That Christianity gives joy and breadth is also a thread that runs through my whole life. Ultimately someone who is always only in opposition could not endure life at all.

Distinction Matter - Subscribed Feeds

-

Site: Mises InstituteDespite the accusations that Javier Milei is a fascist in libertarian clothes, many of his reforms have been successful in reversing some of the damage done to Argentina's economy by real fascists.

-

Site: Steyn OnlineProgramming note: If you fancy an alternative to tomorrow's Eurovision Song Contest, my new weekly show on Serenade Radio airs Saturday at 5pm British Summer Time - that's 6pm Central European or 12 midday North American Eastern. You can listen from

-

Site: Steyn OnlineAs we approach the close of The Mark Steyn Club's seventh birthday observances, I want to thank all those First Week Founding Members who've signed up for an eighth year. I'm absolutely delighted. In celebration of the occasion, I've launched a new

-

Site: LifeNews

Bishop Thomas Paprocki of the Diocese of Springfield, Illinois, made a video statement on Thursday calling out President Joe Biden for making the Sign of the Cross at a recent pro-abortion event.

“Last month on April 23, Biden compounded his support for the sin of abortion by making the Sign of the Cross during an abortion rally in Tampa, FL,” Paprocki said. “Making the Sign of the Cross is one of the most profound gestures a Catholic can make in showing reverence for Christ’s death on the Cross and belief in the Holy Trinity.”

“To misuse this sacred death is to make a mockery of our Catholic faith,” the bishop added.

SUPPORT LIFENEWS! To help us fight Joe Biden’s abortion agenda, please help LifeNews.com with a donation!

In the same video, Paprocki quoted Spanish Archbishop José Ignacio Munilla, who had blasted Biden’s “sacrilegious gesture” during a show on Radio María España.

“Bishop Munilla said that crossing oneself is meant to be used as a sign in which we remember that Jesus gave his life for us,” Paprocki said, and quoted Munilla: “He gave his life for all the innocents. He gave his life to restore innocence and to make us saints.”

“To use the sign of the Cross as Biden did, however, is to invoke the Cross in a sacrilegious manner,” Paprocki pointed out. “I fully support Bishop Munilla and agree with what he said.”

Paprocki then cited Paragraph 2120 of the Catechism of the Catholic Church, which defines sacrilege as “profaning or treating unworthily the sacraments and other liturgical actions as well as persons, things, or places, constituted to God.”

“Sacrilege is a grave sin,” Paprocki said.

Paprocki also referenced Cardinal Wilton Gregory’s late March appearance on CBS, where the archbishop of Washington, DC, called Biden a “cafeteria Catholic … especially in terms of the life issues.”

Paprocki added: “I fully support Cardinal Gregory and agree with what he said.”

LifeNews Note: Joshua Mercer writes for CatholicVote, where this column originally appeared.

The post Catholic Bishop Slams Biden for Making Sign of Cross at Abortion Rally appeared first on LifeNews.com.

-

Site: Zero HedgeDog Gone: Kristi Noem Cuts Short Book Tour Citing 'Bad Weather'Tyler Durden Fri, 05/10/2024 - 09:30

Authored by Philip Wegmann via RealClear Wire,

South Dakota Gov. Kristi Noem has cut short a disastrous book tour after receiving withering criticism for her story of shooting an ill-behaved puppy and unverified claims of meeting North Korean dictator Kim Jung Un, RealClearPolitics is first to report. The book, released Tuesday, is titled “No Going Back.”

Noem sat for a series of in-person interviews in New York and was scheduled to travel later in the week to Washington, D.C., before canceling the tour, citing inclement weather.

“Gov. Noem has sold a lot of books on this tour and is back in South Dakota to be prepared for some potential emerging bad weather systems,” spokesman Ian Fury told RCP. Tornadoes touched down in the state Monday, according to the National Oceanic and Atmospheric Administration. Noem sat for interviews Monday and Tuesday in New York before returning home.

Noem was slated to sit down with RealClearPolitics on Thursday before her team canceled the interview and declined to make her available over the phone.

Once heralded as a rising star on the right, in one week the governor was reduced to a punchline. She provided all the material. “We were supposed to have Gov. Kristi Noem on the show tonight, but she canceled. Her staff blamed bad weather,” deadpanned Greg Gutfeld Tuesday night. “We go to locals for reaction.” The Fox News funnyman then cut to a clip of barking dogs.

Noem had billed her book as “a how-to guide” for political activism, pegging its publication to the ongoing veepstakes to join former President Trump on the GOP ticket. Calamity followed when an excerpt leaked to The Guardian, and what was planned as a national audition was overshadowed by the grisly stories the governor told about herself.

Noem writes of dragging a 14-month-old dog into a gravel pit on her property after the poorly trained animal spoiled a pheasant hunt and attacked a neighbor's chickens. She killed the puppy named “Cricket” with a shotgun. After dispatching the dog, she turned her attention to an unruly goat. Noem took a shot, but the billy jumped. She writes in her memoir that she left the goat tethered, retrieved more ammunition, then “hurried back to the gravel pit and put him down.”

Despite a growing firestorm of criticism, the author went ahead with her tour, sitting down on Sunday with Margaret Brennan of CBS News. The story from two decades ago, Noem insisted, showed her willingness to make tough decisions.

“This dog was a working dog and had come from a family that had issues with this dog and I had put months and months of training into this dog. This dog had gone to other trainers as well,” Noem said.

“So all of that is the facts of the story, and all of that shows that when you put someone in a position where they have to make a decision and they want to protect their family and protect children and other people from getting attacked from an animal that has attacked others and killed livestock, that’s the choice I made over 20 years ago. And that I didn’t ask somebody else to take that responsibility for me,” she continued.

Noem also appeared to joke in the book about euthanizing President Biden’s dog, Commander, who was removed from White House grounds after numerous biting incidents.

“What would I do if I was president on the first day in office in 2025? Thanks for asking. I happen to have a list. The first thing I’d do is make sure Joe Biden’s dog was nowhere on the grounds (‘Commander, say hello to Cricket for me’),” Noem wrote. The White House was not amused.

“We learned last week, obviously like all of you, in her book that she killed her puppy," White House press secretary Karine Jean-Pierre told reporters Monday. “You heard me say that was very, very sad. We find her comments from yesterday disturbing. We find them absurd.”

Perhaps more disastrous was the claim Noem made about traveling to North Korea and meeting Kim Jung Un when she served on the House Armed Services Committee in Congress.

“I’m not going to talk about my specific meetings with world leaders. I’m just not going to do that. This anecdote shouldn’t have been in the book and as soon as it was brought to my attention, I made sure that that was adjusted,” she said when pressed about whether the meeting took place.

The publisher of the book, Center Street, announced that subsequent printings of the book would not include the reference. An audiobook, which the governor narrated, is also expected to be edited and updated. The passage in question is brief and sparse in detail.

The North Korean anecdote is two sentences in a 260-page book: “I remember when I met with North Korean dictator Kim Jong Un. I’m sure he underestimated me, having no clue about my experience staring down little tyrants (I’d been a children’s pastor, after all).”

Prior to the book tour, Noem made little secret about her ambitions for national office. She was quick to criticize the field challenging Trump for the nomination, and in February, the governor traveled to Mar-a-Lago to meet with Trump and pitch him on joining the ticket. According to sources with knowledge of the meeting, Noem showed Trump polling from Kaplan Strategies that showed her boosting his chances in Wisconsin and Michigan with her as a running mate.

Doug Kaplan, the pollster who conducted the survey, cautioned in a brief interview with RCP that those positive numbers were from “a lifetime ago.”

Noem is now haunted by the dog she dispatched two decades ago. During a Tuesday interview with Stuart Varney on Fox Business, the governor became impatient with the host when he kept returning the conversation to how the dead puppy affected her chances at the vice presidency.

“Enough, Stuart. This interview is ridiculous, which you are doing right now,” Noem said. “So you need to stop. It is OK. It is. Let’s talk about some real topics that Americans care about.”

“I’m afraid we’re out of time,” Varney responded.

-

Site: LifeNews

Comedian, actress and disability rights campaigner Liz Carr has said that the prospect of making assisted suicide legal in the UK is “terrifying”.

Ahead of her documentary Better Off Dead? set to be aired on the BBC later this month, in which the actress makes her case against making assisted suicide legal in the UK, Liz Carr has said that making assisted suicide legal for the terminally ill will eventually lead to allowing it for people who are poor, disabled or mentally ill as well.

She described this possibility as “terrifying”.

Speaking to a Canadian clinician, Dr Ellen Wiebe, the Silent Witness actress suggested that “apart from the fact I don’t have the desire, I think probably I would be eligible [for assisted suicide or euthanasia] under Canadian law”.

Dr Wiebe did not disagree, adding that Carr would have to show that she was “suffering unbearably” in order to be given the drugs to end her life.

Carr made reference to the expansion of the assisted suicide and euthanasia law in Canada where in 2021, the Canadian Parliament repealed the requirement that the natural death of those applying for assisted suicide be “reasonably foreseeable”. This took place only five years after the original legislation allowing euthanasia and assisted suicide was passed in 2016.

Click Like if you are pro-life to like the LifeNews Facebook page!

(function(d, s, id) { var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) return; js = d.createElement(s); js.id = id; js.src = "//connect.facebook.net/en_US/sdk.js#xfbml=1&version=v2.10"; fjs.parentNode.insertBefore(js, fjs); }(document, 'script', 'facebook-jssdk'));

The BBC also reported the concerns of Dr Katherine Sleeman, a specialist in palliative care, who said that people may feel they are a burden to their families.

“Patients will say to me: ‘I don’t want to go to a care home really, but I know my family want me to do it and I know it will be easier for them so I think I’m going to say yes’”, she said.

“Substitute the words ‘go to a care home’ with ‘have an assisted death’ and I think it’s a completely different picture”.

Dr Sleeman argued that assisted suicide laws cannot be completely safe and that some people who do not wish to die will inevitably slip through the net.

Liz Carr will present Better Off Dead?, which will air on BBC One on Tuesday 14 May at 21:00.

At the end of last month, a large number of MPs spoke in opposition to assisted suicide after an e-petition requesting a debate on the matter reached more than 100,000 signatures.

The MPs opposed to a future change in the law on assisted suicide emphasised the manner in which the eligibility criteria for assisted suicide in other jurisdictions has rapidly expanded, the risks this legislation imposes on the most vulnerable, and the distortion of the doctor-patient relationship created by assisted suicide, among other concerns.

Study finds “wish-to-die” is transient

A 2021 study in Ireland found that almost three-quarters of people over 50 who had previously expressed a wish to die no longer had that desire two years later. The Irish Longitudinal Study on Ageing (TILDA), surveyed 8,174 people over the age of 50 and found that 3.5% expressed a wish to die at Wave 1 of the study.

However, as the report states: “Seventy-two per cent of these participants no longer reported a wish to die when reassessed 2 years later”.

Researchers behind the study from Trinity College Dublin found that the “wish to die” among older people is often “transient” and linked with depression and feelings of loneliness.

Furthermore, TILDA found that 60% of those who reported a wish to die also had “clinically significant” depressive symptoms while half had been diagnosed with depression.

Spokesperson for Right To Life UK, Catherine Robinson, said “Liz Carr is absolutely right to point to other jurisdictions such as Canada that show how assisted suicide and euthanasia legislation quickly expands beyond its original limits. A 2023 survey in Canada showed that 50% agreed that “disability” should be a reason for euthanasia, with that figure rising to 60% for 18-34 year olds”.

“Cultural attitudes towards disability like this are especially alarming and we would be naive to think that they couldn’t exist here.

LifeNews Note: Republished with permission from Right to Life UK.

The post Actress Liz Carr Blasts UK Measure to Legalize Assisted Suicide appeared first on LifeNews.com.

-

Site: AsiaNews.itThe Reserve Bank of India has changed its rules allowing Russia to use the rupees it earns from crude oil sales in India to invest in local government bonds, stocks, equities, and loans. India's imports from Russia are up by 32.95 per cent to US$ 61.44 billion.

-

Site: The Unz ReviewPierre, I don’t think your questions are relevant. In the US and throughout the Western World, or what little remains of it, the white ethnicities who once constituted nations are now submerged in towers of babel in which the white ethnicities are demonized, and in the US reduced to second class citizenship in law, made...

-

Site: AsiaNews.itThe document released by the International Truth and Justice Project reports the testimonies of 123 victims of detention, abuse and torture. During the conflict that ended in 2009 - between 80 and 100 thousand people died - both separatists and government officials were accused of violence. But the persecution of Tamils by the security forces continued unpunished even after the war was over.

-

Site: AsiaNews.itAmong the 18 agreements signed in Budapest with Xi Jinping there is also cooperation on nuclear power plants. In the background are the difficulties of the new Paks II plant project, under construction with the Russian agency Rosatom and at risk of sanctions. For his part, the Chinese president praises Hungarian support for Beijing on "Taiwan, Hong Kong and human rights".

-

Site: Zero HedgeBoxing Promoter Don King Endorses Trump For PresidentTyler Durden Fri, 05/10/2024 - 08:40

Authored by Tom Ozimek via The Epoch Times (emphasis ours),

Boxing promoter Don King attends the Presidential Debate at Hofstra University, in Hempstead, N.Y., on Sept. 26, 2016. (Drew Angerer/Getty Images)

Boxing promoter Don King attends the Presidential Debate at Hofstra University, in Hempstead, N.Y., on Sept. 26, 2016. (Drew Angerer/Getty Images)

Iconic boxing promoter Don King has endorsed former President Donald Trump for president in the 2024 election.

The 92-year-old made the remarks on May 8 on the sidelines of an event after being asked if he has a message for President Trump, who’s facing a bevy of court cases that threaten to derail his presidential campaign.

“Get reelected,” Mr. King said. “And we must reelect him to save ourselves. You know, a vote for Trump is a vote for yourself. Because we’ve got to fight the system of lies and the creation of wrong being right and right being wrong. That’s got to be eliminated.”

He called President Trump “the only man who’s got the intestinal fortitude to be able to stand up and fight the system like it should be fought,”

Mr. King said the former president “underestimated the power of this strong system of corruption and hypocrisy.”

While Mr. King didn’t elaborate on the “system of corruption and hypocrisy” that he had in mind, it could be a reference to the numerous legal battles that the former president is fighting that he and his supporters argue are thinly veiled attempts to use lawfare to derail his comeback bid.

“I want to say to him, let’s [save] America, let’s save ourselves, and then we can help others to be safe,” Mr. King added.

President Trump shared the video on his social media platform, Truth Social, thanking Mr. King for his endorsement and message of encouragement.

‘He’d Be Muhammad Ali’

Mr. King’s sympathies for the former president are well-established, with the boxing promoter being one of few celebrities who endorsed then-candidate Trump in the 2016 election.

Introducing then-candidate Trump at a church event in Ohio in 2016, Mr. King called him “courageous and brave” and said he believed the future president would fix the “corrupt” and “rigged” system and bring the country “back to inclusiveness.”

In mid-2017, after President Trump had spent several months in office, Mr. King told Politico Magazine in an exclusive interview that he believed he was doing an “excellent job” while lamenting the fact that his presidency was being overshadowed by the so-called “Russian collusion” scandal, which later turned out to be a hoax.

At the time, Mr. King told Politico that he believed President Trump was constantly in the crosshairs of the Washington establishment, saying that they would try to “keep him down” at almost any cost—even saying that he warned the president to be on guard for assassination attempts.

“If Trump were a boxer, who would he be?” the interviewer asked the legendary boxing promoter.

“He'd be Muhammad Ali...because he’s going to win,” Mr. King replied. “He’s going to run his mouth, he’s going to talk a lot and he’s going to win.”

The then-U.S. President-elect Donald Trump, along with boxing promoter Don King, answers questions from the media after a day of meetings at Mar-a-Lago in Palm Beach, Fla., on Dec. 28, 2016. (Don Emmert/AFP via Getty Images)

The then-U.S. President-elect Donald Trump, along with boxing promoter Don King, answers questions from the media after a day of meetings at Mar-a-Lago in Palm Beach, Fla., on Dec. 28, 2016. (Don Emmert/AFP via Getty Images)

The former president has won the support of a number of prominent figures in the fight world, including Mr. King’s best-known protege, former heavyweight boxing champion Mike Tyson, and Dana White, CEO and president of the Ultimate Fighting Championship (UFC).

Mr. Tyson endorsed then-candidate Trump for the 2016 election, while Mr. White said recently he supports his 2024 comeback bid.

“He should be president of the United States,” Mr. Tyson told HuffPost in an exclusive interview in 2015. The former champion said he thought a business-minded leader like Trump was exactly what the country needed.

“Let’s try something new. Let’s run America like a business, where no colors matter. Whoever can do the job, gets the job,” Mr. Tyson said.

‘Unfazed’

Mr. White gave his endorsement in an appearance on the Lex Fridman podcast in April, calling President Trump “the most resilient human being I’ve ever met.”

“They’re trying to attack him. They’re trying to ruin him—unfazed,” the UFC president said. “He will walk through fire.”

Former President Donald Trump (R), alongside UFC CEO Dana White (L), attends the Ultimate Fighting Championship (UFC) 299 mixed martial arts event at the Kaseya Center in Miami, Fla., on March 9, 2024. (Giorgio Viera/AFP)

Former President Donald Trump (R), alongside UFC CEO Dana White (L), attends the Ultimate Fighting Championship (UFC) 299 mixed martial arts event at the Kaseya Center in Miami, Fla., on March 9, 2024. (Giorgio Viera/AFP)

Asked if he thinks President Trump will win reelection, Mr. White said he’s unsure given the “dirty” and “ugly” nature of politics.

“Obviously, I’m rooting for him and I’m behind him and I hope he does.”

It comes as the former president has complained about being stuck in a New York courtroom for his so-called “hush money” trial while he could be out campaigning for reelection.

In a case officially known as The People of the State of New York v. Donald J. Trump, the former president is accused of hiding so-called hush money payments to an adult performer by falsifying business records. If found guilty, he could face a prison sentence.

President Trump has repeatedly denied wrongdoing, and before he entered the courtroom on April 15, the first day of the trial, he reiterated his position that the case is politically motivated.

“This is really an attack on a political opponent. That’s all it is,” he told reporters outside the courtroom before going inside.

-

Site: Zero HedgeUS Futures, Global Markets Storm Higher, Eye All-Time HighsTyler Durden Fri, 05/10/2024 - 08:15

US equity futures pointed to even more gains on the last day of trading, leaving the S&P 500 set for a third weekly rise — the longest run since February. The rally was given fresh legs yesterday by more earnings optimism coupled with disappointing economic data - this time the highest initial jobless claims since last August - that supported the case for Fed rate cuts, but the real test will come with a key US inflation print next week (where we laid out a case for why as OER catches down to real-time rates, CPI may print a big miss). As of 8:00am, S&P 500 futures higher by 0.3% after the index closed less than 1% away from its all-time high, with Nasdaq futures rising 0.4%. European stocks are up 0.9% set for a new record high with Asian stocks also gaining. Treasuries and the dollar were flat; earlier on Friday, the yuan weakened on the news that Biden’s administration is poised to unveil a sweeping decision on new China tariffs as soon as next week, with the measures expected to focus on industries such as electric vehicles, batteries and solar cells, with existing levies largely being maintained. The macro slate includes May preliminary University of Michigan sentiment and April monthly budget statement.

In premarket trading, 3M Co. rose 1.2% in premarket trading after HSBC raised its recommendation to buy from hold. The bank notes the company’s earnings showed nascent signs of an “inflection in growth and margin gains from restructuring” at the manufacturing giant. Akamai fell 10% after its forecast for adjusted earnings per share for the second quarter missed the average analyst estimate. Analysts note weakness in the infrastructure software company’s content-delivery network business. Here are some other notable premarket movers:

- Bumble rises 3.1% as BofA upgrades the online dating company to buy from neutral on both valuation and upside to growth.

- CRH gains 4.3% after what the analysts see as a positive start with performance driven by pricing, early-season activity and favorable weather in important markets, despite lower volumes in Europe.

- Dutch Bros gains 2.6% after Cowen raises the drive-thru coffee chain’s rating to buy from hold, expecting that 2024 will be a “beat & raise year.”

- Ginkgo Bioworks slumps 11% after the genetic engineering company cut its revenue forecast for the full year, following first-quarter sales that fell short of Wall Street’s expectations. The miss and outlook cut triggered a downgrade at William Blair.

- JFrog drops 12% as the software development company’s earnings report failed to impress investors after this year’s rally. The results could prompt questions around the timing and potential contribution from AI-led workloads, which didn’t appear to have much effect this quarter, Bloomberg Intelligence analyst Sunil Rajgopal wrote in a research note.

- MacroGenics sinks 68% after the drug developer reported five deaths in a mid-stage trial of its investigative therapy for prostate cancer. Analysts downgraded their ratings on the stock as confidence in the firm’s program takes a hit following the safety data.

- Natera rises as much as 20% after boosting its revenue guidance for the full year.

- Novavax surges as much as 217% after the vaccine maker signed a licensing agreement with Sanofi that includes commercializing a combined Covid-19 and flu shot.

- Progyny drops 25% after it reported first quarter revenue below average analyst estimates and cut revenue guidance for the full year. KeyBanc analysts downgraded the fertility benefits management company to sector weight from overweight, writing that they “are becoming weary” as more questions arise on visibility into revenue and customer trends.

- SoundHound AI rises 15% after the voice AI software company reported first-quarter revenue that beat expectations and gave a revenue outlook range for the full year that met the average analyst estimate.

- Sweetgreen climbs 19% after the salad restaurant chain’s revenue topped estimates and it boosted its same-store sales forecast for the full year.

- Unity Software falls as much as 4.2% after the video-game software development company reported an 8% drop in first-quarter revenue. Analysts say the shares will remain rangebound until the company’s new CEO crystallizes his own strategy.

- Yelp drops 4.1% after it adjusted Ebitda guidance for the full year and missed the average analyst estimate. Macro headwinds for restaurants and growing competition from delivery platforms could also pressure the online review company’s revenue, according to Jefferies analysts.

The rebound in stocks found fresh momentum from very poor US unemployment claims Thursday, which backed the case for rate cuts before next week’s key US inflation print. Meanwhile, so-called value and cyclical sectors are helping to broaden out a rally that had been fueled by tech giants. Traders will be watching for hints on the timing of policy easing from Fed officials including Michelle Bowman and Neel Kashkari before next week’s CPI data.

"A rally of the laggards is our key allocation call, and so far, we’re witnessing signs that it’s happening,” said Florian Ielpo, head of macro research at Lombard Odier Asset Management. “For this to persist, the market needs to maintain a delicate balance — a sweet spot where the job market remains mildly soft and earnings growth continues.”

European stocks are set for their best week since the end of January on a slew of better-than-expected earnings reports and growing confidence that interest rate cuts are still possible this year. The Stoxx 600 rises 0.9% to a record high with mining, utility and construction shares leading gains. Here are the biggest European movers:

- Enel shares rise as much as 3.5% after 1Q earnings came in materially above expectations, de-risking the utility firm’s full-year outlook and suggesting it could deliver the top end of its guidance.

- Munich Re shares rise as much as 2.6% after BofA lifts its rating on the company to buy from neutral in a note citing “underappreciated earnings strength.”

- Legrand shares advance as much as 3.3% to highest since January 2022 after Citi double-upgrades to buy from sell.

- EDP shares climb as much as 4.6% after the company said investment will decelerate in 2024-2026 as it focuses on “top projects.”

- IAG shares climb as much as 1.8% after the airline group posted a operating profit beat for the first quarter, driven by ongoing recovery in leisure traffic and the timing of Easter.

- Fluidra shares gains as much as 5.5% after JPMorgan upgrades the Spanish pool maker to overweight from neutral.

- Iveco shares rise as much as 7.1% following its first-quarter results, which Morgan Stanley says represent a positive start to the year for the Italian commercial vehicle maker.

- CCC shares jump as much as 19% after the Polish fashion retailer reported strong 1Q preliminary earnings with a 39% beat on Ebitda.

- Dino Polska shares drop as much as 4.4% after it reported further erosion of Ebidta margin, reflecting an ongoing price war in the Polish food retail market.

- Rightmove shares fall as much as 5.3%. The online property portal reiterated its revenue and margin guidance after tweaking other targets.

- Getinge shares drop as much as 9.7%, the most in more than three months, following a US FDA letter to health care providers expressing safety and quality concerns about some of the Swedish medical technology firm’s cardiovascular devices.

- BFF Bank shares plunge as much as 32%, the most on record, after Bank of Italy ordered a temporary halt on profit distribution and expansion abroad as a result of a probe into the Italian specialty finance company.

Asian stocks tracked the gains in the US where a rise in initial jobless claims spurred a dovish reaction. Hang Seng & Shanghai Comp traded mixed with Hong Kong stocks surging on reports China is considering a proposal to exempt individual investors from paying dividend taxes on Hong Kong stocks bought via the Stock Connect, while the mainland faded its initial gains with the US reportedly set to impose tariffs on China EVs and key sectors after a review which could be announced as soon as next week. Nikkei 225 rallied at the open but then slipped from intraday highs with participants reflecting on Household Spending data, US-China and tensions and amid a busy day of earnings releases for Japan. ASX 200 was led by energy, telecoms and financials but with gains capped amid mixed consumer stocks.

