It is sad that there are what you might call professional Catholics who make a living on their Catholicism, but in whom the spring of faith flows only faintly, in a few scattered drops. We must really make an effort to change this.

Distinction Matter - Subscribed Feeds

-

Site: The Eponymous Flowerhttps://rumble.com/v4wmql3-mel-k-and-jack-cashill-ashli-the-untold-story-of-the-women-of-january-6th-5.htmlIn the weeks leading up to January 6th, one guy was looking and talking tougher than Ray Epps and that was this blog's number one fan Thug Gordon. We told him to stay home but laugh now that he could've been sharing a cell with Bozell. It looks like he took our advice and even pulled his video.

-

Site: RT - News

Proposals for a peaceful division will be presented in the next 30 days, Milorad Dodik has said

Republika Srpska will outline proposals for a peaceful split from Bosnia and Herzegovina within 30 days, the region’s President Milorad Dodik has said. The country’s current arrangement is dysfunctional, according to the Serb leader.

Bosnia and Herzegovina was divided into the ethnically Serbian Republika Srpska and a federation run by the Bosnian Muslims (Bosniaks) and Croats, under the US-brokered 1995 Dayton Agreement, which ended the civil war in the former Yugoslav republic.

Dodik has repeatedly stated that Bosnia and Herzegovina had always been a foreign project with no chance of success. There are no logical or historical reasons for the country to exist, he has insisted, and “the only rational thing is to divide it.” This would unite all of the Serbs who found themselves living in different countries after the breakup of Yugoslavia.

“In the next 30 days, an agreement on peaceful demarcation will be proposed,” Dodik wrote on X (formerly Twitter) on Thursday, adding: “Today we start with a formal decision to seek a peaceful demarcation.”

The remarks come as the UN General Assembly is expected to vote on a resolution proposed by Germany and Rwanda on Thursday to designate July 11 as the International Day of Remembrance for the 1995 Srebrenica Genocide – a step opposed by Dodik and the Republika Srpska government.

“The Serbian people can no longer live in this Bosnia and Herzegovina. What the Bosniaks did with the resolution on Srebrenica is illegal and they did not respect the Serbs,” he claimed.

Read more Serb leader comments on prospects of ‘sovereign state’

Serb leader comments on prospects of ‘sovereign state’

The resolution avoids attributing collective responsibility, according to the Serb leader, who described it as a deceitful tactic.

A list of those missing or killed following the events of 1995, compiled by the Bosnian Federal Commission for Missing Persons, contains 8,372 names. Republika Srpska accepts that a “terrible war crime” was committed against Muslims in Srebrenica in the summer of 1995, but not a genocide.

Dodik was quoted by media as saying on Thursday that he “sympathizes with all victims” but is against the portrayal of the Srebrenica events as a genocide. He previously said that “the murder of more than 3,000 Bosnian Serbs in Srebrenica still remains unpunished and is not remembered by anyone except the Serbs themselves.”

He has proposed that Republika Srpska should establish its own day to commemorate both Bosniak and Serbian victims of Srebrenica.

-

Site: LES FEMMES - THE TRUTH

-

Site: Zero HedgePolitical Shellshocks Loom For MarketsTyler Durden Thu, 05/23/2024 - 11:40

By Michael Every of Rabobank

Shellshock

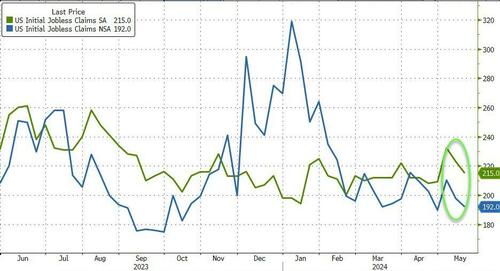

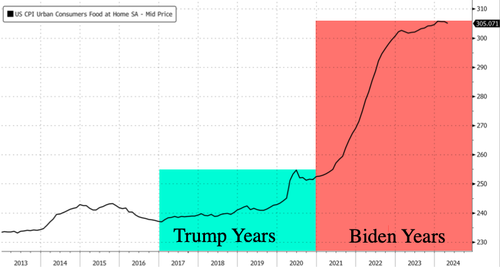

Yesterday, the RBNZ held hawkishly and talked about a rate hike, with no cuts seen until end-2025. The UK’s inflation numbers were awful both headline and core, with services CPI at around 6%: yet the BOE evidently wants to cut rates as soon as it can. Then the Fed minutes from its May meeting made clear several FOMC members are still prepared to vote for a hike, or to keep rates on hold longer than markets expect. (See here for more from our Fed Watcher Philip Marey.)

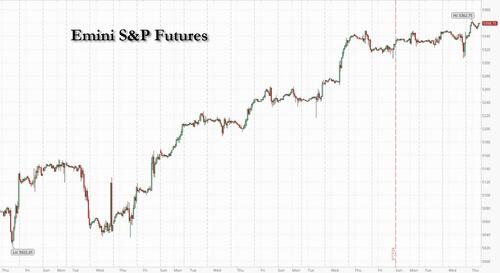

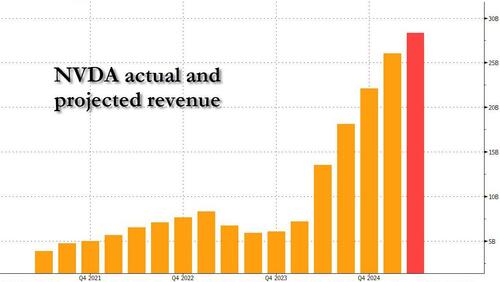

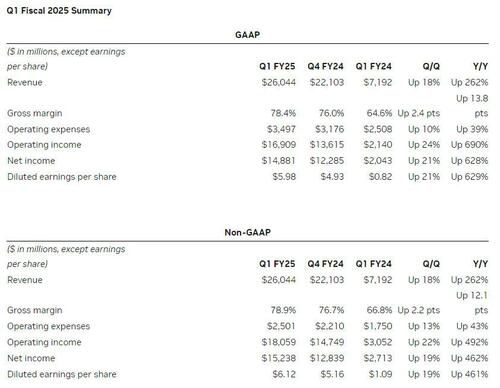

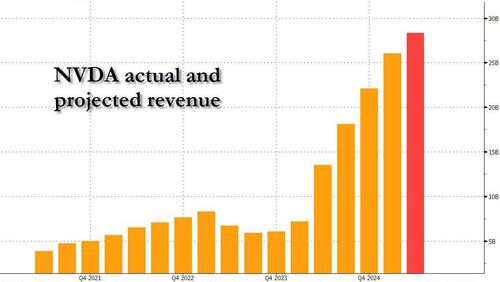

Luckily for markets, however, the AI boom rolls on and on: because where would we be without our US asset bubble du jour?

However, there are still more potential shellshock for markets ahead from politics: Bloomberg’s Shuli Ren asks, ‘Has Xi changed His Mind on Housing and Consumption?’ The NOT neoliberal, but Marx-Lenin-Mao-Xi ideology of China’s political-economy was underlined by its release of an AI based entirely on Xi Jinping Thought, which some dub ‘Chat Xi PT’. However, were Beijing to reflate with serious fiscal stimulus, it would hamper Western central banks’ room for rate cuts: look at what commodity prices are doing without any Chinese version of the West’s Covid stimulus.

A smaller shellshock is the UK holding a rare summer election where polls say it’s “Gone on the 4th of July” for the Conservatives. Indeed, the logic of doing this now rather than waiting for November in the hope opposition support dips has political experts saying either PM Sunak has the inverse Midas touch, or there is a looming scandal so bad it’s prompted the worst-snap election since New Zealand’s drunk Prime Minister called a “Schnapps election” in 1984.

The larger UK shell shock is Shapps: the defence minister states, “Lethal aid is now, or will be, flowing from China to Russia into Ukraine.” Yes, China is helping the Russian economy by supplanting Western-centric industrial supply chains, and some of that has dual use, but actual lethal aid is supposedly a ‘red line’ that triggers US and EU secondary sanctions. Yet in January 2022 I warned these would either prove ineffective or bifurcate the world economy into complying/not complying blocs. Our post-invasion research underlined the same binary, and that it’s impossible to model how much economic damage would be done if secondary sanctions had real teeth. More recently, the IMF made the same point.

Markets may think even if this is correct that, like Shapps, ‘this too will pass’, and we can Keep Calm and Carry On Rate Cuts (and/or AI). Yet that’s the same pre-war naïve thinking I decried in 2022. After all, that would mean there are no red lines, so lethal aid can flow to Russia; its military position vis-à-vis Ukraine would be strengthened further; and it would leave Europe unwilling and unable to respond, and the US unwilling to because it has bigger Chinese fish to fry in Asia. Indeed, things already continue to escalate rapidly:

-

Poland’s Prime Minister Tusk implies Russia may have started a Warsaw department store fire.

-

Russia shifted its maritime boundaries with the EU in the Baltic Sea before deleting the text.

-

Russia is rehearsing tactical nuclear drills near the Ukraine border.

-

The US is reassessing if Ukraine can use US weapons to attack pre-2014 Russian territory.

