Homosexuality is incompatible with the priestly vocation. Otherwise, celibacy itself would lose its meaning as a renunciation.

All

Fr Thermadom, India's first deaf-mute priest, ordained in Kerala

The 38-year-old member of the Congregation of the Holy Cross graduated from college in Mumbai before embracing the religious life. The new priest told AsiaNews: 'My vocation and mission as a priest are to provide all the Sacraments in the Indian Sign Language to all deaf Catholics in India' as well as 'support God calling' them to the religious life.

Russia Ready To Alter OPEC+ Production if Necessary

Russia Ready To Alter OPEC+ Production if Necessary

Tyler Durden

Tue, 05/07/2024 - 10:25

By Tsvetana Paraskova of OilPrice.com

The OPEC+ group is still studying whether to raise oil production but it would act on supply if necessary, Russian Deputy Prime Minister Alexander Novak said on Tuesday.

The possibility to raise supply is still being reviewed, Russia’s top oilman said, as carried by Russian news agency Interfax.

“It always depends on the current situation, the balance of supply and demand,” Novak said.

“Everything is being analyzed. Right now, you don’t need to predict anything, you just need to see how the market feels,” he said.

Novak added that OPEC+ participants “are constantly monitoring the situation, and this is our plan for the second quarter, we agreed with our colleagues that these voluntary cuts can be adjusted to boost supply if necessary.”

“This is a constant process,” Novak stressed.

The OPEC+ group is meeting on June 1 to decide how to proceed with the current production cuts in the second half of the year. The current supply agreement which removes around 2.2 million barrels per day (bpd) off the market now including Saudi Arabia’s 1 million voluntary cut, expires at the end of June.

As of the end of last week, OPEC+ had yet to start formal talks on the alliance’s production policy, sources from producers part of the deal told Reuters.

If oil demand fails to accelerate, the group could keep the oil production cuts in place, the sources added.

“We think there's a good chance that OPEC+ will extend beyond June - but we aren't yet putting a firm view because we don't think they've actually got into the real period of discussion and decision-making,” Richard Bronze of consultancy Energy Aspects told Reuters.

The majority of analysts expect OPEC+ to extend the cut into the second half of 2024, according to a survey by Bloomberg from last week.

The Beast of Ideology Lifts the Lid on Transformation

The Transformation is accelerating. The harsh, often violent, police repression of student protests across the US and Europe, in wake of the continuing Palestinian massacres, exposes sheer intolerance towards those voicing condemnation against the violence in Gaza.

The category of “hate speech” enacted into law has become so ubiquitous and fluid that criticism of the conduct of Israel’s behaviour in Gaza and the West Bank is now treated as a category of extremism and as a threat to the state. Confronted by criticism of Israel, the ruling élites respond by angrily lashing out.

Is there a boundary (still) between criticism and anti-semitism? In the West the two increasingly are being made to cohere.

Today’s stifling of any criticism of Israel’s conduct – in blatant contradiction with any western claim to a values-based order – reflects desperation and a touch of panic. Those who still occupy the leadership slots of Institutional Power in the US and Europe are compelled by the logic of those structures to pursue courses of action that are leading to “system” breakdown, both domestically – and concomitantly – provoking the dramatic intensification of international tensions, too.

Mistakes flow from the underlying ideological rigidities in which the ruling strata are trapped: The embrace of a transformed Biblical Israel that long ago separated from today’s US Democratic Party zeitgeist; the inability to accept reality in Ukraine; and the notion that US political coercion alone can revive paradigms in Israel and the Middle East that are long gone.

The notion that a new Israeli Nakba of Palestinians can be forced down the throats of the western and the global public are both delusional and reek of centuries of old Orientalism.

What else can one say when Senator Tom Cotton posts: “These little Gazas are disgusting cesspools of antisemitic hate, full of pro-Hamas sympathisers; fanatics and freaks”?

When order unravels, it unravels quickly and comprehensively. Suddenly, the GOP conference has had its nose rubbed in dirt (over its lack of support for Biden’s $61bn for Ukraine); the US public’s despair at open border immigration is disdainfully ignored; and Gen Z’s expressions of empathy with Gaza is declared an internal “enemy” to be roughly suppressed. All points of strategic inflection and transformation – likely as not.

And the rest of the world now is cast as an enemy too, being perceived as recalcitrants who fail to embrace the western recitation of its “Rules Order” catechism and for failing clearly to toe the line on support for Israel and the proxy war on Russia.

It is a naked bid for unchecked power; one nevertheless that is galvanising a global blow-back. It is pushing China closer to Russia and accelerating the BRICS confluence. Plainly put, the world – faced with massacres in Gaza and West Bank – will not abide by either the Rules or any western hypocritical cherry-picking of International Law. Both systems are collapsing under the leaden weight of western hypocrisy.

Nothing is more obvious than Secretary of State Blinken’s scolding of President Xi for China’s treatment of the Uighurs and his threats of sanctions for Chinas trade with Russia – powering “Russia’s assault on Ukraine,” Blinken asserts. Blinken has made an enemy of the one power that can evidently out-compete the US; that has manufacturing and competitive overmatch vs the US

The point here is that these tensions can quickly spiral down into war of “Us” versus “Them” – ranged against not just the China, Russia, Iran “Axis of Evil,” but vs Turkey, India Brazil and all others who dare to criticise the moral correctness of either of the West’s Israel and Ukraine projects. That is, it has the potential to turn into the West versus the Rest.

Again, another own goal.

Crucially, these two conflicts have led to the Transformation of the West from self-styled “mediators” claiming to bring calm to flashpoints, to being active contenders in these wars. And, as active contenders, they can permit no criticism of their actions – either inside, or out; for that would be to hint at appeasement.

Put plainly: this transformation to contenders in war lies at the heart of Europe’s present obsession with militarism. Bruno Maçães relates that a “senior European minister argued to him that: if the US withdrew its support for Ukraine, his country, a Nato member, would have no choice but to fight alongside Ukraine – inside Ukraine. As he put it, why should his country wait for a Ukrainian defeat, followed by [a defeated Ukraine] swelling the ranks of a Russian army bent on new excursions?”

Such a proposition is both stupid and likely would lead to a continent-wide war (a prospect with which the unnamed minister seemed astonishingly at ease). Such insanity is the consequence of the Europeans’ acquiescence to Biden’s attempt at regime change in Moscow. They wanted to become consequential players at the table of the Great Game, but have come to perceive that they sorely lack the means for it. The Brussels Class fear the consequence to this hubris will be the unravelling of the EU.

As Professor John Gray writes:

At bottom, the liberal assault on free speech [on Gaza and Ukraine] is a bid for unchecked power. By shifting the locus of decision from democratic deliberation to legal procedures, the élites aim to insulate [their neoliberal] cultish programmes from contestation and accountability. The politicisation of law – and the hollowing out of politics go hand in hand.

Despite these efforts to cancel opposing voices, other perspectives and understandings of history nonetheless are reasserting their primacy: Do Palestinians have a point? Is there a history to their predicament? “No, they are a tool used by Iran, by Putin and by Xi Jinping,” Washington and Brussels says.

They say such untruths because the intellectual effort to see Palestinians as human beings, as citizens, endowed with rights, would force many Western states to revise much of their rigid system of thinking. It is simpler and easier for Palestinians to be left ambiguous, or to “disappear.”

The future which this approach heralds couldn’t be farther from the democratic, co-operative international order the White House claims to advocate. Rather it leads to the precipice of civil violence in the US and to wider war in Ukraine.

