“What is perfection in love? Love your enemies in such a way that you would desire to make them your brothers … For so did He love, Who hanging on the Cross, said ‘Father, forgive them, for they know not what they do.’” (Luke 23:34)

Distinction Matter - Subscribed Feeds

-

Site: Zero HedgeTrump Found In Contempt Again, Judge Threatens "Jail Sanction" NextTyler Durden Mon, 05/06/2024 - 09:39

Former President Donald Trump has been found in contempt of court for a second time by a New York judge overseeing his hush-money trial.

On Monday, judge Juan Merchan said that Trump had violated a gag order with additional social media posts about witnesses in the case, and will consider jail if there are additional violations.

Merchan:

— Adam Klasfeld (@KlasfeldReports) May 6, 2024

"The last thing that I want to do is to put you in jail," calling it a last resort.

The judge notes that Trump is a former president and possibly a future one."It appears that the $1,000 fines are not serving as a deterrent," said Merchan. "Mr. Trump, I want you to understand the last thing I want to do is put you in jail."

"The magnitude of such a decision is not lost on me, but at the end of the day, I have a job to do."

Last week, Merchan fined Trump $9,000 and held the former president in criminal contempt of court for violating the gag order nine times.

-

Site: Zero HedgeColumbia Cancels 2024 Commencement Amid Security ConcernsTyler Durden Mon, 05/06/2024 - 09:35

Columbia University announced Monday that it's canceling its two main 2024 commencement ceremonies on May 15, and will instead hold "smaller-scale, school-based celebrations," according to officials.

Columbia University students participate in an ongoing pro-Palestinian encampment on their campus on April 26, 2024 in New York City.

Columbia University students participate in an ongoing pro-Palestinian encampment on their campus on April 26, 2024 in New York City.

(Photo: Stephanie Keith/Getty Images)The move comes after weeks of pro-Palestinian protesters had to be forcibly removed and suspended after they refused to leave their encampment which sprouted on campus April 17, when around 50 tents were pitched by students demanding a ceasefire in Gaza. The students also insist that the university divest from companies they say could be profiting from war. Dozens of faculty members came out in support.

NOW: Columbia University faculty link arms and form a wall in front of the entrance to the ‘Gaza Solidarity Encampment’ as hundreds of students encircle the both lawns

— katie smith (@probablyreadit) April 29, 2024

Students remaining in the encampment were told they could face disciplinary action after 2PM pic.twitter.com/C1XRgHzs8bAccording to NBC News, the decision was made over security concerns, after administrators at Ivy League school met with student leaders following a NYPD raid on Hamilton Hall, after student protesters broke in, barricaded themselves inside, and wrecked the place.

Taking over Hamilton Hall as done in 1968, Columbia students unfurl a banner that reads "Hind's Hall," in reference to Hind Rajab, a six-year-old girl killed by Israeli forces.

— Prem Thakker (@prem_thakker) April 30, 2024

Hundreds of students cheer as the banner is revealed, erupting into chants to "Free Palestine." pic.twitter.com/Oi8WgdZmqfDestruction inside Hamilton Hall at Columbia University, after police cleared out protesters.

— Rob (@_ROB_29) May 2, 2024

They were all released and all charges dropped so nobody will be held accountable and the destruction will continue pic.twitter.com/UM5tM5gtsF"Our students emphasized that these smaller-scale, school-based celebrations are most meaningful to them and their families," the university said Monday. "They are eager to cross the stage to applause and family pride and hear from their school’s invited guest speakers. As a result, we will focus our resources on those school ceremonies and on keeping them safe, respectful, and running smoothly."

Now, students will be "honored individually alongside their peers" in the smaller ceremonies, called "Class Days."

The "Class Days" and other school ceremonies which were originally scheduled at the South Lawn of Morningside campus have also been relocated to the Columbia Baker Athletics Complex.

"These past few weeks have been incredibly difficult for our community. Just as we are focused on making our graduation experience truly special, we continue to solicit student feedback and are looking at the possibility of a festive event on May 15 to take the place of the large, formal ceremony," said school officials.

"We are eager to all come together for our graduates and celebrate our fellow Columbians as they, and we, look ahead to the future."

Now, on May 15, graduation ceremonies will take place at different times and different locations for the the journalism school, college of physicians and surgeons, Barnard College, and the school of arts. Other school-based ceremonies will occur throughout next week as well.

The University Of Southern California was the first known major university to cancel a graduation ceremony over the nationwide demonstrations.

So all that hard work for this, kids... and on the heels of the pandemic. Normal life eludes once again.

-

Site: Zero HedgeColumbia Cancels 2024 Commencement Amid Security ConcernsTyler Durden Mon, 05/06/2024 - 09:35

Columbia University announced Monday that it's canceling its two main 2024 commencement ceremonies on May 15, and will instead hold "smaller-scale, school-based celebrations," according to officials.

Columbia University students participate in an ongoing pro-Palestinian encampment on their campus on April 26, 2024 in New York City.

Columbia University students participate in an ongoing pro-Palestinian encampment on their campus on April 26, 2024 in New York City.

(Photo: Stephanie Keith/Getty Images)The move comes after weeks of pro-Palestinian protesters had to be forcibly removed and suspended after they refused to leave their encampment which sprouted on campus April 17, when around 50 tents were pitched by students demanding a ceasefire in Gaza. The students also insist that the university divest from companies they say could be profiting from war. Dozens of faculty members came out in support.

NOW: Columbia University faculty link arms and form a wall in front of the entrance to the ‘Gaza Solidarity Encampment’ as hundreds of students encircle the both lawns

— katie smith (@probablyreadit) April 29, 2024

Students remaining in the encampment were told they could face disciplinary action after 2PM pic.twitter.com/C1XRgHzs8bAccording to NBC News, the decision was made over security concerns, after administrators at Ivy League school met with student leaders following a NYPD raid on Hamilton Hall, after student protesters broke in, barricaded themselves inside, and wrecked the place.

Taking over Hamilton Hall as done in 1968, Columbia students unfurl a banner that reads "Hind's Hall," in reference to Hind Rajab, a six-year-old girl killed by Israeli forces.

— Prem Thakker (@prem_thakker) April 30, 2024

Hundreds of students cheer as the banner is revealed, erupting into chants to "Free Palestine." pic.twitter.com/Oi8WgdZmqfDestruction inside Hamilton Hall at Columbia University, after police cleared out protesters.

— Rob (@_ROB_29) May 2, 2024

They were all released and all charges dropped so nobody will be held accountable and the destruction will continue pic.twitter.com/UM5tM5gtsF"Our students emphasized that these smaller-scale, school-based celebrations are most meaningful to them and their families," the university said Monday. "They are eager to cross the stage to applause and family pride and hear from their school’s invited guest speakers. As a result, we will focus our resources on those school ceremonies and on keeping them safe, respectful, and running smoothly."

Now, students will be "honored individually alongside their peers" in the smaller ceremonies, called "Class Days."

The "Class Days" and other school ceremonies which were originally scheduled at the South Lawn of Morningside campus have also been relocated to the Columbia Baker Athletics Complex.

"These past few weeks have been incredibly difficult for our community. Just as we are focused on making our graduation experience truly special, we continue to solicit student feedback and are looking at the possibility of a festive event on May 15 to take the place of the large, formal ceremony," said school officials.

"We are eager to all come together for our graduates and celebrate our fellow Columbians as they, and we, look ahead to the future."

Now, on May 15, graduation ceremonies will take place at different times and different locations for the the journalism school, college of physicians and surgeons, Barnard College, and the school of arts. Other school-based ceremonies will occur throughout next week as well.

The University Of Southern California was the first known major university to cancel a graduation ceremony over the nationwide demonstrations.

So all that hard work for this, kids... and on the heels of the pandemic. Normal life eludes once again.

-

Site: Ron Paul Institute - Featured Articles

As we all know, as part of the U.S. government’s much-vaunted war-on-terrorism racket, some big technology firms have chosen to partner with the government in an effort to win the war on terrorism. In the process, they have aided the government, sometimes illegally, in the destruction of people’s privacy. The firms engage in such wrongdoing either because of some warped interpretation of “patriotism” or for money or both.

When I was a kid growing up in the 1950s and 1960s, the same thing was going on with respect to the Cold War racket. Back then, the big scary thing was communists rather than terrorists. The federal government’s Cold War propaganda convinced most everyone that the Reds were coming to get us, either from Russia, China, Cuba, North Korea, North Vietnam, East Germany, Eastern Europe, and even from here in the United States in Hollywood or the civil-rights movement.