Meanwhile, Taiwan’s new president Lai Ching-te gave an inaugural address that sailed dangerously close to the China’s red lines. The Global Times rails: “Lai shamelessly stated in his speech that "the Republic of China Taiwan is a sovereign, independent nation" and "the Republic of China and the People's Republic of China are not subordinate to each other," spewing various "Taiwan independence" fallacies and hostile provocations against the Chinese mainland… They are well aware that what they are doing now is pushing Taiwan into a dangerous pit of war and danger." China is already responding with the largest joint military drills around Taiwan for a year, "Joint Sword-2024A", which encircle it, and include actions around its outlying islands of Kinmen, Matsu, Wuxi, and Dongyin. This is as reports say ASML added kill switches to TSMC technology to be triggered if China invades Taiwan.

Moreover, as flagged in Tuesday’s ‘Wrath of Khan’ Daily, the international liberal order is fracturing further following the International Criminal Court’s (ICC) request for arrest warrants for the Israeli prime minister and defence minister, and three leaders of Hamas. The EU is split: Belgium, Spain, and Ireland back the ICC; France did too, then prevaricated; Italy and Austria are opposed, and the Netherlands’ Geert Wilders strongly backs Israel; and Germany said it didn’t agree with the Court… but would only obey its orders. Yet there is bipartisan support in the US, which President Biden won’t block, to sanction the ICC for its recent action. Naturally, Russia and China are making as much hay as they Khan, splitting the Global South further from the West in the process.

But, hey, “AI!”, right?

-

-

Site: AsiaNews.itAsiaNews's editorial director looks at the conferences that marked a hundred years since the Council of Shanghai. While acknowledging past mistakes, he insists that most missionaries were committed to the good of the Chinese people. The nationalism of the European powers of that time cannot be used to hide China's nationalism today. When will a Second Chinese Council, free from political interference, be able to speak about the challenges of evangelisation in this land

-

Site: Zero HedgeBoeing Shares Hit Turbulence After CFO Says Q2 Deliveries Will Be Similar To Q1 Amid Regulatory Limbo In ChinaTyler Durden Thu, 05/23/2024 - 11:21

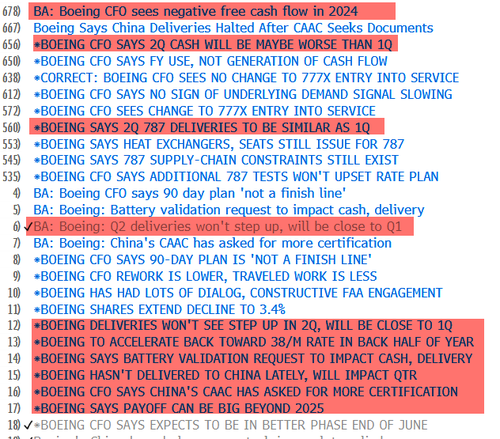

Boeing CFO Brian West confirmed at an industry conference Thursday morning that plane deliveries to China would be delayed due to Chinese regulatory reviews and stated that there would be no increase in second-quarter commercial jet deliveries compared to the first quarter.

- BOEING DELIVERIES WON'T SEE STEP UP IN 2Q, WILL BE CLOSE TO 1Q

The big problem for Boeing is that not even China wants the jets.

*BOEING CFO SAYS CHINA'S CAAC HAS ASKED FOR MORE CERTIFICATION

— zerohedge (@zerohedge) May 23, 2024

*BOEING CFO SAYS CHINA'S CAAC HAS ASKED FOR MORE CERTIFICATION

Not even China wants flying paperweightsWest said the country's Civil Aviation Administration (CAAC) has requested more certification for 737 Max planes.

- BOEING'S CFO SAYS CHINA'S CAAC HAS ASKED FOR MORE CERTIFICATION

Here are the most critical headlines (courtesy of Bloomberg) breaking on West's comments:

Following the comments, Boeing shares in New York plunged as much as 5.4% - the most in almost four months.

*Developing...

-

Site: LifeNews

Two legal organizations have filed a lawsuit after the National Park Service denied, for the second year in a row, the Knights of Columbus’ request to host a Memorial Day Mass inside a national cemetery.

The Knights have hosted the annual Memorial Day Mass inside Poplar Grove National Cemetery in Petersburg, Virginia since the 1960’s.

On May 21, First Liberty Institute and McGuireWoods LLP filed a motion for a temporary restraining order and preliminary injunction against National Park Service, so that the Knights can continue on with hosting their annual Memorial Day Mass at the Cemetery.

According to First Liberty, the National Park Service denied the Knights a permit to host the Mass because a policy change prohibits “demonstrations,” including religious services, in the cemetery.

On May 13, First Liberty sent a letter to Chief Park Ranger Aaron Scott, urging the National Park Service to rescind the denial of the permit and allow the Knights to continue hosting the Mass at the Cemetery.

The letter noted that the Mass does not meet the definition of a “demonstration” and even if it did, the policy’s application would ultimately be discriminatory and a violation of the First Amendment, especially because the National Park Service was denying a group a permit based on the group’s intention to celebrate a religious event.

“If you persist in denying the permit, our clients intend to take all appropriate steps to protect their rights, including through litigation,” First Liberty wrote.

First Liberty requested a response by May 17 about whether or not the permit would be granted.

According to the lawsuit, Chief Park Ranger Aaron Scott responded to First Liberty on May 16, and included “a letter and permit, doubling down on his position that any non-committal ‘religious service’ is a prohibited ‘demonstration’ that cannot be held in a National Cemetery.”

“While the letter purported to grant the Knights permit, in reality, Ranger Scott issued a different permit—one that was never sought—for the Knights to hold their annual Memorial Day mass outside the cemetery,” the lawsuit reads.

SUPPORT LIFENEWS! To help us fight Joe Biden’s abortion agenda, please help LifeNews.com with a donation!

Acting Regional Solicitor Teresa Garrity also responded to the May 13 letter from First Liberty, backing the National Park Service’s decision to deny the initial permit.

According to the motion filed on May 21, Garrity’s letter argued that:

the Knights’ annual Memorial Day mass is a “religious service” that qualifies as a “demonstration” under NPS regulations and Policy Memorandum 22-01, and that, under Policy Memorandum 22-01, “[d]emonstrations within a national cemetery are prohibited ‘without exception.’”

The Knights filed a complaint in the case on May 19, and on May 21, First Liberty and McGuireWoods LLP filed the motion for the temporary restraining order and preliminary injunction.

“The National Park Service is way out of line,” Roger Byron, senior counsel at First Liberty, stated in a news release about the lawsuit. “This is the kind of unlawful discrimination and censorship RFRA and the First Amendment were enacted to prevent. Hopefully the court will grant the Knights the relief they need to keep this honorable tradition alive.”

LifeNews Note: McKenna Snow writes for CatholicVote, where this column originally appeared.

The post Joe Biden Shuts Down Catholic Mass at National Park appeared first on LifeNews.com.

-

Site: Zero Hedge'Unified Reich' Hoax One Of The Most Blatantly Dishonest Attacks On Trump YetTyler Durden Thu, 05/23/2024 - 11:10

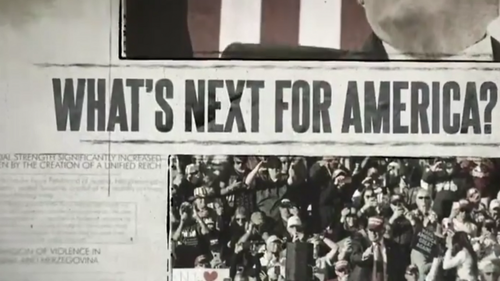

With a brand new set of polls showing Donald Trump leading in six of seven swing states, establishment media has stooped to new levels of transparent dishonesty in a desperate effort to derail his campaign.

The latest example? An all-out hoax that had major outlets telling Americans that Trump shared a video promising that his reelection would lead to the "creation of a unified Reich," in what was supposedly a shocking revelation of his intention to Make Nazism Great Again.

Here's a sampling of the hysterical headlines:

- Newsweek: Donald Trump 'Unified Reich' Video Leaves People Stunned

- MSNBC: Trump's Online Account Promotes 'Unified Reich' Video, Adding To Alarming Pattern

- The Hill: White House Slams ‘Sickening’ Video Shared By Trump Referencing ‘Unified Reich'

- CNN: Trump Posts Video Referencing 'Unified Reich' If Reelected

TV's talking heads gravely shared the news. ABC's George Stephanopoulos said Trump posted a video that "used language from Nazi Germany, the latest in a series of antisemitic and authoritarian statements from Trump and his campaign." Social media erupted in the latest round of bogus outrage, including this pearl-clutching tweet from archetypal deep-stater and Constitution-betraying mass surveillance architect Michael Hayden:

UNIFIED REICH, My God. https://t.co/mfE6L37gJJ

— Gen Michael Hayden (@GenMhayden) May 21, 2024The White House leapt headlong into the propaganda blitz. “It is abhorrent, sickening, and disgraceful for anyone to promote content associated with Germany’s Nazi government under Adolf Hitler,” said Deputy White House Press Secretary Andrew Bates. Piling dishonesty on dishonesty, here's Joe Biden recoiling in phony disbelief as he pretends to be seeing Trump's alleged abomination for the first time:

BOOM! President Biden just responded to Donald Trump calling for a “unified reich” in his campaign ad saying “That’s Hitler’s language, not America’s!” He is absolutely right. Donald Trump is a disgrace to the country. pic.twitter.com/o3zNzhC1VF

— Harry Sisson (@harryjsisson) May 21, 2024So what actually happened? On Monday afternoon, Trump's Truth Social account reposted a video that had been created and posted by someone outside the campaign. The video used imagery of newspaper headlines to imagine a Trump victory in November and the beneficial consequences that would accompany it.

