that progressives can create a fantasy world, state control without the consequences.

23andMe Saved From Collapse After CEO Floats Private Takeover

23andMe Saved From Collapse After CEO Floats Private Takeover

Tyler Durden

Fri, 04/19/2024 - 06:55

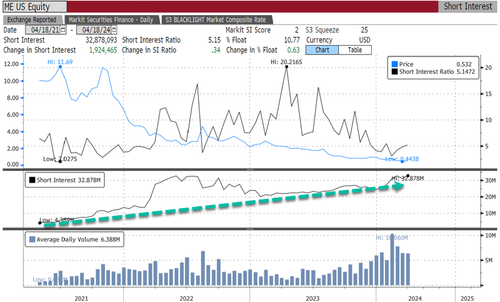

DNA-testing company 23andMe soared in the early cash session in New York on news that Anne Wojcicki, the CEO, plans to take the struggling company private after three years on the public markets. The company once sported a $6 billion valuation and has since collapsed to $235 million.

Wojcicki's big announcement was made in a public filing late Wednesday. The filing stated that she "is considering making a proposal to acquire all of the outstanding shares of 23andMe."

The filing noted that she would reject any other buyer taking over the company. Her ownership stake is around 20% of the total outstanding shares. This means she controls 49.99% of the company's voting power, making it impossible for anyone to purchase the human genetics and biopharmaceutical company.

Around 1030 ET, shares of 23andMe jumped 48% to 53 cents a share. On Wednesday, they were at a record low of $0.36.

Bloomberg data shows 32 million shares, or 10.77% of the float, is short. This leaves room for squeezes.

In 2021, 23andMe went public through a special-purpose acquisition company sponsored by Virgin Group founder Richard Branson. At the time, the company's value jumped to $5.8 billion. By 2022, the valuation plunged to as low as $1 billion.

"As sales of its DNA testing kits have slowed in recent years, 23andMe has pivoted to offering subscription products in hopes of creating repeat customers for its consumer business," Bloomberg pointed out.

There were fears earlier this year that 23andMe would be sold to an overseas PE firm. Thankfully, this has not happened because it would be a national security risk.

23andMe Saved From Collapse After CEO Floats Private Takeover

23andMe Saved From Collapse After CEO Floats Private Takeover

Tyler Durden

Fri, 04/19/2024 - 06:55

DNA-testing company 23andMe soared in the early cash session in New York on news that Anne Wojcicki, the CEO, plans to take the struggling company private after three years on the public markets. The company once sported a $6 billion valuation and has since collapsed to $235 million.

Wojcicki's big announcement was made in a public filing late Wednesday. The filing stated that she "is considering making a proposal to acquire all of the outstanding shares of 23andMe."

The filing noted that she would reject any other buyer taking over the company. Her ownership stake is around 20% of the total outstanding shares. This means she controls 49.99% of the company's voting power, making it impossible for anyone to purchase the human genetics and biopharmaceutical company.

Around 1030 ET, shares of 23andMe jumped 48% to 53 cents a share. On Wednesday, they were at a record low of $0.36.

Bloomberg data shows 32 million shares, or 10.77% of the float, is short. This leaves room for squeezes.

In 2021, 23andMe went public through a special-purpose acquisition company sponsored by Virgin Group founder Richard Branson. At the time, the company's value jumped to $5.8 billion. By 2022, the valuation plunged to as low as $1 billion.

"As sales of its DNA testing kits have slowed in recent years, 23andMe has pivoted to offering subscription products in hopes of creating repeat customers for its consumer business," Bloomberg pointed out.

There were fears earlier this year that 23andMe would be sold to an overseas PE firm. Thankfully, this has not happened because it would be a national security risk.

What Happened To Bitcoin?

What Happened To Bitcoin?

Tyler Durden

Fri, 04/19/2024 - 06:30

Authored by Jeffrey Tucker via The Brownstone Institute,

Those who involved themselves in Bitcoin markets after 2017 encountered a different operation and ideal than those who came before. Today, no one much cares about what came before, speaking of 2010-2016. They are only watching the upward price momentum and are thrilled for the increase in the asset valuation of their portfolio.

