To live without faith, without a patrimony to defend, without a steady struggle for truth – that is not living, but existing.

Distinction Matter - Subscribed Feeds

-

Site: Mises InstituteProgressive historians, journalists, and politicians claim that the Industrial Revolution and the growth of industry brought poverty and exploitation to American workers. The truth is much different, even if it is rarely heard.

-

Site: Mises InstituteProgressives claim that profits are an unjust transfer of wealth from the poor to the rich. In reality, entrepreneurs earn profits by directing resources from less valued to more valued uses to satisfy consumer needs.

-

Site: Mises InstituteDespite the accusations that Javier Milei is a fascist in libertarian clothes, many of his reforms have been successful in reversing some of the damage done to Argentina's economy by real fascists.

-

Site: Mises InstituteWhile Austrian and feminist critiques of neoclassical economics have some similarities, they also differ strongly on important points. Feminist critiques are based upon what Mises called polylogism, while Austrian critiques are based upon praxeology.

-

Site: Mises InstituteWhat better way to explain the relationship between higher-order and lower-order goods than with food? Here, we look at the falafel sandwich.

-

Site: Mises InstituteCongress claims to have targeted TikTok because China's government allegedly uses it to spy on Americans. Besides dealing with a nonexistent threat, the bill gives the federal government vast new powers to misuse.

-

Site: Mises InstituteSomalia is a country invented by European intervention. The region known as Somaliland ought to be free to secede from this imperialist creation.

-

Site: Zero HedgeRed Lobster Abruptly Closes "Dozens" Of Locations, Loses Its Key Supplier And Begins Fire Selling Kitchen EquipmentTyler Durden Tue, 05/14/2024 - 08:55

Restaurant chain Red Lobster appears to be the latest beneficiary of "Bidenomics", with reports surfacing this week that "dozens" of its locations across the country are unexpectedly closing down.

More than 80 locations in at least 27 states have now been listed as "temporarily closed" on the restaurant chain's website, according to CBS affiliate WBNS.

The report said that workers at the locations were offered "no notice whatsoever" as to the closings. The Orlando-based seafood chain known for its endless shrimp deals has been struggling with significant internal and financial challenges, the report says.

Recently, the company faced rumors of bankruptcy as it sought a buyer to avoid filing for Chapter 11, with multiple media outlets reporting the potential filing last month.

It was reported that it might file for bankruptcy to restructure its debt and reduce its 650 US locations.

The chain underwent considerable leadership changes in 2021 and 2022, with new appointees in several top positions including CEO, chief marketing officer, chief financial officer, and chief information officer, all of whom departed within two years - usually not a sign things are moving in the right direction.

Last summer, the company reintroduced its endless shrimp menu deal, which resulted in an $11 million loss.

Even more devastating, CBS reports that Thai Union, Red Lobster's top supplier, has severed ties with the chain.

A liquidation company has started an online auction for kitchen equipment and other contents from the closed Red Lobster locations, the report adds.

Amid these developments, the company has not publicly commented on the recent closures of several locations nor responded to inquiries about them.

-

Site: Ron Paul Institute - Featured Articles

From its founding in 1949 until the start of NATO’s proxy war against Russia in 2022, the principal troublesome issue for the Alliance was Washington’s repeated calls for greater burden-sharing on the part of its allies. Discontent on Washington’s part emerged early and often. President Dwight D. Eisenhower’s Secretary of State, John Foster Dulles, warned NATO’s European members that unless they did more to enhance collective defense the United States might be compelled to reassess the extent of its commitment to Europe’s security. That warning led to repeated promises of greater defense efforts on the part of the allies. Those promises were rarely followed by meaningful actions, however.

Such continued manifestations of free-riding generated periodic US calls to reduce Washington’s overall military commitment to Europe. That sentiment reached a crescendo in the late 1960’s and early 1970’s. The most serious substantive effort took the form of the Mansfield, Amendment, which proposed to reduce the US troop presence in Europe by approximately one- third. The principal sponsor was Senate Majority Leader Mike Mansfield (D-MT). Both Lyndon Johnson’s and Richard Nixon’s administrations waged a vigorous fight against the proposed legislation. Henry Kissinger, Nixon’s national security advisor, eventually led a successful fight against the proposal. Nevertheless, calls for similar action continued during subsequent administrations. Donald Trump was especially vocal in his demands for the Europeans to engage in more substantial burden-sharing.

NATO burden-sharing, however, remained much more prominent in the realm of rhetoric than substance. In 2006 and again in 2014, Alliance members promised to devote a minimum of 2 percent of their annual gross domestic product to defense. At the time that military tensions between Russia and Ukraine exploded into full-scale warfare in February 2022, those promises had remained largely unfulfilled. Despite NATO members embracing a highly confrontational policy toward Moscow, only 11 of the 31 NATO members were fulfilling their pledge of 2 percent GDP for defense. Russia’s invasion, however, led to a more serious commitment to burden-sharing. The nature of that concept also changed in two ways. Two prominent neutral powers now abandoned neutrality and applied to join the alliance. Both Sweden and Finland were prepared to join the Western bloc directed against Russia. This was a crucial development, especially for Sweden, which had been strictly neutral in international conflicts for nearly two centuries. Stockholm had even managed to avoid entanglement in the two world wars. Helsinki’s neutrality was far less voluntary. It occurred during the Cold War only because of the Soviet Union’s intense pressure. In any case, the addition of two significant military players to NATO has increased a dangerous rivalry between two competing blocs.

The other significant change in the burden-sharing concept was that previously, the NATO allies seemed to regard Washington’s desire for greater burden-sharing largely in financial terms. In other words, to both the Europeans and the United States, burden-sharing was seen primarily in terms of the European members paying a little more for policies that remained under Washington’s firm control. Now, however, burden-sharing seems to mean more involvement on the part of Europe’s NATO members with respect to weapons and strategic initiatives. Not only have those countries become more responsive to Washington’s calls for military assistance to Ukraine, several of them, including Poland, Romania, and the Baltic republics, have been taking the lead and pushing the United States to take more action against Russia.

Washington seems content with this arrangement, which amounts to a US proxy war strategy, with Ukraine handling the actual fighting against Russia and with Kiev receiving ample weaponry from NATO members. That military hardware has been coming as much from certain European alliance members as from the United States. Moreover, there has been a steady escalation in NATO’s willingness to supply ever more lethal armaments to Ukraine. For example, early in the fighting, NATO countries were primarily providing weapons with limited reach and lethality. Both aspects have gradually changed. One early escalation was to provide Ukraine with sophisticated anti-tank weapons. Now, weapons shipments even include longer range missiles capable of striking targets inside of Russia. Several allies have successfully pressured Washington into providing more destructive weapons that Biden administration leaders initially refused to authorize. Patriot air-defense missiles and M-17 Abrams tanks are two examples of such escalation.

There are growing rumors of another round of escalation that could be even more dangerous. Some alliance leaders, especially in NATO’s Eastern members, are no longer ruling out providing “volunteers” to help Ukraine in direct combat roles. Such a move would be extraordinarily dangerous and greatly increase the risk of armed clashes between Russia and NATO forces that could lead to World War III. There are media reports that as many as three thousand armed volunteers from foreign countries are already in Ukraine assisting the Ukrainian regime.

It is hard to accept the frightening possibility that Western policy has made Europe’s strategic situation even more dangerous than it was at the height of the Cold War. However, that appears to be the possible consequences of NATO’s evolving policy.

Reprinted with permission from Antiwar.com.

-

Site: LifeNews

Arizona Governor Katie Hobbs has signed the bill to repeal Arizona’s abortion ban, making it so babies will continue being aborted in the southwestern state. But that repeal doesn’t go into effect until later in the year.

Desperate to kill babies in abortions, the Planned Parenthood abortion business filed suit to repeal the abortion ban early.

But the Arizona Supreme Court’s decision Monday rejected that request from the abortion giant. The decision denied an attempt by Planned Parenthood to halt judgment affirming the state’s pro-life law, but to allow a delay for Attorney General Kris Mayes to consider an appeal.

In a response filed today, Alliance Defending Freedom attorneys asked the court to finalize its judgment affirming the state’s pro-life law, but the court temporarily paused that process, allowing the attorney general up to 90 days to consider an appeal.

“Life is a human right, and Arizona’s pro-life law respects that fundamental right. Life begins at conception,” Alliance Defending Freedom Senior Counsel Jake Warner told LifeNews. “At just six weeks, unborn babies’ hearts begin to beat. At eight weeks, they have fingers and toes. And at 10 weeks, their unique fingerprints begin to form.”

“Arizona’s pro-life law has protected unborn children for over 100 years, and while we are deeply saddened by the legislature’s recent vote to repeal the law, it won’t take effect immediately, as the legislature intentionally decided. And though the court paused its judgment, we will continue working to protect unborn children and promote real support and health care for Arizona families,” he continued.

