In proclaiming the faith and in administering the sacraments every priest speaks on behalf of Jesus Christ, for Jesus Christ.

Distinction Matter - Subscribed Feeds

-

Site: Mises InstitutePresident Trump has made a lot of noise in the business community in the first few months of his administration. Unfortunately, his actions and rhetoric have created a lot of uncertainty in the economy, threatening capital development.

-

Site: Henrymakow.com

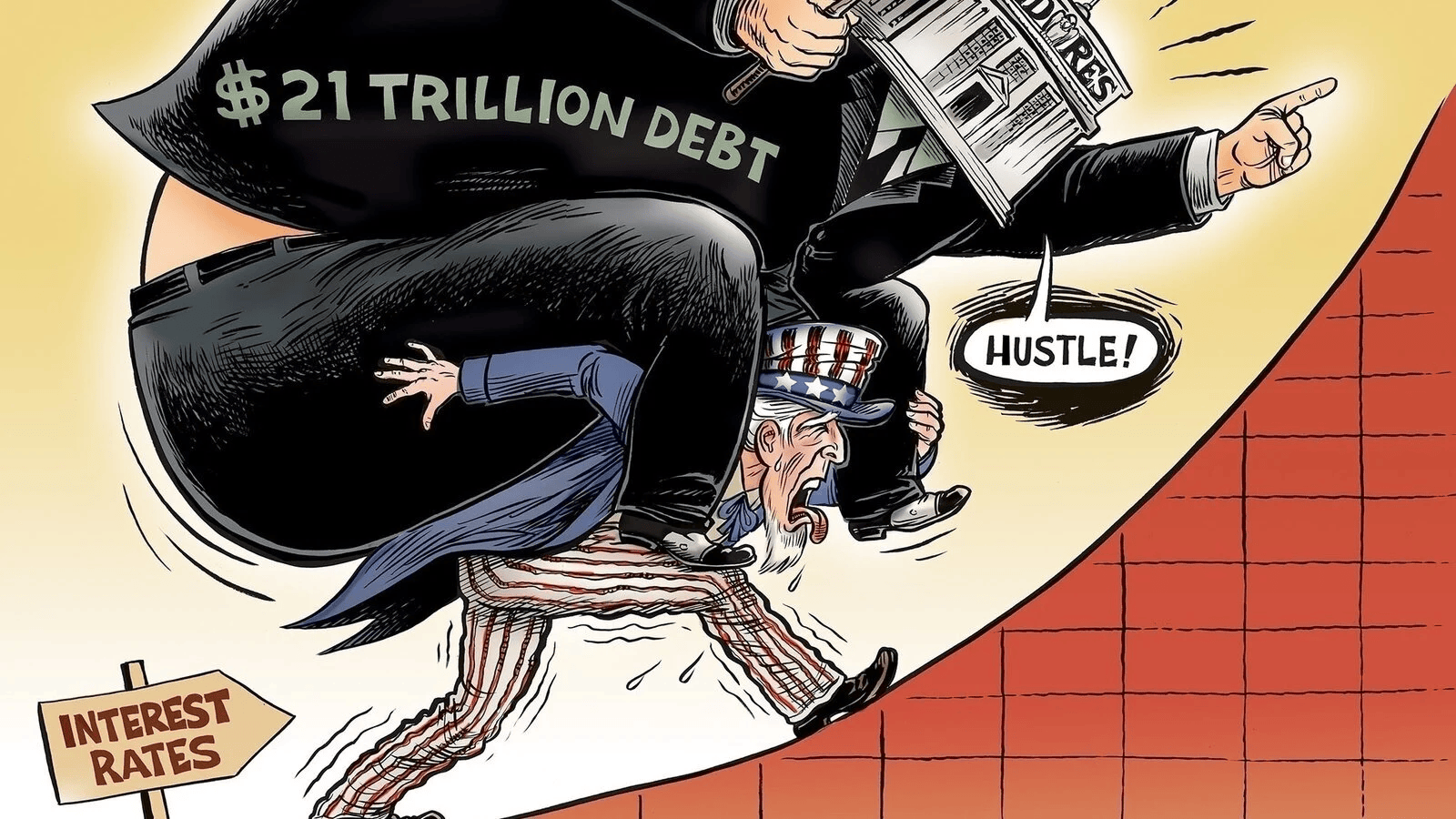

(The debt is now $37 Trillion and counting)Peace talks are stalled in Ukraine and the ME.The world is refusing to finance the burgeoning US DEBT.In spite of this, Trump is planning tax cuts for the rich and a $150 billion "Golden Dome" defence shield."After an all night vote, the US narrowly passed the budget bill in the House that would increase federal deficits by $4 trillion, according to the Congressional Budget Office. This is largely through tax cuts. To offset the lower revenue from taxes, the budget cuts spending by $1 trillion on the back of reduced eligibility for Medicaid and food stamps. Plainly, it's a budget that benefits the highest income earners while limiting resources for the lowest income earners." - Amber KanwarThomas Stone--Federal Reserve is intentionally blowing it up"Yes, the only conclusion I can make is that the Federal Reserve is effectively restricting credit at the worst time on purpose to blow it all up. Let me explain."QE turned the Federal government into a crack addict. Believe me on this one, the Federal Reserve is not being stupid. It is carrying out its instructions to blow it all up.The Fed is absolutely laying it all waste by leaving interest rates persistently elevated above official rates of inflation while they continue to roll off existing Treasury inventory from its balance sheet. The rest of the world cannot replace the Fed's former Treasury demand. If it could, long-term bond yields wouldn't be continuing to creep higher.How stupid can the Fed be? In another couple years, the Federal government interest expenses will hit $1.5 trillion annually."-Trump's Bill Cuts Medicare, Gives to Pentagon. Rep. Massie Says Bill Adds $20 TRILLION to the DebtMeanwhile, zero cuts were made to the Pentagon, instead, about $10 billion was funnelled into it.About 80 million Americans get Medicare and 70 million get Medicaid. Analysis from the congressional budget office shows that 7.6 million people would lose their Medicaid coverage if the current House proposal becomes law. 63% of nursing home care is funded by Medicaid. The bill would also cut 3 million people from the SNAP food stamps program. The Joint Committee on Taxation (JCT) estimated that the bill as written would increase deficits by $3.8 trillion through to 2034.--

(The debt is now $37 Trillion and counting)Peace talks are stalled in Ukraine and the ME.The world is refusing to finance the burgeoning US DEBT.In spite of this, Trump is planning tax cuts for the rich and a $150 billion "Golden Dome" defence shield."After an all night vote, the US narrowly passed the budget bill in the House that would increase federal deficits by $4 trillion, according to the Congressional Budget Office. This is largely through tax cuts. To offset the lower revenue from taxes, the budget cuts spending by $1 trillion on the back of reduced eligibility for Medicaid and food stamps. Plainly, it's a budget that benefits the highest income earners while limiting resources for the lowest income earners." - Amber KanwarThomas Stone--Federal Reserve is intentionally blowing it up"Yes, the only conclusion I can make is that the Federal Reserve is effectively restricting credit at the worst time on purpose to blow it all up. Let me explain."QE turned the Federal government into a crack addict. Believe me on this one, the Federal Reserve is not being stupid. It is carrying out its instructions to blow it all up.The Fed is absolutely laying it all waste by leaving interest rates persistently elevated above official rates of inflation while they continue to roll off existing Treasury inventory from its balance sheet. The rest of the world cannot replace the Fed's former Treasury demand. If it could, long-term bond yields wouldn't be continuing to creep higher.How stupid can the Fed be? In another couple years, the Federal government interest expenses will hit $1.5 trillion annually."-Trump's Bill Cuts Medicare, Gives to Pentagon. Rep. Massie Says Bill Adds $20 TRILLION to the DebtMeanwhile, zero cuts were made to the Pentagon, instead, about $10 billion was funnelled into it.About 80 million Americans get Medicare and 70 million get Medicaid. Analysis from the congressional budget office shows that 7.6 million people would lose their Medicaid coverage if the current House proposal becomes law. 63% of nursing home care is funded by Medicaid. The bill would also cut 3 million people from the SNAP food stamps program. The Joint Committee on Taxation (JCT) estimated that the bill as written would increase deficits by $3.8 trillion through to 2034.-- (Left, Bill Gates demonstrates Masonic handshake with Tedros)Members of the World Health Organisation ("WHO") adopted a global pandemic accord on Tuesday, 20 May 2025; 124 countries voted in favour, no countries voted against, while 11 countries abstained and 46 countries were not present. The total votes cast don't add up, but those are the numbers WHO has declared.For the countries that abstained - of which, shamefully, the UK was not one - their concerns included loss of national sovereignty, lack of legal clarity and the risk of unelected institutions imposing policy.-Iran warns of 'devastating and decisive response' if Israel attacks-Pam Blondi- Jilted - Leftists do a good job of demystifying Pam Bondi--KEENEY: Canada's universities, islands of oppression in a sea of freedom'The treason of the tenured... what Saint Mary's University reveals about the ideological capture of Canada's universities.'The modern university, once a sanctuary for critical inquiry and truth seeking, has become a laboratory for fashionable ideologies. Mark Mercer, a professor of philosophy at Saint Mary's University in Halifax and a longtime defender of academic freedom, has provided us with a disturbing case study that reveals the depth of this transformation.-

(Left, Bill Gates demonstrates Masonic handshake with Tedros)Members of the World Health Organisation ("WHO") adopted a global pandemic accord on Tuesday, 20 May 2025; 124 countries voted in favour, no countries voted against, while 11 countries abstained and 46 countries were not present. The total votes cast don't add up, but those are the numbers WHO has declared.For the countries that abstained - of which, shamefully, the UK was not one - their concerns included loss of national sovereignty, lack of legal clarity and the risk of unelected institutions imposing policy.-Iran warns of 'devastating and decisive response' if Israel attacks-Pam Blondi- Jilted - Leftists do a good job of demystifying Pam Bondi--KEENEY: Canada's universities, islands of oppression in a sea of freedom'The treason of the tenured... what Saint Mary's University reveals about the ideological capture of Canada's universities.'The modern university, once a sanctuary for critical inquiry and truth seeking, has become a laboratory for fashionable ideologies. Mark Mercer, a professor of philosophy at Saint Mary's University in Halifax and a longtime defender of academic freedom, has provided us with a disturbing case study that reveals the depth of this transformation.- Hamdy Mig--"Thanks to your donations, I bought a new tent, rented a small plot of land and put it inside, thank you"This is the last batch of flour, and the last bread left. A sack of wheat costs $600 here. No one can afford it, and we're at great risk of starvation. The financial situation is very difficult. Please help me buy a sack of wheat before it runs out in the city, and before we're hit by another great famine."-Israeli Strikes on Gaza Kill 82 as Aid Still Hasn't Reached PalestiniansThe UN says the small amount of aid that entered Gaza has been loaded onto UN trucks, but still hasn't been distributed due to unsafe conditionsKash Patel & Dan Bongino Repeat Epstein Suicide LIE! - YouTube. The Jimmy Dore Show.These two clowns have always been strong supporters of Israhell, so what did the MAGA cult members expect?!Virginia Governor Signs Executive Order for Safe Classrooms and Combatting Antisemitism in Higher Education - Israel365 News-Bribery Charges Sink Retired Admiral In Navy Ethics Scandalhttps://www.zerohedge.com/political/retired-admiral-convicted-navy-bribery-case-marking-historic-fall-top-military-officialBurke, 63, of Coconut Creek, Fla., was found guilty by a Washington jury after a five-day trial and three days of deliberation. Prosecutors said he steered a Navy training contract in 2021 to a New York-based company, Next Jump, in exchange for a $500,000-per-year job he was to begin after his retirement in 2022.--

Hamdy Mig--"Thanks to your donations, I bought a new tent, rented a small plot of land and put it inside, thank you"This is the last batch of flour, and the last bread left. A sack of wheat costs $600 here. No one can afford it, and we're at great risk of starvation. The financial situation is very difficult. Please help me buy a sack of wheat before it runs out in the city, and before we're hit by another great famine."-Israeli Strikes on Gaza Kill 82 as Aid Still Hasn't Reached PalestiniansThe UN says the small amount of aid that entered Gaza has been loaded onto UN trucks, but still hasn't been distributed due to unsafe conditionsKash Patel & Dan Bongino Repeat Epstein Suicide LIE! - YouTube. The Jimmy Dore Show.These two clowns have always been strong supporters of Israhell, so what did the MAGA cult members expect?!Virginia Governor Signs Executive Order for Safe Classrooms and Combatting Antisemitism in Higher Education - Israel365 News-Bribery Charges Sink Retired Admiral In Navy Ethics Scandalhttps://www.zerohedge.com/political/retired-admiral-convicted-navy-bribery-case-marking-historic-fall-top-military-officialBurke, 63, of Coconut Creek, Fla., was found guilty by a Washington jury after a five-day trial and three days of deliberation. Prosecutors said he steered a Navy training contract in 2021 to a New York-based company, Next Jump, in exchange for a $500,000-per-year job he was to begin after his retirement in 2022.-- Seminole Indians are claiming Mar a Lago and moving Trump and his family to Libya.ARCHBISHOP VIGANO IS SKEPTICAL OF THE CONCLAVE BECAUSE FRANCIS "CREATED" NEARLY 80 PERCENT OF THE CARDINALS WHO ELECTED LEO XIV:Vigano stated: "The death of Bergoglio crystallizes, so to speak, a situation of widespread illegitimacy. Of the 136 Cardinal electors, 108 were 'created' by him; which means that whatever Pope is elected in the upcoming Conclave - even if he were a new Saint Pius X - his authority will be compromised by having been elected by false cardinals, created by a false Pope. For this reason, some time ago, I asked my Brothers in the Episcopate to clarify these aspects before they proceed with the election of a new Pope".-Carney 'devastated and appalled' by killing of 2 Israeli embassy staff in Washington-RFK JR CALS OUT THE UN'S WORST HELL ORGANIZATION (WHO):On 20 May 2025, RFK Jr told the truth about the UN's Worst Hell Organization (WHO):Now we only need ZioFascist Donald Trump to apologize for the COVID-PHARMA GENOCIDE.-

Seminole Indians are claiming Mar a Lago and moving Trump and his family to Libya.ARCHBISHOP VIGANO IS SKEPTICAL OF THE CONCLAVE BECAUSE FRANCIS "CREATED" NEARLY 80 PERCENT OF THE CARDINALS WHO ELECTED LEO XIV:Vigano stated: "The death of Bergoglio crystallizes, so to speak, a situation of widespread illegitimacy. Of the 136 Cardinal electors, 108 were 'created' by him; which means that whatever Pope is elected in the upcoming Conclave - even if he were a new Saint Pius X - his authority will be compromised by having been elected by false cardinals, created by a false Pope. For this reason, some time ago, I asked my Brothers in the Episcopate to clarify these aspects before they proceed with the election of a new Pope".-Carney 'devastated and appalled' by killing of 2 Israeli embassy staff in Washington-RFK JR CALS OUT THE UN'S WORST HELL ORGANIZATION (WHO):On 20 May 2025, RFK Jr told the truth about the UN's Worst Hell Organization (WHO):Now we only need ZioFascist Donald Trump to apologize for the COVID-PHARMA GENOCIDE.- Bumblehive: The entrance to the NSA's Utah Data Center administration building. The purpose of the data center is to track "all forms of communication, including the complete contents of private emails, cell phone calls, and internet searches, as well as all types of personal data trails -- parking receipts, travel itineraries, bookstore purchases, and other digital 'pocket litter.'"Understanding and Countering Sentient World Simulation

Bumblehive: The entrance to the NSA's Utah Data Center administration building. The purpose of the data center is to track "all forms of communication, including the complete contents of private emails, cell phone calls, and internet searches, as well as all types of personal data trails -- parking receipts, travel itineraries, bookstore purchases, and other digital 'pocket litter.'"Understanding and Countering Sentient World Simulation -

Site: Zero HedgeSupreme Court Deadlocks, Leaves In Place Block On Nation's First Religious Charter SchoolTyler Durden Thu, 05/22/2025 - 12:20

Authored by Matthew Vadum via The Epoch Times (emphasis ours),

The U.S. Supreme Court on May 22 voted 4–4 to reject authorization for the nation’s first publicly funded religious charter school.

The U.S. Supreme Court in Washington on May 19, 2025. Madalina Vasiliu/The Epoch Times

The U.S. Supreme Court in Washington on May 19, 2025. Madalina Vasiliu/The Epoch Times

Justice Amy Coney Barrett recused herself and did not participate in the case known as Oklahoma Statewide Charter School Board v. Drummond. The respondent is Gentner Drummond, Oklahoma’s attorney general.

The Supreme Court’s unsigned opinion consists of one sentence: “The judgment is affirmed by an equally divided Court.” No reasons for the ruling were provided.

As the vote resulted in a tie, under court rules, the lower court ruling being appealed is affirmed.

On June 25, 2024, the Oklahoma Supreme Court ruled against the school, ordering the school board to cancel the contract and finding that the school was a governmental entity.

The court determined that, since the school was deemed a state actor, denying it charter status did not violate the free exercise clause.

The state court also found that the school’s contract with the school board violated the Oklahoma Constitution’s prohibition against “using public money for the benefit or support of any religious institution.”

This is a developing story and will be updated.

-

Site: Mises Institute30-year Treasury yield spikes to 5.09%, 10-year yield hits 4.61%. 10-yr yield is back at 2005 levels.

-

Site: Zero HedgeEco-Fascism - 2026 Ballot Measure Seeks "End Of Farming" In ColoradoTyler Durden Thu, 05/22/2025 - 11:55

The Trump administration, focused on delivering economic growth and food production in the U.S., is attracting the opposition of zealots and degrowth monied interests alike.

To wit; two radically authoritarian ballot measures - which have the support of initiatives and frameworks of International Governmental Organizations (IGOs) - ask Colorado and Oregon voters to give up the family dog and hand over their private property rights in what some have called "the end of farming and ranching" in the Mile High state.

Democrats in Colorado are preparing to permanently end farming in the state

— Wall Street Apes (@WallStreetApes) May 13, 2025

“This would be the end of farming and ranching and private (farm) land ownership in Colorado”

“There's something happening in Colorado which is not so good. The corridor of people that don't understand… pic.twitter.com/EDWu2KJNd8The first measure, Colorado ballot initiative 2025-2026#82, reads like a dictator's manifesto - and is essentially a carbon copy of the CCP-backed Convention on Biological Diversity's wildlands project.

