The Eucharist is "the source and summit of the Christian life."

Distinction Matter - Subscribed Feeds

-

Site: Zero HedgeTrump To Scrutinize Pardons Biden Issued Before Leaving OfficeTyler Durden Wed, 05/14/2025 - 08:40

Authored by Zachary Stieber via The Epoch Times,

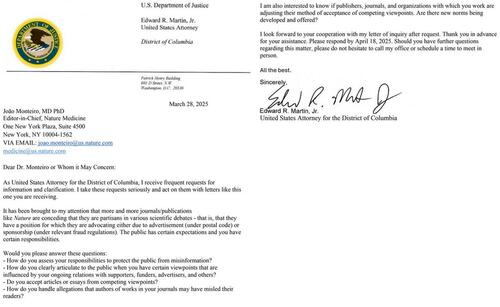

President Donald Trump’s newly tabbed pardon attorney said on May 13 that his work will include scrutinizing pardons that former President Joe Biden issued just before leaving office in January.

“I do think that the Biden pardons need some scrutiny. And they need scrutiny because we want pardons to matter and to be accepted and to be something that’s used correctly,” Ed Martin, the pardon attorney, told reporters during a press briefing in Washington.

“So I do think we’re going to take a hard look at how they went and what they did and if they’re, I don’t know, but null and void, I’m not sure how that operates,” he added.

Biden’s pardons, issued in his final hours in office, went to multiple individuals, including former Rep. Liz Cheney (R-Wyo.).

The pardons were for conduct for which the individuals had not been charged.

Biden said at the time that the people “do not deserve to be the targets of unjustified and politically motivated prosecutions.”

Trump said in March that the pardons were “hereby declared void” because, he alleged, they were done with an autopen, or a device that lets people sign documents with preloaded signatures.

Martin said on Tuesday that the pardons were not particularly reasonable but that he did not necessarily think the use of an autopen would nullify them.

Martin is stepping down as the interim U.S. attorney for the District of Columbia on Wednesday. Trump on May 8 named Martin pardon attorney and director of the Department of Justice’s weaponization working group after some senators publicly opposed Martin’s nomination to take the U.S. attorney post permanently.

Asked later on Tuesday about the resignation of Denise Cheung, who had been chief of the U.S. Attorney’s Office for the District of Columbia’s Criminal Division, Martin said that he had asked Cheung to look into what he described as unprecedented conduct, or $6.7 billion transferred from the government to a nonprofit that was created just six months prior.

That kind of conduct “does make you pause,” Martin said. “That’s what you’re supposed to do, is pause, just like if the Biden pardons are unprecedented in their extent. Right back to when Hunter Biden was whatever age you say, ’that’s uncommon, we ought to take a look at that.'”

Biden also pardoned his son, Hunter Biden, 55.

Martin also said that the weaponization working group has been looking at various actions taken during the Biden administration, including the prosecution of people who participated in the Jan. 6, 2021, breach of the U.S. Capitol. He said that under him, the group will be giving more updates on its work and is exploring the launch of a portal that will enable people to provide them tips.

-

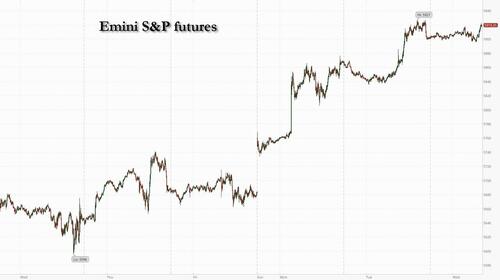

Site: Zero HedgeFutures Rise After Erasing 2025 Loss As Meltup Just Won't StopTyler Durden Wed, 05/14/2025 - 08:27

US equity futures are modestly in the green with tech/AI stocks leading and small caps lagging as equities may see some profit-taking given the relentless strength of the rally. Stocks has now erased their YTD losses, and the recovery pace of the past 6 weeks is the fastest since the 1980s. As of 8:00am ET, S&P futures are up 0.2%, near session highs after reversing earlier losses; Nasdaq futures gain 0.4% with chips higher on new deals being made by Trump in the Middle East regarding chips/AI infra build. Pre-mkt, NVDA/TSLA are higher with the rest of Mag7 mixed but Semis are higher though other Cyclicals are slightly weaker. AI theme is higher, too. The yield curve is twisting steeper as USD strength fizzles sparked by concerns Trump may turn to dollar strength next (following overnight Bloomberg report there was discussion between US and SKorea on dollar strength). Commodities are lower as Energy sells off, and gold is flat around $3220. The macro data focus is on mortgage applications (up 1.1%) and XHB is +5% over the last two days.

In premarket trading, magnificent seven stocks are mixed: Nvidia leads gainers as the semiconductor giant is on track to extend gains after a deal to supply chips to Saudi Arabian AI company Humain for a massive data center project (Nvidia +3%, Tesla +2%, Alphabet +0.6%, Meta +0.7%, Amazon +0.2%, Apple -0.3%, Microsoft -0.3%). Super Micro Computer (SMCI) rises 14%, set to extend Tuesday’s 16% rally, after Saudi Arabia-based data center company DataVolt signs a multi-year partnership agreement with the beleaguered US company. Here are some other notable premarket movers:

- American Eagle (AEO) slumps 12% after the retailer withdrew its fiscal year 2025 guidance due to macroeconomic uncertainty.

- Aurora Innovation (AUR) plunges 18% after Uber, a leading backer, said it plans to sell $1 billion of senior notes exchangeable into shares of the self-driving technology developer.

- Cboe Global Markets Inc. (CBOE) slips 1.5% after Morgan Stanley double downgraded the stock, recommending lower defensives exposure on the back of greater than expected tariff de-escalation between China and the US.

- Dynatrace (DT) rises 3% after the analytics platform company forecast 1Q revenue that beat the average analyst estimate.

- Exelixis (EXEL) climbs 4% after the maker of cancer drug Cabometyx raised its projection for revenue this year.

- Grail Inc. (GRAL) tumbles 13% after the cancer-detection firm posted 1Q revenue that fell short of expectations.

- KKR (KKR) rises 1.8% after Morgan Stanley upgraded the private equity firm to overweight, recommending it as a way to play the anticipated capital markets recovery.

- Nu Holdings Ltd. (NU) slips 2% after the company posted 1Q results that showed higher spending to attract new clients and protect against potential bad loans.

- Septerna (SEPN) soars 62% after the biotech said it’s partnering with Novo Nordisk A/S on the development of oral pills for obesity and type-2 diabetes.

After the recent faceripping rally left the S&P 500 flat for the year, Wall Street strategists - who were skeptical stocks would rebound at all - are now skeptical about how much further stocks can run. Goldman Sachs strategist Peter Oppenheimer warned that equities remain vulnerable if deteriorating economic data reignites recession worries.

“Investors got very bearish in April, missed the market rebound and then were forced to chase it,” said Lilian Chovin, head of asset allocation at Coutts & Co. With focus shifting to the impact of tariffs, he’s using the rebound to take some profit and reduce his equities overweight.

After its recent rally, the dollar weakened 0.4% after Bloomberg reported that the US and South Korea discussed their currency policies in early May, fueling speculation President Donald Trump’s administration is open to a weaker greenback. The won jumped more than 1% and neighboring currencies, including the Japanese yen, also rose against the dollar.

Investors took news of the talks between South Korea and the US as reason to suspect foreign governments may accept strength in their exchange rates to smooth the way to trade deals with the US. Trump and other administration officials have argued weakness in Asian currencies versus the dollar have handed an unfair advantage for regional exporters over US rivals.

In Europe, the Stoxx 600 dipped 0.2% as stocks paused for breath after the rally spurred by trade optimism. Insurance, utility and telecoms stocks outperform, while autos and consumer products lag. Among individual stocks, Burberry surges after the luxury group’s fourth-quarter retail sales beat estimates and the company announced plans to cut almost a fifth of its workforce. Shares in tour operator TUI slide after summer bookings showed a negative inflection. Here are some of the more notable movers:

- Burberry shares rise as much as 9.9% after the British luxury group’s 4Q retail sales beat estimates, sparking hopes among analysts that the company is seeing the early signs of a turnaround.

- EON shares advance as much as 1.6% after the German utility reported strong first-quarter figures, with analysts saying consensus estimates are likely to rise after the report.

- ABN Amro shares outperform as the lender reports a 1Q profit that was bigger than expected, while strong capital fueled share buyback optimism. Lending revenue was disappointing, RBC analysts said.

- Imperial Brands shares drop as much as 8.3%. The tobacco firm’s earnings missed expectations amid declines in volumes and its CEO’s decision to retire caught investors off-guard.

- FLSmidth shares gain as much as 13% to a two-month high after posting a “whopping” 24% beat on first-quarter adjusted Ebitda, according to Jefferies.

- Compass shares fall as much 4.8% as organic growth at the catering firm is slightly below some estimates, with some concern over North America revenue. Panmure Liberum questions the current valuation.

- TUI shares slide as much as 11%, most in three months, after the tour and travel operator signaled a negative bookings inflection for the key summer season.

