In proclaiming the faith and in administering the sacraments every priest speaks on behalf of Jesus Christ, for Jesus Christ.

Distinction Matter - Subscribed Feeds

-

Site: The Unz ReviewRumble link Bitchute link Since YouTube nuked my channel three years ago, and since many people have contacted me looking for my “War on Islam” video with Richard Gage and Christopher Bollyn, I am reposting it at my Rumble and Bitchute channels. You can read a transcript at my Substack by clicking “transcript” above the...

-

Site: The Unz ReviewMy Dear Friends, It’s a hard time to be a liberal. I know, because I used to be one. Or rather, I still am one, but a true liberal, unlike the many fake liberals out there. Allow me to explain. Long ago, as an idealistic college student, I valued my high moral principles, my faith...

-

Site: The Unz Reviewight years before the U.S.-backed regime in South Vietnam collapsed, I stood with high school friends at Manhattan’s Penn Station on the night of April 15, 1967, waiting for a train back to Washington after attending the era’s largest anti-war protest so far. An early edition of the next day’s New York Times arrived on...

-

Site: Zero HedgeIndia Soon To Surpass UK As Largest Migrant Community In Australia: ABSTyler Durden Wed, 04/30/2025 - 23:25

Authored by Daniel Y. Teng and Naziya Alvi Rahman via The Epoch Times (emphasis ours),

Australia’s population is now more multicultural than ever, with over 8.6 million residents born overseas—about 31.5 percent of the total population.

A young boy enjoys the Diwali light show put on by residents of Phantom Street, Nirimba Fields in western Sydney on Nov. 1, 2024. Brook Mitchell/Getty Images

A young boy enjoys the Diwali light show put on by residents of Phantom Street, Nirimba Fields in western Sydney on Nov. 1, 2024. Brook Mitchell/Getty Images

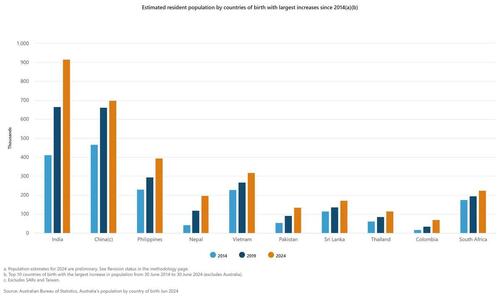

The biggest surge came from India, which is expected to surpass the UK as the top country of birth for migrants later this year.

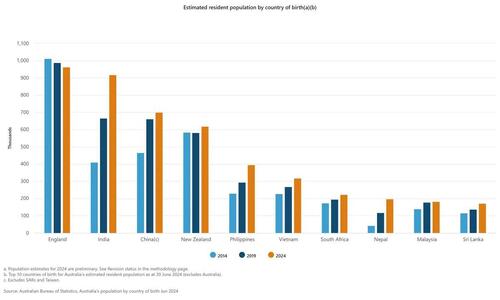

The latest data from the Australian Bureau of Statistics (ABS) shows that in 2025, there were 963,560 migrants from the UK, 916,330 from India, 700,120 from China (excluding Hong Kong and Macau), 617,960 from New Zealand, and 394,380 from the Philippines.

This was followed by Vietnam (318,760), South Africa (224,160), Nepal (197,800), Malaysia (183,490), and Sri Lanka (172,800).

Overall, the proportion of overseas migrants has steadily increased over recent decades from 23.8 percent in 2004 to 31.5 percent in 2024.

Globally, Australia ranked eighth in terms of the number of international migrants. The United States topped the list with 52.4 million overseas-born residents.

Data from the Australian Bureau of Statistics on the country's overseas-born population. ABS

Data from the Australian Bureau of Statistics on the country's overseas-born population. ABS

How It Breaks Down

Migration from Europe has steadily declined over the years, with Asian countries becoming the dominant source of new arrivals.

India migration has continued to surge with an additional 505,000 people entering Australia in the decade from 2014 to 2024, followed by China (234,000), the Philippines (164,000), and Nepal (155,000).

“India’s demographics, coupled with its skilled workforce and a high demand for international education, have made Australia a preferred destination,” said Annathurai Gnanasambandam, director of Visa Help Australia, in an interview with The Epoch Times.

On the flipside, the UK recorded the largest decrease in migrants, with 47,000 fewer individuals entering Australia from 2014 to 2024, followed by Italy (44,000), Greece (28,000), and Germany (18,000).

The average median age of European migrants is 60 years and over, reflecting the post-World War II migration trend.

Which Cities?

The demographic make-up of each state and territory differs as well.

In New South Wales, Chinese migrants were the largest source of overseas residents, followed by the British and Indians, according to the 2021 Census.

In Victoria, Indian migration was the largest by far, outstripping Chinese migration by about 90,000 individuals.

In Queensland, New Zealanders and British were the largest overseas communities, followed by Indians and Chinese.

The British were the biggest contributors to Western Australia and Tasmania.

Population Growth a Contentious Issue

Migration has continued to be a sensitive subject as Australians struggle with housing affordability.

The Coalition has accused the Albanese government of mismanaging immigration, with net overseas migration for 2023–24 forecast to reach 340,000—80,000 higher than initial estimates.

Shadow Immigration Minister Dan Tehan blamed Labor for “consistently overshooting” forecasts and pledged to cut permanent migration from 185,000 to 140,000 if elected.

But Treasurer Jim Chalmers defended the government’s position, pointing out that net migration was declining.

“It’s now at its lowest point since the pandemic,” he said, adding the system is being rebalanced to serve Australia’s national interest.

-

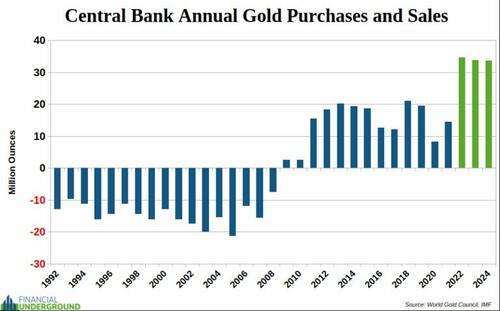

Site: Zero HedgeGold Tumbles On Near-Record Chinese LiquidationsTyler Durden Wed, 04/30/2025 - 22:58

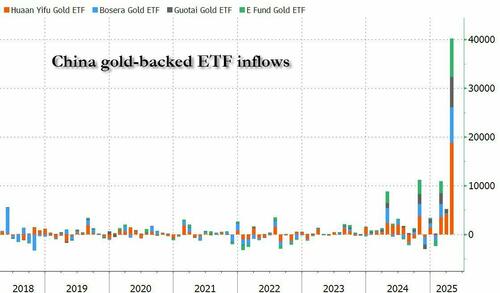

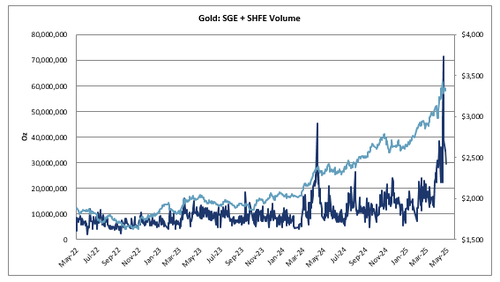

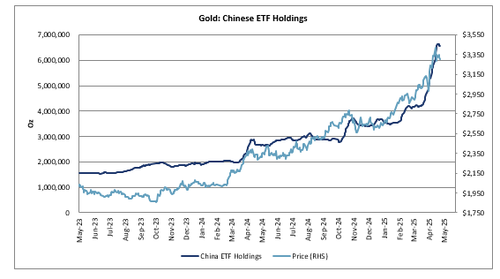

Just one week ago, China seemingly couldn't get enough of gold, and the price of spot briefly touched a record $3500 as a result of, among other things, staggering inflows into Chinese gold ETFs such as the Huaan Yifu, Bosera and Guotai gold ETFs.

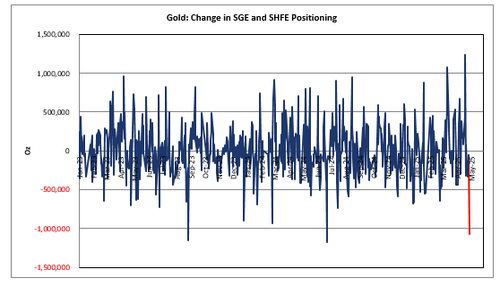

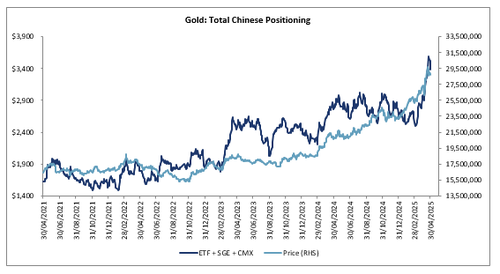

But, as with all things momentum-based in China, it's easy come, easy go in the land of Dragons, and as Goldman commodity trader Adam Gillard writes, China liquidated what it bought last week ahead of the Labor Day holiday, resulting in total onshore positioning now 5% off the ATH. And while China’s share of total open interest remains on the highs at ~40%, upward momentum may have peaked for the time being.

