The Eucharist is "the source and summit of the Christian life."

Political

A Day in the Life of a ‘Foreign Adversary Controlled’ Application

What is truth? Those were the famous words from Pilate to Jesus Christ. Like Pilate, we seek truth yet while the paths to truth may diverge at times, one thing is sure: they cannot be determined by governmental authorities. Ron Paul Institute Director Daniel McAdams spoke earlier this month at the Mises Institute/Ron Paul Institute Lake Jackson, TX, conference on the topics of the recently-extended Section 702 of the FISA Act allowing the government to spy without a warrant and the recent passage of the “TikTok Ban” legislation, where the government has determined it has the authority to determine what we may read or watch on the Internet.

Watch McAdams blast government’s power grab on spying and the media here:

Apollo Slapped With Lawsuit Alleging "Widespread Fraudulent Human Life Wagering Conspiracy"

Apollo Slapped With Lawsuit Alleging "Widespread Fraudulent Human Life Wagering Conspiracy"

Tyler Durden

Tue, 04/30/2024 - 18:40

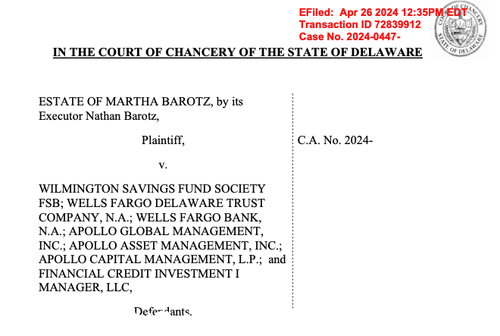

Apollo Global Management has been entangled in a scandalous lawsuit and accused of acquiring illegal life insurance policies on senior citizens through a complex web of shell trusts.

The company allegedly used an affiliate, Financial Credit Investment, to manage about a $20 billion portfolio of stranger-originated life insurance policies, effectively engaging in what the lawsuit claims:

"In short, Apollo has been carrying out a widespread fraudulent human life wagering conspiracy designed to not only hide its involvement, but to create the false appearance that the policies it owns are somehow legitimate."

The complaint continues:

"Worse still, when Apollo senses a claim is going to be brought, it attempts to dissolve its shell entities to give itself yet another layer of protection."

This scheme was designed to give the policies the illusion of legitimacy. Martha Barotz's estate initiated the legal action filed in Delaware's Chancery Court last Friday. It raises serious questions about Apollo's ethical practices.

"In this way, the senior citizens have no idea who owns a policy on their life, and who wants them dead," the suit said, adding, "Apollo was fraudulently and illegally using these shell entities to perpetuate human life wagers not only on the life of Mrs. Barotz, but on the lives of hundreds (if not thousands) of other senior citizens."

Bloomberg first reported on the lawsuit. Responding to BBG's note, Joshua Rosner, a Graham Fisher & Co. managing partner, wrote on X that Apollo's actions are "mind-bending and horrifying."

Even as a co-author of “These are the Plunderers: How Private Equity Runs and Wrecks America”, which details how rapacious Apollo is… this is mind-bending and horrifying! They should be fried. https://t.co/6NxzpaXRSR pic.twitter.com/TPx2GUvnpS

— joshua rosner (@JoshRosner) April 30, 2024"Apollo should have its insurance licenses pulled in every state by the @naic. They predate retirees and pensioners through pension risk transfers and now we find they take out life insurance policies against seniors. @AARP," Rosner said.

#athene #appollo should have its #insurance licenses pulled in every state by the @naic. They predate #retirees and #pensioners through #pension risk transfers and now we find they take out life insurance policies against seniors. @AARP https://t.co/OdthIMcrCo

— joshua rosner (@JoshRosner) April 30, 2024Rosner asks one heck of a question: "With Apollo managing hospitals, nursing & hospice facilities & also the retirement accounts of seniors, are they essentially taking a straddle position on seniors by buying life insurance policies on them?"

One has to ask: with Apollo managing hospitals, nursing & hospice facilities & also the retirement accounts of seniors are they essentially taking a straddle position on seniors by buying life insurance policies on them? @naic @AARP @BenSasse @HawleyMO @GovRonDeSantis… https://t.co/OlTYQop1t4

— joshua rosner (@JoshRosner) April 30, 2024One X user asks: "Did they take out life insurance on Alfred Villalobos and Jeffrey Epstein?"

DoJ Charges 'Bitcoin Jesus' With Tax Fraud

DoJ Charges 'Bitcoin Jesus' With Tax Fraud

Tyler Durden

Tue, 04/30/2024 - 18:20

Authored by Turner Wright via CoinTelegraph.com,

The early crypto investor, often called ‘Bitcoin Jesus,’ faces extradition to the U.S. after being charged with evading nearly $50 million in taxes.

Officials with the United States Department of Justice announced charges against early Bitcoin investor Roger Ver, known by many as ‘Bitcoin Jesus.’

In an April 30 notice, the Justice Department said authorities in Spain had arrested Ver based on criminal charges in the United States, including mail fraud, tax evasion and filing false tax returns.

The U.S. government alleged Ver defrauded the Internal Revenue Service (IRS) out of roughly $48 million with his failure to report capital gains on his sale of Bitcoin and other assets.

According to the indictment filed on Feb. 15 but unsealed on April 29, Ver allegedly took control of roughly 70,000 BTC in June 2017 - before the now famous bull run - and sold many of them for $240 million. U.S. officials said they planned to extradite Ver from Spain to the United States to stand trial.

Reactions to Ver’s arrest on social media were mixed.

However, Bitcoiner Dan Held, the former growth lead at Kraken, claimed Ver “deserves everything that he’s about to get” after he “nearly destroyed Bitcoin.”

“Roger attacked my livelihood by trying to get me fired, called up others to hurt my relationships, and attacked my reputation,” said Held on X.

“He misaligned expectations around Bitcoin so much that it led to a civil war.”

A cryptic message was Ver's most-recent post on X, reading:

Source: Roger Ver

Ver was also a proponent of Bitcoin Cash.

In 2022, he became embroiled in a scandal with crypto investment platform CoinFlex, which claimed he owed them $47 million in USD Coin.

He had not commented on social media regarding the Justice Department charges at the time of publication.

Ver has previously pleaded guilty and served time for selling explosives on eBay.

Blackrock's Larry Fink Jumps On "Next AI Trade", Warning World Will Be "Short Power"

Blackrock's Larry Fink Jumps On "Next AI Trade", Warning World Will Be "Short Power"

Tyler Durden

Tue, 04/30/2024 - 18:00

At the start of April, we penned a lengthy report for premium subs discussing why artificial intelligence data centers, the electrification of the economy, and onshoring trends will result in a major upgrade of the nation's power grid. We followed the note up on Monday with a report titled Everyone Is Piling Into The "Next AI Trade."

Now , BlackRock Chairman and Chief Executive Larry Fink has jumped on the "Next AI Trade" theme at a World Economic Forum event on Monday.

"I do believe to properly um build out AI. We're talking about trillions of dollars of investing. So data centers today could be as much as 200 megahertz - and they're now talking about data centers being one gigawatt. That powers a city," Fink told the audience.

He pointed out that he spoke with the head of one tech company, who said their data centers currently require about 5 gigawatts of power. By 2030, the person told Fink that number could jump to 30 gigawatts.

"The amount of power that's needed to use AI has a huge impact on society," Fink said.

He then asked: "So where's that power going to come from? Are we going to take it off the grid? What does that mean for elevated energy prices?"

Fink then said the surge in power demand because of AI data centers is a "huge investment opportunity."

He warned: "The world is going to be short power - short power - and to power these data companies you cannot have this intermittent power like wind and solar."

"You need dispatchable power because they can't turn off and on these data centers," he continued.

So what kind of clean, reliable energy could Fink be hinting at?

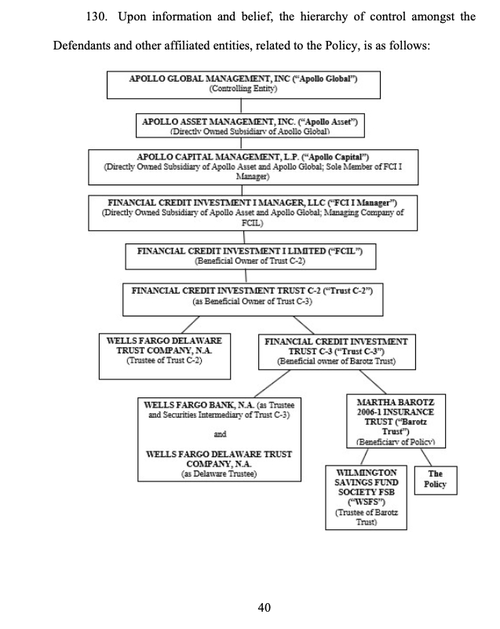

Well, nuclear, as we've explained to readers as early as December 2020: "Buy Uranium: Is This The Beginning Of The Next ESG Craze."

This week, the nuclear power industry appears to be gaining a major comeback. The federal government is expected to continue restarting shuttered nuclear power plants in the coming years, according to Jigar Shah, director of the US Energy Department's Loan Programs Office, who spoke with Bloomberg on Monday.

In March, Shah's office approved a loan to Holtec International Corp. to reopen the Palisades nuclear plant in Michigan. This was a historical shift, and it was the first nuclear power plant to be reopened in the US, setting a precedent for atomic energy to make a triumphal comeback. The plant could begin producing power as early as the second half of 2025.

Shah said, "A lot of the other players that have a nuclear power plant that has recently shut down and could be turned back on are gaining that confidence to try." He declined to give specifics about which plants were slated to reopen.

Now, the head of the world's largest asset manager, with $10 trillion in assets under management, is a believer in the "Next AI Trade," as everyone is seriously piling in.

