“What is perfection in love? Love your enemies in such a way that you would desire to make them your brothers … For so did He love, Who hanging on the Cross, said ‘Father, forgive them, for they know not what they do.’” (Luke 23:34)

Distinction Matter - Subscribed Feeds

-

Site: Zero HedgeNetanyahu: Trump Told Me 'I Have Absolute Commitment To You'Tyler Durden Fri, 05/23/2025 - 17:00

Authored by Dave DeCamp via AntiWar.com,

Israeli Prime Minister Benjamin Netanyahu said at a press conference this week that President Trump had assured him that the US was committed to Israel despite a slew of media reports that have said there’s friction between the two leaders.

"Let me give you some details that perhaps haven’t been made public. A few days ago — I think around 10 days ago, maybe a little more — I spoke on the phone with President Trump," Netanyahu began, according to The Times of Israel.

Via Reuters

Via Reuters

"And he said to me, literally: ‘Bibi, I want you to know — I have absolute commitment to you. I have absolute commitment to the State of Israel,'" the Israeli leader added.

Netanyahu said he also spoke with Vice President JD Vance. "[Vance] said to me… ‘Listen, don’t pay attention to all these fake news spins about this rupture between us… He said: It’s all spin.'"

"This isn’t the truth, you know it’s not true, and I’m telling you, from our side, it’s not true," the Israeli leader said.

Axios recently reported that Vance canceled a trip to Israel because he didn’t want it to appear that the Trump administration approved Israel’s major escalation in Gaza, although Vance denied the report and said he didn’t travel to Israel for "logistical" reasons.

"We’re coordinated with the [Trump] administration," Netanyahu said. “We speak with each other. We respect their interests, and they respect ours — and they overlap. I won’t tell you they align completely — obviously not — but they align almost completely."

The Trump administration has taken several steps in the region that appeared to go against Israel’s interests, including the ceasefire with Yemen’s Houthis and talks with Hamas. But there’s been no sign that the administration is willing to leverage military aid to force Netanyahu to end the genocidal war on Gaza, which continues to escalate.

Meanwhile, growing frustration on the American Right...

What if...

— Judge Napolitano (@Judgenap) May 22, 2025

Trump hosts Netanyahu at the WH to show him videos of the IDF slaughtering Palestinians, like he did the President of South Africa? pic.twitter.com/qfN5uspX9JNetanyahu also said on Wednesday that Israel wants to ensure “Trump’s plan” for Gaza is achieved, referring to the president’s calls for the permanent removal of the Palestinian population as part of a plan for the US to take over the territory. The Israeli leader has now listed the ethnic cleansing plan as a condition to end the war.

-

Site: LifeNews

Former staff of the recently shuttered Boulder Abortion Clinic announced plans to open a new facility in Boulder, Colorado, that would continue killing babies in abortions, including up to the moment of birth.

The move comes just weeks after the closure of the notorious abortion biz, which operated for 50 years and was linked to an estimated 42,000 abortions.

The Boulder Abortion Clinic, founded by Dr. Warren Hern in 1975, closed abruptly in April 2025, a development celebrated by pro-life groups as a victory for the unborn. Operation Rescue, a leading pro-life organization, noted its decades-long efforts to expose the abortion clinic’s practices, including documenting abortion-related injuries and a patient death.

However, the closure’s impact may be short-lived.

Click here to sign up for pro-life news alerts from LifeNews.com

Former staff, led by Alicia Moreno, the former chief operating officer, and Debbie Riccioli, its former director of counseling, have formed the RISE Collective—short for Reproductive Health, Inclusive Care, Support, and Empowerment—to establish a new late-term abortion facility in Boulder. The group, comprising nearly all of the abortion center’s former staff, plans to begin with late-term abortions and later expand to offer early trimester abortions.

“We have the most important part of the formula, which is a very well-trained staff,” Moreno told Boulder Reporting Lab, highlighting that 17 former employees, including 20% of the nation’s doctors trained in later abortions, are part of the effort.

The original Boulder Abortion Clinic faced decades of controversy, with pro-life groups labeling its closure a “victory” for protecting unborn children and their mothers. The abortion center was one of the few in the U.S. to kill babies after 28 weeks.

The RISE Collective’s plans have sparked particular concern due to Colorado’s lack of gestational limits on abortion, making it a destination for women seeking late-term abortions. Pro-life groups warn that the new clinic could continue to attract customers from across the country, perpetuating what they call a “culture of death.”

The former staff’s efforts to open the new abortion center have also raised questions about the abrupt closure of the original facility. Moreno and Riccioli told Boulder Reporting Lab they had spent two years planning a transition to take over the abortion biz, drafting a memorandum of understanding with Hern to formalize the handoff. However, Hern announced the closure on April 15, 2025, just one day after reportedly agreeing to the plan, leaving staff blindsided.

Pro-life advocates argue that the closure and the staff’s subsequent plans highlight the need for stronger protections for the unborn

As the RISE Collective works to secure a location and develop a business plan, pro-life groups are mobilizing to raise awareness and oppose the new abortion center’s opening.

The post Abortion Clinic Killings Babies in Abortions Up to Birth May Open in Colorado appeared first on LifeNews.com.

-

Site: LifeNews

Media coverage has been under a microscope recently, with various podcast hosts taking news reporters to task for their failures to report basic facts about former President Joe Biden. Did they not know the obvious?

That same level of scrutiny should extend to the coverage of the issue of abortion in which too often the obvious is not told. Far too often, news reports seem to treat the unborn child as if she is nothing. Not simply an inconvenience, but a nonentity.

When you take the baby out of the picture, the emphasis is placed on the circumstances of conception, rather than the humanity of the preborn child. This is a disservice not only to the baby but also to her mother. Because women who regret their abortions do not mourn “nothing.”

They mourn a human being, who might have greatly resembled themselves.

They mourn a person with a heartbeat.

They mourn a son or daughter, not a concept or a theory.

Click Like if you are pro-life to like the LifeNews Facebook page!

(function(d, s, id) { var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) return; js = d.createElement(s); js.id = id; js.src = "//connect.facebook.net/en_US/sdk.js#xfbml=1&version=v2.10"; fjs.parentNode.insertBefore(js, fjs); }(document, 'script', 'facebook-jssdk'));

There needs to be vast improvements in the manner in which the media cover the issue of abortion. It is time for some soul-searching. Readers, listeners, and viewers deserve facts, not spin.

Telling the whole story means including the development of the unborn child, and the repercussions when that child is ripped from a mother’s womb or allowed to pass into a toilet. When a woman comes face-to-face with the aborted child, the trauma can be devastating.

Women deserve to know all of the facts before choosing abortion.

It’s high time for the media to give them the truth.

LifeNews.com Note: Maria Gallagher is the Legislative Director and Political Action Committee Director for the Pennsylvania Pro-Life Federation and she has written and reported for various broadcast and print media outlets, including National Public Radio, CBS Radio, and AP Radio.

The post Tell Women the Truth About Abortion: The Baby is a Human Being appeared first on LifeNews.com.

-

Site: Zero Hedge"The Greatest Ass-Covering Op In US History" Created The Democratic Party Of Hoaxes, Hustles, & HatredTyler Durden Fri, 05/23/2025 - 16:20

Authored by James Howard Kunstler,

Stumblebum's Legacy

"Every time I watch The View, I become even more misogynistic."

- Laura Loomer

Bad as it was, “Joe Biden,” the figment president was merely one manifestation of a nation made mad by power-seeking demons, real-live, ill-intentioned human beings driving a runaway political machine, the party of hoaxes, hustles, and hatred.

The country is just now struggling to exit a convulsion of mass mental illness. The demons are still there, though, and still hard at work trying to drag you all back into mass formation.

A central mystery is how the news media made itself the enemy of the people, and this conundrum is not at all explained by Jake Tapper and Alex Marshall in their book Original Sin.

It’s actually just another hustle with overtones of hoax, like everything else in the evil cavalcade of narratives spun out in the news media’s war on reality. Tapper and Marshall want you to believe that a faceless collective they call “the White House” managed to conceal “Joe Biden’s” well-advanced disintegration from the voting public, and that was. . . that. The media wuz fooled! Goll-lee!

Of course, that fails to explain a whole lot — such as: how come anybody watching daily video clips of “Joe Biden” in action, could not fail to see the broken old puppet he is. Alex Marshall, receiving his “award for excellence” from the White House Correspondents’ Association weeks ago said, “We just missed it.”

Yeah, sure...

They also apparently missed the programmatic devastation to American society that was carried out in the old stumblebum’s name.

I will give you the key to that conundrum, and then you will understand why all this happened, and why the many lingering demons are still at it in their self-styled “resistance” to America-in-recovery. Mr. Marshall lied, you understand. The media connived with the demons. They were in on the gag the whole time.

