The Eucharist is "the source and summit of the Christian life."

Distinction Matter - Subscribed Feeds

-

Site: Zero HedgeHighs And LowsTyler Durden Fri, 06/06/2025 - 11:25

By Elwin de Groot, head of macro strategy at Rabobank

Highs and Lows

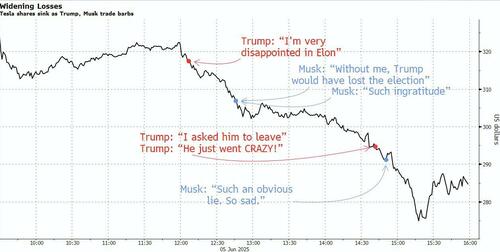

Bond yields were up some 5 basis points globally whilst the euro made a slight reversal after having pushed for a near high of 1.15 as the ECB concluded its press conference. From a ‘low’ inspired by 50% tariffs on US steel and aluminium imports going ‘live’ earlier this week and growing concerns about the US economy and the labor market, sentiment in financial markets briefly swung back to a ‘high’ as President Donald Trump said he had a “very good phone call” with Chinese President Xi Jinping. Gains in equity markets were modest but still good enough for S&P500 to extend its rally to 20% from its 8 April low. That is, before the falling-out between Trump and Musk reached a boiling point on social media. Enough is being written about that right now, so we’ll leave you at it.

After the call with Xi, Trump said that both leaders have agreed to further talks and that there “should no longer be any questions respectively the complexity of Rare Earth products”. That’s up for various interpretations, but it suggests China has offered to speed up its process of lifting its export restrictions. Still, the Chinese readout of the call, unsurprisingly, was more nuanced and said that Xi had urged Trump to remove “negative” measures that have affected trade between the countries in recent months. The upshot, from the market’s perspective is that both sides are, at least, talking and that holds the prospect of further progress in removing some (still very high) tariffs. But, just for balance, Commerce Secretary Lutnick yesterday called for increased enforcement of US export controls on technology, warning that China was “only attacking great American companies.” If President Xi was referring to those export controls with “negative measures”, the market’s positive assessment may be, well, too high.

That further talks with the US can lead to a ‘deal’ (as Keir Starmer can confirm), a stalemate (see EU-US) or a major escalation, as Zelensky can attest, is on any global leader’s mind. Nikkei Asia reports that US negotiators Bessent, Lutnick and Greer keep Japan guessing. “At one point the three cabinet officials put the talks with the Japanese side on hold an began debating right in front of them”, a source tells the Nikkei. In that sense, German Chancellor Merz came away nicely after a 40-minute meeting in the Oval Office, as he let Trump do most of the talking. Little concrete came from that meeting, though Trump acknowledged the ramp-up in German defense spending.

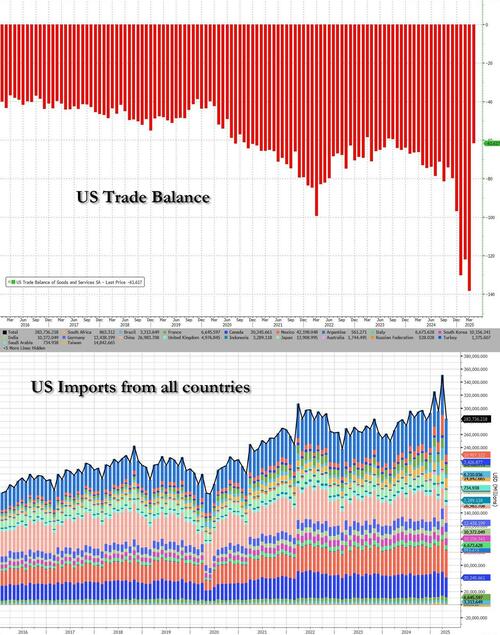

Trade data are going from lows to highs as well, which in some cases makes the Covid-episode data look pale. As the Commerce Department confirmed, the US trade deficit for April shrunk by the most on record, to $61.6bn from $138.3bn in March, driven by the largest-ever decline in imports.

Frontloading in the run-up the tariffs clearly was massive and then collapsed. This also suggests that after its big negative contribution to US GDP growth in Q1 it will be a significant positive factor in Q2. Inventory effects will likely attenuate some of its effect. Bloomberg noted that a drop in imports of pharmaceuticals from Ireland was responsible for an almost $20bn swing in the deficit. The opposite (statistical) effect is thus going to be seen in Europe in Q2. Ireland yesterday reported a significant upward revision in Q1 GDP (which now points to a revision in Eurozone GDP growth to around +0.6% q/q (!) from 0.3% previously). But this will obviously turn to a significant drag in Q2 as those US trade numbers for April just signaled.

Staying in Europe, the ECB seemingly presented itself as an anchor of stability in these times of highs and lows. Lagarde’s new mantra is now “well positioned”, which could be viewed in our opinion as code language for “we’re done cutting, unless…”. This becomes even clearer when you compare it to the previous mantra Lagarde introduced in March when she called ECB policy “meaningfully less restrictive”. We had expected little to no guidance from yesterday’s policy meeting, but these new words – despite lower oil prices and a stronger euro – lead us to maintain our view that we have reached the terminal rate.

However, the ECB leaves ample room to respond if things do not work out the way they envisage. Indeed, it lowered its inflation forecast significantly with core inflation positioned around 2% for the coming years. Moreover, its new scenario analyses unveiled a dovish reaction function to a potential escalation of trade tensions. Should this happen, and paused tariffs were to be reinstated, the ECB’s economists estimate that this could lower GDP growth through 2027 by about 1% cumulatively. And, interestingly, they conclude that inflation would be somewhat lower as well: in such a scenario inflation would average 1.8% in 2027, and that includes the assumption that the EU retaliates. By contrast, our own econometric analysis indicates that European tariffs on the US would be (mildly) inflationary instead.

Lagarde did say that their modelling exercise assumed that higher tariffs could lead to lower demand for euro area exports and to countries with overcapacity rerouting their exports to the euro area thereby putting more downward pressure on inflation. However, she acknowledged that the ECB’s analysis did not include any inflationary impact from a disruption of supply chains. Although this effect, admittedly, is surrounded by even more uncertainty, we did take this into account in our own scenario analysis (which explains why we still have inflation somewhat above the ECB’s target even in 2026). And one only need to take a quick glance at container freight rates (benchmark composite by WCI up by a staggering 175% compared to last month) to understand why be believe the ECB the ECB could be under-estimating the potential highs.

Time will tell, of course. But one thing that the ECB may be right about, is the (initial) downward pressure on imported goods prices due to a diversion of trade. The European Commission yesterday published its first assessment from its trade diversion monitoring tool that was launched in April. The early warning system tracks shipments and prices of goods at a high level of detail. In the short-run lower prices may benefit European importers and thereby consumers, but if those prices are the result of overcapacity in other parts of the world (such as China) this could also undermine European producers. The South China Morning Post reported that “in the month to May 25, imports of light-emitting diodes surged 156 per cent, while their price fell 65 per cent. Shipments of industrial robots shot up by 315 per cent, paired with a 35 per cent price decline. And imports of some bars and rods made from steel alloy soared by over 1,000 per cent as their price plunged 86 per cent.”

Whilst such figures can be extremely volatile due to their level of detail, seasonal patterns etc. and make no distinction between the origin of the content, a heatmap by the Commission shows that China was a significant contributor to these changes. The FT writes that the surge in steel imports, driven by trade diversion, is setting off alarm bells in the steel sector. Forecasting the next steps by the European Commission is a rather speculative affair, but we’d not be surprised if this leads to some form of action. This year the Commission has already launched more than 10 cases against China and/or Chinese producers (based on our count of news articles on the EU’s trade defense website).

-

Site: LES FEMMES - THE TRUTH

-

Site: Zero HedgeUkraine Scores More Hits On Airbase, Defense Factories Deep Inside RussiaTyler Durden Fri, 06/06/2025 - 11:05

Ukraine overnight targeted key Russian sites with more drone attacks, while simultaneously Russian cruise missiles were fired against Kiev and other regions of Ukraine, killing at least four and wounding twenty in the Ukrainian capital.

"Kyiv came under another attack involving drones and ballistic missiles. Rescuers are responding to the aftermath at several locations across the city," the State Emergency Service of Ukraine announced on Telegram. Russia allegedly fired over 400 projectiles into Ukraine, though most were said to be downed by air defenses. On the other side, two airbases, a fuel depot and aviation were reportedly struck deep in Russia overnight.

