Assuredly, the word of truth can be painful and uncomfortable. But it is the way to holiness, to peace, and to inner freedom. A pastoral approach which truly wants to help the people concerned must always be grounded in the truth. In the end, only the truth can be pastoral.

Distinction Matter - Subscribed Feeds

-

Site: Rorate CaeliCharlotte is a vast diocese in one of the fastest growing regions in America: 5.5 million people and over half a million Catholics. For all these, one chapel in an isolated area in an unnamed building in a country highway.They really think we're idiots.The dishonorable bishop's letter (dated from today, Friday, May 23) below:(Click for larger view)New Catholichttp://www.blogger.com/profile/04118576661605931910noreply@blogger.com

-

Site: Zero HedgeWhy Tether Refuses To Comply With MiCATyler Durden Fri, 05/23/2025 - 11:45

Authored by Bradley Peak via CoinTelegraph.com,

Is Tether MiCA compliant?

The EU’s new Markets in Crypto-Assets regulation, better known as MiCA, is the first major attempt by a global economic power to create clear, region-wide rules for the crypto space, and stablecoins are a big focus.

MiCA mandates best practices. If a stablecoin is going to be traded in the EU, its issuer has to follow some stringent rules:

1. You need a license

To issue a stablecoin in Europe, you must become a fully authorized electronic money institution (EMI). That’s the same kind of license traditional fintechs need to offer e-wallets or prepaid cards. It’s not cheap and it’s not quick.

2. Most of your reserves have to sit in European banks

This is one of the most controversial parts of MiCA. If you issue a “significant” stablecoin — and Tether’s USDT certainly qualifies — at least 60% of your reserves must be held in EU-based banks. The logic is to keep the financial system safe.

3. Full transparency is non-negotiable

MiCA requires detailed, regular disclosures. Issuers have to publish a white paper and provide updates on their reserves, audits and operational changes. This level of reporting is new territory for some stablecoins, especially those that have historically avoided public scrutiny.

4. Non-compliant coins are getting delisted

If a token doesn’t comply, it won’t be tradable on regulated EU platforms. Binance, for example, has delisted USDT trading pairs for users in the European Economic Area (EEA). Other exchanges are following suit.

The European Securities and Markets Authority (ESMA) clarified that people in Europe can still hold or transfer USDT, but it can’t be offered to the public or listed on official venues.

In other words, you might still have USDT in your wallet, but good luck trying to swap it on a regulated platform.

Key reasons why Tether rejects MiCA regulations

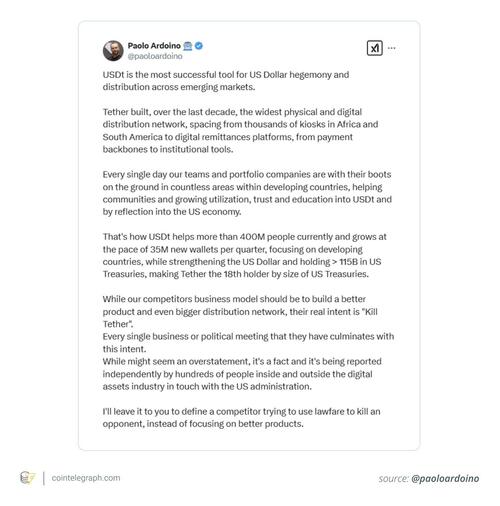

Tether is unique in that it has explained why it wants nothing to do with MiCA regulations. The company’s leadership, especially CEO Paolo Ardoino, has been pretty vocal about what they see as serious flaws in the regulation, from financial risks to privacy concerns to the bigger picture of who stablecoins are really for.

1. The banking rule could backfire

One of MiCA’s most talked-about rules says that “significant” stablecoins — like Tether’s USDt — must keep at least 60% of their reserves in European banks. The idea is to make stablecoins safer and more transparent. But Ardoino sees it differently.

He’s warned that this could create new problems, forcing stablecoin issuers to rely so heavily on traditional banks could make the whole system more fragile.

After all, if there’s a wave of redemptions and those banks don’t have enough liquidity to keep up, we’d witness a struggling bank and a stablecoin crisis simultaneously.

Instead, Tether prefers to keep most of its reserves in US Treasurys, assets it says are liquid, low-risk and much easier to redeem quickly if needed.

2. They don’t trust the digital euro

Tether also has a broader issue with the direction Europe is heading, especially regarding a digital euro. Ardoino has openly criticized it, raising alarms about privacy.

He has argued that a centrally controlled digital currency could be used to track how people spend their money, and even control or restrict transactions if someone falls out of favor with the system.

Privacy advocates have echoed similar concerns. While the European Central Bank insists that privacy is a top priority (with features like offline payments), Tether isn’t convinced. In their eyes, putting that much financial power in the hands of one institution is asking for trouble.

3. Tether’s users aren’t in Brussels. They’re in Brazil, Turkey and Nigeria

At the heart of it, Tether sees itself as a lifeline for people in countries dealing with inflation, unstable banking systems and limited access to dollars.

These are places like Turkey, Argentina and Nigeria, where USDT is often more useful than the local currency.

MiCA, with all its licensing hoops and reserve mandates, would require Tether to shift focus and invest heavily in meeting EU-specific standards. That’s something the company says it’s not willing to do, not at the expense of the markets it sees as most in need of financial tools like USDT.

Did you know? Turkey ranks among the top countries for cryptocurrency adoption, with 16% of its population engaged in crypto activities. This high adoption rate is largely driven by the devaluation of the Turkish lira and economic instability, prompting citizens to seek alternatives like stablecoins to preserve their purchasing power.

What happens when Tether doesn’t comply with MiCA

Tether’s decision to skip MiCA didn’t exactly fly under the radar. It’s already having real consequences, especially for exchanges and users in Europe.

1. Exchanges are dropping USDT

Big names like Binance and Kraken didn’t wait around. To stay on the right side of EU regulators, they’ve already delisted USDT trading pairs for users in the European Economic Area. Binance had removed them by the end of March 2025. Kraken followed close behind, removing not just USDT but also other non-compliant stablecoins like EURT and PayPal’s PYUSD.

2. Users are left with fewer options

If you’re in Europe and holding USDT, you’re not totally out of luck; you can still withdraw or swap it on certain platforms. But you won’t be trading it on major exchanges anymore. That’s already pushing users toward alternatives like USDC and EURC, which are fully MiCA-compliant and widely supported.

Even major crypto payment processors are pulling support, leaving users with fewer options for spending their crypto directly.

3. A hit to liquidity? Probably.

Pulling USDT from European exchanges could make the markets a bit shakier. Less liquidity, wider spreads and more volatility during big price moves are all on the table. Some traders will adjust quickly. Others? Not so much.

Did you know? Tether (USDT) is the most traded cryptocurrency globally, surpassing even Bitcoin in daily volume. In 2024, it facilitated over $20.6 trillion in transactions and boasts a user base exceeding 400 million worldwide.

Tether vs MiCA regulation

Tether may be out of sync with the EU, but it’s far from retreating. If anything, the company is doubling down elsewhere, looking for friendlier ground and broader horizons.

Firstly, Tether’s picked El Salvador as its new base, a country that has fully embraced crypto. After getting a digital asset service provider license, the company is setting up a real headquarters there. Ardoino and other top execs are making the move too.

Moreover, after banking over $5 billion in profits in early 2024, Tether is putting its capital to work:

-

AI: Through its venture arm, Tether Evo, the company has picked up stakes in firms like Northern Data Group and Blackrock Neurotech. Tether has also launched Tether AI, an open-source, decentralized AI platform designed to operate on any device without centralized servers or API keys. The goal is to use AI to boost operations and maybe build some new tools along the way.

-

Infrastructure and AgTech: Tether invested in Adecoagro, a company focused on sustainable farming and renewable energy. It’s a surprising move, but it fits Tether’s bigger strategy of backing real-world, resilient systems.

-

Media and beyond: There are also signs Tether wants a footprint in content and communications, signaling it’s thinking far beyond crypto alone.

Tether’s MiCA exit highlights crypto’s global regulatory chaos

Tether walking away from MiCA is a snapshot of a much bigger issue in crypto: How hard it is to build a business in a world where every jurisdiction plays by its own rulebook.

The classic game of regulatory arbitrage

This isn’t Tether’s first rodeo when it comes to navigating regulations. Like many crypto companies, they’ve mastered the art of regulatory arbitrage, finding the friendliest jurisdiction and setting up shop there.

Europe brings in strict rules? Fine, Tether sets up in El Salvador, where crypto is welcomed with open arms.

However, it does raise questions. If big players can simply move jurisdictions to dodge regulations, how effective are those rules in the first place? And does that leave retail users protected or just further confused?

A crypto world that’s all over the map

The bigger issue is that the global regulatory landscape is incredibly fragmented. Europe wants full compliance, transparency and reserve mandates. The US is still sending mixed signals. Asia is split; Hong Kong is pro-crypto, while China stays cold.

Hong Kong has also passed the Stablecoin Bill to license fiat-backed issuers and boost its Web3 ambitions. Meanwhile, Latin America is embracing crypto as a tool for financial access.

For companies, it’s a mess. You can’t build for one global market; you must constantly adapt, restructure or pull out entirely. For users, it creates massive gaps in access. A coin available in one country might be inaccessible in another just because of local policy.

As a final thought: Tether’s resistance to MiCA seems to be more than just a protest against red tape.

It’s making a bet that crypto’s future will be shaped outside Brussels, not inside it.