And just like today, there were private companies that bought into the Cold War propaganda by partnering with the U.S. government to prevent a communist takeover of the United States.

One of favorite comic books when I was a kid was Superman. Every week, I would use my allowance money to purchase the newest Superman comic book at a newsstand in my hometown of Laredo, Texas. I felt like Lois Lane, Jimmy Olson, and Clark Kent were my best friends. I also loved watching the Superman television series that starred George Reeves.

I recently came across one of the televised Superman episodes named “Stamp Day for Superman.” You can watch it here. It’s a classic example of how the U.S. government was as successful in garnering the support from private entities for its Cold War racket as it is today in garnering support for its war-on-terrorism racket. It also provides a good example of how the federal government uses propaganda and indoctrination to infect the minds of the young.

The segment starts out with a stunning introduction: “The United States Treasury Department presents the Adventures of Superman.” Appearing on the screen is the logo of the Treasury Department.

The U.S. Treasury Department? Why in the world was the U.S. Treasury Department hosting a television episode of the Adventures of Superman? According to Wikipedia, the episode “was produced by Superman Inc. for the United States Department of the Treasury to promote the purchase of U.S. Savings Bonds.” (Links included in the Wikipedia entry.)

There are actually two themes within this particular episode. One theme revolves around a classic Superman type of situation. A pair of burglars breaks into a building and one of them later takes Lois Lane hostage. Superman saves the day by breaking through the thick wall in the building in which Lois is being held, saves Lois, and takes the burglar/kidnapper captive by bending and wrapping a steel rod around him.

The other theme revolves around inducing elementary school students to use their allowances and savings to purchase U.S. government stamps that can later be converted into U.S. savings bonds. I will guarantee that you will break out laughing when you see the group of over-excited kids listening to Superman deliver his pitch for buying the government’s stamps.

The episode was filmed in 1954, when the Cold War was in full swing. The notion, of course, was that everyone, including children, needed to do his part to prevent a communist takeover of the United States.

In fact, I myself fell victim to this Cold War nonsense. When I was in elementary school, I bought those stamps, just as many of my classmates did. I don’t recall what ever happened to them. I know I never converted them into bonds. So, the feds effectively got a free gift of a major portion of my allowance.

One day, my cousins from San Antonio introduced me to Marvel Comics. They immediately became my favorite comics. In fact, I pretty much gave up reading Superman and began using my money to purchase Spiderman and Fantastic Four comics. I can’t help but think that the big reason for my switch was that I subconsciously knew that the Marvel superheroes — and their creators Stan Lee, Jack Kirby, and Steve Ditko — would never cooperate with the federal government’s Cold War racket. In fact, whenever I read Marvel comics, I felt like I was engaging in something subversive. I felt like I was in a world that parents and schoolteachers simply could never understand.

Reprinted with permission from Future of Freedom Foundation.

-

Site: AsiaNews.itNepal has decided to print on its 100 rupee banknotes a map of the country that includes disputed territories with India. The Indian Foreign Minister immediately expressed his disapproval. A working group had been set up in 2024 to resolve the border dispute, but the meetings were suspended from 2019.

-

Site: Zero HedgeCryptos Dump After Robinhood Reveals SEC Wells Notice Related To Its Crypto ListingsTyler Durden Mon, 05/06/2024 - 09:19

For all its positives, bitcoin is perhaps the only security that prices in the same news over, and over, and over again (especially when the news is bad).

We saw this last month when bitcoin tumbled repeatedly after every single fake attack in the fake "Iran-Israel war", as if it was pricing nuclear Armageddon over and over instead of actually reading between the lines of the staged theater between the two middle-eastern states. It eventually rebounded and recouped most losses but not before finding something else to be just as shocked over, even though this too is not news at all.

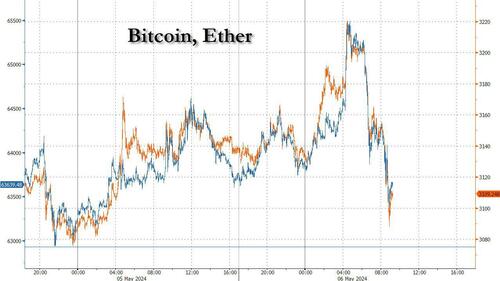

Moments ago, bitcoin and other cryptocurrencies dumped sharply when Bloomberg reported that Ken Griffen's favorite retail frontrunning exchange, Robinhood, has received a Wells Notice, i.e., it has been formally warned by regulators that it may face an enforcement action tied to its cryptocurrency dealings.

The so-called Wells notice - which gives a company time to rebut the agency’s allegations and doesn’t necessarily indicate an enforcement action will follow - from the SEC concerns Robinhood Crypto and its cryptocurrency listings, custody of cryptocurrencies and platform operations, the company said in a regulatory filing Monday.

The agency’s staff told Robinhood that it made a “preliminary determination” to recommend that the SEC file an enforcement action.

The result could be an injunction, a cease-and-desist order, disgorgement and other penalties or limits on activities, according to the filing. The company was previously subpoenaed and has cooperated with the investigation, Robinhood said.

Dan Gallagher, chief legal, compliance, and corporate affairs officer at Robinhood Markets wrote in a May 6 blog post:

“After years of good faith attempts to work with the SEC for regulatory clarity including our well-known attempt to ‘come in and register,’ we are disappointed that the agency has decided to issue a Wells Notice related to our U.S. crypto business.”

Gallagher added that Robinhood doesn’t see any of its listed assets as securities:

“We firmly believe that the assets listed on our platform are not securities and we look forward to engaging with the SEC to make clear just how weak any case against Robinhood Crypto would be on both the facts and the law.”

Of course, anyone with a room-temperature IQ would have been able to anticipate this turn, which comes about a year after the SEC served Coinbase with an identical Wells Notice, and which comes just days before the SEC has to rule - negatively, at least until the courts force it to reverse its decision - on whether to greenlight an Ethereum ETF, something which Liz Warren's pocket fascist enforcer, Gary Gensler, has sworn he will not allow simply because it goes against the interests of Warren's biggest backers. To be sure, eventually the courts will greenlight an ETH ETF, just as Larry Fink requires in order to complete his vision of tokenization as "the next generation for markets" but not before some token resistance from the anti-crypto Democrats in Congress.

And while we wait, bitcoin and ETH both dumped on the news - as of course they always do because the algos that trade them have a 10 millisecond attention span and can't be bothered to even google that what they are reacting to has been widely priced in countless times in the past.

It goes without saying that the rebound is just a formality at this point as the algos that sold just minutes ago on the Wells Notice "news" forget why they sold, and being a momentum ignition program higher, but the bigger question is whether the end of the anti-cyrpto Biden admin in early November will be the biggest pro-bitcoin catalyst in recent history, far bigger even than the halving.

-

Site: Zero HedgeCryptos Dump After Robinhood Reveals SEC Wells Notice Related To Its Crypto ListingsTyler Durden Mon, 05/06/2024 - 09:19

For all its positives, bitcoin is perhaps the only security that prices in the same news over, and over, and over again (especially when the news is bad).

We saw this last month when bitcoin tumbled repeatedly after every single fake attack in the fake "Iran-Israel war", as if it was pricing nuclear Armageddon over and over instead of actually reading between the lines of the staged theater between the two middle-eastern states. It eventually rebounded and recouped most losses but not before finding something else to be just as shocked over, even though this too is not news at all.

Moments ago, bitcoin and other cryptocurrencies dumped sharply when Bloomberg reported that Ken Griffen's favorite retail frontrunning exchange, Robinhood, has received a Wells Notice, i.e., it has been formally warned by regulators that it may face an enforcement action tied to its cryptocurrency dealings.

The so-called Wells notice - which gives a company time to rebut the agency’s allegations and doesn’t necessarily indicate an enforcement action will follow - from the SEC concerns Robinhood Crypto and its cryptocurrency listings, custody of cryptocurrencies and platform operations, the company said in a regulatory filing Monday.

The agency’s staff told Robinhood that it made a “preliminary determination” to recommend that the SEC file an enforcement action.

The result could be an injunction, a cease-and-desist order, disgorgement and other penalties or limits on activities, according to the filing. The company was previously subpoenaed and has cooperated with the investigation, Robinhood said.

