A civilization inspired by a consumerist, anti-birth mentality is not and cannot ever be a civilization of love.

All

As The Dollar Falters, Gold Becomes Insurance, Not Speculation

As The Dollar Falters, Gold Becomes Insurance, Not Speculation

Tyler Durden

Fri, 05/10/2024 - 07:20

Authored by Douglas French via The Mises Institute,

Economics trumps sentimentality, and gold’s elevated price has some people raiding the family jewelry box to pay bills.

“Young people are not wearing grandma’s jewels. Most of the young people, they want an Apple watch. They don’t want a pocket watch,” Tobina Kahn, president of House of Kahn Estate Jewelers told Bloomberg.

“Sentimental is now out the door.”

When times are tough, treasures change hands, the late Burt Blumert, once a gold dealer and Mises Institute Board Chairman, used to say.

“Prices are high, and I need cash,” Branden Sabino, a thirty-year-old information technology worker said, adding that with the cost of rent, groceries, and car insurance rising, he doesn’t have any savings. He sold a gold necklace and a gold ring to King Gold and Pawn on Avenue 5 in Brooklyn.

“People are using gold as an ATM they never had,” said store owner Gene Furman.

At King Gold, fifty-five-year-old Mirsa Vijil pawned a bracelet to pay her gas bill.

“Gold is high,” she said, adding she’d never pawned her jewelry before but will do it again if she needs to.

Adrian Ash, director of research at online gold investment service BullionVault says there is twice as much selling as a year ago on BullionVault’s platform. “People are very happy to take this price.”

“It’s very busy and we are getting more calls than ever before about clients wanting to bring in their jewels,” Kahn said.

“I’m telling the clients to bring them in now, as we are at unprecedented levels.”

So while there is plenty of liquidating to pay the bills, demand at the United States Mint is tepid, with sales in March the worst since 2019 for its American Eagle gold coin.

It turns out more than a few of those well-publicized Costco gold bar buyers are having trouble selling them. The bars, not being American Eagles or other similar gold coins, are not as liquid, given that the seller, Costco, will not buy them back. The Wall Street Journal reports, thirty-three-year old Adam Xi called five different gold dealers to get a price he would accept for the gold bar he bought at Costco in October.

He was offered $200 less by one dealer than the $2,000 he had paid. But he found a Philadelphia coin dealer near his home willing to pay $1,960, or twenty dollars under market price.

Mr. Xi has learned, or should have learned, that buying gold to turn a quick profit is a fantasy. His plan was to rack up credit-card points buying the gold and then quickly resell it for a profit.

Buyers can expect their gold to immediately lose around 5 percent of its value, according to Tom Graff, chief investment officer at the wealth advising company Facet. One pays a premium to buy and pays fees to sell.

“You need a holding period that’s long enough to overwhelm that cost,” said Graff.

Luke Greib told the Wall Street Journal that he sold a one-ounce Credit Suisse bar on a Reddit page dedicated to trading precious metals to avoid taxes and fees.

Buying physical gold is purchasing insurance against monetary mischief by the Federal Reserve, not to earn a profit via a quick flip.

Perhaps it’s hard to imagine currency destruction so devastating that your gold would serve as not only a store of value but a medium of exchange. Peter C. Earle explains in a piece for the American Institute for Economic Research, “During the peak of its 2008 hyperinflation, [Zimbabwe] experienced a catastrophic economic downturn, characterized by the issuance of billion—and trillion-dollar banknotes that were, despite their nominal enormity, virtually worthless.”

Dr. Earle writes that twenty-eight years of inflation “topped a total 231 million percent” and “the ZWD was demonetized in 2009.” The government is making its sixth attempt at a new currency, Zimbabwe gold (ZiG). “ZiG is there to stay forever,” said Vice President Constantino Chiwenga. “This bold step symbolizes government’s unwavering commitment to the de-dollarization program premised on fiscal discipline, monetary prudence and economic revitalization.”

Reportedly, ZiG “is backed by a basket of precious metals including about 2.5 tons of gold along with $100 million of foreign currency reserves held by the central bank.” As always, the Zimbabwe authorities are already blaming speculators for price increases. “Speculators should cease,” Chiwenga said. “Behave, or you get shut down or we lock you up.”

Dr. Earle has his doubts about whether the Zimbabwean authorities will maintain the ZiG backing with the required rigor. While he hopes for success, “Without fundamental changes guaranteeing private property protection, pro-market reforms, and safeguards against corruption, though, the ZiG is likely to retrace the unfortunate steps of its predecessors.”

The reason to buy and hold gold is just in case the Federal Reserve goes the way of Zimbabwe.

