In the name of tolerance, tolerance is being abolished; this is a real threat we face.

Distinction Matter - Subscribed Feeds

-

Site: LifeNews

Melinda French Gates said she experienced “almost a crisis of faith” before embracing a pro-contraception stance, citing a “very liberal” priest as a key influence in her decision to diverge from Catholic teaching.

In an April 17 interview on The Jamie Kern Lima Show, the philanthropist and co-founder of the Bill & Melinda Gates Foundation described how her travels to underserved areas exposed her to families living without contraceptives, People reported. Gates recounted hearing from women who experienced pregnancies in rapid succession — some of which led to the loss of a child or even the mother’s death.

“[T]hey would talk about children,” she said, according to People. “And both the men and the women knew that when they could space the births of those children, they were better off.”

Please follow LifeNews.com on Gab for the latest pro-life news and info, free from social media censorship.

Gates said those stories prompted a personal spiritual conflict.

“I started to realize, I believe in life. I believe in these children’s lives. The worthiness of them, the inherent beauty on the day they’re born,” she said. “But because of a man-made rule in the church that I am in — the Catholic church — we’re not allowing women to have access to contraceptives. And so talk about an incongruency, right? And I had to really then reckon with my faith.”

She described her struggle as “almost a crisis of faith” and turned to scholars at Notre Dame to better understand Church teaching.

Her perspective shifted, she said, after reading the writings of Father Richard Rohr — whom she inaccurately described as a Jesuit. Fr. Rohr is a Franciscan friar and author widely known for promoting progressive theology and spirituality, including positions that diverge from the Magisterium.

“I need to actually unlearn some of these things,” Gates said, “because I can’t square the circle.”

Gates said she ultimately concluded that she believes “in the dignity of life” but felt compelled to speak publicly in support of contraception, believing she had a responsibility to use her platform to advocate for what she called “a tool” for women.

LifeNews Note: Rachel Quackenbush writes for CatholicVote, where this column originally appeared.

The post Melinda Gates: A “Very Liberal” Priest Confirmed I Can be Catholic and Pro-Abortion appeared first on LifeNews.com.

-

Site: Catholic Herald

ROME – Tradition holds that during the anti-Christian persecution of Roman Emperor Valerian in 258, St Lawrence, when given three days to round up the church’s riches before being executed, sold the church’s vessels and gave the money to the poor.

When summoned by Valerian to deliver the church’s property, wealth and treasures, Lawrence triumphantly appeared, ushering in the city’s poor, crippled, blind and suffering masses behind him.

As Pope Francis is laid to rest Saturday, in addition to the various heads of state, dignitaries and celebrities scheduled to attend, also present will be those to whom he dedicated the entirety of his priestly, episcopal and Petrine ministry: the poor.

Not only will groups of the poor, homeless, migrants and refugees be present at his funeral Mass in the Vatican, they will also be welcomed to his final burial place, the Basilica of St Mary Major, by a group of poor and needy people.

Having chose the papal name Francis after St Francis of Assisi, often called the “Poor Man of Assisi” due to his embrace of poverty and shunning of material wealth, Pope Francis shortly after his election told journalists that he was inspired to take the name when, immediately after the final vote was counted in the 2013 conclave and he knew he’d been elected, a fellow cardinal sitting next to him said, “don’t forget the poor.”

Pope Francis went to great lengths throughout his pontificate to prioritize the poor and those on life’ margins, making his first trip outside of Rome to the Italian island of Lampedusa, a primary destination point for migrants and refugees arriving to Europe, if they survived the dangerous voyage across the Mediterranean Sea.

He was known for hosting lunches with the homeless and poor for his birthday celebrations, eating lunch with them inside of the Vatican’s Paul VI Hall, and inviting them inside of the Vatican Museums, or sending them on beach holidays with the help of his almoner, Polish Cardinal Konrad Krajewski.

Francis gave Krajewski a red hat in 2018, indicating just how high of a priority charitable outreach to the poor was for him. He also repeatedly sent Krajewski on humanitarian missions to Ukraine after the outbreak of war in 2022, delivering ambulances filled with food and medical supplies.

In 2016, after making a last-minute daytrip to the Greek Island of Lesbos, a trip made solely to visit refugees stuck on the island, he took 12 Muslim refugees back with him, including six children. He visited the island again, and its largest refugee camp, in 2021.

He also consistently advocated for the safe and secure passage of refugees from camps into Italy through humanitarian corridors, ensuring a protected route for those with their paperwork in order and help integrating into their local communities.

The Vatican in an April 24 statement said the poor not only hold a privileged place in the heart of God, but “This is so also in the heart and magisterium of the Holy Father, who chose the name Francis so as never to forget them.”

“For this reason, a group of poor and needy people will be present on the steps that lead to the Basilica of Saint Mary Major to give a final farewell to Pope Francis before the entombment of his coffin,” following his funeral April 26.

Pope Francis’s funeral Mass is scheduled to take place April 26, at 10a.m. local time, and afterwards he will be taken by car to Saint Mary Major, where he will be entombed in the Pauline Chapel, which also houses the famed Marian icon, Maria Salus Populi Romani, or Mary, Health of the Roman People, which was one of his favorite devotions.

Attending his Mass, according to the Community of Sant’Egidio, an ecclesial movement dedicated to social justice that Pope Francis was close to, will be a group of poor, migrants and refugees.

In an April 25 statement, Sant’Egidio said members, including top leadership, would attend the pope’s funeral along with “his people, starting with the poor who knew and loved him during the course of his pontificate.”

These people, they said, include refugees who returned from Lesbos on board the papal plane with him in 2016, as well as refugees from a camp in Cyprus who came to Italy through its humanitarian corridors program in 2021, following his visit to Greece and Cyprus.

Homeless individuals will also attend, including many who found hospitality and welcome at the Palazzo Migliori, which was inaugurated by Pope Francis in 2019 and entrusted to Sant’Egidio.

Sant’Egidio indicated that the group of poor and needy who will welcome Pope Francis’s coffin to Saint Mary Major also belong to their community.

(Pope Francis greets two young refugee girls at the Reception and Identification Centre (RIC) in Mytilene on the island of Lesbos on December 5, 2021. Photo by Louisa GOULIAMAKI / POOL / AFP)

The post ‘Poor’ to honour Francis at papal funeral first appeared on Catholic Herald.

The post ‘Poor’ to honour Francis at papal funeral appeared first on Catholic Herald.

-

Site: Zero HedgeApple Turbocharges Friendshoring: Your Next iPhone Could Be Made In IndiaTyler Durden Fri, 04/25/2025 - 11:20

Apple is turbocharging its "friend-shoring" strategy, thanks in large part to President Trump's ongoing trade war with Beijing, by initiating plans to shift all iPhone production for the U.S. market from China to India starting next year, according to the Financial Times, citing sources. The move marks a significant step toward diversifying Apple's supply chain away from China, in an effort to avoid tariffs.

The sources said the continued diversification of the supply chain into India may suggest that iPhone production could be ramped up to 60 million units by the end of 2026, or the amount required to satisfy the U.S. market.

Apple still relies heavily on Chinese suppliers for components, but final assembly is being relocated to Indian facilities operated by Foxconn and Tata Electronics. Unbeknownst to U.S. consumers, Apple has already ramped up production of Indian-made iPhones to avoid the 145% tariffs Trump imposed on China.

Daniel Newman of the Futurum Group research firm said Tim Cook's friend-shoring of iPhone production out of China to India (for the U.S. market) "is going to be an important move for the company to be able to maintain its growth and momentum," adding, "We are seeing in real time how a company with these resources is moving at relative light speed to address the tariff risk."

In Trump's first term—or around 2017—Apple began manufacturing iPhones in India, starting with the iPhone SE through its manufacturer, Wistron, in Bengaluru. By 2019, Apple had expanded its manufacturing footprint in the country to begin assembling the iPhone XR, and by 2022, it began production of the iPhone 14 in Tamil Nadu.

The latest data from the International Data Corporation showed that U.S. consumers purchased 28% of Apple's 232.1 million global handset shipments in 2024.

Earlier this month, Trump imposed a reciprocal tariff of 26% on India, although it was paused several days later while New Delhi and Washington negotiators discussed a new trade agreement. U.S. Vice President JD Vance is on a trip this week in India, telling reports that US-India trade talks were making "very good progress."

For more color on Apple's trading partners and latest shipments, the supply chain platform Sayari shows Apple India Private Limited's activity, sourcing mostly from China...

It only took Trump's trade war to get CEO Tim Cook very serious about diversifying supply chains out of China into friendlier countries. While friend-shoring is a must, what about re-shoring?

-

Site: Catholic Herald

The death of Pope Francis leaves us with some very different narratives and perspectives of who he was and how we might assess his life and pontificate. We are faced with trying to reconcile some of the many contradictions his pontificate presented to both the Church and the world. One element with a significant degree of confusion is the way the Press understood him.

