One can readily admit that the Magisterium's manner of expression does not seem very easy to understand at times. It needs to be translated by preachers and catechists into a language which relates to people and to their respective cultural environments. The essential content of the Church's teaching, however, must be upheld in this process. It must not be watered down on allegedly pastoral grounds, because it communicates the revealed truth.

Non-Catholic

Killing the Constitution

In the last days of East Germany, when government officials detected that their power was unraveling, they ratcheted up enforcement of the nation’s reporting laws. The reporting laws made it a felony to know of a crime and fail to report it. It was also a crime to tell the person of whose crime you … Continue reading "Killing the Constitution"

The post Killing the Constitution appeared first on Antiwar.com.

Of Taxes, Elections, and Pharma Desperation

Either Biden's poll numbers really suck, or Team Biden has entirely lost the plot line connecting them to reality. Whatever the cause, if adopted the new proposals out of the White House will crater investment, stoke fear in Biden's political enemies and destroy prosperity.

Market Is Splendidly Indifferent To Rising Inflation Risks

Market Is Splendidly Indifferent To Rising Inflation Risks

Tyler Durden

Wed, 04/24/2024 - 13:25

Authored by Simon White, Bloomberg macro strategist,

There continues to be scant evidence of inflation hedging in markets despite clear signs price-growth risks are rising.

Inflation remains in focus this week as we get the first quarter’s update for US PCE on Friday. Regardless of one data point, the trend is clearly that inflation has stopped falling, with multiple leading indicators suggesting a recurrence.

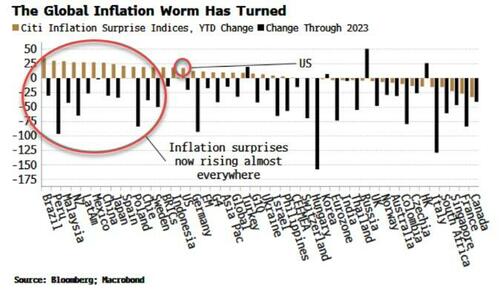

It’s not just in the US though. Globally, inflation is resurfacing. Through last year, the Citi Inflation Surprise indices were falling almost everywhere. Year-to-date in 2024, they are now rising in two-thirds of the countries the indices cover.

But that is not being priced in markets. Ven Ram points out that two-year Treasuries would struggle to sell-off on even a sticky core PCE print later this week, and that’s probably true in the nearer term. But even two-year yields are not yet pricing in the likelihood of a proper inflation shock that would require several more hikes from the Federal Reserve. That’s not a base case at the moment, but its probability is still underpriced.

Yields have been rising, and so have gold and silver, but there is a distinct lack of the inflation urgency seen in 2021 and early 2022, when CPI was hitting decade highs and the Federal Reserve had not yet responded with interest rate hikes.

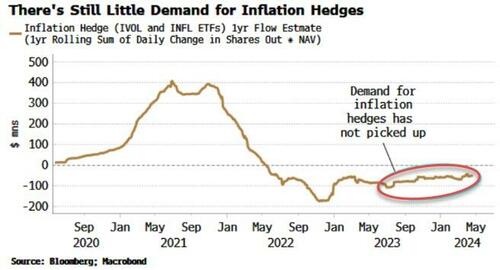

As one sign of the relative complacency, take two ETFs that are designed to hedge inflation, INFL and IVOL.

These saw marked inflows in 2021, but the flows have been muted since the Fed started raising rates in 2022 and have remained so.

There have also been no marked pick-up in flows to ETFs of inflation-linked bonds, such as the TIP ETF.

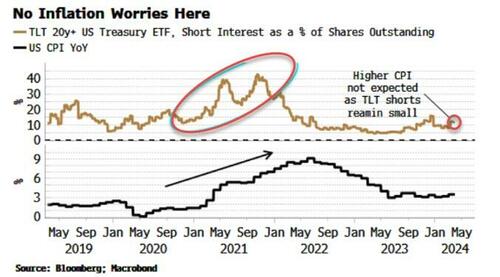

Similarly shorting interest in Treasuries continues to be minimal. JPMorgan’s Client Treasury Survey is registering a near series-low of outright shorts, while short interest in the TLT long-term UST ETF is low and has barely risen.

There are no inflation alarms ringing. But that could prove to be misguided as inflation shows clear signs of resurfacing.

This is even more so as the structural backdrop, with increasingly coordinated fiscal and monetary policy, is conducive to a secular rise in price growth.

Subpar Record 5Y Auction Tails, Pushes Yields To Session Highs

Subpar Record 5Y Auction Tails, Pushes Yields To Session Highs

Tyler Durden

Wed, 04/24/2024 - 13:21

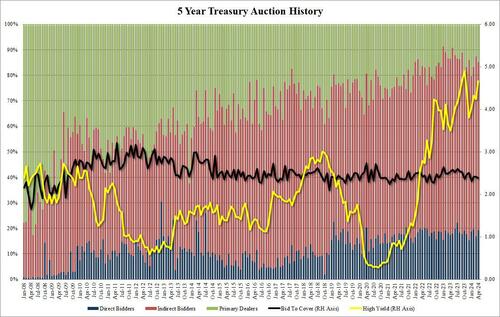

One day after the US sold a record amount of 2 Year paper in a very strong auction, the Treasury has followed that up with a record amount of 5 year paper, this time in a less than impressive sale.

The $70BN in 5Y paper was up $3BN from $67BN last month and was the highest amount on record offered for the tenor. But don't worry there will be plenty more record auctions in the future: after all, the US has now crossed into the Minsky Moment and it is now issuing debt just to pay the interest on its existing debt.

The auction priced at a thigh yield of 4.659%, up sharply from 4.235% last month and the highest since October's cycle high of 4.899%. Unlike yesterday's 2Y auction which stopped through, today's sale modestly tailed the When Issued 4.655% by 0.4bps.

The Bid to Cover was also weaker than last month, dropping from 2.41 to 2.39, and just below the 2.411 six-auction average.

The internals were also subpar, with Indirects sliding to 65.7% from 70.5% last month, if almost on top of the recent average of 65.4%. And with Directs taking down 19.2%, above the 17.9% recent average, Dealers we left holding 15.0%, just below the recent average of 16.7%.

Overall, this was a mediocre and forgettable auction, and one which accelerated the move higher in bond yields which are now at 4.654%, just shy of session highs.