Unification Of CBDCs? Global Banks Are Telling Us The End Of The Dollar System Is Near

Unification Of CBDCs? Global Banks Are Telling Us The End Of The Dollar System Is Near

Tyler Durden

Tue, 04/30/2024 - 17:40

Authored by Brandon Smith via Alt-Market.us,

World reserve status allows for amazing latitude in terms of monetary policy. The Federal Reserve understands that there is constant demand for dollars overseas as a means to more easily import and export goods. The dollar’s petro-status also makes it essential for trading oil globally. This means that the central bank of the US has been able to create fiat currency from thin air to a far higher degree than any other central bank on the planet while avoiding the immediate effects of hyperinflation.

Much of that cash as well as dollar denominated debt (physical and digital) ends up in the coffers of foreign central banks, international banks and investment firms where it is held as a hedge or used to adjust the exchange rates of other currencies for trade advantage. As much as one-half of the value of all U.S. currency is estimated to be circulating abroad.

World reserve status along with various debt instruments allowed the US government and the Fed to create tens of trillions of dollars in new currency after the 2008 credit crash, all while keeping inflation under control (sort of). The problem is that this system of stowing dollars overseas only lasts so long and eventually the consequences of overprinting come home to roost.

The Bretton Woods Agreement of 1944 established the framework for the rise of the US dollar and while the benefits are obvious, especially for the banks, there are numerous costs involved. Think of world reserve status as a “deal with the devil” – You get the fame, you get the fortune, you get the hot girlfriend and the sweet car, but one day the devil is coming to collect and when he does he’s going to take EVERYTHING, including your soul.

Unfortunately, I suspect the time is coming soon for the US and it may be in the form of a brand new Bretton Woods-like system that removes the dollar as world reserve and replaces it with a new digital basket structure. Global banks are essentially admitting to the plan for a complete overhaul of the dollar-based financial world and the creation of a CBDC-centric system built on “unified ledgers.”

There have been three recent developments all announced in succession that suggest the dollar’s replacement is imminent (before this decade is over).

The IMF’s XC Model – A Centralized Policy For CBDCs

The IMF’s XC platform was released as a theoretical model in November of 2022 and matches closely with their long discussed concept of a global Special Drawing Rights basket, only in this case it would tie together all CBDCs under one umbrella along with “legacy currencies.”

It’s promoted as a policy structure to make cross-border payments in CBDCs “easier” and this model is focused primarily on currency exchanges between governments and central banks. Of course, it places the IMF as the middle-man in terms of controlling the flow of digital transactions. The IMF suggests that the XC platform would make the transition from legacy currencies to CBDCs less complicated for the various nations involved.

As the IMF noted in a discussion on centralized ledgers in 2023:

“We could end up in a world where we have connected entities to some degree, but some entities and some countries that are excluded. And as a global and multilateral institution, we’re sort of aiming to, you know, provide a basic connectivity, a basic set of rules and governance that is truly multilateral and inclusive. So, I think that is—the ambition is to aim for innovation that is compatible with policy goals and that is inclusive relative to the broad membership of, say, the IMF.”

To translate, decentralized systems are bad. “Inclusivity” (collectivism) is good. And the IMF wants to work in tandem with other globalist institutions to be the facilitators (controllers) of that economic collectivism.

Bank For International Settlements Unified Ledger

Not more than a day after the IMF announced their XC platform goals, the BIS announced their plans for a unified ledger for all CBDCs called the ‘BIS Universal Ledger.’ The BIS specifically notes that the project is meant to “inspire trust in central bank digital currencies” while “overcoming the fragmentation of current tokenization efforts.”

While the IMF is focused on international policy control, the BIS is pursuing the technical aspects for the globalization of CBDCs. They make it clear in their white papers that a cashless society is in fact the end game and that digital transactions need to be monitored by a centralized entity in order to keep money “secure.” As the BIS argues in their extensive overview of Unified Ledgers:

“Today, the monetary system stands at the cusp of another major leap. Following dematerialisation and digitalisation, the key development is tokenisation – the process of representing claims digitally on a programmable platform. This can be seen as the next logical step in digital recordkeeping and asset transfer.”

“…The blueprint envisages these elements being brought together in a new type of financial market infrastructure (FMI) – a “unified ledger”. The full benefits of tokenisation could be harnessed in a unified ledger due to the settlement finality that comes from central bank money residing in the same venue as other claims. Leveraging trust in the central bank, a shared venue of this kind has great potential to enhance the monetary and financial system.

There are three major assertions made by the BIS in their program – First, the digitization of money is unavoidable and cash is going to disappear primarily because it makes moving money easier. Second, decentralized payment methods are unacceptable because they are “risky” and only central banks are qualified and “trustworthy” enough to mediate the exchange of money. Third, the use of Unified Ledgers is largely designed to track and trace and even investigate all CBDC transactions, for the public good, of course.

The BIS system deals far more in the realm of private transactions than the IMF example. It is the technical foundation for the centralization of all CBDCs, governed in part by the BIS and the IMF, and it is scheduled to go into wider use in the next two years. There are already multiple nations testing the BIS ledger today. It’s important to understand that whoever acts as the middle-man in the process of the global exchange of money is going to have all the power, over governments and over the populace.

If every movement of wealth is monitored, from the shift of billions between governments to the payment of a few dollars from an individual to a retailer, then every aspect of trade can be throttled on the whims of the observer.

SWIFT Cross Border Project – Another Way To Control The Behavior Of Countries

As we’ve seen with the attempt to use the SWIFT payment network as a bludgeon against Russia, there is an ulterior motive for globalists to have a high speed large scale monetary transaction hub. Again, this is all about centralization, and whoever controls the hub has the means to control trade…to a point.

Locking Russia out of SWIFT has done minimal damage to their economy exactly because there are alternative methods for transferring money to keep the flow of trade running. However, under a CBDC based global monetary umbrella, it would be impossible for any country to work outside the boundaries. It’s not only about the ease of shutting a nation out of the network, it’s also about having the power to immediately block the transfer of funds on the receiving end of the exchange.

Meaning, any funds from any Russian source could be tracked and cut off before they are allowed to get into the hands of, say, a recipient in China or India. Once all governments are completely under the thumb of a centralized monetary system, a centralized ledger and a centralized exchange hub, they will never be able to rebel and this control will trickle down to the general population.

I would also remind readers that the majority of nations are going right along with this program. China is most eager to join the global currency scheme. Russia is still part of the BIS, but their involvement in CBDCs is still unclear. The point is, don’t expect the BRICS to counteract the new monetary order, it’s not going to happen.

CBDCs Automatically Require The End Of The Dollar As World Reserve

So what do all these globalist projects with CBDCs have to do with the dollar and its venerated position as the world reserve currency? The bottom line is this: A unified CBDC system completely excludes the need or use-case for a world reserve currency. The Unified Ledger model takes all CBDCs and homogenizes them into a puddle of liquidity, each CBDC growing similar in characteristics over a short period of time.

The advantages of using the dollar disappear in this scenario and the value of currencies becomes relative to the middle-man. In other words, the IMF, BIS and other related institutions dictate the properties of CBDCs and thus there is no distinguishing aspect of any CBDC that makes one more valuable than the others.

Sure, some countries might be able to separate their currency to a point with superior production or superior technology, but the old model of having a big military as a way to ensure Forex and trade favors is dead. Eventually the globalists will make two predictable arguments:

1) “A world reserve currency under the control of one nation is unfair and we as global bankers need to make the system “more equal.””

2) “Why have a reserve currency at all when all transactions are moderated under our ledger anyway? The dollar is no longer any more easy to use for international trade than any other CBDC, right?”

Finally, the dollar has to die because it’s an integral part of the “old world” of material exchange. The globalists desire a cashless society because it is an easily controlled society. Think of the covid lockdowns and the attempts at vaccine passports – If they had a cashless system in place at that time, they would have gotten everything they wanted. Refuse to take the experimental vaccine? We’ll just shut off your digital accounts and you will starve.

This was even partially attempted (think Canadian trucker protests), but with physical cash there’s always a way around a digital embargo. Without physical cash you have no other options unless you plan to live completely off the land and barter goods and services (a way of life most people in the first world need a lot of time to get used to).

I believe that a sizable percentage of the American populace will go to war before they accept a cashless society, but in the meantime, there is still the inevitability of a dollar crash to deal with. Globalist organizations are pushing CBDCs to go active VERY quickly, and as this happens along with the centralized ledgers the traditional dollar will swiftly lose favor. This means that those trillions in greenbacks held overseas will start flooding back into America all at once causing an inflationary disaster well beyond what we are witnessing today.

As much as the economy has benefited from world reserve status in the past it will suffer equally as the dollar fades, only to be replaced by a framework even worse than fiat. That is, unless there’s a dramatic upheaval that removes the globalist order from the equation entirely…

* * *

If you would like to support the work that Alt-Market does while also receiving content on advanced tactics for defeating the globalist agenda, subscribe to our exclusive newsletter The Wild Bunch Dispatch. Learn more about it HERE.

"A Lack Of Job Security": White-Collar Job Growth Stalls Hard

"A Lack Of Job Security": White-Collar Job Growth Stalls Hard

Source: Vanguard, as of October 2023.

Tyler Durden

Tue, 04/30/2024 - 17:20

Source: Vanguard, as of October 2023.