Dan Gallagher, chief legal, compliance, and corporate affairs officer at Robinhood Markets wrote in a May 6 blog post:

“After years of good faith attempts to work with the SEC for regulatory clarity including our well-known attempt to ‘come in and register,’ we are disappointed that the agency has decided to issue a Wells Notice related to our U.S. crypto business.”

Gallagher added that Robinhood doesn’t see any of its listed assets as securities:

“We firmly believe that the assets listed on our platform are not securities and we look forward to engaging with the SEC to make clear just how weak any case against Robinhood Crypto would be on both the facts and the law.”

Of course, anyone with a room-temperature IQ would have been able to anticipate this turn, which comes about a year after the SEC served Coinbase with an identical Wells Notice, and which comes just days before the SEC has to rule - negatively, at least until the courts force it to reverse its decision - on whether to greenlight an Ethereum ETF, something which Liz Warren's pocket fascist enforcer, Gary Gensler, has sworn he will not allow simply because it goes against the interests of Warren's biggest backers. To be sure, eventually the courts will greenlight an ETH ETF, just as Larry Fink requires in order to complete his vision of tokenization as "the next generation for markets" but not before some token resistance from the anti-crypto Democrats in Congress.

And while we wait, bitcoin and ETH both dumped on the news - as of course they always do because the algos that trade them have a 10 millisecond attention span and can't be bothered to even google that what they are reacting to has been widely priced in countless times in the past.

It goes without saying that the rebound is just a formality at this point as the algos that sold just minutes ago on the Wells Notice "news" forget why they sold, and being a momentum ignition program higher, but the bigger question is whether the end of the anti-cyrpto Biden admin in early November will be the biggest pro-bitcoin catalyst in recent history, far bigger even than the halving.

-

Site: Zero HedgeBerkshire's Growing Cash Pile Has A Hidden Message On StocksTyler Durden Mon, 05/06/2024 - 09:05

Authored by Ven Ram, Bloomberg cross-asset strategist,

US stocks are seeing no evil and certainly hearing none, but Berkshire Hathaway’s ever-growing cash pile should hold a tacit warning for those who are overexuberant.

Berkshire’s war chest surged to a record $189 billion at the end of the first quarter, and Chair Warren Buffett told shareholders over the weekend that he expects the pile will rise to $200 billion soon:

“We’d love to spend it, but we won’t spend it unless we think we’re doing something that has very little risk and can make us a lot of money.”

Wall Street, of course, equates higher return with higher risk, but here is one of the best investors of all time decrying the very notion that one needs to do something egregiously risky to earn the additional dollar of return over and above what is available to passive investors who buy the entire market.

Stocks rallied on Friday after the markets interpreted the April non-farm payrolls data as providing just the right backdrop for the Federal Reserve to cut rates eventually. Considering that since of the end of 2022 alone, the S&P 500 has surged about 33% and the Nasdaq almost 50%, one would think that all the good news out there and more is already reflected in their price tag.

Over the long term, stocks can’t yield returns in excess of corporate earnings and economic growth, but investors have been in no mood to listen — and they may yet stay complacent in the short term. The S&P 500 now promises an earnings yield of less than 5%, well below the historical average. The Nasdaq 100 is, of course, trading even loftier, offering a prospective earnings yield of less than 4%.

At the moment, investors are paying a lot for stocks on the premise of promise. That is what Buffett may characterize as too much risk.

-

Site: Zero HedgeBerkshire's Growing Cash Pile Has A Hidden Message On StocksTyler Durden Mon, 05/06/2024 - 09:05

Authored by Ven Ram, Bloomberg cross-asset strategist,

US stocks are seeing no evil and certainly hearing none, but Berkshire Hathaway’s ever-growing cash pile should hold a tacit warning for those who are overexuberant.

Berkshire’s war chest surged to a record $189 billion at the end of the first quarter, and Chair Warren Buffett told shareholders over the weekend that he expects the pile will rise to $200 billion soon:

“We’d love to spend it, but we won’t spend it unless we think we’re doing something that has very little risk and can make us a lot of money.”

Wall Street, of course, equates higher return with higher risk, but here is one of the best investors of all time decrying the very notion that one needs to do something egregiously risky to earn the additional dollar of return over and above what is available to passive investors who buy the entire market.

Stocks rallied on Friday after the markets interpreted the April non-farm payrolls data as providing just the right backdrop for the Federal Reserve to cut rates eventually. Considering that since of the end of 2022 alone, the S&P 500 has surged about 33% and the Nasdaq almost 50%, one would think that all the good news out there and more is already reflected in their price tag.

Over the long term, stocks can’t yield returns in excess of corporate earnings and economic growth, but investors have been in no mood to listen — and they may yet stay complacent in the short term. The S&P 500 now promises an earnings yield of less than 5%, well below the historical average. The Nasdaq 100 is, of course, trading even loftier, offering a prospective earnings yield of less than 4%.

At the moment, investors are paying a lot for stocks on the premise of promise. That is what Buffett may characterize as too much risk.

-

Site: RT - News

The IDF warned of “extreme” military action in southern Gaza, while Hamas decried what it called a “dangerous escalation”

Israel has urged Palestinians to evacuate parts of Rafah, warning that it will take “extreme” military action against Hamas militants in the southern Gaza city. The Jewish state has been preparing for an incursion in Rafah, which is currently home to over a million people, despite warnings against doing so from the US, EU, and UN.

The Israeli military issued “an urgent appeal to all residents and displaced people” living in several neighborhoods of Rafah to “evacuate immediately,” according to Avichay Adraee, the head of the Israel Defense Force’s Arab media division.

“The IDF will act with extreme force against terrorist organizations” in the area, Adraee said in a post on X (formerly Twitter) on Monday. There was no clarification on when the military action might start.

Read more No international pressure can stop Israel – Netanyahu

No international pressure can stop Israel – Netanyahu

A senior Hamas official has told Reuters that the evacuation order was a “dangerous escalation” that would have consequences.

The evacuation call comes a day after Israel closed the main border crossing used to deliver humanitarian aid into Gaza. The closure came in response to a Hamas rocket attack that left three soldiers dead and 11 wounded on Sunday.

West Jerusalem claims Rafah is the last significant stronghold of Hamas, and that potentially dozens of Israeli hostages may be held there. Victory over the militant group is impossible without taking the city, the Israeli government insists.

READ MORE: Israel shuts down Gaza border crossing after Hamas attack

According to the UN agency for Palestinian refugees, Rafah is currently home to 1.4 million Palestinians who have fled the northern parts of the enclave since October. The international community has sounded the alarm over the number of civilian casualties that a military operation in the city could cause.

Top EU diplomat Josep Borrell has described the Rafah evacuation order as “unacceptable” and demanded that Israel denounce its ground offensive plan.

The Rafah plan has opened a rift between Israel and its staunchest ally, the US. The administration of President Joe Biden previously declared that an Israeli invasion of the city would be a “red line,” a statement that was dismissed by Prime Minister Benyamin Netanyahu. Washington has been under increasing pressure from the UN, pro-Palestinian protesters, and human rights organizations to stop arming Israel.

READ MORE: US froze military aid shipment to Israel – Axios

Netanyahu declared war on Hamas after the Palestinian militant group launched a surprise attack on Israel on October 7, killing around 1,200 people and taking around 250 hostages. The death toll from Israel’s retaliation in the enclave is approaching 35,000, according to the Palestinian health authorities.

-

Site: AsiaNews.itManahel al-Qatabi's conviction for seeking an end to male guardianship is just the latest of a long list. A man who denounced corruption and human rights violations on social media was given a death sentence. Scores of people are serving 'lengthy' prison terms.

-

Site: RT - News

Tomasz Szmydt, who is seeking asylum in Belarus, says Warsaw’s foreign policy is dictated by the US and its allies

Polish judge Tomasz Szmydt has asked for political asylum in Belarus in protest over his country’s “unfair and dishonest” anti-Russia stance.

Szmydt, who served at the Provincial Administrative Court in Warsaw and was the head of the legal department at the National Council of Judges, says he was forced to leave his home country after being persecuted and threatened for his “independent political position.” He gave a press conference in Minsk on Monday, where he publicly resigned from his post and asked the Belarusian authorities for protection.

“The resignation from my position as judge is my way to protest against the unfair and dishonest policy pursued by the Polish authorities towards the Republic of Belarus and the Russian Federation,” Szmydt told reporters, as cited by Belta news agency.

According to Szmydt, he has never witnessed any negative attitude towards Russia or Belarus from ordinary Poles, and the anti-Russia sentiment that’s being whipped up by the government in Warsaw has Western roots.

