The Eucharist is "the source and summit of the Christian life."

Distinction Matter - Subscribed Feeds

-

Site: Saint Louis Catholic

-

Site: non veni pacem

Happy Feast of Pope St. Pius V. His Collect is timely.

“It’s almost as if this prayer were pre-ordained by the Divine Providence for us, now, on May 5th, ARSH 2025, as we beg God for a True Pope who will restore the Church and crush her enemies.”

COLLECT: O, God, Who graciously chose blessed Pius as Supreme Pontiff, to crush the enemies of Your Church and to restore divine worship, grant that we may be guarded by his help and remain so steadfast in Your service that, having overcome the snares of all enemies, we may enjoy a lasting peace.

Now, consider this:

Cardinal Robert Prevost by Marco Iacobucci Epp / Shutterstock

Legacy and Catholic media promote one cardinal at the same time: Coincidence or campaign?

VATICAN CITY // In the lead-up to the May 2025 papal conclave, a notable pattern has emerged across legacy and Catholic media outlets: a surge of favorable coverage framing U.S.-born Cardinal Robert Francis Prevost as a leading papal contender.

In the span of 36 hours, The New York Times, the National Catholic Reporter, England’s Catholic Herald, Crux, and The Pillar, all run highly positive profiles praising the alleged many virtues of American Cardinal Robert Prevost, former prefect of the Dicastery for Bishops, presenting him as a frontrunner papabile.

This trend, visible in outlets spanning ideological spectrums, draws questions regarding its timing and selective emphasis amid unresolved questions about the cardinal’s handling of clerical misconduct cases.

The Catholic Herald, The Pillar, and Crux highlight Prevost’s administrative experience, including his role as prefect of the Dicastery for Bishops, where he advised Pope Francis on global bishop appointments. His decades of missionary work in Peru and reputation as a “moderate, balanced figure” are repeatedly cited, with The Pillar noting his “heart of a missionary” and “years of ministerial experience.” The New York Times and The National Catholic Reporter underscore his multilingual skills and perceived diplomatic tact, framing him as a bridge between ideological divides.

Another commonality among the articles is that while acknowledging abuse-related complaints, the pieces often contextualize them defensively.

For example, a significant Chicago case — involving an Agustinian priest placed near a school in 1999 when Cardinal Prevost was his superior — is described as occurring “before the US bishops adopted new standards in 2002,” with Cardinal Prevost’s approval framed as a “formality.”

Allegations in Peru, where three women accused priests of abuse under his oversight, are countered with claims that Cardinal Prevost “opened an initial canonical investigation” and cooperated with civil authorities. The Pillar and Crux also cast doubt on the credibility of accusers’ legal representation, noting their canon lawyer, Ricardo Coronado, was later defrocked for misconduct.

The media profiles position Cardinal Prevost as a “pragmatic successor” to Pope Francis, allegedly favoring institutional stability over “radical reform.” Crux argues a Cardinal Prevost papacy would maintain Pope Francis’ “substance” but with “more pragmatic, cautious and discreet” leadership, while NCR emphasizes his “interest in dialogue.”

Read the rest: https://catholicvote.org/legacy-catholic-media-promote-cardinal-same-time-coincidence-or-campaign/

-

Site: Zero HedgeElon Musk At Milken Conference: AI Will Replace Bloated, Inefficient Federal Gov'tTyler Durden Mon, 05/05/2025 - 10:45

Since President Donald Trump took office in mid-January, the Trump administration has employed Elon Musk's Department of Government Efficiency (DOGE) to streamline government operations. This initiative eliminates redundancies, fraud, and waste while leveraging artificial intelligence to automate and reduce bureaucratic inefficiencies.

On Sunday, Elon Musk attended the closed-door Milken Institute Global Conference, where he provided further details on deploying AI to eliminate government inefficiencies, potentially replacing some public sector workers, according to Bloomberg, citing an attendee of the prestigious conference at the Beverly Hilton in Los Angeles.

Musk told financier Michael Milken at the closed-door event, which tickets start at $25,000 and features high-level individuals, including US Treasury Secretary Scott Bessent, Nvidia's Jensen Huang, Citigroup's Jane Fraser, and Citadel's Ken Griffin, how AI will replace some of the federal government's workforce.

Musk also spoke about his brain implant company, Neuralink, and the development of Starship at his rocket company, SpaceX.

DOGE and the Trump administration bet that AI can replace a sizeable portion of the government workforce—particularly those in administrative, data processing, and customer service roles—to dramatically reduce federal payroll costs, eliminate inefficiencies, and modernize public services.

Last week, the latest data from global outplacement and executive coaching firm Challenger, Gray & Christmas showed the government had led all sectors in job cuts this year, with 281,452 of those cuts attributed to DOGE-related cost-cutting.

Jobless Claims Jumped Last Week As 'DOGE Actions' Spark Biggest YTD Layoffs Since 2020 https://t.co/mPjuSJiyAH

— zerohedge (@zerohedge) May 1, 2025In an interview, late last week on Fox News' Jesse Watters Primetime, DOGE staffer Edward Coristine, nicknamed "Big Balls," described some shocking examples of waste and mismanagement by unaccountable bureaucrats.

EXCLUSIVE: @elonmusk and the @DOGE boys EXPOSE reckless spending at the @usedgov. Caesars Palace and stadiums were being rented out for parties on YOUR dime. pic.twitter.com/pShztaGrT5

— Jesse Watters (@JesseBWatters) May 2, 2025Yet efforts to eliminate waste and fraud from the federal government have been met with intense opposition from the Democratic Party as the era of unchecked spending ends.

-

Site: OnePeterFive

As a conclave approaches, it is important to put forward some suggestions that one hopes will be considered relevant by the Cardinals called to elect the successor of Peter. In truth, given the importance and centrality of these themes, it should not even be doubted that they are considered important for a future Pontiff, but given the times, repetita iuvant. The discourse on God must…

-

Site: Zero Hedge"Resistance Is Futile" - For Both Bulls And BearsTyler Durden Mon, 05/05/2025 - 10:20

Authored by Lance Roberts via RealInvestmentAdvice.com,

“Resistance is futile” was a sentence that struck fear in the hearts of Trekkie fans during “Star Trek: The Next Generation,” specifically in both of the “Best Of Worlds” and “First Contact” episodes. In those episodes, the “Starship Enterprise” crew encountered a species called the “Borg.” The Borg’s primary purpose was to achieve “perfection” by assimilating other beings and technologies into their “hive mind,” known as the “Collective.” They viewed assimilation as a means to expand their collective knowledge, power, and ultimately, their vision of a perfect and harmonious existence. The reason “resistance was futile” was that the centralized control, driven by the Borg Queen, allowed for swift and coordinated actions across vast distances. At the same time, the assimilation process threatened to erase individuality and homogenize the galaxy.

I could go on, but you are asking yourself two questions. First, is Lance a total sci-fi geek? Second, what does this have to do with the markets and investing? The answer to the first question is “yes,” as I grew up with William Shatner as James T. Kirk in the original Gene Roddenberry “Star Trek.”

However, let’s dig deeper into the second question.

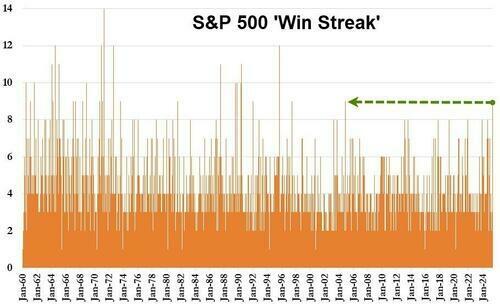

Over the past two weeks, the market has had a furious nine-day rally, the longest winning streak in 21 years. However, there are two takeaways from such a historic advance. First, it is “bullish” as investors return to the market. However, investors should also recognize that if the rally is the longest in 21 years, then previous such rallies failed. As shown in the chart below, there have been longer rallies, with 14 trading days being the peak. But in every case, it is worth remembering the following:

“‘Record levels’ of anything are records for a reason. It is where the point was reached where previous limits existed. Therefore, when a ‘record level’ is reached, it is NOT THE BEGINNING, but rather an indication of the MATURITY of a cycle.”

That reality exists for any data set, at either extreme. Let’s look at two examples.

The Bearish Example

On April 7th, the day the market bottomed, I wrote an article entitled “Hope In The Fear,” in which we discussed the extremes of “bearish sentiment” and technically oversold conditions. To wit:

“There are times when the probabilities of something happening outweigh the possibilities. Following last week’s market crash, the “probability” of at least a near-term rally outweighs the possibility of a further decline. Does that mean it is guaranteed to happen? No. But, several indicators have historically tilted the odds in the investor’s favor.”

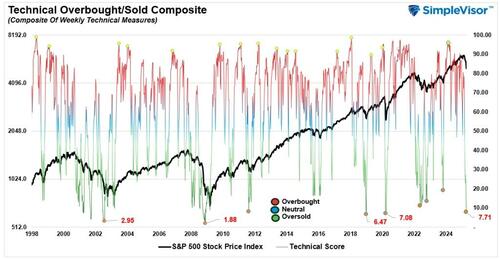

The reason was the extreme technical oversold conditions that existed.

