One can readily admit that the Magisterium's manner of expression does not seem very easy to understand at times. It needs to be translated by preachers and catechists into a language which relates to people and to their respective cultural environments. The essential content of the Church's teaching, however, must be upheld in this process. It must not be watered down on allegedly pastoral grounds, because it communicates the revealed truth.

Distinction Matter - Subscribed Feeds

-

Site: non veni pacem

-

Site: Zero HedgeIsrael Prepares Rafah Evacuation With Help From US, Egypt - New Tent City ErectedTyler Durden Tue, 04/23/2024 - 11:50

The Israeli army is closing in on completing its plans for an assault on the Gaza Strip’s southern city of Rafah, the Wall Street Journal (WSJ) reported on Tuesday.

WSJ cites Egyptian officials as saying that Israel’s plan to evacuate civilians from the city will take two to three weeks and will be carried out in cooperation with Washington, Cairo, and other Arab states, including the UAE.

Image: AFP

Image: AFP

The officials say Israel is planning on gradual deployments of troops to Rafah. The troops will concentrate on specific areas where Tel Aviv believes Hamas leaders are holed up.

The entire operation – including the evacuations – is expected to take at least six weeks, according to WSJ. The attack on Rafah will have a "very tight operational plan because it’s very complex there," an Israeli security official told the outlet. "There’s a humanitarian response that’s happening at the same time."

Israel’s evacuation plan involves moving Rafah’s civilian population upwards towards the southern city of Khan Yunis, as well as other areas of the strip, the report states, adding that shelters with tents, food supplies, and medical facilities will be set up.

Egypt has been briefed on the details of the plan. Al-Araby Al-Jadeed reported last week, citing Egyptian sources, that Egyptian forces and agencies are "at full readiness" in northern Sinai and along the Egyptian border with Gaza. The increased readiness came after "contacts from the Israeli side" relating to preparations for the operation in the southern city.

The Al-Araby Al-Jadeed report adds that the Egyptian Red Crescent has been readying camps in Khan Yunis over the past few months in preparation for the displacement of Palestinians from Rafah. Satellite images obtained by AP this week reportedly show a new tent compound near Khan Yunis.

In February, it was reported that Egypt built a security zone in the Sinai near the border with Rafah. Many speculated at the time that the security zone would aid Israeli plans to push Rafah’s population into the Sinai desert. Egypt's State Information Service said on February 17 that the zone is a logistics hub on the Egyptian side of the Rafah border, which will be used to deliver aid into Gaza.

Israeli army radio reported on Monday that Tel Aviv is now expanding a designated "humanitarian zone" that will "accommodate around one million people." It said field hospitals have also been set up in the area. Army radio added that the zone will extend from Al-Mawasi on Gaza’s southern coast towards Deir al-Balah in the central Gaza Strip.

Satellite photos analyzed by The Associated Press appear to show a new compound of tents being built near Khan Younis in the southern Gaza Strip as the Israeli military continues to signal it plans an offensive on the city of Rafah.https://t.co/5bkOW5ShyF

— Toronto Star (@TorontoStar) April 23, 2024Israel believes Rafah is Hamas’ final stronghold and is dead set on attacking the city. Washington has repeatedly said it would not accept an operation there without a plan to properly and safely evacuate civilians and move them out of harm's way.

The UN and several countries have warned that attacking Rafah would have catastrophic consequences and that there is no safe way to evacuate the desperately overcrowded city.

-

Site: Mises InstituteRecent Iranian missile strikes on Israel in response to its earlier attack on the Iranian consulate in Syria have escalated the prospects of all-out war in the Middle East. There is an alternative to expanding the war: de-escalation.

-

Site: Mises InstituteCalifornia’s draconian fast-food minimum wage law is bad enough, but it turns out a company can avoid the trouble if it has ties to the governor.

-

Site: Zero Hedge"Let Me Go Home, Okay?": Mistrial Declared For Arizona Rancher Accused Of Killing Illegal Immigrant On His PropertyTyler Durden Tue, 04/23/2024 - 11:30

A mistrial was declared in the case of an Arizona rancher accused of fatally shooting an illegal immigrant on his property near the US-Mexico border, after the jury failed to reach a unanimous decision following two full days of deliberation.

George Alan Kelly, 75, was charged with second-degree murder in the Jan. 30, 2023 shooting of 48-year-old Gabriel Cuen-Buitimea, who was in the United States illegally.

"Based upon the jury's inability to reach a verdict on any count," said Arizona Superior Court Judge Thomas Fink, adding "This case is in mistrial."

According to one of Kelly's defense attorneys, Kathy Lowthorp, just one juror was voting 'guilty,' which is why their legal team pushed for deliberations to continue.

"There was one hold out for guilt, the rest were not guilty. So seven not guilty, one guilty," said Lowthorp. "We believe in our gut that there was no way the state proved beyond a reasonable doubt."

George Alan Kelly’s defense attorney Kathy Lowthorp says the mistrial was caused by one holdout juror who believed Kelly to be guilty. She says the other 7 wanted to vote for acquittal. pic.twitter.com/BvS88AupcX

— Adam Klepp (@AdamKleppAZ) April 23, 2024The Santa Cruz County Attorney's office can still retry Kelly for any charge, or drop the case.

Prosecutors accused Kelly of recklessly firing nine shots from an AK-47 rifle toward a group of men who were trespassing on his cattle ranch after running from Border Patrol agents, roughly 115 yeards away. He was also accused of providing inconsistent statements throughout the investigation - initially failing to tell officials that he had fired his weapon, and then allegedly claiming that the illegal immigrants were part of a group of 10-15 people armed with AR-style rifles - and that he'd heard gunshots.

Kelly's attorney said that he had fired "warning shots."

"He does not believe that any of his warning shots could have possibly hit the person or caused the death," she said at the time. "All the shooting that Mr. Kelly did on the date of the incident was in self-defense and justified.

After Monday's ruling, Consul General Marcos Moreno Baez of the Mexican consulate in Nogales, Arizona, said he would wait with Cuen-Buitimea's two adult daughters on Monday evening to meet with prosecutors from Santa Cruz County Attorney's Office to learn about the implications of a mistrial.

"Mexico will continue to follow the case and continue to accompany the family, which wants justice." said Moreno. "We hope for a very fair outcome."

Kelly's defense attorney Brenna Larkin did not immediately respond to an emailed request for comment after the ruling was issued. Larkin had asked Fink to have jurors keep deliberating another day. -CBS News

Following the mistrial, Kelly said: "Let me go home, okay? That alright with y’all? It is what it is and it will be what it will be. I will keep fighting forever. I won’t stop."

“Let me go home,” George Alan Kelly speaks after the mistrial was declared. The Mexican Consulate said they hope the state will re-try the case and justice will be served. pic.twitter.com/IDYpaM806C

— Adam Klepp (@AdamKleppAZ) April 23, 2024 -

Site: AsiaNews.itThe Botika sa Kapilya (Chapel Pharmacy) programme provides drugs and medical consultations to poor people in the region, thanks to the Jesuit missionary, with the help of Catholic health workers, who are also catechists. About 102 people have benefitted from the initiative that reaches out to people struggling with hunger and the effects of El Niño.

-

Site: Euthanasia Prevention CoalitionAlex SchadenbergExecutive Director,Euthanasia Prevention Coalition

Professor David JonesGeorgia Edkins, the Scottish Political Editor for the Daily Mail reported on April 20, 2024 that 16 year-olds with Anorexia could be approved for assisted suicide under Scotland's assisted dying bill. Edkins reports:

Professor David JonesGeorgia Edkins, the Scottish Political Editor for the Daily Mail reported on April 20, 2024 that 16 year-olds with Anorexia could be approved for assisted suicide under Scotland's assisted dying bill. Edkins reports:

Teenagers with anorexia could apply for state-backed ‘suicide’ under ‘extremely dubious’ laws proposed in Scotland, experts warned last night.

Newly published Holyrood legislation would allow NHS patients to request prescriptions for a life-ending cocktail of drugs that induce a coma, shut down the lungs and eventually stop the heart.Edkins reporting on comments by ethicist David Jones writes:

David Jones, professor of bioethics at St Mary’s University in London and director of the Anscombe Bioethics Centre, said: ‘It is extremely, extremely dubious.

We’re talking about “assisted dying” as a euphemism, and it’s always assisted suicide.

‘Suicide is something that we should try to seek to prevent and provide alternatives to, whether it’s for an old person or a young person, whether they have progressive disease or disability.’

‘Terminal in the Scottish Bill is defined as someone having a progressive incurable disease from which you could die. It could cover anorexia.Jones also warned that the assisted suicide bill that is sponsored by Liam McArthur would:- Let people as young as 16 die before their lives had properly begun;

- Not require someone to be close to death to be eligible for ‘assisted dying’;

- Not make a psychiatric assessment mandatory ahead of the life-ending procedure.