The eight-page "Colorado Wildlife and Biodiversity Protection Act" seeks to create the Wildlife and Ecosystem Conservation Commission (WECC).

Astonishingly, the WECC would consist of nine appointed members, with the petition strictly stipulating that no member can have any financial ties to agriculture, energy, or development. The petition then goes on to (laughably) assert that these supposed "elite" members - without "financial ties" - will be appointed by universities, environmental groups, and policy institutes. Naturally, this commission will have total control over agriculture, energy, and all future development in Colorado.

Deal with the Devil

But, have no fear landowners, the petition miraculously provides 25-50% tax abatement for those willing to hand over 49-100% of their private lands as designated wildlands…in perpetuity.

Given the sheer naivete, and the multitudes of legal errors made by petitioners Jessica Presso and Cameron Porter, most would rightly assume the petition would be dead on arrival. Not so fast.

Within days, the Colorado Legislative Council Staff and Office of Legislative Legal Services sent Presso and Porter a nineteen-page how-to guide, effectively giving free legal advice by outlining the requirements for a final draft.

Similar to court filings, when initiated petitions fail to meet filing requirements for single subjects, or properly address statutory amendments, they're simply refused by the Secretary of State - placing the onus upon the petitioner(s) to seek legal advice. However, this departure from the norm now appears to be part of a growing trend in radical leftist states.

Oregon

Leading up to the 2022 election in Oregon, a similarly wonky Initiative Petition 13 was introduced to make raising, riding, eating or owning domestic livestock illegal. Similarly, the state donated resources to the petitioners by sending back a lengthy how-to guide.

After significant tweaks, that Initiative Petition is back as IP28 and greenlit for signature collection ahead of the 2026 election. In addition to making it illegal to own companion animals such as dogs or cats, the IP would make it illegal to render animals for meat in the State of Oregon.

While some might be quick to dismiss the actions of a few, seemingly lone environmental zealots, others cite bigger-picture concerns for connections to IGOs and dark money influence.

Last month, when the Trump administration delivered a long-awaited reform to the Endangered Species Act, monied interests immediately lashed out with threats.

"Trump is trying to drive a knife through the heart of the Endangered Species Act. This will absolutely upend how we've been protecting endangered species for the last 40-plus years," said Noah Greenwald of the Center for Biological Diversity, which makes its money by suing states and the federal government.

"The Center for Biological Diversity will no doubt join other groups in challenging the rule change in federal court," Greenwald added.

Yet by narrowly redefining "harm" as an illegal taking—such as removing or poaching—the Trump administration is attempting to rectify decades of federal overreach that have resulted in the loss of grazing rights on privately owned lands and the lowest cattle volumes in 70 years.

While America's farmers and ranchers are no strangers to authoritarian land grabs, many are now urging voters to take these state-level initiatives seriously as they're not only aligned with the degrowth agendas of foreign-backed IGOs but would also supplant private property rights with eco-fascism.

* * *

Save small ranchers, control your own food supply, and eat clean.

-

Site: Zero HedgeTrump Navigating Base's Opposition To Interventionism With Iran Talks: Victor Davis HansonTyler Durden Thu, 05/22/2025 - 11:30

Authored by Ryan Morgan and Jan Jekielek via The Epoch Times,

As President Donald Trump continues negotiations to limit Iran’s nuclear aspirations, historian and Hoover Institution senior fellow Victor Davis Hanson believes the president is preparing his non-interventionist supporters for the possibility of a more forceful confrontation in the Middle East.

On the 2024 campaign trail, Trump frequently touted his record of avoiding new wars during his first term and emphasized his plans to quickly resolve ongoing conflicts, like the one in Ukraine. At the same time, Trump has described his foreign policy approach as one of “peace through strength,” and he has been willing to threaten military action to press his agenda.

In March, as the U.S. president began his push for a new deal restricting Iran’s nuclear program, he warned, “If they don’t make a deal, there will be bombing.”

In a recent interview with Jan Jekielek, host of EpochTV’s “American Thought Leaders,” Hanson described Trump as having to thread the needle with how he handles his next steps with Iran.

“The MAGA covenant he ran on said no optional Middle East wars, no foreign entanglements, and it’s always better to jawbone than to go to war,” he said.

While the Trump administration has joined successive rounds of indirect talks with Iranian representatives, Hanson assessed that Israeli leaders feel the current moment is a good window of opportunity to strike Iran.

Even if the negotiations don’t result in a deal, Hanson said Trump could use the opportunity to acclimate his base to the Israeli point of view.

“He’s saying to Israel, ‘Let’s just get six or seven months of negotiation ... We‘ll negotiate to the point where they have to shut up or put up. And if you’re right ... then we have a case to be made to our MAGA base.’”

Syria

Hanson assessed Bashar al-Assad’s fall from power in Syria as an important opportunity to further isolate Tehran and diminish its influence across the Middle East.

Assad fled the country in December, amid a surprise offensive led by Hay’at Tahrir al-Sham, a Sunni Islamist faction that began as Al Qaeda’s Syrian offshoot, and which the U.S. government still considers a foreign terrorist organization.

After seizing Damascus, a rebel-led council named Ahmed al-Sharaa—the leader of Hay’at Tahrir al-Sham—as president of a new self-styled Syrian transitional government. The council has named other Hay’at Tahrir al-Sham members to top leadership positions in this transitional government.

Since taking power, Sharaa has tried to present himself as more of a moderate than his past would suggest. In turn, the United States has shown reduced hostility.

In President Joe Biden’s last weeks in office, his administration retracted a $10 million bounty against Sharaa, opening the way for then-Assistant Secretary of State for Near Eastern Affairs Barbara Leaf to meet with the ascendant Syrian warlord.

This month, Trump announced he would retract sanctions against Syria “to give them a chance at greatness.” Trump met with Sharaa during his Middle East tour last week and announced he was considering normalizing ties with Syria’s new leadership.

Trump also urged Sharaa to join the Abraham Accords, a framework for normalizing relations between Israel and its various Muslim neighbor states.

Despite Sharaa’s past, Hanson assessed Turkey, Israel, Syria’s Kurdish population, and the neighboring Arab states all prefer him to Assad, and indicated that Trump may feel the same.

“There may be terrorists, but they may be directed in other directions. I don’t know. But all of these interests felt that it was superior to the Assad regime. And most of the interests were pro-American,” he said.

-

Site: AsiaNews.itLeo XIV met with participants in the Societies' annual assembly, who came from over 120 countries. He expressed his gratitude for their 'mission of evangelization,' which he shared during his years of pastoral work in Peru. ...

-

Site: non veni pacem

She was an Augustinian. So there’s that.

I can attest she is a powerful intercessor. Her national shrine is in Philadelphia. They have daily Mass and Confessions there.

Saint Rita of Cascia, pray for us.

https://www.saintritashrine.org/

-

Site: LifeNews

The Texas House of Representatives has approved a resolution to erect a pro-life monument on the Capitol grounds, a move supporters say honors the sanctity of life and remembers the unborn babies lost to abortion.

The decision, passed on Tuesday with a 98-44 vote, authorizes the construction of the Texas Life Monument, a replica of the National Life Monument depicting a pregnant woman cradling an unborn child in a world-shaped womb.

The resolution, authored by Sen. Tan Parker, R-Flower Mound, and sponsored in the House by Rep. Caroline Harris Davila, R-Round Rock, received strong support from pro-life advocates.

Harris Davila emphasized the monument’s purpose, stating it provides a public space to reflect on the beauty and sanctity of the love of a mother for her child.

LifeNews is on GETTR. Please follow us for the latest pro-life news

“This effort does not involve the use of public funds and aligns with state law guiding additions to Capitol Complex grounds.”

“The monument,” Harris-Davila added, “would serve as a beautiful space for families to honor motherhood, the strength of women, and the hope and beauty of human life.”

She added that the statue, an eight-foot-tall bronze sculpture, will be funded entirely through private donations, ensuring no public money is used.

The Texas Life Monument mirrors efforts in other states to commemorate the lives of the unborn. In Arkansas, a similar monument was proposed in 2024 to honor the estimated 65 million babies lost to abortion since the 1973 Roe v. Wade decision, which was later overturned. Tennessee also approved a Monument to the Unborn in 2018, placed on the Capitol grounds to serve as a reminder of the lives ended by abortion. These memorials reflect a growing movement among pro-life advocates to create lasting tributes to the unborn and to affirm the value of life from conception.

The statue, designed by artist Timothy Schmalz, will join other historical monuments surrounding the Texas Capitol, adding to the state’s collection commemorating significant figures and events.

The post Texas House Approves Pro-Life Monument to Remember Victims of Abortion appeared first on LifeNews.com.

-

Site: Mises InstituteOn Wednesday, the Treasury bonds auction was so weak that 20-year and 30-year yields continued to rise as investors expect a rising wave of mounting federal deficits and debt.

-

Site: Mises Institute

-

Site: Steyn OnlineLaura Rosen Cohen presents her round-up of excellent links from around the world...

-

Site: Rorate Caeliby Serre Verweijfor Rorate CæliWe have a new Pope elected during a Jubilee year. He instantly faces many crucial tasks and dilemmas. This might seem obvious for any new Pope, but in 2013 Pope Francis primarily had to deal with curial reform, he did not have to deal with countless open questions, and even open wounds, left by his predecessors. Pope Leo XIV will have to deal with foreign New Catholichttp://www.blogger.com/profile/04118576661605931910noreply@blogger.com

-

Site: LifeNews

With the help of pro-life advocates, a bill to legalize assisted suicide in Nevada was defeated May 16 when it did was not advanced by a state senate committee.

This is the fifth time that such legislation has failed to pass in the state,

Republican Nevada Gov. Joe Lombardo had previously stated that he would veto any assisted suicide legislation if it passed the senate, according to Breitbart. Lombardo vetoed a similar proposal in 2023.

Assembly Bill 346 would have allowed adults with a prognosis of six months or less to live to end their lives with a prescription from a doctor or nurse practitioner. The bill also stipulated that the adults must be “mentally capable” to make the decision.

REACH PRO-LIFE PEOPLE WORLDWIDE! Advertise with LifeNews to reach hundreds of thousands of pro-life readers every week. Contact us today.

Breitbart explains that the bill failed to advance past a committee deadline on May 16, and therefore is not eligible to pass in 2025.

In an interview with LifeNews, Sarah Davenport-Smith of the Patients’ Rights Action Fund attributed the bill’s defeat in part to pro-life advocates who protested the legislation.

“The bill started out in the Assembly and the first hearing was through a non-traditional ad-hoc committee of hand-picked proponents of assisted suicide,” she said. “The rules of public testimony and a fair hearing did not apply.”

The bill was amended and passed the assembly in a 23-19 vote, as CatholicVote previously reported, and moved to the senate’s Health and Human Services committee. But the pro-life advocates did not give up. Nevada Coalition of the Patients’ Rights Action Fund met with senators, wrote op-eds, and reached out to other pro-life organizations to gain more influence.

“Their work paid off!” Davenport-Smith said of the coalition. “In the end, the votes were not even present in the Senate committee.”

LifeNews Note: Grace Porto writes for CatholicVote, where this column originally appeared.

The post Nevada Rejects Assisted Suicide Bill for 5th Time appeared first on LifeNews.com.

-

Site: Ron Paul Institute - Featured Articles

With nuclear negotiations between the Trump administration and Iran’s Reformist government at a standstill, I held two separate, lengthy background conversations in Tehran this past week with a pair of seasoned Iranian diplomats with detailed knowledge of the talks in Muscat, Oman.

Like most Iranians, the diplomats were eager for a durable deal that would provide sanctions relief. But they said their side could not seem to break through to a Trump team they described as dithering, divided, distracted by other conflicts, and incapable of holding to a consistent position. Worse, as the negotiations drag on, the Trump administration is defaulting toward the hardline Israeli position which rejects all uranium enrichment, even for civilian purposes, violating a right Tehran considers sacrosanct.

The Iranian diplomats have now begun to suspect the Trump administration held an ulterior motive for engaging in talks, and is exploiting the meetings in Oman as a instrument for generating instability to weaken Iran’s economy and foment social strife.

Their comments to me echoed a warning issued by the Leader of Iran’s Islamic Republic, Ayatollah Khamenei, as Tehran considered a request from Trump for nuclear talks last March. “Negotiating with this US administration won’t result in the sanctions being removed,” Khamenei declared. “It will cause the knot of sanctions to become tighter and pressure to increase.”

Following two months of political confusion and a significant escalation of US financial warfare, the Ayatollah’s words have proven prescient. Iran’s Reformist government now risks repeating the folly of the 2015 Joint Comprehensive Plan Of Action, or JCPOA, which failed to deliver meaningful sanctions relief in the brief period before Trump shredded the deal, and ultimately led to a regime of “maximum pressure” culminating with the US assassination of Iranian Maj. Gen. Qasem Soleimani.

Iran’s government entered the latest round of talks under heavy pressure, with Trump dispatching a B-2 bomber strike force to the Diego Garcia Airbase to enforce his demands. The negotiations also took place in the shadow of the post-October 7 wars, in which Iran’s regional allies had suffered serious setbacks and with the last retaliation it vowed against Israel, True Promise III, still unfulfilled. Iranian public opinion researcher Ebrahim Moehseni told me his polling at the time showed that a majority of Iranians from all social sectors supported the talks.

According to the two diplomats I spoke to in Tehran, Iran’s negotiating team arrived in Oman with a sense of pessimism, but quickly grew more positive as they realized the Americans were not introducing demands for Iran to sever relations with its allies in Lebanon and Yemen, scrap its long range ballistic missiles, or destroy its reactors in Natanz and Fordow. But after each encouraging exchange, they watched key Trump negotiators issue bellicose statements to media immediately after returning to Washington, essentially reversing the positions they had taken in Muscat. The Iranians suspected Trump’s team, led by real estate lawyer Steve Witkoff, was kowtowing to Israeli assets like the Foundation for the Defense of Democracies and its top donor, Miriam Adelson.

During each round of talks, the Iranian team introduced concrete proposals to bridge disagreements and maintain momentum. But according to the diplomats I spoke to, they found themselves waiting for a week or more to receive a reply from the Americans. They described Witkoff as distracted by other diplomatic assignments and said he often put Iran on the back burner while he tended to Ukraine-Russia negotiations or the Gaza war.

The diplomats were especially concerned by the apparent power struggle between Witkoff and Secretary of State Marco Rubio. They suspected that Rubio was exploiting US media appearances to project control over the negotiations, and worried that his apparent rivalry with Witkoff would prevent Trump’s team from reaching a consensus on the nuclear issue.

One Iranian diplomat referenced historian Robert Dallek’s book, The American Style of Foreign Policy, to elucidate his view that the Trump administration’s counter-productive approach reflected a deeper crisis in the US establishment. The 1983 book argued that domestic pressures and social shifts at home have placed US foreign policy makers on a persistently irrational trajectory. The diplomat pointed to former Secretary of State Tony Blinken as a case study in Dallek’s thesis, recalling how Blinken routinely moved the goalposts on previous agreements with Iran in order to prevent negotiations from taking concrete form during the Biden years. His implication, as I read it, was the preponderance of pressure from the Israel lobby and military industry had been too overwhelming to allow either the Biden or Trump administration to execute a lasting deal.

Both diplomats I spoke to brought up recent reports revealing that Witkoff had promised Hamas he would force Israel to lift the starvation siege on the Gaza Strip if they released the US-Israeli captive Edan Alexander. They were dismayed that Witkoff had reneged on his promise and allowed Israel to slaughter hundreds of civilians in an apocalyptic frenzy throughout the week. Trump’s bad faith tactics with Hamas have cast a pall over the negotiations in Oman, fueling Iranian pessimism about a workable deal.

But perhaps no statement was more damaging to the prospect of a deal than Witkoff’s proclamation on ABC’s ‘This Week’: “We have one very, very clear red line, and that is enrichment. We cannot allow even 1% of an enrichment capability.”

The comments fit the pattern of Trump negotiators sabotaging progress in Oman by issuing onerous demands and threats immediately after returning to Washington. And few issues are more central to the Islamic Republic’s sense of independence than its civilian nuclear program.

A tour of Tehran’s nuclear reactor illustrates the ‘battle of wills’

While in Tehran, Iran’s Atomic Energy Organization of Iran (AEOI) invited me and a small group of journalists and academics to tour the city’s Nuclear Research Center, an active reactor originally constructed with US assistance under the Shah.

Once inside the vast facility (without our phones, as recording devices were strictly forbidden), we were treated to an exhibition touting the many lifesaving products of Iran’s nuclear program, from advancements in radiotherapy to the production of anti-cancer drugs to the sterilization of medical devices and protection of agriculture.

The visit was clearly designed to illustrate the importance of nuclear energy to Iran’s national development, and the absolute commitment of its leadership to continuing the project despite the continuous threat of assassination, sabotage and all-out war.

Touring the Tehran Nuclear Research Center this May 2025

Following our tour, we met with Beyrouz Kamalvandi, a veteran Iranian diplomat now serving as spokesman for the AEOI. Like the other Iranian diplomats I spoke to, Kamalvandi volunteered his country’s desire to abide by all its obligations under the Non-Proliferation Treaty. But he viewed Iran’s civilian nuclear program as the key to consolidating its technological edge, and an absolute right under international law.

“They want to do with us what they did with Gaza, where the entire society is besieged,” Kamalvandi proclaimed. “But we have a great civilization, and it’s only a matter of time before they realize we won’t submit. This is not just a battle over enrichment, it’s a battle of wills.”

Atomic Energy Organization of Iran spokesman Behrouz Kamalvandi during our tour of the Tehran Nuclear Research Center

At one point during the meeting, Kamalvandi pointed to a young man seated in the back row of the conference room, asked him to stand, and identified him as the son of the Iranian quantum field theorist Massoud Ali-Mohammadi, who was assassinated by a Mossad asset in 2010. Ten years later, Iran lost the godfather of its nuclear program, Mohsen Fakrizadeh, when the Mossad smuggled a machine gun drone into the country and stationed it along a road to attack Fakrizadeh’s convoy. Kamalvandi, for his part, was injured and hospitalized in 2021 while inspecting a part of the Natanz reactor that had been damaged by an Israeli attack.

In the eyes of Iran’s leadership, Witkoff’s demand to end enrichment was not only a recipe for squandering decades of technological advancement, it was an insult to the top tier scientists cut down by Israeli assassins. If this is the new baseline for a deal, negotiations are an exercise in futility. And yet the show goes on.

