Evil too, will always be part of the mystery of the Church. And when we see what men, what the clergy have done in the Church, then that is nothing short of proof that he [Christ] founded and upholds the Church. If she were dependent on men, she would long since have perished.

All

Here's What Will Push Oil Above $100/Bbl

Here's What Will Push Oil Above $100/Bbl

Tyler Durden

Mon, 04/08/2024 - 15:45

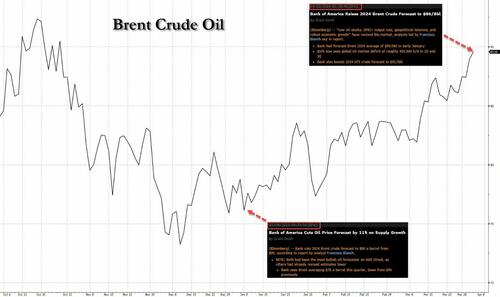

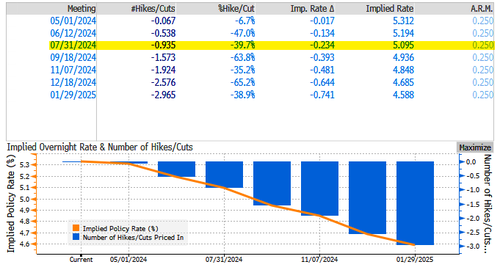

Back in early December, just after Powell's dovish pivot shocked everyone, many closet oil bulls like BofA's energy strategist Francisco Blanch, predicted that a dovish Fed would send oil back to $100. Unfortunately for him, oil did nothing and just one month later, as no oil buying had materialized, Blanch threw in the bullish towel and cut his oil price forecast by 11%, ironically bottom ticking to the dot oil just as it was about to soar by 20% in the next three months, an ascent which was capped with... Blanch raising his Brent oil price forecast.

To be sure, BofA wasn't the only one to predict $100 oil: two weeks ago JPMorgan commodity analyst Natasha Kaneva was looking at Russia's unexpected pivot to producing less oil than it was allowed, and wrote that "the shift in Russia’s oil strategy is surprising" and "at face value, and assuming no policy, supply or demand response, Russia’s actions could push Brent oil price to $90 already in April, reach mid-$90 by May and close to $100 by September, keeping pressure on the US administration in the run-up to elections."

In short, the fate of Biden's re-election was now in the hands of Putin if the Russian leader wanted to push up the price of oil back to triple digits by limiting output, and the only recourse Biden has - according to JPMorgan - was releasing another 60 million barrels of oil from the SPR (see full JPM note here).

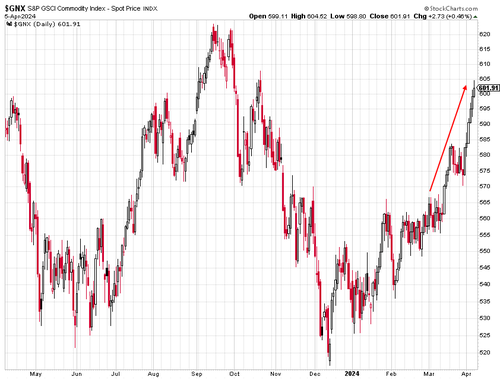

But it increasingly appears that $100+ oil is inevitable, regardless of what Putin does or does not do, and as Bloomberg writes over the weekend, the odds of $100 oil are rapidly rising, because while the recent surge in po; above $90 just days ago was blamed on escalating military tensions between Israel and Iran, "the rally’s foundations went deeper — to global supply shocks that are intensifying fears of a commodity-driven inflation resurgence."

Consider: a recent move by Mexico to slash its crude exports is compounding a global squeeze, prompting refiners in the US (the world’s biggest oil producer) to consume more domestic barrels. At the same time, American sanctions have stranded Russian cargoes at sea, with Venezuelan supply a potential next target. Meanwhile, Houthi rebel attacks on tankers in the Red Sea have delayed crude shipments, and despite all the "turmoil", OPEC and its allies are sticking with their production cuts.

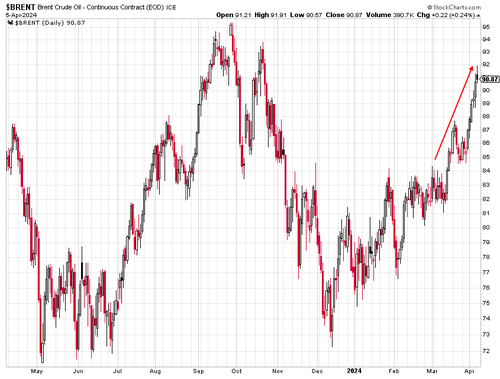

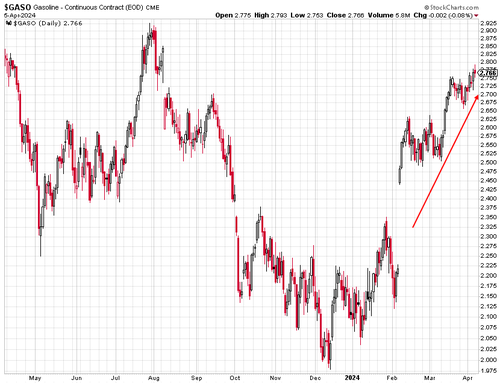

It all adds up to a magnitude of supply disruption that has taken traders by surprise. The crunch is turbocharging an oil rally ahead of the US summer driving season, threatening to push Brent crude, the global benchmark, to $100 for the first time in almost two years; in fact the last time oil was trading there, Joe Biden was draining the SPR to the tune of several million barrels per week. That’s amplifying the inflation concerns that are clouding US President Joe Biden’s reelection chances and complicating central banks’ rate-cut deliberations.

For oil, “the bigger driver right now is on the supply side,” said Amrita Sen, founder and director of research at Energy Aspects. “You have seen quite a few pockets of supply weakness, and demand overall on a global basis is healthy.”

According to Bloomberg, oil shipments from Mexico, a major supplier in the Americas, slid 35% last month to their lowest since 2019 as President Andres Manuel Lopez Obrador tries to make good on promises to wean the country off costly fuel imports. The country’s exports of so-called sour crude — the heavy, dense kind that many refineries are designed to process — now stand to shrink even further as state-controlled oil company Pemex is now planning on cutting an additional 330 kb/d in May, Reuters reported citing sources.

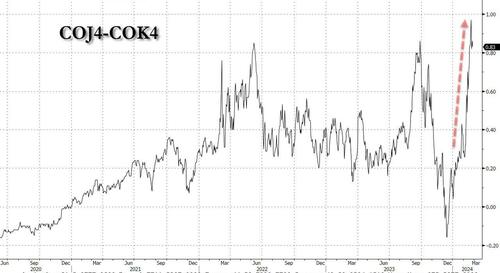

That decision has roiled oil markets around the world. Mars Blend, a medium-density sour crude from the US Gulf Coast, has in recent days risen to a multi-year premium over lighter WTI, the national benchmark. Mars usually trades at a discount to WTI. Brent crude hit $90 a barrel on Thursday, the highest since October, and extended gains on Friday. JPMorgan said it could hit $100 by August or September.

Canadian Cold Lake oil priced at the Gulf Coast traded at the narrowest discount to WTI in almost a year. Key indicators for Middle Eastern medium-sour crude, such as Oman and Dubai contracts, are rallying too.

To be sure, it's not just Mexico's fault: back in February we first warned that long before hedge funds - all heavily short crude - realized what was coming, the physical market was screaming tightness with the Brent prompt spread exploding to a backwardation around 90 cents after tumbling to a multi-year low in late December.

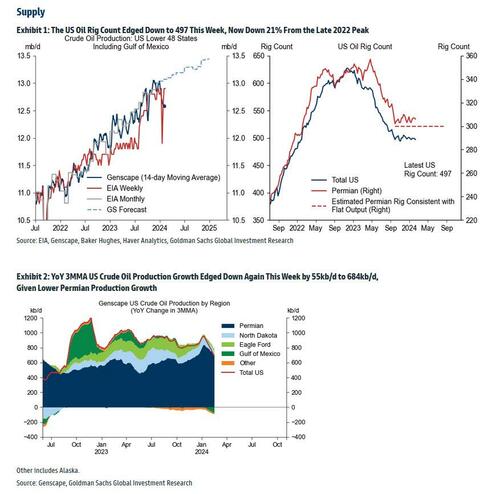

And indeed, a closer look at oil supply showed that there was a clear drop off in production which would guarantee higher prices.

The sharp drop in output in early 2024 came before Mexico’s move, when we noted a sequence of supply disruptions both large and small: in January, a deep freeze ate away at crude output and inventories in the US at a time when they would normally grow, keeping stockpiles below seasonal averages through late March. Then, Mexico, the US, Qatar and Iraq cut their combined oil flows by more than 1 million barrels a day in March, tanker tracking data showed (Baghdad pledged to limit output to make up for non-compliance with prior pledges to OPEC+).

Also adding to the tightness, OPEC member the United Arab Emirates curbed shipments of its Upper Zakum, a medium-sour oil, by 41% in March compared with last year’s average, according to Kpler data. The state oil company is diverting more supplies of that crude to its own refinery, traders told Bloomberg. Though the cuts were expected and Abu Dhabi National Oil Co. is offering buyers another type of crude as a substitute, the decline in Upper Zakum exports is contributing to higher regional prices amid the broader OPEC+ curtailment.

Crude markets in Europe, meanwhile, were pressured higher by the Houthi attacks in the Red Sea, which sent millions of barrels of crude on a detour around Africa, delaying some supplies for weeks. Disruptions to a key North Sea pipeline, unrest in Libya and a damaged pipe in South Sudan also contributed to the rally, while US sanctions have deprived Russia of tankers that previously transported its oil to buyers including India.

Making matters worse for Biden who is absolutely terrified of higher oil and gas prices, the supply pinch could become even more acute in the weeks ahead. That's because Venezuela dictator Nicolas Maduro is showing no sign of heeding promises he made to Biden and other "democracies" to move toward free and fair elections, in response the Biden administration could reimpose sanctions this month, although it most likely won't as it would mean an even lower approval rating for the outgoing US president, confirming once again just how malleable and laughable western "democratic" ideals are.

The plunge in supply - which we warned about two months ago, and which has materialized now - is a stark contrast from just a few months ago, when oil plunged to multi-month lows as US production climbed and Russian seaborne crude exports ratcheted higher despite sanctions, which have since been expanded. The US Energy Information Administration, after forecasting global inventories to remain unchanged this quarter, now predicts they’ll fall by 900,000 barrels a day. That’s the equivalent to the production from Oman.

