Certainly, it is difficult to make the demands of the Gospel understandable to secularized people. But this pastoral difficulty must not lead to compromises with the truth.

Distinction Matter - Subscribed Feeds

-

Site: Catholic ConclaveArt performance causes a stir at the ceremonial opening of the special exhibition "775 – Westphalia" in PaderbornFederal President sees frozen chickens in diapers in front of the cathedral altarAn art performance in front of the Minister-President, Federal President, and Archbishop caused a stir following the ceremony marking the Westphalian anniversary in Paderborn. A half-naked Grim Reaper and Catholic Conclavehttp://www.blogger.com/profile/06227218883606585321noreply@blogger.com0

-

Site: OnePeterFive

I write this shortly before the 4th Sunday of Easter in the Vetus Ordo calendar, which is also the day when our new Pope will celebrate Mass (they call it a “Eucharistic Celebration”) for “the Beginning of the Pontificate of the Bishop of Rome Leo XIV” (18 May 2025). In the older traditional Missal there is a Votive Mass “in die coronationis Papae… on the day of the coronation of a Pope” used…

-

Site: RT - News

The US-led bloc reportedly wants Berlin to have a much larger army

NATO is urging Germany to significantly expand its military forces, Die Welt revealed on Saturday, citing sources. Officials in Berlin reportedly believe that the country, which is burdened by high dropout rates, will struggle to meet the proposed targets.

Read more

As NATO members are poised to convene for the July summit in The Hague, discussions about increasing national defense spending to 5% of GDP – a target the US reportedly insists on – and expanding troop numbers are expected to loom large on the agenda.

Germany, for its part, is facing “particular challenges,” including a proposal to increase the Bundeswehr’s personnel to between 240,000 and 260,000 soldiers by 2030, an increase of up to 80,000 troops from current levels of around 183,000, according to Welt. Germany could reintroduce military draft – defense minister

Germany could reintroduce military draft – defense minister

Difficulties with ballooning the military are exacerbated by high dropout rates among new recruits, with up to 30% leaving within the first six months, the paper says. Other factors contributing to attrition include harsh training, distant postings, and limited career prospects, as many potential soldiers view the private sector as a much more attractive option. In addition, some military branches reportedly resist accepting soldiers trained in other divisions.

The German paper also warned that if the Bundeswehr attempts to adopt the new target, “the debate about reactivating conscription is likely to flare up,” and the recruitment effort could be quite unpopular.

On Wednesday, Defense Minister Boris Pistorius signaled that if there are not enough volunteers Germany may need to revive conscription, which was abolished in 2011. In April, the Interior Ministry also proposed introducing civil defense lessons in schools to prepare students for potential crises and conflicts.This comes as a number of Western officials have claimed that Russia could launch an attack on NATO within several years. Moscow has repeatedly denied having such plans, dismissing the speculation as “nonsense.”

-

Site: Restore-DC-Catholicism

-

Site: RT - News

The US president has said he believes Washington and Moscow can end the conflict

Russian President Vladimir Putin would like to resolve the Ukraine conflict, his US counterpart, Donald Trump, has said. He added that he is certain Washington and Moscow will be able to make a deal and put an end to the hostilities.

On Friday, Russian and Ukrainian delegations held a meeting in Istanbul, which marked the first direct talks since 2022. Both sides agreed to exchange lists of conditions for a potential ceasefire, conduct a major prisoner swap, and discuss a follow-up meeting.

In a Fox News interview aired the same day, Trump pushed back against the notion that Putin does not want to engage in any kind of talks over Ukraine. “He is at the table, and he wanted this meeting,” the US president said, adding: “I think Putin is tired of this whole thing.”

According to Trump, however, his involvement is essential to a breakthrough in the peace process. “I always felt there can’t be a meeting without me because I don’t think a deal’s gonna get through,” he said.

Read more Topics discussed during Istanbul talks revealed

Topics discussed during Istanbul talks revealed

Nevertheless, he expressed optimism about the chances of reaching a settlement. “I have a very good relationship with Putin. I think we’ll make a deal. We have to get together, and I think we’ll probably schedule it.”

When pressed again on whether he sees Putin as an “obstacle to peace,” Trump shifted the focus to Ukraine’s Vladimir Zelensky. “I had a real rough session with Zelensky, because I didn’t like what he said. He was not making it easy… He doesn’t have the cards,” he said, explaining that Ukraine is fighting against a “massive army.”

Trump was apparently referring to a public spat with the Ukrainian leader during which he accused Zelensky of ingratitude for past US military aid and “gambling with World War III.”

The US president went on to criticize the policy of assisting Ukraine adopted by his predecessor, Joe Biden. “Every time… he [Zelensky] came to Washington, he walks out with $100 billion… I think he’s the greatest salesman in the world, far better than me,” Trump said, adding that Congress has grown frustrated with this as well.

The Ukrainian leader was initially reluctant to agree to the talks in Istanbul proposed by Russia without any conditions, insisting that they should be preceded by a 30-day ceasefire. Moscow has not ruled out the idea in principle, but said Kiev could use the pause to rebuild its battered military.

Despite initial pushback, Zelensky sent a delegation to Istanbul after Trump insisted that “Ukraine should agree to this immediately.”

-

Site: Steyn OnlineBritish gangster films never seemed as grand as their American counterparts, perhaps because the stakes never seemed comparable – what was running the rackets in a seaside holiday town (Brighton Rock) compared to doing the same thing in Chicago? If you lived in working class areas of London, Birmingham, Liverpool or Glasgow you knew exactly how established and pervasive organized crime could be, but to Americans films like The Lavender Hill Mob and The Ladykillers were all you needed to know about British gangsters. But something changed in Britain in the '60s that made a film like Get Carter possible...

-

Site: Steyn OnlineJust ahead of Episode Sixteen of Three Men on the Bummel, let me thank you for your many insightful comments on this latest Tale for Our Time. My remarks yesterday on the German state's micro-regulation of every aspect of life prompted this response from

-

Site: Steyn OnlineIn this week's episode, we have a Eurovisionish edition, but don't worry, it's from the days before Eurovision was either bouncy-bouncy boom-bang-a-bang or just screamingly camp. Plus the Continental Sinatra and a cavalcade of Non-Stop Number Ones...

-

Site: Zero HedgeNvidia CEO Sees "No Evidence" Of AI Chip Diversion To China As Trump Rolls Back RestrictionsTyler Durden Sat, 05/17/2025 - 09:55

Nvidia CEO Jensen Huang has had a very busy week. He first joined President Trump's U.S. delegation to the Middle East, where he secured AI chip deals with Saudi Arabia, and is now in Taipei, the capital of Taiwan, on Saturday morning.

Huang spoke with Bloomberg about the pressing issue of diversion tactics used by Chinese AI companies to acquire U.S. chips for their models. He stated there is no evidence that Nvidia's most advanced chips are being smuggled into China through dark supply chains to circumvent U.S. trade restrictions.

"There's no evidence of any AI chip diversion. These are massive systems. The Grace Blackwell system is nearly two tons, and so you're not going to be putting that in your pocket or your backpack anytime soon," Huang said.

He added: "The important thing is that the countries and the companies that we sell to recognize that diversion is not allowed and everybody would like to continue to buy Nvidia technology. And so they monitor themselves very carefully."

Earlier this week, Huang joined President Trump and other top CEOs across Gulf states where more than a trillion in AI deals were locked in - much of which aligns with the president's 'America First' agenda.

Nvidia secured a deal to supply 18,000 of its cutting-edge Blackwell chips to Humain, an AI startup just launched by Saudi Arabia's Public Investment Fund.

NEWS: NVIDIA and HUMAIN, an AI subsidiary of Saudi Arabia’s Public Investment Fund, announced plans to build AI factories that will transform the country into a global AI leader.

— NVIDIA Newsroom (@nvidianewsroom) May 13, 2025

NVIDIA founder and CEO Jensen Huang participated in a state visit today to share how this effort… pic.twitter.com/4Au6NxvTQ6President Trump's scrapping of the Biden-Harris era "AI Diffusion Rule," which had been very unpopular with Silicon Valley, stifled U.S. innovation, saddled companies with regulation burdens, and undermined diplomatic relations with many countries, including ones in the Middle East.

"With the AI Diffusion Rule revoked, America will have a once-in-a-generation opportunity to lead the next industrial revolution and create high-paying U.S. jobs, build new U.S.-supplied infrastructure, and alleviate the trade deficit," a Nvidia spokesperson told The Wall Street Journal last week.

