For many people today, practical atheism is the normal rule of life...If this attitude becomes a general existential position, then freedom no longer has any standards, then everyting is possible and permissible.

Distinction Matter - Subscribed Feeds

-

Site: southern ordersI reprint this from the NcR, believe it or not. I don’t think Pope Leo will put it on, what a bombshell that would be if he did! Talk about the heterodox left freaking out!But no pope is prevented by another pope, Pope Paul VI in this case, not to wear it again.Pope John Paul I, II, Benedict XVI and Francis I chose not to wear it or to be coronated. Paul VI did receive a coronation, but shortly after receiving the tiara chose not to wear it again.Pope Leo has recovered the Mozzetta and papal stole that Francis did away with but did not forbid future popes from using. Pope John Paul I chose to maintain the sedia gestatoria and was carried through St. Peter’s Square. It was cool Catholicism. But his papacy only last one month. No other pope has used it since. Paul VI used it frequently.Given what the NcR says about the Tiara, should a future pope take it again. And can we learn from the Eastern Churches about crowns their bishops wear in place of a miter. And isn’t a miter kind like a tiara? Are we splitting hairs here?

A gold metallic embroidered stole of Pope John XXIII and the papal tiara of Pope Paul VI are displayed at the Basilica of the National Shrine of the Immaculate Conception in Washington on Oct. 30, 2009. (CNS/Bob Roller)

Symbols of the pontificate: papal tiara, pallium and fisherman's ring

Formerly, the enthronement ceremony included crowning the pope with the papal tiara or "triregnum," a golden crown composed of three overlapping crowns, a symbol of spiritual, temporal and supreme power. The last pontiff to wear it was Pope Paul VI in 1963, after which he decided he would give up its use, though he left it to his successors to reintroduce it.

The papal tiara is a symbol of the threefold power (spiritual, temporal and supreme):

- The papal tiara is made of gold, decorated with sacred images and precious stones;

- Shortly after his election, Pope Paul VI (Giovanni Battista Montini) decided not to wear it anymore, as times had changed;

- Paul VI had his own tiara sold and donated the proceeds to international missions;

- Today, Paul VI's tiara is kept at the National Shrine of the Immaculate Conception in Washington, D.C.;

- Although he did not ban its use for his successors, no pope has worn it since.

-

Site: RT - News

Gwyn Jenkins reportedly withheld evidence of extrajudicial SAS executions in Afghanistan instead of forwarding the matter to military police

The British government has appointed General Gwyn Jenkins as First Sea Lord and Chief of the Naval Staff. Approved by King Charles III on Thursday, the decision follows unresolved allegations that Jenkins had failed to report suspected war crimes in Afghanistan and later obstructed the relocation of key witnesses.

The general succeeds Admiral Ben Key, who stepped down last week amid an ongoing misconduct investigation. Media reports suggest that the probe centers on Key’s alleged affair with a more junior female colleague.

Jenkins came under scrutiny two years ago when the BBC reported that the then-Vice-Chief of the Defense Staff had failed to forward evidence of Special Air Service (SAS) soldiers executing handcuffed detainees in Afghanistan to the Royal Military Police.

At the time, Jenkins did not respond to the allegations. The UK Ministry of Defense stated that it was “not appropriate for us to comment on allegations which may be within the scope of the statutory inquiry.”

In April 2024, then-Prime Minister Rishi Sunak appointed Jenkins—then Vice-Chief of the Defense Staff—as National Security Adviser. However, the appointment was later reversed by the incoming government led by Keir Starmer. While Starmer declined to comment on individual appointments, he emphasized the need for an “open and transparent process” for future nominations. Media outlets attributed the reversal to Jenkins’ implication in the ongoing inquiry.

READ MORE: UK special forces had ‘golden pass’ to kill Afghan civilians – officer

Earlier this month, BBC Panorama reported that Jenkins had overseen the rejection of hundreds of relocation applications submitted by Afghan commandos who had served alongside British forces and possessed direct knowledge of UK military operations. The report stated that these rejections effectively blocked key witnesses from reaching Britain and testifying in the public inquiry into the Afghan conflict.

-

Site: Zero HedgeCharter-Cox $34.5 Billion Deal Leapfrogs Comcast As New Cable GiantTyler Durden Fri, 05/16/2025 - 09:15

Charter Communications has agreed to acquire Cox Communications in a blockbuster merger that will create the largest cable TV and broadband provider in the U.S., surpassing Comcast.

The transaction values Cox Communications at $34.5 billion, including $21.9 billion in equity and $12.6 billion in net debt and other obligations. According to a press release, the valuation aligns with Charter's enterprise value-to-2025 estimated Adjusted EBITDA multiple of 6.44x.

Charter, the second largest publicly traded cable company behind Comcast, was up 3% in premarket trading in New York from its Thursday close of $419.57. The Cox family privately holds Cox.

Charter will acquire Cox's commercial fiber, IT, and cloud businesses and contribute Cox's residential cable assets to Charter Holdings.

Cox Enterprises will become the largest shareholder of the combined entity's fully diluted shares outstanding with a 23% stake and have seats on the board.

"This combination will augment our ability to innovate and provide high-quality, competitively priced products, delivered with outstanding customer service, to millions of homes and businesses," Chris Winfrey, President and CEO of Charter, said in a statement.

Winfrey said, "We will continue to deliver high-value products that save American families money, and we'll onshore jobs from overseas to create new, good-paying careers for U.S. employees that come with great benefits, career training and advancement, and retirement and ownership opportunities."

The combined company will remain headquartered in Stamford, Connecticut, and keep a "significant presence on Cox's Atlanta, GA campus following the closing," according to the press release.

The merger with Cox follows Charter's announcement of an all-stock acquisition of Liberty Broadband, with both transactions expected to close concurrently.

Charter expects $500 million in annualized cost synergies within three years of closing the deal.

Bloomberg added context to the merger, describing it as part of an escalating "turf war" in the telecom industry:

Cable and phone companies have been engaged in an intense turf war, seeking to win over customers in areas that others have dominated. Cable providers have been selling their own mobile phone plans by leasing network access from major carriers. At the same time, phone carriers have been poaching home internet subscribers from cable companies.

The bet is that customers will in the future prefer to buy their internet and mobile phone services from the same provider — a trend referred to as convergence. A combination of Charter and Cox would position them to better compete in that environment by allowing them to bundle offerings and more efficiently invest in infrastructure.

Bloomberg Intelligence analysts noted:

"Charter is aggressively marketing its converged mobile fixed bundles at competitive rates to improve subscriber acquisition and retention.

"Regardless, the entire cable sector is being hurt by intensifying telecom competition from both fiber coverage and fixed wireless access."

Axios pointed out:

Some layoffs are expected to result from the merger. Other Cox Enterprises businesses, including Axios and Autotrader, are not directly impacted.

Just like that, the combined entity is set to become America's largest cable TV and broadband provider.

Recall one of the heirs to the Cox empire is a far-left radical...

Fergie Chambers is the heir to the Cox Media empire. He is also a devoted Communist and a fan of Mao (see tattoo on his thigh). He is spending his fortune from capitalism on a proletariat Revolution to overthrow capitalism.

— Xi Van Fleet (@XVanFleet) December 7, 2023

How was he introduced to Communism? By a history… pic.twitter.com/V0KeJutqr7Sigh.

-

Site: LifeNews

A court fight has developed that ultimately will decide whether pro-abortion state officials “can team up with abortion activists” to censor the speech of those who don’t adhere to the ideology of killing the unborn.

“The state’s conduct is not just discriminatory – it’s unconstitutional,” explained the American Center for Law and Justice.

“This case remains one of the most important pro-life and free speech battles in the country. The outcome could set national precedent on whether state governments can team up with abortion activists to suppress the voices of those who offer women hope, help, and life.”

The ACLJ reported the fight focuses on a lawsuit filed on behalf of Your Options Medical, which is a pro-life pregnancy resource center run by Christians.

LifeNews is on GETTR. Please follow us for the latest pro-life news

And it has been “targeted” by “a state-sponsored campaign to discredit and shut down life-affirming services for women.”

Defendants are Massachusetts Gov. Maura Healey, Health Commissioner Robbie Goldstein, abortion promoters Reproductive Equity Now Foundation and its chief, Rebecca Hart-Holder.

“Their actions were nothing less than the weaponization of government,” the ACLJ has charged.

The state, with tax money, “launched an aggressive public misinformation campaign against pro-life pregnancy centers, accusing them of being ‘deceptive’ and ‘dangerous,’ and warned the public against visiting PRCs – even if they are not looking for abortions,” the report said.

The misleading claims were all over, on websites, in videos, on posters, on buses, on benches, and included areas adjacent to the resource center’s home.