- Experian shares fall as much as 1.8% after the UK credit and marketing firm reported in-line earnings and offered organic revenue guidance slightly below expectations.

- Alcon shares slide as much as 9.5%, the most since March 2020, after first-quarter results from the Swiss eyecare firm missed estimates across the board.

- Alstom shares slump as much as 17% after the French transport system company’s earnings. Morgan Stanley says the quarterly print is ahead “but the softer guidance will likely be the focus.”

- InPost shares drop as much as 8.3% after the parcel locker operator guided for softer volumes in Poland in 2Q.

- Spirax shares fall as much as 5.6% after a first-quarter update from the UK engineering services firm that Morgan Stanley says contained both positives and negatives.

Earlier in the session, Asian stocks rose, on track for a fourth-straight session of gains, as Chinese tech firms climbed ahead of earnings announcements. The MSCI Asia Pacific Index advanced as much as 1.1%, with Tencent and Alibaba among the biggest boosts. Chipmakers TSMC and SK Hynix also drove gains, following US peers higher after news that Nvidia and Advanced Micro Devices will supply semiconductors for a large Saudi Arabian data-center project. Hong Kong, South Korea, Taiwan and Indonesia led gains in the region. Japanese stocks bucked the trend, with the benchmark Topix snapping a 13-day win streak, as worries about the nation’s continued lack of a tariff deal with the US and weak earnings from the auto sector drove profit-taking. Traders are looking to China’s tech earnings as another possible catalyst for stocks after this week’s US-China tariff cuts. The results could provide clues on whether the sector’s artificial intelligence-driven rally is back on track, which may offset lingering doubts over the potential for final deals between US and its trading partners.

In FX, the Bloomberg Dollar Spot Index is down 0.5% as the greenback falls across the board after Bloomberg reported the US and South Korea discussed their currency policies in early May and agreed to continue talks, according to a person familiar with the matter. The South Korean won rises 1.7%. The Japanese yen is the best performing G-10 currency with a 1.1% gain.

In rates, the 10-year Treasury yields are higher by 1basis point at 4.48%, reversing an earlier drop. US 2- to 10-year yields are 1bp-2bp cheaper on the day led by the 5-year, with long-end little changed, steepening 5s30s by about 1bp. UK gilts lag Treasuries slightly after an auction of 10-year debt.

In commodities, WTI drops 1% to $63 a barrel. Spot gold falls $20 to around $3,230/oz. Bitcoin falls over 1% toward $103,000.

The US economic data slate is blank; scheduled Fed speakers include Jefferson (9:10am) and Daly (5:40pm)

Market Snapshot

- S&P 500 mini +0.2%

- Nasdaq 100 0.4%

- Russell 2000 mini -0.1%

- Stoxx Europe 600 -0.4%

- DAX -0.6%

- CAC 40 -0.7%

- 10-year Treasury yield little changed at 4.46%

- VIX +0.1 points at 18.34

- Bloomberg Dollar Index -0.5% at 1224.7

- euro +0.7% at $1.1259

- WTI crude -0.8% at $63.18/barrel

Top Overnight News

- House Republicans may reach a SALT deduction compromise today, House Speaker Mike Johnson said. A proposal is being debated to increasing the cap to $30,000 from $10,000. BBG

- Trump’s tariff policies are projected to cut California’s tax revenue by $16 billion in the next fiscal year, Governor Gavin Newsom’s finance department said. BBG

- Qatar Airways is set to announce that it secured an agreement to purchase 150 aircraft from Boeing while President Trump is in Doha on Wednesday, a source familiar with the matter confirmed to NewsNation. The Hill

- China criticizes the US-UK trade deal, warning that Washington shouldn’t pursue agreements that isolate Beijing. FT

- Companies expected to rush inventory to the US from China ahead of the holidays to capitalize on the 90-day détente between the two countries. FT

- Japan’s PPI slowed more than expected to 0.2% in April. BBG

- Trade talks between India and the US are progressing smoothly, with the first tranche of a deal expected by fall, according to people familiar with the discussions. However, it’s unclear if India can secure an interim deal by early July, when Trump’s reciprocal tariffs are expected to kick in. BBG

- Joachim Nagel said markets were close to a meltdown after last month’s US trade announcements. The ECB’s Governing Council member said he couldn’t see how raising barriers to free trade would produce positive outcomes for the US. BBG

- The BOE’s Catherine Mann told CNBC she flipped her vote from a bumper interest-rate cut to a pause because sharp moves on markets had lowered borrowing costs and provided enough easing of financial conditions. BBG

- Fed's Goolsbee (2025 Voter) says some part of April inflation represents the lagged nature of data and the Fed is still holding its breath. It will take time for current inflation trends to show up in data. Right now is a time for the Fed to wait for more information and try get past the noise in the data. Cannot jump to conclusions about long-term trends given all the short term volatility.

Tariffs/Trade

- White House economic adviser Hassett said the administration has more than 20-25 deals on the table with deals close to being finalised and when President Trump returns, he will announce the next deal, according to a Fox interview.

- US-China trade ceasefire is to drive early Black Friday and Christmas stockpiling with ports and shipping companies expecting a surge in demand as retailers take advantage of lower tariffs on Chinese imports, according to the FT.

- China criticised a trade deal between the UK and US that could be used to squeeze Chinese products out of British supply chains, according to the FT.

- Mexico's Economy Minister said they hope to start the USMCA review as soon as possible to give consumers and investors clarity.

Top Overnight News

- White House economic adviser Hassett said the administration has more than 20-25 deals on the table with deals close to being finalised and when President Trump returns, he will announce the next deal, according to a Fox interview.

- US-China trade ceasefire is to drive early Black Friday and Christmas stockpiling with ports and shipping companies expecting a surge in demand as retailers take advantage of lower tariffs on Chinese imports, according to the FT.

- China criticised a trade deal between the UK and US that could be used to squeeze Chinese products out of British supply chains, according to the FT.

- Mexico's Economy Minister said they hope to start the USMCA review as soon as possible to give consumers and investors clarity.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded somewhat mixed but with the region predominantly in the green following the momentum from the constructive performance on Wall St, where most major indices closed higher in the aftermath of the softer-than-expected US CPI data, although demand was contained overnight amid a lack of fresh major catalysts and as participants digested earnings releases. ASX 200 lacked firm direction as strength in energy and tech was counterbalanced by weakness in utilities and consumer stocks, while financials were rangebound despite Australia's largest bank CBA reporting an increase in profits. Nikkei 225 wiped out opening gains and briefly reverted to a sub-38,000 level with the list of worst performers in the index dominated by companies that had just reported earnings results. Hang Seng and Shanghai Comp gained amid strength in Chinese healthcare stocks and tech names leading the upside in Hong Kong ahead of Tencent and Alibaba earnings results scheduled for today and tomorrow, respectively, while the upside in the mainland was limited amid a lack of major fresh catalysts.

Top Asian News

- South Korea is preparing support measures for small and medium-sized firms expected to be hit by tariffs, according to Reuters citing the government.

- CATL (300750 CH/3750 HK) is reportedly to set a price of HKD 263/shr for its upcoming Hong Kong listing, via Reuters citing sources; to increase the HK listing size by 17.7mln shares.

- Foxconn (2317 TW) Q1 (TWD): net 42.12bln (exp. 37.9bln); operating 46.5bln (exp. 46.3bln), revenue 1.64tln (exp. 1.65tln); expects 2025 revenue to see significant growth Y/Y (prev. exp. to grow "strongly").

- Tencent (700 HK) Q1 (CNH) Revenue 180.02bln (exp. 175.6bln), Op. Profit 57.57bln (exp. 59.2bln), Adj. Net Income 61.33bln (exp. 59.68bln).

European bourses (STOXX 600 -0.2%) opened modestly mixed and on either side of the unchanged mark; since, the risk tone has deteriorated to display a mostly negative picture in Europe. European sectors opened mixed and with no clear theme or bias, and with the breadth of the market fairly narrow. Real Estate takes the top spot, joined closely by Telecoms and then Utilities to complete the top three. Autos sit towards the foot of the pile, driven by post-earning weakness in Daimler Truck (-1.1%). US equity futures are flat/modestly lower, attempting to hold onto the gains seen yesterday, strength which was in-part spurred by the plethora of deals announced/reported on during the Saudi event. Barclays raises its 2025 year-end price target for STOXX 600 to 540 (prev. 490, currently 545.09). Barclays European Equity Strategy downgrades Consumer Staples to Underweight; upgrades Consumer Discretionary to Market Weight (prev. Underweight). Goldman Sachs lifts its Stoxx 600 target for the next 12-months to 570 (prev. 520).

Top European News

- BoE's Mann says the UK labour market has been more resilient than expected. Worried that household inflation expectations have increased. Need to see a loss of pricing power by firms, however, goods price inflation is increasing. Trade aversion will result in lower global good prices. Firms will look for the opportunity to rebuild their margins. "Dollar is still king".

- BoE's Breeden: "A macro-prudential approach to the supervision of CCPs is essential given their central role in the financial system".

- ECB's Nagel says there is a good probability the inflation target will be maintained; current uncertainty will be the new "normal", central banks have to get used to manage it Very supportive of the new (German) fiscal debt brake, however, it is clear that Germany will need to return to fiscal rules in the future. USD is very important, but the EUR's role will become stronger as a reserve currency in the next few years.

- Hapag Lloyd (HLAG GY) CEO says they have seen an increase in orders for China-US shipments by more than 50% W/W; demand is considerably higher compared with the time before US tariffs.

FX

- DXY began the European session on a modestly weaker footing, continuing to pare back some of the US-China induced upside. As the session progressed, some hefty Dollar pressure was seen, as the risk tone deteriorated and with some traders pointing towards a technical driven move. Some focus may also be on Deputy Finance Minister Choi's meeting with Kaproth of the US Treasury on May 5th to discuss FX. DXY currently towards the lower end of a 100.28-101.02 range. Data docket ahead is thin, focus will be on commentary from Fed Vice Chair Jefferson and Fed's Daly (2027 voter) - do note that in prepared remarks from Waller, he did not comment on monetary policy.

- EUR is on a firmer footing, largely benefiting from the broader Dollar weakness, rather than any EZ-specific updates, which have been lacking in today’s session. To recap, Spanish and German Final inflation figures were unrevised. Elsewhere, ECB's Nagel said "there is a good probability the inflation target will be maintained; current uncertainty will be the new "normal", central banks have to get used to manage it" - remarks which had little impact on the pair. The Single Currency has made a fresh WTD high at 1.1264.

- JPY is the best-performing G10 currency thus far; early morning strength was thanks to the broadly softer US yield environment, and with some modest deterioration in the risk tone (leading to broader Dollar weakness) USD/JPY managed to dip back below the 147.00 mark to a fresh low at 145.76, taking out the 50 DMA at 146.18.

- GBP is modestly firmer vs the broadly weaker Dollar, but is a little weaker vs EUR. Today has seen a few appearances from BoE members; starting with arch-hawk Mann, she noted that “UK labour market has been more resilient than expected. Worried that household inflation expectations have increased”. Elsewhere, Breeden released a text publication, but that focused more on supervision matters rather than on monetary policy. There was little price action sparked by both members.

- Antipodeans are modestly firmer vs the weaker Dollar; AUD/USD currently trading at the upper-end of a 0.6464-0.65 range; NZD/USD in a 0.5931-0.5968 parameter.

- PBoC set USD/CNY mid-point at 7.1956 vs exp. 7.1813 (Prev. 7.1991)

Fixed Income

- A similar setup to Tuesday morning as USTs find themselves marginally in the green while peers across the pond are a touch in the red. USTs find themselves at the upper-end of a very thin 110-01 to 110-09 band. Fed's Waller did not comment on monetary policy in prepared remarks; next up, Jefferson and Daly.

- Bunds are in-fitting with action at this time on Tuesday, a touch softer in narrow parameters with specifics for the bloc fairly light. No move to a handful of final data points from Germany and Spain. Elsewhere, ECB's Nagel said "there is a good probability the inflation target will be maintained; current uncertainty will be the new "normal", central banks have to get used to manage it" - remarks which had little impact on the pair. Some modest upside was seen as the risk tone was hit a little in European trade and currently trades in a 129.29-59 band. Some modest upside was seen following a well received Bund auction.

- Again, echoes of the dynamic on Tuesday as Gilts find themselves the modest fixed underperformer. Specifics for the UK are a touch light, remarks from BoE’s Breeden this morning largely stayed clear of monetary policy. Before Breeden, “activist” Mann was on the wires and expressed concern that the labour market has been more resilient than forecast and that household inflation expectations have increased; overall, her commentary was hawkish and may be factoring into the bearish bias for Gilts, but nothing overly surprising from the dissenter.

- UK to sell GBP 4.25bln 4.50% 2035 Gilt: b/c 3.13x (prev. 2.85x), average yield 4.673% (prev. 4.638%) & tail 0.3bps (prev. 0.4bps).

- Germany sells EUR 1.313bln vs exp. EUR 1.5bln 1.25% 2048 Bund and EUR 0.818 vs exp. EUR 1bln 2.50% 2054 Bund.

Commodities

- The crude complex is failing to benefit from the weaker dollar, as it gives back a little of Tuesday’s strength with today’s focus on US President Trump in Riyadh, where commentary has weighed on benchmarks, currently down by around USD 0.40/bbl on the day. Crude edged lower this morning amid constructive language regarding the Middle East from the US President, who announced the lifting of sanctions on Syria, expressed interest in normalizing relations, and emphasized a vision for a peaceful and prosperous region. WTI and Brent are just above session lows, in respective USD 62.86-63.68 and 65.82-66.59/bbl ranges.

- OPEC MOMR will be released at 13:00 BST (08:00 EDT).

- Spot Gold, like Crude, is failing to benefit from the weaker dollar, which sees the Dollar index lower by 0.4%. While pressured, the benchmark is in a thin c. USD 30/oz band and one that is essentially a repeat of the confines from Tuesday.

- Copper is modestly firmer, and trading at session highs as base metals are broadly benefitting from Dollar weakness. 3M LME Copper currently in a USD 9,562.6-9,638.45/t range.

- US Private Inventory Data (bbls): Crude +4.3mln (exp. -1.1mln), Distillate -3.7mln (exp. 0.1mln), Gasoline -1.4mln (exp. -0.6mln), Cushing -0.9mln.

Geopolitics: Middle East

- Iranian Foreign Ministry spokesman said they have made it clear that no agreement will be reached with the US without concrete guarantees, according to Iran International. It was also reported that Iran is to hold talks with European parties on Friday in Istanbul, according to European and Iranian sources cited by Reuters.

- Israel's military said it identified the launch of a missile towards Israeli territory from Yemen which was intercepted.

- Jordanian army said a rocket of unknown origin landed in a desert area in the Ma'an, according to a source via X.

- US President Trump is meeting Syrian President al-Sharaa, via AP.

- US President Trump says the US wants to do a deal with Iran. Reiterates that Iran cannot have a nuclear weapon. Lifting sanctions on Syria. Exploring normalising relations with them. Wants a peaceful and prosperous Middle East. Special relationship with Saudi Arabia.

- Syria's President told US President Trump that they are inviting US firms to invest in Syria's oil and gas sector.

Geopolitics: Other

- Senior Russian Lawmaker says the makeup of the Russian delegation to Istanbul for the Ukraine talks will be known on Wednesday evening, via Telegram

- China's Defence Minister met with the UN Secretary General on Tuesday and said that China will put forward new peacekeeping commitments, while China will support the reform and transformation of UN peacekeeping. Furthermore, the Minister said China is always a staunch supporter and constructive force for UN peacekeeping operations, according to Xinhua.

US Event Calendar

- 7:00 am: May 9 MBA Mortgage Applications, prior 11%

Central Banks (All Times ET):

- 5:00 am: Fed’s Goolsbee Appears on NPR

- 5:15 am: Fed’s Waller Speaks on Central Bank Research

- 9:10 am: Fed’s Jefferson Speaks on Economic Outlook

- 5:40 pm: Fed’s Daly Speaks in Fireside Chat

DB's Jim Reid concludes the overnight wrap

It's been another 24 hours where the Trump administration continues to hog the headlines. With the President in the Middle East, various stories on AI supported a huge tech-led rally, which helped the S&P 500 (+0.72%) move back into positive territory for the year. That got a further boost thanks to a softer-than-expected CPI print (the third in a row), and it now means the index is now up +18.1% since the low on April 8. Indeed, the last time the index surged that fast in just over a month was back in April 2020, when markets were roaring back from the initial Covid slump. In the meantime, several other post-Liberation Day moves unwound further, with the VIX closing at 18.22pts, whilst US HY spreads (-6bps) fell to 299bps.

The Nasdaq (+1.61%) and the Mag-7 (+2.24%) led the gains yesterday, elevated by Nvidia’s +5.63% rise on the news they’d help build Saudi Arabia’s AI infrastructure, as part of an Economic Partnership that President Trump struck with Saudi Crown Prince Mohammed bin Salman yesterday. The White House framed the deal as a $600bn investment commitment from Saudi Arabia, while Trump and MBS touted a pledge of $1trn in commercial deals. The deal includes a $142bn defense agreement between the US and Saudi as well as tech firms like Google, Oracle and AMD pledging to invest $80bn in tech across both countries. So it was another win for tech stocks which helped push the S&P 500 +0.72% higher.

Trump’s visit is the first of a four-day trip to the Middle East, as the President seeks to form a series of financial deals with Qatar and the UAE. He's clearly in a mood to do deals so watch out for more on his trip. In fact, Bloomberg reported yesterday that the administration is weighing a deal that would allow the UAE to import 500k of Nvidia’s advanced chips annually, far exceeding limits for AI chip exports set under Biden. Meanwhile on trade, NEC Director Kevin Hassett suggested that Trump will announce the next trade deal upon his return to the US, and there were more than 20-25 deals on the table.

The ongoing rally was also helped by the US April CPI report, which came out weaker than predicted, with monthly headline and core CPI each up +0.2% (vs. +0.3% expected for both). From a market point of view, the main relief was also that tariffs weren’t showing up in a major way in consumer prices, even though April included the 10% universal baseline tariffs, and much higher tariffs on China. Admittedly, there were some categories likely showing tariff-related jumps, like an +8.8% monthly rise for audio equipment, but the broad impact was muted. And in turn, the year-on-year CPI rate fell to just +2.3%, which is the weakest since February 2021. Our US economists think the April data is still too early for the Liberation Day tariffs to show up in the aggregate numbers, and they don’t expect the effects to show up in consumer prices until June.

When it comes to the Fed, markets continued to dial back their expectations for cuts this year, but that was driven by the broader risk-on tone and lower recession fears, rather than the soft inflation print. So by the close, futures were only expecting 53bps of cuts by the December meeting, which was -3.2bps lower on the day, and the fewer cuts priced for this year since February. President Trump continued to call for lower rates, saying in a post that “THE FED must lower the RATE, like Europe and China have done.” Looking forward, our US economists will be watching tomorrow’s PPI data closely for categories that feed through into core PCE, the Fed’s preferred inflation gauge. They now see April core PCE tracking at +0.23% m/m, which would be consistent with the year-over-year rate remaining at 2.6%. See their full CPI reaction note here.

As investors dialled back their pricing of Fed cuts, that in turn helped to bring down front-end Treasury yields, with the 2yr yield falling -1.0bps on the day to 4.00%. By the close, the 10yr yield was also down -0.6bps to 4.47%, but the 30yr yield moved up +0.1bps to its highest closing level since January, at 4.91%. That’s still beneath the intraday peak above 5% just before the 90-day tariff extension, but still up from 4.68% at the end of April.

Back in Europe, markets posted moderate gains, with the STOXX 600 (+0.12%), DAX (+0.31%) and CAC (+0.30%) all moving higher. For the DAX it marked a new all-time high, with the index now up almost +19% YTD, so still well ahead of the S&P 500 which has only just turned positive for 2025 again. The gains came as Germany’s ZEW survey for May was stronger than expected, with the expectations component up to +25.2 (vs +11.3 expected) reaffirming a more bullish sentiment for the country’s economy. Against that backdrop, 10yr bund yields inched up +3.1bps to 2.68%, and sovereign spreads continued to tighten amidst the risk-on mood. For instance, the 10yr Italian spread over bunds tightened to just 102bps, the lowest since 2021.

Meanwhile in the UK, there were signs of an ongoing loosening in the labour market, with the unemployment rate ticking up a tenth to 4.5%, whilst wage growth in March softened to +5.5% year-on-year, the weakest since October. The news helped 2yr gilts to outperform yesterday, falling -2.0bps to 3.97%, unlike 2yr German yields which moved up +1.2bps.

In the commodity space, oil prices moved higher as Trump threatened to ramp up sanctions against Iranian oil if a nuclear deal weren’t reached, and Brent crude rose +2.57% to $66.63/bbl. The likes of gold (+0.43%) and copper (+2.25%) also advanced, in part helped a new decline in the dollar index (-0.77%), which retreated after posting its best day since Trump’s election win on Monday.Overnight, markets have generally held on to their gains, with futures on the S&P 500 up +0.08%. Similarly in Asia, most of the major equity indices have moved higher as well, with a strong gain for the Hang Seng (+1.43%) and the KOSPI (+1.18%), alongside advances for the CSI 300 (+0.27%), the Shanghai Comp (+0.19%). The one exception to that has been Japanese equities however, with the Nikkei down -0.42%, whilst the TOPIX (-0.64%) has lost ground after advancing for 13 consecutive sessions. Otherwise this morning, data showed Japan’s PPI inflation coming in at +4.0% in April as expected, whilst Australia’s Q1 wage index was a bit stronger than anticipated, up +0.9% quarter-on-quarter (vs. +0.8% expected), and yields on 10yr Australian government bonds are up +4.1bps this morning.

To the day ahead now, data releases include Canada March building permits. For Central Bank speakers, expect Fed’s Waller, Jefferson and Daly speak, ECB’s Nagel and Holzmann speak, and BOE’s Breeden speak. Earning releases include Tencent, Cisco, Sony, and Coreweave.

-

Site: southern orders

The sinner Pope Leo greeted is a great worldwide know tennis Sinner, Jannik Sinner.

In his audience with him, Pope Leo XIV wears for the first time the pectoral cross of Pope Leo XIII, through whom we should read our new pope!

-

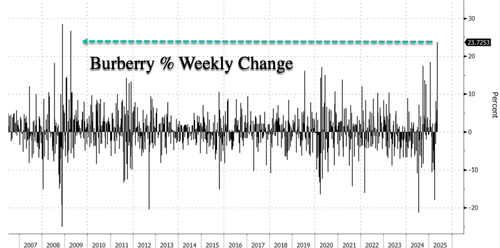

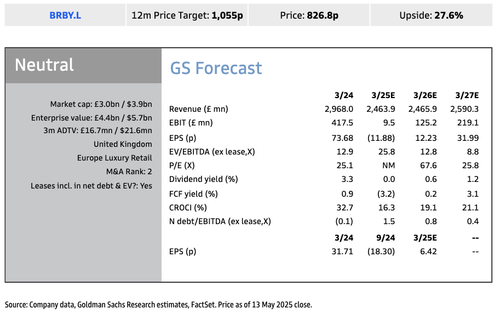

Site: Zero HedgeComing "Back To Life": Burberry On Track For Best Weekly Performance Since Early 2009Tyler Durden Wed, 05/14/2025 - 08:05

Burberry's earnings report, released Wednesday, indicates modest but encouraging progress in its strategic turnaround. One Wall Street analyst remarked that the iconic British trench-coat maker is "showing signs of life," with early traction visible in brand repositioning efforts. While demand remains soft in key markets like China and the U.S., operational improvements suggest the brand may be approaching an inflection point that deserves investors' attention.

Despite a year-over-year decline in revenue and profitability, Burberry delivered several above-consensus results, including sales that fell less than expected in the fourth quarter, while its full-year operating profit and margin beat Bloomberg Consensus estimates. Mainland China and the U.S. remain weak spots for demand.

The results suggest the worst may be behind, and with improved execution, Burberry could be at the start of a recovery phase...

Fourth-Quarter Results:

Retail comparable sales fell 6%, better than expectations of -7.78% (Bloomberg Consensus)

- Asia Pacific: -9% vs. -10.5% est.

- Mainland China: -8% vs. -9.5% est.

- EMEIA (Europe, Middle East, India, Africa): -4% vs. -5.53% est.

- Americas: -4% vs. -2.76% est. (slightly worse than expected)

Full-Year Results:

Adjusted pretax loss of £37M vs. £44.8M loss expected (better than forecast).

Retail comparable sales -12%, estimate -13.1%

Revenue matched expectations at £2.46B, but fell 17% y/y.

- Retail sales: -14% y/y; slightly ahead of consensus.

- Wholesale: -37% y/y; in line with estimates.

- Licensing: +6.5% y/y; beat expectations.

Adjusted operating profit: £26M vs. £4.65M est. (significant beat, though down 94% y/y).

Adjusted operating margin: 1% vs. 0.25% est. (down from 14.1% y/y).

Adjusted EPS: loss of 14.8p vs. loss of 10.4p est.

No dividend declared (0p, as expected).

CEO Joshua Schulman, who joined the company last July, recently unveiled 'Burberry Forward' to revive the faltering brand and boost popularity for its outerwear products and expensive trench coats.

Schulman expanded his turnaround strategy today with a plan to deliver $80 million in cost savings over the next two years, driven partly by a workforce reduction of 1,700 jobs—approximately 18% of total headcount. The move comes amid a broader global slowdown in luxury demand as the company looks to streamline operations and protect margins.

In markets, Burberry shares in London jumped 15% during the cash session. For the week, up nearly 24% - and if gains hold through Friday, this could be the company's best weekly stock performance since the first week of April 2009.

Shares are trading at 2010 lows...

Analyst commentary on the earnings report was mostly positive but cautious.

Goldman analyst Louise Singlehurst and Adrien Duverger provided clients earlier with their first take on the report:

GS View: We think performance in 2H25, and the focus on strong cost control, demonstrates the pace of execution at Burberry. Despite the tough environment, we note that inventory was -7% cFX (ahead of guidance of broadly at least flat) which we also expect reflects that Q4 trading was ahead of company expectations. The key is the additional cost savings target: we see as this as providing increased confidence for investors on the recovery in EBIT, whilst enabling Burberry to invest in the brand's re-acceleration. We note that post FY25 adjusted EBIT of £26m, Visible Alpha Consensus Data adj EBIT for FY26 is at £138m (GSE £125m). We remain Neutral.

Additional commentary from other Wall Street desks (courtesy of Bloomberg):

Deutsche Bank (buy)

- Burberry is showing further progress on its brand turnaround, says analyst Adam Cochrane; an improvement in sales will be the key factor for investors over the next 12 months

- Outerwear and scarves were better than average, while leather goods were weaker

Jefferies (underperform)

- Burberry's results suggest the brand's turnaround case is in slow-burn mode, writes analyst James Grzinic, given fourth- quarter sales momentum has not built on the third-quarter sequential improvement

- Reference to a toughening backdrop and a back-end loading to this year's delivery implies a mixed start to the new year on the sales front

Citi (buy)

- Burberry is coming "back to life," writes analyst Thomas Chauvet, with the company's robust strategic plan set to unlock value in the medium term

- Patience is needed, but the potential rewards now outweigh the risks

RBC Capital Markets (outperform)

- Burberry's results are "an encouraging first step," says analyst Piral Dadhania, with management pursuing the right strategy to reset the business

- This should, in time, support a return to positive revenue and profit growth

Bernstein (outperform)

- Burberry's earnings look like a small beat on low expectations, writes analyst Luca Solca, which the market will take as an "encouraging sign"

- However, the new Burberry is yet to appear, given the new CEO arrived just before the SS25 fashion show

. . .

-

Site: PaulCraigRoberts.org

Trump envoy reveals NATO troop deployment plans for Ukraine

Paul Craig Roberts

I have been wondering if the Trump regime’s peace negotiations are sincere. The plan revealed by Trump’s envoy Keith Kellogg indicates that the negotiations are not sincere. Putin, Lavrov and Security Council Secretary Shoigu, the former Minister of Defense, have all made it clear that NATO troops in Ukraine are unacceptable and could result in World War III. So why has Kellogg supported, or arranged, a joint statement by the foreign ministers of France, Germany, Italy, Poland, Spain, and the UK pledging “robust security guarantees for Ukraine,” consisting of “a coalition of air, land, and maritime reassurance forces that could help create confidence in any future peace and support the regeneration of Ukraine’s armed forces.” This is certainly not the de-militarization of Ukraine that the Kremlin requires, and protection by NATO forces is the same as being a member of NATO.

Putin has brought this upon Russia by his and his foreign minister’s continuous bleating for a negotiated settlement. For more than three years Putin has avoided a military victory. The explanation I offer is that he saw in the conflict what he thought was an opportunity to use it to reach a great power settlement, like the mutual security agreement with the West that he and his foreign minister tried to achieve during December 2021 and February 2022.

Putin’s failure to be prepared for conflict with the West in Ukraine and his withholding of military victory has produced a dangerous situation. Putin’s toleration of a never-ending conflict has widened the conflict into missile strikes deep into Russia and the recent closing of all Moscow airports as a result of drone attacks. This must raise the question among Russians of Putin’s effectiveness as a war leader. One result is that the West has so little regard for Putin that despite his dire warning the West is planning to station NATO forces in Ukraine. It would have been much better if Putin had gone about the business of winning the war instead of trying to use it to negotiate a settlement with the West. The result of Putin’s failure to fight to win is likely to be a much wider war.

https://www.rt.com/news/617483-nato-europe-troops-ukraine/

-

Site: Novus Motus LiturgicusGrand Teton, WY (source) - you won’t see this from Route 80Metaphors are often the best way to grapple with that which is too large or too complex for pure conceptual analysis, or where a full account risks being tedious in its details. A well-chosen metaphor cuts to the heart of the matter. When I first read Graham Greene’s novel The Power and the Glory, I found his metaphors daring and Peter Kwasniewskihttp://www.blogger.com/profile/02068005370670549612noreply@blogger.com0

-

Site: PaulCraigRoberts.org

Peter Koenig tells us that “Most everything we see is not what it appears to be”

President Trump’s tariff war is like a huge TV screen to deviate people’s attention from what happens behind the screen. For example, did you know that the much propagated dissolution of USAID – for so called reasons of corruption and hundreds of billions spent for clandestine regime change preparations around the world, – was actually not dissolved, but discretely transferred to the State Department – where it is safe under Marco Rubio supervision (see Whitney Webb’s analysis, below) .

Thinking about it, wouldn’t it be naïve to imagine that the US / Washington would voluntarily give up such an efficient apparatus like USAID that helped fund the Kiev Maidan Coup in February 2014 – the origin of the current Ukraine – Russia (US-proxy) war (a multi-multi-billion dollar money machine for the war industry on both sides of the Atlantic), and is funding thousands of so-called NGOs, infiltrating governments around the globe,, as spy and regime change prep-agents.

Why would anyone believe the US government would just discard an efficient clandestine extended arm of the CIA, as was USAID? – Now, the same CIA tool will be more camouflaged, less visible, within the maze of the US State Department which is also funding The National Endowment for Democracy (NED), known for worldwide regime-change operations, and funding of terror groups in countries where the US seeks a reason to invade and “clean up” the terrorists it created.

Such, for example, are the origins of Al Qaeda, Hamas, Hezbollah, ISIS – and many, many more – mostly created in close “cooperation” with the UK (MI6) and the Israeli Mossad – and of course the US-CIA.

One of President Trump’s closest ally, Elon Musk, found that hundreds of billions of dollars could be saved if USAID would disappear. Musk was given the newly invented Department of Government Efficiency (DOGE) to discover such aberrations. Of course he did. And he may discover many more of such wasteful agencies, discard them on the surface – on the public TV screen – just to continue them behind the screen, disguised in another dress.

Tariff wars and such “aberrations” – useless spending – is what you can see on the “television screen”, keeps your attention fixed on sensation, while behind the screen, behind the curtain – wars are planned and funded and Peace efforts drowned, because they do not serve the profit greed of the war / killing industries.

The Tariff War is really not a worldwide tariff war, but a “confrontation” sought with China, by the Trump Administration. China plays along, as China never seeks and entertains confrontations. It is not in the Chinese DNA. China’s policies and long-term visions are marked by the the thousands of years-old DAO philosophy. Among other mantras it teaches: Never confront an adversary – submit yourself and play along with it – and in the end you will win.

The non-confrontation lesson, is what we should learn in the west.

We – the world – would live in Peace, and we would all win.

peter

————

The US-China Tariff War (13 May 2025)

PressTV Interview on Tariff Negotiations in Geneva (Loose Transcript)

https://www.globalresearch.ca/the-us-china-tariff-war-peter-koenig/5886721

President Trump’s tariff war is like a huge TV screen to deviate people’s attention from what happens behind the screen. For example, did you know that the much propagated dissolution of USAID – for so called reasons of corruption and hundreds of billions spent for clandestine regime change preparations around the world, was actually not dissolved, but discretely transferred to the State Department – where it is safe under Marco Rubio supervision.

Thinking about it, wouldn’t it be naïve to imagine that the US / Washington would voluntarily give up such an efficient apparatus like USAID, which helped fund the Kiev Maidan Coup in February 2014 — the origin of the current US-proxy war against Russia in Ukraine–a multi-billion dollar money machine for the war industry on both sides of the Atlantic–and is funding thousands of so-called NGOs, infiltrating governments around the globe as spy and regime change prep-agents.

Why would anyone believe the US government would just discard an efficient clandestine extended arm of the CIA, as was USAID? – Now, the same CIA tool will be more camouflaged, less visible, within the maze of the US State Department which is also funding The National Endowment for Democracy (NED), known for worldwide regime-change operations, and funding of terror groups in countries where the US seeks a reason to invade and and finds it in the need to “clean up” the terrorists it created.

Such, for example, are the origins of Al Qaeda, Hamas, Hezbollah, ISIS – and many, many more – mostly created in close “cooperation” with the UK (MI6) and the Israeli Mossad – and of course the US-CIA.

One of President Trump’s closest allies, Elon Musk, found that hundreds of billions of dollars could be saved if USAID would disappear. Musk was given the newly invented Department of Government Efficiency (DOGE) to discover such aberrations. Of course he did. And he may discover many more of such wasteful agencies, discard them on the surface — on the public TV screen — just to continue them behind the screen, disguised in another dress.

Tariff wars and such “aberrations” is what you can see on the “television screen.” It keeps your attention fixed on sensation, while behind the screen, behind the curtain wars are planned and funded and peace efforts drown, because they do not serve the profit greed of the war killing industries.

The Tariff War is really not a worldwide tariff war, but a “confrontation” sought with China, by the Trump Administration. China plays along, as China never seeks and entertains confrontations. It is not in the Chinese DNA. China’s policies and long-term visions are marked by the thousands of years-old DAO philosophy which teaches: Never confront an adversary, submit yourself and play along with it and in the end you will win.

The non-confrontation lesson, is what we should learn in the west. The world would live in Peace, and we would all win.

————

The US-China Tariff War (13 May 2025)

PressTV Interview on Tariff Negotiations in Geneva

https://www.globalresearch.ca/the-us-china-tariff-war-peter-koenig/5886721

-

Site: PaulCraigRoberts.org

An Example of the Filth that Democrats Elect to Congress

-

Site: Zero HedgeNvidia, AMD Secure Saudi AI Data Center Deals During Trump's Gulf States TourTyler Durden Wed, 05/14/2025 - 07:45

Several U.S. tech companies announced big AI deals in the Middle East after the White House announced the kingdom's commitment to invest $600 billion in the U.S.

Among the largest deals, Nvidia will supply 18,000 of its cutting-edge Blackwell chips to Humain, an AI startup just launched by Saudi Arabia's Public Investment Fund.

Tuesday's announcement comes as part of the White House's Gulf tour, which includes President Trump and top CEOs.

"I am so delighted to be here to help celebrate the grand opening, the beginning of Humain," CEO Jensen Huang told the audience at the Saudi-U.S. Investment Forum in Riyadh on Tuesday, adding, "It is an incredible vision, indeed, that Saudi Arabia should build the AI infrastructure of your nation so that you could participate and help shape the future of this incredibly transformative technology."

A New Chapter of Global Technological Leadership — Born in Riyadh!

— Dr Khalid AlShaigi د خالد الشايقي MD MTEI MDI MHI (@K_Alshaigi) May 13, 2025

Today at the #SaudiUSForum2025, history was made.

Tareq Amin, CEO of HUMAIN and Jensen Huang, visionary CEO of NVIDIA, announced a groundbreaking partnership that is setting a new global benchmark: building AI… pic.twitter.com/Vm6ncjYCrAHuang said that AI data centers are power-hungry, and the energy-rich country can use Nvidia's technology to unlock new capabilities.

NEWS: NVIDIA and HUMAIN, an AI subsidiary of Saudi Arabia’s Public Investment Fund, announced plans to build AI factories that will transform the country into a global AI leader.

— NVIDIA Newsroom (@nvidianewsroom) May 13, 2025

NVIDIA founder and CEO Jensen Huang participated in a state visit today to share how this effort… pic.twitter.com/4Au6NxvTQ6Humain plans to develop Arabic versions of large language models. CEO Tareq Amin said the startup would build 1.9 gigawatts of data centers by the decade's end. He anticipates Nvidia's technology will power AI factories across the Middle East.

Here are the AI deals that were announced:

-

Nvidia will supply hundreds of thousands of AI chips to Saudi Arabia, starting with 18,000 Blackwell GPUs for Humain, a newly launched AI firm backed by Saudi Arabia's sovereign wealth fund.

-

AMD announced a $10 billion collaboration with Humain to deploy 500 megawatts of AI infrastructure, including CPUs, GPUs, and orchestration software.

-

Qualcomm signed an MoU with Humain to develop server CPUs for future data centers.

-

Saudi firm DataVolt will invest $20 billion in U.S. AI data centers and energy infrastructure.

-

Google, Oracle, Salesforce, AMD, Uber, and DataVolt will invest $80 billion into transformative technologies across both countries.

Trump's Gulf tour aims to ramp up trillions of investments between the U.S. and Saudi Arabia.

Outside of chips, the White House announced a $142 billion defense deal with the kingdom to provide "state-of-the-art warfighting equipment and services from over a dozen U.S. defense firms." This is nearly double Saudi Arabia's 2025 defense budget.

Tuesday's announcement highlights how Nvidia's chips have become a bargaining tool for the Trump administration.

-

-

Site: Mises InstituteDespite arguments from President Trump and his supporters, there is no such thing as an “optimal” tariff. If anything, Americans have the upper hand in trade because they can run large trade deficits due to the status of the US dollar as the world‘s reserve currency.

-

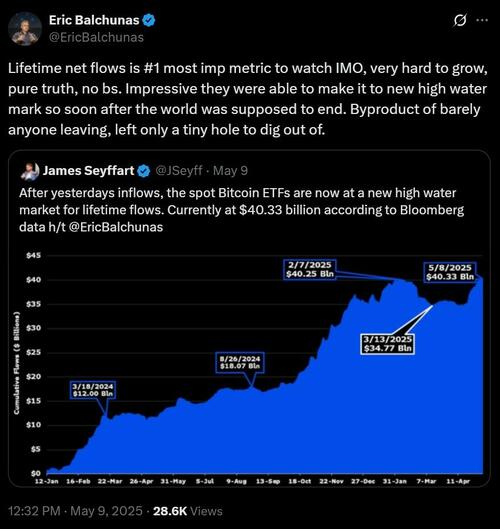

Site: Zero HedgeBlackRock Flags Quantum Computing As Risk For Bitcoin ETFsTyler Durden Wed, 05/14/2025 - 07:20

Authored by Alex O'Donnell via CoinTelgraph.com,

Emerging technologies, including quantum computing, could potentially render the cryptography securing Bitcoin and other blockchain networks ineffective, asset manager BlackRock said in a regulatory filing.

On May 9, BlackRock updated the registration statement for its iShares Bitcoin ETF (IBIT). The revised version addressed potential risks to the integrity of the Bitcoin network posed by quantum computing, the filing shows.

“[I]f quantum computing technology is able to advance […] it could potentially undermine the viability of many of the cryptographic algorithms used across the world’s information technology infrastructure, including the cryptographic algorithms used for digital assets like bitcoin,” BlackRock said.

It is the first time the asset manager has explicitly flagged this risk in its IBIT disclosures. The IBIT ETF is the largest spot Bitcoin ETF, with approximately $64 billion in net assets, according to its website.

Quantum computing is an emergent field that seeks to use the principles of quantum mechanics to greatly enhance computers’ processing capabilities.

Source: James Seyffart/Bloomberg Intelligence

Record-breaking inflows

James Seyffart, an analyst for Bloomberg Intelligence, cautioned that risk disclosures such as IBIT’s are required to highlight every possible risk to an asset, even those that are extremely unlikely.

“They are going to highlight any potential thing that can go wrong with any product they list or underlying asset that’s being invested in,” Seyffart said in a May 9 X post. “It's completely standard. And honestly [it] makes complete sense.”

Since launching in January, Bitcoin ETFs have collectively attracted more than $41 billion in net inflows, according to data from Farside Investors.

Bitcoin ETF inflows reached all-time highs on May 8. Source: Eric Balchunas/Bloomberg Intelligence

On May 8, Bitcoin ETF net inflows surpassed all-time highs of around $40 billion, according to Bloomberg Intelligence.

“Lifetime net flows is #1 most imp metric to watch IMO, very hard to grow, pure truth, no bs,” Bloomberg Intelligence analyst Eric Balchunas said in a May 9 X post.

“Impressive, they were able to make it to a new high water mark so soon after the world was supposed to end.”

In February, Tether CEO Paolo Ardoino predicted that quantum computing would eventually enable hackers to break into inactive Bitcoin wallets and recover the dormant coins.

“Any Bitcoin in lost wallets, including Satoshi (if not alive), will be hacked and put back in circulation,” Ardoino said in a Feb. 8 X post.

-

Site: non veni pacem

Pope Leo XIV? & The Papacy

Who is Robert Prevost? What is the Papacy?

Mini Course, Major Implications

ENROLL

STARTS Thursday May 15th, only $99.

Weekly Live Classes start Thursday May 15, at 5pm PDT/8pm EDT and will run approximately 70-80 minutes. Q&A will follow for 10 minutes or more for those who can stay. I will suggest readings. No tests. No pressure. Content: Ages 13 and up. Recorded video link sent afterwards so you can watch on your own time! (Projected duration 4 weeks)

-

Site: Zero HedgeHow Do US Universities Make Their Money?Tyler Durden Wed, 05/14/2025 - 06:55

The cost of funding American universities is huge - covering everything from faculty salaries and special departments to laboratories.

Not only that, government funding for public institutions has fallen substantially over the past 50 years, making universities rely more heavily on tuition and other sources of revenue. The Trump administration’s freezing of billions in grants and contracts is adding further strain to elite academic institutions.

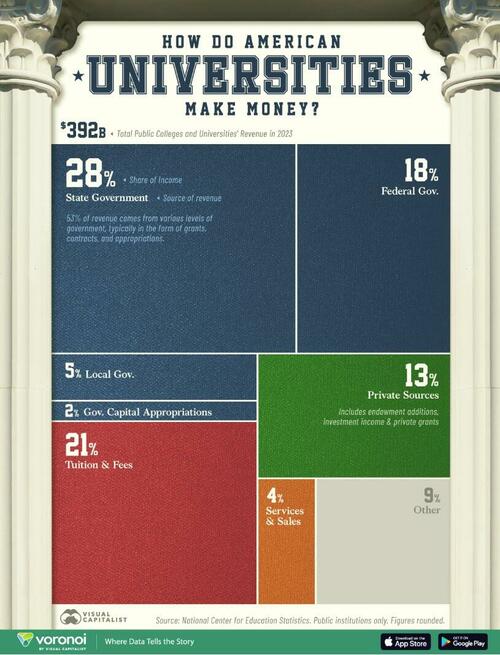

This graphic, via Visual Capitalist's shows how American public universities are funded, based on data from the National Center for Education Statistics.

The Top Sources of Revenue for American Universities

Below, we break down the $392 billion in revenues generated across 1,592 public American institutions as of 2023:

State government funding, typically in the form of research grants, contracts, and appropriations, makes up the largest share at 28%.

Overall, New Hampshire ranks last in spending on higher public education spending per student, followed by Vermont. Going further, 25 states spend less than levels seen in 2008, with Nevada, Arizona, and Louisiana spending 30% less in 2023.

In absolute terms, California and Texas spend the most on academic funding, at $22.3 billion and $11.5 billion, respectively in fiscal 2025.

Meanwhile, tuition and fees generated 21% of revenues totaling $80.8 billion. Despite tuition costs more than tripling since 1990, it has struggled to make up the funding losses from state cutbacks. At the same time, university spending has swelled for administrators, construction, and faculty salaries as demand for higher education has increased.

Looking at private sources of revenue, these brought in $51.2 billion, or 13% of the total. Private sources include endowment additions, investment income, and private grants. While universities have massive endowment funds, funding is often tied to specific purposes. For instance, certain donors will designate funds to scholarships or a specific research center over a series of years.

To learn more about this topic from a global perspective, check out this graphic on the top universities outside of America.

-

Site: Catholic ConclavePope Leo XIV, Robert Francis Prevost, walked the streets of Chiclayo and prayed in the face of the spread of COVID-19 and the increase in cases in Peru.Pope Leo XIV, Robert Francis Prevost, performed various acts of kindness during his apostolic work in Peru. One of these was blessing the streets of Chiclayo during the COVID-19 pandemic, when he served as bishop of that city. The Supreme Catholic Conclavehttp://www.blogger.com/profile/06227218883606585321noreply@blogger.com0

-

Site: Zero HedgeFlorida Troopers Now Federally Credentialed To Arrest Illegal Immigrants On Their OwnTyler Durden Wed, 05/14/2025 - 06:30

Authored by Darlene McCormick Sanchez via The Epoch Times (emphasis ours),

Florida officials announced that 1,800 state Highway Patrol troopers are the first in the nation to receive federal credentials under an Immigration and Customs Enforcement (ICE) agreement allowing them to arrest illegal immigrants on their own.

An Immigration and Customs Enforcement agent and a local police officer arrest an illegal immigrant in Florida in April 2025. ICE

An Immigration and Customs Enforcement agent and a local police officer arrest an illegal immigrant in Florida in April 2025. ICE

Florida Gov. Ron DeSantis said at a press conference on May 12 that the state’s ongoing partnership with ICE included what is known as 287(g) agreements, where state and local law enforcement partner with ICE to help arrest and deport illegal immigrants.

The Florida Highway Patrol entered into a 287(g) task force model that gives them the power to arrest foreign nationals who are in the country illegally and place detainers on them during routine policing, such as traffic stops.

In essence, it allows local law enforcement to operate as an extension of ICE under federal supervision.

DeSantis encouraged other states to support President Donald Trump’s efforts to deport illegal immigrants, noting the success of Operation Tidal Wave. The recent joint federal-state operation arrested more than 1,100 illegal immigrants.

Some of those arrested included members of gangs such as MS-13 and Tren de Aragua, both designated as terrorist organizations by the Trump administration.

Additionally, DeSantis said Florida also swore in 100 troopers as special deputy U.S. marshals, which will allow them to execute federal search warrants and remove dangerous illegal immigrants.

Dave Kerner, director of the Florida Department of Highway Safety and Motor Vehicles, said during the press conference that the Florida troopers are the first fully credentialed law enforcement to be fully operational under the 287(g) task force model.

“What that means is, if you see a state trooper, he or she has federal authorities to detain, investigate, apprehend, and deport,” Kerner said. “We have troopers in all 67 counties of this great state that have that authority.”

Kerner told The Epoch Times that troopers serving as U.S. marshals will be able to go into homes to serve warrants, which isn’t part of the 287(g) agreements.

He said that the programs offer flexibility to state and local jurisdictions, allowing them to determine their level of involvement once they sign up for the agreements.

“It is, by and large, a voluntary effort,” he said. “You can decide how much you want to participate.”

Illegal immigrants from Venezuela turn themselves in to Texas state troopers after crossing the border from Mexico into Del Rio, Texas, on May 18, 2021. John Moore/Getty Images

Illegal immigrants from Venezuela turn themselves in to Texas state troopers after crossing the border from Mexico into Del Rio, Texas, on May 18, 2021. John Moore/Getty Images

DeSantis added that there’s a plan on the table that, if approved by the federal government, would allow military judge advocates to act as immigration judges and provide makeshift detention space and transportation for illegal immigrants.

The governor noted that the state’s experience with disaster response, such as during hurricanes, helped the state come up with the plan. He said there are 70,000 to 80,000 illegal immigrants in the state, with final deportation orders issued by a judge.

Getting rid of criminal illegal immigrants helps cut down on crime and save lives, DeSantis said.

“You’re really making a difference in your community,” he said.

Some 11 million illegal immigrants were apprehended at U.S. borders over the past four years, according to Customs and Border Protection data.

Trump campaigned on border security and illegal immigrant deportations. Upon returning to the White House, he has moved to keep that promise through a whole-of-government approach that has included designating several Mexican cartels and other transnational criminal groups as terrorist organizations. As a result, some members of the MS-13 and Tren de Aragua gangs have been deported to El Salvador’s Terrorism Confinement Center, known as CECOT.

As of May 8, ICE statistics show there are 531 agreements with state and local agencies throughout the country. Another 105 applications are pending.

Although dozens of states have agreements under the 287(g) program, Florida is the first to have its law enforcement officers credentialed.

U.S. military personnel escort alleged members of the Venezuelan gang Tren de Aragua and the MS-13 gang recently deported by the U.S. government to be imprisoned in the Terrorism Confinement Center (CECOT) prison as part of an agreement with the Salvadoran government, in San Luis Talpa, El Salvador, on March 30, 2025. Office of the President's Press Secretary/Reuters

U.S. military personnel escort alleged members of the Venezuelan gang Tren de Aragua and the MS-13 gang recently deported by the U.S. government to be imprisoned in the Terrorism Confinement Center (CECOT) prison as part of an agreement with the Salvadoran government, in San Luis Talpa, El Salvador, on March 30, 2025. Office of the President's Press Secretary/Reuters

Law enforcement nationwide has been encouraged to sign up for 287(g) agreements by the Trump administration because there are not enough federal officers to find and process millions of illegal immigrants.

Besides the task force model, the federal government created the jail enforcement model and the warrant service officer model.

The jail enforcement model allows local officers to identify and process removable noncitizens already booked into local jails. The warrant service officer model allows officers to serve and execute administrative warrants on illegal immigrants already in custody.

Florida had 266 agreements that included all 67 sheriff’s offices in the state, according to the Florida Sheriffs Association. Texas had the second-highest number of agreements at 77.

-

Site: Catholic ConclavePrevost in Chiclayo, the American Bishop who spoke little but did a lotFriends and collaborators, both inside and outside the diocese, review the eight years the new Pope spent in the Peruvian city. They remember a calm, conciliatory, yet efficient and decisive man.It was common to see him on the city streets driving his van, going himself to the market to buy food for the rest of the deacons. OrCatholic Conclavehttp://www.blogger.com/profile/06227218883606585321noreply@blogger.com0

-

Site: Zero HedgeThe Income Needed To Buy A Home In Every US StateTyler Durden Wed, 05/14/2025 - 05:45

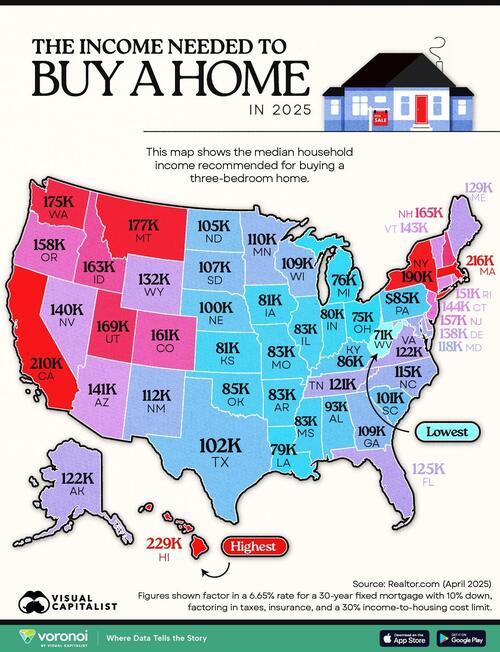

As home prices continue to climb and mortgage rates remain elevated, buying a home in the U.S. has become increasingly out of reach for the average household.

In 2025, buyers now need six-figure salaries to afford a median-priced home in all but 15 states.

This visualization, via Visual Capitalist's Bruno Venditti, using data from Realtor.com, maps the annual income required to purchase a typical three-bedroom home in every state, based on a 10% down payment, a 6.65% interest rate on a 30-year fixed mortgage, and a 30% income-to-housing cost threshold (which includes taxes and insurance).

The Growing Gap Between Income and Home Prices

A recent study found that nearly 50% of U.S. households cannot afford a home priced at $250,000. This is particularly concerning when the median price of a new single-family home nationwide has reached $495,750, according to the National Association of Home Builders.

In many states, the income needed to comfortably afford a median-priced home far exceeds what a typical family earns.

Where Buying a Home Requires the Highest Salaries

Here are the top five most expensive states for homebuyers in 2025:

Hawaii tops the list, where buying a median three-bedroom home requires an annual income of $229,000—the highest in the country. Despite its small population, Montana has climbed into the top five least affordable states, driven by a widening gap between soaring home prices and relatively modest local incomes.

In contrast, in West Virginia a buyer would need a salary of just $71,000 to afford a median-priced home—well below the state’s median household income of $90,000. Other states with lower thresholds include Mississippi, Ohio, and Indiana.

What’s the cost of a median price in every U.S. state? Find out in this map on Voronoi.

-

Site: Real Investment Advice

In 2010, following the financial crisis and market meltdown in 2008 and early 2009, Fed Chairman Ben Bernanke made a notable speech explaining the virtues of the wealth effect. To wit:

Higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion.

While not implicit, Bernanke boasted that by fortifying liquidity in the financial markets via QE and lower Fed Funds, the Fed boosted stock returns and thus greased the wheels of the “virtuous circle.”

Since then, periods of easy monetary policy have correlated well with positive stock market returns. While that relationship is noteworthy, we must also consider the other side of the coin. When the Fed is not providing ample liquidity to the financial markets and stock returns are negative, there must be an adverse wealth effect. Simply, the wheels of Bernanke’s virtuous circle get stuck in the mud.

Accordingly, given the recent market volatility and the possibility of an adverse wealth effect, it's worth quantifying the relationship between stock returns and economic activity.

Marginal Propensity To Consume (MPC)

Marginal propensity to consume (MPC) helps us approximate how gains or declines in wealth or income contribute to or reduce economic activity.

We lead with the MPC calculation for income and then use the same logic for changes in wealth.

MPC quantifies the proportion of additional income an individual will spend rather than save. While the proportion differs for everyone, economists focus on aggregate data. MPC is calculated as the change in consumption divided by the change in income. It is expressed as a ratio between 0 and 1. For example, if a person receives a $1,000 bonus and spends $750, the MPC is 0.75.

The graph below plots annual changes in aggregate consumption and income since 1959. The R-squared of .4432 shows the relationship is relatively strong. Furthermore, based on the slope of the trend line, the MPC is .6182. In other words, consumers in aggregate are likely to spend 61 cents of every dollar they earn in additional income. Income relates to salaries and bonuses, as well as government-related benefits such as lower taxes or stimulus payments.

The Wealth Effect Calculation

To compute the MPC for changes in wealth due to stock market changes, we substitute personal income for individual equity holdings. As we will show, the relationship between changes in equity wealth and spending is not nearly as robust as that between income and spending. However, it has become better in recent years.

The first graph below plots the relationship between personal consumption and equity holdings from 1959 to 1995. The R-squared is statistically inconsequential at .0072. Therefore, the MPC estimate has no value. While statistically meaningless, it's interesting that the relationship is negative, meaning stock market wealth and spending had an inverse relationship during that period. The downward-sloping trend line highlights this.

The relationship between equity holdings and consumption has strengthened more recently. The graph below plots the data from 1995. The R-squared is low at .0952, but the trend line is upward sloping. This denotes that equity holdings and consumption have a positive relationship. The formula indicates an MPC of .0483. Every dollar gain in equity wealth should boost personal consumption by almost a nickel.

The graph below highlights the growing positive relationship between the stock market and consumption. The increasing correlation should be expected as stock ownership as a percentage of the population has grown rapidly, as shown in the second graphic below.

The MPC Multiplier

Thus far, Bernanke’s stock market wealth effect appears minimal, especially compared to the wealth effect on income. While their respective MPCs are vastly different, we must also consider that personal consumption can have an amplified impact on GDP over longer periods. Thus, the MPC underestimates the total economic impact of equity wealth and income changes.

The so-called Keynesian multiplier states that additional personal consumption prompts businesses to produce more, which entails hiring more employees and investing in more output. Accordingly, wages rise, providing consumers with extra money to spend. Thus, the benefit to GDP is not just the MPC but an additional kicker due to the multiplier.

The formula for the Keynesian multiplier is 1 / (1 - MPC). To highlight its power, we compare how $1 of additional income and wealth benefits the economy.

As we shared, the MPC of income is 0.62. Therefore, the multiplier is 1 / (1 - 0.62) = 2.63, meaning a $1 increase in incomes should lead to a $2.63 increase in GDP.

Using the same math, a $1 gain in equity wealth should lead to a $1.054 increase in GDP - (1 / (1 - 0.048) = 1.054).

Remember that the correlation between equity wealth and consumption was statistically weak, so the relationship has little predictive value. Other gauges, like consumer sentiment, which benefits from higher stock prices, might produce a more compelling case for Bernanke’s wealth effect.

Cogs In The Virtuous Circle

We calculated that the MPC of stock market wealth is 0.05, a mere pittance compared to 0.62 on income. While a dollar gain in equity wealth results in slightly more than a dollar of GDP, it pales compared to increases in income.

The following bullet points reveal a few problems that explain its relative inefficiency versus income:

- Retirement Plans: Profits in our retirement account are inaccessible for most investors. Retirement plans are estimated to represent 40% or even more of the total equity holdings.

- Demographics: Retirees tend to be wealthier than younger generations, but many are less likely to consume as their budgets are constrained.

- Time Lags: Our needs and desires to consume do not always occur simultaneously with the growth of wealth.

- Wealth Distribution: As shown below, the wealthiest 20% own the vast majority of stocks. Therefore, the equity wealth effect only applies to a relatively small percentage of the population. Further, the very wealthy do not change their consumption habits based on marginal changes in wealth.

Summary

We wrote that there is almost a one-to-one relationship between the growth of wealth from equity holdings and GDP. That relationship is two-way. In other words, if the stock market falls and equity wealth diminishes, the economy should, on the margin, be negatively impacted.

There are a few things to remember before applying the wealth effect to your GDP expectations.

The post The Wealth Effect Is Not Always Virtuous appeared first on RIA.

-

Site: Real Investment Advice

Bloomberg recently published, This 30-Year Old's Startup Is Bringing Leverage To 401K Savers. Their article details Basic Capital, a new startup providing institutional investment strategies to individual 401K and IRA savers. Basic Capital allows clients on its retirement savings platforms to use up to 4x leverage. For each dollar saved, its investors can borrow $4. Basic is currently charging about 6.25% to borrow the money. Moreover, to further boost potential returns, they help participants invest in private credit investments in addition to more traditional stock and bond assets. Per Bloomberg:

But, the thinking goes, the startup can find private credit investments from the major players in the industry that yield more like 9%, meaning they will throw off enough cash to cover the borrowing costs and then some. Mix in some traditional stock-market exposure, and — assuming those private credit yields persist and that equities gain in line with historical averages — the startup said savers can expect low double-digit returns.

Combining leverage and risky investments increases complexity and risk for retirement savers. While the returns could easily outperform traditional non-leveraged retirement plans over the long run, the risks can be substantial. For instance, at 4x leverage, a 20% decline in the value of a portfolio's assets results in a 100% loss of principal. The article doesn't discuss what happens if the retirement plan loss exceeds 100%.

The graph below charts the hypothetical gains and losses for a range of assumed asset returns, assuming the portfolio utilizes 4x leverage. The calculation includes the 6.25% interest expense for leverage but not Basic Capital's management fees or the 5% it charges on gains upon withdrawal. As shown, a 15% decline in the portfolio value wipes out the investor.

What To Watch Today

Earnings

Economy

Market Trading Update

Yesterday, we discussed the ongoing rally in the S&P index, stating:

"As noted in Monday’s Trading Update, this could still be a “bear market rally,” as we saw in 2022. Such is entirely possible. But with the markets breaking above both resistance levels at the 100 and 200 DMA, there is a rising probability that the correction process is over. With the MACD pushing more elevated levels and the RSI index approaching overbought, we are at levels where we should expect a “pause” in the rally before making the next push higher. If the market can consolidate a bit, without breaking back below those previous resistance levels, we will remove hedges and reduce our cash holdings"

With that analysis still intact, and the market continuing to push higher above key moving averages, the risk of a substantial retracement is fading. While the markets are indeed overbought in the short term, the share buyback surge and the negative professional investor sentiment still support this rally. As such, the risk of a secondary decline over the next month has become substantially diminished.

As shown on the weekly chart below, the market has recovered from a test of support at the two-standard-deviation level below the 4-year moving average. If we assume that we are not involved in a more protracted process as in 2022, previous tests of two-standard-deviation declines were market bottoms before the bull market resumed. We saw similar tests in 2016, 2018, and 2020. In those cases, the weekly MACD signal declined, and the reversal marked entry points previously.

With the MACD signal having reversed below zero and turning up, investors may have to start considering the possibility that the correction is over. If that is the case, investors' challenge is finding opportunities to increase portfolio equity risk. The "bear case" for another "leg down" is compelling; however, the market action suggests a more optimistic outcome.