Aftermath of Russian air strike in Kyiv on June 6, 2025, AFP

Aftermath of Russian air strike in Kyiv on June 6, 2025, AFP

"A successful strike was carried out on the Engels airfield in the Saratov region, a place where enemy aircraft are concentrated," Ukraine’s General Staff said in a statement, in reference to the Engels-2 base which lies roughly 500 kilometers (300 miles) east of the Ukrainian border,

Several fuel tanks at the base were set ablaze, which dramatic images appeared to show following "multiple hits" on the site, per Ukrainian military statements.

Additionally, in the Ryazan Region, Ukraine said it targeted the Dyagilevo airbase, which supports Russian missile operations. The regional governor said the incoming drones were downed by anti-air defense systems.

And in the Tambov Region, drones reportedly targeted a high-tech aviation and missile control systems plant in Michurinsk. Ukrainian sources allege the plant is a military-industrial site, producing components for Russian missile and artillery systems.

Russian military-industrial complex attacked

Russian military-industrial complex attacked

One Ukrainian analyst describes the Tambov plant as follows: "Through facilities like this, Russia maintains serial production of Hyacinth, Msta, Tornado, and even components for Iskander missiles."

The analyst further says "the Progress plant is one of the key enterprises in Russia’s military-industrial complex, and its destruction represents a significant blow to the country’s defense production. This involves the loss of key components that power the military's missile and artillery systems."

BREAKING:

— Visegrád 24 (@visegrad24) June 6, 2025

Ukraine launches huge drone swarm attack against military targets across Russia:

- Fuel depot of the Engels Air Base hit

- Dyagilevo Air Base hit

- Military electronics plant in Tambov hit

- Bryansk Airport hit

+ Podolsk near Moscow & Crimea pic.twitter.com/bC15Tgop94Clearly Russia's anti-air defense systems have been struggling to thwart these now nightly waves of drone swarms. Likely Russia will continue stepping up its major aerial assaults on Ukraine in retaliation.

-

Site: LifeNews

Texas Senator Ted Cruz is making a bold move to honor preborn babies — by officially designating June as “Life Month.”

Cruz introduced a new resolution to honor the anniversary of the Supreme Court’s monumental decision to overturn Roe v. Wade in 2022 — a ruling that sent shockwaves across the country and empowered states to protect preborn children once again. Texas led the charge, becoming the first state to ban abortion.

Now, Cruz wants to ensure we never forget this turning point.

“Every human life is worthy of protection, and it is especially incumbent upon Americans and lawmakers to protect the most vulnerable among us,” Cruz said in a statement.

SUPPORT LIFENEWS! If you want to help fight abortion, please donate to LifeNews.com!

Momentum for this idea is growing. In the House of Representatives, Rep. Chris Smith (R-NJ) introduced a similar resolution and delivered a powerful call for the nation to face the reality of abortion.

“For decades abortion advocates have gone to extraordinary lengths to ignore, trivialize, and cover up the battered baby victim, fostering a culture of denial, disrespect, and bias against the unborn,” Smith said.

“This resolution designating June as Life Month highlights our moral imperative to protect innocent children’s lives from extermination. It calls our nation to reject willful blindness to the realities of abortion—brutally dismembering helpless babies with sharp knife-like curettes or poisoning babies with pills that literally starve them to death and often result in their bodies being flushed down a toilet. This resolution affirms that the cruel injustice of abortion need not be forever: instead, we must defend the unborn and show love and compassion to both mother and child through meaningful assistance and support.”

And the need for this couldn’t be clearer. In 2023 alone, Planned Parenthood committed over 402,000 abortions — its highest number ever. That’s more than 1,100 babies lost every single day. One in five people who walk into a Planned Parenthood choose abortion.

If passed, this resolution would give Americans a powerful opportunity every June to celebrate the value of every life — and remind the nation that the fight to protect the most vulnerable is far from over.

Cruz remains committed to seeing this through:

“Designating June as Life Month is a recommitment to the American principle that every life has dignity,” he emphasized once again. “I call on my colleagues in the Senate to swiftly pass this resolution.”LifeNews Note: Ashlynn Lemos is the communications intern for Texas Right to Life.

The post Ted Cruz Condemns Abortion: “Every Life is Worthy of Protection” appeared first on LifeNews.com.

-

Site: Zero HedgeFeds Say California Bullet Train Has 'No Viable Path', Threaten To Pull $4 BillionTyler Durden Fri, 06/06/2025 - 10:45

Authored by Chase Smith via The Epoch Times (emphasis ours),

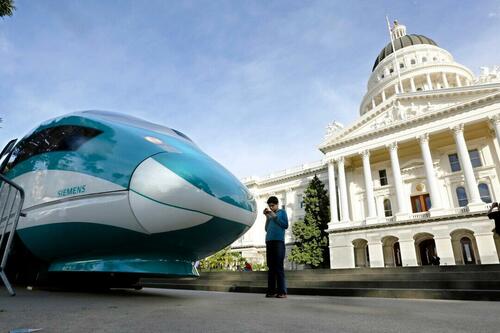

California’s long-delayed high-speed rail project is in default of federal grant agreements and may soon lose more than $4 billion in funding, the U.S. Department of Transportation said on June 4.

A report released by the department accuses the California High-Speed Rail Authority (CHSRA) of chronic mismanagement, unrealistic projections, and failure to meet key obligations, despite receiving billions in taxpayer money.

The Federal Railroad Administration (FRA) concluded that the bullet train has “no viable path” to finish the project’s first operational segment by 2033, the deadline outlined in federal agreements.

In a letter to Ian Choudri, CHSRA’s CEO, the FRA stated that the agency intends to terminate two grants totaling roughly $4 billion unless California responds with a satisfactory corrective plan. CHSRA has up to 37 days to avoid a final termination.

The letter outlines nine key findings from a 310-page compliance review, including a $7 billion funding gap, missed procurement deadlines, and what the FRA referred to as “substantially overrepresented” ridership forecasts.

The FRA letter called the rail project “a story of broken promises and of waste of Federal taxpayer dollars.” It noted that what began as a proposed 800-mile system was “first reduced to 500 miles, then became a 171-mile segment, and is now very likely ended as a 119-mile track to nowhere.”

Transportation Secretary Sean Duffy said the report justifies reprogramming the funds to other projects.

“This report exposes a cold, hard truth: CHSRA has no viable path to complete this project on time or on budget,” Duffy said in a statement.

“CHSRA is on notice—If they can’t deliver on their end of the deal, it could soon be time for these funds to flow to other projects that can achieve President Trump’s vision of building great, big, beautiful things again. Our country deserves high-speed rail that makes us proud—not boondoggle trains to nowhere.”

The FRA report found that CHSRA has not yet laid a single mile of high-speed rail track, despite more than $6.9 billion in total federal funding since 2009. It also said that CHSRA continues to rely on unstable funding sources, such as California’s cap-and-trade auction revenues, to fill budget gaps.

According to the FRA, CHSRA has already spent about $1.6 billion on change orders over the past two years and still faces legal disputes and procurement delays and hasn’t started construction on key segments.

The state originally promised an 800-mile rail line connecting San Francisco and Los Angeles by 2020 for $33 billion. Estimates now range from $89 billion to $128 billion.

In a statement last month, CHSRA said construction is active on 119 miles in the Central Valley and has created more than 15,000 jobs. The agency also said it was making progress on a 171-mile segment from Merced to Bakersfield.

But FRA officials say even that scaled-back version may be unreachable. The agency noted that CHSRA’s internal inspector general found no credible plan to close the current $7 billion gap for the Merced-Bakersfield stretch.

A CHSRA Authority spokesperson told The Epoch Times in an email that they “strongly disagree” with the FRA’s conclusions, which they said are “misguided and do not reflect the substantial progress made to deliver high-speed rail in California.”

“We remain firmly committed to completing the nation’s first true high-speed rail system connecting the major population centers in the state,” the spokesperson said. “While continued federal partnership is important to the project, the majority of our funding has been provided by the state. To that end, the Governor’s budget proposal, which is currently before the Legislature, extends at least $1 billion per year in funding for the next 20 years, providing the necessary resources to complete the project’s initial operating segment. The Authority will fully address and correct the record in our formal response to the FRA’s notice.”

The compliance review concluded that continued federal support would not achieve the goals of the High-Speed Intercity Passenger Rail Program. The FRA said it may redirect unspent funds from the grants to other infrastructure projects and is not currently seeking repayment of the funds already used.

Reuters contributed to this report.

-

Site: Zero HedgeThe Day After: Trump 'Not Interested' In Talking As Musk Continues To Make Case Against BBBTyler Durden Fri, 06/06/2025 - 10:25

After Thursday's grand meltdown between Elon Musk and President Donald Trump over the Big Beautiful Bill, it looked like things were set to simmer down - with Musk posting several things on X that suggested he was open to a path forward, while the Trump White House had scheduled a call with Musk, Politico reported.

On Friday morning, however, it was clear that Trump isn't ready to mend fences - he doesn't want to talk to Musk, and is looking to sell his Tesla - while Musk spent the morning (so far) making clear that Congress needs to fix government spending or America is going to be in a world of hurt.

"I’m not even thinking about Elon. He’s got a problem. The poor guy’s got a problem," Trump told CNN in a brief phone call. When asked if he had a call with Musk, Trump replied "No. I won’t be speaking to him for a while I guess, but I wish him well."

To recap:

- Earlier in the week, Musk came out against the 'Big Beautiful Bill' - which raises the debt ceiling by $5 trillion, and either raises the deficit by $2.4 trillion, or lowers it by $1.4 trillion - depending on who you believe, and fails to address any of the waste, fraud and abuse found by DOGE.

- Thursday morning, Trump was asked about Musk's opposition to the bill, telling reporters on Thursday that he's 'very disappointed in Elon,' and that Musk only opposes the bill because they eliminated electric vehicle tax credits from it.

- Trump then suggested he might pull government funding from Musk's companies such as SpaceX, which owns the only operational US spacecraft capable of transporting astronauts to and from the International Space Station.

"The easiest way to save money in our Budget, Billions and Billions of Dollars, is to terminate Elon’s Governmental Subsidies and Contracts. I was always surprised that Biden didn’t do it!" -President Donald Trump via Truth Social

- Musk went ballistic - announcing he would 'immediately' decommission the Dragon program (which he later walked back Thursday night), proposed a new political party (that's still his pinned post on X), endorsed another Trump impeachment, and said Trump is 'in the Epstein files,' which is why they haven't been released.

Peacemakers emerged - such as former State Department official Mike Benz, who defended Musk and called for the two to patch things up...

Elon Was Always The Secret Weapon Behind Trump 2.0 pic.twitter.com/ii1HBqTKza

— Mike Benz (@MikeBenzCyber) June 6, 2025While two attorneys associated with the Epstein case(s) flatly denied Trump had anything to do with Epstein's sex-trafficking operation.

Just confirming what we already knew. pic.twitter.com/ooZNVwHsjn

— C3 (@C_3C_3) June 6, 2025“The only thing that I can say about President Trump is that he is the only person who, in 2009... is the only person who picked up the phone and said, let’s just talk."

— Kyle Becker (@kylenabecker) June 6, 2025

"[Trump] was very helpful... and gave no indication whatsoever that he was involved in anything untoward… pic.twitter.com/u0FKJrWKejOn Friday, Musk re-posted the following posts and clips making his case;

"The Federal Government today pays more in interest on the debt than we do in budget for the Department of Defense. We pay $1.2B a year in JUST interest on debt. Total government spending is about $7T. Interest payments are $1.2T. DOD is $800B a year. Total debt is $35T and it… pic.twitter.com/fPg3Xo5dkZ

— Tesla Owners Silicon Valley (@teslaownersSV) June 6, 2025Jesse Watters: “The media said that Musk was the co-president… The media said Trump was doing favors for Elon Musk. Well, if you look at this big, beautiful bill, there’s no favors for Elon Musk in it at all”

— Defiant L’s (@DefiantLs) June 5, 2025

pic.twitter.com/9Py3TM5ZklIt’s a borrowing limit. It’s not a function / it’s a rule violated by a weak Congress regularly… https://t.co/4KEkl8aIKz

— Chip Roy (@chiproytx) June 5, 2025This is why Republicans will likely lose the House in 2026 and then Democrats will spend two years investigating and impeaching President Trump.

— Wall Street Mav (@WallStreetMav) June 5, 2025

Trump and the Republicans in Congress need to deliver. We want budget cuts. We want agencies shut down. We don't want big govt. https://t.co/3T3uheQEyfWhile Trump (as noted above) isn't ready to have a phone call with Musk to hash things out.

Meanwhile, DOGE chief architect Joel Fishback slammed Musk and said he's stepping away from the effort following Musk's comments, Politico reports.

"The truth is that Elon set expectations that he relayed to the president, me, and the country that he did not come close to fulfilling. That’s disappointing, but okay," said Fishback. "What’s not okay is his baseless personal attacks against President Trump."

To be continued...

-

Site: Zero HedgeRate-Cut Odds Plunge After Payrolls Beat; Trump Demands "Full Point Cut" From PowellTyler Durden Fri, 06/06/2025 - 10:20

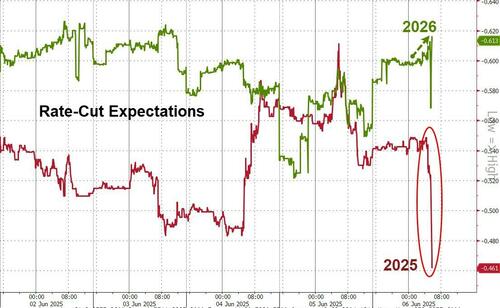

A better than expected headline payrolls print has sparked a surge in stocks and bond yields this morning as the long-await (and hoped for by some) recessionary collapse in the labor market remains elusive.

Even if below the surface things are not so healthy, rate-cut expectations for 2025 have plunged to less than two total cuts (2026 expectations up marginally)...

Never one to miss an opportunity - even on a day when he should probably take a break from social media - President Trump dropped some more advice for Fed Chair Powell:

Strong unemployment, falling inflation, and no signs (except in partisan survey responses) of economic weakness from Trump's tariff-nado. One has to wonder what it is that Powell is waiting for... unlike in September of last year?

Finally, one thought - is this Trump pivoting his rage from Musk to Powell - a far easier, and less wealthy, opposition.

-

Site: AsiaNews.itThe state government wants to arm only indigenous people for self-defence. For BJP Chief Minister Himanta Biswa Sarma, such a step is justified on security grounds, while the opposition sees the attempt to provide weapons to some communities as exacerbating tensions with Bengali Muslims.

-

Site: LifeNews

No parent ever wants to hear these words at an ultrasound: “Your baby may not survive.”

When doctors deliver a life-limiting diagnosis for a preborn child, families are often devastated—and pressured into abortion, with little guidance on choosing Life.

Now, Texas is changing that.

In a major step toward building a more compassionate, Pro-Life culture, state lawmakers passed the Perinatal Palliative Care Act during the 2025 legislative session. Senate Bill 1233 by Senator Kelly Hancock (R–North Richland Hills) and Representative Valoree Swanson (R–Spring) ensures that families receive real information and resources—not silence or pressure.

Prenatal tests indicate possible health issues in 2–3% of pregnancies, but up to 85% of those results are false. Most parents aren’t told that—and tragically, up to 90% of these babies are aborted. Only 19% of women are informed about specialized care options. Every baby deserves dignity, no matter the diagnosis.

SUPPORT LIFENEWS! If you want to help fight abortion, please donate to LifeNews.com!

Perinatal palliative care offers compassionate support to families after a baby is diagnosed in the womb with a serious or life-threatening condition. Care begins at diagnosis and continues until the baby’s first birthday, even if the little one does not make it that long. It includes medical, emotional, spiritual, and practical support from a team of specialists, religious counselors, and community support providers. SB 1233 clarifies that this never includes acts done to cause or hasten the baby’s death.

The law does this by connecting families to nonprofits like Abel Speaks, which walks alongside them through these heartbreaking circumstances.

God created us for community—especially in our hardest moments. The Perinatal Palliative Care Act ensures every family facing a difficult diagnosis receives the guidance and resources they need to love and care for their child, no matter how short that little Life may be.

Too often, families are told abortion is the only “reasonable” response. This law changes that. Texas now affirms: every life has value, no matter how brief or fragile.

One young mother’s story illustrates why this matters.

At her 21-week ultrasound, Ava Trammell was told her baby girl was “incompatible with Life.” Doctors gave her no real options—just a suggestion to fly to Colorado for an abortion or continue the pregnancy without support.

But, Ava chose Life.

“I know she’s not going to survive,” Ava said, “but I only have so much time with her. Why would I cut it any shorter? She’s safe in my womb… she only knows love and doesn’t know pain. Why would I give her such a painful death when she’s perfectly fine with me?”

Because of SB 1233, future mothers like Ava won’t have to face that decision alone.

This law embodies what it means to be truly Pro-Life: walking with families in both joy and sorrow. By equipping parents with life-affirming options and emotional care, Texas is saying clearly: we value every life, and we will walk with every family.

We are deeply grateful to Senator Hancock and Representative Swanson and their teams for standing up for the most vulnerable and helping families meet unimaginable challenges with dignity, compassion, and hope.

LifeNews Note: Ashlynn Lemos is the communications intern for Texas Right to Life.

The post 85% of Prenatal Tests are Wrong, 90% of Those Babies are Aborted appeared first on LifeNews.com.

-

Site: Ron Paul Institute for Peace And Prosperity

What has happened to Europe? Why is its rhetoric so bombastic and militaristic? Why are Europe’s leaders so afraid of democracy? Why is the continuation of the Ukraine war so important for them? And what does any of this have to do with so-called ‘European values’?

CrossTalking with Mats Nilsson, James Pearce, and Daniel McAdams.

!function(r,u,m,b,l,e){r._Rumble=b,r[b]||(r[b]=function(){(r[b]._=r[b]._||[]).push(arguments);if(r[b]._.length==1){l=u.createElement(m),e=u.getElementsByTagName(m)[0],l.async=1,l.src="https://rumble.com/embedJS/ujcwo5"+(arguments[1].video?'.'+arguments[1].video:'')+"/?url="+encodeURIComponent(location.href)+"&args="+encodeURIComponent(JSON.stringify([].slice.apply(arguments))),e.parentNode.insertBefore(l,e)}})}(window, document, "script", "Rumble"); Rumble("play", {"video":"v6s71rn","div":"rumble_v6s71rn"}); -

Site: Steyn OnlineProgramming note: Tomorrow, Saturday, please join me for another eclectic edition of my Serenade Radio weekend music show, Mark Steyn on the Town, surveying the scene from French opera to Jamaican reggae. The broadcast starts at 5pm British Summer Time

-

Site: Steyn OnlineProgramming note: Please join Mark tomorrow, Saturday, for his Serenade Radio weekend music show, On the Town at 5pm British Summer Time - which is 6pm in Western Europe and 12 noon North American Eastern. You can listen from almost anywhere on the

-

Site: Ron Paul Institute - Featured Articles

Mutzig, France – First stop on my annual visit to France’s mighty Maginot Line forts is this lovely Alsatian town. Mutzig was built by the Germans 1893-1916 to defend against enemy approaches to the important city of Strasbourg. It was – and remains – the largest modern fortress in Europe.

The vast fortress, which covers over 800 acres, was never attacked during World War I by the Germans or French. But as Europe’s first important fortress made of concrete and fully electrified, it was eagerly studied by French engineers and served as a template for the Maginot Line forts two decades later.

Both world wars showed the vulnerability of fixed fortifications. An enemy will always find a way round them or discover a fatal weakness. In regard to the 200-mile-long Maginot Line, the forts did not fail. They held out to the bitter end. The reason for France’s stunning defeat in 1940 was the failure of its field army and its blockheaded generals. Interestingly, a French parliamentary deputy with the effervescent name of Perrier precisely predicted where the Germans would break through the Ardennes Forest in 1940.

Though vulnerable, the fixed defenses of the Maginot Line were hugely popular in France and wildly overestimated because they involved huge construction projects for many of the villages and factories along France’s eastern border with Germany. Just as New Deal make-work projects boosted the United States during the Great Depression.

We see a similar mania in the response to President Donald Trump’s plan to create a national ‘golden dome’ defensive shield to protect the nation from assorted nuclear threats. In many ways, it’s a re-run of President Ronald Reagan’s Star Wars missile shield which never got off the ground but was extremely popular among the public.

Frederick the Great of Prussia noted, ‘he who defends everything, defends nothing.’ As true today as it was in the 18th century.

A national missile defense system to cover the entire nation would be impossibly expensive for a nation already deeply mired in debt. The always powerful military-industrial complex will see Trump’s golden dome fantasy as a second Christmas though the basic technology has yet to be proven.

One wonders if the proponents of this defensive system have noticed that Russia has developed ballistic missiles that can alter course, change altitudes and switch targets? Or that China has ICBM’s aboard freighters in the Pacific. What about evolving electronic countermeasures that can fry enemy communications and guidance systems?

It would be far more prudent for the US to pursue disarmament talks and effective inspection regimes with its rivals than pie in the sky defensive systems that will certainly enrich military companies but fail to protect North America. What’s more, having even a partial anti-missile system will likely make the US more aggressive and prone to wars.

Better to spend the trillions on curing cancer or blindness than on space wizardry. Alas, we have a view of what awaits us. This week, Trump banned people from 12 mostly Muslims nations and imposed restrictions on 7 nations. Good work Mr. President. You and your New York City construction buddies have now made enemies of a quarter of the world’s population.

Reprinted with permission from EricMargolis.com.

-

Site: LifeNews

New evidence shows a widescale coverup regarding the dangers of chemical abortion pills.

A new peer-reviewed study by Charlotte Lozier Institute examined nearly 29,000 visits to emergency rooms by women who within 30 days had undergone either a surgical or chemical abortion.

The research revealed widespread miscoding of these ER visits. Women who were suffering serious effects of chemical abortion were often coded as having a miscarriage.

SUPPORT LIFENEWS! If you want to help fight abortion, please donate to LifeNews.com!

This in itself is not surprising but the sheer scale of deceit is stunning.

- The study revealed 79% of abortion pill ER visits were likely to be miscoded as miscarriages comparted with surgical abortions.

- Between 2016 and 2021 almost 84% of abortion pill ER visits were miscoded.

There’s more. Every case examined looked at acuity, meaning the measurement of the severity and complexity of each woman’s condition.

- The miscoded ER visits were 50% more likely to be high acuity when compared with correctly coded visits.

What accounts for this pervasive deception?

Those involved with the wholesale marketing and peddling of abortion pills, usually with no medical supervision, routinely and publicly tell women that if they require immediate medical attention to lie at the ER to cover up the abortion. Why? Because they are keenly aware of the high number of women who suffer serious and often life-threatening side effects. Making them of record is bad for business.

This duplicity runs deeper. The American College of Obstetricians and Gynecologists actually advise medical personnel to not ask women if their urgent health condition is the result of chemical abortion. They claim this is to shield the women legally even though states protect women from prosecution.

Recent research uncovered that nearly one in 11 women who use abortion pills seek medical treatment. A frequent complication is that parts of the baby and/or placenta remain behind after a drug-induced abortion. This requires an additional abortion attempt.

Deceit in the ER impairs a doctor’s ability to fully and effectively treat her condition. Dr. James Studnicki, one of the study’s authors, called the situation “a public health crisis.”

Just days ago, Missouri Senator Josh Hawley published a letter on X. He had asked Dr. Marty Makary, Commissioner of the FDA to do a full review of the safety of chemical abortion pills. Dr. Makary responded that he would. This should give heartburn to the abortion industry and its supporters. For the last decade they and the former leadership of the FDA have been guilty of hiding the serious negative impact abortion pills have on women. Currently, abortionists need only report the complication of death.

The pills designed to kill preborn children can’t stand up to impartial scrutiny because at an alarming rate they are harming the health, fertility and lives of unsuspecting women. Further, there is considerable evidence these dangerous pills are used by sexual predators to cover up criminal activity.

This conspiracy has the potential to be the largest medical deception of our time with grave implications for millions of women and their babies.

LifeNews.com Note: Bradley Mattes is the President of Life Issues Institute, a national pro-life educational group.

The post The Abortion Pill is So Dangerous, Thousands of Women are Going to the ER appeared first on LifeNews.com.

-

Site: OnePeterFive

The Crusade of Eucharistic Reparation is a lay sodality run by OnePeterFive in partnership with Benedictus and LatinMass.com (Mass of the Ages). This crusade was called by His Excellency, Bishop Athanasius Schneider in June of 2020 in response to the profanations of Our Lord in the Blessed Sacrament during the COVID crisis. Now he has also added the intention of the reversal of Traditionis…

-

Site: LifeNews

Zack and Lindsay Knotts have filed a federal lawsuit against the city of Cuyahoga Falls, Ohio, following Zack’s arrest during a pro-life demonstration outside the Northeast Ohio Women’s Center on December 28, 2024.

The case stems from an incident in which Zack was arrested for using a battery-powered megaphone to share his pro-life message from a public sidewalk. According to the American Center for Law and Justice (ACLJ), which represents him, the megaphone was quieter than surrounding traffic, while abortion clinic escorts allegedly used whistles and kazoos in an attempt to drown out Zack’s megaphone.

Despite this, the ACLJ stated, only Zack was arrested for violating a Cuyahoga Falls Ordinance which prohibits “unreasonable noise” that causes “inconvenience or annoyance to persons of ordinary sensibilities.” The ACLJ argues that the ordinance lacks clear standards and was applied selectively in this instance.

The legal team pointed out that officers who made the arrest arrived after the megaphone had already stopped working, leaving them without any direct observation of its use. Because of this, the organization argues, police had no way of assessing whether the volume exceeded any legal limits.

Click here to sign up for pro-life news alerts from LifeNews.com

In addition, the ACLJ noted that the police relied solely on the account of one witness — an off-duty, private security officer employed by the abortion center — and did not interview any others, a detail the group argues presents a conflict of interest.

ACLJ’s case also includes allegations that the Knotts couple were subjected to threats from individuals on site, including a statement directed at Zack to “suck-start a shotgun.” During a prior encounter, Zack had shared that his mother-in-law once considered abortion while pregnant with his now wife, saying that if she had gone through with it, his wife “should be dead.” According to the ACLJ, an escort responded, “We can fix that.”

The ACLJ noted that when Lindsay reported these threats to law enforcement, officers stated that the comments did not constitute a crime.

Zack’s charges were ultimately dismissed at the start of the trial, as CatholicVote previously reported. However, the ACLJ maintains that the legal action had already created a deterrent effect on the Knotts’ future speech.

“The arrest, prosecution, and ongoing threat of future enforcement have already achieved the government’s apparent goal: silencing disfavored speech,” the ACLJ wrote.

The lawsuit seeks a court declaration that the ordinance is unconstitutional, a permanent injunction against its enforcement, the return of Zack’s megaphone, and compensation for alleged violations.

LifeNews Note: Rachel Quackenbush writes for CatholicVote, where this column originally appeared.

The post Arrested for Protesting Abortion, One Pro-Life Family is Fighting Back appeared first on LifeNews.com.

-

Site: Zero HedgeIs DEI DOA? Supreme Court Unanimously Rejects Added Burden For Whites In Discrimination LawsuitsTyler Durden Fri, 06/06/2025 - 08:40

Yesterday, the Supreme Court handed down three major cases with unanimous decisions. One, Ames v. Ohio Department of Youth Services, raises additional questions over diversity, equity, and inclusion (DEI) programs that have been widely used in higher education and businesses. There is no reason to believe that DEI measures are DOA, but the decision is likely to accelerate challenges based reverse discrimination after the Court rejected the imposition of an added burden for members of any “majority group” including straight, white males.

The immediate question before the Court was a circuit split over the standard that applies to a member of a “majority” group who claims that he or she was treated unfairly based on majority characteristics. The Sixth Circuit, along with four other circuits, held that such litigants must shoulder additional pleading burdens under Title VII of the Civil Rights Act.

Many of us long argued that this long-standing rule was itself discriminatory and at odds with both constitutional and statutory authority. It was a bizarre interpretation of a law that barred employees from discriminating based on “race, color, religion, sex, and national origin.” That would ordinarily require a plaintiff to support a claim of disparate treatment by showing that she applied for a position for which she was qualified but was rejected under circumstances giving rise to an inference of unlawful discrimination. However, judges began to add their own burden of white, male or straight litigants in requiring them to show additional “background circumstances” that show the defendant is an “unusual employer” that discriminates against majority groups.

In this case, Marlean Ames, a heterosexual woman, claimed that she was demoted at the Ohio Department of Youth Services after Ginine Trim, a gay woman, replaced her supervisor. Trim hired a younger gay man allegedly based on her sexual orientation and sex. Both the district court and the Sixth Circuit dismissed the complaint because Ames failed to identify any other “background circumstances” that demonstrated her employer discriminated against heterosexual women.

Justice Ketanji Brown Jackson wrote for a unanimous Supreme Court that reversed the Sixth Circuit and rejected the “additional circumstances” test as at odds with the plain text of Title VII.

“As a textual matter, Title VII’s disparate-treatment provision draws no distinctions between majority-group plaintiffs and minority-group plaintiffs. Rather, the provision makes it unlawful “to fail or refuse to hire or to discharge any individual, or otherwise to discriminate against any individual with respect to his compensation, terms, conditions, or privileges of employment, because of such individual’s race, color, religion, sex, or national origin.” The “law’s focus on individuals rather than groups [is] anything but academic.” Bostock v. Clayton County (2020). By establishing the same protections for every “individual”—without regard to that individual’s membership in a minority or majority group—Congress left no room for courts to impose special requirements on majority-group plaintiffs alone.”

Justice Thomas, joined by Justice Gorsuch, filed a concurrence that chastised lower courts and “judges creating atextual legal rules and frameworks.”

The opinion has broader implications for businesses and higher education where DEI has been used to brush aside such reverse discrimination claims. Often such claims are mocked as suggesting that members of a majority group are “victims.” While not imposing this specific “add-on,” these controversies involve much of the same bias against reverse discrimination claims. Litigants complain that they often face greater demand and resistance to their claims as opposed to employees who are part of minority groups.

The Ames decision is a welcome development in bringing greater uniformity in the treatment of discrimination claims. It is also a shot across the bow of businesses and universities that have used DEI to dismiss the countervailing interests and claims of majority-group employees.

Here is the decision: Ames v. Ohio Dep’t of Youth Services

-

Site: LifeNews

Three days after FDA Commissioner Marty Makary promised to “closely monitor the post-marketing safety data on mifepristone for the medical termination of early pregnancy” and a week after National Right to Life wrote Commissioner Makary urging him to reexamine “studies not sponsored by the abortion industry,” four Democrat-led states asked the FDA to remove what pitifully weak “limitations” still exist.

The attorneys general of California, New York, Massachusetts and New Jersey filed a petition Thursday saying the “limitations” are “medically unnecessary.”

The FDA “must follow the science and lift these unnecessary barriers that put patients at risk and push providers out of care,” New York Attorney General Letitia James said Thursday, citing the abortion medication’s alleged “25-year safety record.”

Click here to sign up for pro-life news alerts from LifeNews.com

Their strategy was outlined in the always compliant and agreeable New York Times.

“The F.D.A. is required to respond to the petition within 180 days by granting or denying the request, or saying it needs more time,” according to the New York Times’s Pam Belluck. Belluck, who “covers reproductive health,” added, “it would prevent the F.D.A. from changing mifepristone regulations while the petition is pending.”

New Jersey Right to Life Executive Director Marie Tasy blasted state Attorney General Matthew Platkin.

Attorney General Platkin once again prioritizes the interests of the abortion lobby over the safety and well-being of women. The FDA’s decision to review the safety of the abortion pill comes in response to studies revealing severe adverse effects experienced by many women—including sepsis, infection, hemorrhaging, and other serious medical complications within 45 days of taking the drug. Women deserve leaders who advocate for their health and safety, not activist attorneys general who use their office to advance the agenda of the abortion industry.

NRLC writes the FDA

In its letter to Commissioner Makary, NRLC wrote that the FDA had “deregulated” mifepristone “in 2016, 2021, and 2023 so it can now be prescribed online without an in-person physical examination, shipped by mail to women’s homes or made available for pickup at local pharmacies, creating significant concerns over its safety and oversight.”

The letter cited the new study by the Ethics & Public Policy Center (EPPC) which concluded that “10.93 percent of women experienced complications,” 22 times the less-than-one-percent touted by sponsors of the abortion pill.

The letter ended

It isn’t merely that people need assurances that the FDA is ensuring that unsafe, ineffective drugs are kept off the market, but that women are entitled to know the truth about drugs the abortion industry is aggressively, and we believe dishonestly, promoting.

Both mothers and their children need to be protected from false advertising about what these drugs are and what they do. States which wish to protect those women and their unborn children from these dangerous drugs should be able to do so without having to fight the FDA’s official but erroneous assertions of the drug’s safety and efficacy.

Even with its limited reporting and a less than cooperative abortion industry, the FDA itself already knows of at least three dozen deaths and thousands of serious adverse events experienced by American women this past 25 years. Please put an end to this moral and medical travesty before more women and their innocent unborn children die or are injured.

LifeNews.com Note: Dave Andrusko is the editor of National Right to Life News and an author and editor of several books on abortion topics. He frequently writes Today’s News and Views — an online opinion column on pro-life issues.

The post Democrat AGs Push for Abortion on Demand With No Limits appeared first on LifeNews.com.

-

Site: The Josias

Our hosts, Fr. Jon Tveit and Amanda, are joined by Gideon Lazar for a conversation about Pope Leo XIII, his pontificate, writings, and whether there will be a Leonine revival under our newly elected pontiff, Leo XIV.

Bibliography:

- Longinqua Oceani (1895)

- The Josias Podcast, Episode VI: Ralliement

- Felix de St. Vincent, “Four Catholic Political Postures: Lessons from Leo XIII and Ralliement” (The Josias)

- The Josias Podcast, Episode XXIII: Liberty: the Highest of Natural Endowments

- Gideon Lazar, “Why I am Whitepilled by Pope Leo XIV“

- Pater Edmund, “Divisio Textus of Leo XIII’s Libertas Praestantissimum” (The Josias)

Header Image: Biagio Barzotti, Pope Leo XIII with Cardinals: Rampolla, Parochi, Bonaparte and Sacconi (c. 1890).

If you have questions or comments, please send them to editors(at)thejosias.com.

Follow us on Twitter and Facebook.

Many thanks to our generous supporters on Patreon, who enable us to pay for podcast hosting. If you have not yet joined them, please do so. You can set up a one-tim

-

Site: PaulCraigRoberts.org

The Ever-widening War

Paul Craig Roberts

Scott Ritter says the attack on Russia’s strategic bombers was a British operation that the CIA knew about. https://www.youtube.com/live/5p_faUdJT3w

According to the White House, Trump was not informed. As Russian war doctrine calls for a strategic response to such an attack, both British and US intelligence risked launching a nuclear attack on the country or countries that Russia decided was responsible.

In other words, security agencies, not the president or Congress can launch a nuclear war. A stop must be put to the unaccountability of “security agencies” as clearly they have an independence of action that makes us very insecure.

Putin avoided his responsibility as defined by Russian war doctrine by classifying the attacks as terrorism and not acts of war. Putin substituted pretense for reality and has accepted an attack on Russia’s triad of nuclear forces as a non-event in order to keep alive the Kremlin’s unrealistic hopes of a peace deal that could turn into a broader agreement.

The ever-widening war continues to widen. The consequence of Putin’s good will is likely to be more provocative attacks. Sooner or later Russia will have to respond or surrender.

Can Reality Any Longer Be Acknowledged?

Paul Craig Roberts

https://www.paulcraigroberts.org/2025/06/05/can-reality-any-longer-be-acknowledged/

The attack on Russian strategic forces by Ukraine, with or without President Trump’s knowledge and with or without help from Washington and the British, could have been the most dangerous event in East-West relations during my lifetime. The reason is that recently revised Russian war doctrine states that an attack, even by a non-nuclear country, on the Russian strategic triad requires a strategic response. Strategic usually means nuclear or at least a disabling response.

Putin dodged the responsibility (more later), but no one knew for certain that he would. In other words, whoever is responsible for the attack on Russia’s strategic bombers subjected Ukraine, Europe, the US to the possibility of nuclear attack, depending on whom the Russians decided was responsible. This person or persons is a madman, a maniac who must be identified and removed from his position. Try to imagine how it is possible for, say Zelensky, to launch an attack that could result in nuclear war between the US and Russia. How can control over whether or not the US faces nuclear war be in the hands of Zelensky? If Zelensky is responsible, the US and NATO have a massive failure in command and control. If Trump or someone in the Trump administration gave the green light, they should be removed for committing the most potentially dangerous act during my lifetime.

The extraordinarily reckless and extremely dangerous attack on Russia’s nuclear triad is being treated by all concerned as a nothing event, a mere terrorist act, not an act of war. The fact that there is no acknowledgement in Washington, Europe, Moscow, or the media of the seriousness of an attack on Russian strategic forces, and thereby no measures put in place to prevent such dangerous acts, means either full scale, not proxy, war between Russia and the West or Russia’s surrender. Perhaps Putin would like to surrender in order to avoid nuclear war, but he won’t be permitted to surrender.

Putin took the lead in burying the seriousness of the attack on Russia’s nuclear triad. By designating the attack a “terrorist act” he evades the responsibility that Russian strategic doctrine imposes on him for a strategic response.

Nothing of consequence has happened, says the President of Russia. Amen say Washington and Europe. Therefore, whoever is responsible for the attack knows that the next attack can go further. It too will be unacknowledged as an act of war.

How many times can Putin pretend that attacks on Russia’s sovereignty, which is what attacks on Russia’s nuclear triad are, are mere terrorist events before he discredits himself with the Russian people?

The purpose of the recent revision of Russian strategic doctrine was to discourage or prevent attacks by Western proxies such as Ukraine on Russian strategic forces. It failed because Putin has taught the West not to take him seriously. He is ever ready to turn the other cheek. Now Putin has shown that he will not acknowledge attacks on Russian strategic forces as anything other than a terrorist event, not an act of war. So Putin has negated Russian strategic doctrine. It means nothing. Now that the West knows this, Russia can expect escalating provocations. All of Putin’s good intentions have ended in disaster, and a major war will be the consequence.

It could be that Russia is doomed. Decades of successful Western propaganda have turned most of the Russian professional and intellectual class into Atlanticist Integrationists. They think that Russia belongs as part of the West and are willing to make concessions of sovereignty to be part of the West. Clearly this point of view is strong in the Kremlin and the Russian Foreign Ministry.

The zionist American neoconservatives are very much aware of this Russian weakness, and they are adept at taking advantage of it. They don’t have to do much, because Putin does their work for them.

Putin has declared Ukraine to be conducting terrorism, not war, against Russia. Putin’s declaration also absolves Washington and Europe for any responsibility.

Here are English language Russian headlines of Putin’s hiding from reality that apparently he is unable to face up to. Or perhaps he is not yet ready, being at work constructing a powerful military that US/NATO cannot resist.

“‘Illegitimate Kiev regime’ turning into terrorist organization” – Putin

“The latest terrorist acts carried out by Ukraine in Russia are the outcome of decisions made by the Ukrainian political leadership.” Putin added that “the decisions to carry out such crimes were, of course, made in Ukraine” by the political leadership in Ukraine. In other words, Washington and Europe have no responsibility for the act of war, which is not an act of war, but merely terrorism. https://www.rt.com/russia/618651-kiev-regime-rejecting-peace/

In other words, the Kremlin has said that Washington and Europe have nothing to do with the attack on Russia’s strategic triad, and that Ukraine is merely creating terrorist incidents, not making war against Russia. https://www.washingtonpost.com/opinions/2025/01/31/russia-ukraine-rubio-trump/? utm_source=facebook&utm_medium=social&utm_campaign=wp_opinions

I find it hard to believe that Putin is this stupid. My bet is that he is not yet ready. He keeps the minor Ukraine conflict going while he builds up to remove NATO from Russian borders.

Trump can remove the coming conflict by giving Putin the mutual security agreement Russia has been requesting for years. This would be the costless solution, but Trump is not really in power, and the power and profit of the US military/security complex needs the Russian Enemy.

So, how will a devastating war be avoided? Information such as I have just presented is banned by the official narratives. The American foreign policy community avoids it like the plague.

-

Site: PaulCraigRoberts.org

The Camp of the Saints

Whites to become minority in UK in 40 years

The British government is destroying the British.

White people can’t afford to have children. They are taxed too heavily in order to support immigrant-invaders.

https://www.rt.com/news/618666-study-whites-to-become-minority-uk/

-

Site: PaulCraigRoberts.org

In Latvia if you watch Russian TV they put you in prison

https://www.rt.com/russia/618630-latvia-russian-tv-channels-arrest/

-

Site: PaulCraigRoberts.org

-

Site: AsiaNews.itThe discovery was made thanks to the work of the Rubber Research Institute of Sri Lanka (RRISL). The global problem affects plants by delaying the production of the nutrients they need, impacting latex output. With the disease, yields drop by up to 40 per cent. The problem could get worse in the future.

-

Site: Zero HedgeTrump Nominates Slew Of New Generals To Command Europe, Mideast & AfricaTyler Durden Fri, 06/06/2025 - 07:45

The Trump administration has just nominated a slew of new generals to head up top US military commands in the Middle East, Africa, and Europe.

Importantly, Air Force General Alex Grynkewich has been nominated as NATO’s new Supreme Allied Commander in Europe (SACEUR) and head of U.S. European Command (EUCOM).

Gen. Alexus Grynkewich, via CENTCOM

Gen. Alexus Grynkewich, via CENTCOM

This comes amid reports that the US under the Trump administration is growing frustrated enough to 'step back' from NATO leadership, with lack of collective defense spending out of Europe.

For example, Defense News last month acknowledged, :The nomination to head European Command, which is not yet final, comes at a moment of uncertainty for America’s military commitment to Europe, potentially including cuts to U.S. forces on the continent and a lesser role in the NATO alliance."

Brussels is meanwhile pushing plans for NATO buildup plans in connection with a new spending goal, also at a moment Washington has told the UK that it should reach a target of 5% of GDP spending on defense, according to The Telegraph.

Grynkewich currently serves as Joint Staff Director for Operations and was formerly the top US Air Force commander in the Middle East, which means he oversaw the aerial response to CENTCOM's prior bombing raids against the Houthis of Yemen, as well as previously 'counter-ISIS' ops in northern Syria.

According to his official Air Force bio:

Lt. Gen. Grynkewich received his commission in 1993 after graduating from the U.S. Air Force Academy. He has served as an instructor pilot, weapons officer and operational test pilot in the F-16 Fighting Falcon and F-22 Raptor. Lt. Gen. Grynkewich has commanded at the squadron, wing and Air Expeditionary Task Force levels. His staff assignments include service at Air Combat Command, U.S. European Command, U.S. Central Command, Headquarters Air Force, and the Joint Staff. Prior to his current assignment, he served as the 9th Air Force (Air Forces Central), Shaw Air Force Base, South Carolina, and the Combined Forces Air Component Commander for U.S. Central Command, Southwest Asia.

President Trump also nominated Navy Vice Admiral Brad Cooper, currently CENTCOM’s deputy commander, to lead CENTCOM. Additionally, Dagvin Anderson, director for Joint Force Development, has been tapped to lead US Africa Command (AFRICOM).

The Pentagon announces U.S. Air Force Lieutenant General Alexus Grynkewich as NATO's new Supreme Allied Commander and head of U.S. European Command. pic.twitter.com/IIofVrs7W3

— Clash Report (@clashreport) June 5, 2025This fresh crop of commanders are likely being tapped for their loyalty to Trump's vision of 'make deals, not chaos' for the Middle East and Eastern Europe.

While there's no peace on the horizon as yet when it comes to Ukraine, Gaza, or Yemen - there's been noticeably quiet from the White House these past few days as both conflict theatres heat up. This could be a good thing, given Trump is not issuing threats, but could be patiently waiting for how Russia's retaliation on Ukraine - for example - plays out.

-

Site: Zero HedgeFutures Rise On Easing Trump-Musk Spat As Payrolls LoomTyler Durden Fri, 06/06/2025 - 07:26

S&P 500 futures rose 0.4% as Tesla shares rebounded 4% in premarket on signs that the spat between President Donald Trump and Elon Musk is cooling. Market gains had little conviction as traders brace for Friday’s main event: a pivotal payrolls report (full preview here) that’s likely to set the direction of travel for markets. Nasdaq futures also add 0.5% even as Broadcom shares fall 3% in premarket after giving a a lackluster revenue forecast for the current quarter. European stocks are little changed. Bond yields are 1-2bp lower; the USD is higher; the yen dropped after BBG reported that Bank of Japan officials are likely to discuss slowing their pullback from buying government bonds at a policy meeting later this month. Commodities are mostly higher: Gold climbs $6 to around $3,358/oz while silver tops $36/oz. WTI falls 0.6% to $63 a barrel. Bitcoin rises 3%. Macro headlines were largely muted overnight; All eyes on NFP today.

In premarket trading, Mag7 stocks are higher, led by Tesla, whose shares are set to rebound, rising 4.9% premarket, after plunging on Thursday as the feud between Elon Musk and President Donald Trump showed signs of de-escalation (Amazon +1%, Meta +0.8%, Apple +0.6%, Alphabet +0.6%, Nvidia +0.5%, Microsoft +0.4%).

- Broadcom (AVGO) dropped 3% after the company gave a lackluster revenue forecast for the current quarter, suggesting that the AI spending frenzy isn’t as strong as some investors anticipated. Lululemon added to the gloom after its latest earnings report highlighted the risk posed by new tariffs and exacerbated concerns about slowing growth.

- Docusign (DOCU) shares are down 18% after the e-signature software company gave a second-quarter billings outlook that is weaker than expected.

- Lululemon (LULU) shares plunge 21% after the upscale athletic clothing company cut its earnings per share forecast for the full year.

Markets are still reveberating from the spat between Trump and Musk in which Trump proposed cutting off the billionaire’s government contracts. Musk, who sparked the public feud by criticizing Trump’s signature tax bill, later signaled that he’s keen to dial down the hostility. White House aides have reportedly scheduled a call with the world’s richest person for Friday in an effort to cool things down. Their public back-and-forth triggered the most spectacular real-time destruction of wealth ever, with $34 billion erased from Musk’s net worth. Tesla shares are rebounding in premarket, after tanking 14% Thursday.

“Futures are edging higher, perhaps as Musk has started to suggest on X that he would be open to a cooling-off period in his war of words with the President,” said Jim Reid, global head of macro research and thematic strategy at Deutsche Bank AG.

Moves in other asset clases were more muted as traders awaited Friday’s nonfarm payrolls report for fresh insight on how the Trump administration’s trade war is affecting the economy. Turning to today's main event, economists see payrolls rising by 125,000 after job growth in March and April exceeded projections. The unemployment rate is seen holding at 4.2%. Weak payrolls data would be bad news for markets, with a big miss potentially sending stocks down 1.5%, according to Goldman Sachs traders (full preview here). A softening labor market would support expectations that the Federal Reserve will cut interest rates at least twice this year.

“Investors are getting used to all the noise and are looking at concrete matters like the jobs report or budget,” said Mabrouk Chetouane, head of global market strategy at Natixis Investment Managers. “There is a cooling trend in the labor market, which I expect will show this afternoon. That should further reinforce our call for two or three cuts from the Fed this year.”

Meanwhile, BofA’s Michael Hartnett is warning that global stocks are close to triggering sell signals as both fund inflows and market breadth are running too hot. The strategist said inflows to stocks and high-yield bonds have totaled 0.9% of AUM in the past four weeks. The sell signal will be set off if that exceeds 1%.

European equities are little changed as investors search for fresh catalysts on trade negotiations between the US and China and look ahead to a key US jobs report. The real estate and health care sectors outperform, while consumer shares are among the biggest laggards. Among individual movers, Adidas and Puma fall after Lululemon’s disappointing quarter fueled concerns over rising competition and tariffs. Here are the biggest European movers:

- Chemring gains for an 18th straight day, rising as much as 5.1% following an upgrade to buy at Berenberg which gives the UK defense firm a clean sweep of positive analyst ratings

- Galderma shares gain as much as 3.3%, to the highest level since February after Kepler Cheuvreux initiated coverage of the Swiss pure play dermatology group with a recommendation of buy and a new street high price target.

- Demant shares jump as much as 6.7% as the stock trades for the first time since being upgraded to buy at Citi.

- Huber + Suhner shares rise as much as 4.6% after Berenberg said the Swiss electrical products manufacturer is especially well-positioned for growth as it started coverage with a buy rating.

- Canal+ rises as much as 8.1%, reaching highest since mid December, after the media and entertainment company confirmed its full-year expectations and said it has reached an agreement with France’s cinema agency to settle a tax dispute.

- Recordati shares gain as much as 3.4% to a three-month high after JPMorgan lifted its price target on the stock, saying the Italian pharmaceutical company’s growth outlook is “strong and sustainable,” even before more M&A activity.

- Norwegian salmon stocks gaining after a broad cross-party agreement to delay any sweeping changes to the licensing system for several years, according to a statement from the parties after markets closed on Thursday.

- European athleisure stocks fall as US-listed Lululemon posted a second straight disappointing quarter, fueling concerns around the impact of rising competition and new tariffs.

- Allegro shares drop after two of its major holders — investment vehicles of Cinven and Permira Holdings, sold a 5.2% stake in the company.

- PostNL falls as much as 12.5% as Kepler Cheuvreux analyst Marc Zeck downgraded his recommendation from hold to reduce.

- Dassault Systemes shares decline as much as 2.5% after the company said it aims to double its non-IFRS diluted EPS by 2029, pushing out a more ambitious 2028 goal.

- Polish banking stocks fall after Szymon Holownia, the leader of junior coalition party Polska 2050, told Polsat News that he wants to include a windfall tax on lenders into a renegotiated coalition agreement.

Earlier in the session, Asian stocks traded in a tight range as a much-anticipated call between Donald Trump and China’s Xi Jinping offered little details on how trade negotiations would progress. The MSCI Asia Pacific Index was little changed. Indian stocks rose after the central bank cut interest rates more than projected and unexpectedly reduced the cash reserve ratio for banks. Gauges in Hong Kong fell, while those in Japan rebounded. Markets in Indonesia, Philippines and South Korea were closed for holidays.

In rates, treasuries edge higher ahead of the jobs report, with US 10-year yields falling nearly 2 bps to 3.37%. Bunds outperform their US peers, pushing German 10-year borrowing costs down 5 bps to 2.54%.

In FX, the Bloomberg Dollar Spot Index rises 0.2%. The Japanese yen and Swedish krona are the weakest G-10 currencies, falling 0.4% each. The euro dips 0.3% with little reaction seen after euro-area GDP was revised up for the first quarter. ECB policymakers largely stuck to Thursday’s messaging after they cut rates by a quarter point. USDJPY rose 0.4% to 144.08 after BBG reported that Bank of Japan officials are likely to discuss slowing their pullback from buying government bonds at a policy meeting later this month.

In commodities, gold climbs $6 to around $3,360/oz while silver tops $36/oz. WTI falls 0.6% to $63 a barrel. Bitcoin rises 3%.

Looking at today's calendar, the payrolls numbers are due at 8:30 a.m., while consumer credit data is due later in the day. The Fed’s Bowman is scheduled to give a speech on supervision and regulation.

Market Snapshot

- S&P 500 mini +0.5%

- Nasdaq 100 mini +0.5%

- Russell 2000 mini +0.6%

- Stoxx Europe 600 little changed

- DAX -0.2%, CAC 40 little changed

- 10-year Treasury yield -1 basis point at 4.38%

- VIX -0.3 points at 18.18

- Bloomberg Dollar Index +0.2% at 1210.26

- euro -0.3% at $1.1413

- WTI crude -0.5% at $63.03/barrel

Top Overnight News

- Elon Musk signaled he would move to cool tensions with US President Donald Trump, after differences between the two exploded Thursday into an all-out public feud.

- White House aides scheduled a call with Elon Musk today to take down the temperature after a public feud erupted with Donald Trump. Musk signaled he’s open to cooling tensions. Premarket, Tesla shares (+4.3%) pared some of yesterday’s plunge. Musk also backed off on a threat to decommission SpaceX’s Dragon spacecraft. BBG

- In the midst of the trade war and administration efforts to disentangle the U.S. and Chinese economies, US pharma companies have simultaneously supercharged their interest in China-based biotechs, announcing what are likely to be the biggest deals ever for the rights to experimental medicines invented by Chinese companies. Barron’s

- The US Treasury called on the BOJ to raise rates to strengthen the yen, making a remarkable policy recommendation in its semiannual currency report. Japan’s finance ministry said it doesn’t comment on the views of a foreign government. BBG

- Expectations in the market are intensifying that the Japanese government may adjust debt issuance as soon as next month by increasing sales of shorter maturity securities and trimming offerings of longer-dated ones to prevent a further rise in yields. BBG

- The European Central Bank is approaching the end of its interest-rate cuts, according to two Governing Council members, as others declared inflation has been vanquished.

- The Reserve Bank of India cut its key policy rate on Friday by an unexpectedly sharp 50 bps to 5.5%, its lowest level in nearly three years, as tepid inflation allowed the bank to focus on spurring economic growth. Nikkei

- Iran orders thousands of tons of ballistic missile material from China as Tehran looks to rebuild its arsenal and provide more weapons to proxies in the Middle East. WSJ

- We estimate nonfarm payrolls rose by 110k in May, below consensus of 125k and the three-month average of +155k. On the positive side, big data indicators suggested a healthy pace of job creation. On the negative side, trade policy uncertainty was very high across the survey period and we expect another 10k decline in federal government payrolls from workforce reductions. GIR

- The ECB is approaching the end of its interest-rate cycle, Madis Muller said. Fellow Governing Council member Yannis Stournaras told BTV that the bank should take a break to give officials a chance to assess recent shocks. BBG

- Trump told Senate Republicans he’s open to a SALT cap below the $40,000 in the House-passed tax bill. BBG

Tariffs/Trade

- German Chancellor Merz said Europe is looking for more independence from China and tariffs are having a "terrible" impact on German automakers, while the Chancellery and White House agreed to even closer cooperation on trade talks, according to CNN. Merz also commented that US tariffs are threatening our economy and we are looking for ways to bring them down, according to a Fox News interview. German Chancellor Merz said this US admin is open for discussions, and hearing other opinions; no doubts US will stick with NATO

- Canadian PM Carney spoke with Chinese Premier Li Qiang and exchanged views on bilateral relations, while they emphasised the importance of engagement and both leaders agreed to regularise communication channels between Canada and China. Furthermore, they also discussed trade between the two nations and Carney’s office stated that both governments committed to collaborating on addressing the fentanyl crisis.

- Chinese Premier Li held talks with Canadian PM Carney, according to Xinhua; China willing to safeguard multilaterals and free trade with Canada. There is 'great potential' for cooperation between China & Canada. Both should strengthen cooperation in clean energy, climate change, and innovation.

- Japan's government said trade negotiator Akazawa met with US Commerce Secretary Lutnick and Akazawa strongly sought a review of US tariffs, while they discussed non-tariff barriers and trade expansion.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed following the subdued handover from the US where a stunning online bust-up between US President Trump and Elon Musk overshadowed the recent call between President Trump and Chinese President Xi in which the leaders agreed to start a new round of talks ASAP. ASX 200 saw two-way, rangebound trade as outperformance in the energy and utilities sectors was counterbalanced by losses in gold miners and the top-weighted financial industry, while a lack of pertinent data releases also contributed to the uneventful picture. Nikkei 225 gained with the index supported by recent currency weakness although further upside was capped following disappointing Household Spending data which showed a steeper-than-feared M/M decline and a surprise Y/Y contraction. Hang Seng and Shanghai Comp were indecisive despite the recent phone call between US President Trump and Chinese President Xi which the White House had been touting throughout the week, while Xi reiterated calls for the US to handle the Taiwan issue with caution.

Top Asian News

- RBI cut the Repurchase Rate by 50bps to 5.50% (exp. 25bps cut) and changed its stance to neutral from accommodative, while it cut the Standing Deposit Facility Rate and Marginal Standing Facility Rate by 50bps each to 5.25% and 5.75%, respectively. RBI Governor Malhotra said growth remains lower than aspirations and it is important to stimulate growth, as well as noted that front-loading rate cuts to support growth was felt necessary. Malhotra also stated that inflation has softened significantly over the last six months and inflation is likely to undershoot the full-year target at the margin, while he noted that monetary policy has limited space left to support growth and they retained the FY26 Real GDP growth forecast at 6.5%. Furthermore, the RBI Governor announced to cut the Cash Reserve Ratio by 100bps in four equal tranches, which will release INR 2.5tln, as well as noted that they will continue to monitor and take measures as necessary and that the CRR cut is to reduce the cost of funding of banks and help accelerate policy transmission.

- PBoC set USD/CNY mid-point at 7.1845 vs exp. 7.1935 (Prev. 7.1865).

- Japan's former top FX diplomat says narrowing US-Japan rate gap will likely support the yen at around 135-140 against USD by year-end.

European bourses - Flat/lower trade across Europe following the fallout of the dramatic Trump-Musk spat, but with traders setting their sights on the US jobs report due 13:30 BST/08:30 EDT. On the week, futures of the broad Stoxx 600 and Euro Stoxx 50 indices are currently poised for a second week of gains, though not by much at this stage, and will depend on how the aforementioned data comes in. European sectors - Sectors display a mixed picture with the breadth of the market also narrow, with no real bias. Top gainers at the time of writing include Health Care (+0.6%), Energy (+0.5%), and Retail (+0.3%); losers include Basic Resources (-0.9%), Industrial Goods and Services (-0.4%), and Media (-0.3%). European movers - HSBC (+0.3%) chairman Mark Tucker will step down on September 30th. Adidas (-1.3%), JD Sports (-0.5%), and Puma (-1.6%) are all slipping after US apparel maker Lululemon (LULU) saw its shares tumble by over 20% in extended trading. Airbus (-0.9%) confirmed that it delivered 51 jets in May (-4% Y/Y),

Top European News

- UK government unveiled new concessions to private equity firms regarding its tax break crackdown in which it proposed changes to tax treatment of carried interest that will make the regime less onerous, according to FT.

- ECB's Holzmann says "I dissented" at the rate decision on Thursday (as expected)Lowering rates at a time of high savings and low investments ha no effect except a monetary effectCurrently expansive in monetary policyLagarde said we are at the end of the cycle, wanted to discuss whether that is the caseCurrent nominal neutral rate is around 3%

- ECB's Muller said ECB can be happy with inflation where it is; and he agrees with ECB President Lagarde that cycle almost finished. Hard to say what's coming next on rates.

- ECB's Villeroy said the ECB has won the battle against inflation in Europe, and we will not again see the low rates we saw a few years ago, and added that French inflation is now under control but debt remains a serious issue, "France cannot continue like this", according to Bloomberg.

- ECB's Simkus said interest rates are now at neutral; its important to keep full flexibility, according to Reuters. Stournaras said the best thing for the ECB is to wait and see, ECB rate cutting is nearly done, ECB has achieved a soft landing, and ECB may cut if the economy weakens and inflation falls. Stournaras noted of downside risks to growth, and the bank is "quite" confident in its forecasts, and said he's afraid the Dollar may lose some of its status.

- Bundesbank semi-annual report: German recovery delayed further; economy to tread water in 2025; German GDP to stagnate in 2025, grow by 0.7% in 2026. Increased defence, infrastructure spending to significantly increase growth by the end of 2027. German exports will decline significantly in 2025, increase only slightly next year.