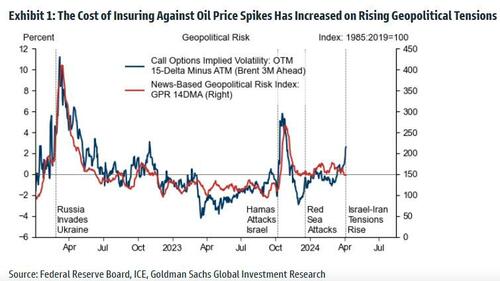

Putting it all together, Goldman - which has turned decidedly less bullish on oil ever since the firm's iconic commodity analyst Jeff Currie quit last year - last night published a report (available to pro subscribers) in which it said that the market is finally pricing in "firm demand and geopolitical supply risks, which together have boosted positioning and valuation."

And while Goldman expects Brent to stay below $100/bbl in its base case in which the bank assumes:

- already solid demand,

- no additional geopolitical supply hit, and

- that elevated spare capacity will lead OPEC+ to raise production in Q3.

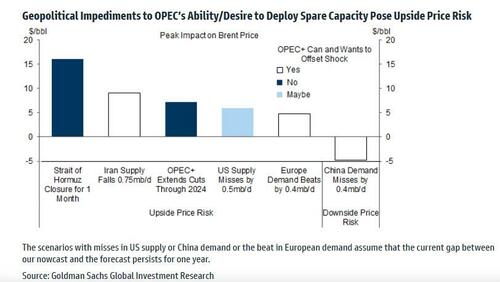

... the bank warns that "geopolitical impediments to OPEC’s ability/desire to deploy spare capacity could send Brent above $100." Needless to say, when it comes to "base case" forecasts from Goldman's research desk (not to be confused with the bank's terrific Sales and Trading desk), they virtually always end up being wrong, which is why $100 oil is now virtually guaranteed.

Goldman also listed other reasons why Brent could reach $100, including i) the Russia-Ukraine or Middle East conflicts may damage upstream, midstream, or downstream oil infrastructure, and ii) Iranian oil supply may decline on disruptions or under a potentially more hawkish US.

Below we excerpt from the Q&A attached to the Goldman report (the full note is available to pro subs in the usual place).

Q. Why have crude oil prices rallied?

Brent has rallied to $91/bbl because the market is now pricing in a firmer demand outlook and some geopolitical downside risks to oil supply, which together have boosted positioning and valuation.

Upgraded market expectations of oil demand have fueled the rally.

- First, the IEA forecast of 2024 oil demand growth has crept higher on solid oil demand data outside China, and GDP upgrades.

- Second, sentiment about demand in investor conversations has turned from bearish to constructive.

- Third, oil prices have also risen after strong activity releases this week, including manufacturing surveys in China, the US, and India and US employment.

The geopolitical risk premium—the compensation investors demand for the risk that geopolitical shocks reduce oil supply—has also picked up following attacks on Russian refineries, and rising Iran-Israel tensions. That said, the cost of insuring against oil price spikes remains less elevated than in October 2023 and in 2022, because Middle East crude production remains unaffected by the war (Exhibit 1).

As the market is now pricing in firm demand and geopolitical supply risks and as oil demand for inflation hedging has picked up, measures of positioning and valuation have risen sharply. Net managed money in crude and refined products has surged by over 400 million barrels since December (Exhibit 2). Our pricing framework suggests that actual Brent 1/36m timespreads have shifted from significantly undervalued in December to now modestly overvalued based on our nowcast of OECD inventories and our assumption of a modest 0.4mb/d Q2 deficit.

And the punchline: Q. What could push Brent oil prices above $100/bbl?

We see only modestly bullish risks to our non-OPEC+ balance from firmer demand in Europe, and likely temporary softness in US supply. In contrast, we believe that lower OPEC supply for longer, for instance because of geopolitical impediments to OPEC’s ability and/or desire to deploy spare capacity, could send Brent above $100 for some time.

Specifically, we see upside risks to our 2023Q3 Brent forecast of $86/bbl in several potential geopolitical scenarios:

- OPEC+ may extend the existing production cuts further in a context of increased tensions between the West and several key OPEC+ countries

- The Russia-Ukraine or Middle East conflicts may damage upstream, midstream, or downstream oil infrastructure (as has happened to Russian refineries)

- Iranian oil supply may decline on disruptions or under a potentially more hawkish US Administration

- While highly unlikely, we estimate that an interruption of oil flows through the Strait of Hormuz would lead oil prices to rise 20% in the first month and eventually double if the interruption persisted for several months

Translation: not just Putin, but all of OPEC+ now controls the outcome of the 2024 US election.

More in the full note available to pro subscribers.

Solana Is Cryptoeconomic Socialism

Solana Is Cryptoeconomic Socialism

Tyler Durden

Mon, 04/08/2024 - 15:25

Most people still don’t understand that the fundamental question of scaling isn’t technical, it’s philosophical.

Monolithic chains want to give the same amount of cryptoeconomic security to a $1 transaction as they do a $1 million transaction. This is highly inefficient.

Nothing else in the economy works this way. If I want to send someone a postcard, I’ll use the postal service. But if I’m sending them a highly valuable work of art I’ll hire an armored car.

Solana says: use the same method for both. So either the postcard (or memecoin transfer) is too secure or the work of art (or a large DeFi trade) isn’t secure enough. Fees are the same so frivolous low-value transfers crowd out more important ones.

Monolithic scaling is cryptoeconomic socialism, and socialism is bad at distributing scarce resources.

The Soviet Union used to subsidize bread, so it was chronically over consumed. People would line up to get it, then let it go stale or feed it to livestock. Kids would play soccer with it, something they’d never do with better bread that cost more.

Sound familiar?

Local fee markets won’t fix this problem, because rationing imposed on top of socialism doesn’t fix distribution. The blockspace freed up by throttling one activity will just be taken up by another.

Further scaling the network/hardware/consensus layers won’t fix this problem, either. Any additional capacity will be taken up by even more small value transfers.

Modular scaling takes a more free-market approach to distributing blockspace.

Low-value transfers live on L2s or L3s where they pay small fees to get low (but sufficient) security.

High value transfers live on the L1 and (gladly) pay up for max security.

Are there trade offs? There are many.

Modular systems are fragmented and can be annoying to use. But so is hiring an armored car to send something valuable. That doesn’t mean you should mail a Warhol.

Solana remains an interesting experiment but is destined to be a chain for low-value transfers.

The other challenge it will face eventually is that socialist countries tend to have weak currencies.

Why bother holding the money if price isn’t the arbiter of distribution?

If Biden Loses The Election, What Will Be The Top Reason

If Biden Loses The Election, What Will Be The Top Reason

Tyler Durden

Mon, 04/08/2024 - 14:45

By Mish Shedlock of MishTalk

New Geography claims EVs will decide the election. That’s a reason, but it’s well down my list. What about yours?

EVs and the Election

New Geography says Electric Cars Will Decide the Outcome of the American Election.

Just last week the administration issued a draconian mileage requirement, one of many ‘nudge’ policies attempting to usher in an all-electric future. Replacing a massive $3 trillion industry with a singular technology represents a severe economic threat under any circumstances, but ramming through changes just as EV sales are slowing is nothing less than madness.

Rarely has a policy brought such negative economic and ultimately political implications. EVs today are simply not practical for most people, unable to afford the higher costs and wary of a charger infrastructure that is far from ready for prime time.

The average price for a brand-new EV is over $60,000, about $12,000 more than the average four-door sedan. Even with tax credits, it is hard to see how consumers come out ahead, at least for now. The electric version of the base version of the Ford F-150 pickup truck, the best-selling vehicle in America, costs an additional $26,000 over the gasoline-powered variety. EVs are not affordable for most Americans: it’s little wonder that only 16 per cent of them are seriously considering a purchase.

Disastrous Energy Policy

It’s true that Biden’s energy policy is a disaster. But right now EVs are more like slow boiling a frog. Most people don’t buy new cars, and most who do, don’t consider EVs.

I agree with the stupidity of Biden’s EV policy, but it won’t decide the election. I have not seen any polls that mention EVs as a reason.

The border and the economy, specifically home prices, are my top two. Israel could easily be ahead of EVs. Heck, what about the botched trump trial in Georgia and overreach everywhere else?

If Recession hits, and it could, move that to spot #1. What about Biden’s Progressive woke madness?

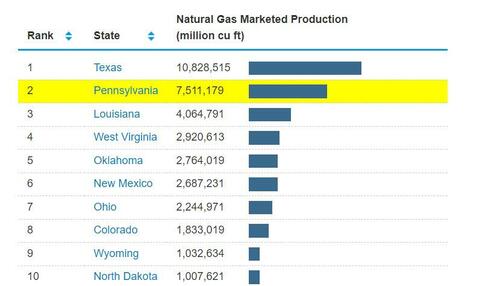

Biden’s ban on natural gas exports could easily cost Biden the state of Pennsylvania. And don’t forget the impact of RFK siphoning off more votes from Biden than Trump.

White House Fact Sheet

On January 26, the Biden-Harris Administration Announces Temporary Pause on Pending Approvals of Liquefied Natural Gas Exports

President Biden has been clear that climate change is the existential threat of our time – and we must act with the urgency it demands to protect the future for generations to come. That’s why, since Day One, President Biden has led and delivered on the most ambitious climate agenda in history, which is lowering energy costs for hardworking Americans, creating millions of good-paying jobs, safeguarding the health of our communities, and ensuring America leads the clean energy future.

Today, the Biden-Harris Administration is announcing a temporary pause on pending decisions on exports of Liquefied Natural Gas (LNG) to non-FTA countries until the Department of Energy can update the underlying analyses for authorizations.

Natural Gas Production

In 2023, the United States leaped over Qatar and Australia to become the largest exporter of LNG.

According to the EIA, the US Energy Information Administration, Pennsylvania is the second largest Natural Gas producer in the US after Texas, and it is the third largest coal producer.

