Certainly, it is difficult to make the demands of the Gospel understandable to secularized people. But this pastoral difficulty must not lead to compromises with the truth.

Zero Hedge

Did Michael Cohen Commit Perjury In The Trump Trial?

Did Michael Cohen Commit Perjury In The Trump Trial?

Tyler Durden

Wed, 05/15/2024 - 10:45

Below is a slightly expanded version of my column in the New York Post on the first day of cross examination for Michael Cohen. He still has one day of cross examination ahead of him on Thursday. With the government resting after Cohen’s cross examination, I believe that an honest judge would have no alternative but to grant a motion for a directed verdict and end the case before it goes to the jury. Judge Juan Merchan will now have to give the full measure of his commitment to the rule of law. Given the failure to support the elements of any crime or even to establish the falsity of recording payments as legal expenses, this trial seemed to stumble through the motions of a trial. Michael Cohen was only the final proof of a raw political exercise. For critics, some of Cohen’s answers appear clearly false or misleading. Like their star witness, the prosecutors have shown that they simply do not take the law very seriously when there is an advantage to be taken. Cohen has truly found a home with the office of Manhattan District Attorney Alvin Bragg.

Here is the column:

On Tuesday, the prosecution surprised many by suddenly announcing that it would rest its case against former president Donald Trump with the completion of testimony by Michael Cohen.

It was surprising because the prosecution never clearly stated the crime that it was proving, the elements of that crime, or even why denoting payments related to Stormy Daniels were not properly recorded as legal expenses.

Indeed, the only thing the prosecutors proved was that, in the pantheon of dishonesty, there are liars, pathological liars . . . and Michael Cohen.

Cohen spent the last two days insisting that he used to be a liar but lied to help former President Donald Trump. If that is the thrust of his testimony, it is just the latest lie told by Cohen under oath.

Cohen has lied to Congress, courts, special counsels, the IRS, the banks, and virtually every creature that walks or crawls on the face of the Earth.

Notably, his past conviction for business and tax fraud were not taken in the interests of Trump but himself.

When he admitted on the stand that he lied during his prior plea agreement, that was not to assist Trump who he had already denounced. It was to advance his own interests.

There is every indication that Cohen is still lying.

Cohen repeatedly said that he could not remember even recent calls after recounting calls from eight years ago with crystal clarity. He said that he could not remember if he leaked information in the case to CNN. However, these paled in comparison to other glaring moments.

Take, for example, his testimony on his unethical decision to secretly record a Sept. 6, 2016 telephone call with Trump.

It was a breathtaking betrayal that most lawyers would not contemplate, let alone carry out.

When asked by the prosecutors about that act, Cohen bizarrely claimed that he did so to guarantee that David Pecker, the former publisher of the National Enquirer, would “remain loyal to Mr. Trump.”

No one seriously believes that this is true. It does not even make sense. Pecker was speaking to Trump about the payments and even met with him at the White House.

Playing for him a call with Trump would produce nothing but confusion rather than pressure for Pecker.

Moreover, why would Cohen tape the call without letting Trump know? The obvious motive was to squirrel away material to use against Trump if he ever needed a little leverage.

Again, it was for Cohen.

Cohen’s testimony showed that he has consistently acted in his sole interest.

After portraying his sudden cooperation with prosecutors as a type of Road to Damascus, jurors learned that all roads lead back to Cohen and his bank accounts.

After telling the jury that he has dedicated his life to righting the wrongs of Trump and holding him accountable, he admitted that he repeatedly acted to undermine the prosecution in order to make a buck.

Told by prosecutors to stop doing public interviews, Cohen did not care. He did roughly two dozen television appearances and recorded hundreds of podcast episodes.

He admitted that Trump is mentioned in virtually every episode, of which he did roughly four a week.

He recounted how he raked in millions on books, including one titled “Revenge.” He admitted that he is selling items like a $32 shirt with a photo of Trump in a jumpsuit behind bars and a coffee mug with the phrase “send him to the big house, not the White House.”

He is also peddling a reality show called “The Fixer,” in which he promises viewers, “I am your fixer.”

After just a few hours of cross examination, it was clear that Cohen is the same grifter saving himself — one Venmo at a time.

Yet, Cohen continued to reframe reality in his own self-constructed image.

When asked about his TikTok antics, he portrayed his postings as a type of sleep deprivation therapy, explaining that “having a difficult time sleeping and [he] found an out.”

No sane prosecutor would rely on Cohen, let alone make him the entirety of their case.

The prosecutors did not even bother to show that Trump was responsible for or knew about how the payments were recorded on ledgers and business records.

They also just shrugged away the need to show why denoting these payments as “legal expenses” was fraudulent — or what the correct description might be.

Those details might be demanded in any other courtroom, but this is New York and the defendant is Donald Trump.

For Bragg and his team, it is all about what they can get out of this case despite the law.

In that sense, they found a kindred spirit in their star witness, and Michael Cohen has finally found a place that values what he calls on his reality show promo his “particular set of skills.”

WTI Rebounds Off Lows After Across-The-Board Inventory Draws

WTI Rebounds Off Lows After Across-The-Board Inventory Draws

Tyler Durden

Wed, 05/15/2024 - 10:39

Oil prices are tumbling this morning despite lower CPI (juicing rate cut hopes), weak retail sales (but strong gas station spending), and a big draw reported overnight by API. It seems the main downside driver was IEA lowering its 2024 demand forecast.

-

World oil demand is forecast to grow by 1.1 million barrels per day this year, down 140,000 bpd from last month's projection.

-

Global crude inventories surged in March by 34.6 million barrels as trade disruptions pushed oil on water to a post pandemic high, according to the IEA.

The question is - will the official data confirm API's big crude draw and re-energize prices.

API

-

Crude -3.1mm (-1.1mm exp)

-

Cushing -601k

-

Gasoline -1.27mm (unch exp)

-

Distillates +349k (+300k exp)

DOE

-

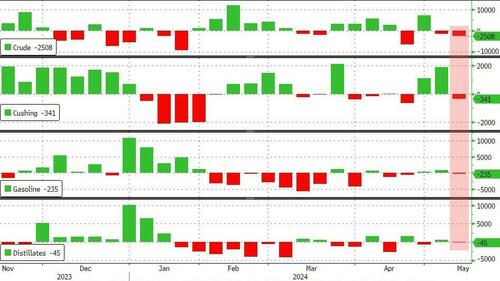

Crude -2.508mm (-1.1mm exp)

-

Cushing -341k

-

Gasoline -235k (unch exp)

-

Distillates -45k (+300k exp)

The official data shows inventory draws across the board with crude stocks down 2.5mm barrels...

Source: Bloomberg

The Biden admin continued to add to the SPR, adding 593k barrels...

Source: Bloomberg

US Crude production remains flat near record highs at 131.mm b/d...

Source: Bloomberg

WTI was trading just above $77 ahead of the official print and rallied further on the across-the-board draws...

Finally, we note that refinery utilization rates are back above 90%, the highest since January. Rates increased in all regions, with the Midwest rising for the second straight week to 90.8%, from 85.2% in the previous week, as refineries wake up from maintenance.

First ATM, Now Debt-For-Equity Swap, AMC Drains Equity In Bid To Stay Alive

First ATM, Now Debt-For-Equity Swap, AMC Drains Equity In Bid To Stay Alive

Tyler Durden

Wed, 05/15/2024 - 10:05

Volatility in "meme stocks" continued in premarket trading on Wednesday as AMC Entertainment Holdings announced a debt-for-equity exchange for $163.9 million in bonds maturing in 2026. This strategy mirrors management's approach that helped the struggling movie theater chain capitalize on retail day traders to boost liquidity in 2021.

A regulatory filing released Wednesday morning detailed how AMC reached a deal to swap about $164 million of its 10% notes due 2026 for 23.3 million shares of newly issued stock. The new stock is valued at $7.33 per share.

"AMC, much of whose debt trades at distressed prices, has been chipping away at its maturities through other swaps and buybacks. It exchanged around $200 million of the debt for shares last year," Bloomberg pointed out.

Today's news sparked a rally in AMC's high-yield bonds. The company has over $2.5 billion in outstanding bonds, most of which will mature in 2026.

News of the added supply sent shares down nearly 9% in premarket trading to the low $6 handle.

Shares were as high as $11.48 early Tuesday in the multi-day meme stock mania, triggered by a post on X from Roaring Kitty, also known as Keith Gill, on Sunday night.

Also, on Tuesday, AMC completed a previously disclosed ATM. The deal was completed through Citigroup Global Markets, Barclays Capital, B. Riley Securities, and Goldman Sachs & Co., raising about $250 million in new capital for the struggling company.

The old saying goes, "Strike while the iron is hot." That's precisely what AMC's management is doing: taking advantage of retail day traders by completing ATM and debt-for-equity exchanges. Somehow, this company, which should've been dead a long time ago, continues to stay alive with help from day traders.

"Trifecta Of Dovish News... Consistent With Fed Cutting In September": Wall Street Reacts To Weaker CPI Print

"Trifecta Of Dovish News... Consistent With Fed Cutting In September": Wall Street Reacts To Weaker CPI Print

Tyler Durden

Wed, 05/15/2024 - 09:51

With the CPI report came in on top of expectations on 3 of the 4 closely watched metrics, with just headline CPI coming in at 0.3%, just shy of the 0.4% expected (with the retail sales print coming in far uglier and missing across the board), there has been some debate among the usual commenting suspects whether this inflation report was enough to tip the scales to an earlier rate cut or not, although the consensus seems to suggest that the print was enough to keep September, if not the July, FOMC meeting in play for a rate cut.

Below we quote some of the most active Wall Street economists and strategists who have already manged to sneak in a bullet point or two with their kneejerk response to the CPI print.

