To live without faith, without a patrimony to defend, without a steady struggle for truth – that is not living, but existing.

Political

Want To Know What Is Really Going On In Biden's Economy, Read This

Want To Know What Is Really Going On In Biden's Economy, Read This

Tyler Durden

Tue, 04/30/2024 - 14:25

One can listen to, and believe, the government's lies about the miraculous growth of the economy and the stellar job that Bidenomics is doing... or one can listen to the truth straight from the countless small companies that make up the economy. We prefer the latter, which is why we love the monthly responses to the Dallas Fed survey, where unlike the other regional Feds, the respondents actually get a fair forum.

So without further ado, here are all the comments in the April Dallas Fed Service Sector Outlook Survey presented unedited and without commentary. Trust us, none is needed (but the highlights are ours).

Truck transportation

- We repair long-haul trucks. The volume just keeps going down, which means everyone is holding back on repairs, so we have no work. Inflation keeps driving our costs up. It's not looking pretty for trucking.

Support activities for transportation

- We are seeing an uptick in rates and activity. The excess capacity slowly bleeding out of the market is causing this.

Publishing industries (except internet)

- Momentum is still based on intuitive smarter software revisions. Commercial interest is also finally increasing with better relationship contacts to speed credible traction and interest for adoption going forward. We are more focused now on marketing and sales.

- The impact of the higher rate environment seems to be catching up, with general purchase intent among customers flattening out. At the same time, budget cuts and political uncertainty have impacted our public sector business as well, creating additional uncertainty across our business.

Credit intermediation and related activities

- The stress of an election year adds to the concern citizens have about the direction of our economy.

- We recently renegotiated our $600 million debt facility. Our cost of funds went from 9 percent to 14 percent—that's a pretty big hit to our bottom line and resulted in us increasing prices to our customers. Our business focus has been on forecasted easing; however, the reality of rates staying higher longer is creating uncertainty.

- Commercial real estate transactions are down by 70-80 percent according to the brokers we talk to, and our loan origination volume reflects that as well. Borrowers are concerned about future business prospects. We recently had a client decide not to take a loan to refinance a warehouse used in their business because they were concerned about their future business prospects. At the same time, the cost of everything we buy, from paper to electricity, is rising.

- The Federal Reserve signaling it will hold the rate at the current level for longer has affected our outlook negatively. One of our biggest issues with inflation is the cost of housing. These high rates do not help that, and prices of everything else are not declining or remaining stable.

Securities, commodity contracts and other financial investments and related activities

- Recent movement in long-term rates, combined with the Fed holding rates longer, have delayed the expected value of investment recovery until 2025 or later.

Insurance carriers and related activities

- We are recruiting experienced insurance professionals, and there is a small pool to draw from, unfortunately. We will keep looking.

- Property insurance and affordability are slowing our growth opportunities.

Real estate

- The increase in treasury yields since last fall has negatively impacted deal-making activity in the income property industry

- We are a real estate broker company and we have about 350 agents. They are independent agents not salaried employees. Our business slows during election years, and high interest rates have hurt first-time buyers.

- Cost of capital is weighing on our customers and decreasing volume.

Rental and leasing services

- We are a construction machinery and material handling dealership. Our business in the first quarter of 2024 was down 2 percent, and the industry was down 12.3 percent. Our manufacturing clients seem almost on the verge of panic, and there is stuff in inventory. We need a guest-worker program to meet our skilled-labor needs long term.

Professional, scientific, and technical services

- Persistent inflation and the Fed potentially delaying rate cuts are causing uncertainty for the second half of 2024.

- We are still worried about the election causing uncertainty in our clients and prompting a slowdown later this year. Some clients are still worried about inflation and are stalling projects because of the volatility in the supply market. Overall, it is tough to make any forecast right now. Our backlog is strong for the next couple of months, but not as far in the future as we would like.

- The market was slower in the first quarter, but it is now in recovery.

- We are increasingly seeing small professional firms shrinking or simply closing up shop. The labor shortage is a major reason for giving up the fight. There's plenty of demand for professional services, but there is not enough trained staff. Retaining staff is a major headache. Owners nearing retirement are giving it up sooner rather than later.

- Burdensome federal regulations are increasing the cost to do business, such as the so-called "Corporate Transparency Act" and minimum wage increases that just continue to drive inflation.

- General outlook has improved primarily due to our increased investment in marketing and an increase in general business activity.

- We see a slight uptick in transactional matters.

- Trying to factor in how remote-work scheduling impacts the need for space and resources is challenging.

- Competitive labor market remains; it’s harder to recruit great talent; health insurance is increasing.

- We have not been this slow since the Great Recession. This includes Covid. We cannot understate how terrible the prospective real estate market is. People are not filing zoning cases, meaning in two years there will not be construction. Volumes have gone down in the automotive industry. It seems they are beginning to turn around, so we're hoping.

- This real estate market is hard to figure out. With the 10-year rate still moving in the wrong direction, and the likelihood of a rate cut not coming this year due to inflation and the strength of the economy, we just can't see the market improving until next year.

- The Fed is now unlikely to cut interest rates; concerns over recession continue.

Management of companies and enterprises

- Overregulation takes away a lot of time and money.

Administrative and support services

- Continued high interest rates, inflation and general economic malaise has caused employers to be very reluctant to hire professional level talent. They may replace talent if they have attrition, but in general, they are very slow to make any new hire decisions.

- There has been a marked decline in requests for quotes for the month. This decline does not fit in our normal seasonal changes.

- The intensity of international conflict and increasing long-term rates certainly raise concerns.

- Geopolitical tensions are creating an uncertain environment. Also, upcoming elections and how this may affect the Fed’s monetary policy is a concern.

- High interest rates have drastically hindered our ability to grow our business, and it looks like a rate cut is not likely happening in 2024.

Texas Retail Outlook Survey

Accommodation

- Between increasing inflation, high interest rates and instability in the Middle East, we are growing more concerned that the upcoming summer travel season will be depressed compared to prior years.

- March 2024 is viewed as a contradiction in that we had several areas perform at or close to expectations and others that were far below. That seems to be the same in April. Difficult to understand what is happening.

Food services and drinking places

- The stalled return to office and the decline of weekday business travel to downtown remain drags on revenue. We see a softening in other meal periods, and we believe it is due to the increase in menu prices. Hiring experienced staff with knowledge remains very difficult. Where did seasoned workers go? Cost of goods sold continues to increase.

- We are still hanging on by a thread after closing one business last month.

- The energy sector continues to be strong, which positively affects my business. Midland continues to attract a younger population.

Motor vehicle and parts dealers

- The margin on new vehicles sold per unit declined 50 percent year over year in March 2024, which was a direct benefit to the consumer.

- We are continuing to see labor shortages in the workforce and a lack of effort to pursue the positions available from those applicants responding to open positions.

Electronics and appliance stores

- Building activity is down still and looks to be getting worse.

China Threatens To Retaliate Against US Over Taiwan Aid And TikTok Ban

China Threatens To Retaliate Against US Over Taiwan Aid And TikTok Ban

Tyler Durden

Tue, 04/30/2024 - 14:05

Authored by Eric Lundrum via American Greatness,

On Monday, the Chinese government threatened to retaliate against the United States after a $95 billion foreign aid package was signed into law, which included aid for Taiwan and a provision to ban the Chinese social media app TikTok.

As reported by Fox News, the bill signed into law by Biden on Wednesday included $2 billion to restock American weapons provided to Taiwan and other allies in the Indo-Pacific, in a direct attempt to deter Chinese aggression in the region. Additionally, the law demands that TikTok’s parent company ByteDance sell the popular app to another company within nine months, or else the app will be banned from use in the United States.

“China firmly rejects the U.S. passing and signing into law the military aid package containing negative content on China,” said Chinese Foreign Ministry spokesman Lin Jian in a briefing.

“We have lodged serious representations to the U.S.”

“This package gravely infringes upon China’s sovereignty. It includes large military aid to Taiwan, which seriously violates the one-China principle, and sends a seriously wrong signal to ‘Taiwan independence’ separatist forces,” Lin continued.

“The legislation undermines the principles of market economy and fair competition by wantonly going after other countries’ companies in the name of ‘national security,’ which once again reveals the U.S.’s hegemonic and bullying nature.”

The issue of Taiwan has remained a contentious point in U.S.-China relations, with some considering Taiwan to be a free and independent nation, while others believe it to be part of China. The federal government has never taken a clear stance on the question, thus highlighting the significance of the decision to provide direct aid to Taiwan.

TikTok has faced widespread scrutiny from both sides of the political aisle, with Republicans pointing out its threat to national security by virtue of it being a Chinese company preying on American users, while Democrats have raised concerns about users’ private information being easily accessed and sold by the company.

TikTok is most popular among younger Americans such as Generation Z, or “Zoomers,” and the ban being signed into law has sparked outrage against Biden among younger voters.

WeWork Snubs Co-Founder Neumann As It Targets Quick Turnaround From Bankruptcy

WeWork Snubs Co-Founder Neumann As It Targets Quick Turnaround From Bankruptcy

Tyler Durden

Tue, 04/30/2024 - 13:45

After years of enriching himself to the tune of billions from his failed company WeWork, co-founder Adam Neumann is finally getting a small dose of karmic payback.