-

-

Site: Zero HedgeWhy Tether Refuses To Comply With MiCATyler Durden Fri, 05/23/2025 - 11:45

Authored by Bradley Peak via CoinTelegraph.com,

Is Tether MiCA compliant?

The EU’s new Markets in Crypto-Assets regulation, better known as MiCA, is the first major attempt by a global economic power to create clear, region-wide rules for the crypto space, and stablecoins are a big focus.

MiCA mandates best practices. If a stablecoin is going to be traded in the EU, its issuer has to follow some stringent rules:

1. You need a license

To issue a stablecoin in Europe, you must become a fully authorized electronic money institution (EMI). That’s the same kind of license traditional fintechs need to offer e-wallets or prepaid cards. It’s not cheap and it’s not quick.

2. Most of your reserves have to sit in European banks

This is one of the most controversial parts of MiCA. If you issue a “significant” stablecoin — and Tether’s USDT certainly qualifies — at least 60% of your reserves must be held in EU-based banks. The logic is to keep the financial system safe.

3. Full transparency is non-negotiable

MiCA requires detailed, regular disclosures. Issuers have to publish a white paper and provide updates on their reserves, audits and operational changes. This level of reporting is new territory for some stablecoins, especially those that have historically avoided public scrutiny.

4. Non-compliant coins are getting delisted

If a token doesn’t comply, it won’t be tradable on regulated EU platforms. Binance, for example, has delisted USDT trading pairs for users in the European Economic Area (EEA). Other exchanges are following suit.

The European Securities and Markets Authority (ESMA) clarified that people in Europe can still hold or transfer USDT, but it can’t be offered to the public or listed on official venues.

In other words, you might still have USDT in your wallet, but good luck trying to swap it on a regulated platform.

Key reasons why Tether rejects MiCA regulations

Tether is unique in that it has explained why it wants nothing to do with MiCA regulations. The company’s leadership, especially CEO Paolo Ardoino, has been pretty vocal about what they see as serious flaws in the regulation, from financial risks to privacy concerns to the bigger picture of who stablecoins are really for.

1. The banking rule could backfire

One of MiCA’s most talked-about rules says that “significant” stablecoins — like Tether’s USDt — must keep at least 60% of their reserves in European banks. The idea is to make stablecoins safer and more transparent. But Ardoino sees it differently.

He’s warned that this could create new problems, forcing stablecoin issuers to rely so heavily on traditional banks could make the whole system more fragile.

After all, if there’s a wave of redemptions and those banks don’t have enough liquidity to keep up, we’d witness a struggling bank and a stablecoin crisis simultaneously.

Instead, Tether prefers to keep most of its reserves in US Treasurys, assets it says are liquid, low-risk and much easier to redeem quickly if needed.

2. They don’t trust the digital euro

Tether also has a broader issue with the direction Europe is heading, especially regarding a digital euro. Ardoino has openly criticized it, raising alarms about privacy.

He has argued that a centrally controlled digital currency could be used to track how people spend their money, and even control or restrict transactions if someone falls out of favor with the system.

Privacy advocates have echoed similar concerns. While the European Central Bank insists that privacy is a top priority (with features like offline payments), Tether isn’t convinced. In their eyes, putting that much financial power in the hands of one institution is asking for trouble.

3. Tether’s users aren’t in Brussels. They’re in Brazil, Turkey and Nigeria

At the heart of it, Tether sees itself as a lifeline for people in countries dealing with inflation, unstable banking systems and limited access to dollars.

These are places like Turkey, Argentina and Nigeria, where USDT is often more useful than the local currency.

MiCA, with all its licensing hoops and reserve mandates, would require Tether to shift focus and invest heavily in meeting EU-specific standards. That’s something the company says it’s not willing to do, not at the expense of the markets it sees as most in need of financial tools like USDT.

Did you know? Turkey ranks among the top countries for cryptocurrency adoption, with 16% of its population engaged in crypto activities. This high adoption rate is largely driven by the devaluation of the Turkish lira and economic instability, prompting citizens to seek alternatives like stablecoins to preserve their purchasing power.

What happens when Tether doesn’t comply with MiCA

Tether’s decision to skip MiCA didn’t exactly fly under the radar. It’s already having real consequences, especially for exchanges and users in Europe.

1. Exchanges are dropping USDT

Big names like Binance and Kraken didn’t wait around. To stay on the right side of EU regulators, they’ve already delisted USDT trading pairs for users in the European Economic Area. Binance had removed them by the end of March 2025. Kraken followed close behind, removing not just USDT but also other non-compliant stablecoins like EURT and PayPal’s PYUSD.

2. Users are left with fewer options

If you’re in Europe and holding USDT, you’re not totally out of luck; you can still withdraw or swap it on certain platforms. But you won’t be trading it on major exchanges anymore. That’s already pushing users toward alternatives like USDC and EURC, which are fully MiCA-compliant and widely supported.

Even major crypto payment processors are pulling support, leaving users with fewer options for spending their crypto directly.

3. A hit to liquidity? Probably.

Pulling USDT from European exchanges could make the markets a bit shakier. Less liquidity, wider spreads and more volatility during big price moves are all on the table. Some traders will adjust quickly. Others? Not so much.

Did you know? Tether (USDT) is the most traded cryptocurrency globally, surpassing even Bitcoin in daily volume. In 2024, it facilitated over $20.6 trillion in transactions and boasts a user base exceeding 400 million worldwide.

Tether vs MiCA regulation

Tether may be out of sync with the EU, but it’s far from retreating. If anything, the company is doubling down elsewhere, looking for friendlier ground and broader horizons.

Firstly, Tether’s picked El Salvador as its new base, a country that has fully embraced crypto. After getting a digital asset service provider license, the company is setting up a real headquarters there. Ardoino and other top execs are making the move too.

Moreover, after banking over $5 billion in profits in early 2024, Tether is putting its capital to work:

-

AI: Through its venture arm, Tether Evo, the company has picked up stakes in firms like Northern Data Group and Blackrock Neurotech. Tether has also launched Tether AI, an open-source, decentralized AI platform designed to operate on any device without centralized servers or API keys. The goal is to use AI to boost operations and maybe build some new tools along the way.

-

Infrastructure and AgTech: Tether invested in Adecoagro, a company focused on sustainable farming and renewable energy. It’s a surprising move, but it fits Tether’s bigger strategy of backing real-world, resilient systems.

-

Media and beyond: There are also signs Tether wants a footprint in content and communications, signaling it’s thinking far beyond crypto alone.

Tether’s MiCA exit highlights crypto’s global regulatory chaos

Tether walking away from MiCA is a snapshot of a much bigger issue in crypto: How hard it is to build a business in a world where every jurisdiction plays by its own rulebook.

The classic game of regulatory arbitrage

This isn’t Tether’s first rodeo when it comes to navigating regulations. Like many crypto companies, they’ve mastered the art of regulatory arbitrage, finding the friendliest jurisdiction and setting up shop there.

Europe brings in strict rules? Fine, Tether sets up in El Salvador, where crypto is welcomed with open arms.

However, it does raise questions. If big players can simply move jurisdictions to dodge regulations, how effective are those rules in the first place? And does that leave retail users protected or just further confused?

A crypto world that’s all over the map

The bigger issue is that the global regulatory landscape is incredibly fragmented. Europe wants full compliance, transparency and reserve mandates. The US is still sending mixed signals. Asia is split; Hong Kong is pro-crypto, while China stays cold.

Hong Kong has also passed the Stablecoin Bill to license fiat-backed issuers and boost its Web3 ambitions. Meanwhile, Latin America is embracing crypto as a tool for financial access.

For companies, it’s a mess. You can’t build for one global market; you must constantly adapt, restructure or pull out entirely. For users, it creates massive gaps in access. A coin available in one country might be inaccessible in another just because of local policy.

As a final thought: Tether’s resistance to MiCA seems to be more than just a protest against red tape.

It’s making a bet that crypto’s future will be shaped outside Brussels, not inside it.

-

-

Site: Zero HedgeIran Tells US "Time To Decide" During 5th Round Of Nuclear Talks In RomeTyler Durden Fri, 05/23/2025 - 11:30

Iranian Foreign Minister Abbas Araghchi and Trump's Middle East envoy Steve Witkoff are leading a fifth round of nuclear talks which kicked off Friday in Rome, through Omani mediators.

FM Araghchi said on X just ahead of the talks starting that it is "time to decide" - in post late Thursday. "Zero nuclear weapons = we DO have a deal. Zero enrichment = we do NOT have a deal," the Iranian top diplomat stated.

The US administration has of late been pushing a demand of no enrichment, but Tehran has rebuked this as a non-starter, saying it sees the issue as a right of national sovereignty. Araghchi had also written, "Figuring out the path to a deal is not rocket science."

Italy’s Foreign Minister Antonio Tajani (L) talks to Iranian Foreign Minister Abbas Araghchi, via Reuters.

Italy’s Foreign Minister Antonio Tajani (L) talks to Iranian Foreign Minister Abbas Araghchi, via Reuters.

Iranian Foreign Ministry spokesman Esmaeil Baghaei has said from Rome, "This round of talks is especially sensitive… we need to see what issues will be raised by the other party … and based on that, we will proceed with our positions."

This strongly suggests the Iranian side could be ready to quit the talks if Washington keeps insisting on its red line. Secretary of State Marco Rubio earlier this week admitted that getting Tehran to where the US wants it to be on the issue "will not be easy".