Romney & The Wrong Question: Senator's Statement On Trump's Guilt Captures The Problem With The Manhattan Trial

Romney & The Wrong Question: Senator's Statement On Trump's Guilt Captures The Problem With The Manhattan Trial

Tyler Durden

Wed, 04/24/2024 - 13:11

Yesterday, Sen. Mitt Romney (R-UT) had a much covered interaction with CNN’s Manu Raju who asked him about Trump’s criminal trial and whether he was guilty of the underlying criminal conduct. Romney responded “I think everybody has made their own assessment of President Trump’s character, and so far as I know you don’t pay someone $130,000 not to have sex with you.” I have previously defended Romney in his votes on impeachment despite our disagreement on the constitutional standard. I also understand that he was making a more general comment on character.

However, his response is precisely what Manhattan District Attorney Alvin Bragg is seeking from the jury: a verdict on Trump as a person rather than the underlying criminal allegations.

Trump is currently facing 34 counts of falsifying business records in the first degree regarding payments made to Daniels during the 2016 presidential election. As I discuss today in the New York Post, many of us (including liberal legal experts) still question whether there is any crime alleged by Bragg. Raju reasonably asked Romney for his own view.

Romney is an interesting person to ask. He is not only a critic of the President from within his own party but he is a former businessman who has had to deal with complex reporting and business obligations.

Romney’s response must be encouraging for Bragg.

Rather than address the ambiguous criminal allegation, Romney suggested that Trump was guilty as charged in having a tryst with a former porn star.

The defense is not contesting the payment and the fact of the affair is not central to the allegations.

The question is whether the payments were unlawfully denoted as legal expenses with the intent to somehow steal the 2016 election.

Asked Mitt Romney about the hush money allegations against Trump.

“I think everybody has made their own assessment of President Trump's character, and so far as I know you don't pay someone $130,000 not to have sex with you." pic.twitter.com/ofBL15MJw1

It is not a crime to use a NDA or other means to quash an embarrassing story.

Bill Clinton had a host of lawyers quashing allegations of affairs and sexual assaults throughout his presidency. He ran into trouble when he committed perjury in the effort to hide what Hillary Clinton called one of his “bimbo eruptions.”

Moreover, denoting this as a legal expense, on the advice of counsel, is not necessarily wrong. It is not clear how it should have been to be denoted. A “nuisance payment”? The campaign of Hillary Clinton and its general counsel Marc Elias hid the funding of the Steele dossier as a legal expense and was fined by the government for doing so. They litigated the question and insisted that that is precisely what it was.

Romney is precisely what Bragg is looking for in these jurors. Smart and savvy, he still viewed the question of the trial as whether Trump had an affair with Stormy Daniels. If so, it was not a legal expense. Yet, quashing the story and avoiding any litigation was a legal matter with the eventual crafting of the NDA.

There are a lot of motivations for NDAs of this kind. Trump was married. He was the host of a hit television show (with a clause on termination for scandalous conduct). And, yes, he was also seeking to be president. He wanted these stories killed and friends like David Pecker were helping in that effort. What those facts say about the former president’s “character” will remain a matter of public debate and, as Romney said, most long ago reached their own conclusions. Yet, it is the crime not the character of Trump that is at issue in Manhattan.

Alvin Bragg would like the trial to remain a verdict on character, which is why he started the trial discussing not the Daniels matter but an uncharged affair and settlement with a former Playboy bunny. It is why he fought hard (and succeeded) in being able to question Trump about past cases involving an alleged assault and fraudulent conduct. As legal experts continue this week to debate if there is even a crime alleged in the indictment, Bragg is making a case that Trump’s lack of character is beyond a reasonable doubt.

To be fair, Romney was not giving a full interview on the case in his statement to CNN and may well have some reservations about the Bragg indictment. However, Bragg is likely hoping that “everybody has made their own assessment of President Trump,” including twelve jurors currently sitting in the Manhattan courtroom.

Cocoa Drops Most Since April 2009, Some Losses Recovered In Muti-Day Volatility Rollercoaster

Cocoa Drops Most Since April 2009, Some Losses Recovered In Muti-Day Volatility Rollercoaster

Tyler Durden

Wed, 04/24/2024 - 13:05

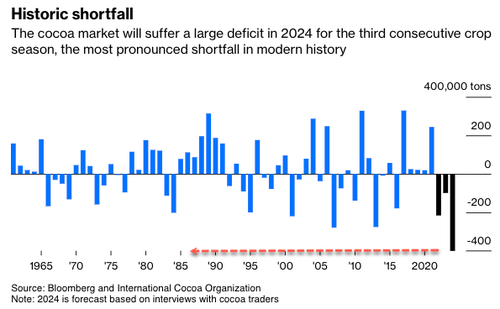

Cocoa futures in London on Tuesday plunged the most since April 2009, tumbling as much as 8.1%, while prices slid as much as 7.7% in New York. Prices recovered some losses on Wednesday morning. It appears the downdraft was caused by fast-money traders taking profits after a record high of $12,250 per ton was recorded in New York on Friday.

Cocoa prices faded record highs as "opportunistic fast traders" exit positions to take profits after bearish signals flashed in recent sessions, Tristan Fletcher, chief executive officer at ChAI, a platform that uses AI to analyze commodity markets, told Bloomberg.

Last week's catalyst for record-high prices came after data about grindings—where cocoa transforms into butter and powder used in candy—showed that demand destruction has not materialized despite soaring prices.

Here's the cocoa grindings data from last week that served as fuel for bulls (via Barchart):

Cocoa also has support on signs that global cocoa demand remains resilient despite record-high prices. Last Thursday, the National Confectioners Association reported that North American Q1 cocoa grindings rose +9.3% q/q and +3.7 % y/y to 113,683 MT. Also, last Thursday, the Cocoa Association of Asia reported that Q1 Asia cocoa grindings rose +5.1% q/q, although they fell -0.2% y/y to 221,530 MT. In addition, the European Cocoa Association reported that Q1 European cocoa grindings rose +4.7% q/q, although they fell -2.2% y/y to 367,287 MT.

Paul Joules, an analyst at Rabobank, wrote in a note that grindings figures are "an indication that for now demand is holding up despite current pricing," adding that "demand destruction will come, but clearly it's taking longer to filter into grind data than the market was anticipating."

Famed commodity trader Pierre Andurand told Bloomberg via an emailed interview, "We will finish the year with the lowest stocks-to-grinding ratio ever, and potentially run out of inventories late in the year." He added that cocoa prices "could break $20,000 later this year" based on the thesis of worsening drought and disease ravaging the world's largest cocoa farms in West Africa.

Paul Torres, a London-based trading and agricultural consultant, said, "I do not foresee prices falling significantly," adding that prices could range between $8,000 to $10,000.

Torres noted: "There could be just some easing of the frenetic moves we've seen."

Meanwhile, analysts from JPMorgan recently told clients that cocoa prices in New York could come down to around $6,000 a ton in the medium term, while Citi analysts said a bear market could begin in early 2025.

