Authored by Victor Davis Hanson via American Greatness,

Secure borders and stationary populations were considered the mark of emerging civilization by classical historians. In contrast to nomadism and constant strife over disputed territory, peoples who had clearly defined and protected borders ascended to statehood, maintained a distinct culture, and achieved greater prosperity and security.

In contrast, what we suffered from 2021 to 2025 was unprecedented.

It was an intentional administration effort to de-civilize the nation by destroying its borders—as if to return to the premodern era, when there were no clearly defined or secure borders, and nomadic peoples migrated as they pleased.

Stranger still, illegal aliens were at times given precedence over citizens—as immigration law was simply discarded.

Without IDs, illegal aliens boarded U.S. flights, while the government ordered citizens to obtain more secure “real” IDs.

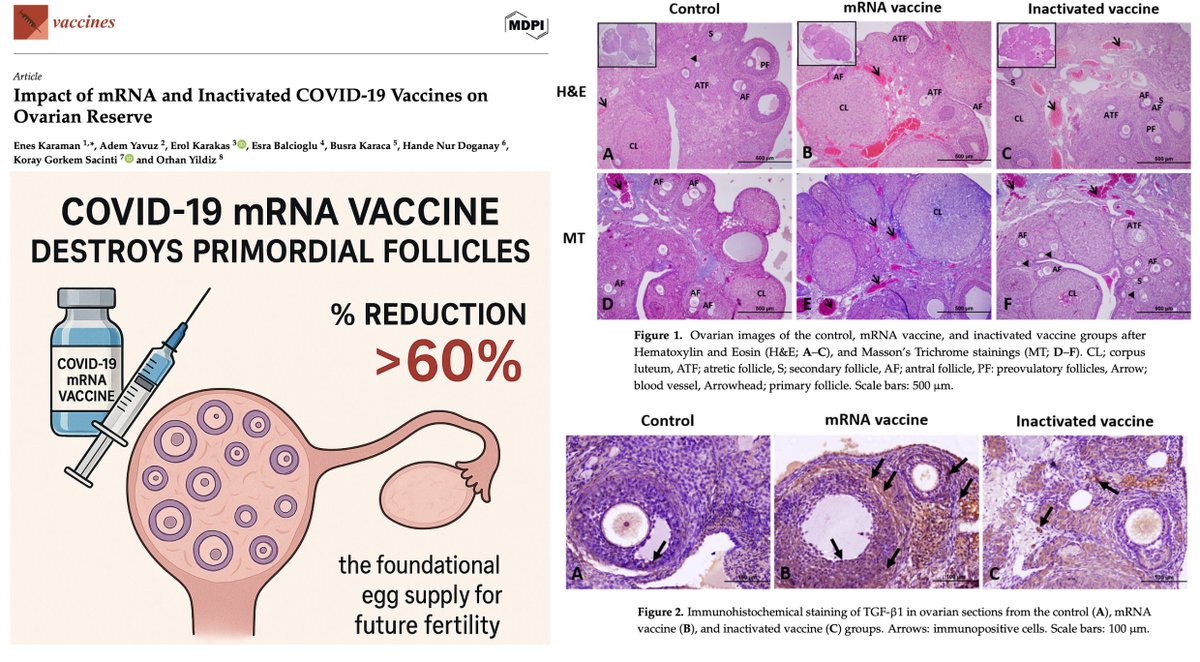

Some 8,500 veteran soldiers were drummed out of the military for refusing the experimental mRNA vaccinations. Yet 10 million simply walked across the southern border into America, without a care from the Biden administration whether they were vaccinated, ill, or had criminal records.

Any American citizen pulled over for speeding with an invalid driver’s license, while trafficking eight illegal aliens without identification, would be jailed and charged with felony counts. Not Abrego Garcia—the violent spousal abuser, M-13 gang-member, and previously deported illegal alien. He was neither arrested nor even cited by the officers who pulled him over.

One of the great hallmarks of Roman civilization and subsequent Western civilization was its ability to create large cities by importing clean water, removing waste through sewers, and collecting garbage from the streets. Even in the age before microbiology, ancient and premodern city planners knew the connection between cleanliness and epidemics and how to lessen disease through sanitation.

But in the last two decades, our major cities have been de-civilizing. Citizens are told not to flush non-biodegradable plastics down their toilets, both to preserve the environment and to ensure municipal septic systems work properly. They are reminded to pick up their pets’ excrement on sidewalks and in parks. For purposes of collective health, they are taught not to urinate, spit, or defecate in public areas.

Is all that for naught? After all, our mayors and city councils in our biggest and most iconic cities simply destroyed centuries of such health protocols and allowed tens of thousands of homeless people with impunity to inject, urinate, defecate, and fornicate in or on storefronts, streets, gutters, parks, and sidewalks. The stench, flotsam, and jetsam have utterly transformed American inner cities. Central Seattle, Los Angeles, parts of San Francisco, Portland, and Washington, DC, now resemble medieval London or Paris—as if a millennium-long knowledge of basic public health was simply ignored or mocked. In truth, the centers of America’s big cities are spaces where public health protocols are no longer enforced, where all the ancient and hard-won rules of civilization no longer apply. It would likely be safer to walk through Dickensian London of 1850 than to take a nocturnal ride on the New York subway.

Another hallmark of Western civilization was the creation of a judiciary that gave the state the power to enforce laws, ensure justice, and deter criminals by swift punishment, unaffected by ideology, bias, bribes, and personal vendettas.

From the law codes of Justinian to the American Constitution, ascendant civilizations rose with a codified legal system applied uniformly, disinterestedly, and fairly.

Not any longer. Ideology has turned the American legal system into a commissariat of sorts in which relativism is now the norm. Vandalize a Tesla in a blue state and, like the South of old, the laws will be lightly if even enforced and applied selectively. No one seriously believes that Alvin Bragg, Letitia James, Jack Smith, and Fani Willis were interested in real crimes rather than concocting them to destroy a presidential candidate and thus warp the political system. In contemporary America, it was far more likely to suffer a jail sentence for walking peaceably but unlawfully in the Capitol than for torching a federal courthouse, historic church, or police precinct in the summer of 2020.

From the ancient world to the medieval city to the modern era, universities were catalysts for the advance of science, medicine, law, politics, and the humanities.

Their civilizing missions were predicated on two unquestioned assumptions. One, unlike prior superstitions, inductive reason would guide intellectual inquiry; examining all evidence would lead to general conclusions rather than cherry-picking data to “prove” predetermined dogmas.

Today, DEI, the Green New Deal, and the “critical theories”—legal, race, and monetary—in the university start with deductive reasoning and then warp evidence to support such faith-based dogmas.

If any of the current violent pro-Hamas and anti-Semitic campus protests were instead directed at reducing abortion, ensuring that biological men do not compete in women’s sports, or banning racial preferences, the protestors would have long ago been arrested, expelled, or deported.

Tribalism was a premodern obstacle to civilization. It remains so in many parts of the Middle East, where it is routine to hire, promote, retain, and reward on the basis of kinship and bloodlines. In America, we were supposed to have a singular meritocracy, civilization’s effort to ensure that those with the most expertise and experience were charged with the most important tasks and responsibilities to ensure the safety and welfare of the majority. Race, religion, gender, and sexual orientation were neither rewarded nor punished.

Instead, we here, too, returned to premodern tribalism and race quotas, regressing to precivilization ideas that we owe our allegiance first to those who share a superficial appearance rather than to the body politic at large.

Finally, civilizations were often judged by their physical infrastructures—whether iconic, like the Parthenon, the Pantheon, medieval cathedrals, or modern towering skyscrapers, or practical by their roads, aqueducts, government buildings, and water and sewage systems.

But by that standard, too, we are decivilizing. Future generations will be amazed at California’s decaying high-speed rail to nowhere. Tens of billions of dollars and over a decade after the start of construction, there is still not a single foot of track laid, but instead only half-finished massive concrete overpasses that now resemble half-destroyed Mycenean palace walls. The nearly one-billion-dollar, half-finished, five-year-old Obama library resembles an oversized Stonehenge monolith.

In California, we do not just blow up dams, the brilliant work of a now-forgotten earlier generation. Instead, we use public bond funds, voted by the citizens to build new dams and reservoirs, to destroy them.

The more California requires lumber for new homes, fuel for its 31 million vehicles, and energy for its 15 million homes, the more the governor and legislature decivilize the state by shutting down timber companies, forcing oil refineries to flee the state, and closing nuclear power plants and fossil fuel generation, while witnessing replacement, new-age battery-power generation plants blow up into flames.

When preventable fires consume whole neighborhoods of Los Angeles, a paralytic government has no clue how to rebuild the work of past generations. The city government of Los Angeles proved uncannily efficient in ensuring such conflagration—canceling preventive brush clearing, the mayor junketing in Africa during fire season, reservoirs left empty, hydrants that did not work—but cannot rebuild, only destroy.

Why is America decivilizing?

In part, our mediocre schools have not produced competent stewards to maintain and expand the sophisticated infrastructure and ethos of a prior, far more capable generation.

In part, the sheer richness of our inheritance lulled our Lotus-Eater generations to consume what they inherited rather than reinvest it, given that since birth they had been insulated from the elemental and unchanging human and natural challenges to civilization.

And in part, a nihilism arose that despised the hard work of civilization and instead romanticized the wild—clueless that natural man, without the bridles of civilization, is a very dangerous beast, as we so often and lamentably see today.

Caroline Perkins, ChurchPOP

Caroline Perkins, ChurchPOP Caroline Perkins, ChurchPOP

Caroline Perkins, ChurchPOP Caroline Perkins, ChurchPOP

Caroline Perkins, ChurchPOP Caroline Perkins, ChurchPOP

Caroline Perkins, ChurchPOP Caroline Perkins, ChurchPOP

Caroline Perkins, ChurchPOP

Satisfaction guaranteed. Simply ask for a refund...

Satisfaction guaranteed. Simply ask for a refund...

Flags showing the face of Abdullah Ocalan, the leader of the Kurdistan Worker's Party (PKK), via AFP.

Flags showing the face of Abdullah Ocalan, the leader of the Kurdistan Worker's Party (PKK), via AFP.

Sheinbaum has satirically suggested renaming North America as "Mexican America"Image: Alfredo Estrella/AFP

Sheinbaum has satirically suggested renaming North America as "Mexican America"Image: Alfredo Estrella/AFP