To live without faith, without a patrimony to defend, without a steady struggle for truth – that is not living, but existing.

Distinction Matter - Subscribed Feeds

-

Site: Fr Hunwicke's Mutual EnrichmentS Paul loved his fellow Jews, his 'kinsmen' and believed "the gifts and call of God are irrevocable". He believed that at the End, those among them who had rejected Christ would be brought in to the chosen people. He believed that they were like olive branches which had been cut off so that the Gentiles, wild olive branches, could be grafted in. But, when the fulness of the Gentiles had entered Fr John Hunwickehttp://www.blogger.com/profile/17766211573399409633noreply@blogger.com3

-

Site: Fr Hunwicke's Mutual EnrichmentLex orandi lex credendi. I have been examining the Two Covenant Dogma: the fashionable error that God's First Covenant, with the Jews, is still fully and salvifically valid, so that the call to saving faith in Christ Jesus is not made to them. The 'New' Covenant, it is claimed, is now only for Gentiles. I want to draw attention at this point to the witness of the post-Conciliar Magisterium of theFr John Hunwickehttp://www.blogger.com/profile/17766211573399409633noreply@blogger.com13

-

Site: Fr Hunwicke's Mutual EnrichmentWe have seen that the Two Covenant Theory, the idea that Jewry alone is guaranteed Salvation without any need to convert to Christ, is repugnant to Scripture, to the Fathers, even to the post-Conciliar liturgy of the Catholic Church. It is also subversive of the basic grammar of the relationship between the Old and the New Testaments. Throughout two millennia, in Scripture, in Liturgy, in her Fr John Hunwickehttp://www.blogger.com/profile/17766211573399409633noreply@blogger.com7

-

Site: Fr Hunwicke's Mutual EnrichmentThe sort of people who would violently reject the points I am making are the sort of people who would not be impressed by the the Council of Florence. So I am going to confine myself to the Magisterium from the time of Pius XII ... since it is increasingly coming to be realised that the continuum of processes which we associate with the Conciliar and post-Conciliar period was already in operationFr John Hunwickehttp://www.blogger.com/profile/17766211573399409633noreply@blogger.com0

-

Site: Fr Hunwicke's Mutual EnrichmentIn 1980, addressing a Jewish gathering in Germany, B John Paul II said (I extract this from a long sentence): " ... dialogue; that is, the meeting between the people of the Old Covenant (never revoked by God, cf Romans 11:29) and that of the New Covenant, is at the same time ..." In 2013, Pope Francis, in the course of his Apostolic Exhortation Evangelii gaudium, also referred to the Old Fr John Hunwickehttp://www.blogger.com/profile/17766211573399409633noreply@blogger.com10

-

Site: Fr Hunwicke's Mutual EnrichmentSince the Council, an idea has been spreading that Judaism is not superseded by the New Covenant of Jesus Christ; that Jews still have available to them the Covenant of the old Law, by which they can be saved. It is therefore unnecessary for them to turn to Christ; unnecessary for anybody to convert them to faith in Christ. Indeed, attempting to do so is an act of aggression not dissimilar to theFr John Hunwickehttp://www.blogger.com/profile/17766211573399409633noreply@blogger.com11

-

Site: AsiaNews.itVietnam's National Assembly voted a resolution in favour of an administrative reform that strengthens the power of the country's current leadership, which emerged victorious from the 'blazing furnace" anti-corruption campaign inside the party. The country of 101 million will be divided between 28 provinces and six centrally run cities.

-

Site: Mises InstituteWe cannot allow the establishment to write the history of 2000–2025. To that end, consider this non-exhaustive bibliography for understanding this turbulent period.

-

Site: Euthanasia Prevention Coalition

Meghan Schrader

Meghan Schrader

By Meghan Schrader

Meghan is an autistic person, an instructor at E4 - University of Texas (Austin) and an EPC-USA board member.Before getting to the main point of this post, I want to acknowledge the tragic passing of my colleague and friend Stephen Mendelsohn, who died instantly when he was struck by a car on June 1st. In my time with Stephen, I enjoyed hearing about his devout Jewish faith and his references to concepts like “tikkun olam,” or “repairing the world.” In addition to being a kind and honorable person, Stephen was the EPC-USA's primary researcher who kept us apprised of the assisted suicide movement’s activities across the country. The anti assisted suicide and disability rights movements are much poorer without him. I’m sorry, Stephen. May you rest in eternal peace.

Stephen Mendelsohn

Stephen Mendelsohn

One of the things I liked most about interacting with Stephen was that as a fellow autistic person, Stephen had a similarly blunt way of communicating his thoughts. It was a refreshing opportunity for camaraderie. In honor of Stephen, I won’t mince words when I talk about the ableist moral cowardice expressed in “A Patient-Directed Approach: How the U.S. Model of Medical Aid in Dying Balances Compassion with Safeguards” by upper middle class, able-bodied Compassion and Choice’s leaders Kevin Diaz and Bernadette Nunley. In the piece contrasting Canada’s “MAiD” program with their policy goals, they assert:

“This commentary does not dispute nor confirm the facts or interpretations of Canadian law referenced in the article. Instead, it highlights key aspects of the U.S. legal framework, exploring its effectiveness and the principles that distinguish it from the Canadian model. Any comparisons are intended for context and insight, not to assert superiority or to question the legitimacy of the Canadian approach.”Ie, “Hey, everyone, murdering disabled people is a matter that we should all agree to disagree about!”

I’m sorry, no deal. I’m all for not making prejudiced judgments about, say, people who need to use EBT benefits or who immigrated from a different country, but forcing disabled people of all backgrounds to live in an environment where the government, medical system, media and members of the general populace function as death pushers is not the same thing.

The moral relativity expressed in the aforementioned essay reflects and reinforces the same callousness demonstrated by Canadian Senator Stan Kutcher during Canada’s “Track 2 MAiD” hearings, when he snidely dismissed Canadian disability rights advocates’s attempts to save disabled people’s lives as “moral panic.”

Well, suggesting “MAiD” to someone who has called a suicide hotline, as my friend “Amy” experienced, is a crime against humanity. It’s evil to subject members of a marginalized group to horrible oppression and then take that to the lowest common denominator by offering them to “choice” to be killed.

When I was helping “Amy,” I sent Amy a box of things that had helped me when I was depressed. When I mailed the box, I had the sense that I was sending humanitarian aid to someone being persecuted by a government, because I totally was.

The ethical equivocation in Diaz and Nunley’s paper is nice for them, I’m sure, as they sip cocktails at their organization’s posh lobby events. But, that kind of ethical cowardice is not nice for the disabled community.

The expedient moral relativism expressed by C&C’s leaders about Canada's Track 2 MAiD is an extreme consequence of the world’s pattern of neutrality towards systemic ableism. It’s because of this longstanding apathy towards disability justice that people support incentivizing disabled people to die by suicide in the first place. If a society routinely persecutes and dehumanizes a marginalized group, then it becomes easier for members of that society to tolerate killing members of that group.

Compassion and Choices’ leadership apparently does not comprehend how predatory it is for a person who is functionally an Angel of Death serial killer to look into the eyes of a viciously subjugated person and suggest that they let themselves be killed. And that does not reflect well on the organization’s agenda. -

Site: Henrymakow.com

In 1990 when Netanyahu was Israel's UN ambassador, he promised Chabad leaderMenachem Schneerson that he would bring about armageddon, a prerequisitefor return of the Jewish Messiah. Trump, Putin and Netanyahu belong to Chabada Jewish supremacist cult dedicated to exterminating all those who refuse to obeyand worship them as God. This includes assimilated Jews.Freemasons are on both sides of every major war which is a pretext for depopulationand increased social control. Iran, Hamas, Hezbollah, Israel, Russia and the US are allled by Freemasons.Please send links and comments to hmakow@gmail.comDC Martin- Trump's statements make it as clear as day--Jewish Nationalist extremists own America:ELINT News @ELINTNews" - Two Israeli officials claimed to Axios that Trump and his aides were only pretending to oppose an Israeli attack in public -- and didn't express opposition in private. "We had a clear U.S. green light," one claimed.