“The situation is such that the US wants to drag Poland into the war, to make it a direct participant in the armed conflict. To prevent this, I have to talk about it, but in Poland I cannot do this,” Szmydt stated, adding that Poland’s foreign policy is directly influenced by the US, UK, and Germany.

Read more ‘Not our war’: Poles march against Ukraine aid (VIDEO)

‘Not our war’: Poles march against Ukraine aid (VIDEO)

He said his departure from Poland and his resignation are in protest “against actions that are aimed at involving my country in a direct armed conflict.” Szmydt urged the Polish government to “normalize and regulate good neighborly relations” between Warsaw, Moscow, and Minsk.

Szmydt added that his resignation will be handed over to the appropriate authorities in Poland through the Polish consulate in Belarus. He plans to apply for political refugee status.

“I am asking for political asylum in the Republic of Belarus. This is an informal request at this time, but... if I want to live, returning to Poland is impossible for me,” he stated.

Commenting on the judge’s resignation and statements, Polish Foreign Minister Radoslaw Sikorski said he was “shocked,” adding that Szmydt’s actions appear to be those of a “traitor.” Defense Minister Wladyslaw Kosiniak-Kamysz said he ordered an investigation into Szmydt’s actions.

READ MORE: EU leaders ‘fooling’ people with horror stories about Russia – Kremlin

Poland has been one of Ukraine’s key backers amid the conflict between Kiev and Moscow, which broke out in February 2022. The country has sent military aid to Ukraine and has served as a hub for weapons provided by other Western nations. Warsaw has grown increasingly hostile in its attitude towards Russia as the conflict drags on. President Andrzej Duda recently signaled that his country is open to hosting US nuclear weapons in order to “strengthen the security of NATO’s eastern flank,” which he claims Russia could attack if it secures victory in Ukraine.

-

Site: Rorate Caeli________________________Mary alone found grace before God without the help of any other creature. All those who have since found grace before God have found it only through her. She was full of grace when she was greeted by the Archangel Gabriel and was filled with grace to overflowing by the Holy Spirit when he so mysteriously overshadowed her. From day to day, from moment to moment, she New Catholichttp://www.blogger.com/profile/04118576661605931910noreply@blogger.com

-

Site: RT - News

Alexander Lambsdorff will leave for one week for consultations over an alleged hacking operation

The German Foreign Ministry is temporarily recalling Ambassador Alexander Lambsdorff from Moscow, its spokesperson announced on Monday.

The senior diplomat will hold consultations before returning to Russia, according to the statement. The move comes after Berlin accused the Kremlin of being behind a hacking attack targeting senior members of the Social Democratic Party (SPD) of Chancellor Olaf Scholz.

The German government claims that a group named ‘АРТ28’ is a front for the Russian Foreign Intelligence Service, and used a vulnerability in Microsoft Outlook software to spy on the party’s leadership. It described the hack as part of a prolonged campaign targeting various entities in Germany, and claimed that it had identified the culprit in conjunction with NATO and EU partners.

”Cyberattacks on political parties, state institutions and critical infrastructure are a threat to our democracy, our national security and our free society,” the German embassy in Moscow said in a statement on Monday.

Read more Russian military destroys German-made IRIS-T system in Ukraine (VIDEO)

Russian military destroys German-made IRIS-T system in Ukraine (VIDEO)

Last week, the Russian embassy in Berlin confirmed receiving a demarche from the German Foreign Ministry over the alleged cyberespionage. It said the accusations were “lacking evidence” and an “unfriendly act aimed at inciting anti-Russian sentiment” in the country.

In March, already tense Russian-German relations suffered a blow when a leaked recording of discussions between senior German military officers was published by Russian media. The tape highlighted Berlin’s involvement in the Ukraine conflict and included a debate on how the possible role of German troops in a proposed attack on Crimea using Taurus cruise missiles could be concealed from the public.

Scholz had publicly refused to provide the weapons, stating that unlike the UK and France, Germany was not prepared to send military personnel to prepare such strikes. German generals on the leaked recording were exploring ways to nudge the chancellor towards allowing such arms supplies.

-

Site: LifeNews

If there’s any politician who deserves the Presidential Medal of Freedom the least, it would be Nancy Pelosi.

Pelosi is a radical abortion activist who has pushed abortions up to birth for decades. She’s trashed pro-life Americans repeatedly, refused to acknowledge the humanity of unborn children, and did her level best to push taxpayer funded abortions on Americans time and time again.

But perhaps the worst thing Pelosi has ever done is deny a vote on a bill to stop infanticide and protect babies who survive abortions.

Not only did she block a vote on one of the most common sense bills Congress could ever vote on, she blocked a vote 80 different times. Over and over again, day after day, Republicans a few years ago requested a vote on a bill to protect babies from infanticide. But day after day Pelosi, when she was Speaker of the House, refused to allow a vote.

That didn’t stop Biden from giving her Americas highest civilian award.

“The Presidential Medal of Freedom, our nation’s highest civilian award — we the people doing what we can to ensure the idea of America, the cause of freedom, shines like the sun to light up the future of the world,” Biden said of the medal in a video promoting the award to Pelosi.

Click here to sign up for pro-life news alerts from LifeNews.com

Rep. Ann Wagner condemned Pelosi’s actions at the time.

“Pelosi directed House Democrats to block one specific piece of legislation over and over. Democrats designated one person to stand up and object, every single day, when Republicans tried to bring this bill to the House floor,” she said.

What legislation could possibly make Pelosi and House Democrats so afraid that they’d go out of their way to avoid even voting on it—after blocking it more than 80 times in total?

The answer is both surprising and distressing: The bill was the Born-Alive Abortion Survivors Protection Act. The Born-Alive Act simply says that a baby who survives an abortion deserves the same degree of medical care as any other newborn—it is a commonsense bill that is narrow in scope, saves lives, and addresses a real problem.

Of course, Democrats might then be forced to acknowledge that every baby is a human being. And so long as Democrats are beholden to pro-abortion radicals for funding, votes, and media cover, they will do everything in their power to prevent the Born-Alive Act from coming to the House floor for a vote or being passed into law.

The Presidential Medal of Freedom was established in 1963 by President John F. Kennedy. It replaced the Medal of Freedom established by President Harry S. Truman in 1945, which honored individuals who rendered significant aid to the U.S. in World War II.

It is the highest civilian award in the nation and is intended to recognize “any person who has made an especially meritorious contribution to (1) the security or national interests of the United States, or (2) world peace, or (3) cultural or other significant public or private endeavors.”

The post Joe Biden Gives National Award to Nancy Pelosi, Who Refused to Stop Infanticide 80 Times appeared first on LifeNews.com.

-

Site: Zero Hedge'Romance' Scammer Promised Fake Gold To Bilk Victims For MillionsTyler Durden Mon, 05/06/2024 - 08:25

Authored by Ken Silva via Headline USA,

It was an old-fashioned romance scam, involving a man posing as a female online to induce unfortunate men to send him their life savings.

This scam, however, was fairly complex, involving a fake bank website and non-existent gold bars. The alleged perpetrator of this scam, Richard Opoku Agyemang, was arrested last month by the U.S. Postal Inspection Service.

According to the complaint against Agyemang, a USPIS agent interviewed a victim in January who sent $345,280 to Agyemang, who was posing online as “Emily.”

The victim told the USPIS agent that Emily spoke with an accent and purported to reside in Miami, where she was working as an ICU nurse at Jackson Memorial Hospital.

Eventually, Emily began asking the victim for money, which he sent to her. Emily told him the funds were going to pay for experimental and expensive medications meant for her mother in London.

“According to Victim 1, Emily also said she needed more money to pay ‘Mercury Assets Security Company’ in order to release two boxes of gold bars worth $9.2 million,” the complaint said.

“Victim 1 has never met Emily in person and has not received any gold bars.”

A second victim in New Mexico allegedly sent Agyemang $410,000 while the defendant was posing online as “Kathy.”

That victim told the same USPIS agent he developed a romantic relationship with “Kathy” that moved to text messages and eventually to speaking on Skype and via email. Instead of enticing him with gold, “Kathy” told the second victim “she” was supposed to be receiving an inheritance of diamond stones from her deceased father valued at $3.8 million.

The scam against the second victim also involved a fake bank website, according to the complaint.