There is some good news for cocoa supply: Bloomberg quoted Marijn Moesbergen, sourcing lead at Cargill, at the World Cocoa Conference in Brussels on Wednesday as saying cocoa production is expected to bounce back next year as the El Nino effect won't be in play.

"The current prices are maybe a bit overshooting. The question indeed is what will be the new equilibrium between this supply issues versus what will be the demand impact going forward," adding, "That question will be answered in the coming period."

The combination of a worsening global supply deficit plus bullish grindings data might only suggest prices have to head higher.

Cities' "Doom Loops" Are Even Worse Than You Imagined

Cities' "Doom Loops" Are Even Worse Than You Imagined

Tyler Durden

Wed, 04/24/2024 - 12:45

Authored by Charles Hugh Smith via OfTwoMinds blog,

This is why those who understand these dynamics are getting out, even though the city was their home.

A correspondent who prefers to remain anonymous sent me this account of the "doom loop" that is playing out in many American cities. The correspondent makes the case that the Doom Loop is not limited to specific cities, but is a universal dynamic in all US cities due to the core causes of the Doom Loop: financialization and the multi-decade decay of cities' core industrial-economic purpose / mission.

I have edited the text slightly, with the correspondent's approval.

The context of the Doom Loop is the process and politics of this decay are the second-order results of central bank easy money (free fiat). That led to financialization becoming the city's core function and the subsequent loss of the city's previous mission. The people living in cities just haven't gotten the message yet.

As such, there is no reversing the process until the centralization of capital itself is reversed.

The typical media articles on metropolitan "doom loops" make it seem like not every city is headed down the path. Now that financialization does not require a physical presence, every city above a certain size will share the same experience. There will be local variations which impact the trend, such as a potential utility as a large pool of voters (i.e. a vote farm), but the decline is part and parcel of financial 'virtualization.'

It is inevitable.

Even hosting one of the twelve central reserve banks won't save you.

The process when a city loses its purpose but persists due to inertia follows this basic pattern:

1. Corporate consolidation costs the city its financial base as Fortune 100 corporations are sold to conglomerates closer to the centers of finance.

This is one more second-order effect of easy money: global corporations can easily finance the acquisition of multi-billion dollar companies.

2. In the past, cities received huge government subsidies for re-development, but none for ongoing maintenance. All the redevelopment projects looked great at first, but with little funding for maintenance, they've gone downhill and many are now dangerous.

Today, the only redevelopment is done by the billionaire class who make most of their money from (surprise) finance. Once the billionaire loses interest, it's gone, too.

I would rather find myself in a developing-world city than an American downtown, at least there would be people around. Many American downtowns are literally apocalyptic.

3. Major league sports are increasingly an exercise in force protection. It's like going inside a forward firebase in Iraq. People still get shot in the stands from guns fired outside the bubble. Unsurprisingly, some major league teams are exploring space outside the cities despite their stadiums being only 20 years old.

4. When federal agencies build new facilities, they're essentially fortresses with direct entrance/egress from the highway. They add little to nothing to the surrounding economy.

5. Real estate, sales and personal property taxes in cities are typically the highest within the state. As tax revenues decline, cities' political leaders increase business taxes and start floating ideas such as taxing non-profit organizations: a financial death spiral indeed. Should taxes increase, organizations and companies have said they will leave.

6. In the industrial economy, the core purposes of cities were derived from advantageous locations and key transportation assets (first water, then rail, then roads, and later aviation). In the information age, those benefits are diminished or gone. As a result of their transportation advantages, cities became manufacturing and warehousing hubs. Those too are diminished or gone.

7. Cities have lost their core economic purpose and are choking on their high legacy costs. The proposed substitute purposes--entertainment and bourgeois lifestyles--are not true substitutes. Fine dining and secure condos with delivery do not replace actual economic functions.

8. Making matters worse, the upper-middle class doesn't want affordable housing in their enclaves, as it lowers property values. So the workers needed to keep the city functioning can no longer afford to live there. Yes In My Backyard (YIMBY) movements to promote affordable housing are not enough.

9. Much of the politics the media focuses on are a consequence of decline, not a cause, and the net result of all the in-fighting is some version of stasis: all sorts of solutions are proposed, but since none address the core sources of decline or the cities' high legacy costs, they boil down to rearranging deck chairs on the Titanic.

This is why those who understand these dynamics are getting out, even though the city was their home.

Of related interest:: The Real Estate Nightmare Unfolding in Downtown St. Louis: The office district is empty, with boarded up towers, copper thieves and failing retail--even the Panera outlet shut down. The city is desperately trying to reverse the 'doom loop.'

* * *

Apple Slashes Vision Pro Shipment Projections By 50% As Demand For $3,500 Headset Craters

Apple Slashes Vision Pro Shipment Projections By 50% As Demand For $3,500 Headset Craters

Tyler Durden

Wed, 04/24/2024 - 12:25

In what will come as a surprise to exactly nobody, the revolutionary if ridiculously overpriced Vision Pro virtual reality headset, which retails for $3,500, is not selling.

While it was hardly necessary - at least for anyone with a functioning frontal lobe - an analysis published this morning by the widely-read TF International Securities analyst Ming-Chi Kuo (best known for gathering intelligence from his contacts in Apple's Asian supply chain), who back in January correctly reported that Apple has lowered its 2024 iPhone shipments to a 15% decline, reported that Apple has cut its full year Vision Pro shipments to 400–450k units by as much as 50% versus the market consensus of 700–800k units or more.

Kuo also notes that Apple cut orders before launching Vision Pro in non-US markets, which means that "demand in the US market has fallen sharply beyond expectations, making Apple take a conservative view of demand in non-US markets."

Of course, it's not like anyone - except of course for AAPL's multimillionare management team - had expected that $3,500 heavy neck braces would sell like hot cakes - so it's not exactly a surprise to anyone, excpet Apple which is now "reevaluating its headset roadmap, potentially delaying the launch of a more affordable mixed-reality headset beyond 2025."

Below we excerpt from the full note.

- Apple has cut its 2024 Vision Pro shipments to 400–450k units (vs. market consensus of 700–800k units or more).

- Apple cut orders before launching Vision Pro in non-US markets, which means that demand in the US market has fallen sharply beyond expectations, making Apple take a conservative view of demand in non-US markets.

- Apple is reviewing and adjusting its head-mounted display (HMD) product roadmap, so there may be no new Vision Pro model in 2025 (the previous expectation was that there would be a new model in 2H25/4Q25). Apple now expects Vision Pro shipments to decline YoY in 2025.