If Truth Could Be Acknowledged, America No Longer Exists

If Truth Could Be Acknowledged, America No Longer Exists

Paul Craig Roberts

Alan Dershowitz, the epitome of a Harvard law school left-winger back in the days before the left-wing went Woke, endorsed two of my books dealing with Washington’s dangerous assaults on American Civil Liberty.

Dershowitz’s failing is that as a defender of Zionist Israel he silences even Jews, such as Norman Finkelstein, who are critical of Zionist Israel. But when it comes to US civil liberty, he stands on the Constitution if Israel is not in the picture.

This is unusual for the left-wing today, which opposes the Constitution as a racist document intended to suppress black people.

In former periods of our history the American left was a countervailing power that protected civil rights. Those days are gone, and Dershowitz is the last.

I doubt that Dershowitz is a Trump supporter. But to Dershowitz, it is the the law, the Constitution, that is important. In a recent article, Dershowitz says, “Every American should be appalled at this selective prosecution. Today the target is former President Donald Trump. Tomorrow it may be a Democrat.”

In other words, Dershowitz is concerned that the US is becoming a Latin American country in which every outgoing president is prosecuted by his successor. Instead of law as a protector, law becomes a weapon.

Dershowitz has this to say:

“Trump’s underlying crime is seemingly a minor misdemeanor — falsifying business records — which long ago expired under the statute of limitations. In order to turn it into a felony within the statute of limitations, prosecutors will have to show that Trump falsified the records in order to impact his election, thus constituting a federal election felony.

The problem is, however, that federal authorities have not prosecuted Trump for this federal election crime. Moreover, state prosecutors have no jurisdiction over federal election law.”

In other words, there is no legal basis for Trump’s indictment.

This has from the beginning been completely apparent, and now it has been stated by America’s most prominent legal authority, a person far more knowledgeable than any member of the US Supreme Court.

“I have been teaching, practicing and writing about criminal law for 60 years. In all those years, I have never seen or heard of a case in which the defendant was criminally prosecuted for failing to disclose the payment of what prosecutors call ‘hush money.’ Alexander Hamilton paid hush money to cover up an affair with a married woman. Many others have paid hush money since. If the legislature wanted to criminalize such conduct they could easily enact a statute prohibiting the payment of hush money or requiring its disclosure. They have declined to do so. Prosecutors cannot simply make up new crimes by jerry-rigging a concoction of existing crimes, some of which are barred by the statute of limitations others of which are beyond the jurisdiction of state prosecutors.” https://dailycaller.com/2024/05/08/opinion-trumps-trial-is-a-stupendous-legal-catastrophe-for-the-history-books-alan-dershowitz/?pnespid=qOlqBH1KL6oRxKfDomjtA5TQ7xKyUJIvJ_y70Oh58ABmWE1d_.03Q3m9YGQz_bqVDR4zq8Cx9A

In other words, America’s pre-eminent lawyer declares the totally unAmerican Biden Regime enemy of the US Constitution to be a direct threat to the existence of a rule of law and a free America.

Despite this, watch the Woke left, women, Woke white males, if male they are, vote Democrat. A country, such as America, which has lost the support of its principles by its own population is a destroyed country.

Zwolinski Tries to Take Rothbard to the Mat

In a recent symposium on Murray Rothbard's For a New Liberty, philosopher Matt Zwolinski takes issue with Rothbard on Murray’s views of freedom and property rights.

Six Reasons To Own Bitcoin In Retirement

Six Reasons To Own Bitcoin In Retirement

Tyler Durden

Fri, 05/10/2024 - 06:30

For newcomers, especially those in and around retirement age, the idea of investing in or owning bitcoin can evoke reactions from skepticism to disbelief. If you look beyond the popular narratives, however, you might find there is more to the story than first impressions suggest.

Here are six reasons to consider owning at least some bitcoin during retirement.

1. BITCOIN HELPS BROADEN YOUR ASSET ALLOCATION BASE

Traditionally, investors use a strategy called asset allocation to distribute and shield funds from investment risk over time. A sound asset allocation strategy is the antidote to putting all of your eggs in one basket. There are several types of asset “classes” or categories over which to distribute risk. Customarily, advisors seek to establish a dynamic mix between debt instruments (i.e., bonds), equities (i.e., stocks), real estate, cash, and commodities.

The more categories you employ to distribute your assets and the less correlated those categories are, the better your chances of balancing your risk, at least theoretically. Recently, due to unintended consequences caused by the aggressive expansion of societal debt and the money supply, assets that were previously less correlated now tend to behave more in kind with one another. When one sector gets hammered today, several sectors often suffer together.

Regardless of these present-day conditions, asset allocation remains a well-conceived strategy for moderating risk. While still in its relative infancy, bitcoin represents an entirely new asset class. Because of this, owning at least some bitcoin, especially due to its distinct properties when compared to other “cryptocurrencies,” provides an opportunity to broaden your asset base and more effectively distribute your overall risk.