However, on Thursday White House press secretary Karoline Leavitt was more optimistic, and described that Trump believes negotiations with Iran are "moving in the right direction."

CNN reviews of where things stand, and what Iran is open to conceding:

Speaking Thursday, Araghchi said Iran was open to enhanced monitoring by international inspectors but would not relinquish its right to pursue nuclear energy, including uranium enrichment. Washington is offering to wind back crippling economic sanctions on Iran in exchange for de-nuclearization.

The US had previously sent mixed signals about whether Iran would be allowed to enrich uranium, but in recent weeks it has hardened its stance, insisting that no enrichment will be permitted.

On Tuesday, Iran's Supreme Leader, Ayatollah Ali Khamenei, called the US demands that Iranian enrichment be taken down to zero "excessive and outrageous," according to state media. He further expressed doubts that current nuclear talks with the Trump administration will actually lead anywhere.

"I don't think nuclear talks with the U.S. will bring results. I don't know what will happen," Khamenei said. He further called on Washington to cease making over-the-top demands in nuclear talks.

Insisting on “zero enrichment” during talks with Iran is a recipe for failure.

— Quincy Institute (@QuincyInst) May 22, 2025

But that’s EXACTLY why hawks like John Bolton & Mike Pompeo have embraced this demand: because it will lead to war.

The American people are sick of endless wars. So let’s hope Trump listens to them.Tehran officials have of late also called the Trump administration's stance "contradictory" - after President Trump attempted overtures, sprinkled with direct threats, in his Iran-related rhetoric while in the Gulf last week.

It should be very clear by the weekend whether the Rome talks lead to any breakthrough. It could all depend on if the American delegation actually softens its stance on zero enrichment.

The fifth round of U.S.-Iran nuclear talks ends after three hours, source with knowledge says

— Barak Ravid (@BarakRavid) May 23, 2025 -

Site: Zero HedgeWoman Who Spat On Former US Attorney Charged With AssaultTyler Durden Fri, 05/23/2025 - 11:15

Authored by Stacy Robinson via The Epoch Times,

The U.S. Attorney’s Office announced on May 22 that it had arrested a woman for assaulting then-interim U.S. Attorney Ed Martin.

Emily Gabriella Sommer, 32, allegedly spat on Martin while he was conducting a television interview. The incident was caught on camera.

According to a statement from the District U.S. Attorney’s Office, Sommer approached Martin while he was standing outside its headquarters in Washington, cursing at him.

“Martin turned to face Sommer. Sommer then said, ‘Are you Ed Martin? You are. Ed Martin.’ Sommer lunged at Martin and spit on his shoulder,” the statement said.

Sommer cursed at Martin again as she turned and walked away, shouting,

“You are a disgusting man. ... My name is Emily Gabriella Sommer, and you are served.”

Following the incident, Sommer allegedly replied to numerous posts on Martin’s X account, taking responsibility for the incident. According to court documents, she posted the same message in each reply.

“ED, that was me that spit in your face today ... that absolutely definitely spit in your face on camera. Hi, hello,” the posts read.

Martin, the former chair of the Missouri Republican Party, was appointed as interim U.S. attorney for the District of Columbia earlier this year by President Donald Trump.

Trump nominated him for the position on a permanent basis, but had to rescind the offer after some GOP senators refused to support him.

Sen. Thom Tillis (R-N.C.) told reporters on May 6 that he would not vote to confirm Martin because they disagreed on the treatment of individuals accused of rioting at the Capitol building on Jan. 6, 2021.

Tills said Martin seemed “like a good man” and that he’d made a good case that some of these individuals had been “over-prosecuted,” but also said there was “friction” on which individuals should be prosecuted.

“If Mr. Martin were being put forth as a U.S. attorney for any district except the district where Jan. 6 happened, the protests happened, I’d probably support him,” Tillis said.

“But not in this district.”

For his part, Martin had a sense of humor about the setback.

He posted on X a picture of himself dressed as pope with the words “Plot twist,” since Trump’s announcement was made on the same day the Vatican was in the process of electing Pope Leo XIV.

On May 13, Martin announced that Trump had appointed him to a dual role in the Department of Justice as “pardon attorney” and director of the Weaponization Working Group, which will investigate government prosecutorial overreach.

-

Site: AsiaNews.itFifty years after the fall of Phnom Penh to Pol Pot and the Khmer Rouge, the book "Beyond the Horizon" is published in Italian. In it a French woman describes the genocide with the eyes of someone who had come to Cambodia for love. The book is her diary of hell, misery, lies and death experienced with her daughters. The story is extremely interesting and credible for a country where a UN tribunal failed to render justice and uncover the truth.

-

Site: Mises InstituteJames Bovard: Today is the 163th anniversary of the battle of Front Royal, Virginia (the town near where I was raised). On May 23, 1862, almost all the Yankee soldiers in Front Royal were captured, killed or wounded.

-

Site: Ron Paul Institute - Featured Articles

American and other Western elites complain ad nauseam, decrying the Iranians’ intransigent, devious, aggressive, and unreliable behavior. They claim Iran will not make or keep an agreement. Never forget, however, that Iran is more than five millennia old with a long history of diplomacy. The Iranians may be difficult, but one of the barriers to an agreement could be the Iranians’ wariness of the United States’ long pattern of broken agreements.

In 1945 the U.S. signed the United Nations charter declaring the importance of protecting the sovereignty of states. Iran was also a signatory of that charter.

But eight years later, in 1953, the CIA and British Intelligence organized Operation Ajax, which overthrew the constitutionally elected Iranian Prime Minister Mohammed Mossadegh and empowered Mohammad Reza Shah Pahlavi, the son of the first Pahlavi shah who was deposed in 1941 by the British and Soviets. The CIA’s actions were in complete violation of Article 2 of the UN Charter. U.S. agencies also armed and trained the Iranian secret police, the Savak, to suppress any opposition, often using the tired old excuse that dissenters were Soviet-inspired or -supported.

American and other Western elites complain ad nauseam, decrying the Iranians’ intransigent, devious, aggressive, and unreliable behavior. They claim Iran will not make or keep an agreement. Never forget, however, that Iran is more than five millennia old with a long history of diplomacy. The Iranians may be difficult, but one of the barriers to an agreement could be the Iranians’ wariness of the United States’ long pattern of broken agreements.

In 1945 the U.S. signed the United Nations charter declaring the importance of protecting the sovereignty of states. Iran was also a signatory of that charter.

But eight years later, in 1953, the CIA and British Intelligence organized Operation Ajax, which overthrew the constitutionally elected Iranian Prime Minister Mohammed Mossadegh and empowered Mohammad Reza Shah Pahlavi, the son of the first Pahlavi shah who was deposed in 1941 by the British and Soviets. The CIA’s actions were in complete violation of Article 2 of the UN Charter. U.S. agencies also armed and trained the Iranian secret police, the Savak, to suppress any opposition, often using the tired old excuse that dissenters were Soviet-inspired or -supported.

Fair Use Excerpt. Read the whole article here.

-

Site: Ron Paul Institute - Featured Articles

The inexorable decline of the American Empire has arrived at an Imperial Paradox. It must either fight a war and die, or not fight a war and yet still die.

Here are the options:

China

Neither South Korea nor Japan want anything to do with a war against China, leaving only the Philippines dumb enough to play along.

The US apparently pulled another brigade out of South Korea. They’ll pull out more in the future. They know damn well the North Koreans could easily conquer the entire peninsula if they chose to do so.

China and its local seas are a vast ocean away from America, and its capacity to defend its local seas is enormous and growing.

The Pentagon must understand it cannot sustain logistics in a war against China in the western Pacific. It simply cannot be done. Anyone who thinks otherwise must upgrade their proficiency in basic arithmetic.

Iran

In the context of a war against Iran, all the geography is against the US.

Iran is an exceedingly mountainous country that has, over the course of millennia, learned to use those mountains to defend itself against would-be conquerors.

They can field a satisfactorily well-equipped million-man army.

They have learned in the 21st century to burrow deep heavily fortified tunnels into their mountains.

Iran is also much more technologically advanced than most people understand. They have become impressively capable in terms of both offensive and defensive missiles. They pose a far greater challenge than the Yemeni have been over the past year and a half.

Indeed, they pose a “near-peer” challenge against US overseas power projection.

The US Navy could only operate at extreme risk in the southern Red Sea, the Gulf of Aden, the Gulf of Oman, the Strait of Hormuz, and the Persian Gulf.

Every US base in the region is well within range of Iranian missile strikes.

The US Navy very demonstrably cannot secure seaborne logistics into the Persian Gulf. They lack both the sealift ships, and the ability to protect them.

They cannot even open the Bab-el-Mandeb!

Russia

From a geographic and logistical standpoint, the only remotely conceivable war is one in Ukraine against Russia.

The US at least has bases and forces already in place in the UK, Germany, Poland, Romania, Finland, and in Baltic chihuahua fantasy-land — and what has served until now as a reasonably secure logistics pathway into all those places.

Of course, whether or not such a condition persists long in a war scenario is another question altogether.

Because, you see, the Russians are now unquestionably the most formidable and battle-hardened military on the planet — at least in the context of a war fought on their doorstep.

So if you’re an empire that thinks it needs a war to reaffirm at least its short-term relevance and fading glory … well, these are your choices.

Sic transit gloria mundi.

Reprinted with permission from imetatronink.