A court recently rejected two separate motions by the defendants to dismiss the case, and instead is allowing the ACLJ to amend its complaint, which now will be expanded.

That’s because the Massachusetts Liberty Legal Center, which also is working on the case, obtained documents, 8,000 pages, that confirm “a calculated effort by government officials, working hand-in-hand with pro-abortion activists, to silence and discredit Christian ministries that offer real alternatives to abortion.”

The report continued, “The evidence is clear – the state’s campaign wasn’t just political rhetoric or support for abortion. It was an organized effort to suppress the viewpoints of pro-life organizations and intimidate them into silence.”

LifeNews Note: This column originally appeared at WorldNetDaily.

The post Massachusetts Teamed Up With Abortion Activists to Censor Pro-Life Free Speech appeared first on LifeNews.com.

-

Site: Mises InstitutePhillip Tourney provides a first-hand account of the 1967 USS Liberty incident.

-

Site: OnePeterFive

Dear OnePeterFive donors, supporters, and readers, A few days ago we said “It’s Time to Purchase your Sacred Heart Flag for June.” Now it’s time to submit your articles for the month of the Eucharistic Heart of Jesus. If our lay sodality of Eucharistic reparation is the core of our apostolate, then the month of June is the core of our year, every year. We view this month as special…

-

Site: Zero Hedge5 Takeaways From Supreme Court Hearing On Nationwide Injunctions, Birthright CitizenshipTyler Durden Fri, 05/16/2025 - 08:55

Authored by Sam Dorman and Matthew Vadum via The Epoch Times,

The Supreme Court on May 15 heard oral arguments in relation to the Trump administration’s request to lift nationwide injunctions placed on the president’s birthright citizenship order.

The decision could determine how judges can address presidential actions.

During the argument, the justices posed questions about how far lower court judges could go in issuing relief from particular policies.

Solicitor General D. John Sauer told the court that nationwide injunctions exceed judges’ authority under Article 3 of the Constitution.

While members of the Supreme Court have criticized nationwide injunctions in the past, they seemed skeptical that it was appropriate to remove the injunctions in this case.

President Donald Trump’s Executive Order 14160, signed on Jan. 20, states that “the Fourteenth Amendment has never been interpreted to extend citizenship universally to everyone born within the United States.”

The executive order has prompted debate over the meaning of the 14th Amendment’s citizenship clause, which states that “all persons born or naturalized in the United States, and subject to the jurisdiction thereof, are citizens of the United States and of the State wherein they reside.”

Here are some takeaways from the arguments, as well as considerations surrounding the Supreme Court’s ruling.

1. No Final Ruling Expected on Constitutionality

The argument stemmed from an emergency request made by the Trump administration to limit three separate nationwide injunctions blocking the president’s birthright citizenship order.

At such an early stage in the litigation, the justices wrestled more with procedural considerations such as the scope of relief rather than the constitutionality of birthright citizenship for illegal immigrants.

However, judges can still consider the likelihood that each side will succeed with its arguments about the more substantive issues. The issue could also reach the Supreme Court again after further deliberation in lower courts, teeing up an opportunity for the justices to make a more definitive ruling on birthright citizenship.

Sauer could have asked the Supreme Court to delve deeper into the constitutional issues, but he did not. Justice Amy Coney Barrett pressed him on this point and asked why he wanted there to be more consideration by lower courts before the justices took on the issue.

“So this one isn’t clear-cut on the merits?” she asked.

Justice Ketanji Brown Jackson said that if Trump’s order is legally wrong, allowing the administration to continue implementing it would be inconsistent with the rule of law.

“It seems to me that your argument says we get to keep on doing it until everyone who is potentially harmed by it figures out how to file a lawsuit, hire a lawyer, etc.,” she said. “And I don’t understand how that is remotely consistent with the rule of law.”

Solicitor General nominee, D. John Sauer, prepares to testify during his confirmation hearing before the Senate Judiciary Committee on Capitol Hill on Feb. 26, 2025. Chip Somodevilla/Getty Images

2. Several Judges Critical of Trump’s Order

During the May 15 arguments, Justices Sonia Sotomayor and Elena Kagan seemed to think that the administration had misinterpreted the 14th Amendment when it ordered a halt to illegal immigrants’ children receiving birthright citizenship.

“As far as I see it, this order violates four Supreme Court precedents,” Sotomayor told Sauer.

Later, Kagan suggested to Sauer that the administration would continue to lose in defending its policy before lower courts. She was asking what incentive the government would have to appeal the case to the Supreme Court if another judge had not issued a nationwide injunction.

“If I were in your shoes, there is no way I'd approach the Supreme Court with this case, so you just keep on losing in the lower courts, and what’s supposed to happen to prevent that?” she asked.

3. Dispute Over Courts’ Historical Authority

Justice Clarence Thomas seemed the most sympathetic to Sauer’s position and suggested that nationwide injunctions do not have a solid historical basis.

Sauer had argued that the first nationwide injunction was issued in 1963 and that the court had consistently said relief should be limited to plaintiffs.

“So we survived until the 1960s without universal injunctions?” Thomas asked.

Sotomayor, meanwhile, asked New Jersey Solicitor General Jeremy Feigenbaum, “We’ve had universal injunctions in some form—correct?—since the founding.”

Both justices asked about the history of courts issuing orders known as “bills of peace,” which resolve a dispute for multiple parties. Sauer described the practice as similar to a modern class action and different from a nationwide injunction. Sotomayor disagreed with that comparison.

4. Alternatives to Nationwide Injunctions?

Justice Brett Kavanaugh suggested that class actions, or lawsuits in which multiple plaintiffs sue on behalf of a larger group of plaintiffs, could take the place of nationwide injunctions.

If nationwide injunctions were not available in this case, people could file class actions, which could “solve a large part of the problem in a way that complies with the rules,” the justice said.

Supreme Court Justices Samuel Alito, Clarence Thomas, Brett Kavanaugh, and Chief Justice John Roberts attend inauguration ceremonies in the Rotunda of the U.S. Capitol on Jan. 20, 2025. Chip Somodevilla/Getty Images

Kelsi Corkran, an attorney for immigration advocacy groups, disagreed, saying such an approach is “just channeling the problems through a different mechanism.”

Kagan said the state of New Jersey, a litigant in the case, is arguing that without the availability of nationwide injunctions, it could face “administrative costs and ... workability problems” as a result of possibly inconsistent court rulings being issued in different states on the citizenship question.

This could also lead to a “magnet problem” as “everybody moves to the state where the more favorable rule exists,” Kagan said.

5. Difficulties Involved in Suing Over Birthright Citizenship

Jackson said the government’s proposal to curtail nationwide injunctions would make it more difficult for people to sue to vindicate their rights.

“Your argument seems to turn our justice system ... into a ‘catch me if you can’ kind of regime ... where everybody has to have a lawyer and file a lawsuit in order for the government to stop violating people’s rights,” she said.

Sauer disagreed, saying that given the status quo, “the ‘catch me if you can’ problem operates in the opposite direction where we have the government racing from jurisdiction to jurisdiction, having to sort of clear the table in order to implement a new policy.”

“Many of us have expressed frustration at the way district courts are doing their business,” Kagan said.

The current system encourages forum-shopping, she said, referring to plaintiffs choosing to file a case in a jurisdiction where they think that the judge will be sympathetic to their case.

During the first Trump administration, litigants sought favorable rulings by filing in courts perceived to be friendly in San Francisco, but in the succeeding Biden administration, litigants filed in Texas, Kagan said.

“There is a big problem that is created by that mechanism,” she said.

-

Site: LES FEMMES - THE TRUTH

-

Site: Zero HedgeSingle-Family Home Permits Plunged In April, But 'Renter Nation' ReturnsTyler Durden Fri, 05/16/2025 - 08:44

A day after homeBUILDER sentiment finally cracked (though still dramatically more 'confident' than homeBUYERS)...

Source: Bloomberg

...and mortgage rates are rebounding higher, Housing Starts and Building Permits expectations were mixed ahead of this morning's print.

The actual data was indeed mixed but both were disappointly below expectations as Starts rebounded just 1.6% MoM (below the +4.0% exp) from the 10.1% MoM collapse last month (small revision higher) while Permits (more forward looking) plunged 4.7% MoM (vs -1.2% MoM)...

Source: Bloomberg

That is the biggest MoM drop in Permits since March 2024, dragging the SAAR down tits lowest since July 2024...