2. BITCOIN OFFERS A HEDGE AGAINST INFLATION AND CURRENCY DEBASEMENT

As a retiree, protecting yourself from inflation is crucial to preserving your long-term purchasing power. In the asset allocation discussion above, we referenced the recent and aggressive money supply expansion. Everyone who has lived long enough to approach retirement age knows that a dollar no longer buys what it used to. When the government issues large amounts of new money, it debases the value of the dollars already in circulation. This generally pushes prices higher as newly created dollars begin to chase the existing limited supply of goods and services.

Our own Parker Lewis touched on this extensively in his Gradually, Then Suddenly series:

In summary, when trying to understand bitcoin as money, start with gold, the dollar, the Fed, quantitative easing and why bitcoin’s supply is fixed. Money is not simply a collective hallucination or a belief system; there is rhyme and reason. Bitcoin exists as a solution to the money problem that is global QE and if you believe the deterioration of local currencies in Turkey, Argentina or Venezuela could never happen to the U.S. dollar or to a developed economy, we are merely at a different point on the same curve.

In contrast to fiat currencies, no one can increase the supply and arbitrarily reduce bitcoin’s value. There are no centralized authorities that govern its monetary policy. Despite arguments to the contrary, bitcoin is similar to gold—but not exactly, because gold miners continue to inflate the supply of gold each year at a rate of 1-2%.

As bitcoin is slowly introduced to the circulating supply (i.e., mined), its inflation rate decreases and will eventually cease. This fact makes bitcoin uniquely scarce among global monetary assets. Ultimately, this scarcity, along with bitcoin’s other monetary properties, should safeguard its purchasing power. As such, owning bitcoin during retirement offers you a hedge against inflation.

3. BITCOIN OFFERS AN OPPORTUNITY FOR ASYMMETRIC RETURNS

Bitcoin’s capacity to mitigate many of the challenges we discuss here rests on its ability to achieve asymmetric returns. Its supply is fixed (there will only ever be 21,000,000 bitcoin), and demand for the asset is growing steadily. As this limited supply collides with increased store-of-value adoption from individuals, institutions, and governments, bitcoin has the potential to dwarf the returns of nearly every competing asset class.

It’s worth noting that people generally improve their returns with bitcoin when they hold it for the long term. In the modern era, retirements lasting decades or more are increasingly common. Over such time periods, even a limited allocation to bitcoin offers ample opportunity to benefit from its upside potential. You just need time to hold through the short-term volatility, which contrary to popular belief, is not evidence of it being a poor store of value.

Sequestering a portion of funds solely for appreciation during retirement runs somewhat counter to conventional wisdom. Modern retirement planning generally optimizes for the liquidation of portfolio funds to provide income. However, setting aside a small amount of bitcoin—kept steadfastly gated from funds earmarked for income—opens the door to benefit from the monetization of bitcoin’s limited supply.

4. BITCOIN OFFERS PROTECTION FROM THE RISK OF LONG-TERM BONDS

Conventionally, high-grade bonds—held directly or as fund shares—make up a significant part of most retirement portfolios due to their low risk levels and tendency toward capital preservation. However, things have changed.

Monetary expansion and increases in societal debt have forced bond yields—or the amount of interest paid (i.e., coupon)—to historically low levels. The yields on most bonds today fall well below the rate of inflation. This “negative real yield” means that owning a bond can cost you money. But the difficulty doesn’t end there.

Because retirees need funds from their portfolios to pay bills, they generally must sell assets at current market rates to derive income throughout retirement. In the case of bonds, at present, this can be very problematic. Consider the following equations.

-

How much money does it take for a bond paying a 2% rate to yield $20? Answer: $1,000. ($1,000 x 2% = $20)

-

How much money does it take for a bond paying a 4% rate to yield $20? Answer: $500. ($500 x 4% = $20)

These two equations reveal that to yield the same $20 return, the market value of the underlying bond changes based on the interest rate promised.

-

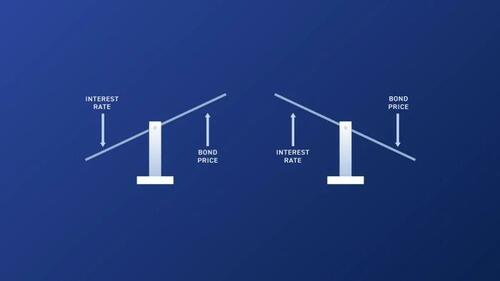

When interest rates go up, the market value of bonds goes down.

-

When interest rates go down, the market value of bonds goes up.

