“If you believe what you like in the Gospels, and reject what you don’t like, it is not the Gospel you believe, but yourself.”

All

A Medieval Hymn for the Ascension

The Roman Breviary of St Pius V derives from the medieval use of the Papal Curia, which was traditionally very conservative in most regards, and especially so in its repertoire of hymns. Many feasts, including some of the greatest solemnities (e.g. Christmas and Epiphany), have only two proper hymns, one of which is sung at both Vespers and Matins, and the other at Lauds; the same is true of Gregory DiPippohttp://www.blogger.com/profile/13295638279418781125noreply@blogger.com0

Holy Door in Prison and empty cradles, the challenges of the Jubilee of hope

On the Solemnity of the Ascension, Pope Francis this evening released the bull "Spes non confundit", announcing the Holy Year in 2025, delivering the document to Churches around the world. Reiterating his call for the guns to fall silent, he calls that the debt of poor countries be forgiven, 'a question of justice'. He also expressed hope that the 1,700th anniversary of the Council of Nicaea will offer a visible path on the ecumenical journey, beginning with the date of Easter.

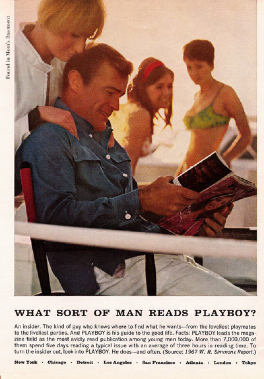

Makow--Playboy and the (Homo) Sexual Revolution

What kind of man is this?

He is fastidious about his appearance, his home, and his possessions. He wants as much sex as possible and chooses sexual partners mostly on the basis of appearance. He is self-absorbed and doesn't want emotional involvement or commitment. He thinks a woman would stifle him and children would be a burden.

Does this sound like many gays? It is also the masculine ideal purveyed by Playboy magazine to men since the 1950s. The hidden agenda was depopulation and family breakdown.

Update! Hugh Haefner was a Satanist. A reader writes-

First Comment from a reader- Hugh Hefner was a Satanist

My ex-girlfriend was working as an admissions counsellor at a private vocational school in Los Angeles and she met a woman inquiring about enrolling in a school program. The woman happened to be a former Playboy Playmate and what she told my girlfriend at the time was shocking, yet it isn't. She became Born-Again-Christian and said that while a Playmate, at the Playboy Mansion, she witnessed Satanism. She said that she witnessed Black Mass and was forced to join in. She said that she witnessed first-hand Hugh Hefner and fellow Playmates involved in this. She said that Hugh Hefner was a Satanist. It may seem shocking because it's a well-kept secret and I have not read about this anywhere, but it's not shocking either because we know that leaders of industry often are involved in this and have sold their soul to the enemy. So why would Hefner be any different? My girlfriend did not tell me the former Playmates' name. She promised the woman she would not reveal her name to anyone. My girlfriend Googled this former Playmate and confirmed she was who she said she was. Sadly I will never know who this Playmate is.

by Henry Makow PhD

(This essay was originally published in 2001)

The essence of manhood is to lead and support a family. Fatherhood is an essential part of a man's development. But in 1972, 3 out of 4 male college students got their ideas about masculinity from Playboy, at an incalculable price to themselves, women, children, and society.

The similarity between the Playboy and homosexual ideal is no coincidence. "The Kinsey Report" (1948) shaped current mainstream attitudes to sex. It championed unfettered sexual expression and became the manifesto of the counterculture. It inspired Hugh Hefner to start Playboy in 1953.

Essentially "The Kinsey Report" said that aberrant sexual behavior was so common as to be normal. Thanks to psychologist Dr. Judith Reisman, we now know that Alfred Kinsey was a homosexual and the "Kinsley Report" was a fraud.

Kinsey, a University of Indiana zoologist, pretended to be a Conservative family man. In fact, he seduced his male students and forced his wife and associates to perform in homemade pornographic films. To prove that children have legitimate sexual needs, Kinsey and his fellow pedophiles either abused 2,000 infants and children and/or relied on data obtained in Nazi concentration camps. (Judith Reisman, Kinsey: Crimes and Consequences, 1998, p.312)

Reisman concludes: "America's growing libidinous pathologies...taught in schools...and reflected in our fine and popular arts, the press, law, and public policy largely mirror the documented sexual psychopathologies of the Kinsey team itself."

Sponsored by the Rockefeller Foundation, Kinsey's goal was "to supplant what he saw as a narrow procreational Judeo Christian era with a promiscuous "anything goes" bi/gay pedophile paradise." ( Reisman, Crafting Gay Children: An Inquiry, p.4

He cruised Times Square looking for subjects. More than 25% of his sample were prostitutes and prison inmates including many sex offenders. Kinsey, who died prematurely of disease associated with impotence and self-mutilation (orchitis, Reisman p. 278), said 10 percent of American men were gay when in fact only two percent were.

Hugh Hefner said the Kinsey Report "produced a tremendous sexual awakening, largely because of media attention..." This shows how the elite orchestrates social change using media hype. (See Reisman, Kinsey, p.307)

With messianic fervor, Playboy took its gospel of sexual freedom to the American male who in the 1950's-1960's still consecrated sex for marriage. Playboy's aim, the aim of all pornographers, was to hook men on the glossy fantasy. To do this, they had to prevent them from finding true satisfaction in marriage.

In Reisman's words, "Playboy was the first national magazine to exploit college men's fears of women and family commitment. Playboy offered itself as a reliable, comforting substitute for monogamous heterosexual love." (Judith Reisman, "Soft Porn Plays Hardball," p 47)

Thus sworn enemies, Playboy and radical feminists, found common ground in hatred of the nuclear family. As a result, society now suffers from epidemics of family breakdown, pornography, impotence, child sexual abuse, sadosexual violence, teen pregnancy, a cocktail of STD's and, of course, AIDS. The birthrate has plummeted by 50% since 1960 and is barely at replacement level.

Homosexuality is a developmental disorder defined by the failure to establish a permanent bond with a member of the opposite sex. Psychologist Richard Cohen, in "Coming Out Straight: Understanding and Healing Homosexuality" (2000) argues it is caused when a male child fails to bond with his father. By having sex with men, the adult gay is trying to compensate for father-love denied in adolescence.

Cohen was gay and is now married with three children. He attributes lesbianism to a woman's reaction to being rebuffed or abused by her father. He has assisted hundreds of homosexuals but is under constant attack for undermining the gay political agenda, (i.e. to redefine societal norms.)

Psychiatrist Jeffrey Satinover has pointed to another cause of homosexuality. A 1990 survey of 1000 gays shows that an older or more powerful partner physically assaulted 37% of them before the age of 19. ("Homosexuality and American Public Life," 1999, p.24). In addition, according to Anne Moir in "Why Men Don't Iron," some men may be "born gay" due to foetal hormone imbalances. They seem to be a minority.

For many decades, gays were told that they were "sick" and cruelly and wrongly persecuted. The gay activist solution: convince the world that, in fact, it is heterosexuals who are sick. In 1973, they bullied the American Psychological Association into proclaiming homosexuality as normal. Together with feminist activists (who believe heterosexuality is inherently oppressive) gay activists began to dismantle all heterosexual institutions: masculinity, femininity, marriage, the nuclear family, the Boy Scouts, sports, and the military.

Backed by the financial elite, gay activists and their supporters now largely dictate our cultural sensibility. They are responsible for the puerile pornographic obsession that pervades television, music videos, and the Internet. This state of arrested human development is characteristic of many homosexuals. But straights have been homosexualized too. With women acting like men, and vice versa, we can't establish a "permanent bond with a member of the opposite sex" either. The elite's purpose is to promote social dysfunction and depopulation. See "Feminism and the Elite Depopulation Agenda".

Gay liberation manuals talk about "normalizing" their sexuality and "de-sensitizing" straights by flaunting it. I was livid in 1997 when I took my 10-year-old son to see Adam Sandler's movie "Billy Madison" and heard one teenage male youth in the film casually ask another: "Would you rather bone Pamela Anderson or a young Jack Nicholson?"

On TV's "Will and Grace," Jack who is gay dons an apron that says "Kiss the cook" pretending he thought the second "o" was a "c". Just as Communists once conned do-gooders to think radicalism was chic, gay activists define trendy for gullible liberals today.

Gay and feminist activists think traditional morality was invented to perpetuate an unjust status quo. In fact, morality is the accumulated wisdom of mankind regarding what is healthy and ultimately fulfilling. Perversion is deviation from what is healthy.

Heterosexual morality places sex in the context of love and/or marriage because it is healthy and human. It ensures that the most profound and intimate physical act between two people expresses a commensurate emotional-spiritual bond. Promiscuous sex is a desperate plea for love. Love and marriage answer that call and provide for the natural and necessary outcome of sex, children.

With Hugh Hefner's help, Alfred Kinsey detached sex from love and procreation. He reduced it to another physical function like urinating. Homosexual activists champion anonymous sex: a majority of gays have 10s-100s of partners each year. In less extreme form, heterosexuals have adopted this model. Recently a social columnist enviously described straight friends whose relationships have ended: "they're out partying, having the time and the sex, it seems of their lives."