In a gleeful message, Hobbs celebrated her own signing of the bill.

SUPPORT LIFENEWS! If you want to help fight abortion, please donate to LifeNews.com!

“With the stroke of my pen, the 1864 abortion ban is about to OFFICIALLY become a thing of the past,” she wrote on X (Twitter).

However, under the state Constitution, any law repeal doesn’t take effect until 90 days after the legislative session ends, and the end date can vary. For example, if this session ends in late July like last year, the repeal would only become effective in late October or early November.

This week, the Arizona Senate bowed to the pro-abortion mob by approving a measure to repeal the state’s new abortion ban before it ever reached implementation to begin saving babies.

With the ban repealed, babies would lose almost all protection in the state. A 15-week abortion ban would go into place that only allows protecting babies up to that point – meaning 90% of more abortions would become legal.

Two Republicans, T.J. Shope and Shawnna Bolick, sided with Democrats to deliver enough votes to pass House Bill 2677, which would repeal the pro-life law that made Arizona one of 19 states to protect babies from abortion.

Bolick described herself as pro-life but said she supported abortions in some rare circumstances. Instead of backing legislation to allow abortions in those very rare cases, she voted to subject every single unborn children to potentially be killed in an abortion.

State Sen. Jake Hoffman condemned the Republican members who voted in favor of the measure and other Republicans complained the bill was fast-tracked through the legislature instead of committees having time to evaluate the legislation and take public input.

The Arizona Life Coalition was saddened by the developments.

“This repeal signifies more than a legislative shift; it marks a profound loss for those who stand for the sanctity of every innocent human life from conception,” it told LifeNews. “Every abortion is a loss of a priceless human being and a failure to protect the most defenseless among us.”

The post Arizona Supreme Court Rejects Planned Parenthood’s Request to Get Rid of Abortion Ban Early appeared first on LifeNews.com.

-

Site: Zero HedgeUS Producer Prices Accelerating At Fastest Rate In 12 Months, Wall Street Reacts...Tyler Durden Tue, 05/14/2024 - 08:43

Ahead of tomorrow's CPI, traders are eyeing this morning's Producer Prices for any hints that the disinflation trend will return...or not.

The answer is "not!"

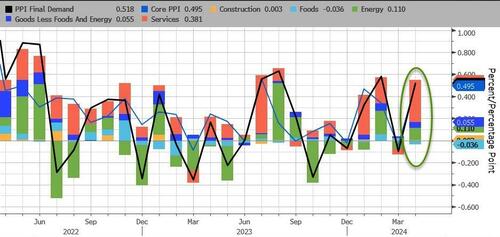

April Producer Prices rose 0.5% MoM (vs +0.3% exp), with March's +0.2% MoM revised down to -0.1% MoM. The downward revision did not stop the YoY read rising to 2.2% (from +2.1% in March)...

Source: Bloomberg

This is the highest YoY read since April 2023 and is the fourth hotter than expected headline PPI print...

Source: Bloomberg

Producer Prices have been aggressively downwardly revised for 4 of the last 7 months...

Source: Bloomberg

Services costs soared, dominating April's PPI gains with Energy the second most important factor. Food prices actually declined on a MoM basis.

Source: Bloomberg

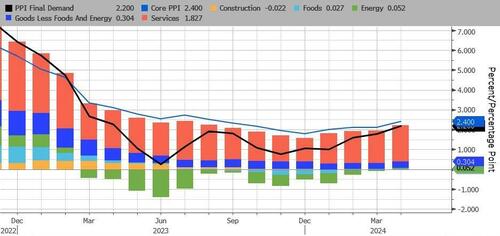

On a YoY basis, headline PPI's rise was dominated by Services (rising at their hottest since July 2023). For the first time since Feb 2023, none of the underlying factors were negative on a YoY basis...

Source: Bloomberg

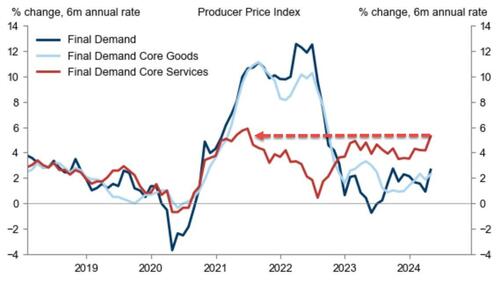

On a 6-month annualized rate, Final Demand Core Services PPI is rising at its highest since Q3 2021...

Source: Goldman Sachs

After last month's farcical 'seasonally adjusted' gasoline price, April saw the PPI Gasoline index rise (with actual prices at the pump) but still has a long way to go...

Source: Bloomberg

Core PPI was worse - rising 0.5% MoM (more than double the +0.2% MoM expected) - which pushed the Core PPI YoY up to +2.4%...

Source: Bloomberg

And finally US PPI Final Demand Less Foods Energy and Trade Services rose by 0.4% MoM and 3.1% YoY (the highest in 12 months).

Worse still the pipeline for primary PPI is not good as intermediate demand is starting to accelerate...

Source: Bloomberg

Here are Wall Street’s reactions to PPI:

Chris Larkin at E*Trade from Morgan Stanley:

Sticky inflation looked downright stuck this morning after a much hotter-than-expected inflation reading. But with last month’s numbers revised lower, this report may not have been as much of an upside shock as it first appeared to be.

Right or wrong, the CPI tends to have a bigger short-term impact on the markets, so the picture could look much different 24 hours from now. But if the CPI also comes in above expectations, the interest rate picture may be thrown into doubt.Bespoke Investment Group:

The results of April’s PPI showed a hotter-than-expected m/m reading. That’s the bad news. On a y/y basis, though, the readings were much closer to expectations as March’s report was revised down to negative 0.1% on both a headline and core basis.”

Chris Zaccarelli at Independent Advisor Alliance:

This week is important for markets because they are worried about inflation and this morning’s producer price index hasn’t done anything to assuage those fears.

The most important data release is tomorrow’s CPI print because the Fed’s dual mandate is based on CPI and unemployment, with the former being what the Fed is solely focused on right now.

We believe that the stock market will move higher throughout the year on strong corporate profits and consumer spending, but volatility is likely to spike in the meantime, because the inflation data is going to keep the Fed on edge.Quincy Krosby at LPL Financial:

Moreover, this report underscores Fed concerns that the path of disinflation has stalled, requiring a higher-for-longer policy stance to combat seemingly entrenched inflation.

An overriding question — and potential dilemma — hovering over markets is whether the broader economic landscape is softening at the same time inflation inches higher, making the Fed’s job increasingly difficult.Bill Adams at Comerica Bank:

Between an upside surprise and downward revisions to prior data, the trend in total PPI was slightly higher than expected in April.

The PPI report suggests upside risk to the April CPI report, which will come out tomorrow.

At the margin the Fed will see the PPI report as another reason to slow-roll interest rate cuts.Paul Ashworth at Capital Economics:

These days we mostly care about what the PPI means for the Fed’s preferred PCE deflator measure of core consumer price inflation.

In that respect, April’s news was mixed but, on balance, encouraging. The bad news is that PPI portfolio management prices increased by 3.9% m/m. But that was more than outweighed by the good news. We’ll know more after the release of April’s CPI tomorrow.Scott Helfstein at Global X:

Inflation and the Fed are less important than growth, and companies have adjusted to the new reality of higher prices and continue to look for technology solutions to manage for profit.

The last mile on inflation was always going to be the hardest, but we should be comfortable with these numbers.Over the past month, 'higher prices' have dominated 'lower prices' in recent survey data...

Higher producer prices:

- New York Empire manufacturing price paid advanced to 33.7 from 28.7.

- Philadelphia Fed manufacturing reported prices paid gained to 23.0 from 3.7 in March.

- Philadelphia Fed non-manufacturing prices paid rose to 31.0 from 26.6 in the prior month.

- Richmond Fed services prices paid rose to 6.11 from 5.43 in March.

- Kansas City Fed manufacturing prices paid advanced to 18 from 17.

- Kansas City Fed services input price growth continued to outpace selling prices.

- S&P Global manufacturing input cost inflation quickened to hint at sustained near-term upward pressure on selling prices.

- ISM Manufacturing prices paid gained to 60.9, the highest since June 2022, from 55.8 in March.

- ISM Services prices paid notched up to 59.2, the highest since January, from 53.4 in March.

Lower producer prices:

- New York Fed Services prices paid fell to 53.4 from 55.1 in March.

- Richmond Fed manufacturing growth rates of prices paid dipped to 2.79 from 3.22 in March

- Dallas Fed Manufacturing outlook reported prices paid for raw materials dropped to 11.2 from 21.1 in the prior month.

- Dallas service sector input prices index nudged down to 28.8 from 30.4 in the prior month.