If there is any “original sin” in the story, it revolves around Hillary Clinton. This monster emerged as the junior partner to her husband, political wonder-boy Bill Clinton. From the get-go, the narrative painted her as a wife sore-beset by her charismatic husband’s infidelities. (Forget that her only child, Chelsea, is a dead-ringer for her former law partner, Webb Hubbell.) However their connubial affairs worked, Hill and Bill had a deal: when he was done, she would eventually rise to become the first woman president, and they would go down in history as two era-defining, Boomer gen, political wonder-geniuses.

It was a flawed plan.

For one thing, Hillary utterly lacked Bill’s political charisma, which was his ability to avidly engage with other people and their issues. Hillary didn’t care much for other people, and only pretended to be interested in their issues. Also, people could easily read that in her demeanor. Nobody was fooled. If anything, she had negative charm, anti-charisma. Her own interests were strictly limited to obtaining power and riches. With enough power, Hillary noticed, you didn’t need charm or charisma. You could simply order people around. But the power couple left the White House broke in 2001, and were caught trying to spirit away some of the presidential dinner-ware.

The next phase of Hillary’s career was fortune-building. The Clinton Foundation was set up in 1997, ostensibly to fund Bill’s presidential library. It would become a fantastic grift magnet in the years to come, taking them from broke-ass-broke to demi-billionaires. Her launching pad was a seat in the US Senate. (She ran and won in New York when she was still First Lady in the 2000 election.)

2008 was supposed to be Hillary’s apotheosis from senator to president. The setup was perfect. The country was tired of Double-ya Bush. The time was exactly right for a woman president. Hillary was the obvious choice by a country mile. Except that she was edged out in the primaries by the Democratic Party’s alternative play for something even more amazing, in a contest of historic firsts, than a woman president — a black president, proving to the world how morally upright the USA had become, America liked how it felt. We were good people, after all!

Barack Obama liked playing his role, and he seemed to have more charisma than Hillary (though he didn’t care much for other people either, really). His sketchy background included a lot of people tinged with Marxism, such as his mentor in Chicago, Bill Ayers, an infamous Sixties radical, rumored to have ghost-written Obama’s books. And he was ensorcelled by big bankers like Robert Rubin of CitiGroup, and by Globalist bigshots orbiting Davos and the WEF.

Yet, Senator Hillary Clinton was still aggregating power as leader of Democratic women voters, a massive base. It was clear that she would remain in the game, aiming for her eventual “turn” in the White House. So, Mr. Obama made a deal with her: he would elevate her to Secretary of State, further fortifying her credentials, and then stand behind her in a 2016 run.

Hillary used her years at State to also fortify the Clinton Foundation’s coffers in various pay-to-play schemes — such as the Skolkovo tech deal with Russia and the Uranium One deal that netted the Clinton Foundation combined pledges of over $275-million, according to Clinton Cash author Peter Schweizer. The 2010 Haiti earthquake crisis was another bonanza for the foundation and its partners. One might also surmise, from the recent DOGE reports, that the fabulous armature for grift that USAID became, spawning countless NGOs, was engineered by Obama appointees like Samantha Powers and Hillary’s State Department machine.

In 2015, Hillary, off-and-running, came to the rescue of the Democratic National Committee. The party was foundering in debt. It entered a joint fund-raising agreement with a PAC called Hillary for America (HFA) and the Hillary Victory Fund. The agreement gave Hillary control over the DNC’s finances, strategy, and staffing decisions that enabled her to snake out Senator Bernie Sanders for the nomination. Hillary’s nomination, the drive toward her “turn,” was when the trouble really blossomed.

Pitted against the rising outsider, Donald Trump, in 2016, Hillary’s lack of charisma was sinking her campaign. So, with a little help from John Brennan at the CIA, Glenn Simpson’s Fusion GPS political media company, the FBI under Director Jim Comey, and lawfare ninja Marc Elias at the Perkins Coie DC law firm, the Russia collusion hoax was dreamed up and put into action.

That was the “original sin” that set up the Party of hoaxes, hustles, and hatred to become greatest lie-spewing operation in US history, with reverberations for the decade-to-come. It also became the greatest ass-covering op in US history, with each successive raft of lies — the Mueller Investigation, impeachment #1, the stolen election of 2020 and installation of “Joe Biden,” the J-6 op, impeachment #2, the Trump prosecutions of 2024 — all requiring successive layers of cover-up and lies.

Since the news media despised Donald Trump, and was convinced by its own bullshit that Hillary would win the 2016 election, they all ran with the Russia collusion story and turned it into RussiaGate. They miscalculated, of course. Mr. Trump won, a stunning surprise, a shock really to everyone, including Mr. Trump himself, who utterly lacked experience running a government and was bamboozled, sand-bagged, and eventually hoaxed into defeat — Covid-19 being the coup-de-grace. The news media had to continue lying to the country throughout and beyond all of that to pretend that they were not equally culpable for all this mischief.

And so, they ran with every deception of “Joe Biden’s” ruinous term in office. Alas for them, the indefatigable Mr. Trump rallied, persevered through the concocted prosecutions cooked up by Norm Eisen, Mary McCord, Lisa Monaco, and the rest of lawfare ninjahood, and is now back in power with an assembled team of appointees who are the Left’s worst nightmare.

What kept it all going — all the lying, gaslighting, deception, prevarication, and sedition — was the lack of accountability. It was a fatal intoxicant. That’s over now, though turning in the direction of justice is necessarily difficult and delicate, considering the elevated level of derangement among the public, the fragility of the national psyche, and the danger signals emanating from the zeitgeist.

It looks like the accounting will begin in earnest now. We are going to find out who was acting behind the empty figure of “Joe Biden,” and who ran the auto-pen. And working backward from there, this will all unspool in one, long, appalling thread of treason.

-

Site: LifeNews

Liberals have a new argument for keeping federal money flowing to Planned Parenthood: defunding the organization would cost taxpayers more.

Democrats and abortion advocates are framing the defunding of one of the largest abortion providers in the country as a financial “cost” to taxpaying Americans. Citing estimates from the Congressional Budget Office (CBO), they are voicing concern that the GOP’s plan to block Medicaid funding for Planned Parenthood through the GOP reconciliation bill would increase the national deficit by $300 million due to more babies being born.

“About three in four people say they oppose defunding Planned Parenthood health centers. But Republicans do not care — they need to appease their far-right, anti-choice fringe,” Democratic Washington Sen. Patty Murray said on May 14 about the CBO’s estimates. “Although the irony is, in this case, defunding Planned Parenthood would actually cost our country more money in the long term.”

HELP LIFENEWS SAVE BABIES FROM ABORTION! Please help LifeNews.com with a donation!

Murray’s office did not respond to the Daily Caller News Foundation’s request for comment.

Planned Parenthood performed over 400,000 abortions in fiscal year 2023-24 and received more than $700 million in government reimbursements and grants, according to its latest annual report. In contrast, private contributions dropped 31% relative to the previous fiscal year, totaling $684.1 million.

The CBO declined to clarify how the deficit would increase due to the federal cuts in response to a DCNF inquiry.

However, the CBO stated in 2015 that a House bill to block federal funding to Planned Parenthood would increase spending by $130 million over the course of a decade. The reason, CBO explained, was that the bill would reduce “services that help women avert pregnancies” and that “additional births that would result from enacting such a bill would add to federal spending for Medicaid.”

“Nearly 200 Planned Parenthood health centers could be forced to shutter, and more than 1.1 million patients could lose access to care. Cancers will go undetected, STIs will go untreated, and birth control will be harder to get,” said Planned Parenthood CEO Alexis McGill Johnson in a statement on the House’s Thursday vote to advance the reconciliation bill. She equated the CBO’s estimates of the deficit impact to “charging the taxpayers nearly $300 million.”

On the other side of the issue, pro-life advocates reject the premise of the estimates.

“While the Congressional Budget Office has yet to provide a full breakdown of its estimate, it appears the analysis includes the costs of supporting children born due to this provision but falls short and overlooks the long-term economic contributions these individuals will make — as workers, taxpayers and contributors to Social Security — in adulthood. Not to mention the benefit each person brings as a valued member of their family, their community and this country,” Emily Erin Davis, vice president of communications for Susan B. Anthony Pro-Life America, told the DCNF. “It’s especially surprising to see Democrats raise cost as a concern, given their longstanding record of opposing efforts to reduce federal spending.”

Some fiscal hawks in the GOP are also skeptical about the CBO estimate. Republican South Carolina Rep. Ralph Norman recently told NOTUS he “doesn’t believe” the agency’s projection, while Republican Texas Rep. Chip Roy said the deficit should be reduced in other ways.

Whether the provision in the GOP megabill survives the Senate remains uncertain, as some moderate Republicans have expressed reservations. For instance, Sen. Lisa Murkowski of Alaska recently told NOTUS she will “continue to be an advocate for the services that Planned Parenthood provides.”

Early this month, 183 pro-life state legislators from across the country sent a letter urging congressional GOP leadership to include the provision in the final reconciliation package.