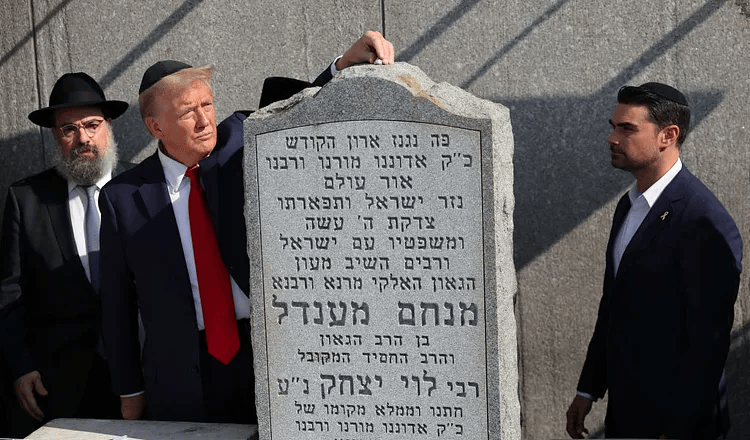

In 1990 when Netanyahu was Israel's UN ambassador, he promised Chabad leaderMenachem Schneerson that he would bring about armageddon, a prerequisitefor return of the Jewish Messiah. Trump, Putin and Netanyahu belong to Chabada Jewish supremacist cult dedicated to exterminating all those who refuse to obeyand worship them as God. This includes assimilated Jews.Freemasons are on both sides of every major war which is a pretext for depopulationand increased social control. Iran, Hamas, Hezbollah, Israel, Russia and the US are allled by Freemasons.Please send links and comments to hmakow@gmail.comDC Martin- Trump's statements make it as clear as day--Jewish Nationalist extremists own America:ELINT News @ELINTNews" - Two Israeli officials claimed to Axios that Trump and his aides were only pretending to oppose an Israeli attack in public -- and didn't express opposition in private. "We had a clear U.S. green light," one claimed. (On Oct 7, 2024, Trump commemorated the 2023 Hamas-Mossad fakse flag by attending the grave of Menachem Schneerson along with Chabad's Howard Lutnick and Ben Shapiro.)Donald Trump on the war against Iran: "I gave Iran chance after chance to make a deal. I told them, in the strongest of words, to "just do it," but no matter how hard they tried, no matter how close they got, they just couldn't get it done. I told them it would be much worse than anything they know, anticipated, or were told, that the United States makes the best and most lethal military equipment anywhere in the World, BY FAR, and that Israel has a lot of it, with much more to come - And they know how to use it.Certain Iranian hardliner's spoke bravely, but they didn't know what was about to happen. They are all DEAD now, and it will only get worse! There has already been great death and destruction, but there is still time to make this slaughter, with the next already planned attacks being even more brutal, come to an end. Iran must make a deal, before there is nothing left, and save what was once known as the Iranian Empire. No more death, no more destruction, JUST DO IT, BEFORE IT IS TOO LATE. God Bless You All!"--The conflict looks contrived. Why can't Iran shoot down attacking jets? Why don't they just close the Strait of Hormuz to force peace?Khamenei threatens: The Zionist regime must expect severe punishmentIran's Supreme Leader vows harsh retaliation after senior IRGC commanders and nuclear scientists killed in an Israeli strike: Israel has doomed itself to a bitter and cruel fate.

(On Oct 7, 2024, Trump commemorated the 2023 Hamas-Mossad fakse flag by attending the grave of Menachem Schneerson along with Chabad's Howard Lutnick and Ben Shapiro.)Donald Trump on the war against Iran: "I gave Iran chance after chance to make a deal. I told them, in the strongest of words, to "just do it," but no matter how hard they tried, no matter how close they got, they just couldn't get it done. I told them it would be much worse than anything they know, anticipated, or were told, that the United States makes the best and most lethal military equipment anywhere in the World, BY FAR, and that Israel has a lot of it, with much more to come - And they know how to use it.Certain Iranian hardliner's spoke bravely, but they didn't know what was about to happen. They are all DEAD now, and it will only get worse! There has already been great death and destruction, but there is still time to make this slaughter, with the next already planned attacks being even more brutal, come to an end. Iran must make a deal, before there is nothing left, and save what was once known as the Iranian Empire. No more death, no more destruction, JUST DO IT, BEFORE IT IS TOO LATE. God Bless You All!"--The conflict looks contrived. Why can't Iran shoot down attacking jets? Why don't they just close the Strait of Hormuz to force peace?Khamenei threatens: The Zionist regime must expect severe punishmentIran's Supreme Leader vows harsh retaliation after senior IRGC commanders and nuclear scientists killed in an Israeli strike: Israel has doomed itself to a bitter and cruel fate. CIVIL WAR ERUPTING IN AMERICAViolence Spreads To Smaller Cities Such As Spokane As Authorities Brace For Unrest In 1,800 U.S. Communities On SaturdayAccording to Fox News, the protesters caused so much chaos that the liberal mayor of Spokane was forced to declare a state of emergency...

CIVIL WAR ERUPTING IN AMERICAViolence Spreads To Smaller Cities Such As Spokane As Authorities Brace For Unrest In 1,800 U.S. Communities On SaturdayAccording to Fox News, the protesters caused so much chaos that the liberal mayor of Spokane was forced to declare a state of emergency...

MICHAEL SNYDER-"If you think that it is just a coincidence that highly volatile protests have suddenly been organized all over the nation, you are being quite naive. As I pointed out the other day, large organizations with plenty of money are involved in this effort. President Trump was able to get the violence in Los Angeles under control by sending in the National Guard, but what is he going to do when violence erupts in dozens or even hundreds of cities? The National Guard can't be everywhere. Unfortunately, violence has already started to happen in smaller cities such as Spokane, Washington. The following timeline of events for the chaos that erupted in downtown Spokane on Wednesday comes from local NBC affiliate KHQ...-ANTI-ICE RIOTERS NOW TAKEOVER CHICAGO, AND MAYOR JOHNSON CAN'T BE FOUND!!!Seventeen people were arrested Tuesday during a massive anti‑ICE protest downtown Chicago, with four individuals now facing felony charges--including aggravated battery on an officer--as the city grapples with the fallout from an open‑borders, left‑leaning demonstration. Thousands marched during rush hour to oppose federal ICE enforcement, forcing law enforcement to act decisively to preserve public safety and traffic flow. These arrests underscore how unchecked liberal activism obstructs everyday life and demands support for strong immigration enforcement. The Trump administration's tough stance on ICE is portrayed as necessary to maintain order amid escalating protests. Ultimately, the arrests serve as a warning: law and order must come before left‑wing disruptions.Tensions escalate in protests across the nation as troops deploy in key cities- L. Putin and his handler Russia Chief Rabbi, Chabad's Berel Lazar"Fck ICE!" - Anti-ICE Protesters Surround Los Angeles Hotel Full of Federal Agents After Front Desk Clerk Outs Their Location (VIDEO)-Brandon Smith--And So It Begins: Leftist Monkey Wrenching Is Leading To Civil WarIf you thought that the leftist delusions of grandeur had finally hit their peak you are about to be unpleasantly surprised.There are no limits to the insanity that progressives will embrace in their pursuit of power, and they continue to adhere to the fantasy that they are the "good guys" despite the fact that most of the world has been telling them for the past several years that their ideology is repugnant. The events in Los Angeles are just the beginning and the path this situation will take is relatively predictable. There is a large enough percentage of the US population (around 25% to 30%) that is inexorably rooted in the ideologies of Marxism and multiculturalism. Many of them might not even understand what they're supporting, but they'll still do what they're told by their gatekeepers.If you thought that the leftist delusions of grandeur had finally hit their peak you are about to be unpleasantly surprised. There are no limits to the insanity that progressives will embrace in their pursuit of power, and they continue to adhere to the fantasy that they are the "good guys" despite the fact that most of the world has been telling them for the past several years that their ideology is repugnant.The events in Los Angeles are just the beginning and the path this situation will take is relatively predictable. There is a large enough percentage of the US population (around 25% to 30%) that is inexorably rooted in the ideologies of Marxism and multiculturalism. Many of them might not even understand what they're supporting, but they'll still do what they're told by their gatekeepers.-Who Is Funding the Los Angeles Riots? Are the Riots Staged? What Is the Endgame?-Nearly Half of London's Public Housing Occupied by Foreigners.Census data from 2021 reveals 48 percent of social housing (public housing) in London, England, is occupied by households with a foreign-born head, compared to a national average of 19 percent. This costs taxpayers the equivalent of around $4.8 billion annually.-