It was reported yesterday by Bloomberg that WeWork and its main backers, including SoftBank, have reached a new agreement to pull the struggling workspace provider out of bankruptcy, rejecting a rival proposal from co-founder Adam Neumann to buy back the company.

Under the deal, senior lenders will provide about $450 million in financing, gaining equity in the reorganized business. Additionally, SoftBank and other creditors may convert their debt into stock post-bankruptcy. This marks a significant step for WeWork, aiming to emerge from court protection with reduced debt and more efficient leases.

And to not be at the behest of, or enriching, Adam Neumann, will really mark a shift in strategy for WeWork...

A lawyer backing the deal told Bloomberg the deal “is some of the best news we’ve had in this case,” and said the company is on a “fast and reliable path out of bankruptcy.”

WeWork aims to exit bankruptcy swiftly due to the high costs and unsustainable administrative expenses of the Chapter 11 proceedings. The proposed restructuring, backed by most senior debt holders and unsecured creditors, sidelines co-founder Adam Neumann's bid to repurchase the company.

Neumann's offer, valued at $650 million, hinges on winning support from senior lenders, who are crucial to the deal's success. However, WeWork's advisors have rebuffed Neumann's attempts to negotiate and have proceeded with the restructuring without public bidding on the company's assets.

Bloomberg reported that US Bankruptcy Judge John K. Sherwood emphasized the lenders' prerogative to decide on negotiations with Neumann based on their economic interests. If executed, the restructuring would result in majority ownership by Yardi's investment arm and involvement from WeWork bondholders.

SoftBank would retain ownership stake, initially at least 16.5%, potentially increasing to 36% depending on the treatment of letters of credit. WeWork must finalize the proposed deal into a contract and seek creditor approval for its broader reorganization plan.

The report notes that Neumann could still contest the deal by petitioning Sherwood to reject the reorganization proposal.

And, normally taking the punchbowl away from someone who has already "earned" billions he didn't deserve shouldn't be of any concern, but we're sure Neumann's ego won't let that be the case. We're certain protest and prolonged litigation from Neumann will come from this, claiming he was "unfairly" snubbed...

*WEWORK CUTS BANKRUPTCY EXIT DEAL THAT LEAVES OUT ADAM NEUMANN

But how will the world's biggest grifter become the world's first trillionaire

Bullish Sentiment Index Reverses With Buybacks Resuming

Bullish Sentiment Index Reverses With Buybacks Resuming

Tyler Durden

Tue, 04/30/2024 - 13:25

Authored by Lance Roberts via RealInvestmentAdvice.com,

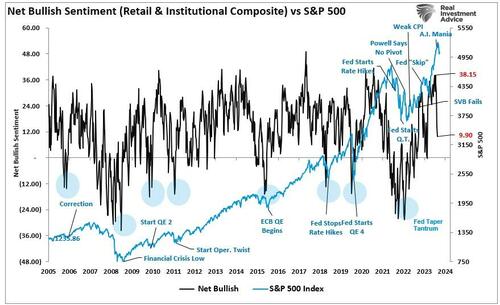

Over the last two weeks, the bullish sentiment index has reversed from extreme greed to fear. The composite net bullish sentiment index, comprised of professional and retail investors, fell from 38.15 to 9.9 in two weeks. The previous drop between July and October last year was similar and marked the bottom of the correction.

While the bullish sentiment index can indeed fall further, what is notable is the sharp reversal of market “exuberance” in such a short span. However, as discussed in “Just A Correction,” there was a significant gap between buyers and sellers.

“However, at some point, for whatever reason, this dynamic will change. Buyers will become more scarce as they refuse to pay a higher price. When sellers realize the change, they will rush to sell to a diminishing pool of buyers. Eventually, sellers will begin to “panic sell” as buyers evaporate and prices plunge.”

Like clockwork, that correction came quickly, with the market finding initial support at the 100-DMA. With solid earnings from GOOG and MSFT, the market rallied to initial resistance at the convergence of the 20- and 50-DMA. It would be unsurprising if the market failed this initial resistance test and ultimately retested the 100-DMA soon. Such a pullback would solidify that support and complete the reversal of the bullish sentiment index.

“Whatever trigger causes a reversal in the bullish signals, we will act accordingly to reduce risk and rebalance exposures. But one thing is sure: investor sentiment is extremely bullish, which has almost always been a good “bearish signal” to be more cautious.

While we have warned of a potential correction over the past few weeks, it reminds us much of June and July last year, where similar warnings for a 10% correction went unheeded. We are now seeing many individuals ‘jumping into the pool’ in some of the most speculative areas of the market. Such is usually a sign we are closer to a market peak than not. As such, we want to make adjustments before the correction comes.”

Very quickly, as supported by the bullish sentiment index, those bulls are turning bearish and are now calling for a more profound decline.

While such is possible, I suspect most of this correction is complete for two reasons.

Earnings Continue To Remain Strong

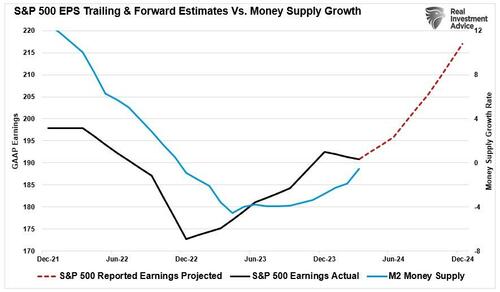

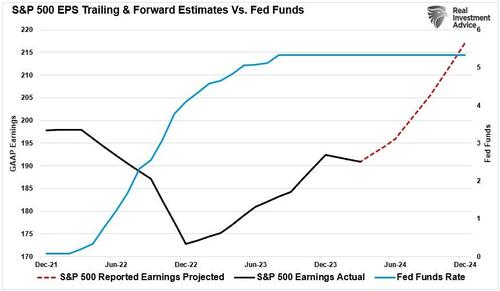

The first reason is that despite higher interest rates, earnings growth continues to remain robust, at least among the “Magnificent 7,” where Google (GOOG) and Microsoft (MSFT), in particular, exceeded estimates by a wide margin. However, overall, and most importantly, earnings growth has continued since the October lows of 2022. Notably, the support for improving earnings comes from the increased fiscal policies such as the Inflation Reduction Act and CHIPS Act.

While those policies will eventually fade, making forward estimates subject to downward revisions, the current earnings environment remains relatively robust. Furthermore, forward estimates remain optimistic that the Federal Reserve will cut rates later this year, lowering borrowing costs and supporting economic activity.

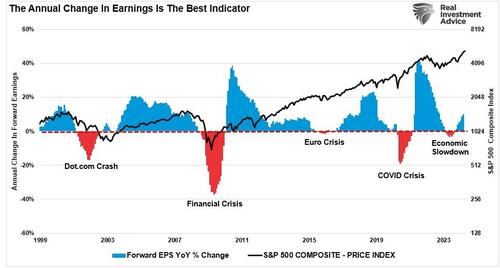

Notably, the increase in earnings, at least for now, remains a strong indicator of rising asset prices. The risk of a deeper market correction (greater than 10%) is significantly reduced during previous periods of improving earnings. While such does not mean a deeper correction can not happen, historically, corrections between 5% and 10% in an earnings growth environment tend to be buying opportunities and limit deeper reversal in the bullish sentiment index.

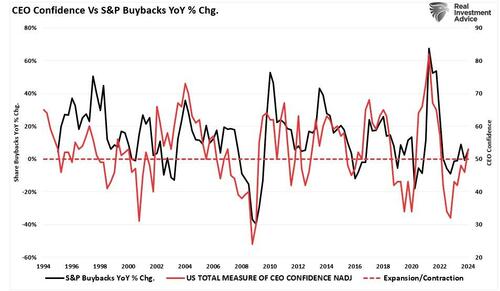

Improving earnings also precedes improving CEO confidence, which has provided pivotal support to financial markets since 2000.

Buybacks Returning

We discussed the most critical reason we expected a market correction in mid-March. To wit:

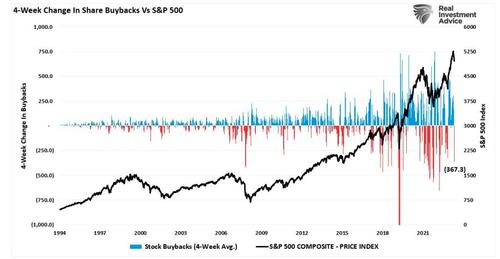

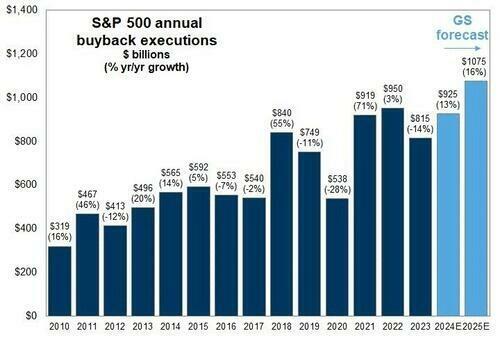

“Notably, since 2009, and accelerating starting in 2012, the percentage change in buybacks has far outstripped the increase in asset prices. As we will discuss, it is more than just a casual correlation, and the upcoming blackout window may be more critical to the rally than many think.” – March 19, 2024

Furthermore, the “blackout” of corporate buybacks coincided with more extreme readings in the bullish sentiment index. Buybacks are crucial to the market because corporations have accounted for roughly 100% of net equity purchases over the last two decades.