Tyler Durden

Tue, 04/30/2024 - 17:20

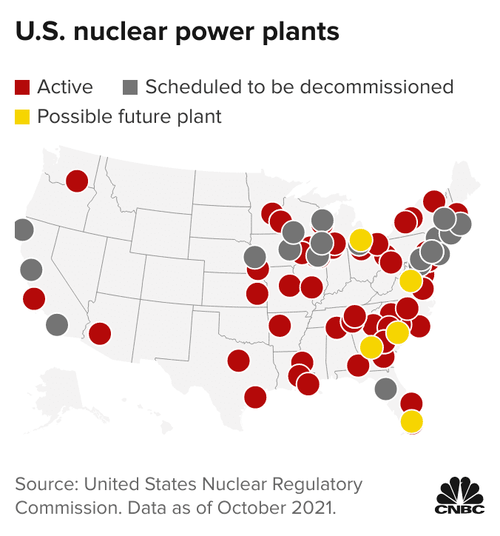

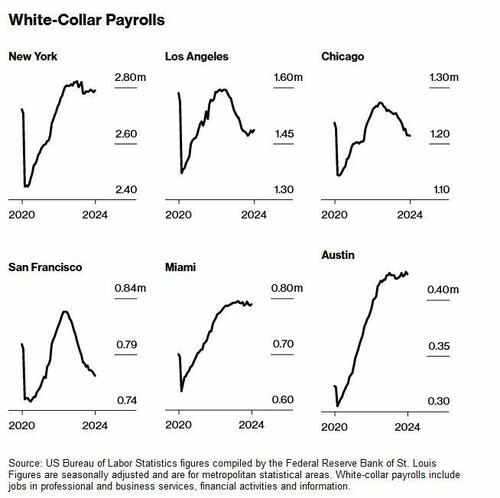

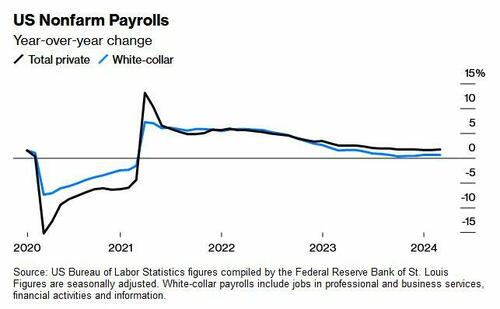

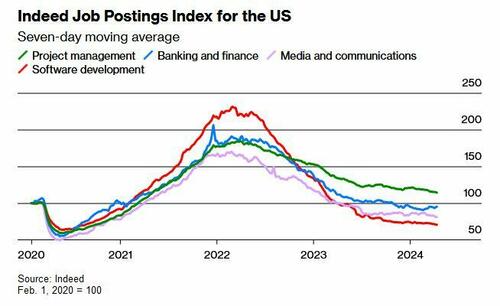

While hiring rates for those in the bottom-third of US income distribution has been on a tear (and largely going to part time workers, most of whom are illegal immigrants), white collar jobs hiring is stalling out across much of the US, with industries such as finance, technology, media, and professional services such as law and accounting all suffering despite the national unemployment rate hovering near historic lows.

To wit, nearly 120,000 corporate positions have vanished from San Francisco, Los Angeles and Chicago combined over the past year, according to an analysis by Bloomberg. White-collar payrolls have also declined in various metros such as Phoenix and Seattle, as well as in pandemic boomtowns such as Miami and Austin, which have seen white-collar growth flatline.

Nationally, payrolls for white-collar types of jobs were up just 0.6% from a year ago in March, about a third of the overall pace of job creation, according to data published by the Bureau of Labor Statistics. Wage growth for high-paid workers has also largely cooled from its peaks.

Banks, consulting firms and tech companies all went on hiring sprees at the height of the pandemic, when low interest rates, easy access to credit and government support made it easier to expand. Many of those incentives have since faded, paving the way for layoffs. Citigroup, McKinsey and Tesla are among the high-profile employers slashing jobs in recent weeks. -Bloomberg

"We’re not seeing the big post-Covid booms anymore," said Alexandra-Dana Gusita, who heads the New York office of Tiger Recruitment. "Employers are more cautious in hiring."

"Even though the labor market looks strong, there’s a lack of job security, especially in tech," said Jack Benedict, 25, who learned that he and 42 other YouTube Music employees had been laid off in February. "All these massive companies are trying to downsize or replace people with AI," he continued, adding that he worries college degrees are "not enough when companies are asking for 10 years of experience."

According to jobs website Indeed, the number of openings in banking, finance, media / communications, and software development are all running below levels seen in February 2020, as the pandemic was kicking into high gear.

Part-time white collar?

According to the report, part of the white-collar weakness is the result of a large pullback in 'temporary-help employment' according to the BLS. The category, considered something of an economic bellwether, indicates that businesses are shedding part-time positions before full-time ones. Since the sector peaked two years ago, 420,000 of those jobs have vanished.

In March note, Vanguard's chief global economist, Joe Davis, wrote that demand is greatest for workers making under $55,000 per year, as hiring rates for those in the bottom-third of the US income distribution far outpaced that of higher-income workers.

Source: Vanguard, as of October 2023.

Source: Vanguard, as of October 2023.

"Many higher-income workers accepted slower wage growth as a trade-off for remote work flexibility," wrote Davis. "These dynamics have all contributed to the faster rise in wages for lower-income workers."

Patrick McHenry Slams SEC's Gary Gensler For Misleading US Lawmakers Over Ether

Patrick McHenry Slams SEC's Gary Gensler For Misleading US Lawmakers Over Ether

Tyler Durden

Tue, 04/30/2024 - 17:00

Authored by Turner Wright via CoinTelegraph.com,

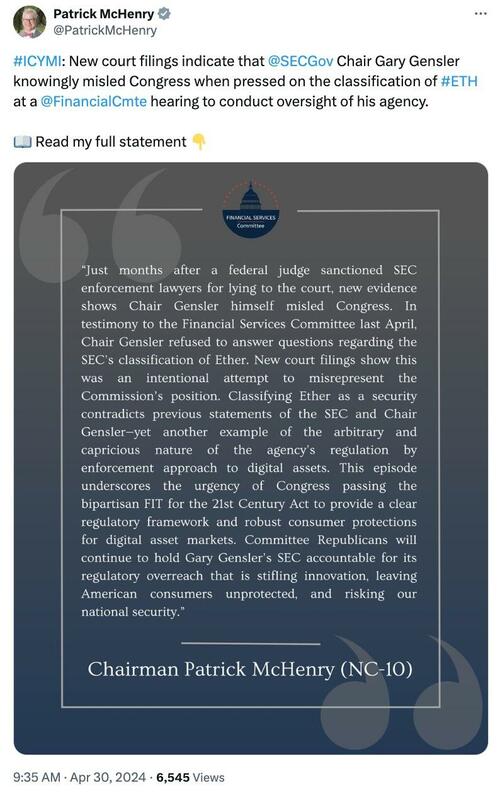

United States House Financial Services Committee Chair Patrick McHenry has alleged Securities and Exchange Commission (SEC) Chair Gary Gensler “knowingly misled Congress” over the regulator’s alleged attempts to classify Ether as a security.

In an April 30 X post, Representative McHenry claimed that Gensler intentionally misled lawmakers in testimony before the Committee.

The U.S. lawmaker referred to claims made in a recent court filing by software development firm Consensys, which filed a lawsuit against the SEC on April 25.

Source: Representative Patrick McHenry

Consensys’s initial complaint in the U.S. District Court for the Northern District of Texas highlighted public inconsistencies in the SEC’s approach to digital assets as securities, specifically Ether. Unredacted sections of the filing appeared on the court docket on April 29, suggesting that the SEC launched an investigation into ETH as security in March 2023.

Gensler appeared before the House Financial Services Committee in April 2023, pivoting or ducking direct questions from McHenry on whether Ether fell under the SEC’s or Commodity Futures Trading Commission’s (CFTC’s) purview. The timing of his testimony suggested that the SEC may have already considered Ether a security.

“Clearly, an asset cannot be both a commodity and a security,” said McHenry in the Committee hearing.

“I’m asking you, sitting in your chair now [...] is Ether a commodity or a security?”

If the SEC is pursuing a path that could put it at odds with the CFTC over Ether, it could have ramifications for approving or denying spot Ether exchange-traded funds on U.S. exchanges. The SEC began approving investment vehicles tied to ETH futures in October 2023, with many experts speculating that the Commission will decide on a spot Ether ETF in May.

McHenry used the opportunity to urge lawmakers to support the passage of the Financial Innovation and Technology for the 21st Century Act (FIT21) to establish clear rules of the road between the CFTC and SEC.

The legislation moved out of Committee in July 2023 and is set for a full floor vote in the House.

WTI Extends Losses After API Reports Unexpected Crude Build

WTI Extends Losses After API Reports Unexpected Crude Build

Tyler Durden

Tue, 04/30/2024 - 16:38

WTI ended April on a down-note (closing lower on the month, as opposed to Brent which saw its fourth straight monthly gain) as hopes for cease-fire talks between Israel and Hamas dampened fears of a wider conflict that could threaten crude supplies.

The recent declines come as a "relief to both central bankers and consumers alike," Stephen Innes, managing partner at SPI Asset Management, told MarketWatch.

There's been a notable decrease in speculation about the possibility of U.S. benchmark WTI surpassing the $100-a-barrel threshold, at least for now, he said. This shift in sentiment can be attributed, in part, to "reduced concerns about disruptions to Iranian production, following Israel's measured response to previous drone attacks."

Meanwhile, "attention should also be directed towards peace talks, as progress in this area could further contribute to a decrease in oil prices," said Innes.

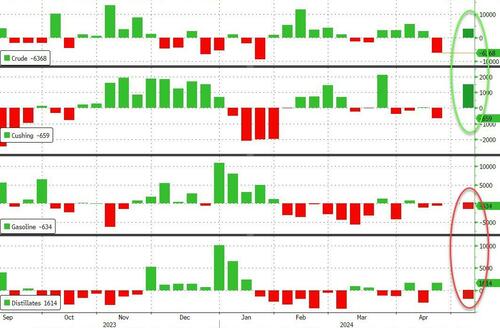

But, after last week's big crude draw, analysts expect another drawdown in stocks this week.

API

-

Crude +4.91mm (-1.5mm exp)

-

Cushing +1.48mm

-

Gasoline -1.48mm (-1.2mm exp)

-

Distillates -2.19mm (+400k exp)

Crude stocks unexpectedly rose almost 5mm barrels last week while distillates inventories declined notably...

Source: Bloomberg

WTI was hovering around $81.65 ahead of the API print and extended losses modestly after...

Despite the reprieve in oil prices, crude-oil markets are expected to remain volatile, said Innes, partly due to uncertainty surrounding the pace of global oil demand growth, the rise in non-OPEC+ and U.S. oil production, the potential for supply disruptions in regions like Russia and the Middle East and, critically, OPEC+'s future production strategy.

"These dynamics underscore the ongoing challenges and complexities within the oil market landscape," Innes said.

