A civilization inspired by a consumerist, anti-birth mentality is not and cannot ever be a civilization of love.

All

Philippine Bishops urge prayers for peace in the South China Sea

Bishop Pablo Virgilio David, who chairs the Bishops' Conference, calls on faithful to 'accompany" the civilian supply mission promoted by the Atin Ito Coalition NGO. About 200 volunteers, 100 fishermen, and five boats evaded China's naval blockade reaching the disputed Scarborough Shoal.

US Housing Starts/Permits Ugly In April After Huge Revisions

US Housing Starts/Permits Ugly In April After Huge Revisions

Tyler Durden

Thu, 05/16/2024 - 08:52

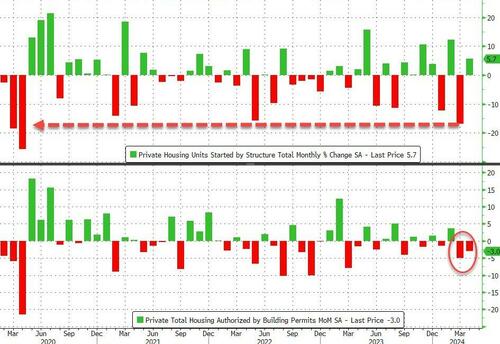

Despite a plunge in sentiment and soaring mortgage rates, analysts expected Starts and Permits to increase in April.

They were half right, but both missed bigly - as Starts rose 5.7% MoM (below the +7.6% exp), up from a downwardly revised 16.8% plunge in March; Permits dropped 3.0% MoM (well below the +0.9% exp), but better than the downwardly revised 5.0% drop in March.

Source: Bloomberg

The downward revision for March meant it saw the largest MoM drop since COVID lockdowns.

Single- and Multi-Family Permits both dropped in April (-0.8% and -9.1% respectively) while Rental Unit Starts surged 31.4% MoM...

Source: Bloomberg

The Multifamily start jump was off COVID lockdown lows...

-

Single family permits down to 976K SAAR from 984K and the lowest since August

-

Multifamily permits down to 408K SAAR from 449K and the lowest since Oct 2020

Finally, just what will homebuilders do now that expectations for 2024 rate-cuts have collapsed?

Source: Bloomberg

The number of completed single-family homes climbed to a 1.09 million annualized rate, the most since November 2022. That may explain the softer advance in new groundbreaking activity... but construction employment is at record highs?

Source: Bloomberg

One thing is for sure, a surge in mortgage rates back above 7% chilled homebuilder sentiment dramatically...

Source: Bloomberg

Is Powell trying to engineer a slow motion crash in housing to lower OER and this CPI?

Jobless Claims Decline After Last Week's Big Surge Amid New York Chaos

Jobless Claims Decline After Last Week's Big Surge Amid New York Chaos

Tyler Durden

Thu, 05/16/2024 - 08:38

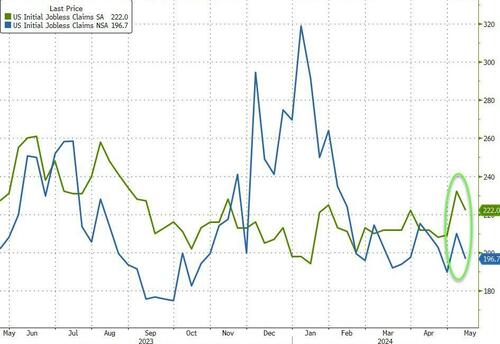

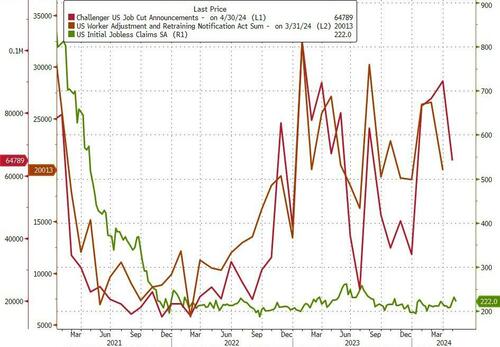

After the prior week's big surprise jump in jobless claims, analysts expect a decline this week back into the lowest-in-forty-years range once again... and they were right as 222,000 Americans filed for jobless benefits for the first time last week (down from a revised 232k the prior week)...