Many of today’s Woke liberals however, would reject the allegation of being anti-free speech, labouring under the misapprehension that their liberalism is is not curtailing free speech, but rather is protecting it from “falsehoods” emanating from the enemies of “our democracy” (i.e. the “MAGA contingent”). In this way, they falsely perceive themselves as still adhering to the classical liberalism of, say, John Stuart Mill.

Whilst it is true that in On Liberty (1859) Mill argued that free speech must include the freedom to cause offence, in the same essay he also insisted that the value of freedom lay in its collective utility. He specified that “it must be utility in the largest sense – grounded on the permanent interests of man as a progressive being.”

Free speech has little value if it facilitates the discourse of the “deplorables” or the so-called Right.

In other words, “Like many other 19th-century liberals,” Professor Gray argues, “Mill feared the rise of democratic government because he believed it meant empowering an ignorant and tyrannical majority. Time and again, he vilified the torpid masses who were content with traditional ways of living.” One can hear here, the precursor to Mrs Clinton’s utter disdain for the “deplorables” living in “fly-over” US states.

Rousseau too, is often taken as an icon of “liberty” and “individualism” and widely admired. Yet here too, we have language which conceals its’ fundamentally anti-political character.

Rousseau saw human associations rather, as groups to be acted upon, so that all thinking and daily behaviour could be folded into the like-minded units of a unitary state.

The individualism of Rousseau’s thought, therefore, is no libertarian assertion of absolute rights of free speech against the all-consuming state. No raising of the “tri-colour” against oppression.

Quite the reverse! Rousseau’s passionate “defence of the individual” arises out of his opposition to “the tyranny” of social convention; the forms, rituals and ancient myths that bind society – religion, family, history, and social institutions. His ideal may be proclaimed as that of individual freedom, but it is “freedom,” however, not in a sense of immunity from control of the state, but in our withdrawal from the supposed oppressions and corruptions of collective society.

Family relationship is thus transmuted subtly into a political relationship; the molecule of the family is broken into the atoms of its individuals. With these atoms today groomed further to shed their biological gender, their cultural identity and ethnicity, they are coalesced afresh into the single unity of the state.

This is the deceit concealed in classical Liberalism’s language of freedom and individualism – “freedom” nonetheless being hailed as the major contribution of the French Revolution to western civilisation.

Yet perversely, behind the language of freedom lay de-civilisation.

The ideological legacy from the French Revolution, however, was radical de-civilisation. The old sense of permanence – of belonging somewhere in space and time – was conjured away, to give place to its very opposite: Transience, temporariness and ephemerality.

Frank Furedi has written,

Discontinuity of culture coexists with the loss of the sense of the past … The loss of this sensibility has had an unsettling effect on culture itself and has deprived it of moral depth. Today, the anticultural exercises a powerful role in western society. Culture is frequently framed in instrumental and pragmatic terms and rarely perceived as a system of norms that endow human life with meaning. Culture has become a shallow construct to be disposed of – or changed.

The western cultural elite is distinctively uncomfortable with the narrative of civilisation and has lost its enthusiasm for celebrating it. The contemporary cultural landscape is saturated with a corpus of literature that calls into question the moral authority of civilisation and associates it more with negative qualities.

De-civilization means that even the most foundational identities – such as that between man and woman – is called into question. At a time when the answer to the question of “what it means to be human” becomes complicated – and where the assumptions of western civilisation lose their salience – the sentiments associated with wokeism can flourish.

Karl Polyani, in his Great Transformation (published some 80 years ago), held that the massive economic and social transformations that he had witnessed during his lifetime – the end of the century of “relative peace” in Europe from 1815 to 1914, and the subsequent descent into economic turmoil, fascism and war, which was still ongoing at the time of the book’s publication – had but a single, overarching cause:

Prior to the 19th century, he insisted, the human way of being had always been “embedded” in society, and that it was subordinated to local politics, customs, religion and social relations i.e. to a civilisational culture. Life was not treated as separated into distinct particulars, but as parts of an articulate whole – of life itself.

Liberalism turned this logic on its head. It constituted an ontological break with much of human history. Not only did it artificially separate the “economic” from the “political,” but liberal economics (its foundational notion) demanded the subordination of society – of life itself – to the abstract logic of the self-regulating market. For Polanyi, this “means no less than the running of society as an adjunct to the market.”

The answer – clearly – was to make society again a distinctly human relationship of community, given meaning through a living culture. In this sense, Polanyi also emphasised the territorial character of sovereignty – the nation-state as the pre-condition to the exercise of democratic politics.

Polanyi would have argued that, absent a return to Life Itself as the pivot to politics, a violent backlash was inevitable. (Though hopefully not as dire as the transformation through which he lived.)

Reprinted with permission from Strategic Culture Foundation.

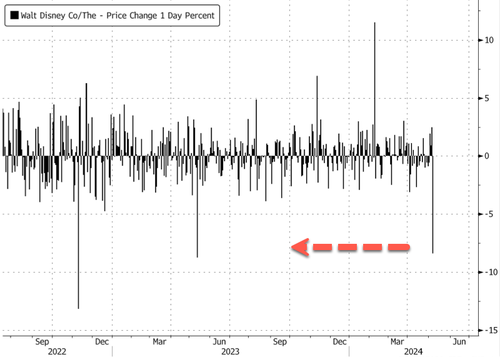

Disney Shares Plunge Most In Year On Subscriber Miss, Disappointing Guidance

Disney Shares Plunge Most In Year On Subscriber Miss, Disappointing Guidance

Tyler Durden

Tue, 05/07/2024 - 10:05

Disney reported fiscal second-quarter profits that exceeded estimates of the average analysts tracked by Bloomberg and raised its full-year earnings guidance. However, shares tumbled in early trading in New York as investors focused more on the Disney+ streaming service, missing its forecast for the quarter.

For the quarter ending March 30, the Disney+ streaming service reported 153.6 million subs, which fell short of Wall Street's expectations of 155.66 million. This is currently overshadowing any positive news from the quarter.

Earnings increased to $1.21 a share, excluding some items, in the quarter, beating the $1.12 average of analysts' estimates. Revenue in the first three months of the year increased by 1.2% to $22.08 billion, compared with analysts' forecast of $22.1 billion.

- Adjusted EPS $1.21 vs. 93c y/y, estimate $1.12 (Bloomberg Consensus)

- Revenue $22.08 billion MEET, +1.2% y/y, estimate $22.1 billion

-

Entertainment revenue MISS $9.80 billion, estimate $10.31 billion

-

Direct-to-Consumer revenue MEET $5.64 billion, estimate $5.64 billion

-

Sports revenue MISS $4.31 billion, estimate $4.33 billion

-

Experiences revenue BEAT $8.39 billion, estimate $8.18 billion

-

However, while the media giant added more than 6 million subscribers in the second quarter to its core Disney+ streaming offering, it was less than expected:

- Disney+ subscribers 153.6 million, estimate 155.66 million

And worse still, CFO Hugh Johnston said the company doesn’t expect to see core Disney+ subscriber growth in the current quarter and profitability in streaming will suffer due to due to additional expenses for cricket rights in India.

Disney bought the India business in 2019 as part of its $71.3 billion acquisition of most of 21st Century Fox.

“We are pleased with the progress we’re making in streaming, although, as we said before, the path to long-term profitability is not a linear one,” Johnston said on a call with investors.

At the start of the cash session, Disney shares slid 8.5%. The latest rebound in the stock has hit heavy resistance at the $120 handle.