LifeNews Note: Melissa O’Rourke writes for Daily Caller. Content created by The Daily Caller News Foundation is available without charge to any eligible news publisher that can provide a large audience.

The post Democrats Oppose Defunding Planned Parenthood Because More Babies Will be Born appeared first on LifeNews.com.

-

Site: Zero HedgeTrump Endorses U.S. Steel-Nippon DealTyler Durden Fri, 05/23/2025 - 16:00

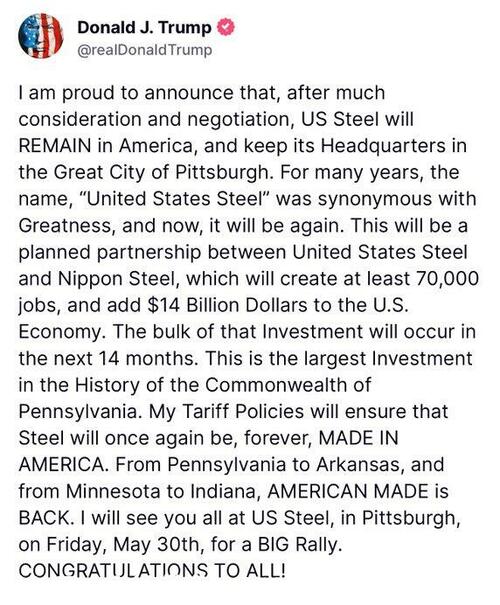

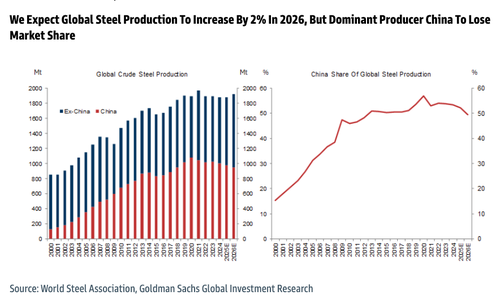

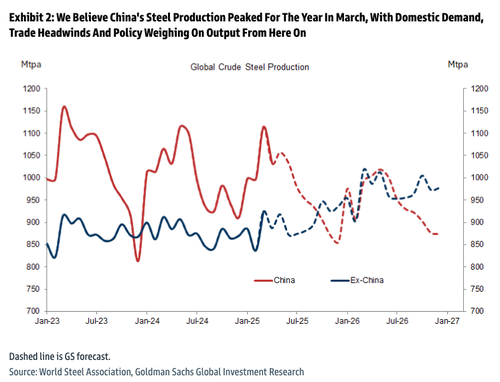

United States Steel Corp. shares surged to their highest level since April 2011 after President Trump announced on Truth Social his full backing of a partnership between the Pittsburgh-based steelmaker and Japan's Nippon Steel.

Trump confirmed that U.S. Steel will remain headquartered in Pittsburgh, calling the deal the largest investment in Pennsylvania's history and a first critical step in revitalizing the nation's steel industry, aligning with his 'America First' agenda of rebuilding critical supply chains.

"I am proud to announce that, after much consideration and negotiation, US Steel will REMAIN in America, and keep its Headquarters in the Great City of Pittsburgh," Trump wrote on Truth Social.

He continued, "For many years, the name, "United States Steel" was synonymous with Greatness, and now, it will be again. This will be a planned partnership between United States Steel and Nippon Steel, which will create at least 70,000 jobs, and add $14 Billion Dollars to the U.S. Economy."

The president said much of the investment will unfold over the next 14 months and will be "the largest Investment in the History of the Commonwealth of Pennsylvania."

Trump concluded the post by stating: "My tariff policies will ensure that steel will once again be, forever, MADE IN AMERICA. From Pennsylvania to Arkansas, and from Minnesota to Indiana, AMERICAN MADE is BACK. I will see you all at U.S. Steel in Pittsburgh on Friday, May 30, for a BIG rally."

Earlier, a Wall Street Journal report said that Nippon sweetened the deal by "roughly doubling its spending plan and even pledging to build a brand-new mill to win Washington's blessing for its takeover of U.S. Steel."

While Trump initially criticized the deal, he has since warmed to it because it aligns with America First's policy goals of bolstering domestic supply chains and revitalizing manufacturing.

The merger agreement between U.S. Steel and Nippon, which values U.S. Steel at $55 per share, expires June 18 unless extended.

Shares of U.S. Steel jumped to the highest level since April 2011 following the president's Truth Social post.

Meanwhile, the United Steelworkers union remains strongly opposed, citing Nippon's history of undercutting U.S. steel markets.

-

Site: Zero HedgeFather Of DC Shooting Suspect Was Democrats' Honored Guest At Trump Congressional AddressTyler Durden Fri, 05/23/2025 - 15:40

Authored by Debra Heine via American Greatness,

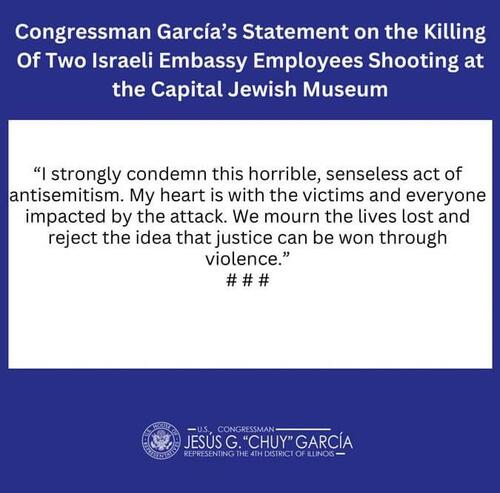

The father of the suspected gunman in the murder of two Israeli Embassy staffers at the Capital Jewish Museum on Wednesday, was the honored guest of a far-left lawmaker at President Trump’s joint address to Congress back in March, the New York Post reported.

Eric Rodriguez is an anti-Trump SEIU member who also spoke at a Democrat press conference ahead of Trump’s address.

His son, accused killer Elias Rodriguez, 30, has been charged with two counts of first-degree murder after allegedly gunning down Yaron Lischinsky, 28, and Sarah Milgrim, 26, who were about to become engaged.

“Eric Rodriguez was our guest during the President’s Joint Speech to Congress, but we don’t know his family,” a spokesperson for Rep. Jesús “Chuy” García (D-Ill.) told the Post Thursday night.

García in March had described Rodriguez as “an outspoken advocate against attacks on veterans’ services and the rights of unionized federal employees.”

His mention of “attacks on veteran services” appeared to be a reference to the Department of Government Efficiency’s work eliminating of waste fraud and abuse from the system.

“Eric represents the very best of our community — someone who has served his country, continues to serve his fellow veterans and fights every day to protect the dignity of working people,” the congressman said in a statement on March 3. “His presence at the Joint Address is a powerful statement: we will not sit back while veterans and workers are treated as political pawns.”

According to the Post, Rodriguez also appeared in a Service Employees International Union (SEIU) video that same day, speaking as an Iraq War vet and an employee with the Veterans Affairs Department.

The SEIU, one of the largest labor unions in North America, donates millions of dollars to left-wing Democrat politicians who promote government expansion and higher taxes.

“I’ve been with the VA for three years, and the reason why I’m in Washington, DC, is because I’m concerned about what Donald Trump, Elon Musk and DOGE are doing to the VA system,” he said in the SEIU video.

Rodriguez was also a featured speaker at an emotional Democrat press conference on March 4.

Flanked by Rep. Ted Lieu (D-Calif.), House minority leader Hakeem Jeffries (D-N.Y.) and other Democrat lawmakers, Rodriguez appeared on the verge of tears as he decried the DOGE cuts.

“Right now the Trump administration is trying to cut the VA, frontline workers, and let billionaires steal our healthcare. Veterans, we’re under attack. Last week, 1,400 workers got fired illegally,” he said.

“They’re slashing staff, crushing unions, and selling out the VA—for what? So billionaires can make more money while Veterans sit on a waitlist. Or worse, get no treatment,” Rodriguez added.

That video was shared on social media by the left-wing veterans group “VoteVets.”

His son Elias on Wednesday unleashed nearly two dozen rounds on the young Jewish couple, and shouted “Free, free Palestine” when he was taken into custody.

[ZH: And while we're down the rabbit hole - CIA contractor and big data expert Tony Seruga says GPS puts the elder Rodriguez at Barack Obama's Washington DC residence for 32 minutes back in March]

GPS—put the Israeli capital Jewish Museum shooter’s father at Barack Hussein Obama II’s Washington, D.C. residence (which is a quick 4 minute walk from The Islamic Center of Washington D.C..) back in March for 32 minutes.

— Tony Seruga (@TonySeruga) May 23, 2025

And now we find out Democrats invited accused terrorist… pic.twitter.com/H1DKcOQkCC* * *

Rep. García condemned the murders in a statement posted on social media Thursday.

