No one is forced to be a Christian. But no one should be forced to live according to the "new religion" as though it alone were definitive and obligatory for all mankind.

Distinction Matter - Subscribed Feeds

-

Site: southern orders

St. Peter’s Square is prepared for tremendous crowds at Pope Leo XIV Wednesday audience. During the reign of Pope Francis, there usually were chairs only in the first section and maybe a few in the second, but never were there chairs in the third section all the way past the obelisk!

This is a screen shot I just took from the Vatican YouTube live feed:

-

Site: Steyn OnlineThe Mark Steyn Club has just celebrated its eighth birthday. We thank all the First Fortnight Founding Members who've decided to re-up for a ninth season with us - and we hope our First Month members will want to do the same as May chunkers on. I'll be

-

Site: Steyn OnlineProgramming note: Tomorrow, Wednesday, I'll be hosting another edition of our Clubland Q&A taking questions from Steyn Clubbers live around the planet at 3pm North American Eastern - that's 8pm British Summer Time/9pm Central European. ~Thank you for

-

Site: AsiaNews.itA process of revision of school textbooks has been announced to mark the eightieth anniversary of independence in August. Critics slam the initiative as an attempt to rehabilitate the late military dictator Suharto by omitting some controversial episodes involving the current president. The impact on the new generations is particularly worrisome since they have no direct memory of the regime's crimes and because of this, they tend to support Prabowo.

-

Site: Ron Paul Institute - Featured Articles

Donald Trump is refusing to follow the Zelensky/European script for trapping Russia. The leaders of the UK, France, Germany and Poland made a desperate effort to get Trump to demand to Russia accept an unconditional, 30-day ceasefire, or face a new round of bone-crushing sanctions. Zelensky, like the trained monkey he is, repeated this mantra. Trump did not take the bait.

Presidents Trump and Putin spoke for about two hours on Monday (May 19). Trump used a big tube of lipstick to describe the conversation. President Trump characterized the conversation as “excellent,” announcing that Russia and Ukraine will “immediately” begin negotiations toward a ceasefire and an end to the war. He proposed the Vatican as a potential host for these talks and indicated that the US would not mediate, asserting that only the two countries understand the nuances of the conflict.

The Kremlin provided a more accurate account. According to the Kremlin’s readout, Putin described the call as “frank and substantive,” expressing Russia’s readiness to work with Ukraine on drafting a memorandum for future peace talks. However, he declined to support the US-proposed 30-day unconditional ceasefire, emphasizing that any ceasefire would require prior agreement on various unresolved issues.

Putin reiterated Russia’s core demands, including the demilitarization of Ukraine and limitations on Western influence, stating that these objectives remain unchanged. He suggested that a ceasefire could only be possible if numerous open questions are addressed beforehand.

In other words, Putin did not budge one inch in the Russian position he presented on 14 June 2024. This is consistent with Russia’s presentation to the Ukrainian delegation last Friday in Istanbul. Russia’s lead negotiator, Vladimir Medinsky, asserted that negotiations could proceed concurrently with ongoing military operations. He emphasized that Russia was prepared to continue the conflict for as long as necessary to achieve its objectives, referencing historical precedents such as the Great Northern War, which lasted 21 years. Medinsky reportedly stated, “We are ready to fight forever,” highlighting Russia’s readiness for a prolonged conflict.

Medinsky is not gaslighting. His words reflect the thinking of Putin and the Russian General Staff. The unanswered question is whether or not Trump and his national security team understand that Russia is not staking out a faux negotiation posture… i.e., presenting a tough demand, but are willing to make concessions? The answer is, NO!

Reprinted with permission from Sonar21.

-

Site: southern orders

It may change today, but the National catholic Reporter has not yet had even a news story of Pope Leo’s shake up of the Pope John Paul II Institute for Life by jettisoning Archbishop Paglia let alone a commentary on it. Are they in a state of shock that Pope Leo XIV will not be the second fluffiest pope everrrr?Oddly enough, too, as I type this, Crux has no story on it or analysis. Perhaps that will come. The Pillar printed a good commentary yesterday.

And truly odd is that the English version of Vatican News has nothing on Paglia either although the Italian version had it since yesterday.

Pope Leo XIV is NOT Pope Benedict XVII and His Holiness certainly is NOT Pope Francis II. His Holiness is His Holiness’ own man and as far as I can tell His Holiness is into the Hermeneutic of Continuity, building upon the pre-Vatican II Church and her papacy before Vatican II and reading Vatican II through every Council the Church has had and every pope too.

PRAISE GOD FROM WHO ALL BLESSINGS FLOW.

And on top of that, Pope Leo XIV looks like a pope and embraces an elegant look to include French Cuffs and Cuff links. How can you go wrong with that?

-

Site: LifeNews

Catholic University of America (CUA) recognized Rep. Chris Smith, R-N.J., with an honorary degree on May 17 for his commitment to the rights of the unborn.

Catholic University also noted that Smith has authored legislation to prevent human rights violations, such as the Victims of Trafficking and Violence Protection Act of 2000.

In a speech at the CUA Honorees Dinner the prior evening, Smith thanked the university for the degree. He also celebrated the election and inauguration of Pope Leo XIV as the first American pope.

“The renewed hope and well-founded expectations are remarkable,” he stated. “Apart from the Holy Spirit, who saw that coming?”

Speaking in Father O’Connell Hall — named after the Bishop David O’Connell of Trenton, New Jersey, whom Smith called “the extraordinarily effective, wise and holy” shepherd of his own diocese — the congressman reflected on his decades of advocacy rooted in Catholic conviction and moral clarity.

“Protection of human rights is the core motivator for my service in Congress and it begins with the right to life,” Smith said. “Stopping the violence of abortion is what led me to run for the House, with the complete support of my dear wife Marie.”

HELP LIFENEWS SAVE BABIES FROM ABORTION! Please help LifeNews.com with a donation!

Smith traced his political calling to his college years, where he and Marie co-founded a pro-life student group that would help pave the way for today’s Students for Life.

“She has been a powerful, talented and incredibly wise, faith-filled pro-life leader,” he said of Marie, who was unable to attend due to illness.

He praised her for her decades of international advocacy, including service with Holy See delegations to the United Nations and her founding of the Parliamentary Network for Critical Issues.

Even amid global suffering, from forced abortion in China to modern-day slavery and organ trafficking, Smith’s message focused on unwavering Christian hope.

“We are a people of indomitable hope—we absolutely refuse to entertain discouragement or defeat,” he said.

Bishop James Su Zhihim, part of China’s Underground Church, is an example of this hope, according to Smith.

Even after enduring decades of torture, Bishop Su still prayed for his captors, Smith noted: “An awe-inspiring example of faithfulness to Jesus’ teaching in the Gospel from Luke: ‘To you who hear I say, love your enemies, do good to those who hate you.’”

Smith spoke of his continued work to expose and end human rights atrocities. The Trafficking Victims Protection Act of 2000 has led to more than 2,225 convictions.

“The TVPA created a new, well-funded whole-of-government domestic and international strategy,” he stated, “and established numerous new programs to protect victims, prosecute traffickers and to the extent possible, prevent human trafficking in the first place.”

His latest legislation, the Stop Forced Organ Harvesting Act of 2025, targets what he called “the worldwide barbaric practice of murdering victims to steal their vital organs.”

“Each year, tens of thousands of young victims, perhaps more — average age 28 — are slaughtered by the Chinese Communist Party for their organs,” he explained.

Ethnic and religious minorities like Uyghurs and Falun Gong practitioners are disproportionately targeted in what he called “a genocide for profit.”

Smith implored Catholic University, and, in particular, the Center for Human Rights, to raise up moral leaders in a world aching for justice who will put an end to these atrocities and protect victims.

Quoting Christ in Matthew 25:45, he offered a reminder that anchored his entire speech: “Truly I tell you, whatever you did not do for one of the least of these, you did not do for me.”

LifeNews Note: Grace Porto writes for CatholicVote, where this column originally appeared.

The post Catholic University Gives Amazing Pro-Life Congressman Chris Smith an Honorary Degree appeared first on LifeNews.com.

-

Site: Ron Paul Institute - Featured Articles

One of the ways that brutal right-wing Chilean dictator Augusto Pinochet would terrorize the Chilean people into patriotic submission to his authority was by disappearing people. This was different from simply torturing and executing them. He and his goons certainly did that too. But disappearing people was different. With executions and bodies, families at least had certainty with respect to what had happened to their loved one. With disappearances, they never could be certain that their loved one really was dead. There was always a small part of people that retained some amount of hope that maybe — just maybe — their loved one would show up after being released from years or decades in some prison. It was a brutal way to psychologically torture the family members of the person who had been disappeared and everyone else in society.

In a sense, disappearing people is what the U.S. government has been doing with immigrants that it is sending to El Salvador. Once U.S. officials deliver people into the clutches of El Salvador’s brutal dictatorial regime, the U.S. government ostensibly loses control over them. At that point, people are taken to the country’s infamous terrorism confinement center where they are subjected to torture and indefinite detention and even the possibility of extra-judicial execution.

Equally important, the inmate is denied any contact with the outside world. His family does not know his condition. For all they know, he could be dead. He has been disappeared into the bowels of the terrorist confinement center for as long as El Salvador’s dictatorial regime wants him there.

In an article in the Los Angeles Times, one of the 110,000 people who have been incarcerated in El Salvador is 37-year-old René Mauricio Tadeo Serrano, who was arrested in 2022 while working at a factory. His mother, Maria Serrano, says that she has not heard from him for nearly three years. According to the Times article, “On a recent morning, Serrano stood outside the prosecutor’s office begging for information on her son’s case, alongside dozens of other mothers whose children have disappeared.”

Three years! Imagine sitting in this brutal prison and not receiving visitors, including your very own family. Imagine not knowing whether you’ll ever get out. That’s assuming, of course, that Serrano is still alive.

It’s worth mentioning that the people who the U.S. government is disappearing into the Salvadoran system for an undefined period of time have not been convicted of any crime, either in the United States or in El Salvador.

Unfortunately, El Salvador’s system of disappearing people is now our system too. That’s because of the partnership that the U.S. government has entered into with El Salvador’s brutal dictatorship.

At the risk of belaboring the obvious, that was not the type of system envisioned by our American ancestors who founded our nation. In fact, it was the Allende-Bukele type of system that our ancestors fiercely opposed.

That’s why our American ancestors demanded the enactment of the Bill of Rights immediately after the Constitution was adopted. They wanted to make it clear that the American system would never become an Allende-Bukele system. Their mindset was clearly reflected in the Fourth, Fifth, Sixth, and Eighth Amendments, which guaranteed that what is being done in El Salvador and what was done in Chile under Pinochet would never happen here in the United States.

That’s how we got due process of law, trial by jury, the right to a speedy trial, right to counsel, the presumption of innocence, protection against cruel and unusual punishments, and other protections, along with the writ of habeas corpus, which has been called the linchpin of a free society.

Many people in El Salvador love Bukele and his brutal system. Indeed, many right-wing Americans do too, just as they loved Pinochet and his brutal system. That’s because they don’t care about freedom as much as they care about being kept “safe.” Thus, like people throughout history, they are eager and willing to trade their liberty for the pretense of safety. But as one Salvadoran put it, “We used to be afraid of the gangs. Now we’re afraid of the state.” In other words, the chickens who eagerly and willingly enter into their cages to be kept safe finally start realizing that being guarded by the fox comes with problems.

Appellate Judge Alex Kosinski once pointed out that people who surrender their guns will only make that mistake once. The reason is that once they have surrendered their guns, their regime will never permit them to get them back in order to be able to make the mistake again.

The same argument applies to civil liberties. If Americans surrender their civil liberties for the pretense of safety or security, they will likely find that they will only make that mistake once, especially after a few hundred of them have been disappeared into the bowels of the terrorism confinement center of El Salvador or some other brutal dictatorial regime. At that point, many people will immediately go silent or, even worse, suddenly becomes ardent supporters of the system, as they did in Chile and as they have done in El Salvador.

Reprinted with permission from Future of Freedom Foundation.

-

Site: LifeNews

Fourteen House Republicans sent a letter Monday to House Speaker Mike Johnson, R-LA, urging him to invite Pope Leo XIV to address Congress—a historic first for a US-born pontiff.

“We as Catholics celebrate the first-ever American pope and hope you will consider an invitation to him,” the lawmakers wrote. “It would be valuable for Congress to hear His Holiness’s vision for the role of Catholic faith in the world and how he plans to lead the over 1.4 billion Catholics worldwide and the many others who look to the Holy See for spiritual and moral guidance.”

Get the latest pro-life news and information on X (Twitter). Follow @LifeNewsHQ//

14 House Republicans, led by @millermeeks, invite Pope Leo to address Congress. https://t.co/56YDc6HfZu pic.twitter.com/1rKX5mhlJ4

— Anthony Adragna (@AnthonyAdragna) May 19, 2025

The request was led by Iowa Rep. Mariannette Miller-Meeks, a Catholic who attended Pope Leo’s inaugural Mass in Rome Sunday.

“What an incredible honor to witness the First Mass (inaugural) of the first American Pope, Pope Leo XVI,” she wrote on social media. “A moment of faith, unity, and deep significance for Catholics across the world.”

In their letter, the lawmakers praised the pope’s decades of service both in the US and abroad, noting that the native of the Chicago area “made history as the first-ever American pope, an unprecedented feat that makes America’s light shine even brighter across the globe.”

“Hearing his address would be of great benefit for Congress and the American people,” they added. “In a time of increasing religious intolerance, we welcome the vision and leadership of Pope Leo XIV and respectfully request that you invite his holiness to address a joint session of Congress this calendar year.”

Pope Francis became the first pope to address Congress in 2015. If invited, Pope Leo would be the first to do so as a native-born American.

LifeNews Note: Elise DeGeeter writes for CatholicVote, where this column originally appeared.

The post Members of Congress Ask House Speaker to Invite Pope Leo to Give Major Speech appeared first on LifeNews.com.

-

Site: Zero HedgeAyatollah Khamenei Slams 'Outrageous' US 'Red Line' Demand Of Iran In Nuclear TalksTyler Durden Tue, 05/20/2025 - 08:45

After several days of back-and-forth public criticisms and US declarations of a "red line" - Iran's Supreme Leader has finally weighed in definitively on where things stand from Tehran's perspective.

Ayatollah Ali Khamenei called the latest US demands that Iranian enrichment be taken down to zero "excessive and outrageous," according to state media. He further expressed doubts that current nuclear talks with the Trump administration will actually lead anywhere.

"I don't think nuclear talks with the U.S. will bring results. I don't know what will happen," Khamenei said. He further called on Washington to cease making over-the-top demands in nuclear talks. Tehran officials have of late also called the Trump administration's stance "contradictory" - after President Trump attempted overtures, sprinkled with direct threats, in his Iran-related rhetoric while in the Gulf last week.

"The American side in these indirect talks should avoid nonsensical remarks," the country's top religious cleric and highest authority continued. "Saying they will not allow Iran to enrich is a big mistake. No-one waits for their permission."

The Ayatollah made the remarks while speaking at a memorial honoring late President Ebrahim Raisi, who one year ago died when his helicopter crashed in northern mountains:

He praised Raisi, a fellow hardline cleric, for refusing direct talks with the US while in office.

"He clearly said 'no' without ambiguity," Khamanei noted, adding that Raisi did not let enemies "drag Iran to the negotiating table through threats or tricks".

Khamenei said nuclear talks under Raisi's predecessor, the moderate cleric Hassan Rouhani, had failed to achieve results, and that he did not think there would be any breakthrough under his successor, Masoud Pezeshkian, who is a reformist.

President Trump had last week said the Iranians "sort of" agreed to the terms of a deal following four rounds of talks mediated by Oman, going back to mid-April.

Also last week, a top Iranian nuclear official said it was possible that Iran could given up enrichment in exchange for sanctions relief. But this was clearly premature, and the Ayatollah is now seeking to clarify the Islamic Republic's stance.

Americans have been told for 20 years: Iran is just a few months away from a nuclear weapon! The world has heard continuously: we have only months to bomb Iran to prevent it!

— Glenn Greenwald (@ggreenwald) May 12, 2025

I cited a sample during my debate in NYC with Alan Dershowitz last year on whether the US should bomb: pic.twitter.com/xJpR9uqMWPTrump envpy Steve Witkoff on the Sunday news shows made clear that the issue of abandoning enrichment is a "red line" from the US administration. He described to ABC the "red line" for Iran is no enrichment, not even one percent. And yet the past couple decades have seen Iran time and again view this as a non-starter.

"Everything begins… with a deal that does not include enrichment… because enrichment enables weaponization, and we will not allow a bomb to get here," he added.

-

Site: LifeNews

Two major battle fronts are happening right now in the fight to defund Planned Parenthood and Big Abortion.

In the Courts, Planned Parenthood is suing to force pro-life states to continue to pay for abortions. Liberty Counsel is on the case.

After witnessing the horrors our client Sandra Merritt revealed in her undercover videos which exposed Planned Parenthood’s evil baby parts for sale scheme, South Carolina banned Medicaid funding for Planned Parenthood.

Sandra’s videos showed Planned Parenthood doctors and officials bragging about violating numerous laws and giddily discussing butchering babies (some alive) to garner higher human organ trafficking prices. Their brutal activities were enough to compel South Carolina to ban Medicaid taxpayer dollars from going to Planned Parenthood.

Get the latest pro-life news and information on X (Twitter). Follow @LifeNewsHQ//

Despite being caught red handed, Planned Parenthood is now SUING South Carolina to force the pro-life state to continue funding the abortion giant’s baby butchery.