The video was not created from scratch, but rather from a stock video template that anyone can buy online. Sold by Envato Elements, it's called "Newspaper Vintage History Headlines Promo." With its old-newspaper feel, whatever headlines are added to it are given a certain historical gravitas. Aside from the Trump-specific banner headlines, the video creator simply left intact all the minor, historical headlines that come with the template and serve as little more than background filler.

For all the freaking out about Trump using the video to implicitly endorse the Third Reich, the vintage headline in question isn't even about that reich. It reads, "German Industrial Strength After 1871 Driven By The Creation Of A Unified Reich."

"It's difficult to convey just how fake the establishment American media really is," said Newsmax's Rob Schmitt, in this segment that lays bare the utter dishonesty behind the latest baseless outrage:

You've been duped again by the Fake News Media, America.

— Kyle Becker (@kylenabecker) May 22, 2024

Add the "Unified Reich Hoax" to the list.

Newsmax's @SchmittNYC did a great job exposing the hoax. You're going to want to watch this. pic.twitter.com/GDrH2x3mAQPredictably, the so-called "fact checkers" at Snopes framed the video controversy in such a way that they could stamp "TRUE" on it, addressing merely whether Trump shared a video that contained the words "creation of a unified reich." Like many of the harpies on social media who've been called out for their deceptive descriptions of the video, Snopes blames the video creator for "fail[ing] to remove" the unified Reich headline -- as if that video creator had used Triumph Of The Will as their starting template.

Meanwhile, with an article explaining why the video "isn't what people are making it out to be," The Atlantic's David Graham pleasantly surprised us -- only to then exasperate us by reinforcing one of the most persistent anti-Trump hoaxes of all. After explaining the benign nature of the video template, Graham proceeded to administer a Trump-mythology booster to The Atlantic's lefty readership, writing that "[Trump] called neo-Nazi marchers in Charlottesville, Virginia, in 2017 'very fine people.”

See that blurry little headline on the left? That reference to German industry in 1871 is what this whole thing is about.

See that blurry little headline on the left? That reference to German industry in 1871 is what this whole thing is about.

Let's go to the transcript...again. In a feisty exchange with reporters, Trump -- referring to politically diverse protesters and counter-protesters who showed up in Charlottesville -- said:

"You had some very bad people in that group, but you also had people that were very fine people, on both sides...You had people in that group that were there to protest the taking down of, to them, a very, very important statue and the renaming of a park from Robert E. Lee to another name."

After questioning whether statues of historical figures should be removed solely because the person in question had some involvement with slavery, Trump said:

"You’re changing history. You’re changing culture. And you had people -- and I’m not talking about the neo-Nazis and the white nationalists -- because they should be condemned totally. But you had many people in that group other than neo-Nazis and white nationalists. Okay? And the press has treated them absolutely unfairly."

Just as the "very fine people" hoax persists at The Atlantic and nearly everywhere else, we're guessing the "unified reich video" hoax will have staying power too. In any event, it looks like it's time for Scott Adams to issue another update to his hoax quiz...

I updated the Hoax Quiz.

— Scott Adams (@ScottAdamsSays) March 17, 2024

Hoax Quiz

How many of these hoaxes do you still believe are true?

Russia Collusion Hoax

Steele Dossier hooker story

Russia paying bounties on US soldiers in Afghanistan

Trump called Neo-Nazis “Fine people.”

Trump suggested drinking/injecting bleach… -

Site: Zero HedgeBiden Goes All-In With War On CoalTyler Durden Thu, 05/23/2024 - 10:50

Authored by American Coal Council CEO Emily Arthun, via RealClearEnergy,

The Biden administration’s war on coal came out of the shadows recently, with the release of a new series of regulations that have the clear intent of locking up millions of acres of federal land from coal mining and drilling for oil and natural gas, as well as shutting down the nation’s remaining coal-fired power generation fleet.

The Bureau of Land Management released a new rule that will effectively make it impossible to continue to mine coal or drill for oil and gas anywhere on federally owned lands. This will cripple coal mining in the Powder River Basin and other western reserves, which provide most of the nation’s thermal coal used for energy production. This action alone would have been devastating, but it was just part of a much larger and far-reaching series of regulatory actions.

The new tranche of regulations was an 11th hour assault, issued literally days before the close of a window of time allowing a new President to reverse the decision by executive order. With this announcement, any reversal will have to come through action by both houses of Congress or by litigation in court.

These actions come despite the clear warnings by some of the Biden Administration’s own electric utility regulators that further closures of baseload energy capacity (such as coal) could result in the failure of the nation’s electric grid.

The new regulations effectively make it impossible for utilities to continue to operate coal-fired power plants without investing in new, largely unproven commercially and highly expensive, carbon capture technologies capable of cutting 95% of carbon dioxide emissions. It would also require the same of any new natural gas-powered facilities. However, existing natural gas facilities would be exempt from the requirement.

Make no mistake about it, this new series of regulations has one intent – to force the shutdown of the nation’s coal-fired generation fleet, starving it of much of its fuel source, and making it economically impossible to continue to operate these units. Far from some panacea, these actions will ripple through the entire economy. They will drive already staggering electric bills out of reach for millions of American families, leaving them struggling with the choice of putting food on the table or heating and cooling their homes. Many of those on fixed incomes, such as retirees on social security, will be the hardest hit.

And even if you can afford to pay for electricity, it may not be there when you need it most. Further closure of baseload generation could (and likely will) push the electric grid past the breaking point during the very times when they need electricity the most – the heat of summer and the cold of winter. It will result in the de facto rationing of energy and will also play out across the rest of the economy, driving inflation even higher and forcing many companies out of business.

Frankly, I do not understand this “damn the torpedoes, full steam ahead” approach to regulation. It seems allegiance to a radical green agenda is all that matters to the Biden Administration and the needs of average American families are not even on the radar.

America needs ready access to reliable and affordable energy. It is what built this great nation. There is no shortage of coal. There is no shortage of gas or oil. However, there does appear to be a shortage of common sense on the part of this administration.

Rather than using our vast resources of coal, oil, and gas, the Biden Administration seems intent on committing economic suicide. Over the next few decades, demand for electricity is projected to skyrocket. How will we meet that demand if we continue this administration’s reckless pursuit of a green fairy tale?

Emily Arthun is president and CEO of the Washington, D.C.-based American Coal Council.

-

Site: LifeNews

On Tuesday the organization Planned Parenthood Great Plains Votes issued a statement on X (formerly Twitter) criticizing the Arkansas Legislature for providing $2 million to support pregnancy help organizations and maternal and infant wellness in Arkansas.

In April the Arkansas Legislature passed — and Gov. Sanders signed — S.B. 64 by Sen. John Payton (R – Wilburn). This good budget measure provides $2 million in state grant funding for pregnancy help organizations.

The $2 million will be disbursed as grants to pregnancy resource centers, maternity homes, adoption agencies, and other organizations that provide material support to women with unplanned pregnancies.

This funding helps serve families at the local level without creating new government programs. The State of Arkansas is expected to start accepting grant applications from pregnancy help organizations in the coming months.

Click here to sign up for pro-life news alerts from LifeNews.com

In 2022 and in 2023 Family Council worked with lawmakers and the governor to create this grant program for pregnancy help organizations. Since then more than two dozen good organizations across the state have applied for funding and used it to give women and families real assistance when faced with an unplanned pregnancy.

S.B. 64 makes improvements to the grant program. It increases state funding from $1 million per year to $2 million. This puts Arkansas’ funding on parr with funding in other states.

The law also clarifies that “pregnancy help organizations” include nonprofit organizations that promote infant and maternal wellness and reduce infant and maternal mortality by:

- Providing nutritional information and/or nutritional counseling;

- Providing prenatal vitamins;

- Providing a list of prenatal medical care options;

- Providing social, emotional, and/or material support; or

- Providing referrals for WIC and community-based nutritional services, including but not limited to food banks, food pantries, and food distribution centers.

S.B. 64 also includes language preventing state funds from going to abortionists and their affiliates.

However, Planned Parenthood criticized the funding measure, posting,

There simply shouldn’t be anything controversial about the State of Arkansas awarding taxpayer funds to organizations that provide material support to women and children and that promote maternal wellness.

Fortunately, Arkansas’ lawmakers and governor don’t agree with Planned Parenthood.

Family Council is grateful to the General Assembly for passing S.B. 64, and we appreciate Governor Sanders signing it into law. We look forward to seeing the state implement S.B. 64 in the coming fiscal year.

LifeNews Note: Jerry Cox is the president of the Arkansas Family Council.

The post Planned Parenthood Condemns Arkansas for Helping Pregnant Women appeared first on LifeNews.com.

-

Site: Zero HedgeWatch: Cruz, Kennedy Destroy Biden Judge For Placing '6 Foot 2 Serial Child Rapist' In Women's PrisonTyler Durden Thu, 05/23/2024 - 10:30

Sens. Ted Cruz (R-TX) and John Kennedy (R-LA) eviscerated a Biden judicial nominee on Wednesday over her 2022 recommendation that a transgender serial rapist, William McClain (aka July Justine Shelby) be housed in a women's prison despite previous convictions for raping children and possessing child pornography.

The Senators grilled U.S. Magistrate Judge Sarah Netburn, who was nominated to serve on the U.S. District Court for the Southern District of New York. Netburn transferred McClain despite an objection from the Board of Prisons.

In a handwritten note, McClain (Shelby) said he feared for his health, safety and life and suffered from gender dysphoria (of course a convicted child rapist wouldn't expect to fare well in prison).

"Miss Shelby said I don't want to go to a male prison. I want to go to a female prison," Kennedy told Netburn. "And the Board of Prisons said 'What planet did you parachute in from? You're going to a male prison with this kind of record.' And you sent him to a female prison, did you? You said that the Board of Prisons was trying to violate Ms Shelby, former Mr. McClain's, constitutional right, didn't you?"

Watch (via @Eddies_X)

WTAF!

— Eddie (@Eddies_X) May 23, 2024

Activist Judge Sarah Netburn, a Biden judicial nominee, recommended in 2022 that a man, William McClain, who goes by July Justine Shelby, be housed with female prisoners, despite his previous convictions for r-ping children and possessing child p-rnography‼️

John Kennedy… pic.twitter.com/CWYmrhCRyTKennedy pointed out that Shelby was convicted for molesting a 9-year-old boy and raping a 17-year-old girl, and had sent child porn to other sex offenders.

"I issued a report and recommendation to the district judge recommending that the district judge transfer the petitioner to a women's facility," Netburn replied. "My recommendation was that the petitioner's serious medical needs were being denied by keeping her in a men's facility."

Cruz then began his line of questioning.

"And this individual. Six-foot-two, biologically a man. A minute ago you said that when this man decided that he was a she, that you said this individual was quote, I wrote it down, ‘sober and entirely a female,’" Cruz said.

"Sorry, what I meant to say was hormonally a female," Netburn replied, admitting that McClain had male body parts.

"So you took a six-foot-two serial rapist. Serial child rapist with male genitalia," Cruz continued. "And he said, you know, I'd like to be in a women's prison. And your answer was, ‘That sounds great to me.’ Let me ask you something. The other women in that prison, do they have any rights?

"Do they have the right not to have a six-foot-two man who is a repeat serial rapist put in as their cellmate?" Cruz continued.

Netburn attempted to defend her decision, robotically repeating iterations of "Senator Cruz, I consider the facts presented to me, and I reached a decision."

Cruz shot back - "This is not a judge's order ... This is a political activist, by the way. The beginning of your order, says. At birth. People are typically assigned a gender. I gotta say, that would astonish a lot of Americans. A lot of Americans think you go to the hospital, a baby is born, and you congratulations."

"You have a little boy, a little girl the assigned a gender. I know you went to Brown (University), but it sounds like it's in a college faculty lounge with no bearing on reality, the Bureau of Prison argued," Cruz said. "What I'm saying right now, that if you put this person in a female prison, there will be a risk of sexual assault to the women. And you know what you did? You said you didn't care about the women. I'm going to quote what you wrote. You wrote, quote, the Bureau of Prisons claimed penal logical interest in protecting female prisoners from sexual violence and trauma. This interest is legitimate."

Watch:

Meanwhile, the redpilling of Bill Ackman continues:

This is demented

— Elon Musk (@elonmusk) May 23, 2024 -

Site: LifeNews

Abortion statistics released by the Department of Health and Social Care this morning show the highest number of abortions ever recorded in England and Wales, with 252,122 taking place in 2022, an increase of 37,253 (17.34%) from 2021.

The figures show that:

- In England and Wales, there were a total of 252,122 abortions in 2022, an increase of 37,253 abortions from 2021 when there were 214,869 abortions.

- 251,377 of these abortions were for residents of England and Wales, an increase of 37,121.

- This represents a 17.34% increase in abortions from the previous year.

- The statistics for 2022 also show a rise in repeat abortions from 91,313 in 2021 up to 102,689 in 2022.

- This represents 11,376 more repeat abortions than in 2021.

- This is a 12.46% increase from 2021.

- 72 ‘selective termination’ procedures were performed, where a twin, triplet or more were aborted in the womb.

- There were 3,124 disability-selective abortions in 2022

- There were 256 late-term abortions for babies with disabilities at 24 weeks and over.

- 760 babies with Down’s syndrome were aborted in 2022

- There were 19 late-term abortions for babies with Down’s syndrome at 24 weeks and over.

- There were 46 abortions where the baby had a cleft lip or cleft palate, an increase of 15% from 2021.

- There were also 6 late-term abortions at 24 weeks and over where a baby had cleft lip or cleft palate.

- Sadly, the figures for cleft lip and palate are likely to be higher; for example, a 2013 review by Eurocat showed 157 babies were aborted with cleft lip and palate in England and Wales between 2006 and 2010. However, the Department of Health and Social Care (DHSC) recorded only 14 such abortions.

- The Department of Health and Social Care also reported that the number of abortions funded by the NHS performed by private abortion providers reached a record high of 200,258. This represents a 362.85% increase since 1999 when there were 43,266 abortions performed by private providers.

This significant rise in abortions has accompanied the second full year that at-home abortion services have been operating in England and Wales. Since home abortions were introduced, a number of significant problems have arisen.

Polling shows large majorities of women in the UK support a number of changes to abortion laws that would have a positive impact on lowering the number of abortions. The polling shows that 70% of women want the current time limit on abortion to be lowered and 91% of women want a ban on sex-selective abortion.

Click here to sign up for pro-life news alerts from LifeNews.com

Polling published in the Daily Telegraph earlier this month today shows that 71% of women support the reinstatement of in-person appointments and only 9% are in favour of the status quo. In contrast, only 16% of the public support current proposals to decriminalise abortion.

Spokesperson for Right To Life UK, Catherine Robinson, said:

“It is a national tragedy that 252,122 lives were lost to abortion in England and Wales in 2022”.

“Every one of these abortions represents a failure of our society to protect the lives of babies in the womb and a failure to offer full support to women with unplanned pregnancies”.

“This significant rise in abortions has accompanied the second full year that abortion services outside of a clinical setting have been operating in England and Wales”.

“Only two years ago, the vote to make at-home abortions permanently available passed by just 27 votes. A large number of MPs had serious concerns about the negative impact these schemes would have on women”.

“Since then, we have seen these concerns confirmed, with women such as Carla Foster performing at-home abortions well beyond the 24-week time limit, putting their health at serious risk. If Carla Foster had been given an in-person consultation, where her gestation could have been accurately determined, she would not have been able to access abortion pills and this tragic case would have been prevented”.

“The clear solution here is the urgent reinstatement of in-person appointments. This would prevent women’s lives from being put at risk from self-administered late-term abortions”.

“Polling shows that 71% of women support the reinstatement of in-person appointments and only 9% are in favour of the status quo”.

“Ahead of the General Election, we are calling on the next Government to urgently bring forward new protections for unborn children and increased support for women with unplanned pregnancies. Polling shows these changes are backed by the public and this would ensure we are working together as a society to reduce the tragic number of lives that are lost to abortion each year”.

ENDS

- For additional quotes and media interviews contact 07774 483 658 or email press@righttolife.org.uk

- For further information on Right To Life UK visit www.righttolife.org.uk

- The full 2022 abortion statistics are available here: https://www.gov.uk/government/statistics/announcements/abortion-statistics-for-england-and-wales-2022

The post Record High 252,122 Babies Killed in Abortions in UK appeared first on LifeNews.com.

- In England and Wales, there were a total of 252,122 abortions in 2022, an increase of 37,253 abortions from 2021 when there were 214,869 abortions.

-

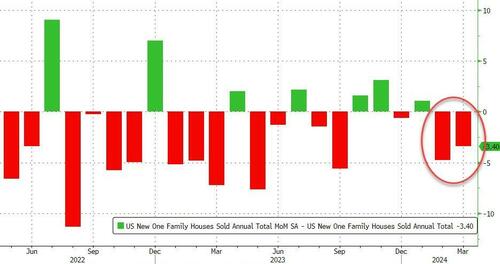

Site: Zero HedgeUS New Home Sales Tumbled In April Amid Further Downward Revisions...Tyler Durden Thu, 05/23/2024 - 10:09

After unexpectedly surging in March, new home sales plunged 4.7% MoM in April (considerably worse than the 2.2% MoM decline expected). This dragged new home sales down 7.7% YoY...

Source: Bloomberg

As usual, previous data was revised downwards...

Source: Bloomberg

With revisions, new home sales SAAR fell to 634k - basically unchanged for eight years...

Source: Bloomberg

New home sales median price remains near record highs...

Source: Bloomberg

Interestingly, the supply of new homes has been soaring up towards record highs...

Source: Bloomberg

Mortgage rates above 7% continue to plague existing-home sales, which are “stuck,” National Association of Realtors Chief Economist Lawrence Yun said last week.

Source: Bloomberg

Just how long can homebuilders fill this gap?

-

Site: Steyn OnlineGreetings and welcome to this week's edition of Laura's Links, another busy one for me and another utterly crazy one for the world. I've got to ask: is there anywhere in the world where things are not actually falling apart? Does anyone out there live in

-

Site: Zero HedgeS&P Global Says US Business Activity Is At Its Strongest In Two Years, But...Tyler Durden Thu, 05/23/2024 - 09:56

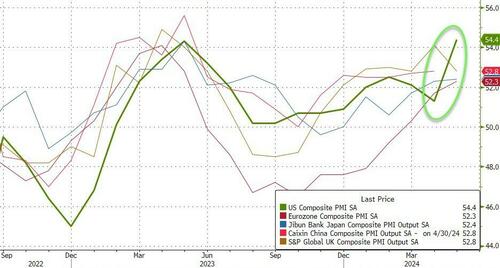

With both 'hard' and 'soft' data declining rapidly recently, why should we be surprised that S&P Global's preliminary PMI prints for May would suddenly surge, with manufacturing back into expansion?

-

Flash US Services Business Activity Index at 54.8 (April: 51.3). 12-month high.

-

Flash US Manufacturing PMI at 50.9 (April: 50.0). 2-month high.

Just ignore the plunge in hard data in May...

Source: Bloomberg

And just to rub salt into the wounds... S&P Global claims that US business activity accelerated in early May at the fastest pace in two years, largely reflecting stronger growth at service providers and accompanied by a pickup in inflation.

The S&P Global flash May composite purchasing managers index advanced by more than 3 points to 54.4, the highest since April 2022.

BUT...Selling price inflation has meanwhile ticked higher and continues to signal modestly above-target inflation.

“What’s interesting is that the main inflationary impetus is now coming from manufacturing rather than services, meaning rates of inflation for costs and selling prices are now somewhat elevated by pre-pandemic standards in both sectors to suggest that the final mile down to the Fed’s 2% target still seems elusive,” Chris Williamson, chief business economist at S&P Global Market Intelligence, said in a statement.

Factory input prices advanced at the fastest rate since November 2022, the report showed.

Prices-paid and received metrics for service providers also picked up.

Commenting on the data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

“The US economic upturn has accelerated again after two months of slower growth, with the early PMI data signalling the fastest expansion for just over two years in May.

The data put the US economy back on course for another solid GDP gain in the second quarter. "

As solid as the 1.6% gain in Q1?

“Not only has output risen in response to renewed order book growth, but business confidence has lifted higher to signal brighter prospects for the year ahead.

However, companies remain cautious with respect to the economic outlook amid uncertainty over the future path of inflation and interest rates, and continue to cite worries over geopolitical instabilities and the presidential election."

So while growth macro data is surprising to the downside, this survey says growth is killing it and Bidenomics rules!

Let's see if this "good news" on growth prompts gains (or losses) in stocks.

-

-

Site: Euthanasia Prevention Coalition

The Boundary of incapacity: must not be crossed. (Link to the original release)Montreal, May 23, 2024 – The Bloc Québécois announced today that it will table a Federal Bill that “would allow advance requests for medical assistance in dying (MAiD) for people suffering from neurodegenerative disorders such as Dementia."

This was presented during a Press Conference in Ottawa, in collaboration of a Coalition made up of the Quebec Association for the Right to Die with Dignity (Association Québécoise pour le droit de mourir dans la dignité, AQDMD), the Quebec Bar (Barreau du Québec), the Chambre des notaires du Quebec (CNQ), the College of Physicians of Quebec (CMQ), the Order of Nurses of Quebec (OIIQ), the Order of Pharmacists of Quebec (OPQ) as well as the Order of Social Workers and Marriage and Family Therapists of Quebec (OTSTCFQ) (see their press release in French) + Dying with Dignity Canada.

Given the tone of the Press Conference, which was very critical of the Liberal government, this maneuver has little chance of finding an attentive ear.

A thorough review is required before expanding access to medical assistance in dying by advance request. Crossing the boundary of incapacity and contemporaneous consent to administer MAiD would have serious and unprecedented consequences.

Here is an excerpt from the Brief from Living with Dignity presented last year during the examination (in Quebec) of Bill 11, An Act to amend the Act respecting end-of-life care and other legislative provisions:

The limits of advanced and substituted consent, the numerous practical issues concerning the administration of MAiD, the possible conflicts of interest (numerous cases of abuse and neglect of elderly individuals) and the major impacts of this new access on a network of already fragile geriatric care, strongly questions the merits of this expansion which we also consider to be marked by ableism.It is important to remember that the opponents of this expansion were not invited to testify in a parliamentary committee concerning Bill 11 last year at the National Assembly of Quebec.

Webinar by Professor Theo Boer

To reflect on the issue of advance directives, the citizen network Living with Dignity invites interested people to follow a webinar organized by Doctors Say No International. At 4 p.m. (Montreal time), Friday, May 24, Professor Theo Boer, Professor of Health Ethics (PThUniversiteit Groningen, Netherlands) will present (in English) during this webinar on Assisted dying and its impact on culture: 40 years of Dutch experience with euthanasia.

Zoom link (password: 089934).

Holland is the only country in the world that allows the death of a person by advanced request when they are Incapable of decision-making and conscious (Belgium only allows it when a person is Incapable and unconscious). Professor Boer's contributions in French during the International Meeting on the End-of-Life are now also available in print (in French), as are those of all the speakers at this gathering held in Paris on February 28, 2024.

-30-

Jasmin Lemieux-Lefebvre

Coordinator

Living with Dignity citizen network

info@vivredignite.org

438-931-1233 -

Site: The Orthosphere

“To teach us reverence, and whom we are to revere,

should ever be the chief aim of education.”Thomas Carlyle, “Review of Goethe’s Works” (1832)*

Commenter Ian objects to my irreverent opinions of some heroes of the Old Testament. I understand his unease because I long read the OT with the pious presupposition that these characters were indeed heroes. But then one day my pious presupposition was not working and I just read the words.

What is admirable about Abraham? What kind of man pimps his wife and then plays the jealous husband for cash and prizes? Abraham pulls this stunt twice! What is admirable about Jacob? What kind of man steals his brother’s birthright and goes on to embezzle his father-in-law’s sheep and goats? What is admirable about Joseph? What kind of man exploits his government post and a famine to expropriate and enslave the nation he governs? What is admirable about Rahab the harlot? What kind of a woman helps foreign spies so that she and her family can escape a massacre of her own people?

When a pious presupposition is not whispering Hero! Hero! in your ear, your lying eyes begin to see a shifty rat.

Recall that the soul of a people is revealed in its heroes. Whom they reverence and teach their children to reverence (not always the same person) is supremely important. One way to understand a people is therefore to read their legends and folktales and histories and ask, Who are the heroes? Are they brave warriors? Pious saints? Patient scholars? Or are, as in these cases, shrewd and devious tricksters?

Are they men who outwit unwary yokels with sharp dealings and shrewd fraud?

When I say sharp dealings and shrewd fraud, I do not mean simple intelligence. I believe simple intelligence is in every culture admired. I mean craft; I mean guile; I mean devious design. I mean a man, for instance, who would set another man up to hit on his wife in order to extort cash and prizes.

Imagine that you knew a man in real life who, with his snaky wife, made millions with this loathsome scam. Would you tell your son, “That man is a hero, my son”? Would you say, “Son, I hope you will grow up to be just like him some day”?

All of this makes me wonder what happens to our souls when we read the legends and folktales and histories of a profoundly alien race, and then stifle our natural revulsion with a pious presupposition. “That sure seems rotten, but I guess it must be alright.” What sort of confusion enters into our souls when our hearts recoil from some outrageous roguery, but our heads say, “No, no, this is really a man (or woman) to whom all honor and glory are due?”

Whatever happens, I very much doubt that reading about rascals with a pious presupposition is a hermeneutic conducive to spiritual health.

*) Thomas Carlyle, “Review of Goethe’s Works” The Foreign Quarterly Review 10 (Aug. and Oct. 1832), pp. 1-44, quote p. 8.

-

Site: Zero HedgeRed Or Blue, Rich Or Poor — Recessions Don't CareTyler Durden Thu, 05/23/2024 - 09:25

Authored by Simon White, Bloomberg macro strategist,

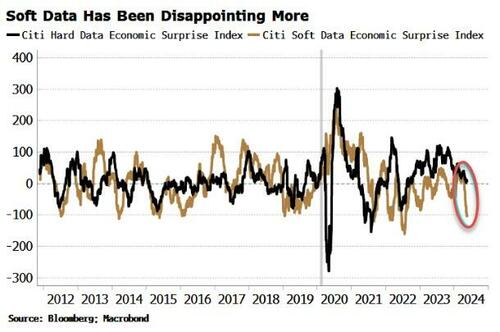

Political affiliation and wealth, it’s speculated, are making a recession look more likely than it really is by introducing systematic bias into the economic data. But this is a distraction. For the data that matters most in gauging the likelihood of a downturn, any potential bias matters little. A robust recession framework shows that the near-term risk of a slump remains low, but is prone to shifting higher quickly.

There is no such thing as unbiased data. How the data is procured and presented will always introduce user bias, and it’s no different with economic data. My colleague Simon Flint recently wrote that recession risk is being overstated due to data biases, while Cameron Crise has previously touched upon apparent political bias in survey data.

A reader also wrote in with an interesting conjecture that perhaps soft data is more geared to those who are less well off, and hard data the better off.

The recent worse performance of soft data – helping to inch up recession risks – is thus a reflection of worsening wealth inequality rather than a bona fide worsening in economic conditions.

We’ll get to these points, but first let’s answer what should be the prime question for investors, keen to avoid the worst equity-market drawdowns:

Is bias in the data overestimating recession risk?

The short answer is no.

Although there is some bias in economic data, it’s not enough to subvert recession prediction when done robustly. Near-term recession risk today remains low, but that risk could rise rapidly, independent of data bias.

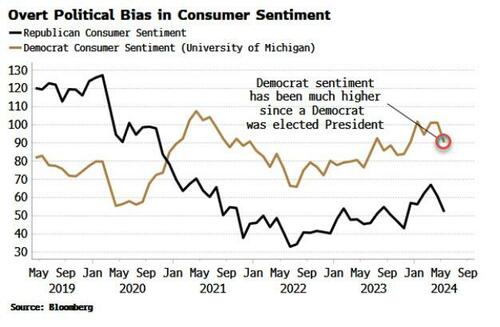

A prevalent bias in some economic data is political. When it comes to some survey data, it can be significant. The Michigan Consumer Sentiment Survey provides a breakdown of political affiliation. Sentiment is being overwhelmingly driven by those who identify as Democrats, and who are currently wildly more optimistic than Republicans.

I am not aware of an explicit breakdown of affiliation in other survey data, but Cameron notes there is an inferable potential skew in the NFIB’s Small Business Optimism Index toward being higher when a Republican is in the White House. Similarly with the Conference Board’s Consumer Confidence Index.

This is all quite interesting, but the core question for investors remains: does it matter for when stock markets experience their worst falls, i.e. recessions?

To begin with, the Conference Board and Michigan’s gauges of consumer sentiment as well as the NFIB are tier-2 data when it comes to predicting downturns.

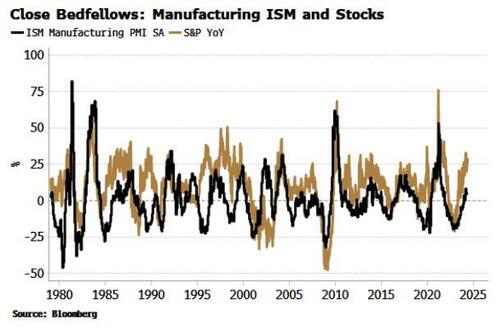

Much better is the manufacturing ISM. As a standalone indicator it excels at unequivocally turning down before a recession begins.

But that’s secondary; the ISM’s real importance stems from it sitting at the nexus between soft and hard data and how they interact to trigger recessions.

This is critical. Recessions metastasize when we get a negative feedback loop developing between hard and soft data. Hard data deteriorates, and this feeds into soft and market data. That in turn hits the wealth effect, which affects investment and spending and feeds back into worsening hard data. Unchecked, a recession typically develops.

The ISM’s role is as a key artery from survey data to the market, and thence ultimately into hard data. The other surveys simply don’t have the same influence, with all of them displaying a much weaker relationship with the S&P.

There is some reflexivity in that ISM-survey respondents’ level of optimism will be affected by the level of the market. But the market also responds to the ISM, as one of the first data points out each month.

Despite Cameron’s view that the ISM does not matter as much as it used to, it in fact remains one of the most important data points (I’ll write more on this very soon).

But we also needn’t overstate its importance. There is no single “killer” recession predictor. The ISM’s utility comes from it having a long history, being minimally revised, having an early release time and its role in facilitating recession-causing negative feedback loops. But other data matter too.

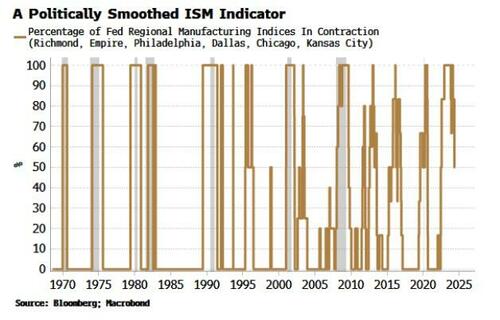

All that said, it would be problematic if the ISM displayed any systematic, significant political bias. There is no data on the political leaning of the survey’s respondents, but we can exploit another feature of recessions to get round any potential bias: their pervasiveness.

Things tend to start going bad everywhere at the same time in a recession. Several Fed member banks produce their own regional manufacturing surveys. The states they cover are fairly evenly balanced overall, with two Democrat strongholds, two Republican ones, and two states that are generally closely fought. This should help even out any potential bias.

A reliable and timely recession indicator, with only a few false positives, has been when all of the regional indexes have been in contraction. Even then this should not be used as a standalone signal. To reiterate, we need to see both hard and soft data self-reinforcedly deteriorating at the same time to trigger a recession.

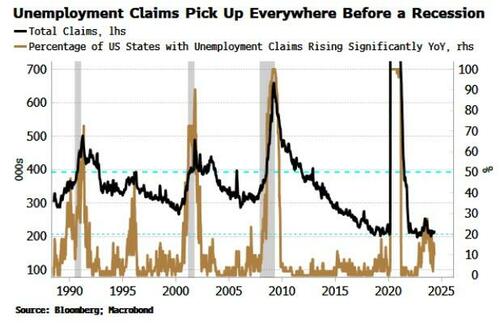

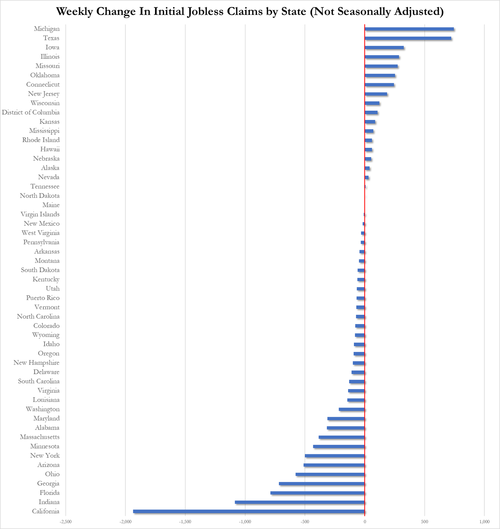

In addition, therefore, we look for a pervasive worsening in hard data too, e.g. the jobs market across states. Unemployment claims in multiple states have picked up sharply ahead of previous recessions.

What about the notion that hard and soft data are biased by wealth inequality, with hard data more geared to the better off, and soft data to the less well off?

Again, there is little bias we can discern. Both better and worse-off households by net worth show a negligible relationship with both hard and survey-based data (even if we use different lags in the data).

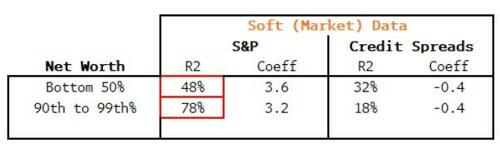

Soft, market-based data does have a much stronger relationship with net worth. But, as the table below shows, stocks have a higher, not lower, R^2 with better-off households than less well-off ones. This is anyway as you would expect given the higher exposure of the wealthier to financial assets.

However, the net worth of less wealthy households has a higher R^2 to credit spreads than better-off ones. That may seem odd at first but is likely explained by credit-spreads’ closer relationship to unemployment.

It’s hard to pinpoint any systematic wealth bias in the data, and likewise it’s hard to find political bias in data that matters for recession prediction, or if so any that we can’t smooth out by exploiting state heterogeneity.

So while it’s recommended to “know your data,” when it comes to what matters - avoiding steep market drawdowns ahead of downturns - investors need not get distracted by second-guessing who votes for whom, and how well-off they might be.

-

Site: Ron Paul Institute - Featured Articles

More than 23 years ago, George W. Bush, Jr. signed Presidential Proclamation 7463 declaring that a “national emergency exists by reason of the terrorist attacks at the World Trade Center, New York, New York, and the Pentagon, and the continuing and immediate threat of further attacks on the United States.”

The White House has demonstrated, in several administrations, both Democrat and Republican, “threat inflation” for the sake of spending endless money on wars, and manipulating fears to hold on to power to continue to spend endless money on even more wars in the ultimate protection racket.

As a result, the constitutional system of checks and balances is being obliterated in favor of an Imperial Presidency, and, as the Constitution is eroded, so too, are our liberties.

The recent chipping away at our First Amendment and Fourth Amendment rights can be traced directly to the psychology of a “State of Emergency,” which licenses shredding of freedom.

Presidents no longer ask Congress for explicit permission to go to war, as the Constitution requires, under Article 1, Section 8. Courts have held that once Congress appropriates money for wars, that is tantamount to congressional approval.

The increased spending for war has militarized our culture, proliferates enemies, creates violence at home and abroad.

We must break this cycle of fear, the endless wars and the emergency powers for Presidents who are not accountable to the Congress, which is directly elected by the people.

Those of us who witnessed the events of 9/11, up close, or from a distance, will never forget the imminent danger, the fear, the grief, the loss, the uncertainty that gripped us in those days. Nor will we forget those whose lives were sacrificed, or those who gave their lives in service to humanity on that day, or those who died following long-term illnesses which began during and after the attacks 23 years ago.

That is why it may surprise some that on September 7, 2023, President Joe Biden proclaimed, “I am continuing for 1 year the national emergency previously declared on September 14, 2001, in Proclamation 7463, with respect to the terrorist attacks of September 11, 2001, and the continuing and immediate threat of further attacks on the United States.”