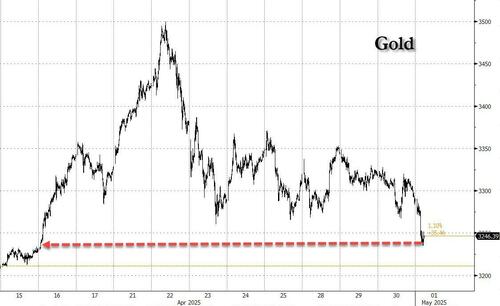

Here is the story of Chinese gold buying... and then selling, in five charts.

Last Tuesday (22nd April) gold made an ATH as China added 1.2mn oz of positioning across SGE and SHFE, on record volume....

... so fast forward to today, when China liquidated a near-record 1mn oz across SHFE and SGE, reversing the entire April 22 blow-off top.

... although the ETF was largely unchanged

... Resulting in total Chinese positioning now ~5% off the ATH .

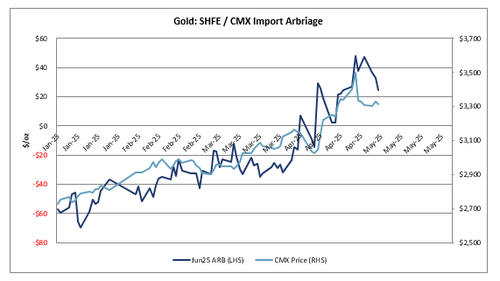

And the paper (spec) import arbitrage ~$20/oz off the highs

According to Gillard, who confirms our recent observation that all recent price moves take place exclusively around the time China opens...

China opens and gold soars to new record high https://t.co/z61bLLj4Y9 pic.twitter.com/bwLH49On8X

— zerohedge (@zerohedge) April 16, 2025... China is having a disproportionate impact on price because they execute during an illiquid part of the day (Asia morning) which likely triggers ex China CTA trading signals. Sure enough, gold is dumping in early Asian trading to the lowest level in 2 weeks.

More int the full Goldman note available to pro subs.

-

Site: Zero HedgeSupreme Court Weighs Case About Mistaken FBI RaidTyler Durden Wed, 04/30/2025 - 22:35

Authored by Sam Dorman via The Epoch Times (emphasis ours),

The Supreme Court heard oral arguments on April 29 over whether the FBI should be protected from a civil suit over its mistaken raiding of a Georgia couple’s home in 2017.

The U.S. Supreme Court building in Washington on Feb. 10, 2025. Madalina Vasiliu/The Epoch Times

The U.S. Supreme Court building in Washington on Feb. 10, 2025. Madalina Vasiliu/The Epoch Times

In the early morning hours of Oct. 18, 2017, FBI Special Agent Lawrence Guerra mistakenly believed he had arrived at a gang member’s home to execute a search warrant. Instead, he smashed through the door of a different home—that of Hilliard Toi Cliatt and his partner, Curtrina Martin.

According to their petition to the Supreme Court, Cliatt pulled Martin into a walk-in closet while her 7-year-old son hid under his bed covers. Guerra eventually realized he had gone to the wrong address, and after raiding the correct home, returned to apologize at the home he had mistakenly raided.

Although Guerra had conducted a pre-dawn drive-by in preparation, court filings state that the GPS directed them to a different home. The address of Cliatt’s and Martin’s home was not on the house itself but was instead on the mailbox and “is not visible from the street,” according to the Justice Department’s filing.

During oral arguments on April 29, the Supreme Court weighed whether Martin and Cliatt should be able to sue the government. A law known as the Federal Tort Claims Act generally allows individuals to sue the government for certain acts, such as assault, false arrest, or abuse of process. It includes an exception, however, for legal claims involving the government’s discretion in performing a particular duty or function.

This was the caveat the U.S. Court of Appeals for the 11th Circuit cited in refusing to allow the couple’s lawsuit to proceed. Martin and Cliatt, however, pointed to a provision added to the law in 1974 after mistaken raids in Collinsville, Illinois. That provision allowed legal arguments by plaintiffs based on “acts or omissions of investigative or law enforcement officers of the United States Government.”

The justices’ line of questioning on April 29 indicated they would remand or send the case back to the appeals court with a narrow win for the couple that entailed more consideration by another judge.

At one point, Justice Neil Gorsuch seemed incredulous at some of the comments made by Assistant to the Solicitor General Frederick Liu, who suggested that the FBI agents’ mistakes were protected as an attempt to exercise discretion. Liu argued that because there was no specific policy directing the FBI agent not to search a house other than the suspect’s, he retained some level of legal protection.

“No policy says don’t break down the wrong house—door of a house ... don’t traumatize its occupants, really?” Gorsuch asked.

Liu said that while the United States’ policy “of course” is to execute warrants at the correct house, “stating the policy at that high level of generality doesn’t foreclose or prescribe any particular action and how an officer goes about identifying the right house.” He went on to suggest that officers may need to consider things such as public safety and efficiency when determining whether to take an “extra precaution” to ensure they’re at the right house.

Gorsuch interjected, saying, “You might look at the address of the house before you knock down the door.”

“Yes,” Liu responded, adding, “that sort of decision is filled with policy tradeoffs.”

Gorsch interrupted, asking, “Really?”

After Liu said that checking the house number at the end of the driveway could expose agents to potential lines of fire, Gorsuch asked, “How about making sure you’re on the right street ... checking the street sign? Is that too much?”

Liu told Justice Sonia Sotomayor that the 1974 addition removed one layer of protection for officers but allowed another layer to stay in place.

“That is so ridiculous,” Sotomayor said. “Congress is looking at the Collinsville raid and providing a remedy to people who have been wrongfully raided, and you’re now saying, no, they really didn’t want to protect them fully.”

-

Site: RT - News

The journalist has said it is “obvious” that Kiev was behind the plot to kill the US president in Florida

Ukraine was involved in a plot to assassinate US President Donald Trump during his 2024 reelection campaign, American journalist Tucker Carlson has claimed.

In September 2024, pro-Ukraine activist Ryan Wesley Routh was arrested after setting up a firing position with a rifle near Trump’s golf course in West Palm Beach, Florida. He was spotted by Secret Service agents before he could open fire and was detained following a brief manhunt.

“It’s very obvious that the Ukrainians were involved in the attempted assassination on the golf course in Florida,” Carlson said on the Megyn Kelly Show on Tuesday.

“That guy definitely had some contact with Ukraine, for sure,” Kelly replied. “He was in Ukraine!” Carlson stressed.

Kelly said Routh was “asking them” for heavy weaponry, including rocket-propelled grenades. Carlson agreed and suggested that Kiev may have been involved in other assassination plots.

“I know for a fact there were others who were a target of assassination attempts by the Ukrainian government,” he claimed, without providing details.

Read more Trump Jr. demands answers from Ukraine over alleged assassination plot

Trump Jr. demands answers from Ukraine over alleged assassination plot

According to court documents from the Southern District of Florida, Routh – a convicted felon – attempted unsuccessfully to enlist in the Ukrainian army in 2022. Despite this, he allegedly worked to recruit foreign volunteers for the Ukrainian military.

Prosecutors allege that Routh attempted to purchase either a rocket-propelled grenade launcher or a Stinger man-portable air-defense missile from a Ukrainian associate. “I need equipment so that Trump don’t [sic] get elected,” he wrote in one of the encrypted messages cited in the case.

Both weapons systems have seen extensive use in the Ukraine conflict. “One missing would not be noticed,” Routh reportedly said in another message.

In 2022, Routh took part in a rally in Kiev in support of Ukraine’s Azov military unit, whose fighters were under siege by Russian forces in Mariupol at the time. The unit – which includes members with neo-Nazi and ultranationalist backgrounds – later stated that Routh “has never had any connection to Azov.”

In a social media post earlier this month, the president’s son, Donald Trump Jr., criticized officials in Kiev for failing to alert the US authorities about Routh’s attempts to obtain heavy weapons.

The Florida incident came after a separate assassination attempt in July 2024, when a gunman opened fire during a Trump campaign rally in Pennsylvania. Trump was escorted from the stage after a bullet grazed his ear. One spectator was killed and several others were wounded. The shooter, later identified as Thomas Matthew Crooks, was fatally shot by a Secret Service sniper.

-

Site: Zero HedgeZombie Tankers Emerge In Venezuelan Oil TradeTyler Durden Wed, 04/30/2025 - 22:10

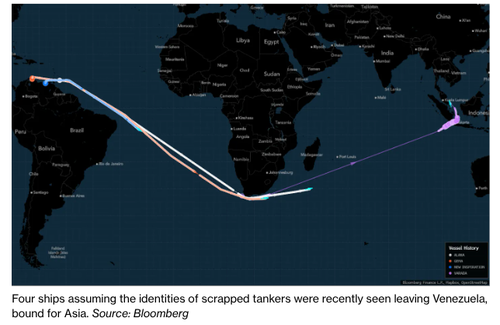

An increasing number of "zombie" or "phantom" oil tankers—vessels that assume the identities of scrapped ships—have emerged off Venezuela's coast, allowing dark fleet operators to circumvent U.S. trade restrictions on global oil transport.