Source: Bloomberg

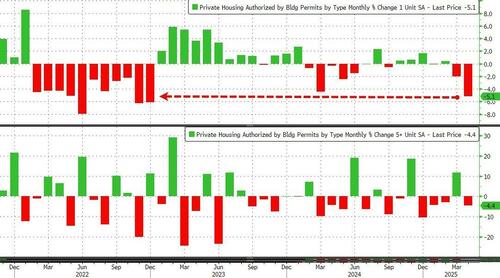

The drop in Permits was largely driven by a huge 5.1% MoM drop in Single-Family apps (multi-family fell 4.4% MoM) - the biggest drop since Dec 2022...

Source: Bloomberg

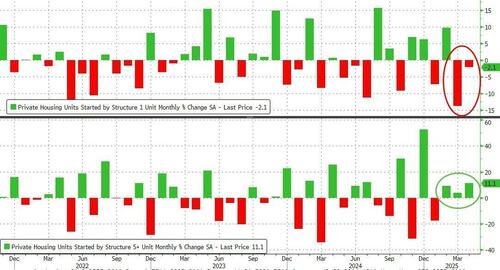

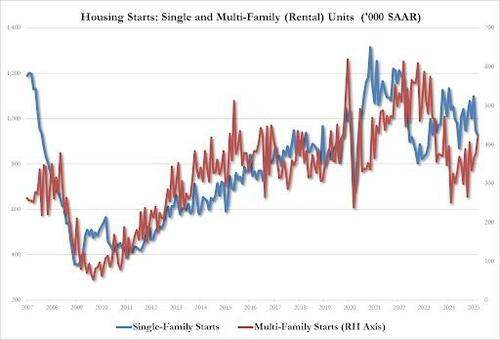

Housing starts were dominated by multi-family unit increases (for the third month in a row) as Renter Nation returns...

-

Single-Family down 2.1% to 927K, lowest since July 2024

-

Multi-family up 11.1% to 420K, highest since Dec 2023

Interstingly Starts picked up modestly despite the plunge in Homebuilder future sales expectations.,..

Source: Bloomberg

Perhaps the most shocking chart - that explains why builders are not building single-family homes is that inventories of unsold NEW homes is surging...

Source: Bloomberg

Rate-cut expectations are not helping...

Source: Bloomberg

So, don't bank on The Fed to save the day.

-

-

Site: Catholic ConclaveIn his election as Pope, Cardinal Robert Francis Prevost received a surprising number of votes in the first round of voting. This was revealed in an interview given by Iraqi Cardinal Raphael Louis Sako to the Italian newspaper "La Repubblica" (Wednesday edition). Sako, according to his own account, sat in the Sistine Chapel, in the seat to the right of Prevost, now Pope Leo XIV.He had not Catholic Conclavehttp://www.blogger.com/profile/06227218883606585321noreply@blogger.com0

-

Site: Zero HedgeUS Futures Rise For Fifth Day In A Row As S&P 6000 LoomsTyler Durden Fri, 05/16/2025 - 08:23

US stock futures are set for a fifth straight session in the green, as US equity funds benefited from their first inflows since the Liberation Day shock, and with 6000 in the S&P now less than a 100 points away. As of 8:00am, S&P 500 futures were up 0.3% after the index closed up 4.5% for the week on Thursday as the latest economic data spurred speculation the Fed will cut interest rates twice this year. Nasdaq futures gained 0.4% with Mag 7 leading (TSLA (+1.1%), GOOGL (+0.9%), and NVDA (+0.7%) are outperforming). The powerful rally this week has pushed the tech-heavy equity benchmark into overbought territory, while the S&P closed Thursday at the highest level since February. Europe’s benchmark Stoxx 600 gauge also gained, heading for a fifth weekly advance. The dollar weakened for a second session against major peers, while the yen and Swiss franc gained, and the 10-year Treasury yield was lower after declining 10 basis points Thursday as traders priced in more Fed cuts: bond yields are lower, with 2-, 5-, 10-, and 30-year yields down by 3.09bp, 3.7bp, 3.5bp, and 2.6bp respectively. Commodities are mostly lower, led by gold while oil reversed earlier losses. Overnight headlines were largely quiet. Today, we will receive University of Michigan Sentiment survey data, where consensus expects a modest bounce (to 53.5 vs. 52.2 prior).

In premarket trading, Mag 7 stocks are mostly higher with the exception of Meta after an equal-weighted gauge of the group fell over 1% on Thursday (Alphabet +1.5%, Tesla +1.1%, Nvidia +0.9%, Amazon +0.4%, Microsoft little changed, Apple +0.1%, Meta Platforms -0.1%). Charter Communications (CHTR) gains 9.4% after agreeing to merge with Cox Communications in a deal that values Cox at an enterprise value of about $34.5 billion. Vistra (VST) is up 5.1% after it said it executed a definitive agreement to acquire seven modern natural gas generation facilities from Lotus Infrastructure Partners for $1.9 billion. Here are some other notable premarket movers:

- Archer Aviation (ACHR) shares rise 5.7%, adding to gains from Thursday following its announcement that the electric vertical take-off and landing aircraft company had been selected as the ‘Official Air Taxi Provider’ for the LA28 Olympic and Paralympic Games.

- Doximity (DOCS) drops 18% after the healthcare-software company’s full-year forecast disappointed, with analysts pointing to a cautious tone from the management team on the call regarding the outlook for market growth.

- Globant (GLOB) shares sink 28% after the technology services provider cut full-year revenue guidance for 2025 to a level that undershot analysts’ expectations.

- Pentair (PNR) shares rise 2.2% after JPMorgan upgrades the water-treatment company to overweight from neutral on expectations of potential guidance upside.

- Quantum Computing (QUBT) shares are up 9.7% after the quantum optics technology company reported its first-quarter results.

- Rocket Cos. (RKT) gains 4.4% after ValueAct Capital Management LLC reported a 9.9% holding in the mortgage finance company, according to a new 13D filing with the US Securities & Exchange Commission.

- Take-Two (TTWO) falls 2% as the video-game publisher’s full-year forecast for revenue came up short.

- Travere Therapeutics (TVTX) shares drop 17% after the biotech’s application for its kidney disease treatment Filspari (sparsentan) failed to get priority review status from the US FDA and is set to face an advisory panel.

One month after the nevertrump media hyperventilated about the "US exceptionalism" trade dying, US equities are back in favor following the de-escalation of trade tensions between the US and China. Stocks are now trading like last month’s rout never happened, even though uncertainty remains about the effect of tariffs on the US economy and the direction that the global trade war will take in the coming months. Bank of America's Michael Hartnett said weekly US equity inflows resumed at $19.8 billion for the first time since Liberation Day. Meanwhile, stocks haven’t been getting rewarded for earnings beats: firms that topped expectations in the first quarter reports saw their share prices rise by less than usual, according to JPMorgan strategists. Meanwhile, Federal Reserve Bank of Atlanta President Raphael Bostic said he expects the US economy to slow this year but not fall into recession.

“For now, we believe that the path of least resistance is still higher for risky assets,” said Mohit Kumar, chief economist and strategist at Jefferies International. “We would start turning a bit more cautious around June/July when we expect the hard data start weakening.”

Thursday afternoon brought a deluge of 13F filings, which showed hedge funds adding healthcare exposure and cutting tech over the first three months of the year. Michael Burry’s Scion Asset Management liquidated almost its entire listed equity portfolio in the first quarter. Meanwhile, Warren Buffett’s Berkshire Hathaway trimmed its holdings of financials stocks.

Traders are also watching negotiations around the US budget with its promise of large tax cuts and the potential impact that will have on the fiscal deficit.

Elsewhere, Japan’s economy shrank for the first time in a year as the surging yen crushed exports, illustrating its vulnerability even before sustaining the impact of Trump’s tariff measures. Paradoxically, the yen gained 0.2% on Friday to trade around 145 per dollar even as Bank of Japan official Toyoaki Nakamura, the most dovish board member, warned against hurrying to raise the benchmark interest rate.

Europe’s benchmark Stoxx 600 gauge also gained, heading for a fifth weekly advance as cooling global trade tensions improve investor sentiment and corporate earnings season comes in better than expected. Health care and food and beverage sectors outperform. Among single stocks Richemont rises after reporting a rise in full year sales. Here are the most notable European movers:

- Richemont shares rise as much as 5.5% after the Swiss firm’s jewelry division saw strong growth thanks to demand for its high-end Cartier and Van Cleef & Arpels brands.

- Orsted shares rise as much as 2.1%, snapping three days of declines, after UBS analysts say the stock is pricing in a “close to worst case” scenario when it comes to a potential halt order on the Danish company’s two US offshore projects.

- 1&1 shares soar after its parent United Internet submitted a partial offer to acquire as much as 9.19% of 1&1 shares, for a cash consideration of €18.5 apiece.