The 8.5% decline is the largest intraday tumble since May 11, 2023.

On the bright side, Disney’s theme parks saw revenue increase 10% in the second quarter and the segment posted a 12% gain in operating income.

But, once again, Johnston said he’s expecting little growth at parks in the current period, due to expenses such as a new cruise ship, before resuming growth later in the year.

Earnings in Disney’s theme-park division rose to $2.29 billion in the second quarter, driven by sharply higher results internationally, especially Hong Kong. Domestically the company’s cruise line and Disney World resort in Florida registered income growth, while California’s Disneyland saw weaker performance due to higher costs.

“While consumers continue to travel in record numbers and we are still seeing healthy demand, we are seeing some evidence of a global moderation from peak post-Covid travel,” Johnston said on the call.

The question remains, just how much can Disney put up park prices before demand literally disappears?

While McDonald's, Starbucks, and Tyson Foods have all reported low-income consumers dialing back purchases as inflation pinches pocketbooks, the Disney CFO claimed that:

"We're not seeing that in our portfolio of products," adding there hasn't been much of an impact after streaming prices were hiked earlier this year.

However, it's only a matter of time before Disney sees low-income or middle-of-the-road consumers pull back on streaming spending and outrageously priced park tickets amid rising stagflationary threats.

The Importance of Hülsmann's Groundbreaking book <em>Abundance, Generosity, and the State</em>

The importance of this book lies primarily in how it shows the interventionist state is at the root of Western society’s increasingly loathsome, self-destructive, and stingy culture.

Tourism industry and government clash as visa costs soar

An incident at Colombo's Bandaranaike International Airport on 1 May sparked tensions between the tourism industry and the Sri Lankan government. Private operators like GBS and VFS have been allowed to issue visas, and raise fees. As accusations whirl around the Ministry of Public Security, the government plans an investigation.

The Secret Badges that we Wear

“She bound the scarlet line in the window.”

Joshua 2:21

A shibboleth is a special kind of password, which is to say a key or badge that opens a social door and grants admission to a social group. As everyone versed in scripture knowledge knows, shibboleth was at first a word that the lisping Ephramites could not pronounce, and that the Sons of Giliad therefore used to identify the survivors of a shattered Ephramite army. When a bloodied and bedraggled warrior staggered down to the ford of the Jordan, he was challenged to pronounce the word “shibboleth,” and thereby show his secret badge. Those who pronounced it “sibboleth” were immediately slain.

As I explained some years ago, shibboleths often take the form of sacrilege. The password that grants admission to one social group is in such cases a violation of the norms of that group’s enemy. Thus anti-Christian secret societies used to require an aspiring member to trample on a crucifix, spit on a Bible, or otherwise treat the sacred objects and words Christianity as profane. In on-line culture, such sacrilegious shibboleths are called “shill tests,” and in these tests an aspiring member is required to type words that an undercover agent would find it very hard to type. As I explained in that long-ago post, to get past the sentries of one group, you must often slay another group’s sacred cow.

A shibboleth is a password that prevents infiltration by spies. A “scarlet thread” is a secret badge with which a traitor makes himself known to his new compatriots, and is thereby passed over when his new compatriots descend like wolves on the people whose compatriot the traitor only pretends to be. Like shibboleth, the term “scarlet thread” comes from the Old Testament, and more particularly from the curious tale of a traitor known as Rahab the Harlot.

Rahab the Harlot dwells in the city of Jericho, and when Joshua sends two spies into that city, the two young men somehow fall in with Rahab, who we must never forget is a harlot, and she hides these two handsome young spies in her house. This house was built on, or rather up against, the city wall; and on its city-wall side had a high window that looked out over the countryside. It was from this high window that Rahab lowered Joshua’s spies on a “scarlet thread,” after telling them that her people were ripe for conquest because they were rotten with fear.

“Your terror is fallen upon us . . . the inhabitants of the land faint because of you.”

Rahab’s reward for betraying her people is that she and her family will be spared when Jericho is sacked and its citizens are slaughtered. But to assure their deliverance, Rahab must keep her family in her house (of ill repute), and must display the “scarlet thread” in the front window. of that house.

“Behold, when we come into the land, thou shall bind this thread in the window which thou didst let us down by; and thou shalt bring thy father, and thy mother, and thy brethren, and all thy father’s household, home unto thee” Joshua 2: 18.

Thus a “scarlet thread” is a means whereby a traitor escapes the destruction brought down by his or her treason. One wonders how many who “miraculously” survive some near-universal destruction owe their deliverance to display of a secret badge or “scarlet thread.” Rahab was a harlot, so she knew how treachery works.

“She bound the scarlet line in the window.”

Not long after, as every Sunday-school scholar knows, Joshua’s army compasses the city of Jericho and “the walls came a tumbling down.” Then, as many Sunday-school scholars do not know, before the sack and slaughter begins, a house displaying a “scarlet thread” is sought and a traitorous harlot is saved. Which was very fortunate for that traitorous harlot and her family, because of Joshua’s army we are told:

“They utterly destroyed all that was in the city, both man and woman, young and old, and ox, and sheep, and ass, with the edge of the sword.” Joshua 6: 21

Like a shibboleth, a “scarlet thread” is a special kind of password, although it grants its possessor the privilege of escape and not admission. It is a secret badge with which traitors and spies show their true colors to their true friends, and by which traitors and spies are exempted when their true friends utterly destroy their pretended friends with the edge of the sword.

Peloton Shares Surge On Private Equity Firm Buyout Report

Peloton Shares Surge On Private Equity Firm Buyout Report

Tyler Durden

Tue, 05/07/2024 - 09:05

Just one week after Barry McCarthy, CEO of Peloton Interactive, announced his departure following a disastrous tenure that saw shares plummet by 92%, CNBC reports private equity firms are circling the struggling company, known for strapping iPads on fancy exercise bikes and charging wealthy consumers a hefty premium, for a potential buyout.

People familiar with the talks say Peloton has spoken with at least one private equity firm. However, the firm's interest in acquiring the company is unclear. The people also say several other private equity firms have been interested in acquiring the company.

Responding to the report, a Peloton spokesperson told CNBC, "We do not comment on speculation or rumors."

"Firms have zeroed in on how to cut Peloton's operating expenses to make a buyout more attractive," CNBC said.

Last week, Peloton CEO Barry McCarthy announced he would step down, while the company said it would undergo another broad restructuring plan that would save it more than $200 million by the end of 2025.

Following the report, the company's shares surged by as much as 18% in premarket trading in New York.

The news comes as Peloton's float is heavily shorted, with at least 15% short, equivalent to about 50 million shares.

Under McCarthy's tenure, shares have plunged 92%, mainly because demand for at-home exercise bikes and treadmills has fallen since the pandemic. Consumers have returned to gyms, and or just can't afford the overpriced equipment Peloton has to offer.

White Genocide is in the Cards that Are Being Played

White Genocide is in the Cards that Are Being Played

Paul Craig Roberts

Three decades ago in my book, The New Color Line, I pointed out that Alfred W. Blumrosen, compliance chief of the Equal Employment Opportunity Commission, turned the statutory language of the 1964 Civil Rights Act on its head and used the EEOC to create race-based legal privileges for blacks, thereby reducing white Americans to second-class citizenship. In place of equal employment opportunity Blumrosen and the liberals of the time used “affirmative action” to create and enforce privileges for blacks in university admissions, hiring and promotion. These privileges created in defiance of Congress by a regulatory authority were the opening wedge against our then merit-based system and created the acceptability of racial discrimination against white Americans. At the time the liberals admitted that it amounted to privileged treatment of a race, but said it was to be temporary in order to give blacks a leg up. It has now been 60 years, a time period that is not temporary. As I pointed out, once privilege is set in law, it becomes a property right of the privileged supported by the passage of time and precedent after precedent. Even though the racial privilege is unconstitutional, those privileged by it have squatters’ rights in the privilege.

