Celibacy is always, shall we say, an affront to what man normally thinks. It is something that can be done, and is only credible, if there is a God and if celibacy is my doorway into the kingdom of God.

All

Eclipse of the Sun, Eclipse of Faith

Without a doubt, in this interpretation lies one of the most profound lessons of the darkness during the crucifixion of the Savior Christ: the “eclipse” of faith. There is no more terrible test, for any of us, than the Cross.

The Deep State Prepares for a Trump Victory

We’ve all wondered if the fix is already in. Given the irregularities of the last election, and the manner in which the whole of the U.S. establishment rallied around one side, maybe a Biden victory in November is a foregone conclusion.

I’m guilty of believing this. I’ve doubted every prediction that Donald Trump or RFK, Jr. can win. This is not because they won’t get votes. It’s because those votes might not matter enough.

The power of haters is awesome and ubiquitous. The whole of legacy media, government, corporate tech, pharma, and both the administrative state and the deep state are dedicated to keeping them and their supporters from power.

We don’t even know if elections really work anymore. It’s entirely possible, in this view, that millions will slog to the polls in November and do their duty in what will only end up as theater. The regime controls the ballots, surely, and nothing can overcome that. A second Biden term, the most unpopular president in my lifetime, is inevitable, in this view. The system is too broken to generate any other outcome.

Admit it: you have been tempted by this outlook too.

Well, I’m here to bring you some good news. The deep state has blinked. I will present evidence to you that the bad guys are actually preparing for a full-blown assault on administrative state hegemony. They are working to protect themselves against a victory by someone other than Joe Biden.

Will it work? I don’t know but what’s super critical is that they are preparing. If it were not possible to win, they wouldn’t bother. In other words, this is very good news!

The evidence comes from a largely unnoticed press release from the Office of Personnel Management. The legacy media did not report on this at all.

It reads as follows:

“The U.S. Office of Personnel Management (OPM) today announced a final rule that clarifies and reinforces long-standing protections and merit system principles for career civil servants,” says the press release.

It goes on to explain that this rule change makes it much more difficult or even impossible for any new president to reclassify “civil servants” as being under the control of the president. Instead, their jobs are permanent and thus protected against any efforts by a future president to reclassify anyone working for the federal government. None can be fired.

In particular, the press release explains, this is designed to thwart another attempt to change their employment status, as happened in November 2020.

“In the first week of the Biden-Harris Administration, President Biden revoked an Executive Order issued by the previous Administration that risked altering our country’s long-standing merit-based civil service system, by creating a new excepted service schedule, known as ‘Schedule F,’ and directing agencies to move potentially large swathes of career employees into this new excepted service status. This attempt would have stripped career civil servants of their civil service protections that ensure that decisions to hire and fire are based on merit, not political considerations.”

The “previous administration” means of course the Trump White House, which issued the greatest executive order in a hundred years.

After four years of being subverted and thwarted by the civil service bureaucracy, the White House finally figured out the core problem. There are more than 2 million permanent bureaucrats, ensconced in 430 agencies, who imagine themselves to live outside the democratic system and the U.S. Constitution itself. They believe they are the state and the elected leaders are mere decoration.

Trump’s executive order insisted that every agency do an internal audit and ferret out any employee who has something to do with making or interpreting policy; that is, anyone whose work impacts on whether the president actually has control of the executive department. All those employees would be reclassified as Schedule F, meaning that they could be replaced if need be.

That’s it. That’s the whole order. Maybe it doesn’t seem like much but it was actually brilliant. The Trump administration is the first to discover the great secret of American public life, which is that the administrative state has taken on a life of its own. After years of trying, the Trump White House finally happened upon a key lever to gain back control for the people. It’s as simple as that.

The Washington, D.C. political press freaked out. It was as if a president had found the engine room and the one switch that controls the whole thing. That was never supposed to happen. This produced mayhem inside the bureaucracy, and a doubling and tripling down on the conviction that he could never win a second term, lest this order be carried out.

That’s why one of the very first actions of the Biden administration was to repeal this executive order. That action made it very clear that Biden’s loyalties were with the deep state first and foremost. He would protect their jobs and power above all else. In fact, the OPM press release brags about this.

At issue here is a phrase from the initial Trump order. Any employee would be reclassified who deals with “confidential, policy determining, policymaking, or policy-advocating.” Notice this word confidential. This would apply to the whole of the intelligence community, perhaps. So wait, are we saying that the president should be in charge of the CIA, FBI, NSA, NSC, and the entire security apparatus, even to the point that he could fire anyone? Maybe so!

Such a situation would be intolerable to the bad guys. From their point of view, this would fundamentally upend the functioning of government in America.

Let’s face it. If the OPM and the whole of the bureaucracy believed there was no threat from Donald Trump or RFK, Jr., such a rule change would not be necessary. They believe it is necessary, which implies that the civil service thinks that the rising populist movement is a genuine threat that could succeed in taking back the country. Otherwise, they wouldn’t bother.

What is the OPM? It was founded out of the Pendleton Act of 1883, which started the permanent bureaucracy in the United States. With it came the Civil Service Commission, the first name of what later was called the OPM.

Until that time, and under the Constitution, the U.S. president had full control of the bureaucracy. The new president would typically replace a vast number of bureaucrats with loyalists. This was denounced as the “spoils system” but it could also be called simple democracy in which the people rule themselves through their elected representatives.

The permanent class of rules grew through wars and crises over a hundred years to become the government that cares not a whit for who is technically elected or otherwise appointed as agency heads. As a matter of habit, they have come to ignore all the comings and goings of the people elected by the population. Elections are just a distraction to them.

The essential point: Donald Trump and RFK, Jr. represent a genuine threat to the gang that has subverted and nearly wrecked this country. Now we know that this threat is real, else we would not see these efforts to entrench the bad guys and protect them against all conceivable threats.

As this proves again, the main struggle alive in this country and all over the world is the one between the people and the deep state consisting of a vast network of elites in government, media, the corporate world, banking and finance, private foundations, and global bureaucracies, all working for their own interests at the expense of everyone else.

It’s a battle for control, and it is the underlying dynamic that shapes our lives right now.

The bad guys are scared. Now we know this for sure, or they would not be trying to pre-rig the system against fundamental change. The elites believe based on long experience that they can always outwit the rest of the population. We shall see.

It’s going to be brutal before and after the election. There will be one or several October surprises. If Donald Trump wins, the onset of Winter will kick off propaganda like you have never seen. As the inauguration approaches, absolute hysteria will dawn. The COVID racket will seem like child’s play. Every day and every hour after will consist of wild attempts to stop the administration from functioning. What a time to be alive.

Reprinted with author’s permission from The Epoch Times.

April 10 - Is Israel Backing Down?

Please send links and comments to hmakow@gmail.com

Mixed signals coming out of Israel. On the one hand, Israel responds to Biden threats to withhold support by withdrawing almost all troops from Gaza. On the other hand, Satanyahu says he has "set a date" for Genocide.02, invasion of Rafah.

They must pretend peace is still an option to obscure the program for the third Masonic Jewish world war.

Israeli commentator Caroline Glick says a feeling of defeatism has swept over Israel.