It is called the Assisted Dying for Terminally Ill Adults (Scotland) Bill, so that proclaims itself as being restricted to people who are terminally ill, but it defines people that are terminally ill only as people who have a progressive incurable disease, which is at an advanced stage. It doesn’t mean that you’re dying.’

Jones referenced the fact that in Scotland, a person is deemed an adult at 16, whereas in Oregon the age is 18. Based on the definition of terminal illness in the bill, someone with Anorexia could be approved for assisted suicide at the age of 16. Jones states:

‘There have been cases of people with anorexia having assisted dying in Oregon.’Edkins ends her article by stating:

Perhaps most troubling is Professor Jones’ suggestion that the embattled NHS in Scotland could resort to suggesting death as a viable replacement for treatment.

He said: ‘What you’re starting to see in Canada is that doctors will suggest to patients, “Have you thought of assisted dying”, including people who, for example, have had difficulty getting support for social services to live at home.

‘There’s nothing in the Scottish legislation that prevents that.’ -

Site: LifeNews

Every member of the Idaho Congressional delegation has released a joint statement urging the Supreme Court to stop Joe Biden from forcing Idaho to turn its ERs into abortion centers.

On Wednesday, the Supreme Court will hold a hearing on the case to stop Biden.

As LifeNews.com reported previously, the Supreme Court ruled in January that Joe Biden can’t force Idaho to turn its emergency rooms into abortion centers. The nation’s highest court ruled that Joe Biden can’t exploit a federal law to try to weaken Idaho’s abortion ban by allowing emergency room doctors to do abortions.

But that decision was a temporary victory and Idaho officials are fighting in court to win the entire case, Idaho v United States. This is the first case to be heard by the Supreme Court directly relating to the Dobbs decision which overturned Roe v. Wade.

Below are quotes from Idaho’s congressional delegation asking the nation’s highest court to stop Biden’s radical abortion agenda.

“The Biden Administration’s attempt to preempt Idaho’s pro-life laws with a false interpretation of the Emergency Medical Treatment and Active Labor Act (EMTLA) would set a precedence that is harmful to America’s women and children. EMTLA was deliberately created to protect women and children in active labor. Every American has the fundamental right to life, including the unborn, and Idaho has strong laws in place to ensure innocent lives are protected. I have faith our justice system will stop this blatant use of federal overreach and put an end to Biden’s harmful abortion agenda.” — Senator Crapo

LifeNews is on GETTR. Please follow us for the latest pro-life news

“Idahoans have passed a strong law to protect the lives of mothers and the unborn, yet the Biden administration is seeking every opportunity to expand abortion. This administration cherry-picked pieces of existing statute and wrongfully reinterpreted it to fit their agenda. Their manipulation of federal law cannot usurp state law, and there is no federal right to an abortion. I submitted an amicus brief that demonstrates how the administration’s substantial federal overreach is aimed at undermining pro-life protections not only in Idaho but around the nation. I hope the Court stands with us in our fight to protect Idaho’s law and life itself.” — Senator Risch

“The Biden administration’s overreaching efforts to expand abortion nationwide is an attempt to take power away from the American people. The Supreme Court rightfully ruled that states have the right to protect life, yet this administration continues to undermine that decision. I strongly support the right of all states to protect the unborn, and I reaffirm this priority by joining this amicus brief.” — Congressman Simpson

“The Biden Administration’s attempt to preempt Idaho’s pro-life laws with a false interpretation of the Emergency Medical Treatment and Active Labor Act (EMTLA) would set a precedence that is harmful to America’s women and children. EMTLA was deliberately created to protect women and children in active labor. Every American has the fundamental right to life, including the unborn, and Idaho has strong laws in place to ensure innocent lives are protected. I have faith our justice system will stop this blatant use of federal overreach and put an end to Biden’s harmful abortion agenda.” — Congressman Fulcher

Last year, the Justice Department filed suit Aug. 2 against the state of Idaho, hoping to undermine its new law prohibiting most abortions by claiming that the state law conflicts with EMTALA and medical treatment for pregnant women in emergency rooms.

The Justice Department filed a lawsuit that challenges Idaho’s protective law — arguing that it would prevent supposedly medically necessary abortions. Despite false reports that abortion bans would prevent doctors from treating pregnant women for miscarriages or ectopic pregnancies, pro-life doctors confirm that is not the case. Some 35 states have laws making it clear that miscarriage is not abortion and every state with an abortion ban allows treatment for both.

U.S. District Judge B. Lynn Winmill found that Idaho’s law conflicts with the federal law because it bans abortions in nearly all circumstances. But the state argued the any emergency abortion is allowed under its abortion ban on elective abortions.

The nation’s highest court will hear oral arguments on Wednesday.

Brandi Swindell, Founder and CEO of Stanton Healthcare, which provides medical care and provides support for pregnant women in need, told LifeNews that the Supreme Court should side with her state.

“It is deeply troubling to see President Biden ignore and disrespect the voices of Idaho’s women as he attempts to advance a radical abortion agenda through federal regulations,” she said. “The Dobbs decision made it clear there is no federal or constitutional right to abortion. Our hope and prayer is the Supreme Court will respect the rights of Idaho’s voters and not allow our emergency rooms to be turned into abortion clinics by the federal government.”

The case involves the Biden administration’s unlawful attempt to use a law that ensures indigent patients receive emergency room care to force doctors to perform abortions that are illegal under Idaho law.

Idaho’s pro-life law imposes penalties on physicians who perform prohibited abortions unless doing so is necessary to save the life of the pregnant woman or other exceptions apply. The federal government claims—and the lower court ruled—that EMTALA requires abortions in violation of this law if an emergency room doctor thinks it is appropriate.

“Hospitals—especially emergency rooms—are centers for preserving life. The government has no business transforming them into abortion clinics,” said ADF Senior Counsel Erin Hawley, vice president of the Center for Life and regulatory practice. “Emergency room physicians can, and do, treat ectopic pregnancies and other life-threatening conditions. But elective abortion is not life-saving care—it ends the life of the unborn child—and the government has no authority to override Idaho’s law barring these procedures. We urge the Supreme Court to halt the lower court’s injunction and allow Idaho emergency rooms to fulfill their primary function—saving lives.”

After the Supreme Court returned the issue of abortion to the states in Dobbs v. Jackson Women’s Health Organization, the federal government sued the state of Idaho, claiming that EMTALA, an ancillary provision of the Medicare statute, preempts Idaho’s pro-life law. But as explained in the emergency application, “EMTALA is silent on abortion and actually requires stabilizing treatment for the unborn children of pregnant women.”

“The United States’ position conflicts with the universal agreement of federal courts of appeal that EMTALA does not dictate a federal standard of care or displace state medical standards. The district court accepted the United States’ revisionist, post-Dobbs reading of EMTALA and enjoined Idaho’s Defense of Life Act in emergency rooms. The district court’s injunction effectively turns EMTALA’s protection for the uninsured into a federal super-statute on the issue of abortion, one that strips Idaho of its sovereign interest in protecting innocent, human life and turns emergency rooms into a federal enclave where state standards of care do not apply,” Hawley notes.

Idaho’s abortion ban permits a physician who does an abortion to raise the affirmative defense that the abortion was necessary to save the mother’s life or that the pregnancy resulted from rape or incest that was reported. In both cases, the physician must choose a procedure that is most likely to save the life of the baby and protect the mother. The law explicitly excludes contraception from the definition of abortion, and women upon whom abortions are performed may not be prosecuted.

The pro-life laws in Idaho and other states include clearly defined exceptions that allow abortions in the cases when a mother’s life is at risk. Because the pro-life movement cares about the lives of both mother and child and there are rare cases in which only the mother’s life can be saved, it supports such exceptions.

But these exceptions mean the Biden administration’s guidance is unnecessary. Undermining Idaho’s life-saving efforts and expanding abortions appear to be the administration’s real goal.

The post Pro-Life Congressmen Ask Supreme Court to Stop Biden Form Turning ERs Into Abortion Centers appeared first on LifeNews.com.

-

Site: LifeNews

The United States Conference of Catholic Bishops (USCCB) has denounced the U.S. Equal Employment Opportunity Commission for violating religious freedom and forcing all employers to provide accommodations for employees to have an abortion.

CatholicVote previously reported that the Equal Employment Opportunity Commission (EEOC) announced a new rule on April 15 that requires employers “to provide reasonable accommodations,” such as leave time, to employees if they wish to have an abortion. The rule falls under the implementation of the Pregnant Workers Fairness Act (PWFA).

Bishop Kevin Rhoades of Fort Wayne-South Bend, chairman of the USCCB’s Committee for Religious Liberty, said in a news release that “No employer should be forced to participate in an employee’s decision to end the life of their child.”