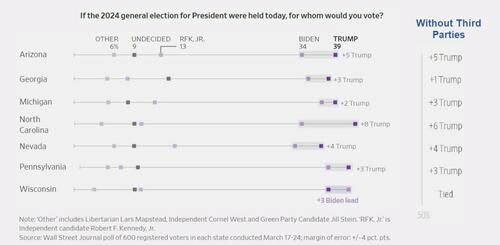

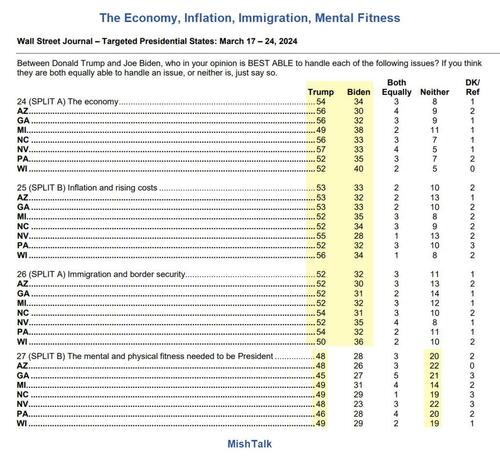

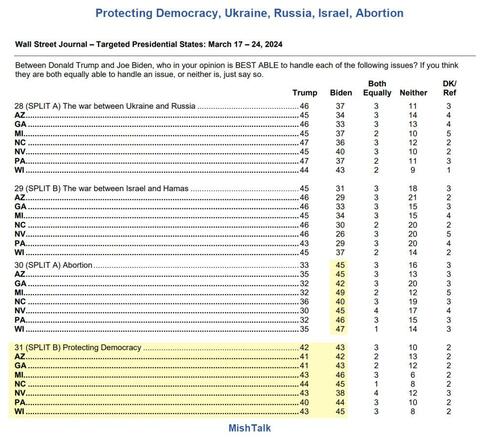

Wall Street Journal Poll

The above clip and the two that follow are from the Wall Street Journal – Targeted Presidential States: March 17 – 24, 2024 Poll.

About 20 percent of those polled do not believe either Biden or Trump are mentally and physically fit to be president. Otherwise, Trump clears the 50 percent mark on the economy, inflation, and immigration.

Biden only attained a single mark, at or above 40 percent. That was a 40 percent mark in Wisconsin for the economy.

Protecting Democracy, Ukraine, Russia, Israel, Abortion

Neither candidate scored over 50 percent on Ukraine, Russia, Israel, Abortion, or Protecting Democracy.

Abortion is still a winning issue for Biden, but Trump can easily negate that with a statement that he would stay out of it or better yet, support abortion up to 15 weeks.

Biden is running on a platform of a strong economy that the public does not believe, abortion that will be decided at the state level not by a president, and protecting democracy.

Protecting democracy is not even a winning issue for Biden. With that, let’s return to the economy one more time.

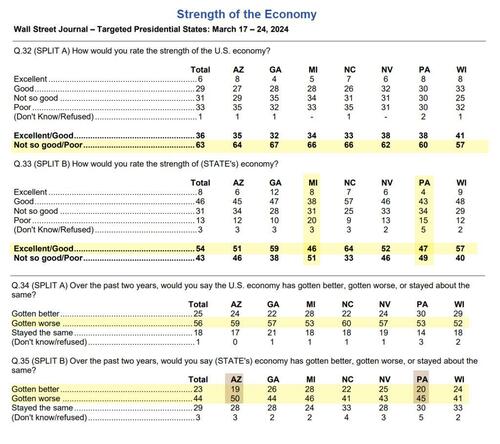

Strength of the Economy

Nationally, it was unanimous, and by large scores, the economy is doing not so good or poor (first horizontal yellow highlight).

Only two states, Michigan and Pennsylvania, had more respondents who said things were worse in their state.

Across the board, more respondents in every state said their economy was getting worse than better. In Arizona and Pennsylvania, the margin of getting worse than getting better was more than 2-1 for getting worse.

It’s the Economy Stupid, But Why?

No poll to date has gotten to the specific point that is most likely to cost Biden the election.

It’s the economy, but specifically housing.

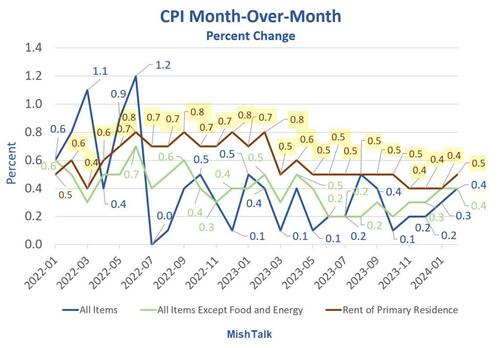

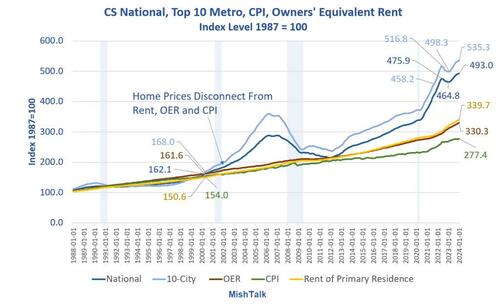

CPI Hot Again Led by Rent

For over two years, analysts said rent was declining or soon would be. But for the 30th consecutive month, rent was up at least 0.4 percent. Gasoline rose 3.8 percent adding to the misery.

Yet Another Groundhog Day for Rent

I repeat my core key theme for over two years now. People keep telling me rents are falling, I keep saying they aren’t.

Rent of primary residence, the cost that best equates to the rent people pay, jumped another 0.4 percent in December. Rent of primary residence has gone up at least 0.4 percent for 30 consecutive months!

The “rents are falling” (or soon will) projections have been based on the price of new leases and cherry picked markets. But existing leases, more important, keep rising.

Q: Income keeps rising so why do more people in all the states keep saying things are getting worse?

A: Rent!

Some of “things are getting worse" is political. The rest expresses frustration with rent that keeps rising and rising and rising.

Compounding the problem are a bunch of Biden and a pack of clueless economists who keep reporting that rent is falling. Perhaps rent is falling in Austin and other seriously overdeveloped areas, but nationally, rents are still rising.

A decline in Austin isn’t going to do much good for anyone in Pennsylvania or Michigan.

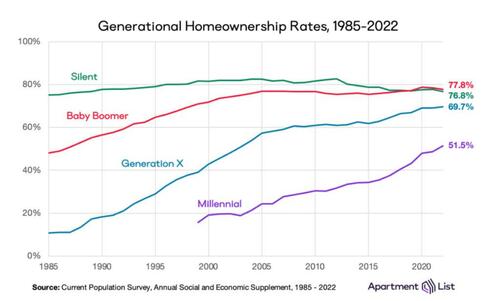

Generational Homeownership Rates

The above chart is from the Apartment List’s 2023 Millennial Homeownership Report

Case-Shiller National Home Price Index Hits New Record High

On March 29, I noted Case-Shiller National Home Price Index Hits New Record High

How many zoomers can afford to buy a home with mortgage rates at 7.0 percent and home prices at a record high?

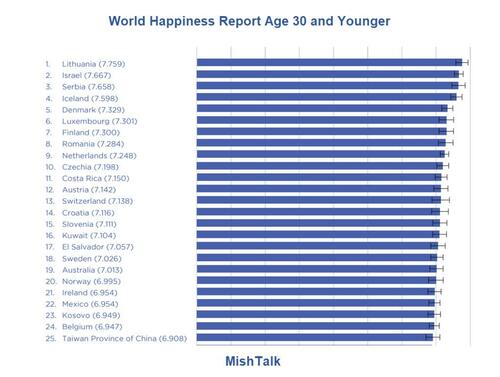

Gen Z, the Most Pessimistic Generation in History

On March 15, I commented Gen Z, the Most Pessimistic Generation in History, May Decide the Election

Economic Reality

Gen Z may be the first generation in US history that is not better off than their parents.

Many have given up on the idea they will ever be able to afford a home.

The economy is allegedly booming (I disagree). Regardless, stress over debt is high with younger millennials and zoomers.

This has been a constant theme of mine for many months.

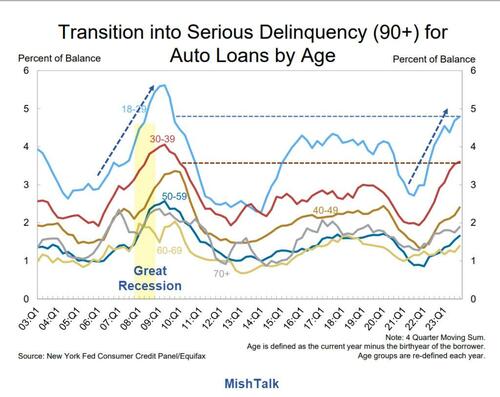

Credit Card and Auto Delinquencies Soar

OK, there is a fair amount of partisanship in the polls.

However, Biden isn’t struggling from partisanship alone. If that was the reason, Biden would not be polling so miserably with Democrats in general, blacks, and younger voters.

This allegedly booming economy left behind the renters and everyone under the age of 40 struggling to make ends meet.

Happiness Age 30 and Below

On March 20, I commented US Drops to Number #23 in the World Happiness Report

For those age 30 and younger, the US fell to spot #62. The US is number 10 for age group 60 and above.

Record High Credit Card Debt

Credit card debt rose to a new record high of $1.13 trillion, up $50 billion in the quarter. Even more troubling is the surge in serious delinquencies, defined as 90 days or more past due.

For nearly all age groups, serious delinquencies are the highest since 2011.

Auto Loan Delinquencies

Serious delinquencies on auto loans have jumped from under 3 percent in mid-2021 to to 5 percent at the end of 2023 for age group 18-29.Age group 30-39 is also troubling. Serious delinquencies for age groups 18-29 and 30-39 are at the highest levels since 2010.

Those struggling with rent and auto loans are more likely to be Millennials and Zoomers than Generation X, Baby Boomers, or members of the Silent Generation.

The same age groups struggling with credit card and auto delinquencies.

What Will and Won’t Decide the Election?

- For younger voters, and blacks, the economy, specifically housing, will be the deciding issue. Biden may still carry this group, but by far less percentages than in 2020.

- For older voters, especially independents who own their own house, the key factors are likely to be immigration, Biden’s wokeness, and Biden’s age.

- In Pennsylvania, natural gas and energy policy will come into play.

- The abortion issue was a huge loser for Republicans in the 2022 midterms. But given the Supreme Court ruling, the matter is up to states. Trump can lessen the issue more by staying away, or better yet pushing back against more extreme measures.

- Biden is campaigning on a need to “Protect Democracy”. Other than abortion, he has little else. But polls show that is not even a winning issue for him. His extreme woke policies, flouting the Supreme Court, and energy mandates have cost him this issue.

Trump Ahead in Swing States

For more on the recent WSJ poll, please see Trump Leads Biden in 6 of 7 Swings States, Pennsylvania is Key

There has not been a single poll suggesting housing specifically.

Nonetheless, based on the above data, I suggest that it’s the top issue among younger voters and blacks. Generation Z and blacks feel economically left behind, never able to afford a house, with rent jumping every year.

Housing is the single most important issue. Blaming immigration is likely a scapegoat for many.

For independents, a trio of ideas that will make it hard for Biden to win. And finally, RFK is more likely to take votes from Biden than Trump.

EVs are a losing issue for Biden, but dwarfed by a half dozen other items. If a recession hits, Trump could easily win in a landslide.