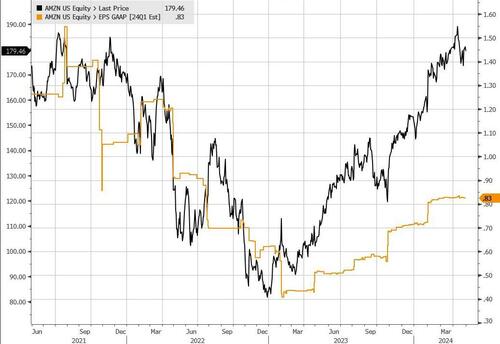

Amazon Swings Wildly After Reporting Blowout AWS Results But Revenue Guidance Disappoints

Amazon Swings Wildly After Reporting Blowout AWS Results But Revenue Guidance Disappoints

Tyler Durden

Tue, 04/30/2024 - 16:37

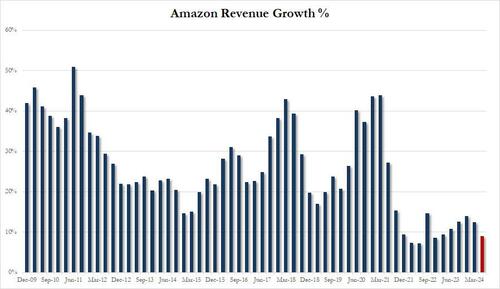

Heading into Amazon's Q1 earnings, we said earlier that the investment thesis is driven by i) ecommerce share, ii) margin expansion and iii) the potential for AWS growth recovery through the year. We also noted that the key bogeys for this extremely popular - among hedge funds - position were the following:

- Q1 Total Sales: high end of guide $138-$143.5 bn

- Q2 Total Sales: $150 bn high end

- Q1 AWS Growth: 15%-16%+

- Q1 EBIT: $13 bn

- Q2 EBIT: $14 bn high end

So with that in mind here is what Amazon - whose stock first tumbled then spiked after hours, reported moments ago:

- EPS 98c vs $1 q/q, and beating estimates of 83c

- Net sales $143.31 billion, +13% y/y, beating estimate of $142.59 billion

- Online stores net sales $54.7 billion, +7% y/y, in line with estimates of $54.77 billion

- Physical Stores net sales $5.20 billion, +6.3% y/y, beating estimate $5.08 billion

- Third-Party Seller Services net sales $34.60 billion, +16% y/y, missing estimate $34.63 billion

- AWS net sales $25.04 billion, +17% y/y, blowing away estimate $24.11 billion

- North America net sales $86.34 billion, +12% y/y, beating estimates $85.55 billion

- International net sales $31.94 billion, +9.7% y/y, missing estimates $32.47 billion

- Amazon Web Services net sales excluding F/X +17% vs. +16% y/y, beating estimate +14.5%

- Third-party seller services net sales excluding F/X +16% vs. +20% y/y, beating estimate +15.8%

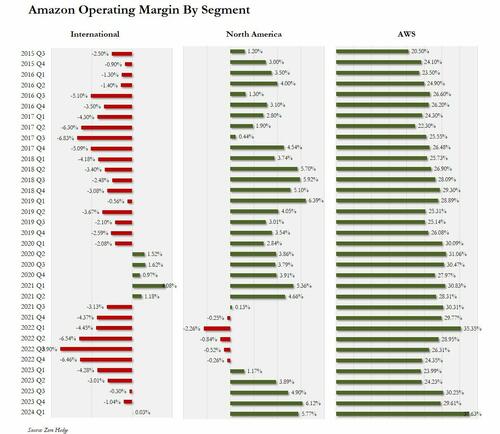

Turning to operating results we get an even stronger tally:

- Operating income $15.31 billion vs. $4.77 billion y/y, smashing estimates of $10.95 billion

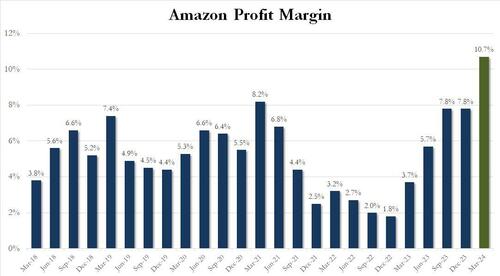

- Operating margin 10.7% vs. 3.7% y/y, beating estimates of 7.63%

- North America operating margin +5.8% vs. +1.2% y/y, beating estimates of +4.92%

- International operating margin 2.8% vs. -4.3% y/y, beating estimates of -1.85%

The operating margin has to be seen to be believed: at 10.7%, it appears to be the highest in AMZN history.

As for expenses, these were generally in line with estimates:

- Fulfillment expense $22.32 billion, +6.8% y/y, below estimate $22.4 billion

- Seller unit mix 61% vs. 59% y/y, beating estimates of 59.5%

Of the above, the most notable highlight was AWS which not only grew revenue by a whopping 17% (ex. FX) and 16% including FX, both of which handily beat estimates of 14.5%, and were the strongest growth in a a year, but whose Q1 operating income of $9.42BN on revenue of $25.04BN, meant that margin surged to 37.6%, which was the highest AWS margin in history!

Sales growth at the cloud unit slowed to a record low last year as businesses cut back on technology spending and sought to curb computing bills that ballooned during the pandemic. Investors have been banking on a rebound this year, particularly after strong results last week from Microsoft and Google, Amazon’s two main rivals in the business of renting computing power and data storage. And, in the case od AMZN, they were right to do so.

The results are the first since Amazon introduced video advertising to the Prime Video streaming service, creating a new revenue source. Advertising revenue rose 24% to $11.8 billion.

Looking ahead, the company's guidance which was soft on the top line but disappointed on earnings:

- Revenues expected to be between $144.0 billion and $149.0 billion, or grow between 7% and 11% YoY, below the consensus estimate of $150 billion.

- Operating income is expected to be between $10.0 billion and $14.0 billion, vs $7.7 billion in Q2 2023 and in line with estimates of $12.56 billion.

If accurate, that would mean Q2 revenue will grow at the slowest pace sine Dec 2022.

So turning the abovementioned bogeys, this is how AMZN did:

- Q1 Total Sales: $143.3 billion, just below the upper end of the guide $138-$143.5 bn

- Q2 Total Sales: $147 billion range midline, below the $150bn high end estimate

- Q1 AWS Growth: 17%, well above the 15%-16% bogey

- Q1 EBIT: $15.31BN, blowing away the $13 bn bogey

- Q2 EBIT: range of $10-$14BN, matching the $14 bn high end

CEO Andy Jassy has been cutting costs in recent years as he refocused on profitability in Amazon’s central retail business, laying off thousands of people and touting a more efficient warehouse network. At the same time, he’s backed big investments in artificial intelligence services that Amazon expects to generate tens of billions in revenue in the coming years.

"The combination of companies renewing their infrastructure modernization efforts and the appeal of AWS’s AI capabilities is reaccelerating AWS’s growth rate (now at a $100 billion annual revenue run rate),” Jassy said in the statement.

The results are also the first since Amazon introduced video advertising to the Prime Video streaming service, creating a new revenue source. Advertising revenue rose 24% to $11.8 billion.

The stock initially tumbled, only to rebound sharply and then fade, closing roughly unchanged with where it was for much of the day around $180.

"There Is No Crime": Dershowitz Says Bragg’s Case Against Trump Will Fail

"There Is No Crime": Dershowitz Says Bragg’s Case Against Trump Will Fail

Alan Dershowitz and former President Donald Trump in file photos. (Mario Tama/Getty Images; Michael M. Santiago/Getty Images)

Tyler Durden

Tue, 04/30/2024 - 16:20

Alan Dershowitz and former President Donald Trump in file photos. (Mario Tama/Getty Images; Michael M. Santiago/Getty Images)

Tyler Durden

Tue, 04/30/2024 - 16:20

Authored by Tom Ozimek via The Epoch Times (emphasis ours),

Retired Harvard law professor Alan Dershowitz said on April 28 that he believes that Manhattan District Attorney Alvin Bragg’s case against former President Donald Trump could fail because prosecutors have charged the former president with fake crimes.

Alan Dershowitz and former President Donald Trump in file photos. (Mario Tama/Getty Images; Michael M. Santiago/Getty Images)

Alan Dershowitz and former President Donald Trump in file photos. (Mario Tama/Getty Images; Michael M. Santiago/Getty Images)

“There is no crime,” Mr. Dershowitz said during an interview on Fox News on April 28, referring to the case in which Mr. Bragg’s office has charged the former president with 34 counts of falsifying business records to hide so-called hush money payments that prosecutors allege amounted to a criminal conspiracy to influence the 2016 presidential election.

Mr. Dershowitz argued that making nondisclosure payments is not a crime and that neither is paying for the non-publication of potentially embarrassing stories (the so-called catch-and-kill dimension of the case), both of which prosecutors have alleged were part of a conspiracy to sway voters.

The retired law professor argued that Mr. Bragg’s office is in danger of having the case thrown out on grounds similar to those on which the conviction of Harvey Weinstein was recently overturned, namely that prosecutors prejudiced the case by a number of “egregious” improper rulings, including allowing testimony that was unrelated to what Mr. Weinstein was charged with.

“They ought to be very careful about this because the Supreme Court of the Appellate Court in Albany just reversed Harvey Weinstein’s conviction on the ground that they put in too much information that wasn’t really relevant to the case,” Mr. Dershowitz said, adding that this is “what’s happening” in the trial against President Trump.

“There is no crime in Manhattan. You cannot figure out what the crime is. That’s why they’re putting on all this evidence of non-crimes,” Mr. Dershowitz said.

“Trying to persuade the jury that ‘catch-and-kill’ is a crime—it’s not. Paying hush money is a crime—it’s not. Putting a corporate statement is a misdemeanor barred by the statute of limitations. You can’t suddenly resurrect that and turn that into a crime by invoking a federal statute which the federal government refused to invoke—the Federal Election Commission refused to invoke.”

The former Harvard law professor has repeatedly criticized Mr. Bragg for elevating the charges against President Trump from misdemeanors to felonies on what Mr. Dershowitz has argued was an invalid legal premise because the Manhattan district attorney invoked federal statutes over which New York has no jurisdiction.