REACH PRO-LIFE PEOPLE WORLDWIDE! Advertise with LifeNews to reach hundreds of thousands of pro-life readers every week. Contact us today.

“The bipartisan Pregnant Workers Fairness Act, as written, is a pro-life law that protects the security and physical health of pregnant mothers and their preborn children,” he added. “It is indefensible for the Equal Employment Opportunity Commission to twist the law in a way that violates the consciences of pro-life employers by making them facilitate abortions.”

CatholicVote reported in August 2023 that in addition to being supported by pro-life organizations, the PWFA was approved by pro-abortion groups, as the language left room for facilitating abortion access.

“The original act required employers to reasonably accommodate a worker’s pregnancy, childbirth, and ‘related medical conditions,’ but left the interpretation of those terms to the Biden administration’s EEOC, the federal agency responsible for regulating workplace discrimination laws,” CatholicVote reported at the time.

LifeNews Note: Hannah Hiester writes for CatholicVote, where this column originally appeared.

The post Catholic Bishops Slam Biden for Trying to Force Christian Employers to Fund Abortions appeared first on LifeNews.com.

-

Site: Zero HedgeUS PMIs Scream Stagflation As Manufacturing 'Contracts', Prices Rise, Heaviest Job Cuts Since GFCTyler Durden Tue, 04/23/2024 - 10:08

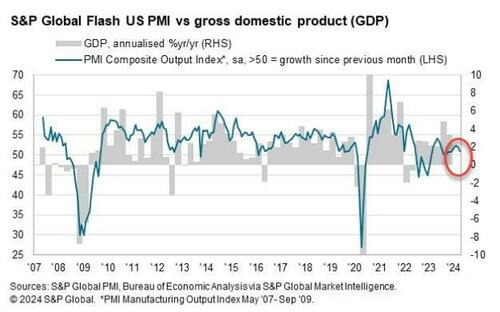

After a mixed bag from preliminary April European PMIs (Services strong-er, Manufacturing weaker-er, surging prices)...

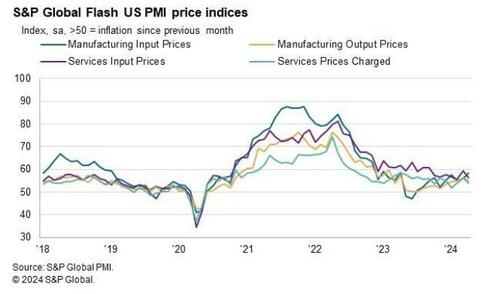

“Accelerated increases in input costs, likely driven not only by higher oil prices but also, more concerningly, by higher wages, are a cause for scrutiny Concurrently service-sector companies have raised their prices at a faster rate than in March, fueling expectations that services inflation will persist. ”

and after March US PMIs exposed the end of the disinflation narrative...

"Most notable was an especially steep rise in prices charged for consumer goods, which rose at a pace not seen for 16 months, underscoring the likely bumpy path in bringing inflation down to the Fed's 2% target. ”

...S&P Global's preliminary US f°r April just dropped and they were ugly with both Manufacturing and Services disappointingly dropping further as the former dropped back into contraction:

-

• Flash US Services Business Activity Index at 50.9 (Exp: 52.0; March: 51.7) - 5-month low.

-

• Flash US Manufacturing PMI at 49.9 (Exp 52.0; March: 51.9) - 4-month low.

Source: Bloomberg

Commenting on the data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

“The US economic upturn lost momentum at the start of the second quarter, with the flash PMI survey respondents reporting below-trend business activity growth in April. Further pace may be lost in the coming months, as April saw inflows of new business fall for the first time in six months and firms’ future output expectations slipped to a five-month low amid heightened concern about the outlook.

“The more challenging business environment prompted companies to cut payroll numbers at a rate not seen since the global financial crisis if the early pandemic lockdown months are excluded.

After March showed accelerating prices, flash April data confirmed the trend

“Notably, the drivers of inflation have changed.

"Manufacturing has now registered the steeper rate of price increases in three of the past four months, with factory cost pressures intensifying in April amid higher raw material and fuel prices, contrasting with the wagerelated services-led price pressures seen throughout much of 2023.”

So slower growth and much faster inflation - that does not sound like a recipe for rate-cuts... in fact quite the opposite.

-

-

Site: Zero HedgeUS PMIs Scream Stagflation As Manufacturing 'Contracts', Prices Rise, Heaviest Job Cuts Since GFCTyler Durden Tue, 04/23/2024 - 10:08

After a mixed bag from preliminary April European PMIs (Services strong-er, Manufacturing weaker-er, surging prices)...

“Accelerated increases in input costs, likely driven not only by higher oil prices but also, more concerningly, by higher wages, are a cause for scrutiny Concurrently service-sector companies have raised their prices at a faster rate than in March, fueling expectations that services inflation will persist. ”

and after March US PMIs exposed the end of the disinflation narrative...

"Most notable was an especially steep rise in prices charged for consumer goods, which rose at a pace not seen for 16 months, underscoring the likely bumpy path in bringing inflation down to the Fed's 2% target. ”

...S&P Global's preliminary US f°r April just dropped and they were ugly with both Manufacturing and Services disappointingly dropping further as the former dropped back into contraction:

-

• Flash US Services Business Activity Index at 50.9 (Exp: 52.0; March: 51.7) - 5-month low.

-

• Flash US Manufacturing PMI at 49.9 (Exp 52.0; March: 51.9) - 4-month low.

Source: Bloomberg

Commenting on the data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

“The US economic upturn lost momentum at the start of the second quarter, with the flash PMI survey respondents reporting below-trend business activity growth in April. Further pace may be lost in the coming months, as April saw inflows of new business fall for the first time in six months and firms’ future output expectations slipped to a five-month low amid heightened concern about the outlook.

“The more challenging business environment prompted companies to cut payroll numbers at a rate not seen since the global financial crisis if the early pandemic lockdown months are excluded.

After March showed accelerating prices, flash April data confirmed the trend

“Notably, the drivers of inflation have changed.

"Manufacturing has now registered the steeper rate of price increases in three of the past four months, with factory cost pressures intensifying in April amid higher raw material and fuel prices, contrasting with the wagerelated services-led price pressures seen throughout much of 2023.”

So slower growth and much faster inflation - that does not sound like a recipe for rate-cuts... in fact quite the opposite.

-

-

Site: Mises InstituteRobert Nozick’s Anarchy, State and Utopia turns fifty this year, and this libertarian classic has stood the test of time.

-

Site: Steyn OnlineWhen upscale white trustiefundies go hardcore...

-

Site: Steyn OnlineProgramming note: Tomorrow, Wednesday, I'll be presenting another Clubland Q&A taking questions from Steyn Club members live around the planet. But please take notice that, for various logistical reasons, we're an hour earlier than usual: 2pm North

-

Site: Ron Paul Institute - Featured Articles

(This paper is the basis of a talk to be given at the 25th Yasin (April) International Academic Event on Economic and Social Development, HSE University, Moscow, April 2024)

In the summer following Israel’s 2006 (unsuccessful) war on Hizbullah, Dick Cheney sat in his office loudly bemoaning Hizbullah’s continuing strength; and worse still, that it seemed to him that Iran had been the primary beneficiary from the US 2003 Iraq war.

Cheney’s guest – the then Saudi Intelligence Chief, Prince Bandar – vigorously concurred (as chronicled by John Hannah, who participated in the meeting) and, to general surprise, Prince Bandar proclaimed that Iran yet could be cut to size: Syria was the “weak” link between Iran and Hizbullah that could be collapsed via an Islamist insurgency, Bandar proposed. Cheney’s initial scepticism turned to elation as Bandar said that US involvement would be unnecessary: He, Prince Bandar, would orchestrate and manage the project. “Leave it to me,” he said.

Bandar separately told John Hannah: “The King knows that other than the collapse of the Islamic Republic itself, nothing would weaken Iran more than losing Syria.”

Thus began a new phase of attrition on Iran. The regional balance of power was to be decisively shifted towards Sunni Islam – and the region’s monarchies.

That old balance from the Shah’s time in which Persia enjoyed regional primacy was to be ended: conclusively, the US, Israel and the Saudi King hoped.

Iran – already badly bruised by the “imposed” Iran-Iraq war – resolved never again to be so vulnerable. Iran aimed to find a path to strategic deterrence in the context of a region dominated by the overwhelming air dominance enjoyed by its adversaries.

What occurred this Saturday 14 April – some 18 years later – therefore was of utmost importance.

Despite the bruhaha and distraction following Iran’s attack, Israel and the US know the truth: Iran’s missiles were able to penetrate directly into Israel’s two most sensitive and highly defended air bases and sites. Behind the whooping western rhetoric lies Israeli shock and fear. Their bases are no longer “untouchable.”