L. Putin and his handler Russia Chief Rabbi, Chabad's Berel Lazar"Fck ICE!" - Anti-ICE Protesters Surround Los Angeles Hotel Full of Federal Agents After Front Desk Clerk Outs Their Location (VIDEO)-Brandon Smith--And So It Begins: Leftist Monkey Wrenching Is Leading To Civil WarIf you thought that the leftist delusions of grandeur had finally hit their peak you are about to be unpleasantly surprised.There are no limits to the insanity that progressives will embrace in their pursuit of power, and they continue to adhere to the fantasy that they are the "good guys" despite the fact that most of the world has been telling them for the past several years that their ideology is repugnant. The events in Los Angeles are just the beginning and the path this situation will take is relatively predictable. There is a large enough percentage of the US population (around 25% to 30%) that is inexorably rooted in the ideologies of Marxism and multiculturalism. Many of them might not even understand what they're supporting, but they'll still do what they're told by their gatekeepers.If you thought that the leftist delusions of grandeur had finally hit their peak you are about to be unpleasantly surprised. There are no limits to the insanity that progressives will embrace in their pursuit of power, and they continue to adhere to the fantasy that they are the "good guys" despite the fact that most of the world has been telling them for the past several years that their ideology is repugnant.The events in Los Angeles are just the beginning and the path this situation will take is relatively predictable. There is a large enough percentage of the US population (around 25% to 30%) that is inexorably rooted in the ideologies of Marxism and multiculturalism. Many of them might not even understand what they're supporting, but they'll still do what they're told by their gatekeepers.-Who Is Funding the Los Angeles Riots? Are the Riots Staged? What Is the Endgame?-Nearly Half of London's Public Housing Occupied by Foreigners.Census data from 2021 reveals 48 percent of social housing (public housing) in London, England, is occupied by households with a foreign-born head, compared to a national average of 19 percent. This costs taxpayers the equivalent of around $4.8 billion annually.- In October 2014, Sri Lanka's Ministry of Foreign Affairs issued a blunt warning: Gary Anandasangaree, now Canada's public safety minister, has deep connections to Liberation Tigers of Tamil Eelam-affiliated diaspora groups.-A twisted safari for the elitesFrom Torah to trauma: A Satanic child abuse scandal blows up in IsraelThere's a coordinated silencing of victims across religious and political hierarchies"Ritual child sexual abuse is a twisted safari sport of sorts for the elite. It combines satanic predilections with congenital moral turpitude. It also serves as a rites de passage for entry into a very select club of global movers and shakers whose inclusivity is dependent on mutual blackmailability. They are motivated by self-preservation and the accumulation of wealth and power foremost even as they dish out copious servings of faux nationalism.According to the Jerusalem Post, which followed up on the Hayom report, "doctors, educators, police officers, and past and present members of the Knesset were involved in these abuses." With prominent members of the public engaging in such activities, do not expect justice to be served. Instead, expect international coordination of the most depraved kind, with the United Nations reporting an alarming rise in child trafficking worldwide. What are those entrusted to guard our borders doing? While the US Immigration and Customs Enforcement agency comes down hard on undocumented immigrants, the dismantling of major child trafficking networks has been sporadic at best.Reader--"It also serves as a rites de passage for entry into a very select club of global movers and shakers whose inclusivity is dependent on mutual blackmailability.» I can't imagine what kind of sick and deranged person does these things. How should humanity deal with shit like this?"

In October 2014, Sri Lanka's Ministry of Foreign Affairs issued a blunt warning: Gary Anandasangaree, now Canada's public safety minister, has deep connections to Liberation Tigers of Tamil Eelam-affiliated diaspora groups.-A twisted safari for the elitesFrom Torah to trauma: A Satanic child abuse scandal blows up in IsraelThere's a coordinated silencing of victims across religious and political hierarchies"Ritual child sexual abuse is a twisted safari sport of sorts for the elite. It combines satanic predilections with congenital moral turpitude. It also serves as a rites de passage for entry into a very select club of global movers and shakers whose inclusivity is dependent on mutual blackmailability. They are motivated by self-preservation and the accumulation of wealth and power foremost even as they dish out copious servings of faux nationalism.According to the Jerusalem Post, which followed up on the Hayom report, "doctors, educators, police officers, and past and present members of the Knesset were involved in these abuses." With prominent members of the public engaging in such activities, do not expect justice to be served. Instead, expect international coordination of the most depraved kind, with the United Nations reporting an alarming rise in child trafficking worldwide. What are those entrusted to guard our borders doing? While the US Immigration and Customs Enforcement agency comes down hard on undocumented immigrants, the dismantling of major child trafficking networks has been sporadic at best.Reader--"It also serves as a rites de passage for entry into a very select club of global movers and shakers whose inclusivity is dependent on mutual blackmailability.» I can't imagine what kind of sick and deranged person does these things. How should humanity deal with shit like this?" -

Site: Catholic ConclaveReport from February - Church and politicians criticise floats for Cologne CarnivalCologne's city dean Robert Kleine considers the themed float on abuse in the church planned for Cologne's Rose Monday parade to be "unsuccessful". The theming is misleading, Kleine continued: spectators could take it to mean that it is not clergymen who are responsible for the crimes, but the Christian Catholic Conclavehttp://www.blogger.com/profile/06227218883606585321noreply@blogger.com0

-

Site: AsiaNews.itThe tragedy involving a Boeing 787 Dreamliner yesterday, with over 200 victims, casts a long shadow on Air India's growth plans. Once the national carrier, it was sold to the Tata Group a few years ago. The accident, the first with multiple deaths for this model, hits the company amid an ambitious expansion, while New Delhi wants India to become a global aviation hub. The investigation is focusing on the engine's thrust, but it will take time.

-

Site: Mises InstituteIsrael’s airstrikes on Iran and US involvement shatter the illusion that America First guides President Trump’s Middle East policy. Article by Brandan Buck.

-

Site: southern orders

Let me start by saying I love the Vatican II words “conciliar” and “subsidiarity”. I know what these mean on the macro and micro aspects of Church life.In my entire 45 years of being a priest. I have supported pastoral councils, finance councils and the myriad of committees I have experienced or created to assist me and the parish in helping us to be taught, governed and sanctified by our bishop and his helpers the priests.

I appreciate subsidiarity. Decisions should be left to the lowest level, when possible and desirable, like a pastor deciding what form of the Mass to celebrate in his parish, how he will advertise it in his bulletin and what options he will use at Mass which are in the Roman Missal and its General Introduction, like intinction to offer the Precious Blood rather than drinking from the common chalice. I had one bishop ask me not to use that option. I asked him if he had any prohibitions on which Penitential Act I should use at Mass. He did not like by comeback.

I loved input on administrative issues we face in parishes and dioceses from financial to organization. As a pastor, I have always had a Director of Administration that managed the parish office, building projects, contracts and the like. I stayed out of that, for my sanity and to keep to what I should be doing as a priest.

I was proud of our Stewardship Committees which encourage everyone sharing their “time, talent and treasure” with the Church and larger community. In fact, I am most proud of that.

The word I dislike, because it still has not been completely defined as the Roman Catholic Church develops it, is Synodality.

Did I say I dislike the word?

The reason is that I find it “sick” in how it has thus far been expressed or reported. It sounds like to me a discussion group where people air their differences with the Catholic Faith and her morals and want to push the Pope to create a different Church like liberal Protestantism has become, especially the Anglican Communion.

If what I have heard or read about our synodal process had led bishops, priests, deacons and laity to go deeper into what the Catholic Church believes, teaches and proclaims, to be revealed by God and how to create a good apologetic to lead Catholics and the world to the True Faith and Faith’s Good Works, I would love synodality even with all the lay input the current synodality method is using, even round table discussion, which i don’t completely care for.

My clairvoyance will be that Pope Leo will clarify synodality, continue to invite a variety of people to be involved in synods but make clear the Catholic role of bishops to teach, rule and sanctify the Church in a hierarchical fashion.

He will focus on making clear Catholicism and her outgoing mission to evangelize her own and the world with the truth, the splendor of truth as St. Pope John Paul understood it!

-

Site: LifeNews

New York pro-life leaders are urging Democratic Gov. Kathy Hochul to protect the vulnerable and veto a bill that would legalize assisted suicide.

Bishop Robert Brennan of the Diocese of Brooklyn told The Tablet in a June 10 report how vetoing the bill, called the Medical Aid in Dying (MAID) Act, would be consistent with the steps Hochul has taken to increase suicide prevention resources in the state, where the numbers of such deaths have reached crisis levels.