Gone is the talk of separating money and state, of a market-based means of exchange, of genuine revolution that would extend from money to the whole of politics the world over. And gone is the talk of changing the operation of money as a means of changing the prospects for freedom itself. The enthusiasts around Bitcoin have different goals in mind.

And during this entire period, the exact time when this digital asset might have protected multitudes of users and businesses from rapacious inflation growing out of the worst and most globalized experience of corporatist statism in modern history, made possible due to the money monopoly of central banks that funded the operation, the original asset that carries the symbol BTC was systematically diverted from its original purpose.

The ideal was nicely articulated by F.A. Hayek in 1974. Much of his career as an economist was spent arguing for sound monetary policies. At every important turning point, he faced the same problem: governments and the institutions they serve did not want sound money. They wanted to manipulate the currency system to benefit elites, not the public. Finally, he refined his argument. He concluded that the only real answer was a complete divorce of money and power.

“Nothing can be more welcome than depriving government of its power over money and so stopping the apparently irresistible trend towards an accelerating increase of the share of the national income it is able to claim,” he wrote in 1976 (two years after his Nobel Prize).

“If allowed to continue, this trend would in a few years bring us to a state in which governments would claim 100 per cent of all resources—and would in consequence become literally ‘totalitarian’.”

“It may turn out that cutting off government from the tap which supplies it with additional money for its use may prove as important in order to stop the inherent tendency of unlimited government to grow indefinitely, which is becoming as menacing a danger to the future of civilisation as the badness of the money it has supplied.”

The problem in achieving this ideal was technical and institutional. So long as state money worked, there was no real drive to change it. Certainly the push would never come from the ruling classes who benefit from the present system, which is precisely where every old argument for the gold standard faltered. How to get around this problem?

In 2009, a pseudonymous developer or group released a white paper, written in language for computer scientists and not economists, for a peer-to-peer system of digital cash. For most economists at the time, its functioning was opaque and not quite believable. The proof came in the functioning itself which unfolded over the course of 2010. To summarize, it deployed a distributed ledger, double-key cryptography, and a protocol of fixed quantity to release a new form of money that operationally tied together money itself and a settlement system in one.

In other words, Bitcoin achieved the ideal about which Hayek could only dream. The key to making it all possible was the distributed ledger itself, which relied on the internet to globalize the nodes of operation, bringing a new form of accountability we had never seen in operation before. The notion of melding together the means of payment plus the mechanisms of settlement on this scale was something that had previously not been possible. And yet there it was, earning its way into the market with ever increasing valuations made possible by the distributed ledger.

So, yes, I became an early enthusiast, writing hundreds of articles, even publishing a book in 2015 called Bit By Bit: How P2P Is Freeing the World.

I could not have known it at the time, but those were in fact the last days of the ideal and just before the protocol came to be controlled by a consolidated group of developers who jettisoned entirely the idea of peer-to-peer cash to turn it into a high-earning digital security, not a competitor with state-based money but rather an asset designed not to use but hold with third-party intermediaries controlling access.

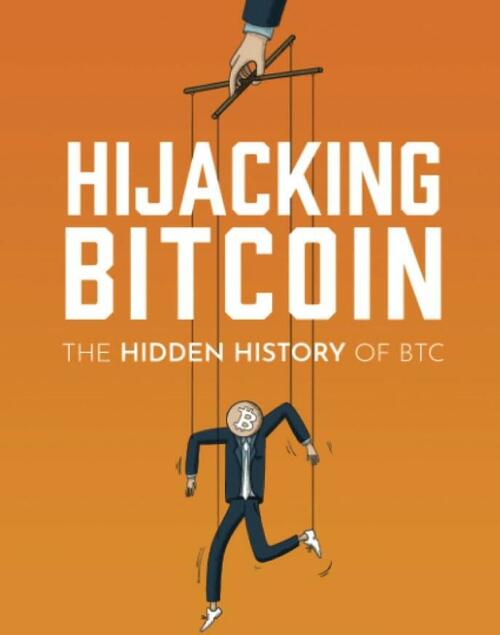

We saw all this unfold in real time and many of us were aghast. All that is left to us is to tell the story, which has not been done in a complete form until now. Roger Ver’s new book Hijacking Bitcoin does the job. It is a book for the ages simply because it lays out all the facts of the case and lets readers come to their own conclusion.