Israel also knows – but cannot admit – that the so-called “assault” was no assault but an Iranian message to assert the new strategic equation: That any Israeli attack on Iran or its personnel will result in retribution from Iran into Israel.

This act of setting the new “balance of power equation” unites the diverse Fronts against the US’ “connivance with Israeli actions in the Middle East, that are at the core of Washington’s policy – and in many ways the root-cause of new tragedies” – in the words of Russian Foreign Minister, Sergey Ryabkov.

The equation represents a key “Front” – together with Russia’s war against NATO in Ukraine – for persuading the West that its exceptionalist and redemptive myth has proved to be a fatal conceit; that it must be discarded; and that deep cultural change in the West needs to happen.

The roots to this wider cultural conflict are deep – but finally have been made explicit.

Prince Bandar’s post-2006 playing of the Sunni “card” was a flop (in no small part thanks to Russia’s intervention in Syria). AndIran, has come in from the cold and is firmly anchored as a primary regional power. It is the strategic partner to Russia and China. And Gulf States today have switched focus instead to money, “business” and Tech, rather than Salafist jurisprudence.

Syria, then targeted by the West and ostracised, has not only survived all that the West could “throw at it” but has been warmly embraced by the Arab League and rehabilitated. And Syria is now slowly finding its way to being itself again.

Yet even during the Syrian crisis, unforeseen dynamics to Prince Bandar’s playing of Islamist identity versus Arab socialist secular identity were playing out:

I wrote then in 2012:

“Over recent years we have heard the Israelis emphasise their demand for recognition of a specifically Jewish nation-state, rather than for an Israeli State, per se”;

– a state that would enshrine Jewish political, legal, and military exceptional rights.

“[At that time] … Muslim nations [were] seeking the “undoing” of the last remnants of the colonial era. Will we see the struggle increasingly epitomised as a primordial struggle between Jewish and Islamic religious symbols – between al-Aqsa and the Temple Mount?”

To be plain, what was apparent even then – in 2012 – was “that both Israel and its surrounding terrain are marching in step toward language which takes them far away from the underlying, largely secular concepts by which this conflict traditionally has been conceptualised. What [would] be the consequence – as the conflict, by its own logic, becomes a clash of religious poles?”

If, twelve years ago, the protagonists were explicitly moving away from the underlying secular concepts by which the West conceptualised the conflict, we, by contrast, are still trying to understand the Israeli-Palestinian conflict through the lens of secular, rationalist concepts – even as Israel quite evidently is seized by an increasingly Apocalyptic frenzy.

And by extension, we are stuck in trying to address the conflict through our habitual utilitarian, rationalist policy tool-set. And we wonder why it is not working. It is not working because all parties have moved beyond mechanical rationalism to a different plane.

The Conflict Becomes Eschatalogical

Last year’s election in Israel saw a revolutionary change: The Mizrahim walked into the Prime Minister’s office. These Jews coming from the Arab and North African sphere – now possibly the majority – and, with their political allies on the right, embraced a radical agenda: To complete the founding of Israel on the Land of Israel (i.e. no Palestinian State); to build the Third Temple (in place of Al-Aqsa); and to institute Halachic Law (in place of secular law).

None of this is what might be termed “secular” or liberal. It was intended as the revolutionary overthrow of the Ashkenazi élite. It was Begin who tied the Mizrahi firstly to the Irgun and then to Likud. The Mizrahim now in power have a vision of themselves as the true representatives of Judaism, with the Old Testament as their blueprint. And condescend to the European Ashkenazi liberals.

If we think we can put Biblical myths and injunctions behind us in our secular age – where much of contemporary western thinking makes a point of ignoring such dimensions, dismissing them as either confused, or irrelevant – we would be mistaken.

As one commentator writes:

At every turn, political figures in Israel now soak their proclamations in Biblical reference and allegory. The foremost of which [is] Netanyahu … You must remember what Amalek has done to you, says our Holy Bible, and we do remember – and we are fighting…’Here [Netanyahu] not only invokes the prophecy of Isaiah, but frames the conflict as that of “light” versus “darkness’ and good versus evil, painting the Palestinians as the Children of Darkness to be vanquished by the Chosen Ones: The Lord ordered King Saul to destroy the enemy and all his people: ‘Now go and defeat Amalek and destroy all that he has; and give him no mercy; but put to death both husband and wife; from youth to infant; from ox to sheep; from camel to donkey’ (15:3).

We might term this “hot eschatology” – a mode that is running wild amongst the young Israeli military cadres, to the point that the Israeli high command is losing control on the ground (lacking any mid-layer NCO (Non-Commissioned Officer) class).

On the other hand –

The uprising launched from Gaza is not called Al-Aqsa Flood for nothing. Al-Aqsa is both a symbol of a storied Islamic civlisation, and it is also the bulwark against the building of the Third Temple, for which preparations are underway. The point here is that Al-Aqsa represents Islam in aggregate — neither Shi’i, nor Sunni, nor ideological Islam.

Then, at another level, we have, as it were, “dispassionate eschatology”: When Yahyah Sinwar writes of “Victory or Martyrdom”for his people in Gaza; when Hizbullah speaks of sacrifice; and when the Iranian Supreme Leader speaks of Hussain bin Ali (the grandson of the Prophet) and some 70 companions in 680 CE, standing before inexorable slaughter against an 1,000 strong army, in the name of Justice, these sentiments simply are beyond the reach of western Utilitarian comprehension.

We cannot easily rationalise the latter “way of being” in western modes of thought. However, as Hubert Védrine, France’s former Foreign Minister, observes – though titularly secular – the West nonetheless is “consumed by the spirit of proselytism.” That Saint Paul’s “go and evangelize all nations” has become “go and spread human rights to all the world”… And that this proselytism is extremely deep in [western DNA]: “Even the very least religious, totally atheists, they still have this in mind, [even though] they don’t know where it comes from.”

We might term this secular eschatology, as it were. It is certainly consequential.

A Military Revolution: We’re Ready Now

Iran, through all the West’s attrition, has pursued its astute strategy of “strategic patience” – keeping conflicts away from its borders. A strategy that focused heavily on diplomacy and trade; and soft power to engage positively with near and far neighbors alike.

Behind this quietist front of stage, however, lay the evolution to “active deterrence” which required long military preparation and the nurturing of allies.

Our understanding of the world became antiquated

Just occasionally, very occasionally, a military revolution can upend the prevailing strategic paradigm. This was Qasem Suleimani’s key insight. This is what “active deterrence” implies. The switch to a strategy that could upend prevailing paradigms.

Both Israel and the US have armies that are conventionally far more powerful than their adversaries which are mostly composed of small non-state rebels or revolutionaries. The latter are treated more as mutineers within the traditionalist colonial framing, and for whom a whiff of firepower generally is considered sufficient.

The West, however, has not fully assimilated the military revolutions now underway. There has been a radical shift in the balance of power between low-tech improvisation and expensive complex (and less robust) weapons platforms.

The Additional Ingredients

What makes Iran’s new military approach truly transformative have been two additional factors: One was the appearance of an outstanding military strategist (now assassinated); and secondly, his ability to mix and apply these new tools in a wholly novel matrix. The fusion of these two factors – together with low-tech drones and cruise missiles – completed the revolution.

The philosophy driving this military strategy is clear: the West is over-invested in air dominance and in its carpet fire power. It prioritises “shock and awe” thrusts, but quickly exhausts itself early in the encounter. This rarely can be sustained for long. The Resistance aim is to exhaust the enemy.

The second key principle driving this new military approach concerns the careful calibration of the intensity of conflict, upping and lowering the flames as appropriate; and, at the same time, keeping escalatory dominance within the Resistance’s control.

In Lebanon, in 2006, Hizbullah remained deep underground whilst the Israeli air assault swept across overhead. The physical surface damage was huge, yet their forces were unaffected and emerged from deep tunnels – only afterwards. Then came the 33 days of Hizbullah’s missile barrage – until Israel called it quits.

So, is there any strategic point to an Israeli military response to Iran?

Israelis widely believe that without deterrence – without the world fearing them – they cannot survive. October 7 set this existential fear burning through Israeli society. Hezbollah’s very presence only exacerbates it – and now Iran has rained missiles down into Israel directly.

The opening of the Iranian front, in a certain way, initially may have benefited Netanyahu: the IDF defeat in the Gaza war; the hostage release impasse; the continuing displacement of Israelis from the north; and even the murder of the World Kitchen aid workers – all are temporarily forgotten. The West has grouped at Israel’s – and Netanyahu’s – side again. Arab states are again co-operating. And attention has moved from Gaza to Iran.

So far, so good (from Netanyahu’s perspective, no doubt). Netanyahu has been angling to draw the US into war with Israel against Iran for two decades (albeit with successive US Presidents declining the dangerous prospect).