“This is where we’re going to try to be hopeful with the governor; she’s given indications that she would sign it, but she’s taking it under consideration – well, I hope she’ll take it under consideration in a way that’s consistent with her bold actions in terms of suicide prevention,” the bishop remarked in a Current Events interview.

ACTION ALERT: Tell Governor Kathy Hochul to veto the dangerous assisted suicide bill.

He noted that it sends “a very mixed message” to say “there are times when life is not worth living,” and asked, “What messages are you sending to somebody who is suffering severe crises?”

Cardinal Timothy Dolan, archbishop of New York, has spoken out similarly in recent weeks. He wrote in a May 29 op-ed for The Wall Street Journal that a state that has worked so much to prevent suicides in its communities should not be simultaneously trying to legalize physician-assisted suicide. He wrote that he prays that Hochul will “step up to protect human life” and defeat the bill.

The New York Senate passed the bill 35-27 on June 9, sending it to Hochul. Following that vote, Cardinal Dolan reiterated his stance in a June 11 X post, writing, “I hope that our Governor Hochul, who has been very strong in helping those suffering through the mental health crisis, does the courageous thing and vetoes it!”

New York State Catholic Conference Executive Director Dennis Poust told The Tablet that Hochul “has made access to mental health care a hallmark of her tenure as governor” and that the bill undermines her suicide prevention efforts.

The New York Alliance Against Assisted Suicide warned that assisted suicide especially endangers people with disabilities and that legalizing the practice sends “a dangerous societal message that their lives are less valuable,” according to The Tablet.

The Alliance warned, “When support systems fail, insurance coverage is uneven, and ableism pervades our institutions, what looks like ‘choice’ can quickly become pressure.”

From the physician’s perspective, the bill also violates the Hippocratic oath to “do no harm,” as the president of the Catholic Medical Association’s Finger Lakes Guild, Dr. Thomas Carroll, told The Tablet.

Legalizing assisted suicide “undermines the very purpose of medicine,” Carroll said, “and it risks changing our role fundamentally from caregiver to death dealer.”

When the bill advanced June 9, Poust issued a statement about the dark tipping point New York has brought itself to and about who can stop it from falling over the edge.

“For the first time in its history, New York is on the verge of authorizing doctors to help their patients commit suicide,” Poust said. “Make no mistake — this is only the beginning, and the only person standing between New York and the assisted suicide nightmare unfolding in Canada is Governor Hochul.”

Canada began its Medical Assistance in Dying (MAiD) program in 2016 with several restrictions, which belied the threat of legalizing euthanasia.

Within mere years, MAiD eligibility has been expanded so dramatically that it has become the country’s fifth-leading cause of death.

The lives of Canadians who aren’t suffering from terminal illnesses have also been at stake. In 2021 the MAiD program expanded its eligibility to people suffering from non-terminal illnesses.

In a heartbreaking testimony shared in March 2025, Canadian citizen Christopher Lyon spoke about how his father had been suicidal for years and the country’s MAiD regime merely accommodated his death.

“When MAiD came along, it was the perfect flattery. It’s telling him suicide is okay,” Lyon said in the interview with anti-MAiD activist Amanda Achtman. “It’s telling him it’s dignity, it’s somehow even beautiful.”

Lyon’s father, who didn’t have a terminal illness, was eligible to apply for MAiD because he suffered chronically from arthritis and diabetes. He was euthanized at age 77.

In November 2024, Quebec enacted a law that enables people with diagnoses like dementia to be euthanized without their consent if they have made a request for it some months or years in advance.

LifeNews Note: McKenna Snow writes for CatholicVote, where this column originally appeared.

The post Pro-Life Leaders tell NY Gov. Kathy Hochul to Veto Assisted Suicide Bill appeared first on LifeNews.com.

-

Site: LifeNews

Montana’s Supreme Court recently struck down as “unconstitutional” three pro-life state laws: protection of life in the womb after 20 weeks of pregnancy, the guarantee that women would have the option to view an ultrasound or hear the heartbeat of their unborn babies before they had an abortion, and limitation of access to abortion pills.

According to AP News, the laws had also protected women and unborn children by prohibiting online abortion pill prescriptions and instituted a 24-hour waiting period after giving informed consent.

Republican Gov. Greg Gianforte had signed all three laws in 2021, regional outlet NonStop Local reported June 11. AP News reported that a judge issued a preliminary injunction against the laws that year, and voters approved an initiative in 2024 to put access to abortion in Montana’s constitution.

Click here to sign up for pro-life news alerts from LifeNews.com

The Supreme Court justices said June 9 that the state constitution includes a “right to be left alone” and a right to abortion, AP News reported. The justices also ruled that the 2022 Dobbs v. Jackson US Supreme Court decision that overturned Roe v. Wade did not affect Montana women’s abilities to pursue abortions.

NonStop Local reported that Gianforte criticized the ruling, calling the justices “activists.”

“Clinging to a shaky, outdated ruling and failing to account for the U.S. Supreme Court’s decisions, these activist justices aren’t interpreting the law,” he stated, according to NonStop Local. “They’re overreaching, making law from the bench and rejecting the will of Montanans’ duly-elected representatives who make laws.”

Republican Rep. Amy Regier, who sponsored the legislation that required that pregnant women be given the opportunity to view ultrasounds before having abortions, said that the bill was meant to protect women and facilitate “good, informed consent.”

“My question to Planned Parenthood is ‘what are you afraid of expecting mothers seeing?’” she asked, according to NonStop Local.

According to AP News, the Montana Family Foundation, a pro-life organization, filed a lawsuit June 9 to challenge the 2024 initiative that added abortion to the state constitution. The foundation argued that voters who registered on Election Day could not make an adequate decision on the initiative because the ballot contained only a summary, not the whole text, of the proposal that registered voters received in the mail.

LifeNews Note: Hannah Hiester writes for CatholicVote, where this column originally appeared.

The post Montana Supreme Court Kills Three Pro-Life Laws appeared first on LifeNews.com.

-

Site: Mises InstituteDr. Hoppe‘s recent email correspondence with a New Yorker writer.

-

Site: LifeNews

The US House voted to pass President Donald Trump’s rescissions package Thursday, codifying the Department of Government Efficiency’s (DOGE) recommendations for deep cuts to controversial taxpayer-funded programs such as the US Agency for International Development (USAID), National Public Radio (NPR), and the Public Broadcasting Service (PBS).

The 214-212 vote sets up a defunding of USAID to the tune of over $8 billion and of public broadcasting by a sum of over $1 billion.

Only four Republican representatives voted against Trump’s DOGE cuts, Newsweek reported, “Mike Turner of Ohio, Mark Amodei of Nevada, Brian Fitzpatrick of Pennsylvania and Nicole Malliotakis of New York—joined all Democrats in opposing the bill.”

Click here to sign up for pro-life news alerts from LifeNews.com

CatholicVote had endorsed the package ahead of Thursday’s vote, with CatholicVote cofounder Joshua Mercer emphasizing the importance of its measure defunding public broadcasting.

“Many liberal pundits insist that public broadcasting provides wonderful programming that the American people want,” Mercer said. “If that’s the case, they don’t need taxpayer funding or the strings that come with it.”

“PBS and NPR have a long history and a strong fan base. They can easily survive with subscriptions or sponsorships,” Mercer added. “There’s no reason to continue borrowing money from China to keep media companies on the dole.”

As CatholicVote reported in April, “Concerns over political bias were spotlighted during a March hearing of the House Oversight Subcommittee, which summoned the CEOs of NPR and PBS to testify.”

NPR CEO Katherine Maher testified that she had “never seen any instance of… political bias determining editorial decisions” at her network. “Republicans,” however, “noted a prior report showing that all 87 of NPR’s editorial staff in the D.C. area were registered Democrats,” CatholicVote reported.

LifeNews Note: Joshua Mercer writes for CatholicVote, where this column originally appeared.

The post House Passes Bill to Defund NPR and PBS appeared first on LifeNews.com.

-

Site: AsiaNews.itIn Hong Kong, the NGO that reported on spontaneous worker protests and workplace accidents in mainland China has been forced to cease operations. It was founded in 1994 by activist Han Dongfang, who tried to set up an independent trade union in Tiananmen Square in 1989. A few hours after the announcement, the website was already down. Sixty civil society groups have now been dissolved since 2020.

-

Site: AsiaNews.itThe NYD is underway centred on the theme "Youth Empowerment for Nation Building". Local families are hosting young people from all Philippine dioceses and 22 Catholic organisations. This is a first step towards WYD Seoul 2027. Meanwhile, in today's Consistory, Leo XIV announced that Pier Giorgio Frassati and Carlo Acutis will be proclaimed saints on 7 September, Peter to Rot on 19 October, Missionary Day.

-

Site: AsiaNews.itThe Archbishop of Tehran-Isfahan of the Latins tells AsiaNews of his concern over the escalation in recent hours. The cardinal, who participated in the conclave that elected Pope Francis, was appointed by the Pope precisely to keep alive the Christian 'presence' with the task of 'integrating, including and being in contact with the nation at its various levels'.

-

Site: southern orders

THE HERMENEUTIC OF CONTINUITY CANONIZATION ON SEPTEMBER 7TH, THE VIGIL OF THE NATIVITY OF THE BLESSED VIRGIN MARY!

Carlo Acutis and Pier Giorgio Frassati to be canonized together as an canonization act of the hermeneutic of continuity!

Pope Leo XIV presides at an Ordinary Public Consistory for the Vote on Causes for Canonization, which gave formal approval for the canonizations of eight Blesseds, and set the date for their canonizations.By Salvatore Cernuzio and Christopher Wells

Pope Leo XIV held the first Ordinary Public Consistory of his pontificate on Friday morning, with Cardinals giving their formal approval for the canonizations of eight Blesseds.

During the ceremony, the Holy Father announced that Blessed Pier Giorgio Frassati and Blessed Carlo Acutis will be canonized together on 7 September.

The canonizations of the two young saints—one from the early twentieth century, the other the first twenty-first-century saint—have been greatly anticipated due to the great devotion among the faithful.

-

Site: PaulCraigRoberts.org

Will War Be the Hallmark of the Trump Administration?

Paul Craig Roberts

Iran has responded to Israel’s blatant attack in the weakest way possible–an appeal to the United Nations. The attack killed the Iranian commander of the Revolutionary Guards, the deputy chief of the army and several scientists, destroyed facilities and residential housing.

Washington disavows any responsibility for Israel’s act of war, but was quick to assure its Israeli master that the US would protect Israel from Iranian “aggression” should Iran respond to the attack. Washington quickly turned Israel’s aggression into an act of self-defense with Israeli puppet House Speaker Mike Johnson affirming “Israel’s right to self-defense: “Israel IS right–and has a right–to defend itself!” Another Israeli puppet, House Armed Services Committee Chairman Mike Rogers, denounced Iran–the country attacked– as “the aggressor.” Washington’s message to Iran is that retaliation against the Israeli attack will be considered aggression against Israel and the US. Having been indoctrinated by years of the “war on terror” narrative, the US population is ready for war with Iran.

President Trump, Israel’s prime puppet, said that he knew of the planned strikes in advance and that the United States will defend Israel. As President Trump knew, did not intervene, and did not warn Iran, Washington does have responsibility for the attack.

The Iranians are shooting off their mouths but not weapons.

I blame the leaders of Russia, China, and Iran. A mutual security agreement between the three countries would bring peace to the Middle East, Ukraine and Europe, and Asia. Israel is not going to attack Iran if it means real war with Russia and China. Is it lack of vision or plain stupidity that is responsible for the lack of a mutual defense treaty?

Where were Iran’s air defenses? Did Putin forbid Iran from using the Russian S-400 air defense system against Israel? How was Iran caught off guard when news reports indicated an attack was coming? Why do Arabs and Iranians sit on their butts and allow Israel and the US to always have the initiative and to knock them off one by one? Are they stupid or afraid to resist?

When Israel invaded Gaza, it was a perfect time for Iran to unleash its missiles on Israel and for Hezbollah to invade Israel. Instead, Iran stupidly demonstrated to Israel that its missiles could penetrate the US-built Iron Dome without doing any damage to Israel, thus gratuitously giving away Iran’s strategic advantage. Hezbollah sat on its butt and was decapitated by Israel. Next the US and Russia conspired in the overthrow of Syria, thereby permitting Israel’s expansion into southern Syria. The last remaining Arab fighting force is the small band of Houthis in Yemen.

Iran has the capability to seriously damage Israel and to wipe out US bases and carriers in the region. But Iran probably figures that if it uses its military capability successfully, the embarrassment to the US could result in a US nuclear attack on Iran. The only thing that could prevent such an attack would be a Russian-Chinese announcement that their nuclear umbrella covers Iran. But neither the Russian or Chinese government would take this step.

The conclusion seems to be that the destruction of the Muslim states will continue until the Middle East is either turned into Greater Israel or into an American neo-colonial empire.

Far from being a peace president, war will be the hallmark of the Trump administration.

What we have witnessed with Washington’s orchestrations of wars that destroyed Iraq, Libya, Somalia, Syria, and Lebanon and now target Iran, and with Washington and Europe’s support of Israel’s genocide of the Palestinians, is the complete absence of morality in the Western World. The West is capable of unleashing any calamity from pandemics to nuclear war. The absence of honesty on this point ensures that it will happen.

-

Site: Catholic ConclaveRudolf Voderholzer (65) has been Bishop of Regensburg since 2013. He is considered a harsh critic of the Synodal Path and rarely appears in the press. Regensburg Bishop Rudolf Voderholzer, along with Cardinal Woelki, is one of the harshest critics of the Synodal Path in the German Catholic Church. In this interview, he explains his understanding of church and politics.Bishop Voderholzer, Catholic Conclavehttp://www.blogger.com/profile/06227218883606585321noreply@blogger.com0

-

Site: PaulCraigRoberts.org

Having Eviscerated Russian War Doctrine Putin Now Brags on the Superiority of Russia’s Nuclear Weapons

Paul Craig Roberts

If Putin had not been a victim of his ridiculous belief that conflict can be avoided by turning the other cheek, and instead had been prepared to quickly and decisively demonstrate the cost of initiating conflict with Russia, we would not be at the point at which Putin has to reassure the Russian people that Russia’s nuclear weapons are the last line of defense.

Putin was caught off guard by Washington’s coup in Ukraine. He stupidly responded with the Minsk Agreement and allowed himself to be deceived for eight years while Washington in plain view built and equipped a large Ukrainian army. He stupidly refused the two Donbas independent republics’ appeal to accept them back into Russia like Crimea. Putin’s refusal left the Russian peoples stuck into Ukraine by the Soviet government open to invasion and slaughter by the US trained and equipped army. At the last minute it dawned on Putin that he had to intervene, but as he had made no preparation he lacked sufficient military resources and made no real effort to mobilize them. Instead, he undertook not an invasion of Ukraine, but a Limited Military Operation to expel the Ukrainian force from the Russian territories.

By failing to be prepared to decisively deal with a dangerous situation before the West had time to get involved and escalate the conflict, Putin created an ever-widening war that would have spun out of control if Putin had not declared the irresponsible attack on Russia’s strategic triad a “terrorist act,” not an act of war.

In other words, Putin chose to continue his denial of the reality of the situation. What will be the next “terrorist act?”

https://www.rt.com/russia/618989-russia-most-advanced-nuclear-weapons/

-

Site: OnePeterFiveThe Perpetual Instruction of the Alta Vendita: Between Historical Truth and Ideological Exploitation

Above: Quirinal Palace circa 1860. The pope’s residence as the head of state of the Papal States. Throughout the history of the Church, there have been numerous occasions when the faithful perceived they were living through the “worst moment” or even the precursors to the end of times, due to social unrest, the moral corruption of certain pastors, and widespread doctrinal confusion.

-

Site: southern orders

I can understand Italian very well, especially street Italian, as I have many relatives in Italy, Livorno specifically. And they know their street Italian as my mother did.Thus when Pope Francis became pope, my Italian relatives loved his vulgar Italian. By that I mean, his street Italian. And he was funny too, when you heard him speak his street Italian. He had an Italian sense of humor. One of my Italian relatives, who I visited in Livorno in 2013 told me that Pope Francis was a regular person that she would feel comfortable inviting into her home for dinner.

In Livorno, the term vulgar Italian means someone who is not very refined and does not have great manners in speech. They’re regular people.

But soon, that wore thin. More and more Pope Francis focused on the negative in the Church in his view. He called nuns “pickled pepper faces”. He told the Roman Curia they all had spiritual Alzheimer’s disease, and that was the nicest thing he said to them over the years.

He called young priests and seminarians little monsters who loved wearing their grandmother’s lace.

He called rad trads, clergy or laity, rigid with serious underlying mental illnesses.

He called those with homosexual tendencies, fags and faggotry. That’s about as street speaking as you can get. He did it more than once too.

Pope Francis was very negative and everyone, except his circle of friends, feared with great anxiety any off-the-cuff remarks he would make that called into question orthodox Catholic teachings, especially interviews he gave which were very frequent and always caused an uproar in some parts of the Church.

Pope Leo has changed all of that and from day one! He looks and acts as a pope wearing very frequently the Mozzetta and ornate papal stole from the first moment of his election and for every formal papal event outside of a liturgy, such as this morning’s first consistory. It was always odd to see the pope wearing only his street cassock at consistories while the cardinals wore proper attire.

He reads his speeches, not tossing them aside, so he can speak off-the-cuff. He is careful in any off-the-cuff remarks and has made no news by speaking off-the-cuff. Even in my liberal 1970’s seminary I had a professor tell me that popes don’t speak off-the-cuff as anything they say could be subject to being an official act or teaching.

But the greatest immediate change Pope Leo has made is to be nice to his Curia, to the Roman Clergy, to the young trads on their pilgrimage in France and to everyone he meets.

Pope Leo is a breath of fresh papal air after the flatulence of the last 12 years. I doubt if we ever will hear Pope Leo speak of people eating sh-t as Pope Francis described some people. Thanks be to God for that!

Fr. Z summed it up best:

For the last month and change, one of the most frequent observations I’ve heard from people is that its funny how we are so happy just to have something like normalcy. The most frequent word I’ve heard in Rome and in these USA, from clergy and laity, Catholics and even non-Catholics is “relief”. One person likened it to the feeling when a migraine ends. Another said it is like the fall of the Berlin Wall.

I told my bishop, I can breath again and I can!

-

Site: Mises InstituteIn this week‘s Friday Philosophy, Dr. David Gordon looks at the methodology of Timothy Williamson. While Williamson might not like the implication, Dr. Gordon notes that Williamson‘s methodology can be used to defend the epistemological views of Murray Rothbard.

-

Site: Catholic ConclaveAll sense of mystery long gone with the first breaths of the Spirit of Vatican II Catholic Conclavehttp://www.blogger.com/profile/06227218883606585321noreply@blogger.com0

-

Site: Novus Motus LiturgicusLost in Translation #127One of the most surprising treats our family ever received was a German Christmas cookie called lebkuchen. The spiced glazed cookie is made with honey, nuts, citrus peel, marzipan and, most importantly, oblaten, paper thin wafers. According to the story, monks and nuns in medieval Bavaria are credited with making the first lebkuchen as a way of making good use of old, Michael P. Foleyhttp://www.blogger.com/profile/02649905848645336033noreply@blogger.com0

-

Site: OnePeterFive

From the Roman office. ℣. Grant, Lord, a blessing. Benediction. May the Gospel’s holy lection Be our safety and protection. ℟. Amen. Reading 1 Continuation of the Holy Gospel according to Luke Luke 5:17-26 At that time, it came to pass on a certain day, as Jesus sat and taught, that there were Pharisees, and Doctors of the law sitting by, which were come out of every town in Galilee…

-

Site: Real Investment Advice

Initial and continuing jobless claims are as close to a real-time proxy on employment as we have. Thus, while they do not hold the same importance to the markets as the monthly BLS data, they are worth tracking. Moreover, when trends are changing, as they may be now, their importance increases. The two graphs below provide perspective on long-term and more recent trends in initial and continuing jobless claims.

The graph on the left provides a long-term perspective on current initial and continuing claims data. The recent increase in both data points is perceptible but very minor when looking back over the last thirty years. However, it is worth noting that initial claims and continuing claims are above those levels preceding the pandemic. Second, jobless payments from states have not kept up with inflation. Thus, it is widely believed that fewer people are making claims as they can earn more freelancing in gig-economy jobs like Uber and DoorDash.

The short-term graph on the right is a little more concerning. As shown, continuing jobless claims are at a three-year high, while initial claims are near similar highs. The rise in continuing claims suggests that individuals filing claims are having a tougher time finding new employment. While the initial and continuing claims will not keep the Fed up at night, they are certainly taking note of the rising trends and concurrent weakening in the monthly BLS data.

What To Watch Today

Earnings

- No earnings releases today

Economy

Market Trading Update

Yesterday, we discussed the rapid recovery of the "big 3" indices, which bodes well for future returns. However, that does not mean the market won't have a short-term correction or correlation to provide a better risk-reward entry point for investors to add exposure. As Mike and I discussed on the #RealInvestmentShow yesterday morning, we are willing to remain patient before deploying cash.

"The market remains overbought short-term, but it is not uncommon for markets to stay overbought longer than most expect. While we patiently await a pullback to increase portfolio exposure, that could be a while longer before it occurs.

Critically, we are not looking for LOWER prices to add exposure. I am okay with paying higher prices. However, we are searching for a better risk/reward opportunity to add exposure. As such, a consolidation period that allows relative strength or momentum to cool off somewhat will provide a better buying opportunity than under current conditions. We already have sufficient exposure to the market to gain performance when markets rise, but deploying capital at these levels is more “risky” than I prefer."

With the market still overbought on multiple measures, but back onto bullish buy signals, the risk/reward of investing capital at these levels is not optimal. However, a pullback to moving average support levels that reduce the short-term overbought conditions will significantly improve investment outcomes. However, the patience of "waiting" is the hard part.

Why will the market pull back? There are many reasons, including the ongoing supply/demand imbalance, the reduction of corporate share buybacks, and the continuing risk from tariff negotiations. With earnings season about to restart, there is also a risk of disappointment as the economy continues to slow. As I noted on "X" yesterday, we are also entering into a seasonally weak stretch for equity prices, which could translate into a pickup in volatility.

While it may seem the market won't quit going up, remember it will. The patience is the hard part.

PPI Underwhelms

Like CPI, PPI was weaker than expected. PPI and Core PPI rose by 0.1%, below expectations of 0.2% and 0.3%, respectively. March and April were revised higher, with April changing from -0.5% to -0.2%, and May increasing from -0.4% to 0%. As shown below, the annualized three-month change in PPI, incorporating the current data and revisions, is -0.74%. For comparison, the CPI is running just north of 1%.

From a tariff perspective, PPI is likely to show tariff impacts before CPI. Typically, price changes flow through PPI to CPI, as PPI measures the prices of raw goods that manufacturers use to create their final products, which are then sold to other corporations or individuals. You can also think of the difference in the change of PPI and CPI as a proxy for corporate profit margins. The initial take, from a tariff perspective, is that the foreign sellers of the goods are eating the cost of the tariffs. Obviously, it will take a few more months of data to fully appreciate the full impact.

Financial Planning For Business Owners

Running a successful business takes grit, vision, and no shortage of time. Between managing operations, leading teams, and scaling growth, personal financial planning often gets pushed to the back burner. When business owners do seek help, they typically turn to their CPA for advice. And while CPAs are invaluable for accounting and tax compliance, they’re not able to cover every financial angle you face as a business owner.

To protect your personal wealth and ensure your financial future, you need more than a CPA—you need a financial advisor who understands your unique position. This partnership is essential for long-term planning, risk mitigation, investment growth, and wealth transfer strategies that extend well beyond taxes.

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post Initial And Continuing Jobless Claims On The Rise appeared first on RIA.

-

Site: Real Investment Advice

Lately, the "deficit narrative" has dominated much of the financial media, particularly those channels that are continual "purveyors of doom." In this post, we will discuss the "deficit narrative," the likely outcomes, and why the cure for the deficit may be found in Artificial Intelligence.

The "deficit narrative" has dominated the media lately as President Trump's "Big Beautiful Bill" winds its way through Congress. The immediate concern is that this bill will add further to the U.S.'s current debt and deficit levels, like before. As we discussed recently in "Ray Dalio Predicts A Financial Crisis," much of the concern stems from the recent CBO scoring of the bill, which projects a never-ending rise in debt.

“Here we remind readers, that the Big, Beautiful Bill currently in Congress has been scored to add about $5 trillion to the debt, resulting in what we said would be Debt Doomsday for the US; this is simply a trade-off of short-term prosperity (a few extra trillion in the next 4 years) for long-term economic collapse (that 220% in long term debt.GDP).” - Duetsche Bank

That is undoubtedly a horrifying chart, as the US has accumulated debt levels not seen since World War II, when federal debt exceeded 100% of GDP.

However, that chart also needs some context and understanding. As shown, the US has run a negative deficit-to-GDP ratio most of the time since 1980. The only period during which there was a surplus was a very brief moment in the Clinton Administration, where he "borrowed" $2 trillion from Social Security to balance the budget. It is worth noting that while there is much "hand-wringing" about the current 6% deficit-to-GDP ratio, such is not that far above the -4% average.

While a 6% deficit is not a "good thing," we must better understand its impact on the economy.

Understanding The Deficit

The fiscal year 2024 deficit was $1.8 trillion. That seems scary, but it is significantly lower than deficits during the COVID pandemic. Furthermore, investors must understand a critical accounting concept: that the government's debt is the household's asset. In accounting, for every debit there is a credit that must always equal zero. In this case, when the Government issues debt (a debit), it is sent into the economy for infrastructure, defense, social welfare, etc. That money is "credited" to the bank accounts of households and corporations. Therefore, when the deficit increases, that money winds up in economic activity, and vice versa. In other words, those shouting for sharp deficit reductions are also rooting for a deep economic recession.

Nonetheless, the deficit trend is worrisome because it persists despite relatively strong but slowing economic growth. Historically, deficits shrink during periods of economic prosperity due to higher tax revenues and lower safety-net spending. Since the pandemic crisis, deficits have indeed shrunk, but are starting to expand again due to ongoing economic weakness. However, while the current structural imbalance shows no signs of abating, which is putting upward pressure on interest rates, it is notable that central banks globally have exited their support of the debt markets. We suspect that if the "deficit becomes critical" due to higher interest payments, the Federal Reserve will reverse its monetary policy course again.

As noted, the lack of interventions has allowed interest rates to rise. However, interest rates must be analyzed in relation to economic growth and inflation. Currently, rates are trading at levels equating to economic growth and inflation and are certainly not outside of historical norms. Interest rate currently "feel" high, only because they are normalizing from abnormally low levels following the pandemic interventions.

The consequence of that lack of intervention and the normalization of rates is the cost of servicing the national debt. In 2024, net interest spending reached $882 billion, surpassing expenditures on Medicare and defense, according to the GAO. Due entirely to the rise in rates, this figure has more than tripled since 2017, when it was $263 billion. However, as shown, if the Federal Reserve begins to cut rates and borrowing costs decline by 1%, the interest payment expense will decline by nearly $500 billion.

However, interest payments are only one side of the equation; the other is the revenue from economic growth.

Why The Deficit Narrative Of Doom May Fail To Mature

As discussed in the Ray Dalio article, there are MANY problems with the CBO projections. To wit:

"These [CBO] forecasts, often treated as gospel by lawmakers and media outlets alike, are used to shape public policy debates, inform budget decisions, and frame the long-term fiscal narrative of the United States. Yet, with striking regularity, these projections fail to materialize. The reason is that these CBO projections are often biased or one-sided estimations, data is excluded, and various other issues impair future accuracy, both good and bad. Furthermore, the agency’s forecasting methodology has structural flaws, ranging from rigid assumptions to exclusions of dynamic economic feedback to blind spots in fiscal behavior and policy change. The result is a set of projections that often mislead more than they inform."

The article linked above goes into further detail about the many problems with CBO projections. However, the most critical flaw is the dismissal of potential upside scenarios. Demographic shifts, productivity surges due to technology, or policy-induced economic acceleration. Conversely, it fails to adequately model downside risks like recessions, geopolitical shocks, or credit events. The result is a misleading “middle path” that rarely reflects actual outcomes.

Looking back at history, previous high debt levels did not lead to "economic devastation" or a "financial crisis." In the post-WWII era, strong economic growth helped shrink that debt ratio to about 25% of GDP by the 1970s. Subsequent decades saw new debt cycles. The 1980s military buildup and tax cuts drove debt up. However, the 1990s tech boom and fiscal restraint brought it down. Then events like 2008 and 2020 sent debt soaring again. Today, U.S. public debt is roughly 120% of GDP, an unprecedented peacetime high. While high debt isn’t new, the current trajectory stands out in scale and persistence.

But just as in the post-WWII era, there are reasons to hope the "deficit narrative" will improve. As noted above, following WWII, the US was the manufacturing epicenter of the entire world. The global demand for US manufacturing increased economic growth rates in the U.S., lowering the debt-to-GDP ratios substantially.

Fortunately, the US again stands at the doorstep of the next industrial revolution with Artificial Intelligence. As UBS recently noted:

"We expect stimulus and structural forces to drive the rebound, while cyclical factors remain weak. We are forecasting construction growth to reaccelerate to 4% in 2026."

The drivers of that growth will come from;

- Structural changes driving spending on Manufacturing, Power, and Data centers/Telecom; potential upside from tax incentives/bonus depreciation

- Stimulus funds are flowing and should contribute to spending growth in 2025 -26

- State finances are in stable to good condition for now; set up for modest public growth.

Suppose the buildout of Artificial Intelligence comes to fruition. If that activity only maintains the economy's current growth rate, the debt-to-GDP ratio becomes more sustainable. This assumes interest rates do not fall, and spending remains at the current growth rates.

However, if the growth rate increases to 4% annually (nominal), as some forecasts project, the debt-to-GDP rate will fall to roughly 100% by 2035.

This is not entirely "high hopes," as the Trump administration has already secured commitments from major corporations of $1.8 trillion. These projects are either "shovel-ready" or near that stage, with many already beginning to gear up.

While $1.8 trillion may not seem like much, compared to the current size of the economy, these are heavily infrastructure-intensive, which can significantly boost economic growth, directly impacting the debt-to-GDP ratio by increasing the denominator (GDP). The U.S. GDP growth rate is projected at 1.8% annually through 2035 by the Congressional Budget Office (CBO), but infrastructure spending could push this higher. The American Society of Civil Engineers (ASCE) estimates that every $1 billion in infrastructure investment creates 13,000 jobs and adds $3 billion to GDP over a decade.

Therefore, if the U.S. invests $1.8 trillion in AI infrastructure by 2030—plausible given the $500 billion energy need, $300 billion for data centers (150 new centers at $2 billion each), and $200 billion for chip production—GDP could rise by $5 trillion over 10 years, or roughly $300 billion annually. However, that $1.8 trillion is only the beginning. McKinsey & Company expects spending to reach $6 trillion by 2030, just 5 years from now, equating to $18 trillion in economic growth.

While that spending will reduce the deficit trajectory, it will also provide investors with a fantastic opportunity to grow wealth.

Taking Advantage Of What's Coming

The current "deficit narrative" overlooks the economic improvements resulting from artificial intelligence's buildout. As discussed in "Electricity May Cure The Debt Problem," the United States' power grid has lacked sufficient investment to handle the increasing burdens of electricity demand in previous years. It isn’t just a growing population that needs more housing, mobile phones, laptops, and computers. However, adding electric vehicles, bitcoin mining, and artificial intelligence will overwhelm the current electricity supply in the U.S.

For example, bitcoin mining demands an extreme amount of electricity. As noted by Paul Hoffman in Bitcoin Power Dynamics:

“The daily consumption of 145.6 GWh for Bitcoin mining in the U.S. is about 1.34% of the total daily power consumption in the country. Despite the small percentage this is still an enormous amount of electricity, keeping in mind that the U.S. is a heavily-industrialized country consuming a lot. When we extrapolate this daily consumption to a year, we get 53,144 GWh.”

However, Bitcoin mining is a small fraction of the buildout needed compared to Artificial Intelligence.

“AI energy demand is projected to surge from approximately $527.4 million in 2022 to a substantial $4,261.4 million by 2032, with a robust compound annual growth rate (CAGR) of 23.9% from 2023 to 2032.” – Medium.

But this isn't just about "Data Centers." The future will be the buildout of "AI Factories," as we saw post-WWII. As more and more companies adopt Artificial Intelligence, every company competing in E-commerce, science, medicine, manufacturing, or service delivery will need to adopt AI, either directly or indirectly. These "AI Factories" owners will be at the top of the food chain.

Investment Opportunities Abound

The physical infrastructure of roads, buildings, power grid, housing, etc., must scale as AI factories come online. Currently, the U.S. has 2,700 data centers in 2024, per Statista, but industry experts estimate a 50% increase is needed by 2030 to support AI growth. Building a hyperscale data center costs $1-2 billion, according to CBRE Group, and requires land, construction, and advanced cooling systems to manage heat from high-performance chips. This buildout necessitates improved broadband infrastructure, as AI applications require low-latency, high-bandwidth networks. The Federal Communications Commission (FCC) notes that 5G coverage must expand to 90% of the U.S. population by 2028, up from 70% in 2024, to support AI data flows.

For investors, the opportunities will be broad. Sure, companies like Amazon (AMZN), Meta (META), Microsoft (MSFT), and Google (GOOG) will be the AI factory owners, but there is more to the story. The infrastructure requirements will be enormous to build these factories, including the utilities required for the electricity provision. This makes natural gas pipelines like OneOK (OKE) and nuclear power like GE Vernova (GEV) exciting opportunities in the future. Furthermore, Blackrock (BLK) is heavily investing in infrastructure (roads, buildings, power grid), and such requires a lot of heavy machinery that will benefit companies like Caterpillar (CAT), Deere (DE), and United Rentals (URI).

Furthermore, the hardware supply chain is critical. According to Gartner, AI relies on specialized chips like Nvidia’s (NVDA) A100 GPUs, which saw a 141% demand increase in 2024. The 2022 CHIPS and Science Act allocated $52 billion to boost domestic semiconductor production. However, McKinsey estimates that the U.S. must double its chip manufacturing capacity by 2030 to reduce reliance on foreign supply chains and meet AI needs. This requires new factories, skilled labor, and raw materials like rare earth elements, often sourced globally.

Conclusion

While investors can profit from the coming infrastructure boom, the deficit narrative will also be positively impacted.

From the deficit narrative perspective, this all suggests that the future is potentially much brighter than most imagine. The infrastructure buildout for AI data factories can drive economic growth by creating jobs, stimulating industries, and enabling AI-driven productivity gains. As noted above, increasing growth only marginally would stabilize the current debt-to-GDP ratio. However, boosting GDP growth to 2.3%- 3% annually would vastly improve outcomes. Furthermore, if interest rates drop by just 1%, this could reduce spending by $500 billion annually, helping to ease fiscal pressures.

Significant money-making opportunities are on the horizon for investors. For individuals, the coming strategic investments, workforce development, and sustainable energy policies could improve economic outcomes while resolving deficit concerns.

Don't let misplaced deficit fears rob you of a potentially fantastic wealth-building opportunity.

For more in-depth analysis and actionable investment strategies, visit RealInvestmentAdvice.com. Stay ahead of the markets with expert insights tailored to help you achieve your financial goals.

The post The Deficit Narrative May Find Its Cure In Artificial Intelligence appeared first on RIA.

-

Site: Real Investment Advice

Inside This Week's Bull Bear Report

- The Bull Rally Continues

- How We Are Trading It

- Research Report - The Deficit Narrative May Find Its Cure In AI

- YouTube - Before The Bell

- Market Statistics

- Stock Screens

- Portfolio Trades This Week

Risk/Reward Favors Patience

I am traveling this weekend, so we are producing our weekly report a day early. As such, some charts using end-of-week data are using either Thursday or mid-Friday prices. All report will return to normal next week.

Let's start with where we left off last week."

"Despite a weakening unemployment report, a spat between President Trump and Elon Musk, a resurgence in the Ukraine/Russia conflict, and remaining tariff uncertainty between China, Europe, and the U.S., the markets continued their bullish ways this past week. Notably, the market broke out of the ongoing consolidation process that has been in place since May 12th. The good news is that bullish breakouts confirm bullish momentum and suggest markets will trade higher into the next resistance level. That next resistance level is 6100, the previous topping process before the March and April decline."

The market's bullish trend continued this week, and it is rapidly approaching all-time highs. However, an Israeli strike on Iran early Friday morning sent stocks tumbling at the open, but as of midday, as I am writing this report, most of the initial decline has fully recovered. We noted that a correction or consolidation process is needed to work off some short-term overbought conditions. But, as seen on Friday, any pullback is quickly bought by investors chasing the market in the near term.

As noted last week, we await a pullback to increase portfolio exposure further. However, given that sentiment and positioning measures are in the middle of their ranges, this suggests the bulls remain in control, and any substantial correction could take a while longer to occur. Let me repeat an essential statement from last week:

"Critically, we are not looking for LOWER prices to add exposure. I am okay with paying higher prices. However, we are searching for a better risk/reward opportunity to add exposure. As such, a consolidation period that allows relative strength or momentum to cool off somewhat will provide a better buying opportunity than under current conditions. We already have sufficient exposure to the market to gain performance when markets rise, but deploying capital at these levels is more "risky" than I prefer."

If we measure risk/reward technically, there is more downside risk than upside potential. The market could reach all-time highs, about 2% above current levels. Conversely, it would take nearly a 6% decline to retrace to the 50-DMA. That is a negative 3-to-1 bet. Most poker players I know would not take those odds. As such, there is no compelling "bet" for deploying capital. However, with some patience and the willingness to sacrifice some short-term performance, we will get an opportunity where the risk/reward proposition improves markedly. Just not when most expect them.

However, the psychological weight of "missing out" on a bull rally that won't seemingly stop is hard to fight in the short term. This is usually when most investors make their worst investment decisions. Patience is a virtue in this type of environment, but it is a tough commodity to come by. Those who have it tend to succeed, those who don't, don't.

Need Help With Your Investing Strategy?

Are you looking for complete financial, insurance, and estate planning? Need a risk-managed portfolio management strategy to grow and protect your savings? Whatever your needs are, we are here to help.

Will This Bull Rally Ever Stop?

The most asked question this past week is, "When will this bull rally end?" This is an interesting note given that in early April, amid the tariff-driven selloff, the question was, "When will this selloff end?" Of course, this is always the issue with market swings as they feed into our emotional biases of "fear" and "greed."

Since hitting its lows in April 2025, the stock market has staged an impressive bull rally, driven by a series of pivotal shifts. The initial trigger was the sharp sell-off sparked by President Trump’s announcement of sweeping tariffs on nearly all U.S. trading partners, which rattled investors. However, the administration’s decision on April 9 to pause tariff increases for 90 days and exempt high-demand tech products like smartphones and computers ignited a historic relief rally, with the S&P 500 soaring 9.52%, the Dow 7.87%, and the Nasdaq 12.16% in a single day.

That momentum, which has been primarily driven by retail investors, has carried forward, helped by corporate earnings where S&P 500 companies posted 12.5% year-over-year profit growth in Q1 2025, led by mega-cap tech, AI-driven firms, and consumer discretionary sectors. Economic data has also supported the bullish sentiment, with May’s Nonfarm Payrolls adding 139,000 jobs and April’s CPI inflation at a lower-than-expected 2.3%, easing fears of tariff-driven price spikes. Falling Treasury yields, from 4.6% in April to below 4.5% by June, and global liquidity boosts from central banks like China’s have further propped up risk assets. The market’s optimism is also rooted in technical strength, with the S&P 500 nearing all-time highs around 6,144 and small-cap indices like the Russell 2000 breaking key levels, signaling sustained bullish momentum.

However, there are technical and fundamental risks for the bull rally to continue. A key risk is the potential reinstatement of tariffs if the 90-day pause expires without resolution or if trade talks, like those with China, falter. Inflation remains an ongoing concern, potentially keeping the Federal Reserve on pause with its rate-cutting cycle, which markets now expect to deliver only 1.77 cuts in 2025, down from 2.19. Signs of economic cooling, such as rising unemployment claims and overall economic data slowing, could put earnings expectations at risk. The economic composite index below, which comprises more than 100 data points, dropped sharply in April with the tariff announcements but rebounded sharply in May. However, it remains in very slow growth territory.

Overvaluation is a growing worry, as lofty valuations in tech and AI stocks may not hold if earnings growth slows—2025 estimates have already been trimmed from 14% to 8.5%.

However, despite those concerns, the bull rally rides a wave of optimism.

Optimism is another word for the current market price momentum levels, which are fed by investors' emotional "fear of missing out." Those rallies tend to last longer than most think.

So, when will this rally end? No one knows; however, some indicators can help us navigate this bull rally.

The Herd Is Right In The Middle

This past Monday, we posted an article about "How To Buy The Dip," which covered two crucial ingredients of both bearish corrections and bullish rallies: sentiment and price. As discussed, sentiment is essential in this analysis for several reasons: