No one is forced to be a Christian. But no one should be forced to live according to the "new religion" as though it alone were definitive and obligatory for all mankind.

All

An Illustrated Sacramentary of the Late 11th Century

Here is another interesting discovery from the endless treasure trove of one of my favorite websites, that of the Bibliothèque nationale de France. This sacramentary was made for the Benedictine abbey of Saint Winnoc, in a town called Bergues in the northernmost part of the modern state of France (less than six miles south of Dunkirk, where the famous evacuation took place in 1940.) It dates to Gregory DiPippohttp://www.blogger.com/profile/13295638279418781125noreply@blogger.com0

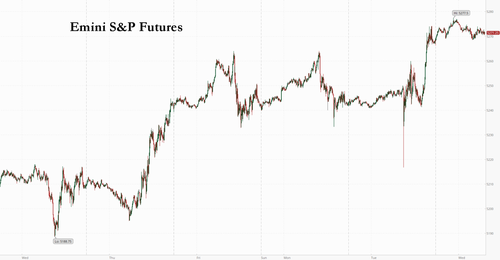

US Futures Coiled Tightly Ahead Of Key CPI Print

US Futures Coiled Tightly Ahead Of Key CPI Print

Tyler Durden

Wed, 05/15/2024 - 07:31

Equity futures were set to hold yesterday's gains ahead of today's CPI report, but will move violently either higher or lower after today's CPI number is released, which will either validate or reject Jerome Powell’s latest signals that interest rates will be higher for longer (our CPI preview is here). European and Asian stocks also gained, and the MSCI All Country World Index extended its longest run of gains since January. At 7:15am ET, futures contracts on the S&P 500 were little changed with small-caps catching a bid, while the MSCI All Country World Index extended its longest run of advances since January. Nasdaq 100 futures were also flat after the underlying index hit an all time high on Tuesday. Bond yields are down 1-2bps across the curve with the USD seeing some weakness. Commodities are higher, led by Energy and Precious Metals. On the macro front, both CPI and Retail Sales at 8.30am ET (previews here and here).

Activity in the premarket is muted with even the meme names up "only" low single digits and Mag7 seeing small moves ex-TSLA which is +0.8%. Here are the most prominent pre-market movers:

- Arcutis Biotherapeutics shares soar 24% after the company reported first-quarter sales that exceeded expectations, citing growth in demand for its prescription medications for skin conditions.

- Dlocal shares slide 27% after the Uruguayan fintech reported net income for the first quarter that missed the average analyst estimate.

- Meme stocks extend their rally into a third day, leading a frenzy affecting other high-risk and heavily shorted companies. GameStop +11%, AMC Entertainment +10%

- New York Community Bancorp shares rise 5.9% after the lender agreed to sell about $5 billion in mortgage warehouse loans to JPMorgan. Analysts were positive on the sale, saying that it will boost capital and liquidity and is in keeping with management’s new strategy.

- Nextracker shares rise 14% after it provided a fiscal 2025 adj. Ebitda forecast that beat estimates. Given the backlog-driven nature of the business, the growing +$4 billion in backlog “should substantially de-risk 2025 outlooks,” according to analysts at KeyBanc.

- Nu Holdings shares gain 6.49% after the parent of Nubank reported record revenue and net income for the first quarter that beat the average analyst estimate. The Brazil-based digital bank has an “open-ended growth opportunity” with a large addressable market, according to KeyBanc analysts.

In other news, overnight China vowed to take “resolute measures” after the Biden administration’s move to increase US tariffs on a wide range of Chinese imports; Bloomberg also reported that China was preparing a soft nationalization of the real estate sector by buying unsold houses to prop up the property market. In other news, Boeing faces possible criminal prosecution after the Justice Department found it violated a deferred-prosecution agreement tied to two fatal crashes half a decade ago.

In the run-up to US consumer price index data, the S&P 500 advanced despite Jerome Powell’s signals that interest rates will be higher for longer and a mixed reading on producer inflation, amid speculation that today's CPI print will come in below estimates: core CPI, which excludes volatile food and energy costs, is seen slowing to 0.3% month-on-month, from 0.4%; the core CPI reading is expected to show the lowest annual increase yet this year, in which case the core PCE deflator, the Fed’s preferred inflation gauge, could also register its lowest reading in 2024. Into the data, Fed-dated OIS price in around 42bp of rate cuts for the year with the first 25bp fully priced in for the November policy meeting (see our preview here for why a lower than expected number seems likely).

“An in-line-with-consensus US core CPI read is discounted and in the price, but that may be enough to promote relief buyers and see the index push higher,” said Chris Weston, head of research at Pepperstone Group Ltd. “A core CPI read below 0.25% month-on-month and I certainly wouldn’t want to be short.”

A survey conducted by 22V Research showed 49% of investors expect the market reaction to the CPI report to be “risk-on” — while only 27% said “risk-off.”

“A downside surprise seems needed,” said Michael Leister, head of rates strategy at Commerzbank AG. “For one, break-evens have already corrected notably and thus should provide less support for the long-end from here. At the same time, the Fed will remain reluctant to give the all-clear considering the lack of disinflation progress.”

European stocks rallied, led by real estate, telecoms and utilities. The IBEX 35 outperformed while the CAC 40 was flat, lagging peers. In individual stocks, Burberry Group Plc declined after reporting a slump in sales, dragging the consumer goods sector lower. ABN Amro Bank NV dropped more than 5% after unchanged guidance, while Finnish refiner Neste Oyj slumped on a downward revision on sales margins for its renewable products. Here are all the notable European movers:

- Merck KGaA shares climb as much as 4.6% after the Germany company reported adjusted Ebitda for the first quarter that beat analyst expectations and forecast a return to organic sales and earnings growth for 2024.

- LEG Immobilien shares rise as much as 3.3% after the German real estate firm’s first-quarter results show what analysts describe as a solid start to the year.

- Hunting shares surge as much as 23% after the oil field services provider said Ebitda will be at the top-end of its current guidance range thanks to a bumper order from the Kuwait Oil Co.

- Keller rises as much as 15% to a record high after the British ground-engineering specialist reported a better-than-expected start to the year and said its annual results will be “materially ahead” of the board’s initial expectations.

- InPost shares jump as much as 10% to hit their highest level since September 2021 following a 1Q earnings beat. That was aided by a 22% rise in parcel volumes and guidance for further volume growth in 2Q is seen positive by analysts, as it confirms that the Polish automated parcel locker operator is gaining further market share.

- Lundbeck shares gain as much as 7.7%, the most in more than 15 months, after the Danish pharmaceutical group reported better-than-expected results for the first quarter.

- SoftwareONE shares rally as much as 6.6% after the Swiss software provider posted solid margin expansion, offsetting slightly below-consensus Ebitda, according to Baader.

- Thyssenkrupp drops as much as 8.1%, the most since Feb. 14, after the steel producer reduced its expectations for a second time in three months amid lower steel prices and carbon dioxide trading losses.

- ABN Amro shares decline as much as 6.5% after the Dutch bank’s first-quarter results showed a capital ratio that missed analyst estimates, overshadowing more positive aspects of the earnings report.

- Burberry shares fall as much as 4.6% after the British luxury-goods maker’s adjusted pretax profit for the full year missed estimates amid a tough backdrop for high-end goods.

- Allianz slips as much as 2.2% despite reporting operating profit for the first quarter that beat estimates. Analysts note misses on accident year loss and solvency ratios, amid otherwise in-line results.

- Neste shares decline as much as 15% to the lowest level since 2018, after it posted a big downward revision of its renewable products sales margin guidance, which implies cuts to the Finnish refiner’s consensus and signals weaker market conditions, according to analysts.

