No one is forced to be a Christian. But no one should be forced to live according to the "new religion" as though it alone were definitive and obligatory for all mankind.

Distinction Matter - Subscribed Feeds

-

Site: Zero HedgeTether USDT Stablecoin Seen On Bolivian Store Price-TagsTyler Durden Mon, 06/09/2025 - 10:45

Authored by Adrian Zmudzinski via CoinTelegraph.com,

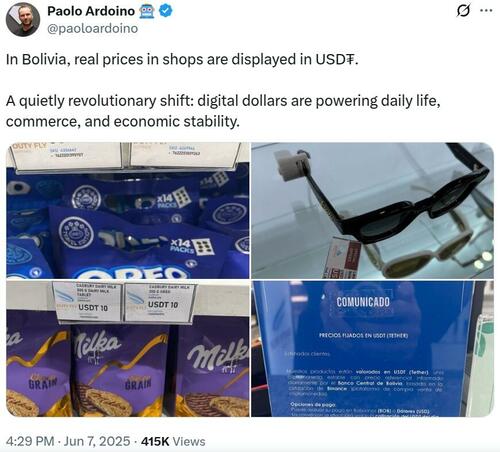

Tether CEO Paolo Ardoino has shared photos of goods in a Bolivian airport shop priced in the company’s stablecoin, USDt, suggesting growing unofficial use of the cryptocurrency amid the country’s ailing economy.

In a Saturday X post, Ardoino shared images of items being priced in USDt in Bolivia, including sunglasses and sweets. One photo showed a notice to customers that prices were set in USDT:

“Our products are priced in USDT (Tether), a stable cryptocurrency with a reference price informed daily by the Central Bank of Bolivia, based on the rate from Binance (a cryptocurrency trading platform),” the notice read.

The notice said customers could pay in either local fiat currency, Bolivianos, or US dollars. USDT was used to establish the dollar-Bolivianos exchange rate.

Source: Paolo Ardoino

USDt making waves in Bolivia

The notice and the items were photographed at Duty Fly, an airport shop offering duty-free items to its customers. Neither Duty Fly nor Tether responded to Cointelegraph’s request for comment.

It’s unclear how widespread the use of USDT is as a pricing benchmark across Bolivia, but other reports suggest that the stablecoin is gaining considerable popularity in the country. In late October 2024, major local bank Banco Bisa began offering a custody service for USDT, stating that it would enable its clients to buy, sell and transfer the asset through the bank.

Bolivia’s economy crumbles

Bolivia’s economy has been in steep decline. The country’s usable foreign reserves fell from $15 billion in 2014 to $1.98 billion in December 2024, equivalent to only 2.9 months of imports. Of that amount, less than $50 million was in cash, and the rest was in gold.

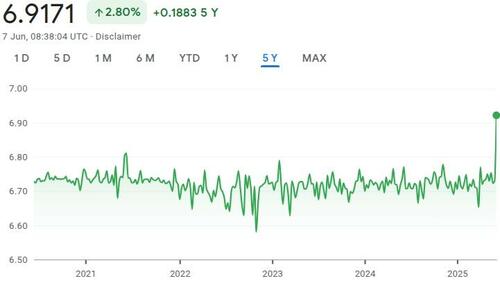

Bolivia has a thriving black market for dollars, with the street rate reaching about 10 Bolivianos per dollar as of mid-2024. The current official exchange rate is approaching 7 Bolivianos per US dollar.

USD/BOB exchange rate chart. Source: Google Finance

The Bolivian government also spends about $56 million per week importing diesel and gasoline, yet it still faces nationwide shortages. The local Consumer Price Index inflation stood at 14.6% as of March 2025.

One of the photos shared by Ardoino showed a pack of Oreos priced between 15 and 22 USDT, underscoring the rapid erosion of the local currency’s purchasing power.

-

Site: Fr. Z's BlogLet’s have a look at the Collect for today’s Mass of Pentecost Monday. COLLECT (1962MR): Deus, qui Apostolis tuis Sanctum dedisti Spiritum: concede plebi tuae piae petitionis effectum; ut, quibus dedisti fidem, largiaris et pacem. I found this prayer in … Read More →

-

Site: AsiaNews.itThe body of Nattapong Pinta, a Thai farm worker who died soon after he was captured, was recovered over the weekend. In Thailand, the authorities expressed their sadness over the death. The sister of another hostage, Bipin Joshi, from Nepal, issued an appeal for his release, but his fate remains uncertain. In Israel, the Israeli parliament (Knesset) is set to vote on Wednesday on a motion to dissolve it over the issue of military service for Haredi Jews.

-

Site: LifeNews

Last Saturday, the Indiana Department of Health released its “Terminated Pregnancy Report” for the first quarter of 2025, revealing alarming developments.

First, we can’t stress enough how shocking this data is…

Out of 22 abortions reported in the first quarter, only 2 individual Terminated Pregnancy Reports (TPRs) were completed and submitted as required by Indiana state law.

%20(1500%20x%20500%20px)%20(1500%20x%20650%20px).png?width=1200&upscale=true&name=VICTORY%20(1500%20x%20500%20px)%20(1500%20x%20500%20px)%20(1500%20x%20650%20px).png)

The Hoosier State’s abortionists are largely ignoring Indiana’s reporting requirements, obscuring their activities in a dark shroud of secrecy.

Our legal team is in the middle of a legal battle against two abortionists who have sued our client, abortion industry watchdog Voices for Life. These abortionists are trying to keep individual TPRs hidden from public review—and this new report reveals that they don’t even bother to follow the law when the public doesn’t hold them accountable.

Second, it’s clear that those reported numbers don’t come close to the true number of abortions happening…

The state’s just-released Complications Report for the first quarter documented 20 complications from abortions in just three months. Of these, 13 were from chemical abortions, with 9 directly linked to the lethal abortion drugs mifepristone and misoprostol.

The most common complications? Incomplete abortions, accounting for 12 cases, alongside infections, bleeding, and inflammatory diseases… all side effects of chemical abortion pill.

This report dropped just days after Indy 500 race spectators were bombarded with “Abortion Pills By Mail” flyover ads during Memorial Day weekend, promoting the drugs responsible for these horrible complications with the coldness of an insurance agency or ice cream brand advertisement…

These findings underscore the importance of our fight to defend Indiana-based Voices for Life, a courageous nonprofit fighting to restore public access to TPRs—non-patient identifying records that keep women and children safe by keeping the abortion industry in check.

A win for Voices for Life is critical to ensuring accountability and safety, but we face fierce opposition…

A preliminary injunction, secured by two Indiana abortionists in March 2025, currently blocks release of TPRs—and women and children are suffering as a result, and the public is being left in the dark…

As our case grows more urgent, I’m eternally grateful for the support and prayers of pro-life Americans like you, Steven. You fuel our fight against the well-funded abortion industry and its foot soldiers, like the abortionists we’re currently battling in court.

Our legal team is appealing on behalf of Voices for Life to restore transparency through TPRs, but this new report just boosted the stakes even higher in this fight.

Losing isn’t an option, and we won’t stop fighting until the public is once again able to access the public records that they have a right to see. The abortion industry is not above the law.

The post Indiana Abortionists are Breaking the Law to Justify Killing Babies appeared first on LifeNews.com.

-

Site: LES FEMMES - THE TRUTH

-

Site: Fr. Z's BlogORIGINAL NOTES: Today is Monday in the Octave of Pentecost, or at least it ought to be in in the Novus Ordo as it is in the older, Traditional Roman Calendar. I dig in to what a liturgical Octave, is … Read More →

-

Site: PeakProsperityAll the news that didn't fit. It's the misfit news of the week, condensed for your reading pleasure. Let's get caught up...

-

Site: Zero HedgeGreta Thunberg Claims She's Been 'Kidnapped' By Israeli ForcesTyler Durden Mon, 06/09/2025 - 09:25

Authored by Ken Silva via Headline USA,

Climate alarmist turned humanitarian activist Greta Thunberg said Sunday that she’s been “kidnapped” after she and the rest of the crew aboard the The Madleen, a sailboat that’s trying to break Israel’s starvation blockade on Gaza, was intercepted and boarded by Israeli forces.

‘My name is Greta Thunberg and I am from Sweden. If you see this video, we have been intercepted and kidnapped in international waters by the Israeli occupational forces, or forces that support Israel,” she said. “I urge all my friends, family and colleagues to put pressure on the Swedish government to release me as soon as possible. ”

"My name is Greta Thunberg and I am from Sweden. If you see this video, we have been intercepted and kidnapped in international waters by the Israeli occupational forces, or forces that support Israel." pic.twitter.com/Ku7QILHpfd

— Prem Thakker (@prem_thakker) June 9, 2025According to antiwar.com’s Dave Decamp, Israeli Defense Minister Israel Katz ordered the IDF to intercept the Madleen earlier on Sunday. DeCamp reported that the boat is carrying 12 civilian activists who are traveling unarmed, including Thunberg.