“Based on screenshots of emails provided by Victim 2, it appears that the suspects created fraudulent websites for the First National Bank of London and for Neelevet, as well as fraudulent ‘customer support’ communications,” the complaint said.

The Virginia and New Mexico victims were the only ones highlighted in the criminal complaint, but the USPIS agent said there are at least “four dozen” other victims that have been bilked for more than $2 million combined.

“I have been able to interview some of the other suspected victims and confirmed that, at least as to those individuals, the funds were sent in connection with a romance fraud,” the agent said in his affidavit.

“For example, one victim provided copies of emails showing that he had been induced to send $13,000 to the RISUN LLC Wells Fargo account to pay for alleged taxes on gold bars being imported to the United States by his alleged online romantic partner.”

Agyemang was indicted on April 24 with one count of conspiracy to commit wire fraud, six counts of money laundering, and several other charges.

He currently has a jury trial set for June 24, though, at this early stage of the case, it’s likely that the Justice Department has yet to offer him a plea deal.

Ken Silva is a staff writer at Headline USA. Follow him at twitter.com/jd_cashless.

-

Site: Zero Hedge'Romance' Scammer Promised Fake Gold To Bilk Victims For MillionsTyler Durden Mon, 05/06/2024 - 08:25

Authored by Ken Silva via Headline USA,

It was an old-fashioned romance scam, involving a man posing as a female online to induce unfortunate men to send him their life savings.

This scam, however, was fairly complex, involving a fake bank website and non-existent gold bars. The alleged perpetrator of this scam, Richard Opoku Agyemang, was arrested last month by the U.S. Postal Inspection Service.

According to the complaint against Agyemang, a USPIS agent interviewed a victim in January who sent $345,280 to Agyemang, who was posing online as “Emily.”

The victim told the USPIS agent that Emily spoke with an accent and purported to reside in Miami, where she was working as an ICU nurse at Jackson Memorial Hospital.

Eventually, Emily began asking the victim for money, which he sent to her. Emily told him the funds were going to pay for experimental and expensive medications meant for her mother in London.

“According to Victim 1, Emily also said she needed more money to pay ‘Mercury Assets Security Company’ in order to release two boxes of gold bars worth $9.2 million,” the complaint said.

“Victim 1 has never met Emily in person and has not received any gold bars.”

A second victim in New Mexico allegedly sent Agyemang $410,000 while the defendant was posing online as “Kathy.”

That victim told the same USPIS agent he developed a romantic relationship with “Kathy” that moved to text messages and eventually to speaking on Skype and via email. Instead of enticing him with gold, “Kathy” told the second victim “she” was supposed to be receiving an inheritance of diamond stones from her deceased father valued at $3.8 million.

The scam against the second victim also involved a fake bank website, according to the complaint.

“Based on screenshots of emails provided by Victim 2, it appears that the suspects created fraudulent websites for the First National Bank of London and for Neelevet, as well as fraudulent ‘customer support’ communications,” the complaint said.

The Virginia and New Mexico victims were the only ones highlighted in the criminal complaint, but the USPIS agent said there are at least “four dozen” other victims that have been bilked for more than $2 million combined.

“I have been able to interview some of the other suspected victims and confirmed that, at least as to those individuals, the funds were sent in connection with a romance fraud,” the agent said in his affidavit.

“For example, one victim provided copies of emails showing that he had been induced to send $13,000 to the RISUN LLC Wells Fargo account to pay for alleged taxes on gold bars being imported to the United States by his alleged online romantic partner.”

Agyemang was indicted on April 24 with one count of conspiracy to commit wire fraud, six counts of money laundering, and several other charges.

He currently has a jury trial set for June 24, though, at this early stage of the case, it’s likely that the Justice Department has yet to offer him a plea deal.

Ken Silva is a staff writer at Headline USA. Follow him at twitter.com/jd_cashless.

-

Site: Zero HedgeFutures, Global Markets Rise On Rising Fed Cut BetsTyler Durden Mon, 05/06/2024 - 08:11

Global stocks and US equity futures jumped to start the new week, with the S&P 500 poised to extend last week’s rally as traders grew increasingly confident in the likelihood that the Fed will cut interest rates this year. As of 7:40am, S&P 500 and Nasdaq 100 futures added 0.3%, tracking gains in European and Asian markets although trading volumes were lower than average as UK and Japanese markets are shut for a holiday. Apple slid in pre-market trading after Berkshire Hathaway trimmed its stake for a second consecutive quarter. German 10-year yields fell and the yen weakened. Oil advanced after Saudi Arabia raised prices for customers in Asia. On today's calendar we get the latest Senior Loan Officer Opinion Survey (SLOOS) which will signal whether demand for tight credit remains dismal.

In premarket trading, Apple dropped 1.2% after rising strongly over the past two sessions and as Berkshire Hathaway reported it had trimmed its stake in the company. Shares in cryptocurrency-linked companies rally as Bitcoin nears $65,000 level after adding around 10% in the last four sessions. Some of the biggest movers are Marathon Digital (MARA US) +5.6%, Riot Platforms (RIOT US) +4.1%. Steward Health Care filed voluntary petitions for relief under Chapter 11. Here are some other notable premarket movers:

- Luminar Technologies shares fall as much as 17% after the company confirmed it will cut about 20% of jobs and sub-lease parts or all of some facilities.

- Paramount rises 4.5% as it weighs Apollo and Sony’s $26 billion offer to buy the company.

- Perficient gains 55% after EQT agreed to buy the technology consultant in a deal valued at about $3 billion including debt.

With a light US economic calendar this week, the market’s direction may come from central bank officials, as well as policy meetings in the UK, Australia and Sweden. European Central Bank Chief Economist Philip Lane said recent data have made him more certain that inflation is returning to the 2% goal, according to an interview with Spanish newspaper El Confidencial, raising the likelihood a first interest-rate cut in June. New York Fed President John Williams and the Richmond Fed’s Thomas Barkin are due to make remarks on Monday, followed by Neel Kashkari of Minneapolis on Tuesday.

“This week is expected to be calmer on the economic front: few economic data releases and limited central bankers’ intervention,” wrote Credit Agricole strategists led by Jean-Francois Paren.

But while this week may be boring, strategists are already starting to hone in on the importance of next week’s US inflation print for April. “The price reaction on the back of this release may be more important than the data itself given how influential price action has been on investor sentiment amid an uncertain macro set up,” Michael Wilson wrote in a note.

Europe was broadly higher, tracking US equity futures, with the Stoxx 600 rising 0.6% and trading near session highs although volumes were low due a UK public holiday. Among individual stocks in Europe, PostNL NV shares declined after it reported weak volumes. Demant A/S also fell as it reported a miss in sales driven by soft retail. Atos SE jumped after it received four offers that will frame the discussions with its stakeholders around its restructuring. Here are the biggest movers Monday:

- Indra Sistemas shares jump as much as 11%, after the Spanish defense company beat estimates in the first quarter and forecast Ebit for the full year of above EU400 million

- Know IT gains as much as 6% after Handelsbanken raised its short-term recommendation for the Swedish IT consultancy to hold from sell, noting small green shoots in end markets

- Maurel & Prom rise as much as 10%, the most since October, after the French oil firm received a license for operations in the Urdaneta Oeste field in Lake Maracaibo in Venezuela

- Demant falls as much as 5.3%, the most since November, after the Danish hearing-aid group reported softer-than-expected 1Q sales, with retail a stand-out disappointment, Citi says

- Castellum falls as much as 3% after DNB cut its recommendation for the Swedish landlord to hold, noting “rather soft” 1Q earnings which showed that vacancy rates is a concern

- ING Bank Slaski falls as much as 4.3% after the bank reported first-quarter results below estimates. Citi attributed the earnings miss to low non-core revenue figures and higher net provisioning

Earlier in the session, Asia stocks rose led by Chinese shares which led gains as mainland markets played catchup following a holiday break, although here too conditions were holiday-thinned with Japan and South Korea shut for holidays. The CSI 300 Index jumped as much as 1.8%, while stocks in Hong Kong took a breather following a nine-day winning streak.

- Hang Seng & Shanghai Comp were somewhat varied as Hong Kong stocks took a breather after the recent hot streak and as attention shifted to the mainland where stocks outperformed as they played catch up on their return from the Labour Day Golden Week holidays with property stocks boosted by recent support pledges, while participants also digested Caixin Services PMI data which matched estimates.

- ASX 200 was led higher by continued outperformance in the rate-sensitive sectors, while financials were also underpinned following Westpac's earnings, special dividend and buyback announcement.

