In proclaiming the faith and in administering the sacraments every priest speaks on behalf of Jesus Christ, for Jesus Christ.

All

Fatima Discussion with Dr. Taylor Marshall

This month of May, we discuss the most important miracle since the Resurrection. https://www.youtube.com/live/FrqLdr3U7xg?si=tSRiQpPGz3wnCfX3

US Spy Balloon Crashes In Northeast Syria

US Spy Balloon Crashes In Northeast Syria

Tyler Durden

Thu, 05/16/2024 - 15:05

A sizable surveillance aerostat owned by the US military crashed on Wednesday near the town of Rmelan in Syria's northeastern Al-Hasakah province.

Footage on social media showed the aerostat descending from the sky and, subsequently, its debris on the ground close to Rmelan, which was also near a US base. Allegedly, US fighter jets were seen flying over the vicinity during the event.

The US maintains several illegal bases in Syria, including the one in Rmelan, primarily in the northeastern provinces of Al-Hasakah and Deir Ezzor, as well as Al-Tanf in the southeast, purportedly to combat ISIS remnants.

Several local sources said the spy balloon crashed due to a technical malfunction, while others indicate that unidentified culprits shot down the aerostat. The Pentagon has yet to comment.

The US initially introduced aerostats to its Syrian bases years ago, although they were considerably smaller than the one that crashed near Rmelan.

The significant size of this aerostat indicates it likely carried sophisticated surveillance equipment, potentially including aerial radar systems.

US spy balloon shot down near Rmelan in NE Hasakah, #Syria. https://t.co/0XGm0zT2rF pic.twitter.com/OBiw1zbj2x

— tim anderson (@timand2037) May 16, 2024The day prior, the Lebanese group Hezbollah carried out multiple operations against Israel, including the downing of an Israeli surveillance balloon in the south of Lebanon and the demolition of the launching base and the control equipment utilized for its operation.

Hezbollah has been launching daily assaults on Israeli military installations since October 8, in solidarity with Gaza and in support of Palestinians. It has pledged to persist until the war on Gaza is stopped.

Hezbollah announced that it targeted and destroyed an Israeli balloon used to spy on Lebanon over the Israeli settlement of Adamit.

Through close surveillance, the group was also able to determine and target the spy balloon’s control center, which appeared to have been in a… pic.twitter.com/1NLKV82beN

Hezbollah said, "After tracking the movement of the spy balloon to monitor and spy on Lebanon and after determining its control center, our fighters targeted it with missiles."

The Feast of St John Nepomuk in Prague: Photos by Fr Lew

Our long-time contributor Fr Lawrence Lew has just visited Prague, which today celebrates the feast of one of its patrons, a priest of the archdiocese who was martyred in the year 1393. We are grateful to Father for sharing these pictures us; Prague is one of the loveliest cities in all of Europe, and really deserves to be captured by such a talented photographer.St John’s family name is Gregory DiPippohttp://www.blogger.com/profile/13295638279418781125noreply@blogger.com0

Goldbugs Waited Years For A Massive Comex Short Squeeze, And Finally Got It... Just In The Wrong Metal

Goldbugs Waited Years For A Massive Comex Short Squeeze, And Finally Got It... Just In The Wrong Metal

Tyler Durden

Thu, 05/16/2024 - 14:45

For much of the past decade, gold bugs religiously tracked the physical gold inventory located in the various gold vaults that make up the Comex system, eagerly awaiting the day when there would be more deliverables (via paper shorting of gold) than physical in storage, sparking a historic, Volkswagen-like short squeeze. Well, the day of a historic Comex short squeeze finally arrived... only it wasn't in gold but in the far less precious metal that is copper.

It all started one month ago, when we reported that in an attempt to enforce sanctions against Russia that actually worked (as opposed to the joke that is the western "oil embargo" now openly breached by absolutely everyone), the "US, UK Banned Deliveries Of Russian Copper, Nickel And Aluminum To Western Metals Exchanges." There, in our conclusion, we wrote that "history has taught us that the market will price in some “full-sanction” risk premium which when combined with the current macro bid (reflation narrative, electrification, "copper is the first AI commodity" etc.) means we expect a complex wide rally." Little did we know how truly historic said rally would be just one month later.

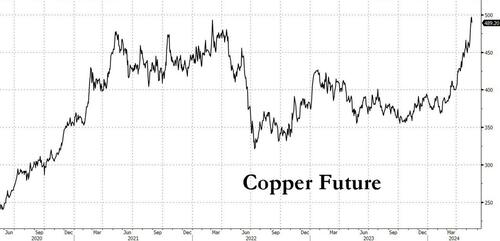

As anyone who has been following the recent moves in the price of copper - which is hitting daily record highs - knows by now, a massive dislocation between the prices for copper traded in New York and other commodity exchanges has rocked the global market for the metal and prompted a frantic dash for supplies to ship to the US.

The source of the disruption, as Bloomberg reports, is a record short squeeze that has driven up copper prices on the Comex exchange to the point where the premium for New York copper futures above the London Metal Exchange price has rocketed to an unprecedented level of over $1,200 per ton, compared with a typical differential of just a few dollars.

The blowout in that price spread has wrong-footed major players from Chinese traders to quant hedge funds, all of whom are now scrambling for metal that they can deliver against expiring futures contracts!

Adding fuel to the fire, the surge in the price is not just driven by technicals but also reflects the surge of interest from speculators after forecasts that long-term copper mine production will struggle to keep pace with demand. We have discussed the fundamental case for copper in "The Copper Supply Shortage Is Here", and most notably in "the Next AI Trade" where we said that copper is starting to show signs of what Goldman has called "AI exposure" considering it is an essential material to produce power, and added that Goldman recently has gone full-bore pushing for copper (see the following note from Goldman S&T "Turning Copper into Gold" available to professional subs).

While less important than the LME, Comex, which is part of the CME Group, is a key playground for investors, some of whom have used the exchange to build up large bullish bets on copper in recent months

“The broader story is that there are new investment funds that are boosting their exposure to copper for a multitude of reasons, and while that’s a global trend, a huge amount of that investment has been heading to Comex,” said Matthew Heap, a portfolio manager at Orion Resource Partners, the largest metals-focused fund manager.

As shown in the charts above, while copper prices had been rising for months, this week’s spike was specific to the Comex and the most-active futures contract for July delivery. By Wednesday, the July price had soared as much as 10%, touching a record high for that contract, even as the global benchmark contract on the LME traded broadly flat. The move, Bloomberg reports citing numerous traders and brokers, was a classic short squeeze as market participants who had placed bets on the Comex contract moving back into line with prices on the LME and in Shanghai, the other global copper benchmark, were forced to buy those positions back as prices rose, creating a vicious cycle and sending the price to a record.

Indeed, as Colin Hamilton, managing director for commodities research at BMO Capital Markets, said the spread of more than $1,000 a ton between Comex and London was “something never seen previously,” adding that “there has been a squeeze on short positions into contract expiry, exacerbating the move.”

In yet another example of hedge funds and other traders being too smart for their own good (i.e. a replay of the original GameStop short squeeze), they had taken the other side of the bullish trades on Comex, betting on narrowing differentials between the contracts in New York, London and Shanghai, or between New York contracts for different delivery dates, often with massive leverage. With prices on the Shanghai Futures Exchange relatively depressed, some Chinese physical market participants had also sold on the LME and Comex, with plans to export.