The weak-than-expected Vision Pro demand means that the following new trends are likely to be below market expectations.

- MR headset devices. The challenge for Vision Pro is to address the lack of key applications, price, and headset comfort without sacrificing the see-through user experience. In contrast, VR is also a niche market, but at least there are proven successful applications (games), and trend visibility is better than MR.

- Pancake. As the upgrade of optical specifications for smartphones has slowed down for several years, investors expect Pancake, which has a significantly higher unit price than lenses, to become a new growth driver for the optical sector. Weaker-than-expected shipments of Vision Pro will lower Pancake’s contribution to the optical industry in the foreseeable future than investors’ expectations.

- Micro OLED. Vision Pro/MR headset is the most critical application of Micro OLED. With key applications not growing as expected, the timeframe of mass production and adoption of Micro OLEDs in other small-sized consumer electronics devices will be delayed.

Judging by the meltup in AAPL stock - as the rest of the tech sector is grinding lower - it seems that the catastrophic launch of the Vision Pro isn't news to anyone.

Yields Will Trigger "Serious Earthquakes" Across The Economy, Former Floor Trader Says

Yields Will Trigger "Serious Earthquakes" Across The Economy, Former Floor Trader Says

Tyler Durden

Wed, 04/24/2024 - 12:05

Submitted by QTR's Fringe Finance

Jack Boroudjian is a legendary former floor trader and now Chairman of SmartXData. Aside from over 30 years of industry experience, Jack is a published author "Secrets of the Trading", Wiley 2007 and has countless articles published in industry periodicals and websites. Jack appears regularly as a paid, guest contributor for CNBC, both domestic and Asia, and has done over 5000 global guest Television appearances. Jack graduated with honors and distinctions from Loyola University of Chicago and is happily married with two adult children.

Jack and I discussed monetary policy, fiscal policy, the move in gold, politics and why the bond market may take the spending keys away from the Biden administration for more than an hour last weekend.

"People have been conditioned to buy dips, and quite frankly, it was almost forced upon us," Jack explains. He points to several factors that shaped this behavior: "The Fed keeping money very loose, the lack of alternative investment avenues, and no real competition for capital—all of these elements contributed to creating a market condition that was, if you think about it, almost obscene."

Boroudjian draws on his experiences from the trading floors to illustrate his point: "It almost feels like what we used to call on the floor of the exchange, the big sucking noise. You'd hear people getting sucked into positions, all chasing the same strategy, and then, suddenly, the market would correct."

He reflects on the impact of such corrections: "I've seen the market correct by 20%, 30% numerous times in my life. But consider this: a 30% correction now equates to 1,500 S&P points. That's more than most people have ever witnessed in their lifetimes."

"Because there are still way too many people convinced that this little 5% pullback is a blip—it's nothing more than a hiccup. I've had at least half a dozen people tell me it's an election year; there's no way they'll let the market break. But the reality is this: if anybody really wants to know what's going on, I would suggest reading Nassim Taleb's book, 'Black Swan.' It talks about it.”

Jack continues: “Nassim was a trader at First Boston—many don't know his story, but I used to handle him on the floor. He was an options trader in the pit and he went broke. This is one of the most brilliant minds on Wall Street, and he went broke as a floor trader. He got off the floor and ended up making billions of dollars. What took him down was a black swan, something that came out of nowhere that he did not expect, and that's exactly what we could see happening now. Could it be something that we've already seen the beginnings of?"

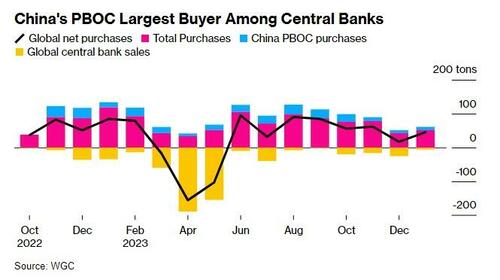

Talking about gold, Jack said: "So fundamentally, something has shifted in the last few months in the gold market. If you've noticed, central bank buying has never been this strong before. All of a sudden, you're starting to see Russia pay for things with gold. People are now paying for Russian oil with gold.”

“Gold is becoming the currency that Bitcoin was hoping to be one day. And it's really starting to turn into something more tangible than fiat currency. It gives you a reflection of how people are starting to feel about paper money. They're starting to realize that maybe there's a problem there. So when central banks start to buy gold, that tells you there is more than just a technical breakout. There's a fundamental shift happening, whether they believe that there is a debasement that is going to occur and continue to occur. And if that's the case, then you will see them stockpile gold, or they see it as a safe haven and see huge problems down the road. And I hope that's not the case,” he continued.

Jack explained that watching the 10 year is going to be the way to gauge the health of the economy.

"This is what I keep telling people: watch the 10-year yield. Keep an eye on the 10-year and the 30, but more importantly, the 10, because that's the part of the curve that the Fed really cannot manipulate. They can do the short end of the curve, but they can't do the long end.”

He continued: “Why do I say that? We used to call them the bond vigilantes in the old days. They were the people that would come in and you'd start to see them hitting that bond market, especially on the long end, because of what you just described. When the bond market starts to understand that the biggest expenditure on the balance sheet now is going to be servicing the debt, bigger than defense, bigger than anything else, you'll start to see bonds get hit, especially on the long end. That's one of the reasons we've started to see the 10-year doing what it's been doing.”

“I think we see a five, maybe even five and a half percent 10-year before we're done here,” Jack said. “And if that's the case, that is going to trigger some serious earthquakes within real estate and other sectors of the economy. So to me, we're on the precipice. You can feel it. But how long will we be here? I don't know. It feels like something can break at any time. But then again, you know what? We could be two years early. And if that's the case, it could stay ridiculously overbought for two years."

"The 10-year bond is the most liquid. It's the one that everybody—the Chinese, the Saudis—is holding. That's the fixed income note of choice for the entire world."

"The one thing that I know about the Treasury market is that less than 5% of the people in finance understand the Treasury market, which is scary when you think about it. And that's the truth, Chris. Think about that. Less than 5%. That's the going rate. And everyone knows stocks. And as you were talking about it, people that have been in the market for the last 10 years have seen the stock market go nothing but up and seen a bond market that's gone nothing but down. But the reality is that this bond market is poised to do something historical in my mind."