I was honored to write the foreword, which follows:

The story you will read here is of tragedy, the chronicle of an emancipationist monetary technology subverted to other ends. It’s a painful read, to be sure, and the first time this story has been told with this much detail and sophistication. We had the chance to free the world. That chance was missed, likely hijacked and subverted.

Those of us who watched Bitcoin from the earliest days saw with fascination how it gained traction and seemed to offer a viable alternative path for the future of money. At long last, after thousands of years of government corruption of money, we finally had a technology that was untouchable, sound, stable, democratic, incorruptible, and a fulfillment of the vision of the great champions of freedom from all history. At last, money could be liberated from state control and thus achieve economic rather than political goals—prosperity for everyone versus war, inflation, and state expansion.

That was the vision in any case. Alas, it did not happen. Bitcoin adoption is lower today than it was five years ago. It is not on a trajectory of final victory but on a different path to gradually increase in price for its earlier adopters. In short, the technology was betrayed by small changes that hardly anyone understood at the time.

I certainly did not. I had been playing with Bitcoin for a few years and was mainly astounded at the speed of settlement, the low cost of transactions, and the ability for anyone without a bank to send or receive it without financial mediation. That’s a miracle about which I wrote rhapsodically at the time. I held a CryptoCurrency Conference in Atlanta, Georgia, in October 2013 that focused on the intellectual and technical side of things. It was among the first national conferences on the topic, but even at this event, I noticed two sides coalescing: those who believed in monetary competition and those whose sole commitment was to one protocol.

My first clue that something had gone wrong came two years later, when for the first time I saw that the network had been seriously clogged. Transaction fees soared, settlement slowed to a crawl, and vast numbers of on-ramps and off-ramps were closing due to high compliance costs. I did not understand. I reached out to a number of experts who explained to me about a quiet civil war that had developed within the crypto world. The so-called “maximalists” had turned against widespread adoption. They liked the high fees. They did not mind the slow settlements. And many were involving themselves in the dwindling number of crypto exchanges that were still in operation thanks to a government crackdown.

At the same time, new technologies were becoming available that vastly improved the efficiency and availability of exchange in fiat dollars. They included Venmo, Zelle, CashApp, FB payments, and many others besides, in addition to smartphone attachments and iPads that enabled any merchant of any size to process credit cards. These technologies were completely different from Bitcoin because they were permission-based and mediated by financial companies. But to users, they seemed great and their presence in the marketplace crowded out the use case of Bitcoin at the very time that my beloved technology had become an unrecognizable version of itself.

The forking of Bitcoin into Bitcoin Cash occurred two years later, in 2017, and it was accompanied by great cries and screams as if something horrible was happening. In fact, all that was happening was a mere restoration of the original vision of the founder Satoshi Nakamoto. He believed with the monetary historians of the past that the key to turning any commodity into widespread money was adoption and use. It’s impossible to even imagine conditions under which any commodity could take on the form of money without a viable and marketable use case. Bitcoin Cash was an attempt to restore that.

The time to ramp up adoption of this new technology was 2013-2016, but that moment was squeezed in two directions: the deliberate throttling of the ability of the technology to scale and the push of new payment systems to crowd out the use case. As this book demonstrates, by late 2013, Bitcoin had already been targeted for capture. By the time Bitcoin Cash came to the rescue, the network had changed its entire focus from use to holding what we have and building second-layer technologies to deal with the scaling issues. Here we are in 2024 with an industry struggling to find its way within a niche while the dreams of a “to-the-moon” price are fading into memory.

This is the book that had to be written. It is a story of a missed opportunity to change the world, a tragic tale of subversion and betrayal. But it is also a hopeful story of efforts we can make to ensure that the hijacking of Bitcoin is not the final chapter. There is still the chance for this great innovation to liberate the world but the path from here to there turns out to be more circuitous than any of us ever imagined.

Roger Ver does not blow his own trumpet in this book, but he truly is a hero of this saga, not only deeply knowledgeable of the technologies but also a man who has clung to an emancipatory vision of Bitcoin from the earliest days through the present. I share his commitment to the idea of peer-to-peer currency for the masses, alongside a competitive marketplace for free-enterprise monies. This is a hugely important documentary history, and the polemic alone will challenge anyone who believes himself to be on the other side. Regardless, this book had to exist, however painful. It’s a gift to the world.

Does this story seem familiar? Indeed it does. We’ve seen this trajectory in sector after sector. Institutions born and built by ideals are later converted by various forces of power, access, and nefarious intent into something else entirely. We’ve seen this happen to digital tech in particular and the Internet generally, not to mention medicine, public health, science, liberalism, and so much else. The story of Bitcoin follows the same trajectory, a seemingly immaculate conception turned toward a different purpose, and serving again as a reminder that on this side of heaven, there will never be an institution or idea immune to compromise and corruption.

FDR's War Against Civil Liberties

Historian David Beito joins Bob to discuss issues such as the Japanese concentration camps and the government's mass surveillance of telegrams.

Albanian "King Of Instagram" Used Platform To Tell Followers How To Sneak Into Britain, Join The Drug Trade

Albanian "King Of Instagram" Used Platform To Tell Followers How To Sneak Into Britain, Join The Drug Trade

Tyler Durden

Fri, 04/19/2024 - 05:45

While we're sure social media sites are busy moderating "misinformation" once again ahead of the all-important 2024 election, one influencer is using Instagram to give his followers tips on sneaking into Britain and making £6,000 a month working illegally in the drug trade.

'You know there are a lot of brothers and sisters in hardship. Can you show how to go there unnoticed, without being detected? How do they do it?' he says in one of his video clips.

Kozak Braci, an Albanian social media influencer with over 500,000 followers on TikTok and Instagram, has hosted live tours of cannabis farms and offered insights into profiting from criminal activities in the UK during his streams, according to a new profile from the Daily Mail.

The Daily Mail reported that one image captures Braci standing beside a man in a black SUV, with a house displaying the Union flag in the background. In another photo, the influencer, whose chest and right arm are adorned with tattoos of AK-47s, sports a Chelsea shirt in front of a red Audi.

Braci, who boasts that he earns £25,000 a month from his social media platforms, frequently posts pictures of himself with luxury cars and designer items.

"It's great to stay in the cannabis house. I can live there without a problem," he tells his followers.

Graham Wettone, an ex-Met Police officer, reacted to the videos shown to him by characterizing them as glorifying drug production in the UK and enticing would-be criminals to come to Britain.

Earlier this year, it was revealed that the Home Office intends to pay Albanian influencers £100,000 to discourage their followers from entering Britain illegally. This modern twist on the public information film aims to reach groups susceptible to traffickers' falsehoods. The initiative, devised by Cass Horowitz of 'Brand Rishi' fame, has been criticized by activists as ineffective 'toy town tinkering.'

A United Nations report indicates that Albanian criminals now dominate the UK's cocaine market, importing the drug via south-east England's ports with the aid of violent European gangs. Among these, the Hellbanianz gang from East London openly flaunts its criminal endeavors on social media.

Additionally, in the first four months of the year, 80 Albanian migrants were collectively sentenced to 130 years in prison.

Tik Tok commented: "TikTok works closely with UK law enforcement, the National Crime Agency and organisations such as STOP THE TRAFFIK to fight this industry-wide issue, and our steadfast efforts helped reduce the number of small boat crossings last year, according to Border Officials. We continue to strictly maintain a zero tolerance approach to human exploitation and proactively find over 95% of content we remove for breaking these rules."

Meta responded: "We have removed the violating content brought to our attention. Buying, selling or soliciting drugs is not allowed on our platforms; our teams use a mix of technology and human review to remove this content as quickly as possible, and we work with the police and youth organisations to get better at detection."

Economic Warning From The NFIB

The latest National Federation of Independent Business (NFIB) survey was an economic warning that departed widely from more robust governmental reports. In a recent analysis of small businesses, we discussed the importance those business owners play in the economy.

“It is crucial to understand that small and mid-sized businesses comprise a substantial percentage of the U.S. economy. Roughly 60% of all companies in the U.S. have less than ten employees.

Small businesses drive the economy, employment, and wages. Therefore, the NFIB’s statements are highly relevant to the economy’s current state compared to the headline economic data from Government sources.”

While recent government data on economic growth and employment remain robust, the NFIB small business confidence survey declined in its latest reading. Not only did it fall to the lowest level in 11 years, but, as far as an economic warning goes, it remained at levels historically associated with a recessionary economy.

The decline in confidence should be unsurprising given the largest deviation of interest rates from their 5-year average since 1975. Higher borrowing costs impede business growth for small businesses, as they don’t have access to the bond market like major companies.

Therefore, as the economy slows and interest rates rise, small business owners turn to their local banks for operating loans. However, higher rates and tighter lending standards make access to capital more difficult.

Of course, given that capital is the lifeblood of any business, decisions on hiring, capital expenditures, and expansion hang in the balance.

Economic Warning – Capital Expenditures

It should be unsurprising that if the economy were expanding as quickly as headline data suggests, business owners would be expending capital to increase capacity to meet rising demand. However, in the most recent NFIB report, the percentage of business owners planning capital expenditures over the 3-6 months dropped to the lowest level since the pandemic-driven shutdown.

Again, given that small businesses comprise about 50% of the economy, there is more than just a casual relationship between their capital expenditure plans (CapEx) and real gross private investment, which is part of the GDP equation.

In other words, if small businesses cut back on CapEx, this will eventually translate into slower rates of private investment and, ultimately, economic growth in coming quarters.

As shown, the correlation between small business CapEx plans and economic growth should not be dismissed. While mainstream economists are becoming increasingly optimistic about an “economic reflation,” the economic warning between real GDP and CapEx suggests caution.

Of course, if small businesses are unwilling to increase CapEx, it is because there is a lack of demand to justify those expenditures. Therefore, if CapEx is falling, we should expect economic warnings from employment and sales.

Something Amiss With Sales

Many reasons feed into a small business owner’s decision NOT to invest in their business. As noted above, tighter bank lending standards and increased borrowing costs certainly weigh on that decision. However, if “business is booming,” business owners will find the capital needed to meet increased demand. However, looking deeper into the NFIB data, we find rising concerns about the “demand” side of the equation.

The NFIB publishes several data points from the survey concerning the “concerns” small business owners have. These cover many concerns, from government regulations to taxes, labor costs, sales, and other concerns confronting business owners. When it comes to the “demand” side of the equation, there are three crucial categories:

- Poor sales (demand),

- Cost of labor (the most significant expense to any business), and

- Is it a “Good time to expand?” (Capex)

In the chart below, I have inverted “Good time to expand,” so it correlates with rising concerns about the cost of labor and poor sales. What should be obvious is that the average of these concerns escalates as economic growth weakens (recessionary periods) and falls during economic recoveries. Currently, these rising concerns should provide an economic warning to economists.

Examining sales and employment figures can help us understand why business owners remain pessimistic about the overall economy. The chart below shows the NFIB members’ sales expectations over the next quarter compared to the previous quarter. The black line is the average of both with a long-term median.

Unsurprisingly, business owners are always optimistic that sales will improve in the next quarter. However, actual sales tend to fall short of those expectations. The two have a very high correlation, which is why the average of both provides valuable information. Sales expectations and actual sales are well below levels typically witnessed during recessions. With sales (demand) weak, there is little need to increase production (supply) substantially.

Here is the economic warning to pay attention to. Real retail sales comprise about 40% of personal consumption expenditures (PCE), roughly 70% of the economic growth rate. The decline in the average of actual and expected sales of small businesses suggests weaker retail sales and, by extension, a slower economic growth rate.

Employment Warning

The demand side of the economic equation is crucially important. If the demand for a business owner’s products or services declines, there is little need to increase employment. Therefore, if economic growth was as robust as headlines suggest, why are small businesses’ plans to increase employment declining sharply?

Furthermore, when demand falls, business owners look to cut operating costs to protect profitability. While cutting future employment is part of that equation, so are plans to raise worker compensation.

The last chart is crucial. The U.S. is a consumption-based economy. However, consumers can not consume without producing something first. Production must come first to generate the income needed for that consumption. The cycle is displayed below.

As employees receive fewer compensation increases (raises, bonuses, etc.) amid rising living costs, they cut consumption, which translates into slower economic growth rates. In turn, business owners cut employment and compensation further. It is a virtual spiral that historically ends in recession.

While this time could certainly be different, the economic warnings from the NFIB survey should not be dismissed. The data could explain why the Fed is adamant about cutting rates.

The post Economic Warning From The NFIB appeared first on RIA.

Bill Maher: The Prophet We Need?

HBO’s Real Time host and longtime leftist Bill Maher made headlines this past weekend when he chastised Republicans’ ever-shifting stance on abortion in a panel discussion on the Arizona Supreme Court’s recent landmark ruling upholding a near-total abortion ban. The Arizona Court took up the case in response to the overturning of Roe v. Wade, which Republicans, including former President Trump…

Terengganu, woman sentenced to corporal punishment under Sharia law

A single mother was found guilty of the sin of 'khalwat' (closeness) in a state ruled by the Islamist party. The sentence - a first - is scheduled to be carried out in Marang prison on 6 May. A case destined to represent a thermometer of the power relations with fundamentalists in Anwar Ibrahim's Malaysia

Cardinal Burke, Gianna Molla, and Us

Our daughter Lucy is about to graduate high school and, in the fall, begin classes at the University of Dallas. Let me tell you her story, the beginning part anyway. My wife and I are late vocations to marriage. I was 47. Cathy was 39. Our first date was on the Feast of Joachim and Anne, and it was the best first date since Joachim met Anne. I think I am on firm theological ground here.

Roomy?

It's many decades since I visited the Episcopalian Church of Old S Paul's in Edinburgh ... but my recollection is of learning that, before its Victorian rebuild, it was so constructed that the Priest and each worshipping family had a separate and independant room to occupy. The door was kept open so that they could hear ... This was presumably so that, in some sort of way, they would be legally Fr John Hunwickehttp://www.blogger.com/profile/17766211573399409633noreply@blogger.com0

Rupantar: Death threats to director and actors over transgender character

At the centre of the controversy is a film that tells the story of a young orphaned painter raised in an ashram. He refuses the courtship of a wealthy woman because he feels like a woman in a man's body. Attacks and controversy on social media. The issues of homosexuality and gender are sensitive in Bangladesh, a Muslim-majority nation.

Turkmenistan's sick economy

In the International Monetary Fund's report, the ills that have always made growth impossible in Ašgabat re-emerge: the 'black accounting' of the Berdymukhamedov regime, in which the revenues from the sale of gas and oil are not shown, and the black market in manat, the local currency, which unloads all the burdens and imbalances onto the shoulders of the population.

India: first polling stations open in the long vote, results on 4 June

Today's news: Israeli raid in Iran, for Tehran nuclear sites 'intact';China, Japan and South Korea voted to recognise Palestine at UN in resolution blocked by US veto;Terrorist attack in Karachi, five Japanese unhurt;The ground in half of China's cities is subsiding due to water extraction;Russia started the withdrawal of its troops from Nagorno-Karabakh now in the hands of Baku.

Swiss Watch Exports Crash In China & Hong Kong

Swiss Watch Exports Crash In China & Hong Kong

Tyler Durden

Fri, 04/19/2024 - 04:15

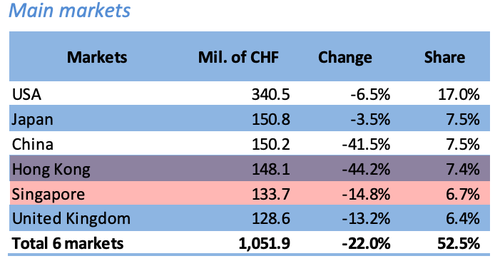

Fears of a luxury slowdown are materializing. New data from the Federation of the Swiss Watch Industry shows that exports of luxury timepieces tumbled the most since 2020 as demand crashed in Asia.

Swiss watch exports dropped in March. Their value fell by 16.1% compared with the same month in 2023 to 2 billion Swiss francs ($2.2 billion). Cratering demand in China and Hong Kong caused most of the decline. Weakness was reported across all six main markets.

Exports to mainland China, the second-biggest market for Swiss watches, plunged 42%, the worst decline since March 2020, when the global economy began seizing up due to government-enforced lockdowns. Shipments to Hong Kong tumbled even more, down 44%.

"The negative trend is even worse than we expected and the decline in China is really worrying and probably indicates that inventories in the region were once again too high," Jean-Philippe Bertschy, an analyst at Vontobel in Switzerland, told Bloomberg.

Faltering demand for Swiss watches comes one day after LVMH Moët Hennessy Louis Vuitton, the world's largest luxury group, controlled by the family of billionaire Bernard Arnault, reported that "uncertain geopolitical and economic environment" has weighed on luxury spending.

LVMH shares in Paris are 10.5% below the peak put in early last year.

For a broader view of global luxury stocks, the MSCI World Textiles, Apparel & Luxury Goods Index also shows the index well below (-21%) the peak put in at the end of 2021.

A combination of China's slower-than-expected economic recovery and generational highs in interest rates across the Western world are some of the reasons why a global slowdown in the luxury market has materialized.

'Israel Propped Up Hamas': Fireworks Ensue During ZeroHedge Debate, Dennis Prager Says Atrocity Claims 'Libel'

'Israel Propped Up Hamas': Fireworks Ensue During ZeroHedge Debate, Dennis Prager Says Atrocity Claims 'Libel'

Tyler Durden

Fri, 04/19/2024 - 04:05

On Wednesday night, against the backdrop of the war in Gaza expanding to Lebanon and Syria, ZeroHedge held a debate to discuss the war in the Middle East.

Debating that question and more at last night’s ZeroHedge debate were talk show host Dennis Prager and Newsweek opinion editor Batya Ungar-Sargon vs. Young Turks founder Cenk Uygur and libertarian Dave Smith. The event was masterfully moderated by Saagar Enjeti, founder of Breaking Points.

Key themes included the morality of Israel's invasion and the broader historical and political context that led to it, historical narratives - including grievances, perceptions of historical rights to land, and the impact of these narratives on current attitudes and policies, and future prospects of potential solutions and the feasibility of peace in the region.

Summarizing the participants' general positions:

-

Dennis Prager: Argues that the root of the conflict is the non-acceptance of a Jewish state by Israel's neighbors. He emphasizes that if Israel disarmed, it would lead to genocide against Jews, drawing a parallel between the hostility Israel faces and historical antisemitism.

-

Cenk Uygur (The Young Turks): Criticizes the conduct of Israel in the conflict, pointing to the high number of Palestinian casualties and the broader humanitarian impact. He challenges the portrayal of Hamas and Palestinian resistance, comparing it to historical resistance movements against oppression.

-

Batya Ungar-Sargon: Focuses on whether Israel's actions since the invasion were just and suggests that while the devastation is immense, Israel's military actions are justified as self-defense against a terrorist group (Hamas) embedded within civilian areas.

-

Dave Smith: Discusses the complexities of the situation, suggesting that simplistic narratives about good vs. evil do not capture the realities of the conflict. He stresses that both Israelis and Palestinians include individuals who desire peace and those who pursue more extreme outcomes.

The feedback was overwhelmingly positive, and we agree - it's worth a watch.

Thank you, It was an interesting, informative, and civil debate.

— Freedom Florida, Free America (@Randrenn) April 18, 2024Everyone should watch this debate

— djbowzer (@djbowzer) April 17, 2024For those who missed it last night, here are some highlights:

Were the Palestinians actually "offered a state"?

Prager and Smith debated what transpired during the Camp David Accords of 2000 between Bill Clinton, Ehud Barak of Israel, and Yasser Arafat of the Palestinian Authority. The event is commonly used to depict the unwillingness of Palestinians to make necessary compromises for the right to establish their own state.

ZH middle-east war debate highlights:

Were the Palestinians actually "offered a state"?

Prager and Smith debated what transpired during the Camp David Accords of 2000 between Bill Clinton, Ehud Barak of Israel, and Yasser Arafat of the Palestinian Authority. The event is… pic.twitter.com/EpH3N7rMPn

Israel has a "superior" culture to the Middle East?

Does Israel’s comparatively freer society and more prosperous society grant it moral authority over the war in Gaza? Prager pressed the issue to Smith and Uygur: “How’s this that none of you like to talk about? There are 2 million Palestinians in Israel.”

ZH middle-east war debate highlights:

Israel has a "superior" culture to the Middle East?

Does Israel’s comparatively freer society and more prosperous society grant it moral authority over the war in Gaza? Prager pressed the issue to Smith and Uygur: “How’s this that none of… pic.twitter.com/DvHsSz7ioh

Smith says there have been atrocities on both sides:

“The internet has a permanent memory” pic.twitter.com/vfN4yjRtm2

— Dave Smith (@ComicDaveSmith) April 18, 2024Cenk vows a tax strike if the US goes to war with Iran!

As the Iran debate heated up, Cenk Uygur said enough is enough when it comes to Middle Eastern wars, making the firm claim that he will refuse to pay taxes if the U.S. “tries to send one of our guys into the Middle East” to “die for Netanyahu.”

ZH middle-east war debate highlights:

Cenk vows a tax strike if the US goes to war with Iran

As the Iran debate heated up, Cenk Uygur said enough is enough when it comes to Middle Eastern wars, making the firm claim that he will refuse to pay taxes if the U.S. “tries to send… pic.twitter.com/frztg5JBTg

Netanyahu covertly funded Hamas

Smith challenged Prager and Ungar-Sargon on Netanyahu’s covert campaign to fund Hamas for the purpose of undermining a Palestinian state. Both pro-Israel candidates acknowledged the veracity of such reports but claimed Netanyahu “didn’t know” it would lead to October 7.

Prager then went on to claim that Israel does not commit atrocities (outside of wartime). “That is a libel of Israel and it’s dishonest!” he said when Smith stated that both sides have affected “ungodly” atrocities.

ZH middle-east war debate highlights:

Netanyahu covertly funded Hamas

Smith challenged Prager and Ungar-Sargon on Netanyahu’s covert campaign to fund Hamas for the purpose of undermining a Palestinian state. Both pro-Israel candidates acknowledged the veracity of such… pic.twitter.com/25CMjFOiKU

Watch the full debate below:

“Proclaimability” Is Not A Virtue.

The lectionary for the UK is being “renewed” starting from Advent. It has, allegedly, been revised with the help of the Catholic Truth Society. The CTS used to be very Catholic, but these days you never know. The idea is that, with the new translation, the Scripture should be more proclaimable. I did not know […]