- HelloFresh shares fall as much as 7.2% to a record intraday low Wednesday after JPMorgan downgraded the meal-kit company to neutral from overweight, saying its North America business is still “far from stabilizing.”

The euro-zone economy started the year on a stronger footing than anticipated, growing 0.3% in the three months through March following a shallow recession in the latter half of 2023, data Wednesday confirmed. Yet inflation is likely to backpedal more quickly than previously anticipated, with growth picking up next year, according to the European Commission. In contrast to the likely US path for interest rates, Bank of France Governor Francois Villeroy de Galhau said that the European Central Bank is very likely to start easing policy at its next policy meeting in June.

Earlier in the session, Asian stocks closed at the highest level since April 2022, as technology shares were lifted by key earnings reports and gains in US peers overnight. The MSCI Asia Pacific Index climbed as much as 0.6%, with Sony providing the biggest boost after announcing strong results and a buyback. Taiwan stocks led gains among regional equity gauges, with shares also rising in Australia. Markets were closed for holidays in Hong Kong and South Korea.

In FX, the dollar extended declines; Norwegian krone and yen outperformed as all G-10 FX rose. US equity futures were steady while

In rates, major global bonds rallied, led by gilts. US 10-year yields dropped to a five-week low of around 4.42% before US CPI data as treasuries were slightly richer across the curve, following wider gains in core European rates where German yields are lower by 4bp to 7bp, outperforming peers. Gains in Treasuries extend Tuesday’s rally as traders set up for Wednesday’s April CPI and retail sales reports. US yields richer by up to 2bp across belly of the curve which outperforms slightly, steepening 5s30s spread by almost 1bp on the day; 10-year yields around 4.42% with bunds and gilts outperforming by 5bp and 3.5bp in the sector.

In commodities, oil held gains after an industry report showed shrinking US stockpiles, overshadowing a softer demand growth outlook by the International Energy Agency for the rest of the year. WTI traded within Tuesday’s range, adding 0.5% to near $78.42. Most base metals trade in the green. Copper futures in New York rallied to a record high after a short squeeze that’s prompted a scramble to divert metal in other regions to US shores. Spot gold was up roughly $15 to trade near $2,373/oz.

Looking at today's calendar, US economic data slate includes May Empire manufacturing, April CPI and retail sales (8:30am New York time), March business inventories and May NAHB housing market index (10am) and March TIC flows (4pm). Fed officials’ scheduled speeches include Barr (10am), Kashkari (12pm) and Bowman (3:20pm)

Market Snapshot

- S&P 500 futures little changed at 5,271.50

- STOXX Europe 600 up 0.4% to 523.60

- MXAP up 0.6% to 179.55

- MXAPJ up 0.6% to 562.20

- Nikkei little changed at 38,385.73

- Topix little changed at 2,730.88

- Hang Seng Index down 0.2% to 19,073.71

- Shanghai Composite down 0.8% to 3,119.90

- Sensex down 0.2% to 72,945.92

- Australia S&P/ASX 200 up 0.3% to 7,753.70

- Kospi up 0.1% to 2,730.34

- German 10Y yield little changed at 2.49%

- Euro up 0.1% to $1.0834

- Brent Futures up 0.6% to $82.87/bbl

- Gold spot up 0.5% to $2,369.50

- US Dollar Index down 0.19% to 104.82

Top Overnight News

- China is considering buying millions of unsold homes to support the property market, people familiar said. Local governments would be asked to purchase units from distressed developers at steep discounts using loans provided by state banks. The offshore yuan strengthened. BBG

- The IEA lowered its outlook for crude demand growth this year amid an economic slowdown and mild weather in Europe. Still, annual consumption remains on track to reach a record of more than 103 million barrels a day. The agency kept its estimates for 2025. BBG

- The ECB is very likely to start cutting interest rates at its next policy meeting in June, Bank of France Governor Francois Villeroy de Galhau said. Barring surprise shocks, the ECB remains committed to bringing inflation to its 2% goal by next year from 2.4% currently, he said in an interview on RTL radio on Wednesday. BBG

- The Biden administration is encouraging Arab states to participate in a peacekeeping force that would deploy in Gaza once the war ends, in the hope of filling a vacuum in the strip until a credible Palestinian security apparatus is established. FT

- The Biden administration notified Congress on Tuesday that it was moving forward with more than $1 billion in new weapons deals for Israel, U.S. and congressional officials said, a massive arms package less than a week after the White House paused a shipment of bombs over a planned Israeli assault on Rafah. WSJ

- CPI: We expect a 0.28% increase in April core CPI (vs. 0.3% consensus), corresponding to a year-over-year rate of 3.61% (vs. 3.6% consensus); We think an upward pressure from Car Insurance, a neutral impact from health insurance, and see rent inflation slowing, while OER should remain strong. SPX implied moving into the event is 95bps. GIR

- A top official at the Federal Reserve said it was too soon to say that progress bringing down inflation had stalled and said it was appropriate for the Fed to hold rates steady as it awaits evidence that price pressures are easing further. “It’s too early to really conclude that we stalled out or that inflation is going to reverse,” said Cleveland Fed President Loretta Mester in an interview Tuesday. “I kind of always suspected that we wouldn’t be able to make as quick progress as we got in the second half last year.” WSJ

- Washington is increasingly concerned about Russia’s momentum in Ukraine, although the Pentagon still hopes that once American weapons begin arriving (around July), many of Moscow’s recent gains can be reversed. NYT

- Brazil’s President Luiz Inacio Lula da Silva fired Petrobras CEO Jean Paul Prates following a dispute over dividend payments. The government is proposing Magda Chambriard to replace him.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly higher following the momentum from the US where the major indices ultimately gained and the Nasdaq posted a fresh record close with two-way price action seen following PPI data. ASX 200 was led by the mining, materials and healthcare sectors, while participants also digested the recent budget announcement with the government planning to boost spending next year ahead of an election. Nikkei 225 gained but was well off today's best levels with newsflow dominated by earnings releases including from Sony and Sharp, while the Japanese megabanks are also scheduled to announce their results today. Shanghai Comp was pressured after the recent US tariff announcement and with Stock Connect trade shut owing to the holiday closure in Hong Kong, although the real estate industry found solace from news that China is mulling purchases of unsold homes to ease the glut.

Top Asian News

- PBoC conducted CNY 125bln (CNY 125bln maturing) in 1-year MLF with the rate kept unchanged at 2.50%.

- China mulls government purchases of millions of unsold homes from distressed developers at steep discounts to ease the glut, while Beijing is seeking feedback on the preliminary proposal, according to Bloomberg sources.

European bourses, Stoxx600 (+0.2%) are mostly firmer, continuing the positive sentiment seen in APAC trade overnight. European sectors hold a strong positive tilt; Real Estate is the clear outperformer, lifted by post-earning gains in Leg Immobilien (+2.9%). Basic Resources is lifted by broader strength in underlying metals prices. Consumer Products & Services is weighed on by losses in the Luxury sector, namely Burberry (-3.1%). US Equity Futures (ES U/C, NQ U/C, RTY +0.3%) are modestly firmer, attempting to build on the prior session’s advances, though still mindful of the upcoming US CPI & Retail Sales.

Top European News

- CB's Rehn says if the confidence that inflation is approaching its target in a sustainable manner continues to strengthen, the restrictiveness of monpol can be reduced.

- European Commission Forecasts (Spring 2024): A gradual expansion amid high geopolitical risks.

- Riksbank Minutes: Floden said "Monetary policy will remain contractionary even after a policy rate cut to 3.75 per cent. If these developments continue, it will therefore be appropriate to continue to cut the rate by a few more steps".

FX

- DXY has continued its descent below the 105 mark and is approaching its 100DMA at 104.78 ahead of today's US CPI & Retail Sales.