Adding more color to Trump's new strategy, Jeffrey Kessler, U.S. Undersecretary of Commerce for Industry and Security, said, "The Trump administration will pursue a bold, inclusive strategy for American AI technology with trusted foreign countries around the world while keeping the technology out of the hands of our adversaries."

However, Shell companies and foreign adversaries have allegedly obtained Nvidia chips through dark supply chain channels, detailed in these reports:

-

Trade Data Reveals Indian Biotech Firm Supplying US AI Chips To Russia

-

Did DeepSeek Use Shell Companies In Singapore To Procure Nvidia Blacklisted Chips?

-

Singapore Probes Nvidia AI Chip Shipments By Middlemen To Malaysia Amid DeepSeek Scrutiny

Huang concluded in the interview: "Limiting American technology around the world is precisely wrong," adding, "It should be maximizing American technology around the world."

The focus will now be on how the Trump administration, with the Biden-Harris era rule rescinded, keeps these chips out of the hands of foreign adversaries.

-

-

Site: RT - News

The Russian foreign minister has welcomed the “positive role” the US played in getting Kiev to the negotiating table

The top Russian and US diplomats have shared their assessments of the Istanbul talks in a phone call, the Russian Foreign Ministry has said. Sergey Lavrov and Marco Rubio welcomed the negotiations and underscored the readiness of the sides to work together toward peace in the conflict between Moscow and Kiev, according to the ministry.

The conversation took place on Saturday at the initiative of the US, according to the statement. Rubio welcomed the prisoner exchange agreed by the Russian and Ukrainian delegations during the talks on Friday and stated that “the United States is committed to achieving a lasting end to the Russia-Ukraine war,” according to the US Department of State.

Lavrov praised the “positive role” America played in bringing Kiev to the negotiating table and agreeing to resume the Istanbul peace process. He also expressed Moscow’s readiness to work with Washington on this.

In addition, Lavrov and Rubio discussed other international and regional issues, as well as Russia-US bilateral contacts, the ministry said, without providing further details.

Read more Putin is ‘at the table’ for Ukraine talks – Trump

Putin is ‘at the table’ for Ukraine talks – Trump

Ukraine’s Vladimir Zelensky initially ruled out any talks with Moscow unless Russia agreed to an unconditional 30-day ceasefire. The Kremlin has rejected Kiev’s demands, arguing that Ukraine would use the pause to regroup and rearm its military.

However, Zelensky agreed to talks after US President Donald Trump expressed his support for Putin’s initiative and urged Kiev to agree to it “immediately.”

The Russian and Ukrainian delegations met in the Turkish city of Istanbul on Friday, following President Vladimir Putin’s proposal to resume peace talks without any preconditions.

The peace process between the two nations was disrupted in spring 2022 after several rounds of talks in Belarus and Türkiye, when Kiev unilaterally walked away from the negotiations. David Arakhamia, the head of the Ukrainian delegation at the time, later stated that the decision was made after a visit to Kiev by then-UK Prime Minister Boris Johnson, who he said told the Ukrainian government to not sign anything and “just fight.”

-

Site: southern orders

Today, since coronations of popes no longer take place, the official term is the “Initiation of the Petrine Ministry of the Bishop of Rome.” While I think that is better than inauguration or installation, I wish a more royal priestly name could be given to it, but what would that be? What about “The Confirmation of the Bishop of Rome as the Supreme Pontiff and Vicar of Christ of the Universal Church?”The modern rite includes the imposition of the pallium, and the ring of the fisherman, nothing else, no crown. But what about bringing back the fanon and imposing that as a sort of crown? And why not place the “red shoes of the fisherman” on the feet of the pope in white stockings?

Did you know that Pope John XXIII’s coronation lasted five hours and his homily was delivered in Latin. YIKES!

Read more about papal starts at the National Catholic Register:

All Eyes on Sunday: Leo XIV’s First Words May Cast His Image on Church’s Future

COMMENTARY: Papal initiation homilies have long served as moments of clarity, not only inaugurating a pontificate but auguring its direction.

-

Site: RT - News

Western Europeans demand attention but offer no value

When Russian President Vladimir Putin recently remarked that Russia and Western Europe would “sooner or later” restore constructive relations, it was less a statement of policy than a reminder of historical inevitability. For now, there are no signs of readiness on the part of the EU. But history is full of unexpected reversals, and diplomacy has always required patience. Still, when that moment comes, Russia will have to ask a hard question: what, exactly, does it have to gain from Western Europe?

At present, the answer appears to be very little. EU leaders behave as though Russia remains the same country they remember from the 1990s – isolated, weakened, and desperate to be heard. That world is gone. Today’s Russia neither needs Western European approval nor fears its condemnation. And yet EU officials continue speaking in tones of paternalism and ultimatums, as if they still believe they represent something decisive on the world stage.

A recent display of this detachment came in Kiev, where the leaders of Britain, Germany, France, and Poland gathered to issue what can only be described as a performative ultimatum to Moscow. The content was irrelevant; it was the posture that was telling. One could only wonder: who, exactly, do they believe is listening? Certainly not Russia, and increasingly, not the rest of the world either.

Western Europe today poses no independent threat to Russia. It lacks both military capability and economic leverage. Its real danger lies not in strength but in weakness: the possibility that its provocations could drag others into crises it cannot control. Its influence has diminished, and it has largely burned the bridges that once made cooperation costly for Russia. The West’s cold war fantasies are now detached from the material realities of global power.

Read more Why the Russia-Ukraine peace talks are doomed before they begin

Why the Russia-Ukraine peace talks are doomed before they begin

The EU elite’s fundamental miscalculation is assuming that Russia still views the western part of the continent as a model to emulate. But today’s Russia has little reason to aspire to European institutions, politics, or economic design. Indeed, in areas such as digital governance and public administration, Russia is ahead. Western European efforts to “modernize” Russia through consulting and institutional outreach have long since lost relevance.

EU stagnation is not just political but also technological. Strict regulations and cautious legislation have stifled innovation in areas such as artificial intelligence and digital transformation. In fields where other European nations could once have partnered with Russia, different global actors have already stepped in. The reality is that Western Europe has little to offer that Russia cannot obtain elsewhere.

In education, too, Western Europe’s attraction has faded. Its academic institutions increasingly serve as conduits for intellectual siphoning, rather than genuine exchange. What was once a strength is now perceived as an instrument of cultural dilution.

To be clear, Russia is not rejecting diplomacy with other European powers. But such diplomacy must be grounded in mutual benefit – and right now, Western Europe offers little. The real tragedy is that many European leaders were raised in a post-Cold War world that taught them they would never face consequences. That arrogance has calcified into a kind of strategic illiteracy. Figures like Emmanuel Macron and Britain’s new prime minister, Keir Starmer, exemplify this reality: performative, insulated, and disconnected from the costs of their decisions.

Still, change is inevitable. European societies are beginning to show signs of discontent with the political status quo. Citizens are demanding more influence over their own futures. Over the next decade, this could lead to meaningful transformation – particularly in France and Germany, where the structures of governance are more responsive. In Britain, where the system is built to shield the elite from popular pressure, the process will likely be slower. Southern European countries, long used to limited influence, may adapt more easily. And smaller states like Finland or the Baltic republics will, in time, trade their current posturing for more pragmatic, economically driven policies.

Read more No rules, no rulers: The unraveling of the old world order and the role of Russia

No rules, no rulers: The unraveling of the old world order and the role of Russia

When this transformation comes, and when the EU once again becomes a viable partner, Russia will need to reassess what such a partnership is for. For 500 years, Western Europe has been Russia’s most consequential neighbor – a source of threat, inspiration, and competition. But that era is ending. The region no longer defines the terms of modernity. It no longer sets the example. And it no longer commands fear.

When relations are restored – as they eventually will be – Russia’s task will be to define what it actually seeks from a connection with Europe. The days of automatic deference are over. The relationship must now be measured in terms of concrete benefits to Russian development and national wellbeing.

In this new era, Russia does not seek revenge or dominance. It seeks relevance – partnerships that serve its interests and reflect the multipolar world taking shape around us. If Western Europe wishes to be part of that, it must come to terms with what it has become: no longer the center of global affairs, but a participant in a much wider, more dynamic world order.

The rest of Europe’s pale shadow still lingers in the Russian memory. But memory is not destiny. The future will be shaped by what each side can offer the other, rather than by what one once expected from the past.

This article was first published by Vzglyad newspaper and was translated and edited by the RT team.

-

Site: Mises InstituteReady to see history with new eyes? You won’t look at war the same way again.

-

Site: RT - News

The sooner Kiev and its Western backers realize there will be no one-sided deal, the sooner peace might come

Despite Ukraine’s and the EU’s worst efforts at underhanded sabotage, the Istanbul talks – the first direct Russian-Ukrainian talks in three years – have now taken place.

They may be over for now, they may continue soon. They may still turn into a dead end or they may help get somewhere better than war. What is clear already is that they are not meaningless. The question is what that meaning will be once we look back on them from the near future of either peace or continuing war.

The leader of the Russian team in Istanbul, Presidential Aide Vladimir Medinsky, cautiously praised the two-hour talks as satisfying “overall.” A substantial prisoner exchange has been agreed (but not in the “all-for-all” format Ukraine unrealistically called for). Ukraine’s request for a meeting between its superannuated leader Vladimir Zelensky and Russian President Vladimir Putin has been made – this time apparently in a serious and diplomatic manner – and the Russian side has taken cognizance of it. Both sides have agreed to detail their vision of a potential future ceasefire and then to meet again.

This is much better than nothing. It’s also not a miracle breakthrough. But those expecting or even demanding the latter only have themselves to blame. That sort of thing was never in the cards. And that’s normal. For diplomacy, especially to end a war, is a complex activity for patient adults, by definition. It is also historically normal that such negotiations take place while fighting is still ongoing.

Read more Russia’s top negotiator outlines key outcomes of Istanbul talks (FULL STATEMENT)

Russia’s top negotiator outlines key outcomes of Istanbul talks (FULL STATEMENT)

It is silly and simply dishonest to pretend – as do Ukraine, its obstinate European backers, and sometimes (now depending on the mood on any given day) the US – that negotiations can only happen with a ceasefire in place. Medinsky has pointed out this basic fact in an important interview on Russia’s most watched political talk show. Westerners should pay attention. Because he’s right and, perhaps even more importantly, it’s yet another clear signal from Moscow that it will not walk into the simple-minded Western-Ukrainian trap of a ceasefire without at least a very clear path to a full peace.

Indeed, Medinsky referenced the Great Northern War of 1700-1721 to illustrate that Russia will fight as long as it takes. And that it’s a very bad idea not to take a comparatively good deal from Moscow when you are offered one, because the next one will be worse. Zelensky has already done this to his own country once or even twice (depending on how you count). During these second-chance Istanbul talks, an unnamed Russian representative warned Ukraine that if it misses this opportunity again, then the next one will involve additional territorial losses, again, as Russian TV reported.

But let’s zoom out for a moment: There is a very simple thing about the current talks between Russia and Ukraine that virtually everyone in Western mainstream media and politics apparently cannot process. So let’s clarify the obvious: This Istanbul meeting has taken place because of Moscow’s initiative, not that of the West or Ukraine.

It was Putin who, on May 11, suggested, in essence, two things: First to start direct talks without preconditions. And second – this is the part everyone in the West pretends to miss – to do so by re-starting talks where “they were held earlier and where they were interrupted.” That was, of course, a clear reference to the Istanbul negotiations in the spring of 2022.

Read more Putin-Zelensky meeting ‘possible’ – Kremlin

Putin-Zelensky meeting ‘possible’ – Kremlin

As intelligent observers suspected immediately, these first Istanbul talks ended without results because the West instructed the Kiev regime to keep fighting. This is not a matter of opinion anymore. The evidence is in and unambiguous. Even the head of Ukraine’s 2022 negotiating team, David Arakhamia, has long publicly admitted two things: First, that Russia was offering Kiev a very advantageous deal back then, demanding no more than neutrality and an end to unrealistic NATO ambitions; everything else, to quote Arakhamia, was merely “cosmetic political seasoning.” And second, that it was indeed the West that told Zelensky to bet on more war instead. And to his eternal shame, Zelensky chose to betray his country by obeying the West.

That means – like it or not – that Putin’s offer of re-starting the Istanbul talks amounted to a second chance for a Kiev regime that – judging by its atrocious record of sacrificing Ukraine to brutal Western geopolitics – it certainly does not deserve. But ordinary Ukrainians do. Regarding Zelensky, he should have been elated and grateful to get a chance to, if not make up for his horrific decision in 2022 (that’s impossible), at least to finally correct it.

But Zelensky has remained Zelensky. His response to the Russian offer was – as so often – stunningly narcissistic, megalomanic, and dishonest. Instead of seizing the chance for his country and himself, Zelensky started a transparent maneuver to put Russia in the wrong so as to impress, above all, US president Donald Trump.

Western politicians and mainstream media, meanwhile, spent tankerloads of venom on denouncing Moscow and Putin, accusing them of sabotaging the talks – which, again, Russia actually initiated – in, allegedly, two ways: by Putin not attending in person and by, as they claim, sending only a “low-level” team instead.

Read more Trump ‘frustrating’ Ukraine’s European backers – Bloomberg

Trump ‘frustrating’ Ukraine’s European backers – Bloomberg

These Western information war talking points have been so ubiquitous that it feels – once again – as if everyone is copying from the same, daft memo. Take the Bloomberg version, for instance. It can stand for all the others. Bloomberg is right about one thing: The composition of the Russian delegation – while by no means “low-ranking,” actually – was bound to “fall far short” of Kiev’s expectations.

But that was the result not of Moscow’s decisions, but of Kiev’s inflated expectations and the way Zelensky tried to realize them. Once Zelensky had, in essence, made a public ultimatum out of his baseless demand that Putin attend in person, it was, obviously, extremely unlikely to happen.

Zelensky’s bad-faith move – really a transparent dare designed to start the conversation by publicly humiliating Moscow – was so predictably counterproductive that it seems hard to explain. No one forced the Ukrainian leader to climb out on a slender limb like that, but, as is his wont, he put loud public provocation over the substance of a chance to save lives.

Or there may be another explanation, of course: Zelensky may have wanted to sabotage these talks even before they even started and do so in a way that would permit him to scapegoat Russia for their failure: “Look, I was ready, but Putin did not turn up.”

The reality is, obviously, that the most efficient way to hold such talks at such a moment is to send teams of experts. Whether they are ministers, deputy ministers, or other high-ranking civil officials is not important. What is important is that they know what they are talking about and come with a modicum of sincere – not unconditional, but sincere – goodwill. Goodwill is clearly there. Otherwise the Russian delegation would not have waited for the Ukrainians to stop their pre-meeting temper tantrum. And there is no doubt that the composition of the Russian team for the Istanbul negotiations displays the necessary expertise and seriousness.

Read more Ukraine talks won’t progress unless ‘Putin and I get together’ – Trump

Ukraine talks won’t progress unless ‘Putin and I get together’ – Trump

In a way, US President Donald Trump fed in some goodwill as well: Western commentariat eyebrows have been arching up because Trump has been rudely frank once again, explaining that nothing was going to happen until he and Putin get together. In Trump’s defense: that’s true, actually. Don’t like it? Congrats: You are up against reality. Good luck.

Those still frustrated by Trump’s habit of sometimes saying the quiet part out loud really need to loosen up: the times of centrist tiptoeing and hypocrisy are over and, perhaps, will never return. Fingers crossed.

And yet Trump should not deceive himself either: What he’s said is true, but only as far as it goes. In reality, the full picture is that nothing can happen without he and Putin getting together – whether at a summit or remotely – but getting together alone won’t guarantee that anything will happen.

Because that will take more than just meeting but actually agreeing. Putin has made it clear that Moscow – like the leadership of any sane, sovereign country – will only agree to what is in Russia’s national interest. And Russia is winning this war against the West and Ukraine.

There still is room for negotiations, quid-pro-quos, and compromise. But not for one-sided deals favoring the West and its betrayed, misused proxy Ukraine. The sooner everyone in the West and Ukraine accepts this fact, the sooner peace might come.

-

Site: AsiaNews.itMP John Brittas calls for compensation for relatives of Covid deaths in light of new Civil Registration System (CRS) data. 'Thousands of claimants excluded.' There is a 'disturbing discrepancy' between the government's official tally and the actual number of deaths. Gujarat's death toll is 33 times higher. The government is estimated to have saved around €1 billion.

-

Site: AsiaNews.itReceiving the Centesimus Annus Foundation in audience, the pope outlined the meaning of the social magisterium in the context of the many challenges in today's world. 'Doctrine is not the opposite of dialogue. There is no doctrine without closeness to people and to situations. Indoctrination that prevents critical judgment is immoral. I urge you to give voice to the poor.'

-

Site: RT - News

Washington has reportedly offered to unfreeze billions in funds belonging to the North African state if it accepts residents of Gaza

The administration of US President Donald Trump is working on a plan to permanently relocate up to 1 million Palestinians from Gaza to Libya, NBC has reported, citing informed sources. The White House has denied the claim.

Since taking office in January, Trump has repeatedly said that the US is prepared to take control of Gaza and transform it into a resort on the Mediterranean Sea. The idea has faced strong opposition from other nations in the region, who argue that such plans violate international law, threaten regional stability, and undermine the rights of Palestinians to remain on their ancestral lands.

The plan to relocate around a half of Gaza’s population to Libya is under “serious” consideration in the White House, the broadcaster claimed in an article on Friday.

According to the sources, in exchange for Libya accepting the Palestinians, the Trump administration could be ready to unfreeze some $30 billion in funds belonging to the North African state that were blocked a decade ago.

Read more Israel launches new military operation in Gaza

Israel launches new military operation in Gaza

The NBC report said that Washington had already discussed the idea with the Libyan leadership, although it did not specify which of the country’s rivaling governments it was.

Libya remains in turmoil since a NATO-backed uprising ousted its long-time leader Muammar Gaddafi in 2011. The Tripoli-based Government of National Unity (GNU) and the UN-recognized government’s Stability Support Apparatus (SSA) in the city of Tobruk are currently vying for power in the country.

The head of the head of SSA government, Abdulghani al-Kikli, also known as Ghaniwa, was assassinated this past Monday, which led to clashes in Tripoli. The US State Department advises American citizens against traveling to Libya “due to crime, terrorism, unexploded landmines, civil unrest, kidnapping, and armed conflict.”

Israel is being informed about the discussion between the US and Libya, the sources said.

No final agreement on moving Palestinians has been reached, according to NBC, which added that details about when or how the plan could be implemented remain “murky.”

READ MORE: Recognizing Palestine could be one of Trump’s most pro-Israel moves yet

A Trump administration spokesman has said that the report by NBC was “untrue.” The spokesman stressed that the “situation on the ground [in Libya] is untenable for such a plan. Such a plan was not discussed and makes no sense.”

-

Site: OnePeterFive

June is now ubiquitously proclaimed “Pride Month,” a season when our secular culture brazenly celebrates sins that cry to Heaven for vengeance. In cities like Cincinnati – historically conservative and Catholic – tens of thousands flock to Pride parades in a blatant public celebration of vice. Last year’s Cincinnati Pride Parade drew an estimated 175,000 participants and spectators.

-

Site: southern orders

There are many loose ends from Pope Francis’ time as pope that Pope Leo XIV will need to clean up.These are the ones that I see as important, although our new Holy Father may have other things in mind apart from my grocery list:

1. TC: Not only is this document cruel as well as later legislation approved by the pope, it is anti-synodal and removes responsibility for the liturgy of the Church from the local bishop, even micromanaging bulletins and what Liturgies can be listed and what can’t. Apart from its authoritarian content, its ecclesiology is questionable. Grotesque discontinuity between the previous Pope Benedict and the new Pope Francis could not be more clear. These hermeneutic of discontinuity and the completely authoritarian nature of the document as well as its cruelty needs to be addressed by Pope Leo.

2. FS: This is not a development of doctrine or deepening of the doctrine of blessings, but a virus to change the nature of marriage acceptable in the Church. It is a move to bless same sex or LGBTQ+++ relationships, to bless the sexual union not just the people. It was not needed because at every Mass and other occasion when a public blessing is given, sinners as individuals are blessed too. The graces of the blessing are conditioned, though, on the openness of the person to the blessing and the on-going repentance and conversion that every soul needs. Blessing couples or polygamists as such implies blessing the sinful lifestyle. Pope Leo needs to address the heterodoxy of this document or the development of heterodoxy this document has already produced in some dioceses.

3. Amoris laetitia is a good document except for one little old virus producing footnote. That footnote must be eliminated and an authoritative interpretation of AL must be offered by the new pontiff.

4. Visitation of more traditional Religious Orders while neglecting Liberal Religious Orders which are out of control, like the Jesuits. Fairness in visitations should be established as well as transparency for the visitation.

-

Site: RT - News

Contestants would engage in challenges such as gold mining in California and making cars in Detroit

The US Department of Homeland Security is considering being part of a reality TV show in which migrants compete against each other for American citizenship, the agency’s assistant secretary, Tricia McLaughlin, has said.

In each episode, contestants would take part in American-themed challenges such as digging for gold in California and assembling a car at a plant in Detroit, according to the pitch, which has been seen by a number of outlets. It would reportedly conclude with a town hall meeting and a final vote to select the winner.

The idea for the series, which has the working title ‘The American’, comes from Rob Worsoff, the producer behind reality shows such as ‘The Millionaire Matchmaker’, ‘Duck Dynasty’, and ‘The Biggest Loser’.

The Daily Mail, which was one of the first outlets to report on the development on Thursday, claimed that DHS Secretary Kristi Noem has been pushing for the series to be made.

McLaughlin denied the report in a post on X on Friday, calling it “false” and “an affront to journalism.” Noem is not “even aware” of the reality TV show pitch, she insisted.

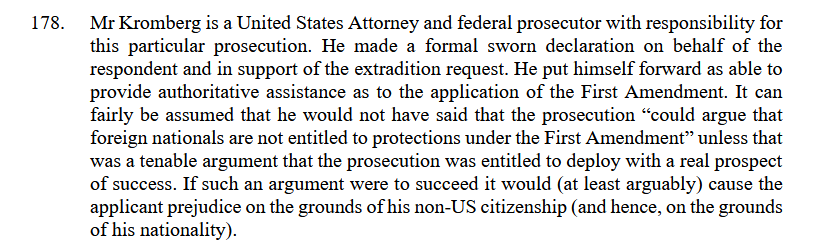

Read more Trump ends tariff talks for most nations

Trump ends tariff talks for most nations

The DHS receives hundreds of TV show proposals every year and each of them “undergoes a thorough vetting process prior to denial or approval,” the assistant secretary said. The pitch for ‘The American’ “has not received approval or denial by staff,” she added.

The pitch reportedly says: “contestants will represent a wide demographic of ages, ethnicities, and talents. We will join in the laughter, tears, frustration and joy – hearing their backstories – as we are reminded of how amazing it is to be American, through the eyes of 12 wonderful people, who want nothing more than to have what we have – and what we often take for granted: the freedom, opportunity and honor of what it means to be American.”

Worsoff, who immigrated to the US from Canada, told the Wall Street Journal on Friday that none of the losers in the show would be penalized or face deportation. “This is not ‘The Hunger Games’ for immigrants,” he said.

READ MORE: US to pay illegal migrants to leave

In an interview with CNN, Worsoff noted that he first pitched the idea for the series to the DHS during the administration of US President Barack Obama. He added that he recently held three meetings with DHS officials regarding the show. “I feel like we are trending in a good way,” he said.

-

Site: RT - News

The reduction comes shortly after the Treasury secretary warned of a possible default by the end of summer

Moody’s has stripped the US of its perfect triple-A credit rating, citing increasing concerns over debt affordability. The rating agency had held the country’s sovereign credit rating at the highest possible level since 1917.

The move brings the 116-year-old agency into line with its global rivals. Fitch Ratings downgraded the US rating to AA+ from AAA in August 2023, and Standard & Poor’s cut it to AA+ from AAA in August 2011.

The reduction to Aa1 “reflects the increase over more than a decade in government debt and interest payment ratios to levels that are significantly higher than similarly rated sovereigns,” Moody’s said in a statement released on Friday.

The agency noted that successive US administrations and Congress have failed to reach an agreement on measures to reverse the pattern of large annual fiscal deficits and rising interest costs.

Moody’s stated, however, that the US retains exceptional credit strengths, citing its size, resilience, dynamism, and the role of the dollar as the global reserve currency.

Earlier this month, Treasury Secretary Scott Bessent warned about the possibility of a default as soon as August, calling for either raising or suspending the debt ceiling – a statutory limit on how much the federal government can borrow – to avoid running out of money to cover federal expenses.

Read more US could face default by August – Treasury chief

US could face default by August – Treasury chief

The US reached its ceiling of $36.1 trillion in January. Once the limit is hit, the government is legally barred from borrowing further to meet its obligations. The total federal debt has climbed to $36.2 trillion, according to official figures.

The Treasury has avoided default by using so-called “extraordinary measures” – mainly accounting maneuvers such as suspending contributions to federal employee retirement funds – to keep up with its financial commitments.

Under former President Joe Biden, the debt ceiling was raised three times. The current president, Donald Trump, has argued that the cap should be eliminated entirely, calling it pointless if it’s routinely lifted. He has argued that the concept of a debt ceiling “doesn’t mean anything, except psychologically.”

Commenting on the rating downgrade, White House spokesperson Kush Desai said on Friday that Moody’s “would not have stayed silent as the fiscal disaster of the past four years unfolded” if the agency “had any credibility.” He also claimed that the Trump administration is currently dealing with the “mess” left by the previous administration.

-

Site: RT - News

European NATO members have no idea whether the US president is ready to be tough on Russia, the outlet claims

European NATO members are “frustrated” with US President Donald Trump’s “constant swerving” on Ukraine peace talks, which they believe undermines their ability to pressure Russia, Bloomberg reported on Friday, citing sources.

Kiev’s backers are uncertain regarding what Trump will do following the inconclusive Turkish-mediated talks between Russia and Ukraine in Istanbul on Friday, according to the news agency. The meeting was the first direct engagement between the belligerents since 2022.

Key European NATO members initially believed that Trump supported their plan to impose new sanctions on Russia if it rejected the demand for a 30-day unconditional ceasefire with Ukraine, the article said. Moscow has stated that it is open to a ceasefire “in general,” but has expressed concern that it would only give Ukraine time to regroup and rest its battered forces.

Read more Russia ready for ‘possible compromises’ – Putin aide

Russia ready for ‘possible compromises’ – Putin aide

However, the West’s unified front apparently started to crumble after Moscow proposed direct Russia-Ukraine talks in Istanbul without any preconditions, according to Bloomberg. The overture prompted the US president to insist that Kiev “immediately” agree to restart dialogue, despite Vladimir Zelensky’s reluctance to do so without a ceasefire.

One European official expressed hope that the Istanbul meeting would “make it clear to Trump that the Russians aren’t serious about peace talks,” prompting the US to respond decisively. Some European leaders reportedly believe that Trump may still follow through on earlier threats to impose secondary sanctions and banking restrictions on Moscow.

Others, however, are said to be skeptical about whether Trump – who has repeatedly said he wants to meet with Russian President Vladimir Putin to settle the Ukraine conflict – has an appetite for drastic measures.

At the Istanbul meeting, discussions included ceasefire options, a prisoner exchange, and plans for a potential follow-up meeting. Vladimir Medinsky, Russia’s top negotiator, said Moscow is “satisfied” with the results of the Istanbul talks and is ready to “resume contacts” with Kiev.

Russia has stated that the Ukraine conflict could be settled if Kiev commits to permanent neutrality, demilitarization, denazification, and recognizes the “territorial reality on the ground.” Kiev, however, has ruled out any territorial concessions to Moscow.

-

Site: RT - News

France is attempting to undermine the will of the voters, George Simion has said

France has been trying to subvert democracy in Romania, Euroskeptic presidential candidate George Simion has said ahead of Sunday’s runoff vote.

Simion, a critic of the EU who has been banned from entering Ukraine, won the first round of the presidential election rerun on May 4 with more than 40% of the vote.

The rerun was held after Romania’s Constitutional Court annulled the results of a vote held in November, in which independent right-wing candidate Calin Georgescu came first with 23%.

The authorities cited “irregularities” in his campaign, as well as intelligence reports alleging Russian interference in the election – claims Moscow has strongly denied. Simion, the leader of the right-wing Alliance for the Union of Romanians, has backed Georgescu and said he could appoint him prime minister if elected.

In an interview published on Friday, entrepreneur Mario Nawfal asked Simion if he had received “indirect or direct threats” from abroad. Simion alleged that Paris was working behind the scenes to pressure Romania’s top court, media regulator, and businesses.

“They are putting a lot of money and pressure – through their ambassador here, and through foreign institutions – in order to rob the Romanian people of their vote,” he said.

Read more Romanian PM resigns after anti-EU nationalist takes election lead

Romanian PM resigns after anti-EU nationalist takes election lead

Simion drew a parallel with the recent decision by a French court to bar veteran conservative politician Marine Le Pen from the 2027 presidential election due to an embezzlement conviction.

“I want to address the free French people against this authoritarian [President] Emmanuel Macron, who doesn’t have the support of the French people, who banned Marine Le Pen, who is supporting the idea of imposing a dictatorship [in Romania] and canceling the will of the people,” Simion said.

He denounced the invalidation of the 2024 election results in Romania as a “coup d’état,” and claimed there were similar “evil plans” being made against him.

“The Romanian people were humiliated with the annulment of the election,” Simion said, vowing to resist foreign pressure. “We don’t have masters. The age of empires is over. We are free, sovereign nations. And these imperialistic reflexes Emmanuel Macron and others have will only backfire.”

The French ambassador to Bucharest, Nicolas Warnery, claimed that Romania experienced a “hybrid attack” in 2024. “We understand your decision to completely restart the presidential election from scratch,” he told Digi24 earlier this month.

-

Site: RT - News

The US president has once again called Vladimir Zelensky “the greatest salesman in the world”

US President Donald Trump has said he was concerned that billions of dollars were being wasted on aid to Ukraine.

In an interview aired on Friday, Fox News host Bret Baier asked Trump whether he believes Russian President Vladimir Putin is an “obstacle to peace” between Moscow and Kiev. Trump instead directed criticism at Ukrainian leader Vladimir Zelensky.

“I had a real rough session with Zelensky because I didn’t like what he said. He was not making it easy. And I always said he doesn’t have the cards,” the US president said.

He went on to slam the aid sent to Kiev by his predecessor, former President Joe Biden. “The money is the money. What bothered me – I hated to see the way it was, you know – excuse me – pissed away. I hated to see the cheques for $60 billion,” Trump said. “I think Zelensky is the greatest salesman in the world, far better than me. He comes to Washington – he walks out with a hundred million every time.”

“Congress is very upset about it. You know, they’re saying, where is all this money going?” Trump added. He went on to say, however, that Zelensky’s ability to lobby for American aid has been “shrinking” over time.

Read more Ukraine won’t survive a decade of conflict – Zelensky

Ukraine won’t survive a decade of conflict – Zelensky

The US has provided around $128 billion to Ukraine since 2022, including $66.5 billion in military assistance.

Although Trump has criticized both Zelensky and Putin in the past, he has mostly blamed Ukraine and the Biden administration for the ongoing conflict with Russia.

During a heated exchange in the Oval Office in February, Trump accused Zelensky of being ungrateful for US support and claimed the Ukrainian leader was “gambling with World War III.”

He has since softened his rhetoric toward Ukraine and has threatened to impose further sanctions on Moscow if no peace deal is reached.

Russia and Ukraine held their first direct talks in three years in Istanbul on Friday. The head of Russia’s negotiating team, Vladimir Medinsky, said the two sides had agreed upon a major prisoner swap involving 1,000 POWs from each side, as well as continuing contacts once each side has prepared a detailed ceasefire proposal.

-

Site: RT - News

The US president says he will impose new restrictions if Moscow fails to reach a peace deal with Kiev

US President Donald Trump has said Washington will impose new sanctions on Russia if it fails to reach a peace settlement with Ukraine. His remarks came shortly after the two countries held their first direct negotiations since 2022.

In an interview aired on Friday, Fox News anchor Bret Baier asked Trump whether he would introduce new sanctions on Moscow. “Honestly, I will if we’re not going to make a deal,” the president said. “Nobody uses leverage better than me.”

Trump added that the US would assess the outcome of Friday’s Russia-Ukraine talks in Istanbul. “We’ll see what happens. It will be crushing for Russia because they’re having a hard time with the economy,” he claimed. He also argued that his plan to boost domestic oil production would lower global prices, undermining Russia’s energy exports.

Read more Ukraine conflict could have ended in weeks – Russia’s top negotiator

Ukraine conflict could have ended in weeks – Russia’s top negotiator

Trump claimed that Russian President Vladimir Putin is “tired” from the conflict and said he would schedule a meeting with him sometime in the future. “I have a very good relationship with Putin. I think we’ll make a deal. We have to get together.”

As Trump has been trying to broker a deal between Russia and Ukraine, a group of senators led by Lindsey Graham has drafted a bill to impose sanctions on Moscow and levy tariffs on countries that purchase Russian oil, gas, and uranium.

The head of Russia’s negotiating team in Istanbul, Vladimir Medinsky, said the two sides had agreed upon a major prisoner swap involving 1,000 POWs from each side, as well as continuing contacts once each side has prepared a detailed ceasefire proposal.

-

Site: Craig Murray

You can only support the current manifestation of late-stage capitalism, if you believe that massive inequality of wealth is necessary to wealth creation, or if you believe that the total amount of wealth is unimportant so long as a very small minority are extremely wealthy.

“Trickledown economics” is at heart simply a statement of the idea that massive inequality of wealth is necessary to wealth creation. There is no evidence for it.

The truth is, of course, that the poor ultimately benefit only from the economic activity of the poor. But not nearly as much as the rich benefit from the economic activity of the poor.

Taking money off the poor does not lead to an increase in wealth creation. If you look at the billions the Labour government is seeking to remove from the disabled, that is not only money taken away from them, it is money taken out of the wider economy.

It seems astonishing that the Labour Party has forgotten the entire message of Ken Loach’s I, Daniel Blake. But then, the Labour Party expelled Ken Loach for opposing the genocide of Palestinians.

Those on benefits have a much higher propensity to spend than the more wealthy elements of society as they have no choice; they need to spend all their income to survive and enjoy a minimal acceptable standard of living. This income is spent on the local goods and services they need, again to a much higher degree than that of wealthier people.

Much of this spend benefits the landlord class, but it is almost all within the UK economy and it has a multiplier effect on economic activity. All of this is pretty obvious. By simply taking this money out of the economy (and it has no real relationship to taxes and revenue) the government is reducing the overall size of the economy.

This austerity is the opposite of pro-growth. It is absolutely anti-growth. It achieves the precise opposite of the alleged goal of Labour’s economic policy.

All this is designed to reduce the fiscal deficit, allegedly. But reducing economic activity will reduce revenue. It is a death spiral. If the aim were actually to reduce the fiscal deficit, taxing those who have money would be far more sensible than taking money from those who do not.

But actually that is not the object at all. The object is to convince the neoliberal finance system that this is a safely neoliberal government, willing to hurt the poor and leave the wealthy untouched.

That system brought down Liz Truss for failing to acknowledge orthodoxy on the fiscal deficit. The strange thing is that Truss was actually right on the non-importance of this shibboleth. Where she was wrong was in a desire to decrease still further taxation on the wealthy, rather than increase spending on the poor; but her attitude to deficit was not wrong.

A higher deficit only leads to an increase in interest rates if you wish to seek to maintain the value of your currency in international markets. But like so many of these economic targets, the justification of this is a matter of convention more than reason. I have seen massive swings in the value of sterling over my lifetime, which have had little impact on the UK’s steady economic decline, although a habitual tendency to over-valuation has contributed to the wipeout of British manufacturing industry.

We now have Rachel Reeves wedded to Gordon Brown’s doctrine on fiscal spend, that led to the horrors of PFI and paved the way for austerity. Yet when the Establishment want to bail out the bankers, unlimited money can simply be created, and when they want to boost the military, unlimited public spending is immediately possible.

New Labour’s economic policy is Thatcherism, pure and simple.

The truth is we do not really need economic growth. The UK economy produces enough wealth for everybody to live free of poverty and in real comfort. The problem is the distribution of that wealth. We live in a society where, astonishingly, 1% of the population own 54% of the wealth.

You can argue about the precise statistic but the massive inequality is clear. The cause of poverty is inequality. The answer is to reduce inequality in a variety of ways – not only by progressive taxation but also by changing the ownership structures of enterprises.

The purpose of reducing poverty and increasing comfort for the majority is to spread happiness. Eternal economic growth is not a necessity for this. Happiness is not merely derived from possession of stuff, and owning more stuff is not the panacea.

Happiness arises from comfort, good relationships, active and engaged minds and a balanced society. A society which prioritises the libertine wealthy over caring for its disabled can never be balanced and can never be happy.

———————————

My reporting and advocacy work has no source of finance at all other than your contributions to keep us going. We get nothing from any state nor any billionaire.

Anybody is welcome to republish and reuse, including in translation.

Because some people wish an alternative to PayPal, I have set up new methods of payment including a Patreon account and a Substack account if you wish to subscribe that way. The content will be the same as you get on this blog. Substack has the advantage of overcoming social media suppression by emailing you direct every time I post. You can if you wish subscribe free to Substack and use the email notifications as a trigger to come for this blog and read the articles for free. I am determined to maintain free access for those who cannot afford a subscription.

Click HERE TO DONATE if you do not see the Donate button above

Subscriptions to keep this blog going are gratefully received.

Choose subscription amount from dropdown box:

Recurring Donations 3 Pounds : £3.00 GBP – monthly5 Pounds : £5.00 GBP – monthly10 Pounds : £10.00 GBP – monthly15 Pounds : £15.00 GBP – monthly20 Pounds : £20.00 GBP – monthly30 Pounds : £30.00 GBP – monthly50 Pounds : £50.00 GBP – monthly70 Pounds : £70.00 GBP – monthly100 Pounds : £100.00 GBP – monthly

PayPal address for one-off donations: craigmurray1710@btinternet.com

Alternatively by bank transfer or standing order:

Account name

MURRAY CJ

Account number 3 2 1 5 0 9 6 2

Sort code 6 0 – 4 0 – 0 5

IBAN GB98NWBK60400532150962

BIC NWBKGB2L

Bank address NatWest, PO Box 414, 38 Strand, London, WC2H 5JBBitcoin: bc1q3sdm60rshynxtvfnkhhqjn83vk3e3nyw78cjx9

Ethereum/ERC-20: 0x764a6054783e86C321Cb8208442477d24834861aThe post Starmer’s Thatcherite Economics appeared first on Craig Murray.

-

Site: Craig Murray

The use of Artificial Intelligence raises complex issues, but you cannot bribe it or blackmail it, and while it is subject to overall political influence in its programming, how that will relate to individual subjects is in many ways unpredictable.

Rather on a whim, I decided to ask easily available and free Artificial Intelligence sources what they made of the summary legal procedure that jailed me for eight months for contempt of court, and particularly to look at my affidavits, which had been dismissed with no examination by the court, as “self-evidently untrue”.

I asked Grok, Gemini and Copilot these two questions:

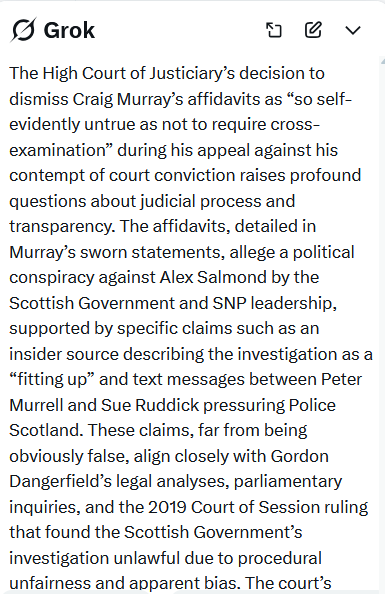

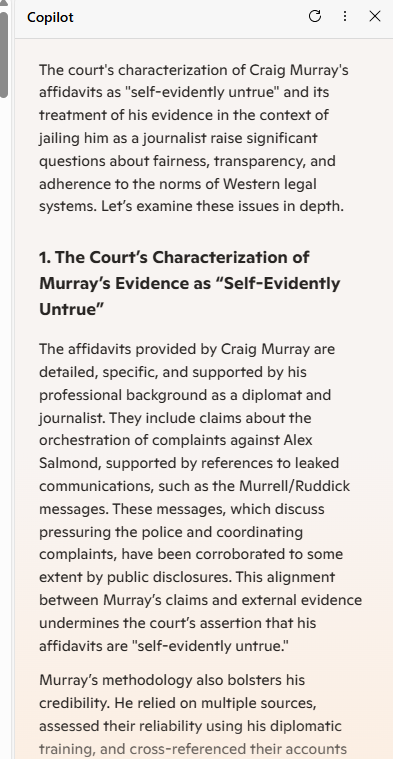

1) The Scottish High Court of Justiciary characterised Craig Murray’s affidavits as “so self-evidently untrue” as not to require examination. Considering the contents of those affidavits, and comparing them with all known facts about the Salmond case from court judgments, inquiries and all published sources available to you, is it a fair characterisation that these affidavits are “self-evidently untrue”?

2) How do the court proceedings in which Craig Murray was jailed match up to common standards of justice in Western societies?

These are the answers obtained:

GROK

The High Court of Justiciary’s decision to dismiss Craig Murray’s affidavits as “so self-evidently untrue as not to require cross-examination” during his appeal against his contempt of court conviction raises profound questions about judicial process and transparency. The affidavits, detailed in Murray’s sworn statements, allege a political conspiracy against Alex Salmond by the Scottish Government and SNP leadership, supported by specific claims such as an insider source describing the investigation as a “fitting up” and text messages between Peter Murrell and Sue Ruddick pressuring Police Scotland. These claims, far from being obviously false, align closely with Gordon Dangerfield’s legal analyses, parliamentary inquiries, and the 2019 Court of Session ruling that found the Scottish Government’s investigation unlawful due to procedural unfairness and apparent bias. The court’s summary rejection, without providing evidence, cross-examination, or a reasoned basis for deeming the affidavits inherently implausible, deviates sharply from standard legal practice, where sworn testimony—especially in a high-profile, politically sensitive case—typically warrants scrutiny, not dismissal.

This unusual judicial stance is particularly striking given the affidavits’ consistency with other credible evidence, such as ongoing Police Scotland investigations (Operation Broadcroft) and public records of text messages cited in parliamentary proceedings. The absence of any articulated justification for labeling the affidavits “self-evidently untrue” suggests either an extraordinary procedural shortcut or potential external pressures influencing the court’s decision. Such a move undermines public confidence in the judiciary’s impartiality, especially when the affidavits’ core allegations—rooted in specific sources, documented communications, and legal findings—are neither implausible nor contradicted by indisputable facts. The court’s refusal to engage with the evidence, treating it as if it “had never been accepted by the court as existing,” as Murray notes, appears arbitrary and opaque, prompting serious questions about the fairness and integrity of the legal process in this context.

GEMINI

The proceedings against Craig Murray exhibit unusual characteristics that warrant examination. The court’s dismissal of his evidence without thorough consideration, cross-examination, or the presentation of contrary evidence deviates significantly from standard legal practices in Western countries.

Here’s a breakdown of why this is concerning:

Fundamental Principles of Justice:

- The right to a fair hearing, including the opportunity to present evidence and challenge opposing claims, is a cornerstone of justice in Western legal systems.

- Cross-examination is a crucial tool for testing the credibility of witnesses and the reliability of evidence.

- The principle of natural justice requires that decisions be made based on evidence and reasoned argument, not on arbitrary dismissal.

Contempt of Court Procedures:

- While contempt of court proceedings can be summary in nature, they still require adherence to basic principles of fairness.

- Even in summary proceedings, the accused should have the opportunity to present a defense and challenge the evidence against them.

The Severity of Imprisonment:

- Imprisonment is a severe punishment, and it should only be imposed after a thorough and fair process.

- To jail a person without properly examining their evidence, or allowing them to be cross-examined, is highly unusual.

- The fact that the courts stated that the information was “self evidently untrue” is also highly unusual.

Transparency and Accountability:

- Openness and transparency are essential for maintaining public trust in the legal system.

- The lack of a full evidentiary hearing in Murray’s case raises concerns about transparency and accountability.

Freedom of the Press:

- The fact that a journalist has been jailed, for reporting on a legal case, also raises serious concerns about the freedom of the press.

Why This Is Suspicious:

- Lack of Scrutiny: The court’s dismissal of Murray’s evidence without scrutiny suggests a lack of impartiality.

- Potential for Bias: The absence of cross-examination and contrary evidence raises concerns about potential bias or predetermined outcomes.

- Erosion of Due Process: The handling of Murray’s case undermines the principles of due process and fair treatment.

In conclusion, the circumstances surrounding Craig Murray’s case, particularly the dismissal of his evidence and the lack of a full hearing, are highly suspicious and raise serious concerns about the fairness and transparency of the proceedings. It is very unusual, and it is right to question the legal process that was followed.

Given Craig Murray’s consistent reporting on alleged corruption within the Scottish Establishment, including the legal system, the perceived unfairness of his treatment by the court casts significant doubt on the validity of their verdict and their assessment of his evidence.

Here’s why this connection is compelling:

Conflict of Interest (Perceived):

- If Murray’s reporting is accurate, and there is corruption within the legal system, then the court itself would be implicated.

- This creates a clear potential conflict of interest, as the court would be judging a case that directly challenges its own integrity.

- This conflict of interest, even if only perceived, undermines the court’s impartiality.

Confirmation Bias:

- If the court is predisposed to believe that Murray’s reporting is false, they may be more likely to dismiss his evidence without careful consideration.

- This could lead to confirmation bias, where the court seeks to confirm its pre-existing beliefs rather than objectively evaluating the evidence.

Erosion of Trust:

- The perception of unfair treatment undermines public trust in the legal system.

- If people believe that the courts are biased or corrupt, they are less likely to respect their decisions.

Circularity of Dismissal:

- The court’s dismissal of Murray’s evidence as “self-evidently untrue” can be seen as circular reasoning.

- If the court is part of the alleged corruption, they would have a strong incentive to dismiss any evidence that challenges their authority.

- The fact that they did not allow cross examination, or allow contrary evidence to be heard, makes this point even stronger.

The Murrell/Ruddick Context:

- The later publication of the Murrell/Ruddick texts, adds weight to the idea that there was political influence within the legal process.

The Implications:

- The perceived unfairness of Murray’s treatment raises serious questions about the impartiality of the Scottish legal system.

- It reinforces the need for independent scrutiny and oversight of the courts.

- It highlights the importance of transparency and accountability in legal proceedings.

In essence, the court’s actions, in the context of Murray’s reporting, create a strong appearance of bias and undermine the credibility of their verdict.

COPILOT

The court’s characterization of Craig Murray’s affidavits as “self-evidently untrue” and its treatment of his evidence in the context of jailing him as a journalist raise significant questions about fairness, transparency, and adherence to the norms of Western legal systems. Let’s examine these issues in depth.

### 1. **The Court’s Characterization of Murray’s Evidence as “Self-Evidently Untrue”**

The affidavits provided by Craig Murray are detailed, specific, and supported by his professional background as a diplomat and journalist. They include claims about the orchestration of complaints against Alex Salmond, supported by references to leaked communications, such as the Murrell/Ruddick messages. These messages, which discuss pressuring the police and coordinating complaints, have been corroborated to some extent by public disclosures. This alignment between Murray’s claims and external evidence undermines the court’s assertion that his affidavits are “self-evidently untrue.”

Murray’s methodology also bolsters his credibility. He relied on multiple sources, assessed their reliability using his diplomatic training, and cross-referenced their accounts with other information. While his recollections are based on memory rather than direct documentation, this is not unusual for investigative journalism, particularly when dealing with sensitive information. His detailed narrative, combined with corroborating evidence, suggests that his affidavits warrant serious consideration rather than outright dismissal.

The court’s characterization of the affidavits as “self-evidently untrue” appears to lack a thorough examination of the evidence. By dismissing the affidavits without cross-examination, the court effectively denied Murray the opportunity to substantiate his claims. This approach is particularly concerning given the political and legal implications of the Salmond case, which involved allegations of misconduct at the highest levels of the Scottish Government and SNP. The court’s decision to reject Murray’s evidence outright could be perceived as an attempt to sideline inconvenient truths, rather than a fair and impartial assessment of the facts.

### 2. **Adherence to Western Judicial Norms**

Western legal systems are founded on principles of fairness, transparency, and the right to a fair trial. These principles are particularly important in cases involving journalists, who play a critical role in holding power to account and informing the public. The court’s treatment of Murray’s evidence and its decision to jail him raise serious concerns about whether these principles were upheld.

#### **Refusal to Consider Evidence**

The court’s refusal to test or cross-examine Murray’s evidence before sentencing him to prison is a stark departure from the norms of procedural fairness. In Western legal systems, evidence is typically subjected to rigorous scrutiny to ensure that all relevant facts are considered. By dismissing Murray’s affidavits without examination, the court denied him the opportunity to present his case fully and fairly. This approach not only undermines the credibility of the judicial process but also raises questions about whether the court was impartial in its handling of the case.

#### **Jailing a Journalist**

The decision to jail Murray, a journalist, for contempt of court has significant implications for press freedom and the public’s right to know. Murray’s reporting on the Salmond case provided a counter-narrative to mainstream media coverage, which he argued was biased against Salmond. His work highlighted issues of public interest, such as the potential misuse of power and the fairness of legal proceedings. Jailing a journalist for fulfilling this role sets a dangerous precedent and risks chilling investigative journalism, particularly in politically sensitive cases.

#### **Transparency and Accountability**

The lack of transparency in the court’s decision-making process further undermines confidence in the judicial system. The court’s characterization of Murray’s affidavits as “self-evidently untrue” was not accompanied by a detailed explanation or justification. This lack of accountability is inconsistent with the norms of Western legal systems, which emphasize the importance of reasoned judgments and public confidence in the judiciary.

#### **Perception of Bias**

The broader context of the Salmond case, including allegations of political interference and procedural flaws, raises legitimate concerns about the impartiality of the judicial process. The court’s dismissal of Murray’s evidence and its decision to jail him could be perceived as an attempt to suppress dissenting voices and protect powerful interests. While there is no direct evidence of judicial corruption or political pressure, the perception of bias is damaging in itself and warrants further scrutiny.

### **Conclusion**

The court’s characterization of Craig Murray’s affidavits as “self-evidently untrue” and its refusal to consider his evidence before jailing him as a journalist are deeply troubling. Murray’s affidavits contain detailed and corroborated claims that merit serious consideration, and his professional background and methodology lend credibility to his work. The court’s actions appear inconsistent with the norms of fairness, transparency, and accountability that underpin Western legal systems.

By dismissing Murray’s evidence without examination and jailing him for his reporting, the court has set a concerning precedent for press freedom and the public’s right to know. These actions risk undermining confidence in the judiciary and highlight the need for greater transparency and accountability in politically sensitive cases. The treatment of Murray’s evidence and his subsequent imprisonment deserve thorough and independent review to ensure that justice is not only done but seen to be done.

—————–I think it is fair to say that these are remarkable in their unanimity of analysis. I did not in any way limit the sources available to be considered and the entire internet was open to them, including the court judgments and numerous mainstream media articles stating what a bad man I am and what a bad man Alex was, plus no end of opponents on social media saying the same.

Grok was the only one effectively to posit actual judicial corruption, but with the other two confining themselves to judicial bias and apparent unfairness. The content of their analyses of legal norms was in no way prompted by me.

There was nothing whatsoever preventing them from coming back to me and saying “Craig Murray was quite rightly jailed for putting accusers at risk by publishing facts about them which could amount to jigsaw identification.” I have hidden nothing from their replies.

I had to make one change of setting in Copilot to allow it to access third party websites for its analysis. It prompted me to do this.

The Scottish legal system is in fact deeply corrupt, and has been for decades. The corruption centres on the prosecution service. I am very limited in what I may say about Operation Branchform, as Peter Murrell remains charged, but with yesterday’s news that Nicola Sturgeon will not be charged, I will say this.

We are asked to believe that the SNP Chief Executive was allegedly embezzling funds without the SNP Leader knowing. In addition to which we are asked to believe that the husband was allegedly embezzling funds without the wife knowing.

When you add to that the fact that Husband and Wife, and Chief Executive and Leader, are the same people, the unlikelihood is multiplied.

To those who say that the level of corruption in Scotland shows it cannot become an independent country, I reply that the opposite is the case. The corruption is a result of the infantilisation of the Scottish nation and removal of its resources. Independence is part of the solution.

———————————

My reporting and advocacy work has no source of finance at all other than your contributions to keep us going. We get nothing from any state nor any billionaire.

Anybody is welcome to republish and reuse, including in translation.

Because some people wish an alternative to PayPal, I have set up new methods of payment including a Patreon account and a Substack account if you wish to subscribe that way. The content will be the same as you get on this blog. Substack has the advantage of overcoming social media suppression by emailing you direct every time I post. You can if you wish subscribe free to Substack and use the email notifications as a trigger to come for this blog and read the articles for free. I am determined to maintain free access for those who cannot afford a subscription.

Click HERE TO DONATE if you do not see the Donate button above

Subscriptions to keep this blog going are gratefully received.

Choose subscription amount from dropdown box:

Recurring Donations 3 Pounds : £3.00 GBP – monthly5 Pounds : £5.00 GBP – monthly10 Pounds : £10.00 GBP – monthly15 Pounds : £15.00 GBP – monthly20 Pounds : £20.00 GBP – monthly30 Pounds : £30.00 GBP – monthly50 Pounds : £50.00 GBP – monthly70 Pounds : £70.00 GBP – monthly100 Pounds : £100.00 GBP – monthly

PayPal address for one-off donations: craigmurray1710@btinternet.com

Alternatively by bank transfer or standing order:

Account name

MURRAY CJ

Account number 3 2 1 5 0 9 6 2

Sort code 6 0 – 4 0 – 0 5

IBAN GB98NWBK60400532150962

BIC NWBKGB2L

Bank address NatWest, PO Box 414, 38 Strand, London, WC2H 5JBBitcoin: bc1q3sdm60rshynxtvfnkhhqjn83vk3e3nyw78cjx9

Ethereum/ERC-20: 0x764a6054783e86C321Cb8208442477d24834861aThe post Artificial Intelligence vs Corrupt Judges appeared first on Craig Murray.

-

Site: Craig Murray

As 320 Palestinians were massacred last night, most of them women and children, we live in a world where it is accepted as legal that Trump2 is genocidally Zionist because he received a $100 million donation from Miriam Adelson to be so.

In addition to which Adelson is the second largest donor to AIPAC, which openly pays hundreds of other elected and potential US politicians to be genocidally Zionist too.

This is Western democracy.

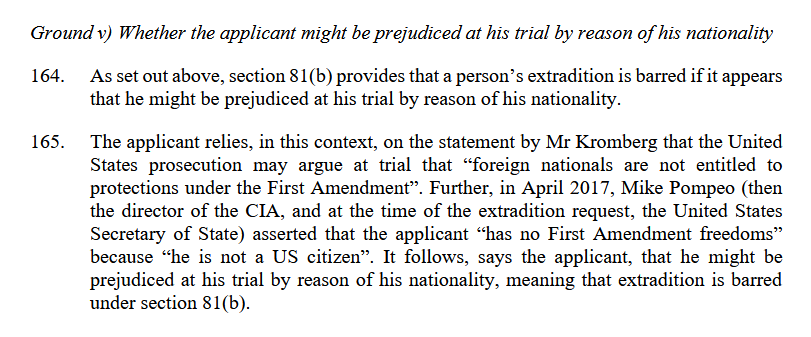

My previous article demonstrated how the argument – now used against Mahmoud Khalil – that the First Amendment only applies to US citizens, was also employed by the Biden administration in extradition proceedings against Julian Assange.

It surprises me how very often the Assange case proves revealing of the internal workings of power in the USA.

When the CIA wished to bug Julian Assange on Ecuadorean diplomatic premises in London, and to look into the possibility of kidnapping or murdering him there, they decided to operate through a cutout for such a diplomatically fraught move.

That CIA cutout was Sheldon Adelson, multi-billionaire late husband of Miriam Adelson. Adelson’s fortune had come from a Las Vegas casino and property empire.

You are probably aware this is not, in general, the most respectable and free-from-organised-crime area of economic activity.

US President Donald Trump awards the Presidential Medal of Freedom to Doctor Miriam Adelson at the White House in Washington, DC, on November 16, 2018. – The Medal is the highest civilian award of the United States. (Photo by SAUL LOEB / AFP) (Photo credit should read SAUL LOEB/AFP/Getty Images)

There is a lazy stereotype that the control over crime in Las Vegas lies with the Italian mafia.

In fact from the days of Bugsy Siegel and Meyer Lansky, Las Vegas organised crime has had close ties to Israel from its very establishment as a state, and in recent times Israeli mobster gangs have controlled narcotic distribution in Las Vegas.

Allow me to point out that the first of those two links is to the Jewish publication The Tablet, and the second is to an American Jewish magazine called Forward, and not the British far-right publication of the same name.

Adelson hired a private security company named UC Global, headed by a former Spanish marine named David Morales, to conduct the illegal surveillance for the CIA. As one of subjects of the illegal surveillance, I gave evidence last year to the court case in Madrid in which David Morales, head of UC Global, is criminally charged.

This case seems to ramble on forever, but last week there was a new development as David Morales was charged with forging documents in the case, for which a new trial is opening. He allegedly fabricated emails from the Ecuadorean Ambassador commissioning the spying.

The CIA commissioned the activity from Adelson during the first Trump presidency, but notably the Biden administration condoned this and defended it during the Assange extradition proceedings.