But to cut Iran down to size would require US military assistance.

Netanyahu senses Biden’s weakness and has the tools and knowhow by which he can manipulate US politics: Indeed, worked in this way, Netanyahu might force Biden to continue to arm Israel, and even to embrace his widening of the war to Hizbullah in Lebanon.

Conclusion

Israel’s strategy from past decades will continue with its hope of achieving some Chimeric transformative “de-radicalisation” of Palestinians that will make “Israel safe.”

A former Israeli Ambassador to the US argues that Israel can have no peace without such “transformative de-radicalisation.” “If we do it right,” Ron Dermer insists, “it will make Israel stronger – and the US too.” It is in this context that the War Cabinet’s insistence on retaliation against Iran should be understood.

Rational argument advocating moderation is read as inviting defeat.

All of which is to say that Israelis are psychologically very far from being able to reconsider the content to the Zionist project of Jewish special rights. For now, they are on a completely different path, trusting to a Biblical reading that many Israelis have come to view as mandatory injunctions under Halachic Law.

Hubert Védrine asks us the supplementary question: “Can we imagine a West that manages to preserve the societies it has birthed – and yet “is not proselytizing, not-interventionist? In other words, a West that can accept alterity, that can live with others – and accept them for who they are.”

Védrine says this “is not a problem of the diplomatic machines: it’s a question of profound soul-searching, a deep cultural change that needs to happen in western society.”

A “trial of strength” between Israel and the Resistance Fronts ranged against it likely cannot be avoided.

The die has been deliberately cast this way.

Netanyahu is gambling big with Israel’s – and America’s – future. And he may lose.

If there is a regional war, and Israel suffers defeat, then what?

When exhaustion (and defeat) finally settles in, and the parties “scrabble in the drawer” for new solutions to their strategic distress, the truly transformative solution would be for an Israeli leader to think the “unthinkable” – to think of one state between the River and the Sea.

And, for Israel – tasting the bitter herbs of “things fallen apart” – to talk directly with Iran.

Reprinted with permission from Strategic Culture Foundation.

-

Site: Mises Institute

-

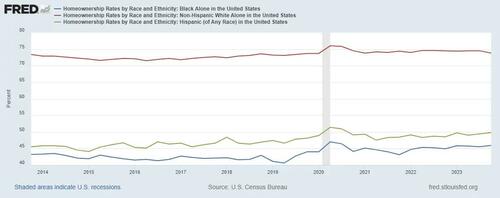

Site: Zero HedgeBiden's America: 40% Of Renters Think They'll Never Own A Home, Up From 27% Last YearTyler Durden Tue, 04/23/2024 - 09:40

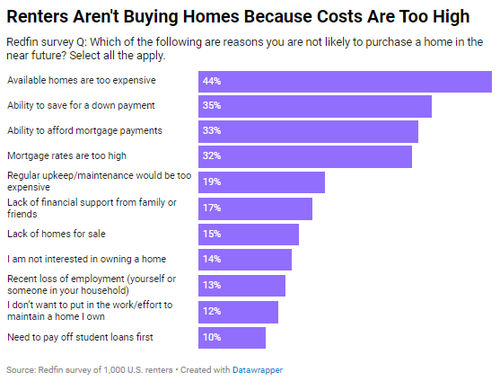

Bidenomics 101: the American dream of owning a home has become the American nightmare for almost half the US population.

As housing specialist Redfin reports, rising home prices and mortgage rates "are making it harder to believe in the American dream of homeownership. Lack of affordability is the most commonly cited reason renters don’t believe they’ll ever own a home."

The details are dire: Nearly two in five (38%) U.S. renters don’t believe they’ll ever own a home, up from roughly one-quarter (27%) less than a year ago.

This is according to a Redfin-commissioned survey of roughly 3,000 U.S. residents conducted by Qualtrics in February 2024. This report focuses on the 1,000 respondents who indicated they are renters. The relevant questions were: “Do you believe that you will ever own your own home in the future?” and “Which of the following are reasons you aren’t likely to purchase a home in the near future?” The 27% comparison is from a Redfin survey conducted in May and June 2023.

Lack of affordability is the prevailing reason renters believe they’re unlikely to become homeowners. Nearly half (44%) of renters who don’t believe they’ll buy a home in the near future said it’s because available homes are too expensive. The next most common obstacles: Ability to save for a down payment (35%), ability to afford mortgage payments (33%) and high mortgage rates (32%). Roughly one in eight (14%) simply aren’t interested in owning a home.

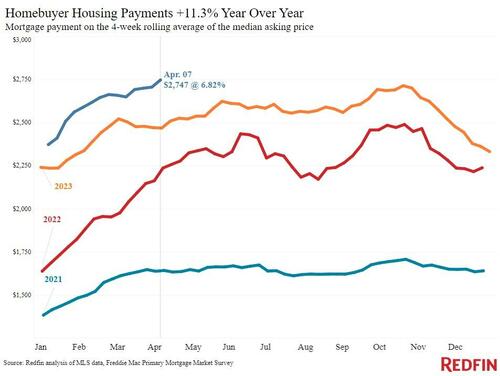

Buying a home has become increasingly out of reach for many Americans due to the one-two punch of high home prices and high mortgage rates. First-time homebuyers must earn roughly $76,000 to afford the typical U.S. starter home, up 8% from a year ago and up nearly 100% from before the pandemic, according to a recent Redfin analysis. Home prices have skyrocketed more than 40% since 2019, due to the pandemic homebuying frenzy and a shortage of homes for sale. And the current average 30-year fixed mortgage rate is 6.82%. While that’s below the 23-year-high of nearly 8% hit in October, it’s still more than double the record low rates dropped to in 2020.

Home prices have risen 7% in the last year alone, and monthly mortgage payments have risen more than 10%, which helps explain why renters today are more likely than they were last year to say they don’t see themselves owning a home anytime soon.

Many renters can’t fathom homeownership because they’re already struggling to afford their monthly housing costs. Nearly one-quarter (24%) of renters say they regularly struggle to afford their housing payments, and an additional 45% say they sometimes struggle to do so.

Rents have soared over the last few years because so many people moved during the pandemic, upping demand for rentals. The median U.S. asking rent is roughly $2,000, near the record high hit in 2022–but the good news for renters is that prices aren’t growing nearly as fast as they were during the pandemic, partly because an influx of apartment supply is taking some of the heat off prices.

“Housing costs are high across the board, but renting is a more affordable and realistic option for many Americans right now–especially those who have never owned a home and aren’t able to tap into equity from a previous sale,” said Redfin Chief Economist Daryl Fairweather. “While owning a home is usually a sound longterm investment, the barriers to entry and upfront costs of buying are higher than renting. Buying typically requires a sizable down payment and approval for a mortgage–things that are difficult for many people today, when the typical down payment is near $60,000 and mortgage payments are sky-high. The sheer expense of purchasing a home is causing the American Dream of homeownership to lose some of its shine.”

Gen Z renters are most likely to believe they’ll own a home

Broken down by generation, Gen Z renters are by far the most likely to believe they will become homeowners (maybe it's because they are also the dumbest). Just 8% of Gen Z renters believe they’ll never own a home, compared to 22% of millennials, 40% of Gen Xers and 81% of baby boomers.

-

Site: Zero HedgeBiden's America: 40% Of Renters Think They'll Never Own A Home, Up From 27% Last YearTyler Durden Tue, 04/23/2024 - 09:40

Bidenomics 101: the American dream of owning a home has become the American nightmare for almost half the US population.

As housing specialist Redfin reports, rising home prices and mortgage rates "are making it harder to believe in the American dream of homeownership. Lack of affordability is the most commonly cited reason renters don’t believe they’ll ever own a home."

The details are dire: Nearly two in five (38%) U.S. renters don’t believe they’ll ever own a home, up from roughly one-quarter (27%) less than a year ago.

This is according to a Redfin-commissioned survey of roughly 3,000 U.S. residents conducted by Qualtrics in February 2024. This report focuses on the 1,000 respondents who indicated they are renters. The relevant questions were: “Do you believe that you will ever own your own home in the future?” and “Which of the following are reasons you aren’t likely to purchase a home in the near future?” The 27% comparison is from a Redfin survey conducted in May and June 2023.

Lack of affordability is the prevailing reason renters believe they’re unlikely to become homeowners. Nearly half (44%) of renters who don’t believe they’ll buy a home in the near future said it’s because available homes are too expensive. The next most common obstacles: Ability to save for a down payment (35%), ability to afford mortgage payments (33%) and high mortgage rates (32%). Roughly one in eight (14%) simply aren’t interested in owning a home.

Buying a home has become increasingly out of reach for many Americans due to the one-two punch of high home prices and high mortgage rates. First-time homebuyers must earn roughly $76,000 to afford the typical U.S. starter home, up 8% from a year ago and up nearly 100% from before the pandemic, according to a recent Redfin analysis. Home prices have skyrocketed more than 40% since 2019, due to the pandemic homebuying frenzy and a shortage of homes for sale. And the current average 30-year fixed mortgage rate is 6.82%. While that’s below the 23-year-high of nearly 8% hit in October, it’s still more than double the record low rates dropped to in 2020.

Home prices have risen 7% in the last year alone, and monthly mortgage payments have risen more than 10%, which helps explain why renters today are more likely than they were last year to say they don’t see themselves owning a home anytime soon.

Many renters can’t fathom homeownership because they’re already struggling to afford their monthly housing costs. Nearly one-quarter (24%) of renters say they regularly struggle to afford their housing payments, and an additional 45% say they sometimes struggle to do so.

Rents have soared over the last few years because so many people moved during the pandemic, upping demand for rentals. The median U.S. asking rent is roughly $2,000, near the record high hit in 2022–but the good news for renters is that prices aren’t growing nearly as fast as they were during the pandemic, partly because an influx of apartment supply is taking some of the heat off prices.

“Housing costs are high across the board, but renting is a more affordable and realistic option for many Americans right now–especially those who have never owned a home and aren’t able to tap into equity from a previous sale,” said Redfin Chief Economist Daryl Fairweather. “While owning a home is usually a sound longterm investment, the barriers to entry and upfront costs of buying are higher than renting. Buying typically requires a sizable down payment and approval for a mortgage–things that are difficult for many people today, when the typical down payment is near $60,000 and mortgage payments are sky-high. The sheer expense of purchasing a home is causing the American Dream of homeownership to lose some of its shine.”

Gen Z renters are most likely to believe they’ll own a home

Broken down by generation, Gen Z renters are by far the most likely to believe they will become homeowners (maybe it's because they are also the dumbest). Just 8% of Gen Z renters believe they’ll never own a home, compared to 22% of millennials, 40% of Gen Xers and 81% of baby boomers.

-

Site: LifeNews

Independent presidential candidate Robert F. Kennedy Jr. just released a new policy platform on abortion titled, “More Choices, More Life.”

“Abortion is one of the most divisive issues in American politics,” states Kennedy’s official campaign webpage on abortion. “We’ve been offered two positions — pro-life and pro-choice — with hardly any room between or outside them.”

Kennedy’s campaign claims that his proposed abortion policy “will dramatically reduce abortion in this country, and it will do so by offering more choices for women and families, not less.”

The policy clarifies that a Kennedy administration would seek to “make it easier for women to choose life.”

In order to accomplish this goal, the policy seeks to “make our society as welcoming as possible to children and to motherhood.”

“The centerpiece of More Choices, More Life is a massive subsidized daycare initiative,” the policy continues:

We will safeguard women’s reproductive rights while redirecting the funds being spent on the war in Ukraine to subsidize community- and home-based daycares, along with stay-at-home parents. Instead of padding the pockets of our weapons manufacturers, we will pay 100% of care for the three million children under five who live beneath our poverty line. And we will cap the cost at 10% of family income for everyone else.

“[W]e will also strengthen our adoption infrastructure to make it the best in the world,” the policy platform goes on to state. “We will increase the child tax credit, and we will fund sanctuaries for women in need to have babies, places like Angie’s House where they get support not just in pregnancy and birth but also in those precious months afterwards.”

REACH PRO-LIFE PEOPLE WORLDWIDE! Advertise with LifeNews to reach hundreds of thousands of pro-life readers every week. Contact us today.

“That way, [women’s] only ‘choice’ isn’t abortion,” the policy indicates. “They have another choice, a viable choice to give birth.”

Kennedy’s campaign adds that the proposed policy “won’t end the debate, but it offers a way forward that most Americans can support.”

CatholicVote President Brian Burch issued a statement in reaction to the announced platform.

“RFK Jr.’s abortion policy offers a stark contrast to the ‘shout your abortion’ extremism coming from the Biden campaign,” Burch said.

“While RFK Jr. is wrong for pledging to continue to protect the ‘right’ to destroy innocent lives, he deserves credit for not ducking the need to help women choose life,” he continued.

“Abortion is not simply a state’s rights issue,” the CatholicVote president pointed out. “The federal government does indeed have a role in helping to reduce abortion by empowering pregnant mothers to keep their children.”

“[Kennedy] also deserves credit for recognizing the unique role of stay at home parents by proposing that any day-care subsidies equally apply to mothers or fathers who choose to stay home to raise their children,” Burch outlined.

“Kennedy’s position, while problematic in principle, aims in the right direction,” he concluded. “Abortion is always a tragic choice, and we must do everything we can to help as many women as possible choose life.”

Kennedy is a self-professed Catholic.

LifeNews Note: Joshua Mercer writes for CatholicVote, where this column originally appeared.

The post Robert Kennedy Jr Releases New Abortion Policy Supporting Abortions Up to Birth appeared first on LifeNews.com.

-

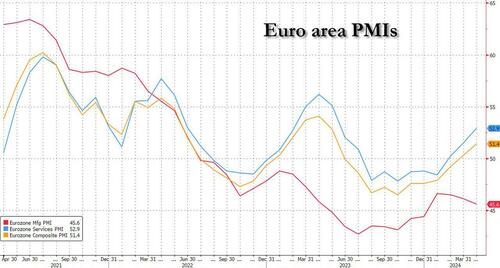

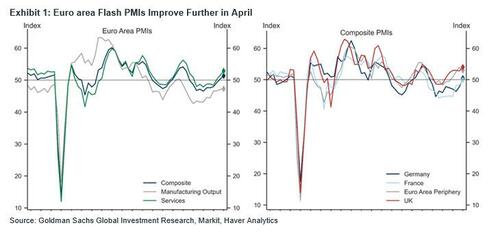

Site: Zero HedgeEuro Area PMI Activity Hits 11 Month High On Service Expansion As Manufacturing Recession Gets WorseEuro Area PMI Activity Hits 11 Month High On Service Expansion As Manufacturing Recession Gets WorseTyler Durden Tue, 04/23/2024 - 09:30

Europe's study in paradoxical contrasts continues. On the same day, ECB's de Guindos said a June rate cut looks like a set deal (unless there are surprises) with the end of inflation fight is in sight, the Euro-area's private-sector activity advanced to the highest level since May 2023, driven by a buoyant services sector and Germany's return to growth; UK firms also reported the strongest growth in almost a year

Here are the details:

France

- Services Flash PMI (Apr) 50.5 vs. Exp. 49.0 (Prev. 48.3);

- Manufacturing Flash PMI (Apr) 44.9 vs. Exp. 47.0 (Prev. 46.2);

- Composite Flash PMI (Apr) 49.9 vs. Exp. 48.8 (Prev. 48.3);

- "Overall, our HCOB nowcast model for the second quarter points to a recovery of the French economy, driven by the services sector".

Germany

- Manufacturing Flash PMI (Apr) 42.2 vs. Exp. 42.9 (Prev. 41.9);

- Services Flash PMI (Apr) 53.3 vs. Exp. 50.5 (Prev. 50.1);

- Composite Flash PMI (Apr) 50.5 vs. Exp. 48.6 (Prev. 47.7);

- "Factoring in the PMI numbers into our GDP Nowcast, we estimate that GDP may expand by 0.2%".

UK

- Services PMI (Apr) 54.9 vs. Exp. 53.0 (Prev. 53.1);

- Manufacturing PMI (Apr) 48.7 vs. Exp. 50.4 (Prev. 50.3);

- Flash Composite PMI (Apr) 54.0 vs. Exp. 52.7 (Prev. 52.8)

Euro-Area

- Services Flash PMI (Apr) 52.9 vs. Exp. 51.8 (Prev. 51.5);

- Manufacturing Flash PMI (Apr) 45.6 vs. Exp. 46.6 (Prev. 46.1);

- Composite Flash PMI (Apr) 51.4 vs. Exp. 50.8 (Prev. 50.3);

- "Considering various factors including the HCOB PMIs, our GDP forecast suggests a 0.3% expansion in the second quarter".

Putting it all together, the Euro area composite flash PMI increased by 1pt to 51.4 in April, above the 50.7 consensus estimate, in expansion (>50) for the second straight month and the highest since May 2023. As shown in the chart below, the improvement in the composite index was skewed heavily towards the services sector, where the index rose (by 1.4pt) to 52.9, while the manufacturing PMI continued to sink.

Across countries, the improvement in the area-wide index was driven by Germany - which was above that key 50 expansion mark for the first time in 10 months driven by services (even as manufacturing continued to shrink, though at a slower pace than the month before) defying analysts who had expected another sub-par reading - and France, partially offset by a slight deceleration in the periphery.

In the UK, the composite flash PMI improved notably to 54.0, above consensus expectations of a decline, on the back of a pick-up in services activity, where the index grew by 1.8pt to 54.9, which was partly offset by a slowdown in manufacturing activity.

Commenting on the results, Goldman saw three main takeaways from today's data.

- First, there are continued improvement in the Euro area headline numbers, coupled with continued, but moderating, optimism for the upcoming year.

- Second, the PMI price components ticked up in April, driven by both sectors, with the risks to cost inflation coming from higher wages and oil prices.

- Lastly, the UK saw another month of expanding activity, also driven by the services sector, which should support growth momentum going forward.

While output prices ticked up only marginally in both the Euro area and the UK, it is important that firms' pricing behavior remains supportive for the disinflationary process, Goldman's economists noted.

The positive figures suggest that the euro area will probably expand by 0.3% in the second quarter, matching the rate of growth in the January-March period, said Cyrus de la Rubia, chief economist at Hamburg Commercial Bank. That’s a more upbeat prediction than the Bloomberg consensus, which sees just 0.1% growth at the start of the year, with data due on April 30.

“It appears that the recession was predominantly concentrated within the manufacturing sector, while the broader economy may have narrowly skirted such a downturn,” de la Rubia said. “The service sector may serve as a catalyst for the overall economy.”

After contracting in the final quarter of last year, Germany was long expected to have had a shallow recession over the winter. But the Bundesbank last week said output may have grown slightly in the first three months of the year because of a pickup in industrial production, exports and construction — meaning the country would avoid such a scenario.

De la Rubia agreed, saying a Nowcast model points to economic expansion of 0.1% in the first quarter followed by 0.2% in the second. German bonds fell across the curve and money markets reduced wagers on the scope for interest-rate cuts after data for the country were published. The two-year maturity, which is sensitive to changes in monetary policy, rose as much as three basis points to 2.99%.

The overall performance was also better in France, where activity remained broadly stable after contracting for 10 months. That development was also driven by services, where rising demand resulted in the first expansion in almost a year. New orders placed with factories fell at the steepest pace since January, increasing the wedge between manufacturers and services firms.

“The French services sector is the workhorse of the economy,” said Norman Liebke, an economist at Hamburg Commercial Bank. “French manufacturing output stays subdued, but we expect it will soon follow the path of the services sector. The manufacturing sector delays the overall economy’s recovery for now, though.”

But the better momentum in both countries was flanked by stronger price pressures, which as Bloomberg notes is a potential source of concern for European Central Bank officials who are gearing up for a first interest-rate cut in June. That development was also centered on the services sector, where rising wages are playing a bigger role. Diverging fortunes were equally visible in the labor market. While German and French services firms added workers at a quicker pace, factories shed jobs.

Overall though, the currency bloc’s top two economies couldn’t keep pace with the rest of the region, which appears to be recovering after the energy crisis that stifled its post-Covid rebound.

The rise in power costs — triggered by Russia’s war in Ukraine — also fanned inflation, though consumer-price growth has since slowed markedly. The purchasing-manager data showed that price pressures “intensified slightly” this month.

“The PMI figures are poised to test the ECB’s willingness to cut interest rates in June,” de la Rubia said. “Accelerated increases in input costs, likely driven not only by higher oil prices but also, more concerningly, by higher wages, are a cause for scrutiny. Concurrently, service-sector companies have raised their prices at a faster rate than in March, fueling expectations that services inflation will persist.”

Still, he doesn’t expect that to derail a well-telegraphed easing at the ECB’s next monetary-policy meeting. “However, we doubt that the central bank will adopt a ‘pragmatic speed,’ as suggested by Francois Villeroy de Galhau” de la Rubia said. “Instead, we expect a more cautious approach.”

As noted above, comments by ECB Vice President Luis de Guindos earlier on Tuesday reinforce that approach. “The level of uncertainty makes it very difficult to say,” he told Le Monde, according to a transcript on the ECB website. “I already mentioned June. As for what happens afterwards, I’m inclined to be very cautious.”

A separate set of data for the UK showed the economy’s recovery from recession unexpectedly gathered pace at the start of the second quarter as private-sector firms reported the strongest growth in almost a year. PMIs are closely watched by markets as they arrive early in the month and are good at revealing trends and turning points in an economy. A measure of breadth of changes in output rather than depth, business surveys can sometimes be difficult to map directly to quarterly GDP.

US figures later are set to show continued growth. Earlier numbers from Australia, India and Japan pointed to faster expansion.

-

Site: Zero HedgeEuro Area PMI Activity Hits 11 Month High On Service Expansion As Manufacturing Recession Gets WorseEuro Area PMI Activity Hits 11 Month High On Service Expansion As Manufacturing Recession Gets WorseTyler Durden Tue, 04/23/2024 - 09:30

Europe's study in paradoxical contrasts continues. On the same day, ECB's de Guindos said a June rate cut looks like a set deal (unless there are surprises) with the end of inflation fight is in sight, the Euro-area's private-sector activity advanced to the highest level since May 2023, driven by a buoyant services sector and Germany's return to growth; UK firms also reported the strongest growth in almost a year

Here are the details:

France

- Services Flash PMI (Apr) 50.5 vs. Exp. 49.0 (Prev. 48.3);

- Manufacturing Flash PMI (Apr) 44.9 vs. Exp. 47.0 (Prev. 46.2);

- Composite Flash PMI (Apr) 49.9 vs. Exp. 48.8 (Prev. 48.3);

- "Overall, our HCOB nowcast model for the second quarter points to a recovery of the French economy, driven by the services sector".

Germany

- Manufacturing Flash PMI (Apr) 42.2 vs. Exp. 42.9 (Prev. 41.9);

- Services Flash PMI (Apr) 53.3 vs. Exp. 50.5 (Prev. 50.1);

- Composite Flash PMI (Apr) 50.5 vs. Exp. 48.6 (Prev. 47.7);

- "Factoring in the PMI numbers into our GDP Nowcast, we estimate that GDP may expand by 0.2%".

UK

- Services PMI (Apr) 54.9 vs. Exp. 53.0 (Prev. 53.1);

- Manufacturing PMI (Apr) 48.7 vs. Exp. 50.4 (Prev. 50.3);

- Flash Composite PMI (Apr) 54.0 vs. Exp. 52.7 (Prev. 52.8)

Euro-Area

- Services Flash PMI (Apr) 52.9 vs. Exp. 51.8 (Prev. 51.5);

- Manufacturing Flash PMI (Apr) 45.6 vs. Exp. 46.6 (Prev. 46.1);

- Composite Flash PMI (Apr) 51.4 vs. Exp. 50.8 (Prev. 50.3);

- "Considering various factors including the HCOB PMIs, our GDP forecast suggests a 0.3% expansion in the second quarter".

Putting it all together, the Euro area composite flash PMI increased by 1pt to 51.4 in April, above the 50.7 consensus estimate, in expansion (>50) for the second straight month and the highest since May 2023. As shown in the chart below, the improvement in the composite index was skewed heavily towards the services sector, where the index rose (by 1.4pt) to 52.9, while the manufacturing PMI continued to sink.

Across countries, the improvement in the area-wide index was driven by Germany - which was above that key 50 expansion mark for the first time in 10 months driven by services (even as manufacturing continued to shrink, though at a slower pace than the month before) defying analysts who had expected another sub-par reading - and France, partially offset by a slight deceleration in the periphery.

In the UK, the composite flash PMI improved notably to 54.0, above consensus expectations of a decline, on the back of a pick-up in services activity, where the index grew by 1.8pt to 54.9, which was partly offset by a slowdown in manufacturing activity.

Commenting on the results, Goldman saw three main takeaways from today's data.

- First, there are continued improvement in the Euro area headline numbers, coupled with continued, but moderating, optimism for the upcoming year.

- Second, the PMI price components ticked up in April, driven by both sectors, with the risks to cost inflation coming from higher wages and oil prices.

- Lastly, the UK saw another month of expanding activity, also driven by the services sector, which should support growth momentum going forward.

While output prices ticked up only marginally in both the Euro area and the UK, it is important that firms' pricing behavior remains supportive for the disinflationary process, Goldman's economists noted.

The positive figures suggest that the euro area will probably expand by 0.3% in the second quarter, matching the rate of growth in the January-March period, said Cyrus de la Rubia, chief economist at Hamburg Commercial Bank. That’s a more upbeat prediction than the Bloomberg consensus, which sees just 0.1% growth at the start of the year, with data due on April 30.

“It appears that the recession was predominantly concentrated within the manufacturing sector, while the broader economy may have narrowly skirted such a downturn,” de la Rubia said. “The service sector may serve as a catalyst for the overall economy.”

After contracting in the final quarter of last year, Germany was long expected to have had a shallow recession over the winter. But the Bundesbank last week said output may have grown slightly in the first three months of the year because of a pickup in industrial production, exports and construction — meaning the country would avoid such a scenario.

De la Rubia agreed, saying a Nowcast model points to economic expansion of 0.1% in the first quarter followed by 0.2% in the second. German bonds fell across the curve and money markets reduced wagers on the scope for interest-rate cuts after data for the country were published. The two-year maturity, which is sensitive to changes in monetary policy, rose as much as three basis points to 2.99%.

The overall performance was also better in France, where activity remained broadly stable after contracting for 10 months. That development was also driven by services, where rising demand resulted in the first expansion in almost a year. New orders placed with factories fell at the steepest pace since January, increasing the wedge between manufacturers and services firms.

“The French services sector is the workhorse of the economy,” said Norman Liebke, an economist at Hamburg Commercial Bank. “French manufacturing output stays subdued, but we expect it will soon follow the path of the services sector. The manufacturing sector delays the overall economy’s recovery for now, though.”

But the better momentum in both countries was flanked by stronger price pressures, which as Bloomberg notes is a potential source of concern for European Central Bank officials who are gearing up for a first interest-rate cut in June. That development was also centered on the services sector, where rising wages are playing a bigger role. Diverging fortunes were equally visible in the labor market. While German and French services firms added workers at a quicker pace, factories shed jobs.

Overall though, the currency bloc’s top two economies couldn’t keep pace with the rest of the region, which appears to be recovering after the energy crisis that stifled its post-Covid rebound.

The rise in power costs — triggered by Russia’s war in Ukraine — also fanned inflation, though consumer-price growth has since slowed markedly. The purchasing-manager data showed that price pressures “intensified slightly” this month.

“The PMI figures are poised to test the ECB’s willingness to cut interest rates in June,” de la Rubia said. “Accelerated increases in input costs, likely driven not only by higher oil prices but also, more concerningly, by higher wages, are a cause for scrutiny. Concurrently, service-sector companies have raised their prices at a faster rate than in March, fueling expectations that services inflation will persist.”

Still, he doesn’t expect that to derail a well-telegraphed easing at the ECB’s next monetary-policy meeting. “However, we doubt that the central bank will adopt a ‘pragmatic speed,’ as suggested by Francois Villeroy de Galhau” de la Rubia said. “Instead, we expect a more cautious approach.”

As noted above, comments by ECB Vice President Luis de Guindos earlier on Tuesday reinforce that approach. “The level of uncertainty makes it very difficult to say,” he told Le Monde, according to a transcript on the ECB website. “I already mentioned June. As for what happens afterwards, I’m inclined to be very cautious.”

A separate set of data for the UK showed the economy’s recovery from recession unexpectedly gathered pace at the start of the second quarter as private-sector firms reported the strongest growth in almost a year. PMIs are closely watched by markets as they arrive early in the month and are good at revealing trends and turning points in an economy. A measure of breadth of changes in output rather than depth, business surveys can sometimes be difficult to map directly to quarterly GDP.

US figures later are set to show continued growth. Earlier numbers from Australia, India and Japan pointed to faster expansion.

-

Site: Ron Paul Institute - Featured Articles

Russia’s free running in the Ukraine war in the most recent months is about to end as the Biden Administration has met with success, finally, in the US Congress on the long-stalled Ukraine aid bill. The aid approved by the House on Saturday would send $60.8 billion to Ukraine.

Senate approval is expected as soon as Tuesday. President Biden has promised, “I will immediately sign this law to send a signal to the whole world: we support our friends and will not allow Iran or Russia to succeed,”

To be sure, the US is doubling down to frustrate Russia’s perceived plans for an outright Russian military victory in Ukraine through this year. Unsurprisingly, Washington’s transatlantic allies are also rallying, which is the message coming out of the virtual meeting of the NATO-Ukraine Council at the level of Allied Defence Ministers chaired by Secretary-General Jens Stoltenberg at Brussels on Saturday.

The sense of relief in Kiev is palpable with President Volodymyr Zelenskyy telling NBC, “I think this support will really strengthen the armed forces of Ukraine, and we will have a chance for victory.” He said the US lawmakers moved to keep “history on the right track.”

On the other hand, the Russian foreign ministry reaction has been rather polemical — as if Moscow was anticipating the development. What seems to perturb Moscow most in the US aid bill is the thinking favouring the confiscation of frozen Russian assets to fund Ukraine, which, the Kremlin spokesman Dmitry Peskov singled out “because this is essentially the destruction of all the foundations of the economic system. This is an encroachment on state property, on state assets and on private property. By no means should this be perceived as legal action — it is illegal. And accordingly, it will be subject to retaliatory actions and legal proceedings.”

Moscow would sense that the American intention is, first, to force the EU too onto a similar trajectory and thereby destroy whatever residual prospects remain for reconciliation between Russia and Europe for a long time to come; second, provide the wherewithal to ultimately utilise the Russian frozen assets to generate business for the US military-industrial complex; and, three, in geopolitical terms, create a precedent in any future showdown between the West and China.

Suffice to say, Moscow is right in estimating that in a longer term perspective, the 21st Century Peace through Strength Act, which was also passed by the US House of Representatives with a bipartisan vote of 360-58 on Saturday empowering empowering the US executive branch to seize and transfer frozen Russian assets held in the US to Ukraine is fraught with consequences far more devastating than the $60 billion financial aid for Ukraine. Curiously, they complement each other too.

Make no mistake about the bipartisan consensus in the Congress in this regard. This is important to know as Donald Trump has apparently shed his ambivalence and decided to be supportive of the Ukraine aid bill. The meeting between Trump and the Republican House speaker Mike Johnson in the run-up to the vote in the House on Saturday would suggest that Johnson might not be ousted, after all, by his far-right House Republican colleagues.

Beijing understands the diabolical play perfectly well. A commentary in the Global Times on Sunday said, “If the bill [on Russian assets] ultimately becomes law and goes into effect, it will set a disastrous precedent against the existing international financial order.”

Of course, the Russian military moves going forward will be keenly watched. For, in such fluid circumstances, actions will speak better than words. At any rate, an inflection point has come since, evidently with an eye on Russian President Vladimir Putin’s forthcoming visit to Beijing, the Biden Administration is also shifting gear to explicitly threaten China for allegedly supporting the Russian defence industry. The US Secretary of State Antony Blinken is paying a 3-day visit to China on Wednesday.

Taken together, what emerges is that the Biden Administration is doubling down on the Ukraine war, contrary to earlier prognosis that war fatigue is setting in. Meanwhile, Pentagon spokesperson Maj. Gen. Pat Ryder has disclosed to Politico in a statement that the Biden Administration is considering sending additional military advisers to Ukraine, since “security conditions have evolved.”

These additional personnel “would not be in a combat role, but rather would advise and support the Ukrainian government and military.” The specific numbers of personnel remain confidential “for operational security and force protection reasons.” They will support logistics and oversight efforts for the weapons the US is sending Ukraine and “new contingent will also help the Ukrainian military with weapons maintenance.”

Indeed, the sophistry of non-combat role apart, what is in the cards is an incremental expansion of the US military presence in Ukraine, notwithstanding Biden’s repeated assertions that US troops wouldn’t participate in the war on Ukraine’s behalf, as doing so would increase the risk of a direct Russian-American military confrontation.

Citing sources, Politico further reported that “One of the tasks the advisers will tackle is helping the Ukrainians plan sustainment of complex equipment donated by the US as the summer fighting is expected to ramp up.”

How does the new US $60.75 billionaid package add up? It includes $23.2 billion intended to replenish US weapons stocks; $13.8 billion for the purchase of advanced weapons systems for Ukraine; and another $11.3 billion for “ongoing US military operations in the region.”

That is to say, in effect, the direct military assistance to Ukraine will actually amount to about $13.8 billion till end-2024. The Russian experts estimate that this allocation rules out another Ukrainian “counteroffensive.” But that is small comfort, since the increased flow of US weaponry will beef up the Ukrainian military capability to withstand the Russian offensive, which cannot but impact the present balance of forces at the front.

From a military angle, in immediate terms, the cutting edge of the aid bill lies in the fact that it opens the gateway for the transfer to Ukraine of tactical missile systems [ATACMS] capable of hitting targets at a distance of up to 300 km, which brings Crimea within its range. Reportedly, French troops are already on the ground in Odessa numbering 1000 and another contingent is expected shortly. This was of course forecast a few weeks ago by the Russian foreign intelligence but Paris had flatly denied it. (here and here)

The bottom line here is that the aid package aims on the one hand to avoid a catastrophic military situation arising at the front in the coming months, which could be politically damaging for Biden’s re-election bid, while on the other hand, the bulk of funds actually goes to the US arms manufacturers in some key “swing states” and gratifies the influential military-industrial complex and the Deep State.