My book was favorably reviewed by Harvard Law Professor Alan Dershowitz, by Irving Kristol, editor of The Public Interest, by Judge Robert H. Bork, by the New York Times Book Review, by The Wall Street Journal, by the Washington Post, by California Governor Pete Wilson, and many others. Henry Regnery said that my book was the most important work his firm had ever published. Yet my book had zero effect. Three decades after its publication American corporations, universities, and the US military have institutionalized racial discrimination against white Americans.

60 years too late Tucker Carlson has raised this issue with Jeremy Carl who has just published The Unprotected Class: How Anti-White Racism is Tearing America Apart. As a large percentage of the white population has been indoctrinated into seeing themselves as guilty and undeserving, the white majority is incapable of rectifying its second-class legal status. As the white American majority is rapidly disappearing under the Democrats’ policy of open borders and recruitment of immigrant-invaders into the United States, within a few years time not even the theoretical possibility of restoring American whites to equality under the law will be possible. https://twitter.com/TuckerCarlson/status/1783254594480730380

If you want to see your future, read Jean Raspail’s The Camp of the Saints. The Camp of the Saints is an accurate description of the fate of the Western World. We are experiencing that fate now. If you dare to know your future and that of your children and grandchildren, you can read this novel that correctly predicted our future in 1973. The book was a best seller, but the rot had already set in. Today the book is suppressed. You can read it here:

https://www.jrbooksonline.com/PDFs/Camp_of_the_Saints.pdf

As racial denigration of white ethnicities is institutionalized in every Western government, all white ethnicities can expect the same fate. The fate of white ethnicities is sealed. They have lost their countries and are reviled by their own white governments, universities, and media. They are doomed. Perhaps a few will be kept in zoos as examples of racist evil.

Biden Regime Continues Massive Program to Replace White American Population with Illegal Aliens

Biden Regime Continues Massive Program to Replace White American Population with Illegal Aliens

https://texasscorecard.com/federal/thousands-of-illegal-aliens-flown-into-texas-airports/

The trial brought by Democrat excrement in the non-American state of New York is revealed to have ZERO LEGAL BASIS.

The trial brought by Democrat excrement in the non-American state of New York is revealed to have ZERO LEGAL BASIS.

As I have reported, the Trump indictments are nothing but the use of state power against a chosen victim. The corrupt Democrats’ trials of Trump are worst offenses than Stalin’s Show Trials of the leaders of the Bolshevik Revolution. Just as Democrats accuse Trump of being a Russian agent, Stalin accused the leaders of the Communist Revolution to be capitalist agents. The US Department of Justice (sic) is a far worse evil than the abuse of Soviet Law by Stalin’s “attorney general” Andrey Vyshinsky. The excrement that is Biden’s attorney general is more evil than Vyshinsky himself.

And “America is a free country?

Netanyahu Announces the Final Solution Is Underway

Netanyahu Announces the Final Solution Is Underway

If I understand this report, the Israeli Zionist government has stood up in its Satanic robes and announced the destruction of Rafah. The final solution proceeds to its finish while the world stands aside, except for Biden who sends the bombs. for the Final Solution.

Medical Boards are shills for Big Pharma

Texas state representatives ask Texas Attorney General and Governor to intervene in the corrupt Texas Medical Board’s vendetta against Dr. Mary Talley Bowden who cured 6,000 Covid patients by ignoring the mandated deadly Covid protocols.

Medical Boards are shills for Big Pharma

What Will CBDCs Mean For Gold?

What Will CBDCs Mean For Gold?

Tyler Durden

Tue, 05/07/2024 - 08:45

With the eventual introduction of central bank digital currency (CBDCs) now seemingly inevitable, there are a lot of directions central banks could take with their digital currency projects that would have dramatic implications for the price of gold.

Touted for their “convenience” and “efficiency,” the endgame of digital currencies is not only achieving greater power over the currency but also a means of surveilling and micromanaging the personal finances of each individual. Owe taxes or a parking ticket? It could be automatically deducted. Does the Fed think it needs to cool inflation? Deduct money straight from people’s accounts, or impose a daily spending limit. The possibilities for control and profit are endless, and too tempting for control freak bureaucracies and amoral tech companies to ignore.

As countries like China implement their own CBDCs, buy more precious metals, and generally buck dependence on the US dollar for trade, Western central banks also feel like they have to compete in order to retain their power. That’s the essence of the other motivation for CBDCs — a currency race between East and West wherein the winner solidifies not only unprecedented control over its own citizenry but a place atop the global power structure for the next century or longer.

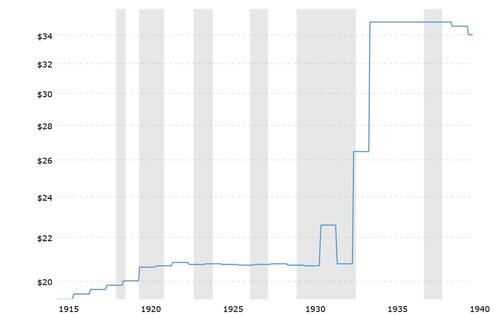

Since CBDCs and the idea of a “cashless society” are mostly about increasing centralization and control on the societal and individual level, it’s easy to see how they might be accompanied by new legislation banning precious metals investing and other non-state-approved financial activities. All they need is a severe enough financial crisis to provide the justification. After all, during the Great Depression, the federal government swiftly used an Executive Order to demand that citizens submit their gold to the Federal Reserve en masse.

And with new developments in crypto-tokenization technology and a brewing global financial crisis, the Tech-Banking-Political complex is preparing for what they collectively know will be a crucial window of opportunity to force their CBDCs down the throats of the people and make opting out from their new system after the fact nearly impossible.

Once their CBDC is rolled out, central bankers will have more ability than ever to manipulate the money supply and your personal finances according to their whims. This summary from a 2023 BIS report on the promise of CBDCs to increase the scope of central bank activities describes in (cheery banker-speak) the increase in power and control that central planners will grant themselves under a unified digital currency system:

“As well as improving existing processes through the seamless integration of transactions, a unified ledger could harness programmability to enable arrangements that are currently not practicable, thereby expanding the universe of possible economic outcomes.”

Zimbabwe’s new CBDC experiment uses an interesting ”gold-backed” approach, appearing on paper to be a combination of the traditional gold standard with digital currency tech. This is a promising approach, but to avoid being corrupted by authorities, it needs a protocol that makes it nearly impossible to fake a higher gold supply with tokens for gold that doesn’t really exist. Otherwise, its claims of returning to a “gold standard” are meaningless.

I wouldn’t expect a Western CBDC to contain gold backing or the protection of any kind of restrictive protocol, but I predict that in a centralized national or international digital currency system of any kind, central banks will still hold large amounts of gold in reserve. Just as Bitcoin isn’t truly “digital gold” but only numbers on a screen, bankers know they will still have to hold real money as an insurance policy.