Neil Birrell, CIO at Premier Miton Investors:

“The usual excitement over US inflation ended up being a damp squib, as it came in exactly as expected. However, retail sales were weaker than expected and the core rate is back to levels not seen for quite some time, which might well see optimists calling for rate cuts and markets rallying.”

Capital Economics

"Core CPI was even better than it looked, particularly given that we already know the PPI components that feed into the Fed’s preferred PCE deflator measure came in, on balance, weaker than expected. We estimate that core PCE increased by around 0.20%m/m. All things considered, this is consistent with the Fed cutting interest rates in September."

David Russell, Global Head of Market Strategy at TradeStation

"Shelter didn’t ease as hoped, but there was improvement in transportation and healthcare. The number wasn’t perfect, but we’re staggering toward lower inflation. Weaker data on retail sales and the Empire Index also suggest growth is slowing, which keeps rate cuts on the table. It was a trifecta of dovish news."

Nick "Nikileaks" Timiraos, WSJ resident Fed leaker:

"One good print can't offset three unfavorable ones. It may take a couple more for officials to get over the PTSD of the Q1 inflation. It reduces the risk of any shift to a neutral bias (ie, open the door to hikes)."

Florian Lepo, Lombard Odier Asset Management

“With this in-line inflation print, rates are likely to break the [4.4%] level, dragged down by real rates. With that, the dollar should fall, supporting most assets labeled in it.”

Rubeela Farooqi, chief US economist at High Frequency Economics:

“Overall, price pressures remain elevated but are moving in the right direction. We think the data support the case for a patient approach on policy decisions from the Fed going forward although the base case remains one of lower rates this year.”

Gregory Faranello, head of US rates for AmeriVet Securities:

“Fed friendly data for the most part with both the CPI and retail sales. Both indicate a tempering which is what the Fed is looking for. These numbers support Chair Powell’s notion of ‘higher for longer’ to potentially lower.”

Ira Jersey, head of rates at Bloomberg

“The relief-rally knee-jerk reaction may be more about retail sales slowing meaningfully than the close-to-expected CPI. Sales have tended to lead goods CPI by a few months. The CPI report being pretty close to consensus underlines the continuing trend of lower-volatility core CPI sectors contributing nearly 4% on a year-on-year basis, while higher-volatility ones (right now generally goods sectors) contribute nothing. So although the data was broadly in line, inflation continues to run above the Fed’s comfort level, meaning near-term rate cuts aren’t likely.”

Source: Bloomberg

Consumer Prices Have Risen Every Month Since 'Bidenomics' Began, Up 19.5% To Record High

Consumer Prices Have Risen Every Month Since 'Bidenomics' Began, Up 19.5% To Record High

Tyler Durden

Wed, 05/15/2024 - 09:41

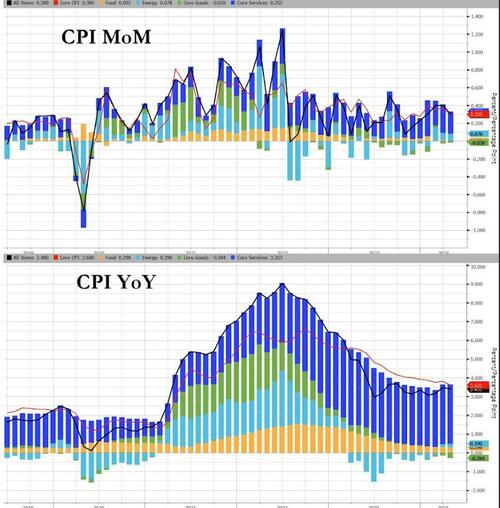

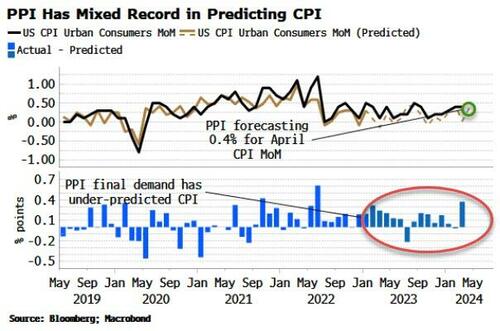

After a fourth straight month of hotter than expected PPI, analysts' expectations for CPI were tightly ranged around 0.3-0.4% MoM and printed +0.3% MoM (slightly below the 0.4% expected). The YoY headline CPI fell to +3.4% as expected from +3.5% prior

Source: Bloomberg

Under the hood, Services slowed modestly MoM...

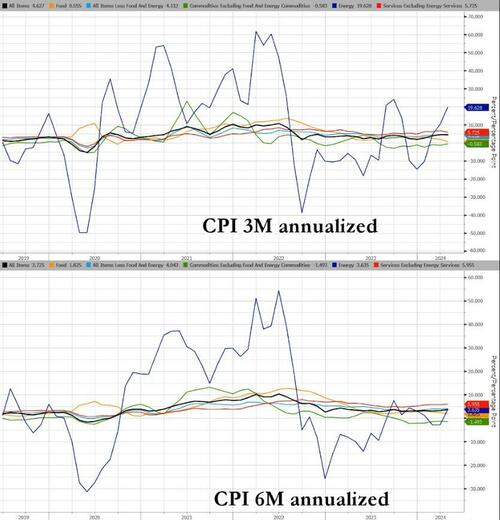

On a 3m and 6m annualized basis, Energy costs are reaccelerating most...

Source: Bloomberg

Used car and truck prices along with Gas Utility prices plunged on a MoM basis...

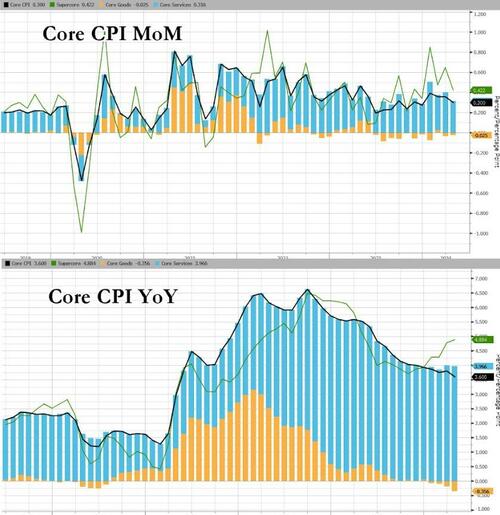

Core CPI rose 0.3% MoM (as expected) with YoY slowing to +3.6%, also as expected...

Source: Bloomberg

Core goods deflation continues while Core Services continue to rise...

Source: Bloomberg

Core CPI YoY was 3.6% in April, the lowest it's been in 3 years. The 1-month annualized fell to the same 3.6% as the YoY, which is why the YoY has been more reliable as a trend measure recently.

-

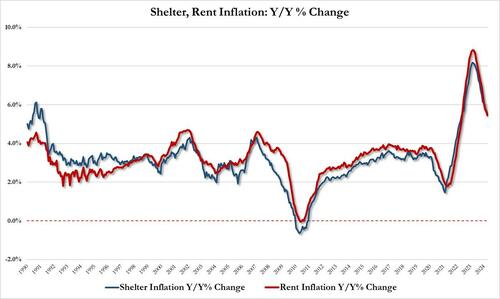

Housing (rent and OER) contributed 17.5 bps to monthly core CPI inflation in April. While still hot (2018-19 average was 11 bps), it's the lowest monthly contribution since Dec 2021. And as we show in the chart, YoY housing in CPI is cooling.

-

Virtually all of the excess core CPI inflation YoY--the part of inflation above and beyond Fed target - resulted from housing & auto insurance. Core non-housing services have heated up on a higher frequency basis but haven't weighing much (yet) on the annual print.

-

Also, while not in core, but extremely important for anyone who eats food: grocery prices actually fell -0.2% MoM in April and are running 1.1% YoY according to the Biden BLS. We doubt anyone will believe this number, which was goalseeked so that wage growth would strongly outpace grocery inflation. Relative to wages, grocery prices are back down below their 2019 levels. This, too, won't be believed by anyone.

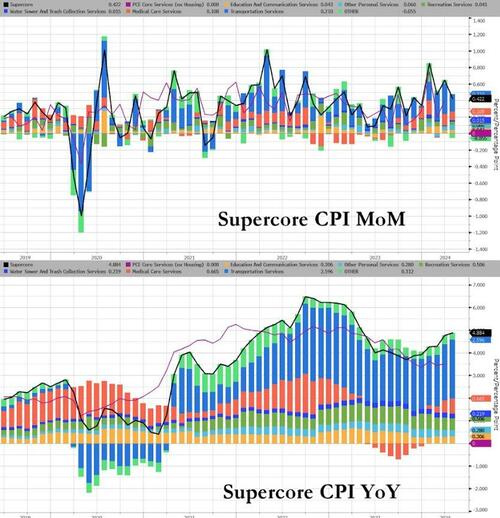

And one step deeper - the so-called SuperCore: Core CPI Services Ex-Shelter index - rose 0.5% MoM up to 5.05% YoY - the hottest since April 2023...

Source: Bloomberg

Under the hood of SuperCore CPI, Education costs rose (to pay for cleaning up all those protests?) and Transportation Services dominated on a YoY basis...

Source: Bloomberg

And while Shelter costs rose on a MoM basis, they continues to slow on a YoY basis...

Source: Bloomberg

Goods prices are deflating at the fastest pace since April 2004, while Services prices are stuck around +5.3% YoY...

Source: Bloomberg

We note that consumer prices have not fallen in a single month since President Biden's term began (July 2022 was the closest with 'unchanged'), which leaves overall prices up over 19.5% since Bidenomics was unleashed (compares with +8% during Trump's term). And prices have never been more expensive...

Source: Bloomberg

That is an average of 5.5% per annum (more than triple the 1.9% average per annum rise in price during President Trump's term).

Finally, and most notably it was a miss... but not for the reason expected...