- S&P Global Service saw input costs slowed from six-month highs in March.

Do you see the 'flation' now, Jay?

So, no, The Fed does not have inflation under control.

However, there is some hope for tomorrow's CPI as many of the drivers for the consumer prices that are echoed in the producer prices are not accelerating...

No reason to be alarmed by PPI... Strong stock market performance drove part of the gains, but airfares down sharply, auto insurance flat, and general consumer goods markups down... https://t.co/8478c7rykF

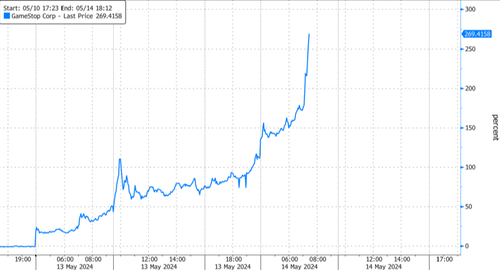

— Gregory Daco (@GregDaco) May 14, 2024A big surprise miss tomorrow, of course, would send stocks to the moon (GME-style) and give Powell what he needs to start cutting.

-

Site: Zero HedgeMarkets Now Face Make Or Break Inflation DataTyler Durden Tue, 05/14/2024 - 08:20

By Michael Msika, Bloomberg markets live reporter and strategist

European stocks are hovering around record highs on conviction that interest rates will come down and revive the economy, making this week’s inflation data a key to extending the rally.

Monetary policies in the US and in Europe are expected to diverge for a few months, with the European Central Bank seen cutting rates earlier than the Fed with inflation looking more in check on the old continent. Yet, US data is always in the driver’s seat when it comes to financial markets, and this week should be no exception, making it all about US CPI.

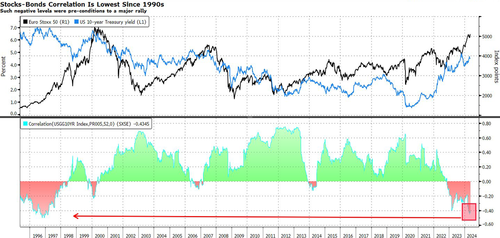

Whatever the print, the impact that the figure may have on bond yields is looking increasingly important as the correlation between European equities and US treasury yields is now the most negative since the mid-1990s, a pre-condition to a major rally back then.

Morgan Stanley strategists led by Marina Zavolock see the case continuing to build up for a 1990s play-book that saw stocks rallying around the Fed pivot, driven by bond-sensitive sectors like real estate, construction and materials, as well as utilities. “A key catalyst to make or break the trade is this week’s US CPI print,” they say.

The disinflation process is continuing but has been stalling in past months, triggering a repricing in the outlook for rate cuts, particularly in the US. Yet, the subsequent wobble seen in stock markets in April has now been erased, with volatility back to subdued levels both in the US and in Europe. In fact, our preferred measure of near-term stress, the 2/8 VIX future spread is already back to calm levels.

“We think vol (VIX) and vol-of-vol (VVIX) have now found a lower bound in the near-term,” say UBS derivatives strategists led by Maxwell Grinacoff, seeing over 1% implied move for the market on CPI data. “We favor selling puts to fund upside call spreads to position for a moderate retracement higher in volatility risk premia ahead of key CPI and retail sales data.”

Granted, the market has been sensitive to macro data, especially inflation, as shown in the chart below. While some of the moves have often been short-lived, investors may want to keep in mind that the S&P 500 has not had a 2% drop in over 300 trading days, which is abnormal, so some deeper correction can’t be excluded based on history.

Still, one thing that could play in favor of the market is that positioning is now a bit more balanced. While vol control funds’ allocation is still near the historical maximum, CTAs have reduced their equity long positions globally, and risk parity funds also trimmed their exposure to around historical average, according to Deutsche Bank strategists.

“Squeeze risks for rate-sensitive laggards on a CPI miss outweigh downside risks on a CPI beat,” say Bank of America derivatives strategists including Ohsung Kwon. They add that with inflation above consensus for five straight months, the rates market has already priced out five cuts so far this year. But they see equities able to tolerate higher inflation. An in-line print should also be net positive, removing the inflation overhang at least in the near term, they say.

“We expect this week’s April CPI report will likely be central to market participants’ focus and the tone that the market will likely take on near term,” says Oppenheimer Asset Management chief strategist John Stoltzfus. “Near-term volatility could in our view continue to present opportunity for investors to ‘catch babies that get thrown out with the bath water’ in periods of market down drafts.”

-

Site: AsiaNews.itInternational Nurses' Day offered an opportunity to acknowledge this valuable service. The event also highlighted the violence they often endure because of their gender and beliefs. Sister Alvina, a Franciscan in charge of the parish's medical dispensary for 30 years, laments that nurses are 'often discriminated' and 'discouraged by their superiors in hospitals.'

-

Site: Zero HedgeAMC Raised $250 Million In ATM Offering As 'Meme' Stocks Rocket HigherTyler Durden Tue, 05/14/2024 - 08:05

Update (0915ET): Is this 'meme stock frenzy', The Fed's fault once again?

The last time US financial conditions were this easy (jawboned by Fed officials' pivot) was the start of the first manic meltup in GME and its meme-mates...

The meme mania has started to spread with not just AMC and GME, but Virgin Galactic, BlackBerry, Nikola, and SunPower all soaring among many others...

* * *

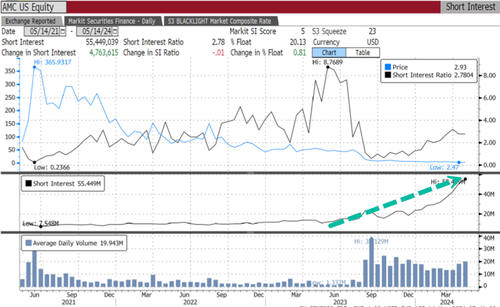

With AMC Entertainment and GameStop's short squeezes causing significant losses for short sellers on Monday, we noted the growing likelihood that "bankers are burning the phones at GME and AMC pitching ATM equity offerings for after the close."

You know jefferies bankers are burning the phones at GME and AMC pitching ATM equity offerings for after the close

— zerohedge (@zerohedge) May 13, 2024Fast forward to Tuesday morning.

And there it is

— zerohedge (@zerohedge) May 14, 2024

AMC Raised About $250M of New Equity Capital in ATM Offering

Thank you retail investors https://t.co/MPu8vfEmNzAnd this.

And 99% of the stock was sold yesterday bro

— zerohedge (@zerohedge) May 14, 2024Bloomberg reports that AMC completed a previously disclosed ATM on March 28. The deal was completed through Citigroup Global Markets, Barclays Capital, B. Riley Securities, and Goldman Sachs & Co., raising about $250 million in new capital for the struggling company - at an average price of $3.45 per share - or about 72.5 million shares.

Meanwhile, AMC is up 95% in premarket trading in New York, trading around the $10 handle. In the last two days, shares are up a whopping 232%.

Before yesterday's ripper, AMC was a perfect candidate for a squeeze, with 55.4 million shares, or about 18.82% of the float short.

The revival of the 'Meme day trading army' - occurred oddly with a post on X from Roaring Kitty, also known as Keith Gill, on Sunday night.

— Roaring Kitty (@TheRoaringKitty) May 13, 2024GameStop is also higher in premarket, +124% to the $68 handle, on yet another massive short squeeze. In two days, shares have squeezed over 269% higher.

Hedge funds were scorched in yesterday's Meme stock squeeze.

Hedge funds got roasted in today’s Meme Stock squeeze.

— David Marlin (@Marlin_Capital) May 14, 2024

We just witnessed a 4-Sigma day in HF VIP Longs vs Most Shorted Stocks (-5.9%).

This is the 2nd worst day since the original Meme Stock Mania. $GME $AMC $NVAX $BYND pic.twitter.com/fIjZDGZiehGS' Most Shorted Stock Index had the largest single-day increase since mid-December.

On Monday, we cited a note from Goldman Sachs flow of funds guru, Scott Rubner, who told clients, "I am starting to see some real FOMO start to develop based on incomings last week. Roaring Kitty is back, the message boards are going crazy this am. It is time for a thread."

Being a squeeze, and just a squeeze, nothing is constant - and what goes up, at some point - after the hedge funds are roasted - must come down—yet another painful lesson.

-

Site: RT - News

Estonia’s defense minister has dismissed remarks by a presidential advisor regarding a possible military deployment

Estonian Defense Minister Hanno Pevkur has insisted that neither Tallinn nor the European Union are considering proposals to deploy troops to Ukraine.

He was commenting on remarks made by Madis Roll, the national security advisor to Estonian President Alar Karis, who told news outlet Breaking Defense last week that the country was “seriously” considering sending troops to fill “rear” roles in Ukraine.