- Tate & Lyle shares gain as much as 3.1%, among the best performers in the Stoxx 600’s food, beverage and tobacco subgroup, after Citi upgrades the stock to buy from neutral, saying the risk/reward “looks attractive.”

- CVC Capital shares climb as much as 5.4%, to the highest in six weeks, after Morgan Stanley upgrades its recommendation on the alternative investment manager to overweight, seeing scope for recovery after recent underperformance.

- Nibe falls as much as 4.1% after Handelsbanken cut its recommendation on the Swedish heat-pump manufacturer to sell from hold, quoting recent strong share performance.

- Eutelsat shares drop as much as 11% after the satellite operator said on earnings call that it’s “far too early” to discuss the European Union’s revenue commitment to its next-generation low-earth orbit satellites, dampening hope of enhanced government support in the near term.

- Rubis shares fall as much as 3.7% after the French energy solutions firm said Nils Christian Bergene will step down as chairman and a member of the supervisory board, a departure that CIC analysts called a surprise.

- Workspace Group shares fall as much as 11% after the landlord to mostly small- and medium-sized London businesses warned rising vacancies in its portfolio will dent profits.

- Future shares decline as much as 9.2% after the UK specialist publisher said its FY25 organic revenue will face a low-single-digit decline, below estimates.

- Tokmanni falls as much as 14%, the most since last July, after the Finnish retail group missed expectations in its first-quarter report.

- Dino Polska drops as much as 7.5%, most since August, as Poland’s food retailer reported slowing like-for-like sales in 1Q, raising concerns about its business model and triggering profit taking after 42% rally YTD.

Earlier in the session, Asian stocks traded in a narrow range as the rally sparked by US-China trade talks continued to cool and earnings from Chinese e-commerce giant Alibaba underwhelmed. The MSCI Asia Pacific Index swung between a gain of as much as 0.3% and loss of 0.2%. NetEase was the biggest contributor to the gains, after the China-based video-game company reported first-quarter results that beat expectations. Meanwhile, Alibaba was among the major drags, after its quarterly revenue missed estimates and cloud business disappointed. Key indexes dropped in mainland China, Hong Kong and India, while benchmarks rose in Australia and Taiwan. Goldman Sachs strategists raised their 3-month and 12-month targets for the MSCI Asia Pacific ex-Japan Index to 610 and 660, respectively, from 570 and 620, expecting “moderately higher” returns for the region thanks to improved earnings growth amid a better-than-expected outcome to US-China trade talks.

In FX, the Bloomberg Dollar Spot Index fell as much as 0.2%, declining for the second straight day; it is on track to end the week 0.1% higher; the yen and Swiss franc among the beneficiaries.

In rates, the 10-year Treasury yield was lower after declining 10 basis points Thursday as traders added bets on Fed rate cuts; treasuries are richer across the curve with futures adding to Thursday’s gains and 10-year yields dropping back to 4.405% and near 100-DMA. US yields richer by 2bp to 3bp across the curve with spreads broadly within a basis point of Thursday close; in the 10-year sector bunds and gilts outperform Treasuries by 2.5bp and 1.5bp so far on the day.

In commodities, gold fell to extend its weekly loss as demand for haven assets waned. Oil prices declined after Iran’s foreign minister cast doubts on the status of US-Iran nuclear talks.

Looking at today's US data calendar, key events includes April housing starts/building permits, import/export price index, May New York services business activity (8:30am), University of Michigan sentiment (10am) and March TIC flows (4pm). Fed speaker slate includes Daly at 9:40pm

Market Snapshot

- S&P 500 mini +0.3%

- Nasdaq 100 mini +0.3%

- Russell 2000 mini +0.4%

- Stoxx Europe 600 +0.6%

- DAX +0.7%, CAC 40 +0.6%

- 10-year Treasury yield -3 basis points at 4.4%

- VIX -0.2 points at 17.66

- Bloomberg Dollar Index -0.1% at 1228.52

- euro +0.2% at $1.1208

- WTI crude -0.3% at $61.45/barrel

Top Overnight News

- Donald Trump said he’d set tariff rates for US trading partners “over the next two to three weeks.” BBG

- US Deputy Treasury Secretary Faulkender said he is not concerned about persistent increases in prices, while he added that inflation will return to target levels and they are setting the foundation for the US economy to take off in H2.

- The Trump administration plans to put a number of Chinese chipmaking companies (including memory chipmaker ChangXin Memory) on an export blacklist, but some officials want to delay the move to avoid hurting efforts to strike a long-term trade agreement with China. FT

- Hopes faded for Russia-Ukraine talks set to take place today in Istanbul. The focus now shifts to when Trump may meet Vladimir Putin.

- US President Trump says deals from his trip are worth USD 12-13tln, includes deals already announced and some that will be outlined "very shortly". Will be sending out letters to nations for trade deals soon.

- China approves 10 nuclear reactors, putting the country on pace to surpass the US in nuclear power capacity by 2030. Nikkei

- NVDA is seeing to build a research and development center in Shanghai that would help the world’s leading maker of AI processors stay competitive in China, where its sales have slumped due to tightening US export controls. FT

- Japan’s Q1 GDP falls short of expectations, dropping 0.7% on an annualized basis vs. the consensus forecast of -0.3%, with the shortfall driven by weak consumption and higher imports. Nikkei

- Japan has signaled it is prepared to hold out for a better deal with the US over trade tariffs, pushing for full removal of his 25% duty on imports of Japanese cars rather than risk a domestic political backlash. FT

- The Fed’s Raphael Bostic said in a May 14 interview that he expects the US economy to slow this year but not fall into recession, and reiterated that he sees one rate cut in 2025. BBG

- The cost to ship a container of Chinese-made goods to the U.S. is jumping as importers race to pull cargo across the Pacific during a 3 month trade war truce. Freight rates from China to the US west coast have risen about 8% this week as bookings have boomed. Importers rushing to ship Chinese goods to the US during a short reprieve from higher tariffs may boost freighters. The surprise truce is seen causing a surge in transpacific shipping, Bloomberg Intelligence said. BBG, WSJ

- BofA card spending, week to May 10th: -1.3% (1.0% April average), spending has seen a recovery from the Easter slowdown.

Tariffs/Trade

- US President Trump's administration is reportedly split on adding Chinese chip makers to export blacklists as some US officials fear the move could jeopardise trade talks with Beijing, while the Commerce Department has compiled a list of Chinese companies including memory chipmaker ChangXin Memory to add to the 'entity list' although the timing of the move has been complicated by the recent agreement by China and the US to cut tariffs, according to sources cited by the FT.

- US told Vietnam its trade deficit is unsustainable and a major concern amid tariff talks, according to Vietnam state media.

- Mexican President Sheinbaum spoke with Canadian PM Carney regarding the importance of USMCA in strengthening the competitiveness of the three North American countries, while they also discussed the continuity and strengthening of the seasonal agricultural worker program.

- Greenland's Foreign Minister has suggested that she wants to deepen bilateral ties with the EU, highlighting Greenland's mineral resources as an area for collaboration, via Politico.

- Japan has reportedly indicated that it is prepared to hold out for a better deal with the US, pushing for the full removal of the 25% duty on car imports, via FT.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed after the recent soft US data releases spurred Fed rate cut bets, while participants also digested weak data from Japan and earnings reports. ASX 200 was led by strength in miners and outperformance of gold producers after the recent rally in the precious metal. Nikkei 225 initially retreated amid recent currency strength and after GDP data for Q1 showed a steeper-than-expected contraction in Japan's economy, although the index gradually recovered and returned to flat territory as USD/JPY regained some composure and with the weak data effectively narrowing the scope for the BoJ to resume normalisation. Hang Seng and Shanghai Comp declined with sentiment dampened by earnings releases after Alibaba's results underwhelmed which pressured its Chinese blue-chip tech and ecommerce peers such as Tencent, Meituan and JD.com.

Top Asian News

- BoJ Board Member Nakamura said Japan's economy has recovered moderately, but some weakness has been seen, while he added the economy is facing mounting downward pressure due to the implementation of US tariff policies. Nakamura said the momentum for wage hikes has accelerated but could weaken depending on impact of US tariff policies and noted that it is appropriate to keep monetary policy steady for the time being. Furthermore, he said uncertainty over the economic outlook is heightening, so a cautious monetary policy approach is necessary and hiking rates prematurely when growth is slowing could curb consumption and capex.

- Japan's Economy Minister Akazawa said improvements in job and income conditions are likely to underpin moderate economic recovery, while he added must be mindful downside risk to the economy from US trade policy and the hit to consumption and household sentiment from sustained price rises also becoming a downside risk to Japan's economy.

European bourses (STOXX 600 +0.6%) opened modestly firmer across the board, and have traded with an upward bias this morning. European sectors hold a strong positive bias, with only a handful of industries in negative territory. Healthcare takes the top spot, with gains in the sector seemingly broad based. In terms of stock specific stories, Sanofi (+2.2%) gains after it received FDA orphan designation for treating sickle cell disease. Bayer (+3.5%) benefits from an FT report which suggested it is seeking a Roundup settlement.

Top European News

- ECB's Villeroy says "we are not currently in a currency wars situation but rather a trade war situation".

- ECB's Kazaks says a meeting by meeting approach at the ECB is right and notes a lot of uncertainty around trade measures, according to CNBC.

FX

- Dollar is on the backfoot, continuing the pressure seen following Thursday’s disappointing Retail Sales and softer-than-expected PPI data. As a reminder, this led money markets to fully price in two Fed cuts by year-end; currently pricing in roughly 57bps. DXY currently sits in a 100.52-78 range. Further downside for the index will see a potential test of the week’s trough at 100.27 – should that be taken out, 100.00 will be next in focus. Ahead, US Import Prices, UoM Survey and commentary from Fed's Barkin.

- EUR is modestly firmer vs the Dollar, with specific for the Bloc very light today – Final Italian inflation metrics were revised marginally lower but ultimately had little impact on the Single-Currency. Commentary via ECB’s Kazaks and Villeroy this morning has not added too much to the agenda; the former reiterated the need for a meeting-by-meeting approach and highlighted the uncertainty around trade. This morning EUR has climbed back above the 1.12 mark and has traded in a busy 1.1182-1.1219 range.

- JPY is slightly firmer vs the Dollar after choppy price action overnight, which saw USD/JPY initially trickle lower amid initial haven flows into the yen and recent declines in US yields, but later bounced off support at the 145.00 level. USD/JPY was little moved following weaker-than-expected GDP data. USD/JPY currently trading around 145.30 in a 144.93-145.68 range

- GBP is flat/incrementally firmer vs the Dollar and holds just above the 1.33 mark, in a very thin 1.3300-1.3320 range. UK-specific updates have been lacking today. Some focus has been on an FT article which suggested that EU leaders are urging UK PM Starmer to improve the region’s mobility deal – particularly for EU students.

- Antipodeans are the best performers vs the Dollar, nursing some of the losses seen in the prior session. The Kiwi is the best G10 performer today; overnight, New Zealand 1yr and 2yr inflation expectations are both seen higher, which may explain some of the outperformance in today’s session. Do note that the NZD is outmuscling the AUD in the AUD/NZD cross; some traders may be focused on next week’s RBA meeting, where markets widely expect the Bank to deliver a 25bps cut.

- PBoC set USD/CNY mid-point at 7.1938 vs exp. 7.2085 (Prev. 7.1963).

Fixed Income

- Firmer start to the day as USTs continue the data-induced upside from Thursday with newsflow since a little light and markets largely awaiting updates on numerous geopolitical situations. At the top-end of a 110-10 to 110-20 band. As it stands, on track to end the week almost flat, opened the week at 110-18, despite the marked pressure seen in the first half on US-China progress. Trade developments that sparked notable hawkish action Monday through Wednesday, before being offset by Thursday’s data deluge. Ahead, the docket is comparably light but does feature Building Permits/Housing Starts, Import Prices (factor into PCE) and the prelim. Uni. of Michigan series for May.

- Bunds are in-fitting with USTs, but with action slightly more pronounced as EGBs experienced a marginal rally early doors as European players entered the fray and reacted to the bullish bias of APAC trade. Specifics light. A few ECB officials on the wire but nothing that has fundamentally shifted the narrative. Bunds just off highs in a 130.11-50 confine and, as with USTs, near-enough on track to end the week flat despite a WTD range in excess of 135 ticks.

- Gilts are outperforming slightly, likely on account of the marginal underperformance vs Bunds seen at points this week and as such, the UK is catching up on the final session of the week. As above, Gilts are also set to end the week essentially unchanged, currently just off highs in a 91.84-92.00 band. Resistance at 92.59 from mid-April and thereafter 93.00 before highs from the last few weeks, beginning at 93.59.

Commodities

- A hesitant start for WTI and Brent as geopolitics dominates ahead of the weekend. WTI and Brent traded largely flat through the morning but are currently down by around USD 0.10/bbl, nearing overnight lows.

- In terms of Iran-related headlines, crude prices whipsawed on conflicting media reports yesterday and mixed signals from US and Iranian officials. This morning, Iran's Foreign Minister stated that negotiations will continue as long as the other party remains engaged, maintaining that no formal proposal from the US has been received.

- On Russia-Ukraine, talks are underway in Istanbul, with the Trilateral meeting between Turkey-US-Ukraine supposedly concluded. We are yet to hear the readout from it. Ahead, there will be another trilateral meeting, this time with Russia taking the place of the US.

- Spot gold is continuing losses, pulling back from yesterday’s gains after soft data, lower yields and Fed rate cut bets aided the yellow metal. At the time of writing, the yellow metal trades towards the upper end of a USD 3,205.49-3,252.17/oz range.

- Base metals are softer after the subdued mood in its largest buyer, China, overshadows the positive sentiment in Europe this morning. 3M LME Copper currently rests within, but at the lower-end of, a USD 9,474.9-9,591.42/t range.

- Shanghai Copper warehouse stocks +27.44k/T (prev. -8.60k/T), Aluminium stocks -13.59k/T (prev. -6.19k/T)

- ADNOC Chief says the UAE and the US plan investment of USD 440bln in the energy sector through 2035.

Geopolitics

- US President Trump says he is willing to meet with Ukrainian President Zelensky and Russian President Putin as soon as arrangements can be made; going to take care of Gaza; will make good progress on geopolitical situations in the next two or three weeks In one way or another, will take care of Iran.

- Iranian Foreign Minister says the nation's position is clear and we are ready to build confidence and adopt transparency in our Nuclear Programme in exchange for the lift of sanctions. Not received any agreement proposal from the US; is possible will be informed via a meditator

- Hamas is reportedly holding direct negotiations with the US Administration, according to a senior Hamas official cited by Al Arabiya.

US Event Calendar

- 8:30 am: Apr Housing Starts, est. 1363.5k, prior 1324k

- 8:30 am: Apr P Building Permits, est. 1450k, prior 1467k

- 8:30 am: Apr Import Price Index MoM, est. -0.3%, prior -0.1%

- 10:00 am: May P U. of Mich. Sentiment, est. 53.5, prior 52.2

- 4:00 pm: Mar Net Long-term TIC Flows, prior 112b

- 4:00 pm: Mar Total Net TIC Flows, prior 284.7b

Central Banks

- May 16: Fed’s Barkin Gives Commencement Speech

- May 17: Fed’s Daly Gives Commencement Address

DB's Jim Reid concludes the overnight wrap

Markets continued to advance over the last 24 hours, as weak US inflation data and lower oil prices raised expectations that the Fed would still cut rates this year. By the close, that meant the S&P 500 (+0.41%) had posted a 4th consecutive gain, which now brings its advance since the April low to +18.75%. In fact, the index isn’t far away from a +20% gain that would mark the technical definition of a bull market, and futures this morning are pointing to another modest gain. So it’s been an astonishing turnaround from where we were just over a month ago at the height of the tariff uncertainty.

There were several factors driving the rally, but a critically important one was the US PPI data for April. It showed inflation pressures were much softer than expected, with headline PPI down -0.5% on the month (vs. +0.2% expected). So that marked the biggest monthly decline in producer prices since April 2020 and the Covid lockdowns, and it pushed the year-on-year reading down to +2.4% (vs. +2.5% expected). Core PPI was also softer than expected, with the measure excluding food energy and trade down -0.1% on the month (vs. +0.3% expected), which was the first negative print since April 2020. It also helped broader inflation expectations to move lower, and the US 10yr inflation swap fell -4.7bps on the day to 2.50%, marking its biggest decline in over a month.

With investors feeling less concerned about inflation, they then dialled up their expectations for Fed rate cuts in response. For instance, the amount priced in by December up +7.1bps on the day to 56bps. And in turn, that contributed to a large rally in Treasury yields across the curve, with the 2yr yield (-9.0bps) falling back to 3.96%, whilst the 10yr yield (-10.5bps) fell to 4.43%.

Those moves got further momentum from the latest decline in oil prices, which added to the sense that inflationary pressures were easing. The move followed comments from President Trump, who said “I think we’re getting close to maybe doing a deal” with Iran. Moreover, Trump posted an NBC news story citing a top Iranian official that Iran would sign a nuclear deal in exchange for lifting economic sanctions. So the newsflow led to growing expectations that oil supply could rise, and Brent crude fell another -2.36% on the day to $64.53/bbl.