We are left with the paradoxical impression that he might have been more popular with the secular Press than he was with the Church. He was almost universally celebrated by the media. The response within the Church was a matter of greater complexity.

It was press coverage and the way it chose to celebrate some issues, while closing its eyes to others that appeared inconsistent, that has been critical to the forging of the reputation of Pope Francis when alive and posthumously.

We might well ask why the media, so long suspicious and resentful of Catholicism, has given Pope Francis such a welcome.

The Press depicted Benedict XVI as the hardline “God’s Rottweiler” because his intellectual gifts and personal reserve played poorly with populist sentiment. Had he been judged by some of his work on redistributive economics, the Left might have discovered him as, in terms of social redistribution, one of their own.

It might indicate that the press is driven by feelings and superficial judgements. And as it happened, Pope Francis was masterful in the way that he gave the Press comments that were high octane in the currency of “feeling”, and didn’t trouble them to much over any complexity of content.

It would be too simplistic to assume that it was just that he was making the faith more congenial to their world view by diluting, since looking back, (with the exception of the death penalty) he changed little.

And yet, he did have the capacity for “reading the room” and finding way to touch a populist nerve in a way that gained public confidence and sympathy.

Some of his sound bites were astonishingly effective, even though when they are more closely examined, they don’t stand the weight of scrutiny.

He had in particular, a gift for presenting an image of non-judgemental compassion, with just a hint of a progressive tint that the secular world responded to with an instinctive welcome and crucially without asking too many questions.

His apparent off the cuff remark “who am I to judge?” made during an on-flight informal press conference, might on its own be seen to have come to define his public persona.

Why does secular culture react so powerfully to embrace non-judgementalism when it finds it? In part because its supposed hatred of judgmentalism is a symptom of its rejection of traditional ethics. Ethical restraint interferes with hedonism, and is therefore taboo. And Catholics do restraint.

In the ears of the media, “Who am I to judge” sounds like a signal that Catholic ethics have been abandoned and replaced by the sanction of “all that matters is sincerity”, which along with “intending no harm”, is one of the few ethical standards modernity is willing to tolerate.

In fact, “who am I to judge” was a carefully parsed remark which when read in context carries a very different message from the universal spin placed on it by the media. But the emotional feel of it entirely overwhelmed the contextual limitations and it became a celebratory meme in its own right. It did nothing to change the teaching of the Church, but it gave the impression that the teaching was changed or changing. And the Press delighted in it, ran with it endlessly.

A number of the Pope’s well-tuned remarks became almost catch phrases. In 2013, he movingly declared: “How I would like a Church which is poor and for the poor!” This immediately was seized as an antidote to the public perception that the Church was inexcusably rich and irresponsibly powerful.

Alongside his much-publicised willingness to take public transport as an Argentinian bishop and embrace the marginalised wherever he found them, this was viewed very favourably, and became an indication of his humility and integrity. When he made it known that he would live in Casa Santa Marta instead of the papal apartments, the public celebration of his down to earth values was ecstatic. “People can come only in dribs and drabs (in the official apartments), and I cannot live without people,” he explained. “I need to live my life with others.”

But observers of life in Casa Santa Marta suggested a different narrative was at least partially at work. They pointed out that one of his most prominent personality traits was the need to micromanage. And for this he needed to be kept in touch with people and what people were saying. The scale between gathering information and enjoying gossip is a subtle one, but the need to been informed and remain in control may well have played a significant part, alongside his humility, in his wanting to avoid seclusion and exclusion in the papal apartments.

That humility on closer inspection was a little patchy. But of course, the Press did not offer closer inspection.

There is an unhappy video of a line of well-wishers coming to him to pay their respects and kiss his papal ring. It clearly meant a great deal to those queueing, even if he found it offended his sense of humility. The body language optics were awful. The Pope impatiently was seen whipping his hand away just as each person reached out for it. It looked more like petulance than humility. But then, who are we to judge? Certainly, the Press decided to ignore it.

It is of course true that Pope Francis was assiduous in taking well-judged actions in helping the marginalised when he could. His provision of showers and facilities for the homeless in Rome was once again rightly welcomed, recognised and publicised by the Press. They liked that very much. It accorded with their picture of him. And so, practising a pronounced cognitive dissonance they blanked his remarks on other shibboleths, including and especially abortion. Yet these were as emotionally charged as they were uncompromising and were completely ignored.

Abortion, “It’s like hiring a hitman …”

“… I have had occasion to return to the subject of abortion recently. You know that I am very clear about this: it is a homicide and it is not licit to become an accomplice.”

“… We are victims of the throwaway culture…there is the throwing away of children that we do not want to welcome. Today this has become a normal thing, a habit that is very bad; it is truly murder. In order to truly grasp this, perhaps asking ourselves two questions may help: is it right to eliminate, to end a human life to solve a problem? Is it right to hire a hitman to solve a problem?”

On other controversial issues, he could be and was also crystal clear:

“Gender ideology? It is the greatest danger; it resembles the method with which the Hitler Youth was trained.”

Will there be women priests or deacons? “No.”

Will ecclesiastical celibacy be abolished? “I won’t do it.”

Can gay couples be blessed? “People are blessed, not the union, marriage and family are born from a man and a woman.”

Euthanasia and assisted suicide? “They are practices to be rejected, daughters of the throwaway culture.”

And the rented womb? “It’s modern slavery.”

The many of the obituaries of Pope Francis demonstrate the tension that arose from the mixture of progressive soundbites accompanied by what appeared to a desire to shake the institution while remaining wholly orthodox on certain hot button ethical issues.

There was something to please and infuriate everyone. German progressives were delighted at the ambiguities introduced over gay blessings, and furious that feminist assaults on the diaconate were resisted. Traditionalists were devastated by the unexplained blitzkrieg on the Latin Mass, but reassured by the clarity on abortion. “Who am I to judge” captured the hearts of those who wanted a move towards LGBTQ+ sympathies, but became more problematic when applied to Fr Marko Rupnik’s alleged rape of nuns, and the conniving at the hiding of other clerical sex abusers.

All this too did not fit into the narrative the media built about Francis so it was left largely unreported.

The Press had constructed the public persona of the Pope in their own image, and they were and are reluctant to allow other facts or pieces of information to disturb what they had found so comfortable and comforting. As always, reputation as well as beauty is in the eyes of the beholder.

(Archbishop of Barcelona Cardinal Juan Jose Omella speaks to members of the media at the Barcelona cathedral during an impromptu press conference in Barcelona, on April 21, 2025. Photo by Josep LAGO / AFP)

The post The media’s selective understanding of a complexed pope first appeared on Catholic Herald.

The post The media’s selective understanding of a complexed pope appeared first on Catholic Herald.

-

Site: Ron Paul Institute - Featured Articles

As part of its border strategy, the administration deported Venezuelan migrants to a notorious prison in El Salvador, claiming the deportees were Tren de Aragua gang members. Because of the nature of gang documentation, the claim that they are all violent gang members is dubious. The policy is more than a legal civil liberties nightmare; it is strategically ill-advised. Deporting suspected gang members will not stop gangs. Transnational gangs are a serious problem, but there is a better way to deal with them.

Many have heard of the MS-13 gang because of its penchant for violence. Few, however, know that MS-13 was a small crew for much of its early history before becoming one of the largest criminal enterprises in the world. How did this happen?

Researchers have argued that immigration reforms in the mid-1990s had the unintended consequence of spreading criminal networks. University of California, San Diego, anthropology professor Elana Zilberg made the observation in her book “Space of Detention” that America’s policy of deporting Salvadoran youth contributed to the spread of MS-13. The gang was born in Los Angeles, but it flourished in Central America only after the United States shipped its members back to unstable countries with policies that exacerbated gangs. Rather than eliminating MS-13, the problem was exported, and then it boomeranged back even stronger to the United States.

President Trump is poised to repeat the same mistake. In his first term, Trump “pointed the finger” at President Barack Obama, suggesting that Obama’s “open-door immigration” was responsible for MS-13 prominence. However, the gang’s size and strength were established before Obama, and the argument does not explain MS-13’s success in other countries.

A key flaw in Trump’s approach and America’s handling of gangs is the belief that harsher punishments prevent gang activity. While deterrents are needed, gangs are fundamentally different from typical petty criminals.

In 2019, Erin Yoshino of the University of Southern California studied why harsher penalties for gang members are ineffective, finding that longer sentences do not deter crime and that people join gangs knowing full well that death is a possibility. Instead, incarceration can enhance respect and loyalty among gang members as they maintain control from jail. If threats of mortal danger or prison do not dissuade gang membership, a one-way flight to a Salvadoran prison is unlikely to do better.

People join gangs for various social reasons, such as feelings of belonging or a sense of protection, but they thrive and grow violent as money-making enterprises, primarily through the sale of illicit drugs. Steven Levitt, known for “Freakonomics,” researched how the allure of reaching the top is a strong motivator for drug dealers despite the perils and terrible working conditions. The potential rewards outweigh the risks of imprisonment or death for those who accept the job.