Putting this all together, and on Wednesday morning, the July Comex copper contract soared to a record $5.128 a pound ($11,305 a ton), also trading at a record premium above the September Comex contract — a monster backwardation that is hallmark of a short squeeze.

While the spike was driven by short covering rather than any overall physical shortage, traders and brokers say, but it has shined a light on relatively tight supplies in the US copper market, just as we warned a month ago in "The Copper Supply Shortage Is Here. Case in point, inventories tracked by the Comex currently total 21,066 short tons, while LME inventories in the US are just 9,250 tons. For comparison, annual US copper demand is almost 2 million tons. Traders say solid demand, and shipping issues at the Panama and Suez canals, have left the market tight. Indeed, US copper imports year-to-date are down 15%, according to consultancy CRU Group.

“We continuously monitor our markets, which are operating as designed as market participants manage copper risk and uncertainty,” the CME said in a statement.

Of course, as our readers know too well, short squeezes are nothing new in commodity markets, and they often prompt a mad scramble to find supplies of raw materials that underpin paper contracts. The most recent and vivid example is the Nickel short squeeze of March 2022, when the Russian invasion of Ukraine led to a huge shortage in the market, and a staggering surge in the price which nearly bankrupted one of China's biggest commodity traders and the LME itself.

A similar squeeze took place in 2020, when Covid locked down much of the world, and gold traders raced to ship metal to address a similar dislocation between New York and London bullion prices. And in 1988, a short squeeze in aluminum led some traders to load the metal into jumbo jets — a highly unusual and costly mode of transport for industrial raw materials — in order to get it on to the LME as soon as possible.

The current Comex copper squeeze has triggered a similar dash to send copper to the US: Chinese traders have spent the past 24 hours calling around shipping companies to try to secure transit to the US, according to people familiar with the matter.

Traders and miners in South America have also raced to boost their US shipments. According to Bloomberg, Chilean copper-mining giant Codelco is directing all of its available volumes to the market and also negotiating with customers to postpone some sales so that it can maximize deliveries.

That said, there are tentative signs that the squeeze is easing: the July copper contract edged lower on Thursday morning after coming off its highs from Wednesday, while the premium over cash copper on the LME narrowed to $573 a ton — although still a historically elevated level.

There may be further relief ahead, as investors with bullish positions via commodity indexes are set to start rolling their copper positions in early June, providing an opportunity for traders with short positions to defer delivery, potentially easing the backwardation. Still, it remains unclear if that will be enough to resolve the squeeze ahead of the expiry of the July contract, which goes into delivery at the start of that month. And any attempts to provide further metal to the US to ease the squeeze may face challenges: Chinese traders seeking to transport metal to the US have found that shipping schedules are fully booked, with the earliest available shipping slots from Shanghai to New Orleans at the beginning of July, said Gong Ming, analyst with Jinrui Futures Co.

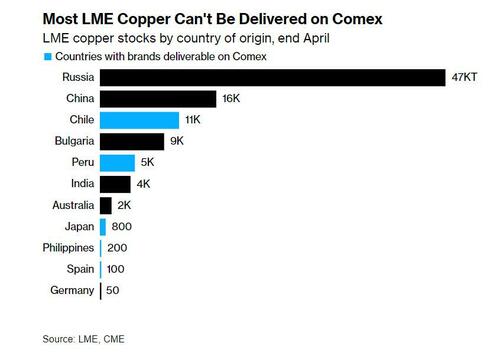

Adding to the plight of those caught out by the squeeze is the fact that much of the copper inventories outside the US is from brands that aren’t deliverable against Comex futures. For example, more than 80% of the 94,700 tons of copper on the LME at the end of April was produced in Russia, China, Bulgaria or India — countries whose copper isn’t deliverable on Comex as we reported a month ago, in a development that has eventually cascaded into today's historic squeeze.

And while substantial inventories have built up in China in recent months, traders estimate that only about 15,000 to 20,000 tons of that could be delivered against Comex futures.

“We do not think the physical arbitrage activity will be sufficient by the July expiry to close the arb on the near month. There is not enough material and not enough time,” said Anant Jatia, chief investment officer at Greenland Investment Management, a hedge fund specializing in commodity arbitrage trading.

“However, physical traders are currently heavily incentivized to move copper into the US and over time the arb market will stabilize.”

As for gold bugs, watching with sheer shock - and outright jealousy - the epic squeeze roiling the less precious metal, all they can hope for is that one day the massive paper shorts on the comex will lead to a similar meltup in gold. All that may be needed is a pair of enterprising Hunt Brothers for the new millennium to pull it off.

Harrison Butker for President

Three-time Super Bowl Champion Harrison Butker is the latest target of the Woke Mob. His offense? Butker, a Catholic, spoke about Catholicism at a Catholic school’s graduation ceremonies. Clearly he now must be canceled. Of course it’s more complicated than that. Butker specifically spoke of those aspects of Catholicism that we’re not supposed to talk about—such as a woman’s primary vocation…

$27,000 Gold

$27,000 Gold

Tyler Durden

Thu, 05/16/2024 - 14:25

Authored by James Rickards via DailyReckoning.com,

I’ve previously said that gold could reach $15,000 by 2026. Today, I’m updating that forecast.

My latest forecast is that gold may actually exceed $27,000.

I don’t say that to get attention or to shock people. It’s not a guess; it’s the result of rigorous analysis.

Of course, there’s no guarantee it’ll happen. But this forecast is based on the best available tools and models that have proved accurate in many other contexts.

Here’s how I reached that price level forecast…

This analysis begins with a simple question: What’s the implied non-deflationary price of gold under a new gold standard?

No central banker in the world wants a gold standard. Why would they? Right now, they control the machinery of global currencies (also called fiat money).

They have no interest in a form of money they can’t control. It took about 60 years from 1914–1974 to drive gold out of the monetary system. No central banker wants to let it back in.

Still, what if they have no choice? What if confidence in command currencies collapses due to some combination of excessive money creation, competition from Bitcoin, extreme levels of dollar debt, a new financial crisis, war or natural disaster?

In that case, central bankers may return to gold not because they want to, but because they must in order to restore order to the global monetary system.

What’s the Proper Gold Price?

That scenario begs the question: What is the new dollar price of gold in a system in which dollars are freely exchangeable for gold at a fixed price?

If the dollar price is too high, investors will sell gold for dollars and spend freely. Central banks will have to increase the money supply to maintain equilibrium. That’s an inflationary result.

If the dollar price is too low, investors will line up to redeem dollars for gold and then hoard the gold. Central banks will have to reduce the money supply to maintain equilibrium. That reduces velocity and is deflationary.

Something like the latter case happened in the U.K. in 1925 when it returned to a gold standard at an unrealistically low price. The result was that the U.K. entered the Great Depression several years ahead of other developed economies.

Something like the former case happened in the U.S. in 1933, when FDR devalued the dollar against gold. Citizens weren’t allowed to own gold, so there was no mass redemption of gold. But other commodity prices rose sharply.

That was the point of the devaluation. Resulting inflation helped lift the U.S. out of deflation and gave the economy a boost from 1933–1936 in the midst of the Great Depression. (The Fed caused another severe recession in 1937–1938 with their customary incompetence.)

The policy goal obviously is to get the price “just right” by maintaining the proper equilibrium between gold and dollars. The U.S. is in an ideal position to do this by selling gold from U.S. Treasury reserves, about 8,100 metric tonnes (261.5 million troy ounces), or buying gold in the open market using freshly printed Fed money.