The difference is, that banks could be the only ones who are allowed to hold gold, while broader society will no longer have access to cash. With all other potential options to opt out of this system fully digitized and prevented from competing with CBDCs, gold, and silver will become the only way to exist and transact outside the Central Bank’s digital control grid with any semblance of true freedom or agency. Black markets will have to turn to various forms of analog money, and gold and silver will rise as the top options.

Just look at the gold chart for 1933: When Executive Order 6102 demanded that citizens give up their gold, the price skyrocketed, never again returning to pre-1933 levels. A similar effect would occur from the announcement of CBDCs, phasing out of paper cash, and restrictions on private gold ownership:

Gold vs USD Pre and Post-Executive Order 6102

Some legislators are recognizing the CBDC threat and fighting against it, declaring CBDCs a threat and empowering precious metals holders. However, I’m not sure it will be enough to fight the CBDC tide being engineered by central planners. The system may begin as optional, but with the phasing-out of cash and other incremental measures, will eventually become permanent either through direct legislation or by making it totally impractical to resist.

If the architects of CBDCs can market their new system as the solution to an epic financial crash (of their own making), it will likely appear as a sign of stability that calms global markets, possibly causing gold and silver to drop. But as precious metals emerge as the best form of physical money in a tightly controlled, micromanaged financial dystopia, they’ll become the only way to make private or off-grid transactions, making them more valuable than ever — not only as investments, but a means of survival outside the fully-digitized fiat nightmare.

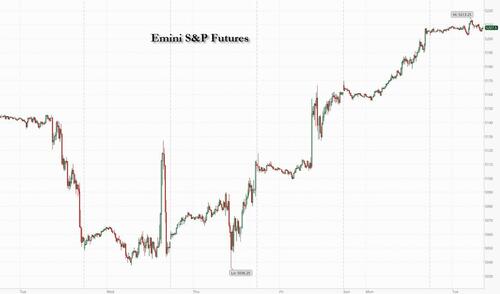

Futures Flat As Post-FOMC Rally Takes A Breather

Futures Flat As Post-FOMC Rally Takes A Breather

Tyler Durden

Tue, 05/07/2024 - 08:30

US stock futures are flat after the S&P 500 and Nasdaq 100 both closed 1% higher on Monday, helped by growing optimism among investors that the economy is finally slowing greenlighting earlier rate cuts by the Fed. As of 8:00am ET S&P futures were unchanged at 5,206, trading about 1% above its 50DMA, while Nasdaq futures were down 0.2% amid some mega-cap weakness. European stocks are higher, while indexes in Japan and the UK are catching up after being closed for holidays yesterday. Shares in Swiss bank UBS jumped after it returned to profit and showed more progress in its integration of Credit Suisse. Treasuries rise, with US 10-year yields falling 3bps to 4.46%. The Bloomberg Dollar Spot Index rises 0.1%. The yen weakens 0.4% against the greenback, pushing USD/JPY up to ~154.50. The Aussie falls 0.4% after the RBA kept rates on hold and maintained a neutral stance. Oil prices advance, with WTI rising 0.3% to trade near $78.70. Spot gold falls 0.4% and bitcoin traded in a range around $64,000 with the now daily European open/US slam down pattern. US economic data slate includes March consumer credit at 3pm, while Fed's Kashkari is scheduled to speak twice (11:30am, 1:20pm).

In premarket trading, Disney reported fiscal second-quarter profit that beat estimates, thanks to sharply narrower losses in its streaming TV business and higher ticket prices at theme parks. Still, the stock tumbled 6% after the company reported fewer subscribers to its Disney+ streaming service in the fiscal second quarter than analysts had projected. Here are some of the other notable US movers before the opening bell:

- Celsius falls 8.4% after the energy-drink maker reported first-quarter revenue that missed even the lowest estimate among analysts tracked by Bloomberg.

- Coherent climbs 8.5% after the maker of components for the telecommunications industry raised the bottom end of its year revenue forecast.

- Datadog slips 11% after the cloud software company said that Amit Agarwal will be stepping down as president. The company also posted 1Q results.

- Esperion Therapeutics rallies 25% after the drugmaker’s first-quarter revenue was ahead of analyst estimates.

- Fidelity National Information Services’ rises 4% after the company raised its outlook for full-year profit.

- Gap rises 3% after Citi raised its rating on the retailer to buy on positive momentum and margin upside.

- Hims & Hers Health jumps 14% after the telehealth company boosted its adjusted Ebitda guidance for the full year.

- Lucid drops 8% after the EV maker posted a wider-than-expected loss for the first quarter.

- Oscar Health climbs 15% after the health insurer reported earnings per share for the first quarter that outpaced Wall Street’s expectations.

- Palantir falls 13% as the market appeared unimpressed by the company’s outlook for annual sales after the stock has tripled in the past year.

- Symbotic jumps 14% after the warehouse robotics and automation firm posted forecast-beating 2Q revenue and surpassed expectations for its fiscal 3Q revenue outlook.

- Vimeo gains 10% after the video software company reported first-quarter results that beat analyst expectations and provided a forecast.

- Zeta rises 16% after the software company gave a forecast revenue for the second quarter that beat the average analyst estimate.

In a week light on data but heavy on Fedspeak, Minneapolis Fed President Neel Kashkari is set to appear Tuesday, one day after his Richmond President colleague Thomas Barkin said Monday said he expects high interest rates to eventually cool US inflation to the central bank’s 2% target. Despite the hawkish rhetoric, swaps traders are betting on about 45 basis points of Fed rate cuts by December, an increase vs before the disappointing jobs report.

“In this environment of growth not rolling over as much as we feared and potentially cuts coming in, there is upside for earnings going forward,” Beata Manthey, head of European equity strategy at Citigroup Inc., said in an interview with Bloomberg TV

"The market is taking a positive view about the US job data and anticipating that the Fed will indeed be able to cut rates," said Arnaud Girod, head of economics and cross-asset strategy at Kepler Cheuvreux in Paris.

European stocks rose for the third consecutive session, boosted by solid company earnings and renewed optimism the Federal Reserve will cut interest rates later this year. The Stoxx 600 is up 0.6%. UBS jumps more than 8% after it returned to profit and UniCredit climbed on better-than-forecast results. German semiconductor-maker Infineon Technologies AG cut its revenue forecast, signaling demand from the automotive industry remains weak.

Earlier in the session, Asia’s equity benchmark traded little changed on Tuesday as a catch-up rally in Korean and Japanese stocks on their return from a holiday was offset by declines in Hong Kong. The MSCI Asia Pacific Index rose 0.1% after capping a three-day gain on Monday. Technology was the best-performing sector in the region, much like in the US session overnight, amid rising hopes that the Federal Reserve may cut interest rates this year. Shares of Samsung Electronics and SK Hynix were the biggest contributors to gains on South Korea’s Kospi Index, which jumped 2%, the most in Asia. Shares in Hong Kong fell, with the Hang Seng Index snapping a 10-day winning streak that was the longest since 2018 amid some concern that the rally is overdone.

In FX, the Bloomberg Dollar Spot Index rose 0.1%, marking the second consecutive session of gains, as the greenback rose against most Group-of-10 currencies. The yen weakens 0.4% against the greenback, pushing USD/JPY up to ~154.50. The Aussie falls 0.4% after the RBA kept rates on hold and maintained a neutral stance.