The fall in yields came despite comments from Fed Chair Powell yesterday, who indicated that the Fed were reconsidering the language on average inflation targeting in their latest review. For reference, in 2020 they changed their approach to permit a period of inflation above the 2% target, if it followed a period of inflation running beneath target, so that was a significant shift. However, the potential to move back off that again was seen in a hawkish light, as it implied less tolerance for higher inflation in the future, and Treasury yields briefly spiked as the headlines came through.

Nevertheless, the Powell comments weren’t enough to counteract the broader rally, and there was also relief yesterday that the US data continued to point away from a recession. For instance, the weekly initial jobless claims remained at 229k over the week ending May 10 (vs. 228k expected), so still in their recent range and not signalling a sharper deterioration. In the meantime, the retail sales data showed modest growth of +0.1% in April (vs. unch expected), which was a slowdown from March, but still not the contractionary territory that might be expected in an outright recession. And with the latest data in hand, the Atlanta Fed’s GDPNow estimate for Q2 moved up to an annualised +2.5% pace.

That environment proved to be a strong one for equities on both sides of the Atlantic, with the S&P 500 up +0.41% on the day. The advance was reasonably broad-based, with 75% of the index moving higher. Defensive sectors outperformed, with utilities (+2.12%) and consumer staples (+2.00%) leading the gains for the S&P 500. By contrast, the Magnificent 7 (-1.09%) ended a run of 5 consecutive gains. Within the Mag-7, Meta fell -2.35% following a WSJ report that it was delaying the rollout of a flagship AI model. In terms of other individual moves, Walmart (-0.50%) lost ground after their earnings, and they warned that prices would go up as a result of the tariffs. And Cisco Systems gained +4.85% following their own earnings after the previous day’s close.

Earlier in Europe, bond markets had also rallied on hopes for weaker inflation, and yields on 10yr bunds (-7.7bps), OATs (-8.5bps) and gilts (-5.2bps) all moved lower. There were similar gains for equities, with the STOXX 600 (+0.56%) closing at a 7-week high, alongside a fresh record for the DAX (+0.72%). That positivity was reinforced by strong UK GDP numbers, with Q1 growth running at a quarterly +0.7% pace (vs. +0.6% expected), and the FTSE 100 (+0.57%) closed above its Liberation Day level for the first time.

Overnight in Asia however, the tone has generally been more negative, with several of the major indices losing ground. Sentiment hasn’t been helped by Japan’s Q1 GDP reading, which showed a larger-than-expected contraction, with the economy shrinking at an annualised -0.7% pace in Q1 (vs. -0.3% expected). So that raised fears about how resilient the economy was, particularly given those numbers were before the Liberation Day announcement in April. Against that backdrop, Japan’s Nikkei fell -0.28%, and elsewhere there’ve been losses for the Hang Seng (-0.76%), the CSI 300 (-0.57%) and the Shanghai Comp (-0.52%). That said, there have been some gains, including South Korea’s KOSPI (+0.19%), and Australia’s S&P/ASX 200 (+0.57%).

Looking forward, the planned US budget reconciliation bill will remain in focus today. Politico reported yesterday evening that today’s planned procedural vote in the House Budget Committee may be in peril due to opposition from fiscally hawkish Republicans to the CBO’s scoring of the bill, and proposed delays to Medicaid cuts. Yesterday our US economists published a report (see here) analysing the details of the tax bill released this week, which they see putting the US on course for a 6.5% of GDP fiscal deficit in the coming years.

In geopolitics, it’s also worth keeping an eye on today’s talks between Russian and Ukrainian officials in Istanbul. These mark the first direct talks since spring 2022, but with Moscow sending a relatively low-level delegation, no immediate progress is expected. Trump claimed yesterday that “nothing’s going to happen” in terms of resolving the war in Ukraine until he and Putin meet.

To the rest of the day ahead, data releases include the University of Michigan’s preliminary consumer sentiment index for May, along with April’s building permits, housing starts, and the import and export price indices. In the Euro Area, we’ll get the March trade balance. And from central banks, speakers include the Fed’s Barkin, the ECB’s Lane, and the BOE’s Lombardelli.

-

Site: Rorate CaeliThe central message of the new pope in his address to the Diplomatic Corps today:Truly peaceful relationships cannot be built, also within the international community, apart from truth. Where words take on ambiguous and ambivalent connotations, and the virtual world, with its altered perception of reality, takes over unchecked, it is difficult to build authentic relationships, since the New Catholichttp://www.blogger.com/profile/04118576661605931910noreply@blogger.com

-

Site: AsiaNews.itAbout 570,000 Vietnamese live in Japan, many attracted by promises of qualified jobs linked to the Gijinkoku visa. Yet many are employed as trainees and underpaid. In Chiba, 150 workers are suing an agency for unpaid wages. The story puts the spotlight on a murky and abusive recruitment system.

-

Site: Novus Motus LiturgicusMay 16th is the feast of St John Nepomuk, a priest of the Archdiocese of Prague who was martyred in the year 1393. His family name is variously written Wölflein or Welfin, but he is generally called “Nepomuk” or “Nepomucene” after the town where he was born between 1340-1350, about 65 miles to the southwest of Prague. As vicar general of the archdiocese, St John fell afoul of the king of Bohemia,Gregory DiPippohttp://www.blogger.com/profile/13295638279418781125noreply@blogger.com0

-

Site: PaulCraigRoberts.org

Is the Supreme Court in the Process of Burying American Democracy?

Paul Craig Roberts

American voters elected Trump president three times. The first election was prevented from producing any results that the people wanted by fake charges of Russia-gate, 2 impeachments, pornstar-gate, documents-gate, insurrection-gate. The second election was stolen by the Democrats and media. The third election is being stolen by the judiciary, which is in the process of deciding that alleged rights of immigrant-invaders prevail over the will of citizens as expressed in elections.

The courts seem determined to impose on us the Camp of the Saints. Judges regard democracy as less important than the right of a pregnant woman to sneak into the country and give birth to an anchor baby, thus making the entire family US citizens. To forbid birth citizenship harms the right of all other illegals to steal citizenship in this way. Deporting immigrant-invaders harms their and the entire world’s right to live in the United States. The judiciary has no concern about the harm done to US citizens by their rulings. Obviously, like everything else, no careful attention was given to the appointment of judges.

All of this is fine with the judges. It advances Kritarchy, rule by judges.

Here is an anchor baby, now a Democrat US Representative, asserting the rights of illegals over rule by citizens: https://www.breitbart.com/immigration/2025/05/14/watch-dem-rep-daughter-illegal-migrant-demands-kristi-noems-resignation/

-

Site: PaulCraigRoberts.org

While Trump Speaks of Ukraine Peace, Washington Opens a Second Front Against Putin

Paul Craig Roberts

The US House of Representatives Has Passed the MEGOBARI Act (HR 36) that places Georgia, now an independent country and once a province of the Soviet Union, under American protection. Washington has to protect free and fair elections in Georgia from Russia and protect Georgia’s “sovereignty and territorial integrity from further Russian aggression.”

There has been NO Russian aggression against Georgia. With the collapse of the Soviet Union caused by the Politburo’s house arrest of Russian President Gorbachev, Russia under Yeltsin accepted Washington’s dismemberment of the Soviet Empire. Soviet republics, some of which had not ever been independent states, such as Ukraine, were turned by Washington into New Countries.

In 2008 a Georgian Army trained and equipped by Washington invaded South Ossetia, a Russian protectorate and a part of Georgia that did not want to exit Russia. Russian peacekeepers were killed, and this brought Putin, inattentive as always, back from the Chinese Olympics to send in the Russian Army. The American equipped and trained Georgian Army was totally defeated within a few hours, and Georgia was in Putin’s hands. What did he do? He released Georgia to themselves and took his army home.

How is this Russian aggression?

As is obvious the members of the US House of Representatives are completely ignorant and uninformed morons. America, as Mark Twain said, elects morons to represent them. And that is what Americans have. We are governed by morons.

Protecting Georgia from Russia is the excuse for Washington to take over Georgia, and, of course, bags full of money will facilitate the process by being handed over to key members of the Georgian government.

So what we have here is Washington’s effort to open a second war front against Russia. Adam Dick with the Ron Paul Institute gives us a reliable indiction of what is happening. https://www.lewrockwell.com/2025/05/no_author/us-house-approves-megobari-act-to-pursue-in-georgia-more-ukraine-style-intervention-and-conflict-with-russia/

So, what do we make of this? On the one hand Trump is pursuing peace negotiations in Ukraine with Russia. On the other hand, Washington is preparing another Maidan, this time in Georgia.