In FX, the Blooomberg Dollar index steadied as the Norwegian krone, British pound and Australian dollar led Group-of-10 gains; The prospect of central bank easing boosted risk sentiment sending global stocks higher. USD/JPY advanced as much as 0.6% to 154, paring some of last week’s more than 3% drop as short dollar positions by fast-money accounts were squeezed, according to an Asia-based FX trader. EUR/USD steadied around 1.0768, after composite PMI data for April came in above estimates and euro-area PPI for March fell 0.4% month-on-month in line with forecasts; ECB Chief Economist Philip Lane said recent data has made him more confident inflation will return to the 2% goal.

In rates, Treasuries reopened with yields lower by around 2bps at 4.48% after being closed for Japan and UK holidays. Gains have support from bunds, rallying on comments from ECB Chief Economist Philip Lane. US yields lower by around 2bp to 3bp across the curve with German yields down 3bp to 5bp after ECB’s Lane said recent data has improved his confidence that inflation will return to the 2% goal. Treasury auction cycle begins Tuesday with $58b 3-year note sale, followed by $42b 10- and $25b 30-year new issues Wednesday and Thursday.

In commodities, oil rebounded strongly after tumbling on Friday as hopes for a ceasefire in the Middle East once again died a miserable death. WTI traded 1.2% higher above $79 and Brent rose to $83.70. Gold was also significantly higher, trading about $2320.

In crypto, Bitcoin is back on a firmer footing and now holds around $65k, while Ethereum hovers around $3.2k, both have erased last week's sharp losses. The next potential objective/resistance level for Bitcoin is at $67,200 and that represents a 61.8% correction of the 73,797-56,527 fall, via market contacts.

Looking at today's calendar, the US economic data slate empty for the session, though Fed releases Senior Loan Officer opinion survey on bank lending practices at 2pm New York time. The calendar is light this week, leaving focus on Treasury refunding auctions and about a dozen Fed speakers scheduled. Fed members’ scheduled speeches include Barkin (12:50pm) and Williams (1pm). Ahead this week are Kashkari, Jefferson, Collins, Cook, Daly, Bowman, Logan, Goolsbee, Barr and Mester

Market Snapshot

- S&P 500 futures up 0.2% to 5,165.25

- STOXX Europe 600 up 0.3% to 506.89

- MXAP up 0.3% to 178.04

- MXAPJ up 0.7% to 551.80

- Nikkei little changed at 38,236.07

- Topix little changed at 2,728.53

- Hang Seng Index up 0.6% to 18,578.30

- Shanghai Composite up 1.2% to 3,140.72

- Sensex little changed at 73,916.80

- Australia S&P/ASX 200 up 0.7% to 7,682.37

- Kospi down 0.3% to 2,676.63

- German 10Y yield little changed at 2.46%

- Euro up 0.1% to $1.0775

- Brent Futures up 0.9% to $83.74/bbl

- Gold spot up 0.8% to $2,319.71

- US Dollar Index little changed at 105.03

Top Overnight News

- China’s May Day holiday saw aggregate spending rise 13.5% above pre-pandemic levels, although spending per capita lagged behind 2019 levels. RTRS

- China’s effective exchange rate is back to where it was in 2014 in real terms (given CNY weakness and the absence of domestic inflation) and this is turbocharging the country’s exports, creating trade friction with the US, EU, and other economies. WSJ

- The case for a ECB interest rate cut in June is getting stronger as services inflation is finally starting to ease, ECB Chief Economist Philip Lane told Spanish newspaper El Confidencial on Monday. The ECB has all but promised a rate cut on June 6, provided incoming data strengthen policymakers' belief that inflation will head back to its 2% target by the middle of next year. RTRS

- A US crackdown on banks financing trade in goods for Vladimir Putin’s invasion of Ukraine has made it much more difficult to move money in and out of Russia, according to senior western officials and Russian financiers. Moscow’s trade volumes with key partners such as Turkey and China have slumped in the first quarter of this year after the US targeted international banks helping Russia acquire critical products to aid its war effort. FT

- The Israeli military has told tens of thousands of Palestinians to leave the southern Gazan city of Rafah as Israel’s defense minister warned of an imminent military “operation” as talks to free Israeli hostages appeared to have stalled. At least 100,000 civilians in eastern Rafah, along the border with Israel, should move to what Israel calls a humanitarian zone on the Mediterranean, an Israel Defense Force spokesperson told reporters, in “a limited scope” operation as part of a “gradual plan”. FT

- Saudi Arabia and its allies in OPEC+ are likely to keep oil production unchanged for a further three months when ministers review output allocations on June 1. The tightening of petroleum supplies and depletion of inventories widely anticipated at the start of the year has failed to materialize so far. RTRS

- Maersk warned that ongoing Red Sea shipping disruptions will reduce industry capacity between the Far East and Europe by 15-20% in Q2. RTRS

- The final chief executive of Credit Suisse, Ulrich Körner, is set to leave UBS in the coming weeks, as the Swiss bank prepares to complete a crucial step in the integration of its former rival. FT

- Warren Buffett said Apple is “even better” than AmEx and Coca-Cola. The stock will remain Berkshire’s top holding despite selling a large chunk. The sale bolstered his firm’s cash pile to a record $189 billion. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded with a positive bias after a dovish jobs report from the US but with the upside limited amid holiday-thinned conditions with Japan and South Korea shut for holidays. ASX 200 was led higher by continued outperformance in the rate-sensitive sectors, while financials were also underpinned following Westpac's earnings, special dividend and buyback announcement. Hang Seng & Shanghai Comp were somewhat varied as Hong Kong stocks took a breather after the recent hot streak and as attention shifted to the mainland where stocks outperformed as they played catch up on their return from the Labour Day Golden Week holidays with property stocks boosted by recent support pledges, while participants also digested Caixin Services PMI data which matched estimates.

Top Asian News

- PBoC Shanghai is reportedly to support the renewal of large-scale equipment.

- Chinese President Xi said the China-France relationship is a model of peaceful coexistence and win-win cooperation between countries with different systems, while he added they are ready to consolidate the traditional friendship, enhance political mutual trust, build strategic consensus, as well as deepen exchanges and cooperation with France, according to Xinhua.

- EU is lobbying China to exclude agriculture from a series of escalating commercial disputes and called for the ‘strategic sector’ to be protected from trade tensions in the renewable energy and electric vehicle industries, according to FT.

- A magnitude 6.1 earthquake was reported in Seram, Indonesia, according to GFZ.

European bourses, Stoxx600 (+0.3%) are entirely in the green, albeit modestly so, taking impetus from a positive APAC session. EZ Final PMIs were generally revised higher, though ultimately sparked little reaction in the equities complex. European sectors are mostly firmer, though with the breadth of the market fairly narrow. Insurance takes the top spot, alongside Energy. The latter is benefitting from broader strength in the crude complex given the recent updates around Rafah. US Equity Futures (ES +0.2%, NQ +0.2%, RTY +0.5%) are entirely in the green, building on the strength seen on Friday. Apple (-1.1%) is lower pre-market after Berkshire Hathaway declared it had decreased its stake in the Co. in Q1 and in a breather from Friday's post-earnings strength.

Top European News

- UK PM Sunak reportedly cancelled plans for a summer general election after local election defeats with the election anticipated to occur in Autumn, according to The Telegraph.

- UK PM Sunak was warned by Conservative MPs to show some vision and start digging his party out of a hole after a disastrous set of local election results, while it was also reported that the Labour Party comfortably won the London mayoral contest to give Sadiq Khan an unprecedented third term as London Mayor, according to FT.

- ArcelorMittal (MT NA) warned the UK government that one of its main divisions could be forced to exit the UK if an application to close and redevelop a commercial port in south-east England receives approval this week, according to FT.

- ECB's Lane said in an interview with El Confidencial that the April slowdown in services inflation marks significant progress and confidence on inflation is improving, while he added exaggerating the impact of the ECB and Fed divergence is not necessary and Fed decisions have limited impact on the euro area.

- Fitch affirmed Italy at BBB; Outlook Stable and affirmed Denmark at AAA; Outlook Stable on Friday.

FX

- DXY is modestly softer and within a very tight 105.02-20 range, should selling pressure intensify, the 105.00 mark could be brought into focus.