It was a miss but not for the reason expected: OER catch down STILL to kick in; next few CPI print will be a dovish meltdown https://t.co/w1px0HrJN0

— zerohedge (@zerohedge) May 15, 2024Which means the next few months CPI will be even bigger misses...

Despite Surging Gasoline Spending, US Retail Sales Missed Big In April

Despite Surging Gasoline Spending, US Retail Sales Missed Big In April

Tyler Durden

Wed, 05/15/2024 - 09:39

For once, BofA's analysts 'missed' as their expectations for a small beat in retail sales was eviscerated by a huge miss across the board.

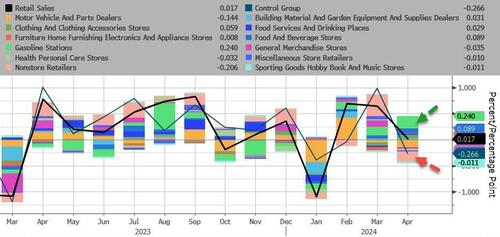

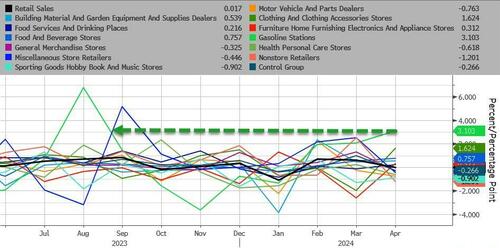

Headline Retail sales were unchanged MoM (versus +0.4% exp) and last month's +0.7% MoM move was revised slightly lower to +0.6% MoM.

Source: Bloomberg

Nonstore retailers and Motor Vehicle and Parts Dealers saw the biggest MoM declines while spending at Gasoline Stations rose the most (biggest MoM rise since Aug 2023)...

Source: Bloomberg

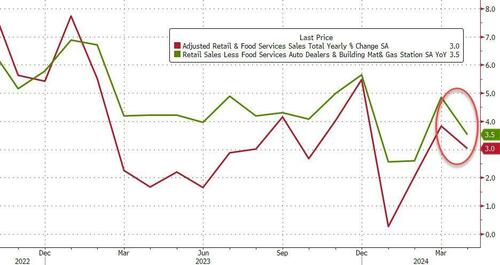

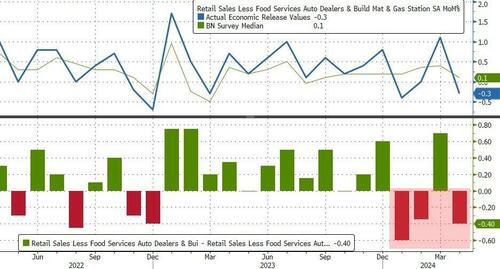

Both headline and core retail sales slowed on a YoY basis (ex-Autos and Gas Stations actually declined 0.1% MoM)...

Source: Bloomberg

Finally, the crucial core-control group - used in GDP calculation - plunged by 0.3% MoM (vs +0.1% MoM exp) - its third big miss in the last four months...

Source: Bloomberg

Not a good start for Q2 GDP.

Russia Is About To Overrun Ukraine's Defenses – Why Are There No Peace Negotiations?

Russia Is About To Overrun Ukraine's Defenses – Why Are There No Peace Negotiations?

Tyler Durden

Wed, 05/15/2024 - 09:20

Authored by Brandon Smith via Alt-Market.us,

There are two classic propaganda narratives used by governments when it comes to keeping the public invested in any war campaign that does nothing to advance their national interests:

-

First, there’s the “commitment” lie, which says that once you step in to support a war effort you then must stay exponentially committed, even if that war effort is exposed as pointless. Anytime the public pulls back from that war in a bid to reconsider what purpose it serves they are ridiculed for potentially “risking lives” and setting the stage for defeat. In other words, you must support the effort blindly. You’re not allowed to examine the conflict rationally, because who wants to be blamed for losing a war?

-

Second, there’s the “domino effect” lie, which says that if you allow a particular “enemy” to win in one conflict, they will automatically be emboldened to invade other countries until they own the entire planet. It’s the same claim used to trick the American populace into supporting the war in Vietnam and it rarely turns out to be true. In fact, nations that engage in regional wars tend to be so weakened by the fighting that they don’t have the means to move on to another country even if they wanted to.

In the US we heard both of these narratives heading into the recent congressional vote for billions more in monetary and logistical aid to Ukraine. Neocons and Democrats worked together to force the bill through with a percentage of true conservatives fighting to stop it. Those conservatives were attacked relentlessly by the media for “helping the Russians”, but the reality that no one in the mainstream wants to talk about is that Ukraine has already lost the war.

No amount of additional funding or arms shipments are going to help them, and it has nothing to do with conservatives questioning the validity of war spending. Anyone who has a basic understanding of military strategy knows that the key to winning is ALWAYS manpower first, logistics second. Not superior technology or armaments, not superior cash and certainly not popular support from foreign interests.

This is especially true in a war of attrition, and attrition is in fact the method being used by Russia to systematically whittle down Ukraine’s forces. However, the western media refuses to discuss what’s really happening and has been acting as a hype machine for Ukraine instead.

In September of 2022 I noted that the Russian pullback to the Donbas was not the “retreat” the western media made it out to be. Many establishment talking heads claimed that this was the beginning of the end for Vladimir Putin and that Ukrainian forces would be taking Crimea in the near future.

I argued that Russia was likely trying to consolidate its position as western artillery and tanks flooded into Ukraine. I also suggested that Russia wanted to avoid urban combat in major cities while tens-of-thousands of seasoned mercenaries were rushing to the front from the US and Europe. I predicted that the Russian pullback was in preparation for surgical strikes on western Ukraine’s resources and grid infrastructure.

With Ukraine’s grid heavily damaged, a large portion of the population would leave the cities and head for Europe until the war played out. Putin has specifically avoided major fighting within larger urban centers for a reason. Driving civilians out of metropolitan areas would make it easier for Russia to strike Ukraine in a secondary offensive without risking extensive collateral damage in the form of civilian casualties. This is exactly what has happened.

Almost 7 million Ukrainians left the country outright in the past 2 years, with another 6 million displaced (mostly from larger cities). Currently, Russia is moving to push civilians out of Kharkiv, Ukraine’s second biggest city, and they will probably be successful given their momentum and the destruction of water and power resources. With civilians out of the way a more aggressive attack can then be initiated.

Russia has been using an “artillery bubble” as a tool to protect ground forces as they push an advance. Meaning, troops will only attack as far as the artillery can reach. Artillery is vital to a large scale offensive. Coincidentally, Russia doubled its importation of explosive materials commonly used for artillery in the past several months. They are now reportedly producing triple the amount of artillery that NATO is providing to Ukraine.

Mainstream analysts claim the push towards Kharkiv move might be a feint, allowing Russia to increase the size of its buffer zone. They continue to assert that Russia doesn’t have the forces necessary for a major offensive. I would say it depends on how weak Ukraine’s defensive lines actually are. Russia has been consistently using large scale Pincer movements to envelop defensive positions and destroy them.

In the past two weeks alone Russia has gained considerable ground. Russian troops recently made confirmed advances northwest of Svatove (Luhansk Oblast), near Avdiivka (Donetsk Oblast), in Robotyne (Zaporizhzhya Oblast), and in east (left) bank Kherson Oblast, U.S.-based think tank Institute for the Study of War reported on May 6th. The reason for this is relatively simple – Ukraine lacks the manpower to effectively establish defense in-depth. All the reports coming from the front support this theory.

That is to say, Ukraine’s defensive lines are a facade with no secondary positions or trenches to stall Russian breakthroughs. Once the Russians cut the main line there’s nothing much stopping them from gaining large stretches of ground. Some analysts have blamed this development on a lack of Ukrainian foresight or strategic preparedness, but I would argue that they just don’t have enough people to defend more than a single forward line.

My position is backed by numerous reports of the government’s desperate struggles with conscription. For the past six months the average age of Ukraine recruits is 43 years old. Meaning, youth recruitment is waning, either because younger people don’t want to fight and are avoiding the draft by leaving the country, or too many have died.

The conscription problem has been hidden by the western media for many months now, but even corporate news platforms are starting to admit that there is a severe lack of new recruits. Front line fighters have been complaining for months that they need to be cycled away from the trenches and given rest.

Another bad sign is the fact that Ukraine has been using Special Forces soldiers for trench duty. These units are trained specifically for asymmetric hit-and-run warfare, not sitting in mud holes waiting for artillery strikes to rain down on their fixed and exposed positions. It seems like pure stupidity, but it makes sense if Ukraine is actually running out of people to hold their only defensive line.

The cover-up of massive casualties is something I mentioned in past articles on the war and I think it bears repeating: Western warhawks continue to claim that it will be “cheaper” to use Ukrainian soldiers to fight Russia than to fight a larger war down the road with American and European lives.

The sociopathy behind this rationale is disturbing. The lack of manpower in Ukraine cannot be solved. It is a product of endless death paid for with our tax dollars. NATO has prolonged the fighting with funding and arms, but not to win, only to sacrifice more people in a bloody conflict Ukraine is destined to lose.

Their argument also assumes that Americans and Europeans are going to jump blindly into military service in a war against Russia. I don’t know about Europeans, but I do know for a fact that most Americans are not going to buy in and will refuse a draft. The majority of the US public doesn’t even want to send further aid to Ukraine; they certainly aren’t going to go die for Ukraine. The arrogance of the warhawks is mind boggling.

The bottom line is this: Ukraine is about to be overrun. They didn’t have the manpower to effectively launch a counteroffensive. They don’t have the manpower to establish defense in-depth. And, they are using their most seasoned soldiers as cannon fodder in the trenches.

This dynamic demands that diplomatic solutions be entertained, but no one seems to be talking about that. Why?

