Homosexuality is incompatible with the priestly vocation. Otherwise, celibacy itself would lose its meaning as a renunciation.

Distinction Matter - Subscribed Feeds

-

Site: Catholic Conclave“Initially he had thought about the possibility of calling himself Augustine, but, in the end, he thought Leo would be better”. Cardinal Fernando Filoni, who was also present at the Conclave, said this in an interview with Il Fatto Quotidiano. The reason for this thought is easy to say and is linked to Prevost’s vocation.In the solemnity of the moment, when the world heard the name of the new Catholic Conclavehttp://www.blogger.com/profile/06227218883606585321noreply@blogger.com0

-

Site: AsiaNews.itHundreds of people rallied demanding justice for Amshika who took her own life after 'months of official neglect and public shaming'. A teacher accused in connection with the affair was later released. A political cover-up is suspected. The story is highlighting the shortcomings of Sri Lanka's education system, as well as the pervasiveness of gender-based violence.

-

Site: LifeNews

More than a decade before he was elected and addressed the media as pontiff, Pope Leo XIV had spoken about evangelization amid modern media in an address that is still accessible, a Vatican expert spotlighted this week.

In 2012, then-Father Robert Prevost gave an address at a Synod about evangelization convened by Pope Benedict XVI, Sandro Magister explained in a May 13 article for his blog. The address considers how several Church Fathers responded to the non- and anti-Christian media of their time, which in turn provides insight for evangelizing amid the present-day’s media culture.

Please follow LifeNews.com on Gab for the latest pro-life news and info, free from social media censorship.

Magister described then-Fr. Prevost’s remarks as “astonishing, for the acuteness of the diagnosis of the mediatic distortions of today’s society, but even more for the reference to the Fathers of the Church — from Augustine to Ambrose and Leo the Great to Gregory of Nyssa — as teachers brilliant in taking up the challenges of communication of their time, and therefore in understanding how to best evangelize the society of the late empire.”

In his address during the 2012 Synod on Evangelization, then-Fr. Prevost said that mass media in the West “is extraordinarily effective in fostering within the general public enormous sympathy for beliefs and practices that are at odds with the Gospel; for example, abortion, homosexual lifestyle, euthanasia.”

Mass media may be tolerant of religion when the latter does not directly contradict the media’s positions on ethical problems, but if religious leaders do speak out, the media label their messages “as ideological and insensitive in regard to the so-called vital needs of people in the contemporary world,” he said.

In order to effectively evangelize against media-created ethical falsehoods, catechists and religious leaders need to develop better understanding of laboring amid the current media climate, he urged.

Church Fathers were successful in evangelizing “in great part because they understood the foundations of social communication appropriate to the world in which they lived,” then-Fr. Prevost said. “Consequently, they understood with enormous precision the techniques through which popular religious and ethical imaginations of their day were manipulated by the centers of secular power in that world.”

Magister shared the full text of the address, which can be accessed here.

LifeNews Note: McKenna Snow writes for CatholicVote, where this column originally appeared.

The post In 2012, Pope Leo XIV Slammed the Media for Its Liberal Bias and Promoting Abortion appeared first on LifeNews.com.

-

Site: LES FEMMES - THE TRUTH

-

Site: LifeNews

Prosecutors dropped charges May 9 against an Ohio pro-life advocate who was arrested in December for providing a Christian witness with a megaphone outside an abortion facility.

CatholicVote previously reported that Zack Knotts was on a public sidewalk outside a Cuyahoga Falls abortion facility and using a megaphone to advocate for the unborn and to tell women entering the facility, “There’s hope in the Gospel of Jesus Christ for all of you.”

Police then approached Knotts and ordered him to go with them, later telling him that they had received complaints of “disorderly conduct” that caused “inconvenience, annoyance, or alarm” to those around him.

Please follow LifeNews.com on Gab for the latest pro-life news and info, free from social media censorship.

Knotts appeared in court Jan. 2 and pleaded not guilty to the charges. Represented by the American Center for Law and Justice (ACLJ), he stood trial May 9. The prosecutors ultimately dismissed the charges.

According to the ACLJ, pro-abortion advocates outside the clinic had been loudly shouting violent threats at Knotts and his wife, Lindsay Davis-Knotts, but the police targeted him instead. ACLJ stated that the police did not take statements from anyone except a fellow police officer acting as private security at the abortion facility. The police ignored other witnesses, did not corroborate claims against him, and refused to acknowledge video evidence that Knotts was innocent, the ACLJ added.

“Zack and Lindsay never left the public sidewalk. They never blocked access to the abortion clinic. They never threatened anyone,” the ACLJ stated. “The same cannot be said for those who tried to silence them. What happened here wasn’t just a mistake — it was a warning shot to pro-lifers everywhere: ‘Speak out, and we’ll come for you.’ But today’s dismissal shows what can happen when you refuse to back down.”

In an emailed statement, Knotts told CatholicVote that he and his wife are “overwhelmed with gratitude to God.”

“As we walked into that courtroom, I carried a deep, unshakable peace — because I knew God would fight for me. And He did,” Knotts said. “He showed up in power, and so did the army of friends, family, and faithful saints who have stood beside us, many of whom labor shoulder-to-shoulder with us on the sidewalks outside abortion clinics. Though the process at times felt like a heavy weight — just the constant cloud of waiting for resolution — we never walked alone. God sustained us.”

Quoting Proverbs 24:11 and 31:8-9, which are commands to defend the defenseless, he stated that an effort must be made to end abortion once and for all.

“We will not stop. We will obey what God has commanded and defy tyrants. We will continue to be a voice for the voiceless, to rise and speak for those who have no defender,” he said. “And we call on the church — the body of Jesus Christ — to wake up. This isn’t a suggestion; it’s a command. We are all called to this. Silence in the face of child sacrifice is complicity.”

LifeNews Note: Hannah Hiester writes for CatholicVote, where this column originally appeared.

The post Charges Dropped Against Pro-Life Pastor for Preaching Outside Abortion Center appeared first on LifeNews.com.

-

Site: RT - News

Finland has proposed raising the maximum age of reservists from 50 to 65 amid wider militarization within the EU

The Finnish Defense Ministry has submitted a proposal to raise the maximum age for military reservists to 65, according to a press release published on Wednesday. The move is part of a broader militarization trend among European NATO member states.

The proposed reform would apply to all citizens liable for being called up who were born in 1966 or later, potentially adding 125,000 personnel to Finland’s reserve forces over a five-year transition period. If enacted, the total number of reservists is projected to reach one million by 2031, the Defense Ministry noted.

Currently, rank-and-file soldiers are removed from the reserves at age 50, while officers exit at 60. The proposal would not apply retroactively to those already over 60.

According to the ministry, refresher training for 50–65-year-olds would be organized for those assigned wartime duties. No upper age limit would be set for military service volunteers.

The bill is expected to be submitted to the Finnish Parliament before its summer recess begins in late June.

The EU countries, including Finland, have been militarizing amid persistent claims that Russia could attack the bloc in the coming years. Moscow has denied having such intentions and has accused NATO and EU officials of “irresponsibly stoking fears” of a fabricated threat.

Read more NATO militarization pressure mounts ahead of summit – Bloomberg

NATO militarization pressure mounts ahead of summit – Bloomberg

Finland, which shares a long land border with Russia, applied for NATO membership in 2022 following the escalation of the Ukraine conflict and formally joined the US-led military bloc in 2023. Since then, Helsinki has supported Kiev politically and militarily, with Finnish President Alexander Stubb backing its bids to join both NATO and the EU.

In March, during US-mediated ceasefire negotiations, Stubb called on Kiev’s Western backers to pump Ukraine with weapons and money “to its teeth.”

Helsinki exceeded NATO’s spending target by shelling out approximately 2.41% of its gross domestic product (GDP) on the military last year. Finland also formalized an agreement with the US that allows American forces access to Finnish bases near the Russian border.

Russia has lamented that Finland’s NATO accession has effectively erased beneficial bilateral ties between the two neighbors which had lasted decades. Moscow has condemned the US-led military bloc’s expansion towards its borders, viewing it as a threat to its national security.

READ MORE: Germany could reintroduce military draft – defense minister

In March, Foreign Ministry spokeswoman Maria Zakharova said the EU had “degraded into an openly militarized entity,” accusing the bloc of “inciting war” through its rearmament strategies.

-

Site: Zero HedgeUS Factory Production Tumbled In April, But...Tyler Durden Thu, 05/15/2025 - 10:10

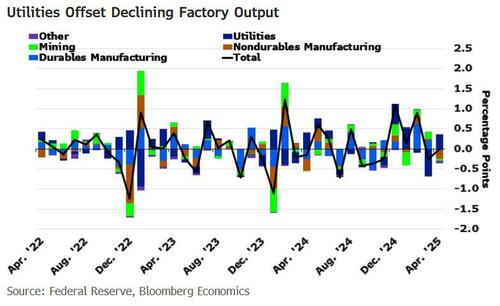

Headline industrial production held steady in April, driven by utilities production, while manufacturing production declined 0.4% due to decreased production of vehicles and nondurable goods.

Source: Bloomberg

The 0.4% decrease in manufacturing production (followed an upwardly revised 0.4% gain a month earlier) was the first decline since October 2024 and worse than the expected 0.3% decline...

Source: Bloomberg

However, as the chart above shows, despite the decline, upward revisions raised production by 1.2% YoY - the biggest rise since Oct 2022 (tariff-front-running?).