Here is the math of net flows if you don’t believe the chart:

-

Pensions and Mutual Funds = (-$2.7 Trillion)

-

Households and Foreign Investors = +$2.4 Trillion

-

Sub Total = (-$0.3 T)

-

-

Corporations (Buybacks) = $5.5T

-

Net Total = $5.2 Trillion = Or 100% of all equities purchased

-

Unsurprisingly, that blackout window coincided with a sharp contraction of more than $367 billion in buybacks over the last 4-weeks. Consequently, when you remove a critical “buyer” from the market, the ensuing correction is unsurprising.

However, corporate share buybacks will resume in the next couple of weeks, and with more than $1 trillion slated for 2024, many buybacks remain to complete. Such is particularly the case with Google adding another $70 billion to that total.

As noted above, improving earnings and a decent outlook for the rest of this year also boost CEO confidence. (If you don’t understand why buybacks benefit insiders and not shareholders, read this.)

With robust economic activity supporting earnings growth, that improvement boosts CEO confidence. As CEOs are more confident about their business, they accelerate share buybacks to increase executive compensation.

The liquidity boost from buybacks and stronger earnings will likely provide a floor below the market. This doesn’t mean the current correction doesn’t have more work to do. However, it is unlikely that it will resolve into something more significant.

At least for now.

Your Tax Dollars At Work: US To Buy Ukrainian-Made Weapons For Ukraine

Your Tax Dollars At Work: US To Buy Ukrainian-Made Weapons For Ukraine

Image via Reuters

Tyler Durden

Tue, 04/30/2024 - 13:05

Image via Reuters

Tyler Durden

Tue, 04/30/2024 - 13:05

It's not just US and Western defense contractors and arms makers that have been raking in the billions as a result of Washington's mammoth defense aid handed over to Ukraine, but Ukrainian defense companies are also enjoying the largesse at US taxpayers' expense.

"A total of $1.6 billion of the recent US aid to Ukraine would go to the purchase of Ukraine-made weapons, said a senior Kyiv official," Defense Post reports of the $61 billion in US aid just approved.

Image via Reuters

Image via Reuters

G7 countries have been planning broader assistance to Ukraine which would develop and prop up a Ukrainian domestic military-industrial complex for the long-term, in order to ensure the country's independence from Russia well into the future.

Ukraine parliamentarian and foreign policy committee member Arseniy Pushkarenko has said, "This is very important today, because it is about the creation of joint defense enterprises that will be located on the territory of Ukraine or in neighboring countries, taking into account security aspects."

The funds will be taken from the $14 billion apportioned by Congress for the Ukraine Security Assistance Initiative (USAI), allowing the DoD to purchase new weapons for Ukraine.

Interestingly, Pushkarenko admitted that all of this is about more than just defending Ukraine from the Russian military onslaught, but is also about 'testing' new weapons systems in real combat.

"This is one of the factors in the development of the Ukrainian economy. Today, the military technologies that we have are tested in combat conditions, which makes our military-industrial complex attractive enough for many countries of the world," he said.

Other Western countries, including the United Kingdom and Denmark, are expected to establish programs ensuring the purchase of Ukrainian-made weapons.

As we've long documented, over the course of more than two years of war in Ukraine, American defense firms are making a killing, with four US-based companies having been ranked as among the world’s five largest military companies.

Zelensky promises more Ukraine-made weapons in new year speech https://t.co/7UCb6pLX17

— BBC News (World) (@BBCWorld) January 1, 2024The legendary early 20th century US Marine Corps Major General Smedley Butler said it best:"War is a racket. It always has been... It is possibly the oldest, easily the most profitable, surely the most vicious. It is the only one international in scope. It is the only one in which the profits are reckoned in dollars and the losses in lives."

New Biden Energy Rules Will Raise The Cost Of A New Home By $31,000

New Biden Energy Rules Will Raise The Cost Of A New Home By $31,000

Tyler Durden

Tue, 04/30/2024 - 12:45

Authored by Mike Shedlock via MishTalk.com,

New HUD energy rules will raise the cost of home construction by imposing stricter building codes. Payback time is 90 years...

Homes To Become Even More Unaffordable

The Wall Street Journal comments on Biden’s New Plan for Unaffordable Housing.

The Department of Housing and Urban Development is mandating costly new energy standards for new homes insured by the Federal Housing Administration (FHA), which will become de facto nationwide building codes.

HUD last Thursday announced that it will require new homes financed or insured by its subsidy programs to follow the 2021 International Energy Conservation Code standard.

Many governments have declined to adopt the 2021 standards because of their higher costs. The National Association of Home Builders says the energy rules can add as much as $31,000 to the price of a new home. It can take up to 90 years for a buyer to realize a payback on the higher up-front costs through lower energy bills.

Not to worry, HUD says taxpayers will help cover the cost. It “is anticipated that many builders will take advantage” of numerous tax incentives in the Inflation Reduction Act “as well as rebates that will become available in 2025 or earlier for electric heat pumps and other building electrification measures,” the rule says.

These incentives include a $5,000 per unit tax credit for “zero energy” multifamily construction that meets prevailing-wage requirements that also raise building costs. HUD adds that builders may also “take advantage of certain EPA Greenhouse Gas Reduction Fund programs, especially the Solar for All initiative” and an investment tax credit that can offset 50% of a solar project’s cost.

Even with the subsidies, HUD estimates the price of a new home will go up by $7,229.

You get a $5,000 credit but only if the builder pays union wages for everything. How much will that cost?

My general rule of thumb is to take government estimates and triple them. That’s for short projects like building a home. But 10x would not be surprising. And this is with subsidies.

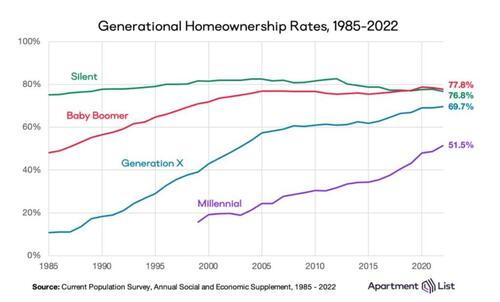

Generational Homeownership Rates

Home ownership rates courtesy of Apartment List

Who Are the Renters?

The answer is younger voters and blacks.

Generation Z homeownership is dramatically lower than the home ownership rate of millennials.

And according to the National Association of Realtors, the homeownership rate among Black Americans is 44 percent whereas for White Americans it’s 72.7 percent.

That’s the largest Black-White homeownership rate gap in a decade.

Home Prices Hit New Record High

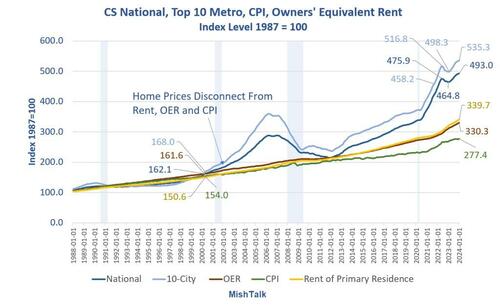

Case-Shiller, OER and CPI data from St. Louis Fed, chart by Mish

The latest Case-Shiller housing data shows home prices hit a new record high. Adding insults and costs, the 30-year mortgage rate ended last week at 7.50 percent

Youth Poll

On April 20, I commented People Who Rent Will Decide the 2024 Presidential Election

Q: What is it that young voters really have on their minds?

A: Rent

Many with rent as their top concern will switch to Trump. They are fed up with rising inflation. Rent is up at least 0.4 percent per month for 30 months.

Young voters propelled Biden over the top in 2020. Things look very different today. Many voters who do not like either Trump or Biden will sit this election out.

Walmart Targets Gen-Z With Cheap Private Label Food As Youngsters Struggle In Era Of Failed Bidenomics

Walmart Targets Gen-Z With Cheap Private Label Food As Youngsters Struggle In Era Of Failed Bidenomics

Tyler Durden

Tue, 04/30/2024 - 12:25

Walmart executives must be paying attention to Gen Z consumers bitching on TikTok and X about the failures of Bidenomics, as many of them have to work multiple jobs and still can't afford to put food on the table, pay shelter costs, and buy gasoline at the pump. That's why America's largest retailer is launching a new line of cheap store-brand groceries for consumers, more importantly, targeting lost and hopeless youngsters.

Bettergoods is Walmart's "largest private brand food launch in 20 years and the fastest food private brand Walmart has brought to market," according to the retailer in a press release published Tuesday morning.

The new brand targets young consumers and will offer them 300 items, including frozen, dairy, snacks, beverages, pasta, soups, coffee, chocolate, and more. Prices of the goods range from under $2 to under $15, with most products available for under $5.

"Today's customers expect more from the private brands they purchase – they want affordable, quality products to elevate their overall food experience. The launch of bettergoods delivers on that customer need in a meaningful way," said Scott Morris, senior vice president of private brands, food and consumables.