In FX, the Bloomberg Dollar Spot Index steadied and Treasury yields were little changed across the curve as traders awaited commentary from several Fed officals; Sterling rose after a much stronger than expected UK GDP print, which saw the country emerge from recession, provided a modicum of support to the pound which is up 0.1% against the dollar. The Norwegian krone tops the G-10 FX pile, rising 0.3% after CPI topped estimates.

- USD/NOK dropped 0.3% to 10.8155 as the Norwegian krone led G-10 gains against the dollar; Norway’s underlying inflation rate fell less than analysts expected last month

- AUD/USD fell as much as 0.3% to 0.6599, while NZD/USD dipped as much as 0.3% to 0.6014, on a report that the US is poised to unveil a sweeping decision on China tariffs

- GBP/USD inched up as much as 0.1% to 1.2541, after data showed the UK economy bounced back from a shallow recession

In rates, treasuries are little changed with futures holding Thursday’s advance, underpinned by gains for gilts following UK data raft including GDP, manufacturing and industrial production. US yields are within 1bp of Thursday’s closing levels, 10-year around 4.46%, with gilts and bunds outperforming by 2bp and 3bp in the sector; curve spreads likewise little changed, 2s10s holding Thursday’s flattening move. Gilts have rallied despite stronger-than-expected UK GDP figures, with UK 10-year yields falling 3bps to 4.11%.

In commodities, Oil prices advance, with WTI rising 0.6% to trade near $79.80 a barrel and near the week’s high. Spot gold climbs 1.1% to around $2,372/oz.

Looking at today's calendar, the US economic data slate includes May preliminary University of Michigan sentiment (10am New York time) and April monthly budget statement (2pm). Fed officials’ scheduled speeches include Bowman (9am), Logan (10am), Kashkari (10am, 2:15pm), Goolsbee (12:45pm, 2:15pm) and Barr (1:30pm)

Market Snapshot

- S&P 500 futures up 0.3% to 5,254.00

- STOXX Europe 600 up 0.7% to 520.47

- MXAP up 0.8% to 177.68

- MXAPJ up 0.9% to 554.50

- Nikkei up 0.4% to 38,229.11

- Topix up 0.5% to 2,728.21

- Hang Seng Index up 2.3% to 18,963.68

- Shanghai Composite little changed at 3,154.55

- Sensex up 0.2% to 72,580.19

- Australia S&P/ASX 200 up 0.4% to 7,748.96

- Kospi up 0.6% to 2,727.63

- German 10Y yield little changed at 2.46%

- Euro little changed at $1.0783

- Brent Futures up 0.2% to $84.02/bbl

- Gold spot up 0.9% to $2,367.89

- US Dollar Index little changed at 105.23

Top Overnight News

- Stocks rallied on earnings optimism and US data that supported the case for interest-rate cuts. A raft of Federal Reserve speakers are slated for Friday as traders await a key US inflation print next week.

- President Joe Biden’s administration is poised to unveil a sweeping decision on China tariffs as soon as next week, one that’s expected to target key strategic sectors while rejecting the across-the-board hikes sought by Donald Trump, people familiar with the matter said.

- Britain bounced back strongly from a shallow recession, providing some relief for Prime Minister Rishi Sunak who has so far struggled to deliver on his promise to grow the economy.

- Money managers are piling into the European Union’s bonds in anticipation of a major shift in their status that would open up the bloc’s debt to a bigger pool of investors.

- JPMorgan Chase & Co. is on track to include India in its emerging market debt index from June with most of its clients ready to trade despite some “teething issues,” according to the firm’s global head of index research.

- China CPCA said China sold 1.55mln passenger cars in April, -5.8% Y/Y; Tesla (TSLA) exported 30,746 China-made vehicles in Apr

- US Treasury Secretary Yellen said inflation has come down substantially but is not where it needs to be, according to a Marketplace interview.

- White House is poised to nominate Kristin Johnson to fill a top role at the Treasury overseeing banks, according to Bloomberg citing sources.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks mostly tracked the gains in the US where a rise in initial jobless claims spurred a dovish reaction. ASX 200 was led by energy, telecoms and financials but with gains capped amid mixed consumer stocks. Nikkei 225 rallied at the open but then slipped from intraday highs with participants reflecting on Household Spending data, US-China and tensions and amid a busy day of earnings releases for Japan. Hang Seng & Shanghai Comp traded mixed with Hong Kong stocks surging on reports China is considering a proposal to exempt individual investors from paying dividend taxes on Hong Kong stocks bought via the Stock Connect, while the mainland faded its initial gains with the US reportedly set to impose tariffs on China EVs and key sectors after a review which could be announced as soon as next week.

Top Asian News

- US is set to impose tariffs on China EVs and key sectors after its Section 301 review as early as next week, according to Bloomberg.

- China is unlikely to lift home purchase restrictions completely, according to CCTV.

- Honda (7267 JT) FY (JPY): Pretax profit 1.64tln, +86.7% Y/Y, Op. Profit 1.38tln, +77% Y/Y; says it will buy back of up to 3.7% of own shares worth JPY 300bln.

- Earthquake felt in Taiwan's capital Taipei; magnitude 5.7, via EMSC.

- China Auto Industry CPCA says market sluggishness was worse than expected while some automakers still derived to produce and resulted in rising inventories at dealerships

European bourses, Stoxx600 (+0.7%) are entirely in the green, taking the lead from a mostly positive APAC session. Both the FTSE 100 and the DAX 40 made fresh ATHs today. European sectors hold a strong positive tilt, with the exception of Autos and Media, with the former continuing the losses seen in the prior session. Utilities takes the top spot, lifted by post-earning strength in Enel (+3.6%) and EDP (+2.5%). US Equity Futures (ES +0.3%, NQ +0.3%, RTY +0.4%) are entirely in the green, albeit modestly so, attempting to build on yesterday’s advances.

Top European News

- UBS expects the BoE to start cutting interest rates in June (prev. expected Aug)

- Over one in two firms with Germany's residential construction sector reported a lack of orders in April, via Ifo; 55.2% (prev. 56.2%) reported this

FX

- Steady trade for the USD after yesterday's data-induced losses dragged DXY to a low of 105.20. Uni. of Michigan is the main data highlight but is very much in the shadow of next week's CPI print. If DXY trundles lower once again, support ahead of the 105 mark comes via the 7th May low at 105.03.

- EUR is steady vs. the USD with EZ drivers once again lacking in today's session. EUR/USD made an incremental high at 1.0786 but catalysts today for a push beyond 1.08 are not obvious. ECB Minutes due at 12:30 BST / 07:30 EDT.

- GBP is the marginal best performer across the majors following hotter-than-expected UK GDP metrics which sent GBP/USD higher from 1.2519 to a 1.2540 peak before running into resistance at the 200DMA.

- USD/JPY's ascent has once again continued after a brief blip yesterday in a week that has seen jawboning from officials fail to stop the rot. The next inflection point will likely be US CPI data.

- Antipodeans are both marginally softer vs. the USD after benefitting yesterday from the dollar's post-data selling pressure. AUD/USD remains on a 0.66 handle in quiet newsflow with the monthly high at 0.6647.

- NOK: A slightly hotter than expected CPI which has sparked some modest NOK strength, sending EUR/NOK lower from 11.6940 to 1.6820.

- PBoC set USD/CNY mid-point at 7.1011 vs exp. 7.2102 (prev. 7.1028).

- CNB Minutes (May): Easing process could be paused/terminated at any point at still restrictive levels. Holub & Frait mentioned the possibility of 75bp of easing, ultimately went for 50bp

Fixed Income

- USTs are flat with specifics light thus far though the docket ahead is packed with multiple Fed speakers. USTs are holding at 109-03+ matching yesterday's auction-driven high but still a handful of ticks shy of the WTD peak at 109-09.

- Gilts gapped higher by 15 ticks despite hawkish direction from the strong UK GDP numbers earlier in the morning. Upside which has continued and extended to a 98.29 fresh WTD high as markets digest the BoE beginning to thread-the-needle to a first cut in the near term.

- Bunds are bid but to a slightly lesser degree than Gilts with specifics light thus far. Upside which has paused at a 131.40 peak shy of 131.63-86 from earlier in the week.

- Italy sells EUR 9.25bln vs exp. EUR 7.5-9.25bln 2.95% 2027, 1.10% 2027, 3.45% 2031, 5.00% 2040, 2.15% 2072 BTP.

- Orders for Italy's BTP Valore reach EUR 11bln (circa. EUR 10bln on Thursday). Books close at 12:00BST

Commodities

- Crude benchmarks in the green but only modestly so as markets await an update to the Israel-Hamas situation after hostage negotiations ended and Israel pledged to continued with its operation in Rafah. Brent July off best levels and currently resides around USD 84.20/bbl.

- Precious metals are supported and seemingly benefitting from the modestly bullish tone for fixed income thus far. XAU up to a USD 2370/oz peak thus far, eclipsing the 21-DMA of USD 2337/oz with ease and bringing USD 2400/oz and then USD 2431/oz into view.

- Base metals are firmer, lifted by the broader risk tone and somewhat softer Dollar; though Aluminium is the standout laggard after a sizeable LME stock update of +424k (prev. -2.75k).

- Saudi's crude oil supply to China to fall by 5.8mln/bbl in June vs May, via Reuters citing sources.

- LME Stocks: Aluminium +424k (prev. -2.75k)

Geopolitics

- Israeli PM Netanyahu said they have destroyed 20 of Hamas's 24 battalions so far and hopes he and US President Biden can overcome disagreements, while he added that they have to defeat Hamas in Rafah.

- Israel's army reportedly carried out bombing operations on buildings east of Rafah in the southern Gaza Strip, according to Al Jazeera.

- US State Department said Secretary of State Blinken confirmed to his Egyptian counterpart US President Biden's "clear" position not to support the Rafah operation, according to Al Arabiya.

- US Secretary of State Blinken is expected to submit Israel conduct report to Congress today and is expected to criticise Israel but say it isn't breaking weapons terms, according to Axios.

- Group of 20 US Senators introduced a bill that would restrict funding to the UN or any organisation that gives the Palestinian Authority higher than observer status, according to Asharq News.

US Event Calendar

- 10:00: May U. of Mich. Sentiment, est. 76.2, prior 77.2

- 10:00: May U. of Mich. Current Conditions, est. 79.0, prior 79.0

- 10:00: May U. of Mich. Expectations, est. 75.0, prior 76.0

- 10:00: May U. of Mich. 1 Yr Inflation, est. 3.2%, prior 3.2%

- 10:00: May U. of Mich. 5-10 Yr Inflation, est. 3.0%, prior 3.0%

- 14:00: April Monthly Budget Statement, est. $250b, prior $176.2b

Central Bank Speakers

- 09:00: Fed’s Bowman Speaks on Financial Stability Risks

- 10:00: Fed’s Logan Participates in Moderated Q&A

- 10:00: Fed’s Kashkari Participates in Q&A

- 12:45: Fed’s Goolsbee Speaks in Moderated Q&A

- 13:30: Fed’s Barr Gives Commencement Speech

- 14:15: Fed’s Kashkari, Goolsbee on CNBC

DB's Jim Reid concludes the overnight wrap

Risk assets posted further gains yesterday, thanks to growing confidence that central banks would still cut rates this year. In part, that was because of the weekly initial jobless claims in the US, which hit an 8-month high and added to fears that the labour market was cooling further. But alongside that, the Bank of England announced their latest policy decision, where Governor Bailey said it was “ likely that we will need to cut bank rate over the coming quarters ”. So this all cemented the theme that global monetary policy was heading towards a less restrictive stance, not least after the Riksbank’s rate cut earlier in the week. The next hurdle will be the US inflation numbers for April next week, but so far this month at least, investors have moved to expect a more dovish stance of monetary policy than they thought would happen at the end of April.

This trend was very helpful for equities, with several European indices up to new records yesterday, including the STOXX 600 (+0.19%), the FTSE 100 (+0.33%) and the DAX (+1.02%). Indeed, it marked a 5th consecutive advance for all three indices, and it leaves the DAX on track for its best weekly performance since November, having risen by +3.81% since the start of this week. Meanwhile in the US, the S&P 500 (+0.51%) was up to a 5-week high, and the index remains on track for a third consecutive weekly gain for the first time since February. On top of that, it’s also been the strongest performance for the S&P 500 over 6 sessions so far this year, having advanced by +3.90% since its recent low on May 1. The gains for the S&P 500 were broad-based with 10 of 11 industry groups higher on the day, and came even as the Magnificent 7 (-0.07%) was weighed down by losses for Nvidia (-1.84%) and Tesla (-1.57%).

That jobless claims data was the initial catalyst for the advance yesterday, and up until that point, S&P 500 futures had actually been in negative territory. The release showed that initial jobless claims were up to 231k (vs. 212k expected) in the week ending May 4, which was their highest level since late-August, and above every economist’s estimate on Bloomberg. But even though the data was weaker than expected, it meant investors grew more confident that the Fed would still cut rates this year, as it added to recent prints suggesting the labour market could be cooling. For instance, last week’s data showed job openings were down to a 3-year low in March, whilst the broader U6 measure of unemployment (which includes the underemployed and those marginally attached to the labour force) rose to its highest in over two years in April, at 7.4%.

But even with the uptick in jobless claims, this isn’t necessarily a leading indicator of a downturn. For instance, there was a previous spike last year, which pushed the 4-week average above 250k by late-June. But after that, the numbers came down again shortly afterwards, and there wasn’t a notable rise in the unemployment rate. And for the time being at least, the smoother 4-week average is still only at 215k, so it’s important to bear in mind that lots of other indicators are still looking more positive, and the Atlanta Fed’s GDPNow indicator is suggesting that Q2 growth will come in at an annualised +4.2% rate.

This belief in future rate cuts was supported by the Bank of England’s latest decision as well. The main headline was that they kept rates unchanged at 5.25%, in line with expectations. But unlike the March meeting, when the vote was 8-1 to keep rates on hold, there was now a 7-2 split after Deputy Governor Ramsden also voted for a cut. Moreover, there was an additional line in the statement, which said that the committee would “consider forthcoming data releases and how these inform the assessment that the risks from inflation persistence are receding.” Then in the press conference, Governor Bailey said that a cut at the next meeting in June was “neither ruled out nor a fait accompli ”, and he suggested that the reductions in bank rate could be “possibly more so than currently priced into market rates”. There are two more CPI prints coming out ahead of the BoE’s next decision, so those will be in focus ahead of that, and this morning we’ve also got the Q1 GDP release shortly after we go to press.

Overall, the decision and these comments led investors to price in a growing probability of a rate cut by the next BoE meeting in June, with overnight index swaps raising the chance from 55% the previous day to 60% by the close. Front-end gilts also rallied on the prospect of faster rate cuts, with the 2yr yield coming down by -5.7bps. 10yr gilts did lose a bit of ground, with yields up +0.2bps, but that was actually an outperformance relative to the rest of Europe, where yields on 10yr bunds (+3.3bps), OATs (+4.3bps) and BTPs (+3.7bps) all saw larger moves higher.

Meanwhile in the US, Treasuries outperformed after the jobless claims data led futures to dial up the likelihood of rate cuts this year. For instance, 46bps of cuts were priced in by the December meeting at the close, up +1.9bps relative to the previous day. In turn, the 2yr yield was down -2.1bps to 4.82%. And 10yr yields were down -4.1bps to 4.45%, with long-dated Treasuries supported by a solid 30yr auction that saw the highest direct bidder share since July.

Overnight in Asia, this strength for risk assets has broadly continued, with the Hang Seng (+1.74%) rising to its highest level in almost nine months, whilst the Nikkei (+0.24%) and the KOSPI (+0.60%) have also advanced. The exception to this has been in mainland China, where the CSI 300 (-0.28%) and the Shanghai Comp (-0.22%) have both lost ground, which comes as a Bloomberg report said that the US would announce new tariffs on China. The report cited people who said an announcement was scheduled for Tuesday, and there would be a focus on strategic sectors including electric vehicles. Elsewhere, US equity futures are also positive this morning, with those on the S&P 500 up +0.09%.

To the day ahead now, and data releases include the UK GDP reading for Q1, Italian industrial production for March, Canadian employment for April, and in the US there’s the University of Michigan’s preliminary consumer sentiment index for May. From central banks, we’ll hear from the Fed’s Bowman, Logan, Kashkari, Goolsbee and Barr, the ECB’s Cipollone and Elderson, and the BoE’s Pill and Dhingra. We’ll also get the account from the ECB’s April meeting.

-

Site: Zero HedgeUnited Airlines Boeing 737 Makes Emergency Return To Japanese Airport After Wing Flap "Irregularity"United Airlines Boeing 737 Makes Emergency Return To Japanese Airport After Wing Flap "Irregularity"Tyler Durden Fri, 05/10/2024 - 07:45

Wednesday:

Thursday:

Good morning, readers. There has been another Boeing incident overnight. This news is particularly alarming for anyone flying domestically or internationally on a Boeing jet, especially given the two Boeing mishaps earlier this week.

Aviation news website Simply Flying reported a United Airlines Boeing 737-800 that departed from Fukuoka Airport in Japan earlier today experienced an "irregularity" with a wing flap(s).

UA166, which was taking off from Fukuoka Airport to Guam Antonio B. Won Pat International Airport, climbed to an altitude of 10,000 feet after takeoff, then leveled off and held a holding pattern. Around this time, pilots detected a wing flap(s) issue.

"Eventually, after holding for more than 30 minutes, the aircraft began its approach to FUK by descending and lining up on the airport's sole runway, runway 16/34, with the United Airlines aircraft landing at the aircraft on the former configuration," Simply Flying said.

Simply Flying, local media outlets nor officials provided additional information about the flap 'issue.'

What's important to understand here is that flaps are crucial for producing additional lift in takeoff and landing procedures. For the pilots out there, the flaps are critical for more lift on a 'normal' approach that provides reduced speed and controlled flight ahead of the round-out phase of landing. In other words, with full flaps deployed, a steep approach on landing means reduced speed and shorter runway distance is needed. A straight-line approach with no flaps deployed means higher speed and more runway distance required.

Given the brief aviation lesson about wing flaps, the 737-800 usually requires 6,500–7,000 feet for landing. Many calculations go into that, including weight and wind. Data shows the plane used the entire 9,186-foot runway, a possible indication of wing flap issues.

The good news is that the plane landed without an issue, and all 49 souls onboard were safe.

Another day, another issue with Boeing.

-

Site: Novus Motus LiturgicusLost in Translation #86In the days that remain of Paschaltide, we turn to the Vidi Aquam, which is used from Easter to Pentecost at the Asperges rite instead of the antiphon Asperges Me and the verse, Psalm 50,3.The AntiphonThe antiphon for the season is:Vidi aquam egredientem de templo a látere dextro, allelúja: et omnes ad quos pervénit aqua ista salvi facti sunt, et dicent: allelúja, Michael P. Foleyhttp://www.blogger.com/profile/02649905848645336033noreply@blogger.com0

-

Site: PaulCraigRoberts.org

This article precisely explains how the Democrats stole the 2020 and 2022 elections and how they will steal the November presidential election

-

Site: PaulCraigRoberts.org

Regulatory Agency Again Subverts the Law

Recently I explained to you how a regulatory agency rewrote the 1964 Civil Rights Act to impose racial quotas that the Act prohibited. https://www.paulcraigroberts.org/2024/05/07/white-genocide-is-in-the-cards-that-are-being-played/

Now the same regulatory agency has rewritten Title IX’s prohibition on discrimination against women to include self-declared genders that allows biological males access to female spaces such as women’s showers.

Again I ask, why are women so self-destructive that they vote Democrat?

-

Site: PaulCraigRoberts.org

Congress Criminalizes the New Testament

The Democrats Have Taken Our Country Away from Us and Given it to Immigrant-invaders and the Republicans Have Taken the New Testament Away from Us

https://www.lewrockwell.com/2024/05/chuck-baldwin/congress-criminalizes-the-new-testament/

-

Site: PaulCraigRoberts.org

I received a request for an interview from a French University Ph.D. Student for His Dissertation

This is my reply:

Pierre, I don’t think your questions are relevant.

In the US and throughout the Western World, or what little remains of it, the white ethnicities who once constituted nations are now submerged in towers of babel in which the white ethnicities are demonized, and in the US reduced to second class citizenship in law, made to feel guilty and not only silenced but actually punished for protesting the over-running of their countries by Immigrant-invaders.

The intrusion of government into the family has destroyed the authority of parents. It is the state that has power over children. The children are brainwashed and indoctrinated in public education that they and their parents are racists and that they might be born into the wrong body from their real gender. In the US fortunes are being made in changing the gender of children in a process that legally has been taken out of the hands of parents.

Everyone knows that the immigrant-invaders are not “refugees from oppression.” Official US statistics document “refugees” from 160 countries. As there are only 200 countries, that would mean 80% of countries are tyrannies from which people are refuges.

The most oppressed countries in the world are the US and its West European puppet states such as France, once a great nation. If the Western peoples complain about the loss of their national identity, they are harassed, often prosecuted, for “hate crimes,” “racial crimes,” “hate speech” as is Marine Le Pen, described in the French press as a fascist or a Nazi. In Scandinavia, women are afraid to complain about being raped by immigrant-invaders as such raped women have been charged with racism. Even the feminists are too brainwashed or cowardly to come to their support..

The dispossession of white ethnicities of their countries by their own white governments is the most extraordinary event in human history.

I report on the total collapse of Western civilization, which is 90% complete, in my columns on my website.

If you are interested in real issues, instead of buttressing official narratives about “the Trump danger,” the fascist Alt Right, and the other bullshit, I warn you that your career will be squashed. If you are interested in truth, your dissertation will not be accepted.

I see no point in the interview.

To test what I have told you, try to find a dissertation committee anywhere in France or Europe or the US that will permit you to compare Jean Raspail’s 1973 predictions in his novel, The Camp of the Saints, with the reality today.

You will be thrown out of the university.

-

Site: Zero HedgeAs The Dollar Falters, Gold Becomes Insurance, Not SpeculationTyler Durden Fri, 05/10/2024 - 07:20

Authored by Douglas French via The Mises Institute,

Economics trumps sentimentality, and gold’s elevated price has some people raiding the family jewelry box to pay bills.

“Young people are not wearing grandma’s jewels. Most of the young people, they want an Apple watch. They don’t want a pocket watch,” Tobina Kahn, president of House of Kahn Estate Jewelers told Bloomberg.

“Sentimental is now out the door.”

When times are tough, treasures change hands, the late Burt Blumert, once a gold dealer and Mises Institute Board Chairman, used to say.

“Prices are high, and I need cash,” Branden Sabino, a thirty-year-old information technology worker said, adding that with the cost of rent, groceries, and car insurance rising, he doesn’t have any savings. He sold a gold necklace and a gold ring to King Gold and Pawn on Avenue 5 in Brooklyn.

“People are using gold as an ATM they never had,” said store owner Gene Furman.

At King Gold, fifty-five-year-old Mirsa Vijil pawned a bracelet to pay her gas bill.

“Gold is high,” she said, adding she’d never pawned her jewelry before but will do it again if she needs to.

Adrian Ash, director of research at online gold investment service BullionVault says there is twice as much selling as a year ago on BullionVault’s platform. “People are very happy to take this price.”

“It’s very busy and we are getting more calls than ever before about clients wanting to bring in their jewels,” Kahn said.

“I’m telling the clients to bring them in now, as we are at unprecedented levels.”

So while there is plenty of liquidating to pay the bills, demand at the United States Mint is tepid, with sales in March the worst since 2019 for its American Eagle gold coin.

It turns out more than a few of those well-publicized Costco gold bar buyers are having trouble selling them. The bars, not being American Eagles or other similar gold coins, are not as liquid, given that the seller, Costco, will not buy them back. The Wall Street Journal reports, thirty-three-year old Adam Xi called five different gold dealers to get a price he would accept for the gold bar he bought at Costco in October.

He was offered $200 less by one dealer than the $2,000 he had paid. But he found a Philadelphia coin dealer near his home willing to pay $1,960, or twenty dollars under market price.

Mr. Xi has learned, or should have learned, that buying gold to turn a quick profit is a fantasy. His plan was to rack up credit-card points buying the gold and then quickly resell it for a profit.

Buyers can expect their gold to immediately lose around 5 percent of its value, according to Tom Graff, chief investment officer at the wealth advising company Facet. One pays a premium to buy and pays fees to sell.

“You need a holding period that’s long enough to overwhelm that cost,” said Graff.

Luke Greib told the Wall Street Journal that he sold a one-ounce Credit Suisse bar on a Reddit page dedicated to trading precious metals to avoid taxes and fees.

Buying physical gold is purchasing insurance against monetary mischief by the Federal Reserve, not to earn a profit via a quick flip.

Perhaps it’s hard to imagine currency destruction so devastating that your gold would serve as not only a store of value but a medium of exchange. Peter C. Earle explains in a piece for the American Institute for Economic Research, “During the peak of its 2008 hyperinflation, [Zimbabwe] experienced a catastrophic economic downturn, characterized by the issuance of billion—and trillion-dollar banknotes that were, despite their nominal enormity, virtually worthless.”

Dr. Earle writes that twenty-eight years of inflation “topped a total 231 million percent” and “the ZWD was demonetized in 2009.” The government is making its sixth attempt at a new currency, Zimbabwe gold (ZiG). “ZiG is there to stay forever,” said Vice President Constantino Chiwenga. “This bold step symbolizes government’s unwavering commitment to the de-dollarization program premised on fiscal discipline, monetary prudence and economic revitalization.”

Reportedly, ZiG “is backed by a basket of precious metals including about 2.5 tons of gold along with $100 million of foreign currency reserves held by the central bank.” As always, the Zimbabwe authorities are already blaming speculators for price increases. “Speculators should cease,” Chiwenga said. “Behave, or you get shut down or we lock you up.”

Dr. Earle has his doubts about whether the Zimbabwean authorities will maintain the ZiG backing with the required rigor. While he hopes for success, “Without fundamental changes guaranteeing private property protection, pro-market reforms, and safeguards against corruption, though, the ZiG is likely to retrace the unfortunate steps of its predecessors.”

The reason to buy and hold gold is just in case the Federal Reserve goes the way of Zimbabwe.

-

Site: PaulCraigRoberts.org

If Truth Could Be Acknowledged, America No Longer Exists

Paul Craig Roberts

Alan Dershowitz, the epitome of a Harvard law school left-winger back in the days before the left-wing went Woke, endorsed two of my books dealing with Washington’s dangerous assaults on American Civil Liberty.

Dershowitz’s failing is that as a defender of Zionist Israel he silences even Jews, such as Norman Finkelstein, who are critical of Zionist Israel. But when it comes to US civil liberty, he stands on the Constitution if Israel is not in the picture.

This is unusual for the left-wing today, which opposes the Constitution as a racist document intended to suppress black people.

In former periods of our history the American left was a countervailing power that protected civil rights. Those days are gone, and Dershowitz is the last.

I doubt that Dershowitz is a Trump supporter. But to Dershowitz, it is the the law, the Constitution, that is important. In a recent article, Dershowitz says, “Every American should be appalled at this selective prosecution. Today the target is former President Donald Trump. Tomorrow it may be a Democrat.”

In other words, Dershowitz is concerned that the US is becoming a Latin American country in which every outgoing president is prosecuted by his successor. Instead of law as a protector, law becomes a weapon.

Dershowitz has this to say:

“Trump’s underlying crime is seemingly a minor misdemeanor — falsifying business records — which long ago expired under the statute of limitations. In order to turn it into a felony within the statute of limitations, prosecutors will have to show that Trump falsified the records in order to impact his election, thus constituting a federal election felony.

The problem is, however, that federal authorities have not prosecuted Trump for this federal election crime. Moreover, state prosecutors have no jurisdiction over federal election law.”In other words, there is no legal basis for Trump’s indictment.

This has from the beginning been completely apparent, and now it has been stated by America’s most prominent legal authority, a person far more knowledgeable than any member of the US Supreme Court.

“I have been teaching, practicing and writing about criminal law for 60 years. In all those years, I have never seen or heard of a case in which the defendant was criminally prosecuted for failing to disclose the payment of what prosecutors call ‘hush money.’ Alexander Hamilton paid hush money to cover up an affair with a married woman. Many others have paid hush money since. If the legislature wanted to criminalize such conduct they could easily enact a statute prohibiting the payment of hush money or requiring its disclosure. They have declined to do so. Prosecutors cannot simply make up new crimes by jerry-rigging a concoction of existing crimes, some of which are barred by the statute of limitations others of which are beyond the jurisdiction of state prosecutors.” https://dailycaller.com/2024/05/08/opinion-trumps-trial-is-a-stupendous-legal-catastrophe-for-the-history-books-alan-dershowitz/?pnespid=qOlqBH1KL6oRxKfDomjtA5TQ7xKyUJIvJ_y70Oh58ABmWE1d_.03Q3m9YGQz_bqVDR4zq8Cx9A

In other words, America’s pre-eminent lawyer declares the totally unAmerican Biden Regime enemy of the US Constitution to be a direct threat to the existence of a rule of law and a free America.

Despite this, watch the Woke left, women, Woke white males, if male they are, vote Democrat. A country, such as America, which has lost the support of its principles by its own population is a destroyed country.

-

Site: Mises InstituteIn a recent symposium on Murray Rothbard's For a New Liberty, philosopher Matt Zwolinski takes issue with Rothbard on Murray’s views of freedom and property rights.

-

Site: Zero HedgeSix Reasons To Own Bitcoin In RetirementTyler Durden Fri, 05/10/2024 - 06:30

For newcomers, especially those in and around retirement age, the idea of investing in or owning bitcoin can evoke reactions from skepticism to disbelief. If you look beyond the popular narratives, however, you might find there is more to the story than first impressions suggest.

Here are six reasons to consider owning at least some bitcoin during retirement.

1. BITCOIN HELPS BROADEN YOUR ASSET ALLOCATION BASE

Traditionally, investors use a strategy called asset allocation to distribute and shield funds from investment risk over time. A sound asset allocation strategy is the antidote to putting all of your eggs in one basket. There are several types of asset “classes” or categories over which to distribute risk. Customarily, advisors seek to establish a dynamic mix between debt instruments (i.e., bonds), equities (i.e., stocks), real estate, cash, and commodities.

The more categories you employ to distribute your assets and the less correlated those categories are, the better your chances of balancing your risk, at least theoretically. Recently, due to unintended consequences caused by the aggressive expansion of societal debt and the money supply, assets that were previously less correlated now tend to behave more in kind with one another. When one sector gets hammered today, several sectors often suffer together.

Regardless of these present-day conditions, asset allocation remains a well-conceived strategy for moderating risk. While still in its relative infancy, bitcoin represents an entirely new asset class. Because of this, owning at least some bitcoin, especially due to its distinct properties when compared to other “cryptocurrencies,” provides an opportunity to broaden your asset base and more effectively distribute your overall risk.

2. BITCOIN OFFERS A HEDGE AGAINST INFLATION AND CURRENCY DEBASEMENT

As a retiree, protecting yourself from inflation is crucial to preserving your long-term purchasing power. In the asset allocation discussion above, we referenced the recent and aggressive money supply expansion. Everyone who has lived long enough to approach retirement age knows that a dollar no longer buys what it used to. When the government issues large amounts of new money, it debases the value of the dollars already in circulation. This generally pushes prices higher as newly created dollars begin to chase the existing limited supply of goods and services.

Our own Parker Lewis touched on this extensively in his Gradually, Then Suddenly series:

In summary, when trying to understand bitcoin as money, start with gold, the dollar, the Fed, quantitative easing and why bitcoin’s supply is fixed. Money is not simply a collective hallucination or a belief system; there is rhyme and reason. Bitcoin exists as a solution to the money problem that is global QE and if you believe the deterioration of local currencies in Turkey, Argentina or Venezuela could never happen to the U.S. dollar or to a developed economy, we are merely at a different point on the same curve.

In contrast to fiat currencies, no one can increase the supply and arbitrarily reduce bitcoin’s value. There are no centralized authorities that govern its monetary policy. Despite arguments to the contrary, bitcoin is similar to gold—but not exactly, because gold miners continue to inflate the supply of gold each year at a rate of 1-2%.

As bitcoin is slowly introduced to the circulating supply (i.e., mined), its inflation rate decreases and will eventually cease. This fact makes bitcoin uniquely scarce among global monetary assets. Ultimately, this scarcity, along with bitcoin’s other monetary properties, should safeguard its purchasing power. As such, owning bitcoin during retirement offers you a hedge against inflation.

3. BITCOIN OFFERS AN OPPORTUNITY FOR ASYMMETRIC RETURNS

Bitcoin’s capacity to mitigate many of the challenges we discuss here rests on its ability to achieve asymmetric returns. Its supply is fixed (there will only ever be 21,000,000 bitcoin), and demand for the asset is growing steadily. As this limited supply collides with increased store-of-value adoption from individuals, institutions, and governments, bitcoin has the potential to dwarf the returns of nearly every competing asset class.

It’s worth noting that people generally improve their returns with bitcoin when they hold it for the long term. In the modern era, retirements lasting decades or more are increasingly common. Over such time periods, even a limited allocation to bitcoin offers ample opportunity to benefit from its upside potential. You just need time to hold through the short-term volatility, which contrary to popular belief, is not evidence of it being a poor store of value.

Sequestering a portion of funds solely for appreciation during retirement runs somewhat counter to conventional wisdom. Modern retirement planning generally optimizes for the liquidation of portfolio funds to provide income. However, setting aside a small amount of bitcoin—kept steadfastly gated from funds earmarked for income—opens the door to benefit from the monetization of bitcoin’s limited supply.

4. BITCOIN OFFERS PROTECTION FROM THE RISK OF LONG-TERM BONDS

Conventionally, high-grade bonds—held directly or as fund shares—make up a significant part of most retirement portfolios due to their low risk levels and tendency toward capital preservation. However, things have changed.

Monetary expansion and increases in societal debt have forced bond yields—or the amount of interest paid (i.e., coupon)—to historically low levels. The yields on most bonds today fall well below the rate of inflation. This “negative real yield” means that owning a bond can cost you money. But the difficulty doesn’t end there.

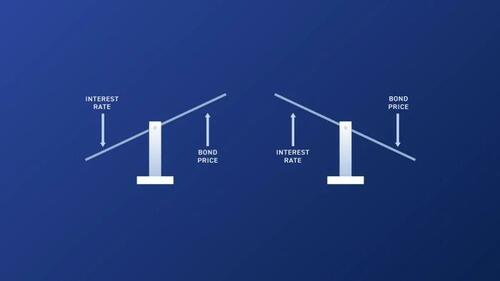

Because retirees need funds from their portfolios to pay bills, they generally must sell assets at current market rates to derive income throughout retirement. In the case of bonds, at present, this can be very problematic. Consider the following equations.

-

How much money does it take for a bond paying a 2% rate to yield $20? Answer: $1,000. ($1,000 x 2% = $20)

-

How much money does it take for a bond paying a 4% rate to yield $20? Answer: $500. ($500 x 4% = $20)

These two equations reveal that to yield the same $20 return, the market value of the underlying bond changes based on the interest rate promised.

-

When interest rates go up, the market value of bonds goes down.

-

When interest rates go down, the market value of bonds goes up.

The market value of bonds has an inverse relationship to interest rates. Consider that interest rates today hover near historic lows. Over the next twenty to thirty years, what will happen to the market value of bonds held by retirees if interest rates increase substantially? The answer: the market value of their bonds will collapse.

This changes the entire risk paradigm for bonds in retirement portfolios and potentially makes them far less safe than typically imagined. Bitcoin exists in a separate asset class from bonds; it is a bearer instrument that is not exposed to the same money market risks. As such, owning bitcoin may help you offset at least some of the potential risk incurred from owning bonds in retirement.

5. BITCOIN OFFERS A POTENTIAL SOLUTION FOR LONG-TERM HEALTHCARE RISK

Another area of concern for retirees is the cost of healthcare. Here, I am not referring so much to ordinary medical bills but rather to the potential to incur long-term care expenses in later age. Insurance is available for long-term care, but it has some unique and increasingly difficult challenges to overcome.

Healthcare, in general, takes a double-hit when it comes to price inflation. Not only do healthcare costs rise due to monetary debasement, but healthcare faces additional headwinds from demand spurred by growth in the aging population.

Source: Administration for Community Living – 2020 Profile of Older Americans

States regulate insurance for long-term care. To keep policyowners safe, insurers face scrutiny over where and how they invest policy premiums. To preserve capital required for future claims, insurers generally rely on low-risk, intermediate and long-term bonds. However, as our discussion above on bonds reveals, low yields and the potential for rising rates complicate this practice. One immediate fallout is that premiums for long-term care insurance policies have risen substantially.

We noted earlier bitcoin’s usefulness as an inflation hedge and its potential for long-term price appreciation. As it relates to long-term healthcare, it may make sense to set aside some bitcoin explicitly dedicated as a hedge for this rapidly increasing expense.

6. BITCOIN OFFERS YOU INDIVIDUAL SOVEREIGNTY

The final reason we’ll consider for owning bitcoin in retirement is that it offers you increased individual sovereignty. Bitcoin provides you a level of ownership that is not achievable with other assets. It can easily be carried across borders with a hardware wallet or seed phrase, for example, or transferred peer-to-peer anywhere in the world at low cost.

If you hold bitcoin securely in a wallet you control, no central bank can steal the value of your bitcoin by printing it into oblivion. No CEO can dilute its value by issuing more of its “shares.” Nor can a bank arbitrarily block access to or confiscate your funds. Unlike centralized financial custodians, which can be ordered to freeze or withhold funds on the whims of government or other third-party authorities, bitcoin with keys properly held is resistant to these kinds of overreach.

Specifically for retirement purposes, you can also hold your own keys for bitcoin in an IRA. Products like the Unchained IRA are a robust tool for building and saving your wealth on a tax-advantaged basis. And holding your bitcoin keys in the form of a multisig collaborative custody vault allows you to eliminate all single points of failure while you do so.

SOUND FINANCIAL PRINCIPLES AND OWNING BITCOIN

Benefitting from bitcoin does not require committing to wild speculation or thoughtless abandonment of sound financial principles. In contrast, the more you look at bitcoin through sound financial principles and apply them to your thinking, the greater the opportunities it provides. One steadfast financial principle that coincides with bitcoin ownership is prudence.

Macro-economic investment strategist Lyn Alden often speaks of establishing a “non-zero position” in bitcoin (i.e., owning at least some). The risk of losing a few portfolio percentage points in a worst-case scenario is, in my estimation, worth the potential upside. But to be clear, each person’s situation is unique. You must do your own research and make the best decisions you can about what works in your particular scenario.

* * *

Visit Unchained.com for $100 off any Unchained financial services product with code “BTCMAG100”

-

-

Site: Zero HedgeNew York Flight Attendants Accused Of Smuggling Millions In Drug Money To Dominican RepublicTyler Durden Fri, 05/10/2024 - 05:45

Four flight attendants from the New York City area have been accused of participating in a multimillion-dollar drug money smuggling operation which saw $8 million make its way to the Dominican Republic, according to the U.S. Attorney’s Office for the Southern District of New York.

The accused, identified as Jarol Fabio, 35, of New York City; Charlie Hernandez, 42, of West New York, New Jersey; Sarah Valerio Pujols, 42, of the Bronx; and Emmanuel Torres, 34, of Brooklyn, allegedly transported the funds over a span of several years, exploiting their positions as flight attendants to bypass the stringent security measures in place at JFK International Airport.

“These flight attendants smuggled millions of dollars of drug money and law enforcement funds that they thought was drug money from the United States to the Dominican Republic over many years by abusing their privileges as airline employee[s]," stated U.S. Attorney Damien Williams. "Today’s charges should serve as a reminder to those who break the law by helping drug traffickers move their money that crime doesn’t pay."

According to prosecutors, the scheme involved using their status as "Known Crewmembers"—a designation that allows flight crew members to undergo less rigorous security screenings—to smuggle large sums of cash without detection. This privilege, intended to streamline operations for crew members, became their tool for illegal activities.

Delta Airlines, where two of the defendants were employed, has been cooperative with the authorities following the revelation that security protocols meant to protect the passengers were systematically abused.

According to court documents, the detailed operation was exposed with the help of two cooperating witnesses, themselves previously arrested on money laundering charges. These witnesses played a pivotal role in unveiling the transactions that tied some of the smuggled funds to fentanyl sales, adding a dire public health dimension to the criminal activities.

In one incident, prosecutors detailed how Hernandez and Pujols divided over $120,000 in drug money in December 2019, with each taking their share on subsequent trips to the Dominican Republic. Such episodes illustrate the methodical approach taken to avoid detection while exploiting their roles within the airline industry.

If convicted, the penalties are severe. Torres and Fabio face up to 15 years in prison, Hernandez could see 20 years, and Pujols, facing an additional smuggling charge, could be sentenced to up to 25 years. These stiff potential sentences reflect the serious nature of their alleged crimes, which compromised airport security systems and endangered public trust in the safety of air travel.

-

Site: Real Investment Advice

When it comes to the financial markets, investors have a litany of investment vehicles to choose from. The choices are nearly unlimited, from brokered certificates of deposit to complex derivative instruments. Of course, investment vehicles’ proliferation comes from investors’ demand for everything from excess benchmark returns to income generation to downside protection.

Of course, every investor wants “all the upside, with none of the downside.” While there are vehicles, like indexed annuities, that can provide no downside risk, they cap the upside return. If you buy an index fund, you can get “all the upside” and “all the risk.”

However, an email from a reader last week got me thinking about the perfect “investment vehicle” and the search for the “holy grail” of investing.

“My wife and I are looking for a place to position some of our ’emergency funds’ for a better return. Our requirements are pretty simplistic:

- Guarantee at least a 4% rate of return.

- Allow me to withdraw cash without penalty when needed.