Output at utilities increased, while mining and energy extraction dropped.

The decrease in April factory output reflected declining production of motor vehicles, computers and apparel.

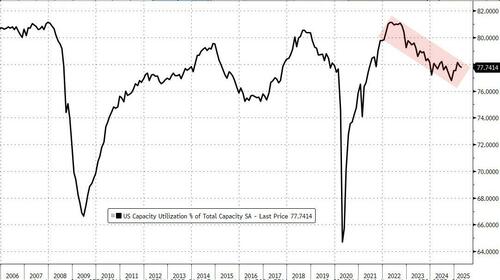

The Fed’s report showed capacity utilization at factories, a measure of potential output being used, fell to 76.8%.

Does April's decline mean we reached peak tariff-front-running? And will that drag down 'hard' data?

-

Site: Mises InstituteHomeschooled children are educated more effectively than public school students and at a fraction of the cost of public education. Naturally, the government wants to destroy it, with Illinois currently leading the anti-homeschooling mob.

-

Site: RT - News

Support for refugees has dropped significantly, with many now reportedly being told to “go back to Ukraine”

Public sentiment in Poland toward Ukrainian refugees has deteriorated over the past three years, with a growing number of Poles now calling for them to return to Ukraine, according to media reports.

Support for Ukrainian refugees in Poland has declined sharply, a March 2025 poll by the CBOS Center showed, with only 50% of Poles in favor of accepting them – well below the 81% recorded two years earlier.

Warsaw, which has been one of Ukraine’s main backers since the escalation of the conflict with Russia in 2022, initially willingly accepted more than a million refugees from the neighboring state.

Social tensions have been mounting as some citizens reportedly perceive Ukrainian immigrants as freeloaders and potential criminals. Government data shows that at least 2.5 million Ukrainians reside in Poland, making up nearly 7% of the country’s population.

Oksana Pestrykova, a refugee support coordinator in Warsaw, told The Times on Wednesday that the atmosphere had been much more welcoming three years ago, and that Ukrainians now tend to avoid speaking their own language in public or on public transport.

“People are saying that children at school and people in line for an appointment with a doctor are telling them to go home to Ukraine,” she said.

Another Ukrainian resident told the BBC that anti-Ukrainian sentiment has surged in recent months, with reports of abuse on public transport, school bullying, and xenophobic content online.

“At work, many people have been saying Ukrainians come here and behave badly. And my Ukrainian friends say they want to go home because Polish people don’t accept us. It’s frightening to live here now,” one refugee told the outlet.

Read more Ukrainians who moved to the West not coming back – MP

Ukrainians who moved to the West not coming back – MP

Tensions have been heightened by a divisive presidential election campaign in Poland, with the first round of voting set for Sunday.

Far-right politician Slawomir Mentzen, polling in third place, has taken a strongly anti-Ukrainian stance and backs striking a peace deal with Russia.

Conservative candidate Karol Nawrocki, currently in second, opposes Ukraine’s membership in the EU and NATO as well as financial aid for refugees, although he supports continued military assistance for Kiev.

Leading the race is Rafal Trzaskowski, aligned with Prime Minister Donald Tusk’s coalition and seen as the most pro-Ukrainian contender, although he too has pledged to cut social benefits for Ukrainian nationals.

Roughly one million Ukrainians are officially registered as having arrived since 2022, and Poland has allocated 4.2% of its GDP to their support, according to the BBC.

-

Site: Steyn OnlineGreetings one and all and welcome to this week's edition of Laura's Links. I'll start off by riffing a little on Mark's theme of "as I said twenty years ago". My variation on that theme has been trying to explain very slooooooowly to anyone who will listen, for the past twenty or so years, that Canada is going the way of Europe...

-

Site: Steyn OnlineJust ahead of Episode Fourteen of Three Men on the Bummel, thank you again for your kind comments upon The Mark Steyn Club's eighth birthday. Paul Smith, a Steyn Clubber from southern England, writes: Happy birthday MSC from a fellow May baby. I was

-

Site: Rorate CaeliA Pope of the AnglosphereJoseph ShawPresident, Una Voce Federation (FIUV)During the reign of Pope Francis, a lot of attention was, rightly, given to his Argentinian background, and the Argentinian assumptions and habits of minds that he may have carried. I am grateful to our Argentinian friends who helped us to understand what was going on, during a rather confusing time. Now we have a Pope from New Catholichttp://www.blogger.com/profile/04118576661605931910noreply@blogger.com

-

Site: AsiaNews.itDuring the official visit of the Malaysian prime minister, the two countries rebooted their historic economic, technological and cultural cooperation. Malaysia remains non-aligned in global power politics. Anwar said he raised the issue of flight MH17 shot down in 2014, after a UN body recently blamed Russia for the incident.

-

Site: LifeNews

Planned Parenthood’s leaders launch into its 2023-2024 annual report with a markedly sad tone: “It’s been over two years since the U.S. Supreme Court took away our constitutional right to abortion.”

Very quickly, however, readers can see the truth: that never before in its history has the abortion giant been so well-funded by American taxpayers, and never before has it ended more unborn lives than this past year – nearly three years since the Supreme Court held there is no right to abortion in the US Constitution.

“Abortion bans have made pregnancy more dangerous, put patients and providers at risk for criminalization, and even caused some women to lose their lives,” Planned Parenthood CEO Alexis McGill Johnson and Board Chair Tanuja Bahal claim, repeating an already-debunked narrative in the report’s introduction.

Follow LifeNews on the MeWe social media network for the latest pro-life news free from Facebook’s censorship!

According to the report released Monday, in year 2023-2024, America’s largest abortion provider ended 402,230 pregnancies – its highest number yet – and took in $792.2 million in taxpayer funds in the form of government health services reimbursements (such as through Medicaid) and grants.

Those taxpayer funds provided 39% of Planned Parenthood’s total revenue of $2 billion – its single greatest source of income during the past year.

In comparison, Planned Parenthood’s prior year annual report showed it performed 392,715 abortions, with 34% of its revenue provided by taxpayer funds.

“The more it collects, the more it kills,” Catholic pro-life nonprofit American Life League (ALL) posted Tuesday.

“Leave it to Planned Parenthood to reveal their billions of dollars in abortion income on the heels of Mother’s Day weekend,” said ALL National Director Katie Brown Xavios, who referred to the move as “horrifically inappropriate.”

“We didn’t need any other concrete reasons to defund them,” Xavios added, “but $792,200,000 in federal tax dollars should tip the scale. We revealed in our recent 2025 Report on Planned Parenthood CEO Compensation that these abortion executives reside in the 98th percentile of American wage earners, earning an average of $317,000 annually. Their new annual report shows just how much the American people have helped to line the pockets of the Planned Parenthood elite.”

Among Planned Parenthood’s boasts in its latest report is the area of “education,” where the abortion vendor touts “1.31 million participants in education programming, outreach, and training.”

The organization claims to have “conducted nationally representative research assessing parents’ awareness, beliefs, and attitudes about K-12 school-based sex education.”

“The results confirmed that parents overwhelmingly want their children to get sex education that covers a comprehensive range of topics and is age-appropriate and fact-based,” Planned Parenthood asserts.

The abortion provider also celebrated that failed Democratic presidential nominee Kamala Harris “became the first sitting vice president to visit an abortion provider when she visited Planned Parenthood North Central States’ health center in St. Paul, MN.”

In addition, Planned Parenthood has become one of the nation’s largest distributors of cross-sex hormones.

Lila Rose, foundress of Live Action, recently exposed Planned Parenthood’s alleged prescriptions of cross-sex hormones for minors via virtual appointments.

Former Planned Parenthood facility director Abby Johnson, who has since founded And Then There Were None and ProLove Ministries, called the “sky high number of abortions” both “sickening” and “revolting.”

“How our government, and Republicans who have for years claimed to want to defund Planned Parenthood but who are backing down when it’s time to put words into action, can possibly continue to give almost $2 million a day to this organization is beyond reason,” Johnson said in a press statement.

House Republicans are pushing to end federal funding of abortion providers in their reconciliation bill.

Meanwhile, other pro-life leaders are urging Americans to call upon their lawmakers to stop funding Planned Parenthood and other abortion vendors:

Mary Szoch, director of the Center for Human Dignity at Family Research Council, told The Washington Stand that “Planned Parenthood carries out over 1,100 abortions per day and receives over $2 million a day in taxpayer funding.”

“This should absolutely disgust Americans,” Szoch added. “It’s past time for Congress to say, ‘American taxpayers will not be forced to pad the wallets of Planned Parenthood executives while women receive shoddy treatment in unsanitary conditions and their unborn children are killed.’”

LifeNews Note: Susan Berry writes for CatholicVote, where this column originally appeared.

The post 39% of Planned Parenthood’s Revenue Comes From Our Tax Dollars appeared first on LifeNews.com.

-

Site: Zero Hedge"A Modest Request": The Supreme Court Hears Challenge To National Or Universal InjunctionsTyler Durden Thu, 05/15/2025 - 09:40

Today, the United States Supreme Court will hear three consolidated cases in Trump v. CASA on the growing use of national or universal injunctions. This is a matter submitted on the “shadow docket” and the underlying cases concern the controversy over “birthright citizenship.” However, the merits of those claims are not at issue. Instead, the Trump Administration has made a “modest request” for the Court to limit the scope of lower-court injunctions to their immediate districts and parties, challenging the right of such courts to bind an Administration across the nation.

The case is the consolidation of three matters: Trump v. CASA out of Maryland; Trump v. Washington out of Washington State, and Trump v. New Jersey, out of Massachusetts. These cases also present standing issues since the Administration challenges the argument that there is a cognizable “injury” to individuals who may travel to the states bringing the actions.

However, the main question is the scope of injunctions.

As I have previously written, district court judges have issued a record number of injunctions in the first 100 days of the Trump Administration.

Under President George W. Bush, there were only six such injunctions, which increased to 12 under Obama.

However, when Trump came to office, he faced 64 such orders in his first term.

When Biden and the Democrats returned to office, it fell back to 14.

That was not due to more modest measures.

Biden did precisely what Trump did in seeking to negate virtually all of his predecessors’ orders and then seek sweeping new legal reforms. He was repeatedly found to have violated the Constitution, but there was no torrent of preliminary injunctions at the start of his term.

Yet, when Trump returned to office, the number of national injunctions soared again in the first 100 days and surpassed the number for the entirety of Biden’s term.

This is a rare argument.

First, it is a shadow docket filing that usually results in summary decisions without oral argument. Moreover, this matter came after what is commonly viewed as the final day for oral arguments. The Court granted a rare late oral argument, reflecting that multiple justices view this matter sufficiently serious to warrant a break from standard operating procedures.

Rather than arguing a “question presented” on birthright citizenship, the Administration is solely looking for limits on the district courts as appeals continue on the “important constitutional questions” raised by birthright citizenship.

The Administration argues that the Constitution does not give judges the power to issue universal injunctions and that courts are limited to addressing the cases before them in a given district. The Administration acknowledges that class actions can create the basis for universal injunctions, offering a moderate resolution to the Court. In such cases, if the parties can meet the standard for a national class, they can seek a national or universal injunction.

In today’s arguments (which I will be covering for Fox and on X), we can expect to hear from justices who have previously been critical of universal injunctions, including Justice Clarence Thomas, who, in his concurring opinion in Trump v. Hawaii, called them “legally and historically dubious.”

Likewise, Justices Gorsuch and Alito have criticized such injunctions. In a prior dissent to an emergency filing in Department of State v. AIDS Vaccine Advocacy Coalition, Alito was joined by Thomas, Gorsuch, and Kavanaugh in stating that the government “has a strong argument that the District Court’s order violates the principle that a federal court may not issue an equitable remedy that is ‘more burdensome than necessary to’ redress the plaintiff’s injuries.”

Many of us will be watching three members the most closely: Chief Justice John Roberts and Associate Justices Elena Kagan and Amy Coney Barrett. Roberts is the ultimate institutionalist, and we should see in his argument how he views the impact of such injunctions on the court system as a whole. He is very protective of the courts’ inherent authority but may also have misgivings about the scope of these orders.

During the Biden Administration, Justice Kagan has previously criticized universal injunctions. In an interview at Northwestern University Law School, Kagan flagged the “forum shopping” by litigants in filing cases before favorable courts:

“You look at something like that and you think, that can’t be right. In the Trump years, people used to go to the Northern District of California, and in the Biden years, they go to Texas. It just can’t be right that one district judge can stop a nationwide policy in its tracks and leave it stopped for the years that it takes to go through the normal process.”

Justice Barrett previously joined with Kavanaugh in stating that the power of district courts to enter a universal injunction “is an important question that could warrant our review in the future.”

The argument today will start at 10 am and I will be doing a running review of the arguments on X.

U.S. Solicitor General D. John Sauer will argue the government’s case.

Jeremy Feigenbaum, New Jersey’s solicitor general, will argue for the state and local governments and Kelsi Corkran, the Supreme Court director at Georgetown’s Institute for Constitutional Advocacy and Protection, will argue for the private individuals and groups.

Jonathan Turley is the Shapiro Professor of Public Interest Law at George Washington University where he teaches a course on the Supreme Court and the Constitution.

-

Site: Ron Paul Institute - Featured Articles

What if the writ of habeas corpus has been guaranteed to the British since 1215 and to Americans since 1789? What if this encompasses the right of every person who is confined by the government against his or her will to compel the jailer to justify the confinement before a neutral judge?

What if this right is personal and individual and applies to all persons at all times? What if the right can be exercised by anyone who is arrested, whether it be for spitting on the sidewalk or murder? What if this right — to be free from an unjust confinement; to be free from arrest without trial — is one for which the Founders and the Framers fought the American Revolution?

What if habeas corpus is today recognized by all judges in the United States? What if judges actually stop court proceedings when a habeas corpus petition is received in order to hold a hearing and compel the government to lay out the evidence against the accused and justify his or her confinement, lest he or she spend one minute more behind bars than is lawful?

What if British monarchs and their subjects believed that the monarchy was divinely created? What if they actually believed that God the Father chose whomever was the king at a given moment to rule over them? What if they called this the divine right of kings? What if the divine right of kings enabled the monarch to write any law, prosecute any person and impose any punishment he wished for real or fanciful or even imagined crimes?

What if even this divine right of kings nonsense — once universally accepted and now universally rejected — had an exception to it? What if that exception was habeas corpus? What if even the most tyrannical and absolute of monarchs in Britain recognized and respected habeas corpus for their subjects in Britain?

What if British kings failed to recognize habeas corpus for the colonists in America? What if their governments arrested folks here and then brought them months later to London for trial? What if there was no mechanism for habeas corpus in the colonies to protect one from the wrath of the British government?

What if on the few occasions where habeas corpus was recognized, the colonial judges — who were dependent on the king for their jobs and their salaries — persistently ruled in favor of continued confinement, no matter how flimsy the evidence against the accused or how unlawful the charges?

What if Thomas Jefferson condemned this practice in the Declaration of Independence? What if the failure of colonial judges to recognize here in America the same rights recognized of Englishmen in Britain played a significant role in arousing the colonists to revolution in 1775 and 1776?

What if colonial revulsion at the refusal to recognize habeas corpus was so great that James Madison — who wrote the Constitution — insisted that this right be preserved in the Constitution? What if this was done before the Bill of Rights was added?

What if Madison recognized that in cases of invasion or rebellion, Congress might want to suspend habeas corpus until the rebellion or invasion subsided? What if Congress — in order to prevent frivolous or politically based suspensions of the right — defined invasion or rebellion as a state of affairs of such calamity that the federal courts are unable to conduct proceedings?

What if Abraham Lincoln suspended habeas corpus during the War Between the States in certain regions in the north so he could arrest his critics without trial? What if the Supreme Court ruled that under the plain meaning and recognized structure of the Constitution, only Congress — not the president — can suspend habeas corpus? What if, before the court invalidated Lincoln’s tyranny, thousands of folks were arrested and confined without charges, appearances before judges, trials or any meaningful opportunity to be heard — in the North where there was no invasion or rebellion?

What if Franklin D. Roosevelt did the same based on race during World War II and he claimed he did so based not on invasion or rebellion but on the fear of invasion or rebellion? What if — in one of its lowest moral rulings in history, at a time of anti-Japanese racial animosity in America — the court permitted the suspension?

What if subsequent Congresses and presidents and courts condemned this ruling and this suspension? What if Congress — 40 years later — compensated those still living and their offspring for these arrests without trial?

What if George W. Bush tried to suspend habeas corpus in the months following 9/11? What if on the day after the attacks of 9/11 in lower Manhattan the federal courts were able to conduct proceedings? What if the Supreme Court ruled against him? What if Congress tried to implement arrest without trial and the Supreme Court ruled that there was no invasion or rebellion of such chaotic magnitude that the federal courts could not conduct proceedings, and so it invalidated the suspension of habeas corpus?

What if here we go again? What if the White House announced last week that it — not Congress — is contemplating the suspension of habeas corpus, but only for certain persons?

What if the concept of arrest without trial in America is unfathomable? What if the cornerstone of American jurisprudence is the existence of an independent judiciary to which all persons may turn for relief when being pursued by the government, justly or unjustly?

What if suspending this right attacks the core values of America — fairness, equality, rule of law? What if the right to fairness from the government is the realistic expectation and historical lesson understood and expected by all in America?

What if arrest without trial transforms our democracy into a monarchy? What if this happens right before our eyes? What do we do about it?

To learn more about Judge Andrew Napolitano, visit https://JudgeNap.com.

COPYRIGHT 2025 ANDREW P. NAPOLITANO

DISTRIBUTED BY CREATORS.COM -

Site: Zero HedgeWhite House Has Presented Iran With Written Nuke Deal Proposal In Huge FirstTyler Durden Thu, 05/15/2025 - 09:19

Update(10:30ET): With President Trump and his envoy having arrived in the United Arab Emirates (UAE) for the last leg of the president's Gulf tour, new details of behind the scenes US-Iran negotiations have come to light on Thursday.

In a huge first, the Trump White House has sent Iran a written proposal toward forging a new nuclear deal. White House envoy Steve Witkoff has led several rounds of talks, and Axios has revealed that the communication was issued to Tehran last Sunday.

"Iranian Foreign Minister Abbas Araghchi took the proposal back to Tehran for consultations with Supreme Leader Ali Khamenei, President Masoud Pezeshkian and other top officials," writes Axios.

Via Associated Press

Via Associated Press

It was the Iranian side which initiated the swap of written proposals first, as the talks which have been on since April went from 'indirect' to more 'direct':

- During the third round of talks in late April, Araghchi gave Witkoff an updated document with Iranian ideas for a nuclear deal. This time, Witkoff took the document.

- A U.S. team of experts studied it and sent the Iranians a list of questions and requests for clarification. The Iranians replied and added questions of their own, two sources said.

- Meanwhile, Witkoff and his team prepared a U.S. proposal laying out the Trump administration's parameters for an Iranian civilian nuclear program and requirements for monitoring and verification, the sources said.

It appears that thus far both sides have received the other's written proposals positively, and that's what was driving President Trump's "olive branch" comments on Tuesday. He had stressed while speaking in Saudi Arabia that "this is not an offer that will last forever. The time is right now for them to choose."

President Trump followed up on Thursday by saying from Qatar, "We're in very serious negotiations with Iran for long-term peace," according to AFP.

He said, "We're getting close to maybe doing a deal without having to do this... there (are) two steps to doing this, there is a very, very nice step and there is the violent step, but I don't want to do it the second."

Trump's comments followed an NBC News interview with Ali Shamkhani, a top political, military and nuclear adviser to Iranian Supreme Leader Ayatollah Ali Khamenei, who said Tehran is prepared to sign a nuclear deal—provided key conditions are met—in exchange for the lifting of U.S. economic sanctions.

Trump reposted the NBC article indicating Iran is ready to reach a deal (though the details of that deal suggest it would look essentially identical to the JCPOA). pic.twitter.com/LPDLzqu0nd

— Gregory Brew (@gbrew24) May 15, 2025NBC News pointed out that Shamkhani's comments "appear to be the clearest public statement yet on Iran's expectations and willingness to reach a deal from the supreme leader's inner circle."

And the fact that written proposals have already been exchanged is yet further confirmation of this positive trend towards peace. Trump has emphasized that Iran can never have a nuclear bomb, but Tehran itself has long said it's not pursuing a nuke, and that its program is only for peaceful domestic energy purposes.

* * *

Brent crude prices fell on Thursday as geopolitical risk premiums eased following President Trump's comments during his Gulf tour, where he signaled that the U.S. is nearing a nuclear deal with Iran. Unlike earlier headlines on AI, defense, and aviation deals with Saudi Arabia and Qatar, Trump's comments suggested a potential breakthrough in U.S.-Iran nuclear talks.

"We're in very serious negotiations with Iran for long-term peace," Trump told reporters in a press pool that AFP News first reported.

Speaking in Doha, Qatar, during his Middle East trip, the president said, "We're getting close to maybe doing a deal without having to do this... there (are) two steps to doing this, there is a very, very nice step and there is the violent step, but I don't want to do it the second way."

An Iranian source told Reuters that negotiations with Trump administration officials still needed to bridge some gaps before a final deal could be reached.

Trump's comments followed an NBC News interview with Ali Shamkhani, a top political, military and nuclear adviser to Iranian Supreme Leader Ayatollah Ali Khamenei, who said Tehran is prepared to sign a nuclear deal—provided key conditions are met—in exchange for the lifting of U.S. economic sanctions.

With Trump Touring Gulf, Iran Offers Huge Nuclear Concession https://t.co/NQ4259UIsE

— zerohedge (@zerohedge) May 14, 2025Trump confirms reports that Iran have “sort of agreed to the terms” that they cannot have nuclear capabilities!

— Clandestine (@WarClandestine) May 15, 2025

Trump confirms he is currently in “very serious negotiations with Iran, for long-term peace”!

Trump also highlights how “many people” want war with Iran, but that he… pic.twitter.com/rVSkScNRINNBC News pointed out that Shamkhani's comments "appear to be the clearest public statement yet on Iran's expectations and willingness to reach a deal from the supreme leader's inner circle."

Trump has offered "an olive branch" to Tehran after a multi-month maximum-pressure campaign, including economic sanctions and deploying long-range stealth bombers to America's "unsinkable aircraft carrier" - located in the Indian Ocean - ready to be deployed at a moment's notice.

However, last week, ahead of Trump's Gulf tour, we spotted at least one of these stealth bombers returning to the U.S. We suggested this may have been an act of goodwill ahead of talks by the U.S. or possibly just a routine flight.

On Thursday, Brent crude futures fell 3% to $60 a barrel on expectations that a U.S.-Iran nuclear deal would ease sanctions and increase crude oil on international markets.

"The overnight development of a possible nuclear deal is the sole reason for the morning's weakness. If an agreement is reached, Iran agrees to halt enriching weapon grade uranium and the deal is effectively enforced, which is hard to believe, then the Persian Gulf country's crude oil exports can rise by as much as 1 [million barrels per day]," PVM analyst Tamas Varga told CNBC in an emailed statement.

"It sounds price negative, but its impact will possibly be mitigated by OPEC+ rolling back on its plan to release barrels back to the market faster than originally planned," he added.

Goldman trader Rich Privorotsky commented on the development:

Staying with geopolitics there are some rather positive stories emanating out of Iran. "Iran is ready to sign a nuclear deal with certain conditions with President Donald Trump in exchange for lifting economic sanctions, a top adviser to Iran's supreme leader told NBC News on Wednesday." Unclear if the U.S. will agree to the terms but they seem fairly broad: "He said Iran would commit to never making nuclear weapons, getting rid of its stockpiles of highly enriched uranium which can be weaponized, agree to only enrich uranium to the lower levels needed for civilian use, and allow international inspectors to supervise the process, in exchange for the immediate lifting of all economic sanctions on Iran." (NBC news) If confirmed I think oil could eventually end up heading back to the recent lows and I would continue to express any cyclical concerns in this space.

Here's the latest commentary from UBS traders:

Oil Equity Resilience Amid Oil Price Drop Oil prices are down, mainly because of a potential deal with Iran. That could mean up to 500kb/d increased supply coming to market very quickly. Oil equities, however, are already underweight for generalists and specialists have already de-grossed, following the OPEC+ surprises so far this year - hence oil equities are proving to be relatively resilient even though the oil price is down.

If Trump secures a nuclear deal with Tehran, it would cap off a week of landmark agreements with Gulf nations—collectively worth trillions—and add to an already bullish news cycle for the president. Also, this would mean continued easing of geopolitical risk premiums in the region, in other words, lower energy prices for Trump to pursue his 'America First' agenda.

-

Site: Zero HedgeIs DOGE Starting To Work? 'Deep TriState' Jobless Claims Surged Last WeekTyler Durden Thu, 05/15/2025 - 09:13

The number of Americans filing for jobless benefits for the first time was flat from the prior week at 229k (the same level it was at in Jan 2022)...

Source: Bloomberg

Headline continuing claims remains below the Maginot Line of 1.9 million Americans...

Source: Bloomberg

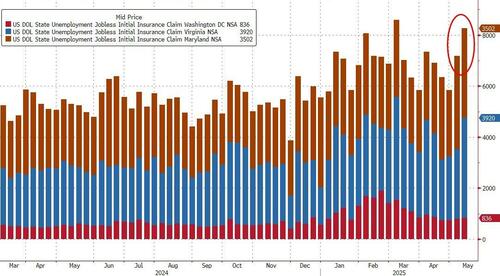

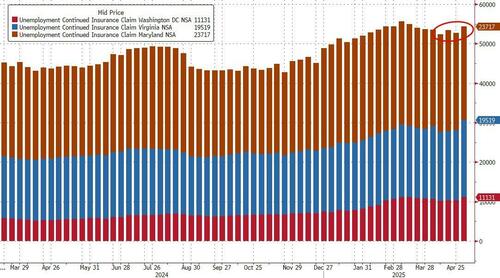

But, drilling down, the 'Deep Tristate' saw initial jobless claims spike last week...

Source: Bloomberg

...and continuing jobless claims in the 'Deep TriState' also rose as perhaps DOGE is starting to have some effects...

Source: Bloomberg

Finally, the chart that sums up the entire farcical FUD-fest about the US labor market and Trump's terrible tariff trauma...

Source: Bloomberg

When will the CEOs face reality?

-

Site: Catholic ConclaveMarist Miguel Ángel Contreras Llajaruna in Callao, first episcopal appointment of Leo XIVFather Contreras Llajaruna is superior of the Marist District of South America.Pope Leo XIV made his first episcopal appointment as Pope this Thursday, in the person of Father Miguel Ángel Contreras Llajaruna, superior of the Marist District of South America, the Congregation to which he belongs. He has been Catholic Conclavehttp://www.blogger.com/profile/06227218883606585321noreply@blogger.com0

-

Site: Ron Paul Institute - Featured Articles

During the 1988 campaign, George W. Bush came to the Courthouse in Maryville, TN to speak at a rally for his Dad. As we were leaving, I told my friend and later Chief of Staff, Bob Griffitts, “Bob, he is better than his Dad.”

When he ran for President in 2000, then Governor Bush went all over the Country saying we needed a more humble foreign policy, and according to Foreign Policy Magazine, he “famously campaigned against nation building.”

The Independent Institute reported that in a 2000 debate, candidate Bush said “If we are an arrogant nation, they will resent us; but if we are a humble nation, but strong, they’ll welcome us.”

Wikipedia says Bush criticized President Clinton as being too interventionist and said: “If we don’t stop extending our troops all around the world in nation-building missions, then we’re going to have a serious problem down the road, and I’m going to prevent that.”