The goal would be to maintain the dollar price of gold in a narrow range around the fixed price.

What price is just right? This question is easy to answer, subject to a few assumptions.

$27,533 Gold

U.S. M1 money supply is $17.9 trillion. (I use M1, which is a good proxy for everyday money).

What is M1? This is the supply that is the most liquid and money that is the easiest to turn into cash.

It contains actual cash (bills and coins), bank reserves (what’s actually kept in the vaults) and demand deposits (money in your checking account that can be turned into cash easily).

One needs to make an assumption about the percentage of gold backing for the money supply needed to maintain confidence. I assume 40% coverage with gold. (This was the legal requirement for the Fed from 1913–1946. Later it was 25%, then zero today).

Applying the 40% ratio to the $17.9 trillion money supply means that $7.2 trillion of gold is required.

Applying the $7.2 trillion valuation to 261.5 million troy ounces yields a gold price of $27,533 per ounce.

That’s the implied non-deflationary equilibrium price of gold in a new global gold standard. Of course, money supplies fluctuate; lately they’ve been going up sharply, especially in the U.S.

There’s room for debate about whether a 40% backing ratio is too high or too low. Still, my assumptions are moderate based on monetary economics and history. A dollar price of gold of over $25,000 per ounce in a new gold standard is not a stretch.

Obviously, you get around $12,500 per ounce if you assume 20% coverage. There are many variables in play.

The Fundamental Model

This model is also straightforward. It relies on factors we learned about in our first week of Intro to Economics — supply and demand.

The most significant development on the supply side is the decrease of new mining output. As the chart shows below, mine production of gold in the U.S. has been decreasing steadily since 2017.

These figures reveal a 28% decrease over seven years, at the same time gold prices were rising and miners were motivated to expand output.

That’s not to argue that the world has reached “peak gold,” (output could expand in future for a variety of reasons). Still, my contacts in the mining community consistently report that gold is becoming more difficult to source and the quality of newly discovered ore is low-to-medium at best.

Flat output, all things equal, tends to put a floor under prices and to support higher prices based on other factors.

The Demand Side

The demand side is driven largely by central banks, ETFs, hedge funds and individual purchases. Traditional institutional investors are not large investors in gold. Much of the demand from hedge funds is conducted in derivatives such as gold futures.

Derivatives generally don’t involve physical delivery of gold. They involve “paper gold” that far exceeds the actual, physical gold supply. It’s this paper gold market that accounts for volatility in the gold market, not gold itself.

Meanwhile, central bank demand for gold has surged from less than 100 metric tonnes in 2010 to 1,100 metric tonnes in 2022, a 1,000% increase in 12 years. Central bank gold demand remained strong in 2023 with 800 metric tonnes acquired through Sept. 30.

That puts central bank gold demand on track for a new record. There’s no sign of that demand slowing in 2024.

Overall, the picture is one of flat supply and increasing demand, mostly in the form of official purchases by central banks.

A Math Lesson

Finally, a bit of elementary math is helpful in understanding how the dollar price of gold can move past $25,000 per ounce in the next two years. For this purpose, we’ll assume a baseline price of $2,000 per ounce (although gold has been in the $2,300 range lately with no signs of falling back to the $2,000 level).

But for our purposes, we’ll keep it simple.

A move from $2,000 per ounce to $3,000 per ounce is a heavy lift. That’s a 50% increase and could easily take a year or more. Beyond that, a further increase from $3,000 to $4,000 is a 33% increase: another large rally. A further gain from $4,000 per ounce to $5,000 per ounce is a further gain of 25%.

But notice the pattern. Each gain is $1,000 per ounce, but the percentage increase drops from 50% to 33% to 25%. That’s because the starting point is higher while the $1,000 gain is constant. Each $1,000 jump represents a smaller (and easier) percentage gain than the one before.

This pattern continues. Moving from $9,000 per ounce to $10,000 per ounce is only an 11% gain. Moving from $14,000 per ounce to $15,000 per ounce is only a 7% gain. Gold can move 1% in a single trading day, sometimes 2% or more.

As an extreme example, a move from $99,000 per ounce to $100,000 per ounce is about a 1% move. Those $1,000 pops get even easier as we approach my calculated gold price of $27,533.

The lesson for you as an investor is to buy gold now.

As prices continue to rally, you’ll get more gold for your money at the outset and high-percentage returns as gold rallies from a lower base. Toward the end of the long march past $25,000 per ounce, you’ll have bigger dollar gains because you started with more gold.

Others will jump on the bandwagon, but you’ll already have a comfortable seat.

May 16 - Israelis Realize They Fell Into a Trap

(Retired IDF General Itzak Brick)

Please send links and comments to hmakow@gmail.com)

Mahmod Od--IDF General: "WE'RE LOSING TO HAMAS AND THE WORST IS YET TO COME"

For a year Itzak Brick has been making a realistic appraisal of what has happened. Israelis have been duped into a disastrous war.

IDF soldiers are refusing to reenlist. Parents preventing their sons from re-enlisting. General decadence of Israeli society has undermined the IDF. Discipline is terrible.

Egypt considering ripping up peace accords. If Egypt, Iran and Turkey got together, goodbye Israel. Brick advises a ceasefire to prepare for this wider war.

"These facts cannot be debated, and yet Halevi continues to hold his title, thanks to his accomplices, PM Benjamin Netanyahu and Defense Minister Yoav Gallant. This group could bring us total destruction. It is simply unimaginable how this group that should have stood trial continues to manage the country and the war for us. These three and all their followers should resign from their jobs, sit in their homes until the end of their days, and atone for their sins."

Brick has warned about an Oct 7 attack for years

Morale is terrible----The warning comes on the heels of a number of polls showing that a large portion of Israeli citizens have lost faith in the future of their nation. A poll published by the Pnima Movement at the start of the month showed that 40 percent of Israelis were not optimistic about the country's future. It also showed that 33 percent of Israeli youth are seriously considering emigrating out of the occupied territory.

Meanwhile, at least 75 percent of Israeli Arabs believe Jews have no right to sovereignty in occupied Palestine, according to a survey by Habithonistim-Protectors of Israel published on 9 May.

She was a friend

Israel Begged Quatar to Fund Hamas

In February 2020, during Halevi's tenure as commander of the Southern Command, he joined the former director of the Mossad, Yossi Cohen, on a secret trip to Doha, the capital of Qatar. There, the two met with Mohammad bin Ahmad Al-Musnad, the national security adviser of the Emirate of Qatar, and with Mohammad al-Emadi, Qatari businessman.

In response to this meeting, MK Avigdor Liberman stated on Channel 12, "The head of the Mossad together with the commander of the Southern Command on Netanyahu's behalf, begged the Qataris to continue pouring money into Hamas after March 30."