According to Roll, the Estonian government is weighing up the potential move in a bid to help Kiev solve its manpower problem and send more soldiers to the front line.

The article reported that Estonian troops could be positioned away from the battlefield and assume non-direct combat roles from Ukrainian Armed Forces in order to free them up to fight on the front line.

The outlet said Roll had suggested that the move could be part of a full NATO mission “to show broader combined strength and determination,” but didn’t rule out the possibility of Estonia acting with a smaller group of allies.

The idea “has not reached anywhere” either in Estonia or at EU level, Pevkur said, adding that there had been no specific discussion within government on the matter.

Read more Baltic state backs sending NATO troops to Ukraine

Baltic state backs sending NATO troops to Ukraine

“I think that, according to Madis Roll, it has perhaps been interpreted too boldly” he told ERR. “There is certainly no initiative of Estonia’s own, and Estonia is certainly not going to do anything alone,” added the defense minister.

Estonia, along with Latvia and Lithuania, has been at the forefront of the West’s confrontation with Moscow since the beginning of the Ukraine conflict in 2022. Tallinn and the other Baltic states have long touted a strategy of backing Kiev with NATO troops.

Last week, Lithuanian Prime Minister Ingrida Simonyte told the Financial Times that she had been given the authority by parliament to deploy troops to Ukraine for training, but that Kiev had not made such a request.

Lithuanian Foreign Minister Gabrielius Landsbergis told The Guardian last week that he favors deploying NATO military instructors with air defense cover to Ukraine.

In recent months, French President Emmanuel Macron has repeatedly floated the idea of sending NATO troops to Ukraine. Several other member states have pushed back against Macron’s comments, however, insisting they have no plans to deploy troops.

Russia has repeatedly warned that it would view any NATO troop deployments in Ukraine as a major escalation, adding that it would not change the situation on the battlefield.

-

Site: Zero HedgeAnglo Goes Bold: Unveils Breakup Plan To Transform Into Copper Giant Amid BHP Takeover BattleTyler Durden Tue, 05/14/2024 - 07:45

London-listed Anglo-American has unveiled a "clear, compelling, and decisive plan to unlock significant value from its portfolio." This strategy involves selling its platinum and diamond business units while concentrating on copper, positioning itself to prosper off the 'Next AI Trade' as data centers and power grids will use an enormous amount of the base metal to 'power up' the digital economy. Also, it's a move to thwart a hostile takeover attempt from BHP Group.

Anglo was forced to radically transform itself into a copper giant because of BHP's twice-rejected takeover bid, now worth £34 billion ($43 billion). The move also responds to shareholder pressure to focus on copper assets and demerge its stakes in less profitable ones, such as its steelmaking unit, coal business, Anglo American Platinum, and De Beers (diamonds).

Anglo Chief Executive Officer Duncan Wanblad's major overhaul aims to replicate rival BHP CEO Mike Henry's proposed idea of transforming Anglo into one of the world's biggest copper giants.

Financial Review noted that Wanblad plans to wait until after the South African elections on May 29 before announcing his complete restructuring of the company, which will need South African government approval for a demerger of its platinum and diamond mines.

"The only thing the BHP bid [did] was force the timeline on work we were already doing," Wanblad said on a call at 0300 ET. He will present the overhaul plan at the Bank of America Global Metals, Mining & Steel Conference in Miami, Florida, today.

He continued, "I would probably not have announced this at this particular point in time, it would have been just a little bit later … I would have been much more sensitive in terms of the stakeholder management of this, but I now have no option."

In markets, Anglo shares in London slipped by 3%, while BHP's shares increased by 3%, reflecting the market's perception of a reduced takeover probability.

"The outcome of Anglo's strategic review will not have changed BHP's plans, but they are probably actively assessing where they are now in light of this," said Lachlan Shaw, an analyst from UBS Group AG.

Joshua Mahoney, chief markets analyst at Scope Markets, wrote in a note, "The decision to spin off their diamond, platinum, and coal mining operations will see a greater focus on copper."

Mahoney said, "With copper rising into a fresh two-year high this morning, there is a clear surge in demand for this key material as the world progressively moves towards increased electrification."

Concentrating on copper assets is the correct move for Anglo, as Goldman's Nicholas Snowdon penned in a note last week for clients that metal market is "moving into extreme tightness."

Last month, being uber-bullish on copper, Snowdon wrote, "Copper's time is now" (available to pro subscribers in the usual place)...

Separately, Bank of America's commodity desk jumped on the copper trade, warning that a "supply crisis is here."

In December, billionaire mining investor Robert Friedland explained to Bloomberg TV in an interview that copper prices are set to soar because the mining industry is failing to increase supply ahead of 'accelerating demand.' He warned:

"We're heading for a train wreck here."

As we've noted in "The Next AI Trade" & "Everyone Is Piling Into The "Next AI Trade"", as well as "The "Next AI Trade" Just Hit An All Time High," - data center demand and powering up America will need copious amounts of copper, at a time when mining supplies are dwindling. We all know what that means for price.

-

Site: RT - News

The bloc is on track to be producing 2 million shells per year for Ukraine, the European commissioner for the internal market has said

The European Union’s defense industry has partially switched to a war economy, European Commissioner for Internal Market Thierry Breton has said.

Kiev could face a “dangerous period” this year as the focus of Western politicians backing it has now turned to the European Parliament elections on June 6-9 and US presidential election on November 5, Breton explained in an interview with French broadcaster BFMTV on Monday.

Russia may well take advantage of this “uncertainty” and “move forward” on the front line, he said.

“Because of this, we in Europe have decided to significantly increase our subsidies in terms of weapons and ammunition” for Ukraine, the commissioner stressed.

According to Breton, the EU is now on track to be producing 2 million shells, including 155mm caliber, per year for Ukraine.

Read more Ukraine facing ‘a nightmare’ – CNN

Ukraine facing ‘a nightmare’ – CNN

He said that it is fair to say the EU has “moved into a war economy” at least in terms of shell production.

“Now the challenge is for us to move into a war economy in all segments of the European defense industry,” the commissioner added.

In March, the European Commission approved the allocation of €500 million ($590 million) to boost the production of shells in the EU. According to Brussels, the bloc will be able to make 2 million shells annually by the end of 2025.

Last year, the EU vowed to supply Kiev with 1 million shells by March 2024. However, it later acknowledged that it would not be able to meet this goal. Ukrainian officials said that they received around a third of what had been promised.

In April, French President Emmanuel Macron insisted that the switch to a war economy was “necessary” as defense spending and military orders have been on the rise across the EU.

READ MORE: Danish PM reveals timeline for first F-16 delivery to Ukraine

Russia has warned repeatedly that foreign weapons being sent to Kiev will not prevent Moscow from achieving its military goals, but will merely prolong the fighting and increases the risk of a direct confrontation between Russia and NATO. According to officials in Moscow, the provision of arms, intelligence sharing, and the training of Ukrainian troops mean that Western nations have already become de-facto parties to the conflict.

-

Site: Novus Motus LiturgicusThe following texts are take from William Durandus’ Rationale Divinorum Officium, book 6, chapter 104, in my own translation. On the feast of the Lord’s Ascension, which is celebrated on the fortieth day after Easter, since Christ on the fortieth day after the Resurrection ascended into heaven, a solemn procession is held; for the Lord commanded that His disciples go before him to the Mount of Gregory DiPippohttp://www.blogger.com/profile/13295638279418781125noreply@blogger.com0

-

Site: Zero HedgeThe Broken Magic Trick Behind Dollar DominanceTyler Durden Tue, 05/14/2024 - 07:20

Authored by Peter Reagan via Birch Gold Group,

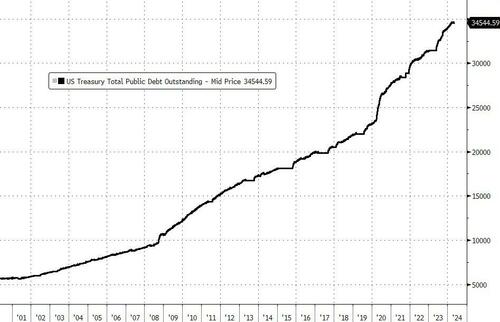

The total debt owed by the United States federal government has reached incredible levels. Today, the total is $34,541,727,970,599.17 – but by the time you read this article, it’ll probably be higher.

I say “probably” because the debt is growing exponentially that by the time you read this, it’s quite possible that another few hundred billion have taken the total over $35 trillion.

Look at the official chart and attention to how fast total debt has risen since the turn of the century:

In the year 2000, total government debt was $5.7 trillion.

Ah, the good old days…

The nation’s debt has grown more than $5.7 trillion since President Biden took office!

Let me put it another way:

-

It took the federal government 224 years, the Louisiana Purchase, the Civil War and two World Wars to rack up the first $5.7 trillion in red ink

-

And then it took the Biden administration just three years to rack up the last $5.7 trillion!