Subscribe and support here. -

Site: Zero HedgeChina's Two-Decade Global Steel Expansion "Has Now Ended"Tyler Durden Fri, 05/23/2025 - 10:45

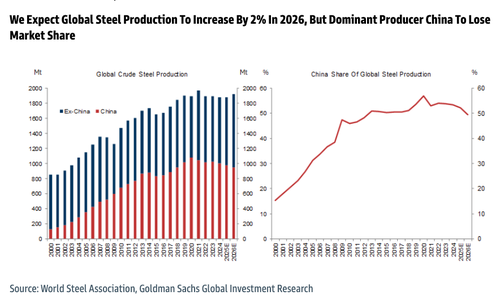

In Goldman's latest global steel outlook, analysts Aurelia Waltham, Eoin Dinsmore, and others highlight a key inflection point: China's share of global steel production has declined for the first time in over two decades, reversing a multi-decade expansion period.

"After more than two decades of China increasing its share of global steel production, we believe this structural trend has now come to an end as China's domestic demand continues to falter and barriers to steel exports intensify," Waltham and her team wrote in a note published on Friday morning.

The analysts noted that their global steel supply and demand model forecasted a 3% and 4% year-over-year increase in ex-China steel demand for 2025 and 2026, respectively. As Chinese steel exports are expected to decline, ex-China crude steel production is projected to rise by 3% in 2025 and 8% in 2026.

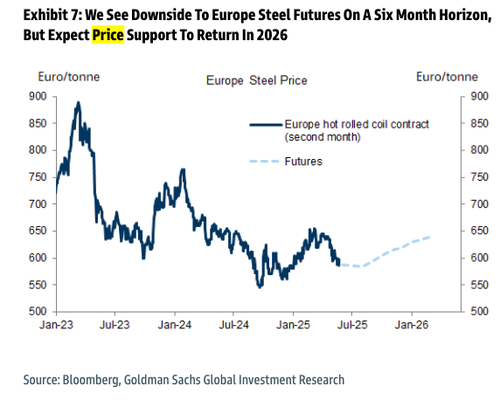

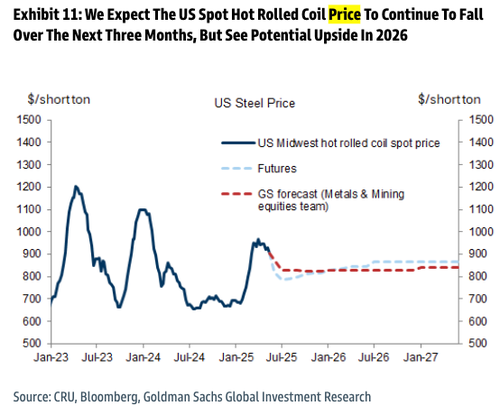

"While we are bearish on US and European steel prices on the three-to-six month horizon, we expect a re-acceleration in demand growth and lower Chinese steel exports to provide price upside in 2026," Waltham said.

They outlined the biggest risk to their forecast of China losing global market share:

We see the biggest risk to our call that China will start to lose market share of global steel production to the rest of the world over the next two years being indirect[1] Chinese steel exports continuing to climb, pushing down rest of world apparent steel demand. This would likely see China steel demand from the manufacturing sector exceeding our current expectations, preventing a decline in Chinese steel output and apparent domestic demand, while at the same time meaning rest of world steel production growth would fall below end use consumption growth. However, this would be at odds with China's policy to reduce steel output.

Following a 25-year expansion that saw China increase its share of global steel production from approximately 15% in 2000 to about 55% by 2020, analysts now forecast a decline to about 50% by 2026.

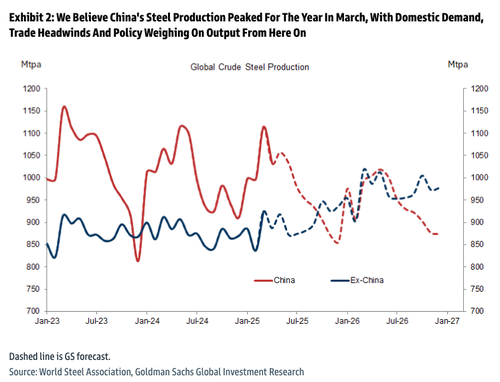

China's steel production for 2025 already peaked in March.

Key takeaways about China's declining influence in global steel markets:

-

Peak Reached: China's steel production likely peaked in March 2025 and is expected to decline by 2–3% YoY through 2026.

-

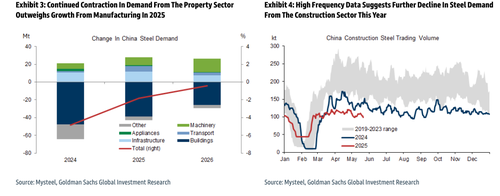

Domestic demand slowdown: A continued decline in construction activity, especially new housing starts (forecasted to drop 24% in 2025), will more than offset gains from manufacturing (e.g., autos and appliances).

-

Export headwinds: Chinese finished and semi-finished steel exports are forecast to drop 33% YoY in 2026, from 12% to under 8% of ex-China steel consumption.

-

Policy risk: If exports or output stay elevated, the Chinese government may impose mandated production cuts (likely via emissions controls) in Q4 2025 to meet policy targets.

China's economy is still a mess. Property sector will continue to weigh on steel demand.

However, the analysts view a rebound in ex-China steel:

-

Ex-China growth: Production outside China is expected to rise 3% in 2025 and 8% in 2026, helped by recovering demand and lower competition from Chinese exports.

-

Regional demand: Demand in the U.S., EU, and India will gradually improve. Apparent demand outside China is forecast to rise 3–4% annually into 2026.

Global Steel Price Outlook:

-

Near-term weakness: U.S. and European prices face further downside in the next 3–6 months due to lackluster demand and high inventories.

-

2026 upside: Prices are forecast to rise in 2026 as Chinese exports fall and global demand picks up, particularly in Asia and the EU. Anti-dumping measures and trade friction will help contain Chinese supply abroad.

European Steel Price Forcast

US Hot Rolled Coil Price Forecast

The long-standing concern over China flooding global markets with steel may finally be easing—a shift that could pave the way for Western producers to ramp up output. We anticipate this trend will be evident in the U.S amid President Trump's 'America First' era.

-

-

Site: Zero HedgeChina's Two-Decade Global Steel Expansion "Has Now Ended"Tyler Durden Fri, 05/23/2025 - 10:45

In Goldman's latest global steel outlook, analysts Aurelia Waltham, Eoin Dinsmore, and others highlight a key inflection point: China's share of global steel production has declined for the first time in over two decades, reversing a multi-decade expansion period.

"After more than two decades of China increasing its share of global steel production, we believe this structural trend has now come to an end as China's domestic demand continues to falter and barriers to steel exports intensify," Waltham and her team wrote in a note published on Friday morning.

The analysts noted that their global steel supply and demand model forecasted a 3% and 4% year-over-year increase in ex-China steel demand for 2025 and 2026, respectively. As Chinese steel exports are expected to decline, ex-China crude steel production is projected to rise by 3% in 2025 and 8% in 2026.

"While we are bearish on US and European steel prices on the three-to-six month horizon, we expect a re-acceleration in demand growth and lower Chinese steel exports to provide price upside in 2026," Waltham said.

They outlined the biggest risk to their forecast of China losing global market share:

We see the biggest risk to our call that China will start to lose market share of global steel production to the rest of the world over the next two years being indirect[1] Chinese steel exports continuing to climb, pushing down rest of world apparent steel demand. This would likely see China steel demand from the manufacturing sector exceeding our current expectations, preventing a decline in Chinese steel output and apparent domestic demand, while at the same time meaning rest of world steel production growth would fall below end use consumption growth. However, this would be at odds with China's policy to reduce steel output.

Following a 25-year expansion that saw China increase its share of global steel production from approximately 15% in 2000 to about 55% by 2020, analysts now forecast a decline to about 50% by 2026.

China's steel production for 2025 already peaked in March.

Key takeaways about China's declining influence in global steel markets:

-

Peak Reached: China's steel production likely peaked in March 2025 and is expected to decline by 2–3% YoY through 2026.

-

Domestic demand slowdown: A continued decline in construction activity, especially new housing starts (forecasted to drop 24% in 2025), will more than offset gains from manufacturing (e.g., autos and appliances).

-

Export headwinds: Chinese finished and semi-finished steel exports are forecast to drop 33% YoY in 2026, from 12% to under 8% of ex-China steel consumption.

-

Policy risk: If exports or output stay elevated, the Chinese government may impose mandated production cuts (likely via emissions controls) in Q4 2025 to meet policy targets.

China's economy is still a mess. Property sector will continue to weigh on steel demand.

However, the analysts view a rebound in ex-China steel:

-

Ex-China growth: Production outside China is expected to rise 3% in 2025 and 8% in 2026, helped by recovering demand and lower competition from Chinese exports.

-

Regional demand: Demand in the U.S., EU, and India will gradually improve. Apparent demand outside China is forecast to rise 3–4% annually into 2026.

Global Steel Price Outlook:

-

Near-term weakness: U.S. and European prices face further downside in the next 3–6 months due to lackluster demand and high inventories.

-

2026 upside: Prices are forecast to rise in 2026 as Chinese exports fall and global demand picks up, particularly in Asia and the EU. Anti-dumping measures and trade friction will help contain Chinese supply abroad.

European Steel Price Forcast

US Hot Rolled Coil Price Forecast

The long-standing concern over China flooding global markets with steel may finally be easing—a shift that could pave the way for Western producers to ramp up output. We anticipate this trend will be evident in the U.S amid President Trump's 'America First' era.