Source: Bloomberg

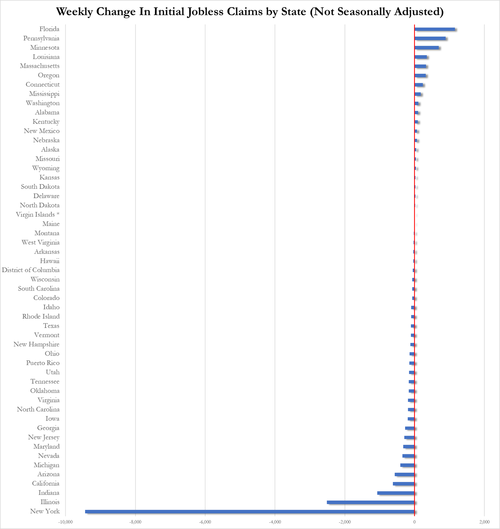

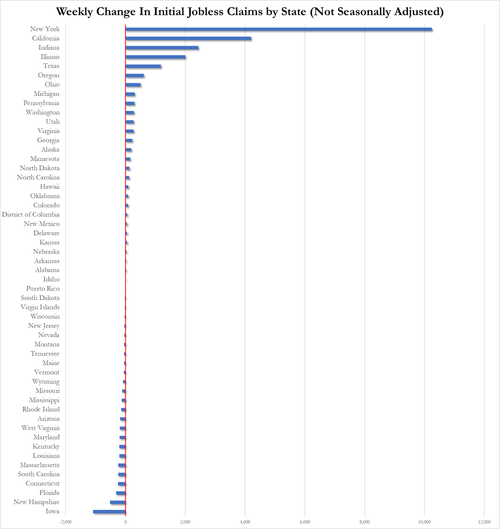

This week saw claims plunge in New York...

...reversing the prior week's massive surge in New York...

How does anyone believe these numbers?

Continuing claims remained glued around the 1.8mm range (1.794mm - slightly above 1.78mm exp)...

Source: Bloomberg

The BLS data remains completely decoupled from reality still...

Source: Bloomberg

Will this all change in November (depending who wins?)

CME Plans To Launch Spot Bitcoin Trading

CME Plans To Launch Spot Bitcoin Trading

Tyler Durden

Thu, 05/16/2024 - 08:25

The Chicago Mercantile Exchange (CME), the world's largest futures exchange, is planning to offer spot bitcoin trading on its platform, according to a Financial Times report.

This move would provide major hedge funds and institutional traders with a regulated venue to trade Bitcoin.

As Vivek Sun reports via Bitcoin Magazine, CME is already the global leader in Bitcoin futures trading. By adding spot bitcoin, it can offer clients an integrated platform that includes both spot and derivatives markets.

This enables complex trading strategies like arbitrage and basis trading that leverage price differences between the two.

Currently, most spot bitcoin trading occurs on offshore exchanges like Binance.

CME, providing a regulated alternative, targets institutional investors who require strict due diligence and compliance standards.

The exchange has reportedly held talks with traders expressing strong interest in trading bitcoin in a regulated environment.

The move comes as Wall Street ramps up its Bitcoin offerings amid surging demand. Several firms already provide access to SEC-approved Bitcoin ETFs earlier this year. CME would differentiate itself by allowing sophisticated trading strategies beyond simple directional bets.

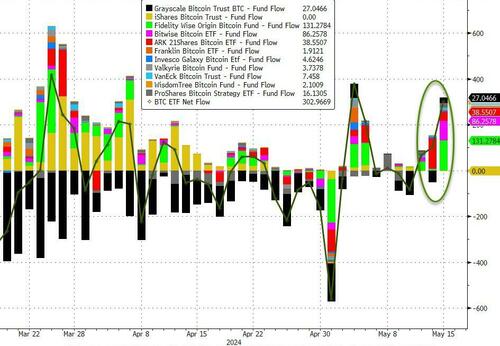

Yesterday saw the largest daily rise in bitcoin price in 14 months and a large net inflow to BTC ETFs...

Institutional funds are more inclined to use CME than platforms like Coinbase due to existing relationships. The transparency and trust in CME's decades-long track record outweigh its lack of Bitcoin specialization.

By tapping into extraordinary demand from institutional clients, CME can significantly boost its Bitcoin exposure, helping satisfy the appetite of hedge funds, family offices, pension funds and more for regulated and familiar avenues to access Bitcoin.