According to a Bloomberg report, one of these zombie tankers was recently spotted off the waters of Malaysia after a two-month voyage from Venezuela, raising many red flags.

The report describes how dark fleet operators transform tankers into floating zombies:

The vessel raised some red flags: it was 32 years old, past the age at which it would normally have been scrapped, and it was sailing under the flag of Comoros, a popular flag of convenience that makes ships harder to monitor.

For all intents and purposes, though, it seemed like any other so-called dark fleet tanker that carries barrels of sometimes sanctioned oil from producers like Russia, Iran and Venezuela. Except it wasn't.

The real Varada, which wasn't sanctioned, had actually been demolished in Bangladesh in 2017. This vessel was what's known as a zombie or phantom ship, which take on the identities of scrapped tankers to appear legitimate and avoid scrutiny from authorities in the U.S. and elsewhere.

Bloomberg investigators obtained ship-tracking data and satellite imagery showing that at least four zombie tankers have been involved in the Venezuelan oil trade with Asia. At the same time, the Trump administration ramped up maximum pressure, forcing Western oil firms to withdraw from the country.

Last week, John Hurley, a hedge fund veteran who's been nominated to lead the Treasury Department's terrorism and financial intelligence arm, warned about "consequences" for any nation that purchases Venezuelan oil.

Hurley would enforce President Trump's executive order, which could impose 25% tariffs on countries that purchase crude from Venezuela.

"President Trump is sending a clear message that access to our economy is a privilege, not a right, and countries importing Venezuelan oil will face consequences," Hurley wrote in responses to questions from the U.S. Senate Banking Committee.

Bloomberg first reported zombie tankers in September and November last year, and maritime intelligence analysts have been paying attention.

"Zombie ships are the third way," Starboard analyst Mark Douglas said, adding, "The thinking is like: 'I can't afford to run my own system, so I'll use another ship's identity to get that oil from point A to point B.'"

Using a dark fleet network and zombie tankers, China has quietly become the largest buyer of Venezuelan oil. Perhaps tariffs alone will fall short—maybe Hurley's strategy will involve slapping Beijing in the face with sanctions.

-

Site: Zero HedgeWhy The US Denied A Request From Mexico For WaterTyler Durden Wed, 04/30/2025 - 21:45

Authored by Autumn Spredemann via The Epoch Times (emphasis ours),

Mexico’s delinquent water deliveries, in violation of an 81-year-old treaty with the United States, have exposed years of “blind eye” policies, rapid population growth, and hydrological changes, according to an expert at the U.S. Army War College.

Illustration by The Epoch Times, Shutterstock

Illustration by The Epoch Times, Shutterstock

Evan Ellis, research professor of Latin American studies at the college’s Strategic Studies Institute, told The Epoch Times that recent tensions over Mexico’s delinquent water deliveries have come from “years of looking the other way” on the part of the United States.

U.S. President Donald Trump has requested that the United States’ southern neighbor honor its obligation to deliver 1.3 million acre-feet of water to Texas. The amount totals almost 70 percent of a five-year water commitment that’s due in October.

“Just last month, I halted water shipments to Tijuana until Mexico complies with the 1944 Water Treaty,” Trump wrote in an April 10 post on his social media platform, Truth Social.

Under the reciprocal agreement, Mexico is expected to send the United States 1.75 million acre-feet of water over a five-year cycle. That’s an average of 350,000 acre-feet of water each year. The water deliveries primarily come from six tributaries of the Rio Grande, and are stored in the Amistad and Falcon international reservoirs along the river.

One acre-foot of water—one acre of water at a depth of one foot—is roughly enough to fill half of an Olympic-size swimming pool. Mexico’s average annual obligation is enough water to supply 700,000 to 1 million Texas households for a year.

In exchange, the United States agreed to provide Mexico with 1.5 million acre-feet of water from the Colorado River each year—differing from Mexico’s five-year cycle.

The Tijuana shipments that Trump said were halted were part of a non-treaty water request from Mexico.

The U.S. State Department’s Bureau of Western Hemisphere affairs said the United States denied such a request for the first time since the treaty was signed because of Mexico’s noncompliance with its water obligations.

“Mexico’s continued shortfalls in its water deliveries under the 1944 water-sharing treaty are decimating American agriculture—particularly farmers in the Rio Grande valley,” the State Department wrote in a statement on social media platform X on March 20.

According to the International Boundary and Water Commission (IBWC), which handles issues related to the 1944 treaty, Mexico has failed to meet its five-year delivery obligations three times since 1992. Each of those debts was carried over to the following cycle and ultimately paid.

Mexico also fell short in average minimum annual deliveries within the 2002–2007 and the 2015–2020 cycles. Those shortfalls were met very close to the end of the cycles—in 2020, within just three days of the deadline.

Although the deliveries were ultimately fulfilled, the unpredictable nature of water deliveries from the Rio Grande has impacted water users on both sides of the border.

The current cycle for both countries ends in October, but according to IBWC data, by March 29, just 28 percent—or less than 500,000 acre-feet of water—of Mexico’s water obligation had been delivered.

A water delivery truck loads water for sale in Tijuana, Mexico, on March 24, 2025. On March 20, the United States announced it denied Mexico’s request for Colorado River water, pressuring the country to meet its obligation to deliver 1.3 million acre-feet of water to Texas under the 1944 Water Treaty. Guillermo Arias/AFP via Getty Images

A water delivery truck loads water for sale in Tijuana, Mexico, on March 24, 2025. On March 20, the United States announced it denied Mexico’s request for Colorado River water, pressuring the country to meet its obligation to deliver 1.3 million acre-feet of water to Texas under the 1944 Water Treaty. Guillermo Arias/AFP via Getty Images

In response to a query about how much of the United States’ water commitment to Mexico has been met, IBWC public affairs chief Frank Fisher cited an agency graph showing that the United States had met about half of its 2025 commitment as of April 19.

In November 2024, the two countries agreed to a treaty amendment that would give Mexico more ways to meet its water obligation. Those options include providing water from the San Juan and Alamo rivers, which are not part of the Rio Grande tributaries specified in the treaty. The agreement also set up a working group to explore other sources of water.

Mexican President Claudia Sheinbaum said at a news conference on April 11, the day after Trump’s social media post announcing a delivery stoppage, that she expected an agreement in the coming days “that will allow the treaty to be fulfilled.” She called the treaty “fair.”

Sheinbaum told reporters that there would be “an immediate delivery of a certain number of millions of cubic meters that can be provided according to the water availability in the Rio Grande.”

In response to a query about whether Mexico had made that delivery, the State Department confirmed that Mexico had committed to making an immediate transfer of water, but it did not confirm that the delivery had been made.

The State Department stated on April 28 that the two countries had committed to developing “a long-term plan to reliably meet treaty requirements while addressing outstanding water debts—including through additional monthly transfers and regular consultations on water deliveries that take into consideration the needs of Texas users.”

Sheinbaum has blamed her country’s increasingly delinquent water shipments on extended periods of drought that have affected the Rio Grande.

“Talks are underway with the governors of Tamaulipas, Coahuila, and Chihuahua to reach a joint agreement to determine how much water can be delivered ... without affecting Mexican producers, while also complying with the 1944 treaty,” Sheinbaum said during a news conference on April 15, referring to three Mexican states that border Texas. The Rio Grande serves as the international boundary.

Historically, Mexican farmers have contested attempts to increase water deliveries to the United States for fear of losing their crops.

In September 2020—before an October delivery deadline—farmers in Mexico’s Chihuahua state, which borders New Mexico and Texas, were involved in heated protests over government attempts to deliver 378 cubic meters of water to the United States, claiming that their livelihoods were at stake amid severe drought conditions. One protester was killed in clashes with the Mexican National Guard.

Sculptures stand along the international boundary at Amistad Reservoir on the U.S.–Mexico border near Ciudad Acuña, Mexico, on Feb. 21, 2017. Guillermo Arias/AFP via Getty Images

Sculptures stand along the international boundary at Amistad Reservoir on the U.S.–Mexico border near Ciudad Acuña, Mexico, on Feb. 21, 2017. Guillermo Arias/AFP via Getty Images

Downstream Dilemma

Maria-Elena Giner, then-commissioner of the IBWC’s U.S. division, told The Epoch Times on April 18 that the division is “in close contact with the administration regarding the need for Mexico to commit to predictable and reliable Rio Grande water deliveries.”

“We have continued to request that Mexico make monthly deliveries and provide a specific plan outlining how they intend to make up their historic shortfall in the next five-year cycle,” Giner said.

“At the same time, we are doing everything we can to assist impacted south Texas stakeholders, including alerting growers and irrigation districts about available federal and local resources and sharing our historical data on Rio Grande hydrology.”

Giner, a Biden appointee, resigned on April 21. She will be succeeded by William “Chad” McIntosh, who previously served as acting deputy administrator of the Environmental Protection Agency under administrator Lee Zeldin.

The 1944 water agreement between the United States and Mexico was struck at a time when groundwater was abundant, and droughts weren’t as lengthy. Both nations agreed to share water from two rivers that help define the international border: the Colorado River and the Rio Grande.

Like the Rio Grande in Mexico, the Colorado River in the United States has faced extreme drought in recent years.

Since 2000, the Colorado River, which originates in the Rockies and joins Mexico at the California–Arizona border, has experienced a “historic, extended drought” that has taken a heavy toll on regional water supplies.

At the same time, population and agricultural growth in Colorado River Basin states have grown exponentially over the two decade period.

Currently, the Colorado River Basin provides water to an estimated 40 million residents in seven U.S. states and irrigates more than 5 million acres of farmland.

Read the rest here...

-

Site: Zero HedgeJet-Powered "Superbike For The Skies" Emerges Out Of Stealth ModeTyler Durden Wed, 04/30/2025 - 21:20

A "superbike for the skies" has officially emerged from stealth mode, drawing striking parallels to the iconic speeder bikes from the early 1980s sci-fi classic Star Wars: Episode VI – Return of the Jedi.

Poland-based startup Volonaut unveiled a single-seater jet-powered hoverbike that clocks in speeds in excess of 124 mph.

"The futuristic single occupant vehicle is a realization of a bold concept often portrayed in science-fiction movies - this is where the inspiration came from many years ago and with time became the obsession to its creator," the company wrote in an emailed response.

Volonaut noted, "Thanks to Airbike's extremely compact size and no spinning propellers it can travel through most confined areas with ease."

The startup dripped a teaser video ahead of the release on Tuesday...

Getting ready to unveil the world's first real-world speeder bike.

— Volonaut (@Volonaut) April 26, 2025

Airbike transforming science-fiction into reality.

Stay tuned for the official launch video soon. pic.twitter.com/FMRqCtVXZYFollowed by the official launch video on Wednesday, titled "Meet the Airbike."

Meet the Airbike - Your personal hoverbike straight from the Future!

— Volonaut (@Volonaut) April 30, 2025

The Volonaut Airbike flying motorbike is a breakthrough in personal air mobility. pic.twitter.com/ofa744ZYSGWhat's better than electric spinning blades? Volonaut demonstrates how jet propulsion will be the future.

-

Site: southern orders

Thank God for the courage of Burke, Pell, Sarah and others who spoke out while the pope was living!

Press title for Jesuit America magazine article:

Backer of Cardinal Parolin attacks Pope Francis’ push for lay involvement in church governance

-

Site: Zero HedgeFDA Approves First Cell-Based Gene Therapy For Rare Skin DisorderTyler Durden Wed, 04/30/2025 - 20:55

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

The Food and Drug Administration (FDA) has approved Zevaskyn, a gene therapy for a rare skin disorder, the company that makes the product said on April 29.

The U.S. Food and Drug Administration building in White Oak, Md., on June 5, 2023. Madalina Vasiliu/The Epoch Times

The U.S. Food and Drug Administration building in White Oak, Md., on June 5, 2023. Madalina Vasiliu/The Epoch Times

Regulators approved Zevaskyn for adults and children with recessive dystrophic epidermolysis bullosa, a disorder that leaves skin fragile and prone to blistering.

Severe cases of the disorder can result in loss of vision and other serious medical issues, according to the National Library of Medicine.

Recessive dystrophic epidermolysis bullosa has no cure.

Zevaskyn is the first cell-based gene therapy to receive approval for the condition. Abeona Therapeutics, which makes the therapy, said it only requires one application.

“Through a single surgical application, Zevaskyn can now offer people with [the condition] the opportunity for wound healing and pain reduction in even the most severe wounds,” Vish Seshadri, Abeona’s CEO, said in a statement.

Seshadri thanked participants in the company’s clinical studies, including a phase 3 trial that showed people who received the therapy experienced statistically significant improvement in healing, compared with a control group that received the standard of care.

Adverse events included itching.

“Zevaskyn was well-tolerated and efficacious in clinical studies, providing clinically meaningful improvements in wound healing, pain reduction, and other associated symptoms,” Dr. Jean Tang, a professor of dermatology who was the trial’s principal investigator, said in a statement.

Zevaskyn involves taking a patient’s skin cells and genetically modifying the cells to produce collagen. Up to 12 of the resulting cellular sheets are then surgically applied to a patient’s wounds.

The FDA did not return a request for comment.

Brett Kopelan, the executive director of Debra of America, which advocates for people with epidermolysis bullosa, expressed support for Zevaskyn, saying in a statement released by Abeona that the therapy “can significantly increase the quality of life of patients.”

Abeona said it expects Zevaskyn to be available starting in the third quarter of 2025. Patients seeking the therapy can receive it through Zevaskyn-qualified treatment centers.

About 3.3 per million people are affected by recessive and dominant dystrophic epidermolysis bullosa, according to the National Library of Medicine. The condition is caused by mutations in a gene called COL7A1. The mutations disrupt the body’s production of type VII collagen. That’s the collagen that Zevaskyn produces.

Two treatments are currently available. The Food and Drug Administration approved Vyjuvek, a gene therapy from Krystal Biotech, in 2023. The gel is applied to wounds regularly, typically once a week.

Filsuvez, also approved in 2023, and made by Chiesi Global Rare Diseases, can also be used. The gel, which contains birch bark, is also applied to wounds.

-

Site: Zero HedgeEPA Chief Lee Zeldin Touts 100 'Environmental Actions' Taken To 'Power The American Comeback'Tyler Durden Wed, 04/30/2025 - 20:30

Environmental Protection Agency (EPA) administrator Lee Zeldin unveiled 100 actions the agency has undertaken since Trump's inauguration to "power the American comeback."

"The Trump Administration’s first one hundred days have been historic. The American public made themselves heard last November, and we are delivering on this mandate. Promises made, promises kept. At EPA, we are doing our part to Power the Great American Comeback. To mark this momentous day, we are proudly highlighting 100 environmental actions we have taken since January 20th to protect human health and the environment," Zeldin said in a video post reported by Breitbart.

To mark the 100th day of President Trump’s second term, @EPA is proudly highlighting 100 environmental actions we have taken since January 20th to protect human health and the environment.

— Lee Zeldin (@epaleezeldin) April 30, 2025

Clean air, land, and water for ALL Americans! pic.twitter.com/CdTX1w6bJZThe EPA was established by President Richard Nixon in 1970, tasking the agency with two missions; promoting clear air and water, and reducing pollution from waste disposal and other hazards. According to Zeldin, the agency has refocused on its primary mission of ensuring clean air and water instead of pushing "climate change religion."

"Here are a few top highlights: To protect our nation’s waters, we updated water quality standards for 38 miles of the Delaware River to protect critical fish species and keep the river clean. We approved a plan to further restore and protect the Long Island Sound over the next decade. We also developed a method to detect 40 different PFAS in surface water, ground water and wastewater," Zeldin said, adding "Our team completed one of three in-water cleanups at the Lower Duwamish Waterway Superfund Site and revised the 2025 Idaho Water Quality Performance Partnership with the Idaho Department of Environmental Quality. To ensure clean air for all Americans, we demanded answers from an unregulated geoengineering start-up, Make Sunsets, that has been launching sulfur dioxide into the air to receive ‘cooling credits.'"

According to Taylor Rogers, an assistant White House press secretary, the Trump administration and Zeldin have "taken monumental steps to quickly remove toxins from our water and environment, provide clean land for Americans, and use common-sense policies to Power the Great American Comeback."

Here are the 100 actions the EPA has undertaken via Breitbart;

1. Issued immediate action items for Mexico to permanently end the Tijuana River sewage crisis.

2. Responded quickly to a citizen complaint about discharges into New York’s Hutchinson River; inspected and ordered corrective action.

3. Developed a Clean Water Act permit for hotels, condominiums, and apartment complexes to protect water quality in the U.S. Virgin Islands.

4. Finalized Arkansas 2022 Section 303(d) list assessing statewide water quality.

5. Approved Kansas Triennial Water Quality Standards Package.

6. Approved Total Maximum Daily Load (TMDL) plan in South Dakota to protect Big Sioux River quality from E. coli.

7. Announced plans to finalize outdated clean water standards for 38 miles of the Delaware River.

8. Approved removal of the Drinking Water Beneficial Use Impairment in Wisconsin’s Green Bay and Fox River Area of Concern.

9. Advanced Navajo Nation’s first in the country water permitting (“Treatment as a State”) authority.

10. Completed Phase 1 hazardous materials clean up after the catastrophic Los Angeles wildfires. EPA cleared 13,612 residential properties and 305 commercial properties, and removed 645 electric and hybrid vehicles and 420 energy storage systems in under 30 days.

11. Supported redevelopment at 21 Superfund sites across 13 states.

12. Completed a contaminated site cleanup in Hillsborough, New Hampshire, and Stratford, Connecticut.

13. Oversaw U.S. Navy’s time-critical removal of 20,000 cubic yards of contaminated soil at the Naval Education Training Center Superfund Site in Newport, Rhode Island.

14. Cleared all or a portion of 4 sites from the Superfund National Priorities List.

15. Cut two years from the cleanup timeline at West Lake Landfill, a Superfund site in St. Louis, Missouri.

16. Completed 55 property cleanups at Region 8 Brownfields. This is 31% of the national goal and 131% of Region 8’s Fiscal Year 2025 goal.

17. Completed laboratory work required for selecting a remedy at Lower Darby Creek Area Superfund Site in Pennsylvania. EPA collected 1500 sediment and water samples.

18. Responded to a mercury incident in Fremont, Ohio; safely removed and disposed of a 60-pound overpack and 15-pound bucket containing jars of elemental mercury and mercury containing devices.

19. Provided air monitoring support at the Chicago Magnesium Casting Co. after a large magnesium fire.

20. Completed Emergency Removal Action at the Marion Ohio Mercury Spill site in Ohio.

21. Oversaw Navy cleanup operations at Red Hill Fuel Facility in Hawaii, including removal of all sludge and pressure washing at two 12.5 million-gallon tanks.

22. Developed a method to detect 40 PFAS compounds in water sources.

23. Finalized eight Water Quality Standard Actions for Region 6 states.

24. Completed a second round of PFAS sampling at Region 7 Tribal Drinking Water Systems.

25. Provided interim PFAS lab certification for Alaska’s Department of Environmental Conservation (ADEC).

26. Signed an agreement to connect Joint Base Lewis-McChord residences to municipal water system if PFAS exceeds standards.

27. Started Final Remedial Actions for Jackson Ceramix Superfund in Falls Creek Borough, Pennsylvania, with construction to begin in the Spring of 2025.

28. Provided training to help New Mexico administer the National Pollutant Discharge Elimination System, a permit program established by EPA under the Clean Water Act to regulate water pollution by controlling point sources that discharge pollutants into U.S. waters.

29. Coordinated PFAS drinking water well sampling around Fort Bragg, North Carolina.

30. Utilized EPA lab Method 522 to test tribal drinking water systems for PFAS; performed 62 analyses.

31. Completed lead testing assistance (3T’s Protocol) for Puerto Rico schools and childcare facilities.

32. Reviewed 29 public water systems that had lead action level exceedance notifications in Region 4.

33. Completed 25 State Implementation Plans allowing environmental requirements to go into effect faster, 16 of which were backlogged from the previous Administration.

34. Finalized air quality rulemaking in the Washington D.C. Area ensuring ozone compliance.

35. Conducted ambient air monitoring technical system audits (TSAs) across Region 9.

36. Upgraded the RadNet monitoring station in Edison, New Jersey, to detect airborne radioactivity.

37. Awarded $165,000 to San Diego Air Pollution Control District for air filters and $1.26M for hydrogen sulfide monitoring to address air quality at the border and concerns with sulfur odors from Tijuana River sewage.

38. Promoted clean air quality compliance for new chip manufacturing projects in Phoenix, Arizona.

39. 27 Brownfields sites were made Ready for Anticipated Use, boosting property values and economic opportunities in Hartshorne, Oklahoma, Minden, Louisiana, West Memphis, Arkansas, and more.

40. Completed 107 assessments of Brownfield properties in Region 7, which is 82% of their Fiscal Year 2025 goal.

41. Achieved 21 contaminated Brownfield redevelopment successes in Region 9.

42. Held a Superfund Job Training at Missouri’s Ozark Correctional Center.

43. Completed review of 81 New Chemicals to ensure they are safe for human health and the environment.

44. Conducted a safety review of 14 pesticides to set tolerances to support a safe and reliable food supply.

45. Approved 48 pesticides to provide growers with necessary tools while ensuring appropriate restrictions were imposed to protect human health, the environment, and endangered species.

46. Proposed 35 significant new use rules (SNURs) for chemical oversight to ensure chemicals do not pose an unreasonable risk to human health or the environment.

47. Led a Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) Week-In-Residence Enforcement Training event for newly hired state inspectors to equip new inspectors with the knowledge necessary to uphold consistent inspection standards.

48. Blocked illegal pesticide imports totaling over 200,000 pounds across multiple regions.

49. Announced approval of Texas’s clean-air plan to address vehicle emissions and improve air quality in the San Antonio area.

50. Issued amended PCB risk-based disposal approvals to expedite repairs at public schools.

51. Led a Resource Conservation and Recovery Act (RCRA) State Authorization Conference to strengthen the hazardous waste program across all states.

52. Sent mobile drinking water lab to flood-impacted Eastern Kentucky.

53. Cleared more than 1,700 orphan containers of oil, propane, and other hazardous materials from land and waterways around the French Broad River after Hurricane Helene.

54. Tested over 1,500 private wells in North Carolina’s Buncombe and Watauga counties.

55. Assisted in restoring drinking water service to 150,000 people in North Carolina.

56. Concluded 297 enforcement cases reducing 15 million pounds of pollution.

57. Superfund enforcement secured $296 million worth of cleanups addressing more than 700,000 cubic yards of contamination.

58. Completed cleanup at Metals Refining Co. hazardous waste site in Indiana after discovering thirty-two, 55-gallon drums most of which were damaged and some leaking and an additional 200 to 300 miscellaneous containers of hazardous waste.

59. Removed approximately 10,000 tons of soil and debris contaminated with asbestos containing material from an unsecured 10-acre property in Indiana.

60. Collaborated to replace lead-contaminated soil at Atlanta’s Lindsay Street Park.

61. Analyzed children’s blood lead data to improve South Dakota lead prevention efforts.

62. Supported tribal waste management programs with multiple trainings to address dangerous materials like refrigerants, mercury switches, PCBs, and petroleum components.

63. Conducted 6,000 1-on-1 engagements with communities impacted by fires.

64. Held 104 public meetings or community events for fire response updates.

65. Provided training, guidance, and support to monitor and cleanup Underground Storage Tanks on Navajo Nation lands.

66. Started cleanup of radium-contaminated soil at the Silbert Watch Co. Superfund Site in Elgin, Illinois.

67. Developed EPA Method TO-15 to analyze 65 toxic Volatile Organic Compounds in indoor and outdoor air in support of Superfund and Clean Air Act.

68. Supported Los Alamos National Lab in transporting hazardous tritium containers for cleanup.

69. Conducted lead contamination studies at the Bunker Hill Superfund site.

70. Completed the review of the Houston area Ozone Exceptional that allows the state to proceed with their Air Program planning and implementation.

71. Worked with U.S. Customs to stop illegal pesticide imports at multiple ports.

72. Blocked over 56,000 pounds of unregistered pesticide products from entering through Region 4 ports.

73. Provided technical assistance support to communities at 31 Superfund sites across the country.

74. Cleanup of the HPI Chemical Products in Missouri, where thousands of containers of pesticide and herbicide containing hazardous substances, pollutants, and contaminants were housed.

75. Began a Remedial Investigation of the Historic Potteries site in Trenton, New Jersey.

76. Completed 7 property cleanups in Brownfields in the First 100 Days in Region 7.

77. Approved updated Comprehensive Conservation & Management plan for the Long Island Sound Partnership, to further restore and protect the Sound.

78. Initiated sediment removal projects at the Lower Duwamish Waterway Superfund Site removing approximately 13,700 cubic yards of contaminated sediment.

79. Oversaw cleanups at tribal and local jurisdictions under CERCLA and Clean Water Act.

80. Supported redevelopment at the Mississippi Phosphate Superfund site with a new treatment plant.

81. Completed analysis for wood treating contaminants at 181 residential properties around the Union Pacific Railroad Superfund site in Houston, Texas, with seventy four percent found to be safe for use.

82. Managed post-disaster hazardous materials spills in Ohio and North Carolina.

83. Inspected and mitigated vapor intrusion impacting Los Angeles from a former Superfund site.

84. Obtained court settlement for cleanup work at the San Fernando Valley Superfund Site located in North Hollywood-Burbank to restore a critical drinking water supply for the city of Los Angeles.

85. Responded to hydraulic oil spill into a creek in Whitehouse, Ohio.

86. Supported voluntary cleanups under consent decrees.

87. Began a removal action in Dartmouth, Massachusetts, to excavate and dispose of contaminated soil at three residential properties as part of a larger ongoing cleanup effort.

88. Approved eight plans for cleanup and disposal of toxic Polychlorinated Biphenyl (PCB) materials to facilitate reuse and economic development across properties in New England.

89. Finalized Native Green Grow Air Permit for large greenhouse facility in North Dakota, providing the Tribe with food security.

90. Advanced Native American environmental oversight efforts.

91. Granted a Water Infrastructure Finance and Innovation Act (WIFIA) loan to Weber Basin Water Conservancy District, for drinking water infrastructure to over 20% of Utah’s population while creating local jobs to support the projects.

92. Supported grant programs to monitor and clean up abandoned USTs.

93. Provided federal funds to conduct Highway 24 lead and arsenic clean up in Colorado.

94. Helped prevent spread of hazardous materials from warehouse fires including sulfuric acid, nitric acid, hydrochloric acid, sodium hypochlorite, potassium cyanide, sodium cyanide, and lead.

95. Collaborated with fire rescue teams in North Carolina to retrieve containers from flooded rivers.

96. Provided technical guidance to local water operators, supporting efforts to restore and maintain drinking water systems and other essential services during Hurricane Helene Recovery efforts.

97. Completed all residential soil and indoor dust cleanup at the Colorado Smelter Superfund site.

98. Completed the 5-Year Review for Puerto Rico’s Corozal Superfund Site, paving the way for its deletion from the CERCLA Superfund National Priority List.

99. Submitted a demand for information to a start-up company called “Make Sunsets,” which is launching balloons filled with sulfur dioxide (SO2) seeking to geoengineer the planet and generate “cooling” credits to sell.

100. Announced major actions to combat PFAS contamination.

-

Site: Henrymakow.com

Woah. Read this.Fair election my a$$The Liberal upset the Conservative incumbent by 235 votes!!!by MaryAnn Gill(henrymakow.com)I worked as an Information Officer, in the Federal Election on April 28, 2025. I was at the - Dr Knox Ecole /School- Polling Station in Kelowna BC from 5:45 AM until 8:30 PM .I want to put in writing what I witnessed:1- Numerous voters , at least 50%, asked if they could use their pen, that they brought to vote. I said YES.LATER- after the polls closed, I was then asked to, do the Tally. ( Record the choice of vote on the ballot ) As the Deputy Returning Officer called out the Name of The Candidate selected, I was to record it.I noticed, None Of the ballots were in Pen. Only pencil. I know for a Fact, I sent most voters, that had a voting card, to desk # 17.The total of votes tallied at desk #17 were the most of any other desk in the Polling Station. I asked my DRO why none were in pen. No answer offered.These ballots were then put in an envelope and sealed. My signature is on record as I tallied the total.2- I noticed many voters turned away that had proper ID. I talked with many to ask why they were refused as these voters were very upset and felt very concerned that they were refused. It turned out that an ENTIRE APARTMENT BUILDING on Valley Road was missing from Elections Canada Information. Meaning none of the residents had voter cards. Without the cards they needed to provide valid ID. Without PROOF OF The Building Existing, none of the occupants could vote, even with valid Passports, Drivers Licenses, morgage docs, rental agreements, bills ect. It was mindboggling to watch these people turned away. I brought each person to the supervisor to help them vote and the Supervisor said there was nothing they could do without without Election Canada approval.3- Election Canada was not accessible most of the day. By the afternoon, no supervisor or senior officers could get through for any verification.4- over 60% of voters were under 35 at this location. There were a handful of 70 year old and up. This was remarkable to see such a massive amount of youth. I lost count of how many youth told me it was their 1st Time voting Federally. I asked for stickers or anything to hand out. There was nothing for 1st time voters or children attending with parents.5-One other Information Officer informed me, his wife was working at the head of Elections Office in the Landmark Building where all the Special Ballots were. These ballots were done very early and you wrote the Candidate name on the ballot. This was done for weeks. Other specail ballots are the mobile voting and mail in votes, ect. The ballots were not precounted. I spoke with this man after the polls closed and after we tallied to ask if his wife's still counting. He said they did not finish yet and that there was approximately 20,000 ballots. STRANGE that Kelowna called out a winner without that many ballots counted.6- Many voters spent the day going from Polling Station to Polling Station trying to vote because the Election Canada website was not working so no one could troubleshoot all these oddities with missing voters cards and locations of Polling Stations based on the address of the voters.7- I can assure all Canadians what I saw in only 1 poll would have a difference in the outcome of this riding. When an entire apartment building is missing, that is not a simple insignificant issue . Hundreds of voters are not counted and that will change the outcome of elections.My experience is of only 1 poll, in 1 riding, in 1 city, in BC . If it happened here I'm safe to understand it happened in other places. That is one of endless reasons that Elections Canada was not reachable or web sites working for most of the day.Very clear interference in the Voting Of eligible Voters witnessed today.

Woah. Read this.Fair election my a$$The Liberal upset the Conservative incumbent by 235 votes!!!by MaryAnn Gill(henrymakow.com)I worked as an Information Officer, in the Federal Election on April 28, 2025. I was at the - Dr Knox Ecole /School- Polling Station in Kelowna BC from 5:45 AM until 8:30 PM .I want to put in writing what I witnessed:1- Numerous voters , at least 50%, asked if they could use their pen, that they brought to vote. I said YES.LATER- after the polls closed, I was then asked to, do the Tally. ( Record the choice of vote on the ballot ) As the Deputy Returning Officer called out the Name of The Candidate selected, I was to record it.I noticed, None Of the ballots were in Pen. Only pencil. I know for a Fact, I sent most voters, that had a voting card, to desk # 17.The total of votes tallied at desk #17 were the most of any other desk in the Polling Station. I asked my DRO why none were in pen. No answer offered.These ballots were then put in an envelope and sealed. My signature is on record as I tallied the total.2- I noticed many voters turned away that had proper ID. I talked with many to ask why they were refused as these voters were very upset and felt very concerned that they were refused. It turned out that an ENTIRE APARTMENT BUILDING on Valley Road was missing from Elections Canada Information. Meaning none of the residents had voter cards. Without the cards they needed to provide valid ID. Without PROOF OF The Building Existing, none of the occupants could vote, even with valid Passports, Drivers Licenses, morgage docs, rental agreements, bills ect. It was mindboggling to watch these people turned away. I brought each person to the supervisor to help them vote and the Supervisor said there was nothing they could do without without Election Canada approval.3- Election Canada was not accessible most of the day. By the afternoon, no supervisor or senior officers could get through for any verification.4- over 60% of voters were under 35 at this location. There were a handful of 70 year old and up. This was remarkable to see such a massive amount of youth. I lost count of how many youth told me it was their 1st Time voting Federally. I asked for stickers or anything to hand out. There was nothing for 1st time voters or children attending with parents.5-One other Information Officer informed me, his wife was working at the head of Elections Office in the Landmark Building where all the Special Ballots were. These ballots were done very early and you wrote the Candidate name on the ballot. This was done for weeks. Other specail ballots are the mobile voting and mail in votes, ect. The ballots were not precounted. I spoke with this man after the polls closed and after we tallied to ask if his wife's still counting. He said they did not finish yet and that there was approximately 20,000 ballots. STRANGE that Kelowna called out a winner without that many ballots counted.6- Many voters spent the day going from Polling Station to Polling Station trying to vote because the Election Canada website was not working so no one could troubleshoot all these oddities with missing voters cards and locations of Polling Stations based on the address of the voters.7- I can assure all Canadians what I saw in only 1 poll would have a difference in the outcome of this riding. When an entire apartment building is missing, that is not a simple insignificant issue . Hundreds of voters are not counted and that will change the outcome of elections.My experience is of only 1 poll, in 1 riding, in 1 city, in BC . If it happened here I'm safe to understand it happened in other places. That is one of endless reasons that Elections Canada was not reachable or web sites working for most of the day.Very clear interference in the Voting Of eligible Voters witnessed today. -

Site: Zero HedgeWorkless 'Lost Generation' Suffering Mental Health Issues: ReportTyler Durden Wed, 04/30/2025 - 20:05

Authored by Rachel Roberts via The Epoch Times (emphasis ours),

The British Chambers of Commerce (BCC) is warning of a workless “lost generation,” caused partly by the number of young people suffering from poor mental health.

A man wearing a mask walks past a mural painted as part of the Cities of Hope festival in 2016 and highlighting the effects of mental health, in Ancoats, northern Manchester, England, on Oct. 16, 2020.Oli Scarff/AFP via Getty Images

A man wearing a mask walks past a mural painted as part of the Cities of Hope festival in 2016 and highlighting the effects of mental health, in Ancoats, northern Manchester, England, on Oct. 16, 2020.Oli Scarff/AFP via Getty Images

The body is calling for immediate government action which it says is needed to help young people from generation Z, generally defined as those born between 1997–2012, to enter the workplace or education.

Its report, “Creating Job Opportunities for Gen Z,” released on Monday, follows research published last week which found the number of young people claiming benefits owing to poor mental health or neurodiverse conditions such as autism and ADHD was not economically “sustainable.”

‘Double Whammy’

Shevaun Haviland, director general of the BCC, said: “The UK’s active workforce is rapidly ageing, while the number of young people who are not in employment, education or training is at its highest level for a decade.

“Generation Z face a double whammy of increasing barriers to entering the workforce, and reducing opportunities as the number of vacancies continues to fall.

“But research shows the longer we leave this pool of talent to drift away from the workplace the harder it becomes for them to engage.”

The BCC, which represents a large number of smaller businesses, is calling on the government to spend more on mental health support and further education and for a more “collaborative approach” across the various Whitehall departments.

‘Rise of Anxiety’

Last week’s report from the Tony Blair Institute (TBI) pointed to soaring numbers of people reporting poor mental health and claiming benefits since the COVID-19 lockdown era.

“One clear trend is the rise of anxiety particularly since the COVID-19 pandemic. Data from the Annual Population Survey show that prior to the pandemic, self-reported levels of anxiety in the population were relatively stable. Since 2019, however, the number of people reporting high levels of anxiety has surged and remained high, with 23 per cent of working-age adults reporting ‘poor anxiety’ in 2023,” authors for the former prime minister’s organisation wrote.

Mental health conditions are now the most commonly reason cited by people across all age groups who are out of work owing to long-term sickness, the report by the TBI notes.

“The reasons behind this shift remain unclear. It may reflect a rise in true prevalence, but other factors could also be at play – such as distorted financial incentives within the system, overdiagnosis or changing public attitudes and awareness around mental health.

“Whatever the cause, one thing is clear: the current trajectory is unsustainable,” the authors concluded.

The study highlights a 168 percent reported increase in depression, anxiety, and stress among those aged 16–24 in the two decades ending in 2019, with a 42 percent rise seen across all age groups.

It also notes a doubling in the prescribing of ADHD medication since 2018–2019, with the younger age group the main driver behind this increase.

Surging Benefits Bill

Claims for mental health conditions have fuelled a nationwide surge in benefits payments since the lockdown era, with an estimated 25 percent in income tax predicted to be used to fund sickness benefits by the end of this decade, unless the trajectory changes.

An estimated 13.4 percent of all young people aged 16 to 24 were classed as NEET (“not in education, employment, or training”) in October to December 2024, an increase of 1.3 percent compared with October to December 2023, according to the latest release from the Office for National Statistics.

The precise figures are not reliable, because they are based on the statistics agency’s labour market survey, which is hampered by low response rates, especially for younger age groups.

Signage for the Department of Work and Pensions in Westminster, London, in an undated file photo. PA

Signage for the Department of Work and Pensions in Westminster, London, in an undated file photo. PA

Research by The King’s Trust, carried out in 2022, shows that one in four classed as NEETs said they would like to work but cannot, owing to their poor mental health, with “lack of confidence” also cited as a major barrier to entering the workforce by 23 percent of young people.

Almost half (46 percent) of those surveyed told The King’s Trust researchers they have additional mental health issues or caring responsibilities owing to the lockdown era which meant they were out of work.

More than half (52 percent), said the longer they were unemployed, the harder they were finding it to get work, while 45 percent said being out of work meant they had lost confidence in their skills.

Youth Guarantee Scheme

Last month, the government announced a series of welfare reforms, including sweeping cuts to disability benefits and an expansion of so-called “back-to-work support,” which it said will help young people diagnosed with mental health problems to enter the workforce.

The Department for Work and Pensions (DWP) announced a Youth Guarantee Scheme in November, aimed at giving all 18- to 21-year-olds access to training, an apprenticeship, or support to find work, as part of a broader strategy aimed at tackling worklessness and ill health in the wider population.

Releasing its white paper, the DWP said: “Stark figures show almost one and a half million people are unemployed, over nine million people are inactive [and] a record 2.8 million people are out of work due to long-term sickness.

“Young people have also been left behind with one in eight young people not in education, employment or training, and nine million adults lack the essential skills they need to get on in work.”

The government proposes to set up eight youth “trailblazer” areas across the country, allocating £45 million to identify those “most at risk of falling out of education or employment and match them to opportunities for education, training or work,” with a further £40 million allocated to transform the Apprenticeship system.

However, the BCC said in its report that there was a lack of clarity as to how the youth guarantee scheme will work in practice, and whether there will be sufficient funding to last the entire course of the next Parliament.

“Details of how this will be delivered, and the role of employers, are still unclear. While employers want to support the initiative, the rising cost of employment and the squeeze on training budgets could restrict their ability to participate.”

The BCC noted that there is a “lack of incentive” for small- and medium-sized businesses to take on young people, particularly those classed as NEET, because of the financial risk.

“Employers report that young people are more resource-intensive to train and employ, due to their increased need for pastoral care, and their higher staff turnover. Combined with the likelihood that NEETs may have additional needs such as Special Educational Needs (SEN) or mental health challenges, resource-stretched SMEs may feel unable to offer the support needed,” the authors said, adding that the role of government should be to “derisk” this for businesses that take on and retain these young people.

-

Site: Public Discourse

It is common to hear that climate justice requires redistributive payments from those countries, like the US, that contribute most to greenhouse gas emissions to those poorer societies that contribute little to the problem but suffer disproportionately from the consequences. Cass Sunstein’s recently released book, Climate Justice, tries to prove this point, while also attempting to link the argument to a fundamentally Christian ethic.

But the argument has its flaws. For the sake of argument, let us say we agree that greenhouse gas emissions have contributed to the increase in average global temperature over the past century. (This is still debatable.) But the practical effects of that temperature increase are hard to measure. For instance, does the American contribution to greenhouse gas emissions make hurricanes worse? How much worse? Does it cause greater periods of drought? How much greater?

Sunstein writes, with unfounded certainty, that “Everyone knows that climate change is creating horrors.” But he spends little more than half a page addressing the causation question. He concludes by claiming that while causation problems “weaken . . . corrective justice claims,” they “are not fatal” to them.” But the fact that we have no way of proving whether a monsoon in Pakistan on a given date was caused by climate change, natural fluctuation of weather patterns, or some combination of the two seriously weakens Sunstein’s argument.

He does acknowledge, though briefly, the difficulty of assigning culpability for climate consequences. He also employs an analogy of a rich and poor individual, and their relationships and duties to one another, to illustrate the rich nation’s obligation to aid the poor. But the analogy is weak, and Sunstein admits that individuals are not nations. It is not clear that it is morally justified to require poor people in rich nations to contribute to the redistributionist climate change plan Sunstein advocates, or to permit rich people in poor countries to benefit from it. Perhaps, he admits, individual Americans cannot be held responsible for their outsized use of resources. But Sunstein suggests that Americans are guilty of tolerating political administrations that have not done enough on climate change. Only a few pages in the book are dedicated to the causation and culpability problems before Sunstein concludes, unconvincingly, that “[r]ough justice is still justice.”

Sunstein’s redistributivist approach on this issue is, he assures us, consistent with the Golden Rule of “Jesus of Nazareth,” as well as with the second of the two great commandments given in the Gospels (“Love your neighbor as yourself”). But Sunstein fails to substantiate these claims. “Do to others as you would like them to do to you” does not necessarily mean that those with greater resources must always give to those with fewer resources, no questions asked. Interpretation of “love your neighbor as yourself” requires an investigation of the nature of love of self. Sunstein fails to make such an investigation.

Yet the greatest flaw of Sunstein’s argument is his failure to acknowledge the supernatural character of the worldview driving it. Jesus instructed followers to orient themselves not simply to moral results in this world, but especially to the pursuit of moral rewards in the next. The Golden Rule and the command to love thy neighbor were hardly presented as contributions to the brand of social utopianism much later taken up by proponents of the so-called “Social Gospel.” The reason for reciprocity and a spirit of love was not the production of a this-worldly ethic of material equality, but a contribution to the spiritual perfection of souls whose telos is heaven. One makes himself more like Jesus, and therefore more spiritually meritorious, through compassion and love toward others. For Sunstein, this approach to life has material benefits. But for the Christian, acts of love matter for their own sake.

Another point of disconnect is evident in Sunstein’s confident theorizing about the comparative value of human life now and in a hypothesized future. One of his central premises is that “people who are alive now do not deserve greater attention and concern than people who will be born twenty years hence, or forty years hence, or a hundred years hence.” “Intergenerational neutrality” is the principle all nations should follow, he urges. This is consistent with the abstract humanism of much of the political Left. Human lives are objects of value in a theoretical sense, whether actually existing or only possible or probable at some future point. But Christianity rejects abstraction on this issue. It is real human souls that are sacred, and we encounter them in this world only in their embodied forms. Those persons who have lived and died are recognized as occupying the same spiritual status, though we now cannot relate to them morally in the same concrete way we can to those still alive.

But those yet to come are abstractions. Contemplation of the end times is a central metaphysical foundation of Christianity, while materialist redistributionism can hope for nothing beyond the immanent frame. Sunstein’s certainty about what we owe to those who may or may not ever come into existence is beyond the reasonable knowledge of the faithful Christian.

Even if we limit our understanding of the Golden Rule and love of neighbor to material, immanent matters, a Christian respondent to Sunstein might inquire whether the “doing” here on the part of rich countries is as harmful as he suggests. Sunstein is certainly right that any negative environmental effects of consumption might disproportionately affect poor countries. But he has nothing to say about how wealthy countries’ production of climate-harming products can help poorer ones. For example, cutting back on oil and gas use in countries like the US will harm regions that are producers and exporters of petroleum and natural gas (Oil is Africa’s greatest export.) Also, pharmaceutical production is a significant cause of greenhouse gas emissions. And poor countries, especially those in Africa and the Middle East, import food, the production and shipping of which create greenhouse gas emissions. If we cut back on that, those countries will have less food to import, and this will harm their populations.

Sunstein does not consider these effects—he does not even acknowledge the existence of the positive benefits. He worries that poor countries near the equator will suffer increases in malaria burden because of climate change. But he does not acknowledge that some portion of our greenhouse gas emissions involves work on malaria vaccines that might eradicate the disease.

Sunstein assures readers that the only morally defensible position is for all countries to consider the whole world, and not just their own needs, in managing activities that might harm the climate. The position of Christianity on love of and preference for one’s own country and, more generally, the moral correctness of attending more carefully to those closer in relation than to those more distant (the “ordo amoris” explained by St. Augustine and, later, St. Thomas Aquinas), is more complicated than Sunstein acknowledges. Pope St. John Paul II was, for example, opposed to “an unhealthy nationalism,” but he writes in Memory and Identity that patriotism, the specific love each of us has for his own country and his countrymen, “leads to a properly ordered social love.” In his letter to the people of Poland, “My beloved Fellow-countrymen,” he argues that “[l]ove of our country. . . springs from the law of the human heart. It is a measure of man’s nobility.”

It is undeniable that the Church calls Christians to aid those who suffer. But real demographic and political realities frame this responsibility. Sunstein provides no answers to reasonable questions about a country’s obligation to curtail its use of sustaining industries, even those that cause harm on a global scale. It is telling that he is so supremely confident in the ability of Americans to endlessly produce material abundance while he is simultaneously so lacking in knowledge about the dominant spiritual foundations underlying that productivity.

Image by malp and licensed via Adobe Stock.

-

Site: Zero HedgeCalifornia Child Sex Trafficking Bill Advances After Language Removed To Make Purchase Of 16 & 17-Year-Olds A FelonyTyler Durden Wed, 04/30/2025 - 19:40

California lawmakers on the Public Safety Committee advanced a bill that would crack down on child sex trafficking - but only after language was removed that would have made it a felony to purchase 16 and 17-year-olds.

Assemblymembers Mia Monta (D) and LaShae Sharp Collins (D) abstained from the vote.

Assembly Bill 379, introduced by Assemblymember Maggy Krell (D), targets buyers of commercial sex. Krell previously worked at the California DOJ, where she became known for prosecuting the operators of Backpage.com - which was shut down in 2018 for facilitating sex trafficking and prostitution.

The bill is opposed by Assemblymember Mark Gonzalez (D-Los Angeles), who says the bill would disproportionately impact communities of color.

Democratic Assemblyman is concerned that this bill addressing human/sex trafficking (and was supposed to make it a felony to solicit 16 and 17 years old) will disproportionately affect black and brown communities and LGBTQI+ community. pic.twitter.com/rDPO4GeMw9

— California Republican Party (@CAGOP) April 29, 2025So, it's racist to crack down on child sex trafficking. Got it.

The bill, introduced in February, includes provisions to create a misdemeanor for loitering with the intent to solicit commercial sex - and imposes fines as high as $25,000 for soliciting minors under the age of 16. It also allows felony human trafficking charges for repeat offenders who buy sex from minors.

It also would create a first-of-its-kind Survivor Support Fund - which would go to community-based organizations led by survivors of human trafficking.

As the Epoch Times notes further, while introducing the bill to the committee, Krell said it would support victims and give law enforcement better tools to prosecute the buyers.

“Demand is the buyers,” she said. “It is the rows of cars of men lined up on street corners to buy teenagers for sex,” she said. “Without the buyers, we don’t really have sex trafficking.”

The bill drew support from the California District Attorneys Association, the California Police Chief Association, the San Bernardino County Sheriff’s Department, the City of Stockton, the Association for L.A. Deputy Sheriffs, the League of County Board of Supervisors, and more.

The bill also reinstates penalties for offenses that were decriminalized by a 2022 California law, such as loitering with the intent to purchase a victim. Those convicted would face a misdemeanor and pay up to a $1,000 fine that would go toward the fund for survivors.

Opponents, including survivors of child trafficking, focused on this aspect of the law in their testimony.

Jess Torres, a child trafficking survivor and director of programs at Rising International, respectfully opposed the bill, saying it hinges on a vaguely defined suspicion of intent to do something criminal, rather than evidence.

“This bill will only escalate violence against survivors because persons who are trafficked in commercial sex are harmed when they operate in a criminalized environment,” Torres said. “When buyers believe they are taking on greater risk, they often become more demanding, and that pressure frequently becomes compromising.”

Leela Chapelle of the Coalition to Abolish Slavery and Trafficking also opposed the bill, arguing that loitering with intent laws harm communities they claim to protect and are unconstitutional.

“We do believe that this will cause the same issues that we have seen over and over again, that we spend our resources clearing the criminal records of survivors, that should not have happened in the first place—these criminal records that prevent them from lives of stability,” Chapelle said.

Opposition also included the LA Public Defenders Union and the San Francisco Public Defender’s Office.

The bill is now due to advance on to the Assembly Appropriations Committee before it can advance to a full vote on the Assembly floor and the Senate.

-

Site: LifeNews

The Hialeah Heartbeat of Miami pregnancy help clinic had a triple slam dunk during the month of March.

Heartbeat of Miami;s press release noted the “March Madness” in college basketball was also true in pregnancy care.

Executive director Martha Avila said she had been in the center’s boutique on the phone one day in March with a representative from the Florida Pregnancy Care Network. An ultrasound was taking place in the next room.

“All at once, I heard this commotion,” Avila told Pregnancy Help News during a phone interview.

HELP LIFENEWS SAVE BABIES FROM ABORTION! Please help LifeNews.com with a donation!

She put her caller on hold to see what was happening.

The women in the next room were shouting with shock and joy. Not only had a baby been discovered on the screen, but three babies were visible.

Triplets.

According to the release:

“When (the mom) came to us she was very high risk for abortion,” Avila said.

“(The client) had been in a relationship with her boyfriend for three years, living with her mother, but now, facing this unexpected news, she didn’t know what to do. The timing just didn’t feel right. When the pregnancy test came back positive, her heart sank, but after a long, heartfelt counseling session, (the client) bravely agreed to have the ultrasound we offered to confirm if the pregnancy was viable.”

The ultrasound revealed three babies at seven weeks, four days gestation.

Heartbeat of Miami provided a video of the client who is Cuban and a Spanish speaker.

She said, “I still cannot believe it!”

Heartbeat of Miami’s release stated that everyone in the room, the staff, client and the client’s mother, was in tears.

“The sound of three tiny heartbeats filled the room, the proof of life that brought tears to everyone’s eyes,” the release said.

The client Facetimed her boyfriend, the father of the babies, who also cried as he saw the images.

Triplets saved at Heartbeat of Miami/Heartbeat of Miami

Triplets saved at Heartbeat of Miami/Heartbeat of Miami

Avilla said many of the women who come to their clinic are from Cuba.

“Cuba calls abortion a ‘deregulation,’” Avila said, noting it is a “very atheist country.”

“We told her, ‘See how God does things?’” Avila said.

Avilla said the client’s mother was a support for her, and Avila was not surprised.

“In Cuban families there is a lot of support from the grandmothers,” she said. “You could see both of them crying. It was very emotional.”

Heartbeat of Miami provided the new mom of multiples with referrals for emergency medical assistance, the name of a high-risk pregnancy provider, diapers and prenatal vitamins. They are prepared to keep in touch with this growing family.

This is proof once more of the ever-present help of pregnancy help centers. Heartbeat of Miami has beaten the odds of its enemies who tried to destroy the image of one of its locations in 2022 after the overturning of Roe v. Wade.

They are a network that relies on God to fight their battles and provide victory for life, Avila said.

“God lines up everything for His honor and His glory,” Avila said, “It’s not like we say to women, ‘Ok, have your baby, goodbye.’ God provides for us in our hardest scenarios.”

This is not the first set of triplets to come out of the Heartbeat of Miami offices. The center has been present in five locations for 18 years. This client’s “March Madness” is the fifth trio staff has witnessed within its locations.

“Our first set of triplets just turned 11 years old,” Avila said, adding mom was 47 at the time, making history at the University of Miami Hospital.

“We are all still friends,” she said of the first family, “and (staff members) were there when the triplets were born.”