- AUD/USD led losses falling as much as 0.6% to 0.6587, following the RBA’s interest rate decision; Australia’s central bank opted to maintain policy but markets likely expected the RBA to revert to prior guidance that a further increase in interest rates couldn’t be ruled out

- USD/JPY rose as much as 0.5% to 154.65, the highest level since May. 2, BOJ Governor Kazuo Ueda said he’s carefully watching the impact of the weak yen on prices and that he discussed recent moves with Prime Minister Fumio Kishida

- EUR/USD fell as much as 0.1% to 1.0754; German factory orders dropped 0.4% month-on-month in line with expectations, while eurozone March retail sales were up 0.8% from February

In rates, treasuries rose with US 10-year yields falling 3bps to 4.46%. Treasuries were underpinned by bigger gains in core European rates after Germany factory orders unexpectedly declined, pointing to persistent economic headwinds. During Asia session, Treasury futures drew support from dovish reaction to RBA maintaining its neutral bias, keeping interest rates at 4.35%. Focal points of US session include 3-year note auction, ahead of 10- and 30-year sales Wednesday and Thursday. US yields richer by 2bp to 3bp with the curve extending Monday’s flattening move; 10-year around 4.46% is ~2.5bp richer on the day with bunds and gilts outperforming by 1bp and 5bp in the sector. Treasury auction cycle begins at 1pm New York time with $58b 3-year note sale; $42b 10-year and $25b 30-year new issues follow Wednesday and Thursday.

In commodities, oil prices advance, with WTI rising 0.3% to trade near $78.70. Spot gold falls 0.4%.

In crypto, Bitcoin firmer today and has reclaimed the USD 64k handle, with Ethereum now holding around USD 3.2k.

Looking at today's calendar, US economic data slate includes March consumer credit at 3pm. Fed members’ scheduled speeches include Kashkari (11:30am, 1:20pm). Elsewhere we get, German March trade balance and factory orders data, French Q1 wages and Eurozone March retail sales. And as the earnings season continues to wind down, releases include Walt Disney, BP, Arista Networks, Duke Energy, McKesson, and Ferrari.

Market Snapshot

- S&P 500 futures little changed at 5,207.25

- STOXX Europe 600 up 0.6% to 511.10

- MXAP up 0.3% to 178.44

- MXAPJ up 0.3% to 552.71

- Nikkei up 1.6% to 38,835.10

- Topix up 0.6% to 2,746.22

- Hang Seng Index down 0.5% to 18,479.37

- Shanghai Composite up 0.2% to 3,147.74

- Sensex down 0.4% to 73,564.94

- Australia S&P/ASX 200 up 1.4% to 7,793.32

- Kospi up 2.2% to 2,734.36

- German 10Y yield little changed at 2.44%

- Euro little changed at $1.0762

- Brent Futures up 0.3% to $83.59/bbl

- Brent Futures up 0.3% to $83.58/bbl

- Gold spot down 0.3% to $2,315.95

- US Dollar Index up 0.16% to 105.22

Top Overnight News

- RBA leaves rates unchanged (as expected) and suggests there won’t by any additional hikes but also doesn’t seem in a rush to ease (new forecasts show no rate cuts until 2025). RTRS

- Taiwan’s CPI for Apr comes in below expectations, w/the headline number at +1.95% (vs. the Street +2.2% and down from +2.15% in Mar). BBG

- China tightened rules for hedge funds, raising the minimum-asset threshold of the 5.5 trillion yuan ($762 billion) industry while imposing restrictions on the use of derivatives and leverage. BBG

- Israel sent ground troops into Rafah on Monday night, seizing the main border crossing between Gaza and Egypt as international mediators struggled to continue talks aimed at ending the conflict. FT

- BP ended a mixed set of Big Oil results by maintaining share buybacks even as profit and cash flow fell more than expected. Aramco will pay $31 billion in dividends to the Saudi government and other investors despite lower profit. BBG

- UBS returned to profit with wealth management and the investment bank driving the beat. The firm targets another $1.5 billion in cost savings by year-end but sees integration expenses of $1.3 billion this quarter, and cautioned that the Swiss central bank’s recent rate cut will hurt NII. The stock climbed. BBG

- Social Security and Medicare will exhaust their funds in a little more than 10 years unless action is taken to address the shortfalls (although the new exhaustion dates for Social Security and Medicare are 1 and 5 years later than the prior forecasts). CNN

- Citigroup CEO Jane Fraser said Monday that consumer behavior has diverged as inflation for goods and services makes life harder for many Americans. Fraser, who leads one of the largest U.S. credit card issuers, said she is seeing a “K-shaped consumer.” That means the affluent continue to spend, while lower-income Americans have become more cautious with their consumption. CNBC

- AAPL has been working on its own chip designed to run artificial intelligence software in data center servers, a move that has the potential to give the company an advantage in the AI arms race. WSJ

- Donald Trump’s prized Manhattan office tower at 40 Wall St. is getting swept up by the worst storm to hit the office market since the global financial crisis. Like thousands of other U.S. office buildings, 40 Wall is now under duress because of weakening office demand. WSJ

Earnings

- Infineon (IFX GY) Q2 (EUR): Revenue 3.63bln (exp. 3.6bln), adj. EPS 0.42 (exp. 0.38), Gross Margin 38.6% (exp. 39.8%).

- BP (BP/ LN) Q1 (USD): Adj. Net 2.72bln (exp. 2.92bln). Revenue 49.96bln (exp. 52.44bln). Adj. EPS 0.16 (exp. 0.17). Dividend 0.0727 (exp. 0.0730)Announces USD 1.75bln share buyback for Q1. Continues to expect 2024 Capex around USD 16bln.

- Nintendo (7974 JT) 2023/24 (JPY): Net 490.6bln, +13.4%; Operating 528bln, +4.9%; Recurring 680bln, +13.2%. Sold 15.7mln Switch consoles in FY23/24 (exp. 15.5mln, prev. 17.9mln FY22/23). To make an announcement on a Switch successor in FY24; will not be announcing anything re. successor hardware at Nintendo Direct in June.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed as the region only partly sustained the momentum from Wall St where the major indices extended on post-NFP advances amid rate cut hopes, while key markets returned from the long weekend. ASX 200 traded higher with a further boost in late trade after the RBA proved to be less hawkish than many feared. Nikkei 225 gained on return from holiday as it took its first opportunity to react to last week's NFP report and renewed US rate cut hopes. Hang Seng & Shanghai Comp were subdued with the former set to snap its 10-day win streak and longest consecutive run of gains since 2018, while the mainland index took a breather after yesterday's catch-up rally amid a lack of fresh catalysts.

Top Asian News

- US will host China's special envoy for climate change Liu Zhenmin in Washington on May 8th-9th, according to the State Department.

- Japanese top FX diplomat Kanda said it is important for currencies to move in a stable manner reflecting fundamentals and the government must take appropriate steps if there's excessive volatility in the FX market, while he added it is usual that they don't comment whether currency intervention was carried out.

- RBA kept the Cash Rate Target unchanged at 4.35%, as expected, while it reiterated the Board remains resolute in its determination to return inflation to the target and it is not ruling anything in or out. RBA stated that returning inflation to the target within a reasonable timeframe remains the board’s highest priority, as well as noted that inflation remains high and is falling more gradually than expected. Furthermore, the RBA raised its inflation forecasts for 2024 but trimmed forecasts for GDP and unemployment, while its forecasts assume that rates will stay at 4.35% until mid-2025 which is nine months longer than previously assumed.

- RBA's Bullock says they must be vigilant on inflation risks, believe rates are at the correct level to get inflation back to target. Board discussed the option of hiking. Will tighten if necessary, do not think they necessarily have to tighten again. Should not read too much into the technical assumptions re. rate forecasts. Policy risks remain reasonably balanced.

