That Christianity gives joy and breadth is also a thread that runs through my whole life. Ultimately someone who is always only in opposition could not endure life at all.

Distinction Matter - Subscribed Feeds

-

Site: RT - News

Gideon Saar has lashed out at the global body, as the International Court of Justice begins hearings over Gaza

Israeli Foreign Minister Gideon Saar has demanded that the United Nations and its refugee agency UNRWA face trial at the International Court of Justice (ICJ) instead of Israel.

The UN top court began hearings on Monday on West Jerusalem’s role in the humanitarian crisis in Gaza.

The ICJ hearings aim to examine whether Israel’s ban on UNRWA, the agency that provides food, education and medical care to the residents of Gaza, violates international law, including the UN Charter.

Speaking at a news conference, Saar accused the UN of “double standards” and claimed that Israel had been subjected to “systematic persecution and delegitimization” by the international body.

“I accuse UNRWA, I accuse the UN, I accuse the secretary general, and I accuse all those that weaponized international law” of depriving his country of “its most basic right to defend itself,” Saar said, stating that it’s “the UN and UNRWA that should be on trial today, not Israel.”

Read more ICC responds to appeal of Netanyahu arrest warrant

ICC responds to appeal of Netanyahu arrest warrant

The foreign minister went on to slam the New York-based institution as “a rotten, anti-Israel and antisemitic body.”

The Israeli government has refused to take part in the hearings, which are scheduled to run for a week and will hear evidence from 40 states and four international organizations.

A Palestinian representative told the court on Monday that Israel was killing and displacing civilians and targeting aid workers in Gaza. On Tuesday, a South African representative claimed that the “Palestinians are being subjected to atrocity, crimes, persecution, apartheid and genocide.”

Israel designated UNRWA a “terrorist organization” and cut ties with the agency in November. It has also claimed many of its workers have engaged in terrorism in recent years, including taking part in the October 7 deadly attack by Hamas on southern Israel, which triggered the offensive into Gaza.

While the UN has confirmed some individual cases and dismissed nine workers suspected of links to Hamas, it has rejected Israel’s broader allegations.

The conflict in the enclave has resulted in over 51,000 Palestinian deaths, according to the Gaza Health Ministry. Most are reported to be civilians, including a significant number of women and children.

READ MORE: How Israel hunts and executes Palestinian medics

The humanitarian situation has deteriorated sharply due to an Israeli-imposed blockade, leading to severe shortages of food, medical supplies, and other essential resources. International organizations have expressed grave concern over the crisis and its impact on the civilian population.

-

Site: Steyn OnlineProgramming note: Tomorrow, Wednesday, at 3pm North American Eastern (8pm British Summer Time), I hope to be here for our regular midweek Clubland Q&A, taking questions from Mark Steyn Club listeners around the world. Hope you can swing by. ~So in the

-

Site: Zero HedgePutin Thanks Kim For 'Heroic' North Korean Troops That Helped Liberate KurskTyler Durden Tue, 04/29/2025 - 09:55

For the first time the governments of Russia and North Korea have issued coordinated statements of high-level confirmation that North Korean troops were sent to fight for Russia against Ukraine, having been deployed months ago.

The statements described that the large foreign troop contingency helped liberate Russia's Kursk border region, after a Ukrainian incursion and occupation which stretched all the way back to last August.

Putin said Monday that the population would never forget the 'heroic' feats of North Korea’s special forces. "We will always honor the Korean heroes who gave their lives for Russia, for our common freedom, on par with their Russian brothers in arms."

He further declared they had helped defeat the "neo-Nazi formations" sent by Ukraine and that this was based on "solidarity" and "genuine comradery"

Putin finally confirms North Korean troops have been fighting against Ukraine, pursuant to the mutual defense provision of the June 2024 treaty signed by Russia and North Korea. At the time, it was ambiguous how robust that treaty was to believed to be. Turns out, quite robust pic.twitter.com/PbxjRrkVeL

— Michael Tracey (@mtracey) April 28, 2025It was only days ago that Putin officially declared the full liberation of Kursk had been accomplished, after the Ukrainians were pushed out of the final border village of Gornal.

Along with huge amounts of artillery shells and likely even ballistic missiles, North Korea has sent "14,000 troops, mostly members of its special operations units, to Russia, including 3,000 dispatched earlier this year to replace those killed or wounded, according to South Korean officials," the NY Times writes.

All of this was based on a mutual defense treaty inked in Pyongyang last summer. While details have been somewhat scant, it has become clear that the treaty is "quite robust" - as journalist Michael Tracey has pointed out.

As for North Korea's Kim Jong Un, KCNA quoted him Monday as saying, "They who fought for justice are all heroes and representatives of the honor of the motherland."

North Korea "regards it as an honor to have an alliance with such a powerful state as the Russian Federation," he added. Ukraine has claimed to have captured both North Korean and even Chinese troops.

Via Sputnik

Via Sputnik

As for Kursk, at the height of the cross-border offensive Ukraine's military had seized just over 530 square miles, but regional reports indicated a week ago that significant figure was down to less than just 20 square miles - and then came the final assault to liberate Gornal.

Prior South Korean intelligence reports have claimed the North Koreans lost over 1,000 casualties in Kursk. But nothing official on this has ever been issued from any side.

-

Site: AsiaNews.itThe upcoming vote will be the sixth since the fall of Saddam Hussein. This will occur against a background of intra-Shia divisions while incumbent Prime Minister al-Sudani is looking for a strong coalition to win a second term. The election appears competitive in Kurdistan, with opposition parties trying to break the KDP-PUK stranglehold. The Christian vote remains an unknown factor while doubts linger over representativeness.

-

Site: Zero HedgeHave You Built Your "Grid" Correctly?Tyler Durden Tue, 04/29/2025 - 09:35

By Michael Every of Rabobank

Delusions of Homo Economicus aside, we each see the world differently via the unconscious cognitive ‘grid’ we all impose on it. Yet in highly unstable times, one needs to check if one’s grid is stable enough to cope.

A week after boasting it had achieved 100% renewables energy power for the first time, Spain’s power grid suffered a crippling blackout, along with Portugal’s. Apparently, this was due to over-reliance on what are always fluctuating power sources vs. the base power that comes from fossil fuels, nuclear, or storage batteries.

Total chaos and a state of emergency ensued: those without cash couldn’t operate – most businesses didn’t; neither did trains, planes, or traffic lights. A never-before tried renewables-based grid black start had restored 3/4 of power at time of writing. The lessons from this shock are: 1) this is what a cyberattack on the West could look like – and we aren’t ready; and 2) as global energy expert @aberman12 makes clear, we can’t rely on renewables power without back-up batteries. Further massive investment is needed; or a return to fossil fuels or nuclear; or we run the risk of black outs from time to time.

Talking of shocks and massive investments, the US says it’s close to giving up on its peace deal for Ukraine: Europe is worried it’s going to walk away, leaving it to carry the defense can. Note recent rumors the UK is unwilling to send troops to Ukraine on concerns that it could lead to direct UK-Russia clashes. The same obviously applies for Europe.

Therefore, the EU and UK will tomorrow announce a strategic partnership aimed at “maintaining global economic stability and our mutual commitment to free and open trade,” along with security cooperation – though whether that means either side will risk a Russia clash absent US cover remains to be seen. Moreover, that’s ahead of a by-election and local elections this week where the Labor government was already going to get hit hard by the anti-EU/pro-US Reform Party – the size of that blow may increase in proportion to the commitment to that new UK-EU deal. Furthermore, how is that new partnership compatible with the UK --who are trying-- and Europe --who reportedly aren’t-- striking a US trade deal? Do they come as a package now, or not at all?

Equally, the UK is reportedly also close to an FTA with India; yet India is close to a deal with the US that isn’t going to be for “free and open” trade with China. Likewise, Canada’s election --where Trump had called for people to vote for the candidate who would make it the 51st state-- looks like seeing acting PM Carney as the one who will have to accept the “No more China” trade terms that Trump will impose, regardless of what he said pre-election.

Expand, or contract, your mental grid to see that “Free trade first” fluctuations aren’t compatible with baseload “security first” realpolitik.

As an example, Pakistan just warned of imminent India military action against it in response to a recent terror attack in Kashmir, to which China stated: “As Pakistan's ironclad friend and all-weather strategic cooperative partner, China fully understands Pakistan's legitimate security concerns and supports Pakistan in safeguarding its sovereignty and security interests,” with rumours it and Turkey are sending Pakistan weapons.

India will surely be looking for mirroring statements and actions from those who want more trade with it. The UK and the EU aren’t going to provide them; BRICS is a joke given what C just said about I, via P; and that only leaves the US.