- EUR/USD is on firmer footing vs. USD and now above the 1.08 mark, with its 100DMA at 1.0822. EZ-specific updates have been non-incremental for today's session.

- GBP is a touch firmer vs. peers with nothing in the way of UK-specific drivers. As such, the dollar side of the equation will likely prove more pivotal. A dovish CPI print could see GBP/USD test the May high at 1.2634.

- Antipodeans are both performing well vs. the USD with some support seen after reports that China is mulling purchases of unsold homes to ease the glut; has helped prop up metals prices. AUD/USD has printed a new high for the month at 0.6651.

- A two-way reaction for the SEK post-CPI. Initially, EUR/SEK moved lower from 11.6760 to 11.6520 with the focus likely on the hot ex-energy M/M. However, this swiftly retraced with EUR/SEK surpassing pre-release levels and going as high as 11.7035 given the slight uptick in the headline Y/Y was less than expected.

Fixed Income

- USTs are firmer by a handful of ticks at a fresh WTD peak of 109-07+, with the complex continuing to build on the post-PPI gains; data which whilst is hawkish at first-glance, contained some softer components relevant to the US PCE.

- Gilts are the modest outperformer as the complex continues to pick up from Wednesday's PPI-induced downside, alongside broader fixed benchmarks, and as the dovish commentary from Pill remains the main development for the Gilt market in recent sessions. Gilts holding above 98.0 at a fresh WTD peak of 98.18.

- Bund price action is in-fitting with peers, but less-so than Gilts. Bunds are holding just above the 131.00 mark and matching the 131.13 double-top from Monday & Tuesday; price action was little reactive to the dual-tranche 30yr Bund auction, which was strong.

Commodities

- Crude is in the green with magnitudes comparable to equity performance as the complex appears to be following the overall risk tone and perhaps taking some impetus from USD downside into CPI. Brent July currently holds around USD 82.80/bbl, whilst WTI hovers USD 76.50.

- Gas benchmarks outperform after commentary from the QatarEnergy and TotalEnergies CEO around significant gas demand and there being no chance of a LNG surplus currently.

- Precious metals are supported given the cooler-take from PPI for CPI/PCE and after Chair Powell's comments on the readings. XAU around USD 2372/oz, just shy of last week's USD 2378/oz peak.

- Base metals are entirely in the green with sentiment lifted amid reports of further Chinese support measures.

- IEA OMR: cuts 2024 oil demand growth forecast by 140k BPD to 1.1mln BPD, 2025 demand expected to grow by 1.2mln BPD (vs. prev. forecast of 1.1mln BPD). 2024 demand forecast lowered due to weak deliveries, notably in Europe, shifted Q1 OECD demand into contraction. World oil supply to rise by 580k BPD in 2024 to a record 102.7mln BPD. Oil market looks more balanced in 2024. Even in the event that OPEC+ voluntary production cuts were to remain, global oil supply could rise by 1.8mln BPD in 2025 compared to the 580k BPD rise in 2024.

- US Energy Inventory Data (bbls): Crude -3.1mln (exp. -0.5mln), Cushing -0.6mln, Gasoline -1.3mln (exp. +0.5mln), Distillate +0.3mln (exp. +0.8mln).

- Explosion was reported after a drone attack at Russia's Rostov fuel depot, according to Russian agencies.

Geopolitics: Middle East

- A Hezbollah commander was killed in an Israeli airstrike targeting a car in southern Lebanon's Tyre, according to two Lebanese security sources cited by Reuters.

- Iraqi armed factions targeted an Israeli military target in Eilat with drones, according to Sky News Arabia.

- US President Biden would veto the Israeli bill on the floor this week, according to Punchbowl citing the White House. It was separately reported that the US State Department moved USD 1bln weapons aid for Israel to a congressional review process, according to a senior official cited by Reuters.

- Israel's Defence Minister Galliant set to to give security briefing to press at 16:00 BST/11:00ET.

Geopolitics: Other

- Ukrainian officials are making a new push to get the Biden administration to lift its ban on using US-made weapons to strike inside Russia, according to POLITICO.

- France and Netherlands seek EU sanctions on global financial institutions that help Russia's military, according to a proposal seen by Reuters.

- Russian President Putin said Russia and China are promoting the prosperity of both nations through expanded equal and mutually beneficial cooperation, as well as noted that Russian-Chinese economic ties have great prospects. Furthermore, Putin said China clearly understands the roots of the Ukraine crisis and its global geopolitical impact, while he is open to a dialogue on Ukraine, but added that such negotiations must take into account the interests of all countries involved in the conflict, including theirs, according to Xinhua.

- North Korean leader Kim oversaw a tactical missile weapon system on Tuesday, according to KCNA.

US Event Calendar

- 08:30: April CPI MoM, est. 0.4%, prior 0.4%

- 08:30: April CPI YoY, est. 3.4%, prior 3.5%

- 08:30: April CPI Ex Food and Energy MoM, est. 0.3%, prior 0.4%

- 08:30: April CPI Ex Food and Energy YoY, est. 3.6%, prior 3.8%

- 08:30: April Retail Sales Advance MoM, est. 0.4%, prior 0.7%

- 08:30: April Retail Sales Ex Auto MoM, est. 0.2%, prior 1.1%

- 08:30: April Retail Sales Control Group, est. 0.1%, prior 1.1%

- 08:30: May Empire Manufacturing, est. -10.0, prior -14.3

- 10:00: March Business Inventories, est. -0.1%, prior 0.4%

- 10:00: May NAHB Housing Market Index, est. 50, prior 51

- 16:00: March Total Net TIC Flows, prior $51.6b

DB's Jim Reid concludes the overnight wrap

Markets had been on course to continue their quiet holding pattern ahead of today's CPI but a late positive burst powered the S&P 500 (+0.48%) to within a whisker of its all-time high and the NASDAQ (+0.75%) to a new peak, while the 10yr treasury yield (-4.7bps) fell to its lowest level since the last CPI print on April 10. There weren’t obvious drivers, but perhaps the absence of bad news was enough to inject some relief into markets. Y esterday’s PPI data didn't really move the needle much with a notable beat balanced by some notable down revisions and some of the details being neutral for core PCE. So the focus will now shift to April's CPI after 3 upside surprises in a row for core CPI. Don't forget US retail sales as well, released at the same time.

For now at least, the Fed continue to stick to their recent message with Chair Powell yesterday saying that “we’ll need to be patient and let restrictive policy do its work”. So there was little acknowledgement that rate cuts were happening anytime soon, but Powell also didn’t dial up the hawkishness either. That narrative was supported by the PPI print for April, which was a distinctly mixed bag. On the negative side, headline PPI came in at a monthly +0.5% (vs. +0.3% expected), and the measure excluding food, energy and trade was also up +0.4% (vs. +0.2% expected). But in more positive news, the previous month’s headline PPI was revised down three-tenths to show a -0.1% decline. And on top of that, the components that feed into the Fed’s target measure of PCE were more neutral. For instance, portfolio management services were up +3.9%, but domestic airfares came down -4.7%.

For today, our US economists are expecting headline CPI to come in at +0.37%, and core CPI to be at +0.29%. The last three core CPI prints each came in at +0.4%, so this would be a deceleration. But even if those forecasts are realised, the 3m annualised rate for core CPI would still be running at +4.1%, so not the sort of territory where the Fed would ordinarily be cutting rates. For the year-on-year numbers, those forecasts would push the headline CPI rate down to 3.4%, and the core CPI rate to 3.6%. Click here for our US economists’ full preview, along with how to sign up for their webinar immediately afterwards.

Ahead of that, markets turned more upbeat yesterday, with the S&P 500 (+0.48%) closing within two tenths of a percent of its all-time high on March 28. Tech stocks outperformed, with the Magnificent 7 (+1.01%) reaching a new all-time high, led by Tesla (+3.29%) and Nvidia (+1.06%). But the equity rally was broad-based, with the small-cap Russell 2000 up +1.14%. The advance of the S&P 500 was earlier held back by several defensive sectors, with energy stocks (-0.13%) one of the weaker performers as Brent crude oil prices (-1.18%) closed at a 2-month low of $82.38/bbl. Meanwhile in Europe, the STOXX 600 (+0.15%) just about made it up to an all-time high, as the index posted an 8th consecutive advance for the first time since 2021.

The other notable story in the equity space came from several meme stocks, with GameStop up +60.1% on the day, building on its +74.4% advance on Monday. It's now up to $48.75 having traded as low as $10 in late April. Similarly, AMC Entertainment was up +31.98%, whilst Blackberry gained +11.94%.

For sovereign bonds, there was a divergent performance yesterday, with Treasuries rallying whilst most of Europe sold off. Yields on 10yr Treasuries fell by -4.7bps to 4.44%. By contrast, yields on 10yr bunds (+3.8bps), OATs (+3.9bps) and BTPs (+2.6bps) all moved a bit higher on the day. Those moves came in spite of comments from the ECB’s Knot that “June will be a good opportunity to make a first move in removing restriction”, which helped to cement the view that the ECB are moving towards a rate cut at their next meeting. In the UK, gilts saw a relative outperformance, with the 10yr yield down -0.1bps, which came as the unemployment rate ticked up a tenth to 4.3% over the three months to March. Moreover, BoE chief economist Pill sounded open to a rate cut, saying that it was “not unreasonable to believe that through the summer we will begin to see enough confidence in the decline in persistence that bank rate will come under consideration”.

In other news yesterday, we had confirmation that the US were imposing fresh tariffs on $18bn of Chinese imports, including steel and aluminium, semiconductors, and EVs. In fact, the t ariff on EVs will go up from 25% to 100%. Some of the new tariffs will take effect this year, but others won’t happen until 2026. The move comes ahead of November’s presidential election, but both parties have taken a much tougher stance on China over recent years, and Biden has kept most of Trump’s previous tariffs in place. Indeed, Trump himself said at a rally on Saturday that “I will put a 200% tax on every car that comes in from those plants”. So the direction has been towards a more protectionist stance on trade from both parties. Our China economist has written about the potential impact on the domestic macro landscape here.

Asian equity markets are mixed this morning with the Nikkei (+0.18%) and the S&P/ASX 200 (+0.47%) trading higher while Chinese markets are lagging with the CSI (-0.27%) and the Shanghai Composite (-0.17%) both trading slightly lower after the new US tariffs announced yesterday on an array of Chinese imports. Elsewhere, stock markets in South Korea and Hong Kong are shut for a public holiday. US equity futures are slightly higher with Treasuries fairly flat.

In monetary policy action, the PBOC kept the one-year medium-term lending facility (MLF) unchanged at 2.50%. This came despite weaker money supply numbers than expected overnight although Bloomberg are running a story suggesting China are working on a plan to buy up unsold homes to shore up the property sector. Moving ahead, markets will move their focus to China’s industrial production and retail sales data due on Friday.

Looking at yesterday’s other data, the German ZEW survey improved in May, with the expectations component up to 47.1 (vs. 46.4 expected), whilst the current situation reading moved up to -72.3 (vs. -75.9 expected). For the current situation that’s a 9-month high, and for the expectations component, that’s a 2-year high, which was last surpassed in February 2022.

To the day ahead now, and data releases include the US CPI report for April, along with retail sales for April and the NAHB’s housing market index for May. From central banks, we’ll hear from the ECB’s Rehn, Muller, Villeroy and Makhloufi, along with the Fed’s Kashkari and Bowman.

The Results Are In: Free Market Capitalism Improves Lives

Contrary to the drumbeat from political, media, and academic elites, capitalism improves the lives of ordinary people. Socialism receives favorable publicity but fails wherever it is implemented.

Fiscal Bazooka: China Considers Buying Millions Of Homes To Save Property Market

Fiscal Bazooka: China Considers Buying Millions Of Homes To Save Property Market

Tyler Durden

Wed, 05/15/2024 - 06:55

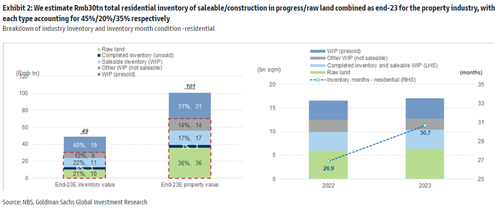

In April's politburo meeting, the Chinese government's newfound focus on an oversupplied housing market was setting the stage to usher in new rescue policies to stabilize the economy. Weeks later, Bloomberg reported that the government was considering a plan for local governments to purchase millions of unsold homes to clear the excess supply.

According to sources familiar with government discussions, the State Council requests feedback from various provinces and government entities on the home-buying plan.

Here's more color on the plan via Bloomberg:

Local state-owned enterprises would be asked to help purchase unsold homes from distressed developers at steep discounts using loans provided by state banks, according to two of the people. Many of the properties would then be converted into affordable housing.

Officials are still debating details of the plan and its feasibility, the people said, adding that it could take months to be finalized if China's leaders decide to go ahead. The housing ministry didn't respond to a request for comment.

In a note earlier, Goldman's Peter Sheren told clients that this news is nothing new and "has been speculated for 3-4 weeks."

"This was one of the initial catalysts for the China Property Sector (GSXACNRE) to rally 21% in the past month," Sheren said.

Housing prices in China have already fallen 25-30% from the peak and presented a dark cloud of economic uncertainty over China's financial system stability and continued risk for China's macroeconomic backdrop. If authorities do proceed with the plan, in a separate note, Goldman's Wang Yi believes "this new initiative might help to stabilize housing prices."

Here's more commentary from Goldamn's Sheren this morning:

"Wang Yi and team think if the coming measures focus on clearing "saleable inventory" (which includes both completed and uncompleted but unsold units, and that are less than 3 years of last year sales volume) or about 1/4 of the entire inventory backlog, property price stabilization might be achievable.

"Wang Yi estimates that there was Rmb30tn (US$4tn) in residential inventory by end-2023. If fully built-up, this will be about 10X what the market sold in 2023, or 1/4 of total housing stock as of end-2023. The required capital investment for completing such inventory could be 5X the construction CAPEX in 2023."

In terms of what's needed in this fiscal bazooka to bottom China's ailing residential housing market, Shujin Chen, head of China financial and property research at Jefferies Financial Group, estimated at least 2 trillion yuan ($277 billion).

Bloomberg Economics pointed out that the property sector "is unlikely to stabilize until the gap between housing supply and demand closes."

Government data shows that about 3.6 billion square feet of unsold housing inventory linger on the market, the highest level since 2016.

Meanwhile, Tianfeng Securities estimates the new plan could cost 7 trillion yuan to absorb the inventory in 18 months.

One major problem local governments face in reducing the housing surplus is the need to increase debt levels. Banks would also face mounting pressure as rising bad loans and contracting margins have weakened their balance sheets.

From a market perspective, this is terrific news, as the CSI 300 Real Estate Index initially jumped 5% after the report.

However, deep, alarming structural problems persist in the world's second-largest economy.