The notion that the US or any Western country is a democracy accountable to the people is the most absurd notion in human history

The notion that the US or any Western country is a democracy accountable to the people is the most absurd notion in human history

“One of the aspects of the emergence of the student movement is that ….there is more and more clarity that the allegation of antisemitism is simply a pretext for suppressing legitimate protest against Israel’s genocidal policies against the people of Gaza. I should also add that among the list of surprises is the fact that a group of Jewish billionaires—in order to suppress campus criticism of Israeli genocide—are now openly using the blackmail weapon. They are telling the universities, the Board of Trustees, and the president—that unless you repress these demonstrations, we are going to withhold our hundreds of millions of dollars.

“This is without question, the most brazen assault by the private sector on academic freedom in our country’s history. And compounding that, there is now an assault by the right-wing in our country exploiting the false claim of antisemitism to repress academic freedom on our campuses. So, it began with Jewish billionaires trying to repress dissent of Israel, and now that false claim of antisemitism is being used by the right-wing in our country to repress any critical thought on our campuses. This is not just an assault on academic freedom, but it’s also a prefiguration of a fascist movement among the right-wing and supported by the billionaire class to suppress any dissent beginning on college campuses but then eventually spreading everywhere else.” — Norman Finkelstein on Genocide in Gaza, https://twitter.com/MayadeenEnglish/status/1785511330813755681

Israel Lobby Knuckles Biden Under

Israel Lobby Knuckles Biden Under

US president is no match for Israel’s lobbyists. How can neoconservatives claim American hegemony over the world when Israel has hegemony over America?

What a weak shameful country America has become.

A Picture of the Degenerate West

https://www.rt.com/pop-culture/597634-eurovision-terrible-russian-minister/

As I asked yesterday, what is left of Western civilization to defend? https://www.paulcraigroberts.org/2024/05/15/does-western-civilization-any-longer-exist/

The Russian education minister said, truthfully, that the West is destroying its future by destroying education, the upbringing of children, and the foundations of humanity.

Maria Zakharova said, “The funeral of Western Europe is going according to plan. No surprises.”

Welcome To LaLa Land As Market Jettisons Tail Risks

Welcome To LaLa Land As Market Jettisons Tail Risks

Tyler Durden

Thu, 05/16/2024 - 08:10

By Simon White, Bloomberg Markets Live reporter and analyst

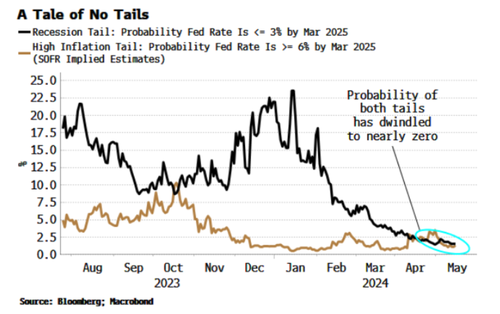

The economy is signaling a more volatile, potentially recessionary period. Markets, however, aren’t paying attention. Not only are the twin tail risks of a downturn or resurgent inflation being ignored, but a near-impossible “immaculate acceleration” of boomy growth and benign price appreciation is becoming the base case.

It’s not the first time that markets and the economy have been at odds, but this is one of the most egregious. Just as the economic mood music becomes more somber and underlying signs of persistent price pressures continue to fester, the market has virtually eliminated the tail risks of a recession or an inflationary shock.

We can estimate what the probability of those are by inferring from SOFR options the odds the Federal Reserve’s rate drops below 3% or rises above 6%. (Even though the time to expiry is falling as we move to the right in the chart below, the message is the same when using SOFR contracts with later expiries, i.e. tail-risk pricing is evaporating.)

The non-recessionary growth of immaculate disinflation has given way to expectations of an immaculate acceleration: accelerating growth and slowing inflation.

Immaculate acceleration is the quintessential two impossible things before breakfast. Yet that is exactly what the market is intending to digest: nominal rate volatility is rapidly picking up – as would be expected if a positive growth shock is foreseen – while real rate volatility is declining, indicative of inflation that is anticipated to keep falling. This is “cake and eat it”-ism writ large.

In the absence of outright panic, it doesn’t take the market long to find the diametrically opposite pole of greed and complacency. You don’t have to believe either a recession or unruly inflation are particularly likely to agree that the scant probability they are ascribed is negligently low.

That leaves the stock market in a more precarious position. It has been content to rally through this cycle with the belief the Fed would aggressively cut rates if a recession looked likely, i.e. the tail risk was underwritten. That’s ultimately still the case, but stocks are now happy to power ahead even though this tail is no longer priced by the rates market. That’s a degree of nonchalance equities have hitherto not yet displayed.