- Nintendo (7974 JT) 2023/24 (JPY): Net 490.6bln, +13.4%; Operating 528bln, +4.9%; Recurring 680bln, +13.2%; is to make an announcement on a Switch successor in FY24. Will not be announcing anything re. successor hardware at Nintendo Direct in June

- Japanese Business Lobby Keidanren Chief Tokura says it is desirable for FX to reflect fundaments in mid and long-term; USD/JPY above 150 is "too much". Does not know if the authorities intervened in the FX market, but if they did, thinks timing was very good. Undesirable for FX to fluctuate through speculators.

- BoJ Governor Ueda had regular exchange of views with Japanese PM Kishida; discussed FX; confirmed with the PM that the BoJ will take into account impact of economy and prices which could be potentially big. Stands ready to keep close eye out on how JPY moves affect trend inflation; to closely monitor how a weak JPY will impact prices. Explained BoJ's stance of guiding policy from standpoint of sustainably reaching inflation goal.

APAC DATA RECAP

Top European News

- Barclaycard said UK April consumer spending fell 4.0% Y/Y (prev. +3.5%) which is the lowest since February 2021.

FX

- DXY is incrementally firmer and in a tight range thus far as markets await fresh impetus following last Friday's post-FOMC NFP-induced slide. DXY sits in a 105.03-28 intraday parameter, with 21 DMA at 105.20.

- EUR is moving in tandem with the Dollar, and has seen no notable catalysts this morning with key releases for the bloc also light this week. EUR/USD sits in a 1.0755-76 range after briefly dipping under yesterday's low (1.0753).

- GBP is subdued ahead of Thursday's BoE confab with the MPC expected to keep the Base Rate at 5.25%. GBP/USD trades in a 1.2533-70 range and dipped under its 200 DMA (1.2544).

- Modestly softer session for the JPY with USD/JPY reclaiming 154.00 status overnight (currently 154.50), whilst Japanese Business Lobby Keidanren Chief Tokura said FX should reflect fundaments in mid and long-term. Elsewhere, BoJ Governor Ueda spoke to PM Kishida regarding FX, though with specifics light.

- Divergence across the Antipodeans following the RBA policy decision in which the central bank left rates unchanged at 4.35% as expected, whilst analysts framed the release as less-hawkish-than-feared. AUD/USD trades in a 0.6588-6643 range.

- PBoC set USD/CNY mid-point at 7.1002 vs exp. 7.2143 (prev. 7.0994).

Fixed Income

- USTs are bid but holding a handful of ticks shy of Friday's 109-09+ payrolls peak & the 10yr yield is holding just above 4.45% by extension. Attention turns to the week's supply, with geopols also a key theme.

- Bunds have surpassed Friday's post-NFP 131.57 peak, printing a fresh high at 131.71. European specifics light with no reaction to the latest Construction PMIs as the broader market awaits a significant update to the Israel-Hamas situation around Rafah.

- Gilts gapped higher by 56 ticks after Monday's Bank Holiday, a move which accounts for that the geopol-related upside and a continuation of the post-payrolls dovish price action. Currently holding around 97.75 and higher by 79 ticks thus far.

Commodities

- Choppy session for the crude complex, as markets await updates from Israel/Rafah; most recently the operation has been said to be "limited". Brent Jul'24 trades between USD 83.30-83.82/bbl.

- Downbeat price action across precious metals despite a steady Dollar, with the complex failing to gain much impetus from a "limited" Israeli operation in Rafah. Spot gold trades in a USD 2,312.00-2,329.93/oz parameter.

- LME prices are mostly firmer as the exchange returns from the early May UK Bank Holiday. Elsewhere, JFE executives expects iron ore prices to remain at current levels in FY24/25 amid sluggish Chinese demand.

- US Senior Adviser for Energy and Investment Hochstein said the US has sufficient supply in Strategic Petroleum Reserve to address any supply concerns and the Biden administration is monitoring markets, according to Reuters.

- Russian Deputy PM Novak says possibility of raising production under the OPEC+ deal is being analysed, according to Interfax. There is no need to predict further OPEC+ steps, need to look at the market. Had agreed that oil output could be tweaked if needed.

- Commerzbank expects Palladium price to rise to USD 1100/troy oz (current 975.78) by end of the year; expects platinum to rise to USD 1100/troy oz (current 963) by end of year

Geopolitics: Middle East

- "Israeli source to CNN: The operation in Rafah is limited and aims to pressure Hamas to conclude an acceptable deal", according to Al Arabiya.

- Gaza crossings authority said the Israeli army stormed the Rafah crossing, according to Al Arabiya. However, Palestinian media said the Egyptian side informed the crossing's authority that Israeli vehicles are conducting a security operation in the vicinity of the Rafah crossing and will retreat tomorrow. It was later reported Israeli military took control of the Palestinian side of the Rafah border with Egypt, according to Bloomberg..

- US official said the US has concerns about Israel's unfolding Rafah strikes but it does not appear to represent a major military operation, according to Reuters.

- 100 congressional staff called on US President Biden and members of Congress to demand an immediate halt to the Israeli offensive before it is too late, according to Axios.

- Qatar Foreign Ministry said Hamas sent mediators its reply to the truce proposal on Monday and the reply could be described as "positive", while it was separately reported that the Qatari delegation arrives in Cairo on Tuesday to resume negotiations on a truce agreement in Gaza, according to Sky News Arabia.

- Jordanian Foreign Minister said Israeli PM Netanyahu is jeopardising the ceasefire deal by bombing Rafah, according to Reuters.

Geopolitics: Other

- A US soldier was detained on charges of criminal misconduct in Russia's far eastern city of Vladivostok last week.

- China reportedly hacked the UK Ministry of Defence with MPs to be told on Tuesday of a large data breach targeting service personnel, according to Sky News.

US Event Calendar

- 11:30: Fed’s Kashkari Participates in Fireside Chat

- 13:20: Fed’s Kashakari Speaks on Bloomberg TV

- 15:00: March Consumer Credit, est. $15bn, prior $14.1bn

DB's Jim Reid concludes the overnight wrap

It was a bank holiday here in the UK and it didn’t stop raining. I had an early round of golf and half way round the greens were flooded and I was drenched. I may have called it a day but the alternative was childcare. Golf in a biblical downpour is more enjoyable that looking after three bored kids inside on a very wet day. The afternoon was proof of that.

The skies are reasonably bright in markets at the moment with the S&P 500 (+1.03% yesterday) extending its 3-day gain to +3.24% last night, the best such run since November. For 10-year yields, the 4-day decline (-19.3bps) is the largest since the start of February. The lack of a ceasefire in the Middle East hasn't so far impacted sentiment.

A strong close to the US session saw the Magnificent 7 (+1.68%) eke out a new all-time high, with the index up more than 10% from its recent low on April 19. Nvidia (+3.77%) and Meta (+3.04%) led the gains amid the mega caps, but the equity advance was broad-based with 76% of the S&P 500 higher on the day. Small caps also saw a modest outperformance, with the Russell 2000 up +1.23%. Europe’s equity markets recorded a more moderate rise earlier on, including for the Stoxx 600 (+0.53%), Dax (+0.96%), CAX (+0.49%), while FTSE MIB outperformed (+1.06%).

The equity move was helped along by the ongoing bond rally, as 10yr Treasury yields (-2.2bps) declined for a fourth consecutive session to 4.49%, their lowest level since the upside surprise in the March CPI print on April 10. The upcoming CPI print next Wednesday (May 15) will surely be key to the sustainability of this rally. The decline in yields did run out of steam at the front end, with 2yr yields up +1.5bps after falling by -21.8bps over the previous three sessions.