- EUR is marginally firmer/flat vs the Dollar, though losing in the EUR/GBP cross. Price action today has been contained within a tight 1.0756-75 range, well within the prior session’s bounds. EZ final PMIs today were generally revised higher, albeit slightly, and provided little lasting move in the EUR.

- GBP is slightly firmer against the Dollar, despite UK equities/gilt markets closed on account of the region's bank holiday and with catalyst light. Currently trading just off session highs of 1.2584.

- JPY is by far the biggest underperformer vs the Dollar, going as high as 154.00, paring much of Friday’s USD/JPY losses, amid holiday-thinned conditions with Japan away.

- Antipodeans are both marginally firmer vs USD, though very much within a contained range as catalysts remain thin. Over in China, the Caixin PMI were in-line with expectations which helped to lift sentiment on the region's return from holiday.

- PBoC set USD/CNY mid-point at 7.0994 vs exp. 7.2127 (prev. 7.1063).

- S&P upgraded Turkey’s rating to 'B+'; Outlook Positive on Friday and cited economic rebalancing.

Fixed Income

- Bunds are bid with specific drivers limited, though upside was trimmed by unusually large upward revisions to the French and then EZ Final PMIs though the internal commentary around German continues to point to stagnation/incremental growth. Current 130.98-131.62 parameters surpassed Friday's best by a handful of ticks with little of note thereafter until 132.00.

- USTs are a touch firmer, in-fitting with EGBs, but with magnitudes thin given the UK Bank Holiday and Japan's absence; docket ahead a touch busier with Fed's Barkin & Williams due after the latest Employment Trend numbers.

Commodities

- Crude benchmarks are bid with geopols in focus. WTI and Brent have been grinding higher throughout the morning as the geopolitical narrative around Rafah continues to gradually escalate. Most recent developments have civilians being evacuated and the Israeli Finance Minister saying the army must enter Rafah today.

- Supported on geopols; XAU to a USD 2324/oz peak but one that leaves it over USD 20/oz shy of last week's best but with the USD 2339/oz 21-DMA the first point of resistance.

- Base metals are bid on China's return to the market with the metal following suit to APAC performance where the region was propped up by Friday's NFP-tailwinds and in-line Chinese PMIs.

- Saudi Arabia raised its oil prices for all grades to Asia for June with Arab Light OSP to Asia set at a premium of USD 2.90/bbl vs Oman/Dubai average and OSP to NW Europe set at a premium of USD 2.10/bbl vs ICE Brent, while it set the OSP to the US at a premium of USD 4.75/bbl vs ASCI.

- UAE’s Sharjah announced the discovery of a new gas field which is said to carry ‘promising quantities’, according to a statement cited by Reuters.

Geopolitics: Middle East

- Israeli forces are now launching raids east of Rafah, via Sky News

- Israel military says not going to put a timeframe on the Rafah evacuation and will make "operation assessments"

- Israeli military says evacuating Rafah as part of a "limited scope" operation

- The Israeli army has ordered civilians in several parts of Rafah to leave the city as it begins an invasion of the southern city, via journalist Soylu

- Israeli Defence Minister, speaking with US Defence Secretary Austin, that action in Rafah is required due to Hamas' refusal of hostage-release proposals

- Senior Hamas Official says to Reuters that Israel's Rafah evacuation order is a "dangerous escalation that will have consequences"; Hamas may withdraw from truce talks due to Rafah operations.

- Israel’s military said the Kerem Shalom Crossing with Gaza is now closed to aid trucks after it came under fire with mortar shelling which killed 3 Israeli soldiers and wounded 12 others from the Givanti and Nahal brigades, while Hamas claimed responsibility for the mortar attack on Kerem Shalom and said it targeted an Israeli army base, according to Reuters.

- Israeli PM Netanyahu said they cannot accept Hamas’s demands for an end to the war and the withdrawal of forces from Gaza, while he noted that ending the Gaza war now would keep Hamas in power and Israel would not accept terms that amount to a capitulation with Israel to keep fighting until its war aims are achieved. It was separately reported that Israel’s Defence Minister said Hamas appears uninterested in a deal meaning strong military action in Gaza’s Rafah could happen very soon, according to Reuters.

- Israeli army is said to have started to evacuate civilians from parts of Rafah, according to Haaretz cited by Walla's Guy Elster. Subsequently, Bloomberg reported that the Israeli military asks some Rafah civilians to move out of the city, according to Bloomberg.

- Hamas’ leader said they are still keen on reaching a comprehensive agreement, while the group said the round of negotiations in Cairo has ended and the delegation will leave to consult with the group’s leadership, according to Reuters. It was separately reported that Hamas agrees that Israel can commit to ending the war in the second stage of the hostage deal not the first, according to Times of Israel via social media platform X.

- CIA chief Burns is to travel to Doha for an emergency meeting with Qatar’s PM as Gaza talks are said to be ‘near to collapse’, while Qatar and the US are to exert maximum pressure on Israel and Hamas to continue negotiations, according to an official briefed on talks cited by Reuters. It was separately reported that Burns will stay in Qatar on Monday and likely travel to Israel this week to meet with Israeli PM Netanyahu, according to an Axios reporter.

- US reportedly put a hold on an ammunition shipment to Israel last week, according to two Israeli officials cited by Axios.

- Iraqi armed factions announced they targeted an Israeli air base in Eilat with drones, according to Al Arabiya.

- Israeli Cabinet decided to close Qatari TV network Al Jazeera’s operations in Gaza, according to a statement cited by Reuters. It was later reported that Israel’s communications ministry said a police raid was conducted at an Al Jazeera premises in Jerusalem.

Geopolitics:

- Russia said it took full control of Ocheretyne village in eastern Ukraine, according to the Defence Ministry, cited by Reuters.

- Russian Defence Ministry says preparations are beginning for the commencement of a missile exercises in the southern district, incl. aviation & navy forces

US Event Calendar

- 14:00: Senior Loan Officer Opinion Survey on Bank Lending Practices

Central Bank Speakers

- 12:50: Fed’s Barkin Speaks on Economic Outlook

- 13:00: Fed’s Williams Participates in Fireside Chat

- 14:00: Senior Loan Officer Opinion Survey on Bank Lending Practices

DB's Peter Sidorov concludes the overnight wrap

Filling in for Jim with the UK off for the May Day bank holiday. As the calendar takes a quieter turn after the deluge of macro events last week, the focus will be on whether markets can continue to find a more solid footing. The latter half of last week saw strong gains for most asset classes thanks to an FOMC meeting that avoided hawkish surprises coupled with a softer payrolls report on Friday that reignited hopes of a soft landing for the US economy. 10yr Treasury yields saw their largest weekly decline of the year so far (-15.5bps) while the S&P 500 posted its best 2-day run in 10 weeks (+2.18%). See the full recap at the end.

Looking forward, the health of the US economic cycle will remain in focus with today’s Senior Loan Officer Survey from the Fed. The SLOOS has seen a gradual improvement in the past few quarters after the sharp tightening following the regional banking stress last March. A key question is whether the rise in yields since the start of the year could derail the nascent improvement in bank credit conditions. In their latest chartbook, Jim and Henry highlighted the delayed pass through of higher rates as one of their “What keeps us awake at night?” themes, while my own earlier note (see here) discussed how further improvement in the bank credit cycle may be unlikely without rate cuts materialising. Later in the week, the University of Michigan consumer survey will attract attention on Friday given the recent softening in US consumer confidence indicators.

The main macro event in Europe will be the latest BoE decision on Thursday. Our UK economist expects this week’s meeting to set the stage for the first rate cut in June and foresees dovish shifts in the MPC’s modal CPI projections and its forward guidance. You can see the full preview here. We will also have the RBA decision on Tuesday (see our economists' preview here), while on Wednesday the Riksbank could deliver the first rate cut of the cycle there. Finally, we’ll have the accounts of April ECB meeting due on Friday. These are unlikely to deliver major surprises, with April's clear if conditional signal of a June rate cut having solidified in recent ECB commentary. But we will watch for any hints on the ECB reaction function beyond June, including on what sort of data might justify consecutive ECB cuts.

The earnings season will begin to taper off this week, with almost 400 of S&P 500 members having already reported. Notable releases will include Walt Disney, Vertex, Uber and Airbnb in the US, Ferrari, Telefonica and Leonardo in Europe and Toyota and Nintendo in Japan.

Asian equity markets are mostly trading higher this morning in holiday thinned trading, catching up to the strong end of last week for US equities. As I type, mainland Chinese stocks are leading gains in the region with the CSI (+1.3%) and the Shanghai Composite (+1.05%) both trading notably higher after returning from a long holiday break while the S&P/ASX 200 (+0.60%) is also edging higher and on pace for a third straight day of gains. Elsewhere, the Hang Seng (-0.05%) is swinging between gains and losses in early trade while markets in Japan and South Korea are closed for a public holiday. Outside of Asia, US stock futures are trading marginally higher (+0.08% for the S&P 500).

In terms of early morning data, China’s Caixin Services PMI came in line with expectations at 52.5 in April (vs. 52.7 the previous month). The Composite PMI edged up from 52.7 to 52.8, its highest level since May 2023, so suggesting a reasonably positive performance of the Chinese economy.

In the FX space, the yen is trading moderately down (-0.57%) against the dollar at 153.92 as I type. The yen had been on course to breach its 1990 lows early last week, but ended up seeing its strongest weekly gain against the dollar since late 2022 (+3.45%) amid suspected FX intervention.On this topic, we heard from US Treasury Secretary Janet Yellen over the weekend, who didn’t comment on whether Japan had intervened but added that “we would expect these interventions to be rare and consultation to take place”.

Events in the Middle East have been in focus over the weekend. Hopes of a ceasefire in Gaza had risen on Friday following comments by Hamas officials that it was studying Israel’s latest proposals with a “positive spirit” but weekend talks ended inconclusively. Israel’s prime minister Netanyahu said on Sunday that it would not agree to Hamas demands to end the war in Gaza completely and Israel closed a crossing into Gaza after a rocket attack by Hamas. Oil prices have moved a little higher this morning with Brent futures (+0.31%) trading at $83.22/bbl, also on news that Saudi Arabia increased its monthly selling oil price to Asia. Geopolitics will remain in focus this week, not least with a visit by China’s President Xi Jinping to Europe that lasts until Friday.

Recapping last week in detail, the US payrolls release on Friday came in softer than expected across an array of indicators. The headline payrolls result rose 175k month-on-month (vs 240k expected), the smallest monthly gain in the last six months. The unemployment rate also ticked up to 3.9% (vs 3.8% expected), while average hourly earnings (+0.2% month-on-month vs +0.3%) and hours worked (34.3 vs 34.4) were both a tenth below expectations. So on the whole, the payrolls print was soft landing positive, with our US economists noting that some ad hoc factors may have overstated the weakening. See their post-payroll labour market chart book here for more.

Off the back of this, markets raised their expectations of rate cuts, with thenumber of Fed cuts priced in by the December meeting rising +11.4bps (and +4.8bps on Friday) to 45bps.The hope for additional Fed rate cuts was given further fuel on Friday after the April ISM services PMI came in at 49.4 (vs 52 expected), its lowest level since December 2022. On the other hand, the ISM services prices paid index rose to a three-month high of 59.2 (vs 55.0 expected), but this was largely driven by an increase in energy prices. This sent 2yr Treasury yields down -5.7bps on Friday, building on the earlier post-FOMC rally and down -17.8bps over the week. 10yr Treasuries also rallied, as yields fell -15.5bps to 4.51% (and -7.2bps on Friday) in their strongest week of the year so far. Lower yields saw the broad dollar index post its worst week in eight weeks (-0.86%).

For Europe, it was a similar story, as investors become increasingly certain that the ECB would be cutting rates at their June meeting. By the end of Friday, markets were pricing in a 95% chance of a rate cut in June, up from 88% at the beginning of the week. That lent support to European fixed income, as 10yr German bund yields fell -8.0bps (and -4.6bps on Friday). 10yr gilts fell -10.2bps (and -6.4bps on Friday).

With the payrolls print boosting soft landing hopes, equities enjoyed a strong end to the week, with the S&P 500 rising +1.26% on Friday and paring back earlier losses (+0.55% on the week). Markets were buoyed by the strong results from Apple, which gained +8.32% last week (and +5.98% on Friday). This saw the tech heavy NASDAQ outperform, rising +1.99% (and +1.43% last week). Overall, the rally was broad-based, as the Russell 2000 index of small caps rose +1.68% (and +0.97% on Friday), returning into positive territory year-to-date (+0.43%). It was a bit gloomier over in Europe, as the STOXX 600 fell -0.48%, although the index posted a small rally on Friday (+0.46%).

Finally in commodities, a more positive geopolitical backdrop and an increase in US oil inventories saw oil prices retreat last week. Brent crude fell -7.31% to $82.96/bbl (-0.85% on Friday), and WTI crude -6.85% to $78.11/bbl (-1.06% on Friday), their lowest levels in seven weeks. Gold retreated for the second week in a row, falling -1.55% to $2302/oz (+0.09% on Friday).

-

Site: Zero HedgeFutures, Global Markets Rise On Rising Fed Cut BetsTyler Durden Mon, 05/06/2024 - 08:11

Global stocks and US equity futures jumped to start the new week, with the S&P 500 poised to extend last week’s rally as traders grew increasingly confident in the likelihood that the Fed will cut interest rates this year. As of 7:40am, S&P 500 and Nasdaq 100 futures added 0.3%, tracking gains in European and Asian markets although trading volumes were lower than average as UK and Japanese markets are shut for a holiday. Apple slid in pre-market trading after Berkshire Hathaway trimmed its stake for a second consecutive quarter. German 10-year yields fell and the yen weakened. Oil advanced after Saudi Arabia raised prices for customers in Asia. On today's calendar we get the latest Senior Loan Officer Opinion Survey (SLOOS) which will signal whether demand for tight credit remains dismal.

In premarket trading, Apple dropped 1.2% after rising strongly over the past two sessions and as Berkshire Hathaway reported it had trimmed its stake in the company. Shares in cryptocurrency-linked companies rally as Bitcoin nears $65,000 level after adding around 10% in the last four sessions. Some of the biggest movers are Marathon Digital (MARA US) +5.6%, Riot Platforms (RIOT US) +4.1%. Steward Health Care filed voluntary petitions for relief under Chapter 11. Here are some other notable premarket movers:

- Luminar Technologies shares fall as much as 17% after the company confirmed it will cut about 20% of jobs and sub-lease parts or all of some facilities.

- Paramount rises 4.5% as it weighs Apollo and Sony’s $26 billion offer to buy the company.

- Perficient gains 55% after EQT agreed to buy the technology consultant in a deal valued at about $3 billion including debt.

With a light US economic calendar this week, the market’s direction may come from central bank officials, as well as policy meetings in the UK, Australia and Sweden. European Central Bank Chief Economist Philip Lane said recent data have made him more certain that inflation is returning to the 2% goal, according to an interview with Spanish newspaper El Confidencial, raising the likelihood a first interest-rate cut in June. New York Fed President John Williams and the Richmond Fed’s Thomas Barkin are due to make remarks on Monday, followed by Neel Kashkari of Minneapolis on Tuesday.

“This week is expected to be calmer on the economic front: few economic data releases and limited central bankers’ intervention,” wrote Credit Agricole strategists led by Jean-Francois Paren.

But while this week may be boring, strategists are already starting to hone in on the importance of next week’s US inflation print for April. “The price reaction on the back of this release may be more important than the data itself given how influential price action has been on investor sentiment amid an uncertain macro set up,” Michael Wilson wrote in a note.

Europe was broadly higher, tracking US equity futures, with the Stoxx 600 rising 0.6% and trading near session highs although volumes were low due a UK public holiday. Among individual stocks in Europe, PostNL NV shares declined after it reported weak volumes. Demant A/S also fell as it reported a miss in sales driven by soft retail. Atos SE jumped after it received four offers that will frame the discussions with its stakeholders around its restructuring. Here are the biggest movers Monday:

- Indra Sistemas shares jump as much as 11%, after the Spanish defense company beat estimates in the first quarter and forecast Ebit for the full year of above EU400 million

- Know IT gains as much as 6% after Handelsbanken raised its short-term recommendation for the Swedish IT consultancy to hold from sell, noting small green shoots in end markets

- Maurel & Prom rise as much as 10%, the most since October, after the French oil firm received a license for operations in the Urdaneta Oeste field in Lake Maracaibo in Venezuela

- Demant falls as much as 5.3%, the most since November, after the Danish hearing-aid group reported softer-than-expected 1Q sales, with retail a stand-out disappointment, Citi says

- Castellum falls as much as 3% after DNB cut its recommendation for the Swedish landlord to hold, noting “rather soft” 1Q earnings which showed that vacancy rates is a concern