Republicans have accused Mr. Bragg of bringing the case against the former president for political reasons.

Mr. Bragg’s office did not respond to a request for comment.

‘Destruction of America’s Rule of Law’

Mr. Bragg indicted President Trump on 34 counts of allegedly falsifying business records in order to conceal $130,000 in payments to adult film actress Stormy Daniels in exchange for keeping quiet about her allegations of an affair she had with President Trump.

President Trump has maintained his innocence and has denied the affair.

“There is no case here. This is just a political witch hunt,” the former president said before court in brief comments to reporters on April 25.

Under New York state law, falsifying business records is a misdemeanor. However, if the records fraud was used to cover up or commit another crime, the charge could be elevated to a felony, though a number of legal experts—including Mr. Dershowitz—have challenged the way that has been done in this case.

“In order to turn the state statute into a felony, you have to borrow a federal statute,” Mr. Dershowitz told The Epoch Times in March 2023. He said that this combining of laws “seems to raise real serious legal questions.”

“In Bragg’s case, what they’re trying to do is add one and one and come up with 11,” Mr. Dershowitz said. “No rational person would look at these two statutes and say that Trump violated them.”

The prosecution’s first witness in the case was former National Enquirer publisher David Pecker. Prosecutors alleged that he participated in a catch-and-kill scheme to suppress unflattering stories about President Trump and help him get elected.

President Trump’s attorney, Todd Blanche, said in court that the catch-and-kill that the jury heard about from prosecutors was not part of the charges against the former president because it was not illegal and happens regularly.

“The reality is that there is nothing illegal about what happened,” Mr. Blanche argued. He added that testimony would be about things from 2015 to 2017 and asked the jury to “think about whether it rings true and whether what they’re saying is accurate.”

“Use your common sense. We’re New Yorkers; that’s why we’re here. You told the court you would put aside whatever view you have about President Trump, the fact that he’s running,” he said. “If you do that, there will be a very swift non-guilty verdict.”

Mr. Dershowitz has said in the past that he believes that New York prosecutors are violating voters’ rights with the case, alleging that the law is being “abused for partisan political purposes and to constitute election interference.”

The former law professor went further in his remarks on Fox News on April 28, arguing that the case is about whether basic civil liberties are protected or undercut.

“If it’s Donald Trump today, they can go after you tomorrow, and your relatives tomorrow, for something that isn’t a crime,” he said.

“That’s why every American, whether you’re a Democrat or Republican, should be opposed to what’s going on in that Manhattan courtroom.

“It’s a scandal and it’s a destruction of America’s rule of law.”

Gold Flowers Amid April 'Stagflation' Showers; Stocks, Bonds, & Crypto Crushed

Gold Flowers Amid April 'Stagflation' Showers; Stocks, Bonds, & Crypto Crushed

Tyler Durden

Tue, 04/30/2024 - 16:00

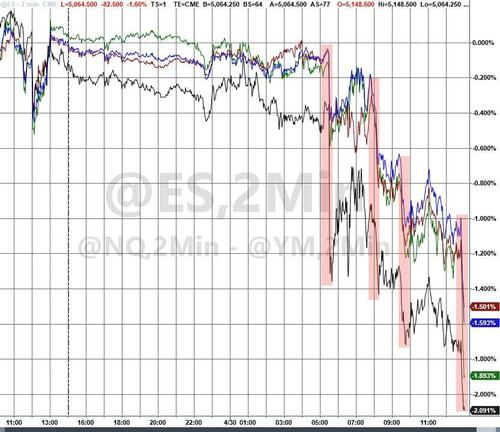

The final day of April was really ugly: ECI way hotter than expected (spooked markets), Case-Shiller home prices soared far more than expected (spooked markets more), Chicago PMI puked (while prices paid increased), Consumer Confidence crashed, and Dallas Fed Services slumped... all of which left stocks, bonds, gold, crude oil, and bitcoin all languishing into month-end while the dollar rallied.

Stocks puked into the month-end close today ahead of AMZN earnings...

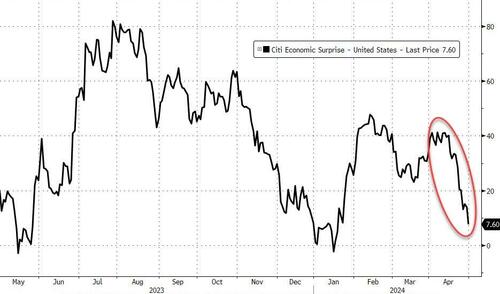

April was a disaster from a macro perspective...

Source: Bloomberg

...with soft survey data collapsing while 'hard' data limped modestly higher...

Source: Bloomberg

...and worse still growth surprises slumped as inflation surprises soared - screaming stagflation so loud no one could ignore it...

Source: Bloomberg

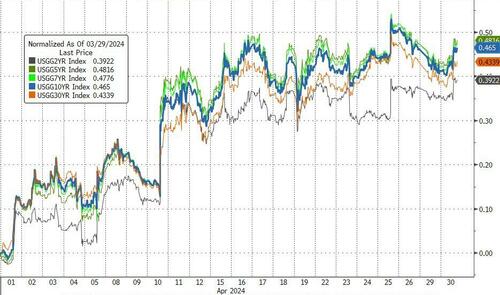

Against the backdrop of US 10Y yields up ~45 bps in the month of April...

Source: Bloomberg

... and the market taking another rate-cut off the board...

Source: Bloomberg

...price action in April is perhaps not overly surprising with Equities broadly lower, albeit, with NDX / Quality / Mag7 continuing to outperform.

Source: Bloomberg

Goldman's Peter Callahan notes that since 2006, the S&P 500 has fallen by an avg of 4% when real yields rose by more than 2 stdev in a month.

April was the first down-month for stocks since The Fed Pivot (Oct 2023). This was the worst month for The Dow since Sept 2022. Nasdaq suffered its worst month since Sept 2023.

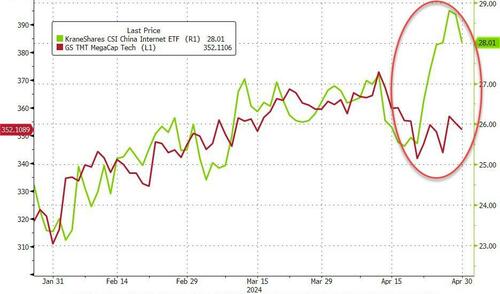

Interestingly, while US majors and sectors were red (broadly speaking) in April, Chinese Internet stocks soared back to life (+9.5% vs US MegaCap -2%)...

Source: Bloomberg

Sectors were very mixed in April with Energy and Utilities outperforming (the latter on AI energy use, since its typical relationship to rates decoupled) and Real Estate lagged (along with Tech)...

Source: Bloomberg

The basket of Magnificent 7 stocks saw red in April for its first monthly loss since October and worst monthly loss since September. The last week has been tempestuous to say the least as TSLA (win), META (lose), MSFT and GOOGL (win) all hit...

Source: Bloomberg

Still, stocks have a long way to catch down to the new reality priced into the short-end of the bond market...

Source: Bloomberg

As we noted above, the TSY curve was up relatively uniformly on the month, but perhaps most notably was the 2Y yield which tested 5.00% numerous times and broke out today...

Source: Bloomberg

One more notable event in April was the tightening of financial conditions (admittedly only marginally), but definitely more what The Fed wants relative to the extreme 'easiness' that had been priced in after Powell's pivot...

Source: Bloomberg

The dollar rallied for the fourth month in a row with the big gains coming mid-month....

Source: Bloomberg

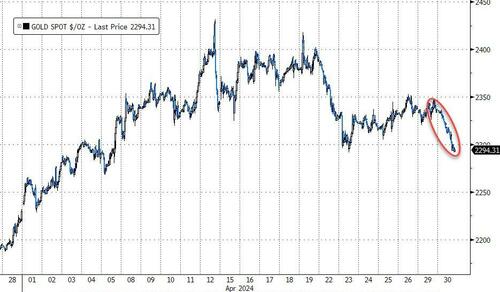

Despite taking a battering today, Gold managed solid gains on the month, topping $2400 at its record highs...

Source: Bloomberg

Oil prices ended the month marginally lower, thanks to today's selloff...

Source: Bloomberg

Copper was the outstanding commodity in April, soaring around 14% to two year highs with practically no drawdown as the reflation trade came back to life (on the back of AI demand)...

Source: Bloomberg

Bitcoin had an ugly month, down 15% after seven straight months of gains...

Source: Bloomberg

As BTC ETF flows started to ebb - Net Flows (including GBTC): April -$183mm, March +$4.62bn, February +$6.03bn, January +1.47bn...

Source: Bloomberg

Finally, the ultimate analog remains in play...

Source: Bloomberg

...with NVDA bouncing back, just like CSCO did.

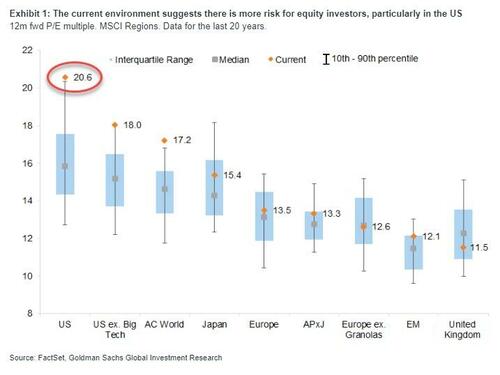

And bear in mind, as Goldman's Peter Oppenheimer points out, US equity market valuation is currently at an extreme level relative to history...

...also a condition that typically means higher rates weigh more heavily on stocks.

And while April showers are over...

The S&P 500's vol term structure suggests the storm is not over yet.

Japan Having Yen Troubles, And Copper Tells The Tale

What happens when commodities are badly mispriced because off too many financial-only speculators distorting the price signal? Eventually, it's big trouble. What happens if the yen completely melts down? I don't know, but it looks like we're going to find out.