Because of statements like these, along with my favorable impression from 1988, and my strong opposition to Vice President Gore, I became enthused about the Bush campaign.

During all of my 15 campaigns for Congress, I held a Duncan Family Barbecue with 6,000 to 8,000 in attendance. I was very pleased when Gov. Bush rearranged his schedule just a few days before the election on very short notice to also attend.

We marched into the Knoxville Coliseum behind the University of Tennessee Pep Band, and he stood in the receiving line much longer than I expected. When I walked him back to his limousine, I said “Governor, you’re going to carry Tennessee.” He replied “If I do, I’ll win the election,” and that is exactly what happened.

That night, my son, Zane, said “Dad, I have never heard you so excited as when you shouted ‘the next President of the United States, George Bush!”

I had been a Pat Buchanan-American Firster all through the 90s, so you can imagine my disappointment when President Bush allowed himself and, more importantly, his foreign policy to be controlled by Neocons.

Of course, in spite of being put into a little secure room at the White House with Condoleeza Rice and the top two leaders of the CIA so they could put pressure on me, I shocked my district and voted against going to war in Iraq.

And then, over the next many years, Reps. Ron Paul and Walter Jones and I were the only Republicans in the U.S. House who consistently and repeatedly spoke and voted to bring our troops home from Iraq and Afghanistan many years before we did.

Then, after Sen. Rand Paul decided not to run for President in 2016, I became one of the first members of Congress to endorse Donald Trump for President. I did this because I thought he was the least hawkish of all who were running for the Republican nomination, and he had made some critical comments about the decision to go to war in Iraq.

But I was disappointed once again when he put Neocons like John Bolton and others into key positions in his Administration, appointments I think he later regretted.

With this history and background, you may think I am very foolish, but my hopes are up once again because of President Trump’s Inaugural Address and even more so because of his speech in Riyadh on Tuesday.

In his Inaugural Address, he said: “We will measure our success not only by little battles we win, but also by the wars that end, and perhaps most importantly, the wars we never get into.”

Then I was ecstatic when I heard what he had said in his speech in Riyadh: “But in the end, the so-called nation builders wrecked far more than they built, and the interventionists were intervening in complex societies that they did not even understand themselves.”

“No, the gleaming marvels of Riyadh and Abu Dhabi were not created by the so-called ‘nation builders’, Neocons or liberal non-profits, like those who spent trillions and trillions of dollars failing to develop Baghdad and so many other cities.”

He added: “The birth of a modern Middle East has been brought by the people of the region themselves—the people that are right here, the people who have lived here all their lives, developing your own sovereign countries, pursuing your own unique visions and charting your destinies in your own way.”

Trump also said what he called the “great transformation” of Saudi Arabia and the Middle East “has not come from western interventionists…giving you lectures on how to live and how to govern your own affairs.” These are words Ron Paul himself could have said.

This speech, along with numerous reports that Trump is tired of being manipulated by Netanyahu, his ending sanctions against Syria, entering negotiations with Iran, stopping the bombing of Yemen, and leaving Israel off his Middle East trip, all give hope for a different and perhaps more diplomatic, less hawkish U.S. foreign policy.

When you add to all these hopeful signs from Trump the May 9th column by Thomas Friedman entitled “This Israeli Government Is Not Our Ally”, change may be in the air.

Friedman wrote that “Netanyahu is not our friend” and added: “On the Middle East, you have some good independent instincts, Mr. President. Follow them.” This may be one of the very few times I have ever agreed with one of the longest-serving employees of the New York Times.

Now, I just wish there were a few more in Congress with the courage of Thomas Massie.

-

Site: PaulCraigRoberts.org

For those who have remained in ignorance of their certain future, here is a review of The Camp of the Saints

https://www.unz.com/article/when-reality-is-worse-than-fiction/

Comment by PCR:

In Raspail’s book the fall of France and all of Europe is instantaneous, with Russia following with a lag. In our reality, the collapse is in line with the boiling of a frog.

In the US the Democrats are the party of mass immigration. They opened the borders and kept them open and now are using the judiciary and media to prevent deportations. It is easy to recognize among our own politicians, professors, and media numerous counterparts to the characters in Raspail’s book. The money of ethnic Americans is being used to finance the invasion. As in Raspail’s book, guilt and pity prevent effective opposition to the overrunning of the country. Consider how many immigrant-invaders in the name of multiculturalism have achieved elected positions in state, local, and federal legislatures, how many there are serving as judges and prosecutors, university professors and school teachers, and you can see the power transformation that is underway.

Meanwhile the idiot white countries pick fights with Russia, China, and Iran. The feminists have transformed white women from child bearers to salary earners. The government has made it impossible for one-earner families to exist. The white birth rate has collapsed throughout the Western world. In Europe white ethnic women who are raped by immigrant-invaders are more likely to be punished for their complaints, which are often judged to be racist, than are their rapists, another indication of the loss of power of white ethnics to immigrant-invaders. Another indication is the development of no-go zones for white ethnics in their own cities. Another indication is the rise in racial intermarriage. White gentile ethnicities are on their way out. They are a disappearing race.

-

Site: PaulCraigRoberts.org

Do You Remember the Dumbshit White Democrat Government of Seattle that not only allowed but encouraged Antifa and Black Lives Matter to burn down the white business center and enabled the looting by defunding the police?

Well the dumbshit Democrats have seen the light:

Seattle City Council committee passes resolution to undo ‘defund the police’ initiatives https://thepostmillennial.com/seattle-city-council-committee-passes-resolution-to-undo-defund-the-police-initiatives#google_vignette

Seattle mayor reveals $47 MILLION payroll tax deficit as companies flee the Emerald City

Last week, the mayor of Seattle announced that the Emerald City collected $47 million less in payroll taxes last year as large companies continue to flee the liberal oasis.

“In 2018, the city council, led by Marxist Councilmember Kshama Sawant, passed the so-called “Head Tax” on the payrolls of large companies to fund affordable housing.” The Camp of the Saints is alive and well in Seattle. Elected Democrat officials seem to consist of mainly foreign immigrant-invaders. Are there any Americans in the Democrat party?

Ideological anti-white Democrats are incapable of governing. They can only destroy.

-

Site: PaulCraigRoberts.org

While Wall St and the Dumbshit Tech Geeks see the future in AI, the truth is AI means death for American cities and Americans’ jobs

Here is Bloomberg’s report:

AI is expected to wipe out between 37% and 43% of white-collar jobs in San Jose-Sunnyvale-Santa Clara, CA, Boulder, Co, Washington-Arlington-Alexandria, San Francisco-Oakland-Berkely, CA, Durham-Chaple Hill, NC, Trenton-Princeton, NJ, Seattle-Tacoma-Bellevue, WA, Austin-Round Rock-Georgetrown, TX, Ann Arbor, MI, Salt Lake City, UT, Boston-Cambridge-Newton MA, Huntsville, AL, Denver-Aurora-Lakewood, CO, Raleigh-Cary, NC, Madison, Wi

The more a city’s economy is oriented around white-collar knowledge work, the more exposed it is to AI.

If truth be known, Americans are too stupid to justify their existence.

Despite its reporting Bloomberg finds possible hope in AI.

-

Site: PaulCraigRoberts.org

As I and John Helmer do, Gilbert Doctorow has Suspicions about Trump’s “peace negotiations”

TRUMP’S UKRAINE PLAN:

PEACE OR DECEPTION?

-

Site: Zero HedgeUS Producer Prices Plunge Most Since COVID LockdownsTyler Durden Thu, 05/15/2025 - 09:00

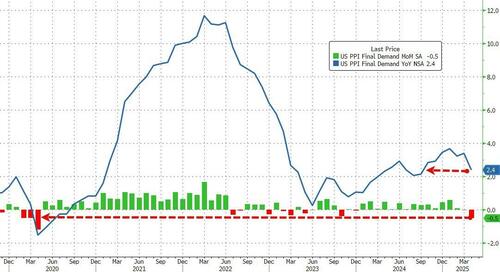

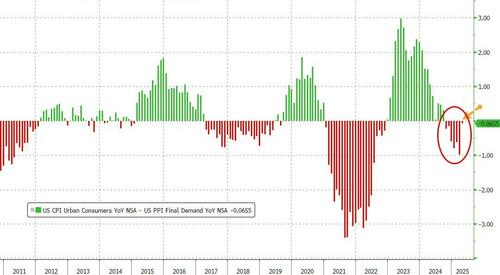

Following the cooler than expected CPI, US Producer Prices plunged in April, down 0.5% MoM (vs +0.2% MoM exp) - the biggest drop since April 2020 (but we note that last month's 0.4% MoM decline was revised up to unchanged). The headline print was dragged down to +2.4% YoY (the lowest since Sept 2024)...

Source: Bloomberg

Under the hood, Prices for final demand services moved down 0.7 percent in April, the largest decline since the index began in December 2009.

Source: Bloomberg

Core Producer Prices plunged by the most on record (back to 2010)...

Source: Bloomberg

PPI Final Demand Services

Prices for final demand services moved down 0.7 percent in April, the largest decline since the index began in December 2009. Over two-thirds of the broad-based decrease can be traced to margins for final demand trade services, which dropped 1.6 percent. (Trade indexes measure changes in margins received by wholesalers and retailers.) Prices for final demand services less trade, transportation, and warehousing and for final demand transportation and warehousing services fell 0.3 percent and 0.4 percent, respectively.