In conclusion, the "sexual revolution" was really a triumph of an elite program of arrested development. See also "The CIA, Homosexuality and Underdevelopment." The elite agenda is to redefine healthy as deviant and vice-versa and they have succeeded. In 40 short years, almost all sexual constraints have dissolved, and heterosexual society is reeling. The cultural and social breakdown will only get worse unless there is a counterrevolution.

The Ignorance of Islamophobia

The deluge of Islamophobia on social media unleashed by supporters of the Gaza genocide has been profoundly shocking. It is one reason I am very sorry that Humza Yousaf was forced out as First Minister of Scotland, as he was a particular target and his ousting will have encouraged the bigots.

On Twitter and Facebook I frequently receive comments suggesting that I should go and live in an Islamic country (from people evidently unaware that I have previously), or that I should meet Hamas or the Taliban (from people again unaware that I have previously) who would behead me, or that Muslims wish to kill all non-Muslims.

What strikes me curiously is the sincerity of their Islamophobic beliefs – they really do believe all these things, because they have been imbued with this hate by absorbing years of propaganda in which Muslims are dehumanised.

I want to tell you, and them, a small story. In Pakistan a fortnight ago, I was in Lahore searching for the house of General Allard, where Alexander Burnes spent time. Allard is a fascinating figure but I do not want to digress here from the point of this story.

I did not find Allard’s palatial residence, which has been demolished long ago, but I did find the tomb where he and his daughter were buried. The tomb was attached to the house, and my fried Masood Lohari and I were able to do some urban archaeology, discovering that elements of the palace and its outbuildings had been incorporated into much later structures now on the site.

We were walking around the dense buildings when a man got off his scooter and invited us in to a doorway. Masood told him what we were doing, and he invited us up many winding steps to his attic apartment, where he opened a trapdoor into a roof cavity that revealed a very old structure.

His attic apartment was clean but very sparsely furnished. It had two rooms, in one of which his invalid father lay on a bed. In the other he and his wife had their bed. There were plastic chairs and table and an incongruously large old fridge.

His wife produced dates and nuts and tea and insisted we sit down to drink. The fridge was opened and the entire contents were emptied out for us. There was a delicious half melon, which was diced and put into bowls. A handful of strawberries were crushed and whipped up with the milk. Bread was broken and the very small amount of meat diced and grilled.

We tried to refuse some of the hospitality but plainly to persist in that would have caused enormous offence. It was obvious that this was a household living by western standards in great poverty, but every single bit of food available was cleaned out and given to the guests. Our beaming hosts told us of the blessing they received in providing hospitality to strangers.

The point is, that I have experienced this often in Muslim countries. In my experience, it is typical of the way that Muslim people behave. It is for example a fact that in the UK, Muslims devote a much higher proportion of their income to charity than non-Muslims.

Hate is bred of fear, and fear is bred of ignorance. It is tragic that in developed countries, resources are available for war but not to counter that ignorance.

But of course, the hate is deliberately inculcated as it is required to bolster suppport for war. From war the Establishment make a great deal of money and foment yet more hatred with which to bolster their authority.

————————————————

Forgive me for pointing out that my ability to provide this coverage is entirely dependent on your kind voluntary subscriptions which keep this blog going. This post is free for anybody to reproduce or republish, including in translation. You are still very welcome to read without subscribing.

Unlike our adversaries including the Integrity Initiative, the 77th Brigade, Bellingcat, the Atlantic Council and hundreds of other warmongering propaganda operations, this blog has no source of state, corporate or institutional finance whatsoever. It runs entirely on voluntary subscriptions from its readers – many of whom do not necessarily agree with every article, but welcome the alternative voice, insider information and debate.

Subscriptions to keep this blog going are gratefully received.

Choose subscription amount from dropdown box:

Recurring Donations 3 Pounds : £3.00 GBP – monthly5 Pounds : £5.00 GBP – monthly10 Pounds : £10.00 GBP – monthly15 Pounds : £15.00 GBP – monthly20 Pounds : £20.00 GBP – monthly30 Pounds : £30.00 GBP – monthly50 Pounds : £50.00 GBP – monthly70 Pounds : £70.00 GBP – monthly100 Pounds : £100.00 GBP – monthly

![]()

PayPal address for one-off donations: craigmurray1710@btinternet.com

Alternatively by bank transfer or standing order:

Account name

MURRAY CJ

Account number 3 2 1 5 0 9 6 2

Sort code 6 0 – 4 0 – 0 5

IBAN GB98NWBK60400532150962

BIC NWBKGB2L

Bank address Natwest, PO Box 414, 38 Strand, London, WC2H 5JB

Bitcoin: bc1q3sdm60rshynxtvfnkhhqjn83vk3e3nyw78cjx9

Ethereum/ERC-20: 0x764a6054783e86C321Cb8208442477d24834861a

The post The Ignorance of Islamophobia appeared first on Craig Murray.

Ascension Thursday Sermon 2024

We buried John-Paul, a ten-year old, just two days ago. Today, I reference the loss of their son at a private Mass at their home on Ascension Thursday.

Did California Dodge a “Right-to-Die” Bullet?

Alex Schadenberg

Executive Director, Euthanasia Prevention Coalition

Mark KomradPsychiatrists, Dr's Mark Komrad and Annette Hanson, Ronald Pies and Cynthia Gepert, wrote a commentary on the recent attempted expansion of California's assisted suicide law that was published by the Psychiatric Times.

Mark KomradPsychiatrists, Dr's Mark Komrad and Annette Hanson, Ronald Pies and Cynthia Gepert, wrote a commentary on the recent attempted expansion of California's assisted suicide law that was published by the Psychiatric Times.

Annette HansonKomrad et al ask if SB 1196 is: A Harbinger of Things to Come? They explain:

Annette HansonKomrad et al ask if SB 1196 is: A Harbinger of Things to Come? They explain:

California Senate Bill 1196 was introduced by Senator Catherine Blakespeare and represented a radical departure from existing California law.

Among its other provisions, SB 1196 proposed the following changes: Ronald PiesAdditionally, SB 1196 contained language that would have turned these practices into a quasi-research protocol by requiring the prescribing physician to report the type of lethal medications prescribed; the time from drug ingestion/administration to death; and any observed complications.

Ronald PiesAdditionally, SB 1196 contained language that would have turned these practices into a quasi-research protocol by requiring the prescribing physician to report the type of lethal medications prescribed; the time from drug ingestion/administration to death; and any observed complications.

Cynthia GeppertAs expansive as these recent modifications are, they pale in comparison to the radical changes proposed in SB 1196.

Cynthia GeppertAs expansive as these recent modifications are, they pale in comparison to the radical changes proposed in SB 1196.

The article explains that Dr Jennifer Gaudiani assisted the suicides of three people with eating disorders. Komrad and Hanson explain:

The third patient—Alyssa B—was actually a coauthor of the paper with Dr Gaudiani. According to the published paper,18 “Dr. G prescribed the MAID medications about 6 weeks after Alyssa entered hospice care.”

The Gaudiani et al paper is notable in acknowledging that: “Alyssa had not completed a full residential eating disorder program; never fully restored weight; never tried newer psychedelic options such as ketamine, psilocybin, or MDMA; and hadn’t had a feeding tube. Dr. G acknowledged that all but the feeding tube might ordinarily be undertaken prior to someone’s seeking end of life care for AN. Yet, [Alyssa] had been suffering for so long, and despite many conversations about all these treatment possibilities, Alyssa would not consent to any of them. Therefore, given her clarity of understanding around these issues and her sense that she could not fight anymore, everyone had to accept that they weren’t meaningful options.”Not surprisingly, the published paper and its rationale were vociferously criticized by many in the psychiatric community. For example, Dr Angela Guarda—the director of the eating disorders program at Johns Hopkins—is quoted as saying that using aid-in-dying medication for anorexia patients is “alarming” and “fraught with problems.” This is partly because “…it is impossible to disentangle this request [for PAS] from the effects of the disorder on reasoning, and especially so in the chronically ill, demoralized patient who is likely to feel a failure.”

In our view, the phenomenon of the slippery slope is, in large part, the expectable consequence of “normalizing” or naturalizing the physician’s direct or indirect killing of the patient; ie, via euthanasia or PAS, respectively. The more widely these acts are performed, the easier it becomes to mischaracterize them as forms of “medical care.” This is epitomized in the obfuscating euphemism, “medical aid in dying.” As the American College of Physicians has stated:

“Terms for physician-assisted suicide, such as aid in dying, medical aid in dying, physician-assisted death, and hastened death, lump categories of action together, obscuring the ethics of what is at stake and making meaningful debate difficult.”

In truth, assisted suicide does not “aid” the dying process—it terminates dying by terminating the patient.

By the same token, the more PAS and euthanasia are viewed as medical care, the easier it becomes to enlarge the eligibility criteria to encompass almost anyone who feels they are “suffering.” Then the slide down the slope can accelerate, from terminal conditions to chronic conditions (such as mental illness), as is happening in our culturally and geographically adjacent neighbor, Canada. That opens the path for the next drift in the evolving ethos—transforming one’s “opportunity” to seek these lethal procedures into the virtue of relieving loved ones from the burden of their condition.