You can listen to my full interview with Jack at this link and for more on how treasury auctions work, you can read this piece: Treasury Auctions Explained For People With Short Attention Spans

QTR’s Disclaimer: I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have not been fact checked and are the opinions of their authors and are either published with the author’s permission or under a Creative Commons license. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Tennessee Republicans Pass Law Allowing Teachers To Be Armed - Democrats Cry "Fascism"

Tennessee Republicans Pass Law Allowing Teachers To Be Armed - Democrats Cry "Fascism"

Tyler Durden

Wed, 04/24/2024 - 11:45

Tennessee House Republicans on Tuesday passed legislation to allow some trained teachers and school staff to carry firearms despite aggressive opposition from Democrats and gun control advocates calling for the bill to be defeated. The bill is all but guaranteed to become law within weeks, as Gov. Bill Lee can either sign it or allow it to become law without his signature. Lee has never vetoed a bill.

The law requires criminal and mental health background checks of prospective teachers along with training courses and approval from school administrators. Democrats railed against the bill, suggesting that training courses are not enough and that it was "unfair" to burden teachers with the job of defending their classrooms from potential assailants. This argument is strange because teachers are already burdened with the job of protecting students from harm (not to mention their own lives), they just haven't had the means to do that job until now.

Democrats also stated that armed teachers would "lead to tragedy," with expectations that merely having a gun in or near a school would inevitably cause a shooting with the teacher at fault. Of course, if a teacher wanted to come to school armed to commit a crime, there's nothing stopping them anyway (except perhaps another armed teacher).

Angry protesters screamed "blood on your hands" when the bill was passed by the House as they attempted to disrupt proceedings. Protesters were eventually cleared from the building by police. Representative Justin Jones, a Democrat and activist politician who has been the subject of multiple expulsions from the House, tried to film the event with his cell phone while chanting along with protester and was removed. Democrats accused Tennessee Republicans of "fascism."

Tennessee Republicans just cut off debate and passed a bill to arm teachers in our schools.

The public chanted “Blood on your hands!” as the Speaker ordered troopers to clear the gallery.

This is what fascism looks like. pic.twitter.com/9mg67oWMxM

And here we find the disconnect that anti-gun advocates don't grasp: They seem to believe that the mere presence of a gun will automatically trigger violence, as if it has magical powers to attract and inspire evil. In reality, the problem is evil people, not "evil" objects. There's nothing stopping a bad person from acquiring and using a firearm for terrible purposes at any place of their choosing. Gun free zones only prevent good people from carrying.

Furthermore, why is it that Democrats rabidly defend pornography and sexualized propaganda in schools, but they're aghast at the notion of teachers being trained to defend children from violent attackers? One might start to think that Democrats want school shootings to continue, but why would that be...?

Keep in mind that the passage of the bill comes one year after the mass shooting at the Christian Covenant School in Nashville. The shooting was perpetrated by Audrey Hale, a far-left trans activists who was allegedly motivated to make a political statement. Her manifesto which was confiscated by the FBI still has yet to be released. Suspicions abound that this is only being done because Hale was part of the LGBT community.

Not surprisingly, leftist activists and Democrats alike defended Audrey Hale as "just another victim" of the shooting while some even argued that the murders were justified because of Tennessee's attempts to stop transgender surgeries for minors.

When common sense is labeled "fascism" the likelihood of reconciliation between leftists and conservatives grows dim. Is it only "democracy" when leftists get their way? Are Democrats really outraged by the idea of teachers being able to effectively save the lives of students or act as a deterrent so that potential mass shooters never consider going through with an attack? Or, are they outraged because they secretly fear that the strategy of armed teachers will work?

Democrats ignore mass shootings in minority neighborhoods all the time because these murders don't serve their purposes. What they want, what they need, are shootings where the tragedy can be turned into political capital. Their true intent is to achieve gun confiscation, and if there are no more school shootings because teachers are armed, then they'll no longer have the leverage they desire.

Hong Kong Bitcoin And Ether ETFs Officially Approved To Start Trading On April 30

Hong Kong Bitcoin And Ether ETFs Officially Approved To Start Trading On April 30

Tyler Durden

Wed, 04/24/2024 - 11:25

Authored by Zoltan Vardai via CoinTelegraph.com,

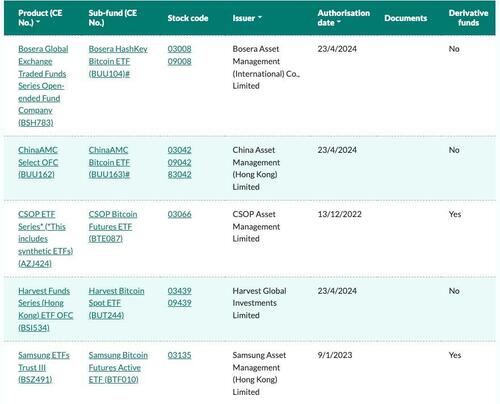

The first wave of spot Bitcoin and Ether exchange-traded funds (ETFs) have been officially approved to start trading in Hong Kong on April 30.

Hong Kong’s financial regulator, the Securities and Futures Commission (SFC), announced the official approval of the first batch of spot Bitcoin and Ether ETFs on April 24, according to a press release shared with Cointelegraph.

The first batch of approved Hong Kong-based ETFs also include China Asset Management’s (ChinaAMC) Bitcoin and Ether-based ETFs, which will start trading on April 30.

The ETFs will offer retail and institutional investors a safer and more convenient way to invest in the underlying digital assets under a regulated framework, according to Thomas Zhu, head of digital assets and head of family office business at ChinaAMC. He wrote in the official announcement:

“The in-kind feature also attracts coin holders by offering the ease of converting coins to fully regulated ETFs managed by professional fund managers and regulated custodians. With the growing adoption of ETFs in institutional asset allocation and retail trading in Hong Kong, we expect robust demand for our offerings.”There are currently over 205 approved ETFs in Hong Kong, according to the financial regulator’s homepage.

List of approved Hong Kong ETFs. Source: SFC

Unlike the cash-creation model of the United States spot Bitcoin ETFs, Hong Kong aims to offer in-kind creation models for ETFs that enable the creation of new ETF shares by using BTC and ETH.

Hong Kong’s in-kind ETF creation model could be a significant opportunity to considerably increase assets under management (AUM) and trading volume for these products, according to a research note by Bloomberg ETF analyst Rebecca Sin, shared in a March 26 X post by Eric Balchunas:

“Hong Kong is aiming for in-kind creation of the ETF, unlike the US, where the transaction is cash only — in the US, it’s cash in, Bitcoin ETF out, while Hong Kong aims for Bitcoin in, ETF out. This could be an opportunity for the market.”Hong Kong ETFs could see a potential fee war

The launch of the first ETFs in Hong Kong could lead to issuers racing to offer the lowest fees to customers, according to an April 24 X post by Bloomberg ETF analyst James Seyffart. He wrote:

“A potential fee war could break out in Hong Kong over these Bitcoin and Ethereum ETFs. Harvest coming in hot with a full fee waiver and the lowest fee at 0.3% after waiver.”The fees for the first ETFs are already lower than previously expected, which is a promising sign, according to Eric Balchunas, senior ETF analyst at Bloomberg, who wrote in an April 24 X post:

“Fees are 30bps, 60bps, and 99bps which is on average lower than we thought, good sign.”Chinese Have "Grabbed Gold By The Throat" As Capital Flight Accelerates

Chinese Have "Grabbed Gold By The Throat" As Capital Flight Accelerates

Tyler Durden

Wed, 04/24/2024 - 11:05

“Chinese speculators have really grabbed gold by the throat...”