I apologize for going on and on about this but I honestly cannot believe it.

It’s hard to call this an apples-to-apples comparison, though, because for the majority of those first two centuries, the dollar’s value was based on a defined quantity of gold or silver.

Well, obviously that cannot be the case any more! Based on my back-of-the-envelope estimate, there’s only $16.1 trillion in gold in the world (based on current prices). The ONLY way to create such an astonishing mountain of debt was to divorce the currency from any intrinsic value.

It’s almost a magic trick.

Think about it…

Once, a dollar was 3/4 oz of silver, or 1/2 oz for a $10 coin. People had to go and dig that precious metal out of the ground, refine it and stamp it. That’s a lot of work.

Then, the dollar became a paper certificate exchangeable for the equivalent weight of gold or silver. That’s just more convenient.

Finally, the dollar became just the paper itself.

It’s like money from nothing!

And to be clear, this “money from nothing” magic trick has been working since Nixon ended the last vestiges of the gold standard just over 50 years ago.

But you know how sleight-of-hand works, right?

It depends on deception.

And every time you do the same trick, the audience is one step closer to figuring out that it’s not really magic after all…

This exact same magic trick that’s been supporting both the federal government and the U.S. dollar for five decades just isn’t working as well as it used to.

The end of magical debt thinking

Writing for Project Syndicate, economist and author Kenneth Rogoff recently summarized the insane mentality that drives the current debt situation:

For over a decade, numerous economists – primarily but not exclusively on the left – have argued that the potential benefits of using debt to finance government spending far outweigh any associated costs. The notion that advanced economies could suffer from debt overhang was widely dismissed, and dissenting voices were often ridiculed.

Just so we’re clear, “debt overhang” is defined as a “debt burden so large that an entity cannot take on additional debt to finance future projects, dissuading current investment.”

Via Investopedia

A debt overhang makes it impossible to do anything other than pay back the debt.

That’s what makes it dangerous.

The people who “widely dismissed” the very idea that a whole nation could suffer from a debt overhang are a lot quieter now.

Rogoff explains why:

The tide has turned over the past two years, as this type of magical thinking collided with the harsh realities of high inflation and the return to normal long-term real interest rates. A recent reassessment by three senior IMF economists underscores this remarkable shift. The authors project that the advanced economies’ average debt-to-income ratio will rise to 120% of GDP by 2028, owing to their declining long-term growth prospects. They also note that with elevated borrowing costs becoming the “new normal,” developed countries must “gradually and credibly rebuild fiscal buffers and ensure the sustainability of their sovereign debt.”

That’s another way of saying, “What got us here won’t get us there.”

The federal government printed its way into this debt mountain – it cannot print its way out. See, they’ve done the magic trick too many times.

The audience caught on.

Now we ALL know there’s no magic. Nothing but a rapidly-growing pile of IOUs.

The question becomes, does the government have time to learn a new magic trick?

“The United States has about 20 years left”

Cole Walmsley of Gaiter Capital wrote an entire essay on X to summarize the conundrum facing the U.S. right now. The whole thing’s worth a read, but here are the highlights:

The U.S. Treasury, which is part of the U.S. Federal Government, has to sell new debt to new investors to pay off the old debt from old investors. This is because of 1) the constant budgetary deficits and 2) the debt from years past coming due.

Remember, the debt is made up of two big chunks: This year’s deficit, and all the other deficits racked up over the decades.

The U.S. Federal Government has been in a budgetary deficit in 49 of the last 53 years, with the last surplus year being in 2001.

But yet, even in that 2001 “budgetary surplus” year, the total debt amount increased.

Why?

Because a whole bunch of debt from years past came due.

He does a good job of putting the concept of “a trillion” into perspective, too:

Trillion is just a word. Let’s make sure we note the significance.

A *billion* seconds ago was 1993 (31 years ago).

A *trillion* seconds ago was 30,000 B.C.

And then multiply that trillion by 34.7.That’s the scale of the United States debt bill.

Finally, Walmsley exposes the shell game at the heart of the federal government’s balance sheet:

The U.S. Treasury always has to have buyers of its debt, because if they don’t, they won’t be able to pay off 1) their deficit spending and 2) the old debt coming due (and the interest on the debt). If they fail to pay those off, the Government would default and collapse.

Well, then, who buys all the U.S. Government debt?

Key point: The largest buyer and owner of the U.S. Federal Government debt is THE U.S. FEDERAL GOVERNMENT THEMSELVES.

Approximately one third of all U.S. government debt is “owed” to another government department!

You know, this would be hilarious if it wasn’t our Social Security he’s talking about…

So how long can this farce last?

We have a couple of answers.

First, the Wharton School of Business explained why the United States is running out of time to recover from the teetering mountain of debt:

We estimate that the U.S. debt held by the public cannot exceed about 200 percent of GDP…

Larger [debt-to-GDP] ratios in countries like Japan, for example, are not relevant for the United States, because Japan has a much larger household saving rate, which more-than absorbs the larger government debt.

Under current policy, the United States has about 20 years for corrective action after which no amount of future tax increases or spending cuts could avoid the government defaulting on its debt whether explicitly or implicitly (i.e., debt monetization producing significant inflation). Unlike technical defaults where payments are merely delayed, this default would be much larger and would reverberate across the U.S. and world economies.

Japan has a debt-to-GDP ratio of about 260% made possible by the savings habits of Japanese households!

Here in the U.S. we save about 3.2% of our income right now – while in Japan, the savings rate averages 13.2% (and has been as high as 62%!)

Obviously, American households aren’t saving anywhere near enough money to support federal government deficits, even if they wanted to.

(We already pay taxes! Why should we give the White House even more of our money?)

In fact, the “end” could truly be drawing near… In his book This Time Is Different: Eight Centuries of Financial Folly, coauthored with Carmen Reinhart, Rogoff identified dozens of sovereign debt crises.

Every one unfolded the same way, at about the same time – all for the same reason.

The government’s irresistible urge to keep spending until it becomes obvious to everyone, even elected officials, that IOU is another way of saying, “You’re screwed.”

Now you know how much a trillion really is and why the U.S. won’t take Japan’s path to managing its debt.

Now you know the magic trick supporting the global financial system is just an accounting con.

So let’s talk about how we can move past the magical thinking, into the clear light of reality…

Real assets, real value

If you want to secure your retirement in the face of insane debt spending on the part of the Biden Administration, then it’s time to consider alternative options.

Unlike the vague promise of the dollar, physical precious metals like gold and silver are tangible physical assets you can hold in your hand. They can’t be replaced, canceled or inflated away.

The Founding Fathers knew this – and that’s why they tried to make certain our nation would never fall into the same trap that destroyed so many proud nations in the past. But they couldn’t save the nation.

That doesn’t mean we can’t save ourselves.

Make sure you’ve sheltered at least some portion of your savings with real safe-haven assets that you can hold in your hand. No amount of economic or government insanity can destroy gold and silver.

Empires rise and fall like tides on the beach of history. Gold and silver simply endure.

* * *

With global instability increasing and election uncertainties on the horizon, protecting your retirement savings is more important than ever. And this is why you should consider diversifying into a physical gold IRA. Because they offer an easy and tax-deferred way to safeguard your savings using tangible assets. To learn more, click here to get your FREE info kit on Gold IRAs from Birch Gold Group.

-

-

Site: Mises InstituteFor most Americans, the debate is about what size the welfare state should be. Austrian economists, however, ask why there should be a welfare state at all.

-

Site: PaulCraigRoberts.org

Putin Needs to Shake-Up Himself

Paul Craig Roberts

Putin is conducting a large shake-up in the Russian government. He needs to give himself a good shaking as well.

Ramzan Kadyrov, leader of Russia’s Chechen providence said on Russia’s Rossiya TV channel:

“I believe that we need to attack more actively, we need to hit hard while there is time. This month we need to take the nearest territory, we definitely need to take Odessa and Kharkiv. Then sit this Zelensky down and force him to sign all the papers that Russia needs for the security of our state, citizens and the Russian-speakers who live on the territory of Ukraine.”

This is the second Russian war leader after Yevgeny Prigozhin, the leader of the Wagner Group, to express dissatisfaction with the glacially slow pace at which Putin is conducting the conflict. One wonders if Kadyrov will have a similar fate to Prigozhin.

I am not an expert on the Russian military. My impression is that the Wagner and Chechen soldiers are Russia’s best combat troops. It is a pity to waste such troops in a war conducted at a snail’s pace.

The slow pace at which Putin has conducted the war has resulted in the war being greatly widened and thus made much more dangerous and difficult to resolve. Indeed, Putin is now in danger of NATO occupying Odessa before Russian troops can get there. If the West can keep Odessa and Kharkiv out of Russian hands, the war will be a defeat for Putin. It is inexplicable that Putin takes this risk. Putin’s dilemma is that a man who sees himself as an instrument of peace is a poor war leader.