“I strongly condemn this horrible, senseless act of antisemitism. My heart is with the victims and everyone impacted by the attack,” García posted on X. “We mourn the lives lost and reject the idea that justice can be won through violence.”

And now we find out Democrats invited accused terrorist (Elias) killer's DAD (Eric Rodriguez) to Trump address just weeks before heinous crime pic.twitter.com/dgGQ6ZX5Af

— Joni Job (@jj_talking) May 23, 2025* * *

Check out this lighter / flashlight combo...

Satisfaction guaranteed or your money back

Satisfaction guaranteed or your money back

-

Site: Zero HedgeOracle To Splurge $40 Billion On Nvidia Chips For Mega AI Data Center In TexasTyler Durden Fri, 05/23/2025 - 15:25

As the U.S. heads into Memorial Day weekend, with pools opening, millions set to travel, and backyard barbecues just ahead, a late-session report from the Financial Times revealed that one of President Trump's first Project Stargate AI infrastructure projects is underway in Texas.

According to FT's sources, the under-construction AI data center in Abilene, Texas, is the first U.S. Stargate project, and Oracle is purchasing a staggering 400,000 Nvidia GB200 "Superchips" that will be housed in eight buildings. When the facility comes online next year, the AI chips will require a massive 1.2 gigawatts of electricity.

Site owners Crusoe and Blue Owl Capital have raised $15 billion in debt and equity to finance the Abilene project. JPMorgan provided a sizeable chunk of the debt financing, totaling $9.6 billion across two loans, with $7.1 billion announced this week, according to people familiar with the matter.

Crusoe and Blue Owl have separately invested about $5 billion in cash. Oracle has signed a 15-year lease for the mega project that will be fully operational by mid-2026.

Your hard hat tour of OpenAI’s Stargate megafactory in Abilene, TX with @sama @ChaseLochmiller and lots of red dirt

— Emily Chang (@emilychangtv) May 20, 2025

pic.twitter.com/mMkeKpLVOUThe Abilene facility is part of the broader Stargate project, a $500 billion effort to scale U.S. AI computing backed by OpenAI, SoftBank, Oracle, and Abu Dhabi's MGX. The new Abilene data center will rival Elon Musk's plans to expand his "Colossus" data center in Memphis, Tennessee.

"The Abilene data center is a crucial step in OpenAI's move to reduce its dependence on Microsoft," FT noted, adding, "OpenAI and Microsoft agreed to terminate their exclusivity agreement earlier this year after the startup became frustrated that its demand for power far exceeded the US tech giant's supply."

Sources said Oracle will be leasing the computer power of the 400,000 Nvidia GB200 chips to chatbot startup OpenAI.

Meanwhile, massive U.S. data centers continue to come online—even as China's DeepSeek AI has demonstrated high efficiency, delivering more useful computation with less power. This raises a critical question: Have U.S. AI projects achieved similar levels of efficiency, or are they falling behind in the AI race? Remember what Goldman said about the data center peak capacity in April? Well...

-

Site: LifeNews

The Texas House of Representatives passed the Stop Tax-Funded Abortion Travel Act (Senate Bill 33) on Thursday with an 87-58 vote. The measure will block local governments from sending tax dollars to organizations that pay for out-of-state abortion costs, like flights and hotels. Now, the policy will head to the Senate for final approval and then be signed into law by the governor.

Texas Right to Life brought the Stop Tax-Funded Abortion Travel Act to lawmakers after the San Antonio and Austin city councils dedicated half a million dollars to abortion groups. Austin, specifically, handed $100,000 in taxpayer funds to an organization that sends teens to other states for free abortions—with or without their parents’ knowledge.

Click Like if you are pro-life to like the LifeNews Facebook page!

(function(d, s, id) { var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) return; js = d.createElement(s); js.id = id; js.src = "//connect.facebook.net/en_US/sdk.js#xfbml=1&version=v2.10"; fjs.parentNode.insertBefore(js, fjs); }(document, 'script', 'facebook-jssdk'));

Governments should not pay to kill their youngest citizens, and taxpayers should not be forced to participate in this violence.

On the same day, the Texas House also passed the Life of the Mother Act (Senate Bill 31). The measure will prevent delays in medical care and equip doctors and lawyers with accurate knowledge of the state’s Pro-Life laws. Despite claims from Democrats and the media, Pro-Life protections and emergency care work in harmony. If a mother faces pregnancy complications, there are several ways doctors can work to save both lives rather than abort the baby. However, if a procedure must be done that costs the life of the child, it can only be in cases where the mother’s condition would be life-threatening, according to Senate Bill 31 and previous standards.

Texas must value and protect mothers and babies together. Thursday’s victory with the Stop Tax-Funded Abortion Travel Act will save lives from out-of-state abortions, but thousands more children are still at risk. Every year, 19,000 abortion pills are ordered online and delivered to Texas in the mail, the abortion industry’s new method to skirt current laws. These drugs not only kill preborn babies but send one in 10 women who consume them to an emergency room. In the final days of Texas’ 2025 legislative session, lawmakers must pass the Woman and Child Protection Act (Senate Bill 2880) to stop the abortion industry’s underground network.

The post Texas House Passes Ban on Taxpayer-Funded Abortion Travel appeared first on LifeNews.com.

-

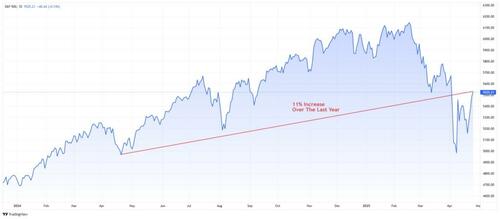

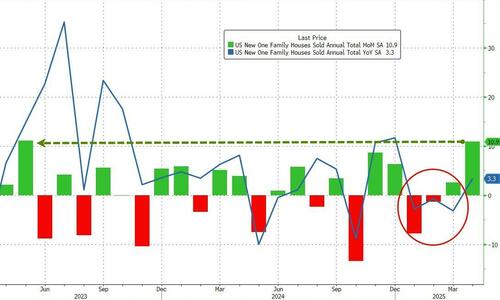

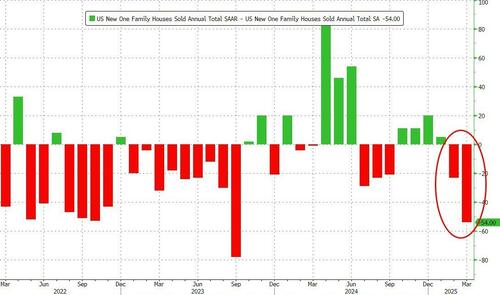

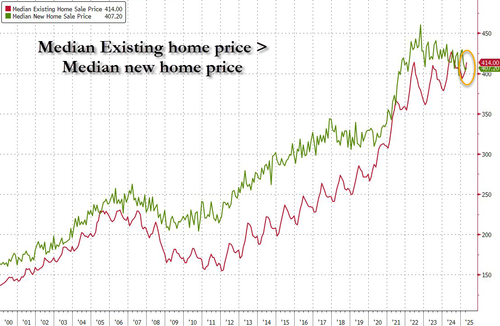

Site: Zero HedgeHere Are 6 Signs That The Housing Market Depression In The US Is Getting Even WorseTyler Durden Fri, 05/23/2025 - 15:05

Authored by Michael Snyder via The Economic Collapse blog,

America’s housing market has been in a “deep freeze” for more than a year.

The combination of very high interest rates and very high home prices has frozen millions of potential buyers out of the market. As a result, home sales have fallen to extremely depressed levels. When I first warned that we were heading into a housing market depression, a lot of people thought that I was exaggerating. But now the numbers show that is exactly what has happened.

The following are 6 signs that the housing market depression in the United States is getting even worse.

#1 Sales of previously-owned homes in the U.S. just fell again. In fact, we just witnessed the slowest April that we have seen since 2009…

The spring housing market continues to struggle amid high interest rates and low consumer confidence.

Sales of previously owned homes in April declined 0.5% from March to a seasonally adjusted, annualized rate of 4 million units, according to the National Association of Realtors. That is the slowest April pace since 2009.

In 2009, there were 306 million people living in the United States.

Today, there are 340 million people living in the United States.

So the fact that we have fallen to a level that we haven’t seen since the Great Recession should deeply trouble all of us.

#2 Sales of previously-owned homes are falling even though active listings and new listings are both rising…

Active listings—the total number of homes for sale—last month hit the highest level since March 2020. They climbed 1.2% from a month earlier on a seasonally adjusted basis and rose 16.7% year over year.

New listings rose to the highest level since July 2022, increasing 1.3% month over month on a seasonally adjusted basis and 8.6% year over year—the largest annual gain since May 2024.