To dismantle transnational gangs, our policies must hit them where it truly stings: their wallets. Researchers know how to do this, but it has not been politically correct to talk about it because it is unpopular to acknowledge defeat, and cognitive bias keeps us from exploring research-backed but counterintuitive policies.

To fight gangs, the strongest weapon is legalizing drugs to undercut their primary source of revenue. The decriminalization of cannabis in the United States has dealt a blow to Mexican cartels, resulting in lower crime rates and gang activity.

Scholars have understood this for decades. Several Nobel laureates have made it a point to publicly express that the war on drugs has failed, all while leading to corruption and violence.

People who advocate for drug prohibition often claim the moral high ground. This is understandable, but they are propping up what they claim to oppose in practice. It is the classic “Baptists and bootleggers” story: the moralists and the criminal profiteers are on the same team as they both want drugs to be illegal. The former claims moral victory, while the latter benefits from governments inadvertently creating lucrative black markets.

Social norms against iniquitous drug use should remain, but it is time to recognize the ineffectiveness of banging our heads against the wall regarding past “get tough” policies toward international drug gangs. The strategy of mass deportations will not stop gang violence. Strip the gangs of their profits. That’s how you defeat them.

Reprinted with permission from Independent Institute.

-

Site: Zero HedgeGold: The Everything HedgeTyler Durden Fri, 04/25/2025 - 11:00

Authored by James Rickards via DailyReckoning.com,

It’s a subject we analyze continually, and we have recommended gold as part of a sound investment portfolio for years. Today the dollar price of gold is hovering near all-time highs over $3,300 per ounce.

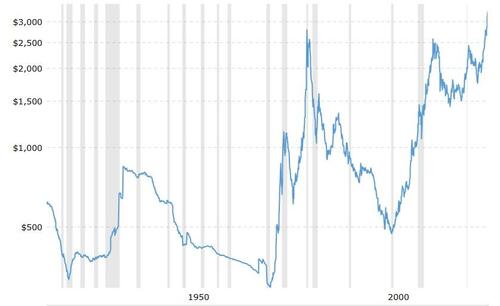

Gold has been on a tear lately. It was $1,830 as of October 5, 2023. At today’s prices, that marks a 75% surge in just 18 months. Gold has outperformed stocks by a wide margin this year, but it has also outperformed stocks for the past twenty-five years. Gold was around $250 per ounce in 1999. The gain since then is 1,180% or almost 12 times the starting price.

This is not the first bull market for gold. In the gold bull market of 1971 to 1980, gold rose 2,185%. In the gold bull market of 1999 to 2011, gold rose 670%. There were notable gold bear markets from 1981 to 1999 and again from 2012 to 2015. There were no bull or bear markets before 1971 because the world was on a gold standard and the price was fixed at $35.00 per ounce from 1944 to 1971. Still, the upward trend in gold prices is relentless and undeniable. Taking the entire period from 1971 until today including bull and bear markets gold has risen over 9,000%. Not bad.

Of course, that’s all in the past. What investors want to know is where do we go from here? The short answer is up significantly.

Here’s Why

The most fundamental reason for the rise in gold prices is simple supply and demand. Central banks predominantly from developing markets moved from being net sellers to net buyers of gold in 2010. Total gold reserves of central banks have risen significantly since then from just over 30,000 metric tonnes (mt) to over 35,000mt today.

The top buyers were the central banks of Russia, China, Turkey, Poland and India. Russia increased its reserves by 1,684mt to a total of 2,333mt. China increased its reserves by 1,181mt to a total of 2,235mt. Iran is also a major buyer of gold, but it is non-transparent, and its purchases and reserves are not publicly known.

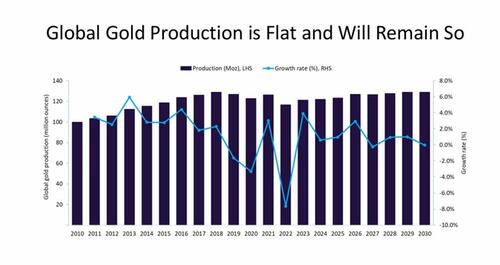

At the same time gold demand has been growing, gold output is flat. Global mining output of gold was about 130 million ounces in 2018 and was about 120 million ounces in 2024. Output declined slowly from 2018 to 2022 and then recovered slowly over the course of 2023 and 2024 but the change in both directions was slight.

Gold production is projected to grow slightly from today until 2030 but is still not projected to exceed the 2018 high. In short, gold production by miners is flat. This does not mean that we are at “peak gold” or that new discoveries are not being made. They are. What it means is that gold is becoming harder to find and costs of production (especially water and energy) are going up, so the total output trend is flat.

Continually increasing demand with flat output is a recipe for higher gold prices.

The second driver of higher prices is the role of BRICS+. From an original membership of Brazil, Russia, India and China in 2009 (South Africa joined in 2010), the group has expanded to include Egypt, Ethiopia, Indonesia, Iran and the UAE. It’s waiting list of additional members who will be added in the years ahead includes Malaysia, Nigeria, Turkey and Vietnam among others.

There was much discussion in 2023 and 2024 about a new BRICS currency that would displace the U.S. dollar in trade among members and might ultimately prove to be an acceptable reserve currency to rival the dollar. In fact, no such alternative currency is in the works. It might happen in the future but it would take ten years or longer properly to design and implement.

Instead, the BRICS are building a new payments system using proprietary cables, secure servers and highly encrypted message traffic protocols along with a blockchain-type ledger. Payments are in local currencies in the new payment channels that cannot be disrupted by western powers.

This begs the question of how trade imbalances accumulating in local currencies can be settled and converted into more liquid assets. The traditional answer was dollars. In short, the BRICS+ already have a new global currency, which is actually quite old – it’s gold. This is one reason why BRICS+ members are among the largest buyers of gold bullion.

The Everything Hedge

Importantly, gold is not just an inflation hedge, in fact it is an imperfect inflation hedge in terms of strict correlation. Gold prices have skyrocketed in recent years even as inflation has remained relatively tame (despite an inflation surge in 2022). A better model is to think of gold as the “everything hedge.”

The vectors of uncertainty are everywhere. These include tariffs, tax policy, the Department of Government Efficiency (DOGE), the War in Ukraine, the rise of China, a likely recession, left-wing violence, and even the status of Greenland and the Panama Canal among others.

It’s difficult to forecast how any one of these situations will turn out, let alone all of them and their complex interactions. Stocks and bonds can be volatile as a result. Gold is the one safe haven asset that powers through them all and offers investors some peace of mind. It is truly the everything hedge.

These drivers are sending gold prices higher and putting a floor under current price levels so that investors can enjoy potential upside with reduced concern about the downside. That’s what we call an asymmetric trade, which greatly favors investors.

Finally, there’s a simple bit of math combined with behavioral psychology that could propel gold prices to the $10,000 per ounce level in far less time than most analysts believe.

Investors naturally focus on dollar gains in the price of gold. When gold goes from $1,000 per ounce to $2,000 per ounce, investors cheer on the $1,000 gain. The same is true when gold goes from $2,000 per ounce to $3,000 per ounce. Again, investors pat themselves on the back for another $1,000 per ounce gain.

What investors don’t realize at least initially is that each $1,000 per ounce gain is easier than the one before. This phenomena involves the interaction of simple math and more complicated behavioral psychology.

The psychology is a matter of what’s called anchoring. The investor anchors on the number of $1,000 as a fixed gain and treats each such gain as the same. In pure dollars, they are the same. You make $1,000 per ounce as each benchmark is passed.

But here’s the conversion of those dollar benchmarks with each gain translated from dollars per ounce to percentages of the prior baseline:

Because each $1,000 per ounce gain begins from a higher level, the percentage gain associated with each dollar gain is less. The increase from $1,000 to $2,000 per ounce is a heavy lift. The increase from $9,000 to $10,000 per ounce is not much more than a good month. (Gold has been going up 1% to 2% daily with recent volatility).

This math is what gives rise to a gold buying frenzy. We’re not there yet. Gold buying has been limited mostly to central banks and large institutions such as sovereign wealth funds (SWFs). Retail interest in the U.S. has been slight although retail buyers have been more active in India and China. Once the frenzy kicks in those $1,000 benchmarks will be passed quickly. That’s why it’s not too late to become a gold investor. Don’t kick yourself about the gains you’ve missed. Instead, look forward to the gains that are coming.

How To Invest

The two main ways to invest in gold are what I call paper gold and physical gold bullion. Paper gold refers to securities and futures linked to the price of gold such as exchange-traded funds (GLD is the most liquid ticker), COMEX gold futures or unallocated gold purchase agreements available from large banks. Paper gold will give you price exposure and the potential for gains, but you do not own gold bullion. Many things can go wrong with a paper gold strategy including early termination of contracts, closure of futures exchanges or the failure of a dealer bank. You may find that you’re out of the gold market just when you most want to be in it.

Physical bullion is my preferred way to invest in gold. American Gold Eagle coins from the U.S. Mint in one-ounce or one-quarter ounce denominations are practical. For larger amounts you can look at 1-kilo gold bars from a reputable refiner. Do not buy “rare” or “pre-1933” gold coins unless you are a collector or numismatic expert. The premium for such coins is high and they are not worth the extra expense. Gold is gold.

Do not store your bullion in a safe deposit box. Banks are the first place the government will lock down in a crisis. Your gold could be seized. Use a private storage company like Brinks or install a home safe. If you’re using a home safe there are several techniques you can use to protect it. The best protection is not to tell anyone you have gold. That way no one will come looking.

-

Site: Ron Paul Institute - Featured Articles

Is Trump’s plan to end the Ukraine conflict a dead letter on arrival? A ceasefire is not peace. Freezing the conflict does not address security issues. Washington provoked this conflict. This is why Trump’s attempt to mediate is doomed to fail.

CrossTalking with Daniel McAdams, Hall Gardner, and Alexandre Guerreiro.

!function(r,u,m,b,l,e){r._Rumble=b,r[b]||(r[b]=function(){(r[b]._=r[b]._||[]).push(arguments);if(r[b]._.length==1){l=u.createElement(m),e=u.getElementsByTagName(m)[0],l.async=1,l.src="https://rumble.com/embedJS/ujcwo5"+(arguments[1].video?'.'+arguments[1].video:'')+"/?url="+encodeURIComponent(location.href)+"&args="+encodeURIComponent(JSON.stringify([].slice.apply(arguments))),e.parentNode.insertBefore(l,e)}})}(window, document, "script", "Rumble"); Rumble("play", {"video":"v6qcyz5","div":"rumble_v6qcyz5"}); -

Site: Ron Paul Institute - Featured Articles

Supporters of liberty had much reason for hope due to Robert F. Kennedy, Jr. becoming secretary of the Department of Health and Human Services (HHS). This man’s tenacity and eloquence in challenging the coronavirus crackdowns suggested great potential accomplishments for both liberty and health at HHS with him in the lead.

Indeed, there are early signs that HHS under Kennedy’s oversight is seeking to roll back the dangerous to health and liberty extreme vaccine pushing mission the department has pursued in recent decades. But, there is also reason to worry — including news earlier this month of the HHS fast-tracking an experimental bird flu shot — that this roll back will turn out to be quite limited.

One thing surprising people is that Kennedy’s HHS is acting like a police baton to whack American institutions and individuals into submission to the demand that they show allegiance to the Israel government. First, HHS became one of three parts of the US government leading an effort to punish colleges if they fail to stomp out “antisemitism” — defined bizarrely to include criticism of the Israel government — communicated by leadership, employees, or students. Kennedy, in the announcement of this endeavor, even made the extraordinary claim that such targeted free speech, press, and assembly is a manifestation of illness. This is the same sort of “medicalization” of ideas and communication that the Soviet Union employed to suppress dissent.

Then, this week, came news that HHS subsidiary the National Institutes of Health (NIH) has, effective immediately, barred any entity that boycotts Israel from continuing to spend, or receiving any new, NIH grants. Given the importance of NIH grants in medical research, this new demand threatens to shut down much research and upend the lives of many people employed in research projects. All this is done based on a criterion that has nothing to do with the task-relevant qualifications of the grant seekers or the quality of their work. Out with merit. In with kissing up. That does not seem conducive to achieving Kennedy’s often repeated goal to Make America Healthy Again. It also seems a big divergence from the protecting liberty objective many Kennedy supporters hoped he would pursue.

These actions from HHS are in a way not a surprise because Kennedy made clear in his 2024 presidential run that he was a major booster for the Israel government, praising it without caveat. He even went so far as to make the following declaration in a Twitter post: “As President, my support of Israel will be unconditional.” But, at the same time, it seemed reasonable to think that, given HHS’s focus on health matters in America, Kennedy’s Israel views would be irrelevant in his new job. Well, surprise, surprise: In the Donald Trump administration it turns out that, with Kennedy at the helm, even HHS can put Israel First.

During the coronavirus crackdowns, Kennedy stood up for people who opposed taking experimental shots, wearing masks, or going along with other government admonitions and dictates. But, now his HHS, reminiscent of the “Soup Nazi” in the Seinfeld episode, is saying “no funding for you” if you don’t stand with Israel. What a letdown.

The HHS thought police are on the march. Fail to fall in line in support of the Israel government and you will be punished. HHS and its fellow US government departments have not reached the level of domination used to ensure love for Big Brother in George Orwell’s 1984. But, hey, the Trump administration is just three months into its Israel boosting operation. These things take time.

-

Site: Zero HedgeFBI Arrests Wisconsin Judge Accused Of Helping Illegal Immigrant Hide From ICE: PatelTyler Durden Fri, 04/25/2025 - 10:40

FBI Director Kash Patel announced Friday that the bureau has arrested Judge Hannah Dugan out of Milwaukee, Wisconsin on charges of obstruction, accusing the Dugan of obstructing an arrest of illegal immigrants last week.

“We believe Judge Dugan intentionally misdirected federal agents away from the subject to be arrested in her courthouse, Eduardo Flores Ruiz, allowing the subject — an illegal alien — to evade arrest,” Patel said in a brief statement shared on X - which was subsequently deleted and re-posted. “Thankfully our agents chased down the perp on foot and he’s been in custody since, but the Judge’s obstruction created increased danger to the public.”

No word on why Patel's post was removed.

The bombshell arrest comes after radio host Dan O’Donnell reported that a federal investigation had been launched Dugan, who was said to have assisted an illegal alien evading FBI and ICE agents attempting an arrest at the courthouse. The alleged incident occurred after a clerk was notified of federal agents’ arrival to apprehend the illegal alien.

WSAU reports:

She then allegedly allowed the illegal migrant to hide in her jury room, which traditionally is not open for defendant use.

Chief Judge Carl Ashley allowed the agents to enter Dugan’s courtroom after he was presented with a warrant to enter the building and arrest the suspect, which led them to learning of Judge Dugan’s alleged obstruction.

The sources told O’Donnell that Chief Ashley sent an email to his fellow judges explaining the incident and said, “All of the agents’ actions were consistent with our draft policies, but we’re still in the process of conferring on the draft,” to which Judge Dugan responded by claiming that a warrant wasn’t “presented in the hallway of the 6th floor,” where her courtroom is located.

New video from our crews: Milwaukee County Judge Hannah Dugan and her attorney leaving the federal courthouse in Milwaukee and not commenting. The FBI arrested her at the MKE Co Courthouse this morning. She's charged with 2 felonies for obstructing an ICE arrest last week pic.twitter.com/3YtgsNHTJl

— Matt Smith (@mattsmith_news) April 25, 2025Obstructing federal officers or providing false information in an investigation carries serious penalties. Under 18 USC § 1001, such actions are felonies, punishable by up to five years in prison, or eight if terrorism is involved, WSAU reports.

This incident follows a memo from Gov. Tony Evers’s Department of Administration, advising state employees they can avoid cooperating with federal agents by declining to answer questions or provide access to files or systems without legal counsel, even when presented with a warrant, according to the local news outlet.

Dugan's arrest follows the arrest of a former New Mexico judge, who is accused of having an alleged Tren de Aragua gang member as a tenant.

Former Doña Ana County Magistrate Joel Cano and his wife, Nancy Cano, were arrested this week at their North Reymond Street home.

The arrests stem from the couple’s ties to Cristhian Ortega-Lopez, an alleged member of the notorious Tren de Aragua gang. As reported by NewsNation affiliate KTSM, Cano rented out a casita on his property to Ortega-Lopez at his wife’s urging last year after she hired the suspect for household chores, the criminal complaint reads.

Two judges down in the past 24 hours.

— Benny Johnson (@bennyjohnson) April 25, 2025

Keep it coming.

This is what I voted for. pic.twitter.com/59EO2LYG8V* * *

Psst! - click here for a sneak peek at new offerings at ZeroHedge Store...

-

Site: LifeNews

Tennessee Gov. Bill Lee has signed a pro-life bill protecting the conscience rights of medical professionals like doctors and nurse who don’t want to be forced to participate in abortions.

The bill creates conscience protections for doctors who are morally opposed to certain medical practices, including abortion.

While Tennessee is one of a couple dozen states with abortion bans that protect the lives of unborn children, abortions can still be done in very limited situations. Also, if the law is ever overturned, pro-life doctors and nurses want to be sure their conscience rights are protected to excuse themselves from abortions that will kill unborn babies.

Follow LifeNews on the MeWe social media network for the latest pro-life news free from Facebook’s censorship!

The bill also applies to other medical situations where pro-life medical workers could be required to participate in something like IVF, surrogacy, assisted suicide or euthanasia or other procedures that violate their pro-life consciences.

Alliance Defending Freedom Senior Counsel Greg Chafuen hailed the governor’s signature on the Medical Ethics Defense Act, SB 955.

“Patients are best served by health care professionals who are free to act consistent with their oath to ‘do no harm.’ Unfortunately, doctors and nurses have been targeted for caring for their patients by refraining from harmful and dangerous procedures,” he told LifeNews. “This ends up discouraging countless young professionals from entering the health care field because of fear that they will be forced to violate their conscience.”

He continued: “Tennessee’s MED Act ensures that health care professionals are not forced to participate in procedures that violate their ethical, moral, or religious beliefs. ADF commends Sen. Pro Tempore Ferrell Haile, Rep. Bryan Terry, and the Tennessee Legislature for their fortitude, and we thank Gov. Lee for standing with health care professionals and the patients they serve by enacting the MED Act. We also thank Tennessee Right to Life for its monumental work on this effort. Now, Tennessee health care heroes are free to care for all patients in a compassionate, ethical manner.”

The post Tennessee Gov. Bill Lee Signs Bill Protecting Doctors From Being Forced to Do Abortions appeared first on LifeNews.com.

-

Site: Zero HedgeChina May Shift From US Treasuries Toward Crypto, Gold; BlackRock ExecTyler Durden Fri, 04/25/2025 - 10:25

Authored by Amin Haqshanas via CoinTelegraph.com,

Central banks, particularly China, may start to shift away from US Treasurys, exploring alternatives such as gold and Bitcoin, according to Jay Jacobs, BlackRock’s head of thematics and active ETFs.

In a recent interview with CNBC, Jacobs said that geopolitical tensions and rising global uncertainty are accelerating diversification strategies among central banks.

He pointed to a long-term trend where countries have been reducing their reliance on dollar-based reserves in favor of assets like gold and, increasingly, Bitcoin.

“This whole diversification away from traditional assets and into things like gold and also crypto [...] probably began three, four years ago,” Jacobs explained.

He said that recent geopolitical fragmentation has intensified the push toward alternative stores of value.

Jacobs referenced growing concerns about the freezing of $300 billion in Russian central bank assets following its invasion of Ukraine, suggesting that such events have prompted countries like China to rethink their reserve strategies.

BlackRock executive Jay Jacobs on CNBC. Source: YouTube

Geopolitical fragmentation to shape global markets

During the interview, Jacobs said BlackRock, the world’s largest asset manager, has identified geopolitical fragmentation as a defining force for global markets over the coming decades:

“We really identified geopolitical fragmentation as a mega force that is driving the world forward over the next several decades.”He noted that this environment is fueling demand for uncorrelated assets, with Bitcoin increasingly viewed alongside gold as a safe-haven asset.

“We’ve seen significant inflows into gold ETFs. We’ve seen significant inflows into Bitcoin. And this is all because people are looking for those assets that will behave differently,” Jacobs said.

Investors highlight Bitcoin decoupling

Notably, Jacobs is not alone in stressing Bitcoin’s declining correlation with US equities. Several analysts have also observed that Bitcoin is beginning to decouple from the US stock market.

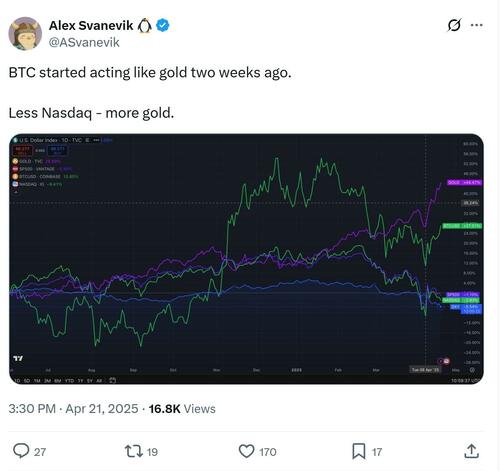

On April 22, Alex Svanevik, co-founder and CEO of the Nansen crypto intelligence platform, said Bitcoin’s price is showcasing its growing maturity as a global asset, becoming “less Nasdaq — more gold.”

He added that Bitcoin was “surprisingly resilient” amid the trade war compared to altcoins and indexes like the S&P 500, but remains vulnerable to economic recession concerns.

Source: Alex Svanevik

Echoing this sentiment, QCP Capital said in an April 21 Telegram note that Bitcoin seemed to be sharing some of gold’s limelight as a hedge against macroeconomic uncertainty.

“With equities finishing last week in the red and extending an April drawdown, the narrative of BTC as a safe haven or inflation hedge is once again gaining traction. Should this dynamic hold, it could provide a fresh tailwind for institutional BTC allocation,” it wrote.

-

Site: Zero HedgeWho Blinks First? China May Exempt Tariffs On US Ethane & Other GoodsTyler Durden Fri, 04/25/2025 - 10:20

By now it's become increasingly clear that both the U.S. and China are eager to de-escalate the trade war, yet neither is willing to make the first move. In China, export orders are drying up, and factories are shutting down. Meanwhile, across the Pacific Ocean in the U.S., containerized cargo volumes through the Port of Los Angeles are teetering on the edge of a very sharp decline, threatening to send shockwaves through Southern California's economy and beyond.

Early Friday, several media outlets reported that China's government has either considered or exempted some U.S. imports from a 125% tariff rate.

Let's begin with Bloomberg, which cited people familiar with the matter who said Beijing is considering removing tariffs on medical equipment and certain industrial chemicals, including ethane.

As we noted earlier this week, the U.S. is a major supplier of ethane—a petrochemical feedstock and component of natural gas. Ethane is a critical input for China's plastics industry, with few alternative suppliers outside the U.S. Needless to say, any disruption to ethane shipments would severely impact China's plastics sector.

Those sources continued down Beijing's laundry list of potential tariffs to be removed, including waiving the tariff for plane leases... Boeing has caught a sigh of relief.

"It's another step toward a de-escalation of the trade war," said Kok Hoong Wong of Maybank Securities, adding that a trade deal might not be imminent, but certainly, "it would appear the worst may truly be over."

Bloomberg Economics analysts Chang Shu and Eric Zhu commented on the BBG headline:

"Exempting critical, hard-to-replace U.S. products from tariffs would be a pragmatic approach that could ease tensions with the U.S. and serve the interests of Chinese industry. Anything that helps lower the temperature in the trade war is also beneficial from the perspective of avoiding broader clashes with the U.S."

In a separate report, Reuters stated that instead of merely considering exemptions, Beijing has already "exempted" certain U.S. imports from the 125% tariff, citing businesses that were notified by authorities about the change.

"As a quid-pro-quo move, it could provide a potential way to de-escalate tensions," said Alfredo Montufar-Helu, a senior adviser to the Conference Board's China Center.

Montufar-Helu warned: "It's clear that neither the U.S. nor China want to be the first in reaching out for a deal."

Earlier in the week, U.S. Treasury Secretary Scott Bessent warned a US-China trade deal could take 2 to 3 years to finalize.

Bessent emphasized at a closed-door investor meeting on Tuesday: "No one thinks the current status quo is sustainable, at 145% and 125%, so I would posit that over the very near future, there will be a de-escalation. We have an embargo now on both sides."

Both sides may want a deal to avoid further tariff fallout in their respective economies, but neither wants to appear desperate on the global stage. China is grappling with shuttered factories and possible ethane supply woes that threaten to roil its core manufacturing economy, while in the U.S., containerized volumes through the Port of Los Angeles are poised for a steep decline in the coming week

-

Site: Zero HedgeBrainwashed Democrats Continue To See Imminent Inflation-pocalypse; But UMich Sentiment Improved Intra-MonthTyler Durden Fri, 04/25/2025 - 10:17

Having been widely mocked - and quantitatvely denigrated by Goldman Sachs - this morning's final print for UMich consumer sentiment for April is now a must watch.

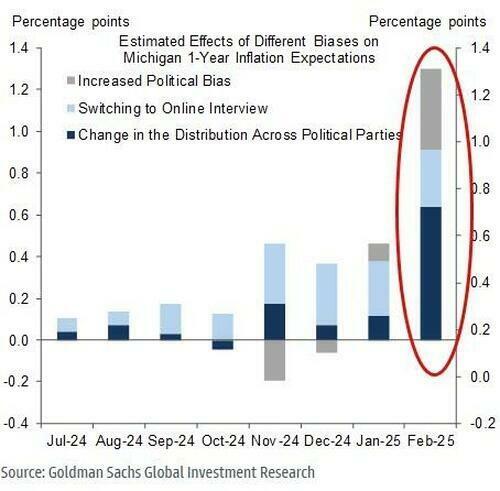

As a reminder, Goldman explained that the Michigan measure has been especially susceptible to the tariff news recently for three reasons.

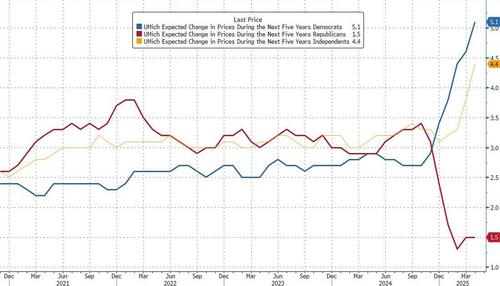

First, inflation expectations in the survey have become extremely partisan.