-

Turkey claims Israel represents a threat

Calls Hamas "first line of defence"

--

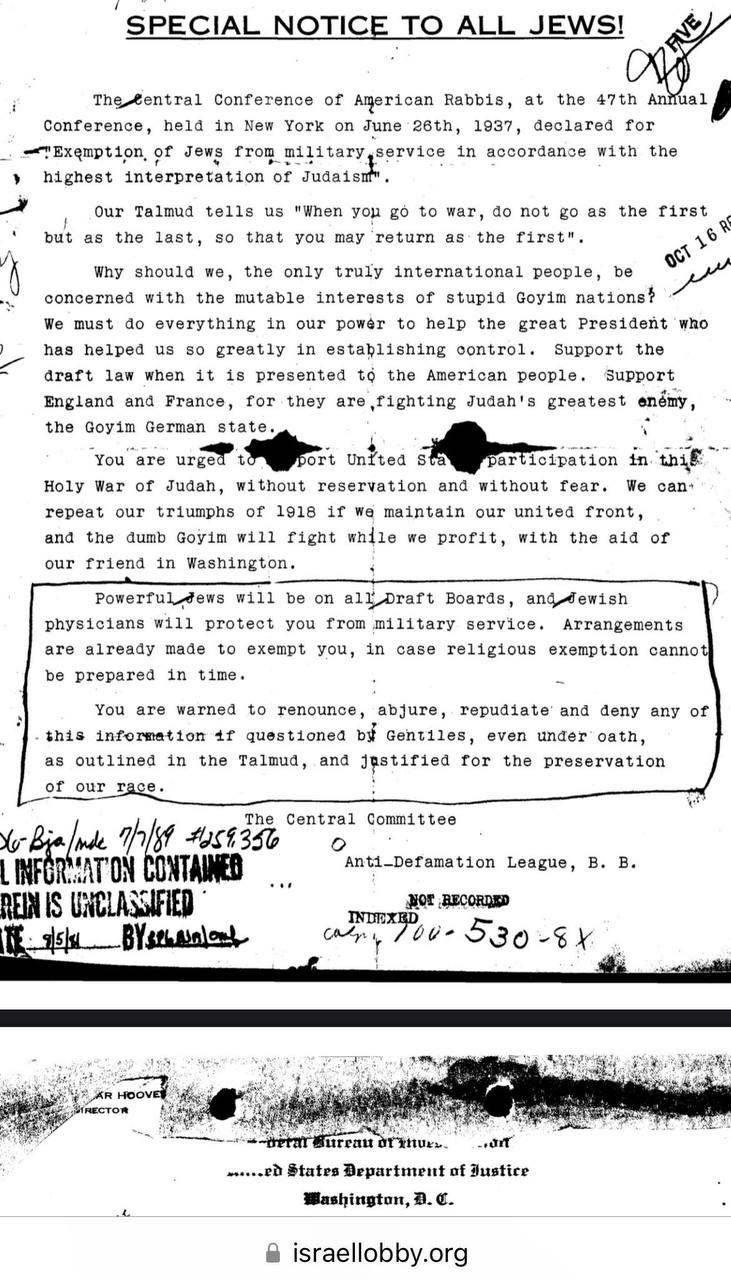

(Helping Jews avoid conscription in 1937)

Secret letter from the "The Central Conference of American Rabbis" revealed?

"the dumb goyim will fight while we profit"

-

Billionaire tells Stephen Colbert- Do not be attached to material things.

Canada's intelligence agency classifies opponents of LGBT gender ideology as a 'violent threat'

The Canadian Intelligence Service contends in a recent report that people in the 'anti-gender movement' are homophobic and transphobic.

-

Japan's most senior cancer doctor: COVID shots are 'essentially murder'

Dr. Masanori Fukushima has called on the World Health Organization to lead an investigation of the harmful outcomes of the COVID shots.

-

Secret, Leaked Speech by Former Chinese Defense Minister Demonstrates China's Intent to Destroy America

Submitted by Dave Hodges on Wednesday, May 15, 2024 - 17:47.

"The central committee believes, as long as we resolve the United States problem at one blow, our domestic problems will all be readily solved. Therefore, our military battle preparation appears to aim at Taiwan, but in fact is aimed at the United States, and the preparation is far beyond the scope of attacking aircraft carriers or satellites.

- Chinese Defense Minister Gen. Wei Fenghe

-

Chemtrails are not a conspiracy theory

Chemtrail pilot reveals the truth. But they are not told why.

-

BC Ferries announces all-gender washrooms, free menstrual supplies for passengers

https://www.westernstandard.news/news/bc-ferries-announces-all-gender-washrooms-free-menstrual-supplies-for-passengers/54582

BC Ferries has announced it is investing in converting its bathrooms from traditionally separate mens' and womens' rooms to "inclusive" washrooms for "all genders."

The publicly-owned, privately run company also pledged to supply menstrual products to all passengers, not just women.

Braille signage will also be added to help accessibility for the blind.

More than 300 existing public and staff washrooms on ferries and at terminals will be converted into these "all-gender" washrooms.

"These initiatives are more than just enhancements to our services; they represent our ongoing commitment to creating an inclusive environment that respects the diverse needs of all our customers," wrote BC Ferries VP of public affairs and marketing Lindsay Matthews in a statement.

--

(Brandon belongs to the Soros-Communist wing of Masonic Jewry)

SHOCKING: Government Told Paramedics To Mark Anyone Over 70 As Not Worthy of Life - Scottish COVID Inquiry

This is plain murder.

"Toe tagging" - means marked for death and ok to let die.

The government told paramedics to mark anyone over 70 as not worthy of life and therefore not to receive treatment for anything!!!

Treatment that may have saved lives!!!

Discussions then took place about reducing this age limit to anyone over 50!!!!!

--

WAYNE ROOT: My Message to President Trump: The Debates are a Trap. Something is Wrong. Drug Test Biden.

Watch: Senior Navy DEI Chief Admits Wokeness Would Be 'Out The Window' If China-Taiwan War Broke Out

Watch: Senior Navy DEI Chief Admits Wokeness Would Be 'Out The Window' If China-Taiwan War Broke Out

Tyler Durden

Thu, 05/16/2024 - 14:05

A senior DEI adviser to US Navy Admiral Lisa Franchetti has admitted in undercover footage that woke initiatives would evaporate if a "world war" breaks out, and that military colleagues think Diversity Equity and Inclusion is a "waste of time."

In undercover footage obtained by Louder with Crowder, Navy Senior Chief Thomas Riggs, who says he leads the military branch's DEI initiatives despite calling it irrelevant, revealed that many of his colleagues frown on the military's emphasis on wokeism.

"Diversity, equity, inclusion? Yeah, of course, they [military colleagues] think it's a waste of time. Except my boss, I mean, Lisa, the admiral, she doesn't think it is. She likes it. But secretly, everybody else is like eh," said Riggs. "You know what's going to happen when the first missile hits the first side of the first DEG [Guided Missile Escort Ship]? What's it going to matter? It won't. Diversity, equity, inclusion. It'll just be out the window."

Riggs also said that the most dangerous threat facing America today is China.

"Soon as China invades -- when China invades Taiwan. None of this is going to matter. That's what they're saying to me about my program," he said, adding that he thinks Donald Trump will win the November election.

"I think he will win [the election]. I think he will. I think he's going to win hands down.

BREAKING: Top DEI Advisor to @USNavy Admiral Lisa Franchetti Tells Undercover Journalist “China” is The United States Biggest Threat and That Woke Initiatives Will Be Gone if a ‘World War’ Breaks Out; Says Military Colleagues Think DEI is a “Waste of Time”; Believes Trump Will… pic.twitter.com/BrWh9Zkqfq

— Steven Crowder (@scrowder) May 16, 2024"Unless something happened…Like he goes to jail or something like that, or somebody kills him. I mean, I hate to say it, but, you know, that's kind of the only way he's -- I mean, people don't have a lot of faith in Biden."

"If we have a Republican in office, it will bolster our military…and I'm a Democrat. But I'm just -- from a strictly military standpoint, Republicans are always better for military."

Where's the lie?

That said, if Trump is reelected, Riggs said his job will be to slip DEI into the military in a more covert way.

"My job will still exist [if Trump is elected]. It's just like I was telling you -- DEI wouldn't, I wouldn't be able to come out and say I'm a DEI practitioner. It's like, now I can say -- I would just say I'm an Equal Opportunity advisor. Big climate specialist. And I would," he said.

"Like I told you, I'd skirt around DEI…would have to be a play on words, I would never be able to come out and say it. People would be like, ‘whoa, whoa, whoa, whoa, whoa.’ There's no such thing as DEI anymore," Riggs continued.

"When I came into the program, I wrote an essay on white privilege in the United States military. I was able to get the job that I've gotten by talking about white privilege."

Florida Condo Owners Dump Units Over Six-Figure Special Assessments

Florida Condo Owners Dump Units Over Six-Figure Special Assessments

Tyler Durden

Thu, 05/16/2024 - 13:45

Authored by Mike Shedlock via MishTalk.com,

Have a Florida condo? Can you afford a $100,000 or higher special assessment for new safety standards?

After the collapse of a Surfside Building on June 24, 2021that killed 98 people, the state passed a structural safety law that is now biting owners.

Not only are insurance rates soaring, but owners are hit with huge special assessments topping $100,000.

New Florida Law Roils Its Condo Market

The Wall Street Journal reports New Florida Law Roils Its Condo Market

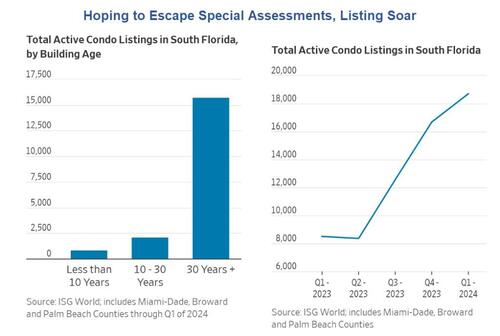

Condo inventory for sale in South Florida has more than doubled since the first quarter of last year, to more than 18,000 units. While the sharp rise in Florida home insurance costs is driving some to sell, most of the units on the market are in buildings 30 years or older. Under the new law, buildings must pass milestone structural inspections no later than 30 years after they are built.

In Miami, about 38% of the housing stock is condos, the highest of any major metropolitan area in the U.S., according to Zillow. Of those buildings, nearly three-quarters are at least 30 years old. For those that have large repairs looming, many owners are scrambling to sell before Jan. 1 when building reserves must be fully funded to be in compliance with the law.

“I think this is just the beginning,” said Greg Main-Baillie, an executive managing director at real-estate firm Colliers, who oversees 40 condo renovation projects across the state.

Owners are struggling to find all-cash buyers because mortgage lenders are increasingly unwilling to take on the risk associated with these units. “It’s not the buyers that aren’t qualifying,” said Craig Studnicky, chief executive at ISG World. “It’s the buildings that aren’t qualifying.”

State law previously allowed condos to waive reserve funding year after year, leading many buildings, including the nearly 50-year-old Cricket Club, to keep next to nothing in their coffers. Now, about 40 units in the building of 220 are listed for sale but are seeing little interest.

“These units are practically being given away,” said Sari Papir, a retired real-estate agent who has lived in the Cricket Club with her partner Shaul Szlaifer since 2018. “Even if we found a buyer, what could we buy with the pennies we’d receive for our unit?”

Some are worried developers may already be purchasing condos in the building for a potential takeover, where a developer tries to gain control of a building to knock it down and build a newer, more luxurious one. These condo terminations are happening up and down the state’s coastline. While the rules can vary by building, if enough people vote to sell their units, the others have to follow along.

No Way to Escape the Assessment

Those who cannot sell and don’t have the special assessment, will be evicted and their units seized for whatever the Associations can get for them.

South Florida listings have doubled in the past year to over 18,000. Few of those units will sell, and those that do sell will be at a huge haircut.

The Journal noted the plight of Ivan Rodriguez who liquidated his 401K to buy a condo for $190,000. He then faced a $134,000 special assessment. Eventually he sold the unit for $110,000.

Got the Insurance Blues?

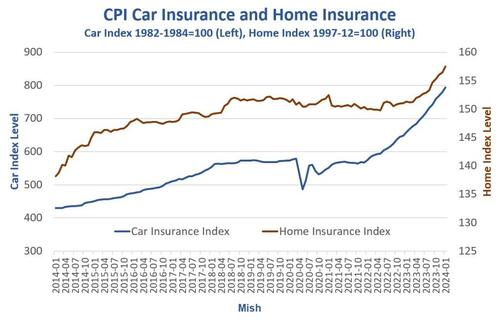

Auto insurance is up more than 20 percent from a year ago. In many places, private home insurance isn’t available at all. Consumers are steaming.

Insurance data from the BLS, chart by Mish

On February 17, 2024 I asked Got the Insurance Blues? Auto and Home Insurance Costs are Soaring

Car insurance is on an amazing run. For 13 straight months, insurance is up at least 1.0 percent. For 20 straight months car insurance is up at least 0.7 percent.

Home insurance, if you can get it at all from any private insurer, is also rising at a fast clip.

If you live in a flood zone, hurricane zone, or fire zone, insurance may be very difficult to get.

Proposition 103 Backfires, State Farm to Cancel 72,000 California Policies

Citing wildfire risk, State Farm will not renew policies on 30,000 homes and 42,000 business in California. Blame the state, not insurers.

On March 26, I noted Proposition 103 Backfires, State Farm to Cancel 72,000 California Policies

Proposition 103 limited the annual increases of insurance companies. State Farm responded by cancelling 72,000 policies.

The Idiot’s Response

Carmen Balber, the executive director of Consumer Watchdog, said “The industry is not going to start covering Californians again without a mandate.”

“That is why we think the legislature needs to step in and require insurance companies to cover people.”

Force companies to cover people. What a hoot. The insurers would all leave and everyone would be on the “FAIR” plan.

Think!

Think carefully about where you want to live. And if it’s a condo, you better be prepared for huge special assessments.

And most of all, know your builder. For discussion, please see America’s Homebuilder: D.R. Horton Homes Falling Apart in Months

Peru Classifies Transgender Individuals As 'Mentally Ill'

Peru Classifies Transgender Individuals As 'Mentally Ill'

There has been high levels of homophobic, transphobic and gender violence in Peru Credit: Fotoholica Press

Tyler Durden

Thu, 05/16/2024 - 13:25

There has been high levels of homophobic, transphobic and gender violence in Peru Credit: Fotoholica Press

Tyler Durden

Thu, 05/16/2024 - 13:25

The Peruvian government has officially categorized transgender and intersex people as "mentally ill," which the health ministry says is the only way that Peru's public health services could guarantee "guarantee full coverage of medical attention for mental health," The Telegraph reports.

Conditions now recognized as mental health disorders include transsexualism, dual role transvestism, gender identity disorder in childhood, other gender identity disorders, fetish transvestism, and egodystonic sexual orientation."

The classification aligns closely with the the Diagnostic and Statistical Manual of Mental Disorders (DSM-5), which classifies "gender dysphoria" as a mental disorder.

Peru's decree follows the release of the 10th edition of the International Classification of Diseases (ICD) by the World Health Organization.

"From the review of the ICD-10 diagnoses included in the Essential Health Insurance Plan, related to the condition, person with a mental health problem, the omission of seven (07) ICD-10 diagnoses has been identified," officials wrote (translated). "In this sense, it is necessary to modify the Essential Health Insurance Plan incorporating seven (07) ICD-10 diagnoses."

There has been high levels of homophobic, transphobic and gender violence in Peru Credit: Fotoholica Press

There has been high levels of homophobic, transphobic and gender violence in Peru Credit: Fotoholica Press

The Health Ministry (MINSA) later released a statement saying that these individuals should not necessarily undergo "reconversion therapies."

Transgender influencer Dylan Mulvaney, who notably killed Bud Light's brand, fled to Peru "to feel safe" in the wake of a national boycot of the brew. He's thus far been silent on the matter.

The Middle Class Is Being Destroyed

Well, it’s that time of the month again. Yes, I am talking about when the BLS, who really but the BS in everything they do, put out their laughably fake inflation numbers.

Indian citizenship: first certificates granted amid opposition protests

The Home secretary handed out certificates to 14 people yesterday. Promulgated in 2019 and implemented in March this year, the CAA provides easier access to Indian citizenship for members of religious minorities from Muslim majority countries. Analysts argue that religion is being used by the BJP to rouse its electorate in the ongoing elections.

Why Trials Like Trump's Must Be Televised

Why Trials Like Trump's Must Be Televised

Tyler Durden

Thu, 05/16/2024 - 13:05

Authored by Alan Dershowitz via The Gatestone Institute,

If you were flipping between CNN and Fox News following the cross-examination of Stormy Daniels in the New York criminal case against former President Donald Trump, you would have had the impression that the CNN commentator, who professed to be reporting what happened in the courtroom, described a completely different event from what the Fox News reporter, who was also in the courtroom, described. It was as if they had seen two different witnesses and two different lawyers.

The CNN commentator reported that Daniels had done a great job holding up against the incompetent cross-examination of Trump's lawyer. The Fox News commentator reported that the extraordinarily effective Trump lawyer had totally destroyed Daniels' credibility. Who were you to believe? The CNN commentator was an experienced lawyer who was purporting to describe accurately what had happened without bias or subjectivity. The Fox News commentator was a former judge and prosecutor with vast experience, who also claimed to be describing the cross-examination without bias. Neither of the commentators even pretended to paint a gray picture. One was starkly black, the other unambiguously white. No nuance in either account.

If the trial had been televised, the dominant color would have been gray. Perry Mason cross-examinations rarely occur in real life, and witnesses like Daniels rarely emerge unscathed from cross-examinations even by mediocre lawyers.

We, the American public, however, have been denied the right to judge for ourselves how the case against the once and possibly future president is going. We cannot judge the credibility of witnesses, the fairness of the judge or the effectiveness of the lawyers. We must depend on the subjective and generally biased accounts of often partisan "reporters."

Polls following the OJ Simpson case suggested that those who personally watched the trial on TV were less surprised by the not guilty verdict than those who only read about it in the media, which generally described it as an open and shut case and predicted a guilty verdict. They downplayed or omitted the gaps in the prosecution case and the mistakes made by prosecutors that may have led jurors to find reasonable doubt.

The same may be true of the Trump case, except that everyone is seeing the case through the prism of the reporters, rather than with their own eyes. Those who get their "news" from anti-Trump sources will be surprised and outraged if there is an acquittal or hung jury in this "strong" case. Those who get their "news" from pro-Trump sources will be surprised and outraged by a conviction in this "weak" case.

The result of making us rely on partisan secondary sources rather than our own direct observations is inevitable distrust in the justice system. If "Sunlight is the best disinfectant," lack of visibility is a major source of distrust.

Every important trial involving public figures should be televised. Now the trial of Senator Robert Menendez is starting. It, too, should be publicized so that the public can see how the judiciary deals with an important case involving a member of the legislative branch. Even the Supreme Court now permits live audio broadcasts of important appellate cases. Hopefully, they will soon allow telecasting since there is little difference between listening and seeing the justices and the lawyers.

The framers of the Constitution intended all judicial proceedings to be public – no secret trials. At the time of the framing, public meant open to print journalists. Today, public means audio and video publication.

The New York trial of Trump is a national scandal. There is no real crime. The judge has allowed testimony that is highly prejudicial and irrelevant. He has made numerous unfair rulings, of which the prosecution has taken advantage. The public has the right to see this abuse with their own eyes, so that we all can judge for ourselves and not allow possibly biased reporters to judge for us.

Now the government's star witness is testifying. Michael Cohen's credibility promises to be a key factor in the jury's deliberation. Every citizen should have a right to make his or her own assessment of his credibility or lack thereof.

There is no good argument for allowing CNN to tell us whether he is believable, when we might come to a different conclusion based on direct observation with our own eyes.

Romney Says Biden Should Have "Immediately" Pardoned Trump To Be "Big Guy"

Romney Says Biden Should Have "Immediately" Pardoned Trump To Be "Big Guy"

Tyler Durden

Thu, 05/16/2024 - 12:45

Trump-hating Utah Republican Sen. Mitt Romney says President Joe Biden should have "immediately" pardoned former President Donald Trump as a power play to look like "the big guy."

"[Biden] should have fought like crazy to keep this prosecution from going forward," Romney told MSNBC. "It was a win-win for Donald Trump."

"You may disagree with this, but had I been President Biden when the Justice Department brought on indictments, I would have immediately pardoned him. I’d have pardoned President Trump," he added. "Why? Well, because it makes me, President Biden, the big guy and the person I pardoned a little guy."

According to Romney, President Lyndon B. Johnson set the precedent for such a move, and that Biden could have urged New York prosecutors in the hush money case to drop the charges.

"I have been around for a while. If LBJ had been president and he didn’t want something like this to happen, he’d have been all over that prosecutor, saying, ‘You better not bring that forward or I’m gonna drive you out of office,’" said the Utah Republican.

Romney also slammed Republican Trump loyalists for showing up to the courthouse to show support for the former president.

"I think it’s a terrible fault for our country to see people attacking our legal system — that’s an enormous mistake," Romney continued. "I think it’s also demeaning for people to quite apparently try and run for vice president by donning a red tie and standing outside the courthouse. It’s just — I’d have felt awkward."

Of note, House Speaker Mike Johnson (R-LA), Rep. Byron Donalds (R-FL) and Sen. J.D. Vance (R-OH) have all attended court this week. Trump VP hopefuls Doug Burgum and Vivek Ramaswamy have also shown up.

On Thursday, Rep. Matt Gaetz (R-FL) joined the action.

Trump has more Republican lackeys, including Gaetz, dressed in Trump costumes behind him in court today pic.twitter.com/PHETnzAZsA

— Aaron Rupar (@atrupar) May 16, 2024Standing back and standing by, Mr. President. pic.twitter.com/gGPeTLtWmv

— Matt Gaetz (@mattgaetz) May 16, 2024

A priest and a layman missing in the Diocese of Baoding

Sources toldAsiaNewsthat two members of the underground Catholic community in Hebei have not been heard from for days, raising serious concern. It is thought that, like in other cases, they have been subjected to restrictive measures by local authorities. The diocese is the same where, a century ago, the Council of Shanghai pushed for the Marian shrine in Donglu. At present, pressure remains very strong on communities that refuse to join the various bodies of China's 'official' Church.

America Is No Longer A Hyperpower, And Others Keep On Rocketing The Free World

America Is No Longer A Hyperpower, And Others Keep On Rocketing The Free World

Tyler Durden

Thu, 05/16/2024 - 12:25

By Michael Every of Rabobank

Stocks up, Stonks up, bonds up, gold up, crypto up, and copper up to a new record high. Almost everything rocketed after US CPI came a slither lower than expected --and 30 minutes earlier than scheduled on the BLS website, which markets looking only at Bloomberg didn’t notice(!)-- but with no decline in crucial core services from near 5% y-o-y, even as retail sales came in much weaker. So, more stagflation overall really, but that’s markets in the free world now, as traders priced in the Fed cuts in September and December which our Philip Marey was already calling.

Meanwhile, US Secretary of State Blinken played ‘Keep on Rockin’ in the Free World’ in Kyiv as Russia rocketed Ukraine and took even more territory from it: the situation there officially remains “worrying.” That’s after humiliating US retreats from Afghanistan and Niger, ally Colombia moving out of the US orbit, Venezuela moving armed forces to the border of Guyana’s oil-rich region of Essequibo; White House calls of a calm Middle East pre-October 7, as war there now goes on, with US forces regularly struck by pro-Iran militias; Iran cooperating with North Korea more; and Filipino (with a US defence treaty) and Chinese flotillas in another tense stand-off in the South China Sea. Realpolitik is saying, “OK, boomer” to those who cover Neil Young.

In the EU, there was an attempted assassination of Slovakia’s pro-Russia Prime Minister Fico, who is still in critical condition: the alleged culprit is a liberal, pro-EU poet. In the Netherlands, the far-right Party for Freedom (PVV) of Geert Wilders announced a coalition government with the centre-right People’s Party for Freedom and Democracy (VVD), the New Social Contract party (NSC), and the Farmer-Citizen Movement (BBB), though Wilders will not be PM, just éminence grise. Near the EU, Moldova signed an agreement with it on cooperation in security and defence: but the EU almost certainly won’t defend it from Russia. The ‘free world’ keeps rocking.

In the US, we are promised Biden-Trump debates on 27 June and 10 September in a new format with no studio audience or third-party candidates: cynics will say markets must therefore stay bid until July at least. Regardless, both men at the debate mean huge fiscal deficits ahead, and the latest tariffs show markets will get ‘Triden’ or ‘Brump’. The ‘free markets world’ keeps rocking too.

More so as China suggested it may institute what I always said was the inevitable endgame for its housing market: using state funds to buy up millions of unwanted homes, and turning them into social housing, effectively nationalizing it. A flurry of related questions remain, including the staggering price tag, but the overall plan is clear: houses are for living in, not speculation, and Chinese capital will be freed up from mortgage lending to focus on (military) industrial production.

And what has the free world got to offer by contrast? In Australia, a housing auctioneer bewails the barista who serves him his coffee has to work for 45 years just to get a deposit. Even the Prime Minister is kicking a tenant out of his rental property because he can cash in on higher house prices. In short, housing is for speculation and not for living in; and western capital is tied up in mortgage lending instead of focusing on (military) industrial production.

This underlines how radically Western policy needs to change. After all, Russia is now spending 8.7% of GDP on defence: economists who pooh-poohed war in early 2022 might note that’s FIVE ‘Italys’, with far higher purchasing power parity. President Putin is talking ‘guns or butter’ choices and appointed an economist as defence minister to make the war economy run more efficiently. The West can’t work out just guns, butter, or housing, let alone ‘guns or butter or housing’.

Linking this all up, the brilliant and needling ‘Keep on Rockin’ in the Free World’ was an attack on the worst side of free-market America that was a global hyperpower that didn’t look after its own poor well, not a way to praise it. Just read the lyrics or watch the video:

“There’s colors on the street; Red, white, and blue

People shuffling their feet; People sleeping in their shoes

There’s a warning sign on the road ahead; There’s a lot of people saying we’d be better off dead

Don’t feel like Satan, but I am to them; So I try to forget it any way I can

Keep on rockin' in the free world (x4)

I see a woman in the night; With a baby in her hand

There's an old street light; Near a garbage can

Now she put the kid away and she’s gone to get a hit; She hates her life and what she’s done to it

There’s one more kid that’ll never go to school; Never get to fall in love, never get to be cool

Keep on rockin' in the free world (x4)

We got a thousand points of light; For the homeless man; We got a kinder, gentler machine gun hand

We've got department stores and toilet paper; Got styrofoam boxes for the ozone layer

Got a man of the people says keep hope alive; Got fuel to burn, got roads to drive

Keep on rockin' in the free world (x4)”

If Neil Young were to update the lyrics today, he might add something about Stonks and crypto perhaps, but an awful lot of it still stings as it is: even more so as America is no longer a hyperpower, and others keep on rocketing the free world.

As Gaza Aid Pier Completed, Pentagon Vows To Protect US Troops Overseeing It

As Gaza Aid Pier Completed, Pentagon Vows To Protect US Troops Overseeing It

Image source: US Central Command (CENTCOM)

Tyler Durden

Thu, 05/16/2024 - 12:05

Image source: US Central Command (CENTCOM)

Tyler Durden

Thu, 05/16/2024 - 12:05

The Pentagon announced Thursday that its floating pier built for Gaza aid has finally been completed and installed. Badly needed humanitarian aid, especially food, will begin being delivered by ships imminently.

The completion comes more than two months after President Biden first unveiled the plan, and has been fraught with challenges including inclement weather as well as threats on Hamas against any potential foreign troop presence.

On this latter point, Navy Vice Adm. Brad Cooper of Central Command, said that "protection of U.S. forces participating is a top priority. And as such, in the last several weeks, the United States and Israel have developed an integrated security plan to protect all the personnel."

Image source: US Central Command (CENTCOM)

Image source: US Central Command (CENTCOM)

He added, "We are confident in the ability of this security arrangement to protect those involved." Israel's military will provide security on the shore while the USS Arleigh Burke and the USS Paul Ignatius patrol waters just off the coast.

US CENTCOM has further confirmed, "Trucks carrying humanitarian assistance are expected to begin moving ashore in the coming days." The military statement added, "The United Nations will receive the aid and coordinate its distribution into Gaza."

Overseeing and handling the inbound humanitarian aid itself will be the UN's World Food Program.

Israel's military commented that "We have been working for months on full cooperation with (the U.S. military) on this project, facilitating it, supporting it in any way possible."

Some humanitarian aid organizations and leaders have still criticized the costly pier project, questioning why Israel doesn't just let overland convoys into the Gaza Strip:

Because land crossings could bring in all the needed aid if Israeli officials allowed, the U.S.-built pier-and-sea route "is a solution for a problem that doesn’t exist," said Scott Paul, an associate director of the Oxfam humanitarian organization.

One recent issue to arise is the increased number of attacks by Israeli settlers on aid trucks and convoys. Israeli media has confirmed these attacks, including the below:

Israeli settlers block an aid truck for Gaza and beat up the driver unconscious pic.twitter.com/vHsss3oTvF

— What the media hides. (@narrative_hole) May 16, 2024Several examples of such filmed attacks on aid convoys have been widely circulating over the last days...