Morris continued, "Bettergoods is more than just a new private brand. It's a commitment to our customers that they can enjoy unique culinary flavors at the incredible value Walmart delivers."

Over the last few years, retailers have made a major push to expand private label brands that offer consumers a cheaper option amid persistent high inflation. This has forced many to drain personal savings and max out credit cards—just to survive the ongoing inflation storm.

We have been documenting the countless number of Gen-Zers who have taken to various social media platforms to complain about how liberal colleges and Bidenomics are scams. Many of these youngsters seem more miserable than millennials who entered the workforce after the 2008 financial crash. At least back then, millennials weren't battered by high inflation.

The latest Gallup poll numbers show youngsters are at a breaking point with Democrats who have promised them nothing but rainbows and unicorns, only to step foot in the real world after obtaining a worthless liberal arts college degree to realize affording rent, $1,000 car payments, and $15 avocado and toast is not what they signed up for.

Walmart is smart. They're reading the crowd's outrage about 'Biden-flation' hitting supermarket items.

And it's only a matter of time before Gen-Zers have to make the difficult decision to trade down from Walmart to Dollar General as the inflation storm heats up (read here). What comes next? Well, it's dumpster diving.

China Hosts Hamas & Palestinian Authority For Rare Talks

China Hosts Hamas & Palestinian Authority For Rare Talks

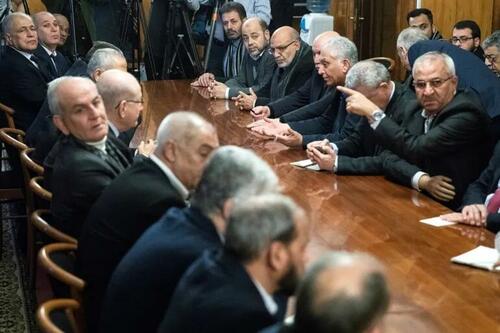

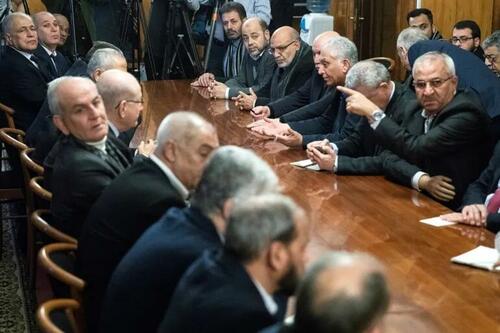

Prior intra-Palestinian talks in Moscow, via Reuters

Prior intra-Palestinian talks in Moscow, via Reuters

Prior file image: Chinese diplomat Wang Kejian met with Hamas political leader Ismail Haniyeh in Qatar on March 17.

Tyler Durden

Tue, 04/30/2024 - 12:05

Prior file image: Chinese diplomat Wang Kejian met with Hamas political leader Ismail Haniyeh in Qatar on March 17.

Tyler Durden

Tue, 04/30/2024 - 12:05

Representatives of Hamas and the Palestinian Authority’s (PA) Fatah party met recently in Beijing and held talks on reconciliation, the Chinese Foreign Ministry announced Tuesday. "Representatives of the Palestine National Liberation Movement and the Islamic Resistance Movement [Hamas] recently came to Beijing," China’s Foreign Ministry spokesman Lin Jian said.

"The two sides fully expressed their political will to achieve reconciliation through dialogue and consultation, discussed many specific issues, and made positive progress," he added. The spokesman did not clarify exactly what day the meeting took place.

Prior intra-Palestinian talks in Moscow, via Reuters

Prior intra-Palestinian talks in Moscow, via Reuters

China, Hamas, and Fatah confirmed beginning last Friday that intra-Palestinian talks would be held in the Chinese capital.

"They agreed to continue the course of talks to achieve the realization of Palestinian solidarity and unity at an early date," Jian went on to say, adding that the two sides thanked China for efforts to "promote Palestinian internal unity and reached an agreement on further dialogue."

China has continued to call for a ceasefire and an end to the war in the Gaza Strip and has long been an advocate of Palestinian unity and a two-state solution between the Palestinians and Israelis.

Chinese diplomat Wang Kejian met with Hamas leader Ismail Haniyeh in Qatar last month, where they both called for an end to the war in Gaza and the achievement of "political goals and aspirations of establishing an independent Palestinian state."

Hamas assumed leadership of Gaza in 2006 after a political victory against Fatah in local elections. The Beijing talks come as Hamas has yet to deliver an official response to a new Israeli–Egyptian initiative for a ceasefire and prisoner release deal.

While the initiative reportedly reflects an Israeli openness for the return of the displaced to northern Gaza and the establishment of a sustainable ceasefire, a Hamas official told Al-Mayadeen on Sunday that the proposal "does not reflect a fundamental shift" in Tel Aviv’s position.

Washington has been promoting the idea of a reformed PA assuming control over post-war Gaza, something Hamas has rejected.

Prior file image: Chinese diplomat Wang Kejian met with Hamas political leader Ismail Haniyeh in Qatar on March 17.

Prior file image: Chinese diplomat Wang Kejian met with Hamas political leader Ismail Haniyeh in Qatar on March 17.

US–Israeli efforts to "create bodies to manage Gaza is a failed conspiracy that will not come to fruition," a Hamas official said last month.

Columbia Student Protesters Break Into, Barricade Themselves Into Building After Deadline To Disperse Passes

Columbia Student Protesters Break Into, Barricade Themselves Into Building After Deadline To Disperse Passes

Demonstrators supporting Palestinians in Gaza barricade themselves inside Hamilton Hall, an academic building which has been occupied in past student movements, in New York on April 30, 2024. (Alex Kent/Getty Images)

Demonstrators supporting Palestinians in Gaza barricade themselves inside Hamilton Hall, an academic building which has been occupied in past student movements, in New York on April 30, 2024. (Alex Kent/Getty Images)

Students/protestors lock arms to guard potential authorities against reaching fellow protestors who barricaded themselves inside Hamilton Hall, an academic building which has been occupied in past student movements, in New York on April 30, 2024. (Alex Kent/Getty Images)

Students/protestors lock arms to guard potential authorities against reaching fellow protestors who barricaded themselves inside Hamilton Hall, an academic building which has been occupied in past student movements, in New York on April 30, 2024. (Alex Kent/Getty Images)

Columbia University students protest the Israel-Gaza conflict at Columbia University in New York City, on April 27, 2024. (Emel Akan/The Epoch Times)

Tyler Durden

Tue, 04/30/2024 - 11:40

Columbia University students protest the Israel-Gaza conflict at Columbia University in New York City, on April 27, 2024. (Emel Akan/The Epoch Times)

Tyler Durden

Tue, 04/30/2024 - 11:40

Dozens of Columbia University students broke into Hamilton Hall on the New York campus early Tuesday and barricaded themselves inside, hours after the school began suspending students who violated a deadline to disperse from a pro-Palestinian encampment.

Demonstrators supporting Palestinians in Gaza barricade themselves inside Hamilton Hall, an academic building which has been occupied in past student movements, in New York on April 30, 2024. (Alex Kent/Getty Images)

Demonstrators supporting Palestinians in Gaza barricade themselves inside Hamilton Hall, an academic building which has been occupied in past student movements, in New York on April 30, 2024. (Alex Kent/Getty Images)

"The safety of every single member of this community is paramount," said Ben Chang, vice president for communications at Columbia University, in an emailed statement to The Epoch Times, adding "In light of the protest activity, we have asked members of the University community who can avoid coming to the Morningside campus to do so; essential personnel should report to work according to university policy."

Holy…. pic.twitter.com/42Lw4kaRHY

— Jessica Schwalb (@jessicaschwalb7) April 30, 2024Taking over Hamilton Hall as done in 1968, Columbia students unfurl a banner that reads "Hind's Hall," in reference to Hind Rajab, a six-year-old girl killed by Israeli forces.

Hundreds of students cheer as the banner is revealed, erupting into chants to "Free Palestine." pic.twitter.com/Oi8WgdZmqf

As the Epoch Times' Katabella Roberts notes further; According to The New York Times, the students began occupying the hall at around 12:35 a.m.

The protesters linked arms and blocked off the main entrance to the building at the Ivy League institution after previously marching around campus to chants of “free Palestine,” according to the publication.

A statement shared on the social media platform Instagram by student groups said the protesters had “taken matters into their own hands,” and would remain in the building until the university “divests from death.” Protesters have been urging the university to pause its investments in companies that, they claim, are profiting from Israel’s war against Hamas in Gaza.

The statement included video footage that appeared to show the students carrying metal barricades into Hamilton Hall as other students cheered them on.

“This escalation is in line with the historical student movements of 1968, 1985, and 1996 which Columbia repressed then and celebrates now,” the statement read. “This action will force the university to confront the blood on its hands.”

In the statement, the student group further accused the university of having been “complicit” in “Israel’s ongoing genocidal assault on the Gaza strip” for the past seven months.

“The students are on the right side of history,” the statement continued. “We know that the university will remember them as anti-apartheid, anti-genocide activists with moral clarity.”

Protesters Make Demands

According to Politico, protesters hung a sign reading “intifada,” which is Arabic for uprising, from the front of the building.

A spokesperson for the New York Police Department told Politico that law enforcement officers were outside the university campus as of Tuesday; however, they declined to elaborate further on exactly how many officers were on site or whether they had authorization to enter the school grounds.

The Epoch Times has contacted a spokesperson at Columbia University and the New York Police Department for further comment.

The takeover of Hamilton Hall occurred just hours after the university confirmed that it had begun suspending some students. The pro-Palestinian students failed to disband before Monday’s 2 p.m. deadline.

Students/protestors lock arms to guard potential authorities against reaching fellow protestors who barricaded themselves inside Hamilton Hall, an academic building which has been occupied in past student movements, in New York on April 30, 2024. (Alex Kent/Getty Images)

Students/protestors lock arms to guard potential authorities against reaching fellow protestors who barricaded themselves inside Hamilton Hall, an academic building which has been occupied in past student movements, in New York on April 30, 2024. (Alex Kent/Getty Images)

Students have occupied the lawn in the middle of campus—in which graduation ceremonies are scheduled to take place for roughly 15,000 students on May 15—for nearly two weeks while calling on the university to disclose and divest from any of its financial ties to Israel.

They are also calling for an end to alleged “land grabs” in the Harlem neighborhood of New York City and Palestine, no more policing on the university campus, and no academic ties with Israeli universities.

However, negotiations between university officials and student protest leaders broke down earlier in the day when the university rejected their demands, prompting officials to issue the 2 p.m. deadline.

In a statement, Minouche Shafik, Columbia’s president, said that ultimately, the university will not divest from Israel, adding that the school is committed to maintaining its core principles and shared values, which include ensuring no students suffer from harassment and discrimination and no anti-Semitic language is used.

Columbia University students protest the Israel-Gaza conflict at Columbia University in New York City, on April 27, 2024. (Emel Akan/The Epoch Times)

Columbia University students protest the Israel-Gaza conflict at Columbia University in New York City, on April 27, 2024. (Emel Akan/The Epoch Times)

School, Students Fail to Reach Agreement

“Both sides in these discussions put forward robust and thoughtful offers and worked in good faith to reach common ground,” Ms. Shafik said. “We thank them all for their diligent work, long hours, and careful effort and wish they had reached a different outcome.”

While the University will not divest from Israel, it has offered to “develop an expedited timeline for review of new proposals from the students by the Advisory Committee for Socially Responsible Investing, the body that considers divestment matters,” Ms. Shafik noted.

“The University also offered to publish a process for students to access a list of Columbia’s direct investment holdings, and to increase the frequency of updates to that list of holdings,” she added.

Ben Chang, vice president for communications at Columbia University, confirmed the suspensions had begun in a press conference late Monday, USA Today reports.

He added that students had been notified in advance that they would face disciplinary action, including suspension if they did not vacate the encampment by 2 p.m. ET and sign a form committing to abide by student politics until either June 30, 2025, or until their graduation, whichever came first.

The site of the protests has created an unwelcoming environment for many Jewish students and faculty members, he said. It has also been a source of loud noise.

“We’ve been suspending students as part of this next phase of our efforts to ensure safety on campus,” Mr. Chang said.

Mr. Chang did not provide further details regarding how many students from Columbia and its affiliate Barnard College have been disciplined. However, he confirmed that those suspended would not be able to finish the semester or graduate, Axios reports.

They will also be banned from entering any campus housing or academic buildings, he added.

Juliette Fairley contributed to this report.

We Have Reached The Geo-Populist Tipping Points: Here Are Four Examples

We Have Reached The Geo-Populist Tipping Points: Here Are Four Examples

Tyler Durden

Tue, 04/30/2024 - 10:45

By Michael Every of Rabobank

Beg, Borrow, or Steel

Yesterday’s JPY slump from 158 to 160, surge to 155 on BOJ intervention, and stop over 156 underlines how volatile markets are as long-run fundamentals finally reach tipping points. Tomorrow’s FOMC decision should make that clear for all asset classes: especially with the Treasury’s quarterly refunding announcement the same day, and as the US borrowed a net $748bn in Q1, expects another $243bn in Q2, $41bn higher than seen in January due to lower receipts, and then $847bn in Q3. As a potential warm-up of sorts, albeit due to traditional overbought dynamics, was a 15% collapse in cocoa.

Today we have a sizeable packet of economic data: we already saw the Chinese official manufacturing PMI at 50.4 vs. 50.3 expected and 50.8 last month, and services at 51.2 vs. 52.3 consensus and 53 in March. Will the rest of today’s numbers show disinflation, inflation, or stagflation? That answer is fundamentally related to a subject which markets understand little and dislike lots: the intersection of political economy and the global economic architecture reductively known as either “geopolitics” or “populism”. There, we are also reaching tipping points.

-

Example 1: The Rhodium Group says for Europe to compete with Chinese EVs would require it to impose ‘Trump 2’ tariffs of at least 50%. However, they expect the EU will make a typically rear-view mirror decision to raise tariffs to the ‘Trump 1’ range of 15-30%. That would push up prices while allowing Chinese EVs to push EU auto production off the market. In short, we either get higher inflation and protectionism; or we get stagflation as prices rise somewhat less, yet Europe loses its key auto sector, taking 7% of GDP, 6% of (well-paid) jobs, the muscle-memory for sideways moves into defence production, and hopes for “strategic autonomy” with it.

-

Example 2: The White House is trying to ban imports of Russian processed uranium, which currently make up 25% of the supply for the 90 US commercial nuclear reactors. Of course, this means inflation. And it can mean stagflation if local supply isn’t brought on-line.

-

Example 3: In the Financial Times, Nobel laureate economist Joseph Stiglitz: (i) argues neoliberalism produces “demagogues”; (ii) implies liberty is not something which can be easily maximized for all, as I alluded to recently via the Quadragesimo anno; and (iii) says the US needs to be like the EU, with higher regulation, state spending, and taxation – yet, in the absence of protectionism, with the same loss of strategic industries? So, again, it’s still inflation or stagflation.

-

Example 4: in an unwitting riposte to Stiglitz, former UK PM Gordon Brown warns, ‘There’s a hard-right tidal wave about to hit Europe – and it will only make the economic crisis worse’ as “near-zero growth has crushed living standards, sending voters to populist demagogues” -- the D word again -- but “they have no solutions to offer.” Brown concludes: “The nationalist timebomb is ticking. Across the continent, Europeans need a plan for better jobs through economic and environmental transformation. When the Polish trade union Solidarity was first formed, its anti-Soviet slogan was “No solidarity without freedom”. But soon many realized that free-for-all neoliberal economics would mean rising inequality and low living standards for the mass of people, and so a new slogan soon rang out: “There is no solidarity in freedom.” If progressives want to prevent an election campaign dominated by anti-immigrant propaganda, they will have to stand up to protectionism and xenophobia by showing the benefits of cooperation.”

But how could Europe do Brown’s Green Keynesianism, with expanded issuance of Eurobonds to fund vast fiscal deficits, without higher inflation? And, absent protectionism, how does it do it without importing the key inputs from China, so running large balance of payments deficits? Moreover, does mass immigration not lower wages or push up rents and house prices via supply vs. demand, as Marx argued, and voters see around them? Must governments boost investment to reduce housing supply pressures (how?) and regulate for higher wages (how?) and build Green Keynesianism and rearm Europe? That implies double-digit fiscal deficits as far as the eye can see. Absent new, hybrid tighter AND looser fiscal-and-monetary policy to match domestic demand to new domestic supply, with inflationary tariffs and industrial policy, that backdrop implies a drift towards becoming a deindustrialised, macro-destabilised, stagflationary emerging market-style economy that certainly produces demagogues.

Allow me to share two related quotes from Classical ‘free market’ economists that are likely to upset Stiglitz and Brown as much as they do those who think we live solely in financial times:

“If any particular manufacture was necessary, indeed, for the defence of the society, it might not always be prudent to depend upon our neighbours for the supply; and if such manufacture could not otherwise be supported at home, it might not be unreasonable that all the other branches of industry should be taxed in order to support it.” – Adam Smith, The Wealth of Nations (Book IV, Chapter V)

* * *

“It would undoubtedly be advantageous to the capitalists of England, and to the consumers in both countries, that under such circumstances, the wine and the cloth should both be made in Portugal, and therefore that the capital and labour of England employed in making cloth, should be removed to Portugal for that purpose... Experience, however, shews, that the fancied or real insecurity of capital, when not under the immediate control of its owner, together with the natural disinclination which every man has to quit the country of his birth and connections, and entrust himself with all his habits fixed, to a strange government and new laws, check the emigration of capital.” - David Ricardo, ‘Principles of Political Economy and Taxation’ (Chapter VII: ‘On Foreign Trade’)

That, dear readers, is the sound of the two great ‘free market’ and ‘free trade’ champions supporting protectionism for national security purposes.