Jamie Dimon Warns World Faces "Risks That Eclipse Anything Since World War II"

Jamie Dimon Warns World Faces "Risks That Eclipse Anything Since World War II"

Tyler Durden

Mon, 04/08/2024 - 14:25

Perhaps the world's most influential banker - JPMorgan Chase CEO Jamie Dimon - warned the world in his annual letter to shareholders that while he expects US economic resilience (and higher inflation and interest rates), and is optimistic about transformational opportunities from AI, he worries geopolitical events including the war in Ukraine and the Israel-Hamas war, as well as U.S. political polarization, might be creating an environment that “may very well be creating risks that could eclipse anything since World War II.”

He begins with an ominous overview of the geopolitical chaos the world faces.

America's Global Leadership is being challenged...

Across the globe, 2023 was yet another year of significant challenges, from the terrible ongoing war and violence in the Middle East and Ukraine to mounting terrorist activity and growing geopolitical tensions, importantly with China. Almost all nations felt the effects last year of global economic uncertainty, including higher energy and food prices, inflation rates and volatile markets. While all these events and associated instability have serious ramifications on our company, colleagues, clients and countries where we do business, their consequences on the world at large — with the extreme suffering of the Ukrainian people, escalating tragedy in the Middle East and the potential restructuring of the global order — are far more important.

As these events unfold, America’s global leadership role is being challenged outside by other nations and inside by our polarized electorate. We need to find ways to put aside our differences and work in partnership with other Western nations in the name of democracy. During this time of great crises, uniting to protect our essential freedoms, including free enterprise, is paramount. We should remember that America, “conceived in liberty and dedicated to the proposition that all men are created equal,” still remains a shining beacon of hope to citizens around the world. JPMorgan Chase, a company that historically has worked across borders and boundaries, will do its part to ensure that the global economy is safe and secure.

In spite of the unsettling landscape, including last year’s regional bank turmoil, the U.S. economy continues to be resilient, with consumers still spending, and the markets currently expect a soft landing. It is important to note that the economy is being fueled by large amounts of government deficit spending and past stimulus. There is also a growing need for increased spending as we continue transitioning to a greener economy, restructuring global supply chains, boosting military expenditure and battling rising healthcare costs. This may lead to stickier inflation and higher rates than markets expect. Furthermore, there are downside risks to watch.

Quantitative tightening is draining more than $900 billion in liquidity from the system annually — and we have never truly experienced the full effect of quantitative tightening on this scale. Plus the ongoing wars in Ukraine and the Middle East continue to have the potential to disrupt energy and food markets, migration, and military and economic relationships, in addition to their dreadful human cost.

These significant and somewhat unprecedented forces cause us to remain cautious.

Inflation and market over-optimism

And he warns that investors seem too complacent about these geopolitical risks when it comes to markets.

Geopolitical and economic forces have an unpredictable timetable - they may unfold over months, or years, and are nearly impossible to put into a one-year forecast. They also have an unpredictable interplay: For example, the geopolitical situation may end up having virtually no effect on the world’s economy or it could potentially be its determinative factor.

We have ongoing concerns about persistent inflationary pressures and consider a wide range of outcomes to manage interest rate exposure and other business risks.

Many key economic indicators today continue to be good and possibly improving, including inflation. But when looking ahead to tomorrow, conditions that will affect the future should be considered. For example, there seems to be a large number of persistent inflationary pressures, which may likely continue.

All of the following factors appear to be inflationary:

-

ongoing fiscal spending, remilitarization of the world,

-

restructuring of global trade,

-

capital needs of the new green economy,

-

and possibly higher energy costs in the future (even though there currently is an oversupply of gas and plentiful spare capacity in oil) due to a lack of needed investment in the energy infrastructure.

In the past, fiscal deficits did not seem to be closely related to inflation. In the 1970s and early 1980s, there was a general understanding that inflation was driven by “guns and butter”; i.e., fiscal deficits and the increase to the money supply, both partially driven by the Vietnam War, led to increased inflation, which went over 10%.

The deficits today are even larger and occurring in boom times — not as the result of a recession — and they have been supported by quantitative easing, which was never done before the great financial crisis.

Quantitative easing is a form of increasing the money supply (though it has many offsets). I remain more concerned about quantitative easing than most, and its reversal, which has never been done before at this scale.

Equity values, by most measures, are at the high end of the valuation range, and credit spreads are extremely tight. These markets seem to be pricing in at a 70% to 80% chance of a soft landing — modest growth along with declining inflation and interest rates.

"I believe the odds are a lot lower than that," Dimon warns.

In the meantime, there seems to be an enormous focus, too much so, on monthly inflation data and modest changes to interest rates. But the die may be cast — interest rates looking out a year or two may be predetermined by all of the factors I mentioned above. Small changes in interest rates today may have less impact on inflation in the future than many people believe.

Therefore, we are prepared for a very broad range of interest rates, from 2% to 8% or even more, with equally wide-ranging economic outcomes — from strong economic growth with moderate inflation (in this case, higher interest rates would result from higher demand for capital) to a recession with inflation; i.e., stagflation.

Economically, the worst-case scenario would be stagflation, which would not only come with higher interest rates but also with higher credit losses, lower business volumes and more difficult markets.

Under these many different scenarios, our company would continue to perform at least okay.

AI Transformational, but...

While we do not know the full effect or the precise rate at which AI will change our business - or how it will affect society at large - we are completely convinced the consequences will be extraordinary and possibly as transformational as some of the major technological inventions of the past several hundred years:

Think the printing press, the steam engine, electricity, computing and the Internet, among others.

...

Over time, we anticipate that our use of AI has the potential to augment virtually every job, as well as impact our workforce composition.

It may reduce certain job categories or roles, but it may create others as well.

Banking crisis is over, for now...

The mini banking crisis of 2023 is over, but beware of higher rates and recession — not just for banks but for the whole economy.

Dimon previously explained that that the crisis was over provided that interest rates didn’t go up dramatically and we didn’t experience a serious recession.

If long-end rates go up over 6% and this increase is accompanied by a recession, there will be plenty of stress — not just in the banking system but with leveraged companies and others.

Remember, a simple 2 percentage point increase in rates essentially reduced the value of most financial assets by 20%, and certain real estate assets, specifically office real estate, may be worth even less due to the effects of recession and higher vacancies.

Also remember that credit spreads tend to widen, sometimes dramatically, in a recession.

Finally, we should also consider that rates have been extremely low for a long time — it’s hard to know how many investors and companies are truly prepared for a higher rate environment.

Dimon concludes:

"When terrible events happen, we tend to overestimate the effect they will have on the global economy. Recent events, however, may very well be creating risks that could eclipse anything since World War II - we should not take them lightly."

Ambitious readers can peruse the entire 30,000 word diatribe below:

Prices Up 2500% Since FDR Abandoned Gold

Prices Up 2500% Since FDR Abandoned Gold

Tyler Durden

Mon, 04/08/2024 - 14:05

On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%.

Our guest commentator explores this tragic history and the legacy of enduring economic turmoil that still plagues America today.

The following article was originally published by the Mises Institute. The opinions expressed do not necessarily reflect those of Peter Schiff or SchiffGold.

The world is full of scraps of paper today.

– Benjamin Anderson, economist, Chase Manhattan Bank (1920 – 1939)

April 1933 found America mired in a crushing economic depression, and newly elected president Franklin DeLano Roosevelt — who had declared the previous month he had a legal power derived from the Trading with the Enemy Act to assume control of our monetary system — responded by taking America off the gold standard. That the Act, an unexploded legislative relic left over from the First World War, was completely irrelevant to the situation at hand (there was no “enemy” to speak of as the nation was at peace) proved an easily passed over quibble.

During FDR’s famous first hundred days, a blizzard of unread legislation sailed through Congress and what they missed was put into action by the president with a mere wave of his hand. FDR’s decree forbidding Americans to touch gold (the bureaucrats christened her Executive Order #6102) was but a sign of the times. It was the 1930s, the Strong Man was much in vogue, and despite growing up a wealthy momma’s boy, FDR was ours. Such are the odd things that a democracy can produce.

FDR needed to confiscate everyone’s gold because, according to his economic recovery plan, he needed to raise prices, though he assured the pubic it would be a “controlled inflation.” History would prove his promise to be less than worthless. The cumulative inflation since 1933 has totaled 2,448 percent (and counting), a debasement previously unknown in our nation’s history. Yet, that’s looking at this story solely from the viewpoint of cold statistics, and that strips out the most important part of the story – or at least it’s most entertaining and interesting part. Sometimes, history can read like the wildest of fiction, as if Kafka took a whack at it.

During the last few months of 1933, the year when his 12 years in office began, FDR would hold informal morning meetings in his bedroom, the president still laying under the covers. To be invited into FDR’s inner sanctum was a sign of his favor, and for a time an economics professor named George Warren basked in Roosevelt’s glow. As the general level of prices was now to be “managed” by the guiding hand of experts, of which George Warren was certainly one, the two of them, FDR in command but Mr. Warren providing the theoretical stars to guide them, worked to raise prices. That required intervening in the gold market, and that required someone to set each day’s target price. A not very serious-minded student (nor executive), FDR would “jokingly consider the meaning of numbers, or flip coins” to fathom what the proper price should be, and in one instance he decided the target would a 21-cent increase, and “smiling broadly” explained to his assembled experts that he chose it because seven times three was a lucky number. I find no record of what Professor Warren thought of all this.

That FDR (or his famous Brains Trust of experts, for that matter) knew nothing about gold and monetary matters did not for a moment make him hesitate; he went at it with a courage born from an insatiable need to do something (“to maintain a government of action” was, in his words, his rule of thumb) and this frenzy of political activity grasped our monetary system. The punch line of it all is that FDR, at the time he first assumed power, was a man who never seemed to take things all too seriously. Even as a young man fresh out of law school he kicked off his legal career with a carefree air by publicly announcing his services included “briefs on the liquor question furnished free to ladies. Race suicides cheerfully prosecuted. Small dogs chloroformed without charge.” A close associate of FDR recalled that when he assumed control of the monetary system, “not even the realization that he was playing nine-pins with the skulls and thighbones of economic orthodoxy seemed to worry him.” He meant it as compliment; he shouldn’t have.

People wondered at his bottomless serenity and humor when Making Big Decisions during the burning intensity of the early New Deal, never guessing that it could have been the result of being safely cocooned and conditioned by a lifetime of inherited wealth, by never having to pick his own clothes up off the floor, so to speak, and so having, according to someone who knew him well, “a perfect faith that somehow, someone would always be round to take care of details satisfactorily.” (He meant it with admirable wonder; he shouldn’t have.) FDR demanded responsibility for our nation’s monetary system then handled it with a pitiless nonchalance. In reading biographies of the man, he does not bring to mind any of history’s great statesmen, but instead Tom and Daisy Buchanan from The Great Gatsby, careless people who “smashed up things and creatures and then retreated back into their money.”