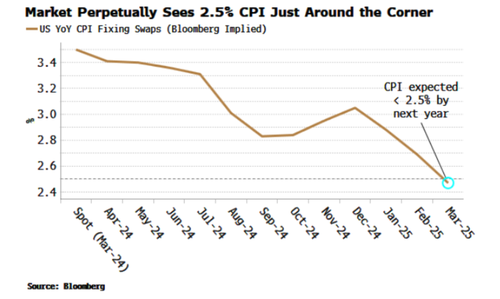

The two impossible things can be glimpsed again by looking at growth expectations. Economists’ forecast for 2024 real annual GDP was 0.6% as recently as August and is now 2.4%, while the Atlanta Fed’s GDPNow estimate for the current quarter is almost 4%. Yet the market is still projecting a steady drop in headline CPI back to 2.5% within the next year.

The market seems to be willfully ignoring many clear signals emanating from the economy. Recession risk has been in abeyance for more than six months, but that is changing. While near-term risk of a downturn is still low, we are at the point where it would not take much to flip the risks of one occurring in the next few months to being very high.

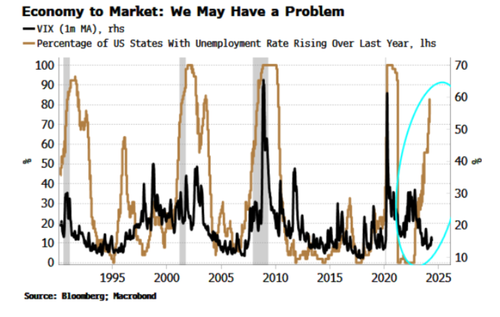

Not only have we had weak ISM services and manufacturing data, the unemployment level by US state is deteriorating. This can be a very early indication of a recession as it is a sign of a pervasive weakening of labor markets across the country — precisely one of the harbingers of a national downturn. That typically augurs much higher market volatility, as cash flows are stressed as companies hold on to workers until the last minute, despite slowing demand.

Yet volatility is muted and asleep at the wheel, seemingly paying no heed to the unemployment ripples spreading out state by state.

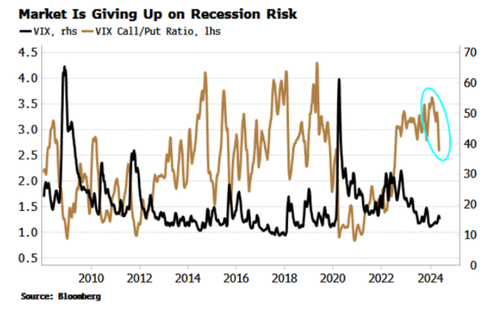

Indeed, hedging demand for higher equity volatility, inferred by the call-put ratio in VIX options is going down after two years at an elevated level. Have even volatility hedgers finally relented and embraced the immaculate acceleration nirvana?

Bond volatility is also ignoring the inflation backdrop. Bond vol is a price on uncertainty, and there is no more of an uncertain consideration for bond holders – even more so than the Fed – than inflation.

It may have come down, but inflation volatility is high and rising again in the US and Europe. Yet bond vol is near two-year lows. A repricing to where inflation volatility is would see a decline in global sovereign-bond liquidity (see chart below), and thus lead to much higher bond volatility.

Commodities are beginning to behave in a less emollient fashion. Copper, cocoa and natural gas are up 30-50% over the last few months and more and more commodity-future curves are going in to backwardation. Volatility has picked up in several commodities, but overall it is still muted.

One silver lining is that the widespread level of complacency in markets along with subdued implied-volatility means portfolio hedging costs are cheap.

That is the prudent way to go when we bear in mind the twin tail risks of inflation and recession have all but been erased from the market’s outlook.

Also overlooked is the possibility we enter a recession with elevated inflation. Needless to say, very few portfolios are likely prepared for this double tail-risk, or either one on its own. Moreover, little consideration is given to the boosting impact on inflation from the rate cuts that are priced in by the market.

Immaculate acceleration is like trying to thread a needle while shaking from an adrenaline rush. In other words, it’s unlikely to go according to plan.

The totally corrupt Australian “justice system” sentences a man to prison for telling the truth

The totally corrupt Australian “justice system” sentences a man to prison for telling the truth

The Western World has become the most hostile place for truth-tellers. All Western governments are determined to banish truth and replace it with official narratives.

https://www.asia-pacificresearch.com/sentencing-australia-david-mcbride/5632026

Putin & Xi Say Their Cooperation Is Not a Threat to Others

Putin & Xi Say Their Cooperation Is Not a Threat to Others

It is a threat to US hegemony, which is why Washington tries to drive wedges between Russia and China.

https://www.rt.com/news/597711-xi-putin-meeting-exemplary-relations/

Climate scientist says only way to save the planet is to cull the human population with a deadly pandemic

Climate scientist says only way to save the planet is to cull the human population with a deadly pandemic

This is the Bill Gates Plan.

The World Health Organization Is the Enemy of Humanity

The World Health Organization Is the Enemy of Humanity

WHO is an instrument for depopulation.

Hillary Projects Her Crime onto Trump

Hillary Projects Her Crime onto Trump

Both Hillary and Biden got free passes for their real crimes while the Democrats are busy at work trying to frame Trump on the same charges that Hillary and Biden were given DOJ passes.

In America law is a weapon used in the service of official narratives. The US Department of Justice serves Democrat political agendas, such as the replacement of white Americans and the creation of a one party state. Republicans and white Americans sit there disbelieving while it happens. The whore media tells them reality is a conspiracy theory.

The Ethics of Transplantation Medicine

A few pieces came into my inbox over the past couple of weeks around organ donation and transplantation that caught my attention. While we don’t often write about this topic, it is within our concern of medical ethics as it relates to new technologies and developments in medicine. I’ve always been both fascinated and concerned about medical ethics in this domain. In my nursing days, I worked in university hospitals that did pediatric transplants (heart, kidney, liver, and bone marrow) so I very clearly saw the pros and cons of transplantation medicine as these issues were in front of us daily.

The first story in my inbox was a report about a woman who is the second person to receive a genetically modified pig kidney transplant. She had suffered from several heart attacks, years of diabetes, and was in kidney failure requiring dialysis just to keep her alive. Because of her serious health issues, she was deemed not to be a suitable candidate for a human organ transplant. Receiving a genetically modified pig kidney seemed to be her only chance of survival and she told herself, “You know what? I’m going to do it. I have to do it – for myself and for the rest of my family.” The previous report of such a transplant was in a 62 year old man. He was in end stage kidney failure when he received his genetically modified pig kidney.

Both people had no chance of long-term survival. These are often the types of patients who are approved to be part of a new clinical trial for a new treatment, whether it be an experimental new drug, medical device, or in this case, being allowed to receive a genetically modified pig kidney.

The ethics of xenotransplantation, the transplanting of tissue or organs between different species, has long been debated. In this new field, the ethical debate usually is framed within three categories. First, is the concern of animal welfare and the ethical and humane treatment of animals who are often sacrificed for their organs or tissue. Next is the real and serious concern of the dangers of organ and tissue rejection and the long-term need for immunological suppression to keep rejection of the transplant at bay. Finally, there is the always heated debate around the procurement and allocation of the organs that are available for transplant. How do we decide who can donate, which includes the debate around living donor donation? And then decide who receives the organ and by what criteria is that decision made? Over 100,000 people in the United States are on a waiting list to receive a transplant with 17 people dying each day because the supply can’t meet the demand.

Which brings me to another story that caught my eye, where it was reported that there was manipulation of data that made certain patients ineligible for liver transplants at a Houston hospital. Memorial Hermann-Texas Medical Center announced that they had stopped their liver and kidney transplant programs while they conduct an investigation after learning that “a doctor made ‘inappropriate changes’ in a database for people awaiting a liver transplant.” The alleged charges involved changing the acceptance criteria, which of course are serious and warrant an investigation, especially since these sorts of breeches in policy erode confidence in medical ethics. The public is already skeptical of the ethics of organ donation in general and allocation of organs in specific and many lack trust in the system. Stories like what happened in Houston only confirm the public worries. Will the increase in xenotransplantation alleviate or heighten skepticism and distrust? Whether the field of transplant medicine expands to include xenotransplantation or not, it is clear that we need to think clearly and ethically about transplantation medicine more broadly. Ethics matter and this ethical debate will get murkier as our ability to sustain life increases. I’d love to hear your thoughts on this.

The post The Ethics of Transplantation Medicine appeared first on The Center for Bioethics & Culture Network.

Speaker Johnson could do something about what he calls a Travesty of Justice

Speaker Johnson could do something about what he calls a Travesty of Justice

The House Republicans could vote to cut the Dept of Justice (sic) budget. The Senate Democrats would not go along, but the House could block future DOJ appropriation bills and leave the corrupt department unfunded.

But do not expect Republicans to do anything except talk.

The West Has an Illiterate Financial Press

The West Has an Illiterate Financial Press

Paul Craig Roberts

The entire the financial press has zero understanding of basic economics. The financial “journalists” just print press releases.

The US debt has never mattered, because the US dollar is the world reserve currency. That means US debt is the reserves of the world’s central banks. If US debt rises, so does the reserves of the world banking system. All central banks were delighted to accumulate more US Treasury debt as it meant the reserves of their banking system went up.

The Federal Reserve can always redeem US Treasury debt by creating money with which to buy it. The debt is always redeemable because it is denominated in dollars.

The problem arrives when the dollar is deserted as world reserve currency. The morons who comprise the Biden regime are scaring central banks away from the dollar as their reserves because of sanctions against Russia, Iran, China, Venezuela, and others. The slow mental processes of central banks are beginning to understand that having your reserves in US Treasury dollar debt means they can be frozen, seized, denied to your use if you cross Washington.

The threat to Washington is, whereas the Fed can print dollars to redeem the debt, the Fed cannot print foreign currencies to redeem the US dollar. So, if central banks shift their reserves out of dollars into gold, as Russia and China are doing, or into other currencies, the supply of dollars in foreign exchange markets have fewer and fewer takers. Consequently the dollar loses its value relative to gold, silver, and rising currencies, and the dollar’s value falls in foreign exchange markets. As America’s manufacturing is offshored and as America relies on imports of food, US inflation rises. Historically, the Fed’s response to inflation has been unemployment.

The Federal Reserve and the institutions used to suppress gold and silver prices use naked shorts to control the price by dumping shorts into the futures market. In other words, contracts unsupported by actual gold holdings can be used to increase the paper supply of gold in futures markets. As the futures market settles in cash, not in gold deliveries, a flood of paper contracts unsupported by actual physical gold can be used to suppress the price. In other words, the supply of paper gold can be printed just like the Fed can print paper money. Myself and Dave Krantzler have explained this over and over on my website.

This price control process fails when the demand for gold exceeds the physical supply at the suppressed price. We have recently witnessed a new outbreak in the gold price. Is this a sign that the controlled price can no longer hold against the demand for physical gold, or is there some other explanation?

As the fools ruling the US continue their destruction of the country, the dollar and living standards will die with the country. America is likely living her last years. Perhaps this is why Putin and Xi don’t bother to dispose of us.

Do Bishops Have Rights vis-à-vis the Pope? Does the Pope Have Duties vis-à-vis the Bishops?

We have all certainly heard about the rights of the pope, who enjoys supreme jurisdiction in the Church; and we have certainly heard about the duties of bishops toward the Chair of Peter. But what about the pope’s duties to the bishops (and, indeed, to the Church as a whole, and to Christ its eternal Head?) And what of the bishops’ rights over against papal overreach?

Os Justi Press has just Peter Kwasniewskihttp://www.blogger.com/profile/02068005370670549612noreply@blogger.com0

Hanoi: Truong Thi Mai, the first woman at the top of the Party, also forced out

She was one of the three candidates to succeed Phu Trong at the head of the Party, the most important post. Forced to resign by the 'fiery furnace' anti-corruption campaign, which is intertwined with the manoeuvres ahead of the Congress scheduled for January 2026. Politburo reduced to 12 members from the previous 18 with incumbent Prime Minister Pham Minh Chinh and Security Minister To Lam in the top positions.

Vicar of Arabia: the jurisdiction of the Syro-Malabars and the 'challenge' to the beauty of unity

Bishop Aldo Berardi, head of the vicariate that includes Bahrain, Kuwait, Qatar and Saudi Arabia, comments on Pope Francis' decision to grant the Syro-Malabar Church jurisdiction over Indian migrants. "This is not a secondary element, it concerns areas that go beyond rituals" and will have to be defined. The problem of places of worship, relations with the State and interlocution with the Muslim world. "Too many voices" can create "confusion".

How Economic Realities Can Curb Activist Politicians

Politicians, bolstered by economic quackery such as modern monetary theory, believe they face no fiscal constraints as they impose their visions upon us. But costs are real things and economic, reality sooner or later sets in.