What To Look For When Amazon Reports

What To Look For When Amazon Reports

Tyler Durden

Tue, 04/30/2024 - 15:00

After the solid results from Microsoft - the world's largest company whose market cap is now flirting with $3 trillion - investors have been incrementally more positive on the Amazon's AWS cloud setup into today's earnings, with the investment thesis driven by ecommerce share, margin expansion and the potential for AWS growth recovery through the year.

Of course, since everyone is well-aware of this thesis, UBS trader Kelsey Perselay notes that "the amount of debate/dialogue has really died down."

Not surprisingly, everyone and their kitchen sink, is long the stock: according to Goldman, client positioning is a 9 on the bank's 1-10 scale, and "most investors feel relaxed/confident into this quarter."

Goldman thinks that people expect a beat and further acceleration on AWS (vs cons ~13% y/y and ~13% y/y last qtr), a slight beat on online sales (vs cons 7%) and a solid beat on EBIT vs cons ~$11bn (for ref, AMZN been beating by $2-4bn last few qtrs). Looking ahead, investors looking for high-end of guide to land near street numbers for Revs (cons ~$150 bn) / OI (~$12.5 bn).

Summarized, here are the top bogeys for the quarter:

-

Q1 Total Sales: high end of guide $138-$143.5 bn

-

Q2 Total Sales: $150 bn high end

-

Q1 AWS Growth: 15%-16%+

-

Q1 EBIT: $13 bn

-

Q2 EBIT: $14 bn high end

Key questions for the 1Q call include:

-

overall EBIT for 2Q as they are expected to show ongoing efficiency this year;

-

cadence of enterprise cloud optimization efforts and signs of growth acceleration for AWS in 2Q;

-

pace of retail margin improvement and medium-term targets for retail;

-

capex outlook for 1Q and for 2024;

-

impact of Amazon Bedrock and any disclosures around growth contribution from GenAI workloads;

-

margin improvements from regionalization of fulfilment operations and broader cost control efforts;

-

the outlook and incremental margins associated with video advertising in Prime content and advertising more generally; and

-

competitive dynamics from Shein, Temu, TikTok, etc.

Catch-Up or Catch-Down...

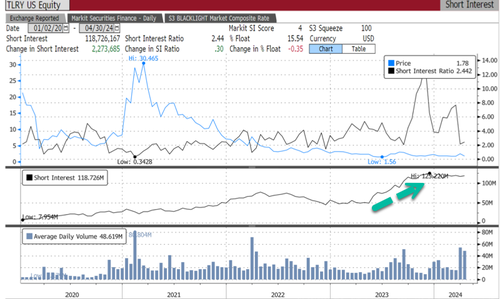

Cannabis Bears Squeezed On Report DEA Is Preparing To Reclassify Marijuana

Cannabis Bears Squeezed On Report DEA Is Preparing To Reclassify Marijuana

Tyler Durden

Tue, 04/30/2024 - 14:40

The Associated Press has learned the US Drug Enforcement Administration is moving to reclassify marijuana to a less dangerous drug category. Shares of cannabis-related companies erupted on the news.

Here's more from AP news:

The DEA's proposal, which still must be reviewed by the White House Office of Management and Budget, would recognize the medical uses of cannabis and acknowledge it has less potential for abuse than some of the nation's most dangerous drugs. However, it would not legalize marijuana outright for recreational use.

The agency's move, confirmed to the AP on Tuesday by five people familiar with the matter who spoke on the condition of anonymity to discuss the sensitive regulatory review, clears the last significant regulatory hurdle before the agency's biggest policy change in more than 50 years can take effect.

Once OMB signs off, the DEA will take public comment on the plan to move marijuana from its current classification as a Schedule I drug, alongside heroin and LSD. It moves pot to Schedule III, alongside ketamine and some anabolic steroids, following a recommendation from the federal Health and Human Services Department. After the public-comment period the agency would publish the final rule.

Following the news, Tilray Brands Inc. shares jumped 22%, while Canopy Growth Corp shares are up 26%.

Tilray's float is about 15% short, equivalent to about 118 million shares short.

Canopy's float is 12% short, equivalent to 9 million shares short.

Meanwhile, AdvisorShares Pure US Cannabis ETF and Amplify Alternative Harvest ETF are broadly higher and appear to be rounding a multi-year bottom.

It's an election year, and the Biden administration is getting desperate.

Want To Know What Is Really Going On In Biden's Economy, Read This

Want To Know What Is Really Going On In Biden's Economy, Read This

Tyler Durden

Tue, 04/30/2024 - 14:25

One can listen to, and believe, the government's lies about the miraculous growth of the economy and the stellar job that Bidenomics is doing... or one can listen to the truth straight from the countless small companies that make up the economy. We prefer the latter, which is why we love the monthly responses to the Dallas Fed survey, where unlike the other regional Feds, the respondents actually get a fair forum.

So without further ado, here are all the comments in the April Dallas Fed Service Sector Outlook Survey presented unedited and without commentary. Trust us, none is needed (but the highlights are ours).

Truck transportation

- We repair long-haul trucks. The volume just keeps going down, which means everyone is holding back on repairs, so we have no work. Inflation keeps driving our costs up. It's not looking pretty for trucking.

Support activities for transportation

- We are seeing an uptick in rates and activity. The excess capacity slowly bleeding out of the market is causing this.

Publishing industries (except internet)

- Momentum is still based on intuitive smarter software revisions. Commercial interest is also finally increasing with better relationship contacts to speed credible traction and interest for adoption going forward. We are more focused now on marketing and sales.

- The impact of the higher rate environment seems to be catching up, with general purchase intent among customers flattening out. At the same time, budget cuts and political uncertainty have impacted our public sector business as well, creating additional uncertainty across our business.

Credit intermediation and related activities

- The stress of an election year adds to the concern citizens have about the direction of our economy.

- We recently renegotiated our $600 million debt facility. Our cost of funds went from 9 percent to 14 percent—that's a pretty big hit to our bottom line and resulted in us increasing prices to our customers. Our business focus has been on forecasted easing; however, the reality of rates staying higher longer is creating uncertainty.

- Commercial real estate transactions are down by 70-80 percent according to the brokers we talk to, and our loan origination volume reflects that as well. Borrowers are concerned about future business prospects. We recently had a client decide not to take a loan to refinance a warehouse used in their business because they were concerned about their future business prospects. At the same time, the cost of everything we buy, from paper to electricity, is rising.

- The Federal Reserve signaling it will hold the rate at the current level for longer has affected our outlook negatively. One of our biggest issues with inflation is the cost of housing. These high rates do not help that, and prices of everything else are not declining or remaining stable.

Securities, commodity contracts and other financial investments and related activities

- Recent movement in long-term rates, combined with the Fed holding rates longer, have delayed the expected value of investment recovery until 2025 or later.

Insurance carriers and related activities

- We are recruiting experienced insurance professionals, and there is a small pool to draw from, unfortunately. We will keep looking.

- Property insurance and affordability are slowing our growth opportunities.

Real estate

- The increase in treasury yields since last fall has negatively impacted deal-making activity in the income property industry

- We are a real estate broker company and we have about 350 agents. They are independent agents not salaried employees. Our business slows during election years, and high interest rates have hurt first-time buyers.

- Cost of capital is weighing on our customers and decreasing volume.

Rental and leasing services

- We are a construction machinery and material handling dealership. Our business in the first quarter of 2024 was down 2 percent, and the industry was down 12.3 percent. Our manufacturing clients seem almost on the verge of panic, and there is stuff in inventory. We need a guest-worker program to meet our skilled-labor needs long term.

Professional, scientific, and technical services

- Persistent inflation and the Fed potentially delaying rate cuts are causing uncertainty for the second half of 2024.

- We are still worried about the election causing uncertainty in our clients and prompting a slowdown later this year. Some clients are still worried about inflation and are stalling projects because of the volatility in the supply market. Overall, it is tough to make any forecast right now. Our backlog is strong for the next couple of months, but not as far in the future as we would like.

- The market was slower in the first quarter, but it is now in recovery.

- We are increasingly seeing small professional firms shrinking or simply closing up shop. The labor shortage is a major reason for giving up the fight. There's plenty of demand for professional services, but there is not enough trained staff. Retaining staff is a major headache. Owners nearing retirement are giving it up sooner rather than later.

- Burdensome federal regulations are increasing the cost to do business, such as the so-called "Corporate Transparency Act" and minimum wage increases that just continue to drive inflation.

- General outlook has improved primarily due to our increased investment in marketing and an increase in general business activity.

- We see a slight uptick in transactional matters.

- Trying to factor in how remote-work scheduling impacts the need for space and resources is challenging.

- Competitive labor market remains; it’s harder to recruit great talent; health insurance is increasing.

- We have not been this slow since the Great Recession. This includes Covid. We cannot understate how terrible the prospective real estate market is. People are not filing zoning cases, meaning in two years there will not be construction. Volumes have gone down in the automotive industry. It seems they are beginning to turn around, so we're hoping.

- This real estate market is hard to figure out. With the 10-year rate still moving in the wrong direction, and the likelihood of a rate cut not coming this year due to inflation and the strength of the economy, we just can't see the market improving until next year.

- The Fed is now unlikely to cut interest rates; concerns over recession continue.

Management of companies and enterprises

- Overregulation takes away a lot of time and money.

Administrative and support services

- Continued high interest rates, inflation and general economic malaise has caused employers to be very reluctant to hire professional level talent. They may replace talent if they have attrition, but in general, they are very slow to make any new hire decisions.

- There has been a marked decline in requests for quotes for the month. This decline does not fit in our normal seasonal changes.

- The intensity of international conflict and increasing long-term rates certainly raise concerns.

- Geopolitical tensions are creating an uncertain environment. Also, upcoming elections and how this may affect the Fed’s monetary policy is a concern.

- High interest rates have drastically hindered our ability to grow our business, and it looks like a rate cut is not likely happening in 2024.

Texas Retail Outlook Survey

Accommodation

- Between increasing inflation, high interest rates and instability in the Middle East, we are growing more concerned that the upcoming summer travel season will be depressed compared to prior years.

- March 2024 is viewed as a contradiction in that we had several areas perform at or close to expectations and others that were far below. That seems to be the same in April. Difficult to understand what is happening.

Food services and drinking places

- The stalled return to office and the decline of weekday business travel to downtown remain drags on revenue. We see a softening in other meal periods, and we believe it is due to the increase in menu prices. Hiring experienced staff with knowledge remains very difficult. Where did seasoned workers go? Cost of goods sold continues to increase.

- We are still hanging on by a thread after closing one business last month.

- The energy sector continues to be strong, which positively affects my business. Midland continues to attract a younger population.

Motor vehicle and parts dealers

- The margin on new vehicles sold per unit declined 50 percent year over year in March 2024, which was a direct benefit to the consumer.

- We are continuing to see labor shortages in the workforce and a lack of effort to pursue the positions available from those applicants responding to open positions.

Electronics and appliance stores

- Building activity is down still and looks to be getting worse.

China Threatens To Retaliate Against US Over Taiwan Aid And TikTok Ban

China Threatens To Retaliate Against US Over Taiwan Aid And TikTok Ban

Tyler Durden

Tue, 04/30/2024 - 14:05

Authored by Eric Lundrum via American Greatness,

On Monday, the Chinese government threatened to retaliate against the United States after a $95 billion foreign aid package was signed into law, which included aid for Taiwan and a provision to ban the Chinese social media app TikTok.

As reported by Fox News, the bill signed into law by Biden on Wednesday included $2 billion to restock American weapons provided to Taiwan and other allies in the Indo-Pacific, in a direct attempt to deter Chinese aggression in the region. Additionally, the law demands that TikTok’s parent company ByteDance sell the popular app to another company within nine months, or else the app will be banned from use in the United States.

“China firmly rejects the U.S. passing and signing into law the military aid package containing negative content on China,” said Chinese Foreign Ministry spokesman Lin Jian in a briefing.

“We have lodged serious representations to the U.S.”

“This package gravely infringes upon China’s sovereignty. It includes large military aid to Taiwan, which seriously violates the one-China principle, and sends a seriously wrong signal to ‘Taiwan independence’ separatist forces,” Lin continued.

“The legislation undermines the principles of market economy and fair competition by wantonly going after other countries’ companies in the name of ‘national security,’ which once again reveals the U.S.’s hegemonic and bullying nature.”

The issue of Taiwan has remained a contentious point in U.S.-China relations, with some considering Taiwan to be a free and independent nation, while others believe it to be part of China. The federal government has never taken a clear stance on the question, thus highlighting the significance of the decision to provide direct aid to Taiwan.

TikTok has faced widespread scrutiny from both sides of the political aisle, with Republicans pointing out its threat to national security by virtue of it being a Chinese company preying on American users, while Democrats have raised concerns about users’ private information being easily accessed and sold by the company.

TikTok is most popular among younger Americans such as Generation Z, or “Zoomers,” and the ban being signed into law has sparked outrage against Biden among younger voters.

WeWork Snubs Co-Founder Neumann As It Targets Quick Turnaround From Bankruptcy

WeWork Snubs Co-Founder Neumann As It Targets Quick Turnaround From Bankruptcy

Tyler Durden

Tue, 04/30/2024 - 13:45

After years of enriching himself to the tune of billions from his failed company WeWork, co-founder Adam Neumann is finally getting a small dose of karmic payback.

It was reported yesterday by Bloomberg that WeWork and its main backers, including SoftBank, have reached a new agreement to pull the struggling workspace provider out of bankruptcy, rejecting a rival proposal from co-founder Adam Neumann to buy back the company.

Under the deal, senior lenders will provide about $450 million in financing, gaining equity in the reorganized business. Additionally, SoftBank and other creditors may convert their debt into stock post-bankruptcy. This marks a significant step for WeWork, aiming to emerge from court protection with reduced debt and more efficient leases.

And to not be at the behest of, or enriching, Adam Neumann, will really mark a shift in strategy for WeWork...

A lawyer backing the deal told Bloomberg the deal “is some of the best news we’ve had in this case,” and said the company is on a “fast and reliable path out of bankruptcy.”

WeWork aims to exit bankruptcy swiftly due to the high costs and unsustainable administrative expenses of the Chapter 11 proceedings. The proposed restructuring, backed by most senior debt holders and unsecured creditors, sidelines co-founder Adam Neumann's bid to repurchase the company.

Neumann's offer, valued at $650 million, hinges on winning support from senior lenders, who are crucial to the deal's success. However, WeWork's advisors have rebuffed Neumann's attempts to negotiate and have proceeded with the restructuring without public bidding on the company's assets.

Bloomberg reported that US Bankruptcy Judge John K. Sherwood emphasized the lenders' prerogative to decide on negotiations with Neumann based on their economic interests. If executed, the restructuring would result in majority ownership by Yardi's investment arm and involvement from WeWork bondholders.

SoftBank would retain ownership stake, initially at least 16.5%, potentially increasing to 36% depending on the treatment of letters of credit. WeWork must finalize the proposed deal into a contract and seek creditor approval for its broader reorganization plan.

The report notes that Neumann could still contest the deal by petitioning Sherwood to reject the reorganization proposal.

And, normally taking the punchbowl away from someone who has already "earned" billions he didn't deserve shouldn't be of any concern, but we're sure Neumann's ego won't let that be the case. We're certain protest and prolonged litigation from Neumann will come from this, claiming he was "unfairly" snubbed...

*WEWORK CUTS BANKRUPTCY EXIT DEAL THAT LEAVES OUT ADAM NEUMANN

But how will the world's biggest grifter become the world's first trillionaire

Bullish Sentiment Index Reverses With Buybacks Resuming

Bullish Sentiment Index Reverses With Buybacks Resuming

Tyler Durden

Tue, 04/30/2024 - 13:25

Authored by Lance Roberts via RealInvestmentAdvice.com,

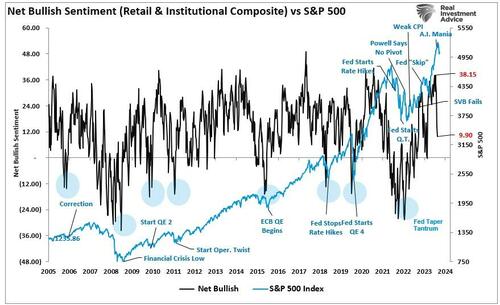

Over the last two weeks, the bullish sentiment index has reversed from extreme greed to fear. The composite net bullish sentiment index, comprised of professional and retail investors, fell from 38.15 to 9.9 in two weeks. The previous drop between July and October last year was similar and marked the bottom of the correction.

While the bullish sentiment index can indeed fall further, what is notable is the sharp reversal of market “exuberance” in such a short span. However, as discussed in “Just A Correction,” there was a significant gap between buyers and sellers.

“However, at some point, for whatever reason, this dynamic will change. Buyers will become more scarce as they refuse to pay a higher price. When sellers realize the change, they will rush to sell to a diminishing pool of buyers. Eventually, sellers will begin to “panic sell” as buyers evaporate and prices plunge.”

Like clockwork, that correction came quickly, with the market finding initial support at the 100-DMA. With solid earnings from GOOG and MSFT, the market rallied to initial resistance at the convergence of the 20- and 50-DMA. It would be unsurprising if the market failed this initial resistance test and ultimately retested the 100-DMA soon. Such a pullback would solidify that support and complete the reversal of the bullish sentiment index.

“Whatever trigger causes a reversal in the bullish signals, we will act accordingly to reduce risk and rebalance exposures. But one thing is sure: investor sentiment is extremely bullish, which has almost always been a good “bearish signal” to be more cautious.

While we have warned of a potential correction over the past few weeks, it reminds us much of June and July last year, where similar warnings for a 10% correction went unheeded. We are now seeing many individuals ‘jumping into the pool’ in some of the most speculative areas of the market. Such is usually a sign we are closer to a market peak than not. As such, we want to make adjustments before the correction comes.”

Very quickly, as supported by the bullish sentiment index, those bulls are turning bearish and are now calling for a more profound decline.

While such is possible, I suspect most of this correction is complete for two reasons.

Earnings Continue To Remain Strong

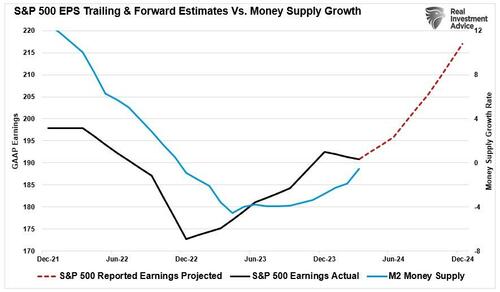

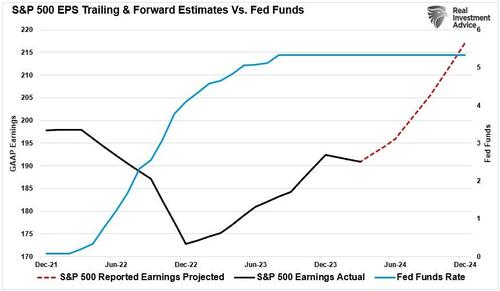

The first reason is that despite higher interest rates, earnings growth continues to remain robust, at least among the “Magnificent 7,” where Google (GOOG) and Microsoft (MSFT), in particular, exceeded estimates by a wide margin. However, overall, and most importantly, earnings growth has continued since the October lows of 2022. Notably, the support for improving earnings comes from the increased fiscal policies such as the Inflation Reduction Act and CHIPS Act.

While those policies will eventually fade, making forward estimates subject to downward revisions, the current earnings environment remains relatively robust. Furthermore, forward estimates remain optimistic that the Federal Reserve will cut rates later this year, lowering borrowing costs and supporting economic activity.

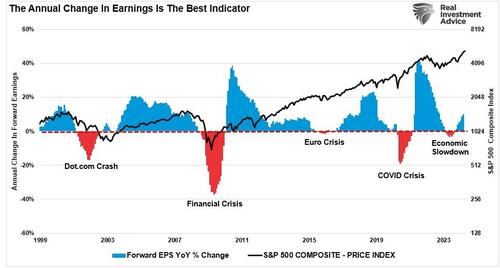

Notably, the increase in earnings, at least for now, remains a strong indicator of rising asset prices. The risk of a deeper market correction (greater than 10%) is significantly reduced during previous periods of improving earnings. While such does not mean a deeper correction can not happen, historically, corrections between 5% and 10% in an earnings growth environment tend to be buying opportunities and limit deeper reversal in the bullish sentiment index.