The U.S. Supreme Court heard oral arguments in Medina v. Planned Parenthood South Atlantic in April, and the High Court is now preparing the written opinion. Our brief exposes the horror inside these abortion clinics.

Meanwhile, we are working with Congress to defund Planned Parenthood and Big Abortion at the federal level as well. Demand Congress defund Planned Parenthood once and for all!

Liberty Counsel staff have been working with top members of Congress to stop giving Planned Parenthood ANY taxpayer dollars.

- Abortion at a Planned Parenthood clinic is the third largest cause of death in the United States.

- Planned Parenthood kills 1,102 babies every day in America. That’s 1 child every 78 seconds.

- Planned Parenthood performs 228 abortions for every one adoption referral it recommends.

- During 2023 to 2024 alone, U.S. taxpayers gave Planned Parenthood nearly 800 million dollars — more than 40% of the abortion giant’s total income.

- According to Planned Parenthood’s own report, abortion makes up 97.1% of its business.

It’s time to stop paying for Planned Parenthood’s killing machine.

The good news is last week the budget bill passed the first hurdle in the U.S. House committee retaining the language to defund Planned Parenthood and Big Abortion. Now we need to pass the bill in the House and in the U.S. Senate. Members of Congress need to hear from you. This will be a huge battle, but we can win if we work together.

Please, join me now in demanding Congress defund Planned Parenthood!

LifeNews Note: Mat Staver is the Chairman of Liberty Counsel Action and Founder and Chairman of Liberty Counsel.

The post Two Major Battles are Happening Right Now to Defund Planned Parenthood appeared first on LifeNews.com.

-

Site: OnePeterFive

Everyone was wondering if the next Pope would take the name Francis II. Now that this has not happened, we are all wondering how Pope Leo will deal with the legacy of his controversial predecessor. Yesterday Pope Leo made an address “to representatives of other churches and ecclesial communities and other religions” who had attended his inuguration Mass on Sunday. (The term “churches” is used for…

-

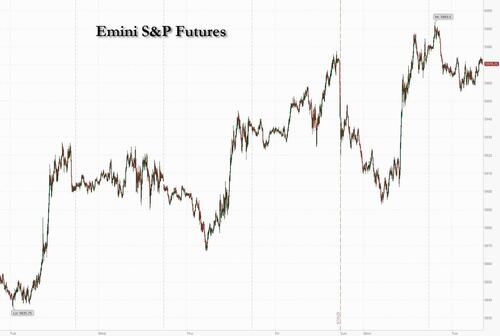

Site: Zero HedgeFutures Slide After Monday's Historic Retail-Driven ReboundTyler Durden Tue, 05/20/2025 - 08:36

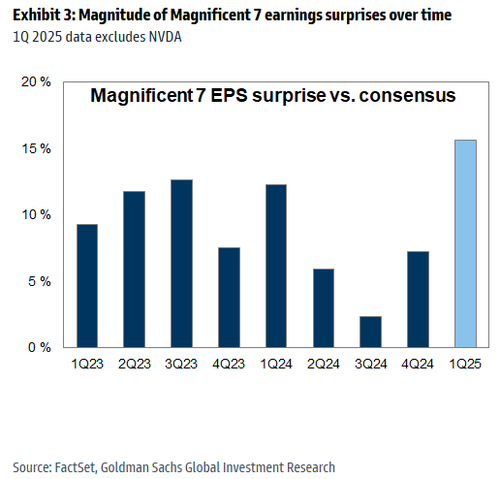

US equity futures are weaker with Tech underperforming, threatening a six-day winning streak that propelled the S&P 500 to the brink of a bull market. Then again, Monday started off even worse and then we saw the biggest burst of retail buying on record resulting in one of the biggest intraday reversals in recent history (according to JPM, more here), so brace for more unexpected moves. As of 8:00am ET, S&P futures are down 0.2%, while Nasdaq 100 futs drop 0.3% with Mag7 stocks mixed amid weakness in semis into today’s Google I/O developer conference; healthcare is leading Defensives over Cyclicals. The yield curve is twisting steeper with the 10Y yield flat and USD weakening. Commodities are mixed with crude down, natgas up, base metals down, precious up, and Ags generally higher. Macro data is light, with just the Philly non-mfg PMI on deck ahead of Thursday’s Flash PMIs & Claims prints, but we have another round of Fed speakers where the message continues to be patience.

In premarket trading, Mag 7 stocks were mixed (Tesla +1.4%, Alphabet +0.5%, Nvidia -0.2%, Microsoft -0.1%, Apple -0.3%, Amazon -0.2%, Meta Platforms -0.3%). Home Depot gained 2.2% after maintaining its guidance for the fiscal year as US sales ticked up, a sign that consumer spending has held up despite economic turbulence. Vipshop’s US-listed shares (VIPS) decline 8% after the China-based online marketplace reported its first-quarter results and gave an outlook. here are some other notable premarket movers:

- Air Lease (AL) rises 1.2% as Citi upgrades to buy, saying a possible capital allocation creates a “tactical opportunity.”

- ASP Isotopes (ASPI) jumps 15% after signing financing and supply agreements with TerraPower to support the construction of a new uranium enrichment facility.

- ImmunityBio (IBRX) rises 4% after Piper Sandler upgraded the drug developer to overweight, saying the launch of the firm’s newly approved bladder cancer drug Anktiva is off to a strong start.

- Pegasystems Inc. (PEGA) rises 6% as the customer relationship management software company will join the S&P Midcap 400 Index before trading opens May 22.

- Pony AI ADRs (PONY) jump 5% after the Chinese autonomous-driving company reported revenue for the first quarter of $14 million vs $12.5 million year-over-year.

- Trip.com (TCOM) US-listed shares fall 4% after the online travel agency reported its first-quarter results.

- Yalla (YALA) falls 8% after the social-network operator saw a drop in the number of paying users on its platform.

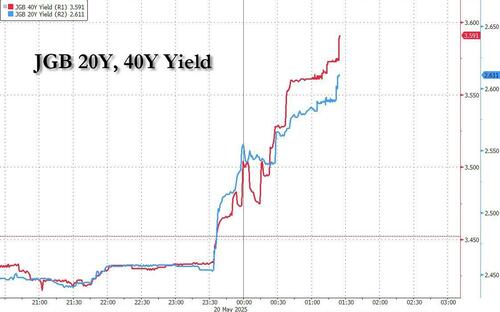

Ironically, as everyone was expecting a Monday metldown in US treasuries - and got just the opposite - the big move was in Japan, where bonds cratered and long-end yields soared to a record high after a near-failed government bond auction saw the weakest bid-to-cover demand since 2012 and the biggest tail since 1987, pointing screaming to increasing concerns about investor support as the Bank of Japan dials back its huge debt holdings.

As markets continue to meltup, investors are looking for clarity on market direction, with strategists in a Bloomberg poll now far more optimistic about European stocks than the US market. Jamie Dimon, meanwhile, has been warning about risks from inflation and credit spreads to geopolitics. “The market came down 10%, it’s back up 10%; I think that’s an extraordinary amount of complacency.”

Meanwhile, the threat of US tariffs showed up in Chinese shipments of smartphones, which fell 72% in April, according to China’s customs data.

Tech has been the main driver of the recent market bounce and will remain in focus into next week’s key earnings release from Nvidia. Google is holding its I/O developer conference, with the keynote speech at 4:30 pm ET. Broader deployment of AI mode on Google search will be a big focus, Bloomberg Intelligence said.

A slate of Fed speakers will be closely watched today for clues on the outlook for the US economy and any commentary on the Moody’s downgrade. Two Fed officials suggested on Monday that policymakers may not be ready to lower rates before September as they confront a murky economic outlook.

In Europe, the Stoxx 600 climbs 0.4%, on pace for a fourth session of gains, led by utilities, telecoms and health care. Germany’s DAX topped 24,000 for the first time. Among individual stocks, Orange advances after Bloomberg reported that Patrick Drahi is weighing a SFR sale. Wall Street strategists are betting European stocks will enjoy their best performance relative to the US in at least two decades as the region’s economic outlook improves. While US stocks have rallied in recent weeks, two Federal Officials warned on Monday that they would adopt a wait-and-see approach before lowering interest rates. Here are the most notable European movers:

- Orange shares rise as much as 3.1% after Bloomberg reported that billionaire Patrick Drahi’s Altice France is considering the sale of a controlling stake in SFR, raising hopes of further industry consolidations in a competitive market.

- Smiths Group gains as much as 4.4%, to highest since Jan. 31, after the UK engineering firm says full-year organic revenue growth is expected to be toward the top end of its guided range.

- SoftwareOne shares gain as much as 4.5% after Kepler Cheuvreux raised the recommendation on the stock to buy from hold saying cost-cutting is gaining traction and 1Q should show early margin recovery.

- Greggs shares rise as much as 8.8% to a three-month high after the UK food-on-the-go retailer gave a trading update in which it said it is seeing an improved performance, and kept its expectations for the year unchanged.

- Diploma shares surge as much as 18%, hitting a record high, as analysts hail the building components supplier’s positive first-half performance, mainly driven by its Controls unit.

- SSP shares rise as much as 5.3%, to the highest in three months, after the operator of food and beverage outlets at travel locations reiterated its full-year outlook, in spite of softer current trading in North America amid weaker travel demand.

- Schaeffler shares rise as much as 7.6% after the German auto parts firm was double-upgraded to buy at Bank of America, which sees the firm’s adjusted Ebit doubling by 2028.

- Orsted shares rose as much as 15% the Trump administration lifted an order that halted construction on Equinor’s $5 billion project off the coast of New York.

- Fincantieri shares rise as much as 9.7% a record high, after it unveiled targets for a newly created Underwater Armament Systems unit.

- UBS shares declined as much as 3.5%, the most since April 9, after Bloomberg News reported the lender is likely to face defeat in its effort to water down the Swiss government’s law that could force it to maintain up to $25 billion in extra capital.

- Salmar falls as much as 5.6%, the most in almost a month, after the Norwegian seafood and salmon company reported its latest earnings, which DNB Carnegie describes as a “big miss.”

- Kingfisher falls as much as 4.8% as Barclays cuts its recommendation on the UK construction and DIY supplier to underweight from equalweight. A 25% rally this year is “overly generous,” the bank says.

Asian stocks gained for the first time in four sessions, with Hong Kong-listed shares leading the advance thanks to a slew of positive corporate developments. The MSCI Asia Pacific Index rose as much as 0.6%, the most in nearly a week, with Alibaba and Sony among key gainers. Xiaomi shares jumped after the CEO said the company is starting mass production of a new chip, while Chinese healthcare stocks surged after biotech company 3SBio entered into a pact with Pfizer. Shares in India slipped. Momentum is returning to Asian stocks with tensions easing on the trade front while global growth seems intact. Chinese battery giant CATL gained in its debut in Hong Kong after wrapping up the world’s largest initial public offering this year, showing the appetite for such themes in the region.

The RBA delivered a 25bp cut at their May meeting, as widely expected, but with clear dovish elements to the meeting as a whole. The statement was materially more positive on the progress made on the inflation mandate, with inflation expected to remain around the RBA’s 2-3% target band, and with a removal of the previous language on being determined to “sustainably return inflation to target”. The updated macro projections were also materially softer, in-line with our economists’ expectations, with lower profiles for growth and inflation, and a higher path for the unemployment rate. Perhaps the most notable dovish news though was Governor Bullock noting that the Board discussed a 50bp cut at today’s meeting, suggesting a clearer break from their previously more cautious thinking. Goldman economists revised their RBA call to include an additional cut at the November meeting, in addition to the cuts they continue to expect at the July and August meetings.

In Fx, the Bloomberg Dollar Spot Index slips 0.1%. The Aussie lags G-10 peers, down 0.6% versus the greenback after RBA Governor Michele Bullock said the board considered a 50bps rate cut before opting for 25. The Dollar continues to underperform, but within tight ranges this morning. EUR (+10bps) price action remains constructive after the trading desk’s flow bias being skewed towards selling yesterday. Our Spot Traders (KBS) note that there was a lack of interest from HFs to chase yesterday - partly an element of some still tending to prior wounds but we seem to have hit the limit of false starts without a clear identifiable catalyst that HFs are willing to chase. USDJPY is trading -25bps lower after a choppy price action overnight. Despite continued spot moves lower in USDJPY and increased speculation that there may be some kind of “currency deal” as part of trade negotiations, our traders noted that downside USDJPY gamma has repriced lower (1m ATM -0.25v vs the roll) with the market struggling to digest front end vol supply the last 48hrs. USDCNH is trading +10bps higher after jumping on headlines that cut benchmark lending rates for the first time since October. The outlier overnight was AUD (-70bps), amid the dovish 25bps cut from the RBA.

In rates, treasuries are mixed as US session gets under way with the yield curve steeper. Front-end yields are 1bp-2bp lower on the day while 30-year is higher by around 3bp near 4.93%. Treasury curve pivots around little-changed 7-year sector, with 10-year near 4.46%, trailing bunds and gilts in the sector by 1.8bp and 2.5bp. Bunds and gilts outperform following softer-than-expected German PPI data and pricing of a £4 billion 2056 syndicated gilt issue. Gilts lead a rally in European bonds, with UK 10-year yields down 3bps to 4.63%. Traders shrugged off BOE Chief Economist Huw Pill’s warning that interest rates may be coming down too quickly. US economic data calendar includes only a regional indicator, however several Fed speakers are slated. Treasury auctions ahead this week include $16 billion 20-year new issue Wednesday and $18 billion 10-year TIPS reopening Thursday

In commodities, Oil pares earlier gains seen after Iran’s Supreme Leader Khamenei voiced skepticism over talks with the US. WTI drops 0.2% to near $62.50. Spot gold rises $8 to around $3,238/oz.

The US economic data calendar includes May Philadelphia Fed non-manufacturing activity (8:30am). Fed speaker slate includes Bostic, Barkin (9am), Collins (9:30am), Musalem (1pm), Kugler (5pm), Hammack and Daly (7pm)

Market Snapshot

- S&P 500 mini -0.2%,

- Nasdaq 100 mini -0.3%,

- Russell 2000 mini -0.3%

- Stoxx Europe 600 +0.4%,

- DAX +0.2%,

- CAC 40 little changed

- 10-year Treasury yield little changed at 4.45%

- VIX +0.3 points at 18.44

- Bloomberg Dollar Index -0.1% at 1223.55,

- euro +0.2% at $1.1262

- WTI crude -0.1% at $62.6/barrel

Top Overnight News

- Freedom caucus chair Harris said the votes are not there for the Trump bill and predicts a deal on the tax bill will be delayed until June.

- Trump has claimed that Russia and Ukraine will “immediately” begin negotiations on preparations for peace talks, but signaled that he was leaving Moscow and Kyiv to find a deal without the US as a broker. FT

- Crypto scored a big win after a group of Democrats dropped their opposition to stablecoin legislation. The bill may pass this week. BBG

- Iranian Supreme Leader Ayatollah Ali Khamenei said negotiations with the US over his country’s nuclear program are unlikely to result in a deal and called the Trump administration’s latest demands on Iran “outrageous.”

- China cut benchmark lending rates for the first time since October on Tuesday, while major state banks lowered deposit rates as authorities work to ease monetary policy to help buffer the economy from the impact of the Sino-U.S. trade war. RTRS

- China’s smartphone exports to the US fell 72% last month, outpacing an overall 21% drop in shipments. At the same time, the value of phone component exports to India roughly quadrupled. BBG

- The Bank of Japan will sound out market participants this week to gauge their views on how aggressively it should proceed with quantitative tightening as yields surge nearly a year after it began scaling back its huge bond purchases. BBG

- Japan's top trade negotiator, Ryosei Akazawa, said on Tuesday there was no change to Tokyo's stance of demanding an elimination of U.S. tariffs in bilateral trade negotiations.

- Tokyo will not rush into clinching a trade deal if doing so risked hurting the country's interests, he said. RTRS

- India is discussing a US trade deal structured in three tranches and expects to reach an interim agreement before July, when President Donald Trump’s reciprocal tariffs are set to kick in, according to officials in New Delhi familiar with the matter. BBG

- Donald Trump plans to go to the Capitol today to push House Republicans to back his tax-cut bill. Speaker Mike Johnson’s meeting with holdout GOP members from high-tax states failed to produce a deal on SALT. BBG

Tariffs/Trade

- Japan is reportedly mulls accepting US tariff reduction, not exemption, according to Kyodo. The Japanese government is reportedly considering the option of accepting a reduction in the rate of additional tariffs and reciprocal tariffs on automobiles and other items. Due to the US, according to sources, refusing to eliminate tariffs in prior negotiations and is said to have "indicated its intention to exclude additional tariffs on automobiles, steel, and aluminium, which are important to Japan, from the talks".

- US Treasury Secretary Bessent will travel to Canada to participate in the G7 Finance Ministers and Central Bank Governors meeting, while he will focus on the need to address global economic imbalances and non-market practices.

- Japanese Economy Minister Akazawa said Japan and the US conducted working-level talks on bilateral trade on Monday, while he added there was no change to Japan's stance of demanding the elimination of US tariffs. It was also reported that the US and Japan could hold talks as soon as this Friday although US Treasury Secretary Bessent is not expected to attend, according to Kyodo.

- Taiwan's President Lai said tariff talks with the US are going smoothly, while he added that Taiwan is to initiate a national wealth fund and is to broaden economic connections with nations other than the US.

- India is discussing a US trade deal structured in three tranches and expects to reach an interim agreement before July.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were marginally higher as the region took impetus from the rebound stateside where the major indices gradually recouped the losses triggered by the US rating downgrade, and both the S&P 500 and the Dow notched six-day win streaks. ASX 200 was led by outperformance in tech and financials, while the attention was on the RBA which delivered a widely expected rate cut. Nikkei 225 rallied at the open in tandem with a surge in USD/JPY but then gave back the majority of the spoils amid currency fluctuations and with little in the way of fresh catalysts for Japan. Hang Seng and Shanghai Comp were kept afloat after China's largest banks cut deposit rates and slashed the benchmark Loan Prime Rates by 10bps as guided by PBoC Governor Pan, while sentiment was also underpinned by a jump in CATL shares on its Hong Kong debut.

Top Asian News

- China's state planner said they will make greater efforts to attract and utilise foreign capital, while China is drafting loan management rules for renewal projects and most policies will be implemented before end of June.

- BoJ releases briefing material used at a meeting with bond market participants: notes some members said JGB market functionality is improving as a trend due to the BoJ taper. Some look for an eventual end to bond buying, some are after bigger cuts in the next plan. Some seek substantial cuts in one go. Deteriorating demand-supply for super-long JGBs is not something the BoJ can fix.

RBA

- RBA cut the Cash Rate by 25bps to 3.85%, as expected, while it stated that inflation continues to moderate and that the outlook remains uncertain. RBA affirmed that maintaining low and stable inflation is the priority and the board judged that the risks to inflation have become more balanced, as well as assessed that this move on rates will make monetary policy somewhat less restrictive. Furthermore, the RBA stated that headline inflation is likely to rise over the coming year to around the top of the band as temporary factors unwind and the remains cautious about the outlook, particularly given the heightened level of uncertainty about both aggregate demand and supply. RBA also released its Quarterly Statement on Monetary Policy which noted that the escalation of global trade conflict a key downside risk to economy and that the global growth outlook was downgraded, while it added that uncertainty has increased due to US tariff policies and it trimmed its core domestic inflation forecasts.

- Governor Bullock: prepared to take further rate actions if required; price increases have slowed; Bullock adds this was a confident cut in rates; There was a discussion between a 50bps cut or a 25bps cut; discussed holding rates or cutting. Cannot say where the cash rate will end up, does not endorse market pricing (Note: ~55bps of cuts currently seen by year-end).

European bourses (STOXX 600 +0.3%) opened modestly firmer across the board and have traded within a tight range thus far, given the lack of pertinent updates. European sectors are mixed, and aside from the top performer, the breadth of the market is fairly narrow. Utilities takes the top spot, with sentiment in wind names boosted after the Trump administration lifted a stop-work on Equinor’s (+1.3%) New York offshore wind farm project; the name is higher by around 1.5% - peers such as Orsted (+14%) have also been edging higher.

Top European News

- BoE's Pill says "dissenting vote stems from a concern that the pace of withdrawal of monetary policy restriction since last summer – quarterly cuts of 25bp – is too rapid given the balance of risks to price stability". Dissent was in line with his preference for “cautious and gradual” cuts in Bank Rate expressed over the past twelve months. Would characterise his dissenting vote as favouring a ‘skip’ in the quarterly pattern of Bank Rate cuts. It should not be seen as favouring a halt to (still less a reversal of) that withdrawal of restriction. Is concerned that structural changes in the price and wage setting behaviour have increased the intrinsic persistence of the UK inflation process. The underlying disinflation continues. The prospective path of Bank Rate from here is downward. Dissent from the most recent decision does not reflect a fundamental difference with the MPC. Says "we should not be dependent on how the data turns out". Can't assume that the inflation "pain" of new economic shocks will dissipate quickly. Agrees with the MPC that there is an easing in the labour markets, has questions over the pace. Some key pay indicators "remain quite strong".

- ECB's Schnabel says disinflation is on track, though new shocks could pose new challenges. Tariffs could be disinflationary in the short run but result in upside risk over the medium term. "We are facing a historical opportunity to foster the international role of the euro" & "When the inflation regime changes, we must be ready to respond swiftly".

- German VCI Chemical Industry Association: Q1 Production +0.6% Y/Y; Revenue +1.8% Y/Y; notes that production is expected to stagnate this year and industry sales will decrease slightly.

FX

- After a contained start, DXY has extended on Monday's downside which was largely attributed to the Moody's downgrade on the US on Friday. Newsflow on the trade front has been non-incremental aside from a Reuters sources piece noting that the US Treasury does not anticipate any trade deal announcements at the G7 Finance Meeting in Canada this week.

- PBoC set USD/CNY mid-point at 7.1931 vs exp. 7.2112 (Prev. 7.1916). Today's speaker slate includes Fed's Bostic, Barkin, Collins, Musalem, Kugler, Daly & Hammack. DXY is just about holding above the 100 mark.

- EUR fractionally firmer vs. the USD with not a great deal in terms of Eurozone newsflow aside from ongoing ECB speak with Executive Board member Schnabel noting that disinflation is on track, though new shocks could pose new challenges. EUR/USD sits towards the top end of Monday's 1.1169-1.1288 range.

- JPY at the top of the G10 leaderboard with some of the move attributed to moves in Japanese yields with the 30yr JGB yield hitting its highest level since its debut since 1999 following a soft JGB auction overnight. On the trade front, Japanese Economy Minister Akazawa said Japan and the US conducted working-level talks on bilateral trade on Monday. Note, Japanese Finance Minister Kato and US Treasury Secretary Bessent are expected to discuss exchange rates on the sidelines of the G7 meeting in Canada this week. USD/JPY has delved as low as 144.10 but stopped shy of the 144 mark.

- GBP is a touch firmer vs. the USD and steady vs. the EUR. This morning has seen remarks from BoE Chief Economist Pill, who dissented at the 8th May rate decision by voting for an unchanged rate vs. consensus for a 25bps cut. Pill noted that his dissenting vote stemmed from a concern that the pace of withdrawal of monetary policy restriction since last summer is too rapid, given the balance of risks to price stability. He added that his vote should be seen as a skip and not a halt to the withdrawal of the restriction process. The remarks had little follow-through to GBP; currently around 1.3370.

- Antipodeans are both softer vs. the USD with AUD lagging across the majors post-RBA. As expected, the RBA pulled the trigger on a 25bps cut whilst offering a cautious view on the outlook and lowering its inflation forecasts in its accompanying Statement on Monetary Policy. At the follow-up press conference, AUD/USD hit a session low at 0.6409 after Governor Bullock revealed that the board discussed cutting by 25bps or 50bps.

Fixed Income

- JGBs were initially firmer, in-fitting with peers after Monday’s eventual intraday recovery from Moody’s-driven pressure. However, upside in Japan was limited into supply. But a poor 20yr outing caused JGBs to slip from 134.40 to a 138.78 base - pressure which has since pared.

- USTs experienced a slight bearish blip on the above auction. However, Monday’s intraday recovery remained intact for USTs overnight and the benchmark has since extended to a 110-14+ high, eyeing 110-21+ from last week as the next point of resistance. Today's speaker slate includes Fed's Bostic, Barkin, Collins, Musalem, Kugler, Daly & Hammack.

- Bunds a little firmer today, in-fitting with peers. Early doors remarks from Schnabel this morning, though nothing that has fundamentally changed the narrative. Numerous speakers ahead incl. Cipollone, Knot & Nagel. Similarly, no move to German Producer Prices printing lower than expectations and the prior, driven primarily by energy prices for both Y/Y & M/M components. Continues to rebound from Monday’s pressure, at best has been 15 ticks above that session’s 130.60 peak. German 10yr and 30yr auctions were well received but had little impact on German paper.

- Gilts are firmer and currently outperforming. Outperformance which comes as Gilts didn’t get as much time to benefit from Monday’s late-door rebound and as the UK benchmark was that session’s underperformer, given EU-UK updates. As it stands, at the upper-end of a 91.45-91.91 band. BoE’s Pill outlined that his vote in May to leave rates unchanged was a “skip”. In fitting with his preference for “cautious and gradual” cuts and stemmed from a view that the recent quarterly pace “is too rapid given the balance of risks to price stability”. No move in Gilts to his speech.

- Hong Kong pension fund managers are reportedly sounding the alarm of potential forced selling of US Treasury holdings following Moody's downgrading US' rating, according to Bloomberg sources Hong Kong Investment Fund Association (HKFIA) has recommended that an exception to the maximum 10% holding rule is made for US Treasuries, to allow funds to invest above the limit even if the US is rated one notch below AAA, according to the sources. Japan's R&I still has an AAA rating (outlook stable) on the US, and is not considering a downgrade currently "don't believe the situation described there has significantly changed"

- UK price guidance for new 5.375% 2056 Gilt in sale via syndication seen +1.75bps to +2.25bps over 4.25% 2055 Gilt, orders over GBP 70bln.

Commodities

- Crude is lower this morning despite a softer dollar but amid a cautious risk tone in Europe and following some of the more sanguine tones from US President Trump regarding Russia, whilst upside was seen on less conciliatory commentary from the Iranian Supreme Leader. He said that he "does not think nuclear talks with the US will be successful", via Mehr news. Brent Jul'25 rose from USD 65.07/bbl to USD 66.00/bbl over three minutes - a move which has since mostly faded.

- Relatively flat and lacklustre trade across precious metals amid a lack of pertinent macro drivers this morning, and following a relatively contained session on Monday. Spot gold resides in a current USD 3.204.67-3.232.85/oz range.

- Mixed trade across base metals and in narrow ranges amid a lack of pertinent catalysts during the European session, whilst the broader risk tone remains cautious. 3M LME copper currently resides in a USD 9,443.05-9,520.90/t.

Geopolitics: Middle East

- Iranian Supreme Leader Khamenei says "I don't think nuclear talks with the US will be successful"; via Mehr news. Says to the US that they must remain from making outrageous demands. Saying that Iran will not be allowed to enrich uranium is excessive and outrageous.

- "Israel Broadcasting Corporation: Netanyahu extends the stay of the Israeli negotiating team in Doha for an additional day", according to Alhadath.

- Israeli PM Netanyahu says "Gaza war could end "tomorrow" if hostages return and Hamas leaders lay down their arms", via Sky News Arabia.

- Iran has received a proposal for the next round of indirect negotiations with the US, according to Iran International.

- "Iranian Foreign Ministry Spokesman: The time and place of the next round of nuclear negotiations with the United States have not yet been decided", according to Sky News Arabia

Geopolitics: Russia-Ukraine

- US President Trump said the US isn't stepping back from Russia-Ukraine negotiations and that it would be helpful to host Ukraine-Russia talks at the Vatican, while he repeated it is not his war and thinks something is going to happen with Russia and believes Putin wants to stop. Furthermore, Trump said he has a red line in his head on when he will stop pushing on Russia-Ukraine but won't say what that red line is and noted there could be a time when Russia sanctions will happen.

- Kremlin spokesman said US President Trump and Russian President Putin talked about a direct conversation between Putin and Ukrainian President Zelensky although there is no decision yet on the place for the next direct contact between Russia and Ukraine. The spokesman stated there cannot be a deadline for preparing a memorandum between Russia and Ukraine, as well as noted that everyone is interested in a speedy settlement in Ukraine and that Russia is interested in eliminating the root causes of the conflict.

US Event Calendar

- Philadelphia Fed Non-Mfg activity survey

Central Bank Speakers

- 9:00 am: Fed’s Bostic Gives Opening Remarks

- 9:00 am: Fed’s Barkin Gives Speech at Richmond Fed Conference

- 9:30 am: Fed’s Collins Hosts Fed Listens Event in New Hampshire

- 1:00 pm: Fed’s Musalem Speaks on Economy, Policy

- 5:00 pm: Fed’s Kugler Gives Commencement Address

DB's Jim Reid concludes the overnight wrap

Yesterday felt like we were somewhere along the line of a "death by a thousand cuts" with regards to the US fiscal situation. Hard to know where in that thousand we are but probably much nearer a thousand than at zero even as yesterday saw an initial sell off reverse as the session went on. At the end of the day the loss of the final US triple-A rating late on Friday night doesn't change anything much immediately but it keeps the drip, drip, drip of poor fiscal news building up against the debt sustainability dam in the background. Anyway, that's enough of the metaphors.

In yesterday's CoTD (link here) I highlighted that Moody's base case is now for US deficits to hit nearly 9% by 2035 and asked in a flash poll whether this would happen, or how it would be avoided or dealt with if it did. I'll keep the poll open for a couple of hours before publishing the results in my CoTD this London lunchtime. See it here. It should only take less than 5 seconds and all views very welcome.

We saw a large round trip in Treasuries around the news, with the 30yr yield briefly reaching its highest intraday level since 2023, at 5.035%, before paring back that move to close at 4.90%, -4.1bps lower on the day and virtually in line with where we were immediately before the news late on Friday. That recovery started shortly after the US open and continued as the session went on. It perhaps indicates the slow moving trend of overseas investors selling Treasuries but domestic investors increasing their holdings.

Earlier on, the cross-asset moves had seen a minor rerun of what happened after Liberation Day as US assets lost ground across the board. The S&P 500 recovered from -1.05% at the lows to end +0.09% higher. The US asset that struggled the most was the dollar, with the index (-0.72%) seeing only a modest recovery from its -1.02% intra-day low. That dollar decline repeated the early April parallels of capital flight scenarios often seen in emerging markets, where the currency struggles even though rates are going up.

This is coming at a delicate time, because the US administration are seeking to pass an extension to the 2017 Trump tax cuts, which are currently due to expire at the end of 2025. My CoTD showed that the CBO believe that the US federal debt held by the public will surge to 220% by 2055 if the tax cuts are extended, with the deficit reaching 12% of GDP. Again feel free to vote in the CoTD flash poll if you want to express a view as to whether something happens way before we get to these type of levels or whether we will take it in our strides like every other debt / deficit landmark in recent years.

In terms of that bond move in more detail, the selloff was initially very aggressive, with the 30yr yield reaching 5.035% and on track for its highest close since 2023 and actually higher for only six business days since 2007. However, that was then pared back, and it actually ended the day -4.1bps lower at 4.90%. Similarly, the 10yr yield hit an intraday high of 4.56%, but eventually closed -3.0bps lower at 4.45%. So the initial fears of the day ultimately didn’t materialise as US buyers stepped in, and at the front end, the 2yr yield fell -2.4bps to 3.98%. Overnight, yields are moving less than a basis point across the curve.

Similarly to the rates move, the S&P 500 rallied from more than -1% down at the open to +0.09% by the close, marking its sixth consecutive gain. Defensive sectors including healthcare (+0.96%) and consumer staples (+0.42%) posted the strongest advances. By contrast, tech stocks didn't fully recover, with the Magnificent 7 down -0.25% after its best weekly performance in over two years. The small cap Russell 2000 (-0.42%) also lost ground. And reflecting the pick up in volatility, the VIX index rose (+0.90pts) rose from Friday’s seven-week low to 18.14pts.

Whilst the US fiscal news dominated attention, in the geopolitical space we had President Trump holding a call with President Putin, but this delivered little new on resolving the war in Ukraine. Trump posted following the call that Ukraine and Russia would “immediately start negotiations”. However, Trump’s comments did not repeat earlier threats of new sanctions against Russia or put immediate pressure on Moscow to deliver a ceasefire and his post suggested that the US might now take more of a backseat in the talks. Meanwhile, Putin was rather vague on the upcoming talks, again referring to the “need to eliminate the root causes of this crisis.”

Otherwise yesterday, several Fed officials signalled they weren’t in a hurry to cut rates. For instance, Vice Chair Jefferson said “I believe that it is appropriate that we wait and see how the policies evolve over time and their impact”. Similarly, Atlanta Fed President Bostic said “I think we’ll have to wait three to six months to start to see where this settles out” and reiterated his expectation of only one more rate cut this year. Meanwhile, New York Fed President Williams said “It’s not going to be that in June we’re going to understand what’s happening here, or in July”. And Minneapolis Fed President Kashkari noted “It’s really just wait and see until we get more information.” So it was little surprise that investors continue to see a near-term rate cut as unlikely, with only a 35% chance of a cut priced by the July meeting.

Earlier in Europe, markets had put in a much steadier performance, with the STOXX 600 (+0.13%) just about posting a small gain. That was echoed on the rates side too, where yields on 10yr bunds (-0.2bps), OATs (-0.4bps) and BTPs (+0.1bps) all saw little change. In the meantime, the UK and the EU also reached an agreement that deepened ties between the two after Brexit. Among others, the UK agreed an extension of EU fishing rights, in return for the removal of most border checks on farm exports. That came alongside a defence and security agreement, along with a potential youth mobility scheme, although the latter will be subject to further discussion. Our UK economists looked at the deal yesterday (link here), and their estimates show the long-run benefits to be around 0.5% of GDP by 2040.

For those of us in the UK fed up by not being able to use e-gates in the EU the deal only refers to the "potential use of eGates where appropriate". I've been in so many long queues in the last couple of years when eGates have been empty.

In Asia risk sentiment has been helped after China’s central bank announced cuts to key lending rates for the first time since October reinforcing expectations of looser monetary policy to support the country’s economy (more below). Across the region, the Hang Seng (+1.29%) is leading gains while the CSI (+0.62%) and the Shanghai Composite (+0.38%) are also edging higher. Elsewhere, the Nikkei (+0.26%), the S&P/ASX 200 (+0.54%) are gaining but with the KOSPI (+0.05%) slipping back towards flat. S&P 500 (-0.29%) and NASDAQ 100 (-0.43%) futures are giving back some of yesterday's recovery from the lows.Coming back to China, the PBOC cut the 1-year loan prime rate (LPR), the reference rate for pricing all new loans and outstanding floating rate loans, to 3.0% from 3.1% and the 5-year LPR to 3.5% from 3.6%. Meanwhile the RBA have just cut rates 25bps (as expected) as I finish this off with the presser ongoing. So far it leans dovishly.

To the day ahead now, and data releases include Canada’s CPI and German PPI for April, along with the European Commission’s preliminary consumer confidence indicator for May for the Euro Area. From central banks, we’ll hear from the Fed’s Bostic, Barkin, Collins, Musalem, Kugler, Hammack and Daly, the ECB’s Wunsch, Knot and Cipollone, and the BoE’s Pill. Finally, earnings releases include Home Depot.

-

Site: La Salette Journey

Here's a difficult question: Which of these two groups is celebrated for the entire month of June and which is largely forgotten except for about 30 seconds while people grill a hamburger or a hot dog?

"The nation which forgets its defenders will be itself forgotten." - Calvin Coolidge

"Those who have long enjoyed such privileges as we enjoy forget in time that men have died to win them." —Franklin D. Roosevelt

Duty, Honor, Country. The first as his guide, the second he applied, for the third he died.Related reading here -

Site: AsiaNews.itThe Tenaganita, an advocacy association, has criticised the Malaysian government for its decision to restart recruiting migrants from Bangladesh after thousands of foreign workers already present in the country were left without work, housing and legal protection, trapped in a corrupt system of exploitation, this according to the NGO's director, Glorene A Das.

-

Site: Zero HedgeUS Senate Moves Forward With GENIUS Stablecoin BillTyler Durden Tue, 05/20/2025 - 08:05

Authored by Brayden Lindrea via CoinTelegraph.com,

The US Senate has voted to advance a key stablecoin-regulating bill after Democratic senators blocked an earlier attempt to move the bill forward over concerns about President Donald Trump’s sprawling crypto empire.

A key procedural vote on the Guiding and Establishing National Innovation for US Stablecoins Act, or GENIUS Act, passed in a 66-32 vote on May 19 local time.

Several Democrats, including Mark Warner, Adam Schiff and Ruben Gallego, changed their votes to pass the motion to invoke cloture, which will now set the bill up for debate on the Senate floor.

Republican Senator Cynthia Lummis, one of the bill’s key backers, said on May 15 that she thinks it’s a “fair target” to have the GENIUS Act passed by May 26 — Memorial Day in the US.

The US Senate voted 66-32 to advance debate on the GENIUS stablecoin bill. Source: US Senate

Several Democratic senators withdrew support for the bill on May 8, blocking a motion to move it forward, citing concerns over potential conflicts of interest involving Trump’s crypto ventures and the bill’s Anti-Money Laundering provisions.

Warner expressed concerns about Trump’s crypto ventures in a statement before the vote, but said the US couldn’t “afford to keep standing on the sidelines” while the crypto industry evolves.

“We cannot allow that corruption to blind us to the broader reality: blockchain technology is here to stay. If American lawmakers don’t shape it, others will — and not in ways that serve our interests or democratic values.”Warren says bill won’t stop Trump’s “crypto corruption”

Democratic Senator Elizabeth Warren, a longtime crypto skeptic, was one of the strongest opponents of the stablecoin bill, arguing before the vote that it failed to address Trump’s “blatant crypto corruption.”

Trump and his family have recently launched various crypto projects, which include memecoins, a crypto platform, a crypto mining company that plans to go public and a stablecoin that has quickly grown to be the seventh-largest by value, CoinGecko data shows.

”Trump and his family have already pocketed hundreds of millions of dollars from his crypto ventures, and they stand to make hundreds of millions more from his stablecoin, USD1, if this bill passes,” she said.

Senator Bill Hagerty introduced the GENIUS Act on Feb. 4, which seeks to regulate the nearly $250 billion stablecoin market, currently dominated by Tether and Circle’s USDC.

The bill requires stablecoins to be fully backed, have regular security audits and approval from federal or state regulators. Only licensed entities can issue stablecoins, while algorithmic stablecoins are restricted.

Hagerty’s stablecoin bill builds on the discussion draft he submitted for former Representative Patrick McHenry’s Clarity for Payment Stablecoins Act in October.

-

Site: AsiaNews.itHow will the new Pope manage the relationship between Beijing and the VaticanThe faithful in mainland China hope that the bishops to be appointed and approved under the agreement will truly love the faithful and know their flock. That they will be skilled in pastoral care and enjoy the support of the faithful. Only in this way will a bishop be able to guide the faithful to love both their country and the Church.

-

Site: southern orders

Catholic orthodoxy is the only way to heal the radical polarization that conservative and liberals have caused the church and their heated, ugly and mean-spirited rhetoric tossed at either side and to the pope himself and bishops in union with him.This is Catholic orthodoxy:

1. It is orthodox to embrace all the social teachings of the Church, especially those in papal enclyicals like Pope Leo XIII!

2. It is orthodox to allow migrants and those persecuted in their own countries to have access to countries when they can be safe and provide a standard quality of life for them and their families.

3. It is orthodox for countries to have laws that protect the integrity of their borders and allow controlled immigration verses an invasion of all kinds of people, even those with criminal records of violent crimes.

4. It is orthodox to ask secular governments who have allowed unbridled immigration to treat with respect and due process those who came in because the government allowed illegal immigration. It is orthodox to ask secular governments to allow those who have contributed to their new communities, are otherwise law abiding to have a way to be made regular without deportation.

5. It is orthodox to have a concern for the poor and marginalized and to promote the Church’s sexual morality without being mean spirited toward those who fail to follow Church teachings.

6. It is orthodox to crack down on bad and immodest behaviors in the Church by those who practice disordered sexual preferences by flaunting it and demanding that they be included in the Church’s public worship while committed sacrilege and insults toward our Lord and then toward orthodox Catholics present for prayer and the liturgies of the Church. It is orthodox to demand proper and modest dress in church according to the cultural norms concerning the only two biological genders male and female.

7. It is orthodox for a Catholic to prefer the TLM and its ancillary sacramental liturgies.

8. It is orthodox to prefer a rubrical correct Modern Vernacular Mass and its ancillary liturgies

9. It is orthodox to allow both forms of the one Roman Rite to co-exist in the same parish

10. It is orthodox to reject an ecclesiology that becomes a false god and obfuscates Christ by placing human elements of organization and who does what above an experience of the Risen Lord

11. It is orthodox to reject the deification of any Council of the Church or any Pope making these a false god

12. It is orthodox to develop pastoral theologies that assist pastors and others who minister to people who are in broken and dysfunctional lives and relationships as long as these are within the internal forum

13. Synodality is orthodox when it is relegated to the Faith, Morals and Canon laws of the Church and doesn’t become a false god that elevates walking together while neglecting the one who leads us, Jesus the Risen Lord.

I can go on and on!

-

Site: Zero HedgeChinese Smartphone Exports To US Crashed In AprilTyler Durden Tue, 05/20/2025 - 07:45

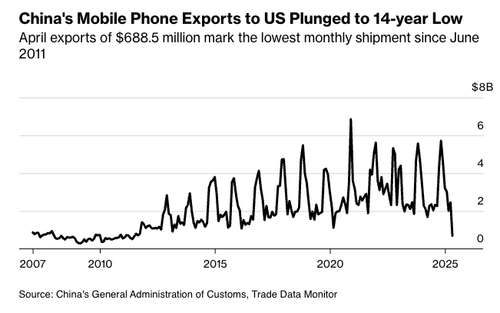

New customs data from China shows that smartphone shipments to the U.S. collapsed 72% in April to below $700 million—the lowest level since 2011. The plunge coincided with the peak of the U.S.-China trade war, as the Trump administration imposed up to 145% tariffs on Chinese goods, disrupting tech supply chains. However, those levies have since been significantly scaled back to 30% as of May.

Using data from China's General Administration of Customs, Bloomberg reported that the 72% plunge in smartphone shipments to the U.S. far outpaced the 21% decline in overall exports to the U.S.

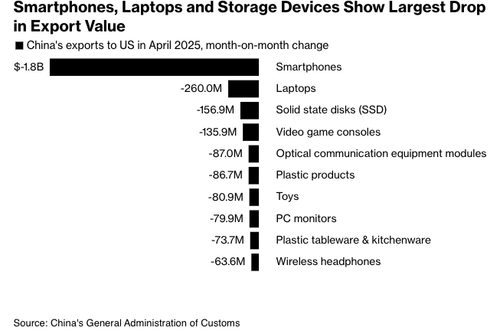

China's export data showed that handsets and laptops suffered the largest shipping declines in April.

April marked the peak of the trade war, with President Trump imposing tariffs of up to 145% on Chinese goods and Beijing retaliating with 125% tariffs on U.S. products. By mid-May, trade tensions had eased, with U.S. tariffs on Chinese goods reduced to 30% and China's tariffs on U.S. goods lowered to 10%.

However, the so-called "breakthrough" trade deal between the U.S. and China last week has Goldman analyst Philip Sun forecasting a surge in imports for U.S. ports. This has abruptly reversed the "empty ports" and "empty shelves" narratives; now, U.S. importers expect to pull forward.

Goldman's Sun explained: "China's exports will be RED HOT in the next 90 days. Frontrunning would be the keyword."

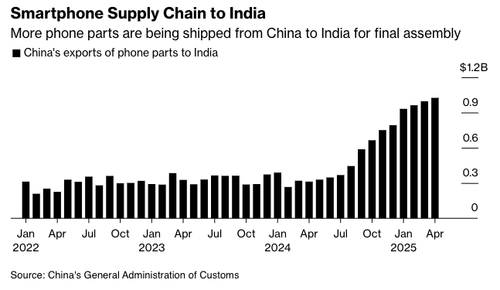

Meanwhile, Apple accelerated a shift of iPhone production to India in anticipation of the trade war.

Last week, President Trump, on his Gulf States tour, publicly called out Apple CEO Tim Cook for the massive expansion of iPhone production in India. Trump said after his conversation about 'Made in America', the CEO would be "upping their production in the United States."

Wedbush Securities recently estimated that a fully American-made iPhone could cost as much as $3,500, compared to the current average price of around $1,000. There are reports the next model could see the first price hike since the 2017 debut of the iPhone X.

Next lineup of iPhone...

. . .

-

Site: PaulCraigRoberts.org

Hillary Endorses White Replacement

Paul Craig Roberts

In a recent speech to a Democrat audience Hillary Clinton reaffirms that it is Democrat Party Policy to Replace White Americans with Immigrant-invaders. Hillary blasted the Trump regime’s emphasis on “return to the family, the nuclear family, return to being a Christian nation, return to producing a lot of children.” It is all a dastardly right-wing trick to take away women’s rights to have careers instead of children. Having children, she said is the function of immigrant-invaders, not of white women.

She told the Democrat audience that “this very blatant effort to basically send a message most exemplified by Vance and Musk, and others, that, you know, what we really need from you women are more children. And what that really means is you should go back to doing what you were born to do, which is to produce more children.” Now that feminists have taught women to take over the male role, here are the vile Trump Republicans trying to roll back the liberation of women from the home and children.

The question is, where can an American male find a female life partner? That is not what an indoctrinated feminist wants to be. She wants to be independent, not constrained by a supportive relationship. Perhaps white American males can find wives among the female immigrant-invaders. The resulting miscegenation destroys both races, thus the result is to eliminate diversity. Funny, isn’t it, that the dumbshit liberal-left is so stupid that they don’t realize that the result of multiculturalism is the elimination of racial diversity.

Hillary, in her unbridled ignorance, actually said that unlike Europe, America’s welcoming of immigrant-invaders has caused our economy to do “so much better than comparable advanced economies across the world.” Hillary says, “we actually had a replenishment, because we had a lot of immigrants, legally and undocumented, who had, you know, larger than normal by American standards, families.”

Does Hillary not know that all of Europe and the formerly British are overrun with immigrant invaders, and that these invaders are protected by the EU and UK governments? So what is the basis of Hillary’s claim that the US, unlike “comparable advanced economies,” is the beneficiary of illegal immigration?

Don’t ask the stupid Hillary. She doesn’t know.

Will the morons who vote Democrat notice these revelations? Are they willing to turn their country over to immigrant-invaders in exchange for the right of white women to appropriate the male role?

It is absolutely clear that the achievement of feminism will be the elimination of white ethnicities. Already corporate advertisers are pushing miscegenation. Seldom do you see a white family in a corporate ad. Miscegenation is a two-edged sword. It replaces both races with a new rootless being without a race, a history, and a culture.

America is being erased, both whites and blacks, but Americans are too insouciant to notice.

-

Site: Catholic ConclaveThe people who made the video say they are scared.Catholic Conclavehttp://www.blogger.com/profile/06227218883606585321noreply@blogger.com0

-

Site: Zero Hedge"They Want War" - Martin Armstrong Slams European Leaders Reinstating Military DraftsTyler Durden Tue, 05/20/2025 - 07:20

Via Greg Hunter’s USAWatchdog.com,

Legendary financial and geopolitical cycle analyst Martin Armstrong is back with an update on his big turn toward war in Ukraine with Russia.

Two weeks ago on USAW, Armstrong predicted, “After May 15, war is turning up (in Ukraine) and it will be turning up into 2026.”

That prediction paid off to the exact day as peace talks between Russia and Ukraine ended on May 15 after just two hours, and neither side agreed to meet again.

War is already here, and there is no stopping it with peace talks. Armstrong says, “Putin knows and understands this is not a just a war with Ukraine, this is a war with NATO..."

"If Putin agrees to a 30-day ceasefire with Ukraine, what’s that going to do? Absolutely nothing.

You have every European country reinstituting drafts. In Germany, even people 60 years old have been told to report. Poland has ordered every able-bodied man to show up for military training. They want war. Their economy is collapsing. You hear about this de-dollarization, and it’s not happening. The capitalization of just the New York Stock Exchange is worth more than all of Europe combined. That’s just the New York Stock Exchange...

You’ve got Macron in France, they call him the ‘Petite Napolean.’. . . Without war, Europe is going to collapse. It’s in a sovereign debt crisis . . . They have done everything against the economy.”

Armstong thinks Russia will finish off Ukraine sometime in 2027 and Europe a year or two after that. And, Yes, Armstrong still thinks Ukraine will disappear from the map.

Armstrong urged his contacts in Washington to “Get the hell out of NATO.” It seems some in the US government are considering this warning as this headline breaks today: “US to Begin European Troop Withdrawal Talks, NATO Ambassador Says.” Armstrong says,

“I have been told by some very influential people on Capitol Hill ‘you’re right, we agree.’ That’s what I have been told. . . . I have been complaining about this for months, and my view is Europe is committing suicide, and let’s not be part of it this time.”

Is President Trump getting this message? Armstrong says, “Yes, I believe so. . . . Trump also said a peace deal does not seem likely, the hatred is too great on both sides.”

The neocons back home also want war with Russia and have wanted it for a very long time. Trump is either going to make peace or walk away and not participate. Maybe this is why former FBI Director James Comey put out his not-so-cryptic call to assassinate President Trump with his “86 47” now deleted Instagram post. Comey was the man who held Armstrong in prison illegally for contempt for 7 years.

Armstrong says, “Comey has always been part of it. Just for the record, he was the US Attorney in New York. He’s the one who kept me in contempt until the Supreme Court said what the hell is going on? Then, they had to release me.”

How did Armstrong land in jail?

Armstrong says, “They asked me to put in 10 billion dollars . . . to take over Russia, and I refused..."

" It was Comey that was the US Attorney for New York, and he kept me in civil contempt, which has a maximum sentence of 18 months, and he kept me in for 7 years.

He kept rolling it and rolling it and rolling it. . . . I was told if I put in $10 billion, I would get $100 billion back.

They intended to have all the assets of Russia going through the trading desk of New York. All the oil, gold, diamonds, platinum, you name it, they would have it all. And I said, no, I’m out. I am not into regime change.”

Fast forward to today, and the powers in Europe still think they can take Russia and steal their assets to fix the extreme financial problems in Europe.

Pensions, banks and bonds are in deep financial trouble in Europe.

Stealing from Russia and gaining control of $75 trillion in natural resources is why they want and need war. Armstrong says,

“They went to negative interest rates in 2014. I warned them. I said listen; you are out of your minds.

You are syphoning money out of the bank reserves and pension finds. It’s a basket case. It really is. They have no appreciable economy. . . it’s shrinking, the number of actual businesses has shrunk in Germany. (Germany is 25% of the EU economy.) This is why they need war.”

Armstrong says Europe is going to lose and lose badly in a war with Russia.

Armstrong says if Trump gets out of NATO, the US will thrive and do much better financially than Europe.

Let’s all hope President Trump gets us out of NATO before it’s too late.

There is much more in the 60-minute interview.

Join Greg Hunter of USAWatchdog.com as he goes One-on-One with Martin Armstrong as he gives his analysis on war, default, depression and unpayable debt that will make a huge mess for the world for 5.17.25.

To Donate to USAWatchdog.com click here

There is free information, analysis and articles on ArmstrongEconomics.com.

-

Site: Mises InstituteRobert Kennedy‘s Make America Healthy Again (MAHA) crusade is being promoted as a government-led effort to eliminate health hazards in food and medicine. However, MAHA depends upon government overreach, which ultimately will undermine any good MAHA does.

-