“If you believe what you like in the Gospels, and reject what you don’t like, it is not the Gospel you believe, but yourself.”

Distinction Matter - Subscribed Feeds

-

Site: Zero HedgeChina's Two-Decade Global Steel Expansion "Has Now Ended"Tyler Durden Fri, 05/23/2025 - 10:45

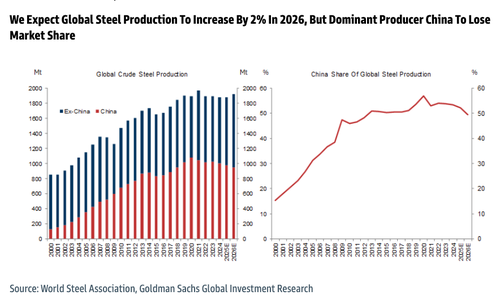

In Goldman's latest global steel outlook, analysts Aurelia Waltham, Eoin Dinsmore, and others highlight a key inflection point: China's share of global steel production has declined for the first time in over two decades, reversing a multi-decade expansion period.

"After more than two decades of China increasing its share of global steel production, we believe this structural trend has now come to an end as China's domestic demand continues to falter and barriers to steel exports intensify," Waltham and her team wrote in a note published on Friday morning.

The analysts noted that their global steel supply and demand model forecasted a 3% and 4% year-over-year increase in ex-China steel demand for 2025 and 2026, respectively. As Chinese steel exports are expected to decline, ex-China crude steel production is projected to rise by 3% in 2025 and 8% in 2026.

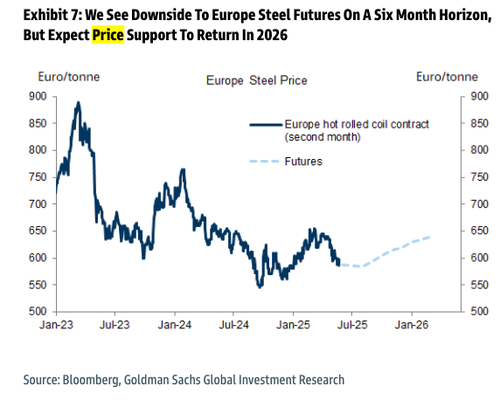

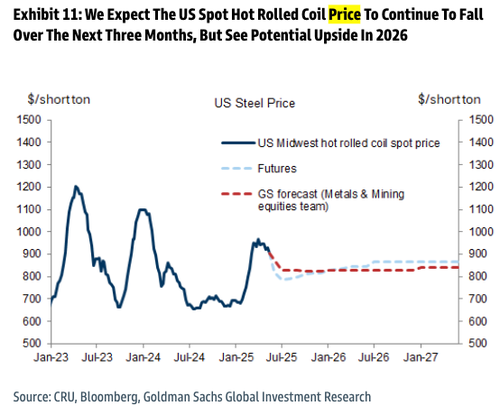

"While we are bearish on US and European steel prices on the three-to-six month horizon, we expect a re-acceleration in demand growth and lower Chinese steel exports to provide price upside in 2026," Waltham said.

They outlined the biggest risk to their forecast of China losing global market share:

We see the biggest risk to our call that China will start to lose market share of global steel production to the rest of the world over the next two years being indirect[1] Chinese steel exports continuing to climb, pushing down rest of world apparent steel demand. This would likely see China steel demand from the manufacturing sector exceeding our current expectations, preventing a decline in Chinese steel output and apparent domestic demand, while at the same time meaning rest of world steel production growth would fall below end use consumption growth. However, this would be at odds with China's policy to reduce steel output.

Following a 25-year expansion that saw China increase its share of global steel production from approximately 15% in 2000 to about 55% by 2020, analysts now forecast a decline to about 50% by 2026.

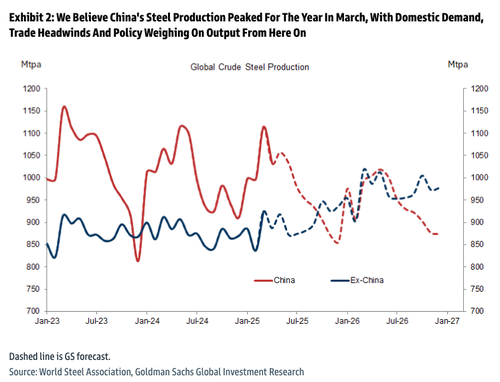

China's steel production for 2025 already peaked in March.

Key takeaways about China's declining influence in global steel markets:

-

Peak Reached: China's steel production likely peaked in March 2025 and is expected to decline by 2–3% YoY through 2026.

-

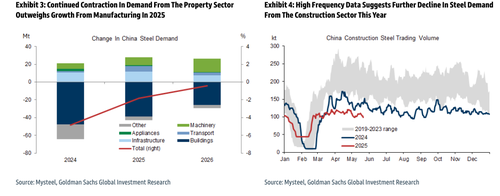

Domestic demand slowdown: A continued decline in construction activity, especially new housing starts (forecasted to drop 24% in 2025), will more than offset gains from manufacturing (e.g., autos and appliances).

-

Export headwinds: Chinese finished and semi-finished steel exports are forecast to drop 33% YoY in 2026, from 12% to under 8% of ex-China steel consumption.

-

Policy risk: If exports or output stay elevated, the Chinese government may impose mandated production cuts (likely via emissions controls) in Q4 2025 to meet policy targets.

China's economy is still a mess. Property sector will continue to weigh on steel demand.

However, the analysts view a rebound in ex-China steel:

-

Ex-China growth: Production outside China is expected to rise 3% in 2025 and 8% in 2026, helped by recovering demand and lower competition from Chinese exports.

-

Regional demand: Demand in the U.S., EU, and India will gradually improve. Apparent demand outside China is forecast to rise 3–4% annually into 2026.

Global Steel Price Outlook:

-

Near-term weakness: U.S. and European prices face further downside in the next 3–6 months due to lackluster demand and high inventories.

-

2026 upside: Prices are forecast to rise in 2026 as Chinese exports fall and global demand picks up, particularly in Asia and the EU. Anti-dumping measures and trade friction will help contain Chinese supply abroad.

European Steel Price Forcast

US Hot Rolled Coil Price Forecast

The long-standing concern over China flooding global markets with steel may finally be easing—a shift that could pave the way for Western producers to ramp up output. We anticipate this trend will be evident in the U.S amid President Trump's 'America First' era.

-

-

Site: Zero HedgeThe Anchoring Problem And How To Solve ItTyler Durden Fri, 05/23/2025 - 10:25

Authored by Lance Roberts via RealInvestmentAdvice.com,

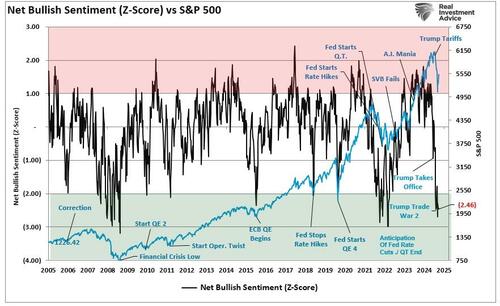

Market perspective is essential in avoiding investing mistakes. With the media constantly pushing a “Markets In Turmoil” narrative, it’s no wonder that investor sentiment recently reached some of the lowest levels since the financial crisis. The following chart is the z-score of the retail and professional investor sentiment composite index of bullish sentiment.

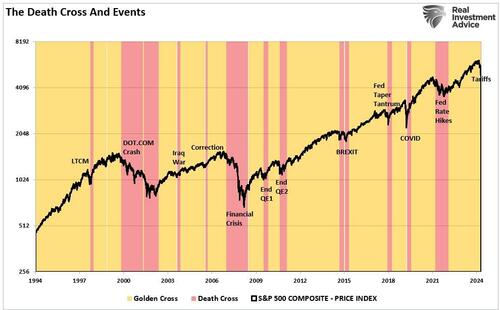

Notably, we are in one of the longest stretches of more extreme bearish sentiment outside structural bear markets. (Read “Death Crosses And Market Bottoms” for more detail and an explanation of the difference between event-driven corrections and structural bear markets.)

Of course, given the recent market decline and the surge in “bearish” media-driven narratives, it is unsurprising that bearish sentiment has risen. However, this is where investors start making mistakes in their investment process.

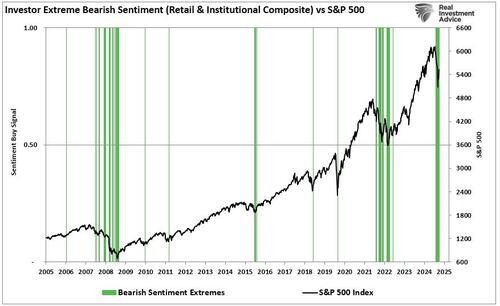

As noted, we are in one of the most extended stretches of bearish sentiment outside a structural bear market. The difference between event-driven corrections and structural bear markets is crucial to understand. However, extremely negative investor sentiment and positioning are the hallmarks of the end of corrections and bear markets. To wit:

In other words, historically speaking, the death cross, more often than not, is a potential contrarian indicator. The difference between whether the death cross is a shorter-term corrective process or a larger “bear market” decline depends mainly on whether the cause of the market decline is “event-driven” or “structural.” This context is important when examining the current decline and triggering of the “death cross.” The chart below shows the difference in the length of “event-driven” versus “structural” corrections, signified by the triggering of the “death cross.” The dot.com and financial crisis periods were structural events, as significant corporate failures and credit-market dislocations occurred amid deep economic contractions. However, outside of those two significant structural impacts, all other “events” were short-lived, and markets soon recovered.”

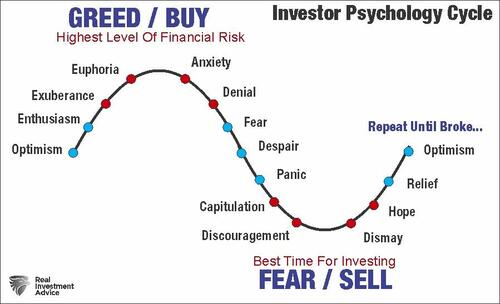

This is because when sentiment is the most bearish and the markets trigger longer-term sell signals, much of the selling has already been exhausted. Nonetheless, now that we are constantly connected to financial media, we are inundated with headlines designed to get “clicks” more than delivering real news. “Investor Resolutions For 2025” noted that investor psychology is the most significant driver of investing failure over time. This cycle of human emotions is continually repeated through investment cycles.

While many behavioral biases significantly negatively impact investor outcomes, from herding to loss avoidance to confirmation bias, “anchoring” is one of the most important.

The Anchoring Problem

“Anchoring is a heuristic revealed by behavioral finance that describes the subconscious use of irrelevant information, such as the purchase price of a security, as a fixed reference point (or anchor) for making subsequent decisions about that security.” – Investopedia

“Anchoring,” also known as the “relativity trap,” is the tendency to compare our current situation within the scope of our limited experiences. For example, I would be willing to bet that you could tell me exactly what you paid for your first home and what you eventually sold it for. However, can you tell me exactly what you paid for your first soap bar, hamburger, or pair of shoes? Probably not.

The reason is that the home purchase was a major “life” event. Therefore, we attach particular significance to that event and remember it vividly. If there was a gain between the purchase and sale price of the home, it was a positive event, and therefore, we assume that the next home purchase will have a similar result. We are mentally “anchored” to that event and base our future decisions around very limited data.

Today, investors are trained by the financial media to “anchor” to a fixed point in the market. Such is why investors consistently measure performance, relative to the market, from January 1st to December 31st. Or, worse, we measure performance from the peak of an advance. For example:

- The market is up 140% from the March 2020 lows.

- The market is down 10% from the 2025 peak.

- Or, the market is down 6% for the year.

The problem is that most investors did not buy the 2020 bottom or sell the 2022 peak. However, one of the most significant forms of anchoring is portfolio “high water marks.” The high water mark is the peak value of an investor’s portfolio over a given time frame. For example, at the market’s peak in 2025, an investor had a portfolio value of $1,000,000. During the recent market correction, the portfolio value declined to $950,000. While that $50,000 loss is significant and is certainly concerning for that investor, it must be put into the context of what is happening in the markets.

- First, before the correction that started in February, the market had rallied nearly 5%. Therefore, our example investor started the year with a portfolio value of roughly $960,000 that grew to $1,000,000.

- Secondly, while the $50,000 decline is significant, the investor is “anchored” to the portfolio’s high-water mark.

- As noted above, the market is down 6% for the year, but the investor is at roughly the same level as he started this year.

- In other words, the portfolio return is roughly a loss of 1% versus a market decline of 6%.

Yes, a decline of $50,000 is significant, but these “anchor” points provide little perspective for the average investor regarding their relative position to their financial goals. However, these “anchors,” tied to constant media updates, feed our emotional decision-making processes driven by “greed” or “fear.”

Let’s take a look at an example:

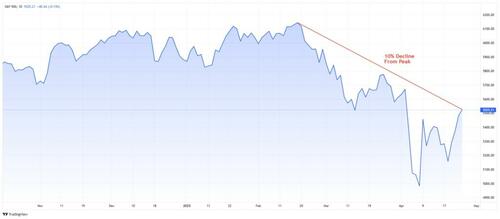

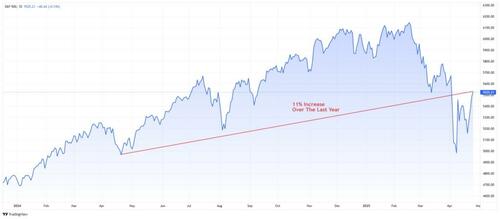

As of Friday’s close, the market is down 10% from its all-time high.

As we warned about several times in 2024 and early this year, when a 10% correction eventually came, it would “feel” worse than it was because of the long period of low volatility.

Yes, it feels terrible. However, investors are now focusing on that “high-water mark.”

But this is the goal of the Wall Street marketing machine. Getting you to focus on current gains or losses creates a “sense of urgency” for you to do something. Why?

“Money in motion creates fees and revenue for Wall Street.”

Therefore, pushing you to take action may not necessarily be “profitable” for you, but it IS profitable for Wall Street.

Changing Your Anchor Point

To reduce your “emotional action button,” step back and change your “anchor” point.

If your portfolio is down 10% from the recent peak, ask yourself two questions:

- Am I losing money? Or,

- Is my portfolio still aligned with my investing goals?

If my goal is to average a 6% annualized return, where am I today relative to that goal? The issue of using the “high-water mark” as the “anchor” is that it resets psychologically to measure our performance from that level. Therefore, we should look back at where we were on a trailing one-year basis. If our goal was 6% a year, we almost doubled that goal over the last 12 months. All of a sudden, the recent decline doesn’t seem as significant.

However, let’s assume an investor was unlucky enough to have bought the market’s peak before the pandemic’s onset. Despite the pandemic shutdown, surging inflation, fears of recession, the Russia/Ukraine war, and every negative headline, the portfolio is still 63% higher. In other words, the portfolio has an annualized return of roughly 12%, double what was required to meet the needed financial goals.

The point here is that where you choose to “anchor” your analysis will significantly affect your emotional psychology when managing your money.

Yes, there has been a lot of volatility this year, but if I “anchor” my view to a longer-term time frame, the recent volatility is much less concerning.

Market perspective is essential.

Stick To Your Process

Does this mean you shouldn’t pay attention to your money or take action when things go wrong? Of course, not.

With the media fueling our fears 24/7, from “Fear Of Missing Out” to “Fear Of Losing It All,” it is difficult not to let our emotions get the better of us. However, “anchoring” our market perspective to a previous high-water mark or portfolio dollar value exacerbates our fragile emotional states.

In the “heat of the moment,” it is easy to get caught up in the emotional pull of markets and portfolio valuation changes. This past weekend’s #BullBearReport discussed the requirement of being more like Dr. Spock from Star Trek when managing your money.

“If I ask you what’s the risk in investing, you would answer the risk of losing money.

But there actually are two risks in investing: One is to lose money, and the other is to miss an opportunity. You can eliminate either one, but you can’t eliminate both at the same time. So the question is how you’re going to position yourself versus these two risks: straight down the middle, more aggressive or more defensive.

How do you avoid getting trapped by the devil? I’ve been in this business for over forty-five years now, so I’ve had a lot of experience.

In addition, I am not a very emotional person.In fact, almost all the great investors I know are unemotional. If you’re emotional then you’ll buy at the top when everybody is euphoric and prices are high. Also, you’ll sell at the bottom when everybody is depressed and prices are low. You’ll be like everybody else and you will always do the wrong thing at the extremes.” – Howard Marks

We all make “bad choices,” and we need guidelines to maintain our market perspective.

A sizable contingent of investors and advisors has never experienced a real bear market. After a decade-long bull market cycle fueled by central bank liquidity, mainstream analysis believes the markets can only go higher. What has always been a concern to us is the rather cavalier attitude toward risk that the media promotes.

“Sure, a correction will eventually come, but that is just part of the deal.”

What gets lost during bull cycles, and is always found most brutally, is the devastation caused to wealth during inevitable declines.

Therefore, it remains essential to follow your investment discipline. If you don’t have a process, here are the guidelines we follow during tough markets.

7-Rules To Follow

- Move slowly. There is no rush to make dramatic changes. Doing anything in a moment of “panic” tends to be the wrong thing.

- If you are overweight equities, DO NOT try to fully adjust your portfolio to your target allocation in one move. Again, after big declines, individuals feel like they “must” do something. Think logically above where you want to be and use the rally to adjust to that level.

- Begin by selling laggards and losers. These positions were dragging on performance as the market rose and they led on the way down.

- If you need risk exposure, add to sectors or positions performing with or outperforming the broader market.

- Move “stop-loss” levels up to recent lows for each position. Managing a portfolio without “stop-loss” levels is like driving with your eyes closed.

- Be prepared to sell into the rally and reduce overall portfolio risk. You will sell many positions at a loss simply because you overpaid for them to begin with. Selling at a loss DOES NOT make you a loser. It just means you made a mistake. Sell it, and move on with managing your portfolio. Not every trade will always be a winner. But keeping a loser will make you a loser of capital and opportunity.

- If none of this makes sense to you, please consider hiring someone to manage your portfolio for you. It will be worth the additional expense over the long term.

Keep your market perspective in check, avoid anchoring, and focus on your investment goals rather than market volatility.

-

Site: Crisis Magazine

The smoke has cleared from the Sistine Chapel, and Pope Leo XVI has been elected to lead the Catholic Church into an uncertain future. As Catholics around the world look to Rome with a mixture of hope and trepidation, one question emerges above all others: How do we navigate the turbulent waters ahead? For more than four decades, Crisis Magazine has been a steady compass for faithful Catholics…

-

Site: Zero HedgeUS New Home Sales Surged In April Despite Slump In Homebuilder ConfidenceTyler Durden Fri, 05/23/2025 - 10:18

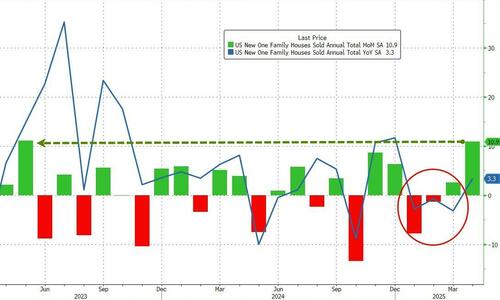

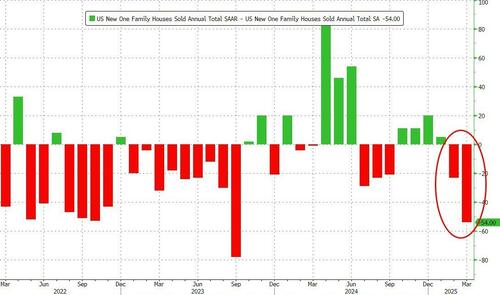

Despite the plunge in homebuilder confidence, US New Home Sales soared in April to 743k SAAR...

The 10.9% MoM surge in sales in April (versus a 4.0% MoM expected decline) was bolstered by a big downward revision in March from +7.4% MoM to just +2.6%...

This is the biggest beat since August 2022... and the second big downward revision in a row...

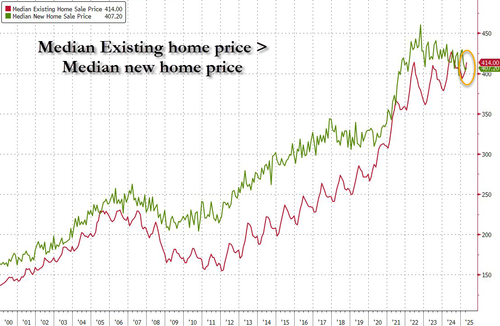

Meanwhile, the median new home sales price decreased 2% from a year ago to $407,200 (on an annual basis, prices have largely been retreating over the past 12 months) and is now back below existing home sale prices...

This month, 34% of builders reporting cutting prices, the largest share since December 2023, according to recent data from the National Association of Home Builders.

The surge in new home sales comes as mortgage rates tumbled...

So, don't hold your breath for a recovery - rates are rising once again!

-

Site: Zero HedgeUS New Home Sales Surged In April Despite Slump In Homebuilder ConfidenceTyler Durden Fri, 05/23/2025 - 10:18

Despite the plunge in homebuilder confidence, US New Home Sales soared in April to 743k SAAR...

The 10.9% MoM surge in sales in April (versus a 4.0% MoM expected decline) was bolstered by a big downward revision in March from +7.4% MoM to just +2.6%...

This is the biggest beat since August 2022... and the second big downward revision in a row...

Meanwhile, the median new home sales price decreased 2% from a year ago to $407,200 (on an annual basis, prices have largely been retreating over the past 12 months) and is now back below existing home sale prices...

This month, 34% of builders reporting cutting prices, the largest share since December 2023, according to recent data from the National Association of Home Builders.

The surge in new home sales comes as mortgage rates tumbled...

So, don't hold your breath for a recovery - rates are rising once again!

-

Site: Zero Hedge"We're In The 3rd Inning Of The Global Currency Death Spiral" - Rubino Sees Gold Topping $10,000Tyler Durden Fri, 05/23/2025 - 10:05

Via Greg Hunter’s USAWatchdog.com,

Analyst and financial writer John Rubino has a new warning concerning Trump’s “Big Beautiful Bill” making its way through Congress and Moody’s downgrade of US debt. The Big Beautiful Bill is going to explode the debt by $20 trillion in the next 10 years, and the credit downgrade has people like billionaire investment fund founder Ray Dalio worries about money printing to pay the $1.5 trillion in interest on federal debt.

Rubino warns, “The story with Moody’s downgrade isn’t that they did it, that they moved the US from triple A (Aaa) to one notch below (Aa1). It’s kind of insane that a government with 125% of GDP has an investment rating at all. Right?"

" They are clearly baking a gigantic currency crisis into the cake. Ray Dalio gets it right.

The rating agencies excuse or explanation for why the US still has an investment grade credit rating is that a country with a printing press can never default because it can just print enough money out of thin air to pay interest on its bonds, and it can do that forever.

So, it’s triple A credit, which does not make any sense at all because if you just print a lot of money out of thin air to pay your debts, then your currency goes down in value, and you are paying back your creditors with depreciating currency, which is a form of default.

The credit rating agencies are only looking at one kind of default where we just stop paying.

They are not looking at paying with cheaper currency year after year, and we stiff our creditors that way.

That’s why you don’t want to own Treasury bonds.

They are not going to stop paying interest, but the interest will not cover inflation going forward. So, you will have a net real loss until they just crater, and then you will have a massive capital loss.”

On top of that, interest rates have been rising and not falling. The 30-year mortgage rate is now just under 7% again. Rubino says,

“We went back up to unsustainable interest rates really quickly. . . .

The Fed has promised a couple of rate cuts this year, and for interest rates to go up while the Fed is inferring easing means we are risking losing control of the financial markets.

If the Fed can’t control interest rates, we are monumentally screwed as a financial system. That’s kind of what we are headed for now.

In the US, interest rates are going back up, but if you want to look at an extreme case, look at Japan. They don’t just have 30-year bonds, they have 40-year and 50-year bonds and those are cratering, which is to say the interest rates on those bonds are spiking. Long term Japanese bonds used to be 0%. Now, they are 3% and change. . . . That change is huge.

So, Japan, the US, Europe, the UK and China, all of these big countries are basically making the same mistakes, and they are all headed in the same direction.

We are in the early stage of a currency death spiral where interest rates start to go up and the government can’t control that and then their debt goes parabolic . . . and this goes until everything breaks down.

We are in the third inning of that game, and the last couple of innings are going to be hair raising.

There are going to be currency crises, which we have never seen in our lifetimes. . . . It will be fun times if you are a gold bug.”

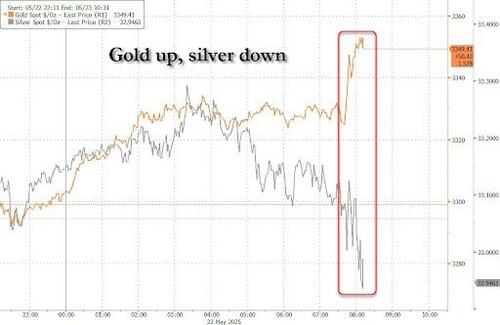

Rubino thinks gold will go up in price way over $10,000 per ounce, and he also expects silver to take off too. Rubino says,

“Silver is a great story because it is an industrial metal that is in deficit. Industrial uses are taking more silver off the markets than what they are producing, and that is going to lead to a shortage.

Even if you don’t look at silver as a monetary metal, the industrial demand makes it a buy right now.”

Rubino does not think the US will be in a civil war, but Europe is going authoritarian, and civil war is most likely there if Russia does not blow them up first. Rubino thinks America will do better than Europe, but we will still have trouble, chaos and a financial reset to work through.

There is much more in the 46-minute interview.

Join Greg Hunter as he goes One-on-One with financial writer John Rubino of the popular site called Rubino.Substack.com for 5.20.25.

To Donate to USAWatchdog.com, Click Here

John Rubino is a prolific financial writer, and you can see some of his work for free at Rubino.Substack.com.

-

Site: Mises InstituteWe would do well to remember the main lesson from World War I: there is no “honor” in warfare. It is pure murder.

-

Site: Steyn OnlineWho owes one million dollars now?

-

Site: Steyn OnlineProgramming note: I'll be back this evening, Friday, with the conclusion of our eighth-birthday Tale for Our Time, Three Men on the Bummel by Jerome K Jerome. And tomorrow, Saturday, please join me for a rather Victorian episode of our Serenade Radio

-

Site: Steyn OnlineProgramming note: On Saturday, please join me for a rather Victorian episode of our Serenade Radio weekend music show, On the Town. The fun starts at 5pm British Summer Time - which is 6pm in Western Europe and 12 noon North American Eastern. You can

-

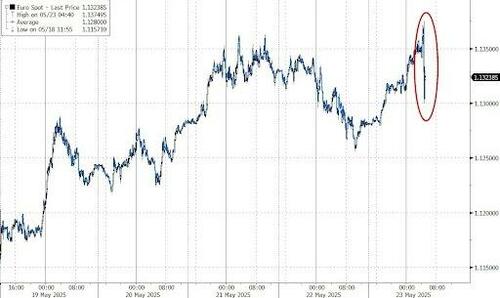

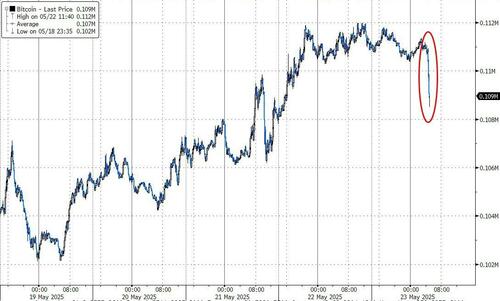

Site: Zero HedgeFutures Plunge After Trump Threatens 25% Tariff On Apple, 50% On Europe; Bonds & Bullion BidTyler Durden Fri, 05/23/2025 - 09:55

It was set to be a relatively quiet day, with stock futures unchanged, yields modestly lower, bitcoin just shy of record highs... and then Trump woke up.

First, in a post on his Truth Social just after 7:20am ET, the clearly angry president said that unless iPhone that are sold in the US are not also built in the US, then a "Tariff of at least 25% must be paid by Apple to the U.S."

The comment immediately wiped out tens of billions in value from AAPL stock, which tumbled $10 to $193, or more than 4%...

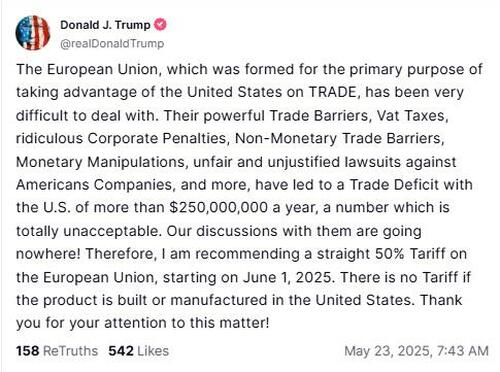

... and while the news also dragged broader futures lower, Trump saved his second market punishment for 25 minutes later when at 7:45am ET, the president doubled down on his post-awakening stream of Truth Social consciousness and wrote that he is "recommending a straight 50% Tariff on the European Union, starting on June 1, 2025. There is no Tariff if the product is built or manufactured in the United States."

His ire was likely triggered by overnight reports that EU talks with the US had gone nowhere, which is why he said that Europe's "powerful Trade Barriers, Vat Taxes, ridiculous Corporate Penalties, Non-Monetary Trade Barriers, Monetary Manipulations, unfair and unjustified lawsuits against Americans Companies, and more, have led to a Trade Deficit with the U.S. of more than $250,000,000 [sic] a year, a number which is totally unacceptable."

The post slammed S&P futures which were already reeling from the AAPL news, and spoos tumbled about 100 points lower from where they were just minutes earlier.

The news also slammed bond yields, the euro, European stocks, crude, and bitcoin...

... while gold was the only asset that rose on the renewed trade war escalation.

VIX spiked back above pre-Liberation Day lows...

Now, we wait to see if 'retail' will step back in to save the day (because macro hedge funds have been positioning for just this kind of Trump-driven turmoil)

The sudden shift in Trump's temperament, not to mention markets, underscores the ongoing risk that shifts in US policy can abruptly upend market dynamics at short notice. Markets had rebounded in recent weeks on optimism that Trump was softening his approach to the tariffs and investor attention had shifted to concerns about the ballooning US debt and deficits.

“It’s going to keep markets on edge,” said Aneeka Gupta, head of macroeconomic research at Wisdom Tree UK Ltd. “Markets were hoping news on tariffs had abated until at least the 90-day pause expired, but that’s clearly not the case. Uncertainties are here to stay. We’re in for a period of very high volatility.”

The rest of this post was going to be the a recap of the overnight news, but obviously none of that matters now that Trump decided to take a nuke to newsflow and blow everything up.

As US traders were scrambling to pick up the pieces of wtf just happened, European stocks were dumping, while traders ramped up bets on further ECB monetary easing after dire wage data earlier. Money markets priced in 65 bps of additional easing in 2025, which implies three quarter-point rate cuts at the ECB’s remaining five scheduled decisions is most likely. Traders favored just two such reductions before Trump’s social media posts.

“I think a lot of people see it as just another Trump tweet, which can be cancelled by another one in a few hours or a few days,” David Kruk, head of trading at La Financiere de L’Echiquier. “I don’t think a lot of European investors are selling on the news.” The same can no be said for US - or certainly crypto investors - who clearly relish this kind of rollercoaster idiocy.

Kruk said the bigger issue for investors remains the budget credibility of the US. Bond markets this week have jolted after Moody’s Ratings stripped the US of its top credit rating and the House’s approved a tax bill that is likely to increase the debt burden.

This week’s selloff in long-dated Treasuries presents a “great entry point” for buyers with the 30-year yield above 5%, according to Bank of America Corp. strategist Michael Hartnett.

The US government is likely to heed warnings from bond vigilantes, who are “incentivized to punish the unambiguously unsustainable path of debt and deficit,” the strategist said.

The Stoxx 600 is little changed as gains in mining and travel shares are offset by losses in insurance and consumer products. Here are the biggest European movers (or at least until the Trump tweets):

- GSK shares climb as much as 1.3% after the British drugmaker won US approval for Nucala as an add-on treatment for some patients with chronic obstructive pulmonary disease (COPD).

- Lundbeck shares rise as much as 5.7% after Kepler Cheuvreux initiated coverage on the stock with a buy recommendation, saying the valuation doesn’t reflect the “full value” of the Danish pharma company’s late-stage pipeline.

- PVA TePla gains as much as 12% after Deutsche Bank raises recommendation on the chip equipment firm to buy from hold, seeing the firm positioned to deliver structurally higher returns from 2026 onwards.

- AJ Bell shares jump as much as 10%, the most in a year, after the investment platform beat expectations in the first half and said annual results should come in above guidance. Shares are now trading at their highest level since December.

- PolyPeptide shares jump as much as 11%, among the top performers in the Swiss Performance Index on Friday morning, after the Swiss contract development and manufacturing organization secured additional financing under its revolving credit facility.

- Azimut gains as much as 5.3%, the most in more than a month, after the Italian asset manager raised its profit outlook for the year and flagged a deal with private equity fund FSI for a digital bank called TNB.

- European mining stocks are the best performers in Europe’s Stoxx 600 benchmark on Friday, as a Treasuries selloff eased, lifting base metals prices.

- KGHM gains as much as 4.2% as Poland’s plans to lower copper tax is set boost the metal producer’s output.

- Thule gains as much as 7.7% after Nordea upgrades to buy from hold, saying the year-to-date drop in the Swedish outdoor equipment maker’s share price offers an attractive entry point.

- Yellow Cake shares jump as much as 8.3%, climbing to its highest level since January, amid reports US President Donald Trump will sign multiple nuclear-related executive actions as soon as Friday.

- Games Workshop shares fall as much as 4.1%, slipping further from a recent record high, after the maker of the Warhammer tabletop game gave a trading update, with analysts pointing to a sparser games release slate for next year and several headwinds, including tariffs.

- Matas falls as much as 11% after full-year earnings from the Danish cosmetics retail group disappointed. DNB Carnegie analysts noted a “soft set of results,” that fell short on several key metrics, including revenues.

Asian equities rebounded, putting them on track for a sixth week of gains, as risk appetite recovers on encouraging progress in trade negotiations. The MSCI Asia Pacific index rose as much as 0.7%, with Japanese shares including Nintendo, Mitsubishi Heavy and Hitachi among the biggest boosts. The Philippines’ stock benchmark jumped 1.7%, recouping Thursday’s loss spurred by a call for the cabinet to quit. Stocks also advanced in India. Investors are looking past worries over US fiscal deficit that had weighed on regional equities throughout the week. Assurances of open communication between US and China also helped lift sentiment.

In FX, the Bloomberg Dollar Spot Index eyes its lowest close since December 2023 as it falls 0.5% on concerns over the US fiscal outlook. The drop accelerate after Trump's tweets. The Swedish krona leads G-10 currencies against the greenback, rising 1%. The pound adds 0.6%, briefly touching a fresh three-year high of $1.35. The euro also climbs 0.6%. Meanwhile, mainland Chinese shares bucked the trend, falling 0.8%. Benchmarks in Taiwan and South Korea also ended slightly lower.

In rates, treasuries extdended their gains, with the 10Y sliding as low as 4.45% after hitting 4.62% yesterday, before moving modestly higher. 30-year yields fell 2 bps to 5.02% having reached 5.15% during Thursday’s session. Longer dated maturities also outperform in Europe with UK and German 30-year borrowing costs falling 2-3 bps each.

In commodities, oil prices are of course in the red, with WTI falling 0.3% to $61 a barrel, because Trump wants to make sure there is zero capex in the shale patch and watch production crater, sending oil to triple digits in a year or so when the bullwhip effect from his punitive policies finally catches up. Spot gold climbs $39 to around $3,333/oz. Bitcoin is steady just above $111,000.

On today's calendar we get New Home Sales and the Kansas Fed.

Market Snapshot

- S&P 500 -1.5%

- Nasdaq 100 mini -1.8%

- Stoxx Europe 600 -2%;

- 10-year Treasury yield -5 basis point at 4.48%

- VIX 24.54

- Bloomberg Dollar Index -0.5% at 1214.85

- euro +0.5% at $1.1337

- WTI crude -0.5% at $60.9/barrel

Top Overnight News

- Trump threatens Apple with 25% tariffs, EU with 50% tariffs

- Trump is to sign orders to boost nuclear power as soon as Friday and will invoke a wartime act over US uranium independence, according to sources.

- Trump’s trade negotiators are pushing the EU to make unilateral tariff reductions on US goods, saying without concession the bloc will not progress in talks to avoid additional 20% “reciprocal” duties. FT

- Bank of Japan Governor Kazuo Ueda said on Thursday the central bank will closely monitor market moves as yields on super-long Japanese government bonds (JGB) reached record highs this week. RTRS

- The U.S. and China agreed to keep lines of communication open, following a call between senior officials Thursday, signaling continued high-level engagement as both sides work toward a broader deal. CNBC

- China has lowered the ceilings on deposit rates, three banking sources with direct knowledge of the guidance said on Friday, as authorities seek to protect banks' profit margins and discourage savings. RTRS

- Big investors say they are diversifying their bond portfolios to include greater exposure to markets outside the US as Trump’s trade war and the country’s growing deficit erode the appeal of the world’s biggest debt market. FT

- Japan’s key inflation gauge accelerated to 3.5% in April, the fastest clip in more than two years, fueled by rising food and energy costs. BBG

- Germany’s Q1 GDP is revised higher from +0.2% Q/Q to +0.4% thanks to a rush of activity as companies attempted to get ahead of Trump’s tariffs. WSJ

- UK retail sales gained 1.2% in April, continuing a surprisingly strong start to the year. Consumer confidence rose to -20 in May, GfK said, also beating estimates. BBG

- Big US banks (including JPM, BAC, C, and WFC) are exploring whether to team up to issue a joint stablecoin, a step intended to fend off escalating competition from the cryptocurrency industry. WSJ

- BofA Flow Show: USD 1.8bln outflows from US equities, USD 4bln from Japanese equities, inflows into European equities for a six week, EM saw largest inflow in 14 weeks

Tariffs/Trade

- US Deputy Secretary of State Landau spoke with Chinese Vice Foreign Minister Ma on Thursday and acknowledged the importance of the bilateral relationship to the people of both countries, while they discussed a wide range of issues of mutual interest and agreed on the importance of keeping open lines of communication.

- US President Trump is pushing the EU to cut tariffs or face extra duties with US negotiators to tell Brussels they expect unilateral concessions, while USTR Greer is preparing to tell EU counterpart Sefcovic that recent "explanatory note" falls short of US expectations, according to FT.

- Japanese PM Ishiba said he held a call with US President Trump in which they discussed tariffs, diplomacy and security, while there might be an occasion where he visits the US for in-person talks with Trump. Furthermore, Ishiba said there are no changes to Japan's stance on US tariffs and demand for the elimination of tariffs, nor to Japan's policy of talking with the US on creating US jobs.

- Japan’s chief tariff negotiator Akazawa reiterated there is no change to stance on requesting elimination of US tariffs, but noted they aim to reach an agreement, while he plans to visit the US around May 30th for the fourth round of trade talks, according to sources cited by Reuters.

- Japan is to reportedly propose investments by Nippon Steel (5401 JT) in tariff talks with the US, according to NHK.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly in the green albeit with gains in the region capped following the indecisive performance stateside where participants digested PMI data and the House approved US President Trump's tax bill to send it to the Senate. ASX 200 eked mild gains as the strength in real estate, energy, tech, telecoms and financials was partially offset by losses in defensives and miners. Nikkei 225 returned to above the 37,000 level with the index unfazed by the firmer-than-expected Core CPI data, while Japanese Economy Minister Akazawa is visiting the US for a third round of talks and is reportedly planning to visit again late next week for a fourth round of discussions. Furthermore, Japanese PM Ishiba had a call with US President Trump and discussed US tariffs, diplomacy and security although no major developments were announced. Hang Seng and Shanghai Comp gained but with advances in the mainland limited in the absence of any fresh significant macro drivers, although there were some talks between the US and China at a deputy ministerial level, in which the US Deputy Secretary of State spoke with his Chinese counterpart on Thursday and discussed a wide range of issues of mutual interest. The two agreed on the importance of keeping open lines of communication.

Top Asian News

- China reportedly lowers deposit rate ceiling to protect banks' interest margins, according to Reuters sources.

- Philippine Central Bank Governor said they are looking at cutting holdings of US Treasuries, while he added they are looking at two more rate cuts which would not necessarily be consecutive and noted that a rate cut is on the table for June.

- Indian economic growth is on track, according to Reuters sources.

- Fast Retailing (9983 JT) 6M (JPY): Net Profit 233.57bln, +19.2% Y/Y, Op. Profit 304.22bln, +18.3% Y/Y; affirms FY24/25 outlook.

- China Vice Premier He Lifeng says China's economy continues to show an upward trend; growth potential of the primary, secondary and tertiary industries are being released, via Xinhua; The economy has shown great resilience and vitality

European bourses opened incrementally firmer and trudged higher throughout the morning - though more recently, some downside has been seen to display a mixed picture in Europe. European sectors opened without a clear bias, but have since moved to a strong positive direction. Basic Resources tops the pile, joined closely by Travel & Leisure and then Healthcare. Retail lags. US equity futures are flat/modestly firmer, following similar price action seen in Europe. Docket ahead is lacking in terms of Tier 1 data, but the focus will be on Fed speak from Musalem and Cook.

Top European News

- ECB's Rehn said a June rate cut is appropriate if backed by data, via Kathimerini.

- ECB's Stournaras said he sees a June rate cut and then a pause, via Kathimerini

- EU confirms it will soon delay bank trading rules by one year, according to Bloomberg.

- UK's OFGEM says from 1 July to 30 September 2025 price for energy for the typical household will go down by 7% to GBP 1,720/yr; this is 9% higher than the price cap set for the same period last year.

FX

- This week's downtrend for the USD has resumed. For today's session, the calendar is light in terms of tier 1 data but Fed's Goolsbee, Musalem, Schmid and Cook are all due on the speaker slate. DXY has just slipped below the bottom end of Thursday's 99.44-100.11 range.

- EUR is capitalising on the softer USD with EUR/USD back on a 1.13 handle. Today's detailed release of Q1 German GDP exceeded expectations but failed to engineer much in the way of additional support from the EUR given that the beat was attributed to front-loading ahead of expected tariff actions by the Trump admin. On the trade front, the FT has reported that US President Trump is pushing the EU to lower tariffs or face additional duties with US negotiators to tell Brussels they expect unilateral concessions. On the speaker front, ECB dove Stournaras has stated that he sees a June rate cut and then a pause, whilst Rehn has backed a June rate reduction, data permitting. The pair was little moved to the latest ECB Wage Tracker. EUR/USD currently around 1.1337.

- JPY is out-muscling the USD in the wake of hot Japanese core inflation data overnight. ING writes that "Excluding both fresh food and energy, core-core inflation rose to 3.0%, suggesting that underlying inflation will remain above the BoJ's target of 2.0%". On the trade front, Japan’s chief tariff negotiator Akazawa reiterated there is no change to the stance on requesting the elimination of US tariffs. However, he noted they aim to reach an agreement and plans to visit the US around May 30th for the fourth round of trade talks. USD/JPY currently sits within Thursday's 142.80-144.40 range.

- GBP stronger vs. the broadly weaker USD with Cable at its highest level since February 2022 - today's peak at 1.3491. Sentiment for the GBP has been underpinned by a strong showing for UK retail sales in April (M/M 1.2% vs. exp. 0.2%, prev. 0.1%). BoE's Pill is due to speak later in the session, however, he gave quite an extensive explanation over his dissent earlier in the week and therefore is unlikely to add much more that will be of use to markets.

- Antipodeans are both at the top of the G10 leaderboard alongside a pick-up in risk sentiment with newsflow otherwise light.

- PBoC set USD/CNY mid-point at 7.1919 vs exp. 7.2151 (Prev. 7.1903).

Fixed Income

- USTs are on a firmer footing, venturing as high as 110.03+ with the next target coming via Wednesday's peak at 110.10+. After a soft start to the week on account of the Moody's downgrade and concerns over the deficit impact of Trump's Tax/Spending Reconciliation bill, US paper is attempting to recover off the lows. Fresh US newsflow is relatively light after yesterday's passage of Trump's bill, which will now move to various Senate committees before being debated and voted on by the Senate floor. Today's Fed docket includes remarks from Goolsbee, Musalem, Schmid and Cook.

- German paper is on the front foot and tracking gains in global peers. Downticks from a better-than-expected outturn for German GDP proved to be fleeting with the beat attributed to front-loading ahead of expected tariff actions by the Trump admin. On the trade front, the FT has reported that US President Trump is pushing the EU to lower tariffs or face additional duties with US negotiators to tell Brussels they expect unilateral concessions. Note, USTR Greer and EU Trade Commissioner are set to meet in June. ECB speak and the latest ECB Wage Tracker today has had little impact on Bunds. Jun'25 Bund is currently sitting just above Thursday's best at 130.00 but down from its earlier session peak at 130.28.

- Gilts are higher despite a strong showing for UK retail sales in April (M/M 1.2% vs. exp. 0.2%, prev. 0.1%). BoE's Pill is due to speak later in the session, however, he gave quite an extensive explanation over his dissent earlier in the week and therefore is unlikely to add much more of note. After hitting a fresh MTD low on Thursday at 90.10, Gilts have ventured as high as 90.73.

Commodities

- Another subdued session for the crude complex despite the slide in the dollar and a revision higher in German Q1 GDP, with sentiment capped by Thursday's source reports that OPEC+ members are discussing whether to agree to another output hike of 411k BPD in July. In other news, the US-Iran nuclear talks will be going ahead today from 12:00 BST/ 07:00 EDT, although views heading into the meeting are rather pessimistic, with Iran suggesting any deal which includes zero enrichment will not go ahead. Most recently, the complex has lifted off worst levels but still resides in negative territory.

- Precious metals are mixed with the yellow metal underpinned by the softer dollar and ongoing tariff uncertainty. Spot gold gradually rebounded from yesterday's trough and returned to above the USD 3,300/oz level in APAC hours amid the cautious risk tone. Spot gold currently resides in a USD 3,287.07-3,334.46/oz range.

- Copper futures traded rangebound and were kept afloat alongside the mildly positive sentiment during the Asia-Pacific trade. 3M LME copper remains north of USD 9,500/t in a USD 9,502.80-9,598.95/t range.

- Russia's Arctic LNG 2 plant has shut down its first production train, according to Reuters sources.

- Japan's Steel Industry Head says Japan must urgently take trade measures against rising steel shipments from China.

Geopolitics

- Russian Foreign Minister says work on the memorandum leading to a ceasefire in Ukraine is at an advanced stage; will hold a second round of direct negotiations with Ukraine.

- Iran-US nuclear talks reportedly set to begin at 12:00 BST/07:00 EDT, according to IRNA.

- "Member of the Security Committee of the Iranian Parliament: The fifth round of negotiations will not reach a result", according to Al Arabiya.

US Event Calendar

- 5:00 am: Apr F Building Permits, est. 1412k, prior 1412k

- 10:00 am: Apr New Home Sales, est. 695k, prior 724k

- 10:00 am: Apr New Home Sales MoM, est. -4.01%, prior 7.4%

Central Banks :

- 8:30 am: Fed’s Goolsbee Appears on CNBC

- 9:35 am: Fed’s Musalem, Schmid Speak in Fireside Chat

- 12:00 pm: Fed’s Cook Gives Speech on Financial Stability

DB's Jim Reid concludes the overnight wrap

After a heavy selloff on Wednesday, markets began to stabilise again over the last 24 hours, despite investors’ ongoing fears about the fiscal situation. In particular, long-end Treasury yields started to fall again, with the 30yr yield (-4.3bps) moving down to 5.05%, whilst the dollar index (+0.37%) also recovered. But even so, there were still several signs of concern, as the 30yr Treasury yield had moved as high as 5.15% on an intraday basis, and a similar pattern was being echoed globally. For example, Japan’s 30yr yield (+3.3bps) moved up to 3.18% yesterday, the highest since that maturity was first issued in 1999. And in the UK, the 30yr yield (+3.2bps) moved up to 5.55%, closing just shy of its highest level since 1998.

Those moves came as the US House of Representatives narrowly passed the tax bill yesterday, with an incredibly tight 215-214 margin in favour. As a reminder, that would extend the Trump tax cuts from his first term, which are currently due to expire at the end of this year, and it also includes a $4tn increase in the debt ceiling. However, there’s still some way to go before passage, as it also has to pass the Senate, which is expected to make changes to the bill. For instance, fiscal hawks in the Senate are unhappy about some of the measures, with Senator Rand Paul having said “I’m not voting to raise the debt ceiling $4 trillion to $5 trillion”, whilst Senator Ron Johnson has described the deficits from the House bill as “completely unacceptable”.

The Republicans have a slightly more comfortable margin in the Senate of 53-47, but they can still only afford to lose 4 votes, and both chambers of Congress need to pass the same version of the bill before it can become law. So any changes made by the Senate will have to be re-voted on by the House, where it already passed by just one vote.

Treasury Secretary Bessent has previously set a goal of July 4 for the bill to be signed, and Trump said in a post that “it’s time for our friends in the United States Senate to get to work, and send this Bill to my desk AS SOON AS POSSIBLE! There is no time to waste.” Another effective deadline is the late summer anyway, as the CBO have estimated that the debt ceiling will become an issue around August-September again, so Congress would need to raise the limit by then to avoid default.

Despite the fiscal concerns, US equities were comparatively resilient, with the S&P 500 (-0.04%) stabilising after its sharp -1.61% decline on Tuesday. That said, there was a late slump, with the index down -0.6% in the final 30 minutes of trading, having been in positive territory for much of the session. And nearly two-thirds of the S&P 500’s constituents declined, with defensive sectors including utilities (-1.41%) and healthcare (-0.76%) underperforming. Moreover, it would have been a larger decline had it not been for the Magnificent 7 (+0.78%), which outperformed after three consecutive declines.

One factor helping US assets to stabilise was some stronger US economic data, which continued to point away from a recession. For instance, the flash composite PMI for May was up to 52.1, up from 50.6 in April, and above the 50-mark that separates expansion from contraction. Moreover, the weekly initial jobless claims also remained in their recent range, coming in at 227k over the week ending May 17 (vs. 230k expected). So again, that showed no sign of a deterioration in the labour market, with the numbers still within their pre-Liberation Day range.

The rally also got a fresh boost from the decline in bond yields, with the 2yr Treasury yield (-2.8bps) falling back to 3.99%, whilst the 10yr yield (-7.0bps) fell back to 4.53%. In part, that followed comments from Fed Governor Waller, who suggested that if the tariffs were closer to 10% and that was done by July, then the Fed would be well placed “to kind of move with rate cuts through the second half of the year”.

In other Fed-related news, yesterday evening the US Supreme Court said that the Federal Reserve was an exception when it comes to the President’s ability to remove officials, referring to the Fed as a "uniquely structured, quasi-private entity" that was different to other independent agencies. So that offered a bit more certainty on the position of senior Fed officials, and whether Chair Powell might be removed before his term as Fed Chair ends in May 2026.

Back in Europe, the last 24 hours saw a much weaker performance, with the STOXX 600 (-0.64%) posting its biggest decline in over 6 weeks. That came amidst a disappointing set of economic data, with the flash PMIs narrowly falling into contractionary territory. For example, the Euro Area composite PMI was down to 49.5 in May (vs. 50.6 expected), which is the first sub-50 reading since December. So even though the data wasn’t showing an aggressive contraction, it added to the signs that the Euro Area economy had lost momentum since Liberation Day, leading to a bigger risk-off move. That was echoed in the country prints as well, with the composite PMIs in Germany (48.6), France (48.0) and the UK (49.4) also coming in below the 50 mark. Nevertheless, it wasn’t all bad news, and in Germany the Ifo’s business climate indicator rose to an 11-month high of 87.5 in May (vs. 87.3 expected).

That backdrop saw European equities lose ground across the board, whilst sovereign bond spreads also widened. So even as 10yr bund yields (-0.3bps) came down slightly, those on 10yr OATs (+1.0bps) and BTPs (+0.9bps) moved higher. So it also meant that the Italian 10yr spread over bunds moved back above 100bps, after recently falling below that mark for the first time since 2021.

Overnight in Asia, the mood has become more positive overnight given the recovery in US Treasuries. So that’s supported gains across the board, including for the Nikkei (+0.61%), the Hang Seng (+0.58%), the CSI 300 (+0.30%) and the Shanghai Comp (+0.08%). The one exception to that is the KOSPI (-0.04%), which has posted a very modest decline. But looking forward, US and European equity futures are also in positive territory, with those on the DAX (+0.10%) and the S&P 500 (+0.05%) both slightly higher.

The other main news overnight has been the latest CPI print from Japan. It showed headline CPI remaining at +3.6% in April (vs. +3.5% expected). Moreover, the core measure of inflation (excluding fresh food) was up to +3.5% (vs. +3.4% expected), which was its fastest level since January 2023. The Japanese Yen has strengthened +0.42% against the US Dollar this morning, although much of that has been driven by dollar weakness, with the dollar index down -0.30% overnight.

Elsewhere, one asset that continued to outperform was Bitcoin, which moved up to another record high of $111,092 yesterday. On the theme of cryptocurrencies, Marion Laboure put out a note yesterday on the GENIUS Act, which would establish rules around stablecoins.

To the day ahead now, and data releases include UK retail sales for April, French consumer confidence for May, and US new home sales for April. Central bank speakers include the Fed’s Musalem, Schmid and Cook, and the ECB’s Lane.

-

Site: LifeNews

Indiana’s 2024 quarterly abortion reports were published by the Indiana Department of Health (IDOH) throughout the year and into early 2025. The state’s annual 2024 abortion report, an aggregate of the 2024 quarterly reports, was published in April 2025.

These reports showed that in 2024, brick-and-mortar abortions in Indiana decreased drastically from 2023. This drastic decrease was likely due to the state’s life-at-conception law being in effect for the entirety of 2024. The law’s exceptions allow abortions to be performed in the cases where a continued pregnancy would threaten the mother’s life or physical health, if the unborn child was conceived via rape or incest, or if the unborn child had a lethal fetal anomaly.

In what follows, Charlotte Lozier Institute (CLI) summarizes the information in the abortion report published by the state. The data published by the state does not include the total number of abortions obtained by Indiana residents out of state or the number of self-managed abortions on women outside of the healthcare system. The report also does not contain the number of mail-order abortion drugs obtained by Indiana residents prescribed by licensed abortion providers in other states under shield laws.

In a separate section, CLI will describe data provided by the Guttmacher Institute’s Monthly Abortion Provision Study that details the number of abortions obtained by Indiana women in other states in 2023. Guttmacher’s abortion estimates include the number of abortions obtained at brick-and-mortar facilities and those provided via telehealth and virtual providers in the United States.

HELP LIFENEWS SAVE BABIES FROM ABORTION! Please help LifeNews.com with a donation!

Indiana’s statute code defines abortion as “the termination of human pregnancy with an intention other than to produce a live birth or to remove a dead fetus. The term includes abortions by surgical procedures and by abortion inducing drugs” (§16-18-2-1).

Abortion Totals and Trends

In 2024, there were 146 abortions reported in Indiana, down 97% from the previous year. Drug-induced abortions decreased by 99% and composed 25% of the total, as opposed to 61% in 2023 (Fig. 1). CLI estimates that Indiana’s 2024 abortion rate was 0.11 abortions per 1,000 women ages 15 to 44, a decrease of 97% from 2023 (Fig. 2).1 As of May 2025, three states have released 2024 abortion statistics, with two showing decreases in abortions from 2023 to 2024.

Four incomplete abortion reports were submitted to IDOH for abortions occurring in the fourth quarter of 2024. The state counted the abortions in the total number of abortions occurring in the state for 2024, but did not include the four abortions in any calculation related to demographics or percentages. For this reason, CLI added the four abortions to all demographic and percentage-based calculations as an “unknown” category.

State Report Summary

In 2024, 95% of the abortions reported in Indiana were performed on state residents. Four abortions were performed on nonresidents, while the residency of four women who obtained abortions in Indiana was unknown. Two abortions were performed on girls under the age of 16, while 16% were performed on girls between the ages of 16 and 24. Just over half (52%) were performed on women aged 25 to 34, and 28% were performed on women between the ages of 35 and 45. Four abortions were performed on women whose ages were unknown.

Sixty-two percent of Indiana abortions were performed on white women and 25% on black women. Three abortions each were performed on Asian women and Pacific Islander/Native Hawaiian women. One abortion was performed on an American Indian/Alaska Native woman. The race of nine women who obtained abortions in Indiana was unknown, while two other women were of other, unspecified races. Eighty-four percent of Indiana abortions were obtained by non-Hispanic women, while 11% were obtained by Hispanic women. Five percent of the abortions in the state were performed on women of unknown ethnicity.

Three of the abortions in Indiana were performed on women with an eighth-grade education or less, and four on women who had attended but not completed high school. Twelve percent of Indiana abortions were obtained by women with a high school diploma or its equivalent as their highest level of education, and 36% were obtained by women who had completed some college but did not have a degree. Nineteen percent of abortions were performed on women with a college degree. The level of education was unknown for 23% of the abortions.

Fifty-one percent of the abortions reported in Indiana were obtained by unmarried women and 46% by married women. The marital status was unknown for four women. Thirty-six percent of Indiana abortions were performed on women with no living children, 29% on women with one child, and 32% on women with two or more children. Ninety-four percent of the abortions were obtained by women with no previous abortions, compared to 3% on women with one prior abortion and one abortion on a woman with more than one prior abortion. Thirty percent of the abortions were performed on women who had previously had a miscarriage.

Forty-two percent of the abortions reported in Indiana were surgically induced. Surgically induced abortions include suction curettage abortions, menstrual aspiration abortions, dilation and evacuation abortions, and other procedures, although the reports did not include the percentage of abortions performed by each specific procedure type. A quarter were drug-induced and 30% were performed via intracardiac injection. Five abortions were performed via unknown means.

All 146 abortions performed in the state in 2024 were performed at hospitals, as all were performed under the exceptions to the state’s life-at-conception law. Since freestanding abortion centers like Planned Parenthood or independent centers do not provide actual medical care, they were unable to provide medical care to women whose lives and/or physical health were threatened by continued pregnancies.2 Furthermore, all freestanding abortion centers in the state closed in August 2023 so abortions performed due to rape and incest or because the unborn child had a lethal fetal anomaly were also all performed in hospitals. However, Indiana’s reports did not break down the reasons for abortion by performing facility. Riley Health Maternity Tower performed 46% of Indiana abortions in 2024, while the Sidney and Lois Eskenazi Hospital performed 36%. Seven other hospitals and four unknown locations performed the remainder of the state’s abortions in 2024.

To see the breakdown of abortions by month in 2024, see the following table:

Total # of Abortions January 16 February 13 March 16 April 12 May 9 June 6 July 12 August 11 September 18 October 13 November 10 December 10 Total 146Additional Information Reported in 2024 Quarterly Reports

As previously mentioned, several changes occurred to Indiana’s abortion reporting requirements after quarter two in 2023, and several additional reporting requirements went into effect for all future abortion reports.

Three babies were reported to have been born alive during an abortion. In 2024, 64% of abortions were performed because the unborn child had a fetal anomaly, and 27% were performed because the mother’s life or physical health was at risk. Nine abortions were performed due to rape or incest while four were performed for unknown reasons.3

Another piece of information Indiana started providing in the last two quarters of 2023 was the number of reports submitted to the IDOH within the required 30 days for abortions performed on girls and women 16 and older, and within three days to the IDOH and Indiana Department of Child Services (DCS) for abortions performed on minors under 16. All but four reports (136) for abortions performed on women ages 16 and older were reported to the IDOH on time. Both abortion reports for girls under 16 were reported to both the IDOH and DCS on time. The timeliness of four reports was unknown.

Fifty-five percent of abortions in 2024 were performed via abortion drugs at eight weeks of gestation or later. Seven percent were performed via surgical abortion at eight weeks or earlier, while 35% were performed via surgical abortion after eight weeks of gestation. In 2024, 41 of 44 intracardiac injection abortions utilized an additional dilation and evacuation abortion, while one intracardiac injection utilized an mifepristone/misoprostol abortion to complete the abortion. Two intracardiac injections did not require a further procedure. One abortion was performed at or after 20 weeks post-fertilization age, and the required second attending physician was present during this abortion.

Abortion Complications

In 2024, 70 complication reports were filed, with information on 91 complications (patients can have more than one complication listed on a report).3 Fifty-nine percent of the complication reports were associated with drug-induced abortions, including four known to have resulted from mail-order abortions. Thirty-nine percent of complication reports involved surgical abortions, and 3% involved an unknown method.

The most frequently reported complication was incomplete abortion (retained tissue), with 51 cases reported. There were 11 cases of vaginal bleeding, eight infections, and four failed abortions. There were 10 uncategorized complications and one case each of psychological complications, uterine perforation, shock, a missed ectopic pregnancy, free fluid in the abdomen, and cervical laceration. One complication was labeled as an adverse event as defined by the U.S. Food and Drug Administration.

Women were admitted to the hospital in 11 cases, 42 complications resulted in surgical intervention, two complications required blood transfusions, and 21 complications were treated with medication. In five cases, other treatment was used, and an unknown treatment was utilized 10 times. Overall, 93% of the complication reports noted that the initial abortion provider was not the one who treated the woman’s complication(s).

The 2024 complication reports included information on the facilities where the patient presented with complications and the number of reports by the facility performing the abortion. Nineteen of the 26 facilities that treated women for abortion-related complications reported zero abortions in Indiana in 2024. Furthermore, the 2024 complication reports showed that 13 of the 146 abortions performed in the state were performed at hospitals that did not treat any complications. There were 13 complication reports stemming from abortions that were performed outside of Indiana (10 from Illinois facilities, one from a Michigan facility, and two from Planned Parenthood centers in unknown states). Six complication reports were from abortions performed in Indiana, while 51 complication reports resulted from abortions that were performed at an unknown location.

Half of the complication reports were for women aged 25 to 34, while 31% were for girls between the ages of 16 and 24. Nine reports were for women between the ages of 35 and 44, and three were for girls under the age of 16. Half of the complication reports were for abortions performed on African American women, and 31% were for white women. There was one report each for multi-racial and Asian women and no reports for American Indian/Alaska Native women. Race was not reported in 11 of the complication reports. Seventy-four percent of the complication reports were for abortions performed on non-Hispanic women, while three were for Hispanic women. Ethnicity was not reported in 15 of the complication reports.

Guttmacher Data4

Guttmacher estimated the number of abortions that were obtained by Indiana residents who traveled to other states to obtain an abortion. This data is only available for 2023, and it is important to note that Indiana’s life-at-conception law went into effect in August of 2023. Therefore, the number of Indiana residents who traveled out of state to obtain an abortion likely increased in 2024 when Indiana’s law was in effect for the entire year. However, it is helpful to list the 2023 data to show how Indiana women are still obtaining abortions out of state despite the state prohibiting almost all brick-and-mortar abortions. For the number of abortions obtained by Indiana women in various states according to Guttmacher, see the following table:

States Traveled to by Indiana Women # of Abortions Obtained by Indiana Women Who Traveled to Other States to Get Abortions, 2023 Illinois 5,500 Michigan 950 Ohio 650 Total 7,100State Ranking

In CLI’s 2024 reevaluation of states’ abortion reporting requirements, Indiana was tied for fourth best. Since CLI’s original evaluation of abortion reporting requirements in 2016, Indiana has vastly improved their abortion reporting. Because the state has prohibited most brick-and-mortar abortions from being performed in the state, and many of the state’s reporting requirements cover topics associated with the abortions that are still performed, the only area of data collection left to improve upon (the mailing of abortion drugs into the state) may not be feasible given the legal landscape of shield laws.

- National rates were calculated by the Guttmacher Institute. Indiana rates were calculated by CLI using the following formula: (total number of abortions performed in Indiana ÷ number of resident women ages 15-44 [based on most recent population estimates]) x 1,000. Rates may differ slightly from previous CLI articles due to revised population estimates. Population estimates were obtained from the CDC WONDER database. Estimates for 2005-2009 are intercensal estimates of the July 1 resident population. Estimates for 2010-2019 are Vintage 2020 postcensal estimates of the July 1 resident population. Estimates for 2020-2024 are Vintage 2023 postcensal estimates of the July 1 resident population. Estimates were produced by the U.S. Census Bureau and the National Center for Health Statistics. Rates for 2024 were calculated using the Vintage 2023 postcensal estimates because 2024 population estimates have not yet been released by the CDC.

- CLI is reporting on this information as it appeared in Indiana’s abortion report. However, it is important to note that the “life or physical health” cases described as exceptions to the state’s abortion law are not the same as elective abortions. They are descriptions of emergency medical care allowed under the state’s law to save the life or physical health of the mother. The state law differentiates these medical procedures from an elective abortion, which, when performed, has the sole intent of causing the death of an unborn baby.

- Statistics on abortion complications reported here represent a minimal number of deaths and complications, as this data is collected in a non-systematic and non-verifiable way. As such, this data cannot be used to calculate either an accurate abortion mortality rate or an accurate abortion complication rate for the state.

- The Guttmacher Institute notes that their monthly abortion totals by states are estimates and that each state’s estimate is within a range of uncertainty. Guttmacher also notes that their estimates do not reflect self-managed abortions or those obtained by women in pro-life states under shield laws. This information is updated as of April 24, 2025.

LifeNews Note: The authors are researchers for the Charlotte Lozier Institute, where this article originally appeared.

The post Indiana Abortions Drop 97% After Abortion Ban Goes Into Effect appeared first on LifeNews.com.

-

Site: Crisis Magazine

In a beautiful address to Eastern Christian pilgrims in Rome, Pope Leo XIV showed this week that the tenets of our Catholic Faith are more than platitudes. In particular, he applied Catholic principles plainly and unflinchingly to the plight of the Christian communities in Bethlehem, located in the West Bank, and in Gaza—defending their right to remain secure where they are. By implication…

-

Site: Zero HedgeUK Welcomes South African Activist Who Chants About Killing White FarmersTyler Durden Fri, 05/23/2025 - 09:25

Authored by C.J.Strachan via DailySceptic.org,

The British Government recently barred French writer Renaud Camus from entering the UK.

His crime?

Not actual incitement, not violence, not lawbreaking, but a controversial idea.

Camus, originator of the ‘Great Replacement’ theory, was scheduled to speak at a Big Remigration Conference organised by the Homeland Party, as well as at the Oxford Union. His Electronic Travel Authorisation (ETA) had been approved. Then, abruptly, it was revoked. The Home Office declared that his visit was “not conducive to the public good”.

Meanwhile, Julius Malema, a South African political figure who openly sings “Kill the Boer” at rallies, glorifies racial violence and promotes land expropriation without compensation, was welcomed.

This is not a metaphor. Malema was allowed into the UK in May 2025 to address his supporters in London. The only reason for his delayed arrival was the May Day bank holiday. When he protested, the British High Commission issued a grovelling apology, assuring him the visa holdup was merely bureaucratic, not moral.

The message could not be clearer: ideas from the Right are criminalised, but hate from the Left is indulged.

Toby Young has recently laid this out in detail in his excellent interview on GB News in the wake of the Lucy Connolly appeal decision. His conclusion: the UK no longer defends free speech as a principle, it defends only approved speech. You can chant about killing white farmers, provided your politics check the right boxes. But offer a sociological theory about demographic change? You’re banned.

Let’s be clear: Renaud Camus’s theory is provocative. It raises uncomfortable questions about identity, culture and immigration. One can challenge or reject it. But to silence it entirely, while welcoming actual political violence wrapped in revolutionary chic, is not only hypocritical. It’s dangerous.

A society that punishes ideas but excuses incitement is not protecting its values. It is broadcasting its fear.

Camus, an elderly intellectual with no history of violence, was treated like a threat to national security. Malema, who has stood before crowds chanting genocidal slogans, was treated like a minor celebrity inconvenienced by airport queues. This isn’t policy. It’s ideology masquerading as law.

Once again, the UK has exposed the workings of its two-tier system. British citizens have been arrested for quoting Churchill, misgendering someone online or holding placards in silence. But a foreign politician calling for racial uprising is welcomed, because his fury flows in the approved direction.

Britain used to be a place where you could say what you thought, provided you didn’t call for violence. Now it’s a place where you can call for violence, provided you think what you’re told.

Renaud Camus was banned not because he posed a risk, but because he posed a challenge, a challenge to the dominant narrative. That makes him, in today’s Britain, more dangerous than a man who sings about killing his countrymen.

Malema is in. Camus is out. And that, sadly, tells you everything about who we are now.

-

Site: LifeNews

March 31 marked the 20th anniversary of my sister Terri Schiavo’s death—a tragic moment reflecting the dangerous direction of our healthcare system and culture. Terri’s death was not natural; it was imposed. She simply needed food and water. That was it.

In response to my sister’s death, my family established the Terri Schiavo Life & Hope Network and a 24/7 National Crisis Lifeline to assist families in crisis who are fighting for the lives of their loved ones. Our mission is simple: upholding human dignity through service to the medically vulnerable.

Since its founding in 2005, the Life & Hope Network has advocated for and supported thousands of vulnerable patients and their families through its resources and trusted allies. The fight to protect the voiceless is critical. We must recognize that the U.S. healthcare system differs from the romanticized version portrayed on TV. Far too many families have faced struggles similar to ours since Terri’s passing and continue to be subjected to the same treatment.

Imagine that your son has been in a terrible car accident. You rush to the hospital, only to learn that he is in the ICU with a profound brain injury. Within days—or even hours—doctors begin discussing “brain death” and insist that there’s no hope for meaningful recovery. Then comes the most shocking part; they’ve set a deadline to withdraw life support—just one week.

Get the latest pro-life news and information on X (Twitter). Follow @LifeNewsHQ//

This scenario isn’t made up; this was the experience of a real family that the Life & Hope Network recently helped. Sadly, this situation was not an isolated incident. We regularly receive calls from families blindsided by rapid decisions to terminate treatment, often just days after brain injuries occur.

Even when families plead for more time, hoping that their loved ones will show signs of improvement, hospitals can—and often do—override their wishes. Dr. Neil Wenger, a UCLA professor and director of the university’s ethics center, once explained: “If there is no resolution, then we have a policy where you can override a family.”

Furthermore, according to a 2005 report by the Robert Powell Center for Medical Ethics, “the laws of all but ten states may allow doctors and hospitals to disregard advance directives when they call for treatment, food, or fluids.”

That’s when we help. We advocate for families in crisis who are given no due process, no time, and no options. We fight to ensure that decisions prioritize the patient’s well-being and are grounded in compassion, dignity, and the possibility of hope.

To truly understand this issue, we must acknowledge the deeply rooted devaluation of life among the medically vulnerable. History offers chilling precedents. Under Nazi Germany’s Aktion T4 euthanasia program, more than 200,000 disabled individuals were killed based on their perceived lack of worth.

This wasn’t solely a German idea. The American eugenics movement, taught at hundreds of U.S. universities and supported by elites, preceded it by decades. Justice Clarence Thomas noted in Box v. Planned Parenthood of Indiana and Kentucky, Inc. (2019) how American eugenics targeted not only certain races but also the disabled—those labeled “feeble-minded,” “deformed,” or “crippled.”

With the legalization of abortion in 1973, this worldview quietly persisted under the narrative of “choice.” Today, more than 50% of unborn children diagnosed with disabilities such as Down syndrome are aborted. The rationale? They don’t meet arbitrary standards of personhood.

The “personhood theory”—championed by bioethicists such as Joseph Fletcher and Peter Singer—claims that being human isn’t enough to warrant rights or dignity; one must possess cognitive traits such as self-awareness and rational thought to qualify as a “person.” Infants, the severely disabled, and those with Alzheimer’s or brain injuries often fall outside this definition.

Such ideas have dangerously shaped modern medicine. Bioethicist Wesley J. Smith warned in 2002 that bioethics has become a tool for deciding who deserves to live and informs policies that prioritize cost-saving over care.

Insurance companies, hospital administrators, and policymakers increasingly make decisions based on cost, not care. Patients are seen as budget lines instead of human beings. Hospitals impose DNR orders without consent, deny treatment under “medical futility” policies, and override families through ethics committee rulings.

Feeding tubes, once considered part of basic care, have been reclassified as “medical treatment,” creating a path to prematurely ending the lives of patients by ceasing “treatment.” Withdrawing feeding tubes against family wishes is currently legal in all 50 states. In my view, this quiet change in the classification of feeding tubes is the Roe v. Wade of the euthanasia movement. It enabled Terri’s death and continues to threaten countless other lives.

In a 2008 New York Times article titled “Terminal Options for the Irreversibly Ill,” Judith Schwarz, a Registered Nurse, cited more than one million deaths tied to decisions to withdraw life-sustaining care in U.S. hospitals annually.

Perhaps it’s sheer indifference, but most Americans seem to be completely unaware of what is happening behind the scenes in hospitals, nursing homes, and hospices nationwide, despite the growing number of warning signs.