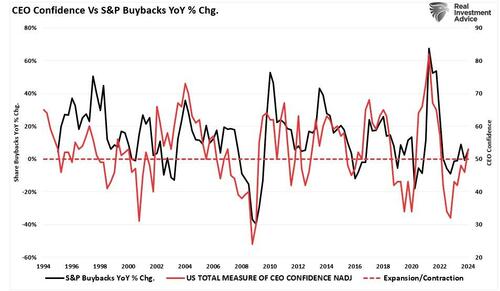

Improving earnings also precedes improving CEO confidence, which has provided pivotal support to financial markets since 2000.

Buybacks Returning

We discussed the most critical reason we expected a market correction in mid-March. To wit:

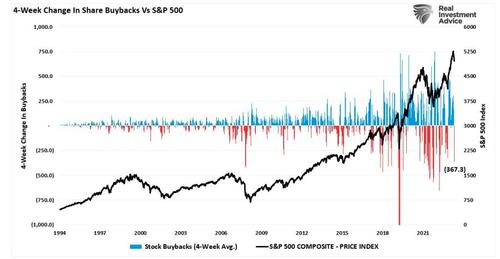

“Notably, since 2009, and accelerating starting in 2012, the percentage change in buybacks has far outstripped the increase in asset prices. As we will discuss, it is more than just a casual correlation, and the upcoming blackout window may be more critical to the rally than many think.” – March 19, 2024

Furthermore, the “blackout” of corporate buybacks coincided with more extreme readings in the bullish sentiment index. Buybacks are crucial to the market because corporations have accounted for roughly 100% of net equity purchases over the last two decades.

Here is the math of net flows if you don’t believe the chart:

-

Pensions and Mutual Funds = (-$2.7 Trillion)

-

Households and Foreign Investors = +$2.4 Trillion

-

Sub Total = (-$0.3 T)

-

-

Corporations (Buybacks) = $5.5T

-

Net Total = $5.2 Trillion = Or 100% of all equities purchased

-

Unsurprisingly, that blackout window coincided with a sharp contraction of more than $367 billion in buybacks over the last 4-weeks. Consequently, when you remove a critical “buyer” from the market, the ensuing correction is unsurprising.

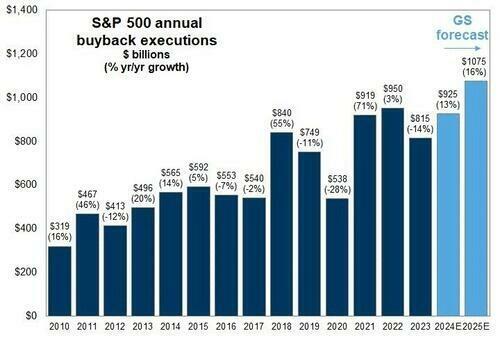

However, corporate share buybacks will resume in the next couple of weeks, and with more than $1 trillion slated for 2024, many buybacks remain to complete. Such is particularly the case with Google adding another $70 billion to that total.

As noted above, improving earnings and a decent outlook for the rest of this year also boost CEO confidence. (If you don’t understand why buybacks benefit insiders and not shareholders, read this.)

With robust economic activity supporting earnings growth, that improvement boosts CEO confidence. As CEOs are more confident about their business, they accelerate share buybacks to increase executive compensation.

The liquidity boost from buybacks and stronger earnings will likely provide a floor below the market. This doesn’t mean the current correction doesn’t have more work to do. However, it is unlikely that it will resolve into something more significant.

At least for now.

Your Tax Dollars At Work: US To Buy Ukrainian-Made Weapons For Ukraine

Your Tax Dollars At Work: US To Buy Ukrainian-Made Weapons For Ukraine

Image via Reuters

Tyler Durden

Tue, 04/30/2024 - 13:05

Image via Reuters

Tyler Durden

Tue, 04/30/2024 - 13:05

It's not just US and Western defense contractors and arms makers that have been raking in the billions as a result of Washington's mammoth defense aid handed over to Ukraine, but Ukrainian defense companies are also enjoying the largesse at US taxpayers' expense.

"A total of $1.6 billion of the recent US aid to Ukraine would go to the purchase of Ukraine-made weapons, said a senior Kyiv official," Defense Post reports of the $61 billion in US aid just approved.

Image via Reuters

Image via Reuters

G7 countries have been planning broader assistance to Ukraine which would develop and prop up a Ukrainian domestic military-industrial complex for the long-term, in order to ensure the country's independence from Russia well into the future.

Ukraine parliamentarian and foreign policy committee member Arseniy Pushkarenko has said, "This is very important today, because it is about the creation of joint defense enterprises that will be located on the territory of Ukraine or in neighboring countries, taking into account security aspects."

The funds will be taken from the $14 billion apportioned by Congress for the Ukraine Security Assistance Initiative (USAI), allowing the DoD to purchase new weapons for Ukraine.

Interestingly, Pushkarenko admitted that all of this is about more than just defending Ukraine from the Russian military onslaught, but is also about 'testing' new weapons systems in real combat.

"This is one of the factors in the development of the Ukrainian economy. Today, the military technologies that we have are tested in combat conditions, which makes our military-industrial complex attractive enough for many countries of the world," he said.

Other Western countries, including the United Kingdom and Denmark, are expected to establish programs ensuring the purchase of Ukrainian-made weapons.

As we've long documented, over the course of more than two years of war in Ukraine, American defense firms are making a killing, with four US-based companies having been ranked as among the world’s five largest military companies.

Zelensky promises more Ukraine-made weapons in new year speech https://t.co/7UCb6pLX17

— BBC News (World) (@BBCWorld) January 1, 2024The legendary early 20th century US Marine Corps Major General Smedley Butler said it best:"War is a racket. It always has been... It is possibly the oldest, easily the most profitable, surely the most vicious. It is the only one international in scope. It is the only one in which the profits are reckoned in dollars and the losses in lives."

New Biden Energy Rules Will Raise The Cost Of A New Home By $31,000

New Biden Energy Rules Will Raise The Cost Of A New Home By $31,000

Tyler Durden

Tue, 04/30/2024 - 12:45

Authored by Mike Shedlock via MishTalk.com,

New HUD energy rules will raise the cost of home construction by imposing stricter building codes. Payback time is 90 years...

Homes To Become Even More Unaffordable

The Wall Street Journal comments on Biden’s New Plan for Unaffordable Housing.

The Department of Housing and Urban Development is mandating costly new energy standards for new homes insured by the Federal Housing Administration (FHA), which will become de facto nationwide building codes.

HUD last Thursday announced that it will require new homes financed or insured by its subsidy programs to follow the 2021 International Energy Conservation Code standard.

Many governments have declined to adopt the 2021 standards because of their higher costs. The National Association of Home Builders says the energy rules can add as much as $31,000 to the price of a new home. It can take up to 90 years for a buyer to realize a payback on the higher up-front costs through lower energy bills.

Not to worry, HUD says taxpayers will help cover the cost. It “is anticipated that many builders will take advantage” of numerous tax incentives in the Inflation Reduction Act “as well as rebates that will become available in 2025 or earlier for electric heat pumps and other building electrification measures,” the rule says.

These incentives include a $5,000 per unit tax credit for “zero energy” multifamily construction that meets prevailing-wage requirements that also raise building costs. HUD adds that builders may also “take advantage of certain EPA Greenhouse Gas Reduction Fund programs, especially the Solar for All initiative” and an investment tax credit that can offset 50% of a solar project’s cost.

Even with the subsidies, HUD estimates the price of a new home will go up by $7,229.

You get a $5,000 credit but only if the builder pays union wages for everything. How much will that cost?

My general rule of thumb is to take government estimates and triple them. That’s for short projects like building a home. But 10x would not be surprising. And this is with subsidies.

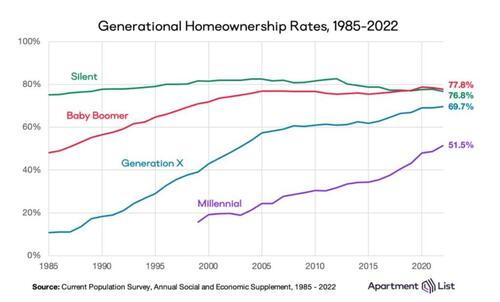

Generational Homeownership Rates

Home ownership rates courtesy of Apartment List

Who Are the Renters?

The answer is younger voters and blacks.

Generation Z homeownership is dramatically lower than the home ownership rate of millennials.

And according to the National Association of Realtors, the homeownership rate among Black Americans is 44 percent whereas for White Americans it’s 72.7 percent.

That’s the largest Black-White homeownership rate gap in a decade.

Home Prices Hit New Record High

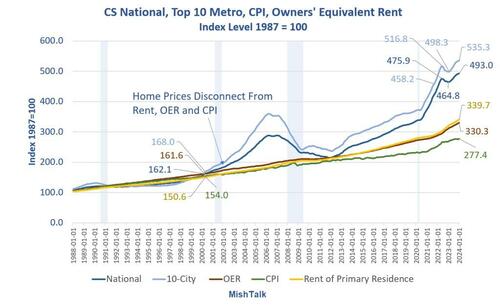

Case-Shiller, OER and CPI data from St. Louis Fed, chart by Mish

The latest Case-Shiller housing data shows home prices hit a new record high. Adding insults and costs, the 30-year mortgage rate ended last week at 7.50 percent

Youth Poll

On April 20, I commented People Who Rent Will Decide the 2024 Presidential Election

Q: What is it that young voters really have on their minds?

A: Rent

Many with rent as their top concern will switch to Trump. They are fed up with rising inflation. Rent is up at least 0.4 percent per month for 30 months.

Young voters propelled Biden over the top in 2020. Things look very different today. Many voters who do not like either Trump or Biden will sit this election out.