-

Disgusting! Many YouTube videos claim Israel and the Houthis are bombing Israel. Not true! This looks like Russia destroying Ukrainian tanks and troops. The voices are Russian!

U.S OIL PLATFORM DESTROYED! Iranian Houthis Fighters Use New Fateh-110 MISSILES!

--

Benny Johnson's show covers many developments suppressed by the Lamestream Media

Janet Yenta in Bejing chiding the Chinese for supporting Russia at the same time as China and Russia cement their alliance!

China Sending Message That 'It Has Russia's Back' If West Escalates

On Tuesday, Russian Foreign Minister Sergey Lavrov met with Chinese President Xi Jinping, sending a strong message to the West that the two countries will continue their strategic relationship. The meeting came a day after US Treasury Secretary Janet Yellen traveled to China and warned it against partnering with Russia.

The Johnsons also highlight Marjorie Taylor Greene's solitary defence on America, attack on Speaker Johnson

In scathing letter, GOP's Marjorie Taylor Greene slams Johnson with speakership under threat

"I will not tolerate our elected Republican Speaker Mike Johnson serving the Democrats and the Biden administration and helping them achieve their policies that are destroying our country. He is throwing our razor-thin majority into chaos by not serving his own GOP conference that elected him," Greene wrote in the letter.

"With so much at stake for our future and the future of our children, I will not tolerate this type of 'leadership,'" Greene later wrote in the letter. "This has been a complete and total surrender to, if not complete and total lockstep with, the Democrats' agenda that has angered our Republican base so much and given them very little reason to vote for a Republican House majority."

-

Moscow Accuses Hunter Biden-Linked Company Burisma Of Financing Terror Attacks

Russia says it has uncovered more damning evidence connecting the US and NATO to recent terror and assassination campaigns in Russia, including making connections to the March 22 Crocus City Hall terror attack which resulted in over 140 Russians dead and hundreds more wounded and injured.

Russia's Investigative Committee, which is the country's top investigative body, announced Tuesday that it has launched a criminal probe into senior US and Western officials who are believed to be "financing terrorism".

The formal statement claims that an ongoing investigation has "established" that money from commercial organizations tied to NATO were used to "eliminate prominent political and public figures" inside and outside Russia, as well as to "inflict economic damage" against the country. Lately there's also been a spate of devastating cross-border attacks on refineries, ports, and oil facilities.

--

FM Katz says Israel will attack Iran directly if retaliation to consulate attack originates there

The only way to stop Israel is to defeat Israel.

-

Biden Says Considering Australia's Request to End Julian Assange Prosecution

--

French teen detained for demanding that foreign rapists be deported

The 19-year-old activist held a placard calling for the deportation of foreign rapists from France at a carnival on Sunday, and was reported by the city's mayor for "inciting hatred"

The campaign group highlighted the fact that 46 women could have been spared from rape by illegal migrants if the authorities had enforced their orders to leave French territory last year (OQTFs), including one incident that occurred in Besançon last August.

The demonstration was denounced by the city's mayor, Anne Vignot, who has previously pushed a pro-mass migration agenda and who announced she would be filing a police complaint against the activists for an alleged hate crime against migrants.

--

UK Column news

NATO gearing up for world war

UK training 30,000 Ukrainian recruits

-

The tide has turned!

Rutgers Unexpectedly Drops Student Vaxx Requirement, Litigation Proceeds

-

Denver considering $3.2M to house pregnant migrants and young children

The city first experienced an influx of migrants in December 2022, which caused it to open several emergency shelters throughout the city

--------

So what happens to our investment accounts after a giant cyber attack? Will public companies become defacto private companies owned by the boards or the Government? I wonder? Looks like a great way to complete the great taking.

There's no need for the powers to do that. Let me explain...

-

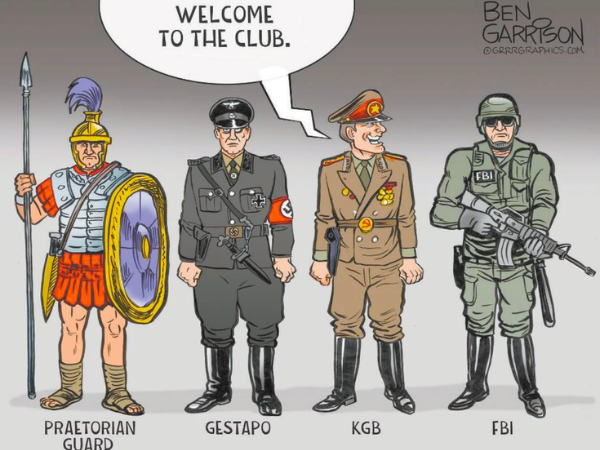

FBI is the American KGB/Gestapo

Bombshell Video: CIA Officer/Former FBI Boasts: We "Can Put Anyone in Jail. Set Them Up"

O'Blennis said of Infowars founder Alex Jones: The FBI "took his money away," and 'chopped his legs off.' O'Blennis stated at least 20 undercover FBI agents were at the US Capitol on January 6, 2021 and some of them are now with the CIA. He also said the FBI uses "embellished" news and "fake social media" to "really get people mad."

-

Idaho: 18-Year Old Planned Attacks on Churches for ISIS. FBI Sources Helped Plan 'Attacks'

Reporter Ford Fisher wrote that at least three FBI confidential human sources (CHS) and an undercover FBI agent helped him plan the attacks before the FBI arrested him. The FBI has a history of orchestrating phony terror plots.

-

ACTRESS LISA BONET ABOUT THE JABS ON 80S PHIL DONAHUE TALK SHOW

Is Gold Overpriced Or Can Its Price Go Even Higher?

Is Gold Overpriced Or Can Its Price Go Even Higher?

Tyler Durden

Wed, 04/10/2024 - 14:20

Authored by Claudio Grass via The Mises Institute,

This question has been at the center of a great many conversations I’ve been recently having with clients and friends. The way I like to answer it is with another question: Expensive compared to what?

Despite its recent surge to record highs, there are compelling reasons why purchasing gold right now is a prudent decision, with strong indications that its value is poised to climb even higher. Making investment decisions solely based on the current price of any asset without considering its underlying value or future potential can be prove to be a very costly mistake.

For one thing, it is obvious that there is a reason why gold has skyrocketed to these new levels. Actually, there are many reasons, and all of them are bound to become increasingly important and clear to more and more people in the months and years to come. For example, it is (or it should be) by now blatantly clear to every thinking person that inflation is not under control. Prices in the real economy, as opposed to the cherry-picked and extremely unrepresentative CPI metrics, have been steadily climbing and pushing countless households to the brink.

This is only going to get worse, as central banks around the world have already paved the way for a policy U-turn and the return to expansive monetary policies, including quantitative easing and near-zero interest rates, in order to stimulate economic growth, or the illusion of it (a very useful ploy in a global election year like 2024). These measures invariably lead to further fiat currency devaluation and erosion of purchasing power. This in turn is also very helpful when it comes to the unsustainable debt burden that most advanced economies are saddled with - another great boost during election season. Gold, on the other hand, maintains its intrinsic value over time, making it an attractive alternative to fiat currencies.