This came as Fed commentary largely echoed Powell’s tone last week, moving away from any signal on the timing of rate cuts but avoiding overtly hawkish messages. Richmond Fed President Barkin said he was “optimistic that today’s restrictive level of rates can take the edge off demand in order to bring inflation back to our target“, noting that “the full impact of higher rates is yet to come.” And New York Fed president Williams signaled eventual rate cuts, though with the timing of these to depend on “the totality of the data”.

We received the latest signal on the impact of the Feds’ earlier tightening with the latest quarterly Senior Loan Officer Survey. This showed the tightness in credit standards continuing to moderate for most loan categories, including mortgages and CRE lending. However, the improvement in conditions for commercial & industrial loans stalled, with credit standards for mid-size and large firms a little tighter (+15.6 vs. +14.5) and demand a little weaker (-26.6 vs. -25.0) than in the previous quarter. Nothing to get too concerned about, but some evidence to support the view that a good chunk of the impact from the tighter policy stance is yet to play out. The question is where will rates and credit standards be by the time borrowing needs accelerate.

Over in euro area, the final April PMIs added to the improving growth picture, with upward revisions to the services (53.3 vs 52.9 flash) and composite (51.7 vs 51.4 flash) readings. The euro area composite is at an 11-month high and has moved above the US one for the first time in 12 months. In other data, euro area PPI inflation for March came in line with expectations at -0.4% month-on-month. This did little to dissuade expectations of a June ECB cut, with ECB chief economist Lane noting in an interview that data since the April meeting “ improve my confidence that inflation should return to target in a timely manner ”. Overnight index swaps continued to price 74bps of ECB rate cuts this year, with a June cut 95% priced. 10yr bonds saw a similar modest rally in Europe as in the US, with yields on bunds (-2.7bps), OATs (-2.3bps) and BTPs (-2.2bps) all moving slightly lower.

In the commodity space, oil prices saw some volatility amid mixed Middle East headlines. Having opened higher on Monday, oil prices briefly fell to flat on the day following news that Hamas accepted a cease-fire proposal brokered by Egypt and Qatar . However, they rallied again soon after on reports that Israel’s’s war cabinet rejected the proposal as being “far from Israel’s necessary demands,” with Axios and AP reporting overnight that Israeli troops had entered the southern Gaza city of Rafah. After falling to a seven-week low on Friday, Brent crude ended Monday’s session +0.45% higher at $83.33/bbl, and is trading around another +0.30% higher overnight as I type. This backdrop also boosted gold, which gained +1.04% to $2,326/oz yesterday.

In Asia, the KOSPI (+1.91%) is leading gains hitting a one-month high with the Nikkei (+1.18%) also seeing notable gains as trading has resumed in both markets after a public holiday. Additionally, the S&P/ASX 200 (+1.25%) is spiking higher as we type after the RBA left rates on hold but could have been more hawkish than they were. The Aussie Dollar has weakened -0.40% with 3yr government bonds yields declining -8.6bps, to trade at 3.94% as I type.

Elsewhere, Chinese stocks are bucking the regional trend with the Hang Seng (-0.69%), the CSI (-0.12%) and the Shanghai Composite (-0.08%) all trading lower. US futures are flat and Treasury yields are edging slightly lower.

The Japanese yen (-0.38%) continues to drift lower trading at 154.50 against the dollar despite fresh warnings from Japanese officials following two rounds of suspected FX intervention last week. Notably, top currency official Masato Kanda indicated that the government will respond appropriately if there are excessive or disorderly movements in the FX market.

Central bank decisions will remain in focus for the rest of the week, most of all with the BoE on Thursday. Our UK economist expects this week’s meeting to set the stage for the first rate cut in June (see his preview here). Before that, tomorrow the Riksbank could deliver its first rate cut of the cycle. Finally, we have the accounts of April ECB meeting on Friday, and with plenty more ECB and Fed speak to digest before the end of the week. It will quieter be on the data front, with the University of Michigan consumer survey on Friday the arguable highlight given the recent softening in US consumer confidence indicators.

To the day ahead, data releases will include US March consumer credit, Germany March trade balance and factory orders data, France Q1 wages and Eurozone March retail sales. In central bank speak, we will hear from the Fed's Kashkari, and the ECB's De Cos and Nagel. And as the earnings season continues to wind down, releases include Walt Disney, BP, Arista Networks, Duke Energy, McKesson, and Ferrari.

Book Recommendation: “The Spiritual History of English,” by Andrew Thornton-Norris

A new edition, revised, expanded and published by Os Justi Press

What makes literature or art Christian? Some would say just

the content, that is, what is said; others would

say both the content and the form, because the way in which

certain truths are conveyed can communicate them more

fully. It’s not just what you say that’s important, but also how

you say it.

If this is the case, the style David Claytonhttp://www.blogger.com/profile/07041908477492455609noreply@blogger.com0

THE DEVELOPMENT OF THE “DOCTRINE” OF BLESSING SINFUL SEXUAL UNIONS—AND IT IS HAPPENING QUCKLY THANKS TO POPE FRANCIS

The are images not a videos:

When I was ordained in 1980, girls were not allowed to be altar boys, I mean, servers. But that did not stop many parishes in the USA from having them. Bishop Lessard of the Diocese of Savannah, knew that many of his parishes had them, including my first parish as “associate pastor” in Albany, Georgia.

When I was ordained in 1980, girls were not allowed to be altar boys, I mean, servers. But that did not stop many parishes in the USA from having them. Bishop Lessard of the Diocese of Savannah, knew that many of his parishes had them, including my first parish as “associate pastor” in Albany, Georgia.

Thus he came up with a diocesan policy that allowed girls to serve as candle and cross bearers, and vested in different liturgical garments than the boys were. Only altar boys could minister directly to the priest by holding the Roman Missal, then called the Sacramentary” and handing the water and wine to him and also washing his hands. Only boys could help with the incense.

That did nothing to stop the process of doctrinal development that has led to the full inclusion of girls as altar boys, I mean, servers. And in fact, Pope Francis has now opened the formal ministries of reader and acolyte to women, once only for men studying for the priesthood. I wonder where that will lead? Of course to women deacons, then eventually priests and bishops and one day as pope.

To see how quickly a policy can develop, all you have to do is to go to the Archdiocese of Chicago’s Saint Vincent de Paul’s Church to see a priest bless the union of two Lesbians, one of whom is a Methodist Minister, in his Church and near the altar.

It is clearly a blessing of their union as spouses. It isn’t spontaneous but planned.

This is the first stage of the development of doctrine that Pope Francis intends for Feducia Supplicans. Pope Francis knows what he is doing and how to accomplish the development of doctrine.

Stay tuned.

You can read the updated “Our Sunday Visitor” article by pressing the following:

Updated May 1, 2024: adds detail about minister’s Arizona church assignment. (OSV News) — A Methodist minister has sought a blessing on her same-sex...

YOU CAN WATCH THE INSTAGRAM VIDEO OF THE RENEWAL OF VOWS AND BLESSING OF THE HOLY SPOUSES OF TWO LESBIANS OFFERED BY THE CATHOLIC PRIEST HERE!

Evil Twins: US Federal Budget Deficits and US Trade

The government’s inflationary borrow-and-spend policies have given Americans a false sense of prosperity. In the end, such policies are unsustainable.