We have long lived in an environment where central banks saying “whatever it takes” was what mattered most to markets (apart from playing ‘higher/lower’ on a daily basis, without which there can be little to do). A well-known idiom for doing whatever it takes is to ‘beg, borrow, or steal’. When looking at China’s mercantilist EV --and steel-- production, as just two examples, and the geopolitical / national security backdrop they are tightly wrapped up in, then the choice of outcomes for Western economies is abundantly clear for those who want to see it:

Beg, borrow, or steel – literally and metaphorically.

The first and second choices imply short-term market-friendly disinflation, then followed by long-term EM-style stagflation. The third choice implies near-term inflation and radical policy framework and market shifts, if done correctly, then disinflation, and near and long-term stagflation if done wrong.

Which will it be?

Judge Holds Trump Contempt With Fine, Jail Threat For Violating Gag Order In 'Hush Money' Trial

Judge Holds Trump Contempt With Fine, Jail Threat For Violating Gag Order In 'Hush Money' Trial

Tyler Durden

Tue, 04/30/2024 - 10:31

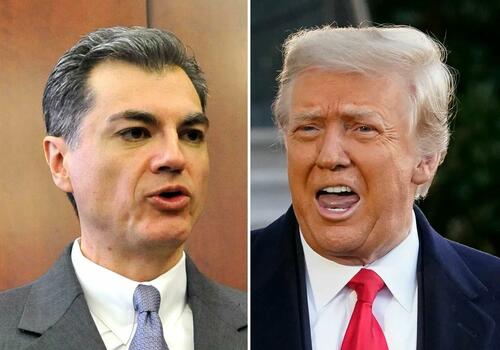

Manhattan Supreme Court Judge Juan Merchan has held Donald Trump in contempt of court for 'repeatedly violating' a gag order in his so-called hush money trial in New York.

According to Merchan, Trump violated the gag order nine times in online posts which targeted jurors or likely witnesses in the trial. The former president was fined the maximum of $1,000 per violation, or $9,000 - and was ordered to remove all of the offending posts by 2:15 p.m. ET on Tuesday.

What's more, Merchan threatened to toss Trump in jail if he willfully violates court orders again.

"Defendant is hereby warned that the Court will not tolerate continued willful violations of its lawful orders and that if necessary and appropriate under the circumstances, it will impose an incarceratory punishment," wrote Merchan in his ruling, CNBC reports.

Merchan read the order aloud before the trial resumed with more testimony from a banker who worked with the former president’s lawyer on a $130,000 hush money payment to porn star Stormy Daniels.

That payment is at the heart of Manhattan prosecutors’ case accusing Trump of falsifying business records as part of a scheme to influence the 2016 presidential election.

Gary Farro, a former senior managing director at First Republic bank, took the stand Friday and continued testifying Tuesday.

On his way into the courtroom, Trump repeated his call for Merchan to both recuse himself from the case and dismiss it entirely. -CNBC

"The judge should terminate the case because they have no case," said Trump in response, adding that he's been unable to campaign for president because he's stuck in court.

That said, Merchan is allowing Trump to attend his son Barron's high school graduation on May 17.

The historic trial began last week, which has included testimony from former National Enquirer publisher David Pecker, as well as Trump's longtime personal secretary, Rhona Graff.

Pecker testified to his efforts to "catch and kill" stories that could be damaging to Trump - including one instance in which his company American Media paying $30,000 for the rights to a former Trump Tower doorman's story about Trump having a secret love child - though Pecker believes the story is untrue.

The company also inked a $150,000 deal with former Playboy model Karen McDougal, who claimed to have had an extramarital affair with Trump, according to Pecker.

Pecker said he did not pay to silence Daniels, who claims she had sex with Trump.

As the Epoch Times notes further, Court was resuming Tuesday with Gary Farro, a banker who helped President Trump’s former attorney Michael Cohen open accounts, including one that Mr. Cohen used to send a payment to adult film performer Stormy Daniels, whose real name is Stephanie Clifford. She alleged a 2006 affair with President Trump, which he denies.

...

Outside the courtroom Tuesday, President Trump criticized prosecutors again. “This is a case that should have never been brought,” he said.

“Our country’s going to hell and we sit here day after day after day, which is their plan, because they think they might be able to eke out an election,” he declared last week in the courthouse hallway.

Don't Buy Rate-Hike Hype, Next Fed Move Is A Cut

Don't Buy Rate-Hike Hype, Next Fed Move Is A Cut

Tyler Durden

Tue, 04/30/2024 - 10:10

Authored by Simon White, Bloomberg macro strategist,

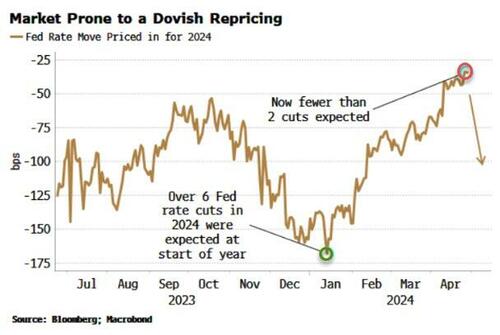

The Federal Reserve’s next move this year is likely to be a rate cut - despite the re-emergence of inflation - leaving markets at risk of a dovish repricing.

When it comes to the Fed, it’s easy to get hung up on what they should do, and neglect what they actually will do. From an inflation perspective, it’s becoming increasingly clear the central bank needs to raise rates further to quell resurgent price growth. But that’s unlikely. Instead, the risks to government funding costs and mounting pressure on liquidity are likely to tilt the Fed in favor of cutting rates, even as inflation is making an unwelcome return.

This week again draws focus to the greater entanglement of monetary and fiscal policy. The Fed meets on Wednesday, but the Treasury’s QRA (quarterly refinancing announcement) is just as consequential for the path of monetary policy. We found out the Treasury’s borrowing requirements on Monday.

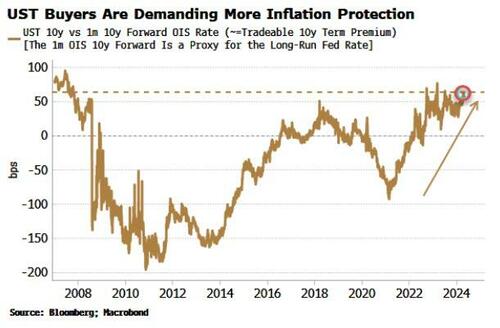

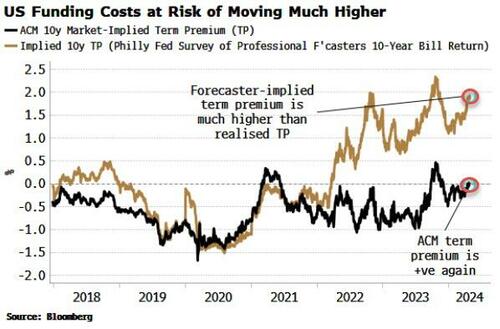

The amounts are eye-watering - $243 billion in 2Q and $847 billion in 3Q - and unthinkable outside a recession only a few years ago. The market is gradually waking up to the Treasury put and the realization the fiscal deficit is unlikely to go back to a non-recessionary norm any time soon. Term premium is rising as lenders demand greater compensation for holding longer-term debt.

The chart below shows a tradeable proxy for term premium - the difference between the 10-year yield and the 1-month OIS rate 10-years forward - that is as high it’s been since the GFC.

Other measures of term premium are also rising. The ACM term premium has gone back into positive territory, while implied measures of term premium based on forecasters’ estimate of the 10-year bill rate are already 150 bps higher than the OIS-based term premium shown above. Even if Treasuries are not as overpriced as this infers, the government still has a problem.

As important for yields as how much the Treasury wants to borrow is how it intends to borrow it. On Wednesday, we will find out the proportion of longer-term versus shorter-term debt (i.e. bills) Treasury expects to issue over the next two quarters.

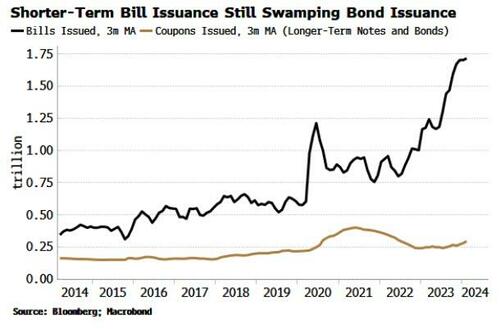

The increase in bill issuance over the last year or so has been of immense importance to markets. The “Yellen pivot” meant that liquidity lying idle in the RRP could be used by money market funds to buy bills and thus help fund the government.

Without this, there’s a strong likelihood the mass of sovereign issuance would have crowded out other assets, and markets would be considerably weaker. The Treasury thus – implicitly or otherwise – aided the Fed by allowing it to keep rates higher for longer and proceed with quantitative tightening.

Wednesday’s announcement will shed further light on whether the Treasury will stick to its stated aim and not significantly increase coupon (i.e. non-bill) issuance for now. A look at the nominal amounts of coupons and bills issued appears to confirm this has been the case.

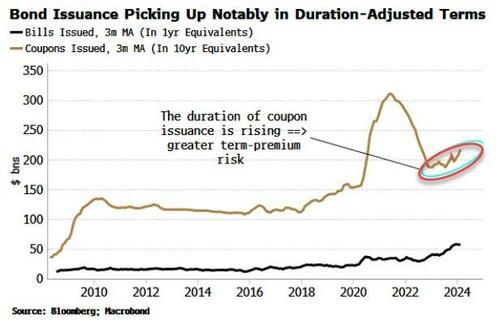

But in duration-adjusted terms the picture is already changing. The amount of coupons issued adjusted for duration is rising. That will amplify the move higher in term premium and ultimately jeopardize support for risk assets.

USTs are simply not in high demand at current prices. Foreigners are more wary due to reserve-confiscation risks, or put off by high FX hedging costs; banks have on net been reducing their ownership of USTs as policy has been tightened; multi-asset managers have less need when Treasuries are a poor recession hedge when inflation is elevated, and a poor portfolio hedge when the stock-bond ratio is positive; and the Fed is busy trying to offload its UST inventory.

Households have become the de facto buyer of last resort for Treasuries. But there’s nothing to suppose they’ll be happy to continue to do so at any price. As the chart below shows, consumers’ long-term inflation expectations typically lead term premium. The market’s view of longer-term inflation, i.e. breakevens, is about 150-200 basis points lower than households’ outlook. As the UST buyer of last resort, households will increasingly set the price, one that’s likely to be lower than it is now.

Higher long-term yields will lead to the government having to borrow yet more to pay its spiraling interest-bill on its outstanding debt. But that points to fewer reserves and falling reserve velocity – effectively undoing the work of the Yellen pivot and leaving the stock market in a precarious spot.

The Fed is thus likely to cut rates in a quid pro quo with the Treasury. This would not only help the government fulfill its borrowing requirements at a non-usurious cost, it also helps the Fed with its responsibility for financial stability by taking the pressure off risk assets and reducing the likelihood of a funding squeeze.

Even though such a move would be unwise, it doesn’t mean it won’t happen. Cutting rates before inflation has been snuffed out threatens to intensify structural risks for price growth.

But in the heat of liquidity drying up, funding risks rising, markets on increasingly shaky ground, and the government locked in an issuance doom-loop as its interest costs soar, the Fed is likely to cut rates as an easy first move to ease the pressure — an outcome made even more likely with an election looming.

In the short-to-medium term, it’s hard to see how quantitative tightening isn’t soon tapered or curtailed. But the Fed is unlikely to want to go full tilt into easing again, or engage in yield curve control. That’s why in the longer term some sort of financial repression – where private cash flows are directed into public debt markets – is very likely.

This would be yet another chip in the de facto erosion of Fed independence. In such an environment, gauging the central bank’s next move needs to consider the spending whims of the government as much as the outlook for inflation and unemployment.

Fastest Drop Since 'Lehman': Chicago PMI Puke Screams Stagflation

Fastest Drop Since 'Lehman': Chicago PMI Puke Screams Stagflation

Tyler Durden

Tue, 04/30/2024 - 09:59

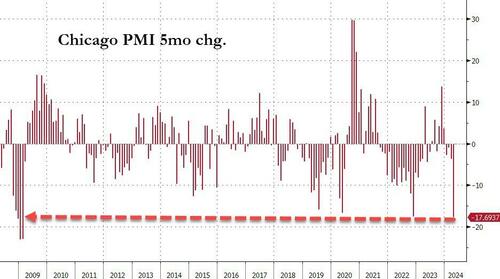

After miraculously surging to two years highs in Nov 2023, Chicago PMI has plunged for five straight months, with the last four months seeing the MoM declines accelerating. Against expectations of a rise to 45.0 (from March's 41.4), April's PMI data printed 37.9

Source: Bloomberg

That is the worst five-month collapse since Lehman...

Source: Bloomberg

More problematically - the underlying data screams stagflation:

-

Prices paid rose at a faster pace; signaling expansion

-

New orders fell at a faster pace; signaling contraction

-

Employment fell at a faster pace; signaling contraction

-

Inventories fell at a slower pace; signaling contraction

-

Supplier deliveries fell at a faster pace; signaling contraction

-

Production fell at a faster pace; signaling contraction

-

Order backlogs fell at a slower pace; signaling contraction

All of which leaves 'hope' languishing at 'Bidenomics'-cycle lows...

Source: Bloomberg

And cue...

cue mainstream media splaining to Chicago: "you don't understand how strong Biden's economy is" https://t.co/W1ewTgjsLx pic.twitter.com/lrhYqDDNM7

— zerohedge (@zerohedge) April 30, 2024The Interlocking of Strategic Paradigms

Theodore Postol, Professor of Science, Technology and National Security Policy at MIT, has provided a forensic analysis of the videos and evidence emerging from Iran’s 13th April swarm drone and missile “demonstation” attack into Israel: A “message,” rather than an “assault.”

The leading Israeli daily, Yediot Ahoronot, has estimated the cost of attempting to down this Iranian flotilla at between $2-3 billion dollars. The implications of this single number are substantial.

Professor Postol writes:

This indicates that the cost of defending against waves of attacks of this type is very likely to be unsustainable against an adequately armed and determined adversary.

The videos show an extremely important fact: All of the targets, whether drones or not, are shot down by air-to-air missiles, [fired from mostly US aircraft. Some 154 aircraft reportedly were aloft at the time] likely firing AIM-9x Sidewinder air to air missiles. The cost of a single Sidewinder air-to-air missile is about $500,000.

Furthermore:

The fact that a very large number of unengaged ballistic missiles could be seen glowing as they reenter the atmosphere to lower altitudes [an indication of hyper-speed], indicates that whatever the effects of [Israel’s] David’s Sling and the Arrow missile defenses, they were not especially effective. Thus, the evidence at this point shows that essentially all or most of the arriving long-range ballistic missiles were not intercepted by any of the Israeli air and missile-defense systems.

Postel adds, “I have analyzed the situation, and have concluded that commercially available optical and computational technology is more than capable of being adapted to a cruise missile guidance system to give it very high precision homing capability … it is my conclusion that the Iranians have already developed precision guided cruise missiles and drones.”

The implications of this are clear. The cost of shooting down cruise missiles and drones will be very high and might well be unsustainable unless extremely inexpensive and effective anti-air systems can be implemented. At this time, no one has demonstrated a cost-effective defense system that can intercept ballistic missiles with any reliability.

Just to be clear, Postol is saying that neither the US nor Israel has more than a partial defence to a potential attack of this nature – especially as Iran has dispersed and buried its ballistic missile silos across the entire terrain of Iran under the control of autonomous units which are capable of continuing a war, even were central command and communications to be completely lost.

This amounts to paradigm change – clearly for Israel, for one. The huge physical expenditure on air defence ordinance – 2-3 billion dollars worth – will not be repeated willy-nilly by the US Netanyahu will not easily persuade the US to engage with Israel in any joint venture against Iran, given these unsustainable air-defence costs.

But also, as a second important implication, these Air Defence assets are not just expensive in dollar terms, they simply are not there: i.e. the store cupboard is near empty! And the US lacks the manufacturing capacity to replace these not particularly effective, high cost platforms speedily.

“Yes, Ukraine” … the Middle East paradigm interlinks directly with the Ukraine paradigm where Russia has succeeded in destroying so much of the western supplied, air-defence capabilities in Ukraine, giving Russia near complete air dominance over the skies.

Positioning scarce air defence “to save Israel” therefore, exposes Ukraine (and slows the US pivot to China, too). And given the recent passage of the funding Bill for Ukraine in Congress, clearly air defence assets are a priority for sending to Kiev – where the West looks increasingly trapped and rummaging for a way out that does not lead to humiliation.

But before leaving the Middle East paradigm shift, the implications for Netanyahu are already evident: He must therefore focus back to the “near enemy” – the Palestinian sphere or to Lebanon – to provide Israel with the “Great Victory” that his government craves.

In short, the “cost” for Biden of saving Israel from the Iranian flotilla which had been pre-announced by Iran to be demonstrative and not destructive nor lethal is that the White House must put-up with the corollary – an attack on Rafah. But this implies a different form of cost – an electoral erosion through exacerbating domestic tensions arising from the on-going blatant slaughter of Palestinians.

It is not just Israel that bears the weight of the Iranian paradigm shift. Consider the Sunni Arab States that have been working in various forms of collaboration (normalisation) with Israel.

In the event of wider conflict embracing Iran, clearly Israel cannot protect them – as Professor Postol so clearly shows. And can they count on the US? The US faces competing demands for its scarce Air Defences and (for now) Ukraine, and the pivot to China, are higher on the White House priority ladder.

In September 2019, the Saudi Abqaiq oil facility was hit by cruise missiles, which Postol notes, “had an effective accuracy of perhaps a few feet, much more precise than could be achieved with GPS guidance (suggesting an optical and computational guidance system, giving a very precise homing capability).”

So, after the Iranian active deterrence paradigm shift, and the subsequent Air Defence depletion paradigm shock, the putative coming western paradigm shift (the Third Paradigm) is similarly interlinked with Ukraine.

For the western proxy war with Russia centred on Ukraine has made one thing abundantly clear: this is that the West’s off-shoring of its manufacturing base has left it uncompetitive, both in simple trade terms, and secondly, in limiting western defence manufacturing capacity. It finds (post-13 April) that it does not have the Air Defence assets to go round: “saving Israel”; “saving Ukraine” and preparing for war with China.

The western maximalisation of shareholder returns model has not adapted readily to the logistical needs of the present “limited” Ukraine/Russia war, let alone provided positioning for future wars – with Iran and China.

Put plainly, this “late stage” global imperialism has been living a “false dawn”: With the economy shifting from manufacturing “things,” to the more lucrative sphere of imagining new financial products (such as derivatives) that make a lot of money quickly, but which destabilise society (through increasing disparities of wealth); and which ultimately, de-stabilise the global system itself (as the World Majority states recoil from the loss of sovereignty and autonomy that financialism entails).

More broadly, the global system is close to massive structural change. As the Financial Times warns,

the US and EU cannot embrace national-security ‘infant industry’ arguments, seize key value chains to narrow inequality, and break the fiscal and monetary ‘rules,’ while also using the IMF and World Bank – and the economics profession– to preach free-market best practice to EM ex-China. And China can’t expect others not to copy what it does. As the FT concludes, the shift to a new economic paradigm has begun. Where it will end is very much up for grabs.

“Up for grabs”: Well, for the FT the answer may be opaque, but for the Global Majority is plain enough – “We’re going back to basics”: A simpler, largely national economy, protected from foreign competition by customs barriers. Call it “old- fashioned” (the concepts have been written about for the last 200 years); yet it is nothing extreme. The notions simply reflect the flip side of the coin to Adam Smith’s doctrines, and that which Friedrich List advanced in his critique of the laissez-faire individualist approach of the Anglo-Americans.

“European leaders,” however, see the economic paradigm solution differently:

The ECB’s Panetta gave a speech echoing Mario Draghi’s call for ‘radical change’: He stated for the EU to thrive it needs a de facto national-security focused POLITICAL economy centered around: reducing dependence on foreign demand; enhancing energy security (green protectionism); advancing production of technology (industrial policy); rethinking participation in global value chains (tariffs/subsidies); governing migration flows (so higher labour costs); enhancing external security (huge funds for defence); and joint investments in European public goods (via Eurobonds … to be bought by ECB QE).

The “false dawn” boom in US financial services began as its industrial base was rotting away, and as new wars began to be promoted.

It is easy to see that the US economy now needs structural change. Its real economy has become globally uncompetitive – hence Yellen’s call on China to curb its over-capacity which is hurting western economies.

But is it realistic to think that Europe can manage a relaunch as a “defence and national security-led political economy,” as Draghi and Panetta advocate as a continuation of war with Russia? Launched from near ground zero?

Is it realistic to think that the American Security State will allow Europe to do this, having deliberately reduced Europe to economic vassalage through causing it to abandon its prior business model based on cheap energy and selling high-end engineering products to China?

This Draghi-ECB plan represents a huge structural change; one that would take a decade or two to implement and would cost trillions. It would occur too, at a time of inevitable European fiscal austerity. Is there evidence that ordinary Europeans support such radical structural change?

Why then is Europe pursuing a path that embraces huge risks – one that potentially could drag Europe into a whirlpool of tensions ending in war with Russia?

For one main reason: The EU leadership held hubristic ambitions to turn the EU into a “geo-political” empire – a global actor with the heft to join the US at Top Table. To this end, the EU unreservedly offered itself as the auxiliary of the White House Team for their Ukraine project, and acquiesced to the entry price of emptying their armouries and sanctioning the cheap energy on which the economy depended.

It was this decision that has been de-industrialising Europe; that has made what remains of a real economy uncompetitive and triggered the inflation that is undermining living standards. Falling into line with Washington’s failing Ukraine project has released a cascade of disastrous decisions by the EU.

Were this policy line to change, Europe could revert to what it was: a trading association formed of diverse sovereign states. Many Europeans would settle for that: Placing the focus on making Europe competitive again; making Europe a diplomatic actor, rather than as a military actor.

Do Europeans even want to be at the American “top table”?

Reprinted with permission from Strategic Culture Foundation.

Cars Used to Make Us Happy

Cars Used to Make Us Happy

Paul Craig Roberts

I attended a classic car show recently and realized why my generation was so happy compared to the current ones. Cars in those days were beautiful and the muscle car element had glorious sounds. Beginning in 1954 but especially with the advent of the 1955 Chevrolet Bel Air coup and Ford Fairlane coup you were looking at beauty enhanced by two-tone paint jobs. Some were a combination of pastels. Others were combinations of strong colors–red and black, yellow and black, red and white, and some were a combination of a strong color and a pastel–navy blue and French blue, pink and black.

In 1955 Chevrolet brought back the V-8 for its cars, and it was a performer. A stock ’55 Chevy V-8 was a match for our souped up 1950 Ford flatheads. What you could do to that 55 Chevy V-8 was something else.

So many of the cars, not only Chevrolets and Fords, but also Pontiac, Oldsmobile, and Dodges had beautiful two-tone paint jobs and delightful styling. The cars also offered wonderful visibility. You could see where you were going, backing up, and what was on either side. For us what constituted safety was visibility, good brakes, and maneuverability.

The mid to late 60s into 1972-73 was the muscle car era. The cars had appealing design as they were designed by designers and not by safety bureaucrats. Some of the colors were outrageous–plum crazy purple, bright lime green, triple black, orange. Such outstanding colors usually indicated potent performance. How fast were the muscle cars of a half century ago?

Very. Plymouth Barracudas, Superbirds, Dusters, Roadrunners, Dodge Daytonas, Chargers, Ford Torinos, Oldsmobile Cutlasses, 442s, Pontaic GTOs, Firebirds, Chevrolet Chevelles, Cameros could compete in quarter mile times with the supercar of the era, a Lamborghini Miura S (1970). The muscle cars would leave in the dust James Bond’s Aston Martin DB5, Ferrari’s 250 GT Lusso, and even beat fast cars from 20 and 30 years later such as the Lotus Esprit Turbo (1988) and Subaru’s 2001 WRX.

Moreover, a muscle car could be souped up to high heaven. Some of them run 9 and 10 second quarter mile times, which beats the entire range of today’s supercars, such as Ferrari, Porsche, Lamborghini, Corvettes, and Shelby Mustangs. Not many of the souped up muscle cars from a half century ago can beat the present day Dodge Demon, but they can run with it.

The thing about muscle cars is that they were so fast that you didn’t need to soup them up like you did a 1950s Ford flathead or a 55 Chevy.

Muscle cars date from the days of 30 cents per gallon gasoline, and in those days it was 100 octane. The combination of low purchase cost (a Plymouth Barracuda with a Hemi engine cost $4,000), operating cost, style, and performance made them a deal that no longer exists.

Today’s cars are loaded down with electronics and “safety” that you don’t need and that is difficult to live with and costly. If the tire pressure in my safe car drops from 32 to 31 on come warning lights and notices on my screen. You have to go through a pointless exercise and then spend half an hour figuring out how to turn off the warning indicators.

Moreover, the accepted safety style comes from federal safety bureaucrats. Consequently, unless you can see the Mercedes star, you can’t tell one from a Toyota.

Today all cars look alike. And you have 4 color choices–white, black, gray, and a dark red. Mopar performance cars, Corvettes, and performance Mustangs are bringing back striking colors and their performance products have a striking appearance. They certainly get your attention, but they are not beautiful.

At a large car show cars from the past and present will be on display. The older cars are beautiful. The new ones are aggressive and heavy in appearance. They don’t inspire. They drive well but they don’t make you happy. They look brutish, like American foreign policy.

In my teenage years driving down a road was like driving along a rainbow. Colors everywhere. Distinctive styles with no possibility of confusing one make with another, glorious sounds if a muscle car passed you, and wonderful visibility.

All of this ended when the fools up high decided to make us safe. One of the consequences has been that we can’t see out of our cars. My safety designer car has great forward vision unless I turn left down hill. Then the massive pillar that makes me safe blocks all vision. There could be a dog, a child, a huge pothole in the road and I am unable to see it.

Rear vision depends on cameras, but they are useless when you are backing out of a parking slot in a shopping center. You can see behind you but not on your side as the enormous pillar blocks all vision. When the massive trucks of today are parked along side of you, it is a game of Russian Roulette to back out.

The emphasis on safety has homogenized car design. There is no distinction, and there are no shapes that work with two-tone paint. The modern car world is drab, and drabness produces depression.

Thus, the cost of our bureaucratic imposed safety is depression. We are mired in sameness and brutal shapes.

When did you last see a happy American?

McCarthyism Returns in a New Guise

McCarthyism Returns in a New Guise

The Israel Lobby rules the US government and US universities.

If you oppose genocide you are an anti-semitic Jew-hater.

Michael Hudson explains

Another Consequence of Globalism

Another Consequence of Globalism

The avocados and berries are for export.

Does Biden’s Campaign Depend on a Taylor Swift Endorsement?

Does Biden’s Campaign Depend on a Taylor Swift Endorsement?

Creating Wealth: The Cantillon or the Smith Way

Although mainstream economists hold that Adam Smith is the father of modern economics, it was Richard Cantillon that recognized the centrality of entrepreneurship in economic development.