FDR’s time in power set into motion a sea change in our monetary system and he is without peer in his personal influence on it, but coupled with the fact he was a very unserious man in a very serious position of power answers why much of what has happened since his time happened at all. Unlike Alexander Hamilton, a thoroughly serious man who created our old monetary system (including our first government bank), FDR kicked off our modern one as casually and carelessly as if he were deciding what socks to wear each morning.

Almost 2,500 percent in endless inflation later, we’re still paying for it.

Blackstone Makes $10 Billion Bet On Multifamily Units As Real Rents Begin Re-Accelerating

Blackstone Makes $10 Billion Bet On Multifamily Units As Real Rents Begin Re-Accelerating

Tyler Durden

Mon, 04/08/2024 - 13:00

Democrats are probably furious this morning after reading The Wall Street Journal's headline announcing Blackstone's $10 billion acquisition of Apartment Income REIT, taking the company private. This move signals the firm's bullishness on the rental housing market, especially when rents are beginning to re-accelerate.

Blackstone agreed to purchase AIR Communities for $39.12 a share, representing a 25% premium to the company's closing share price on Friday. The deal is being completed through the investment management company's $30.4 billion global real-estate fund.

Blackstone favors rental housing as one of the hottest places in the commercial property market to invest. The acquisition of AIR will give the investment manager exposure to 76 rental housing communities in coastal markets, including Boston, Miami, and Los Angeles.

"The acquisition is Blackstone's largest transaction in the multifamily market," WSJ pointed out.

Earlier this year, Blackstone President Jonathan Gray said, "We can see the pillars of a real-estate recovery coming into place," adding, "We are, of course, not waiting for the all-clear sign and believe the best investments are made during times of uncertainty."

Blackstone has been aggressively increasing investments in CRE markets, a major bet the Federal Reserve's interest rate hiking cycle has plateaued and cuts near.

Blackstone's actual bet is based on the idea that rent inflation is reaccelerating.

In December, we noted that shelter CPI lags actual rents by about 18 months. So, by the time the Fed figures out the next surge in shelter costs - it will be too late.

The next paradox for the Fed: since Shelter/OER inflation lags by 18 months, housing inflation will decline well into 2025 even as actual rents are again starting to tick up.

By the time lagged CPI catches up with "today", real rents will be rising double digits. pic.twitter.com/sHOWxN2OVQ

Fast forward to just days ago, we showed readers actual rents are beginning to rise.

this is what the Fed is betting on: OER will keep dropping for the next 18 months due to the huge lag to current rents, and since shelter is 36% of the CPI basket, inflation will soon appear low (even though real rents are rising again... so Fed is two cycles behind now) pic.twitter.com/x9zBi1dvCd

— zerohedge (@zerohedge) April 5, 2024Meanwhile, Democrats have introduced bills in Congress that aim to restrict hedge funds from buying up homes, alleging these funds are responsible for driving up shelter costs.

According to a recent note by Realtor.com, the US housing market is short 7.2 million homes.

Demand for housing continues to increase as population growth outpaces the rate of new home growth. Also, the genius idea by radical progressives in the White House to flood the nation with ten million plus illegal aliens will continue to put upward pressure on shelter costs.

The latest data from Miller Samuel Inc. and brokerage Douglas Elliman Real Estate data shows the median rent in Manhattan is inching back up to record highs.

We guess inflation is not going away anytime soon - or at least before the elections in Novemeber.

Gen Z Is Trapped In A Virtual Cage

Gen Z Is Trapped In A Virtual Cage

In this photo illustration, a teenager uses her mobile phone to access social media in New York on Jan. 31, 2024. (Spencer Platt/Getty Images)

Tyler Durden

Mon, 04/08/2024 - 12:40

In this photo illustration, a teenager uses her mobile phone to access social media in New York on Jan. 31, 2024. (Spencer Platt/Getty Images)

Tyler Durden

Mon, 04/08/2024 - 12:40

Authored by Timothy S. Goeglein via The Epoch Times (emphasis ours),

On Jan. 31, a groundbreaking hearing was held on Capitol Hill as the CEOs of five major social media platforms were called to testify (three only after having to be forced by subpoena) about the alleged harm—sometimes fatal—they have inflicted on America’s youth.

In this photo illustration, a teenager uses her mobile phone to access social media in New York on Jan. 31, 2024. (Spencer Platt/Getty Images)

In this photo illustration, a teenager uses her mobile phone to access social media in New York on Jan. 31, 2024. (Spencer Platt/Getty Images)

For more than four hours, with family members in the audience who had lost children to suicide, these tech gurus tried to deflect any talk about or accept responsibility for the alleged negative influence of their platforms.

In his recent book, “The Anxious Generation,” social psychologist and author Jonathan Haidt writes: “At the turn of the millennium, technology companies created a set of world-changing products that transformed life not just for adults but for children, too. … Yet, the companies that developed them had done little or no research on the mental health effects. When faced with growing evidence that their products were harming young people, they mostly engaged in denial, obfuscation, and public relations campaigns.”

The result has placed our children in a virtual cage that has isolated them physically, socially, and emotionally—with little hope of escape.

Trapped in this virtual cage, girls suffer massive depression as they face pressure to conform to certain body images, become targeted by predators, and are mocked by their peers if they choose not to participate in an online game of one-upmanship based on looks.

Mr. Haidt states: “The more time a girl spends on social media, the more likely she is to be depressed or anxious. Girls who say they spend five or more hours each weekday on social media are three times as likely to be depressed as those who report no social media time.”

Meanwhile, boys are sucked into a virtual world of video games and pornography, which traps them into a world of perpetual adolescence, with no idea of how to communicate with and treat the opposite sex in a gentlemanly manner, while also keeping them from maturing into responsible men.

Thus, given all this, is it any wonder why the suicide and self-harm rates for adolescents (particularly girls) have dramatically increased from 2010 to 2021, basically from the start of the smartphone/social media platform era to today?

Mr. Haidt concludes: “The overwhelming feeling I get from the families of both boys and girls is that they are trapped and powerless in the face of the biggest mental health crisis in history for their children. What should they—what should we—do?”

To free our children from the virtual cage that has entrapped them, he suggests four types of response: (1) no smartphones before 14 years of age; (2) no access to social media before the age of 16; (3) banning smartphones from schools; and (4) allow more unsupervised play and childhood independence.

But while all of these recommendations are good, they continue to put all of the onus on parents who find themselves standing alone against a tsunami of even more technological dangers, in particular, AI, coming their way.

Smartphones are here to stay, there is no going back, so what we must do is chart a new course going forward. And while we can curse the darkness of the virtual cage our children are trapped in, things will likely not change until Big Tech and social media platforms are forced to change.

That is why it is critical that lawmakers act and reform the present roadblocks that Big Tech and social media platforms use to avoid responsibility for any harm they may have caused. Until that happens, they will continue to give faux apologies and issue nice-sounding press releases while more children get trapped in their virtual cage.

Only then will parents be empowered with the tools to free their children from the technological tyranny that may have damaged an entire generation—and will scar more to come—unless action is taken now.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

'Dangerous Provocation': Kremlin Blasts Ukraine For Drone Strike On Zaporizhzhia Nuclear Plant

'Dangerous Provocation': Kremlin Blasts Ukraine For Drone Strike On Zaporizhzhia Nuclear Plant

Image: Russia UN photo

Tyler Durden

Mon, 04/08/2024 - 12:20

Image: Russia UN photo

Tyler Durden

Mon, 04/08/2024 - 12:20

The International Atomic Energy Agency is once again sounding the alarm over the potential that disaster could strike the Russian-controlled Zaporizhzhia Nuclear Power Plant in southeastern Ukraine, which is the largest in Europe.

On Sunday, for the first time since 2022, Ukraine apparently sent a drone against the facility and it struck one of the plant's six nuclear reactors. While Kiev has firmly denied it was behind the attack, Moscow has denounced it as a "very dangerous provocation" from Ukraine forces. Kremlin spokesman Dmitry Peskov denounced it as "a very dangerous practice with very bad negative consequences." He said it's but the latest example of Kiev's "terrorist activity."

"IAEA staff who are on site have had the opportunity to witness these attacks," Peskov added. Russian state-owned nuclear agency Rosatom reported casualties as a result of the strike, detailing that three people were wounded in the "unprecedented series of drone attacks."

Image: Russia UN photo

Image: Russia UN photo

IAEA head Rafael Grossi warned that if this continues, a serious nuclear accident with radiological consequences could occur. "This cannot happen," Grossi wrote on X Sunday. He urged both warring sides to avoid any aggression which violates fundamental principles meant to safeguard nuclear facilities.

Russia has long occupied the facility and overseen its operations, utilizing local Ukrainian engineers, and through the course of the war there have been sporadic Ukrainian assaults on the plant.

"Damage at unit 6 has not compromised nuclear safety, but this is a serious incident with potential to undermine integrity of the reactor’s containment system," Grossi described. The IAEA said that a drone strike resulted in a "detonation" which was "consistent with IAEA observations."

EuroNews further reports that "According to plant authorities, there was no critical damage... Radiation levels at the plant were also normal after the strikes."

Additionally, state-run TASS has confirmed the following details of the plant's current status:

The radiation level at the plant and the adjacent territory has not changed. It corresponds to the normal operation of power units and does not exceed the natural background values. The power unit that was hit is currently in the "cold shutdown" mode. Before that, the Ukrainian military carried out an attack on the ZNPP premises on April 5. Drone attacks were recorded in the area of the cargo port and the nitrogen-oxygen station.

During the opening months of the conflict following Russia's invasion in Feb. 2022, there was widespread condemnation against Russian forces centered on the Zaporizhzhia.

However, after Russia clearly came into full control of the plant's daily operations, and as Ukraine forces began dangerously shelling it and sending the occasional drone, global condemnations of the actions of the Ukraine side were curiously absent. With this newest incident too, UN and Western officials are carefully avoiding naming Ukraine as the culprit.

But of course, the Russians likely didn't just try to drone themselves. But interestingly, in the past Ukrainian media sources sought to claim Moscow would prepare a 'false flag' at the plant. This fresh weekend event is the first time Zaporizhzhia has been the intense focus of international headlines in over a year.

Yields To Stay Elevated As Inflation Emboldens Short Bond Trade

Yields To Stay Elevated As Inflation Emboldens Short Bond Trade

Tyler Durden

Mon, 04/08/2024 - 12:00

Authored by Simon White, Bloomberg macro strategist,

Rising inflation is likely to push more traders to go outright short on US Treasuries, supporting yields.

The inflation tide is turning. Disinflation has stalled in the US, core inflation in Japan is stuck at more than 30-year highs, and the global median inflation rate has stopped falling.

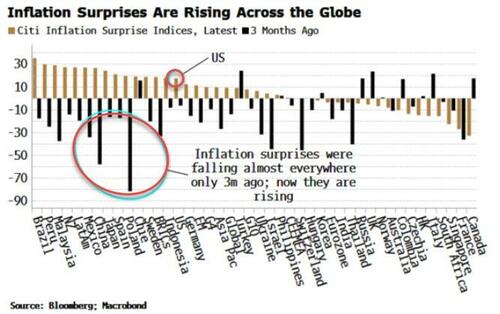

Global disinflation momentum has petered out. The Citi Inflation Surprise indices, which were negative in almost every country only three months ago, are now positive is most countries.

We’ll get updates on inflation this week from several countries in Europe as well as the US. Leading data has been consistently pointing to a re-rise in US inflation.

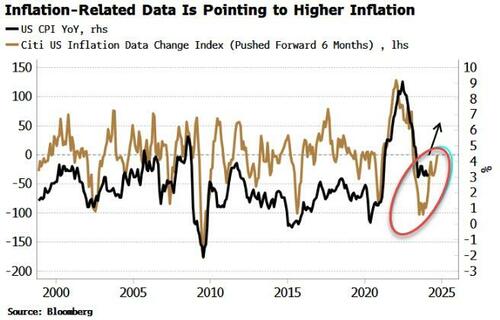

To add to that, Citi also produces an Inflation Data Change Index for the US, which tracks the cumulative change in inflation-related data. It shows US CPI should soon start rising again.

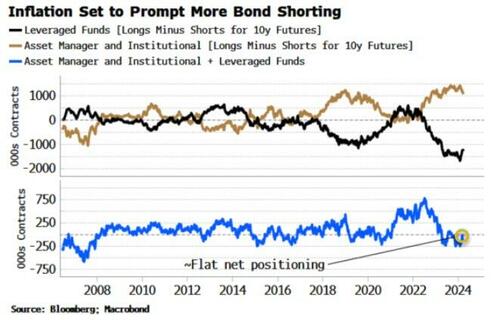

That’s a challenge for bond holders. Speculators’ positioning in USTs in the Commitment of Traders report is very net short, but this data is polluted by the basis trade, i.e. trading the bond future versus the underlying cash bond.

A better way to look at the data to try to account for this is to focus on the positioning of asset managers and leveraged funds. Typically, the second places the trade with the first via the repo market.

If we net the positioning in futures between leveraged funds and asset managers that should eliminate much of the contribution from basis trading. The net position in 10y UST futures is basically flat (orange line in the chart below).

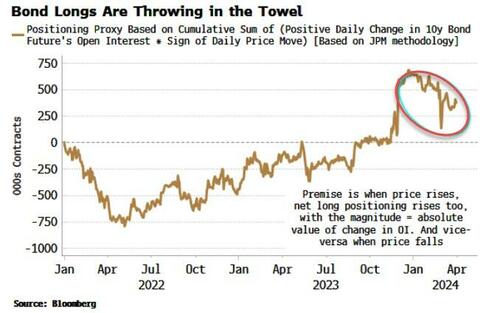

Another proxy for bond positioning shows that longs in 10y notes have been falling quite rapidly from their highs at the end of the last year. Furthermore, JP Morgan’s Client Treasury Survey shows outright shorts at almost series lows.

The overall message is that bond traders have been reducing longs as recession risk has receded, but they have not yet gone net short en masse. However, the inflation picture is likely to soon change that.

This week’s inflation data has a risk tilt, in that a lower-than-expected print is unlikely to prompt a stampede of fresh longs, but data that is above expectations could see any lingering doubts about going short bonds adamantly put to one side.

Why US Public Debt Is Unsustainable And Is Destroying The Middle Class

Why US Public Debt Is Unsustainable And Is Destroying The Middle Class

Tyler Durden

Mon, 04/08/2024 - 11:25

In a recent tweet, a talented financial analyst and investor stated: “The “debt is unsustainable” narrative has been around for 40 years plus. What’s astonishing to me is how the people who push this narrative never ask themselves, “Why has it been sustainable for so long?”.

There is a widespread idea that the fiscal imbalances of a world reserve currency issuer would end in an Argentina-style bankruptcy. However, the manifestation of unsustainability did not even appear as drastic in Argentina itself. Hey, Argentina continues to exist, doesn’t it?

Excessive public debt is unsustainable when it becomes a burden on productive growth and leads the economy to constantly rising taxes, weaker productivity growth, and weaker real wage growth. However, the level of unsustainable accumulation of debt may continue to rise because the state itself imposes public debt on banks’ balance sheets and the state forces the financial sector to take all its debt as the “lowest risk asset.” However, law and regulation have merely imposed and forced this construct. Rising debt bloats the government’s size in the economy and erodes its growth and productivity potential.

Many diabetic and obese people continue to eat too much unhealthy food, thinking nothing has happened so far. That does not mean their eating habits are sustainable.

Those who ignore the accumulation of public debt tend to do so under the idea that nothing has happened yet. This is a reckless way of looking at the economy, a sort of “we have not killed ourselves yet; let us accelerate” mentality.

An ever-weaker private sector, weak real wages, declining productivity growth, and the currency’s diminishing purchasing power all indicate the unsustainability of debt levels. It becomes increasingly difficult for families and small businesses to make ends meet and pay for essential goods and services, while those who already have access to debt and the public sector smile in contentment. Why? Because the accumulation of public debt is printing money artificially.

When money is created in the private sector through the financial system, there is a process of wealth creation and productive money creation. The financial system creates money for projects that yield a genuine economic return. Some fail, others soar. That is the process of productive economic growth and progress. Only when the central bank manipulates interest rates, disguises the cost of risk, and increases the money supply to monetize unproductive deficit spending can it distort this process.

Private banks in an open economy create money to accelerate progress and free-floating interest rates limit the accumulation of unproductive and dangerous risk. When the central bank wants to disguise the worsening solvency of fiscally imprudent governments, it does so by tampering with interest rates—making fiscally irresponsible governments’ borrowing cheaper—and artificially increasing the amount of currency in the system, monetizing public debt—a destructive process of money creation as opposed to the saving-investment function of banking.

When the fiscal position is unsustainable, the only way for the state to force the acceptance of its debt—newly created currency—is through coercion and repression.

A state’s debt is only an asset when the private sector values its solvency and uses it as a reserve. When the state imposes its insolvency on the economy, its bankruptcy manifests in the destruction of the purchasing power of the currency through inflation and the weakening of real wage purchasing capacity.

The state basically conducts a process of slow default on the economy through rising taxes and weakening the purchasing power of the currency, which leads to weaker growth and erosion of the middle class, the captive hostages of the currency issuer.

Of course, as the currency issuer, the state never acknowledges its imbalances and always blames inflation and weak growth on the private sector, exporters, other nations, and markets. Independent institutions must impose fiscal prudence to prevent a state from destroying the real economy. The state, through the monopoly of currency issuance and the imposition of law and regulation, will always pass on its imbalances to consumers and businesses, thinking it is for their own good.

The government deficit is not creating savings for the private economy. Savings in the real economy accept public debt as an asset when they perceive the currency issuer’s solvency to be reliable. When the government imposes it and disregards the functioning of the productive economy, positioning itself as the source of wealth, it undermines the very foundation it purports to protect: the standard of living for the average citizen.

Governments do not create reserves; their debt becomes a reserve only when the productive private sector economy within their political boundaries thrives and the public finances remain under control. The state does show its insolvency, like any issuer, in the price of the I.O.U. it distributes, i.e., in the purchasing power of the currency. Public debt is artificial currency creation because the state does not create anything; it only administers the money it collects from the same productive private sector it is choking via taxes and inflation.

The United States debt started to become unsustainable when the Federal Reserve stopped defending the currency and paying attention to monetary aggregates to implement policies designed to disguise the rising cost of indebtedness from unbridled deficit spending.

Artificial currency creation is never neutral. It disproportionately benefits the first recipient of new currency, the government, and massively hurts the last recipients, real wages and deposit savings. It is a massive transfer of wealth from the productive economy and savers to the bureaucratic administration.

More units of public debt mean weaker productive growth, higher taxes, and more inflation in the future. All three are manifestations of a slow burn default.

So, if the state can impose its fiscal imbalances on us, how do we know if the debt it issues is unsustainable? First, because of the units of GDP created, adding new units of public debt diminishes rapidly. Second, the erosion of the currency’s purchasing power persists and accelerates. Third, because productive investment and capital expenditure decline, employment may remain acceptable in the headlines, but real wages, productivity, and the ability of workers to make ends meet deteriorate rapidly.

Today’s narrative tries to tell us that nothing has happened when a lot has. The destruction of the middle class and the deterioration of the small and medium enterprise fabric in favor of a rising bureaucratic administration that consumes higher taxes but still generates more debt and deficits It does end badly. And all empires end the same way, with the assumption that nothing will happen. The currency’s acceptance as a reserve does come to an end. The persistent erosion of purchasing power and declining confidence in the legally imposed “lowest risk asset” are some of the red flags some are willing to ignore, maybe because they live off other people’s taxes or because they benefit from the destruction of the currency through asset inflation. Either way, it is profoundly anti-social and destructive, even if it is a slow detonation.

The fact that there are informed and intelligent investors who willingly ignore the red flags of weakening the middle class, declining purchasing power of the currency and deteriorating solvency and productivity shows why it is so dangerous to allow governments to maintain fiscal imprudence. The reason why government money creation is so dangerous is because the government is always happy to increase its power over citizens and blame them for the problems its policies create, presenting itself as the solution.

Can debt continue to rise? Of course. The gradual process of impoverishment and serfdom is relatively comfortable when the state can impose the use of the currency and force its debt into your pension by law and regulation.

To think that it will last forever, and nothing will happen is not just reckless “accelerate, we have not crashed yet” mentality. It is ignoring the reality of money. Independent money, gold, and similar, solve this.

99% Of Americans Will Be Able To See Either A Partial Or Full Solar Eclipse In The Next Few Hours

99% Of Americans Will Be Able To See Either A Partial Or Full Solar Eclipse In The Next Few Hours

Tyler Durden

Mon, 04/08/2024 - 11:24

The much-anticipated total solar eclipse will be watched by millions across North America this afternoon.

Because so many Americans live within or very close to the path of totality, it is being projected that this will be the most viewed total solar eclipse that the U.S. has ever experienced…

The total eclipse will first appear along Mexico’s Pacific Coast at around 11:07 a.m. PDT, then travel across a swath of the U.S., from Texas to Maine, and into Canada.

About 31.6 million people live in the path of totality, the area where the moon will fully block out the sun, according to NASA. The path will range between 108 and 122 miles wide. An additional 150 million people live within 200 miles of the path of totality.

There are more than 19,000 cities, towns and villages in the United States, and the very first one the path of totality will hit will be Eagle Pass, Texas…

The eclipse will begin in the U.S. on the afternoon of April 8. It will first be visible as a partial eclipse beginning at 12:06 p.m. CDT near Eagle Pass, Texas, before progressing to totality by about 1:27 p.m. CDT and progressing along its path to the northeast over the next few hours.

As Michael Snyder reports, according to NASA, the path of totality for the Great American Eclipse of 2024 will actually be substantially wider compared to the path of totality for the Great American Eclipse of 2017…

The path of totality – where viewers can see the Moon totally block the Sun, revealing the star’s outer atmosphere, called the corona – is much wider during the upcoming total solar eclipse than it was during the eclipse in 2017. As the Moon orbits Earth, its distance from our planet varies. During the 2017 total solar eclipse, the Moon was a little bit farther away from Earth than it will be during the upcoming total solar eclipse, causing the path of that eclipse to be a little skinnier. In 2017, the path ranged from about 62 to 71 miles wide. During the April eclipse, the path over North America will range between 108 and 122 miles wide – meaning at any given moment, this eclipse covers more ground.

The 2024 eclipse path will also pass over more cities and densely populated areas than the 2017 path did. This will make it easier for more people to see totality. An estimated 31.6 million people live in the path of totality this year, compared to 12 million in 2017. An additional 150 million people live within 200 miles of the path of totality.

If you are not able to make it into the path of totality on Monday, there is a very good chance you will still be able to experience at least a partial eclipse as long as clouds do not completely obscure your view.

NASA is telling us that literally 99 percent of the people that live in the United States will be able to see at least a partial eclipse…

You don’t need to live within the path of totality to see the eclipse – in April, 99% of people who reside in the United States will be able to see the partial or total eclipse from where they live. Every contiguous U.S. state, plus parts of Alaska and Hawaii, will experience at least a partial solar eclipse.

This really is an eclipse for the entire country.

Even on the west coast, approximately half of the sun will be blocked out by our moon…

The moon will block a significant portion of the sun and create a partial solar eclipse outside of the path of totality. The closer an area is to the path of totality, the larger the portion of the sun and its solar radiation – sunlight and energy – will be obscured by the moon.

At least 50% of the sun will be blocked during the eclipse as far west as Anaheim, California, and as far east as Orlando, Florida. Only around 20% of the sun will be blocked in the Pacific Northwest.

How the eclipse will look from where you are

pic.twitter.com/4Gn6VtFgNx

NASA is hosting a livestream of the solar eclipse which can be viewed here...

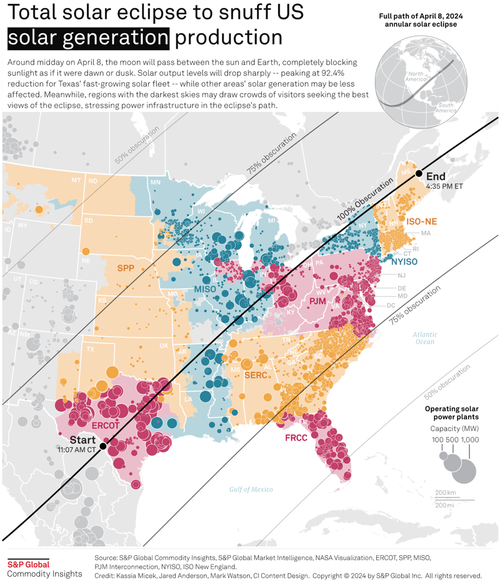

Eclipse Will Cut 30 Gigawatts Of Solar Power Across Nation's Grids

Eclipse Will Cut 30 Gigawatts Of Solar Power Across Nation's Grids

Tyler Durden

Mon, 04/08/2024 - 11:00

Later today, as millions of Americans head outside to observe the total solar eclipse, power grid operators across the country will face a significant reduction in solar power generation. This will place grids in a vulnerable spot, as backup fossil fuel generation and or battery reserves will need to kick on to mitigate grid stress.

Bloomberg data estimates that 30 gigawatts of solar energy—equivalent to 30 nuclear reactors—will be lost today because the eclipse will partially block sunlight for solar fields.

Bloomberg compiled a list of the top US power grids that will experience the largest losses in solar electricity generation:

-

The Texas power grid will be affected the most, losing about 17 gigawatts, according to estimates compiled by the Schneider Capital Group LLC.

-

To the northeast, the grid operated by PJM Interconnection LLC will lose about 4.8 gigawatts of utility-scale solar power and about the same amount from rooftop systems.

-

The impact on the Midcontinent Independent System Operator grid, covering much of the Midwest, will be slightly less — 4 gigawatts.

Here's a timeline of the solar eclipse, as well as the power markets that will be the most affected from Texas to Maine, according to S&P Global.

"Because we know about the eclipse ahead of time, utilities have prepared and planned for the lost solar energy," the Energy Information Administration penned in a recent note.

EIA added, "Several grid authorities have released plans for how they plan to deal with the change in solar generation during the eclipse. During the eclipse, electricity generators in the affected areas will have to increase output from other sources of electricity generation to supplement the decrease in solar power."

The country's last total solar eclipse occurred in 2017. Since then, solar generation has tripled in the US, accounting for about 4% of total power generation.

Today will be a major test of renewable-heavy grids. Maybe it's time, instead of grids focusing on building out unreliable solar and wind power generation - to focus on nuclear. The CEO of Pacific Gas & Electric said last week: "Nuclear should be part of the future."

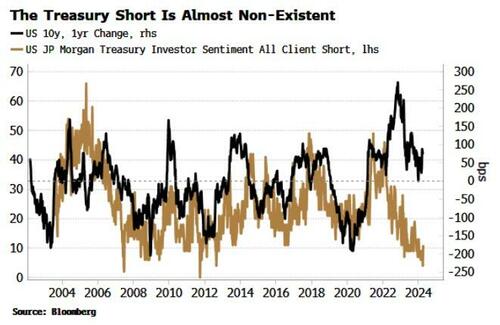

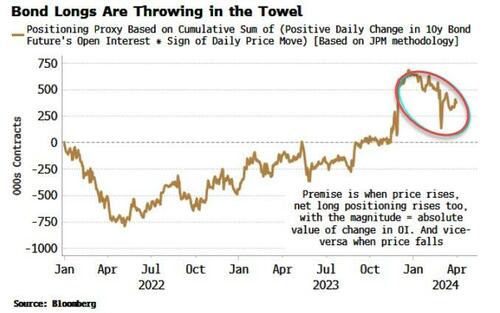

Hardly Anyone Is Short Treasuries; Perhaps They Should Be

Hardly Anyone Is Short Treasuries; Perhaps They Should Be

Tyler Durden

Mon, 04/08/2024 - 07:20

Authored by Simon White, Bloomberg macro strategist,

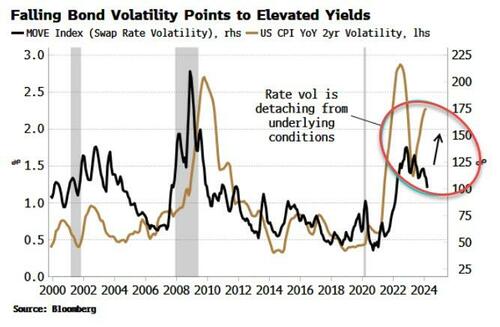

Survey data shows that outright shorts in US Treasuries are near lows. But investors are missing a trick as inflation risks point to higher bond volatility and yields.

JP Morgan’s Treasury Survey tracks their clients’ positioning in Treasuries, asking them whether they are long, neutral or short. The net of the positions is close to flat, but outright shorts are unusually low, with the number of clients saying they are positioned that way near the nadir for the 20-year history of the survey.

The Commodity Futures Trading Commission’s Commitment of Traders data has speculators net short Treasuries, but this is hugely distorted by basis trading (i.e. cash bonds versus futures). However, a position proxy for bond futures (see here) shows positioning is falling but is still net long.

(This proxy, whose methodology is explained in the chart, circumvents the distortion to Commitment of Traders data from the basis trade, i.e. trading the cash bond versus the future.)

The survey rings true in that traders are reducing long Treasury bets as recession risks have receded, but are still reluctant to go outright short.

But bond yields look to be coiling for a larger move.

Bond volatility has been falling, despite upside growth and inflation risks.

There is a yawning disconnect between inflation volatility and bond volatility. Uncertainty in inflation has been rising, and that typically means more volatile yields.

The gap is likely to be closed by rising bond volatility, and given the inflation backdrop, yields are poised to remain elevated.

The few bond shorts that are out there look to be in good shape.

Southwest Shares Fall After FAA Launches Investigation Into Engine Cover Ripping Off Its Boeing Jet

Southwest Shares Fall After FAA Launches Investigation Into Engine Cover Ripping Off Its Boeing Jet

Tyler Durden

Mon, 04/08/2024 - 06:55

Southwest Airlines shares are down around 1% in premarket trading in New York after the Federal Aviation Administration announced on Sunday that it was investigating a Houston-bound Boeing plane operated by the low-budget carrier that lost an engine cover and struck the wing flap during takeoff.

On Sunday morning, Flight 3695, a Boeing 737-800 aircraft operated by Southwest, was taking off from Denver International Airport to Houston when passengers heard a loud bang and recorded the moment the engine cowling ripped off the plane.

Scary moments for passengers on a Southwest flight from Denver to Houston when the engine cover ripped off during flight , forcing the plane to return to Denver Sunday morning. pic.twitter.com/BBpCBXpTsl

— Sam Sweeney (@SweeneyABC) April 7, 2024Part of the engine cover "peeled off within the first 10 minutes" of the flight, Lisa C. told ABC News, adding, "We all felt kind of a bump, a jolt, and I looked out the window because I love window seats, and there it was."

The FAA told ABC News and other corporate media outlets that it's investigating the incident involving Flight 3695.

Another passenger told ABC: "People in the exit row across from me started yelling up to the flight attendants and showed them the damage."

Southwest Airlines told Business Insider in a statement that Flight 3695 experienced a "mechanical issue," and its maintenance team was inspecting the aircraft Sunday afternoon.

"Our Customers will arrive at Houston Hobby on another aircraft, approximately three hours behind schedule," the budget carrier said in a statement.

Not a week goes by that some major incident involving Boeing planes, whether it is a tire falling off, runway excursions, engine fires, hydraulic leaks, pilot seats flailing around the cockpit and slamming the yoke, and or external panels ripping off.

We continue to ask whether these mid-air mishaps are sabotage or just shoddy maintenance.

To avoid Boeing jets while traveling, use the online travel booking website Kayak's plane filter.

What Is Driving Gold To All-Time Highs?

What Is Driving Gold To All-Time Highs?

Gold daily chart

Gold daily chart

Gold daily chart

Gold daily chart

Gold monthly chart

Gold monthly chart

Gold vs. the U.S. Dollar Index

Gold vs. the U.S. Dollar Index

Central bank gold buying

Central bank gold buying

Gold reserves

Gold reserves

Gold beans are becoming popular with young Chinese investors. Photographer: Qilai Shen/Bloomberg

Tyler Durden

Mon, 04/08/2024 - 06:30

Gold beans are becoming popular with young Chinese investors. Photographer: Qilai Shen/Bloomberg

Tyler Durden

Mon, 04/08/2024 - 06:30

Submitted by BullionStar/Jesse Colombo

After more than three years of stagnation, gold has awakened with a vengeance since early-March and has promptly surged by nearly $300 an ounce or 14% to an all-time high $2,330 — a sharp move for a safe-haven asset that has a reputation for its slow and steady trends. Gold’s powerful rally came seemingly out of the blue and has confounded the majority of investors and commentators who have been much more focused on trendy speculative stocks and cryptocurrencies as of late. In this piece, I will explain several of the technical and fundamental factors that are driving gold to all-time highs, what is likely ahead for gold, and how investors can best take advantage of the yellow metal’s resurgence.

A Look at the Technicals

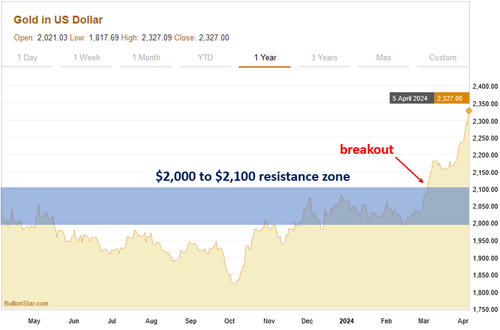

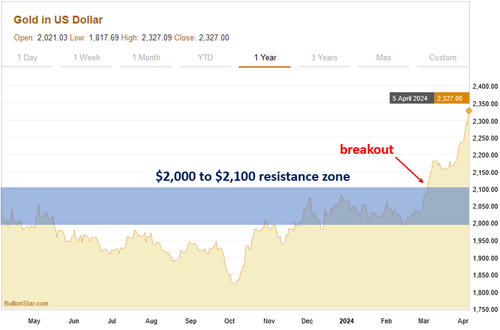

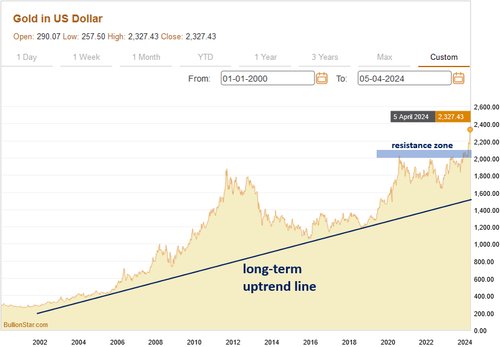

The chart of gold over the past year shows how it suddenly sprang to life over the past month. As I had explained in my last blog post on March 1st, there was an important technical resistance zone from $2,000 to $2,100 that had been acting as a price ceiling for gold since the middle of 2020. Gold’s successful close above that zone signified that a new rally had begun even though the fundamental drivers of it weren’t exactly apparent just yet.

Gold daily chart

Gold daily chart

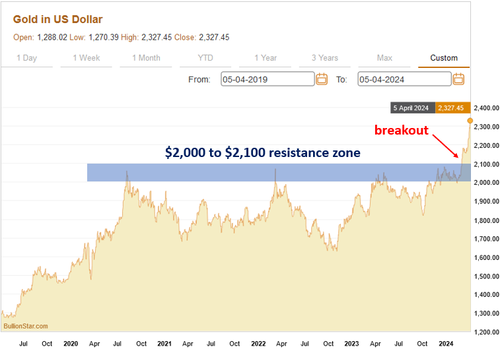

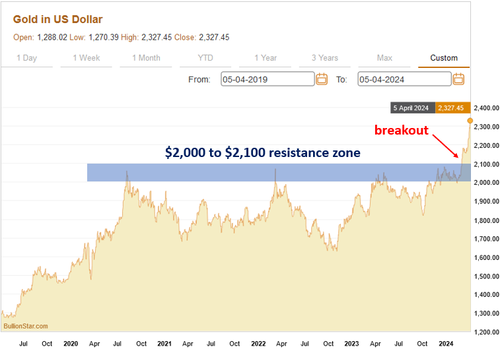

The multi-year gold chart shows the significance of the $2,000 to $2,100 resistance zone and how gold kept bumping its head at that level until it finally pushed through in the past month:

Gold daily chart

Gold daily chart

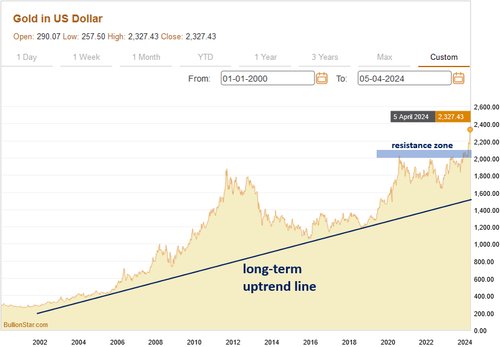

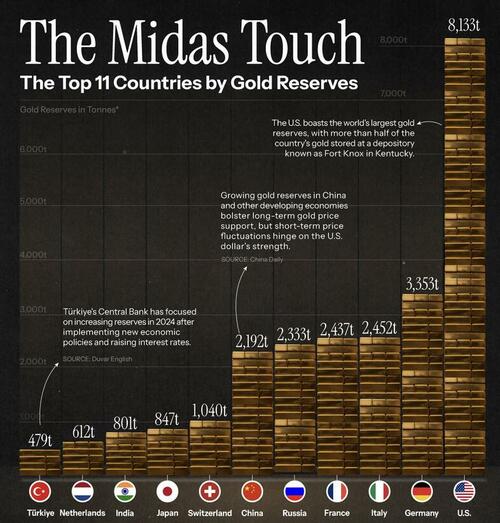

Gold’s multi-decade chart shows that it has been steadily climbing an uptrend line that began in the early-2000s as the U.S. and other countries kicked off an unprecedented debt binge that shows no signs of stopping whatsoever:

Gold monthly chart

Gold monthly chart

Gold is Rising Despite the Strong U.S. Dollar

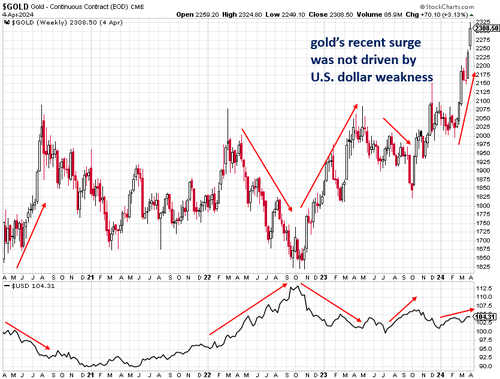

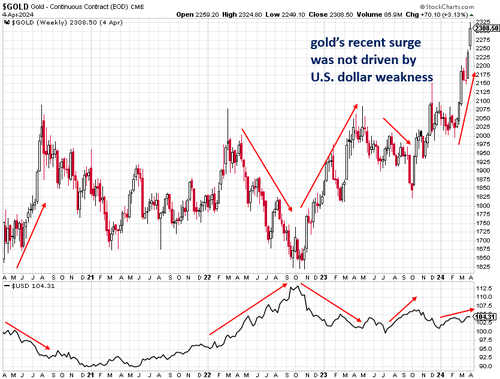

What’s particularly interesting and notable about gold’s surge over the past month is how it has occurred independently of the action in the U.S. dollar. Gold and the U.S. dollar have a long-established inverse relationship, which means that strength in the dollar typically causes weakness in gold, while dollar weakness typically causes the price of gold to rise.

The chart below compares gold (the top chart) to the U.S. Dollar Index (the bottom chart) and shows how action in the dollar often causes an opposite trend in gold. Gold’s recent surge took place while the dollar was trending slightly higher, which is a sign of gold’s strength due to its ability to buck the negative influence of the strengthening dollar.

Gold vs. the U.S. Dollar Index

Gold vs. the U.S. Dollar Index

Mainstream Investors & Journalists Missed Gold’s Rally

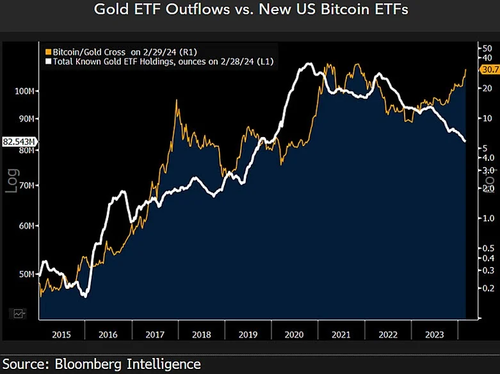

What is also worth noting is how gold’s surprising recent rally has received very little mainstream attention by a press that is much more enamored with hot AI stocks as well as Bitcoin and other cryptocurrencies that have recently benefited from the U.S. government’s approval of a number of Bitcoin exchange-traded funds (ETFs), which has resulted in tremendous inflows from institutional investors and retail investors alike.

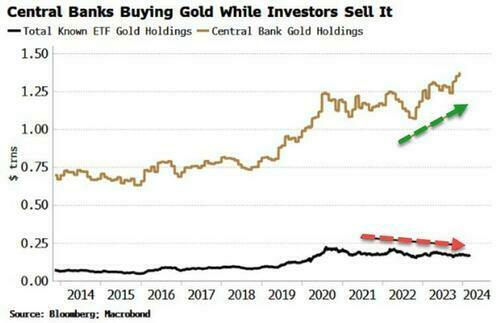

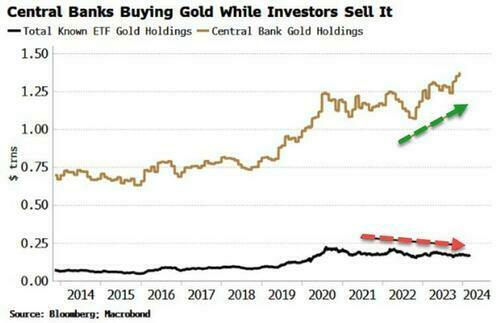

As the chart below shows, investors have pulled billions of dollars worth of funds from gold ETFs in order to re-invest in Bitcoin ETFs, which is ironic considering its timing shortly before gold’s liftoff (and is confirmation of contrarian investing principles). The continuation of gold’s bull market will likely lead to funds flowing back into gold ETFs, providing additional fuel for the rally.