That is how John Reade, chief market strategist at the World Gold Council, describes the scramble in the communist nation among investors looking to move money anywhere but in the yuan or Chinese assets.

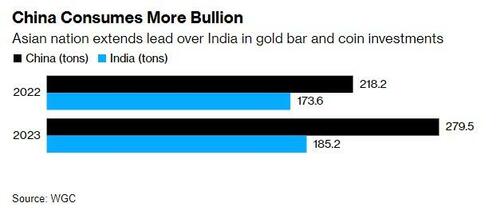

As evidenced by soaring Chinese FX outflows, the recent surges in 'alternate currencies' such as bitcoin and gold strongly suggest where the Chinese are seeking safety.

Of course, worsening geopolitical tensions, unprecedented fiscal profligacy by the Biden administration that shows no signs of slowing, and a Fed that seemed willing to support that spending with rate-cuts that were wholly un-necessary based on the 'data' they are so 'dependent' on (prompting fears of a policy error) are all factors driving precious metals higher, but, as Bloomberg reports, juicing the rally is unrelenting Chinese demand, as retail shoppers, fund investors, futures traders and even the central bank look to bullion as a store of value in uncertain times.

China and India have typically vied over the title of world’s biggest buyer. But that shifted last year as Chinese consumption of jewelry, bars and coins swelled to record levels. China’s gold jewelry demand rose 10% while India’s fell 6%. Chinese bar and coin investments, meanwhile, surged 28%.

And there’s still room for demand to grow, said Philip Klapwijk, managing director of Hong Kong-based consultant Precious Metals Insights Ltd. Amid limited investment options in China, the protracted crisis in its property sector, volatile stock markets and a weakening yuan are all driving money to assets that are perceived to be safer.

“The weight of money available under these circumstances for an asset like gold - and actually for new buyers to come in - is pretty considerable,” he said.

“There isn’t much alternative in China. With exchange controls and capital controls, you can’t just look at other markets to put your money into.”

But, there is another side to the Chinese demand for gold - speculators.

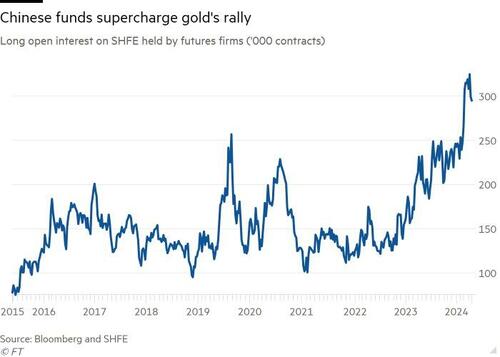

Long gold positions held by futures traders on the Shanghai Futures Exchange (SHFE) climbed to 295,233 contracts, equivalent to 295 tonnes of gold.

That marks a rise of almost 50 per cent since late September before geopolitical tensions flared up in the Middle East.

A record bullish position of 324,857 contracts was hit earlier this month, according to Bloomberg data going back to 2015.

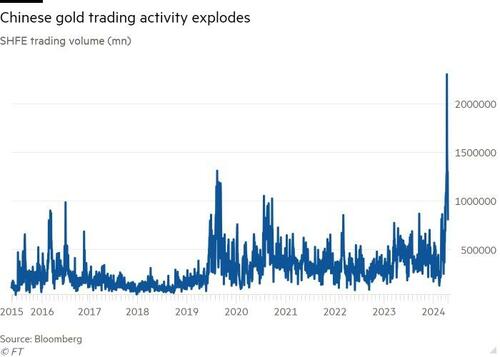

While the scale of gold's rally has surprised many analysts, The FT points out that some point to activity on SHFE and the Shanghai Gold Exchange - where trading volumes on a key contract have doubled in March and April relative to last year - as a big driver of the rally, as Chinese investors aim to diversify from their crisis-ridden property sector and sagging stock market...

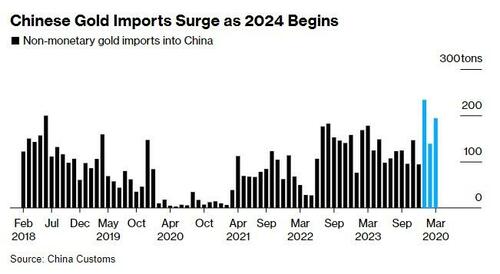

Additionally, Bloomberg reports that although China mines more gold than any other country, it still needs to import a lot and the quantities are getting larger.

In the last two years, overseas purchases totaled over 2,800 tons — more than all of the metal that backs exchange-traded funds around the world, or about a third of the stockpiles held by the US Federal Reserve.

Even so, the pace of shipments has accelerated lately. Imports surged in the run-up to China’s Lunar New Year, a peak season for gifts, and over the first three months of the year are 34% higher than they were in 2023.

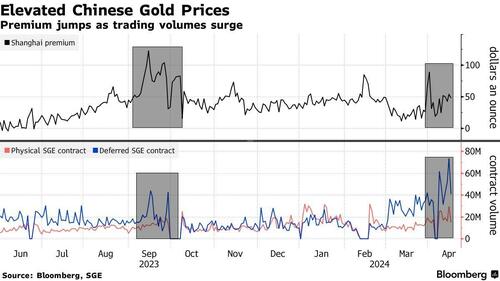

And finally, as evidence of Chinese demand (or the scale of the capital flight), the premium being paid for the precious metal over western prices is soaring...

Of course, China’s authorities, which can be quite hostile to market speculation and extremely hostile to capital flight, have warned, via their state media mouthpieces, that investors should be cautious in chasing the rally in gold.

But, this is made all the more ironic given the fact that it is the Chinese central bank that is among the most prolific buyer of bullion in recent months...

Do as we say, not as we do... or maybe investors should ask 'what does Beijing know?'

Overconfidence In NFL Drafts: A Lesson For Investors

Overconfidence In NFL Drafts: A Lesson For Investors

Tyler Durden

Wed, 04/24/2024 - 10:45

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

Most NFL general managers (GMs) are optimistic and displaying overconfidence today as they prepare for tomorrow’s NFL draft. The draft is a once-a-year opportunity for GMs to acquire talent.