“I have instructed the IDF to act to ensure that the hate flotilla ‘Madleen’ does not reach the shores of Gaza—and to take all necessary measures to achieve this,” Katz wrote on X, as reported by DeCamp.

“A senior Israeli official told Israel’s Channel 12 that if the boat doesn’t turn around, it would be boarded by Israeli Navy commandos and brought to the port of Ashdod,” DeCamp reported.

Israel supporters in the U.S. have suggested Israel should sink the Madleen, including sports gambling mogul Dave Portnoy and Sen. Lindsey Graham (R-SC).

“Hope Greta and her friends can swim!” Graham said in a post on X.

-

Site: Rorate CaeliSunday June 8, 2025Les Courlis Bishop Athanasius Schneider In the name of the Father, and of the Son, and of the Holy Ghost. Amen “Come Holy Ghost, fill the hearts of Thy faithful, and kindle in them the fire of Thy love”. Pentecost is the day when the Church first manifested Herself to mankind in a startling way. She showed Herself to be Catholic because there is only New Catholichttp://www.blogger.com/profile/04118576661605931910noreply@blogger.com

-

Site: Zero HedgeKey Events This Week: CPI, US-China Trade Talks, Treasury AuctionsTyler Durden Mon, 06/09/2025 - 09:16

The highlight this week will be US CPI on Wednesday and a resumption of trade talks between the US and China today in London. Bessent, Lutnick and Greer are set to meet Chinese representatives at the meeting today. So it's all the big guns from the US administration. DB's Jim Reid reminds us that the monthly 30-yr UST auction on Thursday will also be a heavy focus with all the attention on the long-end in recent weeks. There's a 10yr auction the day before as well. So a good test of demand as the fiscal bill meanders its way through Congress.

Before we preview the CPI release the other main highlights this week are the NY Fed 1-yr inflation expectations today; US NFIB small business optimism, UK employment data and Danish and Norwegian CPI tomorrow; that CPI, the 10yr UST auction and the UK Spending Review on Wednesday; US PPI, US jobless claims, UK monthly GDP, the 30yr UST auction and my birthday on Thursday; and the UoM consumer sentiment (including inflation expectations) on Friday. A fuller day-by-day diary of events is at the end as usual.

With regards to US CPI, DB's US economists expect weak seasonally adjusted gas prices to again keep the headline rate (+0.20% forecast vs. +0.22% previous) gain below that of core (+0.31% vs. +0.24%). This should help the YoY rate for both headline and core to rise two-tenths to 2.5% and 3.0%, respectively. Shorter-term trends for core would be mixed with the three-month annualized rate rising by three-tenths to 2.4% while the six-month rate would remain steady at 3.0%. DB's economists do expect tariffs to begin to impact core goods prices, especially in categories like household furnishings and supplies where we saw potential preliminary tariff impacts in the April data. On the services side, economists will be most attuned to the volatile categories like lodging away and airline fares that have been a meaningful drag of late. For PPI the following day, our economists expect a +0.27% increase in May which would reduce the YoY rate by a couple of tenths. As ever, how the subcomponents that feed into core PCE come out will be the most interesting part of the release. Note that the Fed are now on media blackout ahead of next Wednesday's (18th) FOMC.

It's not clear that the Fed will have learnt too much more than they already knew from Friday's payrolls data. May headline (+139k vs. 147k) and private (140k vs. 146k) payrolls were slightly above the 126k consensus but -95k of net revisions to the two previous months softened the beat. We now have very stable private sector hiring trends over the past three (133k), six (146k) and twelve (122k) months. However the narrow breadth in job growth as health care / social assistance (+78k) and leisure / hospitality (+48k) continued to drive the majority of private sector job gains in May and have accounted for 75% of private job growth over the past twelve months.

Staying on employment there will be increased attention on claims this week given the recent tick up. It's not clear whether its seasonals or evidence that there is some real time slipping in employment trends.

Courtesy of DB, here is a day-by-day calendar of events

Monday June 9

- Data: US May NY Fed 1-yr inflation expectations, April wholesale trade sales, China May CPI, PPI, trade balance, Japan May Economy Watchers survey, bank lending, April BoP current account balance, BoP trade balance

- Central banks: ECB's Elderson speaks

Tuesday June 10

- Data: US May NFIB small business optimism, UK April average weekly earnings, unemployment rate, May jobless claims change, Japan May M2, M3, machine tool orders, Italy April industrial production, Sweden April GDP indicator, Norway and Denmark May CPI

- Central banks: ECB's Villeroy, Holzmann and Rehn speak

- Auctions: US 3-yr Notes ($58bn)

Wednesday June 11

- Data: US May CPI, federal budget balance, Japan May PPI, Canada April building permits

- Central banks: ECB’s Lane and Cipollone speak

- Earnings: Oracle, Inditex

- Auctions: US 10-yr Notes (reopening, $39bn)

- Other: UK Spending Review

Thursday June 12

- Data: US May PPI, Q1 household change in net worth, initial jobless claims, UK May RICS house price balance, April monthly GDP, Germany April current account balance, Italy Q1 unemployment rate

- Central banks: ECB's Muller, Escriva, Knot, Guindos and Schnabel speak

- Earnings: Adobe

- Auctions: US 30-yr Bond (reopening, $22bn)

Friday June 13

- Data: US June University of Michigan survey, Japan April capacity utilisation, Tertiary industry index, Germany May wholesale price index, Italy April trade balance, Eurozone April trade balance, industrial production, Canada April manufacturing sales, Q1 capacity utilisation rate

* * *

Finally, looking at the US, Goldman notes that the key economic data releases this week are the CPI report on Wednesday and the University of Michigan report on Friday. Fed officials are not expected to comment on monetary policy this week, reflecting the blackout period ahead of the June FOMC meeting.

Monday, June 9

- 11:00 AM New York Fed 1-year inflation expectations, May (last 3.6%)

Tuesday, June 10

- There are no major data releases scheduled.

Wednesday, June 11

- 08:30 AM CPI (MoM), May (GS +0.17%, consensus +0.2%, last +0.2%); Core CPI (MoM), May (GS +0.25%, consensus +0.3%, last +0.2%); CPI (YoY), May (GS +2.47%, consensus +2.5%, last +2.3%); Core CPI (YoY), May (GS +2.89%, consensus +2.9%, last +2.8%): We estimate a 0.25% increase in May core CPI (month-over-month SA), which would raise the year-over-year rate by 0.1pp to 2.9%. Our forecast reflects a decline in used car prices (-0.5%) reflecting a decline in auction prices, a slight increase in new car prices (+0.1%), and a more moderate increase in the car insurance category (+0.4%) based on premiums in our online dataset. We expect another soft month of travel services inflation based on higher frequency prices measures: we forecast unchanged hotel prices and unchanged airfares. We have penciled in moderate upward pressure from tariffs on categories that are particularly exposed (such as apparel, recreation, and communication) worth +0.05pp on core inflation. We expect the shelter components to decelerate on net (OER +0.31% vs. +0.36% in April; primary rent +0.31% vs. +0.34%). We estimate a 0.17% rise in headline CPI, reflecting higher food prices (+0.4%) but sharply lower energy prices (-1.2%).

Thursday, June 12

- 08:30 AM PPI final demand, May (GS +0.3%, consensus +0.2%, last -0.5%); PPI ex-food and energy, May (GS +0.3%, consensus +0.3%, last -0.4%) ;PPI ex-food, energy, and trade, May (GS +0.3%, consensus +0.3%, last -0.1%);

- 08:30 AM Initial jobless claims, week ended June 7 (GS 260k, consensus 241k, last 247k); Continuing jobless claims, week ended May 31 (consensus 1,910k, last 1,904k): We estimate that initial claims rose a further 13k to 260k in the week ended June 7, reflecting a boost from residual seasonality related to the timing of the Memorial Day holiday.

Friday, June 13

- 10:00 AM University of Michigan consumer sentiment, June preliminary (GS 53.6, consensus 53.5, last 52.2); University of Michigan 5-10-year inflation expectations, June preliminary (GS 4.1%, consensus 4.2%, last 4.2%)

Source: DB, Goldman

-

Site: LifeNews

On Sunday night, the Justice for Victims of Abortion Drug Dealers Act (HB 575) and the Stop Coerced Abortion Act (HB 425) passed through the Louisiana Senate.

HB 575 by Reps. Lauren Ventrella and Julie Emerson empowers Louisiana citizens harmed by abortion to file lawsuits against abortion drug dealers who unlawfully sell abortion services, including predators and abusers.