“Whether or not the current market crash is the beginning of a larger corrective cycle, such low readings have, without fail, marked the near-term low of a market correction. While the market has previously continued its corrective process after such low readings, such did not occur without a meaningful reversal rally first.”

When analyzing the market from a technical perspective, technicians watch two primary levels: support and resistance. As always, the demand between buyers and sellers determines stock prices. When the supply of stock for sale overwhelms the demand from buyers, “resistance” occurs, which impedes prices from moving higher. The same happens during declining markets, where resistance (support) to lower prices forms as the demand from buyers overwhelms the supply of stock for sale.

In that April 7th article, we stated that the markets were three standard deviations below long-term moving averages and challenging rising trend lines. In other words, those were previous levels where “resistance was futile,“ such oversold conditions typically precede short-term rallies to allow investors to reduce exposure to equities. We also noted that the target for a tradable rally was between 5500 and 5700. (The market closed at 5686 on Friday.)

Such is why we focus heavily on investor sentiment and positioning. When investors are extremely bearish and are “panic liquidating” equity exposure during a market decline, that is often a contrarian indicator that resistance to a further decline is forming. When sellers become exhausted, it only takes a few buyers to push higher prices. Of course, when resistance to lower prices forms, the media headlines are often the most negative, and investors’ “loss aversion” behavior is the most extreme.

As we concluded in that article:

“It won’t take much for the market to find a reason to rally. That could happen as soon as next week. If the market rallies, we suggest reverting to the basic principles to navigate what we suspect will be more volatile this year. However, at some point, just as we saw in 2022, the market will bottom. Like then, you won’t want to believe the market is bottoming; your fear of buying will be overwhelming, but that will be the point you must step in.

Buying near market lows is incredibly difficult. While we likely aren’t there yet, we will be there sooner than you imagine. As such, when you want to ‘sell everything,’ ask yourself if this is the point where you should ‘buy’ instead.“

But what about the bull case?

Resistance For The Bulls

As with the bears, “resistance is futile” for the bulls just as much. As noted above, the market has had the longest “positive day” stretch in 21 years. While the media is becoming more convinced that the “bulls are back in town,” which is probably true, it should also be a warning that “resistance” to higher prices is forming since such previous winning streaks have failed.

As noted above, the relentless market rally has pulled many investors back into the market over the last few weeks. Sentiment has quickly changed from extremely bearish to bullish, and professional investors have rapidly ramped up exposures. While sentiment and positioning are not yet back to extremes, the market has technically reversed much of its previous oversold and technically deviated conditions.

Most notably, the market is now approaching the 200-DMA, which is a level at which many buyers were stepping in before the “Liberation Day” market plunge. Many buyers are close to getting back to even and will likely be inclined to sell as they approach breakeven. Furthermore, the 100-DMA, which is close to crossing the 200-DMA, provides further resistance. As noted in “Death Cross,” these moving average crossovers impede further price advances until they reverse.

The 100 and 200-DMA moving averages have historically defined market trends. For example, the 100-DMA (blue line) supported market pullbacks during 2021 and since the October 2022 lows. Conversely, those moving averages defined the peaks of reflexive rallies during the 2022 correction. With the markets again trading below those averages, seeing sellers emerge as markets approach those resistance levels would be unsurprising.

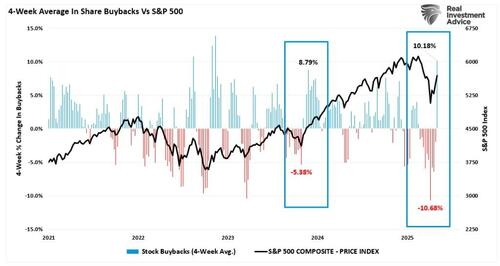

Is the current correction over, and is the bull market resuming? Maybe. We certainly saw such a situation in the summer of 2023, when the markets declined 10%, a “death cross” occurred, and markets immediately bottomed and surged to new highs. Then, like today, there was a surge in corporate buybacks and a quick reversal of very bearish sentiment. However, as shown in the chart above, even if we are experiencing a 2023-type scenario, there will be short-term corrections and pullbacks, providing investors an entry point to increase equity exposure as needed.

So, how do we know if the current market is like 2022 or 2023? Should investors be selling rallies or buying dips?

Beating The Borg

In Star Trek, the crew of the Enterprise eventually defeats the Borg through a combination of strategic attacks and exploiting weaknesses in their collective structure. The crew of the USS Enterprise-D, led by Captain Picard, used their access to the Borg collective, through Picard’s assimilation, to their advantage and were able to disable and destroy the Borg cube by exploiting its regeneration subroutines. Unfortunately, defeating the “collective” of our emotional biases when investing isn’t much easier, but it is possible.

Interestingly, when I write posts like these, someone often comments, “Why won’t you just tell us whether the market is going up or down?” It’s a fair statement, but unfortunately, I am not prescient, nor is anyone else, and navigating markets does not work like that.

If I want to be bearish, it is easy to state the market is at resistance and about to crash, so you better “get out now.” Or, if I wanted to be bullish, I could point to October 2022 and make the case why markets are about to surge higher. Either prediction has a decent chance of being wrong, leaving investors on the wrong side of the trade. As such, this is why we don’t predict, but instead navigate the current market for the possibilities versus the probabilities.

Historically speaking, when markets break longer-term moving averages, the first attempt at reversal often fails. Notice that I said “often” and not “always.” That is because sometimes markets do the unexpected, and, as investors, we must be able to recognize the change and respond accordingly. Such is why we never recommend entirely getting out of markets.

In a recent #BullBearReport entitled Spock & The Logic-Based Approach To Investing, we discussed that as investors, we must weigh possibilities and probabilities and manage our risk accordingly. To wit:

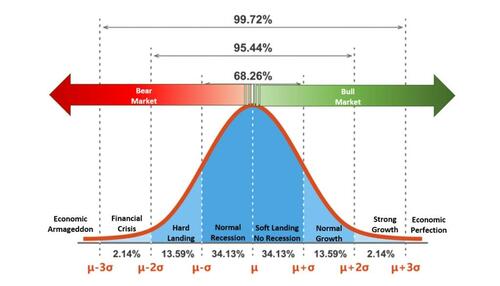

“Investing means cutting through noise, avoiding speculation, and relying on data. For example, the media is jammed with emotionally charged headlines about tariff-induced trade wars, recessions, and de-dollarization. In reality, those events rarely occur. The chart below shows a normally distributed bell curve of potential events and outcomes. In simple terms, 68.26% of the time, typical outcomes occur. Economically speaking, such would be a normal recession or the avoidance of a recession. 95.44% of the time, we are most likely dealing with a range of outcomes between a reasonably deep recession and standard economic growth rates. However, there is a 2.14% chance that we could see another economic crisis like the 2008 Financial Crisis. But what about “economic armageddon?” That event where nothing matters but ‘gold, beanie weenies, and bunker.’ That is a 0.14% possibility.“

So, Where Are We Now

If you want my best guess, here it is:

- We’ve likely seen the market lows for this year.

- We’ve likely seen the highs as well.

Navigating a market trapped between support and resistance becomes emotionally challenging. Investors face sharp rallies into resistance — and retracements back to support — wearing down sentiment until mistakes happen.

Therefore, this is how we are positioned in this current and uncertain market environment.

- Primarily long equities, as the market structure remains bullish.

- Increased cash levels to manage policy and growth uncertainty.

- Short S&P 500 index to hedge downside risk.

We also recommend a healthy portfolio and risk management regimen.

- Tighten up stop-loss levels to current support levels for each position.

- Hedge portfolios against more significant market declines.

- Take profits in positions that have been big winners.

- Sell laggards and losers.

- Raise cash and rebalance portfolios to target weightings.

Here’s the hard truth: you can’t measure risk in advance.

Markets are unpredictable, and while we can guess what might happen, the future is uncertain. When we think about risk, most of us focus on the risk of losing money. However, there are other risks we should be aware of, like missing out on gains by playing it too safe or being forced to sell investments during a market crash. Both can be just as damaging to our portfolios in the long run. We don’t have any foresight into what the market will do next week or month.

All we can do is remain focused on our portfolio, manage the risk of “being wrong,” and realize that “resistance is futile” when investing in the market. As Howard Marks once penned:

“Too little skepticism and too much eagerness in an up-market – just like too much resistance and pessimism in a down-market – can be very bad for investment results.“

Just something to think about.

Now, “Make it so.”

-

Site: The Remnant Newspaper - Remnant ArticlesPope Francis, who famously advocated “making a mess,” applied that maxim to his pontificate, making it highly disruptive, divisive and tumultuous. The mess generated much understandable unease, consternation and, at times, disgust, especially as such a deliberate approach to governance has never been consistent with the Catholic faith, the common good, Divine Revelation, and the natural law.

-

Site: Zero HedgeISM Services Survey Surprises To Upside As Prices Paid SurgeTyler Durden Mon, 05/05/2025 - 10:10

'Soft' survey data continues to slump into this morning's Services PMIs as Manufacturing PMIs were weak and Regional Red surveys were a disaster (despite still solid labor market 'hard' data)

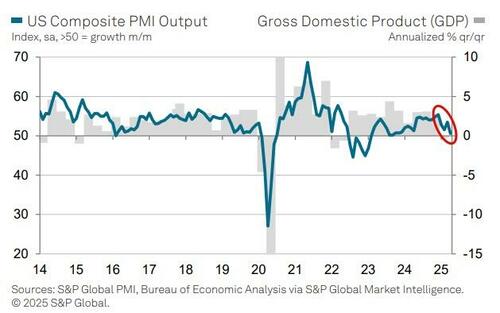

The S&P Global Services PMI fell from 54.4 to 50.8 (below the 51.4 flash print) in final April data - the lowest since Oct 2023.

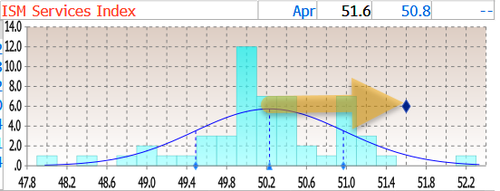

The ISM Services PMI rose from 50.8 to 51.6 (well above the decline to 50.2 expected).

So baffle 'em with bullshit is back:

The ISM print was better than all but one expectations...

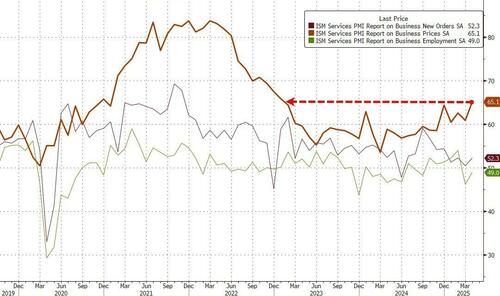

Under the hood, the picture is not so pretty with Prices Paid at the highest since Jan 2023 (even though New Orders and Employment picked up modestly)...

“The past relationship between the Services PMI® and the overall economy indicates that the Services PMI® for April (51.6 percent) corresponds to a 1-percentage point increase in real gross domestic product (GDP) on an annualized basis,” according to PMI.

The S&P Global US Composite PMI® fell to 50.6 in April, down from March’s 53.5 and its lowest level since September 2023.

"While tariff announcements mean manufacturing dominates the news, a worrying backstory is developing in the vastly larger services economy, where business activity and hiring have come closer to stalling in April amid plunging business confidence," Chris Williamson, Chief Business Economist at S&P Global Market Intelligence warns that:

"Business and consumer facing service providers alike, and especially financial services firms, are reporting markedly weaker growth prospects, citing intensifying uncertainty over the economic outlook amid recent tariff announcements and ongoing federal spending cuts."

"A key area of weakness is slumping exports of services, which is now falling at rate not seen since 2022, but domestic demand is also reportedly waning as confidence slides lower.

But the stagflationary aspects seen in the Manufacturing survey are also showing up in Services...

"Higher prices paid for imports due to tariffs are also driving up service sector firms’ costs, feeding though to higher prices, notably in consumer-facing industries such as restaurants and hotels.

"The resulting bottom line from the services sector is a heightened risk of stalling growth and rising inflation, or stagflation."

Bad enough news for Fed cuts? Or hot enough stagflation to leave Powell on pause for longer?

-

Site: Ron Paul Institute - Featured Articles

Benjamin Netanyahu said on Thursday that freeing the Israeli hostages in Gaza was not his top priority, suggesting instead that defeating Hamas should take precedence over a hostage deal.

“We have many objectives, many goals in this war,” Netanyahu said. “We want to bring back all of our hostages. That is a very important goal. In war, there is a supreme objective. And that supreme objective is victory over our enemies. And that is what we will achieve.”

Nothing the prime minister said here is true or valid — unless by “enemies” he means “all Palestinians in the Gaza Strip”.

Netanyahu Says Freeing Hostages Is Not His Priority

— Antiwar.com (@Antiwarcom) May 2, 2025

The Israeli leader said his 'supreme objective is victory over enemies'

by Dave DeCamp@DecampDave #Netanyahu #Gaza #Israel #Palestinians #hostages https://t.co/jI1XBUkA9hNetanyahu has been fairly transparent about the fact that Israel’s ultimate goal in Gaza is neither freeing the hostages nor defeating Hamas, but seizing Palestinian territory and removing its Palestinian inhabitants. He has openly said that Israel will occupy Gaza via military force, completely ruling out the possibility of any form of Palestinian government for the enclave. He has openly said he wants to enact President Donald Trump’s ethnic cleansing plan for Gaza, which explicitly entails removing “all” Palestinians and never allowing them to return.

So they’ve made this perfectly clear. This isn’t about Hamas, except insofar as an armed resistance group will make it difficult to forcibly remove all Palestinians from Gaza. And it certainly isn’t about hostages.

And yet, bizarrely, this is how the western political-media class continues to frame this onslaught. They call it Israel’s “war with Hamas”, when it’s nothing other than an undisguised ethnic cleansing operation. They prattle on about October 7, hostages, and terrorism, even though it has already been made abundantly clear that this has nothing to do with any of those things. They act as though the admission was simply never made.

There is absolutely no excuse for continuing to babble about hostages and Hamas after the US and Israel said the goal is the complete ethnic cleansing of Gaza. They told you what this is really about. They said it. With their face holes. They said it right to you. End of debate.

Israel has been seeking ways to purge Gaza of Palestinians for generations. That’s all this has ever been about. Not October 7. Not hostages. Not Hamas. Not terrorism. Everything about Israel’s operations in Gaza have indicated that their real goal is to remove Palestinians from a Palestinian territory and not to free hostages or defeat Hamas. And then when Trump took office, they started openly admitting it.

Trump Says No Right of Return for Palestinians in Gaza Under His Plan

— Antiwar.com (@Antiwarcom) February 10, 2025

Egypt has called an emergency Arab summit in response to #Trump's repeated calls for the permanent displacement of Gaza's #Palestinians

by Dave DeCamp@DecampDave #Gaza #Israel #Egypt https://t.co/Yg4hswznCUHow is this not the whole entire conversation every time Gaza comes up? How is this not the beginning, middle and end of every single discussion?

This is like a cop looking right into someone’s phone camera while strangling a black man to death and saying “I am killing this man because I am racist and I want to kill black people,” and then afterward everyone’s still saying “resisting arrest” and “we don’t know what happened before the video started recording”. He said what he was doing and what his motives were with his own mouth.

You don’t get to babble about Hamas, October 7 or hostages in defense of Israel’s actions in Gaza anymore. That is not a thing. If you want to defend Israel’s actions in Gaza, the sole topic of conversation is whether or not it’s okay to forcibly purge an entire population from their historic homeland by systematically bombing, shooting and starving them while destroying their civilian infrastructure, solely because of their ethnicity.

That is what the discussion is about. Not anything else. That and that only.

Reprinted with permission from Caitlin’s Newsletter.

Subscribe and support here. -

Site: Mises InstituteAlthough government officials and true believers in “green energy” are denying it, the collapse of the electric grid in Spain and Portugal proves that reliance on renewables for electric production is doomed to failure. Whether people listen is another story.

-

Site: Steyn OnlineThere have been significant elections in His Majesty's three senior realms this last week, and a significant post-election development in Europe, too. I'll get to most of them tomorrow, but for now I'd like to focus a little more narrowly:

-

Site: Steyn OnlineHere we go with Part Four of our brand new Tale for Our Time - my springtime serialisation of Jerome K Jerome's even more idiosyncratic sequel to Three Men in a Boat - from 1900, Three Men on the Bummel. We always get lots of perceptive comments on our

-

Site: Zero HedgeRabobank: The Foreign Film Tax Reads Like A Tax On Wealthy DemocratsTyler Durden Mon, 05/05/2025 - 10:00

By Benjamin Picton, Senior strategist at Rabobank

Australia’s ruling Labor Party was returned to government in emphatic fashion over the weekend, becoming the only first-term government in Australian history to actually increase its numbers in the House of Representatives at its first bid for re-election. The Australian result echoes what we saw a week earlier in Canada, where a centre-left party that had been chronically trailing in the polls just a few months ago suddenly surged to victory. In Australia, as in Canada, the leader of the main centre-right opposition party not only lost the election, he lost his own seat in the parliament.

The return of Donald Trump to the White House looms large in both results and seems to have flipped last year’s dynamic of incumbency being a curse to a new environment where stability is favored and any hints of Trumpian instincts are punished by electors. Nevertheless, while it might be tempting to read this as a uniform embrace of bigger government and globalized trade across the Anglosphere (ex-USA), that might be over-interpreting the signal as there are confounding signs elsewhere.

In England, for instance, things look quite different. Council elections held late last week saw both the ruling Labour Party and the main opposition Conservatives decimated by the right-wing populist Reform party. Reform won 677 out of around 1,600 seats, cementing the party’s position as a genuine third-force in British politics and an existential threat to the Conservative Party in particular. Labour lost control of Doncaster council and was displaced as the largest party bloc in Durham, while areas that have reliably voted Conservative for aeons flipped to Reform.

What to make of these results? Perhaps the most we can say is that a volatile external environment is upending established political norms and, in some cases, established political parties as frustration with politics-as-usual vies against popular revulsion of the leader of the Free World. Local voter profiles will also be a factor here as England particularly tends to lean further to the right than much of the rest of the UK while in Canada the emphatic result papers over rumbling discontent in resource-rich Western Provinces.

Nevertheless, markets are back into risk-on mode with the S&P500 and the NASDAQ closing up ~1.5% on Friday and US 10-year yields poking higher to 4.31%. The Dollar spot index closed above 100 on Friday, but has edged back below that key level this morning following a better than expected US payrolls report on Friday, comments by Trump that tariffs on China would be lowered “at some point” and assurances that he wouldn’t be firing “too slow” Jerome Powell (probably because he can’t).

Crude oil prices have fallen by more than 3% in early trade this morning to see benchmark Brent prices back below $60/bbl. The falls were precipitated by reports that Saudi Arabia could look to increase output even further in response to other OPEC+ producers (particularly Iraq and Kazakhstan) exceeding agreed production levels.

The falls in oil prices are interesting given that tensions in the Middle East have only increased over the last few days. A Houthi missile managed to elude Israel’s Iron Dome to strike just outside the Ben Gurion Airport in Jerusalem, injuring a number of bystanders. Prime Minister Netanyahu said that Israel will respond to the Houthi attack and, critically, to the Houthis’ “Iranian terror masters” at a time and place of Israel’s choosing. Netanyahu’s threat against Iran follows rumours that US National Security Advisor Mike Waltz was fired (at least in part) for coordinating with Israel on plans to attack Iran’s nuclear program even while Trump’s Middle East Envoy, Steve Witkoff, was trying to reach a deal with Iran over the same.

Will Israel unilaterally attack Iranian nuclear assets? Might they attack the oil facilities on Kharg Island that ultimately bankrolls the Iranian nuclear program? These are non-zero probabilities, but any risk premium for crude is MIA while the market continues to stare down the barrel of substantial oversupply.

Still, Treasury Secretary Scott Bessent will be pleased to see lower energy prices coinciding with the recent strengthening of the DXY and bond yields that show no real signs of threatening the 2023 highs. This happy combination might take the edge off of the price impacts of tariffs, which is timely given an announcement by Donald Trump this morning that foreign films will be subject to a 100% tariff rate.

Considerable uncertainty over price pass-through from tariffs still exists. Bessent and Trump tell us that exporters will “eat” the cost, but Amazon has conspicuously passed costs through to consumers and there are plenty of anecdotes to be found about purchasing managers halting new orders. In reality the burden will be shared between exporters (via lower prices), importers (via lower margins) and consumers (via higher prices) with a little bit of deadweight loss tacked on just to upset economists. The price elasticity of demand for each product is going to be the critical factor, which makes the foreign film tariff read like an indirect tax on wealthy Democrats.

How price sensitive are US consumers of French arthouse cinema likely to be?

-

Site: Zero HedgeKey Events This Week: All Eyes On The Fed And BOETyler Durden Mon, 05/05/2025 - 09:55

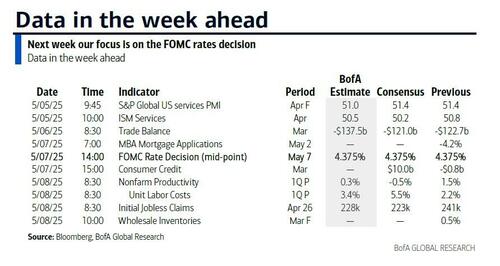

After the busiest week of Q1 earnings season, and a blockbuster week for macro, which included a stronger than expected jobs report, we enter a week that should see attention turn back towards central banks, with the latest Fed (Wed) and BoE (Thu) decisions due. These come as markets have largely shaken off the tariff-driven stress of the past few weeks, as rising optimism on tariff de-escalation and Friday’s solid US payrolls print brought the S&P 500 back above its pre-Liberation Day level, with the index posting its longest winning streak since 2004. Admittedly, the recovery has been far from even across asset classes. A notable laggard is the US dollar, trading nearly -4% below April 2 levels this morning. Investors will continue to keenly watch the tariff headlines and peruse the latest evidence of tariff impacts in this week’s data ranging from the US April ISM services (today) to German factory orders (Wed) and China’s April trade data (Fri).

The full day by day week ahead is at the end as usual, but the main highlight will be the Fed's decision on Wednesday and Chair Powell's press conference afterwards. Most economists expect the Fed to keep rates steady and avoid explicit forward guidance about the policy path ahead. They see the overall tone as likely to echo recent Fed comments that the administration's policies are likely to push the economy away from the Fed's dual mandate objectives for a period of time but that monetary policy is "well positioned" to respond to the evolving outlook. Rate cut expectations were pushed back after the strong jobs report, with risks for further easing contingent on a weaker labor market rather than the Fed delivering pre-emptive cuts. Fed funds futures are pricing a 37% chance of a cut by the next meeting in June, with a full 25bp cut priced by July.

In terms of the rest of the week ahead, central banks will also be in focus in Europe, with policy decisions from the UK, Norway and Sweden all due on Thursday. The BoE is expected to deliver a 25bp cut that would take the Bank Rate to 4.25%, while Norges and Riksbank are expected to keep rates on hold. Meanwhile, the ECB will hold an informal meeting on May 6-7 to discuss its 2025 monetary policy strategy assessment, which our European economists preview here.

Turning to economic data, in the US the main test ahead of the Fed will be today’s April ISM services reading, which economists see declining to 50.3 from 50.8. That comes as the April data so far, including a decent US ISM manufacturing print last week, have shown few signs of either the US or the global economy ‘breaking’ from the tariff turmoil even as sentiment indicators paint a worrying picture.

It will be a pretty quiet data week in Europe, with Germany’s factory orders (Wed) and industrial production (Thu) prints the highlights, while in Asia the April trade figures out of China (Fri) are expected to show a material slowing amid the tariff disruption.

In corporate earnings, key US releases include Palantir, AMD, Walt Disney and Uber. In Europe, earnings from the likes of Novo Nordisk, Siemens Energy, AP Moller-Maersk, BMW, AB InBev and Rheinmetall will be of extra interest in light of the trade tensions.

Courtesy of DB, here is a day-by-day calendar of events

Monday May 5

- Data: US April ISM services, Switzerland April CPI

- Earnings: Vertex, Williams, CRH, Ares, Diamondback Energy, Ford, BioNTech, ON Semiconductor

- Auctions: US 3-yr Notes ($58bn)

Tuesday May 6

- Data: US March trade balance, China April Caixin services PMI, UK April official reserves changes, new car registrations, France March industrial production, Italy April services PMI, Eurozone March PPI, Canada March international merchandise trade

- Earnings: Palantir, AMD, Arista Networks, Intesa Sanpaolo, Ferrari, Constellation Energy, Zoetis, Marriott, Coupang, Fidelity, Electronic Arts, Datadog, IQVIA, Rivian, Vestas, Astera Labs, Zalando

- Auctions: US 10-yr Notes ($42bn)

Wednesday May 7

- Data: US March consumer credit, China April foreign reserves, UK April construction PMI, Germany March factory orders, April construction PMI, France March trade balance, current account balance, Q1 wages, private sector payrolls, Italy March retail sales, Eurozone March retail sales, Sweden April CPI

- Central banks: Fed's decision

- Earnings: Teva, Novo Nordisk, Walt Disney, Uber, ARM, MercadoLibre, DoorDash, Fortinet, Siemens Healthineers, BMW, Carvana, Axon, Vistra, Flutter Entertainment, Occidental Petroleum, Barrick Gold, Legrand, Rockwell Automation, Vonovia, Orsted, Pandora, Telecom Italia, Sandisk

Thursday May 8

- Data: US Q1 nonfarm productivity, Q1 unit labor costs, March wholesale trade sales, April NY Fed 1-yr inflation expectations, initial jobless claims, UK April RICS house price balance, Germany March industrial production, trade balance

- Central banks: BoE, Riksbank and Norges Bank decision, BoJ minutes of the March meeting, BoE's April DMP survey, BoC financial stability report

- Earnings: Toyota Motor, AB InBev, Shopify, ConocoPhillips, Nintendo, DBS, McKesson, Enel, Rheinmetall, Siemens Energy, Coinbase, Cheniere Energy, Infineon, Kenvue, HubSpot, TKO Group, Leonardo, AP Moller - Maersk, Warner Bros Discovery, Toast, Expedia, Pinterest, DraftKings, Affirm, Tapestry, Illumina, Banca Monte dei Paschi di Siena, Rocket Lab, Paramount Global, Davide Campari-Milano, Crocs, Lyft, Puma, Peloton, Sweetgreen

- Auctions: US 30-yr Bonds ($25bn)

Friday May 9

- Data: China April trade balance, Q1 BoP current account balance, Japan March labor cash earnings, household spending, leading index, coincident index, Italy March industrial production, Canada April jobs report, Norway April CPI

- Central banks: Fed's Williams, Waller, Kugler, Goolsbee and Barr speak, ECB's Simkus and Rehn speak, BoE's Bailey and Pill speak

Earnings: Mitsubishi Heavy Industries, Recruit Holdings, Commerzbank, Cellnex

* * *

Finally turning to the US, the key economic data release this week is the ISM services report on Monday. The May FOMC meeting is on Wednesday. The post-meeting statement will be released at 2:00 PM ET, followed by Chair Powell’s press conference at 2:30 PM. There are several speaking engagements by Fed officials on Friday, when the blackout period for the May FOMC meeting ends.

Monday, May 5

- 09:45 AM S&P Global US services PMI, April final (consensus 51.2, last 51.4)

- 10:00 AM ISM services index, April (GS 49.8, consensus 50.3, last 50.8): We estimate that the ISM services index declined by 1pt to 49.8 in April, reflecting sequential softening in our non-manufacturing survey tracker (-1.1pt to 49.4 in April).

Tuesday, May 6

- 08:30 AM Trade balance, March (GS -$138.0bn, consensus -$136.7bn, last -$122.7bn): We estimate that the trade deficit widened to $138.0bn in March, reflecting higher imports ahead of tariff increases and a modest decline in travel exports as a result of foreign boycotts.

Wednesday, May 7

- There are no major economic data releases scheduled.

- 02:00 PM FOMC statement, May 6-7 meeting: We expect the FOMC to leave the fed funds rate unchanged at its May meeting and pushed back the first rate cut in our forecast to the July FOMC meeting (vs. June previously) after stronger-than-expected payrolls and ISM readings last week. As discussed in our FOMC preview, we expect Chair Powell to highlight that tariffs pose risks to both sides of the FOMC’s dual mandate goals of maximum employment and price stability. While the FOMC appears to be setting a higher bar for rate cuts than during the 2019 trade war, we do not think that high inflation would deter it from cutting if the unemployment rate begins to trend higher as the tariff shock hits the economy.

Thursday, May 8

- 08:30 AM Nonfarm productivity, Q1 preliminary (GS -0.9%, consensus -0.7%, last +1.5%); Unit labor costs, Q1 preliminary (GS +5.2%, consensus +5.2%, last +2.2%);

- 08:30 AM Initial jobless claims, week ended May 3 (GS 225k, consensus 230k, last 241k): Continuing jobless claims, week ended April 26 (consensus 1,892k, last 1,916k)

- 11:00 AM New York Fed 1-year inflation expectations, April (last +3.58%); New York Fed 3-year inflation expectations, April (last +3.00%); New York Fed 5-year inflation expectations, April (last +2.86%): The New York Fed will release its measures of inflation expectations for April. The University of Michigan’s 12-month measure of inflation expectations increased by 1.5pp in April on the back of news about tariffs.

Friday, May 9

- There are no major economic data releases scheduled.

- 06:15 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will deliver a keynote address and will take part in a Q&A at the Reykjavik Economic Conference. Text and moderated Q&A are expected. On April 11th, Williams said that “the current modestly restrictive stance of monetary policy is entirely appropriate given the solid labor market and inflation still above our 2 percent goal,” noting that it positions the FOMC “well to adjust to changing circumstances that affect the achievement of our dual mandate goals.”

- 06:45 AM Fed Governor Barr speaks: Fed Governor Michael Barr will deliver a speech on artificial intelligence and the labor market at the Reykjavik Economic Conference. Text and Q&A are expected.

- 08:30 AM Fed Governor Kugler speaks: Fed Governor Adriana Kugler will deliver a speech on maximum employment at the Reykjavik Economic Conference. Text and Q&A are expected. On April 22nd, Kugler said she supported “maintaining the current policy rate for as long as these upside risks to inflation continue, while economic activity and employment remain stable.”

- 10:00 AM Chicago Fed President Goolsbee (FOMC voter) speaks: Chicago Fed President Austan Goolsbee will deliver opening remarks at a Fed Listens event in Chicago. On April 21st, Goolsbee said that the FOMC would want “to figure out the throughline” of where tariff policies ultimately settle, how much retaliation there will be, and how much impact the tariffs will have on supply chains “before we jump to action” on monetary policy.

- 11:30 AM New York Fed President Williams (FOMC voter) and Fed Governor Waller speak: New York Fed President John Williams and Fed Governor Christopher Waller will take part in a panel discussion titled “John Taylor and Taylor Rules in Policy” at the Hoover Institution’s Monetary Policy Conference. Text and Q&A are expected. On April 14th, Waller said he thought “monetary policy is meaningfully restricting economic activity” and that if high tariffs induce a slowdown that is “significant and even threatens a recession, then I would expect to favor cutting the FOMC’s policy rate sooner, and to a greater extent, than I had previously thought.” That said, Waller also noted that he would support “a more limited monetary policy response” in a smaller-tariff scenario with limited effects on inflation and growth.

- 07:45 PM St. Louis Fed President Musalem (FOMC voter), Cleveland Fed President Hammack (FOMC non-voter), and Fed Governor Cook speak: St. Louis Fed President Alberto Musalem, Cleveland Fed President Beth Hammack, and Fed Governor Lisa Cook will take part in a panel discussion at the Hoover Institution’s Monetary Policy Conference. Text is expected for President Musalem and Governor Cook’s remarks. Q&A is expected. On April 11th, Musalem judged that “monetary policy is currently well positioned given the state of the economy and the balance of risks.” On April 16th, Hammack noted that she would rather “be slow and move in the right direction than move quickly in the wrong direction.” And on April 5th, Cook noted that she placed “more weight on scenarios where risks are skewed to the upside for inflation and to the downside for growth,” and that those scenarios “could pose challenges for monetary policy.”

Soruce: DB, Goldman

-

Site: Zero HedgeTaibbi: No, State Media And Democracy Don't Go "Hand In Hand." Just The OppositeTyler Durden Mon, 05/05/2025 - 09:40

Authored by Matt Taibbi via Racket News,

The press watchdog Fairness and Accuracy in Reporting, or FAIR.org, which I read regularly as a young reporter, weighed in on the NPR debate:

One could look at this threat as part of Trump’s general distrust of major media and desire to seek revenge against outlets he believes have been unfair to him… Going after public broadcasters is also a part of the neo-fascist playbook authoritarian leaders around the world are using to clamp down on dissent and keep the public in the dark, all in the name of protecting the people from partisan reporting. That’s largely because strong public media systems and open democracy go hand in hand.

Titled “Cuts to PBS, NPR Part of Authoritarian Playbook,” the above is either satire or written by someone consciously ignoring the history of state media. Yes, Car Talk and the MacNeil/Lehrer report were cool, but outlets like Neues Deustchland, Télé Zaïre, and Tung Padewat more often went “hand in hand” with fingernail factories or firing squads than democracy. It’s bizarre to see Americans trying to whitewash this.

The office of my first full-time reporting job with the Moscow Times was in the Pravda building. I used to spend lunch hours walking through the doors shown in the photo above, beering up in a cafeteria with writers from the sports section of Komsomolskaya Pravda, at the time the Guinness Book record-holder for world’s largest circulation. With over 21 million readers, “Komsomolka” sure as hell qualified as “strong public media,” but hardly went “hand in hand” with democracy. Like the rest of ex-Soviet media, its owed its circulation to decades of forcing insane lies on readers, like cheery dispatches about the “Doctor’s Plot” purges of 1953:

The Russian muckrakers of the 1990s threw themselves into the job like superheroes once they got a whiff of freedom, which in their case usually meant being disentangled from the state. That period, like the lives of many of those folks, didn’t last long. Vladimir Putin sent masked police into the last independent TV station on May 11, 2000, capping less than ten years of quasi-free speech. “Strong state media” remained, but actual journalism vanished.

People who grew up reading the BBC or AFP may imagine a correlation between a state media and democracy, but a more dependable indicator of a free society is whether or not obnoxious private journalism (like the Russian Top Secret, whose editor Artyom Borovik died in a mysterious plane crash) is allowed to proliferate. As for those once-storied European networks, most have now become parodies, operating in concert with multiple official review operations like BBC Verify or the “Trusted Flaggers” of the EU’s Digital Services Act. This layered messaging system essentially guarantees favorable coverage of public policy and is more dangerous than asking the listeners of stations like NPR to pay for media they like.

As anyone who’s read Hate Inc. knows, I was until recently a proponent of public incentives for journalism, which is necessary but hard to fund. The Post Office Act of 1792 charged publishers fractions of normal postage rates. Western expansion was aided by gratis rides on the Pony Express for “newspaper slips,” and the Communications Act of 1934 helped birth broadcast news by requiring licensees of public airwaves to operate in the “public interest, convenience, and necessity.” After the Public Broadcasting Act of 1967 passed, we enjoyed an imperfect system that left room for public and private innovations, from Sesame Street to Radical Chic. Which was great, but how nuts do you have to be to think “strong state media” doesn’t have a dark side? Is the history of this stuff just not being taught?

-

Site: AsiaNews.itThe Philippine Islamic Burial Law fills a regulatory gap that has been a source of tensions with Christians. In compliance with Islamic religious precepts, burial can take place within 24 hours, while violations will be sanctioned with jail time or fines. This success for the Muslim religious minority has sparked reactions among some Catholics.

-

Site: Zero HedgeWhite House Eyes Deep Cuts In Non-Defense Spending, Boosts Military BudgetTyler Durden Mon, 05/05/2025 - 09:20

The Trump administration has unveiled an early discretionary spending request ahead of its formal FY2026 budget submission. The proposal aims to cut discretionary funding by $140 billion - roughly 0.5% of GDP, and significantly shift the balance between defense and non-defense spending.

According to Goldman Sachs' Alec Phillips, the proposal would reallocate $119 billion (0.4% of GDP) from non-defense agencies to defense and border-security-related activities. This includes a $163 billion allocation for FY2026 as part of a broader $325 billion funding assumption for defense and border security within a forthcoming budget reconciliation package. Non-defense agencies - excluding departments such as Homeland Security and Justice - would face an average cut of 23%.

Yet, these headline figures may exaggerate the near-term fiscal impact, as Congress is likely to authorize higher spending than the White House proposes, resulting in only a modest 1% decline in discretionary spending in real terms for FY2026.

Proposed Shift from Non-Defense to Defense Spending

The Office of Management and Budget (OMB) is proposing a $140 billion reduction in discretionary funding, equivalent to 0.5% of GDP, for FY2026. Of this, $119 billion (0.4% of GDP) would be shifted from non-defense to defense spending, with civilian agencies outside of Homeland Security and Justice facing average cuts of 23%.

This marks a sharp shift in tone from previous administrations, including the first Trump term, which often signaled concern about the deficit but ultimately supported expansive spending. As Academy Securities notes:

“Unlike in Trump 1.0 (and pretty much in every other administration which all claimed to be somewhat cautious on the deficit but then spent on everything), there is austerity here.”

The proposal assumes Congress will provide $325 billion in funding for defense and border security in the upcoming reconciliation package, with $163 billion allocated for FY2026.

Realized Spending Cuts Will Likely Be Smaller

Despite the headline cuts, Phillips anticipates only a modest decline in actual spending from this segment in FY2026 for several reasons:

-

Delayed outlays: Agencies typically spend appropriated funds over multiple years. Historically, just over half of fiscal year appropriations are spent in the same year.

-

Expiration of emergency funds: Most of the proposed net reduction reflects the non-renewal of $118 billion in emergency spending passed in late 2024. Goldman had not expected that amount to be renewed, while the Congressional Budget Office projects the spending out of those funds to be even slower than usual.

-

Slow disbursement of past emergency funds: The Congressional Budget Office (CBO) projects that only half of the 2024 emergency funds would be spent in 2025–2026.

These points suggest that the actual decline in spending will be far smaller than top-line figures imply.

From Academy Securities’ vantage point, that could help assuage markets:

“That should help interest rates if it looks like the budget can progress without the austerity measures being dramatically reduced (always a possibility in D.C.).”

Legislative Timing Likely to Delay Final Budget

Phillips projects that Congress is unlikely to settle spending totals for this segment of the budget until much later in 2025. A reconciliation bill that includes supplemental funds for defense and border security is not expected before early August, while standard appropriations bills could take even longer.

This raises the risk of a government shutdown when the new fiscal year begins on October 1, though analysts expect the government to operate under continuing resolutions (CRs) that keep funding flat in nominal terms - possibly well into 2026.

As Academy notes, these delays may begin to have market effects:

“Negotiations will start to move markets in the coming weeks.”

Budget Deficit Expected to Hold Steady Despite Spending Cuts

Even with slightly lower discretionary outlays, Goldman forecasts a 1% real decline in the portion of federal spending that contributes to GDP. However, this is outweighed by rising mandatory spending, which continues to grow due to entitlements and interest obligations.

On the revenue side, Goldman expects:

-

Modestly higher tariff revenue, but

-

Offsetting declines in income and payroll taxes, due to both a downgraded growth outlook and the likely extension of Trump-era tax cuts.

Academy Securities adds a key nuance:

"Only additional or new tax cuts will really be stimulative. The extension of existing cuts... won’t be a boost to the economy since virtually no one is adjusting their spending on the assumption that those won’t be extended."

In other words, extending the current tax cuts may prevent a drag on consumption, but will not provide meaningful new stimulus. Conversely, failure to extend them could cause a sharp pullback.

Ultimately, Goldman projects:

-

FY2026 deficit: $1.95 trillion, or 6.2% of GDP

-

FY2027 deficit: $2.15 trillion, or 6.6% of GDP

Bottom Line

The 2026 budget proposal introduces a rhetorical commitment to austerity that differentiates it from past White House strategies. But procedural hurdles, slow disbursement of prior-year funds, and political resistance in Congress suggest that the real-world impact on fiscal aggregates may be modest—at least in the near term.

Markets are likely to begin reacting as budget negotiations progress, particularly as the fate of tax policy and defense spending becomes clearer.

-

-

Site: Zero HedgeTether AI Platform To Support Bitcoin And USDT Payments, CEO SaysTyler Durden Mon, 05/05/2025 - 09:00

Authored by Helen Partz via CoinTelegraph.com,

Tether AI, the forthcoming artificial intelligence platform from stablecoin giant Tether, will feature payments in major cryptocurrencies, including USDt and Bitcoin.

Tether CEO Paolo Adroino took to X on May 5 to tease the imminent launch of Tether AI, the company’s new AI platform designed to offer “personal infinite intelligence.”

According to Ardoino, Tether’s AI platform will be integrated with USDt and Bitcoin payments, allowing users to make transactions directly through a peer-to-peer (P2P) network.

Source: Paolo Ardoino

The initiative builds on Tether’s December 2024 announcement that it was developing a website for the AI tool, targeting a launch by the end of the first quarter of 2025.

Support of “any hardware and device”

Ardoino emphasized that Tether AI will not use application programming interface (API) keys and will not depend on centralized control points.

Instead, Tether AI will offer a “fully open-source AI runtime” that will run on an “unstoppable peer-to-peer network,” and be “fully modular and composable.”

Additionally, Tether AI will be capable of adapting and evolving on “any hardware and device,” he said.

P2P crypto payments enabled with WDK

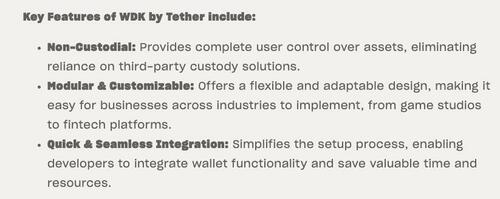

The announcement also said Tether AI’s P2P crypto payments will be “infused” with its open-source wallet development kit (WDK), launched in November 2024.

Tether’s WDK is a toolkit that enables developers to build mobile, desktop and web wallet applications, enabling self-custodial, or non-custodial, holding of USDt and Bitcoin.

An excerpt from Tether’s WDK announcement in November 2024. Source: Tether

Unlike custodial wallets, self-custodial wallet solutions allow users to control assets completely, eliminating reliance on third-party custody solutions for completing transactions.

Tether doubles down on AI

Tether AI is part of a broader strategy to expand the company’s footprint in artificial intelligence.

In April 2024, Tether announced company restructuring to introduce new divisions beyond stablecoin development, launching Tether Data, a dedicated unit focused on AI and P2P development.

In February, Ardoino announced that its AI division was working on a series of AI apps, including AI Translate, AI Voice Assistant and AI Bitcoin Wallet Assistant.

Source: Paolo Ardoino (X post translated by Google)

According to Ardoino, Tether AI has one key goal of providing the “ideal technological foundation” to achieve the vision of AI described by Isaac Asimov, one of the most influential science fiction authors about AI, known for works such as I, Robot, The Robot Series and more.

“AI will, in the coming decades, become part of the very fabric of the universe,” Ardoino said in another X post, written in Italian.

-

Site: Ron Paul Institute - Featured Articles

President Trump has proposed using the revenue from his increased tariffs to lower or even eliminate income taxes — with a priority on removing Americans making less than 200,000 dollars a year from the tax rolls. Exempting more Americans from income taxes — and lowering taxes on other Americans— is certainly a worthwhile endeavor. However, replacing income taxes with tariffs may have negative consequences for the very Americans President Trump wants to help.

Replacing with tariffs what the government raises from income taxes may require raising tariffs even higher than President Trump’s “liberation” tariffs. This would cause more price increases and encourage other governments to retaliate by raising their tariffs, further disrupting supply chains and leading to even higher prices and shortages. The negative impacts of tariffs could dwarf the benefits of lower, or even no, income taxes.

Consumers can try to avoid tariffs on goods. Massive avoidance of tariffs could lead to the imposing of higher tariffs or new taxes. The reason politicians must play the game of “offsetting” tax reductions with tax increases is they refuse to make meaningful reductions in government spending. The politicians’ favorite tax is the Federal Reserve’s inflation tax because it is hidden. It is also regressive, making it the worst type of tax.

The media and big spenders in both parties are screaming about how President Trump’s budget proposal contains large reductions in federal spending. However, even if all of President Trump’s 163 billion dollars of proposed cuts are enacted in law, the federal government will still spend about 1.7 trillion dollars next year in its “discretionary” budget. The cuts would be less than eight percent.

While President Trump is proposing many necessary cuts in federal agencies and programs, including those concerning the use of taxpayer money to promote “wokeness,” his budget increases military spending to around a trillion dollars. It also makes no changes to Social Security or Medicare. This means President Trump’s supposed radical spending plan does not reduce spending on three of the four largest items in the federal budget. The fourth is interest payments on the national debt, which Congress cannot reduce except by cutting spending.

Of course, it is unlikely that all, or even most, of President Trump’s spending cuts will be enacted into law. Prominent Republicans have already announced opposition to some of President Trump’s spending cuts. Some Republican defense hawks, including the chairman of the Senate Armed Services Committee, have criticized President Trump’s budget plan for not spending enough on the military!

The truth is that, if the president and Congress were serious about cutting spending, they would start by slashing the Pentagon’s budget. Very little of the military spending actually goes to defending the American people. Instead, much military spending goes to maintaining a global empire and lining the pockets of the military-industrial complex. Does anyone believe the safety of Americans depends on the US government maintaining over 700 military bases abroad?

The fiscal crisis facing America is rooted in a larger philosophic crisis. Too many Americans have embraced the notion that the US government has the moral right and competence to run the economy, run the world, and even run our lives. This system will not change until a critical mass of people embrace the ideas of liberty. Those of us who know the truth must do all we can to spread the message of liberty, peace, and prosperity.

-

Site: Zero HedgeRomanian Prime Minister To Resign After Conservative Candidate Crushes Coalition In Do-Over ElectionRomanian Prime Minister To Resign After Conservative Candidate Crushes Coalition In Do-Over ElectionTyler Durden Mon, 05/05/2025 - 08:30

Update (0825ET): Romania’s prime minister will resign on Monday after a conservative opposition leader who aligned himself with Donald Trump scored a resounding first-round victory in the Black Sea nation’s presidential election.

Bloomberg reports, that Marcel Ciolacu informed coalition partners of the decision to submit his resignation in a meeting Monday in Bucharest, according to people familiar with the decision who spoke on condition of anonymity. The government will be led by an interim premier until coalition parties choose Ciolacu’s successor. There are no current plans for an early election.

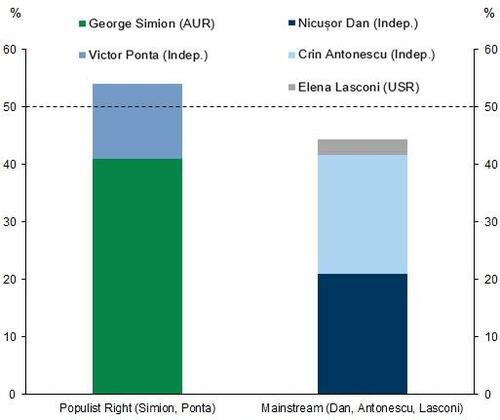

The prime minister’s decision was a response to the electoral defeat of the coalition’s preferred candidate in Sunday’s first-round contest, in which George Simion of the ultranationalist Alliance for the Union of Romanians secured more than 40%.

He’ll face off against Nicusor Dan, the centrist mayor of Bucharest.

As Goldman notes, as a result of his outperformance relative to opinion polls in the first round, the probability of Simion winning the second round has risen sharply in betting markets, from 30% probability prior to the vote to 69%, with Dan at 31%.

As a reminder, the contest was the second attempt to choose a president after the shock victory of another far-right fringe candidate last year prompted accusations of Kremlin interference and the top court’s cancellation of the ballot. The unexpected first-round victory in November of Calin Georgescu, who has been banned from running in Sunday’s race, triggered Romania’s biggest political crisis since the fall of communism.

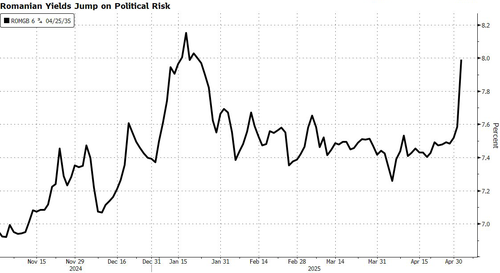

While the Romanian people have spoken a second time, the market seems less excited as Romanian government bonds fell after the first round of a presidential election delivered the victory of a far-right figure and eliminated the candidate backed by the ruling coalition.

The yield on the 10-year domestic notes jumped 20 basis points to 7.79%, the highest since the end of January; yields on shorter maturities also rose.

Romania’s dollar-denominated bonds also weakened and were among the worst performers in emerging markets on Monday; notes due in 2051 fell almost 1 cent on the dollar to about 58 cents

* * *

In the latest chapter in the country's months-long political drama that has seen an election thrown out and the winner charged with political crimes, 38-year-old conservative nationalist George Simion decisively won the first round of balloting in Romania's "do-over" presidential election, sending him to a May 18 runoff where he'll face centrist Bucharest mayor Nicusor Dan.

Simion has likened his political philosophy to Donald Trump's, saying his Alliance for the Union of Romanians party is "a Trumpist party," and promising to "Make Romania Great Again." The win is a buzzkill for Western leftists who've been enjoying the afterglow of comeback victories in Canada and Australia.

Though his first-round win was expected, Simion far outperformed the polling, taking 41% of the vote, versus the 30% projected by a recent poll of polls. Dan took 21%, edging Crin Antonescu, a candidate from the current governing coalition, who took 20%. Simion clearly has the inside track for the runoff, as observers say he's likely to gain quite a few votes from members of other parties whose beliefs align more closely with Simion than Dan. "Simion has a bigger pool of votes than Dan at the moment," political scientist Cristian Pirvulescu told Reuters.

George Simion (right) casts his ballot with fellow nationalist Calin Georgescu, who won the first-round balloting in November only to have the election thrown out

George Simion (right) casts his ballot with fellow nationalist Calin Georgescu, who won the first-round balloting in November only to have the election thrown out

Simion called the election a "victory for Romanian dignity...Despite the obstacles, despite the manipulation, despite a press paid to demean us day after day, Romanians have stood up.” The election has been closely watched by Western powers, as it could reshape Romania's relationships with the European Union and NATO.

However, while he's criticized both entities, don't expect Simion to usher Romania out of either of them. In various comments leading up to the election, he discounted the idea of Romania exiting NATO or the EU, sounded alarms over the supposed Russian menace, advocated continued sanctions against Moscow, and embraced increased European military spending. Consider these Simion quotes from an interview with the Financial Times:

- “Our stance cannot be changed. Eighty percent of the Romanians want NATO and want the European Union. This is not something we can negotiate.”

- “Putin’s Russia was and is one of the biggest threats for the European states, especially for us, for the Baltic states and for Poland."

- “Without a common geopolitical bloc, like . . . NATO, led by the US, we are in a big danger.”

While foreign observers tend to view the election through a NATO/EU lens, domestic political concerns are probably far more important to a public fed up with the corruption and incompetence of the mainstream parties. “Simion is the main representative of a strong anti-system feeling in Romanian society," political analyst Radu Magdin told Politico.

Simion has promised, if elected, to help secure a position in Romanian government for Calin Georgescu -- perhaps as prime minister. In a huge, poll-defying upset in November, nationalist Georgescu won the first round of balloting in Romania's first go at this presidential election. Then, just two days before the runoff, the country's Constitutional Court threw out the election and ordered it to be started anew -- based on shaky allegations that his victory was the result of Russian interference.

Romania has seen large protests against the annulment of November's presidential election and the banning of its winner (Vadim Ghirda, AP via France24)

Romania has seen large protests against the annulment of November's presidential election and the banning of its winner (Vadim Ghirda, AP via France24)

Georgescu was barred from running again. In February, Georgescu was arrested and questioned as he faced Orwellian allegations of disseminating "false information" and "incitement to actions against the constitutional order." Upon his release from custody, he was forbidden from appearing on mass media or creating social media accounts. Huge protests followed each move by the government to banish Georgescu from politics and discourse. In addition to charges of illegal campaign tactics, he's also been charged with helping to establish an organization “with a fascist, racist or xenophobic character.”

Campaigning last fall, Georgescu pledged to restore Romanian sovereignty and put an end to what he characterizes as subservience to NATO and the EU. He took a hard line against the presence of NATO's missile defense system that's based in Deveselu, southern Romania, calling it a "shame of diplomacy" that is more confrontational than peace-promoting. He has also pushed for Romania to pursue a non-interventionist policy in the Ukraine war, and said US arms-makers were manipulating the conflict.

Whatever his degree of nationalism, Simion is poised to become the third nationalist leading an eastern European country, alongside Hungary's Viktor Orban and Slovakia's Robert Fico -- that is, unless the leftists once again find a way to bar a popular right-wing candidate from victory.

-

Site: Zero HedgeFutures Slide, Jeopardizing Longest Winning Streak Since 2004; Dollar, Oil TumbleTyler Durden Mon, 05/05/2025 - 08:26

US equity futures are lower after the S&P gained 2.9% last week and erasing all post-Liberation Day losses. As of 8:00am, S&P futures were down 0.9%, putting the index on track to snap its longest streak of gains since 2004; Nasdaq futures dropped 1.0% with the Mag7 weaker, pulling markets lower, and cyclicals under pressure. Berkshire Hathaway stock is down 2% after Warren Buffett surprised Berkshire’s annual meeting on Saturday by announcing that he plans to step down at the end of the year. Overnight, Trump’s latest flurry of tariff comments gave little clarity on the path forward for markets: the president suggested some deals could come as soon as this week, but also that he had no current plans to speak with Chinese President Xi Jinping; he also said that a trade deal may come as soon as this week (India? Japan? S Korea?). Trading outside the US has been subdued to start the week, with several financial market including Japan, Hong Kong, China and the UK, closed today. The USD is weaker and bond futures are flat around 4.30%. Crude oil slumped after OPEC+ announced it is increasing supply (411k bpd), hurting oil prices but providing a disinflationary offset to tariff. Today’s macro data focus is on ISM-Services with the Fed on Weds.

In premarket trading, Berkshire Hathaway fell 2% after Warren Buffett announced he will be stepping down as CEO of Berkshire Hathaway at year-end, with Greg Abel set to take over upon board approval. The Mag 7 stocks were uniformly lower (Amazon -1.5%, Nvidia -1.1%, Meta -0.9%, Microsoft -0.6%, Apple -1%, Alphabet -0.6%, Tesla -0.7%). Gold mining stocks are rising as bullion advanced after its first back-to-back weekly loss this year (Barrick Gold +2.6%). Media stocks in decline after President Donald Trump announced Sunday that he plans to impose a 100% tariff on films produced overseas, extending his restrictive trade policies on US imports to the entertainment sector for the first time.(Netflix drops 4%; Warner Bros -2%; Paramount -1.5%; Disney -2%). Here are some other notable premarket movers:

- BioCryst Pharmaceuticals climbs 16% after the biotech posted revenue for the first quarter that beat the average analyst estimate.

- Freshpet slips 2% after the pet food maker cut its net sales guidance for the full year.

- Howard Hughes Holdings rose 8% after entering an agreement where Pershing Square will invest $900 million to acquire 9m newly issued shares of the company.

- ImmunityBio slumps 8% after the drug developer said it received a refusal-to-file letter from US FDA regarding its supplemental application to treat papillary disease.

- Sunoco declines 1.6% after agreeing to buy Parkland Corp. in a cash and stock deal valued at about $9.1b, including assumed debt.

Financial markets have steadied in the past two weeks as Trump dialed back his tariffs amid signs that trade talks are progressing, with the S&P 500 rallying for two straight weeks and notching nine successive days of gains. Still, a trade deal with China would be a prerequisite for the US benchmark to sustain the advance, according to strategists at Morgan Stanley led by Michael Wilson.

“Recent cyclical gains in equities don’t change the structural ‘Sell America’ theme,” said Charu Chanana, the chief investment strategist at Saxo Markets in Singapore. “Trade-deal optimism is giving way to the reality of complex, slow-moving negotiations.”

ISM Services data for April is due at 10am, with economists expecting it to decrease to 50.3 from 50.8. Attention will quickly turn to the Federal Reserve meeting on Wednesday, as Trump insists he doesn’t plan to fire Powell but continues pushing him to cut rates. Tyson Foods Inc. is due to report Monday morning, with the chicken and beef producer likely to shed light on consumption trends. Palantir Technologies Inc. is expected after markets close.

European equities were little changed, with the Stoxx 600 rising 0.1% to 536.75 as healthcare and media stocks were the biggest gainers, while energy and chemicals the worst performers. Here are the biggest movers Monday:

- Erste Group Bank shares advanced as much as 7.4% after it agreed to acquire a ~49% stake in Santander Bank Polska and 50% of Santander’s Polish asset management business TFI for a total cash consideration of €7 billion

- Polish bank stocks dropped

- Ratos shares gain as much as 8.8% to the highest level in more than a month after the Swedish investment firm reported Ebitda for the first quarter that beat the average analyst estimate

- European energy stocks declined as oil buckled on concerns of a global glut after OPEC+ agreed to another bumper output increase

- Astral Foods shares fall as much as 7.1%, the most since May 2024, after the agricultural animal-food company said earnings per share probably declined between 45% and 55% in the six months through March 31 from a year earlier

Earlier in the session, stocks in Asia advanced, helped by gains in Indian equities, as investors monitored evolving developments on the trade war front. The MSCI Asia Pacific Ex-Japan Index rose 1% to the highest since February, with Indian shares such as HDFC Bank and Mahindra providing a boost. Stocks in Taiwan fell 1.2%, the most in nearly two weeks, on concerns that a stronger currency would weigh on earnings of companies in the export-oriented economy. Investors are looking for the next cue after President Donald Trump suggested that his administration could strike trade deals with some countries as soon as this week. However, he also said he has no plans to speak with Chinese President Xi Jinping this week. In Australia, market players shrugged off Prime Minister Anthony Albanese’s historic election win as the S&P/ASX 200 Index fell 1%; The gauge was weighed down in part by Westpac’s shares, which fell on concerns about increased competition and headwinds from rate cuts. Markets in Japan, China and South Korea were closed for a holiday. In Singapore — which also saw the ruling party deliver a strong performance in weekend polls — the Straits Times Index ekes out a small gain.

In Taiwan, the biggest contributors to the benchmark index’s decline included Taiwan Semiconductor Manufacturing Co., Hon Hai Precision Industry Co. and Fubon Financial Holding Co. The local dollar surged as much as 5% on Monday, the biggest intraday gain in over three decades, on speculation exporters are rushing to convert their holdings of US dollars to the island’s currency.

In FX, Asian currencies surge on dollar weakness on a day when local holidays shutter most Asian equity markets. The Japanese yen leads major currencies higher gaining 0.5%, the Aussie is bolstered by a solid win for the incumbent Labor Party in weekend elections, and Taiwan’s currency surges as much as 5% to the highest in more than two years. Hong Kong’s dollar tests the top end of its range and the offshore yuan adds 0.2%.

In rates, treasuries are mixed in early US trading, with front-end yields lower as oil and stock prices slide after President Trump said he had no plans to talk to his Chinese counterpart this week. The 10Y yield was unchanged at 4.30%; front-end yields are 2bp-3bp richer on the day, 20- to 30-year cheaper by 1bp-2bp, leaving 2s10s and 5s30s spreads ~3bp wider.

In commodities, crude oil plunged as much as 5.1% in New York before paring the decline after OPEC+ agrees to a further increase in output over the weekend, bolstering global supplies. Gold advanced, and traded back over $3300.

Today's US economic calendar includes April final S&P Global services PMI (9:45am) and April ISM services index (10am). This week’s focal points include first coupon auctions of May-July quarter, beginning with 3-year note sale at 1pm New York time, and Wednesday’s Fed rate decision. Markets in Japan, Hong Kong, China and the UK were closed today.

Market Snapshot

- S&P 500 mini -0.8%

- Nasdaq 100 mini -0.9%

- Russell 2000 mini -0.9%

- Stoxx Europe 600 little changed

- DAX +0.4%

- CAC 40 -0.6%

- 10-year Treasury yield +9 basis points at 4.31%

- VIX +1.7 points at 24.38

- Bloomberg Dollar Index -0.3% at 1220.87

- Euro +0.3% at $1.1332

- WTI crude -2% at $57.14/barrel

Top Overnight News

- Warren Buffet is to step down as CEO of Berkshire Hathaway by year-end with Greg Abel to succeed Buffet as CEO later this year.

- Japan has no intention of using the possibility of selling its US government debt holdings for advantage in trade talks with Washington, Japanese Finance Minister Katsunobu Kato said Sunday. Nikkei

- Taiwan’s currency has recorded its largest two-day jump in decades, as life insurers moved to hedge their exposed US portfolios and markets fretted that a trade deal with Donald Trump might include the exchange rate. FT

- China has stopped publishing hundreds of statistics used by int’l investors to gauge the health of the domestic economy. WSJ

- Chinese exporter are stepping up efforts to avoid tariffs imposed by Trump by shipping their goods via third countries to conceal their true origin. FT

- President Donald Trump suggested that his administration could strike trade deals with some countries as soon as this week, offering the prospect of relief for trading partners seeking to avoid higher US import duties. BBG

- Trump administration officials are exploring ways of challenging the tax-exempt status of non-profits: WSJ.