Like investors, GMs often think they are smarter than their competitors, aka the market. Yet, they frequently have similar mindsets and follow the same narratives that drive their competition.

As we will share, overconfidence and groupthink among football GMs and investors are behavioral flaws that often harm performance. Having the tools and strategies to mitigate our behavioral traits is extremely valuable and can lead you to better returns.

Overconfidence In The NFL

Four of the first five picks in the draft are expected to be quarterbacks. Not only is the quarterback the most important position on the field but this year’s draft is hyped as having several future greats.

Based on data from Warren Sharp, an NFL analyst, most of the quarterbacks taken in the early rounds will be average. His Fox Sports article entitled The success rate of first round QBs makes Lamar Jackson’s case for him, quantifies just how poor the odds are of drafting the next Super Bowl-winning quarterback.

There have been 38 quarterbacks drafted in the first round since 2011, the year the NFL changed the collective bargaining agreement.

These 38 first-round quarterbacks have made a total of 1,909 starts. Their record? 1034-1035-7.

He claims that of those 38 quarterbacks, only one, Patrick Mahomes, has won a Super Bowl. Furthermore, of the 28 from that group who are no longer on their initial contracts, the average time they were a starter was a mere 3.4 years.

Despite the proven mediocrity of quarterbacks taken in the first round, we have little doubt that overconfidence will be on full display by the GMs drafting quarterbacks with their top picks after they make their selections.

Groupthink In The NFL

This behavioral trait arises when people seeking conformity think and act similarly. Typically, groups reach a consensus opinion without proper evaluation and with minimal alternative viewpoints.

For instance, it is widely accepted that the four quarterbacks likely to go in the top five, Williams, Daniels, Maye, and McCarthy, will be excellent pros. Most NFL analysts offer differences between the quarterbacks but praise the physical and mental traits they believe will make them NFL starts. Very few analysts have poor ratings on any of those four quarterbacks.

Choosing one of the four quarterbacks is comforting. Simply, GMs have cover if their pick is a dud. Who could have known? Every expert thought he would be a superstar!

Investor Overconfidence And Groupthink

Replace players with investment ideas and GMs with investors. The overconfidence and groupthink mentality impacting GM draft day decisions are similar to those investors always face.

We quantified the odds of GMs picking above-average quarterbacks earlier. Per DFA Funds, the odds of an investor outperforming the market are even more daunting.

We saw from the data above that an investor has about a 75% chance of underperforming the market in any given year, which means you have a 25% chance of beating the market in any given year.

The message to take away from that statistic is to leave your confidence at the door!

Regarding groupthink, most investors, like GMs, find comfort in knowing that many other investors are doing the same thing. Market narratives are a form of groupthink. Narratives help explain market movements and trends. Often, a narrative develops after a trend has started. In other words, rightly or wrongly, the narrative is the rationale.

Today, narratives appear to be quicker to form and longer lasting. Maybe the advent of social media has allowed for their quicker dissemination and growth.

Narratives describe the mindset of a group of investors. When you unknowingly invest based on a narrative, you are likely setting yourself up for failure.

Strategies To Combat Behavioral Traits

Appreciating that GMs have a one in three chance of successfully using a precious top-five draft pick on a quarterback or that only a quarter of investors will beat the market, we best have tools to manage our behavioral traits and improve our odds of success.

Zig

Warren Sharp advises GMs to “zig while others zag.”

To zig is to have a contrarian mindset. For instance, it’s important for your portfolio to have popular stocks leading the market higher. But at the same time, understand that confidence can wane quickly, and a new set of stocks will take the throne soon enough. Don’t overstay your welcome in a narrative.

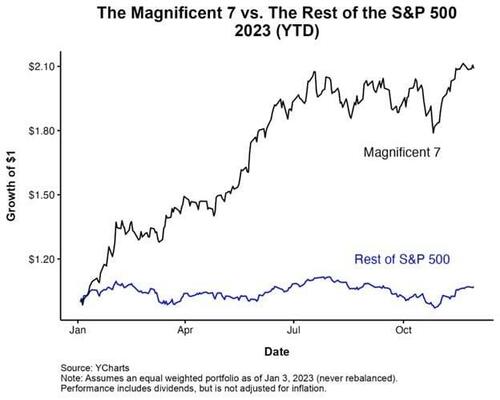

It wasn’t that long ago that the Magnificent Seven stocks were all the rage. Their returns handily beat almost every stock and index. Holding a meaningful subset of the seven stocks was vital to keep up with the broad market indexes. However, the Magnificent Seven’s period of outperformance has either ended or is on pause. But, the narrative still thrives, and whether it’s already happening or will occur shortly, investing in the aged groupthink will catch many investors offside.

Take Profits

It’s hard to sell when others are buying. Still, when the narrative-driven stocks fall out of favor, the prior profits and reduced position sizes will bolster returns and lessen the risk of underperforming the market.

Appreciating what the market, and not popular narratives, tell you is equally vital. For instance, have you noticed that utilities and energy are the best-performing sectors lately? Those solely holding the Magnificent Seven and neglecting other sectors are falling behind.

The SimpleVisor table below shows the relative performance of the Magnificent Seven stocks and XLU, the utility ETF, versus the S&P 500 over various time frames. Other than NVDA, most of the seven have been underperforming the market as of late. Also, the once poorly performing utility sector has been beating the market for the last 45 days. Selling the Magnificent Seven 45 days ago to buy utilities would go against groupthink, but it was a smart call.

Appreciate Your Options

The GMs with the top five picks have a precious option. Instead of picking a quarterback with limited odds of success, they can trade the pick to another team. In exchange, they might receive multiple high-level draft picks, boosting the odds of success.

Other positions in the NFL draft have much better success rates than quarterbacks. If a GM can set aside their confidence in their ability to pick the right quarterback, they can increase the odds that they could easily land at least two very good players and possibly a pro bowler. Maybe they can even use one of the picks to get a quarterback in the later rounds. Let’s not forget Brock Purdy, the San Francisco quarterback who led the 49ers to the Superbowl, was Mr. Irrelevant, the last person taken in the draft.

Investors have options, too. Many stocks, sectors, and factors will likely outperform the market but do not fit the narrative du jour. While buying what others aren’t may be uncomfortable, it may be more profitable.

The other lesson is to diversify. Putting most of your eggs in one basket can significantly impact your relative performance. You will underperform if you are proven wrong, as is most common.

Let Winners Run

One of the most popular Wall Street sayings is, “Cut your losses short and let your winners run.”