Curiously, Foreign Minister Lavrov says that the West has decided to prolong the war. No. The prolonged war was Putin’s decision. A war that should have been over in three weeks has lasted 27 months.

Putin’s neglect of the war’s requirements is the reason that Russians in the Russian city and region of Belgorod are slaughtered by drones and missiles on their way to work and why “Russian apartment buildings in Russian cities struck by high intensity weapons supplied to Ukraine by the West collapse on the inhabitants. The snail-paced conflict was supposed to save lives. Instead, casualties have multiplied many fold and spread to Russian civilians distant from the battlefield.

Now there is a shakeup at the top of the Russian military with a civilian without military experience taking over as defense minister. I think Putin would be taken more seriously if he had appointed Ramzan Kadyrov as defense minister. Instead, Putin has stuck in an economist who, like Putin’s central bank director, is more concerned with the expense of the conflict–now one-third of the Russian budget–than they are about winning the war before it spins out of control. The neo-liberal Putin supports as Russia’s central bank manager is a failure on all fronts. She left Russian assets in the West to be seized by Washington’s sanctions. She was unable to understand that Russia did not need loans from the West to develop economically. And now she imposes 16% interest rates on the Russian economy. Stalin would have long ago shot her. I have often wondered if Russia can survive Putin’s central bank director.

Putin has done a good job of Russifying a population that was infatuated with the West. The population again thinks of itself as a distinct and proud national entity, not as a wannabe cog in globalist machinery run by Washington. Putin gets kudos for this, but his conduct of the war maximizes the likelihood of the conflict spinning out of control. Prigozhin understood this, and so does Kadyrov. Will Putin understand before his limited military operation spins into World War 3?

Scott Ritter Says Ukraine is Militarily Exhausted and the Conflict Has 3 months to go.

The question is whether Washington accepts the defeat or whether more troops will follow the French Foreign Legion into the conflict.

https://sputnikglobe.com/20240511/scott-ritter-predicts-how-ukraine-will-end-1118382169.html

-

Site: AsiaNews.itThe first meetings between prefects and apostolic vicars took place in 1924, when the country was still a Dutch colony. On the anniversary an extraordinary assembly and the inauguration of the new office building. The government representative for relations with Catholics: 'Let us work together for the most neglected areas of the country'.

-

Site: Zero HedgeWanted: The Most In-Demand Jobs Of The Next DecadeTyler Durden Tue, 05/14/2024 - 06:55

Ever since the release of ChatGPT in late 2022 and other AI tools that have followed in its wake, people have been pondering the potential of artificial intelligence to replace certain occupations, trying to figure out if and how the nascent technology will change the way people work. And while the focus of discussions like this is often on the risk of certain jobs being replaced by emerging technologies; as Statista's Felix Richter reports, these shifts, as well as societal changes, usually offer new employment opportunities as well.

Think of the rise of e-commerce for example: while it has led to a decline in retail jobs, it has supported strong job growth in transportation and warehousing and still does.

According to the U.S. Bureau of Labor Statistics’ Occupational Employment Projections, transportation and warehousing is going to be among the fastest growing sectors over the next decade, with wage and salary employment in the sector projected to grow 8.6 percent between 2022 and 2032.

At 9.7 percent, the biggest increase in employment is expected for the healthcare and social assistance sector, which is driven less by technological changes and more by demographic shifts. Due to the ageing population and the growing prevalence of chronic conditions, the healthcare and social assistance sector is projected to account for 2.1 million new jobs by 2032, making up almost half of all new jobs expected by the end of the projection period.

You will find more infographics at Statista

Looking at individual occupations, this trend is also evident, with home health and personal care aids projected to be by far the fastest-growing occupation over the next decade, adding more than 800,000 jobs by 2032.

With registered nurses and medical and health service managers also in the top 10, it’s clear that the health sector as a whole is going to be a major driver of employment growth in the near future.

-

Site: PaulCraigRoberts.org

The corrupt DOJ prosecutors trying to frame President Trump admit to tampering with evidence, a felony. Will the prosecutors be indicted and put on trial?

-

Site: PaulCraigRoberts.org

WHO’s version of Dr. Fauci prepares us for a more deadly virus than Covid to scare us into a more deadly vaccine than the Covid vax

https://twitter.com/WarClandestine/status/1789787265553576242

As Bill Gates told us, we are going to have one pandemic a year for a decade at the end of which there will be few left of us.

And nothing is done about this genocide plan.

-

Site: PaulCraigRoberts.org

One of America’s Best Men was destroyed by the CIA and the Washington Post

Watergate was a CIA plot to remove Nixon from office before he normalized relations with Russia and China, thus removing the necessary enemies needed by the military/security complex for its power and profit and unaccountability.

Americans fell for the plot against their president. The liberal-left hated Nixon and were delighted with the CIA’s operation against him.

-

Site: Zero Hedge"Markets Extremely Quiet" Ahead Of PPI, CPI, Powell SpeechTyler Durden Tue, 05/14/2024 - 06:33

US equity futures are flat into tomorrow's CPI/Retail Sales print with PPI the major macro data point today, while Fed Chair Powell also speaks. Futures are flat after also closing unchanged yesterday when the return of the meme stonk mania sent GME and AMC soaring, and hammered L/S hedge funds, whose short books exploded, leading to P&L carnage across the board and widespread degrossing which however did not impact index prices. As of 6:30am, S&P and Nasdaq futures were unchanged. Bond yields are down 1-2bps as the yield curve bull steepens. The USD is flat and commodities are mixed with Ags lagging. Meme Stock Mania returned yesterday with GME +74% and AMC +78%, though Bitcoin was only +3%; As JPM's Andrew Tyler asks this morning "has the Retail investor reactivated and do they support Mag7?"

“Markets this morning are in extremely quiet mood ahead of tomorrow’s US consumer price index data that’s going to come out and shake things up or not,” said Kit Juckes, chief FX strategist at Societe Generale SA. “Sentiment about what the Fed’s going to do, sentiment about a lot of markets, will be determined by core CPI.”

The Stoxx Europe 600 index was little changed, hovering near a record high, as gains in auto and consumer product shares offset losses in travel and insurance names. Shares in Anglo American Plc fell after the London-based miner outlined a major shake-up to fend of a takeover approach from BHP Group, with analysts citing execution risks. Delivery Hero SE soared as much as 22% after selling its Taiwan business. A revenue beat by Tencent Holdings Ltd. pushed the stock of its largest shareholder, Prosus NV, higher. Here are the most notable European movers:

- Delivery Hero shares soar as much as 22% after the food delivery firm agreed to sell its Taiwanese operations to Uber for $950 million. The deal is attractively priced as it allows Delivery Hero to reduce debt, although regulatory approval could be a potential concern, according to analysts.

- Vodafone shares rise as much as 3.9% after the telecom operator set full-year profit and cash flow guidance ahead of estimates. The German market, which now accounts for more than 45% of Vodafone’s Ebitda, saw service revenue growth ahead of expectations.

- Nagarro shares jump as much as 23%, the most on record, after the German IT service firm’s results beat expectations. Analysts noted the contrast between its reiterated guidance and US peer Epam’s profit warning.

- Nordex shares jump as much as 8.6%, hitting the highest in two years, after the wind turbine maker beat expectations and delivered a “blowout quarter,” according to Jefferies. Analysts at Oddo upgraded the stock.

- Sonova shares jump as much as 6.6% with Morgan Stanley saying the hearing system firm’s outlook implies upgrades to sales and earnings consensus.

- Societe Generale shares gain as much as 4.1% after French President Emmanuel Macron said he’d be open to seeing a major French bank being taken over by an EU rival to spur deeper integration.

- On The Beach shares drop as much as 12% after its first-half earnings showed ongoing pressures on consumers. However, the group’s reinstated dividend and strong demand remain points of confidence, according to analysts.

- Brenntag shares fall as much as 9.6%, the most since November 2022, after the German chemicals distribution firm’s first quarter missed estimates due to pricing pressures. The company reduced its guidance for the full year to the lower end of its range.

- Rheinmetall shares decline as much as 6% after the German defense company reported a backlog for the first quarter that was €40.2 billion compared with €28.2 billion at the same time last year. Oddo calls it a slow start to 2024, with earnings below consensus.

- DCC shares drop as much as 5.3% after its results came in below expectations, bringing an end to a strong run for the international sales and support service group that took its stock to a two-year high yesterday.

- Lonza shares fall as much as 3.3% after the Swiss maker of drug ingredients reported a subdued start to the year and confirmed a flat sales growth outlook for 2024.

Earlier in the session, Asian stocks traded in a narrow range as investors awaited crucial US inflation data. A rally in Hong Kong stocks stalled ahead of key technology sector earnings due later Tuesday. The MSCI Asia Pacific Index swung between gains and losses of as much as 0.2%. TSMC and Alibaba rose, while AIA and Tokyo Marine fell. Shares in Hong Kong and mainland China closed lower ahead of major earnings. A gauge of Chinese tech companies jumped as much as 2.3% before paring much of the gains. Tech is “expected to be a bright spot amid this earnings season that has been lackluster thus far,” said Marvin Chen, an analyst at Bloomberg Intelligence in Hong Kong.

In FX, the Bloomberg Dollar Spot Index inched up for the third straight day, supported ahead of US producer price data due later Tuesday. Investors also awaited speeches by Federal Reserve President Jerome Powell and Board of Governors member Lisa Cook to see if they offer any additional hints into when US interest rate cuts will start. Markets are bracing for US CPI data due on Wednesday for more steer into whether the Fed will begin easing in September, in line with market pricing.

In rates, Treasuries edge up ahead of US inflation data, with US 10-year yields falling 1bps to 4.48%. UK government bonds have pulled back from session highs having rallied after Bank of England Chief Economist Huw Pill suggested a summer interest-rate cut is in play. UK 10-year yields fall 1bp to 4.16%. His comments also weighed on the pound which is among the weakest of the G-10 currencies, falling 0.2% against the greenback after showing little reaction to UK jobs figures released earlier.

In commodities, oil prices gained before the release of OPEC’s market outlook, with WTI trading near $79.10. Industrial metals including nickel and copper climbed, while gold was steady after Monday’s decline of more than 1%. Spot gold rises 0.5% to around $2,347/oz.

To the day ahead, and central bank speakers include Fed Chair Powell, the Fed’s Cook, the ECB’s Knot and BoE chief economist Pill. US data releases include PPI inflation for April, along with the NFIB’s small business optimism index. Otherwise, we’ll get UK unemployment for March and the German ZEW survey for May.

Market Snapshot

- S&P 500 futures little changed at 5,247.50

- Brent Futures down 0.3% to $83.10/bbl

- Gold spot up 0.1% to $2,338.66

- US Dollar Index up 0.14% to 105.36

- STOXX Europe 600 little changed at 521.06

- MXAP up 0.1% to 178.43

- MXAPJ up 0.2% to 558.88

- Nikkei up 0.5% to 38,356.06

- Topix up 0.3% to 2,730.95

- Hang Seng Index down 0.2% to 19,073.71

- Shanghai Composite little changed at 3,145.77

- Sensex up 0.7% to 73,274.89

- Australia S&P/ASX 200 down 0.3% to 7,726.76

- Kospi up 0.1% to 2,730.34

- German 10Y yield little changed at 2.49%

- Euro down 0.1% to $1.0778

- Brent Futures down 0.3% to $83.10/bbl

Top Overnight News

- European stocks and US equity futures kept to small ranges for a second day, with traders waiting for US inflation reports to give markets fresh direction. US Treasuries and the dollar remained steady.

- US President Joe Biden is hiking tariffs on a wide range of Chinese imports — including semiconductors, batteries, solar cells, and critical minerals — in an election-year bid to bolster domestic manufacturing in critical industries.

- Japanese sovereign bond yields are surging to the highest levels in more than a decade amid signs the central bank is ready to reduce debt purchases to ease pressure on the ailing yen.

- From JPMorgan Chase & Co. to Citigroup Inc., Wall Street’s most prominent trading desks are warning that investors should gear up for a potential break in the calm that’s come over the stock market.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks lacked firm conviction after the indecisive performance in the US ahead of key events. ASX 200 was dragged lower by weakness in real estate and consumer staples ahead of the federal budget announcement, while Australian Treasurer Chalmers had previously cautioned against expectations for a welfare 'cash splash'. Nikkei 225 was choppy amid a weaker currency, mixed earnings releases and relatively in-line PPI data. Hang Seng & Shanghai Comp were initially boosted at the open with strength in tech and real estate although the Hong Kong benchmark eventually faded most of the gains, while sentiment was dampened in the mainland amid the threat of looming US tariffs which are expected to be unveiled today, while developer default concerns also lingered after Agile Group missed a coupon payment and flagged an inability to fulfil all payment obligations.

Top Asian News

- China's embassy said China remains open to cooperating with the US on repatriation of illegal immigrants but the US side should also demonstrate sincerity and address China's concerns, creating a suitable atmosphere for such cooperation, according to Global Times.

- Japanese Finance Minister Suzuki said it is important for the government and BoJ to coordinate policy and it is important for currencies to move in a stable manner reflecting fundamentals, while he added they will take a thorough response for forex and are closely watching FX moves, according to Reuters.

- Former BoJ executive says the BoJ may decide to reduce the size of scheduled bond purchases next month amid largely dysfunctional bond market, adding that the BoJ is likely to hold off on raising rates until September, according to Reuters.

- Australian Budget: sees 2023/24 budget surplus at AUD 9.3bln (vs. Exp. AUD 9bln) and deficits in 2024/25 - 2026/27 (as expected). 2024/25 deficit AUD 28.3bln vs. Exp. AUD 13.9bln. 2023/24 CPI seen at 3.5%, 2024/25 at 2.75% 2025/26 at 2.75%. 2023/24 unemployment seen at 4.0%, 2024/25 4.5% and 2025/26 4.5%. 2023/24 GDP growth at 1.75%, 2024/25 at 2% and 2025/26 at 2.25%. Sees iron ore price falling to USD 60/tonne, thermal coal USD 70/tonne for Q1 2025.

European bourses, Stoxx600 (+0.1%) are mixed and lack any firm direction, continuing the indecisive performance in APAC trade overnight. European sectors hold little bias with the breadth of the market fairly narrow. Autos is found at the top of the pile, building on the prior day’s gains, whilst Travel & Leisure is weighed on by Flutter (-2.5%) post-earnings. US Equity Futures (ES U/C, NQ +0.1%, RTY +0.1%) are mostly and modestly firmer, with trade tentative ahead of today’s PPI. Elsewhere, the White House says US President Biden is directing US Trade Representative to increase tariffs on USD 18bln of imports from China (in-fitting with recent reports).

Top European News

- BoE Chief Economist Pill says there is still some work to do on the persistence of inflation; not unreasonable to believe that over the summer, the BoE will see enough confidence to consider rate cuts. Not unreasonable to believe that over the summer, the BoE will see enough confidence to consider rate cuts; could cut and keep the stance restrictive. Question of when and how restriction is eased.

- Even a very poor EZ inflation reading this month would not necessarily dissuade the ECB's Governing Council from going through with the 25bp rate cut that has been amply signalled for its June meeting, according to a Eurosystem insider cited by Econostream.

FX

- Dollar is a touch firmer vs. most peers and briefly popping above yesterday's 105.36 high in quiet trade, though with traders mindful of today's PPI, and CPI on Wednesday, in addition to Chair Powell at 15:00BST/10:00ET.

- EUR is steady vs the USD after the pair failed to hold above the 1.08 mark. EUR/USD is currently contained within yesterday's 1.0765-1.0806 bounds with newsflow light, ZEW data failed to move the markets.

- GBP is the laggard across the majors. GBP was choppy following mixed jobs data, though commentary from BoE's Pill sent Sterling lower. The Chief Economist continued to talk up the possibility of rate cuts. Cable down as low as 1.2510 with eyes on a test of 1.25; not breached since May 9th.

- JPY is once again losing ground to the USD with markets bracing for upcoming US inflation prints, which could be the next inflection point for the pair. USD/JPY has been as high as 156.56 with not much in the way of resistance until 157.

- Mildly diverging fortunes for the antipodes with NZD edging out moderate gains vs. the USD. AUD/USD is holding above the 0.66 mark and respecting yesterday's 0.6587-0.6628 range in quiet trade.

- PBoC set USD/CNY mid-point at 7.1053 vs exp. 7.2307 (prev. 7.1030).

Fixed Income

- USTs are incrementally firmer but with magnitudes much more contained than EGBs as we await US PPI ahead of Wednesday's CPI print. USTs at the top-end of 108-24 to 108-29 bounds which are contained by Monday's 108-23 to 109-00 parameters.

- Gilts initially gapped lower by just 11 ticks to 97.52 following the morning's data which was hawkish on the wage components, though upticks in unemployment and another sizeable negative employment change provided some dovish reprieve. Speak from BoE's Pill thereafter lifted Gilts to a 97.89 peak just shy of Monday's 97.93 best.

- Bunds are flat after initially being supported in tandem with Gilt price action; the ZEW data once again came in stronger than expected and prompted Bunds to pullback to the 131.00 mark. Bunds to a 131.13 peak post-Pill matching Monday's best.

Commodities

- Subdued trade across the crude complex following yesterday's gains, which saw the contract settle higher but off best levels in a day with light oil newsflow. Brent Jul'24 sits within a USD 82.98-83.62/bbl parameter.

- Precious metals hold an upward bias despite the stronger Dollar, with outperformance in spot palladium this morning whilst spot gold remains caged ahead of the aforementioned risk events including US PPI and Fed Chair Powell later; XAU sits within a tight USD 2,334.89-2,345.99/oz intraday range thus far.

- Mixed trade across base metals with 3M LME copper futures flat but holding onto a USD 10k+ status, while aluminium prices are subdued following another large warehouse stock metric (+131k/T).

- OPEC OMR due at 11:00BST/06:00ET today

- LME Stocks: Aluminium +131k/T.

- Peru copper production dipped slightly in March and was down 0.1% Y/Y, according to government data.

Geopolitics

- "Israeli tanks began to penetrate into the center of Rafah for the first time amid fierce clashes ", according to Al Arabiya

- "Lebanese agency: Israel used 'seismic missiles' in the town of Kafr Kila in southern Lebanon", according to Al Arabiya

- Member of the Hamas Political Bureau told Al Arabiya they are committed to the path of the exchange deal negotiations.

- Heavy Israeli artillery shelling and heavy gunfire reported in the centre and east of the city of Rafah in the southern Gaza Strip, according to Al Jazeera.

- US officials said Israel has mobilised enough forces to launch a large-scale operation in Rafah but they are not sure if We are not sure if Israel has made a final decision to launch a large-scale operation in Rafah, according to CNN.

- US Deputy Secretary of State said we do not believe that the complete victory that Israel seeks to achieve is likely or possible, according to CNN.

- Hezbollah said it targeted two buildings used by enemy soldiers in the settlement of Metulla and achieved a direct hit, according to Al Jazeera.

- EU decided to broaden the scope of its sanctions framework to include not only provision of drones from Iran to Russia but also missiles. It also expands the sanctions regime geographically to cover the Middle East, according to a press release.

- US Secretary of State Blinken arrived in Ukraine on a previously undisclosed trip and intends to send the signal of reassurance to Ukraine at a 'very difficult moment', while US-supplied artillery, ATACMS long-range missiles and air defence interceptors are already reaching Ukraine's front lines from the new US aid package approved on April 24th, according to a US official cited by Reuters.

- US and Taiwan navies quietly held Pacific drills in April, while the exercises involved about a half-dozen ships from both sides but officially didn't take place, according to a Reuters source. Furthermore, a source added that exercises were dubbed 'unplanned sea encounters' and gave the navies a chance to practice 'basic' operations.

US Event Calendar

- 06:00: April SMALL BUSINESS OPTIMISM 89.2, est. 88.2, prior 88.5

- 08:30: April PPI Ex Food, Energy, Trade MoM, est. 0.2%, prior 0.2%

- April PPI Ex Food, Energy, Trade YoY, prior 2.8%

- April PPI Final Demand MoM, est. 0.3%, prior 0.2%

- April PPI Final Demand YoY, est. 2.2%, prior 2.1%

DB's Jim Reid concludes the overnight news

The start of this week has seen a holding pattern ahead of potentially more exciting times to come over the next couple of days. The S&P 500 (-0.02%) and 10yr Treasury yields (-1.0bps) didn't move much. Unless you've been living on Mars, you'll know that we have the US PPI release today, followed by the CPI tomorrow. You'll also likely be fully aware that the first three months of the year all had fairly strong inflation, and all beating expectations, so this is an important week.

If you're looking for a little bit of excitement then Japanese yields are edging to decade plus yield highs overnight on concerns the BoJ will cut bond purchases again at its next regular operation on Friday. Yields on 10yr JGBs increased +2.5bps to 0.965%, its highest in more than a decade while yields on 20yr JGBs touched a high of 1.77%, the most since 2013 before settling at 1.759% as we go to print. 30yr yields hit their highest since 2011, trading at 2.038% as I type. The speculation being that smaller purchases are being planned to help the ailing Yen which has been drifting back down over the last week or so post what is thought to have been two bouts of intervention. So one to watch.

Back to those upcoming US inflation prints and the mood music ahead of them has been a little worrying, as data on inflation expectations showed a further uptick. That came via the New York Fed’s latest Survey of Consumer Expectations, where 1yr inflation expectations were up from 3.0% to 3.3% in April, marking its highest level in 5 months. Moreover, that follows on the heels of the University of Michigan’s survey last Friday, where inflation expectations also surprised on the upside, so there’ve been several pieces of news pointing in that direction. To be fair, the 3yr NY measure did fall a tenth to 2.8%, but the 5yr measure ticked up two-tenths to 2.8%, so it was a mixed bag at the longer time horizons. Separately, there were some labour market indicators that pointed in a weaker direction, with the mean probability of finding a job in the next 3 months (if one’s job was lost today) falling to a 3-year low of 50.9%.

For the April PPI release today, our economists expect headline PPI to come in at a monthly +0.4% pace. That would be an uptick from the +0.2% pace in March, but the focus for our economists will be on those components that feed into the core PCE deflator, which are health care services, portfolio management and domestic airfares. So those are the categories to keep an eye on, since they feed into the PCE measure that the Fed officially targets.

Ahead of that, we did hear from Fed Vice Chair Jefferson, who reflected the cautious tone of the FOMC about future rate cuts. For instance, he said that they “continue to look for additional evidence that inflation is going to return to our 2% target. And until we have that, I think it is appropriate to keep the policy rate in restrictive territory.” So there wasn’t much to move the dial on market expectations, with the number of cuts priced in by the December meeting little changed at 41bps yesterday. Later today, we’ll hear from Fed Chair Powell as well, who’s speaking at an event with the ECB’s Knot.

We’ll have to see what happens today, but for now at least, the S&P 500 (-0.02%) barely budged, which still leaves the index just 0.6% beneath its all-time high from the end of March. It was a similar story in Europe as well, where the STOXX 600 (+0.02%) narrowly eked out another all-time high. Tech outperformance saw modest gains for the NASDAQ (+0.29%) and the Magnificent 7 (+0.28%), with the latter ending a run of four consecutive declines. But the mood was slightly negative otherwise, with 9 of the 11 S&P 500 sector groups down on the day.

Perhaps the most notable equity story of the day was a + 74.4% rise for Gamestop . This followed a post on X (after a long dormant period) by Keith Hill, who gained notoriety during the 2021 meme-stock frenzy under the moniker “Roaring Kitty”. Some of the other heavily shorted stocks also saw sizeable gains, with the high short interest basket within the Russell 3000 up as much as +6.7% intra-day (+4.55% by the close). To refresh your memory GameStop went above 10 in January 2021. Two weeks later at the height of the frenzy it was trading at nearly 90. Since then it's steadily and consistently fallen back to a low of 10 three weeks ago. Last night it closed above 30 again. Let's see if that speculative craze is going to be reignited.

For sovereign bonds, there was also a subdued performance yesterday, with little major movements in either direction yesterday. Indeed, US Treasuries saw one of the larger moves of the day, with the 10yr yield down -1.0bps to 4.49%. The 10yr yield had traded nearly -4bps down on the day early in the US session but then saw a gradual increase, helped along by the NY Fed inflation expectations release. The bond moves were even smaller moves in Europe, where yields on 10yr bunds (-0.7bps), OATs (-0.5bps) and BTPs (+0.7bps) all moved by less than a basis point.

In the commodity space, oil prices recovered, with Brent up +0.77% to $83.43/bbl after falling to an 8-week low on Friday. Meanwhile, copper posted another 2-year high, up +2.36% on the day and extending its year-to-date gain to +23.5%.

In Asia, Chinese stocks are trading slightly lower with the CSI (-0.15%), Hang Sang (-0.05%) and Shanghai Composite (-0.08%) all seeing minor losses. However, the Hang Seng Tech index (+1.10%) is bucking the trend powered by a rally in Chinese tech stocks with Alibaba and Tencent Holdings reporting earnings later today. Elsewhere, the KOSPI (-0.09%) is also struggling to gain traction whilst the Nikkei (+0.05%) is trading just above flat. US equity futures are very slightly lower.

To the day ahead, and central bank speakers include Fed Chair Powell, the Fed’s Cook, the ECB’s Knot and BoE chief economist Pill. US data releases include PPI inflation for April, along with the NFIB’s small business optimism index. Otherwise, we’ll get UK unemployment for March and the German ZEW survey for May.

-

Site: Zero HedgeUNC Chapel Hill Trustees Vote To Redirect DEI Money To Campus SafetyTyler Durden Tue, 05/14/2024 - 06:30

Authored by Bill Pan via The Epoch Times (emphasis ours),

The board of trustees of the University of North Carolina at Chapel Hill has unanimously voted to defund diversity, equity, and inclusion (DEI) programs and instead use the millions of dollars to boost campus safety.