-

-

Site: Zero HedgeThe Anchoring Problem And How To Solve ItTyler Durden Fri, 05/23/2025 - 10:25

Authored by Lance Roberts via RealInvestmentAdvice.com,

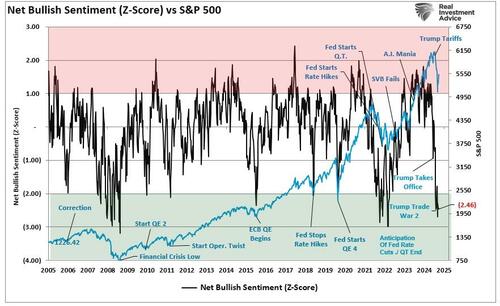

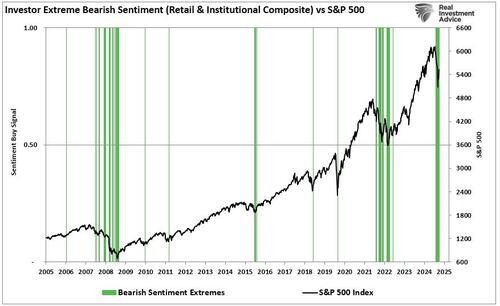

Market perspective is essential in avoiding investing mistakes. With the media constantly pushing a “Markets In Turmoil” narrative, it’s no wonder that investor sentiment recently reached some of the lowest levels since the financial crisis. The following chart is the z-score of the retail and professional investor sentiment composite index of bullish sentiment.

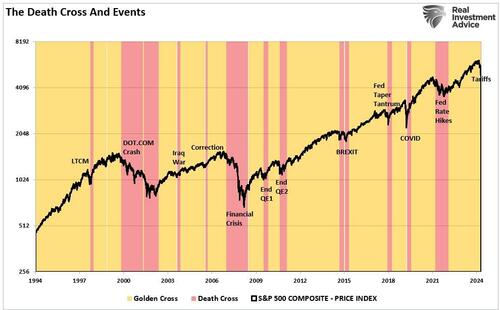

Notably, we are in one of the longest stretches of more extreme bearish sentiment outside structural bear markets. (Read “Death Crosses And Market Bottoms” for more detail and an explanation of the difference between event-driven corrections and structural bear markets.)

Of course, given the recent market decline and the surge in “bearish” media-driven narratives, it is unsurprising that bearish sentiment has risen. However, this is where investors start making mistakes in their investment process.

As noted, we are in one of the most extended stretches of bearish sentiment outside a structural bear market. The difference between event-driven corrections and structural bear markets is crucial to understand. However, extremely negative investor sentiment and positioning are the hallmarks of the end of corrections and bear markets. To wit:

In other words, historically speaking, the death cross, more often than not, is a potential contrarian indicator. The difference between whether the death cross is a shorter-term corrective process or a larger “bear market” decline depends mainly on whether the cause of the market decline is “event-driven” or “structural.” This context is important when examining the current decline and triggering of the “death cross.” The chart below shows the difference in the length of “event-driven” versus “structural” corrections, signified by the triggering of the “death cross.” The dot.com and financial crisis periods were structural events, as significant corporate failures and credit-market dislocations occurred amid deep economic contractions. However, outside of those two significant structural impacts, all other “events” were short-lived, and markets soon recovered.”

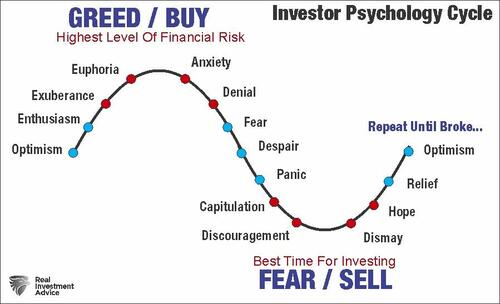

This is because when sentiment is the most bearish and the markets trigger longer-term sell signals, much of the selling has already been exhausted. Nonetheless, now that we are constantly connected to financial media, we are inundated with headlines designed to get “clicks” more than delivering real news. “Investor Resolutions For 2025” noted that investor psychology is the most significant driver of investing failure over time. This cycle of human emotions is continually repeated through investment cycles.

While many behavioral biases significantly negatively impact investor outcomes, from herding to loss avoidance to confirmation bias, “anchoring” is one of the most important.

The Anchoring Problem

“Anchoring is a heuristic revealed by behavioral finance that describes the subconscious use of irrelevant information, such as the purchase price of a security, as a fixed reference point (or anchor) for making subsequent decisions about that security.” – Investopedia

“Anchoring,” also known as the “relativity trap,” is the tendency to compare our current situation within the scope of our limited experiences. For example, I would be willing to bet that you could tell me exactly what you paid for your first home and what you eventually sold it for. However, can you tell me exactly what you paid for your first soap bar, hamburger, or pair of shoes? Probably not.

The reason is that the home purchase was a major “life” event. Therefore, we attach particular significance to that event and remember it vividly. If there was a gain between the purchase and sale price of the home, it was a positive event, and therefore, we assume that the next home purchase will have a similar result. We are mentally “anchored” to that event and base our future decisions around very limited data.

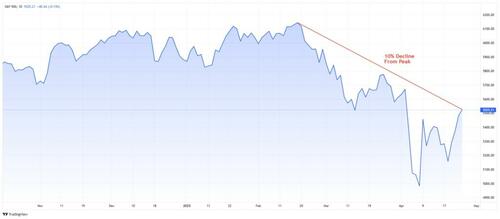

Today, investors are trained by the financial media to “anchor” to a fixed point in the market. Such is why investors consistently measure performance, relative to the market, from January 1st to December 31st. Or, worse, we measure performance from the peak of an advance. For example:

- The market is up 140% from the March 2020 lows.

- The market is down 10% from the 2025 peak.

- Or, the market is down 6% for the year.

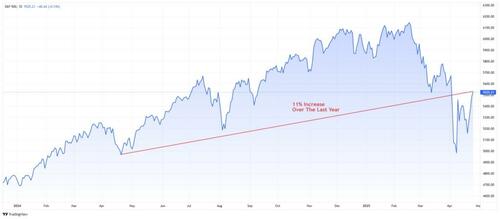

The problem is that most investors did not buy the 2020 bottom or sell the 2022 peak. However, one of the most significant forms of anchoring is portfolio “high water marks.” The high water mark is the peak value of an investor’s portfolio over a given time frame. For example, at the market’s peak in 2025, an investor had a portfolio value of $1,000,000. During the recent market correction, the portfolio value declined to $950,000. While that $50,000 loss is significant and is certainly concerning for that investor, it must be put into the context of what is happening in the markets.

- First, before the correction that started in February, the market had rallied nearly 5%. Therefore, our example investor started the year with a portfolio value of roughly $960,000 that grew to $1,000,000.

- Secondly, while the $50,000 decline is significant, the investor is “anchored” to the portfolio’s high-water mark.

- As noted above, the market is down 6% for the year, but the investor is at roughly the same level as he started this year.

- In other words, the portfolio return is roughly a loss of 1% versus a market decline of 6%.

Yes, a decline of $50,000 is significant, but these “anchor” points provide little perspective for the average investor regarding their relative position to their financial goals. However, these “anchors,” tied to constant media updates, feed our emotional decision-making processes driven by “greed” or “fear.”

Let’s take a look at an example:

As of Friday’s close, the market is down 10% from its all-time high.

As we warned about several times in 2024 and early this year, when a 10% correction eventually came, it would “feel” worse than it was because of the long period of low volatility.

Yes, it feels terrible. However, investors are now focusing on that “high-water mark.”

But this is the goal of the Wall Street marketing machine. Getting you to focus on current gains or losses creates a “sense of urgency” for you to do something. Why?

“Money in motion creates fees and revenue for Wall Street.”

Therefore, pushing you to take action may not necessarily be “profitable” for you, but it IS profitable for Wall Street.

Changing Your Anchor Point

To reduce your “emotional action button,” step back and change your “anchor” point.

If your portfolio is down 10% from the recent peak, ask yourself two questions:

- Am I losing money? Or,

- Is my portfolio still aligned with my investing goals?

If my goal is to average a 6% annualized return, where am I today relative to that goal? The issue of using the “high-water mark” as the “anchor” is that it resets psychologically to measure our performance from that level. Therefore, we should look back at where we were on a trailing one-year basis. If our goal was 6% a year, we almost doubled that goal over the last 12 months. All of a sudden, the recent decline doesn’t seem as significant.

However, let’s assume an investor was unlucky enough to have bought the market’s peak before the pandemic’s onset. Despite the pandemic shutdown, surging inflation, fears of recession, the Russia/Ukraine war, and every negative headline, the portfolio is still 63% higher. In other words, the portfolio has an annualized return of roughly 12%, double what was required to meet the needed financial goals.

The point here is that where you choose to “anchor” your analysis will significantly affect your emotional psychology when managing your money.

Yes, there has been a lot of volatility this year, but if I “anchor” my view to a longer-term time frame, the recent volatility is much less concerning.

Market perspective is essential.

Stick To Your Process

Does this mean you shouldn’t pay attention to your money or take action when things go wrong? Of course, not.

With the media fueling our fears 24/7, from “Fear Of Missing Out” to “Fear Of Losing It All,” it is difficult not to let our emotions get the better of us. However, “anchoring” our market perspective to a previous high-water mark or portfolio dollar value exacerbates our fragile emotional states.