As I theorized in my article ‘World War III Is Now Inevitable – Here’s Why It Can’t Be Avoided’, the underlying plan may very well be to try to force Americans and Europeans to accept an expanding war with Russia. The western public has been bombarded with lies about Ukraine’s ability to win; when they lose people will be shocked and incensed by the outcome.

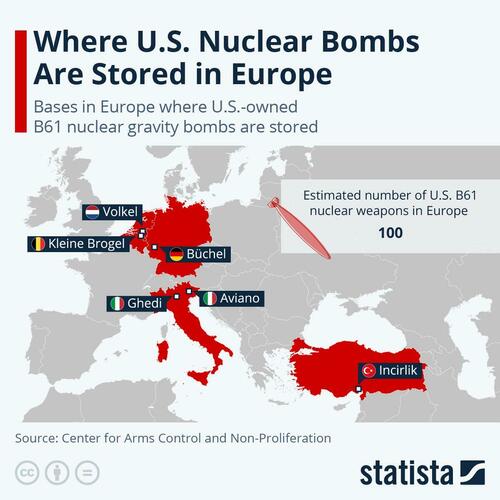

Maybe the elites hope that the populace will be so angry about the loss that they will rally around a larger war effort by NATO? The French government has already asserted that they are willing to send troops to Ukraine in direct confrontation with Russia, while Lithuania and Poland have said they will not rule out the possibility.

Now is the time for peace negotiations, BEFORE Ukraine is overrun. Will this happen? Probably not. But when diplomacy is removed from the table completely the only conclusion we can come to is that a greater war is desired. And when greater war is desired, we also have to conclude that our leadership has something substantial to gain by putting the world at risk.

You might be on the side of Ukraine, you might be on the side of Russia, you might not care about either side, but there’s no denying that this war is being escalated by special interests and we need to ask why?

* * *

If you would like to support the work that Alt-Market does while also receiving content on advanced tactics for defeating the globalist agenda, subscribe to our exclusive newsletter The Wild Bunch Dispatch. Learn more about it HERE.

Stocks, Bonds, Gold, & Crypto Soar As Rate-Cut Hopes Rise On Small CPI Miss

Stocks, Bonds, Gold, & Crypto Soar As Rate-Cut Hopes Rise On Small CPI Miss

Tyler Durden

Wed, 05/15/2024 - 09:11

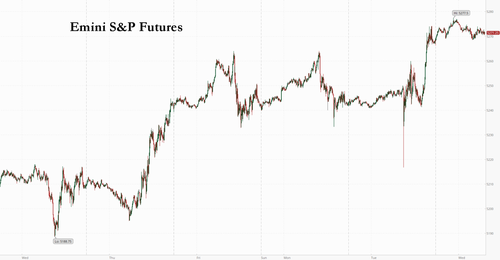

A 0.1% MoM miss in Headline CPI and continued slowing in Core CPI was all the algos needed to 'buy all the things'.

The initial reaction to this morning's data was a surge in rate-cut expectations - two cuts fully priced back in for 2024 and more than three more cuts priced in for 2025...

Source: Bloomberg

That sent stocks soaring...

...and TSY yields tumbling with 10Y erasing all of its increase since the last CPI print...

Source: Bloomberg

Gold is rising - from its pre April CPI level...

Source: Bloomberg

As the dollar dived back towards pre-April CPI...

Source: Bloomberg

Bitcoin rose on the cool CPI...

Source: Bloomberg

Of course, it's still early in the day...

OpenAI Co-Founder & Chief Scientist Departs AI Firm

OpenAI Co-Founder & Chief Scientist Departs AI Firm

Tyler Durden

Wed, 05/15/2024 - 08:50

Authored by Jesse Coghlan via CoinTelegraph.com,

Ilya Sutskever, the co-founder and chief scientist of OpenAI’s for-profit arm who helped briefly oust CEO Sam Altman last year, is leaving the artificial intelligence firm.

“After almost a decade, I have made the decision to leave OpenAI,” Sutskever wrote in a May 14 X post saying he was going to work on a “personally meaningful” project. He added he was confident the firm would build an artificial general intelligence (AGI) that is “safe and beneficial.”

Altman posted on X that Sutskever and OpenAI would “part ways” and the former chief scientist “has something personally meaningful he is going to go work on.”

Source: Ilya Sutskever

— Ilya Sutskever (@ilyasut) May 14, 2024OpenAI announced Jakub Pachocki as its new chief scientist. Pachocki has been the firm’s director of research since 2017 and led the development of its GPT-4 large language model.

Sutskever was part of an effort that successfully saw OpenAI’s board briefly push out Altman as CEO in November last year before he was later re-hired to the role after backlash from employees.

The Information reported at the time that Sutskever — who was one of six board members for the nonprofit OpenAI, Inc. — told employees Altman’s ouster was the board doing its duty to ensure OpenAI “builds AGI that benefits all of humanity.”

Sutskever later wrote in a November X post:

“I deeply regret my participation in the board’s actions.“

After Altman was rehired, Sutskever stepped down from OpenAI’s board and it’s been unclear what role he had at the firm which sparked the meme template “Where is Ilya?” that speculated what position he had at OpenAI.

Source: Elon Musk

AGI is a term for a hypothetical artificial intelligence that can perform the same as or better than humans on a range of tasks.

Altman said last month he doesn’t care how much it costs to make an AGI, even if he spends $50 billion a year.

Others, such as Ethereum co-founder Vitalik Buterin, have called for a measured approach to developing a possible intelligent AI saying it poses unknown risks.

Maybe Everyone's Got The Same Model For Guessing CPI

Maybe Everyone's Got The Same Model For Guessing CPI

Tyler Durden

Wed, 05/15/2024 - 08:20

Authored by Simon White, Bloomberg macro strategist,

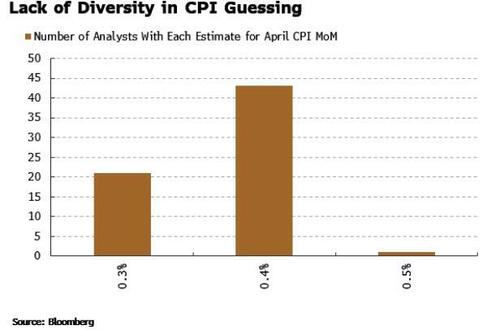

A simple model projects April’s month-on-month CPI to come in at 0.4%. Problem is most other estimates are 0.4%, leaving markets particularly exposed to a miss in either direction. The long gamma position in stocks could get unwound pretty quickly if the inflation outturn is big enough.

The chart below shows a simple regression of month-on-month CPI and PPI final demand (from 2009 to 2022, and running out of sample since then). As we can see the model seems to persistently underestimate CPI. For April’s CPI based on today’s latest final demand PPI data, it projects 0.36%, i.e. 0.4% rounded.

It suggests a lot of people are perhaps looking at it similarly. If we use the estimate for PPI final demand (0.3%) or the actual outturn (0.5%), we get 0.3% or 0.4% for April CPI. Just like everyone else.

Even if analysts aren’t using PPI to estimate CPI, there’s a remarkable lack of variance in these forecasts. A print lower than 0.3% or more than 0.4% could move markets quite significantly in either direction (revisions notwithstanding).

Yields Tumble, Set For Bigger Plunge If CPI Comes In Cool

Yields Tumble, Set For Bigger Plunge If CPI Comes In Cool

Tyler Durden

Wed, 05/15/2024 - 08:00

Perhaps taking a cue from our CPI commentary last week in which we explained why today's inflation print will likely come in on the dovish side after beating estimates for 5 months in a row...

... moments ago 10Y yields plumbed fresh multi-week lows, sliding to just above 4.40% (from a high of 4.65% two weeks ago), ironically the lowest lowest since the last CPI release five weeks ago....

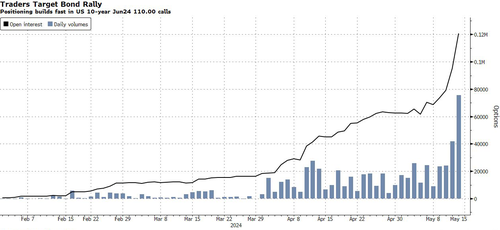

... as traders of Treasury options are positioning for a sharp bond rally in the aftermath of crucial inflation data on Wednesday, according to Bloomberg's Ed Bolingbroke (European bonds posted even stronger gains, with benchmark German and UK rates both falling as much as seven basis points).

According to the Bloomberg strategist, heavy option buying over the past week has centered on options that would stand to benefit from US 10-year yields dropping to roughly 4.3%, the lowest in more than a month. One high-risk trade stood out: it stood to make $15 million windfall by risking just $150,000 should the 10-year benchmark fall even further to 4.25% by May 24.

Open interest, or the amount of new positioning, surged recently in options tied to the so-called 110.00 call strike, which pairs with a roughly 4.3% 10-year yield level, according to CME data. Buying was concentrated in the June tenor expiring May 24, capturing this week’s big economic news including the reports on producer and consumer prices.

"There’s been a lot of positioning both ways, but most recently there’s been a lot more leaning toward the possibility of easing, and conceivably the chance of aggressive easing,” said Alex Manzara, a derivatives broker at R.J. O’Brien & Associates. “The market is clearly concerned about something going bad that could lead to rapid easing.”

But it's not just the expectation that something will break: “There seems to be an expectation that the data will cool from last month and the market does seem to be somewhat set up that way,” said Samuel Zief, head of global FX strategy at JPMorgan Chase Bank.

Indeed, a majority now agrees with our recent take: a survey conducted by 22V Research showed 49% of investors expect the market reaction to the CPI report to be “risk-on” — while only 27% said “risk-off.”

Meanwhile, asset managers continued to add to long bets in futures, adding to bullish positions for a fourth week in a row, data from the CFTC shows.