The market value of bonds has an inverse relationship to interest rates. Consider that interest rates today hover near historic lows. Over the next twenty to thirty years, what will happen to the market value of bonds held by retirees if interest rates increase substantially? The answer: the market value of their bonds will collapse.

This changes the entire risk paradigm for bonds in retirement portfolios and potentially makes them far less safe than typically imagined. Bitcoin exists in a separate asset class from bonds; it is a bearer instrument that is not exposed to the same money market risks. As such, owning bitcoin may help you offset at least some of the potential risk incurred from owning bonds in retirement.

5. BITCOIN OFFERS A POTENTIAL SOLUTION FOR LONG-TERM HEALTHCARE RISK

Another area of concern for retirees is the cost of healthcare. Here, I am not referring so much to ordinary medical bills but rather to the potential to incur long-term care expenses in later age. Insurance is available for long-term care, but it has some unique and increasingly difficult challenges to overcome.

Healthcare, in general, takes a double-hit when it comes to price inflation. Not only do healthcare costs rise due to monetary debasement, but healthcare faces additional headwinds from demand spurred by growth in the aging population.

Source: Administration for Community Living – 2020 Profile of Older Americans

States regulate insurance for long-term care. To keep policyowners safe, insurers face scrutiny over where and how they invest policy premiums. To preserve capital required for future claims, insurers generally rely on low-risk, intermediate and long-term bonds. However, as our discussion above on bonds reveals, low yields and the potential for rising rates complicate this practice. One immediate fallout is that premiums for long-term care insurance policies have risen substantially.

We noted earlier bitcoin’s usefulness as an inflation hedge and its potential for long-term price appreciation. As it relates to long-term healthcare, it may make sense to set aside some bitcoin explicitly dedicated as a hedge for this rapidly increasing expense.

6. BITCOIN OFFERS YOU INDIVIDUAL SOVEREIGNTY

The final reason we’ll consider for owning bitcoin in retirement is that it offers you increased individual sovereignty. Bitcoin provides you a level of ownership that is not achievable with other assets. It can easily be carried across borders with a hardware wallet or seed phrase, for example, or transferred peer-to-peer anywhere in the world at low cost.

If you hold bitcoin securely in a wallet you control, no central bank can steal the value of your bitcoin by printing it into oblivion. No CEO can dilute its value by issuing more of its “shares.” Nor can a bank arbitrarily block access to or confiscate your funds. Unlike centralized financial custodians, which can be ordered to freeze or withhold funds on the whims of government or other third-party authorities, bitcoin with keys properly held is resistant to these kinds of overreach.

Specifically for retirement purposes, you can also hold your own keys for bitcoin in an IRA. Products like the Unchained IRA are a robust tool for building and saving your wealth on a tax-advantaged basis. And holding your bitcoin keys in the form of a multisig collaborative custody vault allows you to eliminate all single points of failure while you do so.

SOUND FINANCIAL PRINCIPLES AND OWNING BITCOIN

Benefitting from bitcoin does not require committing to wild speculation or thoughtless abandonment of sound financial principles. In contrast, the more you look at bitcoin through sound financial principles and apply them to your thinking, the greater the opportunities it provides. One steadfast financial principle that coincides with bitcoin ownership is prudence.

Macro-economic investment strategist Lyn Alden often speaks of establishing a “non-zero position” in bitcoin (i.e., owning at least some). The risk of losing a few portfolio percentage points in a worst-case scenario is, in my estimation, worth the potential upside. But to be clear, each person’s situation is unique. You must do your own research and make the best decisions you can about what works in your particular scenario.

* * *

Visit Unchained.com for $100 off any Unchained financial services product with code “BTCMAG100”

New York Flight Attendants Accused Of Smuggling Millions In Drug Money To Dominican Republic

New York Flight Attendants Accused Of Smuggling Millions In Drug Money To Dominican Republic

Tyler Durden

Fri, 05/10/2024 - 05:45

Four flight attendants from the New York City area have been accused of participating in a multimillion-dollar drug money smuggling operation which saw $8 million make its way to the Dominican Republic, according to the U.S. Attorney’s Office for the Southern District of New York.

The accused, identified as Jarol Fabio, 35, of New York City; Charlie Hernandez, 42, of West New York, New Jersey; Sarah Valerio Pujols, 42, of the Bronx; and Emmanuel Torres, 34, of Brooklyn, allegedly transported the funds over a span of several years, exploiting their positions as flight attendants to bypass the stringent security measures in place at JFK International Airport.

“These flight attendants smuggled millions of dollars of drug money and law enforcement funds that they thought was drug money from the United States to the Dominican Republic over many years by abusing their privileges as airline employee[s]," stated U.S. Attorney Damien Williams. "Today’s charges should serve as a reminder to those who break the law by helping drug traffickers move their money that crime doesn’t pay."

According to prosecutors, the scheme involved using their status as "Known Crewmembers"—a designation that allows flight crew members to undergo less rigorous security screenings—to smuggle large sums of cash without detection. This privilege, intended to streamline operations for crew members, became their tool for illegal activities.

Delta Airlines, where two of the defendants were employed, has been cooperative with the authorities following the revelation that security protocols meant to protect the passengers were systematically abused.

According to court documents, the detailed operation was exposed with the help of two cooperating witnesses, themselves previously arrested on money laundering charges. These witnesses played a pivotal role in unveiling the transactions that tied some of the smuggled funds to fentanyl sales, adding a dire public health dimension to the criminal activities.

In one incident, prosecutors detailed how Hernandez and Pujols divided over $120,000 in drug money in December 2019, with each taking their share on subsequent trips to the Dominican Republic. Such episodes illustrate the methodical approach taken to avoid detection while exploiting their roles within the airline industry.

If convicted, the penalties are severe. Torres and Fabio face up to 15 years in prison, Hernandez could see 20 years, and Pujols, facing an additional smuggling charge, could be sentenced to up to 25 years. These stiff potential sentences reflect the serious nature of their alleged crimes, which compromised airport security systems and endangered public trust in the safety of air travel.

The Investment “Holy Grail” Doesn’t Exist

When it comes to the financial markets, investors have a litany of investment vehicles to choose from. The choices are nearly unlimited, from brokered certificates of deposit to complex derivative instruments. Of course, investment vehicles’ proliferation comes from investors’ demand for everything from excess benchmark returns to income generation to downside protection.

Of course, every investor wants “all the upside, with none of the downside.” While there are vehicles, like indexed annuities, that can provide no downside risk, they cap the upside return. If you buy an index fund, you can get “all the upside” and “all the risk.”

However, an email from a reader last week got me thinking about the perfect “investment vehicle” and the search for the “holy grail” of investing.

“My wife and I are looking for a place to position some of our ’emergency funds’ for a better return. Our requirements are pretty simplistic:

- Guarantee at least a 4% rate of return.

- Allow me to withdraw cash without penalty when needed.

- Reinvest all income

- If bond yields decline as expected, the value of the investment increases.

At this point, I was confident in just suggesting purchasing a 10-year Treasury bond. At current rates, the investment would yield greater than 4% and guarantee the principal. If yields decline, the bond rises in price, reinvestment of income is an option, and the investment is highly liquid.

Theoretically, this would be the “perfect investment” vehicle for their needs. I said “theoretically” because they added one more requirement just as I was about to spout off my terrific idea.

“Oh, and one more thing, the dollar value of the account must remain stable at all times.”

And that, as they say, quickly ended the “perfect investment” vehicle for their needs.

Why did the addition of “price stability” make their request impossible?

The 3-Components Of All Investments

In portfolio management, you can ONLY have two of three components of any investment or asset class:

- Safety – The return of principal without loss due to price change or fees

- Liquidity – Immediately accessible without penalties or fees

- Return – Appreciation in the price of the investment

The table below is the matrix of your options.

The takeaway is that cash is the only asset class that provides safety and liquidity. Safety comes at the cost of return. Equities are liquid and provide returns but can suffer a significant loss of principal. Bonds can offer returns through income and safety if held to maturity. But in exchange for that safety, investors must forego liquidity.

In other words, no investment can provide all three factors simultaneously. While the table above uses only Equities, Bonds, and Cash, those three factors apply to any investment vehicle you may consider.

- Fixed Annuities (Indexed) – safety and return, no liquidity.

- Certificates of Deposit – safety and return, no liquidity.

- ETFs – liquidity and return, no safety.

- Mutual Funds – liquidity and return, no safety.

- Real Estate – safety and return, no liquidity.

- Traded REITs – liquidity and return, no safety.

- Commodities – liquidity and return, no safety.

- Gold – liquidity and return, no safety.

You get the idea.

Let’s revisit our email question.

While I initially focused on the cash requirements, these were also funds set aside for an “emergency.” In other words, these funds must be readily available when an unexpected event arises. Since “unexpected events” tend to happen at the worst possible time, these funds should never be put at risk. The need for “safety” and “liquidity” eliminates the third factor: Return.

No matter what investment vehicle you choose, you can only have two of the three components. Such is an essential and often overlooked consideration when determining portfolio construction and allocation.

8-Reasons To Focus On Liquidity

Liquidity is the most essential factor in making any investment. Without liquidity, I can not invest. Therefore, liquidity should always remain a high priority when managing your portfolio.

I learned a long time ago that while a “rising tide lifts all boats,” eventually, the “tide recedes.” Over the years, I made a straightforward adjustment to my portfolio management, which has served me well. When risks begin to outweigh the potential for reward, I raise cash.

The great thing about holding extra cash is that if I’m wrong, I simply make the proper adjustments to increase the risk in my portfolios. However, if I am right, I protect investment capital from destruction and spend far less time ‘getting back to even.’ Despite media commentary to the contrary, regaining losses is not an investment strategy.

Here are 8-reasons why you should focus on liquidity first:

1) We are speculators, not investors. We buy pieces of paper at one price with hopes of selling at a higher price. Such is speculation in its purest form. When risk outweighs rewards, cash is a good option.

2) 80% of stocks move in the direction of the market. If the market is falling, regardless of the fundamentals, the majority of stocks will decline also.

3) The best traders understand the value of cash. From Jesse Livermore to Gerald Loeb, each believed in “buying low and selling high.” If you “sell high,” you have raised cash to “buy low.”

4) Roughly 90% of what we think about investing is wrong. Two 50% declines since 2000 should have taught us to respect investment risks.

5) 80% of individual traders lose money over ANY 10-year period. Why? Investor psychology, emotional biases, lack of capital, etc. Repeated studies by Dalbar prove this.

6) Raising cash is often a better hedge than shorting. While shorting the market, or a position, to hedge risk in a portfolio is reasonable, it also merely transfers the “risk of being wrong” from one side of the ledger to the other. Cash protects capital and eliminates risk.

7) You can’t “buy low” if you don’t have anything to “buy with.” While the media chastises individuals for holding cash, it should be somewhat evident that without cash you can’t take advantage of opportunities.

8) Cash protects against forced liquidations. One of the biggest problems for Americans is a lack of cash to meet emergencies. Having a cash cushion allows for handling life’s “curve-balls,” without being forced to liquidate retirement plans.Layoffs, employment changes, etc. are economically driven and tend to occur with downturns that coincide with market losses. Having cash allows you to weather the storms.

Importantly, I want to stress that I am not talking about being 100% in cash.

I suggest that holding higher cash levels during periods of uncertainty provides both stability and opportunity.

With the political, fundamental, and economic backdrop becoming much more hostile toward investors in the intermediate term, understanding the value of cash as a “hedge” against loss becomes much more critical.

Chasing yield at any cost has typically not ended well for most.

Of course, since Wall Street does not make fees on investors holding cash, maybe there is another reason they are so adamant that you remain invested all the time.

The post The Investment “Holy Grail” Doesn’t Exist appeared first on RIA.

The #1 Vocation Killer

Unless you have been living under a rock, I am sure you are aware that the Church is experiencing a vocation crisis. The numbers are bleak, and they have been for decades. Sure, there are bright spots here and there, mainly with traditional orders and societies of priests who often ordain more priests in a single seminary than the entire nation of Ireland did last year. Nonetheless…

The Doubter Who Defended Damien of Molokai

That Robert Louis Stevenson had a not-so-secret sympathy with Catholicism is evident in his book Travels with a Donkey in the Cevennes, where he describes a visit to the Trappist monastery Notre-Dame des Neiges (Our Lady of the Snows). I recall the white-washed chapel, the hooded figures in the choir, the lights alternately occluded and revealed, the strong manly singing…

Tajikistan, Moscow's scapegoat

More than a month after the attack on Krokus City Hall, the retaliation against Tajik migrants in Russia has not subsided, to the point of prompting a protest note from Dushanbe. Hundreds remain stranded at airports and at the border with Kazakhstan, but Moscow cannot afford to lose the country where its most important military base in Central Asia is located.

India first to exceed $ 100 billion in migrant remittances

Today's news: arson attack by settlers on the headquarters of the UN agency for Palestinian refugees in Jerusalem, building closed for security reasons;Presidential elections in Sri Lanka between September and October;Seoul opens to foreign doctors in hospitals to cope with strike, controversy over racist web post; Gazprom sells off some properties in Moscow to compensate for losses.

It’s Time For A New Lie

The Gateway Pundit has an article about fewer Americans believing the “threat” of climate change. They give a political slant to it, and say it is to do with the Bidenomics making Americans poorer and the illegal immigration making people focus on real problems. However, I am not persuaded this is more than a secondary […]

Walk On Boy

Walk On Boy

May 9 2024

___________________________________

More Vids!

+BN Vids Archive! HERE!

___________________________________

Support The Brother Nathanael Foundation!