In the “heat of the moment,” it is easy to get caught up in the emotional pull of markets and portfolio valuation changes. This past weekend’s #BullBearReport discussed the requirement of being more like Dr. Spock from Star Trek when managing your money.

“If I ask you what’s the risk in investing, you would answer the risk of losing money.

But there actually are two risks in investing: One is to lose money, and the other is to miss an opportunity. You can eliminate either one, but you can’t eliminate both at the same time. So the question is how you’re going to position yourself versus these two risks: straight down the middle, more aggressive or more defensive.

How do you avoid getting trapped by the devil? I’ve been in this business for over forty-five years now, so I’ve had a lot of experience.

In addition, I am not a very emotional person.In fact, almost all the great investors I know are unemotional. If you’re emotional then you’ll buy at the top when everybody is euphoric and prices are high. Also, you’ll sell at the bottom when everybody is depressed and prices are low. You’ll be like everybody else and you will always do the wrong thing at the extremes.” – Howard Marks

We all make “bad choices,” and we need guidelines to maintain our market perspective.

A sizable contingent of investors and advisors has never experienced a real bear market. After a decade-long bull market cycle fueled by central bank liquidity, mainstream analysis believes the markets can only go higher. What has always been a concern to us is the rather cavalier attitude toward risk that the media promotes.

“Sure, a correction will eventually come, but that is just part of the deal.”

What gets lost during bull cycles, and is always found most brutally, is the devastation caused to wealth during inevitable declines.

Therefore, it remains essential to follow your investment discipline. If you don’t have a process, here are the guidelines we follow during tough markets.

7-Rules To Follow

- Move slowly. There is no rush to make dramatic changes. Doing anything in a moment of “panic” tends to be the wrong thing.

- If you are overweight equities, DO NOT try to fully adjust your portfolio to your target allocation in one move. Again, after big declines, individuals feel like they “must” do something. Think logically above where you want to be and use the rally to adjust to that level.

- Begin by selling laggards and losers. These positions were dragging on performance as the market rose and they led on the way down.

- If you need risk exposure, add to sectors or positions performing with or outperforming the broader market.

- Move “stop-loss” levels up to recent lows for each position. Managing a portfolio without “stop-loss” levels is like driving with your eyes closed.

- Be prepared to sell into the rally and reduce overall portfolio risk. You will sell many positions at a loss simply because you overpaid for them to begin with. Selling at a loss DOES NOT make you a loser. It just means you made a mistake. Sell it, and move on with managing your portfolio. Not every trade will always be a winner. But keeping a loser will make you a loser of capital and opportunity.

- If none of this makes sense to you, please consider hiring someone to manage your portfolio for you. It will be worth the additional expense over the long term.

Keep your market perspective in check, avoid anchoring, and focus on your investment goals rather than market volatility.

-

Site: Crisis Magazine

The smoke has cleared from the Sistine Chapel, and Pope Leo XVI has been elected to lead the Catholic Church into an uncertain future. As Catholics around the world look to Rome with a mixture of hope and trepidation, one question emerges above all others: How do we navigate the turbulent waters ahead? For more than four decades, Crisis Magazine has been a steady compass for faithful Catholics…

-

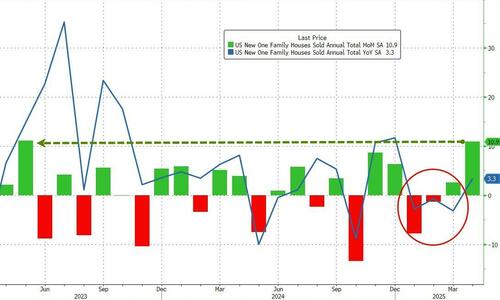

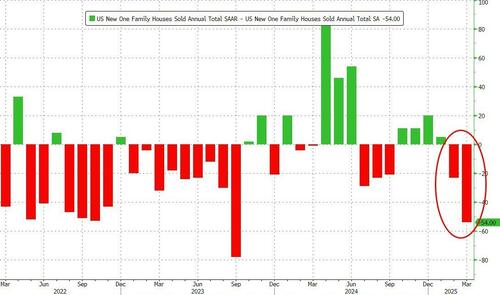

Site: Zero HedgeUS New Home Sales Surged In April Despite Slump In Homebuilder ConfidenceTyler Durden Fri, 05/23/2025 - 10:18

Despite the plunge in homebuilder confidence, US New Home Sales soared in April to 743k SAAR...

The 10.9% MoM surge in sales in April (versus a 4.0% MoM expected decline) was bolstered by a big downward revision in March from +7.4% MoM to just +2.6%...

This is the biggest beat since August 2022... and the second big downward revision in a row...

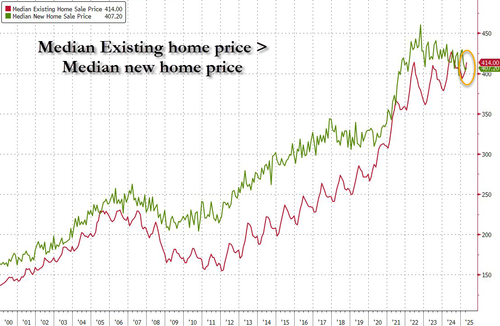

Meanwhile, the median new home sales price decreased 2% from a year ago to $407,200 (on an annual basis, prices have largely been retreating over the past 12 months) and is now back below existing home sale prices...

This month, 34% of builders reporting cutting prices, the largest share since December 2023, according to recent data from the National Association of Home Builders.

The surge in new home sales comes as mortgage rates tumbled...

So, don't hold your breath for a recovery - rates are rising once again!

-

Site: Zero HedgeUS New Home Sales Surged In April Despite Slump In Homebuilder ConfidenceTyler Durden Fri, 05/23/2025 - 10:18

Despite the plunge in homebuilder confidence, US New Home Sales soared in April to 743k SAAR...

The 10.9% MoM surge in sales in April (versus a 4.0% MoM expected decline) was bolstered by a big downward revision in March from +7.4% MoM to just +2.6%...

This is the biggest beat since August 2022... and the second big downward revision in a row...

Meanwhile, the median new home sales price decreased 2% from a year ago to $407,200 (on an annual basis, prices have largely been retreating over the past 12 months) and is now back below existing home sale prices...

This month, 34% of builders reporting cutting prices, the largest share since December 2023, according to recent data from the National Association of Home Builders.

The surge in new home sales comes as mortgage rates tumbled...

So, don't hold your breath for a recovery - rates are rising once again!

-

Site: Zero Hedge"We're In The 3rd Inning Of The Global Currency Death Spiral" - Rubino Sees Gold Topping $10,000Tyler Durden Fri, 05/23/2025 - 10:05

Via Greg Hunter’s USAWatchdog.com,

Analyst and financial writer John Rubino has a new warning concerning Trump’s “Big Beautiful Bill” making its way through Congress and Moody’s downgrade of US debt. The Big Beautiful Bill is going to explode the debt by $20 trillion in the next 10 years, and the credit downgrade has people like billionaire investment fund founder Ray Dalio worries about money printing to pay the $1.5 trillion in interest on federal debt.

Rubino warns, “The story with Moody’s downgrade isn’t that they did it, that they moved the US from triple A (Aaa) to one notch below (Aa1). It’s kind of insane that a government with 125% of GDP has an investment rating at all. Right?"

" They are clearly baking a gigantic currency crisis into the cake. Ray Dalio gets it right.

The rating agencies excuse or explanation for why the US still has an investment grade credit rating is that a country with a printing press can never default because it can just print enough money out of thin air to pay interest on its bonds, and it can do that forever.

So, it’s triple A credit, which does not make any sense at all because if you just print a lot of money out of thin air to pay your debts, then your currency goes down in value, and you are paying back your creditors with depreciating currency, which is a form of default.

The credit rating agencies are only looking at one kind of default where we just stop paying.

They are not looking at paying with cheaper currency year after year, and we stiff our creditors that way.

That’s why you don’t want to own Treasury bonds.

They are not going to stop paying interest, but the interest will not cover inflation going forward. So, you will have a net real loss until they just crater, and then you will have a massive capital loss.”

On top of that, interest rates have been rising and not falling. The 30-year mortgage rate is now just under 7% again. Rubino says,

“We went back up to unsustainable interest rates really quickly. . . .

The Fed has promised a couple of rate cuts this year, and for interest rates to go up while the Fed is inferring easing means we are risking losing control of the financial markets.

If the Fed can’t control interest rates, we are monumentally screwed as a financial system. That’s kind of what we are headed for now.

In the US, interest rates are going back up, but if you want to look at an extreme case, look at Japan. They don’t just have 30-year bonds, they have 40-year and 50-year bonds and those are cratering, which is to say the interest rates on those bonds are spiking. Long term Japanese bonds used to be 0%. Now, they are 3% and change. . . . That change is huge.

So, Japan, the US, Europe, the UK and China, all of these big countries are basically making the same mistakes, and they are all headed in the same direction.

We are in the early stage of a currency death spiral where interest rates start to go up and the government can’t control that and then their debt goes parabolic . . . and this goes until everything breaks down.

We are in the third inning of that game, and the last couple of innings are going to be hair raising.

There are going to be currency crises, which we have never seen in our lifetimes. . . . It will be fun times if you are a gold bug.”

Rubino thinks gold will go up in price way over $10,000 per ounce, and he also expects silver to take off too. Rubino says,

“Silver is a great story because it is an industrial metal that is in deficit. Industrial uses are taking more silver off the markets than what they are producing, and that is going to lead to a shortage.

Even if you don’t look at silver as a monetary metal, the industrial demand makes it a buy right now.”

Rubino does not think the US will be in a civil war, but Europe is going authoritarian, and civil war is most likely there if Russia does not blow them up first. Rubino thinks America will do better than Europe, but we will still have trouble, chaos and a financial reset to work through.

There is much more in the 46-minute interview.

Join Greg Hunter as he goes One-on-One with financial writer John Rubino of the popular site called Rubino.Substack.com for 5.20.25.

To Donate to USAWatchdog.com, Click Here

John Rubino is a prolific financial writer, and you can see some of his work for free at Rubino.Substack.com.

-

Site: Mises InstituteWe would do well to remember the main lesson from World War I: there is no “honor” in warfare. It is pure murder.

-

Site: Steyn OnlineProgramming note: On Saturday, please join me for a rather Victorian episode of our Serenade Radio weekend music show, On the Town. The fun starts at 5pm British Summer Time - which is 6pm in Western Europe and 12 noon North American Eastern. You can

-

Site: Steyn OnlineProgramming note: I'll be back this evening, Friday, with the conclusion of our eighth-birthday Tale for Our Time, Three Men on the Bummel by Jerome K Jerome. And tomorrow, Saturday, please join me for a rather Victorian episode of our Serenade Radio

-

Site: Steyn OnlineWho owes one million dollars now?

-

Site: Zero HedgeFutures Plunge After Trump Threatens 25% Tariff On Apple, 50% On Europe; Bonds & Bullion BidTyler Durden Fri, 05/23/2025 - 09:55

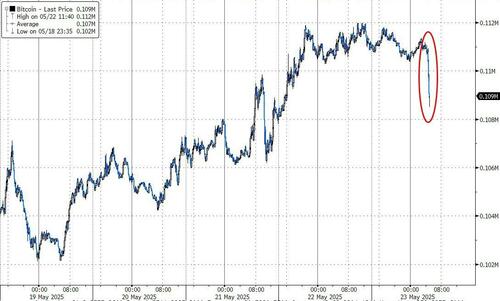

It was set to be a relatively quiet day, with stock futures unchanged, yields modestly lower, bitcoin just shy of record highs... and then Trump woke up.

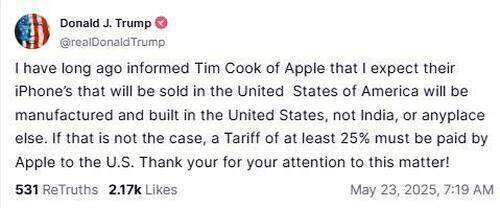

First, in a post on his Truth Social just after 7:20am ET, the clearly angry president said that unless iPhone that are sold in the US are not also built in the US, then a "Tariff of at least 25% must be paid by Apple to the U.S."

The comment immediately wiped out tens of billions in value from AAPL stock, which tumbled $10 to $193, or more than 4%...

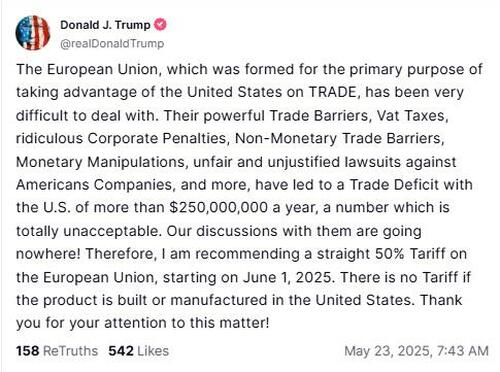

... and while the news also dragged broader futures lower, Trump saved his second market punishment for 25 minutes later when at 7:45am ET, the president doubled down on his post-awakening stream of Truth Social consciousness and wrote that he is "recommending a straight 50% Tariff on the European Union, starting on June 1, 2025. There is no Tariff if the product is built or manufactured in the United States."

His ire was likely triggered by overnight reports that EU talks with the US had gone nowhere, which is why he said that Europe's "powerful Trade Barriers, Vat Taxes, ridiculous Corporate Penalties, Non-Monetary Trade Barriers, Monetary Manipulations, unfair and unjustified lawsuits against Americans Companies, and more, have led to a Trade Deficit with the U.S. of more than $250,000,000 [sic] a year, a number which is totally unacceptable."

The post slammed S&P futures which were already reeling from the AAPL news, and spoos tumbled about 100 points lower from where they were just minutes earlier.

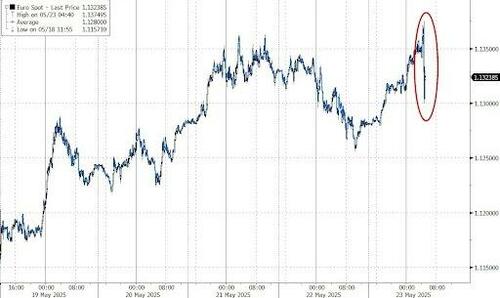

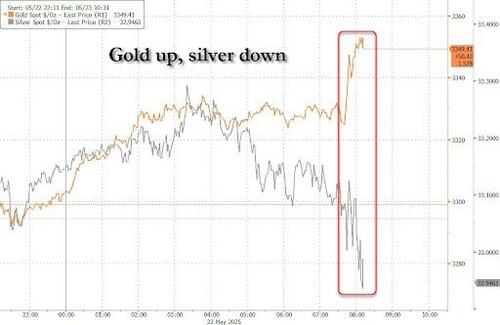

The news also slammed bond yields, the euro, European stocks, crude, and bitcoin...

... while gold was the only asset that rose on the renewed trade war escalation.

VIX spiked back above pre-Liberation Day lows...

Now, we wait to see if 'retail' will step back in to save the day (because macro hedge funds have been positioning for just this kind of Trump-driven turmoil)

The sudden shift in Trump's temperament, not to mention markets, underscores the ongoing risk that shifts in US policy can abruptly upend market dynamics at short notice. Markets had rebounded in recent weeks on optimism that Trump was softening his approach to the tariffs and investor attention had shifted to concerns about the ballooning US debt and deficits.

“It’s going to keep markets on edge,” said Aneeka Gupta, head of macroeconomic research at Wisdom Tree UK Ltd. “Markets were hoping news on tariffs had abated until at least the 90-day pause expired, but that’s clearly not the case. Uncertainties are here to stay. We’re in for a period of very high volatility.”

The rest of this post was going to be the a recap of the overnight news, but obviously none of that matters now that Trump decided to take a nuke to newsflow and blow everything up.

As US traders were scrambling to pick up the pieces of wtf just happened, European stocks were dumping, while traders ramped up bets on further ECB monetary easing after dire wage data earlier. Money markets priced in 65 bps of additional easing in 2025, which implies three quarter-point rate cuts at the ECB’s remaining five scheduled decisions is most likely. Traders favored just two such reductions before Trump’s social media posts.

“I think a lot of people see it as just another Trump tweet, which can be cancelled by another one in a few hours or a few days,” David Kruk, head of trading at La Financiere de L’Echiquier. “I don’t think a lot of European investors are selling on the news.” The same can no be said for US - or certainly crypto investors - who clearly relish this kind of rollercoaster idiocy.

Kruk said the bigger issue for investors remains the budget credibility of the US. Bond markets this week have jolted after Moody’s Ratings stripped the US of its top credit rating and the House’s approved a tax bill that is likely to increase the debt burden.

This week’s selloff in long-dated Treasuries presents a “great entry point” for buyers with the 30-year yield above 5%, according to Bank of America Corp. strategist Michael Hartnett.

The US government is likely to heed warnings from bond vigilantes, who are “incentivized to punish the unambiguously unsustainable path of debt and deficit,” the strategist said.

The Stoxx 600 is little changed as gains in mining and travel shares are offset by losses in insurance and consumer products. Here are the biggest European movers (or at least until the Trump tweets):

- GSK shares climb as much as 1.3% after the British drugmaker won US approval for Nucala as an add-on treatment for some patients with chronic obstructive pulmonary disease (COPD).

- Lundbeck shares rise as much as 5.7% after Kepler Cheuvreux initiated coverage on the stock with a buy recommendation, saying the valuation doesn’t reflect the “full value” of the Danish pharma company’s late-stage pipeline.

- PVA TePla gains as much as 12% after Deutsche Bank raises recommendation on the chip equipment firm to buy from hold, seeing the firm positioned to deliver structurally higher returns from 2026 onwards.

- AJ Bell shares jump as much as 10%, the most in a year, after the investment platform beat expectations in the first half and said annual results should come in above guidance. Shares are now trading at their highest level since December.

- PolyPeptide shares jump as much as 11%, among the top performers in the Swiss Performance Index on Friday morning, after the Swiss contract development and manufacturing organization secured additional financing under its revolving credit facility.

- Azimut gains as much as 5.3%, the most in more than a month, after the Italian asset manager raised its profit outlook for the year and flagged a deal with private equity fund FSI for a digital bank called TNB.

- European mining stocks are the best performers in Europe’s Stoxx 600 benchmark on Friday, as a Treasuries selloff eased, lifting base metals prices.

- KGHM gains as much as 4.2% as Poland’s plans to lower copper tax is set boost the metal producer’s output.

- Thule gains as much as 7.7% after Nordea upgrades to buy from hold, saying the year-to-date drop in the Swedish outdoor equipment maker’s share price offers an attractive entry point.

- Yellow Cake shares jump as much as 8.3%, climbing to its highest level since January, amid reports US President Donald Trump will sign multiple nuclear-related executive actions as soon as Friday.

- Games Workshop shares fall as much as 4.1%, slipping further from a recent record high, after the maker of the Warhammer tabletop game gave a trading update, with analysts pointing to a sparser games release slate for next year and several headwinds, including tariffs.

- Matas falls as much as 11% after full-year earnings from the Danish cosmetics retail group disappointed. DNB Carnegie analysts noted a “soft set of results,” that fell short on several key metrics, including revenues.

Asian equities rebounded, putting them on track for a sixth week of gains, as risk appetite recovers on encouraging progress in trade negotiations. The MSCI Asia Pacific index rose as much as 0.7%, with Japanese shares including Nintendo, Mitsubishi Heavy and Hitachi among the biggest boosts. The Philippines’ stock benchmark jumped 1.7%, recouping Thursday’s loss spurred by a call for the cabinet to quit. Stocks also advanced in India. Investors are looking past worries over US fiscal deficit that had weighed on regional equities throughout the week. Assurances of open communication between US and China also helped lift sentiment.

In FX, the Bloomberg Dollar Spot Index eyes its lowest close since December 2023 as it falls 0.5% on concerns over the US fiscal outlook. The drop accelerate after Trump's tweets. The Swedish krona leads G-10 currencies against the greenback, rising 1%. The pound adds 0.6%, briefly touching a fresh three-year high of $1.35. The euro also climbs 0.6%. Meanwhile, mainland Chinese shares bucked the trend, falling 0.8%. Benchmarks in Taiwan and South Korea also ended slightly lower.

In rates, treasuries extdended their gains, with the 10Y sliding as low as 4.45% after hitting 4.62% yesterday, before moving modestly higher. 30-year yields fell 2 bps to 5.02% having reached 5.15% during Thursday’s session. Longer dated maturities also outperform in Europe with UK and German 30-year borrowing costs falling 2-3 bps each.

In commodities, oil prices are of course in the red, with WTI falling 0.3% to $61 a barrel, because Trump wants to make sure there is zero capex in the shale patch and watch production crater, sending oil to triple digits in a year or so when the bullwhip effect from his punitive policies finally catches up. Spot gold climbs $39 to around $3,333/oz. Bitcoin is steady just above $111,000.

On today's calendar we get New Home Sales and the Kansas Fed.

Market Snapshot

- S&P 500 -1.5%

- Nasdaq 100 mini -1.8%

- Stoxx Europe 600 -2%;

- 10-year Treasury yield -5 basis point at 4.48%

- VIX 24.54

- Bloomberg Dollar Index -0.5% at 1214.85

- euro +0.5% at $1.1337

- WTI crude -0.5% at $60.9/barrel

Top Overnight News

- Trump threatens Apple with 25% tariffs, EU with 50% tariffs

- Trump is to sign orders to boost nuclear power as soon as Friday and will invoke a wartime act over US uranium independence, according to sources.

- Trump’s trade negotiators are pushing the EU to make unilateral tariff reductions on US goods, saying without concession the bloc will not progress in talks to avoid additional 20% “reciprocal” duties. FT

- Bank of Japan Governor Kazuo Ueda said on Thursday the central bank will closely monitor market moves as yields on super-long Japanese government bonds (JGB) reached record highs this week. RTRS

- The U.S. and China agreed to keep lines of communication open, following a call between senior officials Thursday, signaling continued high-level engagement as both sides work toward a broader deal. CNBC

- China has lowered the ceilings on deposit rates, three banking sources with direct knowledge of the guidance said on Friday, as authorities seek to protect banks' profit margins and discourage savings. RTRS

- Big investors say they are diversifying their bond portfolios to include greater exposure to markets outside the US as Trump’s trade war and the country’s growing deficit erode the appeal of the world’s biggest debt market. FT

- Japan’s key inflation gauge accelerated to 3.5% in April, the fastest clip in more than two years, fueled by rising food and energy costs. BBG

- Germany’s Q1 GDP is revised higher from +0.2% Q/Q to +0.4% thanks to a rush of activity as companies attempted to get ahead of Trump’s tariffs. WSJ

- UK retail sales gained 1.2% in April, continuing a surprisingly strong start to the year. Consumer confidence rose to -20 in May, GfK said, also beating estimates. BBG

- Big US banks (including JPM, BAC, C, and WFC) are exploring whether to team up to issue a joint stablecoin, a step intended to fend off escalating competition from the cryptocurrency industry. WSJ

- BofA Flow Show: USD 1.8bln outflows from US equities, USD 4bln from Japanese equities, inflows into European equities for a six week, EM saw largest inflow in 14 weeks

Tariffs/Trade

- US Deputy Secretary of State Landau spoke with Chinese Vice Foreign Minister Ma on Thursday and acknowledged the importance of the bilateral relationship to the people of both countries, while they discussed a wide range of issues of mutual interest and agreed on the importance of keeping open lines of communication.

- US President Trump is pushing the EU to cut tariffs or face extra duties with US negotiators to tell Brussels they expect unilateral concessions, while USTR Greer is preparing to tell EU counterpart Sefcovic that recent "explanatory note" falls short of US expectations, according to FT.

- Japanese PM Ishiba said he held a call with US President Trump in which they discussed tariffs, diplomacy and security, while there might be an occasion where he visits the US for in-person talks with Trump. Furthermore, Ishiba said there are no changes to Japan's stance on US tariffs and demand for the elimination of tariffs, nor to Japan's policy of talking with the US on creating US jobs.

- Japan’s chief tariff negotiator Akazawa reiterated there is no change to stance on requesting elimination of US tariffs, but noted they aim to reach an agreement, while he plans to visit the US around May 30th for the fourth round of trade talks, according to sources cited by Reuters.

- Japan is to reportedly propose investments by Nippon Steel (5401 JT) in tariff talks with the US, according to NHK.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly in the green albeit with gains in the region capped following the indecisive performance stateside where participants digested PMI data and the House approved US President Trump's tax bill to send it to the Senate. ASX 200 eked mild gains as the strength in real estate, energy, tech, telecoms and financials was partially offset by losses in defensives and miners. Nikkei 225 returned to above the 37,000 level with the index unfazed by the firmer-than-expected Core CPI data, while Japanese Economy Minister Akazawa is visiting the US for a third round of talks and is reportedly planning to visit again late next week for a fourth round of discussions. Furthermore, Japanese PM Ishiba had a call with US President Trump and discussed US tariffs, diplomacy and security although no major developments were announced. Hang Seng and Shanghai Comp gained but with advances in the mainland limited in the absence of any fresh significant macro drivers, although there were some talks between the US and China at a deputy ministerial level, in which the US Deputy Secretary of State spoke with his Chinese counterpart on Thursday and discussed a wide range of issues of mutual interest. The two agreed on the importance of keeping open lines of communication.

Top Asian News

- China reportedly lowers deposit rate ceiling to protect banks' interest margins, according to Reuters sources.

- Philippine Central Bank Governor said they are looking at cutting holdings of US Treasuries, while he added they are looking at two more rate cuts which would not necessarily be consecutive and noted that a rate cut is on the table for June.

- Indian economic growth is on track, according to Reuters sources.

- Fast Retailing (9983 JT) 6M (JPY): Net Profit 233.57bln, +19.2% Y/Y, Op. Profit 304.22bln, +18.3% Y/Y; affirms FY24/25 outlook.

- China Vice Premier He Lifeng says China's economy continues to show an upward trend; growth potential of the primary, secondary and tertiary industries are being released, via Xinhua; The economy has shown great resilience and vitality

European bourses opened incrementally firmer and trudged higher throughout the morning - though more recently, some downside has been seen to display a mixed picture in Europe. European sectors opened without a clear bias, but have since moved to a strong positive direction. Basic Resources tops the pile, joined closely by Travel & Leisure and then Healthcare. Retail lags. US equity futures are flat/modestly firmer, following similar price action seen in Europe. Docket ahead is lacking in terms of Tier 1 data, but the focus will be on Fed speak from Musalem and Cook.

Top European News

- ECB's Rehn said a June rate cut is appropriate if backed by data, via Kathimerini.

- ECB's Stournaras said he sees a June rate cut and then a pause, via Kathimerini

- EU confirms it will soon delay bank trading rules by one year, according to Bloomberg.

- UK's OFGEM says from 1 July to 30 September 2025 price for energy for the typical household will go down by 7% to GBP 1,720/yr; this is 9% higher than the price cap set for the same period last year.

FX

- This week's downtrend for the USD has resumed. For today's session, the calendar is light in terms of tier 1 data but Fed's Goolsbee, Musalem, Schmid and Cook are all due on the speaker slate. DXY has just slipped below the bottom end of Thursday's 99.44-100.11 range.

- EUR is capitalising on the softer USD with EUR/USD back on a 1.13 handle. Today's detailed release of Q1 German GDP exceeded expectations but failed to engineer much in the way of additional support from the EUR given that the beat was attributed to front-loading ahead of expected tariff actions by the Trump admin. On the trade front, the FT has reported that US President Trump is pushing the EU to lower tariffs or face additional duties with US negotiators to tell Brussels they expect unilateral concessions. On the speaker front, ECB dove Stournaras has stated that he sees a June rate cut and then a pause, whilst Rehn has backed a June rate reduction, data permitting. The pair was little moved to the latest ECB Wage Tracker. EUR/USD currently around 1.1337.