23 years later and trillions upon trillions of dollars spent to “make us safer” and we are still in a “State of Emergency,” facing the same terror threats?

America has been in and continues to be in a State of Emergency which has endowed the Presidency with broad powers and undermined the Constitutional role of Congress, while placing presidential emergency declarations on par with congressional declarations of war, under Article 1, Section 8 of the U.S. Constitution. Presidents from Bush, Jr., to Biden have all capitalized on declarations of a state of emergency.

Congress is a co-equal branch of government. America’s Founders did not design the Congress to be subordinate to the Presidency, but strong presidents and weak Congresses have created that condition.

According to Congressional Research Service (CRS), there are 106 laws which further empower the executive branch following a presidential declaration of a “National Emergency.” The Brennan Center for Justice has identified a total of 136 expanded executive powers.

The emergency powers may not have been used explicitly but their use is authorized once a “National Emergency” is declared. Among the emergency powers of the President, (as cited by CRS) without a need for congressional permission:

- Executive ability to detail members of the armed forces to foreign countries, without congressional approval.

- Undertake military construction.

- Carry out military construction with NATO funds.

- Order “Ready Reserve” to active duty for two years, without their consent.

- Additional penalties for “gathering, transmitting or losing defense information.”

- Lift prohibition on infectious medical waste being dumped in the ocean.

- Seize, shutdown or appropriate broadcast stations.

- Suspend laws concerning production and transportation of chemical, biological and “warfare agents.”

We live in a forever state of emergency, with forever wars, forever fears, forever siphoning off our tax dollars.

Remember:

– The Bush Administration lied when it claimed that Iraq was behind 9/11, but proceeded to characterize Iraqis as terrorists in an attempt to justify killing one million Iraqi citizens.

– Since 9/11, over $8 trillion dollars of our $34 trillion dollar national debt is attributable to wars which never had to be fought, wars which put the lives of America’s brave sons and daughters on the line.

– The United States shelved diplomacy in favor of weaponry as a means of international relations.

– At present the USA spends close to one trillion dollars a year for supporting a war machine and that nearly 60% of all discretionary spending goes for preparation for war.

– The 2002 National Intelligence Estimate, (NIE) which was the (closely held) product of all US intelligence agencies, did not identify Iraq as a major threat, because it was not. The publicly available 2024 Annual Threat Assessment (ATA) of the U.S. Intelligence Community brings forth two paragraphs, out of a 41 page report, regarding “global terrorism.”

There was no discussion in the ATA of the basis for President Biden’s most recent declaration of a national emergency and the “continuing and immediate threats” even though the ATA report was being drafted at about the time that the President continued the “National Emergency” in the name of a 23-year fight against “terrorism.”

The CATO Institute, whose pocket Constitution I carried with me during my years in Congress, suggests amending the National Emergencies Act to rein in Executive power by requiring congressional approval, and putting expiration dates on emergency powers.

Does the US have enemies? Yes. Should we be on our guard? Yes.

“Eternal vigilance is the price of liberty.”

We should also be vigilant against government manipulating our love of country, playing with our fears, in order to control us, or to use us to support the continued erosion of our US Constitution and advance the malevolent ambitions of the military industrial complex, of which President Eisenhower warned in 1961.

Reprinted with permission from The Kucinich Report.

Subscribe and support here.

-

Site: LifeNews

Pope Francis spoke to a palliative care symposium in Canada and told those seeking alternatives to euthanasia and assisted suicide that killing people is a “failure to love.”

The head of the Catholic Church said “authentic palliative care is radically different from euthanasia, which is never a source of hope or genuine concern for the sick and dying.”

“All who experience the uncertainties so often brought about by sickness and death need the witness of hope provided by those who care for them and who remain at their side,” the pope said in his message to the symposium.

“In this regard, palliative care, while seeking to alleviate the burden of pain as much as possible, is above all a concrete sign of closeness and solidarity with our brothers and sisters who are suffering. At the same time, this kind of care can help patients and their loved ones to accept the vulnerability, frailty, and finitude that mark human life in this world.”

SUPPORT LIFENEWS! If you want to help fight abortion, please donate to LifeNews.com!

Catholic News Agency has more:

Quoting his 2020 encyclical Fratelli Tutti, Pope Francis called euthanasia “a failure of love, a reflection of a ‘throwaway culture’ in which ‘persons are no longer seen as a paramount value to be cared for and respected.’”

He also repeated a conviction he has shared before that assisted suicide and euthanasia constitute a “false compassion.”

“‘[C]ompassion,’ a word that means ‘suffering with,’ does not involve the intentional ending of a life but rather the willingness to share the burdens of those facing the end stages of our earthly pilgrimage,” he explained.

“Palliative care, then, is a genuine form of compassion, for it responds to suffering, whether physical, emotional, psychological, or spiritual, by affirming the fundamental and inviolable dignity of every person, especially the dying, and helping them to accept the inevitable moment of passage from this life to eternal life.”

Pope Francis has repeatedly condemned euthanasia, as he did in comments last year.

“You don’t play with life, neither at the beginning nor at the end. It is not played with!” he told reporters aboard the papal airplane heading home from events in France.

“Whether it is the law not to let the child grow in the mother’s womb or the law of euthanasia in disease and old age,” he said, “I am not saying it is a faith thing, but it is a human thing: There is bad compassion.”

Here’s more on the Pope’s comments:

Aboard the plane, Pope Francis was asked by a French journalist whether he had spoken about euthanasia in his private conversation with France’s President Emmanuel Macron earlier in the day.

The French government is currently preparing to pass a controversial bill on end-of-life issues that could legalize assisted suicide and euthanasia in the country. The vote, which was postponed because of the pope’s visit, will be held Sept. 26–28.

Francis said he did not address the topic of euthanasia with Macron on Saturday but that he had expressed himself “clearly” on the issue when the French president visited him at the Vatican last year.

Pope Francis said it is not just an opinion that life should be safeguarded and warned that it is easy to fall into an idea that pain should always be prevented, even through what some might consider a “humanistic euthanasia.”

Instead, science has made great strides in helping people to control pain with medication, he noted, repeating that “you don’t play with life.”

Earlier this year, Pope Francis condemned killing unborn children and the so-called right to abortion.

The Pope tied the two together as joint evils and said ending the lives of babies before birth was a “tragic defeat” for their right to life.

“This is the baneful path taken by those forms of ‘ideological colonization’ that would cancel differences, as in the case of the so-called gender theory, or that would place before the reality of life reductive concepts of freedom, for example by vaunting as progress a senseless ‘right to abortion,’ which is always a tragic defeat,” the Pope said.

He urged European nations to instead focus their laws on the dignity of human beings and their inherent worth and value.

“How much better it would be to build a Europe centered on the human person and on its peoples, with effective policies for natality and the family — policies that are pursued attentively in this country — a Europe whose different nations would form a single family that protects the growth and uniqueness of each of its members,” the Holy Father said.

The post Pope Francis Condemns Euthanasia: Killing People is a “Failure to Love” appeared first on LifeNews.com.

-

Site: Ron Paul Institute - Featured Articles

“Which is better — to be ruled by one tyrant three thousand miles away or by three thousand tyrants one mile away?”

— Rev. Mather Byles (1706-1788)Does it really matter if the instrument curtailing liberty is a monarch or a popularly elected legislature? This conundrum, along with the witty version of it put to a Boston crowd in 1775 by a little-known colonial-era preacher, addresses the age-old question of whether liberty can long survive in a democracy.

Byles was a loyalist, who, along with about one-third of the American adult white male population in 1776, opposed the American Revolution and favored continued governance by Great Britain.

He didn’t fight for the king or agitate against George Washington’s troops; he merely warned of the dangers of too much democracy.

No liberty-minded thinker I know of seriously argues today in favor of a hereditary monarchy, but many of us are fearful of an out-of-control democracy, which is what we have in America today. I say “democracy” because that’s what the government calls itself. Yet the levers of federal government power today are only nominally pulled by elected representatives. The real levers of power are held by the military/industrial/warfare/welfare/surveillance/banking/donor class cartel that has had a stranglehold on the federal government for the past 50 years.

The Senate as originally crafted did not consist of popularly elected senators. Rather, they were appointed by state legislatures to represent the sovereign states as states, not the people in them. Part of James Madison’s genius was the construction of the federal government as a three-sided table. The first side was the people — the House of Representatives. The second side was the sovereign states that created the federal government — the Senate. And the third side was the nation-state — the presidency. The judiciary, whose prominent role today was unthinkable in 1789, was not part of this mix.

In his famous Bank Speech, Madison argued eloquently against legislation chartering a national bank because the authority to create a bank was not only not present in the Constitution but also was retained by the states and reserved to them by the 10th Amendment.

In that speech, he warned that the creeping expansion of the federal government would trample the powers of the states and also the unenumerated rights of the people that the Ninth Amendment — his pride and joy because it protected individual personal natural rights — prohibited the government from denying or disparaging.

He gave that speech in February of 1791, 11 months before the addition of the Bill of Rights — the first 10 amendments — to the Constitution. Given the popular fears of a new central government, Madison assumed that the Bill of Rights would quickly be ratified. He was right.

His Bank Speech remains just as relevant today.

Had Madison been alive during the presidency of the anti-Madisonian Woodrow Wilson — who gave us World War I, the Federal Reserve, the administrative state and the federal income tax — he would have recoiled at a president destroying the three-sided table. Wilson did that by leading the campaign to amend the Constitution so as to provide for the direct taxation of individuals and the direct popular election of senators.

Part of Madison’s genius was to craft restraints on the feds into the Constitution. And some of them — like retaining state sovereignty — created laboratories of liberty. President Ronald Reagan reminded the American public in his first inaugural address that the states formed the federal government, not the other way around. Had I been the scrivener of that speech, I’d have begged him to add: “And the powers that the states gave to the feds, they can take back.”

Reagan also famously said that we could vote with our feet. If you don’t like the over-the-top regulations in Massachusetts, you can move to New Hampshire. If you are fed up with the highest state taxes in the union in New Jersey, you can move to Pennsylvania.

But the more state sovereignty the feds absorb — the more state governance that is federalized — the fewer differences there are among the regulatory and taxing structures of the states. This has happened because Congress has become a general legislature without regard for the constitutional limits imposed on it.

If Congress wants to regulate an area of governance that is clearly beyond its constitutional competence, it bribes the states to do so with borrowed or Federal Reserve-created cash. Thus, it offered hundreds of millions of dollars to the states to lower their speed limits on highways and to lower the acceptable blood alcohol level in peoples’ veins — this would truly have set Madison off — before a presumption of DWI may be argued; all in return for cash to pave state-maintained highways.

The states are partly to blame for this. They take whatever cash Congress offers, and they accept the strings that come with it. And they, too, are tyrants. The states mandated the unconstitutional and crippling lockdowns of 2020-2021, not the feds. The states should be paying the political and financial consequences for their misdeeds, not the feds. They, not the feds, took property and liberty without paying for it as the Constitution requires them to do.

Byles feared a government of 3,000. Today, the feds employ close to 3 million. Thomas Jefferson warned that when the federal treasury becomes a federal trough, and the people recognize it as such, they would only send to Washington politicians — faithless to the Constitution — who promise to bring home the most cash. He also predicted that in the long run, liberty would decrease and government increase. He was correct on both.

Today the government claims it can right any wrong, tax any event, intrude upon any relationship, even suppress any speech that it chooses. That’s because the majority in a democracy that is faithless to constitutional guarantees will take whatever it can get from the minority — including its liberty and property — just to please its benefactors; and to stay in office.

To learn more about Judge Andrew Napolitano, visit https://JudgeNap.com.

COPYRIGHT 2024 ANDREW P. NAPOLITANO

DISTRIBUTED BY CREATORS.COM

-

Site: Zero HedgeGerman Parliament Votes To Decriminalize The Possession Of Child PornographyTyler Durden Thu, 05/23/2024 - 09:05

Are you starting to see a pattern yet?

First there was the introduction of gender fluid and LGBT ideology into public schools, then there were sexualized drag queen performances for children, then leftist activists demanded that pedophiles be referred to as "MAPS" (Minor Attracted Persons) because "they can't help who they are attracted to," then California passed a law reducing charges for adults engaged in sexual relations with minors.

Now, the German Parliament has forwarded a bill that makes possession and distribution of child pornography a misdemeanor instead of a felony, greatly reducing diminishing possible penalties.

German officials claim the new law is meant to address inconsistencies in previous child pornography laws which are sometimes applied to people who "receive images or videos through email or social media without their permission." They also cited instances where two minors traded images and were charged with creation or possession of child pornography.

Critics of the bill argue that the German government could have easily made legal adjustments for those specific exceptions to avoid innocent people being wrongly imprisoned. Instead, they are trying to institute sweeping changes that reclassify the crime and give greater legal protections to an array of child predators. The new law does not make exceptions for adult offenders.

According to the Bundestag (Parliament), the bill stipulates that “possession and acquisition should be punishable with a minimum penalty of three months’ imprisonment, and distribution with a minimum penalty of six months’ imprisonment, and distribution with a minimum penalty of six months’ imprisonment. The offenses regulated in Section 184b of the Criminal Code are therefore classified as misdemeanors and not as crimes.”

It should be noted that the criminal classification for possession of sexual materials related to minors has shifted a number of times in Germany, with felony status applied most recently in 2021. In other words, the German government decided after only three years that punishing pedophiles with longer prison sentences was just not fair.

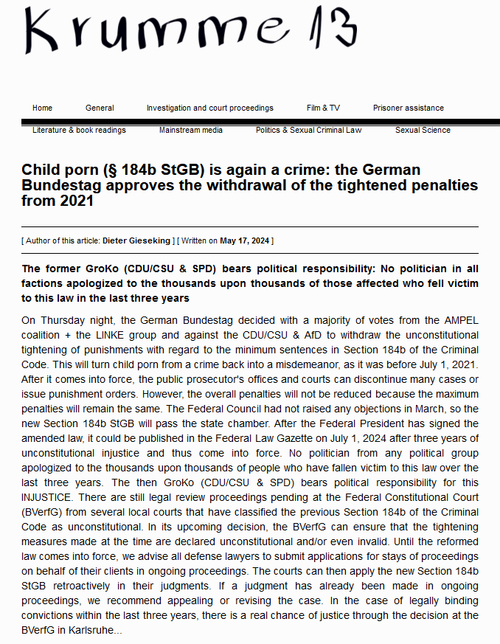

The move has already been celebrated by a German pro-pedophile activist group known as Krumme-13, or simply K13. the activist group has been described as a “self-help” organization for “pedosexuals.” In a blog post written by its founder and dated May 17, K13 laments that “no politician in all factions apologized to the thousands upon thousands of those affected who fell victim” to the 2021 law which had made possession of child sexual abuse materials a felony."

In 2019 the German Bundestag accepted a petition outlining "children’s rights" which was drafted by Krumme-13. The lobby group advocated for lowering the age of consent to 12 years old and legalizing child pornography. They announced on their website that a resolution developed by the group’s founder, Dieter Gieseking, had achieved enough votes to be added to the constitution, or Basic Law.

Gieseking’s petition amends Article 6 of the Basic Law to add statements regarding children’s rights, and states that “children should be viewed as legal subjects with their own rights.” Article II of the petition includes the "right to sexual self determination." In other words, the group petitioned the German government to give children legal adult status (making them fair game for pedophiles), and the government seems to be taking them seriously.

Beyond the natural inclination of all moral people to be inherently disgusted by those who fetishize children, beyond the fact that pedophiles have long been seen as dangerous and malicious parasites that need to be removed from society, the root legal argument is one of consent. It is an argument which leftist activist groups and political parties continue to ignore.

Children cannot consent. They are not mentally and emotionally mature enough to be capable of informed consent, which means they can be easily targeted for exploitation if they are not protected by the law and by their parents.

The fact that this is a debate we are having in 2024 is mind boggling until you recognize what kinds of people we have lurking in the halls of power. It's not hard to see the tip-toe that is happening today, with the eventual end game being the total legalization of child sex abuse in the name of "inclusion."

-

Site: Mises Institute

-

Site: Zero HedgeThe Copper Bull: Speculation Vs. FundamentalsTyler Durden Thu, 05/23/2024 - 08:45

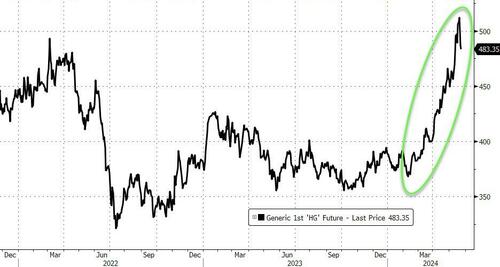

Copper has gone mad: Liquidated shorts from a flood of speculators, an AI bubble, a supply crisis, and a renewable energy craze have all combined with high global inflation to recently send it to historic all-time highs. While I believe there will be major corrections as some of these factors come back down to earth, the most important one — out-of-control inflation — will ultimately send copper even higher in the longer-term.

Yes, the market has taken on more froth than a Starbucks drink. Copper went high enough to wreck a batch of short sellers who betted that the party was over. The resulting short squeeze forced them to pony up, buying more paper copper to cover their positions and pushing prices even higher. Expect more volatility in the near-term, as the crowd of speculators looking to snatch short-term profits from copper are still here and will keep riding the wave.

Copper Futures (USD/lb) 6-Month

Source: Bloomberg

That’s because the bullish action has been too juicy to resist, and it has enough fundamentals to support more upward action in the medium and longer-term.

High inflation and a supply shortage are conspiring with increased demand for electric vehicles, a boom in renewable energy tech, and an AI bubble to keep the price going up even without the flood of speculative money.

I suspect a cooldown in a few factors driving the copper frenzy: first, I expect the AI market coming come back down to earth. In the longer-term, I also expect practical revisions of renewable energy targets like the impossible “Net Zero,” which are more about making politicians look good in the short-term than being pragmatic and achievable long-term goals. But the demand will still be there, and the current supply squeeze and inflationary pressures are here to stay.

If you’re a buyer, waves of speculation along the way can provide buying opportunities for physical copper in the form of epic volatility and dramatic dips.

While the current narrative is that inflation is easing, any apparent relief from higher prices will be temporary. To avoid a banking and commercial real estate crisis, the Fed will have no choice but to cut interest rates at some point. This will invite a new torrent of inflationary expansion as the Fed ignores the pressure cooker that its policies helped create.