Agreeing with the general setup, Bloomberg commentator Ven Ram writes that "the recent bullish mood in Treasuries is likely to extend if today’s inflation and retail-sales data for April prove to be soft" and he points out that on Tuesday, 10-year bonds made the most of higher-than-forecast PPI numbers. With Chair Jerome Powell describing the data as “mixed,” the markets ran ahead with the idea that components from the data that feed into the Fed’s own PCE gauge weren’t all pointing northward.

To Ram, that mindset suggests that barring a shock, above-forecast inflation readings today, Treasuries will more likely extend their nascent rally, however tenuous that may be. A reading that matches the median expectation for 0.4% on month will spur the markets to move in the direction of pricing 50 basis points of interest rate cuts for the year (current pricing is about 44 basis points). Based on correlations that we have seen this year, that would suggest a 10-year yield at 4.3592%.

A double whammy of soft inflation and weak retail sales would kindle the markets’ imagination afresh, spurring traders to fully price in a first cut in September and more than 50 basis points of policy reduction by the end of the year. That would send the two-year yield toward 4.6809% in the coming days and the 10-year toward 4.30%.

His conclusion is that "whether or not the rally has endurance is a different matter, but the market’s mood seems to be decidedly one of a bullish tactical bias heading into the all-important data sets today."

Finally, it's not just bonds that will rip higher (in price, not yield) if CPI comes in soft: “An in-line-with-consensus US core CPI read is discounted and in the price, but that may be enough to promote relief buyers and see the index push higher,” said Perpperstone's head of research Chris Weston.

“A core CPI read below 0.25% month-on-month and I certainly wouldn’t want to be short.”

US Futures Coiled Tightly Ahead Of Key CPI Print

US Futures Coiled Tightly Ahead Of Key CPI Print

Tyler Durden

Wed, 05/15/2024 - 07:31

Equity futures were set to hold yesterday's gains ahead of today's CPI report, but will move violently either higher or lower after today's CPI number is released, which will either validate or reject Jerome Powell’s latest signals that interest rates will be higher for longer (our CPI preview is here). European and Asian stocks also gained, and the MSCI All Country World Index extended its longest run of gains since January. At 7:15am ET, futures contracts on the S&P 500 were little changed with small-caps catching a bid, while the MSCI All Country World Index extended its longest run of advances since January. Nasdaq 100 futures were also flat after the underlying index hit an all time high on Tuesday. Bond yields are down 1-2bps across the curve with the USD seeing some weakness. Commodities are higher, led by Energy and Precious Metals. On the macro front, both CPI and Retail Sales at 8.30am ET (previews here and here).

Activity in the premarket is muted with even the meme names up "only" low single digits and Mag7 seeing small moves ex-TSLA which is +0.8%. Here are the most prominent pre-market movers:

- Arcutis Biotherapeutics shares soar 24% after the company reported first-quarter sales that exceeded expectations, citing growth in demand for its prescription medications for skin conditions.

- Dlocal shares slide 27% after the Uruguayan fintech reported net income for the first quarter that missed the average analyst estimate.

- Meme stocks extend their rally into a third day, leading a frenzy affecting other high-risk and heavily shorted companies. GameStop +11%, AMC Entertainment +10%

- New York Community Bancorp shares rise 5.9% after the lender agreed to sell about $5 billion in mortgage warehouse loans to JPMorgan. Analysts were positive on the sale, saying that it will boost capital and liquidity and is in keeping with management’s new strategy.

- Nextracker shares rise 14% after it provided a fiscal 2025 adj. Ebitda forecast that beat estimates. Given the backlog-driven nature of the business, the growing +$4 billion in backlog “should substantially de-risk 2025 outlooks,” according to analysts at KeyBanc.

- Nu Holdings shares gain 6.49% after the parent of Nubank reported record revenue and net income for the first quarter that beat the average analyst estimate. The Brazil-based digital bank has an “open-ended growth opportunity” with a large addressable market, according to KeyBanc analysts.

In other news, overnight China vowed to take “resolute measures” after the Biden administration’s move to increase US tariffs on a wide range of Chinese imports; Bloomberg also reported that China was preparing a soft nationalization of the real estate sector by buying unsold houses to prop up the property market. In other news, Boeing faces possible criminal prosecution after the Justice Department found it violated a deferred-prosecution agreement tied to two fatal crashes half a decade ago.

In the run-up to US consumer price index data, the S&P 500 advanced despite Jerome Powell’s signals that interest rates will be higher for longer and a mixed reading on producer inflation, amid speculation that today's CPI print will come in below estimates: core CPI, which excludes volatile food and energy costs, is seen slowing to 0.3% month-on-month, from 0.4%; the core CPI reading is expected to show the lowest annual increase yet this year, in which case the core PCE deflator, the Fed’s preferred inflation gauge, could also register its lowest reading in 2024. Into the data, Fed-dated OIS price in around 42bp of rate cuts for the year with the first 25bp fully priced in for the November policy meeting (see our preview here for why a lower than expected number seems likely).

“An in-line-with-consensus US core CPI read is discounted and in the price, but that may be enough to promote relief buyers and see the index push higher,” said Chris Weston, head of research at Pepperstone Group Ltd. “A core CPI read below 0.25% month-on-month and I certainly wouldn’t want to be short.”

A survey conducted by 22V Research showed 49% of investors expect the market reaction to the CPI report to be “risk-on” — while only 27% said “risk-off.”

“A downside surprise seems needed,” said Michael Leister, head of rates strategy at Commerzbank AG. “For one, break-evens have already corrected notably and thus should provide less support for the long-end from here. At the same time, the Fed will remain reluctant to give the all-clear considering the lack of disinflation progress.”

European stocks rallied, led by real estate, telecoms and utilities. The IBEX 35 outperformed while the CAC 40 was flat, lagging peers. In individual stocks, Burberry Group Plc declined after reporting a slump in sales, dragging the consumer goods sector lower. ABN Amro Bank NV dropped more than 5% after unchanged guidance, while Finnish refiner Neste Oyj slumped on a downward revision on sales margins for its renewable products. Here are all the notable European movers:

- Merck KGaA shares climb as much as 4.6% after the Germany company reported adjusted Ebitda for the first quarter that beat analyst expectations and forecast a return to organic sales and earnings growth for 2024.

- LEG Immobilien shares rise as much as 3.3% after the German real estate firm’s first-quarter results show what analysts describe as a solid start to the year.

- Hunting shares surge as much as 23% after the oil field services provider said Ebitda will be at the top-end of its current guidance range thanks to a bumper order from the Kuwait Oil Co.

- Keller rises as much as 15% to a record high after the British ground-engineering specialist reported a better-than-expected start to the year and said its annual results will be “materially ahead” of the board’s initial expectations.

- InPost shares jump as much as 10% to hit their highest level since September 2021 following a 1Q earnings beat. That was aided by a 22% rise in parcel volumes and guidance for further volume growth in 2Q is seen positive by analysts, as it confirms that the Polish automated parcel locker operator is gaining further market share.

- Lundbeck shares gain as much as 7.7%, the most in more than 15 months, after the Danish pharmaceutical group reported better-than-expected results for the first quarter.

- SoftwareONE shares rally as much as 6.6% after the Swiss software provider posted solid margin expansion, offsetting slightly below-consensus Ebitda, according to Baader.

- Thyssenkrupp drops as much as 8.1%, the most since Feb. 14, after the steel producer reduced its expectations for a second time in three months amid lower steel prices and carbon dioxide trading losses.

- ABN Amro shares decline as much as 6.5% after the Dutch bank’s first-quarter results showed a capital ratio that missed analyst estimates, overshadowing more positive aspects of the earnings report.

- Burberry shares fall as much as 4.6% after the British luxury-goods maker’s adjusted pretax profit for the full year missed estimates amid a tough backdrop for high-end goods.

- Allianz slips as much as 2.2% despite reporting operating profit for the first quarter that beat estimates. Analysts note misses on accident year loss and solvency ratios, amid otherwise in-line results.

- Neste shares decline as much as 15% to the lowest level since 2018, after it posted a big downward revision of its renewable products sales margin guidance, which implies cuts to the Finnish refiner’s consensus and signals weaker market conditions, according to analysts.

- HelloFresh shares fall as much as 7.2% to a record intraday low Wednesday after JPMorgan downgraded the meal-kit company to neutral from overweight, saying its North America business is still “far from stabilizing.”

The euro-zone economy started the year on a stronger footing than anticipated, growing 0.3% in the three months through March following a shallow recession in the latter half of 2023, data Wednesday confirmed. Yet inflation is likely to backpedal more quickly than previously anticipated, with growth picking up next year, according to the European Commission. In contrast to the likely US path for interest rates, Bank of France Governor Francois Villeroy de Galhau said that the European Central Bank is very likely to start easing policy at its next policy meeting in June.

Earlier in the session, Asian stocks closed at the highest level since April 2022, as technology shares were lifted by key earnings reports and gains in US peers overnight. The MSCI Asia Pacific Index climbed as much as 0.6%, with Sony providing the biggest boost after announcing strong results and a buyback. Taiwan stocks led gains among regional equity gauges, with shares also rising in Australia. Markets were closed for holidays in Hong Kong and South Korea.

In FX, the dollar extended declines; Norwegian krone and yen outperformed as all G-10 FX rose. US equity futures were steady while

In rates, major global bonds rallied, led by gilts. US 10-year yields dropped to a five-week low of around 4.42% before US CPI data as treasuries were slightly richer across the curve, following wider gains in core European rates where German yields are lower by 4bp to 7bp, outperforming peers. Gains in Treasuries extend Tuesday’s rally as traders set up for Wednesday’s April CPI and retail sales reports. US yields richer by up to 2bp across belly of the curve which outperforms slightly, steepening 5s30s spread by almost 1bp on the day; 10-year yields around 4.42% with bunds and gilts outperforming by 5bp and 3.5bp in the sector.

In commodities, oil held gains after an industry report showed shrinking US stockpiles, overshadowing a softer demand growth outlook by the International Energy Agency for the rest of the year. WTI traded within Tuesday’s range, adding 0.5% to near $78.42. Most base metals trade in the green. Copper futures in New York rallied to a record high after a short squeeze that’s prompted a scramble to divert metal in other regions to US shores. Spot gold was up roughly $15 to trade near $2,373/oz.

Looking at today's calendar, US economic data slate includes May Empire manufacturing, April CPI and retail sales (8:30am New York time), March business inventories and May NAHB housing market index (10am) and March TIC flows (4pm). Fed officials’ scheduled speeches include Barr (10am), Kashkari (12pm) and Bowman (3:20pm)

Market Snapshot

- S&P 500 futures little changed at 5,271.50

- STOXX Europe 600 up 0.4% to 523.60

- MXAP up 0.6% to 179.55

- MXAPJ up 0.6% to 562.20

- Nikkei little changed at 38,385.73

- Topix little changed at 2,730.88

- Hang Seng Index down 0.2% to 19,073.71

- Shanghai Composite down 0.8% to 3,119.90

- Sensex down 0.2% to 72,945.92

- Australia S&P/ASX 200 up 0.3% to 7,753.70

- Kospi up 0.1% to 2,730.34

- German 10Y yield little changed at 2.49%

- Euro up 0.1% to $1.0834

- Brent Futures up 0.6% to $82.87/bbl

- Gold spot up 0.5% to $2,369.50

- US Dollar Index down 0.19% to 104.82

Top Overnight News

- China is considering buying millions of unsold homes to support the property market, people familiar said. Local governments would be asked to purchase units from distressed developers at steep discounts using loans provided by state banks. The offshore yuan strengthened. BBG

- The IEA lowered its outlook for crude demand growth this year amid an economic slowdown and mild weather in Europe. Still, annual consumption remains on track to reach a record of more than 103 million barrels a day. The agency kept its estimates for 2025. BBG

- The ECB is very likely to start cutting interest rates at its next policy meeting in June, Bank of France Governor Francois Villeroy de Galhau said. Barring surprise shocks, the ECB remains committed to bringing inflation to its 2% goal by next year from 2.4% currently, he said in an interview on RTL radio on Wednesday. BBG

- The Biden administration is encouraging Arab states to participate in a peacekeeping force that would deploy in Gaza once the war ends, in the hope of filling a vacuum in the strip until a credible Palestinian security apparatus is established. FT

- The Biden administration notified Congress on Tuesday that it was moving forward with more than $1 billion in new weapons deals for Israel, U.S. and congressional officials said, a massive arms package less than a week after the White House paused a shipment of bombs over a planned Israeli assault on Rafah. WSJ

- CPI: We expect a 0.28% increase in April core CPI (vs. 0.3% consensus), corresponding to a year-over-year rate of 3.61% (vs. 3.6% consensus); We think an upward pressure from Car Insurance, a neutral impact from health insurance, and see rent inflation slowing, while OER should remain strong. SPX implied moving into the event is 95bps. GIR

- A top official at the Federal Reserve said it was too soon to say that progress bringing down inflation had stalled and said it was appropriate for the Fed to hold rates steady as it awaits evidence that price pressures are easing further. “It’s too early to really conclude that we stalled out or that inflation is going to reverse,” said Cleveland Fed President Loretta Mester in an interview Tuesday. “I kind of always suspected that we wouldn’t be able to make as quick progress as we got in the second half last year.” WSJ

- Washington is increasingly concerned about Russia’s momentum in Ukraine, although the Pentagon still hopes that once American weapons begin arriving (around July), many of Moscow’s recent gains can be reversed. NYT

- Brazil’s President Luiz Inacio Lula da Silva fired Petrobras CEO Jean Paul Prates following a dispute over dividend payments. The government is proposing Magda Chambriard to replace him.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly higher following the momentum from the US where the major indices ultimately gained and the Nasdaq posted a fresh record close with two-way price action seen following PPI data. ASX 200 was led by the mining, materials and healthcare sectors, while participants also digested the recent budget announcement with the government planning to boost spending next year ahead of an election. Nikkei 225 gained but was well off today's best levels with newsflow dominated by earnings releases including from Sony and Sharp, while the Japanese megabanks are also scheduled to announce their results today. Shanghai Comp was pressured after the recent US tariff announcement and with Stock Connect trade shut owing to the holiday closure in Hong Kong, although the real estate industry found solace from news that China is mulling purchases of unsold homes to ease the glut.

Top Asian News

- PBoC conducted CNY 125bln (CNY 125bln maturing) in 1-year MLF with the rate kept unchanged at 2.50%.

- China mulls government purchases of millions of unsold homes from distressed developers at steep discounts to ease the glut, while Beijing is seeking feedback on the preliminary proposal, according to Bloomberg sources.

European bourses, Stoxx600 (+0.2%) are mostly firmer, continuing the positive sentiment seen in APAC trade overnight. European sectors hold a strong positive tilt; Real Estate is the clear outperformer, lifted by post-earning gains in Leg Immobilien (+2.9%). Basic Resources is lifted by broader strength in underlying metals prices. Consumer Products & Services is weighed on by losses in the Luxury sector, namely Burberry (-3.1%). US Equity Futures (ES U/C, NQ U/C, RTY +0.3%) are modestly firmer, attempting to build on the prior session’s advances, though still mindful of the upcoming US CPI & Retail Sales.

Top European News

- CB's Rehn says if the confidence that inflation is approaching its target in a sustainable manner continues to strengthen, the restrictiveness of monpol can be reduced.

- European Commission Forecasts (Spring 2024): A gradual expansion amid high geopolitical risks.

- Riksbank Minutes: Floden said "Monetary policy will remain contractionary even after a policy rate cut to 3.75 per cent. If these developments continue, it will therefore be appropriate to continue to cut the rate by a few more steps".

FX

- DXY has continued its descent below the 105 mark and is approaching its 100DMA at 104.78 ahead of today's US CPI & Retail Sales.

- EUR/USD is on firmer footing vs. USD and now above the 1.08 mark, with its 100DMA at 1.0822. EZ-specific updates have been non-incremental for today's session.

- GBP is a touch firmer vs. peers with nothing in the way of UK-specific drivers. As such, the dollar side of the equation will likely prove more pivotal. A dovish CPI print could see GBP/USD test the May high at 1.2634.

- Antipodeans are both performing well vs. the USD with some support seen after reports that China is mulling purchases of unsold homes to ease the glut; has helped prop up metals prices. AUD/USD has printed a new high for the month at 0.6651.

- A two-way reaction for the SEK post-CPI. Initially, EUR/SEK moved lower from 11.6760 to 11.6520 with the focus likely on the hot ex-energy M/M. However, this swiftly retraced with EUR/SEK surpassing pre-release levels and going as high as 11.7035 given the slight uptick in the headline Y/Y was less than expected.

Fixed Income

- USTs are firmer by a handful of ticks at a fresh WTD peak of 109-07+, with the complex continuing to build on the post-PPI gains; data which whilst is hawkish at first-glance, contained some softer components relevant to the US PCE.

- Gilts are the modest outperformer as the complex continues to pick up from Wednesday's PPI-induced downside, alongside broader fixed benchmarks, and as the dovish commentary from Pill remains the main development for the Gilt market in recent sessions. Gilts holding above 98.0 at a fresh WTD peak of 98.18.

- Bund price action is in-fitting with peers, but less-so than Gilts. Bunds are holding just above the 131.00 mark and matching the 131.13 double-top from Monday & Tuesday; price action was little reactive to the dual-tranche 30yr Bund auction, which was strong.

Commodities

- Crude is in the green with magnitudes comparable to equity performance as the complex appears to be following the overall risk tone and perhaps taking some impetus from USD downside into CPI. Brent July currently holds around USD 82.80/bbl, whilst WTI hovers USD 76.50.

- Gas benchmarks outperform after commentary from the QatarEnergy and TotalEnergies CEO around significant gas demand and there being no chance of a LNG surplus currently.

- Precious metals are supported given the cooler-take from PPI for CPI/PCE and after Chair Powell's comments on the readings. XAU around USD 2372/oz, just shy of last week's USD 2378/oz peak.

- Base metals are entirely in the green with sentiment lifted amid reports of further Chinese support measures.

- IEA OMR: cuts 2024 oil demand growth forecast by 140k BPD to 1.1mln BPD, 2025 demand expected to grow by 1.2mln BPD (vs. prev. forecast of 1.1mln BPD). 2024 demand forecast lowered due to weak deliveries, notably in Europe, shifted Q1 OECD demand into contraction. World oil supply to rise by 580k BPD in 2024 to a record 102.7mln BPD. Oil market looks more balanced in 2024. Even in the event that OPEC+ voluntary production cuts were to remain, global oil supply could rise by 1.8mln BPD in 2025 compared to the 580k BPD rise in 2024.

- US Energy Inventory Data (bbls): Crude -3.1mln (exp. -0.5mln), Cushing -0.6mln, Gasoline -1.3mln (exp. +0.5mln), Distillate +0.3mln (exp. +0.8mln).

- Explosion was reported after a drone attack at Russia's Rostov fuel depot, according to Russian agencies.

Geopolitics: Middle East

- A Hezbollah commander was killed in an Israeli airstrike targeting a car in southern Lebanon's Tyre, according to two Lebanese security sources cited by Reuters.

- Iraqi armed factions targeted an Israeli military target in Eilat with drones, according to Sky News Arabia.

- US President Biden would veto the Israeli bill on the floor this week, according to Punchbowl citing the White House. It was separately reported that the US State Department moved USD 1bln weapons aid for Israel to a congressional review process, according to a senior official cited by Reuters.

- Israel's Defence Minister Galliant set to to give security briefing to press at 16:00 BST/11:00ET.

Geopolitics: Other

- Ukrainian officials are making a new push to get the Biden administration to lift its ban on using US-made weapons to strike inside Russia, according to POLITICO.

- France and Netherlands seek EU sanctions on global financial institutions that help Russia's military, according to a proposal seen by Reuters.

- Russian President Putin said Russia and China are promoting the prosperity of both nations through expanded equal and mutually beneficial cooperation, as well as noted that Russian-Chinese economic ties have great prospects. Furthermore, Putin said China clearly understands the roots of the Ukraine crisis and its global geopolitical impact, while he is open to a dialogue on Ukraine, but added that such negotiations must take into account the interests of all countries involved in the conflict, including theirs, according to Xinhua.

- North Korean leader Kim oversaw a tactical missile weapon system on Tuesday, according to KCNA.

US Event Calendar

- 08:30: April CPI MoM, est. 0.4%, prior 0.4%

- 08:30: April CPI YoY, est. 3.4%, prior 3.5%

- 08:30: April CPI Ex Food and Energy MoM, est. 0.3%, prior 0.4%

- 08:30: April CPI Ex Food and Energy YoY, est. 3.6%, prior 3.8%

- 08:30: April Retail Sales Advance MoM, est. 0.4%, prior 0.7%

- 08:30: April Retail Sales Ex Auto MoM, est. 0.2%, prior 1.1%

- 08:30: April Retail Sales Control Group, est. 0.1%, prior 1.1%

- 08:30: May Empire Manufacturing, est. -10.0, prior -14.3

- 10:00: March Business Inventories, est. -0.1%, prior 0.4%

- 10:00: May NAHB Housing Market Index, est. 50, prior 51

- 16:00: March Total Net TIC Flows, prior $51.6b

DB's Jim Reid concludes the overnight wrap

Markets had been on course to continue their quiet holding pattern ahead of today's CPI but a late positive burst powered the S&P 500 (+0.48%) to within a whisker of its all-time high and the NASDAQ (+0.75%) to a new peak, while the 10yr treasury yield (-4.7bps) fell to its lowest level since the last CPI print on April 10. There weren’t obvious drivers, but perhaps the absence of bad news was enough to inject some relief into markets. Y esterday’s PPI data didn't really move the needle much with a notable beat balanced by some notable down revisions and some of the details being neutral for core PCE. So the focus will now shift to April's CPI after 3 upside surprises in a row for core CPI. Don't forget US retail sales as well, released at the same time.

For now at least, the Fed continue to stick to their recent message with Chair Powell yesterday saying that “we’ll need to be patient and let restrictive policy do its work”. So there was little acknowledgement that rate cuts were happening anytime soon, but Powell also didn’t dial up the hawkishness either. That narrative was supported by the PPI print for April, which was a distinctly mixed bag. On the negative side, headline PPI came in at a monthly +0.5% (vs. +0.3% expected), and the measure excluding food, energy and trade was also up +0.4% (vs. +0.2% expected). But in more positive news, the previous month’s headline PPI was revised down three-tenths to show a -0.1% decline. And on top of that, the components that feed into the Fed’s target measure of PCE were more neutral. For instance, portfolio management services were up +3.9%, but domestic airfares came down -4.7%.

For today, our US economists are expecting headline CPI to come in at +0.37%, and core CPI to be at +0.29%. The last three core CPI prints each came in at +0.4%, so this would be a deceleration. But even if those forecasts are realised, the 3m annualised rate for core CPI would still be running at +4.1%, so not the sort of territory where the Fed would ordinarily be cutting rates. For the year-on-year numbers, those forecasts would push the headline CPI rate down to 3.4%, and the core CPI rate to 3.6%. Click here for our US economists’ full preview, along with how to sign up for their webinar immediately afterwards.

Ahead of that, markets turned more upbeat yesterday, with the S&P 500 (+0.48%) closing within two tenths of a percent of its all-time high on March 28. Tech stocks outperformed, with the Magnificent 7 (+1.01%) reaching a new all-time high, led by Tesla (+3.29%) and Nvidia (+1.06%). But the equity rally was broad-based, with the small-cap Russell 2000 up +1.14%. The advance of the S&P 500 was earlier held back by several defensive sectors, with energy stocks (-0.13%) one of the weaker performers as Brent crude oil prices (-1.18%) closed at a 2-month low of $82.38/bbl. Meanwhile in Europe, the STOXX 600 (+0.15%) just about made it up to an all-time high, as the index posted an 8th consecutive advance for the first time since 2021.

The other notable story in the equity space came from several meme stocks, with GameStop up +60.1% on the day, building on its +74.4% advance on Monday. It's now up to $48.75 having traded as low as $10 in late April. Similarly, AMC Entertainment was up +31.98%, whilst Blackberry gained +11.94%.

For sovereign bonds, there was a divergent performance yesterday, with Treasuries rallying whilst most of Europe sold off. Yields on 10yr Treasuries fell by -4.7bps to 4.44%. By contrast, yields on 10yr bunds (+3.8bps), OATs (+3.9bps) and BTPs (+2.6bps) all moved a bit higher on the day. Those moves came in spite of comments from the ECB’s Knot that “June will be a good opportunity to make a first move in removing restriction”, which helped to cement the view that the ECB are moving towards a rate cut at their next meeting. In the UK, gilts saw a relative outperformance, with the 10yr yield down -0.1bps, which came as the unemployment rate ticked up a tenth to 4.3% over the three months to March. Moreover, BoE chief economist Pill sounded open to a rate cut, saying that it was “not unreasonable to believe that through the summer we will begin to see enough confidence in the decline in persistence that bank rate will come under consideration”.

In other news yesterday, we had confirmation that the US were imposing fresh tariffs on $18bn of Chinese imports, including steel and aluminium, semiconductors, and EVs. In fact, the t ariff on EVs will go up from 25% to 100%. Some of the new tariffs will take effect this year, but others won’t happen until 2026. The move comes ahead of November’s presidential election, but both parties have taken a much tougher stance on China over recent years, and Biden has kept most of Trump’s previous tariffs in place. Indeed, Trump himself said at a rally on Saturday that “I will put a 200% tax on every car that comes in from those plants”. So the direction has been towards a more protectionist stance on trade from both parties. Our China economist has written about the potential impact on the domestic macro landscape here.

Asian equity markets are mixed this morning with the Nikkei (+0.18%) and the S&P/ASX 200 (+0.47%) trading higher while Chinese markets are lagging with the CSI (-0.27%) and the Shanghai Composite (-0.17%) both trading slightly lower after the new US tariffs announced yesterday on an array of Chinese imports. Elsewhere, stock markets in South Korea and Hong Kong are shut for a public holiday. US equity futures are slightly higher with Treasuries fairly flat.

In monetary policy action, the PBOC kept the one-year medium-term lending facility (MLF) unchanged at 2.50%. This came despite weaker money supply numbers than expected overnight although Bloomberg are running a story suggesting China are working on a plan to buy up unsold homes to shore up the property sector. Moving ahead, markets will move their focus to China’s industrial production and retail sales data due on Friday.

Looking at yesterday’s other data, the German ZEW survey improved in May, with the expectations component up to 47.1 (vs. 46.4 expected), whilst the current situation reading moved up to -72.3 (vs. -75.9 expected). For the current situation that’s a 9-month high, and for the expectations component, that’s a 2-year high, which was last surpassed in February 2022.

To the day ahead now, and data releases include the US CPI report for April, along with retail sales for April and the NAHB’s housing market index for May. From central banks, we’ll hear from the ECB’s Rehn, Muller, Villeroy and Makhloufi, along with the Fed’s Kashkari and Bowman.

Fiscal Bazooka: China Considers Buying Millions Of Homes To Save Property Market

Fiscal Bazooka: China Considers Buying Millions Of Homes To Save Property Market

Tyler Durden

Wed, 05/15/2024 - 06:55

In April's politburo meeting, the Chinese government's newfound focus on an oversupplied housing market was setting the stage to usher in new rescue policies to stabilize the economy. Weeks later, Bloomberg reported that the government was considering a plan for local governments to purchase millions of unsold homes to clear the excess supply.

According to sources familiar with government discussions, the State Council requests feedback from various provinces and government entities on the home-buying plan.

Here's more color on the plan via Bloomberg:

Local state-owned enterprises would be asked to help purchase unsold homes from distressed developers at steep discounts using loans provided by state banks, according to two of the people. Many of the properties would then be converted into affordable housing.

Officials are still debating details of the plan and its feasibility, the people said, adding that it could take months to be finalized if China's leaders decide to go ahead. The housing ministry didn't respond to a request for comment.

In a note earlier, Goldman's Peter Sheren told clients that this news is nothing new and "has been speculated for 3-4 weeks."

"This was one of the initial catalysts for the China Property Sector (GSXACNRE) to rally 21% in the past month," Sheren said.

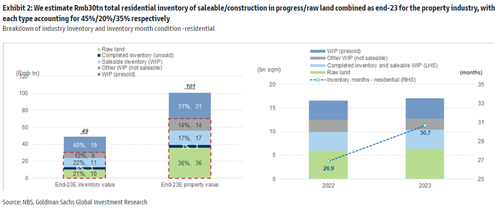

Housing prices in China have already fallen 25-30% from the peak and presented a dark cloud of economic uncertainty over China's financial system stability and continued risk for China's macroeconomic backdrop. If authorities do proceed with the plan, in a separate note, Goldman's Wang Yi believes "this new initiative might help to stabilize housing prices."

Here's more commentary from Goldamn's Sheren this morning:

"Wang Yi and team think if the coming measures focus on clearing "saleable inventory" (which includes both completed and uncompleted but unsold units, and that are less than 3 years of last year sales volume) or about 1/4 of the entire inventory backlog, property price stabilization might be achievable.