Economic sabotage behind the guise of negotiations

Since negotiations began, the value of the Iranian rial has fluctuated wildly against the dollar, improving in value after the first round of positive exchanges, then depreciating following each wave of bellicose threats from Trump and his team. I personally witnessed Iran’s financial chaos each time I attempted to exchange dollars for rials, as business owners consulted their phones for the new rate, which seemed to shift from day to day depending on the US president’s rhetoric. A friend joked that I would have paid a substantially lower rate to book a hotel room for my family if negotiations were not currently taking place.

Trump’s statements about the negotiations have also roiled oil markets. On May 16, when Trump claimed he was “getting close to maybe a deal” with Iran, the price of oil plummeted by 3.4%. Then came Witkoff’s call to cease enrichment, and on May 20, US intelligence leaked a warning that Israel was planning to attack Iran’s oil facilities, causing a sudden surge in oil prices.

The American president’s ability to manipulate financial markets both inside and outside Iran with his bluster has contributed to a sense that entering the negotiations have weakened Iran’s political position. Meanwhile, Trump’s crude insults to Iran’s sense of national honor and sovereignty have disrupted whatever goodwill existed when talks began.

The president’s announcement on May 7 that he was considering renaming the Persian Gulf to “the Arabian Gulf” fueled outrage across Iran — uniting everyone from pro-government principlists, to reformists, to pro-regime change monarchists in opposition to the insult to their national pride. Tehran responded with a billboard campaign condemning the change and a lawsuit against Google for abiding by the name change on its Maps applications.

Trump’s speech in Riyadh deepened the enmity, as he attempted to pit the Iranian public against its leadership, praising his unelected, monarchic hosts for supposedly having “turned dry deserts into fertile farmland,” while accusing Iran’s leaders of “turn[ing] green farmland into dry deserts, as their corrupt water mafia…causes droughts and empty riverbeds. They get rich, but they don’t let the people have any of it.”

Two days after Trump’s address in Riyadh, dust storms from the growing deserts of Saudi Arabia gusted into Iran, clouding the skies over Tehran and keeping many residents indoors. The irony did not escape those who heard Trump’s praise for the House of Saud’s supposed green miracle. Meanwhile, there is a growing sense that war clouds are gathering as well.

One well-connected Iranian academic in Tehran told me he expected his country to be on the receiving end of Israeli sabotage and confrontation throughout the summer. Both diplomats I spoke to insisted that in such a scenario, True Promise III was an option on the table.

Reprinted with permission from The Grayzone.

Subscribe and support The Grayzone here. -

Site: LifeNews

U.S. Health and Human Services Secretary Robert F. Kennedy Jr. told the World Health Assembly (WHA) he is calling for a “reboot” of a global health system that will mirror what the Trump administration is implementing through its Make America Healthy Again (MAHA) movement in the US.

In a video message Tuesday to world health ministers gathered in Geneva, Switzerland, Kennedy reviewed the reason President Donald Trump withdrew the US from the World Health Organization (WHO), the health agency of the United Nations (UN), via an executive order on the first day of his new term.

“Like many legacy institutions, the WHO has become mired in bureaucratic bloat, entrenched paradigms, conflicts of interest and international power politics,” Kennedy asserted. “While the United States has provided the lion’s share of the organization’s funding, historically, other countries, such as China have exerted undue influence over its operations in ways that serve their own interests and not particularly the interests of the global public.”

REACH PRO-LIFE PEOPLE WORLDWIDE! Advertise with LifeNews to reach hundreds of thousands of pro-life readers every week. Contact us today.

He also observed that, during the COVID pandemic, the WHO succumbed to pressure from China to suppress reports “of human-to-human transmission” of the virus “and then worked with China to promote the fiction that COVID originated from bats or pangolins rather than from a Chinese government sponsored research at a biolab in Wuhan.”

“Not only has the WHO capitulated to political pressure from China,” Kennedy argued, “it’s also failed to maintain an organization characterized by transparency and fair governance by and for its member states.”

“The WHO often acts like it has forgotten that its members must remain accountable to their own citizens and not to transnational or corporate interests,” he added.

Kennedy continued that, even though he believes most of those who work for the WHO have good intentions, too often “the WHO’s priorities have increasingly reflected the biases and interests of corporate medicine; too often it has allowed political agendas like pushing harmful gender ideology to hijack its core mission; and too often, it has become the tool of politics and turned its back on promoting health and health security.”

Despite the US’ withdrawal from the WHO, President Trump and his administration remain invested in global cooperation on the issue of health, according to Kennedy.

Nevertheless, even with exposure of the corruption behind COVID pandemic policies, the WHO “has doubled down with the pandemic agreement, which will lock in all of the dysfunctions of the WHO pandemic response,” he warned.

“We’re not going to participate in that,” Kennedy asserted. “We need to reboot the whole system, as we are doing in the United States.”

In explaining the Trump HHS’ MAHA agenda, Kennedy said the US will still “focus on infectious disease and pandemic preparedness” but shift its priorities “to focus on chronic diseases, which are prevalent in the United States” and “sickening our people and bankrupting our healthcare system.”

“We’re going to make healthcare in the United States serve the needs of the public, instead of industry profit-taking,” by “removing food dyes and other harmful additives from our food supply,” he said. “We’re investigating the causes of autism and other chronic diseases. We’re seeking to reduce consumption of ultra-processed foods, and we’re going to support lifestyle changes that will bolster the immune systems and transform the health of our people.”

Kennedy said the changes the US is making amount to a “systemic overhaul,” adding that the Trump administration would like to “see a similar reordering of priorities on the global stage, especially considering the fact that through the leadership of the United States and funding from our country, over the past 25 years, millions of global citizens have seen a reduction in premature death due to HIV, TB and malaria.”

The US secretary urged his counterparts in other nations and the WHO “to take our withdrawal from the organization as a wake-up call.”

“It isn’t that President Trump and I have lost interest in international cooperation, not at all,” he said. “We just want it to happen in a way that’s fair and efficient and transparent for all the member states.”

Kennedy also noted the Trump administration has already reached out to other “like-minded countries,” urging others to join them.

“We want a free international health cooperation from the straitjacket of political interference by corrupting influences of the pharmaceutical companies, of adversarial nations and their NGO proxies,” he concluded. “I would like to take this opportunity to invite my fellow health ministers around the world into a new era of cooperation.”

LifeNews Note: Susan Berry writes for CatholicVote, where this column originally appeared.

The post HHS Secretary Robert Kennedy Defends US Leaving WHO appeared first on LifeNews.com.

-

Site: Novus Motus LiturgicusThis is the second installment of a series on the thirteen papal namesakes of our new Holy Father Leo XIV; click these links to read part 1 and part 2. Four Popes named Leo reigned with a span of about 62 years in the 10th century; their reigns are all quite brief, and their careers for the most part so obscure that the precise dates of some of them are not even known, so this will be a short Gregory DiPippohttp://www.blogger.com/profile/13295638279418781125noreply@blogger.com0

-

Site: Zero HedgeOil Prices Dip On Report Of Another Potential OPEC+ Supply BoostTyler Durden Thu, 05/22/2025 - 09:25

OPEC+ is considering a third straight monthly output hike, departing from the norm of stabilizing oil markets. According to Bloomberg, the group of 12 major oil-exporting nations, including Saudi Arabia, UAE, and others, is considering a July increase of 411,000 barrels per day (bpd)—roughly triple the previously planned amount. This would mirror supply increases in May and June. Such an increase in July could lead to a breakdown in Brent crude's $60-per-barrel price floor (as long as the war risk premium remains suppressed).

Brent fell to $63 a barrel, down about 1.7% following the news. West Texas Intermediate dropped to around $60 a barrel.

According to delegates, the increase would mark the third consecutive month of added supply, though they noted that no final agreement had been reached.

Bloomberg provided more color about the strategy at play with OPEC+ that would only increase concerns about a global glut:

The strategy appears aimed at disciplining quota violators by pushing prices lower. But it will add to the overall picture of oversupply -- not only is there a chance of more Iranian barrels hitting the market, energy demand globally looks set to soften.

"We're seeing the market reacting to evidence that OPEC is letting go of a strategy to defend price in favour of market share," said Harry Tchiliguirian at Onyx Capital Group, adding, "It's a bit like taking off a Band-Aid; you do it in one fell swoop."

Department of Energy data released Wednesday morning showed that commercial crude inventories rose for a second consecutive week. Rising inventories and weakness in broader markets have added downward pressure on oil prices.

RBC Capital analyst Helima Croft noted that a 411,000 bpd increase in July is the "most likely outcome," mainly from Saudi Arabia. She said, "A key question will be whether the voluntary cut will be fully drawn down before the leaves turn brown in many parts of the world, in line with the original taper schedule."

OPEC+ is considering another large output increase. However, the macroeconomic backdrop of rising U.S. 10-year Treasury yields may signal a warning: Rising yields reflect tightening financial conditions and slower growth expectations, raising concerns that higher oil supply could weigh on prices. Now, lower prices could be all but derailed if Israel launches a preemptive attack on Iran's nuclear sites with stealth fighters.

-

Site: Ron Paul Institute - Featured Articles

A recent Supreme Court oral argument about the liability of the FBI for invading and terrorizing the wrong home has brought to mind the dark and dangerous history of law enforcement.