If our chances of beating the market are one in four, doesn’t it make sense to trade your portfolio actively? Many investors do the opposite. Their confidence and the attraction of groupthink keep them in underperforming stocks. At the same time, alternative stocks that are less followed may be the best bets.

It can be appropriate and profitable at times to follow the crowd. However, at all costs, don’t ignore alternative views.

Summary

We risk underperforming the market by falling victim to our natural behavioral traits. Therefore, we owe it to ourselves to entertain and understand alternative views. As odd as it may seem these days, we need to watch FOX News and read the New York Times. We must challenge ourselves to understand better things that may not be comfortable.

Seek out and study the views of others with whom you disagree. By better understanding opposing opinions, you will strengthen your existing views or better recognize flaws in your current logic. Either way, an investment thesis is better for it.

Most importantly, remember that you are only human. The Patrick Mahomes of the investment world are few and far between. At times, overconfidence is a good trait, but it can also be a critical flaw.

WTI Jumps After Bigger-Than-Expected Crude Inventory Build, Gasoline Demand (Reportedly) Slumps

WTI Jumps After Bigger-Than-Expected Crude Inventory Build, Gasoline Demand (Reportedly) Slumps

Tyler Durden

Wed, 04/24/2024 - 10:38

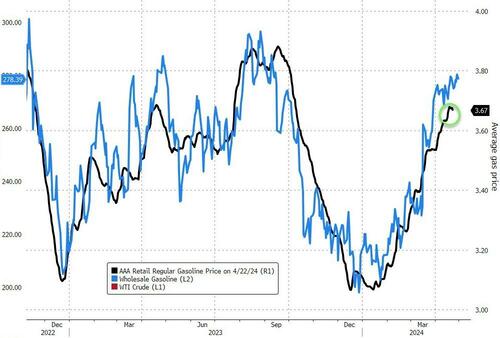

Oil prices are drifting lower this morning, despite API reporting a surprise crude inventory draw last night, as hopes that geopolitical tensions are easing (hope is not a strategy) combined with a reduced expectation of economy-juicing rate-cuts are weighing on crude prices.

Supporting the upside, the US Senate, meanwhile, passed tougher measures against Iran in response to its attack on Israel earlier this month, with President Joe Biden saying he’ll sign the legislation into law. But the market is clearly calling Biden's bluff on this threat as he faces soaring pump prices domestically which will do nothing to help his "but I fixed inflation" narrative into the election...

Source: Bloomberg

However, for now, all eyes are on the official inventory and supply data for any signs of overall tightness, and refined products demand as the summer driving season is fast approaching.

API

-

Crude -3.23mm (+500k exp)

-

Cushing -898k

-

Gasoline -595k (-1.5mm exp)

-

Distillates +724k (-1.0mm exp)

DOE

-

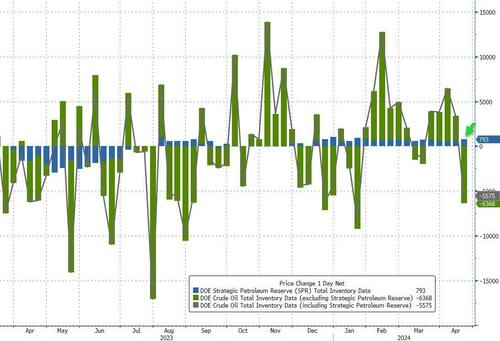

Crude -6.4mm (+500k exp)

-

Cushing -659k

-

Gasoline -634k (-1.5mm exp)

-

Distillates +1.6mm (-1.0mm exp)

Confirming API's report, the official data showed crude inventories plunging last week by the most since January. On the product side, it was mixed with gasoline drawing down by distillates building...

Source: Bloomberg

There was a 909k b/d drop in the adjustment factor versus last week, the biggest decline since February, coinciding with the big increase in crude exports. At 257k b/d this week’s balancing measure was pretty small by its own highly volatile standards.

Source: Bloomberg

The Biden admin added 793k barrels to the SPR last week - the largest addition since January... and probably the last!

Source: Bloomberg

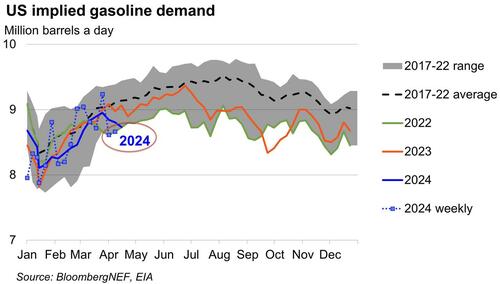

Implied gasoline demand fell yet again, nearly slipping back below 2022 seasonal levels for the first time since early March.

The figure typically sees decent growth at this point in the year, yet a post-Spring Break slump appears to have become the norm since 2020.

In comparison to pre-pandemic demand, the figure is at its lowest since 2014.

Source: Bloomberg

US crude production was flat at 13.1mm b/d (near record highs) and we note a very modest rise in rig count trends starting...

Source: Bloomberg

WTI was trading around $83.00 ahead of the API data and jumped back into the green for the day after the crude draw...

The conflict in the Middle East has "undoubtedly exacerbated tensions in an already volatile region," Stephen Innes, managing partner at SPI Asset Management, told MarketWatch.

"While the recent attacks have been downplayed, the potential for further escalation cannot be entirely dismissed."

However, "there's a lesson to be gleaned from this situation, particularly in how swiftly demand responded to higher oil and gasoline prices, as evidenced by the increase in U.S. oil stockpiles," he said.

Finally, timespreads are signaling tighter conditions, with the gap between Brent’s two nearest contracts widening to $1.05 a barrel in backwardation, a bullish pattern in which the nearer contract trades at a premium to the next in sequence. That compares with 69 cents a week ago.

Driver’s Licenses Waive Personal Responsibility and Contribute to Disorder on the Road

People often stubbornly hold to false beliefs, one of them being that government regulation of driving prevents chaos. However, the opposite seems to be true: government involvement in anything, including driving a car, creates the chaos we claim we want to avoid.

Live Around the Planet: Wednesday April 24th

Mark takes questions from Steyn Club members around the world...

Preface

Preface to Breaking Away: The Case for Secession, Radical Decentralization, and Smaller Polities.

Chapter 2. Political Anarchy Is How the West Got Rich

Chapter 2 of Breaking Away: The Case for Secession, Radical Decentralization, and Smaller Polities.

Chapter 5. Secession as a Path to Self-Determination

Chapter 5 of Breaking Away: The Case for Secession, Radical Decentralization, and Smaller Polities.

Chapter 8. Why the US Supports Secession for Africans, but Not for Americans

Chapter 8 of Breaking Away: The Case for Secession, Radical Decentralization, and Smaller Polities.