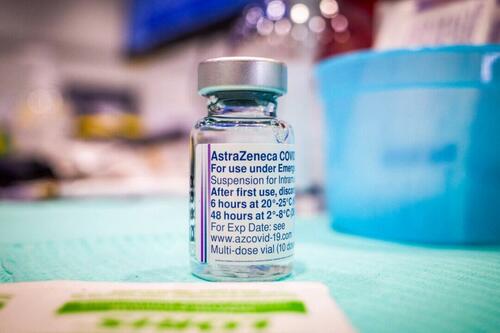

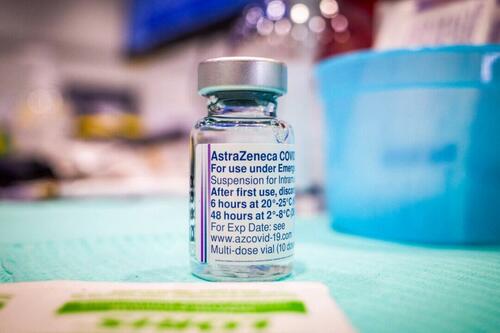

"They Left Us No Choice": Woman With Vaccine Injury In Clinical Trial Sues AstraZeneca

"They Left Us No Choice": Woman With Vaccine Injury In Clinical Trial Sues AstraZeneca

A vial of AstraZeneca vaccine is seen at a mass COVID-19 vaccination clinic in Calgary, Alta., on April 22, 2021. (The Canadian Press/Jeff McIntosh)

A vial of AstraZeneca vaccine is seen at a mass COVID-19 vaccination clinic in Calgary, Alta., on April 22, 2021. (The Canadian Press/Jeff McIntosh)

Brianne Dressen in New York on Jan. 6, 2023. (Jack Wang/The Epoch Times)

Tyler Durden

Wed, 05/15/2024 - 06:30

Brianne Dressen in New York on Jan. 6, 2023. (Jack Wang/The Epoch Times)

Tyler Durden

Wed, 05/15/2024 - 06:30

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

A vial of AstraZeneca vaccine is seen at a mass COVID-19 vaccination clinic in Calgary, Alta., on April 22, 2021. (The Canadian Press/Jeff McIntosh)

A vial of AstraZeneca vaccine is seen at a mass COVID-19 vaccination clinic in Calgary, Alta., on April 22, 2021. (The Canadian Press/Jeff McIntosh)

An American woman who suffered an injury from AstraZeneca’s COVID-19 vaccine sued the company on May 13, alleging the company breached a contract by not paying for the medical care she requires to deal with the injury.

“They left us no choice,” Brianne Dressen, a preschool teacher in Utah, told The Epoch Times in an email.

Ms. Dressen has paid tens of thousands of dollars to drugs to treat the nervous system disorder and other issues she’s experiencing, according to the complaint, filed in federal court in her home state.

Ms. Dressen chose to participate in AstraZeneca’s clinical trial in 2020 because she wanted to help the company develop its COVID-19 vaccine. The consent form she signed stated in part that AstraZeneca would “cover the costs of research injuries” and “pay the costs of medical treatment.”

“With these reassurances should something go wrong, Bri signed the form, rolled up her sleeve, and let the drug company inject the experimental product into her arm. Her mind was at peace, as Bri believed she was doing the right thing for her country, her students, and her family,” the suit states.

Ms. Dressen soon started experiencing problems, including blurred vision, tinnitus, and vomiting. She later became extremely sensitive to light and suffered spikes in her heart rate.

Ms. Dressen went to see numerous doctors as she attempted to figure out what was wrong with her, and seek treatment.

In 2021, U.S. National Institutes of Health doctors diagnosed Ms. Dressen as having “post-vaccine neuropathy,” according to records reviewed by The Epoch Times.

Bills for the doctors’ visits and drugs they prescribed began piling up quickly. The immunoglobulin recommended by government doctors alone costs $9,909.82 a month.

Ms. Dressen and her husband, a chemist with the U.S. Army, kept AstraZeneca and Velocity, which ran the trial for the company, apprised of the accumulating costs, according to the suit.

The family messaged Velocity on Jan. 15, 2021, with the first set of payment records for treatment but received no response, according to the suit. “Checking on updates for this. . . . When may we expect payment?” Brian Dressen, Ms. Dressen’s husband, wrote several weeks later.

“I am sorry you have not heard anything as of yet. Hopefully I get an answers [sic] soon. I will reach out again today,” a Velocity official responded.

No funds came to the family, forcing them to refinance their home.

“I’d like to know when we can expect the first payment on Brianne Dressen’s medical bills? Two months since submitting...“ Mr. Dressen wrote on March 18, 2021. The Velocity official said that she was ”forwarding on” the payment records.

“Hey this is Brianne Dressen. Can you advocate a bit for us here help us get a timeline for payment? I am still not doing well, we have had to hire for after school childcare. We really need this money,“ Ms. Dressen wrote on March 24, 2021. The official said the following day she would be escalating the issue and did not understand ”why it is taking so long.”

The back-and-forth continued for months with no reimbursement paid to Ms. Dressen.

Brianne Dressen in New York on Jan. 6, 2023. (Jack Wang/The Epoch Times)

Brianne Dressen in New York on Jan. 6, 2023. (Jack Wang/The Epoch Times)

After a local television station reported on Ms. Dressen’s case on July 13, 2021, Velocity contacted the Dressens and said a payment of $590.20 was forthcoming.

The company issued the payment and said it was in touch with AstraZeneca regarding the approval of additional funds.

In December 2021, the official sent a statement for Ms. Dressen to sign that said in part that Ms. Dressen would accept $1,243 in exchange for dropping any additional claims to payment.

The Dressens declined the offer, describing it as insulting.

In March 2022, AstraZeneca representatives began directly contacting the Dressens, requesting billing and medical records.

One representative wrote on Aug. 12, 2022, that the company was waiting on medical records from providers to assess the claims. The representative said on Sept. 26, 2022, that all of the medical records had been received.

AstraZeneca and Velocity never contacted the Dressens again, according to the suit.

“I did everything they asked of me. I honored my obligations to them. They have not honored any. When they needed me, I was there, I cooperated. When I needed them, they were nowhere to be found,” Ms. Dressen said in a statement.

The suit acknowledges that COVID-19 vaccines are and were covered by the Public Readiness and Emergency Preparedness Act, which gives manufacturers immunity to liability in most cases. The suit accuses the companies of breach of contract and breach of duty. It asks for damages for medical expenses, emotional fallout, loss of income, and other expenses, as well as attorney fees and prejudgment interest.

Ms. Dressen is seeking a jury trial.

Velocity did not respond to a request for comment. AstraZeneca did not return an inquiry.

AstraZeneca’s vaccine was never cleared for use outside clinical trials in the United States.

The UK-based company announced earlier this month it is withdrawing the vaccine, citing limited demand. The announcement came several months after it acknowledged the shot can cause blood clots and low levels of platelets, a combination known as thrombosis with thrombocytopenia syndrome.

Johnson & Johnson’s shot, which was cleared in the United States and also causes the syndrome, was pulled from the market in 2023.

Bishop Peiris, theologian and promoter of social sciences, has died

After leading the National Seminary he had been auxiliary of Colombo and secretary of the Episcopal Conference. He is credited with founding the magazine Living Faith for the country's clergy and religious. Sr. Deepa Fernando: "He encouraged us sisters to deepen our studies in economics and political science.

Economy trumps freedoms as Emir launches new government and 'freezes' Parliament

The 83-year-old Meshal al-Ahmad al-Jaber al-Sabah has given the green light to the new executive. He suspended the assembly (only two precedents in 1976 and 1986) and parts of the Constitution. Behind the decision is the clash between the leadership and the 'pro-Islamist' opposition. Analysts and activists fear an authoritarian drift, priority to the issues of 'national development and stability'.

Should You Believe Faulty U.S. Crime Stats Or Your Own Lying Eyes?

Should You Believe Faulty U.S. Crime Stats Or Your Own Lying Eyes?