Finally, we believe it essential that the APA maintain its ethical opposition to PAS/E, consistent with the American Medical Association Code of Ethics.4 Doing otherwise will create a schism between the APA and the AMA. Indeed, we hope that as our colleagues consider these issues at the APA meeting, they bear in mind the teaching from medical ethicist Dr Leon Kass: “We must care for the dying, not make them dead.”

Executive Director, Euthanasia Prevention Coalition

Mark KomradPsychiatrists, Dr's Mark Komrad and Annette Hanson, Ronald Pies and Cynthia Gepert, wrote a commentary on the recent attempted expansion of California's assisted suicide law that was published by the Psychiatric Times.

Mark KomradPsychiatrists, Dr's Mark Komrad and Annette Hanson, Ronald Pies and Cynthia Gepert, wrote a commentary on the recent attempted expansion of California's assisted suicide law that was published by the Psychiatric Times.Komrad et al, express their concerns that, even though SB 1196 was pulled by its sponsor that it represents the strongest example of slippage with the US assisted suicide laws to a far more permissive position. They state:

As opponents of PAS/E, we often hear proponents claim that the “slippery slope” argument is merely hypothetical—an alarmist bogeyman used to scare away supporters of PAS/E. We also hear that, even if the slippery slope metaphor applies in foreign countries, “It would never happen here” in the US. We respectfully disagree. For while the angle of the slope is considerably greater in Canada and the Benelux countries than in the US, we find troubling signs of slippage here at home.

As opponents of PAS/E, we often hear proponents claim that the “slippery slope” argument is merely hypothetical—an alarmist bogeyman used to scare away supporters of PAS/E. We also hear that, even if the slippery slope metaphor applies in foreign countries, “It would never happen here” in the US. We respectfully disagree. For while the angle of the slope is considerably greater in Canada and the Benelux countries than in the US, we find troubling signs of slippage here at home.

Annette HansonKomrad et al ask if SB 1196 is: A Harbinger of Things to Come? They explain:

Annette HansonKomrad et al ask if SB 1196 is: A Harbinger of Things to Come? They explain:California Senate Bill 1196 was introduced by Senator Catherine Blakespeare and represented a radical departure from existing California law.

Among its other provisions, SB 1196 proposed the following changes:

- It eliminated the California residency requirement for PAS.

- It replaced the criterion of “terminal disease” with “grievous and irremediable medical condition” that is “causing the individual to endure physical or psychological suffering… that is intolerable to the individual and cannot be relieved in a manner the individual deems acceptable.”

- It changed the criterion of the disease from “expected to result in death within 6 months” to “it is reasonably foreseeable that the condition will become the individual’s natural cause of death.” (This is identical to the vague language invented in Canada’s 2016 C-14 bill, which was never statutorily defined).

- It included a diagnosis of early to mid-stage dementia in the definition of a “grievous and irremediable medical condition.”

- It expanded the definition of “mental health specialist” to include neurologists and omitted any requirement for an evaluation by a psychiatrist or psychologist.

- It authorized “the self-administration of an aid-in-dying drug through intravenous injection.” This would have allowed health care practitioners to facilitate death by inserting an IV line—not merely writing a prescription, or dispensing and preparing the lethal drugs.

Ronald PiesAdditionally, SB 1196 contained language that would have turned these practices into a quasi-research protocol by requiring the prescribing physician to report the type of lethal medications prescribed; the time from drug ingestion/administration to death; and any observed complications.

Ronald PiesAdditionally, SB 1196 contained language that would have turned these practices into a quasi-research protocol by requiring the prescribing physician to report the type of lethal medications prescribed; the time from drug ingestion/administration to death; and any observed complications.Komrad et al explain how assisted suicide laws are "stretching the boundaries." They explain:

This extraordinary attempt to expand California's law illustrates what many states may expect if laws permitting PAS (or euthanasia) are adopted. Indeed, contrary to the “It can’t happen here” argument, we have already seen examples of slippage in several US states. These expansionary rules may be categorized as modifications of (1) waiting periods for PAS; (2) conditions of PAS eligibility; or (3) expansion of authority to carry out PAS; or some combination of these modifications.

For example,

For example,

- In New Mexico, advanced practice nurses and physician assistants are now allowed to carry out assisted suicide, and the waiting period between evaluation and lethal prescription has shrunk from 15 days to 48 hours. In addition, “a provider can waive the 48-hour waiting period if the patient is unlikely to survive the waiting period.”

- In Oregon, the state residency requirement has been eliminated, and if the patient’s death is predicted to be within 15 days, the lethal drugs may be prescribed on the same day as evaluation of the patient. Notably, “Prescriptions for lethal doses of medication in Oregon increased by nearly 30% in 2023, the same year an amendment to the state's Death with Dignity Act removed the in-state residency requirement for patients…”

- In 2022, Vermont bill S.74 was signed into law, allowing patients to request the lethal prescription using telemedicine. S.74 also got rid of the final 48-hour waiting period. Then, in 2023, Vermont removed the residency requirement from Act 39, the Patient Choice at End of Life law.

- In Washington State, as of 2023, physician assistants and advanced registered nurse practitioners are now permitted to prescribe the lethal drugs, and mental competency can be evaluated by any licensed ‘mental health counselor.’ If death is deemed “imminent,” the lethal prescription can be written the same day as the eligibility evaluation.

Cynthia GeppertAs expansive as these recent modifications are, they pale in comparison to the radical changes proposed in SB 1196.

Cynthia GeppertAs expansive as these recent modifications are, they pale in comparison to the radical changes proposed in SB 1196.Komrad et al comment on the extension of assisted suicide to people with Anorexia Nervosa. They write:

In March of 2022, the Colorado Sun ran the following headline: “Denver doctor helped patients with severe anorexia obtain aid-in-dying medication, spurring national ethics debate.”The third patient—Alyssa B—was actually a coauthor of the paper with Dr Gaudiani. According to the published paper,18 “Dr. G prescribed the MAID medications about 6 weeks after Alyssa entered hospice care.”

The Gaudiani et al paper is notable in acknowledging that: “Alyssa had not completed a full residential eating disorder program; never fully restored weight; never tried newer psychedelic options such as ketamine, psilocybin, or MDMA; and hadn’t had a feeding tube. Dr. G acknowledged that all but the feeding tube might ordinarily be undertaken prior to someone’s seeking end of life care for AN. Yet, [Alyssa] had been suffering for so long, and despite many conversations about all these treatment possibilities, Alyssa would not consent to any of them. Therefore, given her clarity of understanding around these issues and her sense that she could not fight anymore, everyone had to accept that they weren’t meaningful options.”Not surprisingly, the published paper and its rationale were vociferously criticized by many in the psychiatric community. For example, Dr Angela Guarda—the director of the eating disorders program at Johns Hopkins—is quoted as saying that using aid-in-dying medication for anorexia patients is “alarming” and “fraught with problems.” This is partly because “…it is impossible to disentangle this request [for PAS] from the effects of the disorder on reasoning, and especially so in the chronically ill, demoralized patient who is likely to feel a failure.”

Komrad et al explain how the three assisted suicide deaths of people with eating disorders is another clear sign of a practical slippery slope with US assisted suicide laws.

They conclude their article by stating:In our view, the phenomenon of the slippery slope is, in large part, the expectable consequence of “normalizing” or naturalizing the physician’s direct or indirect killing of the patient; ie, via euthanasia or PAS, respectively. The more widely these acts are performed, the easier it becomes to mischaracterize them as forms of “medical care.” This is epitomized in the obfuscating euphemism, “medical aid in dying.” As the American College of Physicians has stated:

“Terms for physician-assisted suicide, such as aid in dying, medical aid in dying, physician-assisted death, and hastened death, lump categories of action together, obscuring the ethics of what is at stake and making meaningful debate difficult.”

In truth, assisted suicide does not “aid” the dying process—it terminates dying by terminating the patient.

By the same token, the more PAS and euthanasia are viewed as medical care, the easier it becomes to enlarge the eligibility criteria to encompass almost anyone who feels they are “suffering.” Then the slide down the slope can accelerate, from terminal conditions to chronic conditions (such as mental illness), as is happening in our culturally and geographically adjacent neighbor, Canada. That opens the path for the next drift in the evolving ethos—transforming one’s “opportunity” to seek these lethal procedures into the virtue of relieving loved ones from the burden of their condition.

Finally, we believe it essential that the APA maintain its ethical opposition to PAS/E, consistent with the American Medical Association Code of Ethics.4 Doing otherwise will create a schism between the APA and the AMA. Indeed, we hope that as our colleagues consider these issues at the APA meeting, they bear in mind the teaching from medical ethicist Dr Leon Kass: “We must care for the dying, not make them dead.”

It is my belief that SB 1196 is the direction of the assisted suicide lobby, not just an experimental bill to gage a reaction.

Extraordinary treatment of a layman by the Pope. Layman sues Bishop in civil court.

A judge admits a lawsuit by the former Gaztelueta professor against Bishop SatuéNew bishop of Teruel José Antonio SatuéProblems for the investigating judge through canonical means of the well-known 'Gaztelueta Case' that was reopened by express order of Pope Francis, ignoring numerous elementary principles of law.José María Martínez Sanz, member of Opus Dei and therefore a layman, who is being Catholic Conclavehttp://www.blogger.com/profile/06227218883606585321noreply@blogger.com0

Yields Slide To Session Low After Stellar 30Y Auction

Yields Slide To Session Low After Stellar 30Y Auction

Tyler Durden

Thu, 05/09/2024 - 13:27

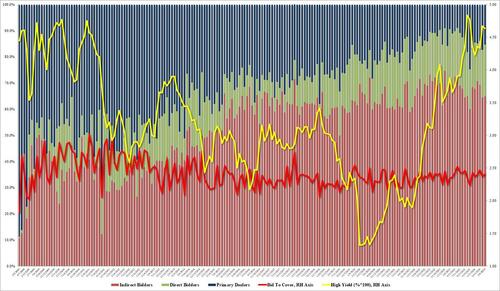

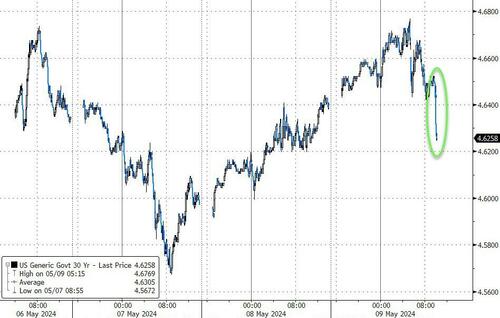

After a stellar 3Y auction and a solid, but tailing 10Y auction, moments ago the Treasury held the week's final refunding auction when it sold $25 billion in 30Y bonds in yet another stellar auction.

The high yield of 4.635% was fractionally below last month's 4.671% (and well below the cycle high of 4.837%in October 2023); it also stopped through the When Issued 4.642% by 0.7bps, following last month's modest tail, and was the 5th stopping through auction in the past 6.

The bid to cover rose to 2.409% from 2.367%, and also above the six-auction average of 2.38%.

The internals were solid with Indirects awarded 64.9%, up from 64.4% but below the recent average of 66.8%. And with Directs awarded 19.8%, Dealers were left holding 15.4% of the final auction.

Overall, this was a very strong close to refunding week, and the market clearly approved with yields sliding to session lows in kneejerk reaction to the solid demand for the ultra-long dated paper.

Trump Announces 'Major Motion' Filed In New York Appeals Court Over Gag-Happy Judge

Trump Announces 'Major Motion' Filed In New York Appeals Court Over Gag-Happy Judge

Former President Donald Trump speaks to the press as he arrives for his trial for allegedly covering up hush money payments linked to extramarital affairs, at Manhattan Criminal Court in New York City, on April 30, 2024. (Justin Lane/AFP)

Tyler Durden

Thu, 05/09/2024 - 13:20

Former President Donald Trump speaks to the press as he arrives for his trial for allegedly covering up hush money payments linked to extramarital affairs, at Manhattan Criminal Court in New York City, on April 30, 2024. (Justin Lane/AFP)

Tyler Durden

Thu, 05/09/2024 - 13:20

Authored by Jack Phillips via The Epoch Times (emphasis ours),

Former President Donald Trump on Thursday confirmed that his lawyers asked a New York state appellate court to issue a ruling on a judge’s gag order that prohibits him from speaking about certain individuals connected to his ongoing trial.

Former President Donald Trump speaks to the press as he arrives for his trial for allegedly covering up hush money payments linked to extramarital affairs, at Manhattan Criminal Court in New York City, on April 30, 2024. (Justin Lane/AFP)

Former President Donald Trump speaks to the press as he arrives for his trial for allegedly covering up hush money payments linked to extramarital affairs, at Manhattan Criminal Court in New York City, on April 30, 2024. (Justin Lane/AFP)

His team filed a motion on Wednesday, which has been sealed and is inaccessible, according to the court docket. The Manhattan district attorney’s office filed a response to the motion, but it was also sealed.

While speaking with reporters outside the courthouse on Thursday morning, President Trump confirmed the move. Anonymously sourced reports published Wednesday said that it was a motion to expedite the ruling.

“I just want to let you know that we’ve just filed a major motion in the appellate division concerning the absolutely unconstitutional gag order, where I’m essentially not allowed to talk to you about anything meaningful that’s going on in the case. And many good things are going on with the case. It shouldn’t have been filed,” he said.

During his comments to reporters, he did not go into specifics about the motion.

The former president is under a gag order that prohibits him from making public statements about potential witnesses, court staff, prosecutors’ staff, or family members. Judge Juan Merchan, who issued the order and later expanded it, ruled that President Trump violated his directive 10 times before threatening to jail the former president if he makes future comments that he believes violate that

Previously, the New York Court of Appeals rejected the former president’s bid to pause the trial while he battles the gag order. They also rejected an attempt to pause the enforcement of the order, which was issued in March after prosecutors requested it.

His lawyers have argued that the gag order violates the former president’s First Amendment right to free speech, noting that he is currently the leading Republican presidential candidate.

But earlier this week, Judge Merchan fined the former president for a 10th time for an April remark that he made to a media outlet about the Manhattan jury pool, which he said was “95 percent” Democratic. The judge then said that a $1,000 fine isn’t enough and that he might have to jail the former president, although he did not go into specifics about how that would look like.

“Your continued willful violations of this court’s orders threaten to interfere with the … administration of justice,” Judge Merchan said before issuing a warning about possible jail time.

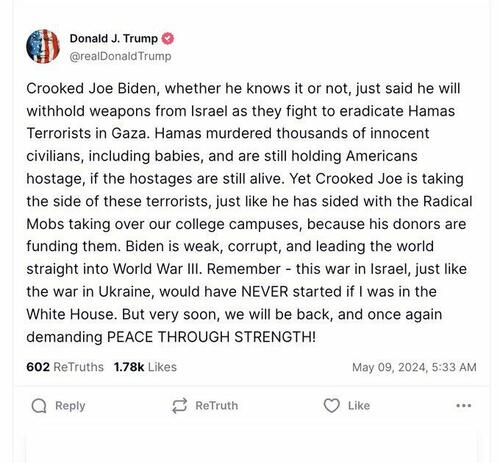

The former president, in response, criticized the judge and wrote on Truth Social that he is now not allowed to respond publicly to “lies and false statements” made about him during the New York trial. It came after witness Stormy Daniels made salacious allegations about President Trump during her first trial appearance, which President Trump has denied.

According to emails reviewed by The Epoch Times, the Trump campaign also used the judge’s threat as a means to fundraise for his presidential campaign. “The liberal judge in New York just threatened to THROW ME IN JAIL,” read one of the emails, adding that they want him “in HANDCUFFS.”

During his remarks to reporters on Thursday, the former president also quoted multiple legal analysts’ commentary on the case to say that it should never have been brought against him. Those analysts, which President Trump read aloud from a piece of paper, stated prosecutors revived the case after more than seven years in a politicized attempt to harm his 2024 reelection campaign.

“‘I’ve been doing this for 60 years, and I don’t understand what crime he’s been charged with. Nobody understands this. I just don’t get the crime. There’s no evidence of any crime whatsoever. This is a sham,’” President Trump said, quoting retired Harvard professor Alan Dershowitz.

The trial is expected to last another two weeks. On Thursday, Ms. Daniels, whose real name is Stephanie Clifford, again took the witness stand and was grilled by defense attorneys about whether she was using her allegations against President Trump to make money for herself and bolster her name recognition.

President Trump is charged with 34 counts of falsifying business records to cover up his former lawyer Michael Cohen’s $130,000 payment to Ms. Daniels for her silence ahead of the 2016 election about the alleged encounter. President Trump has pleaded not guilty and denies Ms. Daniels’ claims.

The case is seen by some as the least consequential of the four criminal prosecutions President Trump faces. But the chances of the other three, going to trial before the election are growing more distant. He has pleaded not guilty in all the cases.

The former president’s cases in Georgia and Washington were paused by the respective judges overseeing them. Meanwhile, in a major legal win, a Florida federal judge suspended his classified documents case indefinitely after prosecutors revealed that the contents of an evidence box were inexplicably rearranged.

Reuters contributed to this report.

Understanding the True Meaning of Charity

State-provided gratuitousness is not only sterile but positively harmful, the exact opposite of the gratuitous goods provided by free and responsible citizens. The truth is that generosity and abundance flourish in a free economy.

Don’t Believe The Wrong Things

If you've got a couple of spare decades on hand, and you don't believe in Peak Oil, go head and buy these markets at these prices. Eventually you might break-even.

Biden's Handling Of Israel War Has "Tremendously Increased The Risk Of A Fresh Eruption"

Biden's Handling Of Israel War Has "Tremendously Increased The Risk Of A Fresh Eruption"

Tyler Durden

Thu, 05/09/2024 - 12:40

By Michael Every of Rabobank

Yesterday saw the Riksbank in Sweden cut rates by 25bp to 3.75% for the first time since 2016 (as Brazil cut 25bp to 10.50% as expected, yet the BoJ opened the door to another tiny June hike). Rate cuts, and a month before the ECB is expected to do the same! As Bloomberg put it, “their choice signals that the domestic situation, with subsiding inflation and a sputtering economy, takes precedence over any concern that moving ahead of bigger peers will lead to another bout of korona weakening that in turn would fuel import prices.” Or that cutting rates doesn’t see speculation and inflation return locally; and/or that the global backdrop doesn’t suddenly do anything (additionally) nasty that would complicate the inflation environment for everyone.

On that latter note, the headlines speak to a dynamic that risks exactly that kind of development, if not immediately then over time.

First, ‘Biden warns Israel he will halt US weapon supplies if it invades Rafah’. The US president doesn’t mean just the $260m of munitions already on hold despite Congressional approval, but most offensive weapons, even if defensive systems such as iron dome interceptors will still flow.

There are few topics less well understood and more passionately championed on both sides that the current conflict between Israel and Hamas, but these points hopefully underline why this US action has a key geopolitical, and potential market, impact.

- The US is trying to dictate Israel’s policy, but far too belatedly to please the anti-Israel crowd.

- It removes the only pressure-point left to force Hamas to release the remaining Israeli hostages which it holds (including dual US citizens), displeasing the pro-Israel crowd.

- This as a huge political win for Hamas. It leaves Israel with only the recent Hamas-penned deal that would see it hold hostages for longer, retake control of Gaza, and gain the release of high-profile Palestinian prisoners into the West Bank. That latter action would crush the popular standing of the Palestinian Authority, leading to a Hamasification that would undermine both US/Western hopes for Arab states helping rebuild Gaza under a reformed Palestinian Authority and a two-state solution.

- This US “offense things bad, defensive things good” strategy is a mirror image of what they have tried and failed with vs. Russia (re: Ukraine) and Iran (re: Israel), among others, so far.

- Saudi Arabia will be wondering if a defense alliance with the US is worth it when their future actions might be proscribed by a White House National Security Advisor who a week before 7 October proudly claimed that the Middle East was “the quietest it has been in years.” Other allies in other regions, from Europe to Asia, may also start to wonder how reliable the US is when push really comes to shove.

- Israel, seeing this as existential, could ignore the US, creating a rupture between key allies. Or it could pivot to attack Hezbollah in Lebanon, which would be a far more destructive, destabilising conflict: and any US refusal to supply ammunition for that would be a true geopolitical earthquake that would embolden all forces pushing back on the US and its allies further.

In market terms, this doesn’t mean anything for energy prices immediately: indeed, some may wrongly take it as a “de-escalation” signal. However, the underlying pressure on the geopolitical tectonic plates has increased enormously, and the risks of a fresh eruption of some kind --with an inflationary impact of various potential forms (i.e., look at the Houthis)-- has increased in tandem.

Second, the IMF’s Gopinath this week stated: “Consider a world divided into three blocs: a U.S. leaning bloc, a China leaning bloc, and a bloc of nonaligned countries.” Which is of course exactly what we did years ago, when almost nobody else in markets was talking about it seriously. While she stresses that “connector countries” like Mexico and Vietnam are key ‘middlemen’ between the US and China, she notes we are seeing signs of real embryonic geopolitical and geoeconomic rupture.

The currency composition of cross-border payments for US-leaning countries is unchanged, but for those China-leaning the CNY share has more than doubled, from around 4% to 8% - and this is not only Russia, but a broader upstream trade commodity finance shift I have flagged before. She notes China’s shift from SWIFT to its own CIPS; central banks’ increased gold purchases for FX reserves; and flags the potential risks of trade fragmentation like Brexit on steroids, financial fragmentation that will see capital flows shift, and even that “the global payment system could become fragmented along geopolitical lines with the emergence of new payment platforms with limited or no interoperability.” Which is what happened in the 1930s, as well as in the Cold War, and which I have flagged as a risk repeatedly for years – and I have stressed that the dollar still wins even in a fractured world order where we all lose.

In a mild scenario, the IMF thinks this could reduce world GDP by 0.2%; in an extreme scenario, losses could be 7%; and low-income countries could experience 4 times the GDP loss of other countries in the event of fragmentation of commodity markets into two blocs. Most of the losses would be due to trade restrictions of agricultural commodities, raising concerns about food security in poorer countries: you think cocoa is volatile now? Again, we did this geopolitical work on agri commodity flows years ago.

Fragmentation of trade in minerals for the green transition would also make the already vastly expensive energy transition even more costly, as these minerals are geographically concentrated and not easily substituted. Again, this is a point made here before.

Understandably, the IMF asks, “So, what can we do to prevent this?” Yet the answer is: “The ideal solution would be to preserve and strengthen the multilateral rules-based global trading system and the international monetary system… and making more progress on dealing with subsidies and national security trade restrictions and developing international rules and norms on… industrial polices… But given where we are today, the ideal may be difficult to achieve.”

So, all the IMF can offer is “to keep open the lines of communication and stay engaged,” and “work together on areas of common interest,” which means little, and “limit harmful unilateral policy actions, including industrial policies” – which are about to expand massively, even in Europe.

Third, US presidential candidate RFK, Junior says that he has a dead worm in his brain and, “I have cognitive problems, clearly. I have short-term memory loss, and I have longer-term memory loss that affects me.” But not to worry, because you have the alternative choice of Joe Biden. Or of Donald Trump.

That all says, “disinflation and rate cuts”, right? So, surely, it’s time to risk doing just that?

“We are made and destined for a higher, larger, and nobler life than the present, of which the Ascension forcibly reminds us.”

“It is idle to speak of the expediency of the Ascension or, indeed, of the supernatural at all to such as these; nor do I, except by way of warning. We live in an age of no belief, or half belief, or make belief. But the truth, ” The word of the Lord endureth forever,” and our attitude towards it, can make no difference. God is still in the world, behind its forces, and guiding and controlling them, even though men neither see nor believe in Him. Men and women are still His creatures, the works of His hands–adorned with grace and destined for glory. We are on earth, it is true, but our eyes and heads, aye, and hearts too, point to the skies. No sophist, nor school of sophists, with all their arts of style and argument, have ever yet persuaded mankind at large that life ends at the grave, and that the happiness we crave and strive for and can never reach on earth is an empty dream, never to be realized. No! God made nothing in vain. We are made and destined for a higher, larger, and nobler life than the present, of which the Ascension forcibly reminds us. It reminds us, too, of the life of grace, the life of true, pure holiness over and above mere natural rectitude, a necessary precedent to the life of glory; and which our Lord, by withdrawing Himself visibly, enables us, if we will, to live.

“Let us therefore lift up our hearts to heaven where Christ has gone “to prepare a place for us.” We have not seen Him ascend; but we know by faith He is there. He is the head of the mystic body of which we are members, and limbs should join the head. “Ubi caput praecessit ibi spes vocatur et corporis.” Be faithful, then, to grace, lead a life not of pleasure, but of duty. Peace is only found where God placed it–in a dutiful, self-denying life. ” Therefore,” in the words of St. Paul, “if you be risen with Christ, seek the things that are above; where Christ is sitting at the right hand of God: Mind the things that are above, not the things that are upon the earth. . . . When Christ shall appear, who is your life, then you also shall appear with him in glory” (Col.iii. 1,2,4).”

https://www.thinkinghousewife.com/2024/05/ascension-thursday-2/

What Frustrates Americans The Most About The Tax System

What Frustrates Americans The Most About The Tax System

Tyler Durden

Thu, 05/09/2024 - 12:20

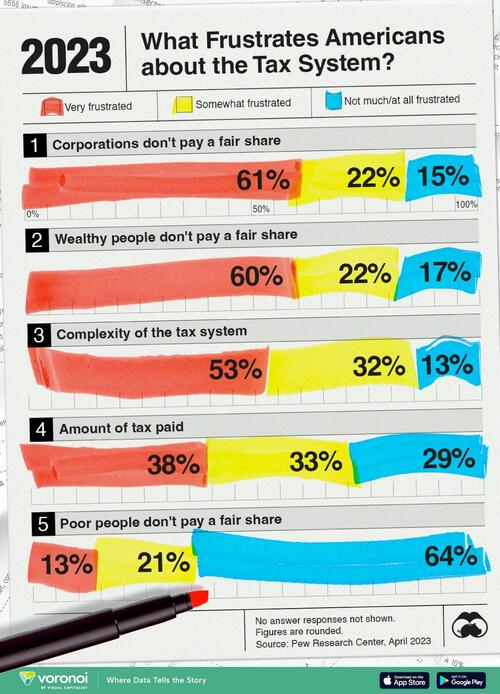

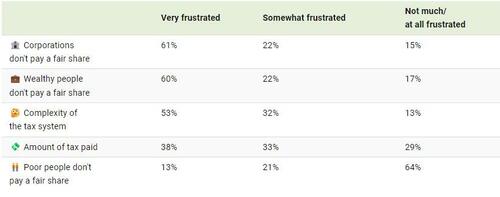

In this visualization, Visual Capitalist's Pallavi Rao shows Pew Research’s findings on what bothers Americans the most about the tax system.

This data was collected after surveying more than 5,000 American adults between the period of March 27-April 2, 2023.

The survey was weighted to be representative of the U.S. adult population. Visit Pew Research’s methodology page for more details.

Americans Want More Taxes for Some

Six in every 10 Americans feel that both corporations and the wealthy don’t pay their 'fair share' in federal taxes.

Their sentiments are not entirely unfounded.

Note: No answer responses are not shown, thus percentages may not sum to 100.

A 2021 ProPublica investigation found some of the wealthiest Americans - also the wealthiest people in the world - did not pay a single penny in federal income taxes in some years.

A significant part of why this is possible is how taxes are collected depending on the source. Since much of the top 1% grow their wealth in equity and property, they are not subject to taxes until they make an actual transaction.

As this Brookings Institution article explains: most Americans make money through their wages, and wages are subject to heavier taxation than capital income.

Thus, the tax share of America’s highest-income households is often lower than America’s middle-income households.

Finally, Pew Research noted that their findings were essentially unchanged since 2021.

We Need To Talk About Recession Risk Again

We Need To Talk About Recession Risk Again

Tyler Durden

Thu, 05/09/2024 - 12:00

Authored by Simon White, Bloomberg macro strategist,

It’s time once more to increase vigilance for a US recession.

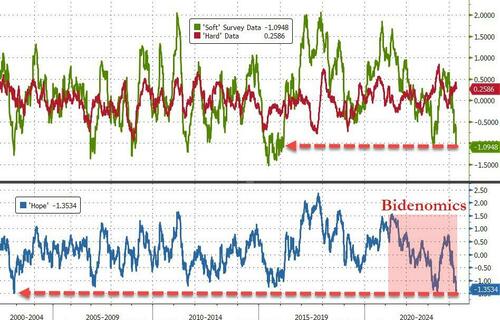

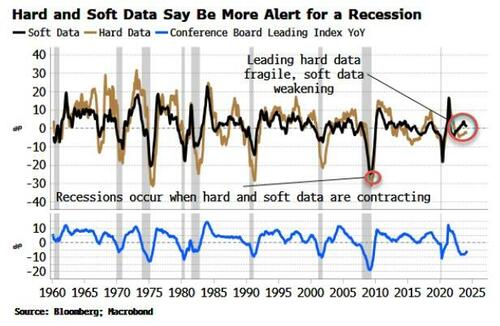

Soft, survey data is starting to deteriorate, while hard data is already fragile. Expectations of a downturn are currently low, but they could quickly swing higher.

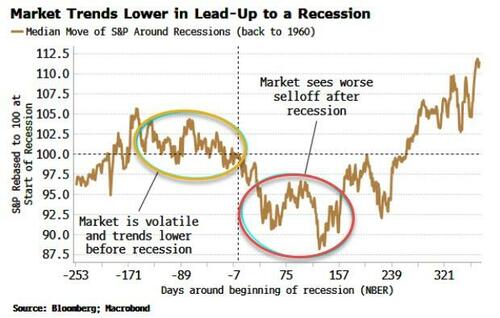

Stocks – which experience their worst drawdowns in recessions – are not priced for such an outcome, while yields are biased lower in the coming months.

S curves are nature’s approximation of a binary on-off switch. They pop up in all sorts of places, from neurons in the brain to the progression of diseases, and from population growth to the adoption of new technologies. They also describe how recessions evolve.

Economies are typically believed to develop in a linear fashion, from a non-recessionary to a recessionary state. But instead they do so in a highly non-linear way, with recessions often happening abruptly. Downturns have either a low risk of occurring in the next 3-4 months, or a high risk, but rarely anything in between – much like the shape of an S as depicted below.

That is why most standard recession models don’t make a lot of sense, as they assume recession risk can evolve smoothly. But it is essentially meaningless to talk of the likelihood of a recession rising from, say, 45% to 50%, when we acknowledge their regime-shift nature.

Just now we are at the bottom-left hand side of the S, with a low risk of an imminent recession. But the data has evolved in the last few weeks to suggest we could soon move to the right and on to the steep upward section of the curve – meaning the probability could quickly climb much higher. If so that would make a recession more likely than not over the next 3-4 months.

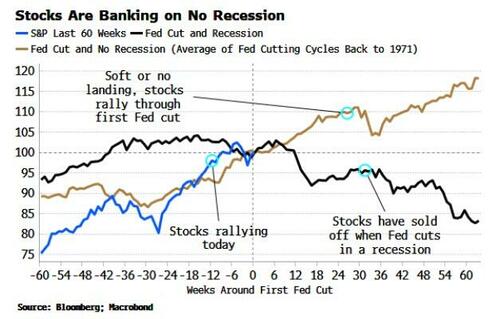

Stocks are expecting a soft or no landing. They are currently behaving in a way consistent with the Fed’s first rate cut — the most likely move if it changes rates this year — occurring in the absence of a recession. However, rate cuts that happen when there is a slump have historically led to a much worse outcome for equities — both before and after the recession — than currently priced (white line in chart below).

Six months ago I wrote that a US recession was unlikely through most of 2024. That could still end up being the case, but if we are shifting along the S curve, then investors should be prepared for an environment that could quickly look more recessionary, even if an actual downturn doesn’t arrive for another six months. Remember: stocks sell off before the onset of a recession, and even longer before the NBER finally announces the economy is in one.

The upgrading of recession risk has been prompted by the weakening in soft data in recent weeks, coinciding with hard data that remains fragile.

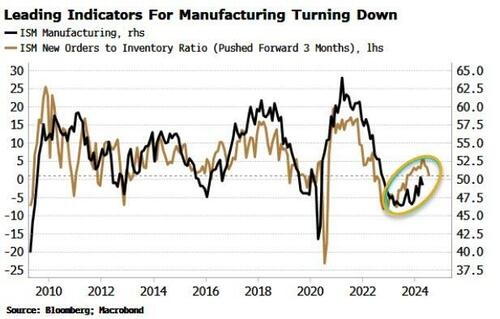

The manufacturing ISM is one of the single-most important data points for the economic and stock outlook.

The headline survey dropped below 50 in April. It is led by the new orders-to-inventory ratio, which is turning lower and slipped below the important level of one, where orders are expected to be just enough to match inventory.

It was the rise in this ratio, along with other indicators, that fed the view last year that the US was likely to avoid a recession for a while yet.

Yet as much as it’s unhelpful to be a perma-bear and constantly expect a recession, it also doesn’t make sense to assume there will be no recession at all. As I have described, one can only have a reasonably accurate view on a downturn occurring over the next 3-4 months, and that view by its nature is likely to change abruptly, not smoothly.

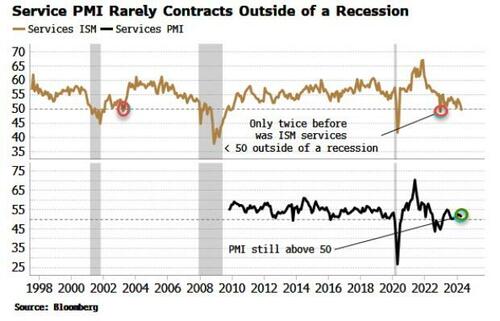

Adding to the difficulty in forecasting recessions, the goods and services economies have fallen out of sync in this cycle. Normally the goods sector leads the rest of the economy into a downturn, which is why so many traditional recession indicators over-emphasized the risk of one last year. But at some point, the economy is likely to resynchronize.

Why it’s particularly important to be more vigilant now is that services might also be notably slowing, as flagged by the services ISM also slipping below 50 in April; it has only done so twice before outside of a recession.

The usual caveats apply. The ISM is quite volatile, and the PMI services survey is still above 50, even though it is also turning lower. But this drop in important soft-data points comes at a time when hard data is showing signs of fragility too.

Recessions occur when both hard and soft data are contracting at the same time. Using the inputs to the Conference Board’s Leading Index, growth in leading hard-data has been turning higher, but is still contracting, while leading soft-data is close to slipping into the contraction zone. That would be ominous for recession risk.

Revisions will also be key to monitor. Typically data sees its biggest revisions before and after the occurrence of a recession. Data can be revised lower very quickly which is why recessions can happen faster in revised time than in real time.

What does all this mean practically for investors?

It leaves stocks more vulnerable. As the chart below shows, even though equities see a sharp drawdown after a recession begins (which, remember, we don’t know when that is until after the fact when the NBER announces it), they begin selling off beforehand. Moving to the right of the S curve means more volatile stock prices with a bias lower, even if it does not ultimately mean a full recession-like decline and an end to the bull market.

It also means bond yields are more likely to see some retrenchment in the coming months. But with elevated inflation in the background, bonds are primed to not rally as much as in non-inflationary recessions (see chart below). Moreover, yields are still structurally biased higher due to waning interest in owning USTs at current prices, and an inundation of supply.

Investing is about gauging forward probabilities. The probability of a near-term recession is currently low, but in a month’s time it could be much higher. That would be a lot of new information asset prices would have to quickly digest. A more nimble investment stance is advised at this trickier part of the cycle.

Watch: Billionaire Real Estate Investor Expects 'One Or Two' Bank Failures A Week, UK Economist Says "Entering A New Dark Age"

Watch: Billionaire Real Estate Investor Expects 'One Or Two' Bank Failures A Week, UK Economist Says "Entering A New Dark Age"

Tyler Durden

Thu, 05/09/2024 - 11:40

Billionaire Barry Sternlicht, Founder, Chairman and CEO of Starwood Capital Group has issued an ominous warning about America's regional banks, which he says will fail at a rate of 'one or two' per week.

Speaking with CNBC on Tuesday, Sternlicht says he thinks that primary real estate lenders - community and regional banks - are about to get whacked.

"You're going to see a regional bank fail every day, or not — every week, maybe two a week," he said, adding that Fed Chair Jerome Powell's ongoing rate hikes will continue to have consequences for the real estate sector.