The practice of British agents rummaging through the private possessions on the private property of anyone against that person’s will was a significant contributing factor to the American Revolution.

Their most notorious invasion of private property was a subterfuge, perpetrated by the British Parliament, which sought to remind colonists that the king could enter their homes through his agents whenever he wished.

In 1765, Parliament enacted the Stamp Act, which required government stamps — they were actually inked images of government seals, more akin to what is seen when a postage stamp is canceled — on all papers in the possession of the colonists. This included letters, financial and legal documents, newspapers, pamphlets, even posters intended to be nailed to trees. To facilitate the enforcement of the Stamp Act, Parliament enacted the Writs of Assistance Act.

Much like America’s Foreign Intelligence Surveillance Act, the Writs of Assistance Act permitted British agents to obtain search warrants from a secret court for the homes of colonists based on governmental need and without identifying the name or address of the homeowner or even the object sought by the search.

These were general warrants. They were limitless in scope, as they authorized the bearer to search wherever he wished and seize whatever he found. Some students at the College of New Jersey — now called Princeton University — calculated that it cost more for the British government to enforce the Stamp Act than was generated in revenue from the sale of the stamps. We now know that power, not revenue, was the true goal of this dreaded law.

The violent colonial reaction to the enforcement of the Stamp Act led to its repeal by Parliament after just one year. But the Writs of Assistance Act — allowing the London issuance and colonial execution of general warrants — stayed in force until the British left in 1783. And general warrants were not outlawed here until the ratification of the Fourth Amendment in 1791.

The Fourth Amendment was written to protect the quintessentially American right to be left alone. The violation of the right to be left alone usually implicates two fundamental liberties — the right to privacy and the right to own and possess property.

Privacy is a natural right because there are aspects of human existence and personal behavior that are not subject to the government. Natural rights come from our humanity. The natural right to own property has three aspects — the right to use the property, the right to alienate (lease, pledge or sell) it, and the right to exclude whomever the owner wishes — including the government.

As natural rights stem from our humanity, they may only be violated when we give them up or waive them by our violation of someone else’s natural rights. When James Madison wrote the Fourth Amendment, he rejected the waiver standard and instead chose the easier-for-the-government probable cause standard as the sole element justifying a government invasion of property rights.

Today, to get physically — or even digitally — onto your property in defiance of your will, the government theoretically must meet Madison’s probable cause standard.

That standard requires a showing to a neutral judge that it is more likely than not that a crime has been committed and that it is more likely than not that evidence of that same crime can be found in the place to be searched or the person or thing to be seized. These standards come directly from the language of the amendment itself.

Does the probable cause standard adequately protect property rights? It does not; just ask the folks whose home the FBI destroyed.

The probable cause standard involves a weighing and balancing test pitting the nature of property ownership against the government’s claimed need for evidence. It weighs the harm to property rights caused by a government invasion as against the harm to the government by denying it the fruits of its planned invasion.

But the very concept of weighing a natural right against a government need is totalitarian. The government needs whatever it wants, whereas our rights are inalienable unless we waive them. A natural human right always supersedes a government wish. Thus, the only standard that morally justifies a government invasion of private property is waiver by the violation of another’s natural rights.

For example, if a bank robber runs into his house with stolen loot, he has waived his property rights in the house until he has been arrested and the loot retrieved, as he has violated the natural rights of the depositors in the bank and the bank’s right to exclude him from its property. If the government cannot demonstrate waiver by a violation of another’s natural right, then the property owner — even if he is the sought-after bank robber — can morally exclude the government from his property.

Because privacy and property ownership are inalienable rights and the government is an artificial creation based on a monopoly of force, when the government wants to enter upon private property against the will of the owner, and it seeks a warrant from a judge, the owner’s natural rights and the government’s needs can never be in equipoise.

Even when the government seeks to demonstrate waiver, the government should be presumed to be wrong, and every inference and bias should be drawn against it because the essence of government is the negation of liberty. We were born with natural rights. The government’s only source of wealth and power is what it has been taken from us.

Regrettably, none of this is the law today as the Constitution is a demonstrable failure. Today we are back to search wherever you wish and seize whatever you find.

To learn more about Judge Andrew Napolitano, visit https://JudgeNap.com.

COPYRIGHT 2025 ANDREW P. NAPOLITANO

DISTRIBUTED BY CREATORS.COM -

Site: Zero HedgeDeath Of The Dollar: An Eternal TaleTyler Durden Thu, 05/22/2025 - 09:05

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

The following paragraph, courtesy of Amazon, reviews the book Death of the Dollar by William Rickenbacker.

Death of the Dollar by William F. Rickenbacker is a critical examination of the economic policies and monetary mismanagement that the author argues are eroding the value of the U.S. dollar and threatening financial stability. Rickenbacker contends that the actions of money managers, including excessive government spending, inflationary policies, and the detachment of the dollar from the gold standard, are systematically devaluing the currency. The book warns of an impending monetary disaster, highlighting how these policies disproportionately harm everyday citizens who rely on the dollar’s stability for savings and investments. Through a blend of economic analysis and historical context, Rickenbacker underscores the dangers of unchecked financial intervention and the potential for a collapse of the dollar’s purchasing power.

Plenty of books, articles, and social media posts herald the same grim forecast as Rickenbacker. For the most part, they rely on similar reasoning. Essentially, lax monetary policy and gross fiscal spending, both deemed to be inflationary, will result in dollar devaluation and ultimately the death of the dollar.

The difference between Rickenbacker’s book and other dollar demise forecasts is that Death of the Dollar was written in 1968! Fifty-seven years later, despite, or possibly because of Rickenbacker’s justifications, the dollar is still the world’s reserve currency, and no other sovereign currency, cryptocurrency, or precious metal will replace it anytime soon.

Given the topic’s importance and the gross misinformation spread about the dollar’s imminent demise, we review Rickenbacker’s thesis to highlight that today’s warnings have been around for decades and why the odds of them coming to fruition this time are very low, as they were decades ago.

Removal Of The Gold Standard

Rickenbacker’s book was published in 1968, three years before President Nixon closed the gold window, essentially making the dollar a fiat currency. While his book accurately predicted that ground-shaking event, it did not correctly anticipate its impact.

He reasoned that without gold regulating the supply of dollars, unchecked monetary policy would result in reckless “money printing.”

He was correct that the Fed would have more flexibility in managing the money supply. Furthermore, with this added power, we have seen reckless behavior, as he theorized. However, Rickenbacker erred on the money printing allegation.

The Fed doesn’t print money. All money is lent into creation by banks. The Fed prints bank reserves, which allow banks to make loans, i.e., print money, if they choose. More importantly, even if the money supply increases due to Fed incentives to lend, it’s unclear whether such activity is good or bad for the economy and how it impacts inflation and ultimately the dollar’s value. That is a function of the productivity of debt.

Simply, productive debt drives economic growth, increases the nation’s prosperity, and reduces deficits as a percentage of economic activity. Unproductive debt detracts from economic growth and prosperity and worsens deficits. Weaker growth from unproductive debt tends to be disinflationary.

As judged by an increasing debt-to-GDP ratio, aggregate debt has been unproductive, leading to lower inflation growth rates. Thus, if the concern is that “money printing” would lead to inflation, it may lead to disinflation.

Fed Flexibility

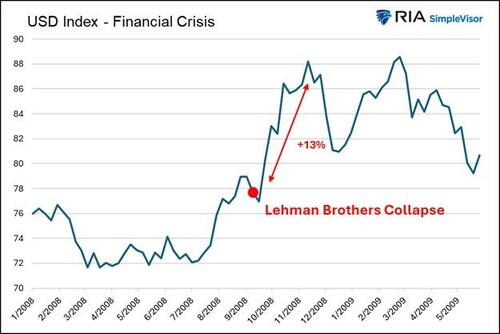

In one respect, Rickenbacker correctly said that giving the Fed more flexibility was a curse. Easy money policy has led to periods of gross speculation and crises, such as in 2008.

However, without the gold shackles, the Fed has incredible power to manage economic crises and avoid a currency collapse. In fact, despite the 2008 crisis having roots in the US mortgage market and the prospect of the collapse of the US banking system, the world flocked to dollars during the crisis, as shown below.

Most crises have been accompanied by a stronger dollar, proving that the dollar is the port in the storm foreign investors seek when economic confidence is lacking, and liquidity is paramount.

Excessive Government Spending

The book criticizes massive federal expenditures, particularly on social programs and military efforts, which create budget deficits, drive up inflation, and ultimately devalue the dollar. The book was written while Lyndon Johnson spent heavily on the Vietnam War and domestic programs. Again, Rickenbacker was correct in worrying about inflation, a big problem throughout the 1970s.

Despite ever-increasing government spending and an increasing debt-to-GDP ratio, the globalization of trade has expanded rapidly since his book was published. With it, foreigners’ demand for dollars has been growing, and in mirror fashion, so is their need to invest the dollars, which helps us fund our deficits.

Even today, with “runaway” deficits making headlines daily, the dollar remains in the upper range of the last 35 years.

Dollar Devaluation In Context

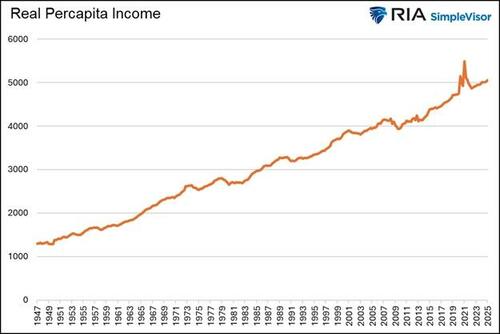

Rickenbacker believed that easy money Federal Reserve policies, such as low interest rates and expanding the money supply, would fuel inflation that would erode the dollar’s purchasing power. He was right, as evidenced by comparing what a dollar buys today versus yesteryear. However, the argument provides little context.

For instance, in the 1950s, a hamburger (15 cents), fries (10 cents), and a Coke (10 cents) at McDonald’s cost less than 50 cents. Today, the same meal could run nearly $10.

Although decades of inflation have drastically eroded the dollar’s value, our standard of living has risen appreciably. To wit, the purchasing power of one dollar in 1947 has eroded to 7 cents. However, as shown below, inflation-adjusted incomes have risen fivefold since 1947. The dollar buys less, but our incomes buy more!

Trade and Balance of Payments Deficits

Rickenbacker points to persistent U.S. trade deficits and dollar outflows abroad, which weaken the currency’s global standing. He is correct that trade deficits have steadily increased, resulting in more dollars flowing abroad. However, more dollar outflows are a result of more demand for dollars. Furthermore, those dollars ultimately return to the US through investments and loans to the government and corporations. The larger the global economy, the greater the need for dollars, and the more dollars that need to be invested in the US economy.

Rickenbacker Was Right

The author’s concerns are valid and, in many cases, have proven true. However, the victim has not been the dollar. The victims are larger deficits, lower productivity growth, hollowing out of manufacturing, and a growing wealth divide, to name a few.

While these are big problems, they do not necessarily threaten the dollar’s status. As we wrote in Four Reasons The Dollar Is Here To Stay:

The pundits will be right someday. The dollar’s death as the reserve currency will come, and some other nation’s currency, cryptocurrency, gold, shells, or something else will take its place. However, that day is not coming anytime soon. The four reasons we describe in the article leave the world with no alternative.

While China is rapidly growing its economy and global trade footprint, it lacks the rule of law and liquid capital markets to sustain a global currency. It’s difficult to see how a communist country can overcome those challenges.

The Euro is the most viable competitor. They have the rule of law, but their capital markets are not nearly liquid enough to facilitate global trade. They also lack the military might to force the usage of the Euro. Let us also remember its finances are in equally bad or even worse shape than the U.S. There is no reason to suspect the euro could overtake the dollar.

Bitcoin? Forget about it! The government will never relinquish its control over the currency because, with that, they lose control of the nation.

Summary

Had Rickenbacker’s Death of the Dollar book solely focused on monetary and fiscal imprudence and its negative implications for the country, he would have been proven a seer. Unfortunately, he was wrong to insist that the dollar would lose its status as the world’s reserve currency.

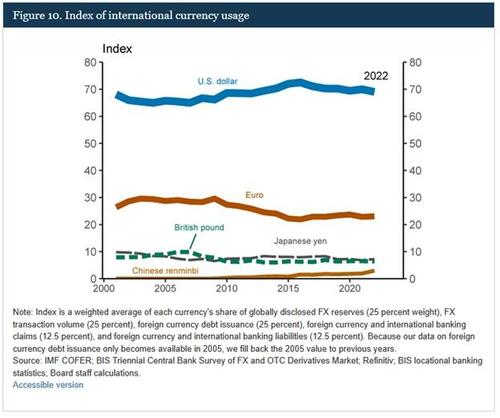

The graph below, courtesy of the Federal Reserve, shows how the dollar’s usage in global transactions has been stable for the last two decades.

The index calculation, as detailed at the bottom of the graphic, is based on the primary uses of currencies.

-

Site: Mises InstituteGovernment protection and deposit insurance slows the inevitable—until it doesn’t.

-

Site: AsiaNews.itIn his first visit to Lebanon since 2017, the Palestinian president is committed to disarmament, although without setting a timetable. This complex process is seen in Beirut as a prerequisite for the total end of Hezbollah's armed struggle. The joint statement with President Aoun includes an 'implicit' recognition of Israel's right to exist.

-

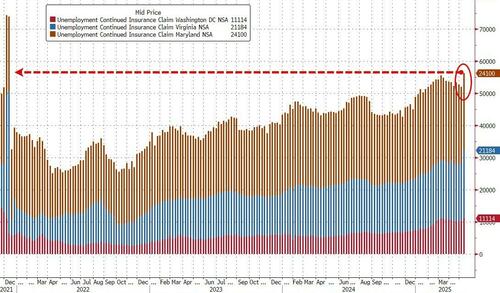

Site: Zero HedgeDOGE Damage Deepens As 'Deep TriState' Continuing Jobless Claims Highest Since Dec 2021Tyler Durden Thu, 05/22/2025 - 08:51

The number of Americans filing for jobless benefits for the first time fell modestly last week to 227k (below expectations) and is basically unchanged since December 2021...

...despite the public sentiment panic by CEOs, layoffs refuse to rise (is all that whining just signaling how much virtue they have, or is it like UMich, damaged by TDS in their imaginations, but not enough to impact the real world)...

Continuing jobless claims pushed back above the critical 1.9 million Americans level once again...

...as while the private sector CEOs seem to refuse to budge (despite their misery), the 'Deep Tristate' is seeing continuing jobless claims surge to the highest since December 2021...

DOGE is working!!

-

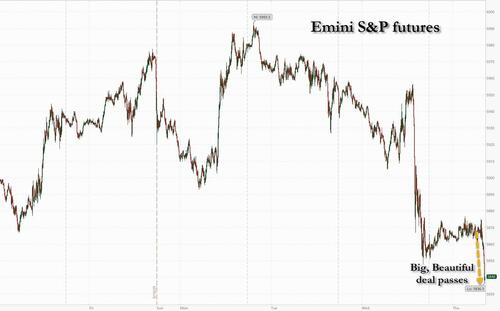

Site: Zero HedgeFutures, Treasuries Slide After "Big, Beautiful Bill" PassesTyler Durden Thu, 05/22/2025 - 08:41

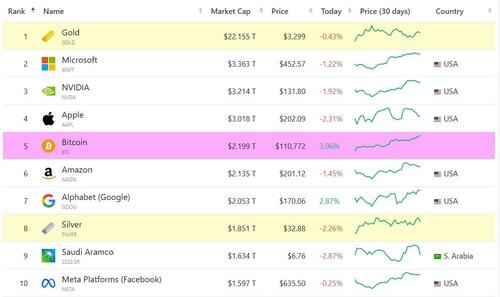

US stocks and treasuries sold off after President Trump’s signature tax bill passed the House by the narrowest of margins (214-215), sparking fears that the surging deficit - already at a nosebleed 6.5% of GDP - necessary to fund the bill will spark even higher rates at a time when foreign buyers are boycotting US Treasury purchases. As of 8:00am, S&P futures slumped by 0.5%, trading near session lows and reversing an earlier gain of about 0.3%. Nasdaq futures dropped 0.4%. Treasuries also slumped, extending days of losses in which the 30-year yield hit the highest since 2023: the 10Y was trading at session highs of 4.62%. The dollar ended a three-day losing run while Bitcoin pushed further into record territory. Commodities are weaker across all 3 complexes: oil slumped again after BBG reported that OPEC+ is considering another production hike at the June 1 meeting. SCMP reports that Mexico pledges neutrality between US/China in the Trade War; this follows a similar announcement from Indonesia last month. Today’s macro data focus is on Flash PMIs, weekly claims, existing home sales, and regional Fed activity indicators.

In premarket trading, Mag 7 stocks were mixed (Alphabet +1.2%, Nvidia +0.5%, Amazon +0.5%, Tesla -0.2%, Meta Platforms +0.3%, Microsoft +0.02%, Apple -0.1%). Solar stocks sink as US House Republicans’ new version of the tax and spending bill accelerates the end of incentives for clean electricity production (Sunrun -34%, Array Technologies -14%, First Solar -6%). Crypto-linked stocks gained in premarket trading after Bitcoin hit an all-time high. The world’s largest cryptocurrency reached a record price of $111,878 on Thursday amid growing optimism around the US stablecoin bill (Galaxy Digital (GLXY) +5%, Riot Platforms (RIOT) +3%, Mara Holdings (MARA) +3%). Here are some other notable premarket movers:

- Advance Auto Parts (AAP) soars 30% after the retailer of aftermarket auto components reaffirmed its comparable sales forecast for the full year.

- Analog Devices (ADI) rises 2% after the chipmaker reported adjusted earnings per share for the second quarter that beat the average analyst estimate.

- Delcath Systems (DCTH) rises 2% after the specialty pharmaceutical and medical devices company issued full year 2025 guidance and announced a plan to enter into a National Medicaid Drug Rebate Agreement to expand patient access.

- Nike (NKE) shares rose in premarket trading as the company returns to Amazon.com’s online store after leaving it in 2019.

- Humana (HUM) falls 5% and UnitedHealth Group (UNH) slips 2% after the Centers for Medicare & Medicaid Services said it will embark on a “significant expansion” of its auditing efforts for Medicare Advantage plans.

- LiveRamp (RAMP) climbs 10% after the marketing technology company reported fourth-quarter results that beat expectations.

- Lumen Technologies (LUMN) advances 12% after AT&T agreed to buy the company’s consumer fiber operations for $5.75 billion, expanding its fast broadband service in major cities like Denver and Las Vegas.

- Manchester United (MANU) drops 5% after the English football club lost the high-stakes Europa League final to Tottenham Hotspur in Bilbao, Spain last night.

- Navitas Semiconductor (NVTS) surges 175% after the semiconductor company said Nvidia picked it to collaborate on data center power infrastructure.

- Sable Offshore Corp. (SOC) falls 4% after the oil and gas company priced its stock offering.

- Snowflake (SNOW) gains 9% after the software developer forecast product revenue for the second quarter above the average analyst estimate.

- Urban Outfitters (URBN) rises 18% after the apparel retailer reported net sales for the first quarter that beat the average analyst estimate.

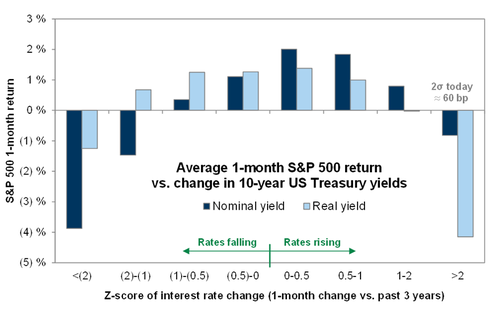

Just before 7am ET, after an all night session in the House, US lawmakers passed Trump's "big, beautiful bill", a sprawling multi-trillion dollar package that would avert a year-end tax increase at the expense of adding to the US debt burden. The move comes after a downgrade by Moody’s Ratings thrust concerns over the ballooning deficit into the spotlight. This has shown up in Treasuries, sapping sentiment after an equity rebound put the S&P 500 on the cusp of a bull market. Goldman calculated the yield at which stocks would crack: the bank notes that on May 1st, 10yr yield was 4.12%...we just touched 4.6% yesterday after the weak 20yr auction. At what level do yields start to put real pressure on the stock market? The easy big round number is 10yr @ 5%. The more nuanced answer is >4.7% (before the end of May) as velocity of move in rates matters much more than absolute levels (in regards to impacting stocks). When 10yr yield has moved higher by 2SD (60bps) within a one month period the stock market comes under pressure.

“Bond vigilantes are back,” Beata Manthey, a strategist at Citigroup Inc., told Bloomberg TV. “The market is worried about debt sustainability. It’s not very helpful, given how strong a rebound we’ve been seeing in equity markets.”

Later on Thursday, S&P Global will issue its preliminary May survey of manufacturing and service providers. Based on economists’ projections, industrial weakness probably continued while growth in services activity may have picked up slightly. Weekly jobless claims data is also due.

Meanwhile, the doom and gloom from Jamie Dimon continued, after the JPMorgan CEO said he can’t rule out the US economy will fall into stagflation as the country faces huge risks from both geopolitics, deficits and price pressures. “I don’t agree that we’re in a sweet spot,” Dimon told Bloomberg TV in Shanghai.

With everything else being sold, traders turned to non-fiat alternatives: Bitcoin surpassed $111,000 for the first time with traders increasingly bullish on the prospects of the cryptocurrency., gold traded back over $3,300.

“Bitcoin, and the crypto market in general, have largely decoupled from equities over the last few days,” said Richard Galvin, co-founder of hedge fund DACM. “Bitcoin continues to benefit from its market position as a non-system, store of value.”

European stocks fall as worries over rising bond yields curbed investor appetite for risky assets. The Estoxx index slumped 1%, with the yield-sensitive technology sector is among the biggest laggards. Among individual stocks, EasyJet Plc falls after the low-cost airline reported bigger-than-expected losses, while Johnson Matthey rises on a major sale of its technology business. Here are some of the biggest movers:

- Johnson Matthey shares jump as much as 34%, the most in over three years, after the company announced the sale of its catalyst technology business at an enterprise value of £1.8 billion, with the bulk of proceeds to be returned to shareholders.

- Mitchells & Butlers gains as much as 2.2% after the pub and restaurant operator delivers what analysts view as a strong update, with full-year operating profit expected to be at the top end of current consensus.

- Grenergy Renovables gains as much as 8%, hitting a new record high. RBC Capital says the Spanish renewables company has achieved strong growth in the first quarter, supported by gains of the Atacama storage project.

- Gimv gains as much as 8.9%, the most since March 2020, after the investment company posts what KBC Securities describes as another record year

- Stora Enso gains as much as 7% to its highest since March 20 after the Finnish forest and paper company said it will divest around 175,000 hectares of forest land in Sweden for a total value of €900 million.

- EasyJet shares fall as much as 6.1% after the travel firm reported a loss in the first half.

- BT shares drop as much as 5.3% after the telecom company reported a decline of 243,000 Openreach broadband lines in the quarter ended March, a sign of heightened competition among UK’s fiber builders.

- British Land shares drop as much as 7.1% in their worst one-day loss in two years, after the UK property firm’s unchanged guidance and forecast for flat 2026 earnings per share tempered a recent rally in the stock.

- Freenet shares sink as much as 16%, the most since May 2022, after the mobile communications service provider reported Ebitda for the first quarter that missed estimates.

- Elior drops as much as 5.3% following a mixed first-half report from the commercial catering company.

- Intertek shares drop as much as 3% after the inspection services provider reported disappointing organic growth for the first four months of the year.

- MPC Container Ships falls as much as 17%, the most since 2021, after the Norwegian shipping firm presented its latest earnings and a new dividend policy.

Asian equities dropped the most in two weeks, driven by losses in technology stocks after Treasury yields jumped overnight on concerns about the US budget deficit. The MSCI Asia Pacific Index fell as much as 0.8%, the biggest decline since May 8, with Alibaba, TSMC and Samsung contributing the most to the losses. South Korea’s Kospi retreated over 1%, while benchmark gauges in Hong Kong, Japan and India also lost ground. Philippine stocks weakened after President Ferdinand Marcos Jr. ordered his cabinet to resign.

In FX, the Bloomberg Dollar Spot Index rebounded to rise 0.1% after three straight days of losses. EUR/USD fell 0.2% to 1.131 after data showed private-sector activity in the euro area unexpectedly shrank in May. USD/JPY slumped as much as 0.6% to 142.81, the lowest level in two weeks, before paring the move to trade 0.2% lower. Despite the latest drop, the Hang Seng China Enterprises Index remains on track to cap a sixth straight week of gains. JPMorgan Chase is committed to long-term investment in China, despite tensions with the US, Chief Executive Officer Jamie Dimon said in a Bloomberg TV interview.

In rates, the yield for 10-year Treasuries advanced two basis points to 4.62% on Thursday. The worry in debt markets is that the tax bill would add trillions of dollars to an already bulging deficit at a time when investors’ appetite is US assets is slumping. The 30-year yield reaching new multimonth highs of 5.15% while short-end tenors richen, pivoting around a little-changed 7-year sector. 5s30s spread near 97bp is widest since May 1. European sovereign curves are also steeper. The Treasury will sell $18 billion of 10-year TIPS in a reopening at 1pm New York; Wednesday’s 20-year new-issue auction tailed by about 1bp, spurring long-end yields higher. Focal points include House Republicans narrowly passing President Trump’s tax bill shortly before 7am, PMI and jobless claims data, a 10-year TIPS auction and comments by NY Fed President Williams.

Looking at today's calendar, US economic data includes April Chicago Fed national activity index and weekly jobless claims (8:30am), May preliminary S&P Global US PMIs (9:45am), April existing home sales (10am) and May Kansas City Fed manufacturing activity (11am). Fed speaker slate includes Richmond Fed President Barkin (8am) and Williams (2pm).

Market Snapshot

- S&P 500 mini -0.5%

- Nasdaq 100 mini -0.4%,

- Stoxx Europe 600 -1%

- DAX -0.8%, CAC 40 -1%

- 10-year Treasury yield -2 basis points at 4.58%

- VIX -0.4 points at 20.49

- Bloomberg Dollar Index +0.1% at 1220.46

- euro -0.3% at $1.1297

- WTI crude -1.5% at $60.66/barrel

Top Overnight News

- A man fatally shot two Israeli Embassy staff members late Wednesday near a Jewish museum in downtown Washington. WSJ

- Scott Bessent and his Japanese counterpart Katsunobu Kato confirmed existing currency views and didn’t discuss FX levels when they met in Canada. BBG

- On a call Monday, President Trump told European leaders that Russian President Vladimir Putin isn’t ready to end the Ukraine war because he thinks he is winning. This runs counter to what Trump has often said publicly, that he believes Putin genuinely wants peace. WSJ

- BOJ board member Asahi Noguchi said on Thursday he saw no need for the central bank to intervene in the bond market to stem recent sharp rises in super-long yields, describing the moves as "rapid but not abnormal." Noguchi also said the central bank must pause its interest rate hikes for the time being until there is more clarity on the impact of U.S. tariffs on the economy. RTRS

- Israel is making preparations to “swiftly” strike Iran’s nuclear facilities if talks between Washington and Tehran collapse without a deal. Axios

- OPEC+ members are discussing whether to agree on another super-sized production increase at their meeting June 1, delegates said. That would be the third straight month of adding more barrels to the market. Oil declined. BBG