Tyler Durden

Wed, 05/15/2024 - 05:45

Authored by James Varney via RealClearInvestigations,

Americans can be forgiven for suffering from whiplash regarding law and order.

In recent weeks the Biden administration and many news outlets, including USA Today and The Hill, have touted declines in violent crime statistics to argue that America is becoming a safer place.

“Right now, with 2023 figures and early 2024, the trends are all pointing down, in a positive direction,” Jeff Asher, whose New Orleans-based AH Datalytics is developing his own “Real-Time Crime Index,” told RealClearInvestigations.

Conservative outlets, including City Journal and the editorial page of the Wall Street Journal, assert that minor declines in headline grabbers like homicides fail to capture what is really happening in the U.S.

From 2017 to 2019, the U.S. had an average of 16,641 homicides a year. In 2021 and 2022, however, the country saw considerably more bloodshed, with an average of more than 22,000 annual homicides. Even if the 2023 number drops slightly, it will still represent a large increase over the recent past, before the pandemic and racial upheaval set in motion in 2020.

Many criminologists say this illlustrates one of the problems with the official numbers that are at the center of public debate: They give a distorted impression of true levels of crime. They note that crime stats have become notoriously incomplete in recent years. In some years many big cities did not report their numbers to the FBI, and there are such wide discrepancies in these tallies that the picture they provide has more blur than clarity.

Declining arrest rates and slowing police response times to 911 calls also help explain why polls show Americans believe crime is rising. The experts say the numbers only give some sense of lawbreaking, while most Americans – the vast majority of whom are not crime victims in a given year – are influenced by their largely media-driven perception of whether society feels orderly.

“There are social media videos of people walking into a CVS and walking out with a shopping cart full and there seems to be no consequences – that’s part of the problem,” said Jay Town, former U.S. Attorney for the Northern District of Alabama. “And then you have people arrested a dozen times and they’re out with no bail. There are no consequences, and thus there are more criminals in the street.”

Americans may fall back on such perceptions in part because the official reports are incomplete and rife with error. “I don’t think with any crime statistics we can ever be precise,” said Asher.

For decades, the traditional gold standard for criminologists was the FBI’s Uniform Crime Reports, annual compilations by the Bureau of stats provided to it by state and local law enforcement agencies. The FBI’s data, which currently show declines in several criminal categories, especially homicide, provide the basis for many of the stories arguing that, in terms of crime, the U.S. situation is improving.

But the FBI statistics aren't what they used to be, according to several criminologists who pointed to gaps in coverage and apparent errors. The problem began in 1988 when the bureau began to move toward a complex new system of reporting – the National Incident-Based Reporting System (NIBRS). It promised to provide more comprehensive detail and enable authorities to pinpoint high-crime areas, criminals, and victims more accurately.

But the transition proved to be a herculean task, so much so that the FBI allowed departments to delay their full adherence to the program even after the feds doled out $120 million to agencies to assist with compliance. Still, in 2020, 2021 and 2022, either all or some of the biggest police forces in the U.S. -- New York City, Chicago and Los Angeles -- did not provide data.

There have also been problems with the data that was submitted, including the news in 2022 of major problems with the St. Louis Police Department data, and more recent revelations that figures for sexual crimes provided by the New Orleans Police Department were wrong.

In Baltimore, the Police Department and various news reports put the total for 2022 homicides between 332 and 336, but the FBI’s dataset puts the number at 272. Baltimore police officials did not reply to RCI’s inquiries about the wide spread in the reported numbers, and if anyone in the city’s police department had brought the matter to the FBI’s attention.

The Baltimore department acknowledges its numbers may not be the same as those it submits to the FBI, but states on its website that “any comparisons are strictly prohibited.”

Similarly, the police departments in Milwaukee and Nashville did not respond to questions about divergences between their stats on robberies and those from the federal bureau. Milwaukee police reported a 7 percent increase in robberies in 2023, but the FBI recorded a 13 percent decline.

An FBI spokesperson told RCI, “It is the responsibility of each state UCR [Uniform Crime Reports] program or contributing law enforcement agency to submit accurate statistics and correct existing data that are in error.”

Criminologists cite other discrepancies in the official measurements they use to assess the situation. While FBI stats show declines in violent categories, the Department of Justice’s survey reports more people saying they have been victims of such crimes. The Centers for Disease Control figures for homicides, which have long moved in the same direction as the FBI’s, started exceeding the FBI’s in 2020 and the gap has widened since then.

“I wouldn’t say the FBI is cooking the books, but that the data they are putting out is half-baked,” said Sean Kennedy, the executive director of the Coalition for Law, Order and Security, which has pushed back against recent media reports that crime is falling noticeably in the U.S.

“So it’s not a conspiracy but a rush job, and it’s giving people a false picture,” he told RCI. “They infer something is true, and then because it’s politically expedient they don’t bother correcting it.”

A Sharp Decline in Arrests

Some criminologists say there is another, hidden dynamic within the crime statistics that helps explain why most Americans think crime is on the rise – the dramatic decline in arrests. Scouring FBI data, John Lott, the founder of the Crime Prevention Research Center, found that arrests for reported violent crimes in major cities fell 20 percent in 2022, from 42.5 percent in 2019 – the year before the COVID pandemic and BLM protests in response to George Floyd’s death while in police custody.

The percentage of murder and rapes cleared by arrests fell to 40.6 percent from 67.3 percent in those years; for rapes from 33.8 percent to 17.4 percent, and arrests for reported property crimes in major cities dropped to 4.5 percent in 2022 from 11.6 percent in 2019.

It is not clear how much of this decline is due to reductions in the size of many departments – New Orleans, for example, reportedly lost 20% of its force between 2020 and 2022.

“There are lots of issues here, and I’m in disbelief about some of them,” said Lott. “It’s mind-boggling to me – we already know many crimes have always been underreported and now it seems to be, ‘Why bother reporting a property crime’ to the police? The bottom line is our law enforcement system seems in some ways to be falling apart, especially in the big cities.”

Calling the Cops ... and Then Waiting

The plummeting arrest rates contribute to the general sense of lawlessness, a feeling compounded by surging increases in response times to calls. Comparing data for 15 law enforcement agencies from 2019-2022, Asher found only one city – Cincinnati – that reduced its response time, and that by 0.7 minutes. In New Orleans, the average response time nearly doubled, from 50.8 to 145.8 minutes, while Nashville saw a rise from 44.2 minutes to 73.8 minutes and New York City a 33-minute increase.

Some cities are even worse.

“If it’s not a shooting or a stabbing we’re up to about two hours for responding to property calls,” Jared Wilson, president of the San Diego Police Officers Association, told RCI. “As a result, we’ve seen a significant problem with reporting of crime right now.”

Wilson said auto thefts better capture the state of crime and perceptions of it: As thefts of essential registered property, they tend to be reported. In San Diego, Wilson said, those have risen year-to-year, with a whopping 27% jump in 2021, all of which contribute to people’s perception of increased criminal activity.

Betsy Branter Smith, a retired cop and spokeswoman for the National Police Association, said such issues contribute to a deteriorating relationship between citizens and the police. That unraveling, along with increasing hostility between police departments and district attorneys in some big cities like Philadelphia and Los Angeles, has made some cops less pro-active on the job.

“It’s not so much hostility’’ toward cops, but frustration and resignation,” she said. “It’s time-consuming to be a crime victim, and if prosecutors aren’t going to do anything, why report it?”

Smith said many police officers, in turn, are frustrated by bail reform and other efforts that put many alleged lawbreakers back on the streets quickly. Yes, she said , many officers have almost certainly become less pro-active. “We know it, we see it. It’s a sad state of affairs for law enforcement. Cops represent the government, basically, and we’re losing faith in the government we’re supposed to represent.”

Then there is media coverage. Although “if it bleeds, it leads” journalism is not new, the steady flow of stories in traditional and social media of mass shootings, smash-and-grab crime sprees, cops beaten on the streets of Manhattan and young women punched in the face for no apparent reason spawn a sense of disorder. So too do migrants pouring across the southern border, students taking over campus quads, squatters commandeering other people’s homes, the rise of homeless encampments and open-air drug use in several major cities.

“There is this tension there - this reality of visible signs of lawlessness and disorder that generate a feeling of unease,” said Rafael Mangual, a fellow at the Manhattan Institute of Policy Research.

Asher agreed: “People are inundated by pictures of lawlessness and there’s no doubt that contributes to a lack of a full awareness among Americans about what might actually be happening.”

Stimulus Today Costs Dearly Tomorrow

Since the pandemic-related bazooka of fiscal stimulus, the outstanding Federal debt has risen appreciably. In nominal dollar terms, the recent debt surge is mindboggling. However, the increase is on par with the government’s negligent ways over the last fifty years.

The red bars show the percentage increase in debt starting in 1966. The bars reset to zero every time they hit 50%. The numbers to the left of each series of bars correspond to the number of quarters it took for every 50% increase.

Over the last sixteen quarters, 2020 through 2023, the outstanding federal debt has risen by 46%. Of the 11 times the debt has increased by 50% since 1966, five occurred over 15 quarters or less.

That said, the repercussions of relying on stimulus for economic growth and growing debt faster than the ability to pay for it have significant economic consequences. The recent surge in debt will only further handicap our economy and prosperity in the future.

There are predominantly two ways our growing debt load negatively impacts economic growth, as we will share.

#1 Manipulated Interest Rates Cripple Capitalism

Growing debt faster than one’s income is a Ponzi scheme. No matter how politicians sugarcoat fiscal stimulus, there are no two ways around such a characterization. Individuals and corporations that run such a scheme ultimately end up bankrupt. The same holds for governments, but they tend to have much longer runways.

The Federal Reserve allows the government to perpetuate its Ponzi scheme. The Fed keeps borrowing costs lower than they should be through lower-than-market interest rates and asset purchases.

Not only is the growing ratio of debt to income problematic, but it is also a sure sign that the debt in aggregate is used for unproductive purposes. In other words, the debt costs more than the financial benefits it provides. If it were productive debt, income or GDP would rise more than the debt.

In the long run, unproductive debt reduces a nation’s productivity, aka economic potential.

Negative Real Rates And QE

A lender or investor should never accept a yield below the inflation rate. If they do, the loan or investment will reduce their purchasing power.

Regardless of what should happen in an economics classroom, the Fed has forced a negative real rate regime upon lenders and investors for the better part of the last 20+ years. The graph below shows the real Fed Funds rate (black). This is Fed Funds less CPI. The gray area shows the percentage of time over running five-year periods in which real Fed Funds were negative. Negative real Fed Funds have become the rule, not the exception.

Starting in 2008, with QE, the Fed began using its balance sheet to manipulate interest rates further. Currently, the Fed holds $8 trillion in Treasury and mortgage-backed securities. Their Treasury holdings account for almost 25% of all Treasury securities outstanding to the public.

By reducing the supply of bonds on the market, they effectively lower interest rates below where the free market would price them. This makes fiscal stimulus more appetizing for politicians and, by default, encourages even greater federal debt loads.

Like the Fed’s negative real rate interest rate policy, QE also reduces interest rates, allowing for more unproductive federal and private sector debt.

#2 Negative Multiplier

As we note, debt increasing faster than economic growth proves that borrowing and spending are unproductive. Unproductive government debt or private sector debt also results in a negative economic multiplier. Essentially, the ultimate expense of the debt outstrips its benefits over the long run.

Economists define the multiplier effect as the change in income divided by the change in spending. Over an extended period, if the change in spending is more significant than the change in income, the effect of said spending is negative. Replace GDP for income and government debt for spending to compute the government’s spending multiplier.

Multiplier = Change Income / Change Spending

Government Multiplier = Change GDP / Change Debt Outstanding

To help appreciate the negative multiplier, let’s consider the two rounds of stimulus checks sent to the public during the pandemic. Consumers and businesses spent a large percentage of the funds on goods or services that no longer provide economic benefit. The initial result of the direct stimulus was a massive boost to economic activity. Three to four years later, the economic growth spurt is finished, and the debt and its annual interest costs remain. The interest on the debt is capital that will not be put to productive use.

Yesterday’s tailwind is slowly becoming tomorrow’s headwind.

There are other economic considerations as well.

Ricardian Equivalence

This economic theory states that when individuals anticipate tax increases to finance current and future government spending, they increase their savings to offset the expected tax burden. Therefore, any increase in government spending financed by debt may not stimulate consumption and investment, potentially resulting in a negative multiplier effect.

Crowding Out

High levels of government borrowing can lead to crowding out of private investment. This occurs when government borrowing forces higher interest rates, making it more expensive for businesses and individuals to borrow for investment. Further, as banks are asked to hold more government debt, they have less ability to lend to the private sector. Consequently, private investment, likely to be more productive than government spending, may decline.

Capitalism Is Eroding

The graph below shows why capitalism matters. It plots the Heritage Foundation’s Index of Economic Freedom, a measure of capitalism, versus the average family wealth for 137 countries. As shown, economic freedom and wealth have a strong positive correlation.

With that relationship in mind, government spending is a key component of the economic freedom index. Massive government stimulus spending reduces our index score. Further, while not a part of the score, manipulation of free market interest rates also detracts from the benefits of capitalism. As our index score falls, denoting the retreat from capitalism, so does our wealth.

Summary

Nothing is free, it’s just a question of how it’s paid for. While the government spends like there is no tomorrow and the Fed does everything in its power to help them, we must understand that the longer-term consequences of their actions are weaker economic growth and growing wealth disparity, as we discuss in Fed Policies Turn The Wealth Gap Into A Chasm. To wit:

QE may have served as an emergency way to add bank reserves to the system and boost confidence. However, its continued use, even during economic prosperity periods, only makes the wealth gap wider.

We should take the matter personally because, as we have shown, there is a strong link between government borrowing and our prosperity. While the cost of deficits may not be higher taxes, it does show up invisibly in lesser wages and wealth than we otherwise could attain. Any wonder why millennials are on track to be the first generation to fail to exceed their parents in income?

The post Stimulus Today Costs Dearly Tomorrow appeared first on RIA.

What should a Catholic think about the Israeli Palestinian conflict?

Obviously both parties are by and large proceeding from a world-view drawn from false religious premises. The level of falsity differs greatly between the two but proximity to the truth does not necessarily make an error less problematic, often the reverse. Unlike other disputes between states, one is faced in this case with the oddity […]

The post What should a Catholic think about the Israeli Palestinian conflict? appeared first on Voice of the Family.

G K Chesterton, Joan of Arc and the merry month of May

“Bowing down in blind credulity, as is my custom, before mere authority and the tradition of the elders, superstitiously swallowing a story I could not test at the time by experiment or private judgment, I am firmly of opinion that I was born on the 29th of May, 1874, on Campden Hill, Kensington.”1 It is […]

The post G K Chesterton, Joan of Arc and the merry month of May appeared first on Voice of the Family.

Keeping the commandments: sermon on Pentecost Sunday

“If anyone love me, he will keep my word.” From this Sunday’s epistle, we can see that even before the coming of the Holy Spirit upon the Church, there was already a feast called Pentecost. What did this Old Testament feast of Pentecost celebrate? Among other things, it was the day when the Jews commemorated […]

The post Keeping the commandments: sermon on Pentecost Sunday appeared first on Voice of the Family.

Circus Degeneracy, The European Way

Many of you probably don’t know the Eurovision contest. It is, or it was, a European competition with a system ( if I understand it correctly) of both viewers and “jurors” vote. This contest has – many years ago already – degenerated into a freak show, where the most astonishing nutcases try to get the […]

It’s Time to Double Down on Casti Connubii

Legendary mutual fund manager Peter Lynch teaches that investors should “let their winners pay for their losers.” In other words, hold on to companies that show good financials and reasonable prospects for growth, regardless of the share price. If you see a stock go up 20-30 percent, don’t necessarily conclude that it’s time to sell. You have to forget about the price and reexamine the…

Fourteen Years a Priest

Cum his qui oderant pacem, eram pacificus.—Psalm 119:7. Today is the 14th anniversary of my ordination to the priesthood. I am often reminded there is only One High Priest, Jesus Christ. We ministerial priests share in that priesthood both ontologically and by suffering as Christ suffered. The above picture was taken before or after a [...]

Rail Union Warns German Train System Turning Into "Battleground" Thanks To Male Migrants

Rail Union Warns German Train System Turning Into "Battleground" Thanks To Male Migrants

Tyler Durden

Wed, 05/15/2024 - 05:00

Authored by Paul Joseph Watson via Modernity.news,

The head of a German rail union warns that the country’s train system is turning into a “battleground” thanks to a wave of violence and intimidation being unleashed by male asylum seekers against female staff.

In an interview with Focus Online, Steffi Recknagel, the head of the Railway and Transport Union (EVG) in Thuringia, says that the average day is “sometimes life-threatening” for employees due to the sheer amount of abuse being dished out by migrants.

“I have an average of three employees sitting in my Erfurt office every week for legal advice. They were attacked, spat on, insulted, threatened or pushed,” said Recknagel, adding that female employees are being slapped, kicked, spat at and threatened with being stabbed by the ‘refugees’.

“The worst case was that a train attendant was threatened with a knife,” said Recknagel, adding that another was physically attacked from behind and “the air was knocked out of her.”

The union boss said that one stretch of the network was particularly bad, specifically the one frequented by Syrian, Afghan, and Turkish migrants from the local asylum center.

“I drive the Erfurt-Suhl route every day,” said Recknagel.

“And unfortunately, I have to say it like this: It is mostly young men from the initial reception center who misbehave completely on our trains. They always travel in groups and feel strong together.”

Instead of intervening when the migrants engage in violent or threatening behavior towards other passengers, train staff look the other way or even run and hide in locked compartments to avoid becoming the next victim.

“Our people are afraid, very afraid. We have employees who say: If these groups are on the train, then I won’t check tickets. Then, they say they’ll stay at the front with the train driver or lock themselves in their cabin until they get to a safe station and they get out,” said Recknagel.

She noted that nothing ever happens to the migrants who behave in such a manner, with the police largely powerless to step in.

A four page letter sent to Thuringia Prime Minister Bodo Ramelow (Left Party) complains that female workers have been subjected to “sexist insults and spit on in a disgusting manner,” which includes migrants flashing their genitals.

The letter notes that the chaos is almost entirely the responsibility of “people with a migration background,” including one incident where rival migrants fought a running battle, leaving an entire train compartment covered in blood.

“Our colleague had to continue the journey to the Suhl train station in fear of death and with a railcar that was heavily contaminated with human blood,” states the letter. “We don’t need to talk at this point about the psychological consequences for our still very young colleague and the passengers, given the scenes that could have come from a civil war zone!”

The letter goes on to vent fury about how Germans are being told to embrace “tolerance towards migrants” while being violently attacked by migrants.

“How can you expect citizens of this country to be open to the refugee policy that is being practiced when it happens — practically every day, and not just on public transport! — that we have to witness such violence, brutalization and absolute contempt for our laws and society?”

The Alternative for Germany (AfD), the country’s leading anti-mass migration party which the establishment is trying to ban, responded to the story by asserting, “The railway and transport union in Thuringia is sounding the alarm: Train attendants and railway employees are regularly attacked, spat on, insulted, threatened or beaten.”

As we recently highlighted, foreign migrant suspects are responsible for nearly 6 in 10 violent crimes in Germany according to new figures released by the federal government.

Despite comprising roughly 14.6 per cent of the population, foreign migrants were responsible for 58.5 per cent of all violent crimes.

* * *

Your support is crucial in helping us defeat mass censorship. Please consider donating via Locals or check out our unique merch. Follow us on X @ModernityNews.

The Cultural Relevance of Intelligent Design

On Saturday, May 4, 2024, devout Christian, noted philosopher of science, and prominent proponent of Intelligent Design (ID) Dr. Stephen C. Meyer appeared on Piers Morgan Uncensored, in an episode titled “Can This Man PROVE That God Exists? Piers Morgan vs Stephen Meyer” (more about this interview below). In July of 2023, Meyer also appeared on arguably the most popular podcast in the world…

Emergency Blackouts Introduced Across Ukraine As Temperatures Dip

Emergency Blackouts Introduced Across Ukraine As Temperatures Dip

Tyler Durden

Wed, 05/15/2024 - 04:15

Following several weeks of stepped-up Russian aerial attacks which have pummeled Ukraine's energy and electrical grid, state power operator Ukrenergo on Tuesday announced that rolling emergency blackouts have gone into effect across the country.

It comes amid a drop in temperatures which has served to further strain the grid. "From 21:00 to 24:00 (1800-2100 GMT), Ukrenergo is forced to introduce controlled emergency shutdowns in all regions of Ukraine," it stated on Telegram.

"The reason for this is a significant shortage of electricity in the system as a result of Russian strikes and increased consumption due to a cold snap," Ukrenergo added.

The Kiev region has for example seen the temperature drop into the 40s this week, and during the day has been in the 50s.

While likely there's been greater impact in harder hit parts of the war-ravaged country, especially in the east and south, the capital of Kiev saw at least 10% of households get disconnected Tuesday.

Reuters described that "Footage shared on social media from the western city of Lviv showed buildings in complete darkness in the city center and street lights switched off."

International report have further indicated blackouts hit Kharkiv and Donetsk and many other places, with predictions of increased disruptions throughout the late evening hours. Currently fighting is heaviest in these oblasts, and Russian forces are trying to establish a 10km deep buffer zone along the border in Kharkiv region.

The below video shows an area of Lviv in complete darkness as cars travel through the city center...

After massive attacks in Ukraine, there is a shortage of electricity power, outages are occurring and emergency schedules are being introduced

▪️In the video, the Lviv Center is without light, the traffic lights are not working.

▪️In Lviv, Sumy, Volyn and Ivano-Frankivsk… pic.twitter.com/vViHJzl868

Authorities are scrambling to find any way possible to meet demand:

Ukraine plans record electricity imports from five European countries on Monday after reporting significant energy infrastructure damage from Russian strikes, the energy ministry said.

Imports are expected to rise to 19,484 megawatt hours (Mwh), beating the record of 18,649 Mwh at the end of March after the first wave of Russian attacks on Ukraine's energy sector.

Ukraine forces have been keeping up their cross-border mortar and drone attacks, especially targeting Russia's own energy depots and oil facilities. Putin has vowed to hit back, and Russian strikes on Ukrainian cities have increased over the last month.

The return of the USSR in Russian government

The appointment at the Ministry of Defence in Moscow of the economist Belousov (master of ceremonies of the Orthodox Church) in place of Šojgu seems to indicate a willingness to make the war industry the main engine of increasingly protracted conflicts. While the new energy minister - on whose activities 70% of Russia's GDP depends - is now Sergei Tsivilev, husband of Putin's niece.