"He's got a hard task with a blunt tool, and the consequence is the real estate markets are taking it on the chin because rates rose so fast. We could have handled this, but we couldn't handle it this fast," he said. "The 1.9 trillion of real estate loans, that's a fragile animal right now."

Watch:

As Schiff Gold notes, the fed must cut to avoid a banking crisis.

Most at-risk firms are smaller banks representing assets under $10 billion, with a handful of larger regional ones. Some might be able to avoid closing by halting expansion plans or offering fewer services. Others might save themselves by merging with larger banks. But with inflation too high for the Fed to cut now, “higher for longer” interest rate policy is looking increasingly likely, and banks with high exposure to troubled commercial real estate are at particular risk of starting a domino effect of small collapses that lead to bigger ones and bleed into becoming a real estate crisis.

...

In all its hubris, the Fed is stuck between preventing a banking crisis and preventing inflation from getting even more out of control. It needs higher rates to reduce inflation, but crucial sectors of the economy that are heavily dependent on lending can’t survive in a higher-rate environment, even if they don’t appear insolvent at first glance.

There are more than 4,000 regional and community banks throughout the United States, however just one - Republic First Bank - has shuttered since the start of 2024, after the FDIC seized $4 billion in deposits and $6 billion in assets last month.

Read more here, here, here, and most detailed here.

Meanwhile, UK fund manager, former MEP, and previously Nigel Farage's economic spokesman Godfrey Bloom has issued a similar warning to Stenlicht, telling former UK parliamentary candidate Jim Ferguson on his podcast that the banks are insolvent.

"We are entering a new dark age," says Bloom, who recommends that people "take your money out of the banks."

Watch:

Exclusive Alert Breaking: "British Banks are all on the brink of collapse" Godfrey Bloom.

Banks in America are collapsing at the rate of one a month.

"we are entering a new dark age"

Godfrey Bloom ,Author, Fund manager, Former MEP and former British Army Major with the 4th… pic.twitter.com/KEk6nmGYtp

Uzbekistan ready to send migrants to South Korea

Uzbekistan's Employment Minister Behzod Musaev was in Seoul to discuss with South Korean officials opening new sectors for Uzbek workers. South Korean businesses have called for the unprofessional worker visa to be extended to more areas. Since President Yoon took office, foreign work permits have jumped considerably.

The Missing Piece Of The Puzzle: Behind The Inexplicable "Strength" Of US Consumers Is $700 Billion In "Phantom Debt"

The Missing Piece Of The Puzzle: Behind The Inexplicable "Strength" Of US Consumers Is $700 Billion In "Phantom Debt"

Tyler Durden

Thu, 05/09/2024 - 11:33

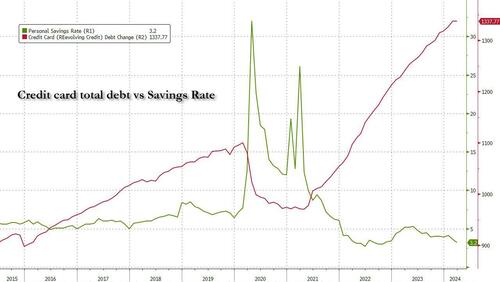

Yesterday we discussed the latest consumer credit data, which revealed that the amount of credit card debt across the US has hit a new record high of $1.337 trillion (even though it appears to have finally hit a brick wall, barely rising in March by the smallest amount since the covid crash), even as the savings rate has tumbled to an all time low.

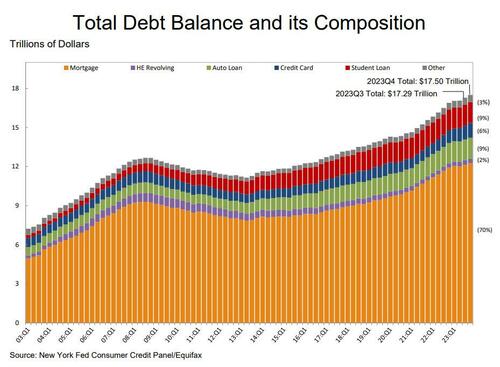

To be sure, credit card debt is just a small portion (~6%) of the total household debt stack: as the next chart from the latest NY Fed consumer credit report shows, the bulk, or 70%, of US household debt is in the form of mortgages, followed by student loans, auto loans, credit card debt, home equity credit and various other forms. Altogether, the total is a massive $17.5 trillion in total household debt.

But staggering as the mountain of household debt may be, at least we know how huge the problem is; after all the data is public. What is far more dangerous - because we have no clue about its size - is what Bloomberg calls "Phantom Debt", and we have repeatedly called Buy Now, Pay Later debt. How much of that kind of debt is out there is largely a guess.

Let's back up: the topic of Buy Now, Pay Later, or installment debt, is hardly new: we have covered it extensively in the past year, as this selection of articles reveals:

- "Buy Now, Pay Later" Mania Sends Americans Deeper Into 'Black Hole' Of Debt: April 2023

- Consumers Use 'Buy-Now, Pay-Later' Option To Fund Record Black Friday Purchases: Nov, 2023

- BIS Reveals 'Buy Now, Pay Later' Use Is Soaring Among Working Poor Youngsters: Dec 2023

- Self-Checkout Kiosks At 4,500 Walmarts Now Offer 'Buy Now, Pay Later' Loans For Basic Items: Dec 2023

- Many Are Addicted To "Buy Now, Pay Later" Plans, It's A Big Trap: Feb 2024

But while it is easy to ensnare young, incomeless Americans into the net of installment debt where they will rot as the next generation of debt slaves for the rest of their lives, there is an even more sinister side to this extremely popular form of debt which allows consumers to split purchases into smaller installments: as Bloomberg reports in a lengthy expose on installment debt, the major companies that provide these so called “pay in four” products, such as Affirm Holdings, Klarna Bank and Block’s Afterpay, don’t report those loans to credit agencies. That's why Buy Now/Pay Later credit has earned a far more ominous nickname:

It's hard enough for central bankers and Wall Street traders to make sense of the post-pandemic economy with the data available to them. At Wells Fargo & Co., senior economist Tim Quinlan is particularly spooked by the “phantom debt” that he can't see.

Which is not to say that we have no idea how much "phantom debt" is out there: according to the report, it is projected to reach almost $700 billion globally by 2028, and yet, time and again, the companies that issue it have resisted calls for greater disclosure, even as the market has grown each year since at least 2020. That, as Bloomberg accurately warns, is masking a complete picture of the financial health of American households, which is crucial for everyone from global central banks to US regional lenders and multinational businesses.

In fact, the recent explosion in installment debt may explain why the US consumer remains so resilient even when most conventional economic metrics suggest consumers should be struggling: "Consumer spending in the world’s largest economy has been so resilient in the face of stubbornly high inflation that economists and traders have had to repeatedly rip up their forecasts for slowing growth and interest-rate cuts."

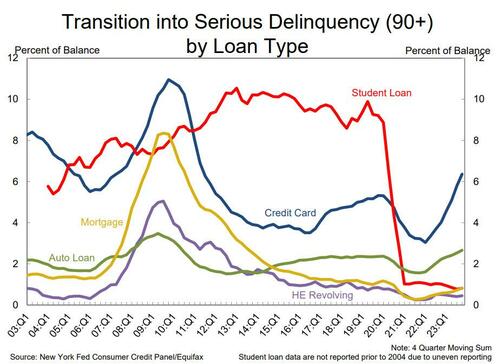

Still, cracks are starting to form. First it was Americans falling behind on auto loans. Then credit-card delinquency rates reached the highest since at least 2012, with the share of debts 30, 60 and 90 days late all on the upswing.

And now, there are also signs that consumers are struggling to afford their BNPL debt, too. A recent survey conducted for Bloomberg News by Harris Poll found that 43% of those who owe money to BNPL services said they were behind on payments, while 28% said they were delinquent on other debt because of spending on the platforms.

For Quinlan, a major concern is that economic experts are being “lulled into complacency about where consumers are.”

“People need to be more awake to the risk of BNPL,” he said in an interview.

Well, those who care, are awake - we have written dozens of articles on the danger it poses; the problem is that those who are enabled by this latest mountain of debt - such as the Biden administration which can claim a victory for Bidenomics because the economy is so "strong", phantom debt be damned - are actively motivated to ignore it.

So why is this latest debt bubble called a "phantom"?

Well, BNPL is a black box largely because of a longstanding blame game among BNPL providers and the three major credit bureaus: TransUnion, Experian and Equifax. The BNPL companies don’t provide data on their installment loans that are split into four payments, which were used by online shoppers to spend an estimated $19.2 billion in the first quarter, according to Adobe Analytics, up 12.3% compared with the same period last year.

The BNPL giants say credit agencies can’t handle their information — and that releasing it could harm customers’ credit scores, which are key to securing mortgages and other loans. The big three bureaus say they're ready, while two of the major credit scoring firms, VantageScore Solutions and Fair Isaac Corp. (FICO), say they're equipped to test how the products will affect their figures. Meanwhile, regulation is looming over the industry, but this stalemate has left the status quo mostly in place.

In other words, not only do we not know just how big the BNPL problem is, it is actively masked by credit agencies which can't accurately calculate the FICO score of tens of millions of Americans, and as a result their credit capacity is artificially boosted with far more debt than they can handle... and that's why the US consumer has been so "strong" in recent years, defying all conventional credit metrics.

The good news is that despite the tacit pushback of the administration, there has been some signs of progress. Apple earlier this year became the first major BNPL provider to furnish transaction and payment data to Experian. As of now, it provides a snapshot of consumers’ overall debt load from Apple Pay Later transactions, but the information won’t be used for consumer credit scores. In separate statements to Bloomberg, Klarna, Affirm and Block said they want assurance that consumers’ credit scores and their data would be protected before reporting customer information. Representatives for TransUnion, Experian and Equifax said they’ve updated their structures and the data would be secure.

Still, the lack of transparency has researchers at the Federal Reserve Bank of New York, which publishes a comprehensive quarterly report on the $17.5 trillion in US household debt, convinced they’re missing some of what’s happening in the economy.

“They’ve reached a certain scale that they could impact economists’ assumptions about their economic outlooks," said Simon Khalaf, Chief Executive Officer of Marqeta Inc., a firm that helps BNPL providers process their payments.

Meanwhile, the pernicious effects of BNPL credit are piling up: the Harris Poll survey conducted last month, provides some crucial clues about how Americans use BNPL. For one, splitting payments into smaller chunks encourages more spending, obviously.

More than half of respondents who use BNPL said it allowed them to purchase more than they could afford, while nearly a quarter agreed with the statement that their BNPL spending was “out of control.” Harris also found that 23% of users said they couldn’t afford the majority of what they bought without splitting payments, while more than a third turned to the services after maxing out credit cards.

The findings also show that the spending, which for more than a third of users has exceeded $1,000, isn’t entirely on big-ticket items. Almost half of those using BNPL say they've started, or have considered, using it to pay bills or buy essential items, including groceries.

Translation: Americans are no longer even charging everyday purchases they traditionally used cash and savings to pay for; now they are using installment plans to pay for bread!

It's not just the lower classes that are abusing BNPL credit: while whatever small pockets of consumer distress have emerged so far in the US, have been chalked up to a bifurcated economy where working class Americans struggle to make ends meet, the survey found that middle-class households are relying on BNPL, too. The shocking punchline: about 42% of those with household income of more than $100,000 report being behind or delinquent on BNPL payments!

“BNPL essentially lets people dig a deeper and deeper hole of credit, which will be harder and harder to climb out of,” said Ed deHaan, a professor of accounting at Stanford Graduate School of Business, adding that it happens “more easily when there’s no transparency.”

Of course, installment debt is nothing new: the option to pay in installments using short-term loans has been around for a ong time, but it exploded in popularity during the pandemic, especially with younger, digitally savvy consumers who gravitated to the services as an alternative to credit cards. The pioneering BNPL companies, including Afterpay, Klarna and Affirm, launched with trendy retailers, partnered with social media influencers and became a common option on apps and online checkouts.

BNPL offers quick credit approvals and lets consumers pay in installments. The first is usually due right away, and the others are often collected once every two weeks for the popular “pay in four” loans. There’s typically no interest or fees, as long as payments are made on time. Like credit card companies, BNPL firms make money on fees from merchants — and some have steep penalties for missed payments.

While normally larger banks would avoid this kind of "new and much more dangerous subprime", this time is different: the rapid adoption of the products has enticed major financial institutions to offer the option to split payments, even as regulators warn them of the risks. That includes PayPal, U.S. Bancorp and Citizens Financial. Even big banks like Citigroup and JPMorgan have similar capabilities on their credit cards.

The industry has branded itself a financial equalizer. They argue that “soft-credit checks” — when a lender runs a consumer’s credit history without affecting their score — expand credit access to those underserved by traditional lenders, while zero-interest provides a better deal than many cards.

Affirm said its customers have an average outstanding balance of $641, while Afterpay and Klarna put the figure at $250 and $150, respectively. Unfortunately, there is no way to check these numbers. And while the average credit card balance was $6,501 in the third quarter of 2023, according to Experian data, the BNPL balances mean that most Americans can't even afford a weekly outing to their grocery store without putting it on an installment plan, a truly terrifying scenario.

Critics naturally argue that BNPL is particularly attractive to the financially vulnerable. The Consumer Financial Protection Bureau has flagged risks to consumers, including surprise late fees and “hidden interest” — or when BNPL purchases are made with credit cards charging high interest rates. The CFPB has also expressed concern about “loan stacking,” when individuals take out several BNPL loans at once with different providers, which is most of them.

Some BNPL services, including Afterpay and Klarna, require borrowers to agree to “mandatory autopayment,” meaning the companies can automatically charge the credit card or bank account on file when a payment is due. Those who link the latter are potentially vulnerable to overdraft fees.

Meanwhile, as rates remains sky high, even Wall Street's perpetually cheerful analysts are wondering where is all the consumption coming from?

Robust consumer spending and low unemployment rates have many economists convinced the US consumer remains strong, making Wall Street bullish on the economy. But lately, stubbornly persistent inflation has dialed back expectations for imminent interest-rate relief.

That’s set to ramp up pressure on households that are already stretched thin by higher prices for everything from gas and food to rent and apparel. As of the end of December, almost 3.5% of credit-card balances were at least 30 days past due, according to the Philadelphia Fed, the most since the data began in 2012. Nominal card balances also set a new high.

For those who are falling behind, BNPL offers what appears to be a no-brainer decision: space out payments... at least until this last credit buffer fills up and bankruptcy is the only possible outcome.

That was the thinking of Hayden Waschak, a 23-year-old in Pittsburgh. Even though he said it felt “dystopian” to use BNPL to pay for food, he began using Klarna in February to spread out payments on a grocery delivery app. It helped his finances — at first. After he lost his job as a documents processing specialist at University of Pittsburgh Medical Center in March, he relied more heavily on the service. And without any income, he became delinquent on payments and started racking up late charges. He eventually paid off the nearly $200 balance, but he said his credit score dropped.

“Unexpected life events caused me to lose income,” Waschak said. “I ended up paying more than if I had paid for it all at once.”

Meanwhile, the fact that BNPL balances do not count against your credit rating, means users get little upside when it comes to their credit — paying on time won’t help them build up their score. On the other hand, the downside is still there for falling behind: not only can they get charged late fees, but delinquent BNPL loans can be turned over to debt collectors.

The latter is what Fabrizio Lopez said happened to him. He used Affirm to split up a $500 online payment for used-car parts in 2019. The Long Island-based mechanic, who doesn’t have a traditional credit card, said that while he received the items a week later, he never got a bill. That is, until debt collection letters started pouring in from across the US.

Lopez said he primarily relied on cash before that purchase, so the unpaid loan stands out on his credit profile. Now 30, he worries that a the BNPL purchase has created “invisible barriers” to the financial system.

“They hook you with the idea of no interest rates,” he said. “I thought that I would be able to build my credit if I paid it back — I was so wrong.”

He is not the only one who is "so wrong": just as wrong are all those Panglossian economists at the Fed and Wall Street who believe that the US economy is growing at what the Atlanta Fed today laughably "calculated" was a 4.2% GDP, even as the DOE found that the most accurate indicator of overall economic strength, diesel demand, was the lowest since covid, an glaring paradox... yet glaring to all except those who refuse to see just how rotten the core of the US economy has become, and will be "absolutely shocked" when the next credit crisis destroys tens of millions of Americans drowning in what is now best known as "phantom debt."

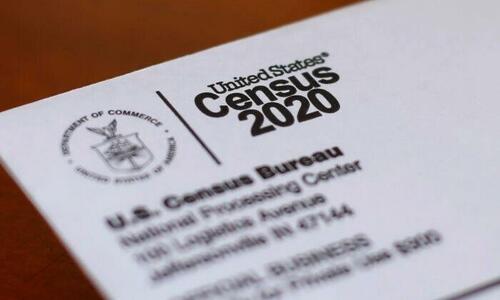

House Passes 'Electoral Integrity' Bill To Restore Citizenship Question To Census

House Passes 'Electoral Integrity' Bill To Restore Citizenship Question To Census

Tyler Durden

Thu, 05/09/2024 - 11:20

Authored by Katabella Roberts via The Epoch Times,

The House of Representatives voted on Wednesday to pass a measure that would add a citizenship question to the next U.S. census, as part of the latest efforts by conservatives to “protect America’s democracy and electoral integrity.”

The legislation, known as the “Equal Representation Act,” was led by Rep. Chuck Edwards, (R-N.C.), who spoke on the floor Wednesday regarding the need to ensure only American citizens are counted when apportioning congressional seats and Electoral College votes.

It passed in a vote of 206-202 along party lines.

The measure would direct the Census Bureau to add a question to the once-a-decade census asking whether or not the respondent is a citizen of the United States. It asks that only citizens be considered when determining how many lawmakers each state gets in the House of Representatives, as well as how many Electoral College votes each of the 50 states receives.

The measure creates new reporting requirements for data gathered from the citizenship question, noting that “the citizenship makeup of the population in the United States is a basic data point that should be available to U.S. policymakers, and the decennial census questionnaire is the best way to obtain such detailed information on citizenship status.”

The next decennial census is set to take place in 2030.