"Wang Yi estimates that there was Rmb30tn (US$4tn) in residential inventory by end-2023. If fully built-up, this will be about 10X what the market sold in 2023, or 1/4 of total housing stock as of end-2023. The required capital investment for completing such inventory could be 5X the construction CAPEX in 2023."

In terms of what's needed in this fiscal bazooka to bottom China's ailing residential housing market, Shujin Chen, head of China financial and property research at Jefferies Financial Group, estimated at least 2 trillion yuan ($277 billion).

Bloomberg Economics pointed out that the property sector "is unlikely to stabilize until the gap between housing supply and demand closes."

Government data shows that about 3.6 billion square feet of unsold housing inventory linger on the market, the highest level since 2016.

Meanwhile, Tianfeng Securities estimates the new plan could cost 7 trillion yuan to absorb the inventory in 18 months.

One major problem local governments face in reducing the housing surplus is the need to increase debt levels. Banks would also face mounting pressure as rising bad loans and contracting margins have weakened their balance sheets.

From a market perspective, this is terrific news, as the CSI 300 Real Estate Index initially jumped 5% after the report.

However, deep, alarming structural problems persist in the world's second-largest economy.

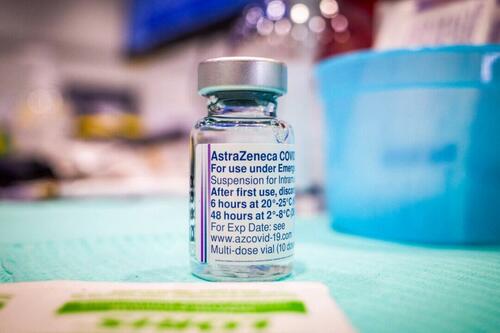

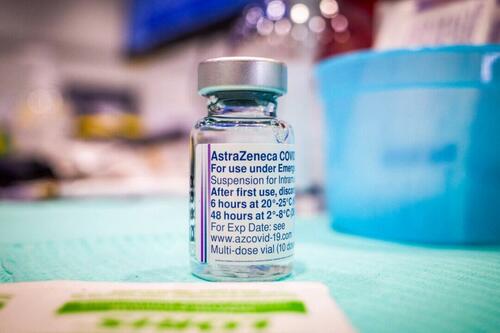

"They Left Us No Choice": Woman With Vaccine Injury In Clinical Trial Sues AstraZeneca

"They Left Us No Choice": Woman With Vaccine Injury In Clinical Trial Sues AstraZeneca

A vial of AstraZeneca vaccine is seen at a mass COVID-19 vaccination clinic in Calgary, Alta., on April 22, 2021. (The Canadian Press/Jeff McIntosh)

A vial of AstraZeneca vaccine is seen at a mass COVID-19 vaccination clinic in Calgary, Alta., on April 22, 2021. (The Canadian Press/Jeff McIntosh)

Brianne Dressen in New York on Jan. 6, 2023. (Jack Wang/The Epoch Times)

Tyler Durden

Wed, 05/15/2024 - 06:30

Brianne Dressen in New York on Jan. 6, 2023. (Jack Wang/The Epoch Times)

Tyler Durden

Wed, 05/15/2024 - 06:30

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

A vial of AstraZeneca vaccine is seen at a mass COVID-19 vaccination clinic in Calgary, Alta., on April 22, 2021. (The Canadian Press/Jeff McIntosh)

A vial of AstraZeneca vaccine is seen at a mass COVID-19 vaccination clinic in Calgary, Alta., on April 22, 2021. (The Canadian Press/Jeff McIntosh)

An American woman who suffered an injury from AstraZeneca’s COVID-19 vaccine sued the company on May 13, alleging the company breached a contract by not paying for the medical care she requires to deal with the injury.

“They left us no choice,” Brianne Dressen, a preschool teacher in Utah, told The Epoch Times in an email.

Ms. Dressen has paid tens of thousands of dollars to drugs to treat the nervous system disorder and other issues she’s experiencing, according to the complaint, filed in federal court in her home state.

Ms. Dressen chose to participate in AstraZeneca’s clinical trial in 2020 because she wanted to help the company develop its COVID-19 vaccine. The consent form she signed stated in part that AstraZeneca would “cover the costs of research injuries” and “pay the costs of medical treatment.”

“With these reassurances should something go wrong, Bri signed the form, rolled up her sleeve, and let the drug company inject the experimental product into her arm. Her mind was at peace, as Bri believed she was doing the right thing for her country, her students, and her family,” the suit states.

Ms. Dressen soon started experiencing problems, including blurred vision, tinnitus, and vomiting. She later became extremely sensitive to light and suffered spikes in her heart rate.

Ms. Dressen went to see numerous doctors as she attempted to figure out what was wrong with her, and seek treatment.

In 2021, U.S. National Institutes of Health doctors diagnosed Ms. Dressen as having “post-vaccine neuropathy,” according to records reviewed by The Epoch Times.

Bills for the doctors’ visits and drugs they prescribed began piling up quickly. The immunoglobulin recommended by government doctors alone costs $9,909.82 a month.

Ms. Dressen and her husband, a chemist with the U.S. Army, kept AstraZeneca and Velocity, which ran the trial for the company, apprised of the accumulating costs, according to the suit.

The family messaged Velocity on Jan. 15, 2021, with the first set of payment records for treatment but received no response, according to the suit. “Checking on updates for this. . . . When may we expect payment?” Brian Dressen, Ms. Dressen’s husband, wrote several weeks later.

“I am sorry you have not heard anything as of yet. Hopefully I get an answers [sic] soon. I will reach out again today,” a Velocity official responded.

No funds came to the family, forcing them to refinance their home.

“I’d like to know when we can expect the first payment on Brianne Dressen’s medical bills? Two months since submitting...“ Mr. Dressen wrote on March 18, 2021. The Velocity official said that she was ”forwarding on” the payment records.

“Hey this is Brianne Dressen. Can you advocate a bit for us here help us get a timeline for payment? I am still not doing well, we have had to hire for after school childcare. We really need this money,“ Ms. Dressen wrote on March 24, 2021. The official said the following day she would be escalating the issue and did not understand ”why it is taking so long.”

The back-and-forth continued for months with no reimbursement paid to Ms. Dressen.

Brianne Dressen in New York on Jan. 6, 2023. (Jack Wang/The Epoch Times)

Brianne Dressen in New York on Jan. 6, 2023. (Jack Wang/The Epoch Times)

After a local television station reported on Ms. Dressen’s case on July 13, 2021, Velocity contacted the Dressens and said a payment of $590.20 was forthcoming.

The company issued the payment and said it was in touch with AstraZeneca regarding the approval of additional funds.

In December 2021, the official sent a statement for Ms. Dressen to sign that said in part that Ms. Dressen would accept $1,243 in exchange for dropping any additional claims to payment.

The Dressens declined the offer, describing it as insulting.

In March 2022, AstraZeneca representatives began directly contacting the Dressens, requesting billing and medical records.

One representative wrote on Aug. 12, 2022, that the company was waiting on medical records from providers to assess the claims. The representative said on Sept. 26, 2022, that all of the medical records had been received.

AstraZeneca and Velocity never contacted the Dressens again, according to the suit.

“I did everything they asked of me. I honored my obligations to them. They have not honored any. When they needed me, I was there, I cooperated. When I needed them, they were nowhere to be found,” Ms. Dressen said in a statement.

The suit acknowledges that COVID-19 vaccines are and were covered by the Public Readiness and Emergency Preparedness Act, which gives manufacturers immunity to liability in most cases. The suit accuses the companies of breach of contract and breach of duty. It asks for damages for medical expenses, emotional fallout, loss of income, and other expenses, as well as attorney fees and prejudgment interest.

Ms. Dressen is seeking a jury trial.

Velocity did not respond to a request for comment. AstraZeneca did not return an inquiry.

AstraZeneca’s vaccine was never cleared for use outside clinical trials in the United States.

The UK-based company announced earlier this month it is withdrawing the vaccine, citing limited demand. The announcement came several months after it acknowledged the shot can cause blood clots and low levels of platelets, a combination known as thrombosis with thrombocytopenia syndrome.

Johnson & Johnson’s shot, which was cleared in the United States and also causes the syndrome, was pulled from the market in 2023.

Should You Believe Faulty U.S. Crime Stats Or Your Own Lying Eyes?

Should You Believe Faulty U.S. Crime Stats Or Your Own Lying Eyes?

Tyler Durden

Wed, 05/15/2024 - 05:45

Authored by James Varney via RealClearInvestigations,

Americans can be forgiven for suffering from whiplash regarding law and order.

In recent weeks the Biden administration and many news outlets, including USA Today and The Hill, have touted declines in violent crime statistics to argue that America is becoming a safer place.

“Right now, with 2023 figures and early 2024, the trends are all pointing down, in a positive direction,” Jeff Asher, whose New Orleans-based AH Datalytics is developing his own “Real-Time Crime Index,” told RealClearInvestigations.

Conservative outlets, including City Journal and the editorial page of the Wall Street Journal, assert that minor declines in headline grabbers like homicides fail to capture what is really happening in the U.S.

From 2017 to 2019, the U.S. had an average of 16,641 homicides a year. In 2021 and 2022, however, the country saw considerably more bloodshed, with an average of more than 22,000 annual homicides. Even if the 2023 number drops slightly, it will still represent a large increase over the recent past, before the pandemic and racial upheaval set in motion in 2020.

Many criminologists say this illlustrates one of the problems with the official numbers that are at the center of public debate: They give a distorted impression of true levels of crime. They note that crime stats have become notoriously incomplete in recent years. In some years many big cities did not report their numbers to the FBI, and there are such wide discrepancies in these tallies that the picture they provide has more blur than clarity.