Second, the share of respondents in the Michigan survey who are Democrats has always been consistently higher than the share of respondents who are Republicans

Third, switching from a phone-based to an online-based data collection process has led to more extreme answers on inflation expectations.

These three issues together have boosted short-term inflation expectations in the Michigan survey by about 1.3pp and long-term inflation expectations by 0.5pp since 2024Q4. In particular, the change in distribution across political parties and increased partisanship together generated an outsized 1.0pp boost to the 1-year inflation expectation in February.

So, with all that in mind, let's see what the final data looks like - did it get even crazier?

The short answer is - YES!

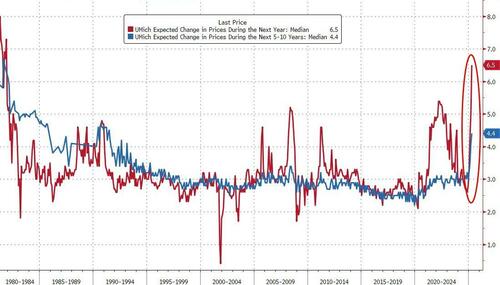

UMich 1Yr inflation expectations rose to 6.5% (slightly lower than the 6.8% expected but still the highest since Nov 1981) while the 5-10Y expectations jumped to 4.4% - the highest since June 1991...

Source: Bloomberg

The gaping chasm of propaganda-driven fear is evident below the surface with Republicans expected 0.4% inflation while Democrats expect - wait for it - 8.0% price rises in the next year (Independents also saw inflation expectations rising)...

Source: Bloomberg

Source: Bloomberg

Bear in mind that Democrat's 1Yr inflation expectations are now more than 2 times higher than they were in June 2021 when inflation would actually rise to 9%. Back then the Democrats were only off by a factor of 3x.

The final April sentiment index declined to 52.2 from 57 a month earlier, but this was considerably better than the 50.8 preliminary number and the median estimate of 50.5 in a Bloomberg survey of economists.

"While this month’s deterioration was particularly strong for middle-income families, expectations worsened for vast swaths of the population across age, education, income, and political affiliation," Joanne Hsu, director of the survey, said in a statement.

“ Consumers perceived risks to multiple aspects of the economy, in large part due to ongoing uncertainty around trade policy and the potential for a resurgence of inflation looming ahead."

The survey showed the expectations index plunged 11.4 points, the sharpest drop since 2021, to 52.6 this month. The current conditions gauge decreased to a six-month low of 63.8.

Source: Bloomberg

After five straight months of disappointments, April saw the biggest beat for headline UMich sentiment since June 2024...

Source: Bloomberg

“ Labor market expectations remained bleak,’’ Joanne Hsu, director of the survey, said in a statement.

“ Even more concerning for the path of the economy, consumers anticipated weaker income growth for themselves in the year ahead. Without reliably strong incomes, spending is unlikely to remain strong amid the numerous warnings signs perceived by consumers.”

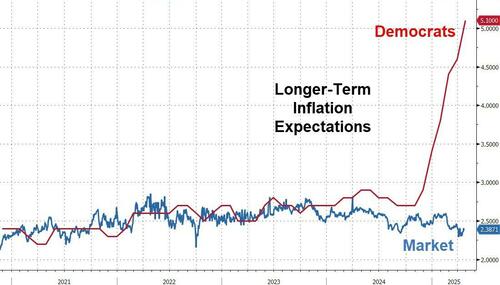

Compare UMich's survey for the longer-term inflation expectations, according to Democrats, to what the market is pricing in...

Source: Bloomberg

Is it really any surprise that even Fed Chair Jay Powell dismisses this survey's farcical numbers as a partisan outlier.

-

Site: Mises InstituteWhile focusing on the Holocaust, people often forget the economic fallacies of the Third Reich. Hitler‘s policies were based upon socialism and state control, a no regime can prosper under those condition.

-

Site: OnePeterFive

De mortuis nil nisi bonum dicendum est. This Latin phrase means “Of the dead nothing but good should be said.” Its origins, however, are not Latin, but Greek. It is attributed to Chilon of Sparta, whose Greek original is τὸν τεθνηκóτα μὴ κακολογεῖν. This is slightly different than the Latin translation, as the Greek says “let evil words not be spoken against the dead man.” The verb here is…

-

Site: Steyn OnlineProgramming note: Join me tonight for a rather different installment of Tales for Our Time, and then tomorrow, Saturday, for the latest episode of our Serenade Radio weekend music show, On the Town. The latter starts at 5pm British Summer Time - which

-

Site: Steyn OnlineEver since we launched Tales for Our Time almost eight years ago, I have had a persistent ripple of emails from listeners demanding that I set aside our audio fiction and do more audio non-fiction. Except for a few highly specific works, I can't say it

-

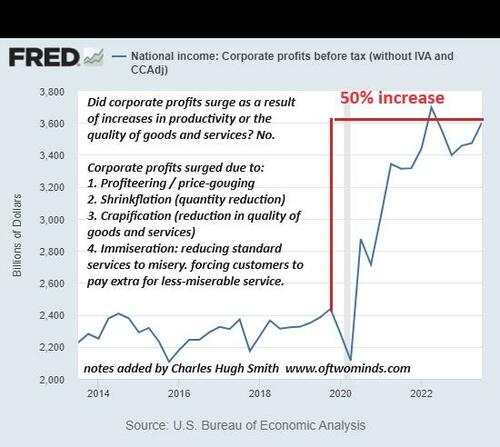

Site: Mises InstituteTrump has tried to claim that he favors "Main Street over Wall Street." Unfortunately, by pushing aggressive low-interest-rate monetary policy, Trump has put himself squarely in the camp of “Wall Street over Main Street.”

-

Site: LifeNews

Colorado Governor Jared Polis has signed a bill forcing Colorado taxpayers to fund abortions.

Polis signed SB25-183, a recently approved state measure that would allocate a minimum of $1.5 million per year of taxpayer funds to cover elective abortions. With Colorado having abortions up to birth, that means taxpayers will be on the hook for paying for killing viable babies who could easily live outside the womb.

And with the $1.5 million figure a minimum, Colorado residents may be forced to pay even more to kill thousands of babies.

“One thing pro-life and pro-choice people agree on nationwide is that they don’t want to pay for other people’s abortions, and yet Colorado is asking its citizens to do just that,” said Priests for Life National Director Frank Pavone to LifeNews this morning condemning Polis’ signature.

Please follow LifeNews on Rumble for the latest pro-life videos.

Pavone noted, as have other pro-life advocates, that the amendment Colorado voters passed to make killing babies in abortions a state constitutional right made it clear that state residents would not have to fund abortions.

While 62 percent of Coloradans voted for Amendment 79 in November, removing the prohibition on public funding for abortion, the electorate was informed by the legislative blue book and media that Amendment 79 would not cost the state money. Four months later, the state legislature introduced SB 183 with a 1.5-million-dollar fiscal note in a year when Colorado is in a 1-billion-dollar deficit.

“This is part two of last November’s vote on Amendment 79,” Pavone said. “That misguided and destructive measure creates the fiction that somehow there is virtue enforcing people to pay for child-killing.”

“A Colorado lawmaker recently touted the cost-saving benefits in ‘averted births,’ but abortion averts birth by killing children. These advocates might want to point that out. Polis has just signed a death warrant for his own constituents,” he added.

As the Catholic bishops of Colorado noted:

Recent data show a conservative cost estimate of state-funded abortion is actually more than $2 million per year. In an abhorrent effort to offset the costs, the legislative fiscal note stated that the state will save money because more babies will be aborted, and the cost of abortion is cheaper than the cost of labor and delivery. Such a statement is an egregious reflection of the inhumane mentality behind the bill.

Furthermore, the fiscal note drastically underestimates the cost of abortion, calculating the average abortion at $1,300, which is the average cost of first-trimester abortions only.[2] According to the Colorado Department of Health, abortions after 21 weeks’ gestation make up 3.4% of all abortions in Colorado (the national average is 1 percent). In 2024, 1.1% of Colorado abortions were in the third trimester. Second and third-trimester abortions can cost between $3,000 – $30,000. The fiscal note also does not consider the cost of abortion travel of women outside of Colorado for abortion, which has gone up substantially in the last three years.

This legislation was introduced weeks after several botched abortions by unregulated abortion clinics were reported in Colorado — one of which resulted in the loss of life of an 18-year-old Fort Collins young woman. The value of the lives of preborn babies and their mothers is incalculable, and the impact on our state will be catastrophic.

Every human life, from conception to natural death, is a sacred gift from God. No act of law can change this truth, nor can it erase our moral obligation to defend the most vulnerable among us.

The allocation of millions of dollars in taxpayer funds to subsidize the deliberate ending of innocent life is a tragedy for Colorado. Rather than using state resources to support life-affirming alternatives — such as comprehensive prenatal care, adoption services and resources for women facing unexpected pregnancies — this bill instead prioritizes public funding of abortion at the expense of the lives of preborn children, the health of their mothers and the conscience rights of millions of Colorado taxpayers who morally object to abortion.

Despite the current law in Colorado, the Catholic bishops of Colorado and the three dioceses are committed to doing our part to help pregnant mothers who are considering abortion through the ongoing expansion of medical services, housing, counseling and resources, both during their pregnancy and after.

The post Colorado Governor Jared Polis Signs Bill Forcing Taxpayers to Fund Abortions appeared first on LifeNews.com.

-

Site: Zero HedgeBitcoin Extends Gains As Fed Pulls Biden-Era Guidance On Bank's Crypto DealingsTyler Durden Fri, 04/25/2025 - 09:25

The Federal Reserve Board on Thursday announced the withdrawal of guidance for banks related to their crypto-asset and dollar token activities and related changes to its expectations for these activities.

These actions ensure the Board's expectations remain aligned with evolving risks and further support innovation in the banking system.

Bitcoin prices extended gains above $95,000...

Amid a sudden resurgence in net inflows into BTC ETFs...

The Board is rescinding its 2022 supervisory letter establishing an expectation that state member banks provide advance notification of planned or current crypto-asset activities.

As a result, the Board will no longer expect banks to provide notification and will instead monitor banks' crypto-asset activities through the normal supervisory process.

The Board is also rescinding its 2023 supervisory letter regarding the supervisory nonobjection process for state member bank engagement in dollar token activities.

Finally, the Board, together with the Federal Deposit Insurance Corporation is joining the Office of the Comptroller of the Currency in withdrawing from two 2023 statements jointly issued by the federal bank regulatory agencies regarding banks' crypto-asset activities and exposures.

The Board will work with the agencies to consider whether additional guidance to support innovation, including crypto-asset activities, is appropriate.

Additionally, CoinTelegraph reports that Bitcoin is flashing multiple technical and onchain signals suggesting that a rally to $100,000 is possible by May.

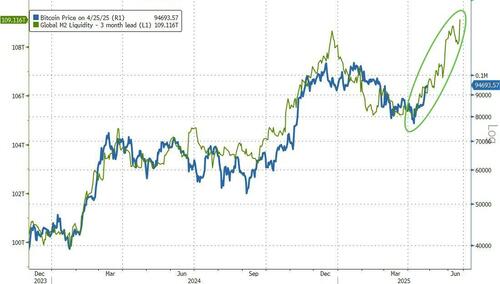

And as we have noted recently, bitcoin continues to track lagged global liquidity almost perfectly...

Combined with bullish chart structures and concentrated short liquidity overhead, BTC remains positioned for a potential move toward $100,000 by May.

-

Site: The Orthosphere

“We may be in the universe as dogs and cats are in our libraries, seeing the books and hearing the conversation, but having no inkling that there is any meaning in it all.”

William James, “Pluralism and Religion,” The Hibbert Journal (1908)*

Speaking as one dog to another, I am inclined to believe that James’ supposition is correct. I would only add that the library is well supplied with superior dogs (and cats) who say they have read the books and understood the conversations, and that only very stupid (or wicked) dogs (and cats) find it hard to believe them.

*) William James, “Pluralism and Religion,” The Hibbert Journal, 6.4 (July 1908), pp. 721-728 , quote p. 724. This was later published in The Pluralistic Universe (London: Longmans, Greens, and Co., 1909), p. 309.

-

Site: LES FEMMES - THE TRUTH

-

Site: LifeNews

On Monday Governor Sanders signed a good law to help teach public school students about unborn children.

S.B. 450 by Sen. Breanne Davis (R — Russellville) and Rep. Kendra Moore (R — Lincoln) lets public school students see a recording of a high-definition ultrasound video as part of human fetal growth and development education courses.

The law also makes it possible for students to learn important facts about how unborn children develop in the womb.

LifeNews is on TruthSocial. Please follow us here.

Similar legislation has passed in North Dakota, Tennessee, Idaho, and Kansas.

With the governor’s signature, S.B. 450 is now Act 915 of 2025. Act 915 received overwhelming support in the Arkansas Senate and House of Representatives, and we want to recognize the legislature for supporting this good law and Governor Sanders for signing it on Monday.

Very few medical advancements have done more to change hearts and minds on abortion than ultrasound technology. In fact, research has shown that some women are less likely to have an abortion if they see an ultrasound image of their unborn child. Act 915 will help students understand that unborn children are human beings.

LifeNews Note: Jerry Cox is the president of the Arkansas Family Council.

The post Arkansas Governor Sarah Huckabee Sanders Signs Law to Teach Kids Fetal Development appeared first on LifeNews.com.

-

Site: Mises InstituteAs Trump challenges Powell and the Fed’s authority, Dr. Joe Salerno joins Bob to dive into whether "central bank independence" really protects the economy—or just shields elite power.

-

Site: Rorate CaeliCardinal Müller granted the following interview to Iacopo Scaramuzzi, for Italian daily Repubblica, and published yesterday:Iacopo ScaramuzziRepubblicaRome, April 24, 2025“The future pope is not a successor of his predecessor but a successor of Peter": thus German Cardinal Gerhard Ludwig Müller, a member of the conservative wing of the College of Cardinals.Your Eminence what are your New Catholichttp://www.blogger.com/profile/04118576661605931910noreply@blogger.com

-

Site: AsiaNews.itTension remains high between Delhi and Islamabad after the attack in Kashmir that left 26 dead. Airspace closed, agreement on rivers revoked, Hindu nationalists press for armed retaliation. The vice-president of the Bishops' Conference: 'May our efforts for peace continue.'

-

Site: Zero HedgeFutures Slide After Trump Interview Reverses Boost From China Tariff Cut ReportsTyler Durden Fri, 04/25/2025 - 08:29

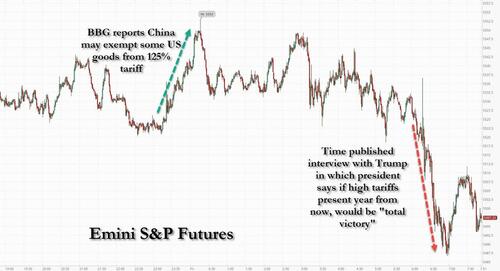

US equity futures are mixed after three days of gain, with tech leading, highlighted by GOOG (+5.6% amid strong earnings results last night), META (+3.5%), and TSLA (+1.6%). S&P futures first rose to session highs during the Asian session, when sentiment was first buoyed by dovish remarks from Fed officials Christopher Waller and Beth Hammack, which bolstered expectations for a potential interest-rate cut as soon as June; but the session highlight was a Bloomberg report that China was considering suspending its 125% tariff on some US imports including plane leases, indicating a shift in the game theoretical "game of chicken" balance and suggesting a deal may come sooner than expected as pain levels are rising for Beijing. Later, foreign ministry spokesman Guo Jiakun reiterated that China is not in talks with the US over tariffs, contradicting Trump and underscoring the complexities for investors tracking headlines out of Washington and Beijing. Futures then slumped to session lows just after 6am ET after Time published an interview with Trump (which took place on April 22) in which the president said China's President Xi has called him (something China denies), said he would not call XI himself, and when asked if high tariffs are still present a year from now, Trump said that would be a "total victory" adding that he expects trade deals in the next 3-4 weeks. In other words, if China may have been offering an olive branch before the interview, those hopes were dashed after its publication and S&P futures reflected that, sliding to session lows down about 0.4% after earlier they rose by the same amouint.

The dollar strengthened, while the yen and Swiss franc retreated as investor demand for non-US haven assets waned. Gold slid 1.5%. Treasuries extended their gains from Thursday; Bond yields dropped (2-, 5-, 10-yr yields are 0.8bp, -0.2bp, -1.6bp lower). Commodities were mixed with Base Metals higher and Precious Metals lower. The US session includes revised April University of Michigan sentiment gauges, and Fed’s external communications blackout ahead of the May FOMC meeting starts Saturday.

In premarket trading, Alphabet shares jumped as much as 5% after posting first-quarter revenue and profit that exceeded analysts’ expectations, buoyed by continued strength in its search advertising business. Alphabet was the top gainer in the Magnificent Seven stocks (Alphabet +4.9%, Meta +3.2%, Amazon +0.5%, Tesla +0.9%, Nvidia +0.4%, Microsoft -0.2%, Apple -0.8%; Alphabet rises 4.9%). Intel tumbled 7% as CEO Lip-Bu Tan gave investors a stark diagnosis of the chipmaker’s problems, along with the sense that it will take a while to fix them. Gilead drops 3.9% after the biopharmaceutical company posted 1Q revenue that fell short of estimates as sales of Trodelvy and Veklury disappointed. Here are some other notable premarket movers:

- Eastman Chemical Co. (EMN) falls 2.3% after the chemicals and plastics maker provided a disappointing second-quarter profit forecast, citing factors including tariffs between the US and China.

- Hasbro rises 1.0% as Citi upgrades to buy, citing underlying momentum of the toymaker’s business.

- Ironwood Pharmaceuticals climbs 9.3% after the company reaffirmed its revenue forecast for the full year.

- Sphere Entertainment rises 13% after its wholly-owned unit MSG Networks reached a deal to restructure the debt of its subsidiaries and amend the media rights agreements with the New York Knicks and the New York Rangers.

- T-Mobile falls 5.7% after the company reported fewer new wireless phone subscribers than analysts expected in the first quarter.

- Skechers USA slides 6.9% after the footwear company said it’s not providing financial guidance and withdrawing its previous annual outlook due to macroeconomic uncertainty.

On the trade front, Bloomberg News reported that China is considering suspending its 125% tariff on some US imports. Later, Foreign Ministry spokesman Guo Jiakun reiterated that China isn’t in talks with the US over tariffs, contradicting President Donald Trump and underscoring the complexities for investors tracking headlines out of Washington and Beijing.

“We are currently in tariff purgatory,” said Joachim Klement, strategist at Panmure Liberum. “There is no fundamental change to the outlook, so markets latch on to noise and get constantly whipsawed by the ever-changing utterances of Donald Trump and his cabinet.”

Confirming that, in an interview Time published with Trump just after 6am ET, and which took place on April 22, Trump said China's President Xi has called him even though China has denied this; when asked if high tariffs are still present a

year from now, Trump said that would be a "total victory."- In the interview, Trump said tariffs are still necessary.

- "If we still have high tariffs, whether it’s 20% or 30% or 50%, on foreign imports a year from now, will you consider that a victory?", he responded, "Total victory"

- When asked if he would call Xi (if Xi did not call him), Trump replied "No".

- US Treasury Secretary Bessent and Secretary of Commerce Lutnick "did not tell me" to do a 90-day pause.

- ”1 certainly don’t mind having a tax increase" on millionaires

- Being serious when talking about acquiring the Panama canal, Greenland, and making Canada the 51st state

- Trade deals expected in the next 3-4 weeks

More recently, on Thursday, Trump said his administration was talking with China, even as Beijing denied the existence of negotiations and demanded the US revoke all unilateral tariffs. Meanwhile, the US and South Korea could reach an “agreement of understanding” on trade as soon as next week, said Treasury Secretary Scott Bessent.

Traders also took some early comfort from hopes that the Fed may reduce interest rates earlier than expected. Markets currently favor a quarter-point cut in June and a total of three such reductions by year-end. Fed Governor Christopher Waller said he’d support rate cuts in the event aggressive tariffs under President Trump’s trade policies hurt the jobs market, speaking on Bloomberg Television. Cleveland Fed President Beth Hammack told CNBC the central bank could move on rates as early as June if it has clear evidence of the economy’s direction.

While the dollar was on course for its first weekly gain in a month, Bank of America strategists said investors should sell into rallies in US stocks and the greenback, cautioning that the conditions for sustained gains are missing. The dollar is in the midst of a longer term depreciation while the shift away from US assets has further to go, according to the BofA team led by Michael Hartnett. The trend would continue until the Fed starts cutting rates, the US reaches a trade deal with China and consumer spending stays resilient. The depreciation of the dollar is the “cleanest investment theme to play,” according to Hartnett.

The Stoxx 600 rises 0.3%, on track for a fourth day of gains as worries about trade tensions between China and the US subsided, with most significant moves triggered by a continued deluge of earnings, including from Saab and Safran. Alten and Hemnet are among the biggest laggers. Here are the biggest movers Friday:

- IMCD shares rise as much as 8.5% after the chemicals maker’s earnings met expectations, which analysts said was a relief given yesterday’s plunge on the shock news its CEO was leaving

- Saab shares gain as much as 4.3%, reversing earlier declines of 5.2%. The Swedish defense firm’s 1Q earnings beat expectations, though their order intake missed

- Safran shares rise as much as 4.8% after the French aerospace and defense firm reported adjusted revenue for the first quarter that beat the average analyst estimate

- Yara shares rise as much as 5.7% after the Norwegian agricultural chemicals firm reported adjusted Ebitda for the first quarter that beat the average analyst estimate

- Accor shares rise as much as 5.6% to the highest level this month. Analysts say the French hotel operator’s results are favorable, noting positive demand commentary and expectations for net unit growth throughout the year

- Saint-Gobain rises as much as 4.3% after the construction materials producer’s 1Q. Analysts are generally positive on the results, with Morgan Stanley praising the firm’s consistent delivery

- Alten shares slide as much as 12% after the French IT firm reported a 5.5% drop in organic sales in 1Q, warning that some of its major clients are freezing or postponing projects due to tariff uncertainties

- Hemnet shares drop as much as 11%, their worst drop since October, after the Swedish property platform missed expectations in the first quarter, giving up gains leading into the results

- Kemira shares fall as much as 15%, the steepest drop in almost 14 years, after the Finnish chemicals company warned over the impact on end-markets of increased economic uncertainty

- Mobico Group shares plunge as much as 11% after the company announced it is selling its school bus business in North America. Analysts said the price tag is disappointing

Asian equities also advanced after a Bloomberg report said Beijing is weighing a suspension of its 125% tariff on some US imports, though the Chinese Foreign Ministry spokesman Guo Jiakun later denied that they’re in talks with the US.

Earlier in the session, Asian stocks gained as signs of progress in trade negotiations boosted sentiment, with a major regional benchmark erasing all losses driven by Trump’s April 2 Liberation Day announcement of reciprocal tariffs. The MSCI Asia Pacific Index rose 0.9%, with TSMC and Tencent among the biggest contributors. Benchmarks in Taiwan, Hong Kong, Japan and South Korea all advanced. The key MSCI Asian index joins benchmarks in India, Korea, Australia and Indonesia in recouping losses from this month’s tariff selloff. The regional gauge is on track to cap its second-straight week of gains. Meanwhile, stocks and bonds tumbled in India, as traders braced for a potential worsening of the geopolitical situation with neighboring Pakistan. Indian shares were the worst performers in Asia on Friday, while the rupee and the nation’s bonds also slid, indicating growing angst among traders over any further ramping up of tensions between the two nuclear-armed nations. Markets are closed in Australia and New Zealand for holidays Friday. Key events to watch next week include rate decisions in Japan and Thailand as well as China PMI data.

In FX, the Bloomberg Dollar Spot Index rose as much as 0.4% and is set to notch its first weekly gain in a month. The greenback gained versus all G-10 currencies; The Japanese yen is among the weakest of the G-10 currencies, falling 0.5% against the greenback; USD/JPY rises 0.8% to 143.85.

In rates, Treasury futures rose to session highs in early US trading, with yields 1bp-4bp richer across a flatter curve, outperforming European bonds after stronger-than-expected UK retail sales data. The 10-year yield near 4.29% was ~3bp richer on the day, outperforming German counterpart by 5bp, UK by 2bp. Among US yield-curve spreads, 2s10s and 5s30s are 1bp-2bp flatter. Shorter-dated maturities also underperform in Germany where two-year borrowing costs rise 4 bps.

In commodities, WTI falls 0.5% to $62.50 a barrel. Bitcoin rises 2% to just shy of $95,000. Haven assets underpeform, with gold falling nearly $50 to below $3,300/oz.

Looking at today's calendar, the US session includes revised April University of Michigan sentiment gauges, and Fed’s external communications blackout ahead of the May FOMC meeting starts Saturday.

Market Snapshot

- S&P 500 mini -0.2%

- Nasdaq 100 mini -0.3%

- Russell 2000 mini -0.5%

- Stoxx Europe 600 +0.1%

- DAX +0.4%

- CAC 40 +0.7%

- 10-year Treasury yield -3 basis points at 4.28%

- VIX +0.4 points at 27

- Bloomberg Dollar Index +0.3% at 1227.23,

- euro -0.3% at $1.1353

- WTI crude -0.3% at $62.6/barrel

Top Overnight News

- China has exempted some U.S. imports from its 125% tariffs and is asking firms to identify critical goods they need levy-free, according to businesses notified, in the clearest sign yet of Beijing's concerns about the trade war's economic fallout. RTRS

- Apple plans to import most of the iPhones it sells in the US from India by the end of next year, accelerating a shift beyond China, people familiar said. The goal will require Apple to double its India capacity. BBG

- President Trump signed an executive order boosting the deep-sea mining industry, while the order instructs the Commerce Secretary to expedite permits under the Deep Seabed Hard Mineral Resource Act, as well as instructs the Commerce and Interior Departments to issue a report on opportunities for seabed mineral exploration on the US outer continental shelf.

- China aims to implement more growth-supporting measures amid rising challenges from hefty U.S. tariffs. The government will seek to coordinate policy measures to support domestic economic aims amid external economic and trade struggles. the government intends to cut interest rates and the amount of cash banks are required to set aside at the central bank, while making full and effective use of existing fiscal and monetary policies, the Politburo said. WSJ

- Bessent says South Korea trade negotiations are moving along at a faster pace than anticipated. Nikkei