“A lot of people are selling their homes and downsizing because they’re worried about the economy,” said Meme Loggins, a Redfin Premier real estate agent in Portland, OR. “During the pandemic, everybody wanted more space for a home office or for their kids to run around, but now people are more focused on saving money. A lot of folks are getting rid of their investment properties, and I’m working with a couple of federal employees who are afraid of losing their jobs, so they’re selling their homes and thinking of moving into condos.”

#3 Most potential young homebuyers have been completely forced out of the market. Shockingly, the average age of a homebuyer in the U.S. has surged to an all-time record high of 56…

The average age of homebuyers in the U.S. has risen by six years since July 2023 — another sign that younger Americans are being priced out of the market due to escalating ownership costs.

The average age of homebuyers is now 56, up from 49 in 2023, according to the National Association of Realtors’ annual state-of-the-market report released Monday. That’s a historic high, up from an average age in the low-to-mid 40s in the early 2010s.

#4 The median age of first-time homebuyers is spiking as well…

The median age of first-time buyers also rose from 35 to 38, while the share of first-timers dropped from 32% to 24% of all buyers for the year ending July 2024. That marks the lowest percentage since NAR started tracking the metric in 1981.

“In my two decades in the mortgage business, I’ve never seen a more difficult time for millennials to purchase a home,” says Bob Driscoll, senior vice president and director of residential lending at Massachusetts-based bank Rockland Trust.

This is a really bad thing for our society.

If most young couples cannot purchase a home until they are in their late thirties, something has gone horribly, horribly wrong.

#5 Zillow is reporting that home values have fallen in 27 U.S. states so far this year. Is this the beginning of a price crash?…

Home values fell in half the country as the housing market faces a nationwide downturn.

According to Zillow, monthly home values dropped in 27 out of the 50 states this year. While Florida, Colorado, Washington, D.C., California and Washington state experienced the greatest value declines from March to April, the data could foreshadow a larger housing market shift.

#6 Meanwhile, employers continue to conduct mass layoffs all over the nation, and this is only going to increase pressure on the housing market. For example, Walmart just announced that it will be laying off about 1,500 very well paid corporate employees…

Walmart is laying off around 1,500 corporate employees across various departments within its home office in Bentonville, Arkansas, multiple reports say.

In a memo shared with associates on May 21, Walmart executives said the company is “reshaping” some of its teams in an effort to modernize its business and enhance “associate, customer and member experiences.”

Most of the U.S. population simply cannot afford to shell out several thousand dollars for a mortgage payment every month.

Either interest rates will have to come down or housing prices will.

And if housing prices start falling like we saw in 2008 and 2009, that will cause all sorts of problems for our major financial institutions.

So hopefully the Federal Reserve will cut interest rates before it is too late.

One recent survey discovered that financial stress is at an all-time high for 70 percent of the U.S. population.

Absurdly high housing costs are one of the biggest reasons why so many people are financially stressed right now.

Home prices are way too high and so are rental prices.

If you were able to purchase a home and lock in a mortgage more than five years ago, you were extremely fortunate.

Those that wish to relocate now are facing ridiculously high prices and painfully high interest rates.

It has been said that he who hesitates is lost.

In this case, that is so true.

A lot of people out there that waited to pull the trigger have completely missed their chance.

Now the housing market is entering a very difficult chapter, and a tremendous amount of pain is ahead.

* * *

Michael’s new book entitled “10 Prophetic Events That Are Coming Next” is available in paperback and for the Kindle on Amazon.com, and you can subscribe to his Substack newsletter at michaeltsnyder.substack.com.

-

Site: AsiaNews.itOn Tuesday the company informed its employees via WhatsApp, shocking workers and unions. A worker told AsiaNews that, 'compensation will help us for a few days, but what about after that' The Ministry of Labour was not informed until the last moment. The 'Company has threatened workers against requesting an inquiry,' reports the Dabindu Collective.

-

Site: LifeNews

On a quiet Saturday morning in Palm Springs, California, Guy Edward Bartkus drove to a fertility clinic, detonated a car bomb, and blew himself apart—injuring four others and aiming to destroy not only a building, but thousands of innocent lives.

Bartkus wasn’t just a disturbed loner. He was a radicalized pro-mortalist and anti-natalist—someone who hated babies, despised human reproduction, and believed the world would be better if humanity ceased to exist. In his twisted view, even frozen embryos—children in their earliest stages—were so repugnant, he sought to wipe them out in a single blast.

This wasn’t a clinic bombing. It was an attempted mass murder of thousands of preborn children—a vile act that, if successful, could have eclipsed 9/11 in death toll, without a bullet fired or a plane hijacked.

Click Like if you are pro-life to like the LifeNews Facebook page!

(function(d, s, id) { var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) return; js = d.createElement(s); js.id = id; js.src = "//connect.facebook.net/en_US/sdk.js#xfbml=1&version=v2.10"; fjs.parentNode.insertBefore(js, fjs); }(document, 'script', 'facebook-jssdk'));

This brutal act by an angry, broken, and murderous young man is the natural progression of a shamelessly promoted anti-god, anti-life ideology.

It’s the true face of the modern left: the Democrat Party, radical environmentalists, global depopulation zealots, and abortion industry profiteers. From abortion-on-demand to anti-natalist propaganda, they preach the same godless gospel: “Human life is the problem—kill it!”

These monsters preach and act on that philosophy—hence the attempted assassinations of Rep. Steve Scalise, President Donald Trump, and even myself, as I have received death threats simply for defending life.

This ghastly philosophy is akin to Hitler, Stalin, Mao, and the Chinese Communist Party—ideologues who saw people as disposable, and who sacrificed millions on the altar of control, or eugenics. Cecile Richards and Margaret Sanger would be proud.

Thankfully, however, the world is not governed by the likes of these insane pro-mortalists, not yet anyway. Thankfully, the unchangeable moral ethic established on Mount Sinai continues to prevail. Human life is not a virus to be eradicated. It is the highest expression of divine beauty. Each person is made in the image of God, imbued with eternal worth, and offered redemption through the life, death and resurrection of Jesus Christ.

Bartkus’s bombing was demonic, yes—but it was also the logical conclusion of a world that embraces abortion, glorifies suicide, and calls child-killing “progress.” Anyone who gives themself to that type of darkness can become another Bartkus.

At Operation Rescue, we exist to shine a light into that darkness—to expose the killers in lab coats, the lawmakers who protect them, and the philosophies that fuel their culture of death. To engage the culture of death with the light of Christ.

And we will not back down. We will not be silent. To those who traffic in death, your reign of terror cannot last, because the God of Life cannot be mocked. Life and Light will always prevail.

LifeNews Note: Troy Newman is the president of Operation Rescue.

The post Radical Abortion Activist Hated Babies So Much He Blew Up a Fertility Clinic appeared first on LifeNews.com.

-

Site: Fr. Z's BlogI bring to your attention something I found which was uplifting: An American tale with an American pope It’ll take just a few seconds to read. Next, Jesuits (who else) pray to … wait for it… the demon “Pachamama”. HERE … Read More →

-

Site: Zero HedgeOil War Makes Landfall: Permian Rigs, Crew Counts Crater As Oil Prices Plunge, And It's About To Get Much Worse...Tyler Durden Fri, 05/23/2025 - 14:45

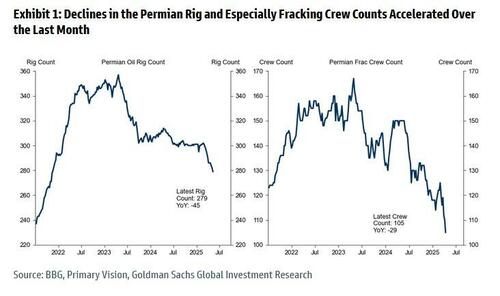

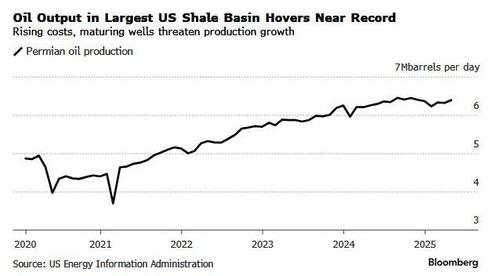

Two weeks after Travis Stice, CEO of shale giant Diamondback Energy, warned that the US energy industry "is at a tipping point" and - more ominously - that US shale output has finally peaked (resulting in Diamondback slashing its capex budget as Saudi Arabia launched the latest OPEC+ price war), we now have confirmation that the CEO was right.

As Goldman commodity strategist Yulia Grigsby writes in her latest Oil Tracker note, amid continued declines in oil prices, there was a silver lining: namely that US total rig and frac spread count continued to decline quickly, especially in the Permian, -14% and -22% from year ago, respectively, as shown in the chart below.

Grigsby speculates that while the Permian activity slowdown may partly reflect the preservation of the best inventory rather than wells shutdowns, oil fields with higher breakevens, e.g. North Dakota shale, are also planning to reduce drilling activity.

And, having previously taken stock of Q1 earnings reports, we remind readers that several high profile public producers already reduced their drilling and completion activity on the back of lower prices and most producers reduced their 2025 capex guidance. As a result, Goldman expects the crude production in the US Lower 48 to decline by 0.4mb/d by 2026Q4 from 2024Q4.

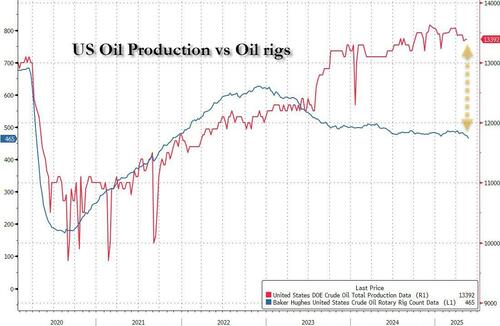

Incidentally the latest Baker Hughes data showed that rotary rigs in the US tumbled by another 8 in the latest week...

...and are now down to a 4 year low of 465 as the industry enters crisis "cash conservation" mode.

But one doesn't have to believe in "peak oil" to expect further US production declines: regulation and sharply higher extraction prices may suffice to send the price of oil surging.

According to Bloomberg, Texas regulators are warning that wastewater from fracking in the biggest US oil basin is causing a "widespread" increase in underground pressure — a development that risks hindering crude output and harming the environment.

Shale oil wells in the Permian Basin generate millions of gallons of chemical-laced water, which drillers then pump back into the earth. Landowners and activists have said for years that this process causes toxic leaks. Now the state’s powerful oil and gas regulator, the Railroad Commission of Texas, is acknowledging the scale of the problem and imposing restrictions that could increase crude production costs.

Chevron Corp., BP Plc, and Coterra Energy Inc. as well as water management specialists Waterbridge Operating LLC and NGL Energy Partners, are among the companies that have received notices about the pressure issue from the Railroad Commission of Texas, according to a Bloomberg News review of public records. The RRC sent the messages to companies applying for new wastewater disposal wells.

Producers began injecting more water into shallow rock formations roughly five years ago after pumping it deep below the surface was found to trigger earthquakes. But the volumes are now so large that the dirty water is breaching wells and causing the ground to swell and rupture, threatening to contaminate drinking supplies for people and livestock.

Potential restrictions on both deep and shallow injection zones could mean producers will have to pump their wastewater farther afield, increase recycling or pay to clean it up. All of these options would add to costs in the Permian, which accounts for about half of America's total crude production. It would be the latest blow to US producers already grappling with low oil prices and a shrinking inventory of top-tier drilling sites, despite President Donald Trump’s pledge to unleash US “energy dominance” by backing fossil fuels.

According to Bloomberg, the RRC has updated its standard language in the letters to producers in a nod to the severity of the problem. It now says that disposing wastewater into the Delaware Mountain Group rock formation in the prolific western part of the Permian “has resulted in widespread increases in reservoir pressure that may not be in the public interest and may harm mineral and freshwater resources in Texas.”

“Drilling hazards, hydrocarbon production losses, uncontrolled flows, ground surface deformation, and seismic activity have been observed,” the commission says.

Guaranteeing that US oil output will slide, starting next month, the RRC will place limits on water-pressure levels due to “the physical limitations of the disposal reservoirs.” It will also require operators to assess old or unplugged oil wells within half a mile of the disposal site, twice the previous distance.

The RRC’s staff has been studying issues related to wastewater disposal for several years, spokesperson Bryce Dubee said in an email.

“Let there be no doubt that our work and analysis to protect residents and the environment in West Texas has been happening for years and will continue,” Dubee said. The commission conducted a two-hour webinar on Thursday to explain its new guidelines for permitting saltwater disposal wells in the Permian.

Permian Basin oil production has soared over the past decade to about 6.7 million barrels of oil each day, more than the output from Iraq and Kuwait combined, and in some views has become a global swing producer. But for each barrel of crude, it produces three to five barrels of water that contain so much salt and toxic materials that pumping it back underground is the only cost-effective disposal method.

The shallow disposal zones, located between oil-rich layers of shale and the surface, consist of porous rock that can absorb water. But the 100-year history of crude production in the Permian means they are perforated with thousands of well bores, some up to a mile deep. Because of higher water pressure, fluids are now breaking through to oil drilling areas and old wells that were either abandoned or poorly cemented shut decades ago.

The regulator’s tighter restrictions come just weeks after Coterra was forced to halt some oil production in Culberson County, Texas, after waste fluids leaked into its wells. Executives said the problem was localized and could be fixed by strengthening the protective casing around its wells.

Coterra is remediating the affected wells but did not give an expected completion date. The company said it doesn’t expect the issue to affect its long-term reserves.

“We thought we were well calibrated,” Blake Sirgo, Coterra’s senior vice president for operations, said on a call with analysts May 6. “Sometimes the oil field still surprises us.”

One person who’s not surprised is Sarah Stogner, the district attorney for three West Texas counties in the Permian Basin. She’s been warning of rising subsurface pressure since 2021, when a landowner noticed oil and gas oozing from old wells on her property that had sat idle for decades. Stogner, then a lawyer for the landowner, publicized the case on social media, calling them “zombie wells.” Over the next few years, several more wells blew out in the area, with some ejecting toxic fluids more than 100 feet in the air for several days.

“These were old fields that suffered from a lack of pressure for decades,” she said. “Suddenly we were seeing pressure where it shouldn’t be. It was clear even back then there was a field-wide problem.”

The RRC mostly ignored her appeals for a thorough investigation, she said. Its elected commissioners, whose campaigns are largely funded by the oil and gas industry, framed the issue as primarily a plugging problem, claiming that old and abandoned wells had been improperly cemented shut, or not at all.

But it’s now becoming clearer that the underlying problem is too much wastewater injection.

One blowout near Imperial, Texas, gushed toxic water high in the air for two weeks and had to be cemented shut in 2022. Researchers at Southern Methodist University later found the ground around the eruption site had been steadily bulging for three years, eventually rising 40 centimeters (16 inches) before it burst open. Wastewater injection volumes several kilometers away “strongly correlate” with the ground movement, they said in a paper published in July 2024.

SkyGeo, an analytics company that uses radar to track ground movements, reached a similar conclusion.

“The injection of saltwater causes this unnaturally high pressure, and then it’s going to find weak spots to come out,” said CEO Pieter Bas Leezenberg.

The RRC said its new permitting requirements will “ensure injected fluids remain confined to the disposal formations to safeguard ground and surface fresh water.” To Stogner, the measures are an admission that toxic water leaks are a serious problem for the regulator, and for the Permian Basin. “They just completely ignored us,” she said. “But now they cannot deny that it’s happening.”

And with that, oil producers will no longer be able to sweep the toxic problem under the rug - or ground as it may be - and since the mandated changes will require millions if not billions in additional spending to comply with regulations, which means all-in production costs are set to soar, and since oil prices will only continue to slide, we are about to see a wholesale shutdown of the Permian, and - as because the commodity cycle never fail - all the excess production in the US will turn into a deficit, sending oil prices soaring as the commodity bullwhip effect comes home.

-

Site: AsiaNews.itThe young woman, killed in Washington with her colleague and boyfriend Yaron Lischinsky, by an attacker who shouted "I did it for Gaza, I did it for Palestine', was actively involved with an NGO that brings together Israelis and Palestinians to build common ground and coexistence using new technologies. Unlike the extremists who fan the flames, the group sees 'people behind the propaganda'.

-

Site: Zero HedgeLargest POW Swap Of Ukraine War Unfolds - 2K Total In Coming DaysTyler Durden Fri, 05/23/2025 - 13:25

Last week's Istanbul peace talks between Russia and Ukraine did not lead to much in terms of achieving ceasefire or peace as there were no breakthroughs whatsoever. However, it did give the two sides a chance to increase their swaps of POWs, and this is where Istanbul bore fruit.

The delegations agreed to a swap of 1,000 captives from each side, totaling 2,000 - which makes it by far the biggest single exchange of the war. Friday saw the two sides complete an initial round of fulfilling this agreement, with almost 800 people released.

Image source: Zelenskyy/Telegram

Image source: Zelenskyy/Telegram

The Russian Ministry of Defense said in a statement that "270 Russian servicemen and 120 civilians" were returned to Russia on Friday, wile Ukraine said 390 people arrived back to Ukraine, including 270 military personnel and 120 civilians. Three women were among the Ukrainians released.

"We are bringing our people home," Ukraine’s President Volodymyr Zelensky declared on social media. The swap happened at the Belarus-Ukraine border, and was facilitated by several buses.

Zelensky confirmed: "The first part of the agreement to exchange 1000 for 1000 has been implemented."

"On the Ukrainian side, dozens of people waited for hours to greet the returnees at a meeting place in Chernihiv region in northern Ukraine, many hoping to see their family members among those being brought back," observed one report.

"Many brought Ukrainian flags and photographs of their loved ones – in case any of the returnees would recognize them and give them information about their whereabouts," the report added.

The NY Times alleges that Ukrainian prisoners in Russian hands are treated much worse:

Unlike Moscow, Kyiv is also sensitive to demands by the Western nations backing its military that Ukraine comply with international law on the treatment of prisoners.

The Ukrainians allow visits to prisoner of war camps by both the United Nations and Red Cross; those organizations have largely been denied access in Russia and the Ukrainian territory it occupies.

Russia and Ukraine have begun a large exchange of prisoners of war on Friday, the Russian Defense Ministry said, with around 1,000 soldiers from each side expected to be swapped at the Ukraine-Belarus border when completed. https://t.co/ud6wQNWAbN pic.twitter.com/NovYMwGJkp

— ABC News (@ABC) May 23, 2025This largest prisoner exchange of the war is expected to continue over the coming days. There remain significant logistical challenges to be able to make it happen.

As drones and large-scale aerial attacks continue being exchanged, prisoner swaps have been rare bright spot in the war. Other than this, the warring sides haven't agreed on anything else.

-

Site: Bonfire of the Vanities - Fr. Martin Fox

When I prepare a homily, sometimes I write out notes on the readings to organize my thoughts. I don't need these anymore, but I thought maybe they'd be of interest, so I'll post them here. Watch this space for the resulting homily.

The first reading talks about healing a dispute. It may not be clear without more context but: it asks everyone to make adjustments to maintain unity; for individuals to make some personal sacrifices for the common good.

The second reading describes the City of God, which represents who we will be in the New Creation. Our eternity with God isn’t about each of us being individuals, all on our own, but rather, being a community. The city is peaceful, unified and glorious. Its gates are always open. It is always full of light.

Jesus’s words in the Gospel emphasize that when you and I are fully united to him, whether he is walking on earth – as he was with the Apostles – or he is at the right hand of the Father in heaven – as he is now – we have no reason to be sorry or sad. Jesus continues to be our source of life and transformation. He is the one who is building us into that City of God!

The Apostles’ letter:

The first reading refers to a dispute that arose after non-Jews were being baptized and becoming Christians – the first Christians were all Jews, as was Jesus, Mary, Joseph and the Apostles. The influx of non-Jewish believers prompted the question: did they need to adopt the practices that belonged to Judaism, such as a limited diet and circumcision? The answer was no. This came from the St. Peter, based on Scripture and what he observed of God’s action through him, and endorsed by St. James the Apostle – in whose name some had advocated a different course. The Apostle James recommended certain steps, described in this letter, that would foster unity between Christians who were either Jewish or non-Jewish in origin.

This reminds us that, then as now, there can arise disputes and disagreements, based on good-faith attempts to do the right thing. The decision of the Apostles at that time was an accommodation that bridged the differences. Non-Jewish Christians were urged to avoid eating certain things; today we don’t even talk about this, it’s a non-issue, but it was a different world then. It reflects the overriding goal of each of us being interested in supporting our fellow believers, and making sacrifices that help them, rather than creating scandal or distractions.

In our time, can you and I think of ways individual Christians might either cause scandal to others, by insisting on “doing it my own way” – versus making a sacrifice that might help maintain unity and help others not to be discouraged?

The City of God:

Described as 1,500 long, wide and high. This would stretch from Dayton to Utah to the west, and to the Caribbean Sea to the south, and go west into the Pacific Ocean; and way up to where our satellites circle the globe.

The city is made of “pure gold, transparent as glass.” This is curious: gold can’t be “transparent” as we understand it, except when hammered out to extreme thinness, or theoretically under intense pressure that we cannot create. This language may be better understood as not “transparent” but “pure”; more likely, it is deliberately not something occurring in nature, and therefore, belonging to super-nature.

Gates: Angels are gatekeepers? Names on gates: 12 Tribes of Israel.

This reminds us that God’s gifts and call to Israel are, as St. Paul said in Romans, “irrevocable.” There have been disturbing re-occurrences of hatred and contempt toward Jews – a murder in our nation’s capital, and ugly graffiti on S.R. 741 – so we remember that we Christians are called never to hate, and to oppose hate, and to recognize the Jewish people as continuing to enjoy God’s favor and to have a role to play in his plan.

Foundation: Apostles – note, they are essentially united to Jesus, who is the true, ultimate foundation.

Jesus’ words in the Gospel:

Jesus is answering a question from St. Jude: why are you manifesting yourself to us, but not to the world?

Jude’s question may have reflected the belief among Jews of his time (and since) that the Messiah would manifest himself to the whole world. Hence, he is puzzled by what he just heard Jesus say.

The answer given here is that, in the next phase of the plan of salvation, Jesus will manifest himself to those who love him and keep his commandments; this will involve the Father’s love and the presence of the Holy Trinity in that person’s life.

However, other Scriptures (Matthew and Revelation to name two) make clear that at a certain point, the Savior will, indeed, be manifested to the world. Further, we might understand it this way: for a time, Jesus will be manifested to the world by invitation – through the witness of Christians and with the assistance of grace – leading to conversion. But at a definite point, the Messiah will be manifested as Judge.

Why should the Apostles rejoice that Jesus goes to the Father?

For three reasons at least. First, for Jesus himself who is both human and divine; as a human being, will not his Ascension be a wonderful thing? Second, for the consequences of his Ascension, which will be the outpouring of the Holy Spirit, which means the Apostles – and everyone – will take a big step forward in knowing the Holy Trinity, and in being empowered as witnesses, and in becoming truly the Body of Christ.

Third, what he is saying is that if the disciples fully, truly loved Jesus, they would have no fear or anxiety about his ascension. They would have the greatest possible closeness and have full trust and confidence. Jesus understands that we don’t always have that, and he doesn’t react to that inadequate love by rejecting us. Rather, he always seeks to raise us up. This is what he did with Peter: he lifted him when he sank into the water; and when, in his confession of love after the Resurrection: Peter’s “yes, I love you” was a weaker expression of love, but Jesus accepted it, and ultimately, transformed Peter into one who gave his life for Jesus.

How can the Father be greater than the Jesus? The Father and Son are equal in divinity; yet Jesus in his humanity is the creature of the Trinity.

-

Site: Ron Paul Institute - Featured Articles

On the eve of Iran’s meeting in Rome on Friday, Iran’s Foreign Minister, Seyed Abbas Araghchi, summarized the situation quite succinctly… accept Iran’s offer to not build nuclear weapons or there is no deal. I do not think this is hyperbole or posturing. I believe it is the firm position of Iran. The decision is now in the hands of Donald Trump.

The Friday meeting in Rome marks the fifth time that Iran and the US have met for indirect talks. Oman has the unenviable task of running back-and-forth between the two delegations, who have declined to meet in person and talk directly to each other. Over the course of the last month, Iran has heard conflicting positions from Steve Witkoff, Trump’s lead negotiator. After the first round of talks in April, Witkoff said the US was willing to accept Iran’s peaceful enrichment of uranium, which is 3.6%. But, upon returning to Washington, the Zionist crowd clobbered Witkoff, which led him subsequently to make repeated public remarks that Iran would not be allowed to have any enrichment capability.

Iran, with the backing of Russia, China and Saudi Arabia, is willing to accept a 3.6% limit and to allow unfettered inspections of Iranian nuclear facilities in order to ensure compliance. The fly in the ointment is Israel. Bibi Netanyahu and the Zionist zealots are pulling out all stops to pressure Trump and toprevent him from making such a deal. An Iranian agreement to never build a nuke would remove one of Israel’s major excuses for its genocidal activites against the Palestinians and Hezbollah.

Netanyahu and company continue making threats to attack and destroy Iran’s nuclear program, but realize it is an impossible goal without the full support of Washington. Domestic politics in the US is another factor that will constrain, if not prevent, Trump from making a sensible deal with Iran. A large number of the political whores that comprise the Republican and Democrat members of Congress, are insisting that Iran must also destroy its ballistic missile force and end all contacts with Hamas, Hezbollah and the Houthis. Because Trump needs the votes of people like Lindsey Graham and Ted Cruz to pass his Big Beautiful Bill to fund the government and deliver tax cuts, he is unlikely to make any compromise with Iran.

The murder of two Israeli diplomats on Wednesday in DC adds even more emotional rocket fuel to the heat Trump is facing for even entertaining a deal with Iran. I want to be proven wrong, but I don’t think Trump has the courage or the backbone to do the right thing with respect to Iran.

For those of you who live outside the United States, I must emphasize that a majority of Americans hold an irrational, rabid hatred of Iran, Hezbollah and Hamas… at least those Americans holding political office. We have reached the point that anyone who tries to argue on behalf of the Palestinians is immediately denounced as an antisemite. The same emotional derangement that infects many in Israel is prevalent in the US with respect to Iran and the Palestinian people. Facts no longer matter.

While the prospect of a US-supported attack by Israel on Iran looms on the horizon, there is a chance that diplomatic intervention by the Gulf Arabs might dissuade Trump from embracing the suicidal proposal of Israel to destroy Iran’s nuclear processing facilities. Trump is also keen on making the Abraham Accords a reality — an impossible goal if the US attacks Iran in tandem with Israel. I agree with Doug MacGregor’s view that an attack on Iran will likely lead to Iran launching military strikes that will shutter the Persian Gulf. Maybe I am grasping at straws, but I am trying to identify some alternatives to a devastating, horrific war that the US will not be able to control or win.

Reprinted with permission from Sonar21.

-

Site: Mises InstituteMMT uses chartalism and a few dubious examples to appeal to history to establish the theory‘s authority and validity, only to discard this element as irrelevant and unnecessary.

-

Site: Zero HedgeCapitalism Fuels "Racism," Is "Difficult To Survive": Iowa State U. LectureTyler Durden Fri, 05/23/2025 - 13:00

By Hanna Bechtel of The College Fix

Capitalism is an “oppressive system” that is “incredibly difficult to survive,” a financial coach said during a recent lecture at Iowa State University.

The “Anti-Capitalism Personal Finance Lecture” featured Leo Aquino, a “non-binary Filipinx writer, journalist, and financial coach” known for “their commitment to uplifting BIPOC and LGBTQ+ stories,” according to the event description.

During the lecture, Aquino advocated for an “anti-capitalist” budgeting approach that encourages people to reframe their relationship with money to prioritize well-being over profit, mainly benefiting queer and trans-identifying individuals.

The speaker defined anti-capitalism as “the belief that financial systems do not need to adhere to capitalist values for us to survive.”

An anti-capitalist personal finance perspective supports workers’ abilities to control their labor and decide how profits are invested. It requires people to redefine their “definition of wealth,” Aquino said.

The speaker encouraged students to stop blaming themselves for their financial situations and start questioning the underlying system.

Aquino defined capitalism as “an economic system where workers are required to sell [their] labor for a wage in order to survive.”

The financial coach said this system prioritizes profits over people while causing burnout, depression, and anxiety. “[Capitalism] is an oppressive system profiting from our lack of financial literacy and interpersonal conflicts around money.”

Further, capitalism “necessitates racism, ableism, homophobia, colonialism, and other forms of oppression to perpetuate conflict.” It “has forced people from marginalized communities to do unrealistic things to survive in an oppressive system,” Aquino said.

The speaker contrasted traditional budgeting, defined as a monthly estimate of income and expenses, with anti-capitalist budgeting, described as a “neutral space for us to practice compassionate data analysis.”

Aquino said the goal is not “to make the rich richer” but to “help others save, budget and spend money in line with their values.”

The financial coach also described several means of budgeting, with each depending on one’s own personal financial aptitude. One budgeting strategy included using a “needs vs. wants” model. Aquino said “some things are needs and wants [at the same time] … things like makeup and dining out are needs for our mental health.”

People should be able to spend quality time eating out with friends without “thinking so much about the financial consequences of that behavior.” An oppressive capitalist economic system is the cause of this internal conflict, the speaker said.

Further, Aquino characterized money as a tool used to navigate capitalism “with more ease,” adding people don’t necessarily want more money, “they want more freedom to do the things they love and enjoy.”

Queer and trans communities in particular benefit the most from anti-capitalist finance movements. “One-third of LGBTQ elders live in poverty and cannot afford to retire due to discrimination against their community in the past,” Aquino said.

Meanwhile, young trans communities are “going into debt for gender-affirming healthcare due to current legislation.”

When an ISU student asked about how this form of financial planning resists capitalism, Aquino said, “you can only do so much.” Everyone has to be willing to make compromises while still living in a capitalist system.

The coach said people must still advocate “for the changes [they] want to see in the economic world.”

“It is less about resistance and more about coping,” Aquino said.

Aquino is the founder of Queer and Trans Wealth, a financial coaching and education business “dedicated to increasing the financial literacy and economic empowerment of queer and trans communities,” according to its website.

The College Fix reached out to Aquino and the university in the last week via email for further comment on the lecture and its contents, but received no response.

Aquino’s website lists several personal writings, which include titles such as “How to crowdfund your gender-affirming surgery,” “How to share your pronouns,” and “How to make your own porn.”

-

Site: Mises InstituteDr. David Gordon reviews Mary Grabar‘s Debunking FDR, which examines Roosevelt‘s paternalistic worldview and how it shaped his political life and his presidency.

-

Site: AsiaNews.itLife expectancy in Vietnam tops 74 years, but chronic diseases are up among the over 60s, particularly men. Public health authorities are grappling with high costs, inadequate services, and a rapid demographic transition. By 2050, one in four Vietnamese will be elderly.

-

Site: Henrymakow.com

Yaron Lischinsky and Sarah Milgrim, two Israeli embassy staffers gunned down by Elias Rodriguez represent all Jews and humanity in general who are being sacrificed to fulfill a sinister occult agenda. They have been deceived into supporting Israeli expansionism and genocide.Humanity is being whipped into a fratricidal frenzy by the two Masonic wings of Organized Jewry, Communism (Left) and Zionism (right.) This is to instigate a genocidal war against non-Satanists (goyim) that Organized Jewry (Rothschilds) have been waging for centuries.Israel was founded to provide a pretext for WW3 which reprises WW2, Communists (Allies) vs. Fascists (Nazis, Zionists.)Israel and Iran are both controlled by Freemasons. Trump, Netanyahu, Putin are Freemasons and members of Chabad, a Jewish supremacist cult. Trump is banning all criticism of Israel as "antisemitic." This includes cutting Harvard funding and refusing entry to people who opposed Gaza genocide in social media.Those Disingenuous Jews---Jewish media blames the murder on a general rise in "antisemitism" despite the fact that the shooter proclaimed he acted "for Palestine."As long as Jews conflate Israeli barbarism with "antisemitism," they will get their wish. They will be blamed for it despite the majority of Jews (the Commie wing) are vehemently opposed to it. Jews and gentiles alike must expose and disown the puppeteers on both sides bent on destroying Western civilization.Shooting of Israeli embassy staffers in Washington sharpens fears of rising antisemitism in U.S.The Editor of "The Algameiner" wrote, "I want to begin by recognizing Yaron Lischinsky and Sarah Lynn Milgrim. We mourn their loss and condemn the senseless act of antisemitism that took their lives. We stand in unwavering solidarity with the State of Israel and with the families of the victims. May their memories be a blessing."--

Yaron Lischinsky and Sarah Milgrim, two Israeli embassy staffers gunned down by Elias Rodriguez represent all Jews and humanity in general who are being sacrificed to fulfill a sinister occult agenda. They have been deceived into supporting Israeli expansionism and genocide.Humanity is being whipped into a fratricidal frenzy by the two Masonic wings of Organized Jewry, Communism (Left) and Zionism (right.) This is to instigate a genocidal war against non-Satanists (goyim) that Organized Jewry (Rothschilds) have been waging for centuries.Israel was founded to provide a pretext for WW3 which reprises WW2, Communists (Allies) vs. Fascists (Nazis, Zionists.)Israel and Iran are both controlled by Freemasons. Trump, Netanyahu, Putin are Freemasons and members of Chabad, a Jewish supremacist cult. Trump is banning all criticism of Israel as "antisemitic." This includes cutting Harvard funding and refusing entry to people who opposed Gaza genocide in social media.Those Disingenuous Jews---Jewish media blames the murder on a general rise in "antisemitism" despite the fact that the shooter proclaimed he acted "for Palestine."As long as Jews conflate Israeli barbarism with "antisemitism," they will get their wish. They will be blamed for it despite the majority of Jews (the Commie wing) are vehemently opposed to it. Jews and gentiles alike must expose and disown the puppeteers on both sides bent on destroying Western civilization.Shooting of Israeli embassy staffers in Washington sharpens fears of rising antisemitism in U.S.The Editor of "The Algameiner" wrote, "I want to begin by recognizing Yaron Lischinsky and Sarah Lynn Milgrim. We mourn their loss and condemn the senseless act of antisemitism that took their lives. We stand in unwavering solidarity with the State of Israel and with the families of the victims. May their memories be a blessing."-- A deliberate effort to blame all Jews for Israel's barbarism, so the dupes will suffer instead of the perps."If France, Britain and Canada think that Israel's actions are "egregious" what does that mean and what does it tell us about the countries where Jews have decided to live for many years? Opinion."The statement of the three western leaders stating that Israel's actions are not just bad but extremely bad or conspicuously bad reflect a deep hatred for the Jewish State. That is the sad truth."WW3 is Inevitable----Martin Armstrong"War in Europe and Asia is coming, is in fact very likely inevitable, and that war will have consequences for those involved, and for the entire world, including us here in Canada, that will last for decades."-