Central banks themselves obviously understand the implications of their own policies better than the average investor and that’s why they have always increased their gold reserves in times of turmoil and in times of loose money. In the early days of the pandemic, and then again after Russia’s invasion of Ukraine, global central banks continued to add to their gold holdings while ETF investors were selling off theirs. Now, once again, we’re seeing a strong trend of ETF outflows. February marked the ninth month in a row, but the price has still been climbing.

As Simon White, Bloomberg macro strategist, highlighted: “Over the last six months, China, Germany and Turkey have increased their gold holdings by the most (these are official holdings - when it comes to China, its true holdings are likely much higher than stated). Central banks want gold as it is a hard asset, not part of the financialized system when owned outright. But the dominant reason is a desire to diversify away from the dollar. If you’re not on friendly terms with the US, then it is a way to avoid your reserve assets being seized, as happened to Russia.”

This last point gives us a glimpse of a much bigger picture that investors need to bear in mind: Geopolitics.

It’s hard to think of another time in our post-cold-war history that the world has been so bitterly and so dangerously divided. The way the West responded to the Russian invasion of its neighbor, by weaponizing the US dollar and the entire banking system, has caused a lot of countries to think twice about how to safeguard their own assets. The obvious answer is gold, and that is what is behind this monumental transfer of real wealth we’re now seeing from the West to the East. In February, China’s central bank added gold to its reserves for a 16th straight month and it shows no signs of stopping its buying spree, as it is clearly on a mission to diversify its holdings and reduce its dependence on the US dollar.

And it’s not just the Chinese central bank that’s buying. According to the Financial Times, “in recent months, the precious metal has gained a second wind from what analysts describe as “phenomenal” purchases by Chinese consumers seeking a safe place to park their cash after local property and stock markets tumbled.” As ING analysts confirmed in a note, "We expect gold prices to trade higher this year as safe-haven demand continues to be supportive amid geopolitical uncertainty with the ongoing wars and the upcoming U.S. election.”

This is clearly a long-term shift in the gold market and the dynamics behind it have the potential to support much higher prices than what we’re currently seeing. This is precisely why investors need to look at the bigger picture and consider the current levels in their proper content and time horizon.

In other words: Sure, gold might seem expensive today, but today’s price is very likely to seem like a bargain in the not so distant future.

Biden (Yes, Biden) Promises Rate-Cut By Year-End As Fed Minutes Signal Caution But QT Taper 'Fairly Soon'

Biden (Yes, Biden) Promises Rate-Cut By Year-End As Fed Minutes Signal Caution But QT Taper 'Fairly Soon'

Tyler Durden

Wed, 04/10/2024 - 14:04

Thanks to today's magnificent unwind, the market and monetary-policy landscape has changed dramatically since the last FOMC meeting on March 20th. Gold is still the biggest winner while bonds are a bloodbath with stocks flat and the dollar and oil up...

Source: Bloomberg

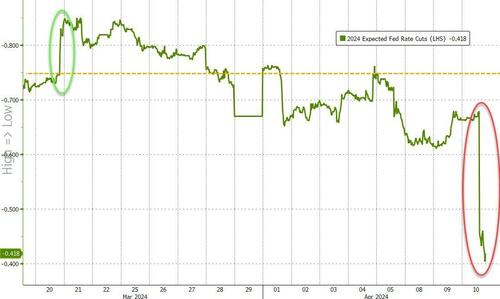

But that's just the start as expectations for rate-cut expectations (and timing) have collapsed in the three weeks since The Fed met...

From three cuts fully priced-in, the market is now pricing in one, with a 50% chance of second....

Source: Bloomberg

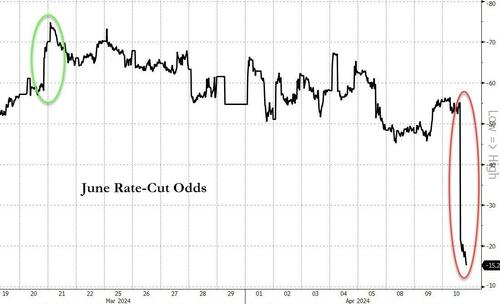

And June is off the table entirely for a cut (with May FF options even hinting at the chance of a rate-hike)...

Source: Bloomberg

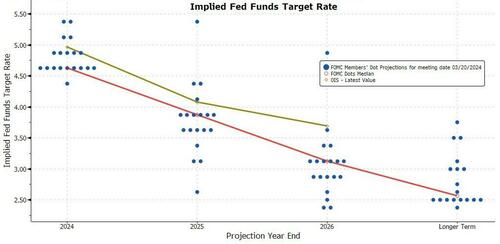

The market is now significantly more hawkish than The Fed's dots from just three weeks ago suggested...

Source: Bloomberg

So, given how stale these Minutes are - what exactly is it that The Fed wants us to know from them?

The highlights:

On inflation goals:

Participants generally judged that risks to the achievement of the Committee's employment and inflation goals were moving into better balance (NOT ANYMORE)

Consumer price inflation continued to decline, but recent progress was uneven. (NOT ANYMORE)

Some participants pointed out that the recent increases in inflation had been relatively widespread, indicating that they should not be dismissed as “merely statistical aberrations.”

On delaying the start of cuts:

...all 19 Fed officials generally agreed that high inflation readings in January and February “had not increased their confidence” that inflation was falling steadily to their 2% target.

On the inevitability of cuts:

"In discussing the policy outlook, participants judged that the policy rate was likely at its peak for this tightening cycle, and almost all participants judged that it would be appropriate to move policy to a less restrictive stance at some point this year if the economy evolved broadly as they expected.

In support of this view, they noted that the disinflation process was continuing along a path that was generally expected to be somewhat uneven.

They also pointed to the Committee's policy actions together with the ongoing improvements in supply conditions as factors working to move supply and demand into better balance.

Participants noted indicators pointing to strong economic momentum and disappointing readings on inflation in recent months and commented that they did not expect it would be appropriate to reduce the target range for the federal funds rate until they had gained greater confidence that inflation was moving sustainably toward 2 percent"

On the economic outlook:

-

Some participants pointed to geopolitical risks that might cause more severe supply bottlenecks.

-

Some participants noted concern that financial conditions might not be as restrictive as desired, which could put upward pressure on inflation.

-

Most participants noted that, during the past year, labor supply had been boosted by increased labor force participation as well as by immigration.

-

Participants further commented that recent estimates of greater immigration in the past few years and an overall increase in labor supply could help explain the strength in employment gains even as the unemployment rate had remained roughly flat and wage pressures had eased.

On tapering QT 'fairly soon':

Although most officials saw the process as proceeding smoothly, they “broadly assessed” it would be appropriate to take a cautious approach to further runoff given market turmoil in 2019, the last time the Fed tried to shrink its portfolio.

“The vast majority of participants thus judged it would be prudent to begin slowing the pace of runoff fairly soon,” the minutes showed.

Tapering QT will be in TSYs, not MBS:

In their discussions regarding how to adjust the pace of runoff, participants generally favored reducing the monthly pace of runoff by roughly half from the recent overall pace.

With redemptions of agency debt and agency mortgage-backed securities (MBS) expected to continue to run well below the current monthly cap, participants saw little need to adjust this cap, which also would be consistent with the Committee’s intention to hold primarily Treasury securities in the longer run.

Accordingly, participants generally preferred to maintain the existing cap on agency MBS and adjust the redemption cap on U.S. Treasury securities to slow the pace of balance sheet runoff.

This was most notable:

FOMC says "majority of survey participants now expecting the [tapering of QT] to start around midyear."

But, The Fed previously has said it won't start tapering QT without cutting rates before/at same time.

Finally, this was very interesting!!!

President Biden chimed in on Fed policy...

“Well, I do stand by my prediction that, before the year is out, there’ll be a rate cut,” Biden said Wednesday at a White House press conference alongside Japanese Prime Minister Fumio Kishida, adding that today's CPI report could delay a rate cut by at least a month...

So much for 'Fed independence' that Powell was spouting on about in his speech last week.

The Fed has been assigned two goals for monetary policy - maximum employment and stable prices.

Our success in delivering on these goals matters a great deal to all Americans. To support our pursuit of those goals, Congress granted the Fed a substantial degree of independence in our conduct of monetary policy. Fed policymakers serve long terms that are not synchronized with election cycles.

Our decisions are not subject to reversal by other parts of the government, other than through legislation.

This independence both enables and requires us to make our monetary policy decisions without consideration of short-term political matters.

Such independence for a federal agency is and should be rare. In the case of the Fed, independence is essential to our ability to serve the public.

Just a reminder...

Interesting pic.twitter.com/dSq89Qd2JM

— TeneX Trades (@TeneXTrades) April 10, 2024And finally...

“One of Chair Powell’s responsibilities is to protect the public standing of the Fed,” said Vincent Reinhart, chief economist at Dreyfus and Mellon.

“The closer the FOMC acts to the election, the more likely it is that the public will question the Fed’s intent.”

Read the full FOMC Minutes below:

Hamas Can't Locate 40 Israeli Hostages Needed For 1st Round Of Ceasefire

Hamas Can't Locate 40 Israeli Hostages Needed For 1st Round Of Ceasefire

FP/Getty Images: Keys are left behind in a door riddled with bullet holes and stained with blood on Oct. 10, after Hamas militants stormed a kibbutz in Kfar Aza, Israel.

Tyler Durden

Wed, 04/10/2024 - 13:25

FP/Getty Images: Keys are left behind in a door riddled with bullet holes and stained with blood on Oct. 10, after Hamas militants stormed a kibbutz in Kfar Aza, Israel.

Tyler Durden

Wed, 04/10/2024 - 13:25

Lebanese and Israeli sources are reporting that Hamas is open to releasing hostages as part of deal that would see IDF troops gradually retreat from the Gaza Strip, instead of its prior demand of full troop withdrawal as a precondition to letting the hostages go free.

But any potential forward progress has been stymied by a significant complication revealed by Hamas to negotiators on Wednesday. The group is unable to identify and locate some 40 Israeli hostages which would be needed to complete the first phase of the ceasefire deal.

FP/Getty Images: Keys are left behind in a door riddled with bullet holes and stained with blood on Oct. 10, after Hamas militants stormed a kibbutz in Kfar Aza, Israel.

FP/Getty Images: Keys are left behind in a door riddled with bullet holes and stained with blood on Oct. 10, after Hamas militants stormed a kibbutz in Kfar Aza, Israel.

A security source told CNN, "The inability - or unwillingness - of Hamas to tell Israel which hostages would be released, alive, is a major obstacle."

This possibly confirms prior reporting by the Israeli newspaper Haaretz, which in March said that Israeli officials believe only 60 to 70 Israeli hostages in Gaza are still alive.

"According to the IDF, a total of 134 hostages and bodies are being held in Gaza," Haaretz wrote Thursday. "Thirty-six of the people were confirmed by the army as killed – some on October 7, when their bodies were taken into the Strip. Of the 98 living hostages, 10 are foreigners (eight Thais, one Nepalese national, and one man with Mexican and French citizenship)."

The 40 'missing' hostages currently being discussed by negotiators may or may not be deceased, and it could be more of an issue of locating where they are being held. The past many months of grinding war has likely served to isolate the cells which are holding them separately, as CNN details:

The majority of the almost 100 hostages who remain alive are believed to be male IDF soldiers or men of military reserve age. Hamas is expected to try to use to them in later phases to try to negotiate more significant concessions, including more high-level prisoners and a permanent end to the war.

The more than 250 hostages captured or killed on October 7 are believed to have been spread out among different members and factions of Hamas, as well as other militant groups, gangs and even held by families.

So there may be this significant wartime logistical hurdle to overcome before the first phase of any potential hostage deal can even be implemented.

A working draft deal mediated by Qatar is said to stipulate as a first phase the release of 40 living hostages made up of women, the elderly, and the sick. This would happen during an initial six-week pause in the fighting. But at this point, per CNN sources, since Hamas is "unable to reach 40 in the proposed categories, Israel has pushed for Hamas fill out the initial release with younger male hostages, including soldiers."

There's a possibility that some of the hostages could have been killed by Israeli's relentless bombing campaign which has decimated entire neighborhoods. A horrifically tragic incident last December saw three Israeli hostages shot dead by Israeli forces who mistook them for Palestinian militants.

Israeli leadership under Netanyahu has been accused by the hostages' families of prioritizing the military operation to defeat Hamas far and above hostage recovery.

Yields Soar After Catastrophic 10Y Auction Shocks With 3rd Biggest Tail On Record

Yields Soar After Catastrophic 10Y Auction Shocks With 3rd Biggest Tail On Record

Tyler Durden

Wed, 04/10/2024 - 13:20

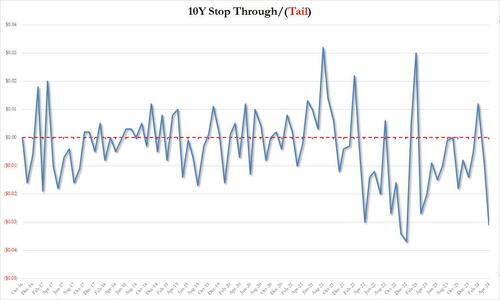

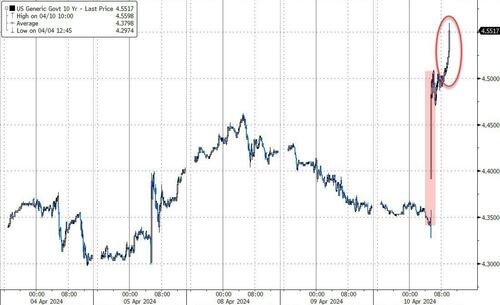

Earlier today we said that while the CPI report would be the day's main highlight, the real shocker should inflation come in hot, would be today's 10Y treasury auction. And when the Treasury sold $39 billion in a 9-Year 11-Month reopening moments ago, all hell broke loose.

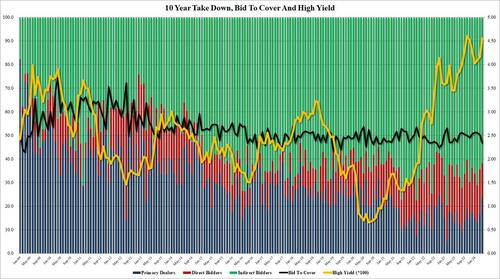

Stopping at a high yield of 4.560%, this was not only almost 40bps higher than last month's 4.166% and the highest since October, it also tailed the 4.529% When Issued by a whopping 3.1bps, a surge compared to last month's tail of just 0.9bps, but also the highest tail since the 3.7bps in Dec 2022 and also the third largest tail on record!

But wait, there's more: the Bid to Cover in today's auction tumbled to just 2.336, down from 2.512 in March and the lowest since Dec 2022; it was also well below the recent average of 2.49.

The internals were even uglier, with foreign buyers tumbling from an already low 64.3% to 61.8% the lowest since Oct 23 and far below the six-auction average of 65.9; and with Directs also sliding to just 14.2%, the lowest since Nov 21, Dealers ended up stepping up bigly and taking down a whopping 24.0%, the highest since November 22.

The market reaction was instantaneous and brutal with 10Y yields, already trading at session and 2024 highs, spiking by 6 bps to another day high of 4.56%, and fast approaching a level where not only stocks will tumble but the entire economy collapses as it grinds to a halt, similar to where Biden's approval rating will be in the very near future.

Modi reignites Katchatheevu Island dispute between India and Sri Lanka

India ceded the atoll in 1974 when the Indian National Congress led by Indira Gandhi was in power. Experts believe the prime minister is using the issue to woo voters in India's southern states ahead of national elections, set to start on 19 April.

Investing Lessons From Your Mother

Investing Lessons From Your Mother

Tyler Durden

Wed, 04/10/2024 - 13:05

Authored by Lance Roberts via RealInvestmentAdvice.com,

Your mother likely imparted valuable investing lessons you may not have known. With Mother’s Day approaching and bullish market exuberance present, such is an excellent time to revisit the investing lessons she taught me.

Personally, when I was growing up, my Mother had a saying, or an answer, for almost everything… as most mothers do. Every answer to the question “Why?” was immediately met with the most intellectual of answers:

“…because I said so”.

Seriously, my Mother was a resource of knowledge that has served me well over the years, and it wasn’t until late in life that I realized that she had taught me, unknowingly, valuable investing lessons to keep me safe.

So, by imparting her secrets to you, I may be violating some sacred ritual of motherhood knowledge, but I felt it was worth the risk of sharing the knowledge that has served me well.

1) Don’t Run With Sharp Objects!

It wasn’t hard to understand why she didn’t want me to run with scissors through the house – I think I did it early on to watch her panic. However, later in life, when I got my first apartment, I ran through the entire place with a pair of scissors, left the front door open with the air conditioning on, and turned every light on in the house.

That rebellion immediately stopped when I received my first electric bill.

Sometime in the mid-90s, the financial markets became a casino as the internet age ignited a whole generation of stock market gamblers who thought they were investors. There is a vast difference between investing and speculating; knowing the difference is critical to overall success.

A solid investment strategy combines defined goals, an accumulation schedule, allocation analysis, and, most importantly, a defined sell strategy and risk management plan.

Speculation is nothing more than gambling. If you are buying the latest hot stock, chasing stocks that have already moved 100% or more, or just putting money in the market because you think you “have to,” you are gambling.

The most important thing to understand about gambling is that success is a function of the probabilities and possibilities of winning or losing on each bet.

In the stock market, investors continue to play the possibilities instead of the probabilities. The trap comes with early success in speculative trading. Success breeds confidence, and confidence breeds ignorance. Most speculative traders tend to “blow themselves up” because of early success in their speculative investing habits.

When investing, remember that the odds of making a losing trade increase with the frequency of transactions. Just as running with a pair of scissors, do it often enough, and eventually, you could end up hurting yourself.

2) Look Both Ways Before You Cross The Street.

I grew up in a small town, so crossing the street wasn’t as dangerous as in the city. Nonetheless, she yanked me by the collar more than once as I started to bolt across the street, seemingly anxious to “find out what’s on the other side.” It is essential to understand that traffic does flow in two directions. If you only look in one direction, you will get hit sooner or later.

Many people want to classify themselves as a “Bull” or a “Bear.” The savvy investor doesn’t pick a side; he analyzes both sides to determine what the best course of action in the current market environment is most likely to be.

The problem with the proclamation of being a “bull” or a “bear” means that you are not analyzing the other side of the argument and that you become so confident in your position that you tend to forget that “the light at the end of the tunnel…just might be an oncoming train.”

It is an essential part of your analysis, before you invest in the financial markets, to determine not only “where” but also “when” to invest your assets.

3) Always Wear Clean Underwear

This was one of my favorite sayings from my Mother because I always wondered about the rationality of it. I always figured that even if you wore clean underwear before an accident, you’re still likely left without clean underwear following it.

The investing lesson is: “You are only wrong – if you stay wrong.“

However, being an intelligent investor means always being prepared in case of an accident. That means simply having a mechanism to protect you when you are wrong with an investment decision.

You will notice that I said “when you are wrong” in the previous paragraph. Many of your investment decisions will likely turn out wrong. However, cutting those wrong decisions short and letting your right decisions continue to work will make you profitable over time.

Any person who tells you about all the winning trades he has made in the market – is either lying or hasn’t blown up yet.

One of the two will be true – 100% of the time.

Understanding the “risk versus reward” trade-off of any investment is the beginning step to risk management in your portfolio. Knowing how to mitigate the risk of loss in your holdings is crucial to your long-term survivability in the financial markets.

4) If Everyone Jumped Off The Cliff – Would You Do It Too?

Every kid, at one point or another, has tried to convince their Mother to allow them to do something through “peer pressure.” I figured if she wouldn’t let me do what I wanted, she would bend to the will of the imaginary masses. She never did.

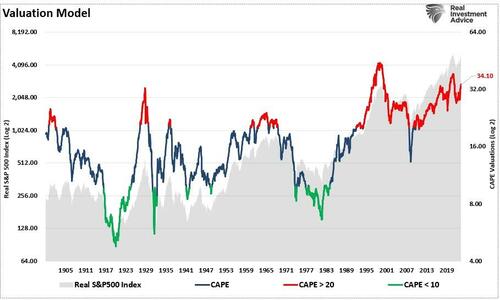

“Peer pressure” is one of the biggest mistakes investors repeatedly make. Chasing the latest “hot stocks” or “investment fads” that are already overvalued and are running up on speculative fervor always ends in disappointment.

Investors buy stocks that have moved significantly off their lows in the financial markets because they fear “missing out.” This is speculating, gambling, guessing, hoping, praying – anything but investing. Generally, when the media begins featuring a particular investment, individuals have already missed the major part of the move. By that point, the probability of a decline began to outweigh the possibility of further rewards.

The investing lesson is to be aware of the “herd mentality.” Historically, investors tend to run in the same direction until that direction falters. The “herd” then turns and runs in the opposite direction. This continues to the detriment of investors’ returns over long periods.

This is also generally why investors wind up buying high and selling low. To be a long-term successful investor, you must understand the “herd mentality” and use it to your benefit – getting out from in front of the herd before you are trampled.

So, before you chase a stock that has already moved 100% or more, figure out where the herd may move to next and “place your bets there.” This takes discipline, patience, and a lot of homework, but you will often be rewarded for your efforts.

5) Don’t Talk To Strangers

This is just good, solid advice all the way around. Turn on the television, any time of the day or night, and it is the “Stranger’s Parade of Malicious Intent.” I don’t know if it is just me or if the media only broadcasts news revealing human depravity’s depths. Still, sometimes, I wonder if we are not due for a planetary cleansing through divine intervention.

However, back to investing lessons, getting your stock tips from strangers is a sure way to lose money in the stock market. Your investing homework should NOT consist of a daily regimen of CNBC, followed by a dose of Grocer tips, capped off with a financial advisor’s sales pitch.

To succeed in the long run, you must understand investing principles and the catalysts to make that investment profitable. Remember, when you invest in a company, you buy a piece of it and its business plan. You are placing your hard-earned dollars into the belief that the individuals managing the company have your best interests at heart. The hope is they will operate in such a manner as to make your investment more valuable so that it may eventually be sold to someone else for a profit.

This also embodies the “Greater Fool Theory,” which states that someone will always be willing to buy an investment at an ever higher price. The investing lesson is that, in the end, someone is always left “holding the bag.” The trick is to ensure that it isn’t you.

Also, you must be aware of this when getting advice from the “One Minute Money Manager” crew on television. When an “expert” tells you about a company you should be buying, remember he already owns it and most likely will be the one selling his shares to you.

6) You Either Need To “Do It” (polite version) Or Get Off The Pot!

When I was growing up, I hated to do my homework, which is ironic since I now do more homework than I ever dreamed of in my younger days. Since I wouldn’t say I liked doing homework, school projects were rarely started until the night before they were due. I was the king of procrastination.

My Mom was always there to help, giving me a hand and an ear full of motherly advice, usually consisting of many “because I told you so…”

Interestingly, many investors tend to watch stocks for a very long period, never acting on their analysis but idly watching as their instinct proves correct and the stock rises in price.

The investor then feels that they missed his entry point and decides to wait, hoping the stock will go back down one more time so that he can get in. The stock continues to rise. The investor continues to watch, becoming more frustrated until he finally capitulates on his emotion and buys the investment near the top.

The investing lesson is to be aware of the dangers of procrastination. On the way up and down, procrastination is the precursor of emotional duress derived from the loss of opportunity or the destruction of capital.

However, if you do your homework and can build a case for the purchase, don’t procrastinate. If you miss your opportunity for the correct entry into the position – don’t chase it. Leave it alone, and come back another day when ole’ Bob Barker is telling you – “The Price Is Right.”

7) Don’t Play With It – You’ll Go Blind

Well…do I need to go into this one? All I know for sure is that I am not blind today. What I will never know for sure is whether she believed it or if it was just meant to scare the hell out of me.

However, kidding aside, the investing lesson is that when you invest in the financial markets, it is very easy to lose sight of your intentions in the first place. Getting caught up in the hype, getting sucked in by the emotions of fear and greed, and generally being confused by the multitude of options available can cause you to lose your focus.

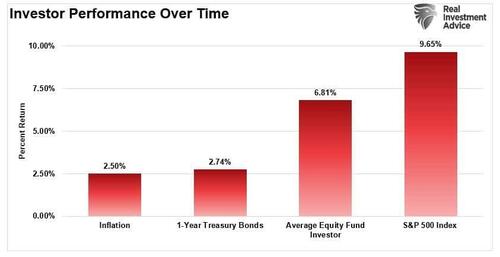

Always return to the basic principle you started with. That goal was to grow your small pile of money into a much larger one.

Putting It All Together

My Dad once taught me a fundamental investing lesson as well: KISS: Keep It Simple Stupid.

This is one of the best investment lessons you will ever receive. Too many people try to outsmart the market to gain a small, fractional increase in return. Unfortunately, they take disproportionate risks, often leading to negative results. The simpler the strategy is, the better the returns tend to be. Why? There is better control over the portfolio.

Designing a KISS portfolio strategy will help ensure that you don’t get blinded by continually playing with your portfolio and losing sight of what your original goals were in the first place.

- Decide what your objective is: Retirement, College, House, etc.

- Define a time frame to achieve your goal.

- Determine how much money you can “realistically” put toward your monthly goal.

- Calculate the return needed to reach your goal based on your starting principal, the number of years to your goal, and your monthly contributions.

- Break down your goal into achievable milestones. These milestones could be quarterly, semi-annual, or annual and will help ensure you are on track to meet your objective.

- Select the appropriate asset mix that achieves your required results without taking on excess risk that could lead to more significant losses than planned.

- Develop and implement a specific strategy to sell positions during random market events or unexpected market downturns.

- If this is more than you know how to do – hire a professional who understands essential portfolio and risk management.

There is much more to managing your portfolio than just the principles we learned from our Mothers. However, this is a start in the right direction, and if you don’t believe me – just ask your Mother.

Plagiarism Scandal Hits The Fed

Plagiarism Scandal Hits The Fed

Lisa Cook, governor of the US Federal Reserve. Photographer: Al Drago/Bloomberg

Tyler Durden

Wed, 04/10/2024 - 12:45

Lisa Cook, governor of the US Federal Reserve. Photographer: Al Drago/Bloomberg

Tyler Durden

Wed, 04/10/2024 - 12:45

Another week, another plagiarism scandal in the ivory towers.

This time, journalists Chris Rufo and the Daily Wire's Luke Rosiak found that Federal Reserve governor Lisa Cook appears to have plagiarized her academic work in violation of her former university's policy.

Lisa Cook, governor of the US Federal Reserve. Photographer: Al Drago/Bloomberg

Lisa Cook, governor of the US Federal Reserve. Photographer: Al Drago/Bloomberg

Cook, who taught economics at Harvard and Michigan State before serving on the Obama administration's Council of Economic Advisers, went on to be appointed to the Federal Reserve Board of Governors in 2022. At the time, her academic record was so thin - and focused on race activism vs. 'rigorous, quantitative econ,' that she had trouble getting confirmed by the Senate (her nomination required VP Kamala Harris to cast a tie-breaking vote).

According to Rufo, "in a series of academic papers spanning more than a decade, Cook appears to have copied language from other scholars without proper quotation and duplicated her own work and that of coauthors in multiple academic journals, without proper attribution." (Click into the below thread on X for more examples).

In "The Antebellum Roots of Distinctively Black Names," Cook copied-and-pasted verbatim language from Calomiris and Pritchett, without using quotation marks when describing their findings, as required by her own university’s written policy. pic.twitter.com/1KwWCtTntU

— Christopher F. Rufo ⚔️ (@realchrisrufo) April 10, 2024According to Michigan State's own policy on plagiarism, Cook is a plagiarist. In the past, administrators have warned students that "plagiarism is considered fraud and has potentially harsh consequences including loss of job, loss of reputation, and the assignation of reduced or failing grade in a course."

Cook's work is littered with these and other instances of plagiarism and self-plagiarism, according to MSU's policy. Some of the instances are minor, perhaps signifying sloppiness, but others are much more troubling, rising to apparent misconduct. pic.twitter.com/zoqwfVEX4Y

— Christopher F. Rufo ⚔️ (@realchrisrufo) April 10, 2024Cook duplicates long passages verbatim without quotation or proper attribution, changing minor words and punctuation.

Cook's most famous "economics" paper is about how the number of black inventors purportedly plummeted suddenly in 1900 due to racism. In reality, one of the largest data sets of inventions Cook was relying on simply ended in that year.

— Luke Rosiak (@lukerosiak) April 10, 2024What's more, Cook's rigor has also come under fire and she misrepresented her own credentials. As Rufo and Rosiak write in City Journal and the Daily Wire:

Her most heralded work, 2014’s “Violence and Economic Activity: Evidence from African American Patents, 1870 to 1940,” examined the number of patents by black inventors in the past, concluding that the number plummeted in 1900 because of lynchings and discrimination. Other researchers soon discovered that the reason for the sudden drop in 1900 was that one of the databases Cook relied on stopped collecting data in that year. The true number of black patents, one subsequent study found, might be as much as 70 times greater than Cook’s figure, effectively debunking the study’s premise.

Cook also seems to have consistently inflated her own credentials. In 2022, investigative journalist Christopher Brunet pointed out that, despite billing herself as a macroeconomist, Cook had never published a peer-reviewed macroeconomics article and had misrepresented her publication history in her CV, claiming that she had published an article in the journal American Economic Review. In truth, the article was published in American Economic Review Papers and Proceedings, a less prestigious, non-peer-reviewed magazine.

When asked for comment, Cook told the journalists: "I certainly am proud of my academic background."

As Rufo and Rosiak note in closing (emphasis ours):

Cook is no stranger to mobilizing such punishments against others. In 2020, she participated in the attempted defenestration of esteemed University of Chicago economist Harald Uhlig for the crime of publicly opposing the “defund the police” movement. She called for Uhlig’s removal from the classroom, claiming that he had made an insensitive remark about Martin Luther King, Jr. (The university closed its own inquiry after concluding that there was “not a basis” to investigate further.) Uhlig, in a 2022 op-ed for the Wall Street Journal, asked the pertinent question: Under the leadership of an ideologue such as Lisa Cook, would the Fed continue to pursue its mandate, or succumb to left-wing activism?

Time will tell if the gears of justice turn against Lisa Cook, or if repeated academic misconduct, defended by some as mere sloppiness or isolated mistakes, is fast becoming an acceptable part of the academic order—as long as the alleged author of that behavior is favored by the powerful.

Archbishop Howlader issues Eid greetings, for a 'stronger relationship' between Christians and ...

The prelate, who chairs the Episcopal Commission for Christian Unity and Interreligious Dialogue, released a statement to mark the end of Ramadan. In it, he says that promoting 'social fraternity and world peace' is a shared task. In addition to Eid celebrations, preparations are underway for Bengali New Year on 14 April.

Lost Boys Screening and Panel Discussion in London, May 29th

Join us on Wednesday, May 29th for a private screening of The Lost Boys: Searching for Manhood, produced by The Center for Bioethics and Culture. This film completes the trilogy of films which explore the topic of the transgender “gender affirmation” therapy as the main treatment for minors and young adults experiencing a misalignment between their body and their feelings. After the film, there will be a panel discussion with the Director, Jennifer Lahl, including several of the movie’s most prominent experts:

- Graham Linehan

- Joe Burgo PhD

- Dr. Az Hakeem

- Gary Powell

The panel will be moderated by the funny and brilliant Mr. Menno.

Time:

6:30 p.m. – 8:30 p.m. (Doors open at 6:00 p.m. with light refreshments served)

Location:

London, UK (Exact location will be disclosed 24 hours prior to the event start for privacy).

COST: £10

DonorboxEventWidget.embed({container: 'donorboxEmbed',embedFormSlug: 'https://donorbox.org/embed_event/582539'});

The post Lost Boys Screening and Panel Discussion in London, May 29th appeared first on The Center for Bioethics & Culture Network.

Finklestein's Folly: How Not to Discredit One's Opponents

In our present age, too many believe the “winner” of an argument is whoever unleashes the most insults. Norman Finkelstein’s recent “debate” with the online personality Destiny is Exhibit A.

Irish Psychiatrist issues warning as physically healthy Dutch and Canadian autistic women are approved for death by euthanasia.

Alex Schadenberg

Executive Director, Euthanasia Prevention Coalition

Maria Maynes was published by RIPT on April 9, 2024 concerning the debate to legalize euthanasia in Ireland. Maynes interviewed Consultant psychiatrist, Professor Patricia Casey, a specialist in Adult Psychiatry. Maynes reportes:recent cases unfolding worldwide involving physically healthy young people should provide evidence to Irish lawmakers that “the slippery slope exists,” as she expressed particular concern about those with autism choosing assisted suicide or euthanasia.

Last month, this publication also reported on the Canadian case of an unnamed 27-year-old woman, who was also autistic, and had chosen to die by physician assisted suicide. While the father of the unnamed woman tried to intervene through court action, arguing that she did not have the ability to consent to the death under Canada’s MAiD programme, his intervention was unsuccessful.

There have also been cases in Belgium, where Asperger’s (now subsumed under the autistic spectrum) is among the most common conditions for which Belgians seek euthanasia on mental health grounds, alongside personality disorders and depression.Maynes quoted Casey as stating:

“There is a danger that when young, autistic people see a problem that they will look for what they see is a simple solution, or a trendy solution,” she said.Casey also stated:

“I was struck by the photograph of 28-year-old Zoraya ter Beek in the Netherlands, who was pictured surreally embraced in the arms of her boyfriend while announcing that she was due to die on May 28th. This photograph conceals the turmoil and nihilism behind her decision and may well be used in the future to promote assisted dying as a calming answer to one’s problems.”Professor Casey compares the issue to the romanticizing of suicide that was successfully countered by national campaigns. Professor Casey fears that the same type of romanticizing of death by euthanasia will also occur.

Professor Anne Doherty examined the issue of suicide rates in jurisdictions that have legalized euthanasia and assisted suicide. Professor Casey referred to her research and stated:

“Prof Doherty found that the rate of non-assisted suicide increased after assisted suicide was legalised, and I fear we will see exactly the same pattern. I also think it is very nihilistic to say to people, ‘There is no help. Why don’t you go for assisted suicide?’ I mean, it is such a dark thing to say to anybody. I think it should be absolutely taboo, but instead of that, it is now becoming glamorised.”Professor also commented on the "bracket creep" in countries that have legalized euthanasia and stated:

“This is what has happened in a range of countries. The Netherlands, for instance, didn’t start with euthanasia for young people with mental illness. It legislated initially for those with terminal illness. Similarly in Canada and in Belgium. Now all of those countries are allowing assisted suicide for young people, or for people with mental illness – or a combination of both.”

As for the concern that people with Autism are more susceptible to requesting euthanasia, Casey stated:

“One of the reasons a young person with autism may be more susceptible is due to the fact that a lot of those with autism have unusual interests and hobbies. For example, some would have an interest in the afterlife, or the occult, or similar. We also know that some individuals who are on the autistic spectrum have very fixed beliefs about things, and so can be quite suggestible.”

“Once something has been suggested, the person can fixate on that. I think the interest in unusual things, something we often see in those with ASD, and some of the things that are outside the norm, along with their tendency to fixate on things, would make that person particularly vulnerable. For instance, people with rigid thinking, such as many of those with ASD, find it difficult to consider alternative solutions to problems. And this may render them more than willing to choose this particular pathway to death.”

Professor Casey also commented on the Social Contagion that is likely to happen with euthanasia:

“There will be a social contagion aspect, because as we know, teenagers and young adults are always online now. One person engaging in, or planning, an assisted suicide, will be in touch with others in their group and that contagion effect is very toxic.”

“We must not forget that suicide clusters existed in the recent past, because of social contagion. And it is difficult to escape that prospect in relation to assisted suicide, also.”

Ireland is currently debating the legalization of euthanasia. A recent parliamentary report was released which advocated that euthanasia be legalized for a person diagnosed with a disease, illness or medical condition that is both incurable and irreversible; advanced, progressive, and will likely cause death within six months (or within 12 months in the case of someone with a neuro-degenerative disease, illness or condition; and suffering in a manner that the person “cannot be relieved in a manner that the person finds tolerable.”

The Irish report obviously decided to push for the legalization of euthanasia in a fairly wide open manner.

For further reading, Gordon Friesen, the President of the Euthanasia Prevention Coalition issued a warning to Ireland in his article: If euthanasia is legalized as a cure for suffering, then suffering people will be "cured" with euthanasia!

The Declaration Dignitas infinita and the Mystery of the Church in our time - by Roberto de Mattei

by Roberto de MatteiApril 10, 2024On April 8, 2024, the Dicastery for the Doctrine of the Faith, headed by Cardinal Víctor Manuel Fernández, published the Declaration Dignitas infinita on Human Dignity, with the "ex audientia" approval of Pope Francis. Cardinal Fernández, dwelling in the Introduction of the Declaration on its genesis, clarifies that the first draft of the text, which dates back New Catholichttp://www.blogger.com/profile/04118576661605931910noreply@blogger.com

Myanmar troops surrender near Myawaddy, while civilians and soldiers flee to Thailand

Fighting is still ongoing after the military junta bombed the city, in Karen State. Thai authorities said yesterday that they expect 100,000 displaced people. Struggling in the country's border regions, the generals are betting everything on conscription, forcing civilians to enlist.

Western civilization's immunodeficiency disease

Liberalism

is to the social order what AIDS is to the body. By relegating the truths of natural law and

divine revelation to the private sphere, it destroys the immune system of the

body politic, opening the way to that body’s being ravaged by moral decay and

ideological fanaticism. I develop this

theme in a

new essay over at Postliberal Order.

Pump-Prices Continue To Surge, Gasoline Inventories See Small Build

Pump-Prices Continue To Surge, Gasoline Inventories See Small Build

Tyler Durden

Wed, 04/10/2024 - 10:38

Crude prices slid back to unchanged this morning - from some overnight gains - after a hotter than expected CPI print took demand-seducing rate-cuts off the table.

However, as Bloomberg reports, oil is still up 19% this year as OPEC+ cuts supply and geopolitical tensions across the Middle East create strong tailwinds. The market is bracing for Iran’s response to a suspected Israeli attack on its consulate in Syria last week, and top traders have been striking an increasingly bullish tone in recent days.

API reported a sizable crude build and another gasoline draw - all eyes will be on the official data for any confirmation.

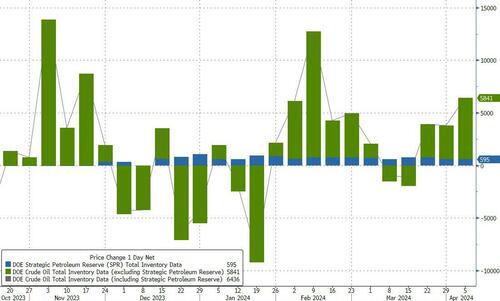

API

-

Crude +3.03mm (+800k exp)

-

Cushing +124k

-

Gasoline -609k (-1.4mm exp)

-

Distillates +120k (-600k exp)

DOE

-

Crude +5.84mm (+800k exp)

-

Cushing -170k

-

Gasoline +715k (-1.4mm exp)

-

Distillates +1.66mm (-600k exp)

Bigger than expected crude build surprised traders but a build in gasoline stocks was probably the most notable aspect of the report...

Source: Bloomberg

In aggregate, this is a pretty chunky nationwide inventory build. Total crude and product stockpiles climbed by 12 million barrels, excluding SPR last week. That’s the biggest weekly gain since July last year. In addition to crude build, there were also increases in the other oils category, as well as gasoline, jet fuel and diesel.

The Biden admin added 595k barrels to the SPR last week...

Source: Bloomberg

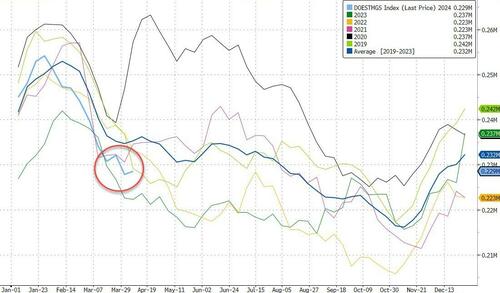

US gasoline stockpiles, which have plunged to the lowest levels this year, though they remain above the same period last year.

Source: Bloomberg

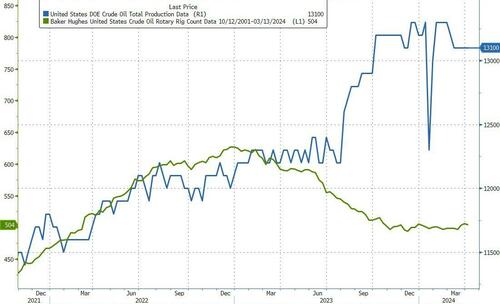

US Crude production was flat at 131.mm b/d, near record highs...

Source: Bloomberg

WTI was hovering around $85.25 ahead of the official data, dipped on the data then rallied higher...

Meanwhile, pump-prices continue to rise, as we expected, tracking wholesale gasoline prices higher...

Source: Bloomberg

...and if you think this morning's CPI was hot, with the highest pump-prices in six-months, just wait for next month...

Source: Bloomberg

Not at all what President Biden wanted to see, but we are sure it's all 'mom and pop' retail gas station owners' greed that is driving this!!!

“Desire Paths” and the Problem with Central Planning

So-called “desire paths” exist as an everyday testament to the flaws of central planning. They are a visual indication of the spontaneous order that occurs when individuals have the freedom to choose their own way.

Kippers, Kedgeree and Kiev

Our Clubland Q&A is now restored to its regular midweek time slot. If you missed today's edition live around the planet, here's the action replay. Mark was back at the microphone, fielding questions on many topics, from the Ukraine war to the State of