Br Nathanael Fnd Is Tax Exempt/EIN 27-2983459

Or Send Your Contribution To:

The Brother Nathanael Foundation, POB 547, Priest River, ID 83856

E-mail: brothernathanaelfoundation([at])yahoo[dot]com

Scroll Down For Comments

New "Guide" Teaches UK MPs To Spot "Conspiracy Theories"

New "Guide" Teaches UK MPs To Spot "Conspiracy Theories"

Tyler Durden

Fri, 05/10/2024 - 02:00

Authored by Kit Knightly via Off-Guardian.org,

The British government has issued a new guidebook to all sitting MPs to help them spot “conspiracy theories”.

Leader of the House Penny Mordaunt MP, who commissioned the guide, has warned that:

The proliferation of conspiracy theories across the UK is deeply disturbing. They are deliberate campaigns to spread disinformation and fear

[…]

If they go unchallenged we risk the public being conned and their wellbeing potentially damaged. These campaigns are also a threat to the health of our democracy.

It is essential that we give the public and their representatives the tools they need to combat this phenomenon.”

And claimed the aim of the new guide was to:

protect the public from the damaging effects of misinformation and safeguard the integrity of our democratic process,”

Which sounds just lovely, doesn’t it?

Oh, and just in case any of you are still caught up in the party politics illusion, the guide has full cross-party support, the Shadow Leader of the House called it “a must-read”.

The report was co-written by “experts” representing several non-governmental organisations, and fact-checkers including:

-

FullFact – funded by (among others) Google, Facebook and the Open Society Foundation.

-

The Institute for Strategic Dialogue – funded by (among others) the Bill & Melinda Gates Foundation, Google, Facebook, over a dozen national governments and the UN.

-

Global Network on Extremism and Technology – The academic research arm of the Global Internet Forum to Counter Terrorism, a thinktank “designed to prevent terrorists and violent extremists from exploiting digital platforms”…and which is funded by (among others) Facebook, Amazon, Youtube and Microsoft.

In short, it’s all a rather incestuous funding pool of the same handful of tech giants and billionaires paying “experts” to tell them what they want to hear.

But we probably shouldn’t judge until we’ve read the “guide” itself, which is tricky because it doesn’t seem to be publicly available (seriously I looked everywhere, if you’re aware of a copy online post it in the comments and we’ll add it the link here).

Fortunately, our old friends at the Guardian have given us a little taste, here’s three things they’re warning about.

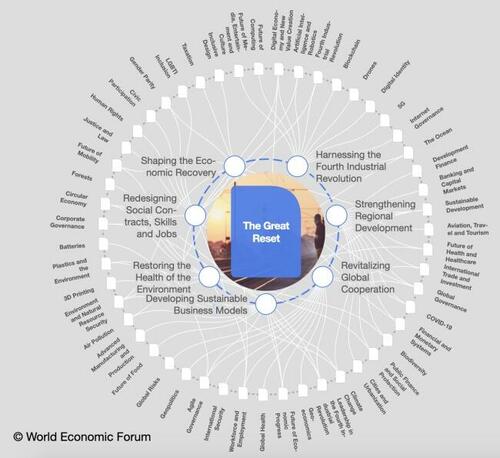

The Great Reset, which the Graun describes as…

…a vague set of proposals from the World Economic Forum to encourage governments to move to adopt more equitable policies, the concept has been hijacked by conspiracy theorists claiming it is a bid by a small group to exert control.

…which is wonderful, because it’s essentially admitting it’s true and then pretending it’s not.

The Great Reset is, indeed, a WEF initiative. It was launched in June 2020 with the backing of world leaders and captains of industry, it aims to totally and completely rebuild the way our society works, including how we travel, what we eat and where we live.

You can read about it in Klaus Schwab’s own words here, or see their handy diagram:

How is that NOT “exerting control”?

How does one go about transforming the farming, travel, taxation and employment policies of every nation on Earth without “exerting control”?

Eating Insects is another “conspiracy theory”, apparently.

With the Guardian warning that:

[conspiracy theories] have included claims – fuelled by attempts to reduce meat consumption – that the WEF wants to make people eat insects.

The only problem being that the WEF really does want people to eat insects:

Like, a lot:

You know what? The Guardian wants people to eat insects too. So does the BBC. And Time. The list is endless.

This is – to use an overused word – gaslighting of the highest degree.

They are at once saying “hey, we all need to eat insects to save the world”, and then claiming anyone who repeats it back at them is a conspiracy theorist.

To encompass how mad this is you have to picture it being done on an interpersonal level.

Imagine a double-glazing salesman comes to your door, wearing a double-glazing company logo and holding a double-glazing sales catalogue and says “I think you should buy some double-glazing”.

To which you reply, “No thanks I don’t need any double glazing.”

At this point the man screams “Double glazing? Who said anything about double glazing!? You lunatic!” storms off down the path, gets in his double-glazing van and drives away.

It’s just that insane.

