Celibacy is always, shall we say, an affront to what man normally thinks. It is something that can be done, and is only credible, if there is a God and if celibacy is my doorway into the kingdom of God.

Distinction Matter - Subscribed Feeds

-

Site: Zero HedgeHow Legal Immigration Is Keeping Farms AfloatTyler Durden Fri, 05/16/2025 - 21:30

Authored by Darlene McCormick Sanchez via The Epoch Times (emphasis ours),

LAKE VILLAGE, Ark.—On a breezy day, sun and shadow dance across Mencer farms, turning it into a patchwork of green in the fertile Arkansas Delta.

It is humid here in the deep South, where the clock seems to run slower and the temperature hotter than in other places.

Joe Mencer, owner of Mencer Farms in Lake Village, Ark., on April 29, 2025. Samira Bouaou/The Epoch Times

Joe Mencer, owner of Mencer Farms in Lake Village, Ark., on April 29, 2025. Samira Bouaou/The Epoch Times

Lake Village is a small town sitting along Lake Chicot, an abandoned channel of the Mississippi River. Over thousands of years, flooding deposited rich alluvial soil, making it ideal for crops such as rice, cotton, soybeans, and corn.

As a child, William Mencer’s grandfather handed him a cowboy hat and a garden hoe to dig up the pigweeds growing between the crop rows.

The 31-year-old farmer remembers spending long, sweltering days alongside the farmworkers, his hands growing rough and calloused with the effort.

“So I learned, you know, what it was like for these workers,” he told The Epoch Times.

He vowed to escape the sweat and toil of the fields by going to law school and working in an office. But the family farm drew him back like a love song.

Now he is partnering with his father, Joe Mencer, to keep the farm afloat with temporary agriculture workers through the H-2A visa program.

The fourth-generation family farm, which costs $4 million per year to operate, includes 6,000 acres that they own and lease.

While some may claim agriculture needs illegal immigrants to pick crops and work the fields, Joe Mencer told The Epoch Times that they’ve never had an illegal immigrant come looking for work.

They can’t get anyone local to work either, meaning that if they didn’t have the guest farm workers, they couldn’t stay in business.

What Is the H-2A Visa?

It costs more to bring in temporary legal workers than it would if they could find enough people locally to work. But without temporary migrant workers, William Mencer said local farms would go bust, affecting the nation’s food security.

The process has become much more complex since the Mencers began using the guest worker program back in the 1980s.

So much so that the younger Mencer started a small law practice helping other farmers obtain the labor they sorely needed.

He also shares his knowledge with other farmers as a member of the Arkansas Farm Bureau.

The process of hiring workers through the program, sometimes called a guest worker program, starts early in the year for the Mencer family.

William Mencer, who works on his fourth-generation family farm, at Mencer Farms in Lake Village, Ark., on April 29, 2025. He partners with his father to keep the farm running with the help of temporary agricultural workers through the H-2A visa program. Samira Bouaou/The Epoch Times

William Mencer, who works on his fourth-generation family farm, at Mencer Farms in Lake Village, Ark., on April 29, 2025. He partners with his father to keep the farm running with the help of temporary agricultural workers through the H-2A visa program. Samira Bouaou/The Epoch Times

The paperwork needs to be filed 60 to 75 days before their start date, which is mid- to late-February, he said.

It costs as much as $5,000 to bring in several guest workers from Mexico to the United States, he said, noting that the cost doesn’t include the housing and transportation provided to the workers.

Most return home in mid-December, but they are eligible to stay for up to three years in certain situations when agricultural work is available.

The program requires the Mencers to advertise their farm jobs locally before they can be given to guest workers.

Joe Mencer, 65, noted that the rules call for him to fire any foreign worker he’s brought over if an American shows up and wants the job.

Tangled in Red Tape

The process to petition for workers with the U.S. Citizenship and Immigration Service is antiquated, with all communications taking place via mail, according to William Mencer.

The government does not offer online services, email, or a phone number. If there’s a problem, then the farm’s labor source is jeopardized because of the lack of communication, he said.

“Sometimes things get lost in the mail. You know, literally,” he said.

One of his client’s petition paperwork didn’t arrive in the mail. So they filed a claim for the lost package and resubmitted the paperwork.

This time, the paperwork made it to the Dallas office, but the postal carrier found the original package and shipped it, too.

With both petitions filed with the government, it almost took an act of Congress to clear it up.

The younger Mencer sent a letter explaining what happened with the evidence to the government officials, just like he would in court, but the office didn’t respond.

He enlisted the help of his congressman to clear things up. By the time it was all done, his client was behind by a month in getting guest workers.

It makes him wonder if the difficulty and red tape is “by design.”

Joe Mencer, owner of Mencer Farms in Lake Village, Ark., on April 29, 2025. The Mencer family began using the H-2A visa program in the 1980s to bring in foreign workers. The program, often called the guest worker program, requires employers to first advertise farm jobs locally before hiring foreign labor. Samira Bouaou/The Epoch Times

Joe Mencer, owner of Mencer Farms in Lake Village, Ark., on April 29, 2025. The Mencer family began using the H-2A visa program in the 1980s to bring in foreign workers. The program, often called the guest worker program, requires employers to first advertise farm jobs locally before hiring foreign labor. Samira Bouaou/The Epoch Times

The workers are so important that the Mencers keep them busy even when the weather is bad, although it doesn’t help their bottom line.

When there’s no field work, they cut firewood for use in the winter months.

Joe Mencer said he realized a few years back that his son’s law degree would be helpful on the farm, especially given the increasing complexity of the H2A visa program.

Guest Worker Success

The Mencers said their farm couldn’t operate without H-2A visa workers, although the labor cost is higher than using local workers.

Farmers’ margins are already slim because of increased production costs for fertilizer, herbicides, seed, and fuel.

José Mondragon, who started as an H-2A visa worker, is now a green-card holder. He has worked for the Mencer family for nearly 30 years.

Others, such as Gabino Mondragon (no relation to José Mondragon) are H-2A visa holders who have only been working at the farm for a few years.

José Mondragon lives with his wife in a little house on the farm surrounded by flowers and trees. The 57-year-old has deep roots in the land, even serving as a pallbearer when Joe Mencer’s father passed away.

In late April, he operated a self-driving orange Case Magnum row crop tractor, which plowed the earth between the corn rows to improve irrigation.

José Mondragon said he’s seen American workers quit after two or three months, long before the crops are harvested in the fall. The lack of local workers can open the door for temporary visa workers, which is good for everyone, he said.

“The people [are] asking us if we have some opportunities to come with my boss, and we say we will ask him,” he said.

José Mondragon said some people come to the United States illegally because they get into trouble with the law back home or to escape the cartels. Others come to make more money to help support their families in their native countries.

Workers from Mexico make $14.83 per hour on the Mencer farm as legal workers, with the wage set by the government for each state.

Green card holder Jose Delores Mondragon operates a tractor at Mencer Farms in Lake Village, Ark., on April 29, 2025.

Green card holder Jose Delores Mondragon operates a tractor at Mencer Farms in Lake Village, Ark., on April 29, 2025.

José Mondragon said human smugglers, known as coyotes, charge people big money to cross the southern border illegally.

Gabino Mondragon has been working at the Mencer farm on a guest visa for two years. He is experienced at running a spreader for nitrogen fertilizer for corn. One truckload of fertilizer can cost $20,000, according to William Mencer, so having a skilled operator is critical.

Gabino Mondragon believes that more people in Mexico would like to apply for an H-2A visa. Still, if they are caught coming into America illegally, they won’t be eligible unless they get a waiver. It would depend on their record.

The Mencers brought Gabino Mondragon’s family over on an H-4 visa so they could live close by while he worked.

The H-4 nonimmigrant visa allows the spouse and unmarried children younger than 21 years of age to accompany the primary visa holder to the United States.

It’s also an excellent opportunity for Gabino Mondragon’s family because his children are going to school and learning English.

“If our people are happy, it just reinforces that it’s a good thing for everybody,” William Mencer said.

Hanging by a Thread

The high cost of labor, diesel, and chemicals is making it extremely difficult for family farms to stay in business, according to William Mencer.

“We’ve been in four or five really bad years now,” he said.

Some farmers are faced with losing their farms to foreclosure by banks over crop production loans, finding a different line of work, or selling out.

Read the rest here...

-

Site: Zero HedgeFederal Contract Activity Slows As DOGE's Cost-Cutting Measures Take EffectTyler Durden Fri, 05/16/2025 - 21:00

President Donald Trump and Elon Musk's DOGE (Department of Government Efficiency) have exposed widespread federal waste and mismanagement that Congress long ignored. Despite the existence of oversight bodies like the Government Accountability Office, it took an executive order to uncover billions of dollars in egregious federal waste.

DOGE's drive to cut waste and root out fraud in the bloated federal bureaucracy has already resulted in nearly 300,000 job cuts and an estimated $160 billion in savings. As detailed in our series of reports, DOGE's actions are delivering tangible results—helping to reduce the nation's overall funding requirements.

The debt-fueled spending spree under the Biden-Harris regime placed the nation on a crash course to financial ruin—but recent corrective actions by the Trump administration and DOGE, for now, have helped steer the trajectory away from a financial crisis.

Readers may recall some of those tangible DOGE-related results:

-

US Treasury Unexpectedly Reports Sharp Drop In Debt Borrowing Needs, Rates Slide

-

US Treasury Shocks With Second Biggest Budget Surplus In History

-

Jobless Claims Jumped Last Week As 'DOGE Actions' Spark Biggest YTD Layoffs Since 2020

-

Is DOGE Starting To Work? 'Deep TriState' Jobless Claims Surged Last Week

Some progresshttps://t.co/hNCBVYB4YV

— Elon Musk (@elonmusk) April 11, 2025Everything outlined above points to a solid start for DOGE, which has already uncovered hundreds of billions in waste, fraud, and abuse. However, that progress could be undone unless Congress moves to lock in those spending cuts through the reconciliation bill.

DOGE has identified hundreds of billions of dollars of waste, fraud, and abuse, but unless Congress makes those spending cuts permanent through the reconciliation process, all that work will have been for nothing.@Paul_S_Mullen pic.twitter.com/7Y8j4T5ehJ

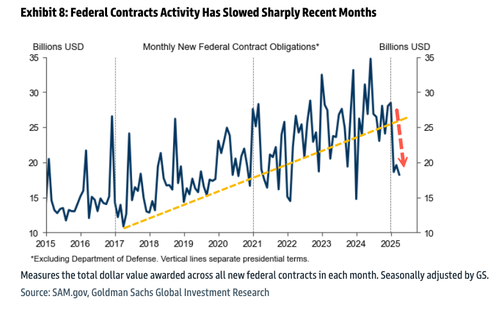

— Heritage Foundation (@Heritage) May 5, 2025Another measure of DOGE's early success is the 20.5% reduction in non-defense federal obligations compared to 2024 levels—a decline that signals reduced future cash outlays as these obligations come due.

"Persistent government-wide contract reviews for wasteful spend, consistent with the DOGE Cost Efficiency Executive Order, are bearing fruit," DOGE's official X account wrote.

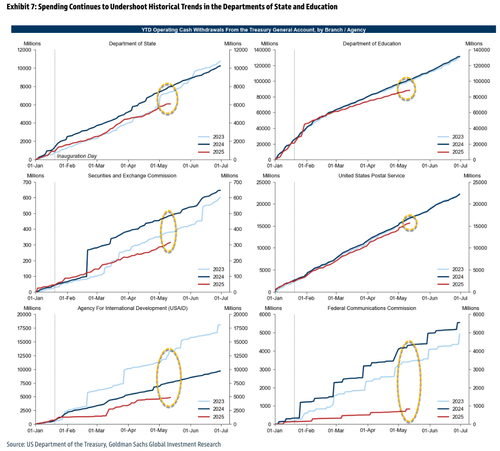

Adding to the visible signs of progress, Goldman chief economist Jan Hatzius, along with analysts Alec Phillips and others, noted Thursday that cash withdrawals from the Treasury General Account across several federal agencies continue to fall below 2023 and 2024 levels—yet another encouraging sign of success.

Also, new monthly federal contract obligations have sharply slowed under DOGE after four years of large spikes under the Biden-Harris regime.

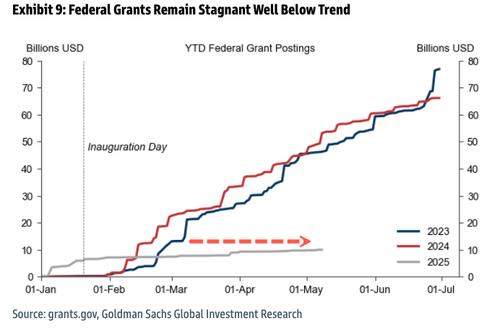

"Notably, new federal contracts data has undershot trend in recent months and stood at $18.2bn in April (compared to $31.1bn in April 2024). Total government grant awards remain stagnated at Inauguration Day levels," the analysts said.

More color here.

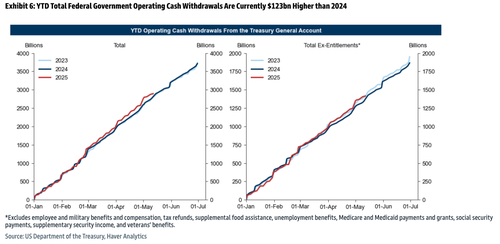

However, Hatzius and his team noted that year-to-date cash withdrawals from the Treasury General Account remain $123 billion above 2024 levels.

The early results of DOGE mark a shift in federal accountability. In just months, DOGE has uncovered hundreds of billions in waste, slashed nearly 300,000 federal jobs, and driven $160 billion in savings. Yet why did it take an executive order from the president to have a group take a deep dive into how federal agencies spend their money?

But this progress is not guaranteed. Without congressional action to lock in these cuts through reconciliation, the swamp remains open for the bureaucratic bloat to return. The message is clear: DOGE is working, but can only be sustained through political action.

-

Site: Zero HedgeJordan's King Warned US Against Assassinating Syria's Sharaa Before Trump MeetingTyler Durden Fri, 05/16/2025 - 20:30

Jordan’s King Abdullah II warned the US against assassinating President Ahmed al-Sharaa before the new Syrian leader met with President Donald Trump, a US senator said on Thursday.

The remarkable statement by a US senator reveals the deep hostility toward Sharaa in some circles of the Trump administration. It reaffirms Trump's own statements that he has been lobbied directly by foreign leaders to give Sharaa a chance, while his own advisors are skeptical.

"I have been concerned by some rumors that I have heard in…some foreign policy circles of the administration that one option that’s been suggested is assassinating the new leader of the Syrian government, Ahmed al-Sharaa," Democratic Senator Jeanne Shaheen said in a Senate hearing on Thursday.

US Senator Jeanne Shaheen, via AP

US Senator Jeanne Shaheen, via AP

According to Shaheen, Jordan’s King Abdullah II heard about the alleged discussions to assassinate Sharaa and warned against it.

“One of the things that was pointed out to us by King Abdullah was that a change in leadership of that kind would create an all-out civil war in Syria. That would not be good to take advantage of the opportunity we have to move that country forward,” Shaheen said.

Shaheen met with King Abdullah in Washington, DC, in May, suggesting that those discussions may have taken place just before Trump cancelled sanctions on Syria and met Sharaa. Shaheen made the remarks during her questioning of Joel Rayburn, Trump’s nominee for undersecretary of state for the Near East, the top Middle East position in the State Department.

The admission by Shaheen is remarkable, given the events of this week. Trump surprised his own senior officials and Israel by announcing he was lifting all sanctions on Syria. Trump then held a meeting with Sharaa in Riyadh on Wednesday.

Speaking to reporters on Air Force One after the meeting, Trump showered praise on Sharaa, saying he was a “young, attractive guy. Tough guy. Strong past. Very strong past. Fighter”.

Asked to comment on the assassination "option", Rayburn replied, “I’m not familiar with efforts like that, but that's clearly not in line with the president's intention…or his description of Sharaa in the past couple of days.”

Blindsided

Trump’s decision to remove all US sanctions on Syria, going back to 1979, was met with thunderous applause in Riyadh, but has annoyed members of the US government. Some in the US State Department who have advocated for sanctions relief also felt sidelined.

It must have been a tense meeting yesterday in Damascus between HTS chief Jolani and the head of Iraqi intelligence. Especially for the Iraqi delegation a hard pill to swallow as Jolani before his time in Syria was in Iraq with Zarqawi blowing up Iraqis. pic.twitter.com/mojl2jTmEd

— Jenan Moussa (@jenanmoussa) December 27, 2024Just a few days before the announcement, the State Department’s Syrian advisors were briefing foreign counterparts that the Trump administration was set to keep sanctions on the new government in Damascus, one regional official told Middle East Eye.

Meanwhile, hardline members of Trump’s National Security Council have told counterparts privately that they would try to drag out the sanctions relief process to obtain concessions from Sharaa, one current and one former US official told MEE.

Democratic Senator Chris Murphy warned on Thursday about members of Trump’s administration working to “undermine” his decision. Rayburn’s hearing was notable because he was seen as hard line on Syria when he served as envoy to the country during Trump’s first term in office.

“I support the President’s goals and his initiative as he laid out,” Rayburn said. “It offers a golden opportunity to turn the page…the president is taking a bold move…he has expectations.”

The White House says it wants Sharaa to expel Palestinian fighters and foreign fighters from Syria, and combat the Islamic State militant group. Trump also said he discussed Syria normalizing ties with Israel. "I told him, 'I hope you’re going to join when it’s straightened out.’ He said, ‘Yes.’ But they have a lot of work to do," Trump said, according to a White House pool report.

Sharaa was the commander of Hayat Tahrir al-Sham or HTS, an Islamist group which toppled the decades-long Assad dynasty in December 2024. Sharaa participated in the Iraq insurgency after the US’s 2003 invasion and served time in a US prison. He once pledged allegiance to al-Qaeda.

The Biden administration removed a $10m bounty on Sharaa's head in early 2025, but he is still designated a "global terrorist". That designation is likely to be removed now, given Trump's order, experts say.

Sharaa’s closest foreign ally is Turkey, but his country has also been moving towards the Gulf states. On Tuesday, Trump told the world he was asked to remove sanctions and had two advocates to credit, President Recep Tayyip Erdogan in Turkey and Saudi Crown Prince Mohammed bin Salman.

The UAE has been holding indirect talks between Israel and Syria to de-escalate tensions. Israel has been striking Syria for months and occupies a swath of southwestern Syria. The Trump administration lobbied Israel and Turkey to enter deconfliction talks in Syria earlier this year.

Ali al-Rifai, director of public relations in Syria's information ministry, was asked by Kan News after Trump’s announcment about the prospect of his country joining the Abraham Accords, the agreement curated by Trump in 2020 that saw a number of Arab countries recognise Israel. “Peace with everyone, without exception,” he responded.

-

Site: RT - News

The US president says he will impose new restrictions if Moscow fails to reach a peace deal with Kiev

US President Donald Trump has said Washington will impose new sanctions on Russia if it fails to reach a peace settlement with Ukraine. His remarks came shortly after the two countries held their first direct negotiations since 2022.

In an interview aired on Friday, Fox News anchor Bret Baier asked Trump whether he would introduce new sanctions on Moscow. “Honestly, I will if we’re not going to make a deal,” the president said. “Nobody uses leverage better than me.”

Trump added that the US would assess the outcome of Friday’s Russia-Ukraine talks in Istanbul. “We’ll see what happens. It will be crushing for Russia because they’re having a hard time with the economy,” he claimed. He also argued that his plan to boost domestic oil production would lower global prices, undermining Russia’s energy exports.

Read more Ukraine conflict could have ended in weeks – Russia’s top negotiator

Ukraine conflict could have ended in weeks – Russia’s top negotiator

Trump claimed that Russian President Vladimir Putin is “tired” from the conflict and said he would schedule a meeting with him sometime in the future. “I have a very good relationship with Putin. I think we’ll make a deal. We have to get together.”

As Trump has been trying to broker a deal between Russia and Ukraine, a group of senators led by Lindsey Graham has drafted a bill to impose sanctions on Moscow and levy tariffs on countries that purchase Russian oil, gas, and uranium.

The head of Russia’s negotiating team in Istanbul, Vladimir Medinsky, said the two sides had agreed upon a major prisoner swap involving 1,000 POWs from each side, as well as continuing contacts once each side has prepared a detailed ceasefire proposal.

-

Site: Zero HedgeThe Rise And Fall Of Synthetic Food DyesTyler Durden Fri, 05/16/2025 - 20:00

Authored by Marina Zhang via The Epoch Times (emphasis ours),

In 1856, 18-year-old chemist William Henry Perkin was experimenting with coal tar-derived compounds in a crude laboratory in his attic.

His teacher, August Wilhelm von Hofmann, had published a hypothesis on how it might be possible to make a prized malaria drug using chemicals from coal tar, and as his assistant, Perkin was hoping that he would be the one to discover it.

Illustration by The Epoch Times, Shutterstock

The experiment was a failure. Rather than the prized drug, Perkin created a thick brown sludge. However, when he went to wash out the beakers with alcohol, it left behind a bright purple residue.

The residue became the world’s first-ever mauve synthetic dye.

Before the invention of synthetic dyes, people obtained dyes through organic materials such as plants, clay, minerals, or certain animals such as insects and squid.

Natural dyes such as those from clay tended to fade quickly, and those that were long-lasting, such as natural indigo dyes, required an arduous extraction process that made them expensive.

However, Perkin’s mauve dye was stable and easy to make.

Mauve dye became an instant hit in the UK and globally. Consumers were seized by “mauve measles.” Everyone wanted a piece of it, including Queen Victoria, a fashion icon at the time who ordered mauve gowns, hats, and gloves.

Perkin’s discovery and commercial success prompted chemists in Europe to find more dyes in coal tar; magenta was discovered in 1858, methyl violet in 1861, and Bismarck brown in 1863.

Synthetic dyes would soon be added to everything—clothing, plastics, wood, and food.

The rapid innovation was not without consequences. Many dyes were found to be harmful within decades of discovery. More than a century later, the United States recently announced the removal of synthetic dyes from food.

Dyes in Food

For centuries, people have colored food to make it appear more appealing. Butter, for example, is not always yellow. Depending on the cattle feed, breed, and period of lactation, the color of butter can fluctuate seasonally, from bright yellow in the summer to pale white in the winter.

“Dairy farmers colored butter with carrot juice and extracts of plant seeds, called annatto, to give them a uniform yellow all year round,” Ai Hisano, an associate professor at the University of Tokyo specializing in cultural and business history, wrote in the Business History Review.

Butter is made at a factory in a biological treatment plant in Albertville, France, on April 26, 2016 (L); Butter melts on toast. Jean-Pierre clatot/AFP via Getty Images, Scott Olson/Getty Images

Natural colors, unlike artificial ones, are susceptible to changing pH, temperature, and moisture. They can change in hue and intensity, and yellows can become pale.

The practice of mass coloring and striving for uniformity likely emerged as a result of industrialization in the late 19th century, when packaged and processed foods became widely available, according to Hisano.

“Mass production and industrialization required easier, more convenient ways of making food, and using coal-tar dyes was one of the solutions for creating more standardized food products,” Hisano told The Epoch Times.

Since packaged foods lose freshness, they may lose color or look less natural. So previously, some companies would add compounds such as potassium nitrate and sodium sulfites to products such as meats to preserve their color. These compounds were relatively harmless.

More lurid examples include toxic metals such as lead used to color cheese and candies. Copper arsenate was added to pickles and old tea to make them look green and fresh, and reports of deaths resulted from lead and copper adulteration.

Dye companies started producing synthetic food dyes in the 1870s. Food regulation began in the 1880s. The Bureau of Chemistry, a branch of the Agriculture Department that would later become the Food and Drug Administration (FDA), looked into food adulteration and modification.

Dairy products such as butter and cheese were the first foods authorized by the federal government for artificial coloring.

Just as synthetic food dyes are a prime target of current Health Secretary Robert F. Kennedy Jr. and FDA Commissioner Martin Makary, they weren’t popular with Bureau of Chemistry head Harvey Wiley, who wrote in 1907, “All such dyeing materials are reprehensible, both on account of the danger to health and deception.”

Despite Wiley’s criticisms, by the time his book “Foods and Their Adulteration” was written, practically all the butter on the market was artificially colored.

“The object of coloring butter is, undoubtedly, to make it appear in the eyes of the consumer better than it really is, and to this extent can only be regarded as an attempt to deceive,” Wiley wrote, arguing that if the cows were properly fed during winter, they would naturally produce butter of the appealing yellow shade.

“The natural tint of butter is as much more attractive than the artificial as any natural color is superior to the artificial.”

The FDA

The previous year, in 1906, Congress passed the Food and Drugs Act, prohibiting the use of poisonous or dangerous colors in food. The FDA was formed on the same day the bill was made into law.

After the prohibition, the FDA approved seven synthetic food dyes—most of which would be banned in the 1950s after new animal studies indicated their toxic effects.

However, the FDA has always given greater scrutiny to synthetic dyes than to natural ones. Synthetic food dyes must be given an FDA certification before they can be used, but there is no requirement for natural dyes. While the FDA regulates synthetic dyes as a food additive, natural dyes can be regulated as generally recognized as safe, which is a less stringent authorization procedure.

In 1938, new laws were passed requiring all food dyes, whether synthetic or natural, to be listed on product labels.

By the 1950s, as oil and gas replaced coal as the main sources of energy, food dyes were no longer made with coal tar derivatives; they were made with petroleum-based compounds instead.

These new petroleum-based food dyes are considered very similar in composition and chemistry to their earlier coal tar counterparts, food scientist Bryan Quoc Le told The Epoch Times.

“Petroleum is cheaper, safer, and available in greater quantities,” he said.

The use of synthetic food dyes has been steadily increasing every decade. Data based on FDA dye certification suggest that food dye consumption has increased fivefold since 1955.

A 2016 study estimated that more than 40 percent of grocery store products that were marketed to children contain artificial colors.

Many packaged snacks contain synthetic food dyes. Scott Olson/Getty Images, Justin Sullivan/Getty Images

Cancer Concern

By the time Wiley became the first head commissioner of the FDA, experts were in contention over which food dye was riskier than the other. Over the following decades, dyes that were initially approved were gradually whittled down to the six remaining dyes of today.

In 1950, many children fell ill after eating Halloween candy containing Orange No. 1, a synthetic food dye. Rep. James Delaney (D-N.Y.) began holding hearings that prompted the FDA to reevaluate all approved color additives.

The hearing also led to the passing of the Delaney Clause, which prohibits the FDA from approving any food additive that can cause cancer in either humans or animals.

Orange No. 1 and several other approved dyes were removed after evidence of animal carcinogenicity.

The Delaney Clause was what prompted the removal of Red No. 3 in January under the Trump administration.

Professor Lorne Hofseth, director of the Center for Colon Cancer Research and associate dean for research in the College of Pharmacy at the University of South Carolina, is one of the few researchers in the United States studying the health effects of synthetic food dyes.

These dyes are xenobiotics, which are substances that are foreign to the human body, and “anything foreign to your body will cause an immune reaction—it just will,” he told The Epoch Times.

“So if you’re consuming these synthetic food diets from childhood to your adulthood, over years and years and years and years, that’s going to cause a low-grade, chronic inflammation.”

Hofseth has tested the effects of food dyes by sprinkling red, yellow, and blue food dyes on cells in his laboratory and observed DNA damage. “DNA damage is intimately linked to carcinogenesis,” he said.

His research showed that mice exposed to Red No. 40 through a high-fat diet for 10 months developed dysbiosis—an unhealthy imbalance in gut microbes and inflammation indicative of damaged DNA in their gut cells.

“This evidence supports the hypothesis that Red 40 is a dangerous compound that dysregulates key players involved in the development of [early-onset colorectal cancer],” Hofseth and his colleagues wrote in a 2023 study published in Toxicology Reports.

The mechanism of how food dyes cause cancer remains to be elucidated.

Hofseth speculates that the biological effects of red and yellow dyes may be attributed to the fact that they are what’s known as azo dyes. The gut hosts bacteria that can break down azo compounds into bioactive compounds that may alter DNA. Hofseth said he believes that if these bioactive compounds impair the gut, they may also contribute to the behavioral problems reported in some children after consuming food dyes.

Behavioral Problems

While the link between food dyes and cancer may remain elusive, the link between food dyes and behavioral problems in some children is much more accepted.

Rebecca Bevans, a professor of psychology at Western Nevada College, started looking into food dyes after her son became suicidal at the age of 7.

Read the rest here...

-

Site: Zero HedgeBiden-Hur Tape Drops, And Boy Is It Rough - Listen To All Five Hours HereTyler Durden Fri, 05/16/2025 - 19:47

Update: Listen to all five hours of the Hur-Biden interview below:

* * *

A segment of former President Joe Biden's October 2023 interview with special counsel Robert Hur just dropped, and boy is it rough.

Biden couldn't remember details such as when his son Beau died, when he left office as vice president, what year Donald Trump was elected, and why he had classified documents in his possession that he shouldn't have had.

According to Axios, which released the recording, Biden frequently slurred words or muttered, and "appears to validate Hur's assertion that jurors in a trial likely would have viewed Biden as "a sympathetic, well-meaning, elderly man with a poor memory."

Listen:

Hur elected not to prosecute Biden for mishandling classified documents based partly on the former president's pea-soup brain - angering Republicans as Trump was facing his own charges of mishandling classified information.

It's also of course notable because the MSM insisted Biden was "sharp," and slammed Hur's assertions as politically motivated.

Tapper says here that the footage of Biden freezing on stage was not a "Cheap fake". Exact words.

— Stephen L. Miller (@redsteeze) May 16, 2025

Okay so when he does he pull Brian Stelter on his show and ask him why he called it that, echoing the White house? When does the media pull Karine Jean-Pierre out of hiding and ask… https://t.co/D0JaXwKv65The audio was from two three-hour sessions on Oct. 8 and 9, 2023 - which the Biden White House refused to release, arguing that they were protected "law enforcement materials," and that Republicans only sought to "chop them up, distort them, and use them for partisan political purposes."

Let's go to the tape...

FLASHBACK: Karine Jean-Pierre attacked Robert Hur — refusing to release the transcript or audio, while claiming he had a partisan agenda to push. pic.twitter.com/DLdZXa4n3O

— Townhall.com (@townhallcom) May 16, 2025Ian Sams:

— Townhall.com (@townhallcom) February 9, 2024

"To suggest that [Biden] couldn't remember when his son died is really out of bounds." pic.twitter.com/Roj31EBJyNDon’t forget the way the press tried to dismiss Hur’s report. https://t.co/9Sd2NdVWuw

— Drew Holden (@DrewHolden360) May 16, 2025How long did Axios have this recording? Before the election?

-

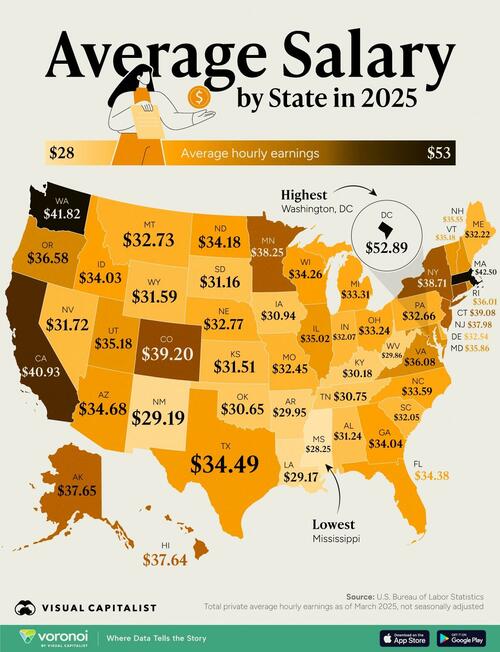

Site: Zero HedgeMississippi Has The Lowest Average Salaries In The US, D.C. The HighestTyler Durden Fri, 05/16/2025 - 19:30

While wages in the U.S. have grown in recent years, many families are still feeling the squeeze of high inflation. Pay levels vary widely not just by profession, but also by geography.

This graphic, via Visual Capitalist's Bruno Venditti, maps the average salary by U.S. state using the latest data from the Bureau of Labor Statistics, as of March 2025. The figures represent total private hourly earnings, not seasonally adjusted.

DC Tops the List

At the top of the list is Washington, DC, where workers earn an average of $52.89 per hour, far outpacing every state. This reflects the region’s concentration of high-paying jobs in government, law, and professional services.

Massachusetts comes in second at $42.50/hour, followed by Washington at $41.82, and California at $40.93. In common, these states are home to major tech, biotech, and finance hubs.

State/District Average hourly earnings District of Columbia $52.89 Massachusetts $42.50 Washington $41.82 California $40.93 Colorado $39.20 Connecticut $39.08 New York $38.71 Minnesota $38.25 New Jersey $37.98 Alaska $37.65 Hawaii $37.64 Oregon $36.58 Virginia $36.08 Rhode Island $36.01 Maryland $35.86 New Hampshire $35.55 Utah $35.18 Vermont $35.18 Illinois $35.02 Arizona $34.68 Texas $34.49 Florida $34.38 Wisconsin $34.26 North Dakota $34.18 Georgia $34.04 Idaho $34.03 North Carolina $33.59 Michigan $33.31 Ohio $33.24 Nebraska $32.77 Montana $32.73 Pennsylvania $32.66 Delaware $32.54 Missouri $32.45 Maine $32.22 Indiana $32.07 South Carolina $32.05 Nevada $31.72 Wyoming $31.59 Kansas $31.51 Alabama $31.24 South Dakota $31.16 Iowa $30.94 Tennessee $30.75 Oklahoma $30.65 Kentucky $30.18 Arkansas $29.95 West Virginia $29.86 New Mexico $29.19 Louisiana $29.17 Mississippi $28.25At the other end of the spectrum are Mississippi ($28.25) and Louisiana ($29.17)—the only two states with average wages below $30 per hour.

Northeastern states dominate the upper end of the scale, with Connecticut and New York joining Massachusetts above the $38/hour mark. In contrast, much of the South and Midwest sits closer to or below the national median. For example, Iowa ($30.94) and Indiana ($32.07) reflect more modest earnings common in the region.

When compared, the earnings gap between the highest (DC) and lowest (Mississippi) is more than $24 per hour. The federal minimum wage is currently $7.25 per hour for workers covered by the Fair Labor Standards Act (FLSA), though many states have set their own, often higher, minimum wage rates.

If you enjoyed this map, check out this map on Voronoi about the income needed to buy a home in every U.S. state.

-

Site: Zero HedgeWill Nuclear Fusion Soon Be The "Norm?"Tyler Durden Fri, 05/16/2025 - 19:05

Authored by Duggan Flanakin via RealClearEnergy,

The dream of humanity to imitate the forces that created their habitat has been alive for at least as far back as the time when humans with a single language decided to build a city with a tower that reached the heavens. For such a people, “nothing they plan will be impossible to them,” it is recorded.

For at least the same time frame, humanity has sought comfort through technology. While primitive heat producers like coal and wood are still used today, the discovery that petroleum, natural gas, and even moving water could generate a newly discovered phenomenon known as “electricity” transformed the industrial revolution into the modern era.

Not until the 1930s did German scientists build on Enrico Fermi’s discovery that neutrons could split atoms to recognize that splitting atoms would release significant energy – energy that could be used for both bombs and electricity generation. By the 1950s, scientists began building nuclear fission-based power plants that today provide about a tenth of the world’s electricity.

Scientists and engineers also began to envision the potential of nuclear fusion -- the reaction of light atomic nuclei powers the sun and the stars. Since that time, they have worked feverishly, but with little success, to replicate this energy-rich reaction using deuterium and tritium.

One group of scientists and engineers decided to try an alternative approach.

Founded in 1998, California-based TAE Technologies has been developing a reactor that runs on proton-boron aneutronic fusion – that is, a fusion reaction that fuses a hydrogen nucleus with non-radioactive boron-11 instead of fusing hydrogen isotopes of deuterium and tritium. Their goal is to develop commercial fusion power with the cleanest-possible environmental profile.

All efforts at fusion require chambers that can withstand temperatures of millions of degrees Celsius and immense pressure that are needed to fuse two isotopes together. To accomplish this requires huge amounts of energy – and until recently, more energy than the fusion produced.

Most fusion researchers, including those building the ITER project being built in France, rely on a donut-shaped tokamak reactor chamber, in which a stream of plasma must be held away from its walls by electromagnets for any energy to be produced. The tokamak design uses a toroidal magnetic field to contain the hydrogen plasma and keep it hot enough to ignite fusion.

Sadly, as with ITER, project costs have soared and timeframes have fallen by the wayside despite occasional breakthroughs. Over decades, tokamak designs became gigantic, with huge superconducting magnetic coils to generate containment fields; they also had huge, complex electromagnetic heating systems.

Spurred by the failures of wind and solar to fully satisfy the desire for “clean energy,” governments and private investors began investing heavily into fission and fusion projects. Oak Ridge, Tennessee, has tapped into a $60 million state fund intended to bolster both fission and fusion energy in atomic energy’s American birthplace.

New research at the University of Texas, in conjunction with Los Alamos National Laboratory and Type One Energy Group, uses symmetry theory to help engineers design magnetic confinement systems to reduce plasma leakage from tokamak magnetic fields.

The old method used for a stellarator reactor relied on perturbation theory. The new method, which relies on symmetry theory, is a game changer. It can also be used to identify holes in the tokamak magnetic field through which runaway electrons push through their surrounding walls and greatly reduce energy output.

The TAE Technology reactor is entirely different than any of the tokamak or stellarator fusion chambers. In 2017, the company introduced its fifth-generation reactor, named Norman, which was designed to keep plasma stable at 30 million C. Five years later the machine had proven capable of sustaining stable plasma at more than 75 million C.

That success enabled TAE to secure sufficient funding for its sixth-generation Copernicus reactor and to envision the birth of its commercial-ready Da Vinci reactor. But in between, TAE developed Norm.

Norm uses a different type of fusion reaction and a new reactor design that exclusively produces plasma using neutral beam injections. The TAE design dumps the toroidal field in favor of a linear magnetic field that is based on the “field-reversed configuration” (FRC) principle, a simpler, more efficient way to build a commercial reactor.

Instead of massive magnetic coils, FRC makes the plasma produce its own magnetic containment field. The process involves accelerating high-energy hydrogen ions and giving them a neutral charge, then injecting them as a beam into the plasma. That causes the beams to be re-ionized as the collision energy heats the plasma to set up internal toroidal currents.

Norm’s neutral beam injection system has cut the size, complexity, and cost, compared to that of Norman, by up to 50%. But not only is an FRC reactor smaller and less expensive to manufacture and operate, says TAE, it can also produce up to 100 times more fusion power output than a tokamak -- based on the same magnetic field strength and plasma volume.

The FRC reactor also can run on proton-boron aneutronic fusion, which, instead of producing a neutron it produces three alpha particles plus a lot of energy. The fewer neutrons also do less damage to the reactor; the energy being released as charged particles is easier to harness. Less shielding is required, and, perhaps best of all, boron-11 is relatively abundant and not radioactive.

So, while “Norm” may not be the final step in developing commercial fusion energy, TAE’s hope is that fusion energy will the “norm” as early as the mid-1930s. FRC technology has materially de-risked Copernicus, according to TAE CEO Michi Binderbauer.

If Norm is as advertised, it will accelerate the pathway to commercial hydrogen-boron fusion – a safe, clean, and virtually limitless energy source.

But is humanity ready for free energy to be the “norm?”

Duggan Flanakin is a senior policy analyst at the Committee For A Constructive Tomorrow who writes on a wide variety of public policy issues.

-

Site: Zero HedgeTrump Fumes After Supreme Court Rules Venezuelan Illegals Can't Be Deported (For Now)Tyler Durden Fri, 05/16/2025 - 18:51

Update (1715ET): President Trump took to TruthSocial to issue his brief but terse statement:

"THE SUPREME COURT WON’T ALLOW US TO GET CRIMINALS OUT OF OUR COUNTRY!"

* * *

The Supreme Court ruled this afternoon to keep in place its block on President Trump's deportations of (alleged) Venezuelan gang members under a 1798 law historically used only in wartime after their ACLU lawyers said the government was set to remove the men without judicial review in violation of a prior order by the justices.

The Supreme Court has previously issued two orders stemming from those cases.

Justices agreed that the president could rely on the centuries-old wartime law to remove immigrants from the country - provided they first have an opportunity to challenge those claims in court - and then temporarily blocked the government from deporting another group of Venezuelans in Texas while their lawyers scrambled to challenge the allegations against them.

In his proclamation invoking the Alien Enemies Act, Trump stated that “all Venezuelan citizens 14 years of age or older who are members of [Tren de Aragua], are within the United States, and are not actually naturalized or lawful permanent residents of the United States are liable to be apprehended, restrained, secured, and removed as Alien Enemies.”

The 7-2 decision clarified an unusual order issued by the justices in the early hours of April 19 that hit pause on any government plans to deport people held in northern Texas.

The Supreme Court delivered a blow to the Trump Administration in blocking deportations under the Alien Enemies Act. However, the Court only did so based on the lack of notice (24 hours) afforded by the Administration. It did not rule on the legality of the use of the AEA...

— Jonathan Turley (@JonathanTurley) May 16, 2025Over the dissents of conservative Justices Clarence Thomas and Samuel Alito, the justices in the latest unsigned decision slammed the Trump admin for only giving the detainees 24 hours to launch legal challenges.

“Notice roughly 24 hours before removal, devoid of information about how to exercise due process rights to contest that removal, surely does not pass muster,” the court wrote in its unsigned opinion.

“But it is not optimal for this Court, far removed from the circumstances on the ground, to determine in the first instance the precise process necessary to satisfy the Constitution in this case. We remand the case to the Fifth Circuit for that purpose,” the opinion continued.

However, as The Hill reports, the justices declined the ACLU’s additional request to leapfrog the lower courts to immediately take up the issue of whether President Trump can invoke the rarely used law outside of wartime.

Instead, the case will return to the lower courts alongside a handful of other challenges being brought by the civil rights group around the country.

So it’s legal for a president to ship millions of illegal aliens into our country but it’s illegal to send them home?

— Rep. Mike Collins (@RepMikeCollins) May 16, 2025

The system is broken. The Supreme Court failed us.

Whose country is this anymore?The issue could ultimately return to the justices, who directed the lower courts to act “expeditiously.”

Now, we all anxiously await President Trump's response to this decision...

-

Site: Zero HedgeBees Are Behind Our Food And Natural Medicines - And They're DisappearingTyler Durden Fri, 05/16/2025 - 18:40

Authored by Emma Suttie via The Epoch Times (emphasis ours),

Bees are dying—and at an alarming rate.

Between 2023 and 2024, US beekeepers lost an estimated 55.1 percent of their colonies—the worst loss in more than a decade and nearly 15 percent higher than the previous 13-year average.

Lisa Schaetzle/Getty Images

Lisa Schaetzle/Getty Images

Bees pollinate three-quarters of the fruits, vegetables, and nuts we eat, and many of us rely on bee products for their nutrition and health-promoting gifts. If bees vanish, it’s scary to think of all we stand to lose. And some say that if the bees go, we go too.

Jeff Pettis, president of Apimondia—The International Federation of Beekeepers’ Associations—sums up the health benefits that bees offer humans in one word: huge.

Although two-thirds of our diet comes from carbohydrates—crops like rice, wheat, and corn—which are pollinated by wind rather than insects, many other important foods require bees.

“So we’re not going to starve if we don’t have bees. But literally, everything you can think of that’s nutritious—fruits, nuts, and vegetables—all of those are, we'll call it, animal-pollinated. The vast majority of those are pollinated by honey bees or other wild bees,” he told The Epoch Times.

Bees Pollinate

Ryan Burris is a third-generation beekeeper and the president of the California State Beekeepers Association. He points out that many people don’t realize how many fruits and vegetables we eat depend on bees for pollination.

“The biggest one, obviously, for beekeepers, is almonds. And then you have things like blueberries, watermelons, and stuff you don’t think about, like onions and carrots—all require pollination. There’s an estimated 100 crops that require pollination,” he told the Epoch Times.

Twenty thousand species of bees grace our planet, and 4000 species are native to the United States. Bees are some of our most well-known and beloved pollinators. One in every three bites of food you eat depends on pollinators to produce, and bees pollinate one in every four bites.

Beyond their critical role as pollinators, bees also gift us powerful products like honey, bee pollen, propolis, and royal jelly—each packed with nutritional and medicinal benefits.

Honey

The Ancient Egyptians may have been the world’s first beekeepers. They crafted clay hives and transported them on rafts along the Nile, allowing bees to pollinate whatever flowers were in season. Bees were deeply revered, and honey was considered sacred.

Throughout history, honey has played many roles—it was used in religious rituals, medicine, currency, and offerings to the gods. When archaeologists uncovered King Tutankhamun’s tomb, they found a sealed jar of honey more than 2,000 years old. Because honey doesn’t spoil, it was still safe to eat.

Honey offers a treasure trove of healing properties. It soothes a cough, benefits digestion and oral health, treats constipation and diarrhea, protects the heart, and has anticancer properties—in addition to being antibacterial, anti-inflammatory, antifungal, and a powerful antioxidant.

Jana Schmidt is a board-certified naturopathic doctor and master herbalist who keeps bees. She says not all honey is created equal, and knowing where your honey comes from is crucial, as many store-bought varieties are synthetically made or artificial. If you want the good stuff, go for raw, local honey—ideally straight from a beekeeper.

“Darker varieties have higher antioxidants than the lighter varieties,” she noted, saying bees make the darker types in the winter months when it’s cold, and they need more nutrition—which is passed to us when we eat it.

She says that honey added to tea before bed can help you sleep—something she did for her children when they were little.

“It helps regulate your sleep, but it also protects the teeth from the bacteria that causes cavities, which seems crazy because it’s sweet. You think, oh, that’s going to cause cavities, but actually, it protects the teeth,” she told The Epoch Times.

Studies have found that honey’s antibacterial properties fight harmful bacteria, such as Salmonella and E. coli. In addition, honey has been studied for its potential benefits against cancer—including breast, liver, and colorectal cancers, where it has shown cytotoxic effects on cancer cells, the ability to inhibit cancer cell growth, and prevent the formation of new blood vessels that tumors need to grow.

Raw honey is a potential source of Clostridium botulinum spores, which can cause botulism—especially in babies. Therefore, it’s generally recommended that infants under one year of age should not be fed raw honey.

Bees are prolific producers of a diverse array of products with numerous potential health benefits, according to experts.

Bee Pollen

Honeybees collect pollen from flowers and mix it with their saliva, which contains special enzymes. They then store it in comb cells inside their hives. Once the pollen is stored and processed in the hive, it is called beebread, or ambrosia—a vital food for the bees—containing proteins, fats, vitamins, and minerals they need. When beebread is stored, it undergoes a natural fermentation process, which preserves it and makes its nutrients easier to absorb.

Bee pollen. hanif66/Shutterstock

Bee pollen. hanif66/Shutterstock

“To me, it’s God’s perfect multivitamin because it has every vitamin and mineral known for human nutrition. It has approximately 96 different nutrients and bioavailable energy. It’s antibacterial, antifungal, antiviral, and the most digestible protein per ounce than anything else out there,” Schmidt said.

Bee pollen offers a source of sustained energy throughout the day and not a spike like you might get from sugar or caffeine, she said.

“I don’t drink coffee or anything like that. I just take my bee pollen in the morning, and I’m good to go,” she beamed.

There is growing scientific interest in bee pollen, particularly because of its antimicrobial properties, which can fight a wide variety of pathogens, including bacteria and fungi. This ability is notable because some bacteria are becoming resistant to antibiotics. Bee pollen (beebread) seems able to fight microbes without creating resistance, which some scientists believe is because it contains several different natural compounds that work synergistically. Bee pollen also supports the body’s good bacteria, benefiting healthy gut microbes—behaving like a prebiotic.

Schmidt adds that as a natural fertility specialist, bee pollen is her number one fertility supplement.

“If you think about it, it’s the fertility for the plants. Why wouldn’t it be fertility for us, too? So sometimes that’s all it takes. The couple start taking bee pollen, and bam, they’re fertile. So that’s been pretty fun to be a part of.”

Studies have found that bee pollen has other wide-ranging medicinal benefits to humans, including:

- Benefiting metabolic syndrome disorders

- Preventing obesity

- Combating liver disorders

- Cardioprotective effects

- Lowering uric acid

- Detoxifying (based on animal studies)

- Regulating ovarian functions

- Alleviating allergic reactions

- Improving digestion and absorption

- Stimulating the immune system

- Improving cognitive dysfunction

“It takes bees working eight hours a day, two to four weeks, to gather one teaspoon of pollen, Schmidt said. They work so hard. They visit over 2 million flowers to get one teaspoon of pollen. It’s pretty amazing.”

Propolis

Propolis, also known as “bee glue,” is a resinous substance bees gather from different types of plants. Bees use it as a type of construction material for the hive. It seals holes and cracks, improves structural integrity, smooths the inner surface of the hive, maintains a constant internal temperature of 95 degrees Fahrenheit, and protects the hive from the elements, predators, and pathogens. Once hardened, it helps create an antiseptic internal environment.

Bee propolis. Ihor Hvozdetskyi/Shutterstock

Bee propolis. Ihor Hvozdetskyi/Shutterstock

Schmidt offers a long list of propolis’s benefits, particularly to the brain. These include reducing inflammation in the brain and oxidative stress, helping reduce the toxic effects of methylmercury—a highly toxic form of mercury—and aluminum in the brain, increasing synaptic efficiency, and protecting against neurodegeneration and cognitive impairment.

She adds that it is a great prebiotic and excellent for gut health.

“Anytime there’s an infection, and you’re not quite sure what it is, I usually go to propolis—it just boosts your immune system like nothing else I’ve ever used,” she said.

Studies have revealed that this amazing substance has many applications for human health and has the following medicinal properties:

- Antioxidant

- Anti-inflammatory

- Antiulcer

- Anticancer

- Immunomodulatory

- Neuroprotective

- Anti-allergic

- Cardioprotective

- Antidiabetic

Studies in humans and animals have shown propolis to possess powerful healing properties beneficial in multiple acute and chronic diseases—from autoimmune diseases like Type 2 diabetes and rheumatoid arthritis to cardiovascular disease, cancer, and COVID-19.

In a 2021 randomized, controlled clinical trial, 124 hospitalized patients with COVID-19 were split into three groups. Two groups received Brazilian green propolis—400 or 800 milligrams daily—in addition to regular treatment—while the third group did not receive propolis.

The researchers found that patients who received propolis were released from the hospital five to six days sooner, and those who received 800 mg of daily propolis had less kidney damage associated with COVID-19. Thus, the study authors concluded that propolis is a safe and effective adjunct treatment for patients with COVID-19.

Royal Jelly

Humans have used royal jelly as a powerful medicine for millennia. It is extremely popular and highly regarded in Chinese medicine—in ancient times and today. Royal jelly is an overall tonic that promotes the robust development of bones, teeth, and the brain. It also helps boost fertility for women and soothe the symptoms of menopause.

Royal jelly. Bin Zhu/Shutterstock

Royal jelly. Bin Zhu/Shutterstock

Royal jelly is a white milky substance secreted by worker bees to feed the queen bee larvae. Worker bee larvae get a different type—called worker jelly that contains fewer nutrients. According to one study, the higher quality royal jelly fed to the queen allows her to live a long life (up to five years) and lay 2,500 eggs daily. In comparison, worker bees only live about 45 days and, although female, do not reproduce.

Rich in proteins, carbohydrates, fats, vitamins, and minerals, royal jelly is a vital food source for bees. Today, humans use it as a dietary supplement, medicine, and ingredient in cosmetic and skincare products.

Studies have shown royal jelly to have the following medicinal properties:

- Antioxidant

- Anti-lipidemic

- Antiproliferative

- Antimicrobial

- Neuroprotective

- Anti-inflammatory

- Immunomodulatory

- Antiaging

- Estrogenic activities

Despite its medicinal benefits, Schmidt says that she does not recommend royal jelly because of how it is harvested, as it hurts the bees and the hive only to collect a tiny amount.

“I just don’t like the practice overall ... I feel like it takes it a step beyond what we should be doing to live well with the bees,” she said.

A 2023 study investigated the effect of royal jelly on liver enzymes and glycemic indices. The researchers found that royal jelly did not significantly affect adults’ glycemic profile or liver function. However, in trials with a longer duration of 8 or more weeks, and those conducted in “non-healthy” populations, there was a significant reduction in serum fasting blood glucose —a measurement of glucose in the blood after fasting. Higher fasting blood glucose levels are a characteristic sign of both prediabetes and Type 2 diabetes.

Why Bees Are Dying

We have all heard about the alarming decline in bee numbers in recent years.

Pettis says the reasons that bees are dying is such huge numbers are multifaceted and complex.

The first, he says, is that bees are losing their natural habitat. A significant reason for this is the rise of monoculture—when farmers plant only one kind of crop in their fields. This lack of diversity limits the flowers available for bees, making it harder for them to get all the nutrients they need to stay healthy and thrive.

“Roundup Ready crops, like corn, soybeans, all these—they create very sterile fields so there are no weeds—and a lot of those weeds are really good for bees,” he said.

Pettis says the second reason is pesticide exposure and the third is pests and diseases affecting bees. He says they all combine in different ways to affect bees and reduce their numbers, making beekeeping more challenging.

“We’ve had a number of exotic things come into the U.S.—two parasitic mites, and then the beetle from Africa, and now we have some invasive hornets coming in from Asia. It’s just one thing after another,” he said.

“It’s really hard to survive when you have all these stressors lining up, one right behind the other.”

Some readers may be wondering about colony collapse disorder.

“I was actually very involved in colony collapse disorder, which is now 20 years old, and we never came up with a single definitive thing. It was just a combination of things that were killing managed honeybees,” Pettis said.

Mites, particularly the varroa mite—which is aptly named Varroa destructor—have become an enormous challenge for beekeepers.

“The varroa mite—Varroa destructor—is the main killer of honey bees because they feed on the bee as it’s growing,” Burris said.

These tiny parasitic mites feed on bee fat and blood, which bees need for energy and a healthy immune system. They also spread viruses, particularly the deformed wing virus, which causes bees to be born with shriveled wings that will never fly.

Burris adds that federal and state regulators do not want honeybees on public lands as they fear they may hurt native pollinators, though he notes they don’t have evidence to support those concerns.

He says they’re arguing about food supply and demand problems without considering that native pollinators and honey bees have different feeding habits.

“They’re not taking into account the size of the honeybee, the size of a native pollinator, the size of their tongues, and how they extract nectar—how they obtain pollen,” he said.

Pesticides, which include insecticides and herbicides, are also detrimental to bees.

“Roundup and other weed killers that contain glyphosate are incredibly harmful to our bodies, but also the bees,” Schmidt said.

A relatively recent class of insecticides called neonicotinoids, or neonics, are the world’s most widely used insecticides and possibly one of the most deadly. They work by making every part of the treated plant toxic while poisoning the soil, surrounding water, and wildlife. They affect the bees’ nervous system, interfering with their ability to learn, remember, and navigate, meaning many exposed bees can’t find their way back to the hive and eventually die.

Since their introduction in the last two decades, neonicotinoids’ widespread use has made U.S. agriculture increasingly destructive to insect life. Neonicotinoids are responsible for 92 percent of this increase in danger to insects.

These deadly insecticides don’t just kill bees. Neonics are linked to losses of birds and fish and birth defects in white-tailed deer. Increasing evidence has also shown that neonics affect human health, especially children. One study found neonics in the urine of half of children 3 to 5 years old, and a 2020 Swiss study found neonics in every sample of plasma and spinal fluid of children receiving treatment for leukemia and non-Hodgkin lymphoma.

How We Can Help Bees

Thankfully, there are things we can all do to help bees and support these essential pollinators.

- Plant native flowers and trees, especially ones that bloom through summer, as bees need food from spring through fall.

- Buy local honey, and honey made 100 percent in the United States to support U.S. beekeepers.

- Avoid using insecticides or pesticides around your yard and use natural methods instead. Schmidt says using vinegar and water with a bit of salt kills weeds without harming anything else.

- Allow an area of your yard or garden to be overgrown or less cut back to provide food and nesting habitats for bees.

- Plant a bee garden with native flowers to attract bees and other pollinators.

- Create a bee watering station with filtered water using a deep plate with pebbles or marbles near flowering plants to give bees a safe place to drink.

- Create a bee house you can hang in your yard to give bees a place to live.

- Keep hives away from sources of wifi radiation and EMFs, which adversely affect bees.

- If you notice a swarm of bees on your property, contact a local beekeeping association, university agriculture department, or local beekeeper to collect them, not an exterminator.

- Encourage state legislators to support laws that support and protect bees.

- Spread awareness about bees and how we can support them.

Schmidt reveres the tiny pollinators that provide us with so much.

“You know, we use the term beekeeping, but I really feel like they keep us—like they know what to do, we just need to provide a nice habitat for them, and they do all the work—they just give and give.”

-

Site: RT - News

The offensive, dubbed Gideon’s Chariots, reportedly aims to “conquer” the entire Palestinian enclave

The Israel Defense Forces (IDF) has announced a new bombing campaign in Gaza aimed at defeating Hamas. The offensive comes after a ceasefire brokered by the US, Egypt, and Qatar expired in March.

“Over the past day, the IDF launched extensive attacks and mobilized forces to seize strategic areas in the Gaza Strip, as part of the opening moves of Operation Gideon’s Chariots and the expansion of the campaign in Gaza,” the military said in a statement on Friday evening.

The IDF reiterated its goals of securing the release of the remaining hostages and achieving “the defeat of Hamas.”

“IDF troops in the Southern Command will continue to operate to protect Israeli citizens and realize the goals of the war,” the Israeli army added.

According to the Times of Israel, the IDF aims to “conquer” Gaza, relocate the Palestinian population to the southern part of the enclave, and prevent “terror groups” from seizing humanitarian aid.

Al Jazeera reports that at least 115 Palestinians have been killed since dawn on Friday.

במהלך היממה האחרונה צה"ל החל בתקיפות נרחבות והניע כוחות לתפיסת שטחים שולטים בשטח רצועת עזה, זאת כחלק ממהלכי הפתיחה למבצע "מרכבות גדעון" והרחבת המערכה בעזה, להשגת כל מטרות המלחמה בעזה, לרבות שחרור החטופים והכרעת החמאס.

— צבא ההגנה לישראל (@idfonline) May 16, 2025

כוחות צה"ל בפיקוד הדרום ימשיכו לפעול בכדי להגן על אזרחי ישראל… pic.twitter.com/WtK8Iy6XyGThe ceasefire between Israel and Hamas broke down in March after the sides failed to agree on implementing the second phase of the truce.

Israel declared war on Hamas following a surprise attack by Palestinian militants on October 7, 2023, which killed around 1,200 people and resulted in over 200 hostages being taken. More than 53,000 Palestinians have been killed since the conflict began, and human rights organizations have accused Israel of genocide.

-

Site: LifeNews

Pro-Life Americans were sorely disappointed today when a House committee voted down the reconciliation bill that has language to defund the Planned Parenthood abortion business.

But House Majority Leader Steve Scalise says he thinks the fiscal policy issues that prompted a handful of pro-life Republican lawmakers to defeat the bill will be resolved and the House will pass the bill next week.

Scalise explained how this one big, beautiful bill will go to the Budget Committee on Sunday night before heading to the Rules Committee, and then the House Floor.

“So Sunday night, the Budget Committee will go back in,” he said in an interview with Fox News. “They’re going to meet.”

SUPPORT LIFENEWS! If you want to help fight abortion, please donate to LifeNews.com!

“Look, we’re talking to those members who voted no today. We’re going to work through it. There were some questions they had for the Trump Administration. We were working on getting them some of those questions answered,” Scalise explained.

“We’re going to get the bill passed. Then, ultimately, by next week, Tuesday, Wednesday, Thursday, on the House Floor, that bill will pass,” he added.” One big, beautiful bill will pass the House, and then it goes to the Senate, and they get to start their process. Although we’ve been keeping Senator Thune, Senator Crapo, all the other members of their leadership informed every step of the way, so they know what’s in this bill. Hopefully, they won’t have to start over from scratch.”

“[It could pass the Budget Committee by] Sunday night. It goes to Rules [Committee], goes to the floor – Tuesday, Wednesday, Thursday, somewhere in there. As fast as we can get it done. Let’s get it done,” the pro-life congressman added.

The bill failed in this morning’s vote in a 16-21 vote, with Reps. Ralph Norman (R-SC), Chip Roy (R-TX), Josh Brecheen (R-OK), Andrew Clyde (R-GA), and Lloyd Smucker (R-PA) joining all Democrats in voting down the bill.

The House Energy and Commerce Committee signed off on the bill earlier this week.

The good news for pro-life Americans is that the measure includes language to defund Planned Parenthood and Big Abortion. The abortion giant just announced that it killed over 420,000 babies in aboritons in its most recent year and mamade over $2 billion.

There were several amendments by pro-abortion Demcorats to take out the pro-life language in that committee. They all failed.

Nearly all committee Republicans voted against an amendment brought by pro-abortion Democrat Rep. Lizzie Fletcher to strike the language that would prohibit Planned Parenthood from receiving federal funds, even through Medicaid payments. Republican Reps. Mariannette Miller-Meeks and Gabe Evans did not vote on the amendment.

Susan B. Anthony Pro-Life America, a leading pro-life group, celebrated that vote.

“We congratulate Energy and Commerce Committee Chairman Brett Guthrie and House GOP allies for their hard work on a budget that serves moms, babies and taxpayers alike. SBA will proudly score in favor of this ‘one big beautiful bill’ that includes the vital priority of stopping forced funding of the abortion industry. To no one’s surprise, pro-abortion Democrats peddled lies and ran cover for abortion businesses like Planned Parenthood,” the group told LifeNews.

“Their taxpayer funding increased almost $100 million in one year, hitting $792.2 million in 2023, as health care like pap smears and breast exams plummeted – all while ending a record 402,230 babies’ lives,” it added. “We applaud pro-life congresswomen Harshbarger, Houchin, Fedorchak and Lee for speaking out during the debate to set the record straight and defeat a Democrat amendment that would have kept funneling money to Big Abortion. The Big Abortion industry is focused on profits, politics and lawfare, not providing quality services for low-income women in a safe environment. Patients are far better off going to community health centers that outnumber Planned Parenthood 15:1, where Medicaid recipients among others can get much more comprehensive care.”

Last week, a few Republicans in the House and Senate expressed their reservations about defunding Planned Parenthood within the budget bill. Asked about that, President Donald Trump expressed confidence that Republicans will resolve internal disagreements to advance legislation defunding Planned Parenthood.

“I don’t know yet. I have to see because you’re just telling me that for the first time, we’ll work something out,” Trump said in response.

The reconciliation process, which allows legislation to pass the Senate with a simple majority, offers Republicans a rare opportunity to strip federal funding from Planned Parenthood, the nation’s largest abortion business. Pro-life groups argue that taxpayer dollars, even if not directly funding abortions, indirectly subsidize Planned Parenthood’s operations, which include killing over 390,000 babies every year.

Pro-life advocates emphasize that community health centers, which outnumber Planned Parenthood clinics and provide comprehensive care without abortions, can absorb patients if funding is redirected.

House Speaker Mike Johnson, a staunch pro-life advocate, has signaled that defunding “big abortion” is a priority in the reconciliation bill, which also addresses Trump’s agenda on taxes, border security, and energy.

The Hyde Amendment already prohibits federal funds from directly paying for abortions, except in cases of rape, incest, or to save the mother’s life. However, Planned Parenthood receives approximately $700 million annually through Medicaid reimbursements and Title X grants. Pro-life leaders argue this funding frees up resources for Planned Parenthood’s abortion operations.

The reconciliation bill, which allows legislation to pass with a simple majority in both chambers, is seen as a critical opportunity to strip federal funding from Planned Parenthood, the nation’s largest abortion business. The abortion company received nearly $700 million in taxpayer funds in its 2022-2023 fiscal year, killing 392,715 babies in abortions, according to its annual report.

Meanwhile, Representative Mary Miller (R-Ill.) is waging a fierce campaign among her Republican colleagues to make defunding Planned Parenthood a non-negotiable piece of the final proposal.

Miller sent a passionate letter to Rep. Brett Guthrie (R-Ky.), chairman of the House Committee on Energy and Commerce, obtained by Breitbart News. In it, she urged Guthrie to “use every legislative option available to cease all federal funds going to Planned Parenthood,” exposing the organization’s deep entanglement in abortion and transgender treatments. “Abortions and transgender treatments have exploded in clinics across the country,” she wrote.

Citing the Charlotte Lozier Institute, Miller highlighted that “abortions made up 97.1% of Planned Parenthood’s pregnancy services from 2021-2022, performing nearly 400,000 abortions.” She also underscored the crisis in her home state, noting, “In 2023, my home state of Illinois performed 72,143 abortions, the most in our history since the state started reporting abortion totals in 1973.” Miller laid bare Planned Parenthood’s financial empire, stating, “Due to a lack of decisive Congressional action, Planned Parenthood has become a federally funded health network with private assets valued at $2.5 billion. Recent numbers show that Planned Parenthood received nearly $700 million in taxpayer revenue from 2022-2023.”

Her letter concluded with a call to action: “It is essential that we protect taxpayer dollars and stop funding this organization. President Trump has already issued an Executive Order that implements such a plan. Therefore, I urge you to do everything possible to ensure Planned Parenthood never receives another penny of taxpayer dollars.”

Speaking to Breitbart, Miller doubled down, declaring, “Planned Parenthood is a multi-billion-dollar abortion business that continues to receive millions in federal funding.” She praised Trump’s leadership, stating, “President Trump had it right when he issued an Executive Order to cut off taxpayer dollars from abortion providers like Planned Parenthood,” and insisted, “it’s time for Congress to make that policy permanent. I urge the Energy and Commerce Committee to ensure that not another dime of American tax dollars goes to this murder-for-profit organization.”

The post Steve Scalise: House Will Pass Bill to Defund Planned Parenthood Next Week appeared first on LifeNews.com.

-

Site: Real Jew News

Episode 80: White Culture And The Church

May 16 2025___________________________________

More Vids!

+BN Vids Archive! HERE!

___________________________________

Support The Brother Nathanael Foundation!

Br Nathanael Fnd Is Tax Exempt/EIN 27-2983459

Or Send Your Contribution To:

The Brother Nathanael Foundation, POB 547, Priest River, ID 83856

E-mail: brothernathanaelfoundation([at])yahoo[dot]com

Scroll Down For Comments

-

Site: non veni pacem

Have you noticed the “Republicans” can’t seem to cut a single dollar from the budget? The whole DOGE thing was smoke and mirrors. The current budget proposal would add another $10T to the debt over the next four years. Quite the Big Beautiful Bill, isn’t it? Good for Moody’s. Drop the bomb and see if it shakes any sense into them. -nvp

Moody’s downgrades United States credit rating, citing growth in government debt

Moody’s Ratings cut the United States’ sovereign credit rating down one notch to Aa1 from Aaa, the highest possible, citing the growing burden of financing the federal government’s budget deficit and the rising cost of rolling over existing debt amid high interest rates.

“This one-notch downgrade on our 21-notch rating scale reflects the increase over more than a decade in government debt and interest payment ratios to levels that are significantly higher than similarly rated sovereigns,” the rating agency said in a statement.

The decision to lower the United States credit profile would be expected, at the margin, to lift the yield that investors demand in order to buy U.S. Treasury debt to reflect more risk, and could dampen sentiment toward owning U.S. assets, including stocks. That said, all the major credit rating agencies continue to give the United States their second-highest available rating.

The yield on the benchmark 10-year Treasury note climbed 3 basis points in after-hours trading, trading at 4.48%. The iShares 20+ Year Treasury Bond ETF — a proxy for longer term debt prices — fell about 1% in after hours trading, while the SPDR S&P 500 ETF Trust that tracks the benchmark index for U.S. stocks dropped 0.4%.

Moody’s had been a holdout in keeping U.S. sovereign debt at the highest credit rating possible, and brings the 116-year-old agency into line with its rivals. Standard & Poor’s downgraded the U.S. to AA+ from AAA in August 2011, and Fitch Ratings also cut the U.S. rating to AA+ from AAA, in August 2023.

“Successive U.S. administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs,” Moody’s analysts said in a statement. “We do not believe that material multi-year reductions in mandatory spending and deficits will result from current fiscal proposals under consideration.”

-

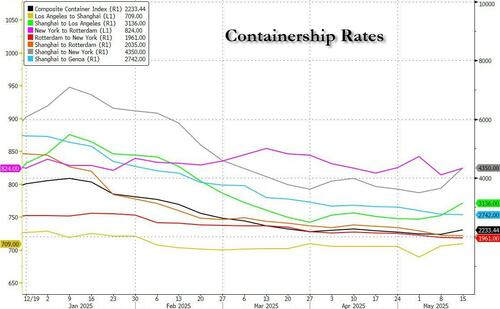

Site: Zero HedgeHapag-Lloyd Sees 50% Surge In Container Bookings From China To The USTyler Durden Fri, 05/16/2025 - 18:15

Bt Stuart Chirls of Freightwaves

Hapag-Lloyd saw container bookings from China to the United States jump by 50% following the break in the tariff battle between the trading partners.