- Product detail: Over 40 percent of the April decline in the index for final demand services is attributable to margins for machinery and vehicle wholesaling, which dropped 6.1 percent. The indexes for portfolio management, food and alcohol wholesaling, system software publishing, traveler accommodation services, and airline passenger services also fell. Conversely, prices for outpatient care (partial) advanced 0.3 percent. The indexes for furniture retailing and for inpatient care also moved up. (See table 2.)

PPI Final demand goods

Prices for final demand goods were unchanged in April following a 0.9-percent decrease in March. In April, the index for final demand goods less foods and energy increased 0.4 percent. In contrast, prices for final demand foods and for final demand energy declined 1.0 percent and 0.4 percent, respectively.

- Product detail: Among final demand goods in April, the index for general purpose machinery and equipment advanced 1.1 percent. Prices for residential electric power, fresh and dry vegetables, non-electronic cigarettes, and utility natural gas also moved up. Conversely, the index for chicken eggs dropped 39.4 percent. Prices for gasoline, gas fuels, diesel fuel, and primary basic organic chemicals also fell.

Margin pressure remains on American corporations...

Source: Bloomberg

It would appear that despite all the FUD, companies are soaking up any tariff price increases and NOT passing them on to customers.

Finally, energy prices are set to drag CPI and PPI even lower in the next month or so...

Source: Bloomberg

Goldman has lowered its PCE expectations:

Based on the details in the PPI and CPI reports, we estimate that the core PCE price index rose 0.11% in April (vs. our expectation of 0.19% prior to today's PPI report), corresponding to a year-over-year rate of +2.46%.

Additionally, we expect that the headline PCE price index increased 0.10% in April, or increased 2.18% from a year earlier.

But, but, but... the PhDs said tariffs were inflationary!!

-

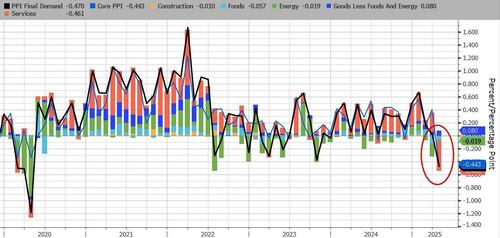

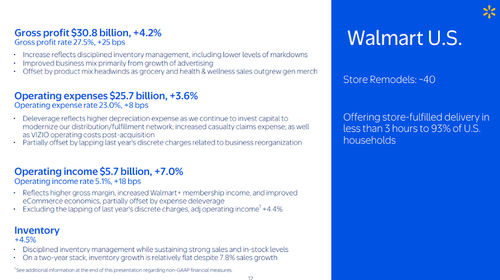

Site: Zero HedgeWalmart Delivers Solid Earnings, Warns Of Imminent Price HikesTyler Durden Thu, 05/15/2025 - 09:00

Walmart reported better-than-expected first-quarter results for the period ending April 30 but cautioned that the trade war will raise prices on certain items as early as this month. The warning underscores that the mega retailer's low-price model is threatened amid an ongoing value war with other U.S. retailers.

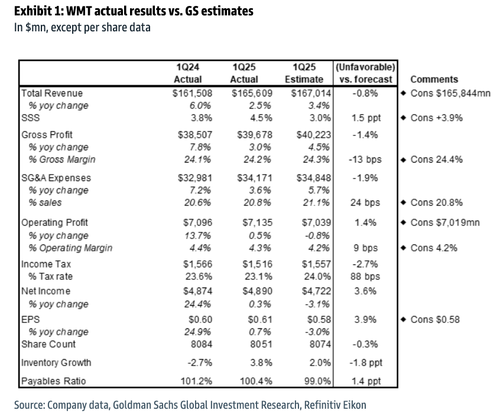

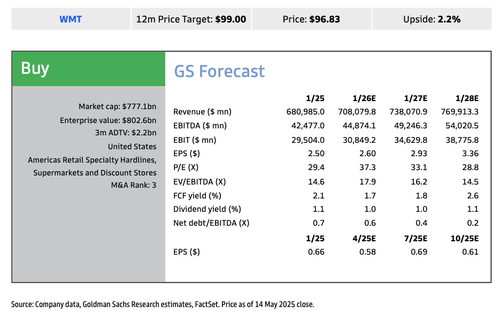

The nation's largest retailer posted first-quarter results showing a 4.5% year-over-year sales increase at U.S. Walmart stores, surpassing the Bloomberg Consensus estimate of 3.85%. Adjusted earnings per share came in at 61 cents, also beating the 58-cent estimate.

1Q25 results demonstrate that Walmart's pricing power to offer low-cost products continues to increase.

Here is the highlight of the 1Q results (ended April 30):

Adjusted EPS: $0.61 vs. $0.58 estimate

Revenue: $165.61B (+2.5% y/y) vs. $166.02B estimate

U.S. Comparable Sales (ex-gas): Walmart

-

Walmart stores: +4.5% vs. +3.85% estimate

-

Sam's Club: +6.7% vs. +4.93% estimate

E-Commerce Growth

-

Walmart U.S.: +21% vs. +13.8% estimate

-

Sam's Club: +27% vs. +14.3% estimate

Operating Cash Flow: $5.4B

From the earnings deck:

Total revenues/gross profit

Operating expense/income detail

EPS/Cash flow

Additional details...

Walmart maintained its full-year guidance, which was issued in February.

-

Q2 Sales Growth Forecast: +3.5% to +4.5%

-

FY2026 EPS Guidance (unchanged): $2.50–$2.60 vs. $2.61 estimate

-

FY2026 Net Sales Growth (unchanged): +3% to +4%

While Walmart delivered another solid quarter of sales and earnings growth, the focus has shifted to the growing negative impact of the trade war.

Goldman analysts Mark Jordan, Emily Ghosh, and others commented on Walmart's earnings:

WMT reported 1Q25 adj. EPS of $0.61, above GS/consensus (Refinitiv) of $0.58/$0.58. Walmart US SSS of +4.5% tracked better than consensus at +3.9%, driven by traffic (+1.6%) and average ticket (+2.8%). By category, grocery was up +MSD, noting increased transactions and units along with inflation of ~150 bps, due primarily to eggs. Health & wellness grew +high-teens, driven by higher script counts, mix shift toward branded from generic, and strong over-the-counter sales. General merchandise was slightly negative, reflecting growth in unit volumes, which was more than offset by MSD like-for-like deflation, while seasonal events were strong; WMT called out sales softness in electronics, home, and sporting goods, offset by strength in toys, automotive, and kids' apparel. Global/Walmart U.S. e-commerce net sales grew +22%/+21% (vs. +16%/+20% in 4Q), while global/Walmart U.S. advertising grew +50% including VIZIO/+31% ex VIZIO (vs. +29%/+24% in 4Q), respectively.

They offered their take on guidance:

WMT reiterated 2025 guidance to net sales growth of +3.0-4.0% (vs. GS/consensus of +4.0%/+3.6%), adj. operating income growth of +3.5-5.5%, and adj. EPS of $2.50-2.60 (vs. GS/consensus at $2.60/$2.61). For 2Q, WMT is guiding to net sales growth of +3.5-4.5% (vs. GS/consensus of +4.0%/+3.5%), while the company is not guiding to operating income growth or EPS given the dynamic macro backdrop.

And maintained their "Buy" rated 12-month price target of $99.

In a post-earnings interview, CFO John David Rainey warned that price hikes at Walmart stores will begin this month: "If you've not already seen it, it will happen in May and then it will become more pronounced."

The retailer warned about trade war uncertainty and how the situation "changes by the week," adding, "The lack of clarity that exists in today's dynamic operating environment makes the very near-term exceedingly difficult to forecast."

Walmart's supply chain offers some insulation from the trade war. About 66% of its merchandise—primarily groceries—is sourced domestically, accounting for roughly two-thirds of its U.S. business. However, CFO John David Rainey noted that imported categories such as electronics, apparel, and toys could face additional price hikes in the coming months.

"We will do our best to keep our prices as low as possible but given the magnitude of the tariffs, even at the reduced levels announced this week, we aren't able to absorb all the pressure given the reality of narrow retail margins," said CEO Doug McMillon in a statement.

Takeaway: Walmart is not entirely immune to tariffs. Despite the 90-day cooling period between the U.S. and China and a substantial tariff rate reduction on both sides of the Pacific, price hikes are still coming. As cost pressures mount, the retailer's ability to fully absorb them is becoming increasingly difficult, potentially jeopardizing its low-price value model amid an ongoing, multi-year value war with other U.S. retailers.

* * *

See: Walmart's full earnings presentation...

-

-

Site: AsiaNews.itBombings continue in Myanmar's western state, long at the heart of tensions with the Muslim minority. The Arakan Army now administers much of the region, but the Rohingya issue remains unresolved. The community is still in the crosshairs of the three armed groups vying for territorial control. Bangladesh, in seeking China's support, proposed the creation of an independent state, but the initiative has made no progress.

-

Site: Zero HedgeUS Retail Sales Surprises To The Upside, But...Tyler Durden Thu, 05/15/2025 - 08:41

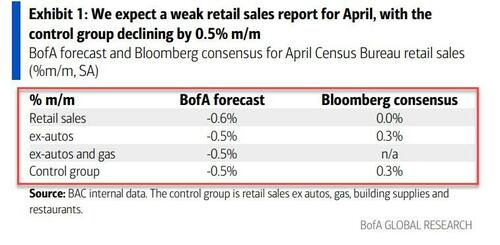

If BofA's omniscient analysts are right (and they have been serially on the correct side of this data series relative to consensus for months), then traders should brace for disappointment this morning for the retail sales data.

But...

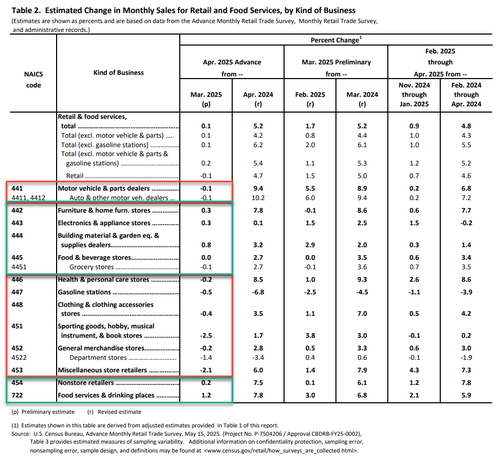

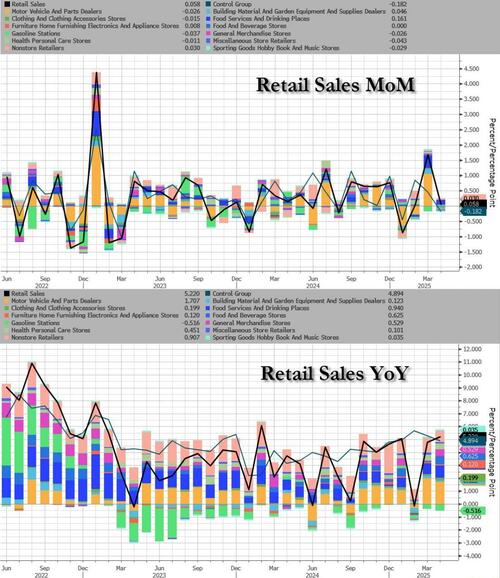

For once, the BofA analysts were incorrect as headline retail sales rose 0.1% MoM (better than the 0.0% MoM exp, but this follows a sizable upward revision in March to +1.7% MoM (from +1.4%). With the revision that left retail sales up 5.2% YoY - near its highest since Dec 2023

Source: Bloomberg

Under the hood, Sporting Goods sales declined the most while Building Materials rose the most...

The (tariff front running) surge in Motor Vehicle Sales last month has gone...

Source: Bloomberg

As a reminder, this data is nominal, so adjusting ()very roughly) for inflation, retail sales rose 2.8% YoY, equalling its highest since Feb 2022...

Source: Bloomberg

More problematically, the Control Group - which feeds directly into GDP - was a big miss, dropping 0.2% MoM (vs expectations of a 0.3% MoM rise)...

Source: Bloomberg

So, the good news is bottom-up Americans are spending... but top-down GDP may be negatively affected.

-

Site: AsiaNews.itThe arrest of Istanbul's mayor has reversed the positive course the country had embarked upon. A study by the EBRD confirms that boycotts and protests have disrupted efforts to curb inflation, triggering "turmoil". In April, the Central Bank raised interest rates after months of holding steady. New arrests among university students have followed clashes with police.

-

Site: LifeNews

Health and Human Services Secretary Robert F. Kennedy, Jr. said Wednesday that he has ordered a top-down review of the abortion drug mifepristone in light of “alarming” research showing the Food and Drug Administration (FDA)-approved pill does far more harm to women than previously reported.

The latest research is “alarming,” Kennedy said during a hearing before the Senate Health, Education, Labor and Pensions Committee. “And clearly it indicates at the very least the [FDA] label should be changed.”

“I’ve asked Marty Makary, who’s the director of the FDA, to do a complete review and to report back,” Kennedy added.

Please follow LifeNews on Rumble for the latest pro-life videos.

A new study on the chemical abortion drug shows 11% of women experience adverse effects serious enough to send them to the ER@SecKennedy just pledged to conduct a top-to-bottom review of the drug – and said the FDA label needs to change

That’s a win for life pic.twitter.com/gy65iCZjI5

— Josh Hawley (@HawleyMO) May 14, 2025

As Dr. Susan Berry reported for CatholicVote April 28, a “bombshell study” by the Ethics and Public Policy Center (EPPC) “revealed nearly 11% of women experience severe or life-threatening complications after an abortion via the drug mifepristone – a rate that is 22 times higher than indicated on the drug’s label approved by the federal Food and Drug Administration (FDA).”

EPPC “analyzed 865,727 mifepristone abortions that occurred between 2017 and 2023, a number that is ‘28 times larger than in all FDA clinical trials combined,’” Berry reported.

CatholicVote reported the following day that the Catholic advocacy group had “joined a coalition of over 30 pro-life organizations Tuesday in urging the Trump administration to evaluate the Food and Drug Administration’s (FDA) approval of the abortion drug mifepristone, immediately following the release of a new study revealing serious health risks.”

The coalition letter argued “that mifepristone—used in over 60% of US abortions—was irresponsibly approved in 2000 and continues to harm women.”

“We respectfully ask that you take swift action to protect the rights of states to defend unborn children, in keeping with your campaign pledge to return the issue of abortion to the states,” the letter read, calling on the administration to stand firm “as a defender of the weak and vulnerable.”

LifeNews Note: Joshua Mercer writes for CatholicVote, where this column originally appeared.

The post HHS Secretary Robert Kennedy Will Investigate Dangerous Abortion Pill appeared first on LifeNews.com.

-

Site: Zero HedgeZelensky In Istanbul Responds To 'Insult' Of Putin Sending Junior Officials To Talks: "I Am Here"Tyler Durden Thu, 05/15/2025 - 08:30

A team of Russian negotiators are in Istanbul on Thursday for the first direct peace talks with Ukraine in more than three years, with Russia's Foreign Ministry officials saying that the delegation is "ready for serious work".

President Putin, who as expected is not there in person, tapped his aide and former culture minister Vladimir Medinsky to lead the talks, which many Western analysts have claimed is an 'insult' given it's not someone more senior. Medinsky, it should be remembered, oversaw the failed 2022 peace talks with Kiev in the weeks after the February invasion.

Alongside Medinsky are Deputy Foreign Minister Mikhail Galuzin, Deputy Defense Minister Alexander Fomin and Igor Kostyukov, the head of Russia’s military intelligence agency (GRU).

Supporting these main negotiators are group of advisers, including senior officials from the Foreign and Defense Ministries, along with Putin aides. The Kremlin confirmed the identities of its negotiating team by releasing footage of Putin meeting with the negotiation group late Wednesday.

On Wednesday evening, Russian President Vladimir Putin held a meeting to discuss arrangements for talks with Ukraine, due to take place today in Istanbul, Kremlin Spokesman Dmitry Peskov told reporters:https://t.co/hRmXK7daoA

— TASS (@tassagency_en) May 15, 2025

Video: Kremlin. ru pic.twitter.com/1e7DHMlFgvOther top officials were seen present in the send-off meeting in Russia, among them Defense Minister Andrei Belousov, Russia’s chief of the General Staff Valery Gerasimov, Security Council Secretary Sergei Shoigu and Federal Security Service (FSB) Director Alexander Bortnikov - which perhaps underscores that Moscow is indeed taking the Istanbul talks very seriously.

But many are calling this a 'slap in the face' and insult to Trump who has strongly backed direct talks, and who even urged Putin to be there in person.

Trump has warned that he is "always considering" additional sanctions against Russia if he believes Moscow is blocking or snubbing the peace process.

Putin sending the same people to Istanbul who, back in 2022, demanded Ukraine's surrender on his behalf is a slap in the face to the Trump administration’s efforts to end this war. The message is clear: fuck off — I have my own objectives, and they haven’t changed since 2022,… https://t.co/8Sj3mprJXe

— Sławomir Dębski (@SlawomirDebski) May 14, 2025As for Ukraine's President Zelensky, he's has for the past week been making a big show of how he's willing to be in Istanbul, and Putin is not. He's been repeatedly goading Putin to be there, saying that if he's not - it proves Moscow is not interested in the peace process.

However, this has clearly been a performative effort more geared to show President Trump that Kiev is 'willing' - likely in hopes that Washington gives Zelensky stronger backing, and of course a steady supply of weapons and intelligence. To some degree, Zelensky's bellicose rhetoric may itself have sabotaged talks before they had even begun.

But Zelensky has shown up in Turkey, somewhat surprisingly. "I am here" - he has emphasized (in once again a bit of messaging primarily aimed at the White House). He's meeting with Erdogan, but apparently this is separate, and happening in Ankara.

Zelensky to Putin from Ankara:

— Clash Report (@clashreport) May 15, 2025

"I am here." pic.twitter.com/67RjF4QFqbThe Wall Street Journal's take is as follows:

"Ignoring Ukrainian President Volodymyr Zelensky’s call to meet for direct high-level talks in Turkey, Russian leader Vladimir Putin dispatched to Istanbul a team of junior officials, making it uncertain that negotiations between the warring nations would occur at all."

But Russia analyst and author of Forged In War: A Military History of Russia From its Beginnings To Today, Mark Geleotti, has a very different take, featured below [emphasis ZH]:

It’s easy (and not wholly untrue) to slam Vladimir Medinsky, leading the Russian delegation to Istanbul as a nobody, but perversely, although I think it monstrously unlikely anything meaningful will come from the talks, the composition of the delegation is encouraging.

Putin was never likely to attend, not least as he wasn’t going to allow it to look as if he had been manipulated and dared by Zelensky. Besides, sometimes it can help break a logjam (think Reagan/Gorbachev), but leaders usually turn up to seal the deal at the end of the process, after experts have done all the hard preparatory work away from the cameras.

Do we honestly think two men who so plainly loathe each other and who have been shamelessly posturing for Trump's benefit were going to reach some kind of meeting of minds? Possible, but unlikely.

Medinsky led the talks in 2022 that failed to reach a usable deal (we can discount the myth that Zelensky was about to agree to Russia's demands until Boris Johnson nixed it) so this is meant to signal continuity in process and demands.

Medinsky's very lack of personal authority isn’t a snub, so much as a sign that Putin wants to manage any process by remote control. He's a human drone, which at least means any positions he advances/agrees already have VVP's ok

The rest of the delegation likewise isn't showy (though the presence of military intel chief Kostyukov is interesting as they were key in POW swaps) but likewise meant to signal a willingness to do serious work. (Although this doesn’t necessarily mean make necessary compromises).

Of course, with no hint that Russia is about to relax its implausible and unfair demands, this may all be for show. It probably is, alas. But talking is always good as there is a *chance*, however minuscule, that talks can lead somewhere.

So although Medinsky is a shallow ideologist, and sending him is in a way a snub, a means for Putin to try and reject Zelensky's challenge while not looking wholly uncooperative in Trump's eyes.

…whereas before I was 99% pessimistic about the talks, now I’m only 98% so. That is as much room for optimism as there is, these days.

-

Site: Fr. Z's BlogThe Eternal City became noticeably brighter with the rising of the sun at 5:48. The light will diminish significantly at 20:26. The Ave Maria Bell is in the 20:45 cycle right now. It is Feast of St. Jean Baptiste de … Read More →

-

Site: Zero HedgeFutures Drop Ahead Of Data Deluge, Powell SpeechTyler Durden Thu, 05/15/2025 - 08:15

US equity futures are lower as investors take profits on Thursday and tech stocks fell as investors worried about an economic slowdown after Steve Cohen warned the chance of a recession is 45% and today’s retail sales numbers are expected to be a miss. As of 8:00am ET, S&P futures are down 0.4%, rebounding from session lows after Walmart reported solid earnings; Nasdaq futures dropped 0.5% with Nvidia, Palantir and Tesla falling about 2% in early trading. On Wednesday, the S&P failed at 5,900 for the second consecutive day. The silver lining according to JPM is that yesterday, NVDA turned positive on the year, joining META and MSFT; if the remaining members follow suit, there is another ~10% upside to the index assuming positive members are flat. YTD, AMZN is -4.2%, GOOG -12.6%, TSLA -13.9%, and AAPL -15.2%. In trade news, China removed curbs on rare earth exports to the US. Trump says India is willing to drop is tariffs on US goods. Brent sank below $64, down more than 3% after President Donald Trump said the US is getting closer to a deal on Iran’s nuclear program, fueling concern that additional oil supply may pressure the market. Bond yields and the USD are lower. Today’s macro data focus is on Retail Sales which are expected to remain unchanged in April (versus 1.5% prior); PPI, Jobless Claims, Philly Fed and Empire Manufacturing numbers are due at 8:30 am in New York, while Industrial Production prints at 9:15am. Also, traders are looking ahead to a speech by Federal Reserve Chair Jerome Powell.

In premarket trading, UnitedHealth shares sank after the WSJ reported it’s under criminal investigation for possible Medicare fraud. Walmart delivered another quarter of solid sales and earnings growth, and cautioned that tariffs and increasing economic turbulence means even the world’s largest retailer can’t hold off on price increases forever. Shares gained 2.4% premarket. Magnificent Seven stocks are lower as risk appetite falters (Tesla -1.8%, Apple -1%, Meta Platforms -1%, Amazon -0.8%, Alphabet -0.7%, Nvidia -0.6%, Microsoft -0.5%). Here are some other notable premarket movers:

- Alibaba ADRs (BABA) decline 5.6% after reporting revenue that missed estimates, dragged by a slowing international e-commerce arm and its Cainiao logistics business that’s under restructuring.

- Boot Barn (BOOT) rises 13% after the retailer of western wear gave a forecast for 1Q same-store sales growth that surpassed Wall Street estimates, despite an expected hit from tariffs.

- Cisco Systems (CSCO) rises 3.3% after the company gave a solid forecast for revenue in the current quarter, a sign the largest seller of networking gear is benefiting from demand for systems using AI technology.

- CoreWeave (CRWV) shares fall 6.6% after the cloud-computing provider’s quarterly profit forecast missed estimates due to some spending being brought forward.

- Crowdstrike Holdings (CRWD) shares are down 2.4% in premarket trading, after Mizuho Securities downgraded the software company to neutral from outperform.

- DXC Technology (DXC) shares are down 14% after the company reported forecast adjusted earnings per share for the first quarter and 2026 full-year guidance that missed the average analyst estimate.

- Dlocal (DLO) shares gain 21% after the financial technology company beat earnings expectations and unveiled plans for a special dividend.

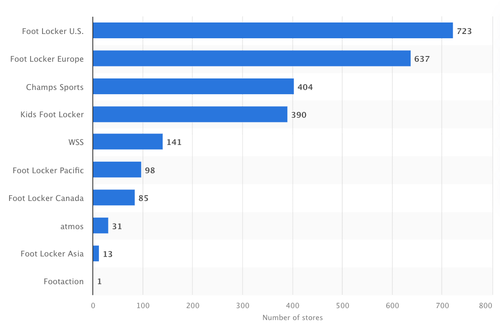

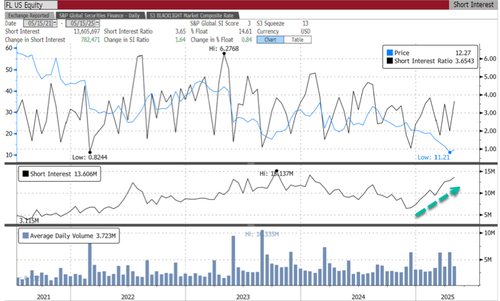

- Foot Locker (FL) is up 84% with Dick’s Sporting Goods to buy it in a cash or stock deal implying an equity value of about $2.4 billion and an enterprise value of about $2.5 billion.

- JetBlue (JBLU) falls 1.6% after Raymond James downgraded the airline company to market perform from outperform, citing a more balanced risk-reward amid an improvement in sentiment.

- Luminar (LAZR) drops 13% after the automotive technology company’s CEO Austin Russell resigned as CEO, overshadowing better-than-expected first-quarter sales.

- NetEase ADRs (NTES) are up 6.7% after the China-based video-game company reported first-quarter results that beat expectations.

- New Fortress Energy (NFE) shares slump 38% after the energy infrastructure firm saw adj. Ebitda plunge in the first quarter, with analysts flagging that the sale of its Jamaican assets will dent cash flow.

There’s also some big company news to digest. Trump wants Apple to stop moving iPhone production to India, while Starbucks is said to be considering options to revamp its China business, including a possible stake sale.

Economic forecasters this week have said that while the Trump administration’s temporary trade deal with China has reduced the risk of a recession, the overall economy is likely to slow. “There’s definitely more clarity than a few weeks ago,” Dubravko Lakos-Bujas, chief of global markets strategy at JPMorgan Chase & Co., said in a Bloomberg Television interview. “Some of the uncertainty around trade, tariffs, policy started to get reined in.”

“The market is globally priced for perfection,” said Michael Nizard, head of multi-asset at Edmond de Rothschild Asset Management. “The retail sales figures should reveal that consumer is already depressed in terms of business confidence.”

Meanwhile, billionaire Steve Cohen, speaking at the Sohn Investment Conference on Wednesday, put the chances of a US recession at about 45%. Cohen, the founder of hedge fund Point72 Asset Management, said he doesn’t expect the Federal Reserve to cut rates right away, because “they are going to be worried about inflation from tariffs.” He said he expects US economic growth next year to slow to 1.5% or less, “which is OK but not phenomenal.”

Looking at today's macro data, Retail sales are expected to rise by a tepid 0.1% in April (versus 1.5% prior) according to Bloomberg economists, while a survey of economists is pointing to flat month-on-month sales. PPI and Empire Manufacturing numbers are due at 8:30 am in New York. Traders were looking ahead to a speech by Federal Reserve Chair Jerome Powell, as well as data on manufacturing and retail sales, for the next readout on US growth and inflation. Economists are expecting no growth in retail sales in April as consumers cut back on some purchases.

European stocks retreat for a second day. Energy stocks lead declines, driven by a fall in oil prices following a report that Iran is willing to forgo nuclear weapons in a deal with the US, while utilities and food and beverage stocks outperform. Among individual stocks, insurance firm Allianz drops after disappointing results. Stoxx 600 falls 0.2% to 542.88 with 327 members down, 263 up, and 10 little changed. Here are the biggest European movers:

- KBC shares rise as much as 2.6% after the Belgian lender reported earnings that analysts said were roughly in line with expectations, and saw a boost from increased insurance revenues.

- Engie shares gain as much as 2.2% after the utility produced what analysts said were strong results that should provide further comfort around full-year guidance and the dividend.