“This driver thought he could bring rice to Gaza. Everything here is on the floor” In a video posted on social media, an Israeli settler expresses joy while recording footage of destroyed aid intended for Gaza. Israeli settlers attacked the truck and destroyed the aid they were… pic.twitter.com/7HwtvFyfCX

— Middle East Eye (@MiddleEastEye) May 16, 2024The US military has further described of what comes next as follows: "Trucks carrying humanitarian assistance are expected to begin moving ashore in the coming days." The statement added: "The United Nations will receive the aid and coordinate its distribution into Gaza."

Hunter Biden Loses Bid To Halt Tax Evasion Court Proceedings As 9th Circuit Dismisses Appeal

Hunter Biden Loses Bid To Halt Tax Evasion Court Proceedings As 9th Circuit Dismisses Appeal

Tyler Durden

Thu, 05/16/2024 - 11:45

Authored by Caden Pearsen via The Epoch Times

Hunter Biden lost his bid to halt his tax evasion district court proceedings in California on Wednesday after the Ninth Circuit declined to hear his appeal.

District Judge Mark Scarsi denied Mr. Biden’s motion for a stay of proceedings in the U.S. District Court for the Central District of California pending the outcome of his appeal. The stay had been requested on May 10 after Mr. Biden filed his interlocutory appeal to the U.S. Court of Appeals for the Ninth Circuit.

On Wednesday, the Ninth Circuit panel ruled in favor of the special counsel and dismissed Mr. Biden’s appeal.

This rendered moot a motion filed by Mr. Biden’s lawyers on Tuesday asking the judge for an expedited hearing on his motion to halt proceedings or, alternatively, for the judge to consider his written motion without hearing oral arguments.

“Because the panel’s order moots Mr. Biden’s motion, the Court grants the application to rule on shortened time and denies the motion,” Judge Scarsi wrote in his order on Wednesday.

Judge Scarsi’s order stated that his prior orders and the trial schedule would remain in place, and that the court would hear any further requests to modify the pre-trial schedule at a conference on May 29.

Mr. Biden, who had argued that the district court’s jurisdiction had been divested once he filed his interlocutory appeal, filed his motion for a stay after the judge wrote in a May 9 order that failing to do so would be “at his own peril.”

Hunter Biden’s Problems ‘Are Entirely of His Own Making’

Special Counsel David Weiss, who is prosecuting the case on behalf of the government, opposed Mr. Biden’s bid to halt proceedings while waiting to hear the outcome from the Ninth Circuit. He argued that any “problems” with scheduling conflicts in both Mr. Biden’s California tax evasion case and his Delaware gun charges case “are entirely of his own making.”

In his brief asking for an expedited hearing filed on Tuesday, Mr. Biden’s lawyers told Judge Scarsi that he wasn’t aware that failing to file a motion to stay pending appeal would be “at his own peril,” and that he promptly filed his motion to stay the next day after the judge’s order came down.

In requesting an expedited hearing, Angela Machala and Abbe Lowell, the lawyers representing Mr. Biden, had sought to address scheduling conflicts in pretrial proceedings that threatened to emerge due to potential appeals court proceedings and an upcoming trial on June 3 in his Delaware case.

The lawyers argued that Mr. Biden was not to blame for the overlap in the separate court proceedings.

Specifically, Mr. Biden’s lawyers asked that a hearing on his motion to stay take place before a pretrial conference scheduled for May 29 to comply with court rules on when hearings can be set.

This potential conflict was rendered moot by the Ninth Circuit’s ruling on Wednesday. Similarly, the Third Circuit, where Mr. Biden had taken his Delaware appeal, also dismissed his motions.

Mr. Biden had previously argued that the district court had been divested of its jurisdiction when he filed an appeal with the Ninth Circuit. This claim was disputed by the special counsel.

On May 9, Judge Mark Scarsi stated that the court “has not vacated the pretrial schedule, and absent a request for [a stay], Mr. Biden ignores the Court’s orders at his own peril.”

In response, Mr. Biden filed his motion for stay pending appeal the next day. In that filing, he maintained his position that the court had been divested of jurisdiction by the act of filing his interlocutory appeal.

Mr. Biden’s lawyers argued that he was not at fault for “creating the crisis” that led to their requesting the stay, nor did the scheduling conflict come about “as a result of excusable neglect.”

In contrast, the special counsel sought to counter these arguments on Tuesday, arguing that “the defendant’s ‘hardship’ is one he has created for himself.”

The Epoch Times contacted Mr. Biden’s attorneys for comment.

Under Armour Approves Restructuring, Warns Of Collapse In Clothing Demand As Buyback Authorized To Save Plunging Stock

Under Armour Approves Restructuring, Warns Of Collapse In Clothing Demand As Buyback Authorized To Save Plunging Stock

Tyler Durden

Thu, 05/16/2024 - 11:25

Under Armour CEO Kevin Plank needs to spend long weekends at his thoroughbred horse breeding farm in steeplechase country in upper Baltimore County to reflect on what has happened to the sportswear company over the past decade. Once a star of the apparel industry, UA is now undergoing a restructuring as its share price plunged to 2010 levels.

Let's skip the fourth quarter fiscal 2024 report and focus on the restructuring plan and the dismal outlook for the year.

UA's Board of Directors approved a restructuring plan estimated to cost about $70 million to $90 million - including employee severance and benefits costs.

-

Up to $50 million in cash-related charges, consisting of approximately $15 million in employee severance and benefits costs, and $35 million related to various transformational initiatives, and

-

Up to $40 million in non-cash charges comprised of approximately $7 million in employee severance and benefits costs and $33 million in facility, software and other asset-related charges and impairments.

This year's fiscal outlook is beyond bleak and outright horrible, with demand expected to implode across the North American segment.

Here are the highlights of the outlook:

-

Revenue is expected to be down at a low-double-digit percentage rate. This includes an expected 15 to 17 percent decline in North America as the company works to meaningfully reset this business following years of heightened promotional activities, particularly in its DTC business and a low-single-digit percent decline in its international business due to more conservative macro consumer trends and actions to protect the brand strength it has built.

-

Gross margin is expected to be up 75 to 100 basis points compared to the prior year, driven by a material reduction in promotional and discounting activities in the company's direct-to-consumer business and product costing benefits.

-

Selling, general, and administrative expenses are expected to be down 2 to 4 percent.

-

Operating income is expected to be $50 to $70 million. Excluding the mid-point of anticipated restructuring charges, adjusted operating income is expected to be $130 to $150 million.

-

Diluted earnings per share is expected to be between $0.02 and $0.05. Adjusted diluted earnings per share is expected to be between $0.18 and $0.21.

-

Capital expenditures are expected to be between $200 to $220 million.

Plank commented on the outlook:

"Due to a confluence of factors, including lower wholesale channel demand and inconsistent execution across our business, we are seizing this critical moment to make proactive decisions to build a premium positioning for our brand, which will pressure our top and bottom line in the near term.

"Over the next 18 months, there is a significant opportunity to reconstitute Under Armour's brand strength through achieving more, by doing less and focusing on our core fundamentals: driving demand through better products and storytelling, running smarter plays like simplifying our operating model and elevating our consumer experience. In parallel, we're focused on cost management and implementing the strategies necessary to grow our brand and improve shareholder value as we move forward."

And, of course, to ensure the company's stock doesn't go to zero, the Board of Directors authorized the repurchase of up to $500 million of UA's outstanding Class C common stock.

Shares initially opened at 2010 lows.

...have since found a panic bid on the buyback announcement.

Sigh, Plank.