Climate Lockdowns are the third “conspiracy theory” the Guardian warns us about, claiming:

The ISD identified “climate lockdown” as the catchphrase for the conspiracy that the climate crisis will be used as a pretext for depriving citizens of liberty.

But climate lockdowns are not a conspiracy theory either, they were first posited in a report in October 2020 published by Project Syndicate and the World Council for Sustainable Development. The proposed lockdown included banning private vehicles, the consumption of red meat and “extreme energy-saving measures”.

Since then we have been inundated with peer-review studies, claiming lockdown is good for the environment.

The Guardian itself headlined, in March 2021:

Global lockdown every two years needed to meet Paris CO2 goals – study

It was such an unpopular story that they sneakily changed the headline.

It’s fairly clear that “climate lockdowns” are far from a conspiracy theory, that they were planned and then abandoned (or delayed) due to public anger at the first lockdown.

* * *

So, it looks like at least three of these “conspiracy theories” MPs are being “warned against” are actually…true. At least partially.

Oh well.

Still, it’s reassuring to know that unnamed experts from billionaire-funded NGOs are writing “guides” teaching our elected officials about the dangers of wrongthink.

What a great way to “safeguard the integrity of our democratic process”.

Somaliland Needs Self-Determination

Somalia is an artificial country that was created by European intervention. Somaliland, however, is an entity that should be recognized as a real nation.

'Genocide Joe' Suffers Another Mortifying Slap-Down at the United Nations, by Mike Whitney

In a clear rejection of US policies and leadership in the Middle East, the UN general assembly voted overwhelmingly to back the Palestinian bid for full UN membership. The western media have mostly ignored Friday's balloting since the widely-anticipated results represent another black eye for Washington. But the outcome of the vote is a blow...

The Respectable Right Discovers Anti-White Hostility, by F. Roger Devlin

Jeremy Carl, The Unprotected Class: How Anti-White Racism is Tearing America Apart, Regnery Publishing, 2024, 369+xviii pages, $29.99 hardcover, $14.99 e-book Jeremy Carl is a senior fellow at the Claremont Institute, served as deputy assistant secretary of the interior under President Trump, and has been associated with the Hoover Institution. His other books have dealt...

University—An Attack on Intelligence, by Patrick Lawrence

Not in my lifetime,” I used to think when contemplating America’s decline and fall—a decline and fall I eagerly anticipate as a prelude to remaking our crumbly republic such that it stands for the ideals it professes to uphold but unreservedly ignores. Blind justice, disinterested leaders and institutions, tolerance of others, freedom of thought and...

Biden’s War on Gaza Is Now a War on Truth and the Right to Protest, by Jonathan Cook

The media’s role is to draw attention away from what the students are protesting – complicity in genocide – and engineer a moral panic to leave the genocide undisturbed As mass student protests quickly spread to campuses across the United States last week, and others took hold in Britain and elsewhere in Europe, the western...

Cardinal Erdő: ‘A man of unity, a bridge between East and West’

The primate of the Church of Hungary has established himself over the years as one of the leading ecclesiastical figures of our time. He is one of the few Catholic authorities to arouse the admiration of his peers and the interest of Catholic observers around the world. Yet he makes himself relatively scarce in the media and keeps away from the controversies and power plays that have often surrounded the Church in recent years. The late Australian Cardinal George Pell once said Péter Erdő is a man he’d like to see become pope.

The primate of the Church of Hungary has established himself over the years as one of the leading ecclesiastical figures of our time. He is one of the few Catholic authorities to arouse the admiration of his peers and the interest of Catholic observers around the world. Yet he makes himself relatively scarce in the media and keeps away from the controversies and power plays that have often surrounded the Church in recent years. The late Australian Cardinal George Pell once said Péter Erdő is a man he’d like to see become pope.

The post Cardinal Erdő: ‘A man of unity, a bridge between East and West’ appeared first on The Catholic Thing.

My kingdom for an adult! Analyzing Columbia’s antisemitic ‘Tentifada’

Even a passing glance at academic life these days makes clear that the men and women rewarded with top jobs on campus aren’t selected for their brilliance, skills, or character. These mediocrities excel precisely at the corporate art form of being simultaneously in power and not in power, enjoying their authority and prestige but claiming ignorance, impotence, or both when difficulties arise. And this is why they lack the courage to oppose faculty and student fascism.

Even a passing glance at academic life these days makes clear that the men and women rewarded with top jobs on campus aren’t selected for their brilliance, skills, or character. These mediocrities excel precisely at the corporate art form of being simultaneously in power and not in power, enjoying their authority and prestige but claiming ignorance, impotence, or both when difficulties arise. And this is why they lack the courage to oppose faculty and student fascism.

The post My kingdom for an adult! Analyzing Columbia’s antisemitic ‘Tentifada’ appeared first on The Catholic Thing.