How stupid are the Russians? Did they learn nothing from the Minsk Agreement? Is the Kremlin blind to the obvious fact that Washington is sequencing its wars with Russia and China by pulling out of Ukraine, turning it over to Europe, so that Washington can focus on China. This is the policy described by West Mitchell in Foreign Affairs. Why has no one but myself and John Helmer commented on this revealing article?

-

Site: PaulCraigRoberts.org

Democrats block white political refugees from refuge in America

Paul Craig Roberts

Here is Richard Stengel, a talking head “political analyst” at MSNBC and former blah-blah person in the Obama regime. Apparently, the Democrats are blocking white South Africans from refuge status in the United States. https://x.com/amuse/status/1922988576544858194

Stengel’s excuse, explained in the video, is that South Africa was once an apartheid state. That was three decades ago before the white government voluntarily gave up rule to the blacks.

Stengel alleges that the South African refugees are the “descendants of the people who created the most diabolical system of white supremacy in history.” He goes on to demonize white people and drags in the Confederacy. His argument is that the sins of the fathers are visited upon the sons.

Stengel is Jewish and so he says nothing about the Apartheid state of Israel in which only Jews can be citizens–thus making Israel the only ethnically pure state on earth–and which is in the final stages of appropriating the entirety of Palestine, all of which was stolen from the Palestinian people in order to complete the creation of an Apartheid Israeli state. But it is OK for Jews, God’s Chosen People, to do this. But others who do it are diabolical white supremacists.

Stengel was editor of Time Magazine for 7 years, so you can see how Americans came to be a brainwashed people.

-

Site: RT - News

The scandal around Pfizer texts and Covid jabs is giving von der Leyen a taste of her own medicine

Well, this is awkward. How many times has Ursula von der Leyen, European Commission president and unelected de facto ruler of the EU, delivered sermons about transparency like she’s the high priestess of some kind of parallel Brussels Vatican? And now the EU’s own top court has called her out in a ruling for neglecting to practice what she preaches.

Back in 2023, during her State of the European Union address, doing her finest impression of someone elected by the actual public, von der Leyen declared the need to douse any and all sketchiness in sunlight in order to “not allow any autocracy’s Trojan horses to attack our democracies from within.”

“Transparency should characterize the work of all the members of the Commission and of their cabinets,” she said as far back as 2019. “I have asked commissioners…to engage more and be more transparent,” she proclaimed in a speech to EU parliamentarians last year. Transparency and accountability also figured prominently in her bid for reappointment by the EU’s ruling elites last year.

Great news! She can now finally embark on this noble mission, and begin her journey with little more than a simple glance in the mirror. Because the European Court of Justice – the body that rules on whether EU institutions have actually crossed into illegality, not just occupying their usual territory of elite-grade idiocy – has just decided that Queen Ursula’s Commission can’t just wave away a pile of her own Covid-era text messages by going, “Whoops! They disappeared. Oh well, what do you do?” Which is basically what the Commission’s response was to the New York Times when it asked to see those messages.

Read more Court rules on von der Leyen’s secret Covid vaccine deal messages

Court rules on von der Leyen’s secret Covid vaccine deal messages

And how did the Times know that these texts even existed? Because Ursula literally told them, bragging in an interview about how she scored so many vaxxes because she’s super tight with Pfizer CEO Albert Bourla. All this was for a piece spotlighting her Covid efforts, published in April 2021: “How Europe sealed a Pfizer vaccine deal with texts and calls.”

The article featured the same kind of glamour photography reminiscent of the good ol’ days when Ursula was Germany’s defense minister from 2013 to 2019, under former Chancellor Angela Merkel, and doing photo shoots in front of military hardware while accusations swirled that she had bungled the budget with shady defense contracts, even as the Bundeswehr was stuck using brooms for guns during a NATO exercise, as the Atlantic Council reported in 2015.

“For a month, Ms von der Leyen had been exchanging texts and calls with Bourla, the chief executive of Pfizer… Pfizer might have more doses it could offer the bloc – many more,” the NYT piece reads, referring to the “personal diplomacy” that “played a big role in a deal” for 1.8 billion Pfizer anti-Covid doses.

So the Times hears about these text messages and was like, “Oh, cool. Let’s see!”

Suddenly Queen Ursula became a lot less chatty. So the Times took the matter to the EU’s own top court to get the disclosure. And now this court has said, in legal terms, that Ursula can’t just ghost the Times – and the public by extension – without giving a real reason. That there has to be a “plausible explanation to justify the non possession” of the texts. And also, the court says that “the Commission has failed to explain in a plausible manner” why it thought that these messages were so trivial that they could be vaporized like they were just her Eurovision contest text voting and not a matter of public record which, by definition, should be maintained.

Out of these little chats came €71 billion in Covid jab contracts with Big Pharma’s Pfizer and AstraZeneca – 11 of them to be precise, totaling 4.6 billion doses, paid for with cash taken straight from EU taxpayers. Enough for ten doses for every EU citizen.

Read more Von der Leyen commission loses Covid vaccine case

Von der Leyen commission loses Covid vaccine case

Turns out that freewheeling it may have resulted in some consequences that could have been avoided had a diverse group of minds been engaged on the issue, as protocol normally dictates, and not just Ursula’s. It’s not like there hasn’t been a costly fallout from all this. A big chunk of the EU, including Germany, Poland, Bulgaria, Hungary, Lithuania, Estonia, Slovakia, and the Czech Republic, is shouting about surplus doses for which they’re on the hook, urging Brussels to renegotiate the contractual terms with Big Pharma. Germany alone has reportedly trashed 200 million of them. Tricky to negotiate, though, when no one’s even sure what the terms were, as the second-highest European court pointed out last year. “The Commission did not give the public sufficiently wide access to the purchase agreements for COVID-19 vaccines… The Commission did not demonstrate that wider access to those clauses would actually undermine the commercial interests of those undertakings,” it ruled.

The details of these contracts – how they were made, what they say, and how anyone’s supposed to back out of them if citizens politely decline to max out their ten-jab punch card – remain a mystery.

Back in 2024, Brussels more or less shrugged and suggested that it could really only be as transparent as the courts forced it to be. So hey, what can you do? “In general, the Commission grants the widest possible public access to documents, in line with the principles of openness and transparency,” the EU said, underscoring that the lower court ruling “confirmed that the Commission was entitled to provide only partial access.”

Well, good news, guys! Your very own top court just ruled that you can now be a lot more transparent! So go crazy. Be the change that you keep saying you want to be in the world. Nothing is holding you back now. If transparency were a vaccine, this court just gave Ursula a booster. So we’ll see if it takes. I won’t hold my breath.

-

Site: Rorate Caeli(Click for larger view and/or for printing)Prayer for the Pope:[Partial indulgence granted: Enchiridion indulgentiarum, IV ed. (al. conc., 25, 1°)] V. Oremus pro Pontifice nostro Leone. R. Dominus conservet eum, et vivificet eum, et beatum faciat eum in terra, et non tradat eum in animam inimicorum eius. Oremus. Deus, omnium fidelium pastor et rector, famulum tuum Leonem, quem New Catholichttp://www.blogger.com/profile/04118576661605931910noreply@blogger.com

-

Site: PaulCraigRoberts.org

Ex-FBI director Comey under investigation for ‘call to assassinate Trump’

-

Site: southern ordersAnd poor MS Winters from the NcR. He sounds like Fr. Z in the first year of Pope Francis’ pontificate as Fr. Z tried to wrapped his head around a papacy unlike any other but desperately trying to read Francis through Benedict:Press article title to read about Winter’s Fr. Z’s moments:

-

Site: PaulCraigRoberts.org

Perhaps Trump Will Free America from Satanic Israel’s Control

Donald of Arabia

-

Site: PaulCraigRoberts.org

Colorado Murder Rate Dives After ICE Deports Tren de Aragua Gangbangers

But the anti-white Democrats still protect the immigrant-invaders.

-

Site: Rorate CaeliFrom the PIMS Instagram account:“Let’s sing with the Pope” is a new initiative from the Pontifical Institute of Sacred Music (PIMS), which is launching a series of short educational video tutorials on social media to help the People of God sing along with the Holy Father during the upcoming major liturgical celebrations.It aims to make the rich heritage of Gregorian chant accessible to all—New Catholichttp://www.blogger.com/profile/04118576661605931910noreply@blogger.com

-

Site: PaulCraigRoberts.org

Immigrant-Invader Bites Off German Policewoman’s Ear

The reason not to have immigrant-invaders and female police.

https://www.infowars.com/posts/african-bites-off-german-police-womans-ear

-

Site: Mises InstituteDid the Marshall Plan save Europe or enrich crony capitalists? Patrick Newman exposes how corporate welfare, hidden deals, and corruption shaped postwar policy, with effects still felt today.