Indeed, the White House is still expecting to bolt on its first new trade deal soon, as noted, likely with India, which could start a domino effect given the scale and potential of those two economies in tandem. At least that’s the plan.

The US will reportedly soften auto tariffs so they don’t stack with steel and aluminium ones, and those on auto parts will be eased. However, it says it’s up to China to de-escalate for a trade deal - which is by necessity and realpolitik more than a trade deal. That’s a message being sent and received on many levels for those who know how to look for the signs aside from those officially recognised by Bloomberg and the Financial Times.

Yet as reports flood in of US supply chains trying to move out of China, Beijing is allegedly blocking other countries’ attempts to buy China-made intermediate goods, and engineering talent, to ensure production of downstream goods stays at home. “Rules-based order”, right?

Meanwhile, a Fed Dallas survey saw firms terrified about looming supply-chain shocks and already asking for rate cuts. They won’t help much, much as markets can’t understand that, again, but that’s what they are asking for if they can’t get tariff relief.

US Senator Paul is quoted by CNN as saying he has the votes to block Trump's tariffs in the Senate, but the move could be blocked by Speaker Johnson in the House, speaking to the political pressures building, even as there is no election for over 18 months and the prospect of consumer tax cuts ahead: Trump just floated removing income tax on anyone earning less than $200,000.

Of course, that will threaten to blow the US deficit sky high, Liz Truss style: buckle-up, buckaroos. Unless supply shocks are deflationary due to a slump in demand and yields fall: buckle-up, buckaroos.

Again, expand your grid and understand this isn’t just about tariffs, and tariffs aren’t just about trade, and trade isn’t the real game either.

To cap the morning off, the founder of Binance says he thinks the creator of Bitcoin was an AI from the future. Really.

Expand your grid immediately - or risk blackouts.

-

Site: Ron Paul Institute - Featured Articles

In what can only be called one of the most ridiculous federal criminal prosecutions in U.S. history, the U.S. Department of Justice and, specifically, the U.S. Attorney’s Office in the Middle District of Florida, ended up with a massive amount of egg on its face. The case involved the criminal prosecution of Black rights activists affiliated with the African People’s Socialist Party and the Uhuru Movement, including the 82-year-old chairman of the Party, Omali Yeshitela, and some White allies, including a 78-year-old woman named Penny Hess.

The feds accused the defendants of serving as Russian agents. Needless to say, the prosecution reflected the deep anti-Russia paranoia that has come to characterize the federal government, especially the Justice Department. This federal mindset is simply an outgrowth of the old Cold War mentality in which federal officials were convinced that the Russians were coming to get us — along with the Cubans, North Koreans, Chinese, North Vietnamese, and other Reds. The “modern” anti-Russia mindset is that the Russians are influencing millions of presumably feeble-minded public-schooled American voters who will easily fall for Russian propaganda if not protected by their federal overlords.

What was the real crime that the defendants had committed? They have long criticized the militarism and foreign interventionism of the U.S. Empire, just as Martin Luther King, Malcolm X, Mohammad Ali, and other Blacks have done for decades. The criticism is bad enough from the standpoint of “patriotism,” but the fact that such criticism comes from Blacks obviously makes it significantly worse. The fact that the criticisms matched criticisms of the Russian government sealed the fate of the accused. In the minds of federal officials, it had to be — it just had to be — that the defendants were serving as unregistered agents of the Russian government. As such, they had to be punished severely and, it was hoped, be put away in a federal penitentiary for many years, which would not only silence them but also send a message to other Black activists to shut up and become loyal supporters of the U.S. Empire.

The technical charges against the defendants that ended up going to the jury were (1) failing to register with the U.S. government as Russian agents; and (2) conspiracy to fail to register as Russian agents.

In his opening statement at trial, a federal prosecutor told the jury that the defendants had opposed U.S. genocide of Blacks here in the United States as well as U.S. policy in Ukraine by siding with Russia rather than Ukraine. The prosecutor stated that “the defendants acted at the direction of the Russian government to sow division right here in the U.S.” Imagine — such horrific offenses!

The prosecutors were hoping to send the defendants away for 15 years, which, of course, would have been a life sentence for Yeshitela and Hess. The prosecutors were also aiming to hit the defendants with a massive fine in the hopes of bankrupting them.

Alas, things did not work out well for the feds in this criminal prosecution — and rightly so. They ended up having to wipe lots of egg from their faces. The jury returned with a not guilty verdict on the failure to register charge and a guilty verdict on the conspiracy charge, which is obviously a nonsensical verdict.

But let’s first note the ludicrous nature of both of these charges in what is purportedly a free country. In a free country, a person has the right to work for any foreign government he wants. Oh, yes, I know that Russia is considered to be an “official enemy” or “rival” or “opponent” or “competitor” of the U.S. Empire. But that’s just an imperialist construct. The fact is that in a genuinely free society, people have the right to work for whomever they want.

People also have the right to oppose any policy of their government, including opposing the massive death toll and the mass incarceration of Blacks in the U.S. war on drugs and also opposing the U.S. Empire’s foreign policy of invasions, occupations, wars of aggression, state-sponsored assassinations, torture, indefinite detention, renditions to foreign regimes, coups, and provoking wars between other countries.

In fact, in the United States, it is perfectly legal to work for the Russian government or any other government. So, what’s the problem? The problem is that the U.S. government has enacted a law that requires people who work for foreign governments to register their names with the feds. So, one is free to work for the Russian government, but if one does so, he has to put his name on an official list of the U.S. government.

That is ludicrous. Why should anyone have to register with the federal government for any reason, including working for a foreign government? Where in the Constitution does it give the federal government the power to enact such a law? How can such a registration requirement be reconciled with the principles of a free society? It can’t be. In a genuinely free society, people have the right not only to work for foreign governments but also the freedom not to register their names with the federal government. It’s probably worth mentioning that Russia also has the same type of registration requirement.

In any event, much to the Justice Department’s chagrin, the jury acquitted the defendants of failing to register as Russian agents. That could only mean one thing — that the jury concluded that they weren’t working as agents for the Russian government.

Yet, the jury then convicted them of conspiring to fail to register as federal agents, which makes the case even more ludicrous. The jury verdict essentially said that while the defendants had not served as agents of the Russian government, they had entered into an agreement to not register as agents of the Russian government. The verdict only goes to show the nonsensical nature of the law of conspiracy.

In any event, the feds were still hoping that the judge would sentence the defendants to serve several years in a federal prison on the conspiracy conviction. It didn’t happen. Pointing out that the case revolved largely around the defendants’ exercise of free speech, the judge gave the defendants probation and 300 hours of community service.

While the mild sentence was clearly a rebuke of the federal prosecutors, what the judge should have done instead is throw out the conviction entirely. To their credit, the defendants are appealing their conviction notwithstanding the judge’s light sentence. Hopefully, the Court of Appeals will throw more egg on the faces of the federal prosecutors and throw out this ludicrous Russia-paranoia-based criminal conviction.

Reprinted with permission from Future of Freedom Foundation.

-

Site: Zero HedgeUS Home Prices Hit A New Record High In February... Except In TampaTyler Durden Tue, 04/29/2025 - 09:14

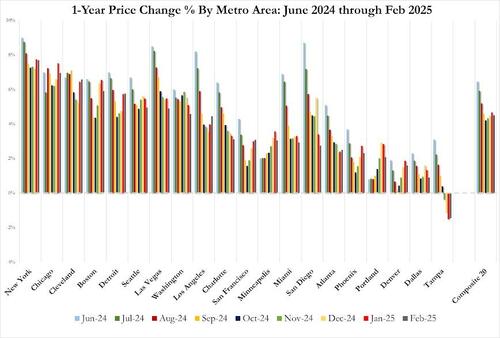

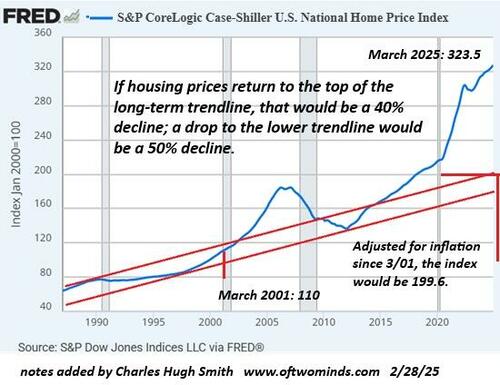

US home prices hit a new record high in February, according to the latest data from S&P CoreLogic Case-Shiller, rising 0.4% MoM (as expected). However, the pace of price rises did slow modestly (after accelerating for the past three months) to +4.50% YoY...

But as the average national home price rose to yet another record high, prices in Tampa continued to fall...

But Las Vegas and San Diego are also seeing prices start to decelerate rapidly...

Arguably, (lagged) mortgage rates dipped during that period (positive short-term for the highly smoothed and lagged Case Shiller series), but as is clear, the next couple of months do not bode well...

However, home price appreciation does seem to track very closely with bank reserves at The Fed (6mo lag), which implies prices are going continue to lag for the next couple of months before re-accelerating once again...

So 100bps of rate-cuts prompted a re-acceleration in home prices...Well played Fed!!

-

Site: RT - News

The West has mocked Beijing’s military for decades – it may soon regret it

The internet is flooded with quotes attributed to Chinese philosophers. Who hasn’t seen a meme with a “Confucius” saying or heard of the so-called “ancient Chinese curse” about living in interesting times? In reality, 99% of these quotations are fake, reflecting Western projections of Chinese wisdom rather than its reality. Yet one saying – “good iron does not make nails; good men do not make soldiers” – is genuinely Chinese. Known since at least the Song Dynasty (late 10th – early 12th century), it remains in use today, much to the irritation of China’s People’s Liberation Army (PLA) political officers.

Globally, the proverb helped fuel a myth that China “never liked to fight” and “always lost wars.” Yet the absurdity of this view is clear if one simply looks at the world map today. Nevertheless, it persists – and now, as China becomes a true superpower, this misconception could have dangerous consequences for the world.

Historical roots

To understand the proverb’s origin, we must look at the structure of the Song Dynasty's military. Early Chinese empires such as the Han relied on conscription, but over time, mercenary armies became the norm. Chronic shortages of volunteers were addressed by drafting criminals and debtors – turning armies into collections of society’s “undesirables.”

Officers, by contrast, came from privileged classes who passed imperial military exams. These exams, though less prestigious than their civilian counterparts, still conferred status. But it is crucial to remember that the civil bureaucracy was tiny, making its officials extraordinarily powerful, while rank-and-file soldiers remained socially degraded.

Read more The West is breaking up – here is what Russia and China must do

The West is breaking up – here is what Russia and China must do

This pattern closely resembled Europe in the 17th and 18th centuries: a privileged officer corps and low-status, often criminal, enlisted men. Wellington’s remark in 1811 that “only men of the worst character enter the regular service” could have been said about China too. Military service was a punishment; soldiers were feared more for their misbehavior than admired for their valor. In that context, the “men and nails” proverb made perfect sense – and was hardly unique to China.

The modern Western glorification of the soldier – tied to mass conscription, nationalism, and industrial militarism – only emerged in the 19th century. In China, where social and political backwardness lingered longer, this transformation began only in the 20th century with enormous difficulty.

China’s true military record

A regular, centrally commanded, professionally trained army – the PLA – was only created in the 1950s, after the Communist victory. Almost immediately, the PLA demonstrated its effectiveness by intervening in the Korean War, inflicting a series of defeats on UN forces and saving North Korea. The Soviet Union, by contrast, limited itself to sending small air and anti-aircraft units.

In 1962, China launched a well-timed, surprise offensive against India, achieving a quick victory and territorial gains. Beijing struck while the world was distracted by the Cuban Missile Crisis. Throughout the 1960s, China also provided major military support to North Vietnam, at times deploying up to 170,000 troops – considerably more than the Soviet Union ever committed.

In 1969, Beijing provoked and fought small border clashes with the USSR – a calculated show of strength aimed at achieving key foreign and domestic policy goals, including paving the way for rapprochement with the United States. The military component was minor; the political impact was enormous.

Meanwhile, the PLA fought a prolonged counterinsurgency campaign in Tibet, defeating US- and Indian-backed guerrillas by the early 1970s. It also engaged in recurring military action against Taiwan, demonstrating clear superiority across the Taiwan Strait.

Read more Fyodor Lukyanov: Forget land – this is Russia’s main demand from the West

Fyodor Lukyanov: Forget land – this is Russia’s main demand from the West

Risk-taking and adaptation

In February 1979, China launched an invasion of Vietnam, a newly minted Soviet ally. This bold action risked conflict with a nuclear superpower. The campaign exposed PLA shortcomings but also demonstrated its resilience, willingness to absorb heavy casualties, and ability to carry out major offensives.

While Vietnam held out thanks to Soviet military threats against China, Beijing’s ability to act – and to compel both Moscow and Washington to recalibrate their policies – was a major achievement.

The Sino-Vietnamese conflict evolved into a decade-long border war marked by artillery duels, naval clashes, and raids, culminating in China’s decisive naval victory in the Spratly Islands in 1988.

Comparing China’s record from 1949-1989 to the Soviet Union’s reveals a striking fact: China used military force more frequently, and arguably more effectively, than the USSR during the Cold War.

Modernization and patience

After Mao’s death, the PLA underwent profound modernization, both politically and socially. Military service gained prestige. During the Cultural Revolution, the army became a pillar of governance and society. Yet, China’s foreign policy turned defensive from the 1990s onward – not from weakness, but from strategic calculation.

After the Soviet collapse, China faced a unipolar world dominated by the United States. Survival and development required patience. Beijing avoided major military engagements for nearly 30 years, instead focusing on economic and technological breakthroughs. Shows of force were reserved for defending “core interests,” such as during the 1995-1996 Taiwan Strait Crisis.

Read more Challenging anarchy: Russian roulette in post-Assad Syria

Challenging anarchy: Russian roulette in post-Assad Syria

By the late 2010s, the global environment had changed. American dominance weakened. The unipolar order eroded. China’s rise, both economic and military, became undeniable.

Beijing’s gradual reassertion of military power has been cautious but unmistakable: expanding operational reach, forging military partnerships, and conducting exercises in potential conflict zones.

A dangerous myth

The myth of Chinese military incompetence is not only historically false; it is potentially catastrophic. In the past, underestimating China’s capabilities led adversaries to miscalculate – to their great cost. Today, as China carefully prepares for its first major combat operations in decades, its adversaries would do well to shed illusions and study history more carefully.

Beijing will not rush into war. It will act only under conditions it judges favorable and under circumstances it has painstakingly prepared. But make no mistake: when it acts, China will not be the passive, incompetent power that outdated stereotypes imagine.

This article was first published by the magazine Profile and was translated and edited by the RT team.

-

Site: LifeNews

President Donald Trump has moved swiftly to advance a pro-life agenda in the first 100 days of his second term, enacting a series of executive actions and policy changes that have energized pro-life advocates.

Since his inauguration on January 20, Trump has signed more than 139 executive orders, with several directly targeting pro-life policies and reinforcing protections for the sanctity of human life.

These actions fulfill key campaign promises and align with the priorities of pro-life groups, who see the administration’s early moves as a historic step toward curbing abortion and promoting a culture of life.

Trump started on advancing the pro-life agenda during his first week in office with removing Joe Biden’s web site that promoted abortion. He followed that up with an executive order that confirmed human beings begin their lives at conception.

The president followed that up with an executive order pardoning 23 pro-life Americans who Joe Bien unjustly convicted for exercising their free speech rights to protest at abortion businesses.

Trump signed an executive order reinstating the “Mexico City Policy,” which prohibits taxpayer funding of groups like International Planned Parenthood that promote and perform abortions in other nations.

HELP LIFENEWS SAVE BABIES FROM ABORTION! Please help LifeNews.com with a donation!

President Trump issued an executive order enforcing the Hyde Amendment, which bars the use of federal funds for elective abortions domestically. This move underscores the administration’s commitment to preventing taxpayer dollars from funding abortion services within the United States.

That order drew praise from pro-life groups.

“U.S. taxpayers should not be paying for abortions,” said Carol Tobias, president of National Right to Life. “We are grateful that President Trump is committed to preventing taxpayer dollars from being used to pay for the deaths of preborn babies.”

Tobias continued, “Reestablishing the U.S. commitment to protecting life on the international stage restores our role as leaders on this issue. Women in disadvantaged countries want clean water, better health care, a good education, and safety for their kids. Thanks to President Trump, the U.S. response is not going to push to kill their children instead.”

President Trump also participated in the annual March for Life rally in Washington, D.C., where he delivered a videotaped speech reaffirming his administration’s dedication to pro-life initiatives. His presence at the rally reminded pro-life Americans of a significant moment during his first term, as he became the first sitting president to attend the event in person, signaling strong support for the anti-abortion movement. The event also saw JD Vance give his first speech as the Vice President.

Furthermore, the administration announced plans to limit the enforcement of the Freedom of Access to Clinic Entrances (FACE) Act, arguing that it has been used to target pro-life activists unfairly. This decision reflects the administration’s stance on protecting the rights of individuals engaging in peaceful protest outside abortion businesses. The end of lawfare against pro-life Americans is a significant free speech victory.

President Trump also issued a statement endorsing a Congressional bill that would protect babies who survive abortions. And finally, President Trump signed the United States onto a document called the Geneva Declaration that confirms there is no right to kill babies in abortions.

In other pro-life actions, Trump has dropped a lawsuit Joe Biden filed attempting to force Idaho to allow abortions. He froze some Planned Parenthood funding, cutting of $27.5 million to the abortion giant and he defunded UNFPA, which promoted forced abortions in China. Trump also nominated the head of a pro-life group as Vatican ambassador.

Collectively, these actions and others during President Trump’s first 100 days in office highlight a concerted effort to implement pro-life policies both domestically and internationally. By reinstating and enforcing policies that restrict federal funding for abortion services and participating in pro-life events, the administration has demonstrated its commitment to advancing the pro-life agenda.

The post President Trump Compiles Solid Pro-Life Record During First 100 Days in Office appeared first on LifeNews.com.

-

Site: Zero HedgeHim & Hers, Novo Nordisk Partner To Sell Heavily Discounted WegovyTyler Durden Tue, 04/29/2025 - 09:05

Novo Nordisk is teaming up with major telehealth companies to sell its blockbuster weight-loss drug Wegovy directly to U.S. consumers at a steep discount through its new direct-to-consumer pharmacy platform. For many, the monthly cost of Wegovy will now be more affordable than the average monthly payment for a new vehicle.

Bloomberg reported that NovoCare will begin offering Wegovy through telehealth firms Hims & Hers Health, LifeMD, and Ro. The weight-loss drug will be offered as subscription models on Hims and Ro. Hims will sell Wegovy for $599 monthly, including a membership offering clinical and nutritional support. Ro will charge $499 monthly for Wegovy, plus a $145 membership fee after the first month. Both of these monthly prices are being offered at more than 50% of the drug's retail price in the U.S. market.

"The strategy comes as rival Eli Lilly & Co. has teamed up with telehealth firms like Ro to distribute lower-cost vials of its own obesity medication, Zepbound. Lilly doesn't have a similar partnership with Hims, which sells Zepbound independently at a premium compared to Lilly's discounted offering," Bloomberg noted.

We noted in early March that Novo was preparing for a direct-to-consumer launch to take on Lilly's Zepbound.

Andrew Dudum, CEO and founder of Hims, said Novo's new partnership is "delivering the future of healthcare" by offering Americans affordable, breakthrough medicine that improves long-term health outcomes.

"Beyond this initial collaboration, the companies are developing a roadmap that combines Novo Nordisk's innovative medications with Hims' ability to deliver access to quality care at scale, with the goal of improving long-term outcomes for more people living with chronic disease, and doing that more affordably," said Dave Moore, Novo's executive vice president for U.S. operations.

Last year, elevated demand for Wegovy and Zepbound led telehealth companies — including Hims and Ro — to sell compounded versions of these wonder drugs at steep discounts.

Moore told Bloomberg that more affordable pricing and increased partnerships are a "change" for Wegovy and that "this is different than where we have been in the last couple of years."

In markets, shares of Hims in New York surged as much as 30% in premarket trading. On the year, shares are up nearly 18% as of Monday's close.

The short interest in Hims recently touched 34.33% of the float, or about 61 million shares short.

-

Site: Catholic Herald

ROME – After initially insisting he would take part in the conclave to elect a successor to Pope Francis, Italian Cardinal Angelo Becciu, stripped of his privileges as a cardinal by the late pontiff in 2020 and convicted of financial fraud by a Vatican court in 2023, has withdrawn after reportedly being shown documents signed by the pope confirming it was his will Becciu not participate.

“Having at heart the good of the church, which I’ve served and will continue to serve with fidelity and love, as well as to contribute to the communion and serenity of the conclave, I’ve decided to obey as I always have the will of Pope Francis to not enter into the conclave, despite remaining convinced of my innocence,” the 76-year-old Becciu said in a statement.

That marks a change of tune for Becciu, who initially insisted he would file into the Sistine Chapel along with other cardinal electors on the grounds that Pope Francis never explicitly told him he couldn’t, and moreover, that a personal invitation from Francis to participate in a consistory in 2022 for the elevation of new cardinals signified a desire by the late pontiff to reintegrate Becciu fully into the College of Cardinals.

Becciu’s position had sparked a mini-furor among experts on church law, who were divided on the question of whether taking part in a conclave is among the “privileges” enjoyed by cardinals, which were taken away by Pope Francis in September 2020 when he sanctioned Becciu over rumors of financial malfeasance, or a “duty,” which was never formally revoked.

Some reports suggested that the question of Becciu’s participation might have to be put to a vote among the cardinal electors, the lone body charged with the ability to make such decisions in the absence of a pope.

That debate, however, apparently was short-circuited by two documents, each annotated by Pope Francis with the initial “F,” expressing the late pope’s intention that Becciu be excluded from a conclave. One dates to 2023, following Becciu’s conviction in the “Trial of the Century” over various charges of financial fraud and misappropriation, while the other dates to March, at a time when Pope Francis was in the Gemelli Hospital fighting double pneumonia.

According to reports in the Italian media, those letters were shown to Becciu by Italian Cardinal Pietro Parolin, who served as the Vatican’s Secretary of State and who will preside over the conclave itself since the Dean of the College of Cardinals, 91-year-old Cardinal Giovanni Battista Re, is over 80 and ineligible to participate.

In theory, even those letters might not have been enough for Becciu to back down, since neither was ever published in the Acta Apostolicae Sedis, the official Vatican gazette, and thus technically did not have the force of law. In this case, however, Becciu apparently decided that discretion is the better part of valor.

His absence from the conclave marks the latest blow to the reputation and legacy of Becciu, who once seemed to stand at the very apex of the Vatican power structure.

Born on the island of Sardinia, Becciu was ordained to the priesthood in 1972. He joined the Vatican’s diplomatic service in 1984, serving in papal embassies in the Central African Republic, Sudan, New Zealand, Liberia, Great Britian, France and the United States. Later, under St. John Paul II, he became an archbishop was named the papal ambassador to Angola and São Tomé and Principe, while under Benedict XVI he was appointed the papal envoy to Cuba.

In 2011 Becciu returned to Rome to take up the über-powerful position of the sostituto, or “substitute,” the number two official in the Vatican’s Secretariat of State, a role in which he was essentially the pope’s chief of staff. By Vatican custom, the sostituto is the only official who doesn’t need an appointment to see the pope, given that he deals with the most pressing business a pope must handle every day.

He was confirmed in that role by Pope Francis and continued in it until 2018, when Francis made him a cardinal and tapped him to run the Congregation for the Causes of Saints.

Becciu’s march up the career ladder came to an abrupt halt in 2020, when rumors of his involvement in various questionable financial maneuvers at the Secretariat of State led to Francis summoning him to the Case Santa Marta and informing him that he was being removed as head of the congregation and stripped of his privileges as a cardinal.

Becciu maintained his innocence at the time, and continued to do so even as he was indicted and eventually convinced and sentence to five and a half years in prison by the Vatican’s civil tribunal for alleged financial crimes, including his role in a spectacularly failed $400 million real estate transaction in London.

Despite his difficulties, Becciu has always made a point of being present at all major Vatican liturgies and events, dressed in his cardinal’s robes and taking part in the ceremonies on an equal footing with other Princes of the Church.

The decision to withdraw from the conclave therefore marks a reversal of form for Becciu, though by no means an end to his proclamations of innocence. Sometime soon he’ll have another opportunity to make that argument in court, when a Vatican panel hears his appeal of his conviction in the London case.

(Photo by ANDREAS SOLARO/AFP via Getty Images)

The post Becciu backs down: fallen Cardinal bows to Pope Francis’s final will first appeared on Catholic Herald.

The post Becciu backs down: fallen Cardinal bows to Pope Francis’s final will appeared first on Catholic Herald.

-

Site: Zero HedgeTariff-Frontrunning Sends US Trade Deficit To New Record High In MarchTyler Durden Tue, 04/29/2025 - 08:56

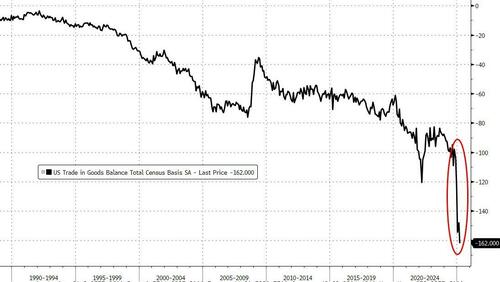

The US merchandise-trade deficit unexpectedly widened in March to a record as companies continued importing goods to get ahead of tariffs.

The shortfall in goods trade grew 9.6% from a month earlier to $162 billion, Commerce Department data showed Tuesday.

Imports rose 5% to $342.7 billion, led by consumer goods, while exports increased 1.2% as firms scrambled to get ahead of President Trump's 'Liberation Day' tariffs...

Imports of consumer goods surged 27.5%, while inbound shipments of motor vehicles and capital goods also increased.

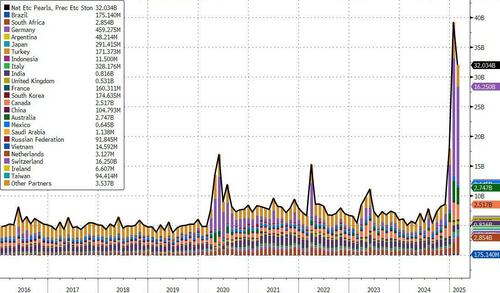

Because this is the 'advance' data release, there is no data for individual nation trade balances or how gold imports have shifted. Remember, gold imports had been soaring through February...

...and blowing up economists' models of GDP growth.

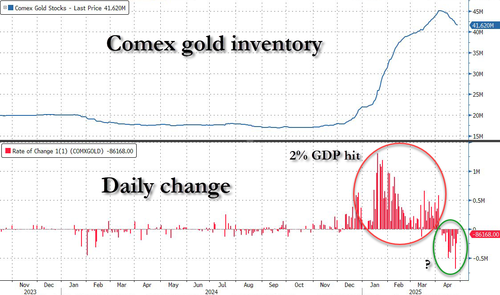

What we do know is that gold inventories at COMEX have been falling in March, suggesting a slowdown in imports... which will juice GDP forecasts (further confounding all the PhDs)

Finally, we note that Tuesday’s Commerce Department report also showed stockpiles at wholesalers increased 0.5%. Retail inventories fell 0.1% last month, reflecting a decline at car dealers.

-

Site: Ron Paul Institute - Featured Articles

Political warfare in Washington is endemic. But the body count at the Pentagon has started to rise precipitously. Three of Secretary of Defence Hegseth’s top advisors were placed on leave, and then fired. The war continues, with the Secretary now in the firing line.

Why this matters is that the Hegseth attrition comes amid fierce internal debates in the Trump administration about Iran policy. Hawks want a definitive elimination of all Iran’s nuclear and weapons capabilities, whilst many “restrainers” warn against military escalation; Hegseth reportedly was amongst those warning against an intervention in Iran.

The recent Pentagon dismissals have all been identified as restrainers. One of the latter, Dan Caldwell, formerly Hegseth’s Top Adviser and an army veteran, wrote a post slamming the “Iran Hawks” – and subsequently was fired. He was later interviewed by Tucker Carlson. Notably, Caldwell describes in scathing terms America’s wars in Iraq and Syria (“criminal”). This adverse sentiment concerning America’s earlier wars is a rising theme, it seems, amongst US Vets today.

The three Pentagon staffers essentially were fired, not as “leakers,” but for talking Hegseth out of supporting war on Iran, it would appear; the Israeli-Firsters, have not given up on that war.

The inflamed fault lines between hawks and traditionalist “Republicans” bleed across into the Ukraine issue, even if the faction membership may alter a tad. Israeli-Firsters and US hawks more generally, are behind both the war on Russia and the maximalist demands on Iran.

Conservative commentator Fred Bauer observes that when it comes to Trump’s own war impulses, they are conflicted:

Influenced by the Vietnam War of his youth … Trump seems deeply averse to long-term military conflicts, yet, at the same time, Trump admires a politics of strength and swagger. That means taking out Iranian generals, launching airstrikes on the Houthis, and boosting the defence budget to $1 trillion.

Hegseth’s potential exit – should the campaign for his removal succeed – could cause the struggle to grow fiercer. Its first casualty is already apparent – Trump’s hope to bring a quick end to the Ukraine conflict is over.

This week, the Trump team (including both warring factions, Rubio, Witkoff and General Kellogg) met in Paris with various European and Ukrainian representatives. At the meeting, a Russian-Ukrainian unilateral ceasefire proposal was mooted by the US delegation.

After the meeting, at the airport, Rubio plainly said that the ceasefire plan was “a take-it-or-leave-it” US initiative. The various sides – Russia, Kiev and the European members of the “coalition of the willing” – had only days to accept it, or else the US was “out,” and would wash its hands of the conflict.

The framework presented, as reported, is almost (maybe 95%) unadulteratedly that previously proposed by General Kellogg: i.e. it is his plan, first aired in April 2024. It appears that the “Kellogg formula” was adopted then as the Trump platform (Trump was at the time in mid-campaign, and unlikely to have been following the complicated minutiae of the Ukraine war too closely).

General Kellogg is also the likely source for Trump’s optimism that the ending to the Ukraine war could come with a click of Trump’s fingers – through the limited application of asymmetric pressures and threats on both belligerents by Trump – and with the timing decided in Washington.

In short, the plan represented a Beltway consensus that the US could implement a negotiated end-state with terms aligned to US and Ukrainian interests.

Kellogg’s implicit assumptions were that Russia is highly vulnerable to a sanctions threat (its economy perceived as being fragile); that it had suffered unsustainably high casualties; and that the war was at a stalemate.

Thus, Kellogg persuaded Trump that Russia would readily agree to the ceasefire terms proposed – albeit terms that were constructed around patently flawed underlying assumptions about Russia and its presumed weaknesses.

Kellogg’s influence and false premises were all too evident when Trump, in January, having stated that Russia had lost one million men (in the war) then went on to say that “Putin is destroying Russia by not making a deal, adding (seemingly as an aside), that Putin may have already made up his mind ‘not to make a deal’.” He further claimed that Russia’s economy is in “ruins,” and most notably said that he would consider sanctioning or tariffing Russia. In a subsequent Truth Social post, Trump writes, “I’m going to do Russia – whose Economy is failing – and President Putin, a very big FAVOR.”

All of Kellogg’s underlying assumptions lacked any basis in reality. Yet Trump seemingly took them on trust. And despite Steve Witkoff’s subsequent three lengthy personal meetings with President Putin, in which Putin repeatedly stated that he would not accept any ceasefire until a political framework had been first agreed, the Kellogg contingent continued to blandly assume that Russia would be forced to accept Kellogg’s détente because of the claimed serious “setbacks” Russia had suffered in Ukraine.

Given this history, unsurprisingly, the ceasefire framework terms outlined by Rubio this week in Paris reflected those more suited to a party at the point of capitulation, rather than that of a state anticipating achieving its objectives – by military means.

In essence, the Kellogg Plan looked to bring a US “win” on terms aligned to a desire to keep open the option for continuing attritional war on Russia.

So, what is the Kellogg Plan? At base, it seeks to establish a “frozen conflict” – frozen along the “Line of Conflict”; with no definitive ban on NATO membership for Ukraine, (but rather, envisaging a NATO membership that is deferred well into the future); it places no limits on the size of a future Ukrainian army and no restrictions on the type or quantity of armaments held by the Ukrainian forces. (It foresees, contrarily, that after the ceasefire, the US might re-arm, train and militarily support a future force) – i.e. back to the post-Maidan era of 2014.

In addition, no territory would be ceded by Ukraine to Russia, save for Crimea which alone would be recognised by the US as Russian (the unique sop to Witkoff?), and Russia would only “exercise control” over the four Oblasts that it currently claims, yet only up to the Line of Conflict; territory beyond this line would remain under Ukrainian control (see here for the “Kellogg map”). The Zaporozhye Nuclear Power Plant would be neutral territory to be held, and managed, by the US There is no mention made of the cities of Zaporozhye and Kherson that have been constitutionally incorporated into Russia, but lie beyond the contact line.

Nothing about a political solution apparently was outlined in the plan, and the plan leaves Ukraine free to pursue its claim to all Ukraine’s former territories – save for only Crimea.

Ukrainian territory west of the Dnieper River however, would be divided into three zones of responsibility: British, French and German zones (i.e. which NATO forces would manage). Finally, no American security guarantees were offered.

Rubio subsequently passed details of the plan to Russian FM Lavrov, who calmly stated that any ceasefire plan should resolve the underlying causes to the conflict in Ukraine as its first task.

Witkoff flies to Moscow this week to present this “pig’s ear” of a plan to Putin – seeking his consent. The Europeans and Ukrainians are set to meet next Wednesday in London to give their riposte to Trump.

What’s next? Most obviously, the Kellogg Plan will not “fly.” Russia will not accept it, and likely Zelensky will not either, (though the Europeans will work to persuade him – hoping to “wrong-foot Moscow” by presenting Russia as the essential “spoiler”). Reportedly, Zelensky already has rejected the Crimea provision.

For the Europeans, the lack of security guarantees or backstop by the US may prove to be a killer for their aspiration to deploy a tripwire troop deployment to Ukraine, in the context of a ceasefire.

Is Trump really going to wash his hands of Ukraine? Doubtful, given that the US neo-conservative institutional leadership will tell Trump that to do so, would weaken America’s “peace through strength” narrative. Trump may adopt supporting Ukraine “on a low flame” posture, whilst declaring the “war was never his” – as he seeks a “win” on the business front with Russia.

The bottom line is that Kellogg has not well-served his patron. The US needs effective working relations with Russia. The Kellogg contingent has contributed to Trump’s egregious misreading of Russia. Putin is a serious actor, who says what he means, and means what he says.

Colonel Macgregor sums it up thus:

Trump tends to view the world through the lens of dealmaking. [Ending the Ukraine war] is not about dealmaking. This is about the life and death of nations and peoples. There’s no interest in some sort of short-fused deal that is going to elevate Trump or his administration to greatness. There will be no win for Donald Trump personally in any of this. That was never going to be the case.

Reprinted with permission from Strategic Culture Foundation.

-

Site: Zero HedgeCalifornia Just Became The World's Fourth-Largest Economy In 2024Tyler Durden Tue, 04/29/2025 - 08:45

Authored by Jill McLaughlin via The Epoch Times (emphasis ours),

California Gov. Gavin Newsom announced on April 23 that California had the fourth-largest economy in the world last year, overtaking Japan.

Construction workers on the site of a new development in Long Beach, Calif., on March 5, 2025. Frederic J. Brown/AFP via Getty Images

Construction workers on the site of a new development in Long Beach, Calif., on March 5, 2025. Frederic J. Brown/AFP via Getty Images

According to Newsom’s spokeswoman, Tara Gallegos, the governor used preliminary estimates of nominal gross domestic product (GDP) for 2024, issued by the U.S. Bureau of Economic Analysis (BEA).

Nominal GDP measures the value of goods and services for a state or country using current market prices and is not adjusted for inflation. In contrast, real GDP data is adjusted for inflation.

In addition to BEA data, Newsom also cited data released on April 22 by the International Monetary Fund (IMF), ranking each country according to its GDP.

California’s GDP for 2024 was valued at $4.1 trillion by the BEA. According to the IMF, Japan’s GDP was $4.03 trillion in 2024.

In an April 23 statement, Newsom said California’s economy ranked fourth-largest internationally, behind the United States as a whole ($29.2 trillion), China ($18.7 trillion), and Germany ($4.7 trillion).

Newsom said that the state’s 6 percent economic growth in 2024 was a “faster rate than the world’s top three economies.”

The governor touted the strength of the state’s agriculture, high-tech, and manufacturing sectors.

“California isn’t just keeping pace with the world—we’re setting the pace,” Newsom said in a statement. “Our economy is thriving because we invest in people, prioritize sustainability, and believe in the power of innovation.”

California Gov. Gavin Newsom speaks in Los Angeles on Sept. 25, 2024. John Fredricks/The Epoch Times

California Gov. Gavin Newsom speaks in Los Angeles on Sept. 25, 2024. John Fredricks/The Epoch Times

University of Southern California professor of business management Michael Mische, however, said California’s ranking has more to do with how other economies did last year.

“California’s number four position has more to do with the poorly performing ... economies of Japan and Germany than it does with any in-state specific initiatives,” Mische told The Epoch Times.

California’s economy grew by 13.3 percent from 2019 to 2024, while Japan’s economy saw only a 0.9 percent increase and Germany’s was only 0.3 percent, Mische said.

“So, Japan and Germany grew at less than 1% for the 2019 to 2024 period in real GDP terms,” he said.

Japan has suffered from a prolonged state of decline, while Germany is enduring high labor and energy costs, he added.

Marshall Toplansky, an associate professor and faculty fellow in innovation at Chapman University’s College of Business and Economics, noted that tariffs could slow California’s economy.

“The interesting question here is whether the impact of tariffs will change this,“ Toplansky told The Epoch Times. ”I think we will be feeling a slowdown in trade if the tariffs continue at high levels.”

Shipping containers line the Port of Los Angeles on March 28, 2025. John Fredricks/The Epoch Times

Shipping containers line the Port of Los Angeles on March 28, 2025. John Fredricks/The Epoch Times

The issue is how high the tariffs will be and how long they will last, he added.

“The ports of Los Angeles and Long Beach will very likely see a drop in volume, and it is not clear to what extent they will hurt overall GDP for the state,” Toplansky said.

Newsom filed a lawsuit on April 16 in federal court challenging President Donald Trump’s tariffs, claiming they will hurt states, consumers, and businesses.

-

Site: LifeNews

Last week Gov. Sanders signed a measure budgeting $2 million for grant funding to charities that help women with unplanned pregnancies.

H.B. 1202 by the legislature’s Joint Budget Committee provides $2 million in funding for grants to pregnancy help organizations.

Under H.B. 1202, grant money can go to pregnancy resource centers, maternity homes, adoption agencies, and other charitable organizations that provide material support to women with unplanned pregnancies.

LifeNews is on TruthSocial. Please follow us here.

The State of Arkansas also can award funding to charities that promote infant and maternal wellness and reduce infant and maternal mortality by:

- Providing nutritional information and/or nutritional counseling;

- Providing prenatal vitamins;

- Providing a list of prenatal medical care options;

- Providing social, emotional, and/or material support; or

- Providing referrals for WIC and community-based nutritional services, including food banks, food pantries, and food distribution centers.

The measure makes it clear that grant money will not go to abortionists or their affiliates.

Since 2022 Family Council has worked with the Arkansas Legislature and the governor to secure funding every year for pregnancy resource centers. These state-funded grants have helped support dozens of charities that assist women and children in Arkansas.

The grants are optional. Pregnancy resource centers are not required to accept public tax dollars if they do not want to. But for those who do receive grant money, the funding may make a tremendous difference.

Pro-lifers in Arkansas have worked hard to prohibit abortion. We need to work to make abortion irrelevant and unthinkable as well. Supporting pregnancy resource centers is one way we can do that.

Pregnancy resource centers give women real options besides abortion — making it less likely they will travel out of state for abortion or order illegal abortion drugs online.

With the governor’s signature, H.B. 1202 is now Act 1006 of 2025.

We want to recognize the Arkansas Legislature for proposing and passing this good law, and we want to thank the governor for signing it.

Act 1006 means Arkansas will be able to continue providing real support to women and families. That is something to celebrate!

LifeNews Note: Jerry Cox is the president of the Arkansas Family Council.

The post Governor Signs Measure for $2 Million to Help Pregnant Moms After Arkansas Bans Abortions appeared first on LifeNews.com.

-

Site: Zero HedgeFutures Flat As Markets Brace For Earnings TsunamiTyler Durden Tue, 04/29/2025 - 08:29

US equity futures were unchanged, erasing a modest gain and loss earlier, after General Motors pulled earnings guidance for 2025 and put share buybacks on hold until it has more clarity on the impact of US tariffs. As of 8:15am, S&P futures were flat, while Nasdaq futures were down 0.2% as TSLA rose +1.0% pre-mkt, followed by MSFT +0.5% and AMZN +0.5%. GM dropped in premarket trading, reversing an earlier gain, as it said it would suspend $4 billion of share repurchases. Bond yields and USD are higher (2-, 5-, 10-yr yields are 1.6bp, 2.9bp, 2.7bp higher). Commodities are mixed with WTI futures dropping 1.7%, adding to sharp losses seen Monday, Base Metals higher, and Precious Metals mixed. WSJ repeated a report from last week that Trump may ease his auto tariffs today; Elsewhere, Scott Bessent set July 4 as the goal to pass Trump’s tax cut package; he will announce the debt-ceiling X-date this week or next. Today, the key macro focus will be JOLTS Job Openings and Conf. Board Consumer Confidence.

In premarket trading, Magnificent Seven stocks are mixed as futures whipsaw )Amazon +0.2%, Alphabet +0.2%, Microsoft +0.1%, Apple +0.1%, Tesla -0.1%, Meta -0.1%, Nvidia -0.7%). General Motors (GM) shares fall 2.4% premarket after the automaker withdrew 2025 earnings guidance and paused $4 billion in share repurchases until it has more clarity on tariff impacts. Hims & Hers Health Inc. (HIMS) shares soared as much as 46% as it’s among companies Novo Nordisk A/S is partnering with to offer its popular weight-loss drug Wegovy to more US patients at a reduced price. Here are some other notable premarket movers:

- Crown Holdings (CCK) shares rise 3.3% after the beverage can maker reported adjusted earnings per share for the first quarter that beat the average analyst estimate. Analysts note strong volumes in Europe and Brazil

- Honeywell International Inc. (HON) shares gain 4.7% after the company raised its full-year guidance for earnings per share.

- PayPal (PYPL) shares are down 4.1% in premarket trading after the company reported fewer payment transactions in the first quarter than analysts expected.

- Okta (OKTA) shares rise 3.8% after S&P Dow Jones Indices announced that the stock will replace Berry Global in the S&P MidCap 400 before trading opens May 1.

- Regeneron (REGN) shares fall 7.5% after the drugmaker reported profit and sales for the first quarter that fell short of expectations.

- Ultra Clean (UCTT) shares are down 10% after the semiconductor manufacturing company reported first-quarter results that missed expectations and gave an outlook that is below the analyst consensus.

- UPS (UPS) shares are up 2% after the company reported adjusted earnings per share in the first quarter above what analysts expected

- Waste Management (WM) shares fall 1.7% after the firm’s first-quarter update missed revenue expectations and free cash flow dropped, with analysts saying that investors could have been hoping for more in order to support the stock’s year-to-date rally

- Wolfspeed (WOLF) shares are up 10% as the chipmaker is set for its sixth session of straight gains to match February’s winning streak

As Bloomberg notes, after weeks of intense volatility, markets now seem to be in a holding pattern. Gold is consolidating after hitting record highs, the DXY dollar index remains below its key 100 level, and oil is drifting lower. For investors, it’s difficult to find consensus, with risk management, confidence, and the guiding narrative on US exceptionalism upended by tariffs.

“With the uncertainty created by the tariffs we need to start pricing at least a probability of a US recession,” Johanna Kyrklund, chief investment officer at Schroders Plc, told Bloomberg TV. “As we analyze each company stock-by-stock, we’re looking for that risk to growth.”

Tariff sentiment continues to drive price action, with investors weighing plans by the Trump administration to ease the impact of auto tariffs by lifting some levies on foreign parts for cars and trucks made inside the US. However, it doesn’t look like a trade resolution is coming anytime soon. China’s top diplomat warned countries against caving in to US tariff threats, and Trump’s tactics are only serving to make China’s Xi Jinping more popular. At home, Treasury Secretary Bessent set a July 4 goal to pass a multi-trillion dollar tax cut package to appease voters getting fed up of Trump’s handling of the economy.

Still, with just over a third of S&P 500 companies reporting quarterly results, of those, 75% have beat estimates, according to data compiled by Bloomberg. S&P 500-listed companies worth $20 trillion are set to deliver results this week in one of the heaviest for 2025 earnings seasons. But the next few days are key: companies worth $20 trillion are set to deliver results this week in one of the heaviest for 2025 earnings seasons.

Beyond the plethora of earnings, investors will be tracking data for clues on economic resilience in the face of tariffs. Prospects for Federal Reserve interest-rate cuts will be guided by Friday’s US non-farm payrolls figures. Sentiment earlier was boosted by signs of easing trade tensions after a White House official said imported automobiles would be given a reprieve from separate tariffs on aluminum and steel.

In Canada, the Liberal Party is projected to win a fourth consecutive election, giving a mandate to former central banker Mark Carney.

European stocks rise 0.4%, with risk sentiment improving after the US said imported autos would be given a reprieve from separate tariffs on aluminum and steel. Miners, travel and banks are the strongest-performing European sectors, while the IBEX lags peers, dropping 0.5%, as Spain deals with the fallout of a massive blackout. In earnings, Deutsche Bank shares rise after its trading unit hit a record. HSBC climbs after announcing a fresh share buyback. BP shares fall after the oil major cut its buyback as profit missed forecasts. Here are some of the biggest movers on Tuesday:

- Rheinmetall shares rise as much as 7.3% after smashing expectations across the board with analysts praising a blowout quarter.

- Deutsche Bank shares gain as much as 4.6% after the lender posted a strong set of results, led by its trading unit hitting a record in the first quarter amid high market volatility.

- Neste shares gain as much as 13% after the Finnish refiner posted an increase in margins within its renewable product unit in the first quarter results.

- HelloFresh shares jump as much as 12% after the meal-kit company reported first-quarter adjusted Ebitda that beat estimates by roughly 30%, a sign that the firm is hastening its pivot to profitability as it cuts fulfillment and marketing expenses.

- Amundi shares slide as much as 2.4% after the investment manager’s first-quarter earnings showed a mixed performance that could weigh on consensus estimates, according to analysts.

- Porsche shares fall as much as 7.6%, their steepest drop since early February, after the luxury carmaker issued another profit warning.

- Deutsche Boerse shares fall as much as 5.7% after the German stock-exchange operator reported earnings for the first quarter that missed the average analyst estimate.

- Lufthansa shares fall as much as 2.9%. Results for the first quarter are largely in line and the carrier expects strong demand during the second quarter, though analysts note that weakening demand on the North Atlantic presents warning signs ahead of the peak summer season.

- Volvo Cars shares fall as much as 11% to a record low after the Swedish automaker posted first-quarter results that missed estimates and withdrew guidance for this year and next due to uncertainty around US tariffs.

- Elekta shares drop as much as 6.2% after an unidentified holder offered up to 15m shares via Goldman Sachs at a discount of 5.5% vs. Monday’s close, according to terms seen by Bloomberg.

- Nordic Semi shares slide as much as 9.4% after the chipmaker forecast 2Q sales below consensus estimates, citing increased risks from trade tensions and tariffs.

Asian equities advanced, rising to the highest level this month, on a rally in some Chinese technology shares and a sentiment boost from further signs of the US dialing down its trade rhetoric. The MSCI Asia Pacific Index gained as much as 0.7% Tuesday. TSMC and Meituan provided the biggest boost to the gauge, while India’s Reliance Industries extended its rally triggered by better-than-expected earnings. Benchmarks advanced in Hong Kong, Taiwan, India and South Korea. Japanese markets were closed for a holiday. Asian markets have largely recovered from the hit sparked by President Donald Trump’s reciprocal tariff announcements on April 2 amid hopes for trade deals. In the latest positive sign, Trump is on track to ease the impact of his auto tariffs, with changes sought by the industry that would lift some levies on foreign parts made inside the US.

- Australia: S&P/ASX 200 +0.92%, extending its winning streak to a 4th straight session as investors brushed off global trade uncertainties. Domestically, expectations are growing that the RBA will deliver another 25-bps cut in May, amid rising economic uncertainty and escalating global trade concerns. Investors are now awaiting Australian inflation data, due Wednesday, for further insight into the RBA’s next move.

- Taiwan: TAIEX +1%, was once again the best performing market in the region as sentiment continues to improve following recent rally in the US. TSMC 2330 TT +0.6% led the way as it closed above TWD900 for the first time since the tariff selloff in the first week of April. Small/mid-caps continued to outperform, as OTC index have rallied for 6th straight days, while beaten down AI ROBOTICS/BBU plays surged today.

- Korea: KOSPI +0.65%, rebounded. led by locals’ inflow. Locals extended their net buying streak for 3 consecutive days, mainly buying Tech (+$69mn) and Financials (+$94mn) today while foreigners remained as net sellers of equities, mainly selling Transport Equipment (-$231mn, comprised heavily of Shipbuilders, Defense, and Autos). Hanwha Ocean 042660 KR -12.1% as the name plunged after Co's shareholder KDB announced to raise up to W1.1trn (c. $735mn) through a block deal. Meanwhile, Korean Autos (KRXAUTO +1.6%) gained as President Trump is expected to soften the impact of this auto tariffs.

- Japan: The market is closed today (Showa Day) and will resume trading on April 30th.

- China: SHSZ300 -0.2%, traded choppy as Sino-US trade uncertainty weighed on sentiment. China reiterated that it is not involved in trade talks with the US. Small cap and TMTs overthrown large cap but neither of them gave a strong conviction. Innovance 300124 CH +4% post earnings beat. Healthcare rebounded, but A is lagging H. Xinqi pharma 300573 +14% post earnings 3x in 1Q. There is also a peer bank report released yesterday calling for China HC re-rating, especially in the domestic pure revenue names like Ping An Good Doctor, and Ali health.

- HK: HSI +0.2%. SB turned net seller of -US$827mm today, continuing general trend of outflows from last week. On the flows front, the desk saw active managers sell into liquidity from passive buying. Wuxi AppTec 2359 HK +4.2% after 1Q25 earnings beat on both top and bottom line. Geely 175 HK also +4.2% after subsidiary Volvo indicated they would reduce costs. In contrast, BYD 1211 HK -2.6% as concerns of waning demand from yesterday persisted.

In FX, the Bloomberg Dollar Spot Index rose 0.2% after falling 0.5% on Monday, when a disappointing manufacturing activity report added to concerns over US economic growth; haven currencies the yen and Swiss franc, were the biggest underperformers versus the dollar, down 0.6% and 0.4% respectively

- CAD/USD was little-changed at 1.3831, outperforming other Group-of-10 currencies which were lower across the board

- EUR/USD fell 0.3% to 1.1388; 10-year bund yield fell 3bps to 2.49%

- GBP/USD also slipped, pulling away from a three-year high; gilts edged up, tracking gains in other European bonds

In rates, treasury futures drift lower into early US session, unwinding a portion of gains seen Monday and underperforming core European bonds. US yields cheaper by 1bp to 3bp across the curve with 2s10s steeper by 1bp on the day; US 10-year yields trade back up 3bps to around 4.24% with bunds and gilts outperforming by 4bp and 5.5bp in the sector.

In commodities, WTI drifts 1.6% lower to trade near $61.03. Spot gold falls roughly $29 to trade near $3,315/oz. Most base metals are in the green. Bitcoin climbs to around $95,000.

The US economic calendar includes March wholesale inventories, February S&P CoreLogic house prices (9am), March JOLTS job openings, April consumer confidence (10am) and April Dallas Fed services activity (10:30am). From central banks, we’ll hear from the ECB’s Cipollone and Holzmann, and the BoE’s Ramsden. The Fed's talking heads remain mute thanks to the communications blackout ahead of the May 7 FOMC meeting. Finally, earnings releases include Starbucks, Visa, Pfizer and UPS.

Market Snapshot

- S&P 500 mini +0.1%

- Nasdaq 100 mini +0.1%

- Russell 2000 mini +0.1%

- Stoxx Europe 600 +0.2%

- DAX +0.6%, CAC 40 -0.1%

- 10-year Treasury yield +2 basis points at 4.23%

- VIX -0.3 points at 24.86

- Bloomberg Dollar Index +0.2% at 1222.16

- euro -0.2% at $1.1394

- WTI crude -1.4% at $61.17/barrel

Top Overnight News

- Canada’s Liberal Party won a fourth straight election, handing Mark Carney a mandate but with a narrow margin of victory. The loonie was steady. The Liberals led with 168 seats, ahead of the Conservative Party’s 144 but short of the 172 required for a majority. The Bloc Québécois would hold the balance of power in a minority government, raising the likelihood of a looser fiscal policy than Carney wants. Carney vowed to win the trade war with the US and strengthen alliances with other countries. BBG

- President Trump is expected to soften the impact of his automotive tariffs, preventing duties on foreign-made cars from stacking on top of other tariffs he has imposed and easing some levies on foreign parts used to manufacture cars in the U.S. WSJ

- White House said Trump wants tax cuts in this reconciliation package, while it was separately reported that Bessent said he hopes the Trump tax bill can be done by July 4th.

- US Treasury Financing Estimates (Q2): expects to borrow USD 514bln in privately-held net marketable debt, assuming end of June cash balance of 850bln (prev. guided USD 123bln, assuming end of June cash balance USD 850bln).

- China’s copper stockpiles are on track to dwindle to nothing in just a few months, as the market suffers “one of the greatest tightening shocks” in its history on fears of US tariffs. FT

- China said it’s open to working with US companies after halting Boeing jet deliveries. India plans to highlight its large pipeline of Boeing orders and potential for more to secure a favorable trade deal with the US. BBG

- China said the US should stop making threats and pursue dialogue based on mutual respect. Earlier, Foreign Minister Wang Yi warned countries against caving in to tariff threats. BBG

- Eurozone inflation expectations rise, with 12-month climbing 30bp to 2.9% (highest since Apr ’24) and 36-month advancing 10bp to 2.5% (highest since Mar ’24). ECB

- Pakistan’s army said it shot down an Indian spy drone along their disputed border in the Kashmir region, as tensions rise over last week’s militant attacks. BBG

- A union representing West Coast dockworkers has sharply criticized President Trump over his “reckless” tariffs that will hurt American workers. The union noted the tariffs have created tension with allies and are a “direct attack” on the working class. The Hill

- Scott Bessent set a July 4 goal to pass Trump’s multi-trillion dollar tax cut package. He also said the debt-ceiling X date will be announced this week or next. BBG

Tariffs/Trade

- US President Trump is expected to soften the impact of his automotive tariffs by preventing duties on foreign-made cars from stacking on top of other tariffs he imposed and easing some levies on foreign parts used to manufacture cars in the US, according to WSJ citing sources. Furthermore, a White House official said those actions are expected on Tuesday and Commerce Secretary Lutnick said President Trump is building an important partnership with both the domestic automakers and American workers, while Lutnick added this deal rewards companies who manufacture domestically, as well as provides a runway to manufacturers who have expressed commitment to invest in America and expand their domestic manufacturing.

- Chinese Foreign Minister Wang Yi said concession and retreat will only make the bully more aggressive.

- China's MOFCOM said on the report that Boeing flew back three 737 MAX planes to be delivered to Chinese airlines, that China and the US have maintained long-term mutually beneficial cooperation in the field of civil aviation, while it added the US wielded the big stick of tariffs to seriously impact the stability of global industrial and supply chains, and many enterprises were unable to carry out normal trade and investment activities.

- Italian PM Meloni says times are not mature yet for an EU-US summit, according to Corriere Della Sera.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly in the green but with some of the gains capped following the choppy performance stateside and in holiday-thinned conditions with Japanese markets closed for a holiday, while reports that US President Trump is expected to soften the impact of his automotive tariffs saw a muted reaction. ASX 200 gained amid outperformance in the energy, tech and resources sectors, while miners were also lifted as participants digested output updates. Hang Seng and Shanghai Comp were varied as the mainland lagged owing to uncertainty from the US-China trade war with US Treasury Secretary Bessent recently commenting that it is up to China to de-escalate and that he has an "escalation ladder in his back pocket", while China's Foreign Ministry reiterated its denial regarding a Trump-Xi call and Foreign Minister Wang Yi warned that compromise and backing down would only embolden the bully.

Top Asian News

- Japan and Malaysia are reportedly exploring broader economic ties including AI and automotive.

- Alibaba (9988 HK) introduced Qwen3 to set a new benchmark in open-source AI with hybrid reasoning.

- Earthquake of magnitude 5.0 strikes China's Tibet region, via CENC.

- Agricultural Bank (1288 HK) Q1 (CNH) Revenue 186bln (exp. 185bln), Net Income 72.1bln (exp. 73.95bln), +2.2% Y/Y, NII 140.6bln (exp. 142.7bln), CET1 11.23%.

- Industrial and Commercial Bank of China (1398 HK) Q1 (CNH) NII 156.78bln (exp. 161.29bln), Net Income 84.70bln, -4% Y/Y.

- China Construction Bank (939 HK) Q1 (CNH) NII 141.92bln, NIM 1.41%.

- Bank of China (3988 HK) Q1 (CNY) Net 54.36bln (exp. 57.4bln), NIM 1.29%, Operating Income 165bln (exp. 155bln)

European bourses opened modestly firmer/flat, but some modest pressure crept into the complex as the morning progressed – with indices generally off best levels, to show a mixed picture in Europe. European sectors hold a slight positive bias, albeit with the breadth of the market fairly narrow. Basic Resources takes the top spot, followed closely by Media and Banks. Energy is found at the foot of the pile, dragged down by post-earning losses in BP (-4%); the continued pressure in the crude complex is also not helping. Autos find themselves towards the middle of the bunch. For the sector more generally, US President Trump is expected to soften the impact of his automotive tariffs, by preventing duties on foreign-made cars from stacking on top of other tariffs he imposed and easing some levies on foreign parts used to manufacture cars in the US, via WSJ. For stock specifics, Porsche AG (-5%) dips after it cut FY25 guidance; Volvo Car (-8.3%) reported a significant miss on its EBIT and Revenue figure and launched a SEK 18bln cost and cash action plan.

Top European News

- ECB Consumer Expectations Survey: March: See inflation in next 12 months at 2.9% (prev. 2.6%); 3y ahead sees 2.5% (prev. 2.4%); 12-month is highest since April 2024. Economic growth expectations for the next 12 months were stable in March, standing at -1.2%.

- ECB's Cipollone says that ECB staff estimates suggest that the recently observed increase in financial market volatility might imply lower GDP growth of about 0.2ppts in 2025.

FX

- USD is attempting to claw back some of yesterday's losses that were in part driven by a soft outturn for Dallas Fed Manufacturing data. On the trade front, US President Trump is expected today to announce measures to soften the impact of his automotive tariffs by preventing duties on foreign-made cars from stacking on top of other tariffs, according to WSJ. DXY has risen as high as 99.31 but is yet to venture near Monday's best at 99.83.