SUPPORT LIFENEWS! If you want to help fight abortion, please donate to LifeNews.com!

HB 425 by Rep. Josh Carlson broadens the current definition of coercion in RS: 87:6 to encompass tactics often employed by abusers, like control or intimidation, that force a woman to undergo an abortion against her will.

Executive Director for Louisiana Right to Life, Benjamin Clapper, said the following after the Senate passage:

We applaud the Louisiana Senate for passing these two pro-life bills that continue Louisiana’s legacy of defending life and protecting women from the abortion industry. The reckless sale of abortion pills by out-of-state businesses have led to increased instances of women being coerced to have abortions. HB 575 and HB 425 strengthen laws to prevent coerced abortion and allow women hurt by abortion to seek justice.

Contrary to Senator Duplessis’ statements on the Senate floor, the word “promoting” was removed from HB 575 in a Senate committee amendment. Therefore, a lawsuit brought under HB 575 cannot be for brought against someone “promoting” the availability of an abortion.

We are grateful for the dedication of Senator Rick Edmonds who boldly defended HB 575 from pro-abortion attacks and Senator Brach Myers for promoting HB 425.

Louisiana Right to Life is committed to a future where women and girls are safe from the predatory tactics of the abortion industry and can pursue justice for themselves and their families.

The post Louisiana Senate Passes Bill Targeting Illegal Abortion Pill Sellers appeared first on LifeNews.com.

-

Site: PaulCraigRoberts.org

THE CAMP OF THE SAINTS

I have never understood why rioters, protestors, whatever you want to call them, burn people’s cars. Insurance seldom covers such events. Violent protests harm innocents.

I also don’t understand why the National Guard is called out as they are not permitted to use their weapons. Try to imagine the National Guard using deadly force to break up looting and burning of property. In America the defense of property and livelihood plays second fiddle to the lives of criminals. Property can be protected only as long as the criminals stealing and damaging it are not harmed.

It seems to me that Hispanics have taken back California. We might as well cede the state back to Mexico. America, or what is left of it, would be better off as California is a main source of Woke, left-wing, anti-white influence. America would be much better off without California. The Democrat governor of California says that the immigrant-invaders are “his people, his community.” https://x.com/DOGE__news/status/1931911364487876934

Indeed, the argument can be made that immigrant-invaders who have been permitted to live in the US for a number of years now have roots in America and squatters’ rights to citizenship. Squatters’ rights–the legal term is adverse possession–has long been a legitimate legal concept. Adverse possession is a legal doctrine that allows a person to acquire title to real property by continuously occupying it without the owner’s permission for a statutorily defined period. The non-enforcement of borders creates squatters’ rights. There is little doubt that courts would include citizenship as a right of adverse possession.

Without a border a country is just an open area to which anyone can come. Other states and cities under Democrat control want citizenship given to whoever walks across the non-existing border.

For now the forces rising to the defense of immigrant-invaders are limited to a small area of Los Angeles. If the deportation attempts continue, the opposition can spread and become more violent. White Democrats will join the rising simply because they oppose Trump.

Decades ago President Reagan faced the problem caused by the need by agribusiness and California fruit and vegetable growers and US chicken processors for labor that US citizens did not want to undertake. Agri-business interests persuaded the Reagan administration to amnesty millions of illegals. But nothing was done about the border. Consequently, now the problem is much worse.

It is impossible to have a nation without borders as the nation dissolves into a Tower of Babel, the ever-closer fate of all Western countries. The US no longer consists of European ethnicities and enculturated American blacks. Today there are large and growing populations of Hispanics, Asians, Arabs. The language and religious base of the country is decaying. There is no doubt that the United States is transforming into a Tower of Babel.

When you look at the news photos and videos, it is interesting that so many white Americans are in the streets claiming California for immigrant-invaders.

It is likely that America is already lost. Deportation of millions of illegals is impossible. Israel can’t get rid of 2 million Palestinians with bombs and bullets and is having to impose starvation and disease. America’s illegals will end up with amnesty. As soon as the Establishment gets rid of Trump, the border will be reopened. Jean Raspail’s prediction for the fate of the Western World is locked into place. European ethnicities have pissed away their existence. All Western ethnicities should be labeled “endangered species.”

-

Site: LifeNews

A majority of the British public opposes attempts to decriminalise abortion and believes that the criminal law provides “clear boundaries” and protects “everyone involved” finds a major new poll from Whitestone Insight.

Asked if “Having an illegal abortion should continue to be a criminal offence to protect both the unborn and vulnerable women who could be coerced into losing a baby they may have wanted, for example by an abusive partner”, more than six in 10 (62 per cent) agreed, while less than one in five (17 per cent) disagreed.

A similar number (64 per cent) agreed with the statement that “Abortion is a matter of life and death and it is therefore appropriate that the criminal law provides a clear boundary to protect everyone involved”. Just 14 per cent of those surveyed disagreed.

The poll of more than 2,000 members of the public, commissioned by the pro-life group SPUC, is the first test of public opinion since plans to decriminalise abortion were put forward as amendments to the Crime and Policing Bill, which is currently in Parliament.

SUPPORT LIFENEWS! If you want to help fight abortion, please donate to LifeNews.com!

It found the public massively under-estimates the number of terminations carried out in the UK each year with one in three (33 per cent) saying fewer than 50,000 and fully one-half (50 per cent) fewer than 100,000, nearly two-thirds of those questioned supported the idea of extending criminal sanctions to abortion providers. Asked if they agreed with the following statement: “It is unjust that pregnant women alone, and not those who prescribe or dispense women abortion pills, are liable for any misuse of those pills” 64 per cent agreed with just 17 per cent disagreeing.

Michael Robinson, Executive Director of SPUC, said the poll shows that the British public, has a better understanding of the complexities around abortion than those “championing abortion on demand”. He said: “The polling, the first since the publication of proposed amendments to the Crime and Policing Bill, clearly shows that the British public doesn’t support abortion on demand and rejects the deeply flawed arguments from the abortion lobby that it should be removed from the criminal law. While believing that the law should be rarely applied, the public recognises that criminal sanction should be applied in some cases and wants the law extended to cover those abortion providers who act in a reckless fashion endangering the lives of mothers and their babies.”

Asked: “The criminal law should continue to be applied in cases of illegal abortion, but only where a woman could not reasonably have known how far through the pregnancy she was when the abortion pills were taken”, half (49 per cent) agreed with one in seven (15 per cent) disagreeing and one third (34 per cent) unsure or not answering.

Testing public opinion further, the survey asked: “Seeking an illegal abortion should not be a criminal offence”. Of those who expressed an opinion nearly six in 10 (58 per cent) disagreed and four in 10 agreed.

Mr Robinson concluded: “While the Great British public massively underestimates the number of abortions each year with half of those surveyed wrongly thinking it’s 100,000 or less, the true figure is nearly 300,000, they recognise a baby’s life is precious and abortion is not like having a bunion removed, it’s the termination of a baby’s life. This is why there must be reserve powers in the criminal law that protect both mother and child. Those peddling abortion on demand and without consequences are step with public opinion and I would urge MPs to reject these amendments and instead look at ways to extend criminal responsibility to those providers who recklessly endanger the health and lives of vulnerable women.”

Poll Methodology:

Methodology note: Whitestone interviewed 2109 UK adults on 28-29 May 2025. Data were weighted to be representative of all adults. Whitestone is a member of the British Polling Council and abides by its rules.

The post New Poll Shows Majority of UK Residents Oppose Legalizing Abortions Up to Birth appeared first on LifeNews.com.

-

Site: LifeNews

The FBI has yet to solve at least five cases it opened into arson attacks targeting pro-life pregnancy centers in 2022, according to an investigation by the Daily Caller News Foundation.

The Biden FBI offered cash rewards in 2022 for information on suspects responsible for firebombings around the country, mainly directed at pro-life facilities, after the preemptive May 2 leak of a Supreme Court ruling that overturned the abortion precedent established by Roe v. Wade. Five local FBI field offices told the DCNF that the bureau is still offering the incentive for cases in Colorado, North Carolina, Washington state, Oregon and New York, indicating suspects were never found or convicted.

The FBI’s Seattle field office told the DCNF that it’s typical for the bureau to update or delete the bulletins asking the public for information if suspects are caught, and if they’re on the website, the FBI is still looking for answers. The FBI’s national press office did not respond to a request for comment.

SUPPORT LIFENEWS! If you want to help fight abortion, please donate to LifeNews.com!

‘Enforce The Law Equally’

One targeted facility’s CEO, Jim Harden, told the DCNF he got a phone call from an employee around two in the morning on June 7, 2022, that changed his life. The Amherst, New York, building that was home to his organization CompassCare was set ablaze in what was eventually determined to be arson. The FBI released footage showing what it said were two suspects arriving in a car at night and throwing Molotov cocktails at the building.

Harden’s team had been on high alert that summer, having already contacted the FBI over concerns about a heightened risk of violence. Soon after the fire, he moved with his wife and children to flee an onslaught of threats against them as extremists lashed out at CompassCare, a Christian nonprofit providing free medical care to pregnant mothers to steer them away from abortion.

“Our lives are very different now,” he said in an interview with the DCNF. “We had to relocate our family … we had people riding past our house pointing guns at our kids.”

Assistant Attorney General for Civil Rights Harmeet Dhillon said in April that there were more than 200 cases of pregnancy resource centers “violently attacked by activists with no action by law enforcement, federal or state” in the past several years. Family Research Council documented almost 50 instances of vandalism and other attacks on pregnancy centers and pro-life organization buildings from May through June 2022.

“I can say we are taking them seriously now and will be for the duration,” Dhillon told the DCNF about such cases. Dillon declined to comment about any specific prosecutions that may be ongoing or forthcoming.

“This Department of Justice is committed to protecting crisis pregnancy centers, pro-life organizations and places of worship from targeted acts of violence and will work to ensure justice is served to criminals who engage in this unlawful behavior,” a DOJ spokesperson said in response to questions about the unsolved cases.

The spree of violence even resulted in arson at a Portland pregnancy center run by a self-professed pro-choice woman in July 2022. As in the five cases involving pro-life groups, the FBI told the DCNF it is still offering a reward for information. The Dobbs opinion leak, which was investigated but never solved, also inspired an assassination attempt on Supreme Court Justice Brett Kavanaugh near his home.

The Portland facility did not respond to multiple requests for comment. The other pregnancy centers with unsolved cases in Longmont, Colorado and Portland did not respond to multiple requests for comment, while one in Seattle declined to comment.

Harden, the CompassCare CEO, said the pro-abortion Biden administration seemed apathetic about solving the cases, despite the FBI interviewing him about the Amherst bombing. He recalled reaching out and asking urgently for updates, leading to a moment when he said an FBI agent “was screaming” over the phone that the bureau was not required to update him.

“Their job was to enforce the law equally, and it did not appear as if they were doing so,” Harden said.

‘Mountain Of Evidence’

While announcements about pro-abortion vandalism cases were scarce, the Biden administration boasted in press releases about several prosecutions of pro-life activists under the Freedom of Access to Clinic Entrances (FACE) Act for protesting at abortion clinics. On his first week in office, President Donald Trump pardoned nearly two dozen pro-lifers accused of federal crimes.

Former Attorney General Merrick Garland explained the discrepancy in March 2023 by telling Congress that “it is quite easy” to identify and charge pro-lifers protesting in daylight.

“Those who are attacking the pregnancy resources centers, which is a hard thing to do, are doing this at night in the dark,” Garland said.

Harden did not — and does not — buy Garland’s explanation whatsoever.

“There’s a mountain of evidence,” Harden said of the vandals, noting that the authorities can search for license plate numbers, body mechanic imagery and cell phone IP addresses. “It’s just not possible they don’t know who they are. The FBI [is] the most technically advanced law enforcement agency on the planet.”

Some attacks on pro-life centers in 2022 were linked to a leftist group called Jane’s Revenge, with activists posting online threats in response to news about the leaked Dobbs decision. The FBI said the CompassCare vandals left the spray-painted message, “Jane was here.”

Harden told the DCNF his Amherst building was repaired at “miraculous” speed in 52 days thanks in part to volunteer workers, but the damage cost millions of dollars.

The attack inspired Harden to become more outspoken about political issues via media interviews. He also launched a campaign on a pro-life platform to fill Republican Rep. Elise Stefanik’s House seat in a New York special election. Stefanik announced she would remain in her role in April after Trump pulled her nomination to represent the U.S. in the United Nations.

‘Heart Problem’

Paula McSwain, executive director of the Crisis Pregnancy Center in Lincolnton, North Carolina, told the DCNF she received a letter from the FBI in August 2024 saying its investigation into arson at her building in June 2022 was closed. Surveillance footage showed someone at nighttime throwing what the FBI said was a Molotov cocktail.

The Lincolnton case is one of several for which the FBI is still offering a reward for information on any suspects, according to the bureau’s Charlotte field office.

McSwain said she was fortunate enough to get the pregnancy center up and running fairly easily.

“If they wanted to destroy the building, they could have done a better job,” McSwain told the DCNF.

The pro-life leader decided to respond to her ordeal by limiting public outcry.

“That’s what they were seeking, was attention,” McSwain said of the vandals.

Harden and McSwain said that if they could give any message to their attackers, it would be one of forgiveness through Jesus Christ.

“If you throw fire at any building, you’ve got a heart problem and there’s something not right with your life … We don’t seek revenge, we just pray for them,” McSwain said.

“The only reason I can forgive you is because forgiveness has been made available to me, and so I would encourage you to come out of the darkness and into the light,” Harden said his words to the criminals would be.

“Nothing is going to go unpunished if it’s sin,” Harden said.

LifeNews Note: Hudson Crozier writes for Daily Caller. Content created by The Daily Caller News Foundation is available without charge to any eligible news publisher that can provide a large audience.

The post Pro-Life Pregnancy Center Still Awaiting Justice 3 Years After Firebombing appeared first on LifeNews.com.

-

Site: LifeNews

A growing number of young men are turning away from the Democratic Party, citing perceptions that it is weak, out of touch, and dismissive of their concerns, according to new findings from a major research initiative reported by Politico.

The “Speaking with American Men” (SAM) project, a two-year, $20 million effort, released its first wave of findings June 4, drawing from 30 focus groups and a national media consumption survey.

According to Politico, “Participants described the Democratic Party as overly-scripted and cautious, while Republicans are seen as confident and unafraid to offend.”

“Democrats are seen as weak, whereas Republicans are seen as strong,” Ilyse Hogue, co-founder of the SAM project, told Politico. “Young men also spoke of being invisible to the Democratic coalition, and so you’ve got this weak problem and then you’ve got this, ‘I don’t think they care about me’ problem, and I think the combination is kind of a killer.”

Click here to sign up for pro-life news alerts from LifeNews.com

SAM’s national survey also revealed just 27% of young men view the Democratic Party favorably, while 43% hold a positive view of Republicans — a stark indicator of the ongoing political shift among younger male voters.

Focus groups also revealed deeper frustrations with how Democrats frame masculinity. One participant noted that Democrats promote “fluid masculinity,” while Republicans embrace “traditional masculinity of a provider.”

Others criticized Democratic campaigns for prioritizing celebrity appearances over real policy solutions. One Latino man from Las Vegas pointed to former Vice President Kamala Harris’ 2024 campaign, which featured appearances with Beyoncé and Lady Gaga.

“It just kind of felt like, what does that have to do with me? I’m trying to move up in life,” the participant said, according to Politico.

By contrast, President Donald Trump’s direct policy promises — such as eliminating taxes on tips and overtime — reportedly resonated with voters as practical and action-oriented.

The SAM findings align with broader national trends. A CNN poll released June 1 found that 40% of Americans identify Republicans as the party of strong leadership, compared to just 16% for Democrats. Republicans also led by wide margins as the party that “gets things done” and drives “change.”

Additional polling underscores growing Democratic disillusionment. A survey last month found that only one-third of Democratic voters felt optimistic about the future of their party — a sharp drop from nearly 60% in July 2024.

LifeNews Note: Elise DeGeeter writes for CatholicVote, where this column originally appeared.

The post Young Men are Abandoning the Democrat Party appeared first on LifeNews.com.

-

Site: LifeNews

A 32-year-old man from the state of Washington has been charged with materially supporting the man who bombed a fertility clinic in California on May 17, federal authorities announced June 4. He faces up to 15 years in federal prison.

Daniel Jongyon Park, of Kent, was arrested June 3 and charged with providing and attempting to provide material support to terrorists, according to a DOJ news release. He appeared in court June 4 in the Eastern District of New York.

The release said, citing an affidavit filed with the federal criminal complaint, that Park shipped and paid for about 270 pounds of ammonium nitrate — an explosive precursor — for Guy Edward Bartkus the 25-year-old man from Twentynine Palms, California, who drove a car that contained a bomb to a clinic in Palm Springs.

Click here to sign up for pro-life news alerts from LifeNews.com

According to a May 23 press release from FBI Los Angeles’ office, Bartkus’ vehicle, a silver 2010 Ford Fusion sedan, exploded in front of the American Reproductive Centers, killing one person who was in or near the vehicle and causing non-life-threatening injuries to four people who were nearby. Power was restored quickly and no embryos were lost in the attack, the release said.

American Reproductive Centers does not perform abortions, the release said. According to the clinic’s website, its services include in vitro fertilization (IVF), intrauterine insemination (IUI), pre-implantation genetic testing (PGT), in-house egg donation, surrogacy, fertility evaluations, egg freezing, elective single embryo transfer, “LGBTQ family building,” and endoscopic surgery.

The DOJ release confirmed that Bartkus killed himself, injured people, destroyed the building, and damaged nearby buildings in the bombing.

“Bartkus’s attack was motivated by his pro-mortalism, anti-natalism, and anti-pro-life ideology, which is the belief that individuals should not be born without their consent and that non-existence is best,” the release said. “Park — who shares Bartkus’s extremist views — shipped large quantities of explosive precursor materials to Bartkus.”

Park flew to Europe a few days after Bartkus bombed the facility, according to the release. He was detained in Poland on May 30 and later was deported to the US. Law enforcement picked him up shortly after he flew into John F. Kennedy International Airport in New York City.

Park and Bartkus spent time at Bartkus’ residence and its garage “running experiments,” the affidavit said, according to the release. Law enforcement found in the garage chemicals commonly used in the creation of homemade bombs.

“This defendant is charged with facilitating the horrific attack on a fertility center in California. Bringing chaos and violence to a facility that exists to help women and mothers is a particularly cruel, disgusting crime that strikes at the very heart of our shared humanity,” Attorney General Pamela Bondi said in the release. “We are grateful to our partners in Poland who helped get this man back to America and we will prosecute him to the fullest extent of the law.”

The FBI’s Inland Empire Joint Terrorism Task Force is investigating. The Palm Springs Police Department; the San Bernardino County Sheriff’s Department; the FBI’s legal attaché in Warsaw, Poland; officials in Poland; and FBI field office personnel in Seattle, New York, San Diego, Las Vegas, and Portland assisted.

Sarah E. Gerdes and Anna P. Boylan, who are assistant US attorneys for the Central District of California, and Patrick J. Cashman, a trial attorney for the National Security Division’s Counterterrorism Section, are prosecuting the case.

LifeNews Note: Mary Stroka writes for CatholicVote, a pro-life group.

The post Man Charged With Helping Abortion Activist Who Bombed Fertility Clinic, Faces 15 years in Prison appeared first on LifeNews.com.

-

Site: PaulCraigRoberts.org

Putin’s Non-response to Provocations Is a Direct Road to Nuclear War

PCR On Target with Larry Sparano

Putin avoided the dire consequences mandated by Russian war doctrine by labeling the attack on Russia’s strategic triad a “terrorist act,” not an act of war. This has delayed, but not prevented a wider and more dangerous war, because what Putin has actually done is to eviscerate Russian war doctrine. If the President of Russia can refuse to acknowledge acts of war against Russia, the country has no defense. What can Putin do now to restore deterrence?

It is extraordinary that the US foreign policy community, the Trump administration, every European government, and Putin himself have zero comprehension of the seriousness of the attack on Russian strategic forces. Putin saved the day by denying any such attack. But the consequence is that the next attack on Russia will be even more provocative. At some point Putin will be forced to stop denying reality.

It is increasingly likely that Putin’s unwillingness to use sufficient force to terminate the conflict with the West in Ukraine will result in nuclear war.

-

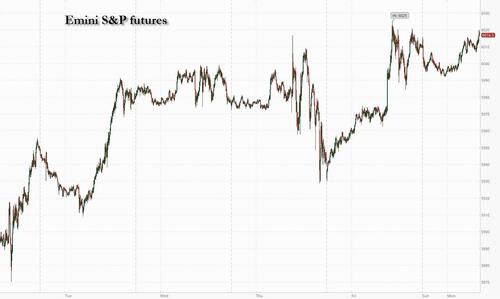

Site: Zero HedgeFutures Rise Ahead Of US-China TalksTyler Durden Mon, 06/09/2025 - 08:16

US equity futures reverse earlier losses and trade near session highs, with small cap/Russell outperformance pointing to a further potential squeeze in high-beta names as investors monitor talks between the US and China in London to defuse tensions over rare-earth minerals and advanced technology. As of 8:00AM, S&P futures rose 0.2% after the main gauge broke through the 6,000 level for the first time since February at the end of last week. Nasdaq 100 futs gained 0.1%, with Mag7 names mixed premarket, Semis are higher, and cyclicals poised to outperform Defensives. Chinese shares trading in Hong Kong entered a bull market. European stocks barely budged, while a gauge for emerging-market equities was set for its highest close in more than three years. Bond yields are lower, and USD is weaker as commodities are led by Energy and precious metals; silver continues to close the gap to gold, although today it is platinum and palladium's turn to shine. Today’s focus is the US/China trade mtg in London: overnight, HK and HSTECH performed well into the summit. Macro data prints include NY Fed’s 1-year inflation expectations (3.63% prior print) which could affect the yield curve as the Fed is in its blackout window.

In premarket trading, Mag 7 were mostly higher with the exception of Tesla which isdown 2.3% after Baird downgraded the stock to neutral, noting that the recent share price rally followed a fundamentally poor quarter for the EV maker. Other names traded flat to up: Nvidia +0.4%, Apple +0.6%, Alphabet +0.6%, Amazon +0.4%, Meta Platforms +0.04%, Microsoft -0.1%. Warner Bros Discovery (WBD) rose 4% after saying it will separate the company into two publicly traded businesses, splitting its streaming and studios business and its TV networks operations by the middle of next year. Here are some other notable premarket movers:

- Air mobility stocks are set to extend gains after President Donald Trump signed an executive action establishing an electric “Vertical Takeoff and Landing” integration pilot program, according to a White House fact sheet.

- Archer Aviation (ACHR) +9%, Joby Aviation (JOBY) +9%, Vertical Aerospace (EVTL) +7%

- EchoStar (SATS) falls 9% after the Wall Street Journal reported the company is weighing a potential chapter 11 bankruptcy filing amid a Federal Communications Commission review of certain of its wireless and satellite spectrum rights, citing people familiar with the matter.

- Etoro Group (ETOR) rises 3.3% after Mizuho, Jefferies and Citizens initiate the investment platform with a buy-equivalent rating, citing a growing retail-investor client base and potential for further growth in Europe and the US.

- Grab Holdings Ltd. (GRAB) inches 1% lower after the company said it isn’t in talks to acquire Southeast Asia internet peer GoTo Group “at this time,” signaling it’s halting or at least pausing a planned $7 billion acquisition of its Southeast Asia internet peer.

- Opendoor Technologies (OPEN) drops 13% after the company announced plans to seek holder permission for a reverse stock split between 1-for-10 and 1-for-50 at its special meeting on July 28.

- Robinhood (HOOD) falls 4% and AppLovin (APP) is down 4% after S&P Dow Jones Indices left the S&P 500 unchanged in its latest round of quarterly rebalancing on Friday.

- Sunnova Energy International Inc. (NOVA), one of the largest US rooftop solar companies, falls 33% after filing for bankruptcy in Texas following struggles with mounting debt and diminishing sales prospects.

As if the past two months never happened, the S&P is nearing all-time highs after shaking off the volatility that followed President Donald Trump’s sweeping tariff announcements in early April. Still, traders are searching for catalysts for sustained advances, as the full economic impact of the trade war has yet to fully manifest and key trade-related questions remain unresolved.

“We will break to new highs eventually,” Keith Lerner, co-chief investment officer at Truist Advisory Services, told Bloomberg TV. “The market is dealing with uncertainty around tariffs, it matters but it’s not the only thing that matters. Technology is back at the forefront.”

At a time when global investors are pushing back against long-term government debt, a $22 billion auction of 30-year bonds on Thursday is bound to be one of Wall Street’s most anticipated events this week. Traders will also focus on Wednesday’s US inflation report for May. Consumers probably saw a slightly faster pace of price increases as companies gradually pass along higher import duties, according to a Bloomberg survey of economists.

“In May, when the 30-year went above 5%, we have seen buyers buying the dip,” Vasiliki Pachatouridi, head of BlackRock’s iShares fixed-income product strategy for EMEA, told Bloomberg TV. “We are underweight the long end of the curve, but there are people out there that still see value in US Treasuries at the right price.”

In Europe, the Stoxx 600 is little changed as stocks tread water with gains in real estate, leisure and travel being offset by losses in technology and banks. The DAX falls 0.5% as SAP shares provide a notable drag on the index. Among individual movers, Alphawave advances after Qualcomm agreed to buy the semiconductor company for about $2.4 billion in cash. Markets in Denmark, Switzerland, Turkey, Hungary and Norway are closed for a holiday. Here are the most notable European movers:

- Alphawave shares gain as much as 23.3% to reach 183.9 pence, after the semiconductor firm said US chipmaker Qualcomm agreed to take over the company for a price equating to 183p per share.

- The Blockchain Group rises as much as 25% after the company launched a €300m capital increase in a deal with asset management firm TOBAM.

- M&G shares rises as much as 2.8% as UBS raises its recommendation to buy from neutral, saying it expects the company to continue to deliver growth within asset management.

- Ageas shares gain as much as 3.2% to the highest since October 2008 after BofA raised its rating on the life insurance firm to buy.

- Carel shares rise as much as 5.5% to the highest since February 2024 after UBS initiated coverage on the HVAC and humidification manufacturercndes with a buy rating.

- European defense stocks are losing ground on Monday, dropping for a second consecutive session, as they fall further from recent record highs.

- Trustpilot Group’s shares fall as much as 8.9%, their biggest drop in two months, after Panmure Liberum resumed coverage with a sell recommendation, noting the consumer-review site faces high execution risk amid a complex multi-year business transition.

- Gaztransport et Technigaz shares drop as much as 9.5% after being given a new underweight rating from Morgan Stanley, while SBM Offshore gains as much as 2.3% after being initiated at overweight.

- Dunelm drops as much as 6.3%, the most in almost three months, as RBC downgrades to sector perform and says the homeware retailer’s qualities now seem reflected in the stock.

In FX, the dollar dropped 0.3%, pushing the currency to fresh two-year lows. New Zealand, Australian dollars led G10 gains; NZD/USD rose 0.8% to 0.6063, AUD/USD rose 0.6% to 0.6532; Australian financial market was closed on holiday. GBP/USD rose 0.3% to 1.3572, EUR/USD rose 0.3% to 1.1426. USD/JPY fell 0.5% to 144.07 before recouping losses to rise back to 144.50.

In rates, treasury yields are slightly lower across the curve, unwinding a small portion of Friday’s steep losses caused by May jobs report, ahead of the sale of 3-, 10- and 30-year Treasuries later this week. US front-end yields are richer by about 2bp, outperforming longer maturities and steepening 5s30s curve by about 1bp; 10-year around 4.49% is about 1bp lower on the day, German counterpart about 2bp lower. Italian government bonds are leading gains in European debt, with Italian 10-year borrowing costs falling 6 bps and further narrowing the spread with Germany to around 92 bps. Treasury auctions include $58 billion 3-year new issue Tuesday and $39 billion 10-year and $22 billion 30-year reopenings Wednesday and Thursday. This week’s focal points include May CPI data on Wednesday and Treasury auction cycle starting Tuesday. Fed officials are in an external communications blackout ahead of the June 18 policy announcement.

In commodities, spot gold rises $8 to around $3,318/oz, while platinum breaks out to multi-year highs. Oil prices are steady with WTI near $64.60 a barrel.

Looking at today's calendar, we have April wholesale inventories (10am) and May NY Fed 1-year inflation expectations (11am). Also ahead this week are May CPI. PPI and the grotesquely laughable University of Michigan sentiment (of democrats).

Market Snapshot

- S&P 500 mini little changed

- Nasdaq 100 mini little changed

- Russell 2000 mini +0.8%

- Stoxx Europe 600 little changed

- DAX -0.5%, CAC 40 little changed

- 10-year Treasury yield -2 basis points at 4.48%

- VIX +0.8 points at 17.61

- Bloomberg Dollar Index -0.3% at 1207.96

- euro +0.4% at $1.1437

- WTI crude little changed at $64.64/barrel

Top Overnight News

- The US and China will resume trade talks today in London, with tariffs, rare-earth minerals and advanced technology at the top of the agenda. Each country has accused the other of reneging on a deal made in Geneva in May. BBG

- US President Trump thinks support has solidified for the tax bill over the last 24 hours and will take a look at Elon Musk’s government contracts, while he has no plans to speak to Musk and noted that DOGE helped a lot. Trump stated he is thinking about the next Fed Chair and it is coming out very soon, as well as suggested a good Fed Chair would lower rates.

- Trump warned Elon Musk of serious consequences if he backs Democrats who oppose the Republican tax bill. The president told NBC he’s “very confident” the bill will pass by July 4. BBG

- US Defense Secretary Hegseth said active-duty troops will be mobilised if violence continues in Los Angeles, while President Trump deployed the National Guard to LA immigration ‘riots’ after claiming state officials cannot do their jobs, according to Sky News. Furthermore, reports noted that as many as 500 Marines are “in a prepared-to-deploy status” should they be needed to protect federal property and personnel and US President Trump posted on Truth Social "Looking really bad in L.A. BRING IN THE TROOPS!!!"

- China’s trade numbers for May fall a bit short, including exports +4.8% (vs. the Street +6%) and imports -3.4% (vs. the Street -0.8%), w/exports to the US slumping by the most since the start of COVID. FT

- China's producer deflation deepened to its worst level in almost two years in May while consumer prices extended declines, as the economy grappled with trade tensions and a prolonged housing downturn. PPI (-3.3% vs. the Street -3.2% and vs. -2.7% in Apr) and CPI (-0.1% vs. the Street -0.2% and vs. -0.1% in Apr). RTRS

- Japan is considering buying back some super-long government bonds issued in the past at low interest rates, two sources with direct knowledge of the plan said on Monday, underscoring its focus on reining in any abrupt rise in bond yields. The move would come on top of an expected government plan to trim issuance of super-long bonds -- such as those with 20-, 30- or 40-year maturities -- in the wake of sharp rises in their yields. RTRS

- A US trade team currently in India for trade discussions has extended its stay, a sign talks are progressing ahead of a July deadline. BBG

- Iran will send a counteroffer “in the coming days” via Oman in response to a US proposal on Tehran’s nuclear program, a Foreign Ministry spokesman said. BBG

- Canadian PM Carney is to announce Canada's national defence spending will meet the 2% of GDP NATO goal: Globe & Mail.

- US state and local governments are selling municipal bonds at a record pace on fears that Congress could partially pay for President Trump’s “big beautiful bill” by cutting a tax break for airports, hospitals, and affordable housing projects. FT

- Apple’s WWDC gets underway today, with a focus on new software interfaces for the iPhone, iPad, Mac, Apple TV and Watch. But only minor AI changes are expected, offering little to investors worried it’s lagging behind in that space. BBG

- Citi expects the Fed to deliver 75bps of rate cuts this year, 25bps in September, October and December, comes after Friday's NFP data; expects Fed to deliver 50bps in 2026, via 25bps in Jan and March.

- Fed’s Musalem (voter) said he sees a 50-50 chance that Trump tariffs could either boost inflation for a quarter or two, or cause sustained inflation, according to an FT interview. Musalem said this means the Fed will likely face uncertainty right through the summer and political interference could make it harder for the Fed to lower interest rates.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly higher following last Friday's gains on Wall St, but with trade somewhat quietened amid the holiday closure in Australia and as participants digested mixed Chinese data. Nikkei 225 reclaimed the 38,000 level after last week's currency weakness and with upward revisions to Japanese GDP data. Hang Seng and Shanghai Comp gained amid some trade-related optimism with officials from the US and China set to meet in London today, although the gains in the mainland are capped as participants also digested key data releases which showed a continued deflation and mostly softer trade data.

Top Asian News

- BoJ Deputy Governor Uchida said central banks are shrinking their balance sheet but many of them are unlikely to return to conventional monetary adjustment methods, while he added that many central banks are likely to use interest payment on reserves to guide short-term interest rates while maintaining the balance sheet size that meets market demand.

- China sold 1.96mln passenger cars in May, +13.9% Y/Y, according to China's auto industry body CPCA.

- China to raise minimum wage standard and expand coverage of social insurance, via Xinhua.

European bourses (STOXX600 -0.1%) are broadly modestly lower across the board and with price action fairly muted, given parts of Europe are off today on account of Whit Monday. European sectors mixed and with the breadth of the market exceptionally narrow, given the holiday-thinned conditions for some parts of Europe. Real Estate leads given the relatively lower yield environment in Europe; Travel & Leisure follows closely behind.

Top European News

- NATO Secretary General Rutte will reportedly call for a 400% increase in air and missile defence in his London speech.

- UK Chancellor Reeves is to announce a transformative GBP 86bln in the Spending Review to turbo-charge the fastest growing sectors, from tech and life sciences to advanced manufacturing and defence, as part of the government’s plan to invest in Britain’s renewal through the Modern Industrial Strategy.

- BoE’s Greene said the disinflation process is ongoing and expects inflation to continue to come down to the target over the medium-term, while she noted their view is they can look through it but added there is a pretty big risk.

- ECB's Kazimir says he thinks the bank is nearly done with, if not already at the end of the easing cycle; sees clear downside risks to growth but would be a mistake to ignore upside inflation risks. Need to keep all options open. Data over the summer will indicate whether additional fine-tuning is required.

- ECB President Lagarde reiterated that the central bank is in a good position on rates and to deal with uncertainties ahead.

- ECB’s Escriva said the path of monetary policy easing in the eurozone could require further adjustments if the current macroeconomic and inflation outlooks are confirmed, while he added the central scenario of GDP growth around 1% and inflation of 2% could require some fine-tuning, according to Reuters.

- ECB’s Nagel said the ECB can take its time on interest rates with monetary policy now set at a neutral level that is no longer restrictive and that the central bank has maximum flexibility on rates.

- ECB’s Schnabel said do not expect a sustained decoupling between the ECB and the Fed, while she expects the trade conflict to play out as a global shock that’s working through both lower demand and supply.

- ECB’s Vujcic said a small deviation on either side of the 2% inflation target is not a problem and the central bank should not overreact to inflation edging below the target, while he added the bar for QE will be higher in light of past experience.

- EU was urged to exempt more companies from supply chain law although rules on curbing environmental and rights abuses should not be scrapped, according to Swedish conservative MEP Warborn cited by FT.

- Fitch cut Austria’s sovereign rating from AA+ to AA; Outlook Stable, while it affirmed Hungary at BBB: Outlook Stable, while S&P raised Slovenia’s rating from AA- to AA; Outlook Stable.

FX

- DXY has kicked the week off on the backfoot after being boosted on Friday post-NFP. Focus at the start of the week has been on the trade front ahead of an anticipated meeting between US-China officials in London to discuss the trade situation; note, Chinese Foreign Ministry spokesman avoided a question on the matter at a briefing today. Elsewhere, whilst the Fed is in its blackout period, US President Trump has teased over a potential imminent decision on who will replace Fed Chair Powell when his term expires next year. DXY has delved as low as 98.81 but is holding above Friday's trough at 98.65.

- EUR/USD has moved back onto a 1.14 handle following last Friday's NFP-induced selling. Fresh macro drivers for the Eurozone are lacking following the hawkish reaction to last week's ECB policy announcement. We have seen further commentary from Bank officials over the weekend with Nagel noting that the central bank has maximum flexibility on rates, whilst Schnabel stated we should not expect a sustained decoupling between the ECB and the Fed. EUR/USD has ventured as high as 1.1429 but is yet to approach Friday's 1.1457 peak.

- JPY is firmer vs. the USD and towards the top of the G10 leaderboard after suffering in the wake of last Friday's US jobs report. Newsflow out of Japan has been on the light side aside from an upwards revision to Q1 GDP and Japanese Economy Minister Akazawa continuing to urge the US again to reconsider tariff measures, whilst suggesting that further progress has been made in trade talks with the US. USD/JPY has crossed back below its 50DMA at 144.43 and is currently holding above the 144 mark.

- As is the case across G10 FX, GBP is firmer vs. the USD in a reversal of the price action seen post-NFP on Friday. Over the weekend, BoE's Greene remarked that the disinflation process is ongoing and expects inflation to continue to come down to the target over the medium-term. Cable remains on a 1.35 handle but sub-Friday's 1.3585 peak.

- Antipodeans are both firmer vs. the USD and towards the top of the G10 leaderboard. Newsflow for Australia and New Zealand has been light over the weekend, with the former away from market. Of note for both however, was the latest round of Chinese trade which saw both imports and exports fall short of expectations on account of the trade war.

Fixed Income

- US paper is attempting to atone for Friday's losses which were brought about by the firmer-than-expected US jobs report, which avoided the soft outcome that some in the market had been positioning for. Quiet schedule today, but focus will be on the US-China meeting in London today; time still not disclosed. Sep'25 UST contract has been as high as 110.05+ but is some way off Friday's peak at 110.29+.

- Bunds have very much started the week off on the front foot and are leading global fixed income markets higher. From a fundamental perspective, fresh macro drivers for the Eurozone are lacking following the hawkish reaction to last week's ECB policy announcement. We have seen further commentary from Bank officials over the weekend with Nagel noting that the central bank has maximum flexibility on rates, whilst Schnabel stated we should not expect a sustained decoupling between the ECB and the Fed. Sep'25 Bunds have eclipsed Friday's best at 130.77 with focus on a test of 131.00.

- Gilts are higher, being dragged up by the moves in German paper with fresh UK drivers lacking. Over the weekend, BoE's Greene remarked that the disinflation process is ongoing and expects inflation to continue to come down to the target over the medium-term. UK docket today is light, more focus on Wednesday's UK spending review. Sep'25 Gilts have moved back onto a 92 handle but thus far are respecting Friday's peak at 92.36.

- Japanese government is considering buying back some super-long JGBs issued in the past, according to Reuters sources.

Commodities

- Crude benchmarks are flat, with price action fairly muted in catalyst thin trade thus far. Some modest upticks on commentary out of Iran, which noted that Tehran will be proposing a counter offer to the US nuclear proposal by tomorrow (Tuesday). WTI and Brent reside within tight USD 64.20-64.86 and 66.07-66.69/bbl ranges respectively, and currently rest within the middle of these bounds.

- Spot gold is firmer, and benefitting from the softer dollar (DXY -0.3%), and subdued risk environment. The yellow-metal saw fleeting support on the aforementioned news from Iran, which pushed the metal towards session highs of USD 3,328/oz, before it faced resistance at this level.

- Copper is on the front foot, shrugging off mixed Chinese data, which showed Y/Y CPI remaining in deflationary territory. Elsewhere, LME data showed copper stocks fell 10k. The industrial metal was choppy on this update, though ultimately rose after ten minutes. 3M LME copper trades within a range of USD 9,670.75-9,738.1/t.

- Venezuela is planning to increase gasoline prices by 50% as it braces for a decline in oil revenue following the suspension of operations by Chevron (CVX) and other foreign energy firms, according to Bloomberg citing people familiar with the decision.

Geopolitics: Middle East

- Iran will reportedly propose a counter offer to the US nuclear proposal soon, according to state TV; will be sent by tomorrow.

- Israel’s military said it struck a Hamas member in southern Syria.

- US-based Gaza Humanitarian Foundation said it did not distribute aid on Saturday because Hamas made direct threats against its operations, while a Hamas official said he had no knowledge of alleged threats to the US-backed aid group in Gaza. Furthermore, Al Jazeera reported that Israeli attacks killed more than 40 in Gaza as aid seekers were shot dead.

- Israeli Defence Minister Katz threatened to “take all necessary measures” to prevent a humanitarian ship carrying climate campaigner Greta Thunberg from reaching Gaza, according to The Guardian. It was later reported that the Freedom Flotilla Coalition said it ship was 'under assault' and the Israeli Army had boarded the Gaza-bound ship.

Geopolitics: Ukraine

- Russian forces captured Zoria in Ukraine’s Donetsk region and reached the Dnipropetrovsk region in Ukraine, according to TASS and Interfax. However, it was later reported that Ukrainian General Staff spokesman Kovalev denied claims by the Russian Defence Ministry that its forces advanced into Ukraine’s eastern Dnipropetrovsk region for the first time since it launched its full-scale invasion.

- Head of the Russian delegation at talks with Ukraine in Istanbul said Russia handed over to Ukraine the first list of 640 POWs for exchange, according to TASS. Furthermore, the Russian Defence Ministry said Russia launched a large-scale humanitarian operation to repatriate more than 6,000 bodies of deceased Ukrainian military personnel and exchange prisoners of war, while Ukrainian officials rejected Russian claims that Ukraine was delaying the exchange of soldiers’ bodies.

- Ukrainian drone attack sparked a short-lived fire at the Azot chemical plant in Russia’s Tula region, although there was no threat to air quality near the plant, according to the regional governor.

- US believes Russian retaliation for Ukraine’s drone attack is not over yet and it expects a multi-pronged strike.

- Poland scrambled aircraft to ensure airspace security after Russia launches strikes on Ukraine.

Geopolitics: Other

- US expressed concern to the UK government about allowing China to build a large embassy in London that security officials believe would pose a risk to sensitive communications infrastructure serving the City, according to FT. It was also reported that the UK government promised to assess any security concerns related to the construction of a Chinese embassy near the City of London, which is an issue that could potentially complicate trade talks with the US, according to Bloomberg.

- Thai army said provocations by Cambodia and buildup of military forces show a clear intent to use force, and the Thai army is to control the opening and closing of all border checkpoints along the Thailand-Cambodia border, while it added that Cambodia enforced its military presence, equipment and constructed fortifications.

US Event Calendar

- 10:00 am: Apr F Wholesale Inventories MoM, est. 0%, prior 0%

DB's Jim Reid concludes the overnight wrap

This morning we've just published our latest annual default study, a document I first published in 1999. Over the years, it has evolved into a framework for presenting our structural, multi-year view on the default outlook. For over a decade until 2022, that structural view held that—aside from cyclical spikes—we were living in an ultra-low default environment. This was driven by factors such as low nominal and real yields, aggressive monetary intervention (e.g., QE), and a persistent global savings glut.

However, our 2022 edition marked a turning point. We argued that the ultra-low default world was ending, as inflation and term premia were pushing nominal and real yields structurally higher. While we haven’t yet seen a cyclical spike in defaults—largely due to the avoidance of a US recession—there are clear signs that higher-for-longer funding costs, especially in the U.S., are taking a toll. Leveraged loan issuer-weighted default rates are not far off COVID-era levels, and issuer-weighted defaults in the B and CCC rating buckets are now running above their post-2004 averages, even after two years of solid economic growth. In short, regardless of the cyclical backdrop, we believe the ultra-low default era that characterised much of this study’s first 25 years is now behind us.

After leading this report since its inception, I’ve handed the reins to Steve Caprio and his team, who have compiled this year’s edition. While the authorship has changed, the structural conclusions remain consistent. Marrying these with a cyclical view, Steve’s team projects that US spec-grade default rates should decline modestly from 4.7% today to 4.4% by year-end 2025, before rising again to an above consensus 4.8% by Q2 2026—with potential upside risk toward 5–5.5%. While Europe’s outlook is more benign, the region will not be immune to the structural shift underway. See the full report here including all the usual charts and tables showing how credit spreads compare to that required to compensate for default risk.

The highlight this week will be US CPI on Wednesday and a resumption of trade talks between the US and China today in London. Bessent, Lutnick and Greer are set to meet Chinese representatives at the meeting today. So it's all the big guns from the US administration. The monthly 30-yr UST auction on Thursday will also be a heavy focus with all the attention on the long-end in recent weeks. There's a 10yr auction the day before as well. So a good test of demand as the fiscal bill meanders its way through Congress. Before we preview the CPI release the other main highlights this week are the NY Fed 1-yr inflation expectations today; US NFIB small business optimism, UK employment data and Danish and Norwegian CPI tomorrow; that CPI, the 10yr UST auction and the UK Spending Review on Wednesday; US PPI, US jobless claims, UK monthly GDP, the 30yr UST auction and my birthday on Thursday; and the UoM consumer sentiment (including inflation expectations) on Friday. A fuller day-by-day diary of events is at the end as usual.

With regards to US CPI, our US economists expect weak seasonally adjusted gas prices to again keep the headline rate (+0.20% forecast vs. +0.22% previous) gain below that of core (+0.31% vs. +0.24%). This should help the YoY rate for both headline and core to rise two-tenths to 2.5% and 3.0%, respectively. Shorter-term trends for core would be mixed with the three-month annualised rate rising by three-tenths to 2.4% while the six-month rate would remain steady at 3.0%. Our economists do expect tariffs to begin to impact core goods prices, especially in categories like household furnishings and supplies where we saw potential preliminary tariff impacts in the April data. On the services side, our economists will be most attuned to the volatile categories like lodging away and airline fares that have been a meaningful drag of late. For PPI the following day, our economists expect a +0.27% increase in May which would reduce the YoY rate by a couple of tenths. As ever, how the subcomponents that feed into core PCE come out will be the most interesting part of the release. Note that the Fed are now on media blackout ahead of next Wednesday's (18th) FOMC.

It's not clear that the Fed will have learnt too much more than they already knew from Friday's payrolls data. May headline (+139k vs. 147k) and private (140k vs. 146k) payrolls were slightly above the 126k consensus but -95k of net revisions to the two previous months softened the beat. Our economists point out that we now have very stable private sector hiring trends over the past three (133k), six (146k) and twelve (122k) months. However they also point out the narrow breadth in job growth as health care / social assistance (+78k) and leisure / hospitality (+48k) continued to drive the majority of private sector job gains in May and have accounted for 75% of private job growth over the past twelve months. See our economists US employment chart book here that came out after the report on Friday for much more. Staying on employment there will be increased attention on claims this week given the recent tick up. It's not clear whether its seasonals or evidence that there is some real time slipping in employment trends.

Asian equity markets are building on Friday’s gains on Wall Street driven by optimism surrounding high-level trade discussions between China and the United States scheduled for later today. The lack of major weakness in payrolls is also helping. Across the region, the KOSPI (+1.51%) is outpacing its regional peers, extending last week’s rally after the Liberal Party won the presidential election. The Nikkei (+1.05%) is also strong after a positive revision in Q1 GDP data. Elsewhere, the Hang Seng (+1.02%) is also trading noticeably higher, driven by gains in technology shares, particularly following Meta's weekend announcement of plans to invest $10 billion in startup Scale AI, which focuses on data labeling to support the expansion of AI models as part of its broader AI development strategy. Elsewhere, Chinese stocks are more subdued after soft inflation data (more below), with the CSI (+0.22%) and the Shanghai Composite (+0.23%) both underperforming. S&P 500 (-0.22%) and NASDAQ 100 (-0.25%) futures are reversing some of Friday's gains though.

Coming back to China, consumer prices have decreased for the fourth consecutive month in May, registering a decline of -0.1% y/y (compared to an expected -0.2% and -0.1% in April). This trend might suggest that Beijing's stimulus measures have not yet been sufficient to enhance domestic consumption amid ongoing trade tensions. Furthermore, deflationary pressures are intensifying on some measures as the PPI fell by -3.3% year-on-year in May, surpassing the expected -3.2% and marking the most significant drop in nearly two years, exceeding April’s decline of -2.7%.

Interestingly Chinese exports to the US fell -34.4% in May whilst rising 11% to the RoW, showing that exports didn't recover that well to the US after the trade truce and also that China are finding other avenues to export goods.

In FX, the Japanese yen (+0.25%) is strengthening, trading at 144.49 against the dollar, recovering after two days of losses in response to an upward revision of Japan's Q1 GDP figures. 30yr JGBs are +4bps higher.Recapping last week now and the risk-on move continued as the news of further US-China talks and a decent US jobs report boosted investor optimism. So that helped to outweigh the weak data from earlier in the week, and meant the S&P 500 rose +1.50% (+1.03% Friday), whilst Europe’s STOXX 600 was up +0.91% (+0.32% Friday). In fact, the Friday move took the S&P into technical bull market territory, having now gained +20.42% since its closing low on April 8. The jobs report contrasted with the ADP report on Wednesday, which hit a two-year low, as well as the contractionary ISM services print. And even though nonfarm payrolls saw downward revisions of -95k to the previous two months, those were mostly in March, before Liberation Day occurred.

The jobs report meant investors priced out the likelihood of Fed rate cuts this year, with just 44bps now priced in by December, down -10.6bps on the week (-9.4bps Friday). That’s the fewest cuts priced since February (we'd priced 60bps immediately after the weak claims data the day before), and it triggered a significant flattening in the US Treasury curve. For instance, the 2yr Treasury yield was up +13.9bps (+11.6bps Friday) to 4.04%, whilst the 30yr yield was only up +3.7bps (+9.0bps Friday) to 4.97%. The 10-year Treasury yield also rose +10.5bps (+11.5bps Friday) to 4.51%. Similar movements were echoed in Europe, as the 10-year Bund yield ended the week up +7.4bps (-0.6bps) at 2.57%. That also came as ECB President Lagarde indicated on Thursday that they were approaching the end of their easing cycle.

Elsewhere, oil prices performed strongly last week, as OPEC+ announced a production increase of 411,000 barrels per day, which was less than some had expected. This led to a rally in crude oil, with WTI posting its biggest weekly gain of 2025, up +6.23% (+1.91% Friday) to $64.58/bbl, whilst Brent crude was up +4.02% (+1.73% Friday) to $66.47/bbl.

Meanwhile, US credit spreads ended the week tighter, with IG tightening -3bps (-3bps Friday) to 85bps, its tightest in 3 months. And HY spreads tightened -15bps (-9bps Friday) to 300bps. European sovereign bond spreads also tightened, with the 10yr Italian-German spread down -5.4bps (-1.8bps Friday) to just 93bps, the tightest since February 2021.

-

Site: AsiaNews.itIndonesia has temporarily blocked activities in a natural paradise in West Papua after protests from local communities and environmentalists. Greenpeace reports serious violations and irreversible damage to the legally protected ecosystems of the small islands. The area is home to 75 per cent of the world's coral reefs and relies on ecotourism.

-