-

Site: Mises InstituteDavid Gordon explores historian Charles Beard’s forgotten warnings and their lasting lessons on liberty and foreign policy.

-

Site: RT - News

A London-based think tank has assessed the time and funding required for preparing for a war without US backing

European NATO members would face a $1 trillion bill over 25 years to replace US military contributions if Washington exited the bloc, according to a study published on Thursday by a British think tank. The EU is planning a militarization drive, which it claims is necessitated by an alleged Russian threat.

Western European leaders have said member states must reduce their dependence on US weapons while implementing a massive increase in military spending. The proposed hike comes amid claims that Russia could attack a NATO member in the coming years. Moscow has denied the allegations and has accused the West of “irresponsibly stoking fears” of a fabricated threat.

The report by the International Institute for Strategic Studies (IISS) outlines the challenges nations would encounter in the event the US withdraws from NATO to focus on confronting China.

According to the IISS, European nations – including the UK – would need to replace some 128,000 American troops, along with a wide array of weapon systems and command infrastructure currently provided by the Pentagon, particularly for air and naval forces.

Read more NATO rocked by corruption scandal

NATO rocked by corruption scandal

”European states would need to invest significant resources on top of already existing plans to boost military capacity,” the report stated. The estimated price tag for replacing American weaponry alone ranges from $226 billion to $344 billion.

Domestic arms manufacturers would face difficulties securing contracts, financing, and skilled labor, while also grappling with regulatory and supply chain hurdles, the report warned. In certain sectors – such as stealth aircraft and rocket artillery – European NATO members currently lack viable alternatives, prompting the IISS to suggest outsourcing production to countries outside the bloc.

Beyond hardware, the study highlighted intangible but critical costs associated with command-and-control functions, space intelligence, and filling high-level leadership roles traditionally held by US officers.

The think tank questioned whether European governments possess the political will to ensure the vast spending required. The administration of US President Donald Trump has accused European NATO nations of taking advantage of American military protection without contributing enough in return.

READ MORE: Washington ready to resume Russia-NATO security talks – Bloomberg

On Thursday, German Foreign Minister Johann Wadephul stirred controversy by vowing to increase defense spending to 5% of GDP, well above Germany’s existing level of 2.1%. The statement, made following a NATO meeting, drew backlash, including from members of Chancellor Friedrich Merz’s coalition. Defense Minister Boris Pistorius later stated that the exact percentage was “not so important” and that Berlin considered 3% to be a more realistic level.

-

Site: southern orders

I can remember being “aghast”, “aghast” I tell you, when Pope Francis visited a Jesuit church in Rome, maybe The Jesu, and as pope concelebrated the Mass simply by placing a plain stole over his papal cassock.First, popes should always be the main celebrant at Mass and not a concelebrant. This is true also for bishops who should not be a concelebrant with a priest as celebrant. In both cases, it is possible for the pope or a bishop to “preside” at the Mass not wearing Mass vestments but rather choir dress. In this case, the pope or bishop participates in the Mass as any lay person would but with a place of honor in the sanctuary. They also receive Holy Communion as a lay person would.

I might be wrong here, but when a pope or bishop presides at Mass where he is not the celebrant, choir dress is worn which would exclude the cope.

In recent years due to Pope Francis being mostly confined to a wheelchair, His Holiness was not the main celebrant for the Mass.

But he seems to have arbitrarily revised the manner of a “presiding” bishop by creating a hybrid form of celebrating the Papal Mass, making it appear that he was the primary celebrant but also a concelebrant.

Wearing not choir dress, but rather a cope, Pope Francis began the Mass with all the Introductory Rites to include the Collect, preached the homily and concluded the Mass with the Post Communion Prayer and Final Blessing.

The Liturgy of the Eucharist, though, had some other bishop or cardinal as the main celebrant. In a cope, though, Pope Francis concelebrated as a priest would. In other words, His Holiness was not presiding at that point but acting as a concelebrant.

There are other examples of his arbitrary liturgical innovations and eccentricities.

God willing, for papal Masses, with Pope Leo XVI, a canonist and rubricist, an arbitrary pontificate in all things to include the liturgy is at an end!

-

Site: RT - News

The push has reportedly been inspired by US Senator Lindsey Graham, who proposed slapping 500% levies on Russian exports

Ukraine’s European backers are considering imposing “punitive tariffs” on Russian exports as part of potential new sanctions set for discussion at the European Political Community summit in Albania on Friday, Politico has reported, citing EU officials.

Western countries have imposed widespread sanctions against Russia since the escalation of the Ukraine conflict in 2022 in a bid to isolate the country, but have held back from a total trade embargo. The restrictions include a ban on Russia’s seaborne oil shipments, cutting the country off from the Western financial system, and freezing around $300 billion in foreign reserves.

The leaders of the UK, France, Germany, and Türkiye are meeting in the Albanian capital for an informal gathering on Friday, which is also being attended by Ukraine’s Vladimir Zelensky.

The talks in Tirana will focus on “dramatically” tightening sanctions against Moscow and include potential “punitive tariffs” on Russian imports, two EU officials told Politico.

EU ambassadors on Wednesday approved a 17th package of sanctions against Russia, which targets nearly 200 oil tankers that the West claims are part of a Russian “shadow fleet,” older vessels operating outside Western insurance systems.

The push for new sanctions has been inspired by US Republican Senator Lindsey Graham, who has proposed “bone-crushing” measures, including imposing 500% tariffs on Russian exports if Moscow resists peace talks. The senator insisted that the goal was “to help the president [Donald Trump]” gain leverage on Russia.

Read more Russia is not afraid of Western sanctions – Kremlin

Russia is not afraid of Western sanctions – Kremlin

“We would take inspiration from the magnitude” of his proposal, one official told Politico.

Earlier this week, French Foreign Minister Jean-Noel Barrot said Western Europe and the US must “go further” and “prepare to brandish devastating sanctions” to “suffocate” the Russian economy “once and for all,” in order to compel Russian President Vladimir Putin to end the Ukraine conflict.

“Russia has found ways around the blockade imposed by Europe and the United States. Turning off the tap in this way is a way of grabbing Russia by the throat,” he told French broadcaster BFMTV on Wednesday.

Russia remains committed to seeking a long-term solution to the Ukraine conflict but will not tolerate being addressed in the “language of ultimatums,” Kremlin spokesman Dmitry Peskov said last week. He earlier noted that Russia is used to Western pressure and is not concerned about new sanctions.

In March, Putin said that a total of 28,595 sanctions had been imposed on Russian companies and individuals in recent years – more than the total number on all other countries combined. According to the president, the West sought to eliminate Russia as a competitor but its economy has only grown more resilient under pressure.

-

Site: AsiaNews.itTrump's announcement could trigger economic 'detente' and encourage the return of Syrian refugees. Reconstruction, trade and banking links between Beirut and Damascus could be revived. In the background looms the possibility of normalisation with Israel. Walid Joumblatt reminds us of the Arab world's key condition: 'Peace in exchange for territory.'

-

Site: AsiaNews.itAfter years of disregarding opposition demands, the Indian government has changed course and decided to include caste classification in the next national census. Behind the political move lie electoral pressures and the growing influence of disadvantaged castes. No official date has been set, but according to local media, the census is expected to take place in 2026.

-

Site: Real Investment Advice

Per an article in the Financial Times titled US Poised To Dial Back Rules Imposed In Wake of 2008 Crisis, US bank regulators are preparing to reduce bank capital requirements. Of particular interest to the bond market is the supplementary leverage ratio, better known as SLR. Unlike other risk-based capital rules that banks adhere to, SLR applies a minimum capital requirement to all bank balance sheet assets. The rule was put in place in 2014 to limit excessive leverage. For more information, click this LINK from the Office of Financial Research.

Banks have long argued that the SLR handcuffs their ability to make loans. Furthermore, and of importance to the administration, banks claim that SLR limits their ability to buy Treasury securities. The article states that intense lobbying from Wall Street argues that SLR hinders competition and impedes lending. Bear in mind that the eight largest US banks are subject to enhanced SLR. These are the biggest buyers of US Treasury securities.

Many analysts suspect that the SLR will change by this summer. However, the pressure to change them sooner could arise if Treasury yields continue to rise. With Treasury yields approaching 5%, we suspect banks will be licking their chops to buy Treasuries once the SLR restrictions are eased. We end with the quote below from Chairman Powell at a Congressional Committee hearing in February: