In the name of tolerance, tolerance is being abolished; this is a real threat we face.

Political

Google Workers Sacked Over Israel Protests File Federal Labor Complaint

Google Workers Sacked Over Israel Protests File Federal Labor Complaint

Tyler Durden

Wed, 05/01/2024 - 21:05

Authored by Aldgra Fredly via The Epoch Times,

Dozens of Google workers who were fired for protesting the tech giant’s cloud deal with the Israeli government filed a complaint on Monday with the National Labor Relations Board (NLRB) over their termination.

The complaint, obtained by The Washington Post, alleges that Google violated the workers’ rights by “terminating and/or placing them on administrative leave in response to their protected concerted activity, namely, participation (or perceived participation) in a peaceful, non-disruptive protest that was directly and explicitly connected to their terms and conditions of work.”

The workers are seeking reinstatement of their jobs and back pay, alleging that Google had “unlawfully retaliated” against them for engaging in “peaceful” protest, Jane Chung, a spokesperson for No Tech for Apartheid, was quoted as saying by the New York Post.

No Tech for Apartheid, the group organizing the protests, claimed that Google fired over 20 workers on April 23, including non-participating bystanders.

This adds to the 30 workers fired last week for their involvement in sit-in protests at Google offices in New York and Sunnyvale, California, bringing the total number of terminated workers to over 50 people.

Google did not immediately respond to a request for comment.

The protests targeted a $1.2 billion deal known as Project Nimbus that provides artificial intelligence technology to the Israeli government.

The fired workers contend that the system is being lethally deployed in the Gaza war.

“Google’s aims are clear: the corporation is attempting to quash dissent, silence its workers, and reassert its power over them,” the group said in an April 23 press release.

“In its attempts to do so, Google has decided to unceremoniously, and without due process, upend the livelihoods of over 50 of its own workers,” it added.

The activist group has vowed to continue organizing until their demands are met: for Google to “drop Project Nimbus and stop powering Israel’s genocide of Palestinians in Gaza now.”

Project Nimbus was signed in 2021. It involves joint cloud computing and AI services provided by Google and Amazon to the Israeli government. Google has said that the program is not being utilized for military or intelligence purposes.

Google has said that it fired the workers after gathering details from coworkers who were “physically disrupted” and it identified employees who used masks and didn’t carry their staff badges to hide their identities. Google didn’t specify how many were fired.

In a blog post on April 18, Google CEO Sundar Pichai hinted that workers will be on a short leash as the company intensifies its efforts to improve its AI technology at a pivotal moment in the industry and, potentially, humanity. He did not openly refer to a specific incident.

“But ultimately we are a workplace and our policies and expectations are clear: this is a business, and not a place to act in a way that disrupts coworkers or makes them feel unsafe, to attempt to use the company as a personal platform, or to fight over disruptive issues or debate politics,” Mr Pichai wrote.

“We have a duty to be an objective and trusted provider of information that serves all of our users globally,” he added.

It’s not the first time Google workers have protested against some of the company’s ventures and its approach to AI development.

A previous protest by employees in 2018 resulted in Google’s termination of a contract with the U.S. Department of Defense called “Project Maven.” The contract was largely focused on assisting armed forces with military video analysis.

Despite this, Google has remained largely unaffected by the internal uproar.

From a financial perspective, the company continues to flourish through revenue obtained through its main sources, primarily digital advertising and a dominant search engine.

The Countries Where The Most People Buy Organic

The Countries Where The Most People Buy Organic

Tyler Durden

Wed, 05/01/2024 - 20:45

According to the Statista Market Insights, more than 15 percent of food sales in Denmark are of organic products, making the country the biggest market for organic food in relative terms.

As Statista's Katharina Buchholz shows in the chart below, Austria, Luxembourg and Switzerland are the only other countries achieving a share above 10 percent, showing that in a global context, food marketed as organic is still a somewhat of a niche despite all the hype surrounding it.

You will find more infographics at Statista

Taking into consideration only foods marketed as organic (and not those which are not sold as such, for example in countries with less formalized food markets), the global share of organic products in total food revenue was just 1.9 percent.

With Germany in rank 7, a strong preference for organic food in German-speaking countries is visible. Interestingly, Benelux and Scandinavian countries are not consistingly achieving rates above 5 percent. Statista analysts also took a look at the development of the market and concluded that it is only growing slowly in most places as price remains a (perceived) hurdle for many consumers.

Also taking into account country size, the United States still had the largest market for organic food out of any country despite a lower share of organic food at 7.2 percent of all food sales in 2023.

This is the equivalent of around $70 billion of the $975 billion U.S. food market (excluding out-of-home).

In comparison, all of Europe generated food revenues almost $2 trillion but lower organic uptake in Eastern and Southern Europe led to a share of 3.9 percent organic food sales overall - the equivalent to an organic food market only slightly bigger than that of the U.S. at $77.6 billion.

California's Perpetual Drought Is Manmade And Intentional

California's Perpetual Drought Is Manmade And Intentional

Lake Shasta Dam in Shasta Lake, Calif., on Feb. 14, 2023. (Allan Stein/The Epoch Times)

Tyler Durden

Wed, 05/01/2024 - 20:25

Lake Shasta Dam in Shasta Lake, Calif., on Feb. 14, 2023. (Allan Stein/The Epoch Times)

Tyler Durden

Wed, 05/01/2024 - 20:25

Authored by Roger Canfield via The Epoch Times (emphasis ours),

The California Department of Water Resources (DWR) last week released its next five-year plan for the State Water Project—Update 2023. After years of meetings, California’s premier water agency has decided to focus on “three intersecting themes: addressing climate urgency, strengthening watershed resilience, and achieving equity in water management.”

Lake Shasta Dam in Shasta Lake, Calif., on Feb. 14, 2023. (Allan Stein/The Epoch Times)

Lake Shasta Dam in Shasta Lake, Calif., on Feb. 14, 2023. (Allan Stein/The Epoch Times)

Water supplies for California’s 40 million people and the planet’s most productive agriculture have third- to fifth-level priority.

There is nothing new here, except to publicly admit to betraying the public trust. Really?

Over several decades, the public has been deceived into voting for water bonds that have little new water in them—phony promises to build new water storage and aqueducts. About 12 percent of bond funds are spent on new water storage. The rest of the bond funds have been squandered on scores of local and special-interest environmental projects, e.g., tearing down four Klamath-area dams—killing fish to save them—and opposing substantial new water projects, e.g., raising Shasta Dam and building Auburn Dam.

Further, by California law, water must be equitably distributed, pumped “equally”—half to human beings (if you count agriculture) and half to fish (the water-short Pacific Ocean, 187 quadrillion gallons). During the big rains of 2024, about 90 percent of the water was flushed to the Pacific through the gills of perhaps a half dozen delta smelt.

Farmers call it a manmade drought.

The politicos halted humans “taking” water, “diverting” it, from fish. Under the U.S. Constitution, the taking of private property requires just compensation—not mass confiscation. Water rights are a complex species of property.

“Our findings show that atmospheric river activity exceeds what has occurred since instrumental record keeping began,” said Clarke Knight, a U.S. Geological Survey research geographer.

Still, DWR scheduled 2024 meetings of the Drought Resilience Interagency & Partners (DRIP) Collaborative for April, July, and October.

The DRIP fantasy continues despite a deluge of 2024 water from two winters of giant “rivers in the sky” dumping excesses of water and creating massive floods and landslides.

Recent massive atmospheric rivers, Ark events, are small compared to ancient monster storms that occurred long before human beings had any impact whatsoever on climate, let alone weather.

Despite plentiful rainfall, DWR continued to limit pumping from the Sacramento-San Joaquin River Delta to Central Valley agriculture to 30–40 percent to protect native fish. Nonnative bass are likely the greatest dangers to native fish. DWR insisted that its ability to move water south has been “impacted by the presence of threatened and endangered fish species.”

Those water districts’ contractors, paying the full cost of State Water Project (SWP) water, thought otherwise.

Jennifer Pierre, general manager of the State Water Contractors, stated: “While we are glad to see this modest allocation, it is still far below the amount of water we need. There is a lot of water in the system, California reservoirs are full, and runoff from snowpack melt is still to come. Even in a good water year, moving water effectively and efficiently under the current regime is difficult.”

California’s drought fixation is entirely manmade. In the past, in wet years, the waters of the Sacramento River, greater than the mighty Colorado, turned the Central Valley into an inland sea.

For over a century, California visionaries followed the lead of the Mesopotamians, Assyrians, Romans, and Nabataeans as well as the Aztecs before them. C.R. Rockwood, William Mulholland, Michael O’Shaughnessy, Gov. Pat Brown, and Gov. Ronald Reagan built dams and aqueducts to store and distribute water and to provide flood protection and hydroelectricity “too cheap to meter.”

As I have said before, California wastes tens of billions of dollars’ worth (at a conservative $100–$200 an acre-foot) of precious fresh water to save handfuls of delta smelt and “restore” salmon runs where salmon never ran before.

As I’ve also mentioned before, tyrannical water police order city folk, who use only 8 percent of California’s water, to drink recycled toilet water and to live on 55 gallons a day. The serfs may bathe every other Saturday whether they need it or not. California demands that its residents take a water conservation pledge: And to the utopia for which it stands. Neighbors turn neighbors in for “wasting” water, not to mention life, liberty, and property.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times.

'Intel Insidious' - Here's All The 'Grants' Given By Biden's US CHIPS Act

'Intel Insidious' - Here's All The 'Grants' Given By Biden's US CHIPS Act

Tyler Durden

Wed, 05/01/2024 - 20:05

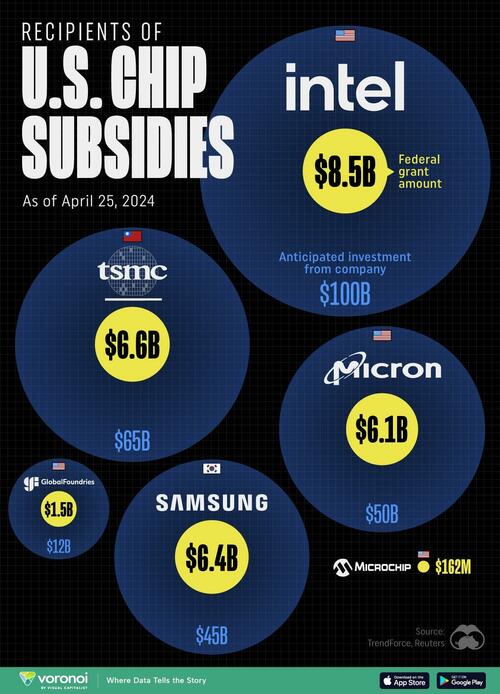

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic, via Visual Capitalist's Marcus Lu, are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

Title IX Rules: 6 More States Sue Biden Admin Over "Radical And Illegal" Changes

Title IX Rules: 6 More States Sue Biden Admin Over "Radical And Illegal" Changes

Tyler Durden

Wed, 05/01/2024 - 18:25

Authored by Katabella Roberts via The Epoch Times,

A group of six Republican state attorneys general filed a lawsuit against the Biden administration’s Department of Education on Tuesday over what they said were “radical and illegal” changes to Title IX rules.

The lawsuit, led by Kentucky Attorney General Russell Coleman and Tennessee Attorney General Jonathan Skrmetti, was filed in the U.S. District Court for the Eastern District of Kentucky.

In their legal filing, the GOP attorneys general argued that the department overstepped its authority when rolling out new updates to Title IX rules that expanded protections to students by incorporating gender identity into the legal text.

They further claimed the changes to the rules override state laws and will harm Tennessee students, families, and schools. The attorneys general called on the court to pause and overturn the newly expanded policy.

“The U.S. Department of Education has no authority to let boys into girls’ locker rooms,” Mr. Skrmetti said in a statement.

“In the decades since its adoption, Title IX has been universally understood to protect the privacy and safety of women in private spaces like locker rooms and bathrooms. Federal bureaucrats have no power to rewrite laws passed by the people’s elected representatives, and I expect the courts will put a stop to this unconstitutional power grab.”

Mr. Coleman, meanwhile argued the new changes to Title IX rules would “rip away 50 years of Title IX’s protections for women and put entire generations of young girls at risk.”

“As Attorney General, it is my duty to protect the people of Kentucky. As a Dad, it is my duty to protect my daughters,” Mr. Coleman said. “Today, I do both.”

Biden Admin Unveils Changes to Rules

The Kentucky attorney general added that his office is joining the lawsuit to “lead this fight for our daughters, granddaughters, nieces, and all the women of our Commonwealth.”

Title IX of the Education Amendments of 1972 is a longstanding policy designed to protect people from discrimination based on sex in schools.

Specifically, the protections prohibit sex-based discrimination in any school or any other education program that receives funding, either directly or indirectly, from the federal government.

However, the Department of Education last week rolled out newly updated Title IX rules that include expanded protections for LGBTQ students for the first time.

Under the updated rules, the prohibition against discrimination based on “sex” has been updated to include a prohibition against discrimination “based on sex stereotypes, sex-related characteristics (including intersex traits), pregnancy or related conditions, sexual orientation, and gender identity.”

The new rules also dictate that any K-12 school or institution of higher education that receives any federal funding may not separate or treat individuals differently based on sex “in a manner that subjects that person to more than de minimis harm,” which Republicans say will lead to shared bathrooms, locker rooms and more.

It does, however, clarify that such separations are allowed “in the context of sex-separate living facilities and sex-separate athletic teams.”

The rules also state that all “non-confidential” school employees are required to notify a Title IX coordinator if they learn of any violations.

According to the Biden administration, the new regulations are set to take effect on Aug. 1.

President Joe Biden (R) speaks in the Roosevelt Room of the White House, on June 30, 2023. (Jim Watson/AFP via Getty Images)

‘Radical, Illegal Attempt to Rewrite the Statute’

In a statement announcing the newly updated rules, U.S. Secretary of Education Miguel Cardona said they “build on the legacy of Title IX by clarifying that all our nation’s students can access schools that are safe, welcoming, and respect their rights.”

“The final regulations promote educational equity and opportunity for students across the country as well as accountability and fairness while empowering and supporting students and families,” the department said.

However, the attorneys general of Kentucky and Tennessee claim the new rules could put schools at risk of losing federal education funding, including access to free and reduced lunch programs and Individuals with Disabilities Education Act (IDEA) grants if they fail to abide by them.

The new rules would also require K-12 schools, colleges, and universities to “allow males identifying as females access to women’s sports, bathrooms and locker rooms,” they said.

“Under this radical and illegal attempt to rewrite the statute, if a man enters a woman’s locker room and a woman complains that makes her uncomfortable, the woman will be subject to investigation and penalties for violating the man’s civil rights,” Mr. Skrmetti said.

“Federal bureaucrats have no power to rewrite laws passed by the people’s elected representatives, and I expect the courts will put a stop to this unconstitutional power grab.”

The attorneys general of Indiana, Ohio, West Virginia, and Virginia have also joined the lawsuit with Tennessee and Kentucky.

It marks the latest lawsuit against the new Title IX changes after Republican attorneys general from nine states including Alabama and Louisiana filed similar legal challenges against the newly updated protections on Monday.

The Texas attorney general also has filed a lawsuit against the expanded rules, calling them “unlawful” and claiming they mandate schools comply with a “radical gender ideology.”

Biden's Dollar Weaponization - Growing Backlash Could Kill The Economy

Biden's Dollar Weaponization - Growing Backlash Could Kill The Economy

Tyler Durden

Wed, 05/01/2024 - 17:45

Authored by Peter Reagan for Birch Gold Group,

President Biden’s decision to participate in the Ukraine-Russia conflict back in February 2022 has taken a new and dangerous turn this year.

The U.S. dollar could suffer dramatically as a result.

Before we explore that new development, we’re going to start by quickly summarizing some of the events that led the United States to this point.

Let’s begin...

In the February 28th, 2022 issue of Matt Levine’s Money Stuff column for Bloomberg, Levine wrote about the sanctions placed on Russia:

the U.S., the European Union, the U.K., Switzerland, Singapore and other countries announced harsh sanctions against Russia for its unprovoked invasion of Ukraine. There are a lot of these sanctions – banning Russian flights through European airspace, limiting Russian banks’ access to the SWIFT interbank messaging system, etc. – but the most drastic might be U.S., U.K. and EU bans on any transactions with the Russian central bank. The bulk of Russia’s foreign reserves are held in the form of securities, deposits at other central banks and deposits at foreign commercial banks. A ban on transactions with Russia’s central bank means that it can’t sell those securities or access those deposits. Its foreign currency reserves turned out to be mostly useless.

As is the case with most geopolitical conflicts, there is always a lot more to the story than gets reported in the mainstream media (Russian, U.S., or otherwise). For example, some of the history behind the current conflict actually dates back to 2014.

Nonetheless, the bottom line is that the financial sanctions placed on Russia in 2022 were supposed to have a severe impact on Russia’s economy.

Unfortunately, for President Biden and NATO allies…

Russia shrugs off brutal sanctions

If the sanctions placed on Russia in 2022 had their intended effect, Russia’s economy would’ve been wrecked, set back 30 years or more. It would’ve become a third-world country by now.

But that hasn’t happened. Russia has prospered despite those sanctions.

A revealing NPR interview shed light on some of the economic impacts, as of December 2023:

Russia has been hit with huge economic sanctions since it invaded Ukraine nearly two years ago. But the Russian economy has remained strong, defying many economists’ expectations.

Alexandra Prokopenko, a fellow at Carnegie Eurasia Center, explained:

Economic growth in Russia in 2023 is likely to exceed 3%. It is – in terms of figures, I mean, it’s great. It’s more than the economy of the United Kingdom or of Germans’ economy. So what’s behind these figures is that over a third of this growth is attributed to the war economy, where defense-related industries are flourishing at double-digit rates.

Now, it makes sense that war would boost military and defense-related industries. But Russia’s economy also doesn’t appear to be suffering much.

In fact, according to Bloomberg, Russia’s economy is actually at risk of overheating.

Even left-leaning think tanks can’t do much more than wag their fingers and exclaim “just you wait”:

Russia’s economy is now stable both in spite of and as a result of Western sanctions…

Russia’s economy could begin to see major challenges in the next year-and-a-half, think tank researchers write.

Just like Bidenomics! “Sure, it’s not working yet, but it will eventually, any day now…”

Nonsense. Russia’s currency, GDP, and banks are thriving:

The ruble is steady at about 92:1 (compare this to Biden’s claims from 2022 that “the ruble will be rubble”). Russia’s debt-to-GDP level is 17.2%, compared with the U.S. level of 131.0%. Russian bank profits for 2024 are projected to exceed the record profits in 2023.

In other words, Russia’s economy is outperforming the U.S. by almost every measure, and is doing so on a more sustainable level from a debt perspective.

So, let’s take stock…

Two years after these shock-and-awe sanctions intended to pressure Russia into ending its invasion of Ukraine:

-

Russia’s economy is outperforming not only the U.S. but also NATO allies (including the UK’s, Germany’s etc.)

-

The embargo on Russian oil by the West had zero impact on Russian exports

-

Russia’s defense and military industries are booming (talk about unintended consequences!)

Don’t misunderstand! I’m no fan of Vladimir Putin.

But I’m also not a fan of the Biden administration’s half-baked plan to teach Russia a lesson. It’s a total failure.

At this point, a rational person would assess the situation, look at the data and make a new plan.

Never one to learn from his mistakes, President Biden has instead opened a new front in his financial war on Russia.

This time, though, I’m seriously concerned he’s gone too far…

“This is outright theft”

Thanks to a recently passed piece of legislation, the Biden administration plans to take control of Russia’s frozen assets.

Rickards provided a nice summary:

The House passed the “REPO Act” this weekend, which authorizes the administration to seize about $20 billion worth of Russian assets sitting in U.S. banks, mostly Treasury securities. It would then transfer that money to Ukraine.

The securities were legally purchased by Russia using dollars earned through the sale of oil prior to the war. They were frozen in early 2022. That means the securities are still legally owned by Russia, but they can’t be sold or pledged, and Russia can’t receive the interest or cash at maturity.

But this legislation goes one step further and authorizes the actual seizure of these assets. This is outright theft and a violation of the Sovereign Immunities Act, but no one seems to care about that.

We’ve discussed dollar weaponization repeatedly over the last couple of years.

This development is next-level.

Freezing assets is bad enough – but seizing those legally-purchased assets? In violation of all international law?

That’s the act of an autocrat. Which is exactly what Biden calls Putin.

Is this a good idea? Probably not. Russia already can’t get its hands on those assets. So how does stealing them make Russia’s situation worse?

It doesn’t!

Instead, what it does accomplish (again, unintended consequences) is send a message to the rest of the world.

It’s not a hopeful message.

Are dollars assets? Or liabilities?

In today’s financialized world, most financial assets are based on debt. They’re promises to pay. As Ray Dalio recently reminded us:

…the dollar, to a lesser extent the euro, to a much lesser extent the yen, and to an even lesser extent the Chinese renminbi… are held in debt assets – i.e., they are debt-backed money—i.e., currency = debt. In other words, when you hold these monies, you are holding debt liabilities, which are promises to deliver you money.

The REPO Act has broken this promise to deliver money.

Which begs the question: What if central banks start to view dollars as a liability rather than an asset?

This Wall Street Journal article shows that economists were already grappling with this question back in 2022:

Recent events highlight the error in this thinking: Barring gold, these assets are someone else’s liability – someone who can just decide they are worth nothing…

What can investors do? For once, the old trope may not be ill advised: buy gold. Many of the world’s central banks will surely be doing it.

Indeed, 2022 was the biggest year for central bank gold-buying in history.

2023 was a close second-place, coming in just 4% below the previous year’s record.

The lesson is quite clear. What we think of as assets can become liabilities overnight.

So what can we do about it?

Do you have enough non-debt money?

Between brutal loss of purchasing power over the last three years, and now this escalation of dollar weaponization, you have to wonder: How much more abuse can the dollar take?

There’s no way to know.

That’s why Dalio wants you to ponder the question, “Do you have enough non-debt money?”

Gold, on the other hand, is a non-debt-backed form of money. It’s like cash, except unlike cash, which is devalued by risks of default or inflation, gold is supported by risks of debt defaults and inflation. It is held by central banks and other investors for this reason. In fact, gold is the third-most-held reserve currency by central banks, more so than the yen or renminbi…

When the financial system is working well – which is when there aren’t debt and inflation crises and the borrower-debtor governments printing debt-backed monies are meeting their obligations and paying their interest without printing and devaluing money – debt assets and other financial assets are good assets to hold; on the other hand, when the reverse is the case, gold is a good asset to own. That’s the main reason that gold is a good diversifier and why I have some in my portfolio.

Physical precious metals are just about the only asset that isn’t someone else’s liability. They aren’t an easily-broken promise to pay. They’re not an obligation.

With physical precious metals, you either own them or you don’t. Learn more about why physical gold ownership is vital.

Do you have enough non-debt money?

If all the promises to pay you own were broken, where would that leave you?

* * *

With global instability increasing and election uncertainties on the horizon, protecting your retirement savings is more important than ever. And this is why you should consider diversifying into a physical gold IRA. Because they offer an easy and tax-deferred way to safeguard your savings using tangible assets. To learn more, click here to get your FREE info kit on Gold IRAs from Birch Gold Group.

A Disappointing First Year For Chicago Mayor Brandon Johnson

A Disappointing First Year For Chicago Mayor Brandon Johnson

Tyler Durden

Wed, 05/01/2024 - 17:05

Authored by Ted Dabrowski and John Klingner via Wirepoints.org,

Nearly one year ago, Chicagoans cheered Mayor Lori Lightfoot’s removal from office.

Gone was her toxic attitude. Her flippant dismissal of the city’s many crises. Her abrasive politics.

In her place was Brandon Johnson, who promised a more inclusive approach to building a “better, stronger, safer Chicago.”

It hasn’t turned out that way.

Today, there’s little disagreement that Mayor Johnson has disappointed on most key issues. On crime. On policing. On migrants. On education. On governance. Even on foreign affairs.

Two recent polls show Chicagoans have a low opinion of Johnson and his performance so far.

A January poll by Tulchin Research found just 21% of registered Chicago voters approved of Johnson. And a new Harris poll shows just 9% of city residents rated Johnson’s performance as above average while 50% rated his performance as below average.

It’s reached the point where some Chicagoans are pursuing a recall initiative to remove the mayor.

As we approach Johnson’s one-year anniversary, let’s review how he’s mishandled the city’s key issues.

On crime

Even before taking office, Mayor Johnson fully embraced soft-on-crime policies. Johnson said in 2020 that defunding the police is not “a slogan, it’s an actual real political goal.” He later defended looting as “an outbreak of incredible frustration and anguish” tied to “a failed racist system.” And at a panel for a police-free future, Johnson said “part of it is removing ourselves away from this state-sponsored policing…”

Johnson has continued to openly excuse crime and violence since becoming Mayor. He declared the youth of last summer’s teen takeovers as just kids being “silly.” He later pushed back against those who complained of youth mobs taking over city streets: “We’re not talking about mob actions…to refer to children as baby Al Capones is not appropriate.”

All that rhetoric has helped fuel Chicago’s crime problem. 2023 ended up with a five-year high in major crimes committed, while Chicago led the country again in homicides for the 12th year in a row. And while murders are down 10% this year, robberies and violent crimes overall are currently running at a six-year high.

Despite that rise in violence, Johnson earlier this year canceled ShotSpotter, a gunshot detection technology, to appease soft-on-crime advocates who declared the program “racist.” He was later pressured to extend the contract through November to ensure ShotSpotter would be in place during the Democratic National Convention.

The saga is not over, however, as now there’s a concerted effort by several aldermen to override Johnson’s decision to get rid of the program. They call ShotSpotter an ‘invaluable tool’ for fighting crime in their homicide-ridden wards.

On illegal immigrants

Mayor Johnson never had a plan – and still doesn’t – for how to handle the inflow of illegal migrants to Chicago. That’s led to a series of walkbacks, unforced errors and costly mistakes by him and his administration. The mayor continues to blame Texas Gov. Greg Abbott for the inflow, but it’s Johnson’s continued support of Chicago’s failed sanctuary status and his increased handouts that keep the migrants coming in.

The Johnson administration has committed nearly $400 million to migrant health and welfare so far and that’s created outrage across the city’s black and brown communities, many of whom protest that the city’s resources are being diverted away from their own struggling neighborhoods. They feel they’ve become second class citizens in their own city.

And then there was the Mayor’s flip-flop on his traveling to the U.S.-Mexico border. Johnson originally said he would travel there to see the impact of the migrant crisis first-hand, but walked that back a few weeks later, with the excuse that he had too much to do and that “I’m doing all of that with a Black wife raising three Black children on the west side of the city of Chicago. I am going to the border as soon as possible.” Mayor Johnson has yet to visit the border.

There’s also the tent city debacle, where the Brighton Park site Johnson chose to host a migrant encampment turned out to be an environmental health hazard. Gov. J.B. Pritzker had to step in and block Johnson and the city from proceeding with the 2,000-bed encampment.

On schools

Johnson staked out his vision for K-12 education long before he ran for mayor, declaring he was “against the structure” of education and decrying homework, standardized tests and selective enrollment schools.

His first step in enacting that vision, a CPS school board resolution calling for a “transition” away from selective enrollment schools and “school choice,” sparked a major backlash from both parents and the state’s political class. Chicago’s selective enrollment and magnet schools are actually among the best, most diverse schools in the state, where black and Hispanic students achieve the same high marks as white students.

A bill protecting those schools from closure recently passed overwhelmingly in the House, serving as a direct repudiation of the Mayor’s efforts.

On Gaza

The mayor recently took the tie-breaking vote in support of a city resolution that called for a ceasefire in Gaza.

That, from the city that leads the country in murders and just hit a five-year high for major crimes.

Even Saturday Night Light Live mocked Johnson and the city council, joking that Gaza had in return called for a ceasefire in Chicago.

On tax hikes

Johnson’s failure to pass his signature “Bring Chicago Home” initiative, a real-estate transfer tax hike to address homelessness, highlighted how little support the mayor has.

Passage of the tax should have been a slam dunk. It was structured to deliver small tax cuts to the overwhelming majority of Chicagoans, while hiking taxes on the wealthy few.

The tax hike, effectively a referendum on Johnson’s performance, failed 52 to 48, dealing a significant blow to the mayor’s authority.

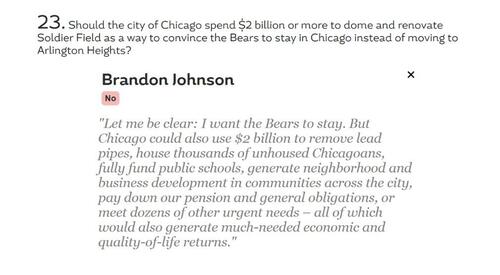

On a new Bears stadium

Johnson is looking for any win to lift his flagging popularity. Cue his support for the Chicago Bears’ plan for a new multi-billion dollar stadium with more than $1.5 billion in taxpayer subsidies.

Never mind that Johnson originally rejected the idea of public subsidies for a stadium during his candidacy, saying that such money would be better spent on new housing, removing lead pipes or “dozens of other urgent needs.”

What makes Johnson’s desperation for a “win” so obvious is that no prominent Democrat stood with him in support, certainly not the ones that matter most: Gov. J.B. Pritzker, Senate President Don Harmon and House Speaker Chris Welch all expressed skepticism of the deal.

* * *

Perhaps nothing better captures the depth of the mayor’s struggles more than this: Johnson was asked not to attend Monday’s funeral of slain police officer Luis Huesca.

His mother said, “Tell the mayor not to come. We do not want him there. Tomorrow is about my son and my family’s grief. We do not want him to disrespect his memory. The mayor does not support the police.”

A Chicago mayor, not attending the funeral of a fallen officer. Nothing more needs to be said.

Read more from Wirepoints:

Yen Soars After Japan Intervenes To Prop It Up For Second Time In 3 Days

Yen Soars After Japan Intervenes To Prop It Up For Second Time In 3 Days

Tyler Durden

Wed, 05/01/2024 - 16:45

Two days after the yen soared after crashing to a 34 year low of 160 against the US, when the Japanese Ministry of Finance reportedly spent around 5 trillion yen, or just over $30 billion, to push the imploding Japanese currency to levels not seen in ... about 48 hours, moments ago with much of the impact from the first intervention having fizzled, the Japanese Ministry of Finance appeared to step in again when moments after the US cash market close, USDJPY cratered in seconds in the second Japanese intervention in as many days.

Of course, one can't help but be amused by the sheer amateur hour at the BOJ where the second consecutive intervention, one which will cost the MOF another $30 billion or so, has managed to push the yen to levels not seen since... last week.

And speaking of the intervention cost, while we won't know how much they officially cost Japan until the end of the month, what is notable is that the first intervention - which took place amid super thin liquidity due to a holiday in Japan which typically exacerbates market moves - cost nearly as much as one of the interventions in 2022, when they bought a record amount of yen, according to a Bloomberg analysis of central bank accounts.

"Despite spending ¥5 trillion in a market where there should have been little trading activity, the yen was pushed up by only a little over ¥5 and quickly recovered more than half its value,” said Takuya Kanda, the head of research at Gaitame.com Research Institute. “That doesn’t seem very cost effective” compared to intervention two years ago, he said.

What is notable about this particular intervention is that it took place just 2 hours after the latest Fed decision - which was viewed as moderately dovish due to the greater than expected QT taper. And indeed, it would be pointless to intervene had the Fed come out as hawkish and sent the dollar soaring.

In fact, one can argue that the BOJ and MOF - having had discussions with Powell and Yellen about this intervention ahead of time - received some assurance that as far the Fed and Treasury are concerned, the US dollar isn't going to spike in the near-future. In fact, one can probably go so far as speculating that Yellen actually leaked to the BOJ what the next NFP and CPI prints will be so that Japan doesn't waste tens of billions in yentervention firepower only to watch the JPY plunge again in two days when a red hot jobs print send the USD soaring.

If so, we've seen the dollar highs for the year.

The Steady Slide Towards Tyranny: How Freedom Dies From A To Z

The Steady Slide Towards Tyranny: How Freedom Dies From A To Z

Tyler Durden

Wed, 05/01/2024 - 16:30

Authored by John & Nisha Whitehead via The Rutherford Institute,

“As I look at America today, I am not afraid to say that I am afraid.”

- Former presidential advisor Bertram Gross

The American governmental scheme is sliding ever closer towards a pervasive authoritarianism.

The American people, the permanent underclass in America, have allowed themselves to be so distracted and divided that they have failed to notice the building blocks of tyranny being laid down right under their noses by the architects of the Deep State.

This steady slide towards tyranny, meted out by militarized local and federal police and legalistic bureaucrats, has been carried forward by each successive president over the past fifty years regardless of their political affiliation.

Biden, Trump, Obama, Bush, Clinton: they have all been complicit in carrying out the Deep State’s agenda.

Frankly, it really doesn’t matter who occupies the White House, because it is a profit-driven, unelected bureaucracy—call it whatever you will: the Deep State, the Controllers, the masterminds, the shadow government, the corporate elite, the police state, the surveillance state, the military industrial complex—that is actually calling the shots.

In the interest of liberty and truth, here’s an A-to-Z primer that spells out the grim realities of life in the American Police State that no one seems to be talking about anymore.

A is for the AMERICAN POLICE STATE. A police state “is characterized by bureaucracy, secrecy, perpetual wars, a nation of suspects, militarization, surveillance, widespread police presence, and a citizenry with little recourse against police actions.”

B is for our battered BILL OF RIGHTS. In the militarized police culture that is America today, where you can be kicked, punched, tasered, shot, intimidated, harassed, stripped, searched, brutalized, terrorized, wrongfully arrested, and even killed by a police officer, and that officer is rarely held accountable for violating your rights, the Bill of Rights doesn’t amount to much.

C is for CIVIL ASSET FORFEITURE. This governmental scheme to deprive Americans of their liberties—namely, the right to property—is being carried out under the guise of civil asset forfeiture, a government practice wherein government agents (usually the police and now TSA agents) seize private property they “suspect” may be connected to criminal activity. Then, whether or not any crime is actually proven to have taken place, the government keeps the citizen’s property and it’s virtually impossible to get it back.

D is for DRONES. Nearly 1500 police departments across the U.S. include drones as part of their technological arsenal, and that number is growing. Although drones may be used for benevolent purposes, they have increasingly become extensions of the surveillance state, carrying out warrantless and constant mass aerial surveillance in violation of the Fourth Amendment. New autonomous police drones can “read a license plate from 800 feet away and follow a vehicle from a distance of 3 miles.”

E is for EMERGENCY STATE. From 9/11 to COVID-19 and beyond, we have been the subjected to an “emergency state” that justifies all manner of government tyranny and power grabs in the so-called name of national security. The government’s ongoing attempts to declare so-called national emergencies in order to circumvent the Constitution’s system of checks and balances constitutes yet another expansion of presidential power that exposes the nation to further constitutional peril.

F is for FASCISM. A study conducted by Princeton and Northwestern University concluded that the U.S. government does not represent the majority of American citizens. Instead, the study found that the government is ruled by the rich and powerful, or the so-called “economic elite.” Moreover, the researchers concluded that policies enacted by this governmental elite nearly always favor special interests and lobbying groups. In other words, we are being ruled by an oligarchy disguised as a democracy, and arguably on our way towards fascism—a form of government where private corporate interests rule, money calls the shots, and the people are seen as mere economic units or databits.

G is for GLOBAL POLICE. The federal government has distributed more than $18 billion worth of battlefield-appropriate military weapons, vehicles and equipment such as drones, tanks, and grenade launchers to domestic police departments across the country. As a result, most small-town police forces now have enough firepower to render any citizen resistance futile. By the time you take those small-town police forces, train them to look and act like the military, and then enlist them to be part of the United Nations’ Strong Cities Network program, you not only have a standing army that operates beyond the reach of the Constitution but one that is part of a global police force.

H is for HOLLOW-POINT BULLETS. The government’s efforts to militarize and weaponize its agencies and employees is reaching epic proportions, with federal agencies as varied as the Department of Homeland Security and the Social Security Administration stockpiling millions of lethal hollow-point bullets, which violate international law. Ironically, while the government continues to push for stricter gun laws for the general populace, the U.S. military’s arsenal of weapons makes the average American’s handgun look like a Tinker Toy.

I is for the INTERNET OF THINGS, in which internet-connected “things” monitor your home, your health and your habits in order to keep your pantry stocked, your utilities regulated and your life under control and relatively worry-free. The key word here, however, is control. This “connected” industry propels us closer to a future where police agencies apprehend virtually anyone if the government “thinks” they may commit a crime, driverless cars populate the highways, and a person’s biometrics are constantly scanned and used to track their movements, target them for advertising, and keep them under perpetual surveillance.

J is for JAILING FOR PROFIT. Having outsourced their inmate population to private prisons run by private corporations, this profit-driven form of mass punishment has given rise to a $70 billion private prison industry that relies on the complicity of state governments to keep their privately run prisons full by jailing large numbers of Americans for petty crimes.

K is for KENTUCKY V. KING. In an 8-1 ruling, the Supreme Court ruled that police officers can break into homes, without a warrant, even if it’s the wrong home as long as they think they may have a reason to do so. Despite the fact that the police in question ended up pursuing the wrong suspect, invaded the wrong apartment and violated just about every tenet that stands between the citizenry and a police state, the Court sanctioned the warrantless raid, leaving Americans with little real protection in the face of all manner of abuses by law enforcement officials.

L is for LICENSE PLATE READERS, which enable law enforcement and private agencies to track the whereabouts of vehicles, and their occupants, all across the country. This data collected on tens of thousands of innocent people is also being shared between police agencies, as well as with government fusion centers and private companies. This puts Big Brother in the driver’s seat.

M is for MAIN CORE. Since the 1980s, the U.S. government has acquired and maintained, without warrant or court order, a database of names and information on Americans considered to be threats to the nation. As Salon reports, this database, reportedly dubbed “Main Core,” is to be used by the Army and FEMA in times of national emergency or under martial law to locate and round up Americans seen as threats to national security. There are at least 8 million Americans in the Main Core database.

N is for NO-KNOCK RAIDS. Owing to the militarization of the nation’s police forces, SWAT teams are now increasingly being deployed for routine police matters. In fact, more than 80,000 of these paramilitary raids are carried out every year. That translates to more than 200 SWAT team raids every day in which police crash through doors, damage private property, terrorize adults and children alike, kill family pets, assault or shoot anyone that is perceived as threatening—and all in the pursuit of someone merely suspected of a crime, usually possession of some small amount of drugs.

O is for OVERCRIMINALIZATION and OVERREGULATION. Thanks to an overabundance of 4500-plus federal crimes and 400,000 plus rules and regulations, it’s estimated that the average American actually commits three felonies a day without knowing it. As a result of this overcriminalization, we’re seeing an uptick in Americans being arrested and jailed for such absurd “violations” as letting their kids play at a park unsupervised, collecting rainwater and snow runoff on their own property, growing vegetables in their yard, and holding Bible studies in their living room.

P is for PATHOCRACY and PRECRIME. When our own government treats us as things to be manipulated, maneuvered, mined for data, manhandled by police and other government agents, mistreated, and then jailed in profit-driven private prisons if we dare step out of line, we are no longer operating under a constitutional republic. Instead, what we are experiencing is a pathocracy: tyranny at the hands of a psychopathic government, which “operates against the interests of its own people except for favoring certain groups.” Couple that with the government’s burgeoning precrime programs, which will use fusion centers, data collection agencies, behavioral scientists, corporations, social media, and community organizers and by relying on cutting-edge technology for surveillance, facial recognition, predictive policing, biometrics, and behavioral epigenetics in order to identify and deter so-called potential “extremists,” dissidents or rabble-rousers. Bear in mind that anyone seen as opposing the government—whether they’re Left, Right or somewhere in between—is now viewed as an extremist.

Q is for QUALIFIED IMMUNITY. Qualified immunity allows police officers to walk away without paying a dime for their wrongdoing. Conveniently, those deciding whether a cop should be immune from having to personally pay for misbehavior on the job all belong to the same system, all cronies with a vested interest in protecting the police and their infamous code of silence: city and county attorneys, police commissioners, city councils and judges.

R is for ROADSIDE STRIP SEARCHES and BLOOD DRAWS. The courts have increasingly erred on the side of giving government officials—especially the police—vast discretion in carrying out strip searches, blood draws and even anal and vaginal probes for a broad range of violations, no matter how minor the offense. In the past, strip searches were resorted to only in exceptional circumstances where police were confident that a serious crime was in progress. In recent years, however, strip searches have become routine operating procedures in which everyone is rendered a suspect and, as such, is subjected to treatment once reserved for only the most serious of criminals.

S is for the SURVEILLANCE STATE. On any given day, the average American going about his daily business will be monitored, surveilled, spied on and tracked in more than 20 different ways, by both government and corporate eyes and ears. A byproduct of the electronic concentration camp in which we live, whether you’re walking through a store, driving your car, checking email, or talking to friends and family on the phone, you can be sure that some government agency, whether the NSA or some other entity, is listening in and tracking your behavior. This doesn’t even begin to touch on the corporate trackers that monitor your purchases, web browsing, Facebook posts and other activities taking place in the cyber sphere.

T is for TASERS. Nonlethal weapons such as tasers, stun guns, rubber pellets and the like have been used by police as weapons of compliance more often and with less restraint—even against women and children—and in some instances, even causing death. These “nonlethal” weapons also enable police to aggress with the push of a button, making the potential for overblown confrontations over minor incidents that much more likely. A Taser Shockwave, for instance, can electrocute a crowd of people at the touch of a button.

U is for UNARMED CITIZENS SHOT BY POLICE. No longer is it unusual to hear about incidents in which police shoot unarmed individuals first and ask questions later, often attributed to a fear for their safety. Yet the fatality rate of on-duty patrol officers is reportedly far lower than many other professions, including construction, logging, fishing, truck driving, and even trash collection.

V is for OPERATION VIGILANT EAGLE. One of several government initiatives dating back to 2009 that call for heightened scrutiny of those who challenge the government’s authority, this particular program calls for surveillance of military veterans, characterizing them as extremists and potential domestic terrorist threats because they may be “disgruntled, disillusioned or suffering from the psychological effects of war.” Coupled with a report that defines extremists as individuals and groups “that are mainly antigovernment, rejecting federal authority in favor of state or local authority, or rejecting government authority entirely,” these tactics bode ill for anyone seen as opposing the government.

W is for WHOLE-BODY SCANNERS. Using either x-ray radiation or radio waves, scanning devices and government mobile units are being used not only to “see” through your clothes but to spy on you within the privacy of your home. While these mobile scanners are being sold to the American public as necessary security and safety measures, we can ill afford to forget that such systems are rife with the potential for abuse, not only by government bureaucrats but by the technicians employed to operate them.

X is for X-KEYSCORE, one of the many spying programs carried out by the National Security Agency that targets every person in the United States who uses a computer or phone. This top-secret program “allows analysts to search with no prior authorization through vast databases containing emails, online chats and the browsing histories of millions of individuals.”

Y is for YOU-NESS. Using your face, mannerisms, social media and “you-ness” against you, you are now be tracked based on what you buy, where you go, what you do in public, and how you do what you do. Facial recognition software promises to create a society in which every individual who steps out into public is tracked and recorded as they go about their daily business. The goal is for government agents to be able to scan a crowd of people and instantaneously identify all of the individuals present. Facial recognition programs are being rolled out in states all across the country.

Z is for ZERO TOLERANCE. We have moved into a new paradigm in which young people are increasingly viewed as suspects and treated as criminals by school officials and law enforcement alike, often for engaging in little more than childish behavior or for saying the “wrong” word. In some jurisdictions, students have also been penalized under school zero tolerance policies for such inane "crimes" as carrying cough drops, wearing black lipstick, bringing nail clippers to school, using Listerine or Scope, and carrying fold-out combs that resemble switchblades. The lesson being taught to our youngest—and most impressionable—citizens is this: in the American police state, you’re either a prisoner (shackled, controlled, monitored, ordered about, limited in what you can do and say, your life not your own) or a prison bureaucrat (politician, police officer, judge, jailer, spy, profiteer, etc.).

None of these dangers have dissipated in any way, and yet suddenly, no one seems to be talking about any of the egregious governmental abuses that are still wreaking havoc on our freedoms: police shootings of unarmed individuals, invasive surveillance, roadside blood draws, roadside strip searches, SWAT team raids gone awry, the military industrial complex’s costly wars, pork barrel spending, pre-crime laws, civil asset forfeiture, fusion centers, militarization, armed drones, smart policing carried out by AI robots, courts that march in lockstep with the police state, schools that function as indoctrination centers, bureaucrats that keep the Deep State in power.

As I make clear in my book Battlefield America: The War on the American People and in its fictional counterpart The Erik Blair Diaries, this is how freedom dies.

If there is any means left to us for thwarting the government in its relentless march towards outright dictatorship, it may rest with the Tenth Amendment, which affirms that “we the people” (in the form of juries and local governments) have the power to invalidate governmental laws, tactics and policies that are illegitimate, egregious or blatantly unconstitutional.

Nullify everything.

Nullify the court cases. Nullify the laws. Nullify everything the government does that flies in the face of the Constitution.

It’s time to rein in our runaway government, reclaim our freedoms, and restore justice in America.

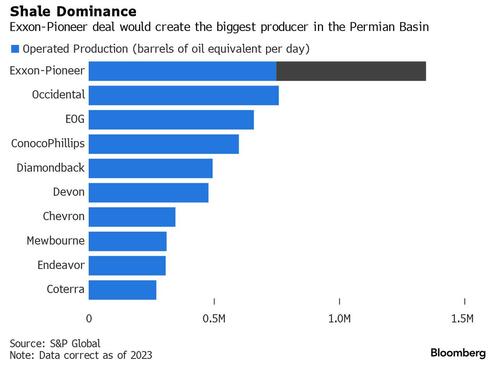

Exxon To Win FTC Approval For $60 Billion Pioneer Deal, Creating Energy Supergiant

Exxon To Win FTC Approval For $60 Billion Pioneer Deal, Creating Energy Supergiant

Tyler Durden

Wed, 05/01/2024 - 16:14

Having adversely intervened in virtually every other M&A deal in the past 3 years, the Biden FTC will reportedly allow Exxon's $60 billion purchase of Pioneer to go through after the companies agreed to minor concessions, Bloomberg reported citing people familiar with the matter. The announcement of the deal will likely come any moment, and the resulting deal will make Exxon - a company which Biden once said makes money money than god - far and away the biggest oil and natural gas producer in the Permian Basin, North America’s largest US oil field, and also the biggest energy company in the US.

Pioneer shares that had been down more than 2% on the day reversed those losses and were trading up as much as 0.9% on the news. Hess Corp, the target of a takeover bid by Chevron, also climbed 0.9% although the probability of that deal passing is far lower especially in light of the ongoing arbitration with Exxon over Guyana. Chevron, Occidental and Chesapeake are among companies with large pending takeovers that are undergoing in-depth reviews before the FTC.

The Pioneer deal will combine two fast-growing Permian operations, lifting Exxon’s production in the basin to the equivalent of about 2 million barrels a day by 2027, up from about 600,000 last year.

More than 50 lawmakers - obviously mostly communists, pardon, democrats - urged the FTC in March to increase scrutiny on concerns a $230 billion wave of consolidation in would increase energy prices for consumers, squeeze suppliers and suppress wages. In short: enforce more Soviet-style central planning and crush conventional capitalism. As a result, investors had feared the agency, which has become more a ruthless enforcer of authoritarian anti-capitalism under Democrat admin puppet Lina Khan, would stand in the way of several large deals, especially in an election year when the Biden administration is seeking to prove its climate credentials and contain gasoline prices at all cost.

In response to the ruling communists, oil executives have claimed the deals will benefit shareholders, consumers and the environment. Exxon CEO Darren Woods said the Pioneer deal would lower its cost of production, making US barrels more competitive in the global market, and provide a strong platform for growth, which would ultimately benefit consumers. Exxon also pledged to reduce climate-warming emissions from Pioneer operations to net zero by 2035, accelerating the prior target by 15 years.

The Biden administration has constantly been at odds with the oil industry, but easing through what many executives see as necessary consolidation is likely to improve relations. With domestic crude prices up roughly 14% this year and tensions rising the Middle East, the administration is vulnerable to Republican attacks on measures that hurt the oil industry and raise fuel prices.

Taper 'Tantrum-ette' - Stocks Pump'n'Dump As Fed 'Eases' Balance-Sheet Pressure

Taper 'Tantrum-ette' - Stocks Pump'n'Dump As Fed 'Eases' Balance-Sheet Pressure

Tyler Durden

Wed, 05/01/2024 - 16:00

Powell to traders today...

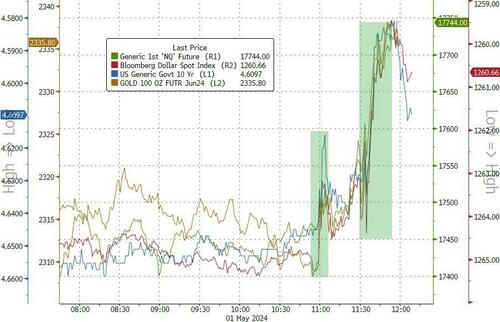

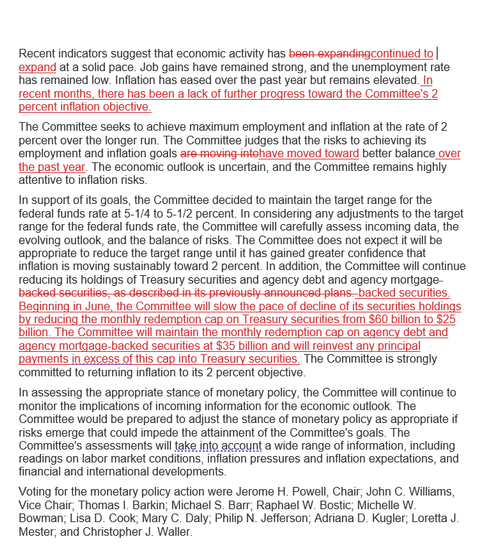

The bigger than expected QT taper announcement juiced markets (stocks and bond prices up, dollar down) into Powell's press conference, then got spooked lower as he admitted "inflation has shown a lack of further progress... and gaining confidence to cut will take longer than thought."

But that dip didn't last long and yields puked, stocks soared, gold rallied and the dollar puked...

Source: Bloomberg

The market shrugged off Powell's comments about "whether rates are at their peak will depend on data" which opened up the path of possible rate-hikes, but he dd add that "he doubts next move will be a hike."

CNBC's Steve Liesman asked the big question that everyone should be asking: you are 'sort of easing' by reducing QT while holding rates flat because you're not confident that inflation is under control - wassup with dat?

Powell replied with some words that meant nothing, stating that they have long planned on tapering QT and claimed that 'reduction in balance sheet run-off is not policy-easing'.

"This is not the easing you're looking for..."

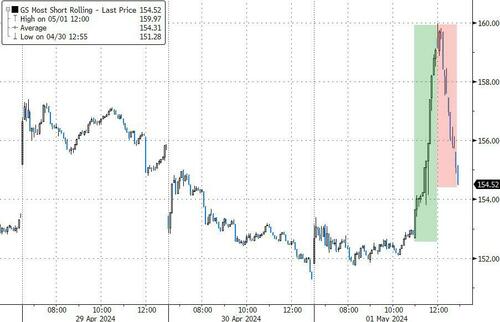

By the close, all of Powell's pig-kissing lipstick had been wiped off (see below for the coordinated crypto/nasdaq take-down) as stocks saw solid gains erased in the hour after Powell stopped speaking... Small Caps and The Dow managed to hold on to the gains but Nasdaq and S&P closed nearer the day's lows...

'Most Shorted' stocks saw a massive squeeze (+5%) on the FOMC headlines, before the late day selling pressure hit...

Source: Bloomberg

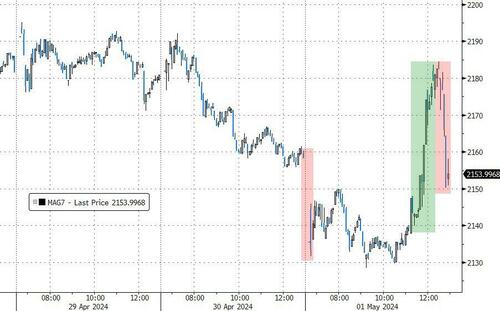

MAG7 stocks ended the day unchanged after giving back their post-Powell gains...

Source: Bloomberg

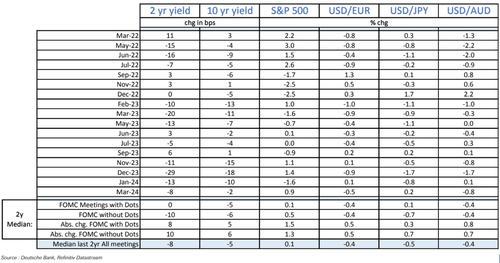

Treasury yields plunged 6-8bps across the curve on the day, with the short-end outperforming, dragging all yields lower on the week...

Source: Bloomberg

The 2Y Yield snapped back below 5.00% once again...

Source: Bloomberg

The yield curve (2s30s) jerked flatter initially, then steepened dramatically back to flat on the week...

Source: Bloomberg

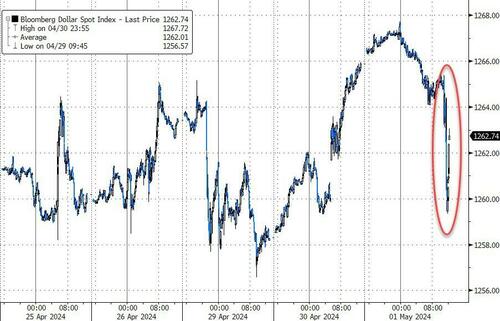

The dollar tumbled on the non-easing 'easing' (but bounced back a bit after Powell finished speaking)...

Source: Bloomberg

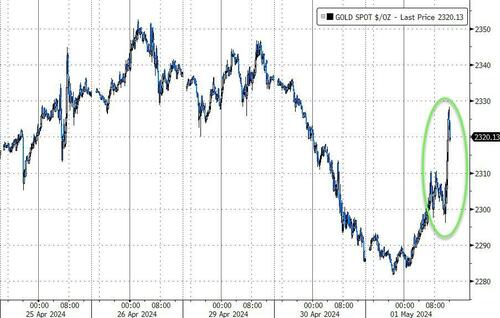

Gold surged back above $2300 on the non-easing...

Source: Bloomberg

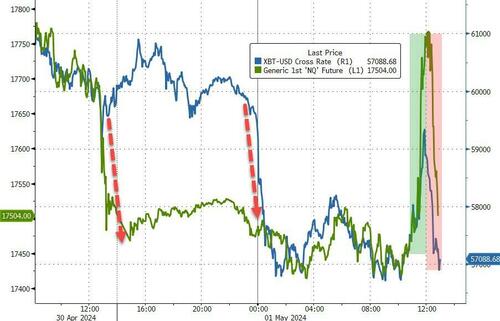

Bitcoin bounced back on the FOMC statement, recovering some of last night's bloodbathery, but somebody did not want it back to $60,000 and that smackdown dragged stocks down with it...

Source: Bloomberg

Oil prices ignored all the fuss around The Fed and fell for the third day in a row (its biggest daily drop since early Jan) with WTI back below $80 at six-week lows...

Source: Bloomberg

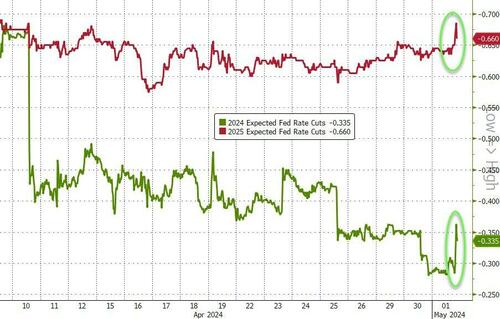

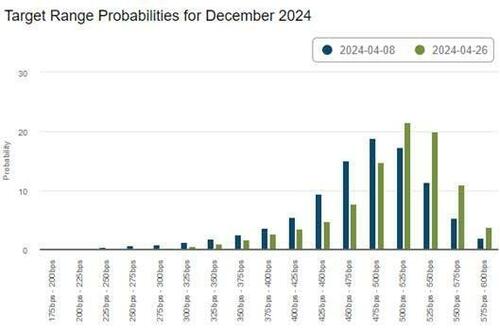

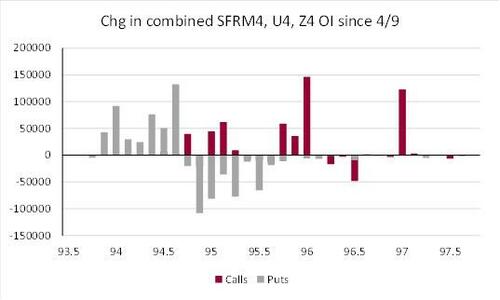

Finally, rate-cut expectations (hawkishly) rose on the day with one-or-two cuts in 2024 now 50-50 and two-or-three cuts more in 2025 around 50-50 also...

Source: Bloomberg

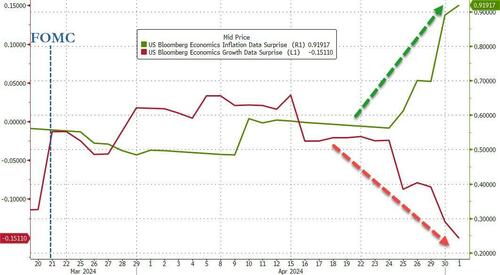

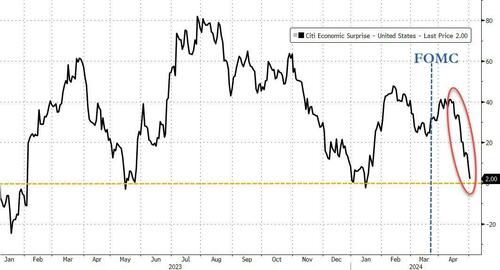

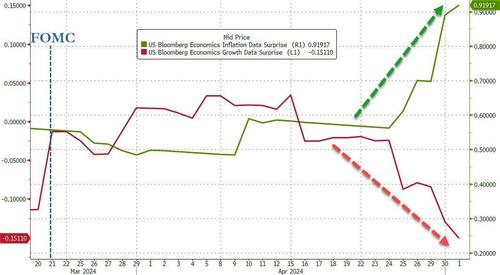

And, also Powell explained that he "doesn't see the stag or the 'flation" in markets... well this should help Jay...

Source: Bloomberg

We can't help but feel like Powell is awfully eager to 'loosen' policy... but he made it clear that the 2024 election "just isn't a part of the Fed's thinking."

So, that's that then!

Food Shortages For The UK, Climate Change and Creak! Pop!

Bad weather leading to farming difficulties is being immediately linked to and blamed on Climate Change. This is one of their many attack fronts. Meanwhile, US economic statistics are pointing to a rather sudden downturn in housing construction and that prior job reports were vastly overstated.,

China Crossed Biden's Red Line On Ukraine, So What?

China Crossed Biden's Red Line On Ukraine, So What?

Tyler Durden

Wed, 05/01/2024 - 15:40

Authored by Mike Shedlock via MishTalk.com,

It’s ridiculous to have red lines if you are not going to do anything when they are crossed. So what should Biden do?

China Has Crossed Biden’s Red Line on Ukraine

A Wall Street Journal Op-Ed moans China Has Crossed Biden’s Red Line on Ukraine.

President Biden warned China two years ago not to provide “material support” for Russia’s war in Ukraine. On Friday, Secretary of State Antony Blinken conceded that Xi Jinping ignored that warning. China, Mr. Blinken said, was “overwhelmingly the No. 1 supplier” of Russia’s military industrial base, with the “material effect” of having fundamentally changed the course of the war. Whatever Mr. Biden chooses to do next will be momentous for global security and stability.

Mr. Biden can either enforce his red line through sanctions or other means, or he can signal a collapse of American resolve by applying merely symbolic penalties. Beijing and its strategic partners in Moscow, Tehran, Pyongyang and Caracas would surely interpret half-hearted enforcement as a green light to deepen their campaign of global chaos. Mr. Xi sees a historic opportunity here to undermine the West.

What sanctions? On Who? On What? For How Long?

Op-ed writer Matt Pottinger provided no details, he just wants action. He needs to explain what sanctions make any sense at all, and how they would work.

Numerous US sanctions on Russia, China, Iran, all failed. Hell some of them on Russia and China not only failed they backfired.

So funny. Adding to my post on red lines and sanction failures.

— Mike "Mish" Shedlock (@MishGEA) May 1, 2024How China Gets Around US Sanctions on Semiconductors

On February 18, 2024, I explained How China Gets Around US Sanctions on Semiconductors

How Russia Makes a Mockery of US Sanctions in One Picture

Unprecedented US and EU sanctions against Russia have had no impact on Russia’s oil exports or revenue. Who’s the beneficiary?

On December 29, 2023 I noted How Russia Makes a Mockery of US Sanctions in One Picture

On September 19, 2023, I commented Lesson of the Day: Sanctions Don’t Work Because They Create New Markets

Why Sanctions Fail

-

Someone always has an incentive to break sanctions.

-

Sanctions create new markets.

This is how Russia sells oil and how China gets access to equipment and parts.

In the case of chips, the US has forced China into a path to self-sufficiency. Hooray?!

Matt Pottinger wants sanctions. He should name some. Nah, what he really wants is to promote his book “The Boiling Moat: Urgent Steps to Defend Taiwan.”

What Color Are Biden’s Red Lines?

On March 10, I asked Are Biden’s Red Lines to Netanyahu Really Yellow or Green?

Presumably you know the answer now, but if not, please consider this idle threat: Biden Threatens Sanctions on Israeli Soldiers Yet Wants More Money for Israel

If you are going to have red lines, I suggest they should be red.

Israel vs China Red Lines

In the case of Israel, there was an easy remedy. Biden could have withheld aid. Instead, when Israel repeatedly crossed lines, Biden stepped up the aid further emboldening Netanyahu.

In the case of China, there are no sanctions or policy actions that make any sense, so there should not be any red lines.

Attempting to set foreign policy for the world is a huge mistake. And setting red lines you cannot or will not do anything about makes one look silly.

Starbucks On Brink Of Worst Crash Since Dot Com After "Stunning" Earnings Miss

Starbucks On Brink Of Worst Crash Since Dot Com After "Stunning" Earnings Miss

Tyler Durden

Wed, 05/01/2024 - 15:25

Starbucks shares plummeted by 16% during the early cash session, approaching the -16.2% level last seen during the Covid crash. If intraday losses surpass 16.2% and remain above this level at closing, it would mark the company's worst single-day loss since the Dot Com crash in early 2000.

"Starbucks reported what's perhaps the worst set of results of any large company so far" this quarter, analyst Adam Crisafulli of Vital Knowledge wrote in a note. William Blair downgraded the coffee chain, citing last quarter's "stunning across-the-board miss on all key metrics."

Starbucks reported a 4% drop in same-store sales in the second quarter compared with the same period last year, while analysts tracked by Bloomberg were expecting growth. In China, same-store sales plunged 11%. The company's top geographic segments are showing a pullback in consumer spending.

On Tuesday evening, CEO Laxman Narasimhan started the earnings call with investors by clarifying his unhappiness with last quarter's results.

"Let me be clear from the beginning. Our performance this quarter was disappointing and did not meet our expectations," Narasimhan said.

He said major headwinds originate from a "cautious consumer," adding, "A deteriorating economic outlook has weighed on customer traffic and impact felt broadly across the industry."

Here's a snapshot of the second quarter's earnings results (list courtesy of Bloomberg):

-

Comparable sales -4%, estimate +1.46% (Bloomberg Consensus)

-

North America comparable sales -3%, estimate +2.05%

-

US comparable sales -3%, estimate +2.31%

-

International comparable sales -6%, estimate +1.36%

-

China comparable sales -11%, estimate -1.62%

-

Adjusted EPS 68c, estimate 80c

-

Net revenue $8.56 billion, estimate $9.13 billion

-

Operating income $1.10 billion, -17% y/y, estimate $1.35 billion

-

Adjusted operating margin 12.8%, estimate 14.5%

-

Operating margin 12.8%, estimate 14.4%

-

North America operating margin +18%, estimate +19.5%

-

International operating margin 13.3%, estimate 15.2%

-

Channel development operating margin 51.7%, estimate 43.6%

-

Average ticket +2%, estimate +2.41%

-

North American average ticket price +4%, estimate +4.15%

-

International avg. ticket -3%, estimate +0.1%

-

North America net new stores 134, estimate 144.33

-

International net new store openings 230, estimate 429.23

-

Comparable transactions -6%, estimate -0.27%

-

North America comparable transactions -7%, estimate -1.86%

-

International comparable transactions -3%, estimate +1.37%

Goldman analysts Eric Mihelc and Scott Feiler told clients, "Expectations were for a clear sales miss and a modest EPS miss, but both came worse than the lowered bar."

They added, "The miss was across geography and was as bad, if not worse, than worst fears."

Other Wall Street analysts shared the same gloom and doom about the coffee chain (list courtesy of Bloomberg):

Deutsche Bank analyst Lauren Silberman cuts Starbucks to hold from buy

-

Says the "challenging" results was a sign "headwinds are more pervasive and persistent than we expected, and we have limited visibility into the pace and magnitude of a recovery"

-

Had thought comparable sales deceleration in the US was more transitory and isolated to a specific cohort

-

However, with the decline in 2Q traffic and what seems to be limited improvement from Lavender and Spicy Refreshers, Silberman sees it being difficult to "underwrite a meaningful reacceleration," which is key to the bull case

William Blair, Sharon Zackfia (cuts to market perform from outperform)

-

After healthy demand over the past three years, Zackfia says the "tide has turned quickly," with Starbucks posting the weakest traffic performance outside the pandemic or Great Recession

-

China now "looks more fragile," with comparable sales down 11%, and even Starbucks Rewards members "took a rare dip," she adds

Jefferies, Andy Barish (hold)

-

There was a "notable" miss on US and international comparable sales as well as EPS, and Barish says there is "no easy fix in sight to reaccelerate SSS near-term"

-

Notes that international comparable sales was "similarly weak," with traffic and comparable transactions both declining; China's comparable sales miss and Middle East volatility more than offset positive comps seen in Japan, APAC and Latin America

-

PT cut to $84 from $94

Citi, Jon Tower (neutral)

-

Starbucks is "putting a lot of oars in the water to try and paddle" its way back to a stable comparable sales outlook that investors would be willing to underwrite

-

However, Tower expresses concern that there is not enough "coxswain keeping oarsmen working in unison/with accountability"; adds that it ignores the "true leak in the bottom of the boat," flagging broad consumer pushback to cumulative transaction growth and the value equation

-

Notes China store margins are still in the double digits and the segment is profitable despite top-line declines

-

PT cut to $85 from $95

Cowen, Andrew Charles (hold)

-

"We believe 2024 guidance has been derisked as we model 0% NA comps & 3% EPS growth, the high end of the range"

-

Expects shares to be in a "holding pattern" as Starbucks restores credibility while competition and tough macroeconomic conditions present headwinds

-

PT cut to $85 from $100

Bloomberg Intelligence, Michael Halen and Jennifer Bartashus

-

"Starbucks slashed fiscal 2024 same-store sales, revenue and EPS guidance and lacks a cogent plan to boost demand"

-

"We believe several initiatives, including targeting overnight sales, dozens of new products and a four-week mobile- app upgrade cycle are overkill — a distraction unlikely to boost traffic"

On Tuesday, a similar story occurred at McDonald's when the burger chain reported lower-than-expected quarterly sales growth.

Notably, working-poor consumers are pulling back spending in a period of stagflation (read here & here).

The Path Of Least Resistance: Northwestern Reaches Controversial Settlement With Pro-Palestinian Protesters

The Path Of Least Resistance: Northwestern Reaches Controversial Settlement With Pro-Palestinian Protesters

Tyler Durden

Wed, 05/01/2024 - 15:05

Northwestern University has agreed to a controversial settlement with pro-Palestinian protesters encamped on its campus this week, including a commitment for scholarships for Palestinians, Palestinian faculty appointments, and special housing for Muslim students.

The protesters will also be allowed to continue their protests while agreeing to stay in a particular area of campus. It will also put the students and supporting faculty on bodies to review any university investments and purchases, a major demand from supporters of the Boycott, Divestment and Sanctions (BDS) movement.

Previously, protesters had reportedly prevented some students and faculty from entering buildings and engaged in property damage.

The Daily Northwestern reported the details of the deal and noted

“the University has committed to provide a conduit for students to engage with the Investment Committee of the Board of Trustees. It will also re-establish an Advisory Committee on Investment Responsibility this fall, which will include students, faculty and staff.

...

In addition, the University committed to some support for Palestinian students and faculty in the agreement. NU will ‘support visiting Palestinian faculty and students at risk,’ and will provide the cost of attendance for five Palestinian undergraduates to attend Northwestern.

...

The University also committed to providing an ‘immediate temporary space for MENA/Muslim students’ — a longtime demand from students on campus — and will provide and renovate a house for MENA/Muslims students as soon as possible. The final house is expected to come in 2026.”

It also includes a commitment of the university to intervene with employers to guarantee that students suffer no consequences for participating in protests in their jobs and internships.

Northwestern (my alma mater) has always chosen the path of least resistance when it comes to protesters, including at times surrendering core academic functions. I have been particularly critical of the loss of freedom of speech and academic integrity on campus.

Students previously succeeded in cancelling a speech by former U.S. Attorney General Jeff Sessions. Student Zachery Novicoff embodied the rising intolerance to free speech on campus. He is quoted as saying “There’s a limitation to free speech. That ends at overtly racist old white dudes.”

I criticized former Northwestern University President Morton Schapiro for his lack of support for free speech on campus. Schapiro denounced what he called “absolute” free speech positions and endorsed speech sanctions, including treating speech as a form of assault.

During his tenure, the university often seemed a mere pedestrian to mob action taken against dissenting voices. For example, we previously discussed a Sociology 201 class by Professor Beth Redbird that examined “inequality in American society with an emphasis on race, class and gender.” To that end, Redbird invited both an undocumented person and a spokesperson for the Immigration and Customs Enforcement. It is the type of balance that is now considered verboten on campuses.

Members of MEChA de Northwestern, Black Lives Matter NU, the Immigrant Justice Project, the Asian Pacific American Coalition, NU Queer Trans Intersex People of Color and Rainbow Alliance organized to stop other students from hearing from the ICE representative. However, they could not have succeeded without the help of Northwestern administrators (including Dean of Students Todd Adams). The protesters were screaming “F**k ICE” outside of the hall. Adams and the other administrators then said that the protesters screaming profanities would be allowed into the class if they promised not to disrupt the class. Really? They were screaming profanities and seeking to stop the class but would just sit nicely as the speaker answered questions?