“What is perfection in love? Love your enemies in such a way that you would desire to make them your brothers … For so did He love, Who hanging on the Cross, said ‘Father, forgive them, for they know not what they do.’” (Luke 23:34)

Distinction Matter - Subscribed Feeds

-

Site: Zero HedgeIn First, 17 Nations Release Joint Statement Demanding Hamas Release All HostagesTyler Durden Thu, 04/25/2024 - 11:25

Hamas has rejected an urgent formal plea from world leaders to release all remaining Israeli hostages, with the designated terror group telling the West "you can't force us to do anything."

Earlier on Thursday the US was among a group of 17 countries which have citizens in Hamas custody that released a joint statement calling on Hamas to free them.

Via Flash90

Via Flash90

This was the first such international joint statement of the conflict, which has run for more than half a year. Prior attempts at similar statements never got past the draft phase as countries had vastly differing perspectives of the Gaza crisis.

"We call for the immediate release of all hostages held by Hamas and Gaza now for over 200 days. They include our citizens," the statement said. "The fate of the hostages and the civilian population in Gaza who are protected under international law is of international concern."

The leaders from the following countries were behind the statement: United States, Argentina, Austria, Brazil, Bulgaria, Canada, Colombia, Denmark, France, Germany, Hungary, Poland, Portugal, Romania, Serbia, Spain, Thailand and the United Kingdom.

They push for both warring parties to see through the deal that's reportedly on the table: "Gazans would be able to return to their homes and their lands with preparations beforehand to ensure shelter and humanitarian provisions," it said.

"We will emphasize that the pending deal for the release of the hostages will lead to an immediate and prolonged ceasefire in Gaza, which will facilitate the introduction of necessary humanitarian aid to be provided throughout Gaza and lead to a reliable end to hostilities," the joint statement continued.

But Israeli officials have continued to lay blame on Hamas for their inability to reach a deal. One official privy to negotiation efforts described, "The core truth, there's a deal on the table. It meets nearly all of the demands that Hamas has had, including in key elements, one of which I just spoke with." The official added: "And what they need to do is release the vulnerable category of hostages to get things moving.'"

It reportedly focuses on an initial release of captive women, wounded, elderly, and the sick. Israel has recently acknowledged there's a high likelihood that dozens of hostages have already died.

According to a new Hamas articulation of its demands via Associated Press:

A top Hamas political official told The Associated Press the Islamic militant group is willing to agree to a truce of five years or more with Israel and that it would lay down its weapons and convert into a political party if an independent Palestinian state is established along pre-1967 borders.

The comments by Khalil al-Hayya in an interview Wednesday came amid a stalemate in months of talks for a cease-fire in Gaza. The suggestion that Hamas would disarm appeared to be a significant concession by the militant group officially committed to Israel’s destruction.

The Netanyahu government has already long rejected this as a possibility. Instead the prime minister has vowed to not stop military operations in the Gaza Strip until Hamas is eradicated.

NEW: Senior admin official says there’s a Gaza cease-fire deal on the table that meets nearly all of Hamas’ demands, but “it’s really down to one guy to accept the deal.”

— Elizabeth Hagedorn (@ElizHagedorn) April 25, 2024

"The answer that comes back from Sinwar personally is no."Additionally, there have already been high-level attempts at the UN Security Council to push through a resolution recognizing a Palestinian state, but the US has vetoed this. At this point in the conflict a full demand for a Palestinian state seems to be a non-starter from the perspectives of Tel Aviv and Washington.

-

Site: LifeNews

Ballot propositions that will either expand access to abortion or place legal abortion into state constitutions will be on the ballot in as many as twelve states this November. It is hardly a secret that, in the years following the Dobbs decision, pro-lifers have not fared well in statewide democracy campaigns.

However, this year, Florida pro-lifers have a good chance to prevail at the ballot box. That is because ballot propositions to amend Florida’s state constitution need more than 60 percent of the vote to take effect.

Two separate surveys show that the proposed amendment to place legal abortion in Florida’s state constitution is polling well below this 60 percent threshold. An Emerson College poll released earlier this month found that the abortion amendment has the support of only 42 percent of Sunshine State voters. Additionally, a recent USA Today/Ipsos poll found the abortion amendment was ten percentage points short of passage.

REACH PRO-LIFE PEOPLE WORLDWIDE! Advertise with LifeNews to reach hundreds of thousands of pro-life readers every week. Contact us today.

This is good news for pro-lifers. A body of polling data from both Ohio and Michigan show that amendments to place legal abortion in the state constitution fail to appreciably gain support during the course of the campaign. Obviously, Sunshine State pro-lifers still have plenty of work to do. Furthermore, both the presidential election and the enforcement of the Heartbeat Act may affect the dynamics of this direct-democracy campaign. However, these two polls show that a pro-life victory in Florida this November is within reach.

LifeNews Note: Michael J. New is an assistant professor at the Busch School of Business at The Catholic University of America and is an associate scholar at the Charlotte Lozier Institute. Follow him on Twitter @Michael_J_New

The post Two Polls Show Florida Amendment for Abortions Up to Birth Will Fail appeared first on LifeNews.com.

-

Site: Zero HedgeLargest Oil ETF Hit With Record Outflow On Subsiding Geopolitical Risk PremiumTyler Durden Thu, 04/25/2024 - 11:05

A reduced geopolitical risk premium for Brent crude this week is likely one of the main drivers resulting in the largest daily outflows for the US Oil Fund ETF. Tensions between Iran and Israel have subsided in recent days, and it's entirely possible the White House is busy mediating both sides to ensure a wider conflict doesn't rocket Brent prices above $100/bbl.

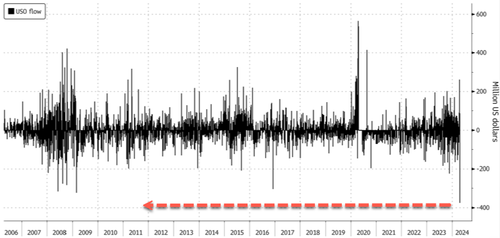

Bloomberg data shows that the US Oil Fund experienced the most massive daily outflow ever on Tuesday, with investors pulling a record $376 million, exceeding the outflow of $323 million set in 2009. Though as the chart below shows, there was a huge inflow just a day or two ago...

"The timing of this activity coincides with a general easing of immediate tension in the Middle East over the weekend," John Love, chief executive officer of USCF Investments, told Bloomberg. USCF Investments is the firm that manages USO.

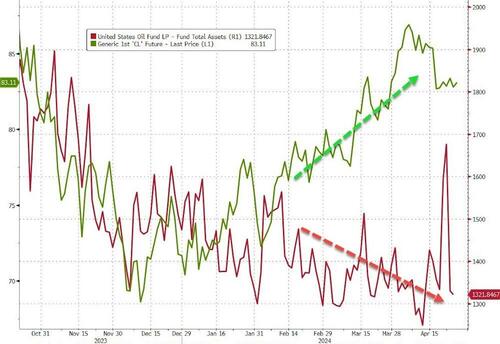

What happened here? USO's total assets decoupled and negatively diverges from oil prices (a similar picture to what we have seen in gold as physical demand soars as paper demand ebbs).

Love said, "Given how high tensions were prior to the strike, it's likely this was an event-driven selloff."

Brent crude prices topped $91/bbl in early April and traded above the $90/bbl level through the mid-point of April as Iran and Israel volleyed missiles and bombs at each other in an unprecedented escalation between the two countries. However, the turmoil appeared more or less theatrics than anything else. Prices have since faded to the $87-$88/bbl level.

"Brent crude oil prices have retreated from their recent highs following a perceived de-escalation in the Israel-Iran conflict, and we continue to expect prices to remain range-bound over the coming months given current fundamentals," Goldman's Jenny Grimberg wrote in a note to clients on Wednesday.

Grimberg shifted up her Brent price floor to $75bbl from the previous line of $70/bbl to reflect OPEC's increasingly strong influence on the market, softening US supply, a more robust demand outlook, and ongoing geopolitical risks. She also adjusted her price forecasts for 2H24/2025 to $86-$82/bbl (from $85-$80/bbl).

"That said, we maintain our $90/bbl ceiling on prices, owing partly to ample OPEC+ spare capacity, which limits upside price risk," she added.

On Thursday, in a separate note, MUFG Bank's Ehsan Khoman outlined a "reduced geopolitical risk premium" impacting Brent prices but said, "a broader risk-off tone is being overshadowed by bullish US crude inventory numbers, with front-end Brent pricing consolidating below the USD90/b handle."

Khoman pointed out that oil bulls are sitting comfortably with prices over the 50-day moving average of $86/bbl.

He expects Brent to trade between the $80/bbl and $100/bbl range for the rest of the year primarily because of "effective OPEC+ market management" on the supply side, adding that the lingering risk remains geopolitics in the Middle East.

That said, the largest USO daily outflow ever is likely not an ominous sign of a major trend change in crude prices but rather just a cooling of the geopolitical risk premium. A combination of lingering threats in the Middle East and OPEC+ market management will keep prices elevated.

-

Site: Zero HedgeLargest Oil ETF Hit With Record Outflow On Subsiding Geopolitical Risk PremiumTyler Durden Thu, 04/25/2024 - 11:05

A reduced geopolitical risk premium for Brent crude this week is likely one of the main drivers resulting in the largest daily outflows for the US Oil Fund ETF. Tensions between Iran and Israel have subsided in recent days, and it's entirely possible the White House is busy mediating both sides to ensure a wider conflict doesn't rocket Brent prices above $100/bbl.

Bloomberg data shows that the US Oil Fund experienced the most massive daily outflow ever on Tuesday, with investors pulling a record $376 million, exceeding the outflow of $323 million set in 2009. Though as the chart below shows, there was a huge inflow just a day or two ago...

"The timing of this activity coincides with a general easing of immediate tension in the Middle East over the weekend," John Love, chief executive officer of USCF Investments, told Bloomberg. USCF Investments is the firm that manages USO.

What happened here? USO's total assets decoupled and negatively diverges from oil prices (a similar picture to what we have seen in gold as physical demand soars as paper demand ebbs).

Love said, "Given how high tensions were prior to the strike, it's likely this was an event-driven selloff."

Brent crude prices topped $91/bbl in early April and traded above the $90/bbl level through the mid-point of April as Iran and Israel volleyed missiles and bombs at each other in an unprecedented escalation between the two countries. However, the turmoil appeared more or less theatrics than anything else. Prices have since faded to the $87-$88/bbl level.

"Brent crude oil prices have retreated from their recent highs following a perceived de-escalation in the Israel-Iran conflict, and we continue to expect prices to remain range-bound over the coming months given current fundamentals," Goldman's Jenny Grimberg wrote in a note to clients on Wednesday.

Grimberg shifted up her Brent price floor to $75bbl from the previous line of $70/bbl to reflect OPEC's increasingly strong influence on the market, softening US supply, a more robust demand outlook, and ongoing geopolitical risks. She also adjusted her price forecasts for 2H24/2025 to $86-$82/bbl (from $85-$80/bbl).

"That said, we maintain our $90/bbl ceiling on prices, owing partly to ample OPEC+ spare capacity, which limits upside price risk," she added.

On Thursday, in a separate note, MUFG Bank's Ehsan Khoman outlined a "reduced geopolitical risk premium" impacting Brent prices but said, "a broader risk-off tone is being overshadowed by bullish US crude inventory numbers, with front-end Brent pricing consolidating below the USD90/b handle."

Khoman pointed out that oil bulls are sitting comfortably with prices over the 50-day moving average of $86/bbl.

He expects Brent to trade between the $80/bbl and $100/bbl range for the rest of the year primarily because of "effective OPEC+ market management" on the supply side, adding that the lingering risk remains geopolitics in the Middle East.

That said, the largest USO daily outflow ever is likely not an ominous sign of a major trend change in crude prices but rather just a cooling of the geopolitical risk premium. A combination of lingering threats in the Middle East and OPEC+ market management will keep prices elevated.

-

Site: Zero HedgeWatch: NYU 'Pro-Palestine' Demonstrators Have No Idea What They're ProtestingTyler Durden Thu, 04/25/2024 - 11:05

Authored by Steve Watson via Modernity.news,

Video captured at New York University shows that some of the students protesting there have no idea why.

NYU is one of several campuses where so called ‘Gaza camps’ have been formed with students refusing to disperse.

Yet it seems that the students don’t really know what they are doing it for.

In the footage below, the videographer asks one of the protesters “What would you say is the main goal with tonight’s protest.”

She responds “I think the goal is just showing our support for Palestine and demanding that NYU stops – I honestly don’t know all of what NYU is doing.”

The student then asks her friend “do you know what they are doing?” To which the other (masked) student responds “I wish I was more educated.”

“I’m not either,” the first protestor then admits, claiming that she came from Columbia University after she was told to.

Watch:

“I wish I was more educated.”

— m o d e r n i t y (@ModernityNews) April 25, 2024

Video captured at New York University shows that some of the students protesting there have no idea why. Full report: https://t.co/iYSbhaxxEf pic.twitter.com/iqXpoZexiPThe NYPD arrested more than 150 demonstrators Monday night as the protests turned violent with protesters throwing bottles and other projectiles at police.

WATCH: Chairs and bottles thrown as New York police clear out the NYU encampment, make arrests

— Daily Caller (@DailyCaller) April 23, 2024

pic.twitter.com/YGBsJyAULYNYU Spokesperson John Beckman stated “We witnessed disorderly, disruptive, and antagonizing behavior that has interfered with the safety and security of our community, and that demonstrated how quickly a demonstration can get out of control or people can get hurt.”

Similar scenes unfolded Wednesday at UT Austin:

Palestinian activists TACKLED to the floor and arrested as Texas DPS troops make dozens of arrests as an unruly mob surround the officers and scream.

— Oli London (@OliLondonTV) April 24, 2024

Hundreds of students have occupied the University of Texas- Austin and have been ordered to disperse.

Video: @RyanChandlerTV pic.twitter.com/lE3RIpgzEr* * *

Your support is crucial in helping us defeat mass censorship. Please consider donating via Locals or check out our unique merch. Follow us on X @ModernityNews.

-

Site: Zero HedgeWatch: NYU 'Pro-Palestine' Demonstrators Have No Idea What They're ProtestingTyler Durden Thu, 04/25/2024 - 11:05

Authored by Steve Watson via Modernity.news,

Video captured at New York University shows that some of the students protesting there have no idea why.

NYU is one of several campuses where so called ‘Gaza camps’ have been formed with students refusing to disperse.

Yet it seems that the students don’t really know what they are doing it for.

In the footage below, the videographer asks one of the protesters “What would you say is the main goal with tonight’s protest.”

She responds “I think the goal is just showing our support for Palestine and demanding that NYU stops – I honestly don’t know all of what NYU is doing.”

The student then asks her friend “do you know what they are doing?” To which the other (masked) student responds “I wish I was more educated.”

“I’m not either,” the first protestor then admits, claiming that she came from Columbia University after she was told to.

Watch:

“I wish I was more educated.”

— m o d e r n i t y (@ModernityNews) April 25, 2024

Video captured at New York University shows that some of the students protesting there have no idea why. Full report: https://t.co/iYSbhaxxEf pic.twitter.com/iqXpoZexiPThe NYPD arrested more than 150 demonstrators Monday night as the protests turned violent with protesters throwing bottles and other projectiles at police.

WATCH: Chairs and bottles thrown as New York police clear out the NYU encampment, make arrests

— Daily Caller (@DailyCaller) April 23, 2024

pic.twitter.com/YGBsJyAULYNYU Spokesperson John Beckman stated “We witnessed disorderly, disruptive, and antagonizing behavior that has interfered with the safety and security of our community, and that demonstrated how quickly a demonstration can get out of control or people can get hurt.”

Similar scenes unfolded Wednesday at UT Austin:

Palestinian activists TACKLED to the floor and arrested as Texas DPS troops make dozens of arrests as an unruly mob surround the officers and scream.

— Oli London (@OliLondonTV) April 24, 2024

Hundreds of students have occupied the University of Texas- Austin and have been ordered to disperse.

Video: @RyanChandlerTV pic.twitter.com/lE3RIpgzEr* * *

Your support is crucial in helping us defeat mass censorship. Please consider donating via Locals or check out our unique merch. Follow us on X @ModernityNews.

-

Site: Padre PeregrinoOn why the Son of God chose to die as a slave before rising from the dead, and why modern martyrs will follow in His footsteps on both. (Correction: I said St. Mark's feast is coming up, but it's today.)

-

Site: Zero HedgeRussia To Seize $440 Million From JPMorganTyler Durden Thu, 04/25/2024 - 10:45

Seizing assets? Two can play at that game...

Just days after Washington voted to authorize the REPO Act - paving the way for the Biden administration confiscate billions in Russian sovereign assets which sit in US banks - it appears Moscow has a plan of its own (let's call it the REVERSE REPO Act) as a Russian court has ordered the seizure of $440 million from JPMorgan.

The seizure order follows from Kremlin-run lender VTB launching legal action against the largest US bank to recoup money stuck under Washington’s sanctions regime.

As The FT reports, the order, published in the Russian court register on Wednesday, targets funds in JPMorgan’s accounts and shares in its Russian subsidiaries, according to the ruling issued by the arbitration court in St Petersburg.

The assets had been frozen by authorities in the wake of the western sanctions, and highlights some of the fallout western companies are feeling from the punitive measures against Moscow.

Specifically, The FT notes that the dispute centers on $439mn in funds that VTB held in a JPMorgan account in the US.

When Washington imposed sanctions on the Kremlin-run bank, JPMorgan had to move the funds to a separate escrow account. Under the US sanctions regime, neither VTB nor JPMorgan can access the funds.

In response, VTB last week filed a lawsuit against the New York-based group to get Russian authorities to freeze the equivalent amount in Russia, warning that JPMorgan was seeking to leave Russia and would refuse to pay any compensation.

The following day, JPMorgan filed its own lawsuit against the Russian lender in a US court to prevent a seizure of its assets, arguing that it had no way to reclaim VTB’s stranded US funds to compensate its own potential losses from the Russian lawsuit.

Yesterday's decision sided with VTB, ordering the seizure of funds in JPMorgan’s Russian accounts and “movable and immovable property,” including its stake of a Russian subsidiary.

JPMorgan said it faced "certain and irreparable harm" from VTB’s efforts, exposed to a nearly half-billion-dollar loss, for merely abiding by U.S. sanctions.

The order was the latest example of American banks getting caught between the demands of Western sanctions regimes and overseas interests. Last summer, a Russian court froze about $36mn worth of assets owned by Goldman following a lawsuit by state-owned bank Otkritie. A few months later the court ruled that the Wall Street investment bank had to pay the funds to Otkritie.

The tit-for-tat continues.

-

Site: Zero HedgeRussia To Seize $440 Million From JPMorganTyler Durden Thu, 04/25/2024 - 10:45

Seizing assets? Two can play at that game...

Just days after Washington voted to authorize the REPO Act - paving the way for the Biden administration confiscate billions in Russian sovereign assets which sit in US banks - it appears Moscow has a plan of its own (let's call it the REVERSE REPO Act) as a Russian court has ordered the seizure of $440 million from JPMorgan.

The seizure order follows from Kremlin-run lender VTB launching legal action against the largest US bank to recoup money stuck under Washington’s sanctions regime.

As The FT reports, the order, published in the Russian court register on Wednesday, targets funds in JPMorgan’s accounts and shares in its Russian subsidiaries, according to the ruling issued by the arbitration court in St Petersburg.

The assets had been frozen by authorities in the wake of the western sanctions, and highlights some of the fallout western companies are feeling from the punitive measures against Moscow.

Specifically, The FT notes that the dispute centers on $439mn in funds that VTB held in a JPMorgan account in the US.

When Washington imposed sanctions on the Kremlin-run bank, JPMorgan had to move the funds to a separate escrow account. Under the US sanctions regime, neither VTB nor JPMorgan can access the funds.

In response, VTB last week filed a lawsuit against the New York-based group to get Russian authorities to freeze the equivalent amount in Russia, warning that JPMorgan was seeking to leave Russia and would refuse to pay any compensation.

The following day, JPMorgan filed its own lawsuit against the Russian lender in a US court to prevent a seizure of its assets, arguing that it had no way to reclaim VTB’s stranded US funds to compensate its own potential losses from the Russian lawsuit.

Yesterday's decision sided with VTB, ordering the seizure of funds in JPMorgan’s Russian accounts and “movable and immovable property,” including its stake of a Russian subsidiary.

JPMorgan said it faced "certain and irreparable harm" from VTB’s efforts, exposed to a nearly half-billion-dollar loss, for merely abiding by U.S. sanctions.

The order was the latest example of American banks getting caught between the demands of Western sanctions regimes and overseas interests. Last summer, a Russian court froze about $36mn worth of assets owned by Goldman following a lawsuit by state-owned bank Otkritie. A few months later the court ruled that the Wall Street investment bank had to pay the funds to Otkritie.

The tit-for-tat continues.

-

Site: LifeNews

Joe Biden showed his bigoted side on April 23 when he spoke in Tampa, Florida about the glory of abortion. It wasn’t abortion, per se, that got him going—it was those whom he identified as pro-life that set him off.

To be specific, he railed against Donald Trump’s pro-life stance, saying the former president made “a political deal” with “the evangelical base of the Republican Party to look past his moral and character flaws.”

Fifty percent of all the money raised by the Democrats comes from Jews. Yet no one is going to say that Biden made a “political deal” with “the Jewish base of the Democratic Party to look past his cognitive flaws.”

Biden refuses to condemn the anti-Jewish rhetoric stemming from Muslims in Dearborn, Michigan. Yet no one is going to say that he made a “political deal” with “the Muslim base of the Democratic Party to look past his cognitive flaws.”

REACH PRO-LIFE PEOPLE WORLDWIDE! Advertise with LifeNews to reach hundreds of thousands of pro-life readers every week. Contact us today.

Notice that Biden’s comment in Tampa wasn’t about Protestants in general. He focused exclusively on evangelicals, and that is because to take a swipe at all Protestants would be to slam the mainline denominations; they are mostly in the pro-abortion camp. He chose a subset of Protestants who are known for their pro-life convictions.

Biden intentionally red-flagged evangelicals, knowing it would appeal to his bigoted base (survey data also show that Democrats do not think highly of Catholics, either). This was a classic example of religious baiting, and it should be condemned by everyone.

As the election year progresses, look for Biden to continue with this demagogic strategy. The “devout Catholic” has no problem manipulating religion to serve his militantly secular agenda.

LifeNews Note: Bill Donohue is the president of the Catholic League for Religious and Civil Rights.

The post Joe Biden Trashed Pro-Life Christians at Abortion Rally appeared first on LifeNews.com.

-

Site: Zero HedgeFalling Bond Yields Show It's Crunch Time In ChinaTyler Durden Thu, 04/25/2024 - 10:30

Authored by Simon Black, Bloomberg macro strategist,

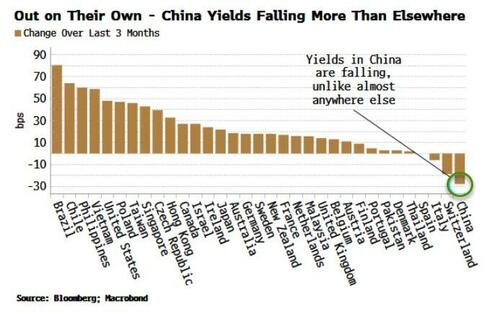

Sovereign yields in China have been falling in recent months, in marked contrast to almost every other major country. This is a key macro variable to watch for signs China is ready to ease policy more comprehensively as its tolerance is tested for an economy that is becoming increasingly deflationary. Further, vigilance should be increased for a yuan devaluation. Though not a base case, the tail-risk of one occurring is rising.

Year of the Dragon in China it may be, but the economy has yet to exhibit the abundance of energy and enthusiasm those born under the symbol are supposed to possess. China failed to exit the pandemic with the resurgence in growth seen in many other countries, and the outlook has been lackluster ever since.

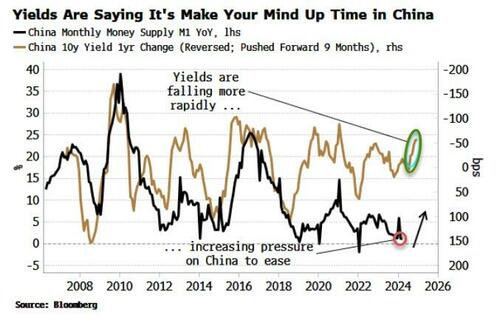

But we are entering the crunch phase, where China needs to respond forcefully, or face the prospect of a protracted debt-deflation. The signal is coming from falling government yields. They have been steadily falling all year, at a faster pace than any other major EM or DM country. Indeed yields have been rising in almost every other country.

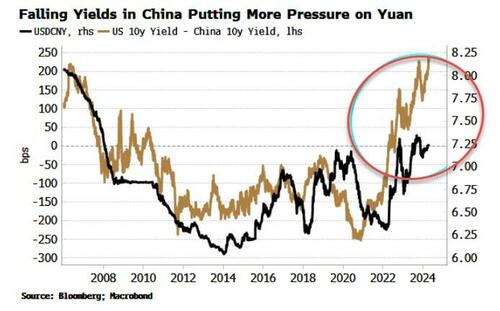

That’s a problem for the yuan. The drop in China’s yields is adding pressure on the currency. Widening real-yield differentials show that there remains a strong pull higher on the dollar-yuan pair.

The question is: will this prompt a devaluation in the yuan? The short answer is less likely than not, but it can’t be discounted, and the risks are rising as long as capital outflows continue to climb.

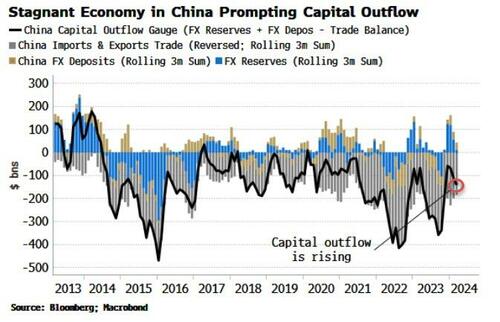

We can’t measure those directly in China as the capital account is nominally closed. But we can proxy for them by looking at the trade surplus, official reserves held at the PBOC, and foreign currency held in bank deposits. The trade surplus is a capital inflow, and whatever portion of it that does not end up either at the PBOC or in foreign-currency bank accounts we can infer is capital outflow.

This measure is rising again, as more capital typically tries to leave the country when growth is sub-par, as it is today.

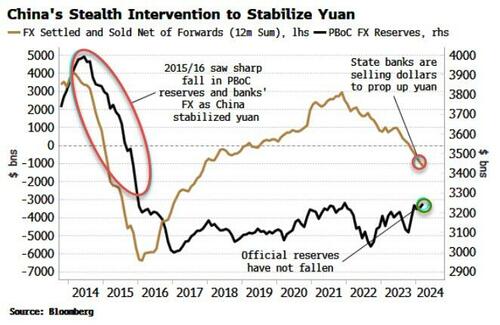

So far, China appears to be managing the decline in the yuan versus the dollar. USD/CNY has been bumping up against the 2% upper band above the official fix for the pair. But China is stabilizing the yuan’s descent through the state-banking sector. As Brad Setser noted in a recent blog, the PBOC has stated that it has more or less exited from the FX market. Instead, that intervention now takes place unofficially using dollar deposits held at state banks.

China has plenty of foreign-currency reserves to stave off continued yuan weakness (more so than is readily visible, according to Setser), but there is always the possibility policymakers decide to ameliorate the destructive impact on domestic liquidity from capital outflow by allowing a larger, one-time devaluation. There is speculation this is where China is headed, and that it is behind its recent stockpiling of gold, copper and other commodities.

However, there are risks attached to such a move, given it might be detrimental to the more normalized markets that China covets in the name of financial stability, as well potentially prompting a tariff response from the US.

A devaluation is a low, but non-zero, possibility that has risen this year. Either way, the drop in bond yields underscores that China will soon need to do something more dramatic to avert the risk of a debt deflation.

In the past, the current rate of decline in sovereign yields has led to a forthright easing response from China, with a rise in real M1 growth typically seen over the next six-to-nine months.

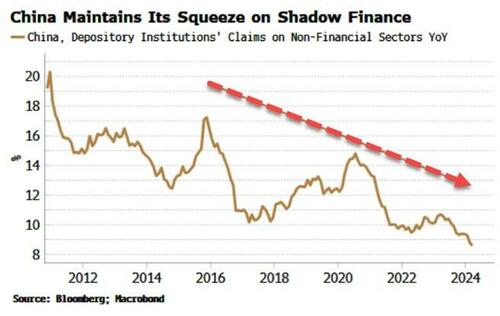

But M1 growth in China has singularly failed to bounce back so far despite several hints that it was about to. This is likely a deliberate policy choice as rises in narrow money are reflective of broad-based “flood-like” stimulus that policymakers in China have explicitly ruled out as recently as January, in comments from Premier Li Qiang. Policymakers are laser-focused on not re-inflating the shadow-finance sector, which continues to be squeezed.

Shadow finance led to unwanted speculative froth in markets, real estate and investment that China does not want to see reprised. But its curbs have been too successful. Credit remains hard-to-get where it is needed most, typically the non state-owned sectors.

The slowdown this fostered was amplified by China’s response to the pandemic. Rather than supporting household demand, policymakers in China supported the export sector, leading to a surge in outward-bound goods.

Stringent lockdowns prompted households to become exceptionally risk averse, increasing their savings, and being reluctant to spend even after restrictions were lifted, lest the government decided to paralyze the economy again at some future time.

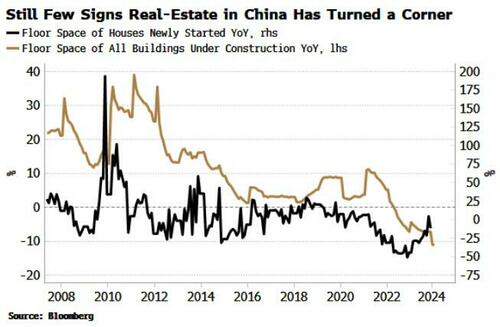

This also caused the real estate sector to implode, prompting multiple piecemeal easing measures to support housing prices and indebted property developers, to little avail so far: leading indicators for real estate such as floor-space started remain muted or weak, while the USD-denominated debt of property companies continues to trade at less than 25 cents in the dollar.

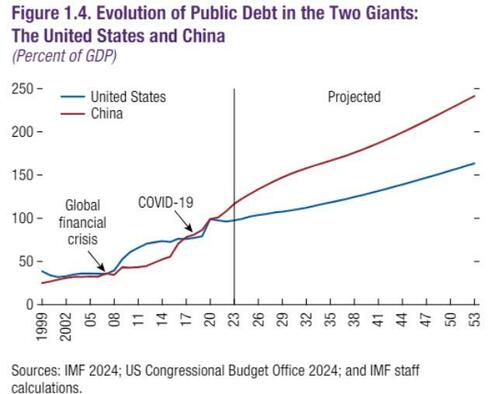

China has a large and growing debt pile that is only set to get worse as its demographics continue to deteriorate. The alarming chart below from the IMF projects public debt (including local government financing vehicles) in China to accelerate way ahead of that in the US in the coming years, to around 150% of GDP by the end of the decade. Total non-financial debt is already closing in on 300% of GDP.

Source: IMF

This raises the risk of a debt-deflation, when the value of assets and the income from them fall in relation to the value of liabilities. Debt becomes increasingly difficult to service and pay back, leading to lower consumption and investment, entrenched deflation and derisory growth that is difficult to escape.

Woody Allen once quipped that mankind is at a crossroads, one road leads to despair and utter hopelessness and the other to total extinction. China’s choices are not yet that stark, but the longer it waits to deliver an emphatic response to its predicament, they may soon become that way.

-

Site: The Orthosphere

I once read an essay lamenting the disappearance of what I recall the essayist calling, “negroes in white shirts and bow ties.” The essayist was one of those late-onset conservatives we call “liberals mugged by reality.” The “negroes in white shirts and bow ties” were the polite, often Christian, white-acting blacks who had won the late-onset conservative’s sympathy when the Civil Rights Movement was young.

What the late-onset conservative did not understand was that the success of the Civil Rights Movement entailed the disappearance of “negroes in white shirts and bow ties.” Obviously, “white shirts and bow ties” here simply signify acting white. That is what respectable white men were wearing around 1960, and because whites were hegemonic in 1960, respectable blacks wore them too.

The wardrobe of lower middle-class American males changed very markedly by the late 1960s, so there were very few blacks outside the Nation of Islam wearing white shirts and bow ties; but the disappearance of “negroes in white shirts and bow ties” was caused by something deeper than the sartorial revolution of the late 1960s.

The success of the Civil Rights Movement meant that blacks were now free to act black. The key word that I just used is hegemony. To this I must add the companion word toady. A hegemon has the power to impose his vision on the world, the toady yields to that power and conforms to that vision.

What we can learn from the lament of the “mugged-by-reality” liberal (a.k.a the “late-onset conservative”) is that hegemons can fail to see their own power. When they survey a throng that dresses and acts like down-market versions of themselves, the hegemon does not see toadies. At least not always. He sees “negros in white shirts and bow ties,” who’s unlikeness to him goes no deeper than to the color of their skins.

But the point of a liberation movement like the Civil Rights Movement is not to allow toadies to go on dressing and acting like their former masters. It is to liberate the toadies from hegemony and allow them to act like themselves.

We see this in the liberation movements we call the Women’s Rights Movement and the Gay Rights Movement, both of which quickly went places that shocked some of their early supporters. Thus the “feminine businesswomen” and “confirmed bachelors” quickly went the way of “negroes in white shirts and bow ties.” They did not all become power-skirts, leather-boys, and black panthers, but enough did to make many former hegemons into “late-onset conservatives.”

The hegemony of straight white Christian males has been, of course, entirely destroyed. This is why the teaching toadies of today’s actual hegemons do little but rail against it. We must never forget that Cassandra was effectively mute, while the appointed oracles of the regime always shriek with contagious alarm at newfangled phantoms and ghosts of rivals long dead.

We must also never forget what I will call the Hegemon’s Illusion, which is to believe he is loved when he is in fact only feared. I do not suppose that straight white Christian males will be in a position to fall under the Hegemon’s Illusion any time soon, but as toadies we may possibly use it to our advantage.

-

Site: LifeNews

Alliance Defending Freedom attorneys representing a Young Americans for Freedom chapter and three students at the University at Buffalo will be available for media interviews Friday following oral arguments in federal district court. ADF attorneys are challenging university officials and the Student Association after they derecognized the conservative student group and barred it from receiving the same benefits as other student groups because it is a chapter of a national organization, Young America’s Foundation.

ADF attorneys filed a federal lawsuit against the school in June, and a month later, the Student Association rescinded its policy and recognized YAF, but it replaced the policy with another unconstitutional one that requires student organizations and their leaders to give up their legal rights in order for the clubs to be officially recognized. Now, because Young Americans for Freedom rightly won’t sign a form waiving its legal rights, the Student Association has blocked the student group from accessing more than $6,000 in student-fee funding in its account, using authority given it by university officials. ADF attorneys filed a motion in March asking the court to allow the student group to access funds while the case proceeds.

“All students, regardless of their political affiliations, should have access to generally available resources, and universities are constitutionally bound to protect these rights,” said ADF Legal Counsel Logan Spena, who will be arguing before the court on behalf of YAF and the students. “Unfortunately, the University at Buffalo and its student government are picking and choosing winners and losers in the marketplace of ideas, first by punishing the group for its national affiliation with a conservative group, then by demanding that group leaders sign away their freedoms. Public universities cannot force student organizations to become an extension of the university or student government. We are urging the court to stand up for the First Amendment rights of all students, not just some.”

REACH PRO-LIFE PEOPLE WORLDWIDE! Advertise with LifeNews to reach hundreds of thousands of pro-life readers every week. Contact us today.

The university’s new policy requires that club leaders certify that they surrender their, and their organization’s, right to file a lawsuit against the university or its officials in the future, exist as a legal entity under state law, have financial accounts as an organization, and enter into agreements with other individuals or organizations. As a result, ADF attorneys amended their lawsuit in University at Buffalo Young Americans for Freedom v. University at Buffalo Student Association after the school rescinded the original policy barring the group from official recognition.

Young Americans for Freedom has existed as a registered student organization on the UB campus since 2017, and for the last two years, the student group has had more than 100 members and has held weekly meetings on campus. As a chapter of Young America’s Foundation, UB Young Americans for Freedom’s purpose is to provide an environment for the students of UB to learn about U.S. history, the U.S. Constitution, individual freedom, a strong national defense, free enterprise, and other topics. Like other clubs, Young Americans for Freedom fulfills its mission by engaging in expressive activities on campus, including posting flyers and signs, hosting tables with information, inviting speakers to campus, and talking with fellow students.

Denis Kitchen, one of more than 4,500 attorneys in the ADF Attorney Network, is serving as local counsel on behalf of Young Americans for Freedom and the students.

The post Conservative Student Group Sues University of Buffalo for Cancelling Club, Blocking Financial Account appeared first on LifeNews.com.

-

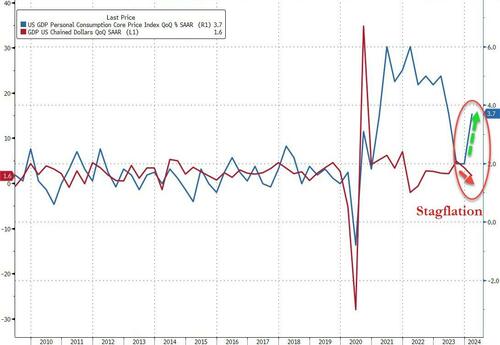

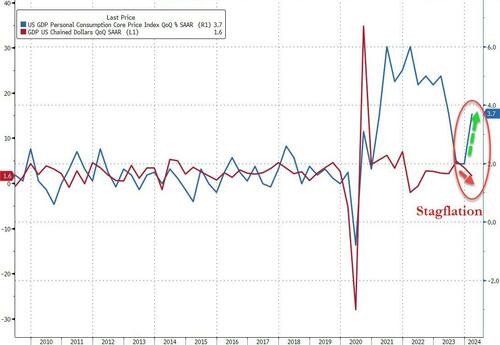

Site: Zero HedgeWall Street Reacts To Today's Stagflationary Data DumpTyler Durden Thu, 04/25/2024 - 10:07

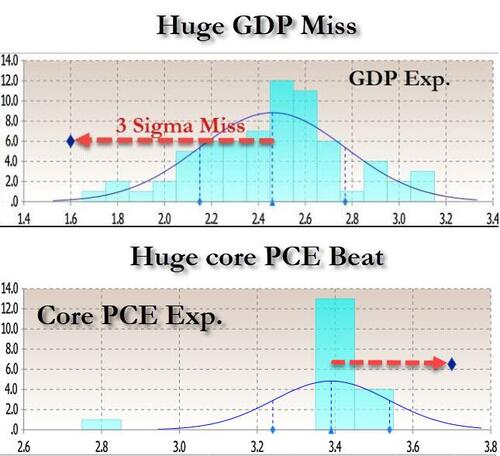

After today's stagflationary GDP print, which came below the lowest Wall Street estimate even as core PCE came in above the highest estimate...

... there has been an outcry of horror from Wall Street's traders, analysts and strategists as the BEA once again steamrolled all over Wall Street's benevolent forecasts for a soft, or no, landing and crash-landed right into stagflation nation.

Below we excerpt from some of the most notable kneejerk responses and comments:

Ian Lyngen at BMO Capital Markets, on the potential implication of the core PCE inflation gauge this morning on tomorrow’s monthly release:

“The question has quickly become whether this is due to revisions from Jan/Feb or if tomorrow’s monthly core-PCE report will reveal a stronger-than-consensus (+0.3%) print.”

Ira Jersey, Bloomberg Intel chief Rates strategist

“The rate market is keenly focused on the PCE deflator beating expectations in 1Q. We still target 4.70% as a key technical level for 10-year Treasury yield. A break of that targets the cycle highs around 5%.”

“It looks like the fiscal drag on the economy may have begun with federal government consumption actually a drag on GDP this quarter. Not huge, but any negative print is still a shift from the past few years. But 2.5% consumption growth still isn’t anywhere near recession, and services consumption growing at 4% suggests a more pronounced slowdown could be a long way off.”

Sebastian Boyd, Bloomberg analyst

Bond traders can read the GDP data in two ways. The growth number was a big miss, but prices rose faster than expected. Of course this is the first pass at the data, but if it holds up then it shows the US economy is considerably weaker than thought, which would open the way to earlier interest rate cuts. On the other hand, the Fed is more likely to focus on inflation than growth, and the price index, especially the core price index, doesn’t offer any comfort on that front. Two-year yields initially fell, but are now much higher on the day. Stock futures are down; the dollar is spiking. Keep an eye on the yen.

Lindsay Rosner, head of multisector fixed income investing at GSAM

"The report has a disappointing headline and consumption line item, but at this point, inflation concerns weigh more than GDP softness for the Fed.”

Quincy Krosby, Chief Global Strategist at LPL Financial:

“The softer first read of Q1 GDP could shift -- again- the Fed’s timetable for initiating the rate easing cycle, with July coming back into play. If the PCE report due tomorrow similarly suggests the downward path of inflation has begun to once again momentum, it could serve as a catalyst for the market.”

Dan Suzuki, deputy CIO at Richard Bernstein Advisors,

"The GDP print is not as bad a print as it appears on the surface. The main drags were in goods demand (which we already knew based on the manufacturing PMIs), government spending and exports. I think it was actually pretty encouraging to see solid investment spending in both capex and housing, while weaker net exports reflect the robust domestic demand for imports, even as economic growth outside the US has been a bit more tepid.”

Enda Curran, Bloomberg Fed watcher and commentator

"The other political takeaway from today’s data is that just six months out from the presidential election, it looks like the economy is finally slowing down. The details of the data are overall robust -- but it’s the headline that counts for politicos."

Rubeela Farooqi, chief US economist at High Frequency Economics:

“The outlook going forward is uncertain. Strength in the labor market is likely to keep household spending and growth positive for now. However, a delay in Fed rate cuts to counter sticky inflation could be headwinds for consumption and the growth trajectory over coming quarters.”

Olu Sonola, head of US economic research for Fitch Ratings:

“The hot inflation print is the real story in this report. If growth continues to slowly decelerate, but inflation strongly takes off again in the wrong direction, the expectation of a Fed interest rate cut in 2024 is starting to look increasingly more out of reach.”

Jan Hatzius, Goldman economist

Real GDP rose 1.6% annualized in the advance reading for Q1 (qoq ar)—0.9pp below consensus and the first quarter below 2% since the second quarter of 2022. The composition was not as soft, as the contribution from inventories (-0.4pp vs. GS +0.2pp) and foreign trade (-0.9pp vs. -0.4pp) accounted for the bulk of the miss. Indeed, domestic demand growth proceeded at a strong pace of +2.8% annualized. This reflected a double-digit pace of residential investment growth (+13.9%) and solid growth in consumption (+2.5%) and business fixed investment (+2.9%), the latter reflecting gains in two of the three capex subcategories (equipment +2.1%, intellectual property +5.4%, structures -0.1%). Government spending growth slowed more than we expected to +1.2% (vs. GS +1.9% and Q4 +4.6%), reflecting a surprising decline in federal (-0.2%) and a smaller-than-forecast rise in state and local (+2.0%) spending.

Alan Detmeister, UBS economist

We had 3.5% so were slightly less surprised than the consensus. The months that go into the Q1 number released today will be used in the 12-month change on Thursday, however the weighting across those months is quite different with the January monthly change getting much more weight in today’s quarterly number than it does in the 12-month change released tomorrow (and the opposite for the March monthly change). Nonetheless the 0.2pp upward surprised on the annualized Q1 core PCE price change definitely increases the risk of an upward surprise to the 12-month change tomorrow. (Treating months equally it would suggest tomorrow’s estimate of the 12-month change around 5bp higher than what we have.) It is more difficult to say anything on the March monthly because it is quite possible that today’s surprise was upward revisions to January or February, so again today’s data raises the upside risk on March, but hard to say how much.

Source: Bloomberg

-

Site: Zero HedgeUS Pending Home Sales Rise In March, But...Tyler Durden Thu, 04/25/2024 - 10:06

After new home sales soared (thanks to prior downward revisions) and existing home sales plunged in March (along with the collapse in housing starts and permits in March), this morning's pending home sales data was expected to rise very modestly MoM (less than in February) but remain lower on a YoY basis.

In an odd turn of events, pending home sales beat on a MoM (SA) basis (+3.4% vs +0.4% exp) but missed on a YoY (NSA) basis (-4.5% vs -3.0% exp). Sales were up 0.1% YoY on a seasonally-adjusted basis...

Source: Bloomberg

This is the 28th straight month of YoY declines for non-seasonally-adjusted pending home sales.

That leaves pending home sales hovering just off record lows...

Source: Bloomberg

The gains were led by the South and the West, and, to a lesser extent, the Northeast, with the MidWest seeing sales slump 4.3$ MoM. All regions are lower on a YoY basis.

While the pending-sales index reached a high point, “it still remains in a fairly narrow range over the last 12 months without a measurable breakout,” NAR Chief Economist Lawrence Yun said in a statement.

“Meaningful gains will only occur with declining mortgage rates and rising inventory.”

And given the tight correlation with mortgage rates, it looks like pending home sales are set to continue their downward slope...

Source: Bloomberg

As a reminder, the pending-home sales report is a leading indicator of existing-home sales given houses typically go under contract a month or two before they’re sold.

-

Site: Mises InstituteUnsurprisingly, Javier Milei’s free-market and antistate initiatives face opposition in Argentina. Whether he is successful depends on his being able to politically outlast his collectivist opposition.

-

Site: Steyn OnlineGreetings one and all and welcome to the Passover 2024 edition of Laura's Links. After many hours of toil, the Cohen household was Kosher for Passover on Sunday last week, just in time to cook up a storm for the Seder that we hosted. The story of the

-

Site: Steyn OnlineIt's time for Part Seven of my latest Tale for Our Time: The Secret Adversary, with Agatha Christie venturing from country-house murders at St Mary Mead into the high stakes of post-Great War politics. Mike Clifson, a Mark Steyn Club member from

-

Site: LifeNews

A mom who chose life and achieved her educational goal of graduating from college has done so with assistance from a pro-life program. And Katie Chihoski will walk across the stage to receive her diploma with her 18-month-old daughter by her side.

Chihoski is the first student to graduate from University of Mary, a Catholic liberal arts college in Bismarck, North Dakota, under a new pro-life program. Launched last year, the “St. Teresa’s” program pledges to help single mothers by providing room, board, and child care as well as opportunities for building relationships necessary to help both mother and child.

Chihoski could have easily had an abortion. But she decided to give birth to her daughter and, as a result, the entire college has stepped up to assist her – doing everything from babysitting to feeding to connecting her with other young moms for support.

The Catholic News Agency has more:

Chihoski hopes to walk across the stage with Lucia, who will be wearing a toddler-sized cap and gown on graduation day.

“I think she will walk across the stage with me, if I can figure out the logistics,” she said. “I would love to make that a tradition for future graduating mothers.”

Chihoski said that although she had some worries about attending school with a young daughter, Lucia has made things “twice as fun.”

Please follow LifeNews.com on Gab for the latest pro-life news and info, free from social media censorship.

“Coming to school, I expected to be seen as different, and somewhat outcast from the typical college life,” she explained. “I think it was difficult to get used to my tag-along when going to events on campus, but Lucia makes the world twice as much fun.”

“Attending school with my daughter, Lucia, has been the most amazing thing to witness,” she said. “Children bring out the joy in people and offer a fuller sense of purpose.”

“Our students hear all the time about how they can give their life away in love,” Ruggles added. “This community shows students what that can look like from a practical perspective and gives students an opportunity to practice that by giving their time and love to these mothers and their children.”

Today, women are told to put off childbearing to “achieve their dreams”: travel the world, graduate from college, succeed in a career, buy a house, volunteer for a cause and make a difference in the world before having children.

The problem is that this prioritization of life goals has led to shame and stigma around young motherhood, whether unplanned or by choice, and many young women who get pregnant feel pressured to abort their unborn babies.

Yet, so many other women have rejected abortion and still graduated from college, which proves abortion is unnecessary.

LifeNews Photo Credit: Fabrizio Alberdi, EWTN News in Depth

The post Mom Who Rejected Abortion Will Graduate From College, Get Diploma With 18-Month-Old By Her Side appeared first on LifeNews.com.

-

Site: Zero HedgeThis "Emperor" Has No ClothesTyler Durden Thu, 04/25/2024 - 09:35

Authored by James Rickards via DailyReckoning.com,

Does the Fed even matter that much to the real economy and investor portfolios?

That’s an important question that doesn’t get nearly enough scrutiny. It’s possible that neither the Fed nor the reporters who cover the Fed want to ask hard questions about what the Fed really does.

Could it be the case that the emperor has no clothes?

Financial journalists often refer to a Goldilocks economy (“not too hot, not too cold, just right!”) as a tribute to the Fed’s finesse in handling rates. It’s also called the “soft landing” scenario because the Fed supposedly tamed inflation without causing a recession.

These narratives have no factual foundations; they’re just stories designed to get you to buy stocks and pump up stock prices.

The truth is the Fed is always behind the curve and doesn’t finesse the economy. And there’s no such thing as a soft landing; the economy does not gradually shift gears. It’s either growing fast or going into recession.

So where does the Fed stand today? Will it start cutting rates as Wall Street keeps (wrongly) predicting?

Wall Street Keeps Getting It Wrong

The Fed will not cut rates at its May or June meetings. Wall Street’s been predicting rate cuts for almost two years and they’ve been wrong every time. They’re predicting a June rate cut, and they’ll be wrong again.

A rate cut at the July 31 meeting is possible but is in jeopardy now due to inflation going up again in the latest report. We’ll have three more months of inflation, unemployment and GDP data between now and then.

If the Fed does cut rates in late July, it won’t be for good reasons. It’ll be because the economy has fallen into a recession. But given the boost to U.S. growth from out-of-control government spending in an election year, the recession may be postponed. So don’t count on a July rate cut either.

There’s no Fed meeting in August. The next meeting after that is Sept. 18. The Fed may be ready for a rate cut by then but here’s the problem: The Sept. 18 date is just seven weeks before the election on Nov. 5. The Fed pretends it’s non-political but in fact, it is highly political.

A rate cut in September will be viewed as helping Biden by boosting the economy and hurting Trump. At the same time, Trump is the likely winner based on currently available polling data and trends.

The Fed won’t want to be in the position of appearing to boost Biden and hurt Trump if Trump is going to win. Trump will make the Fed Public Enemy No. 1 and that’s the last thing they want. So the Fed will take a pass in September.

There’s no Fed meeting in October. The next two Fed meetings after that are on Nov. 7 and Dec. 18, both safely after the election. The Fed could cut rates at both meetings. But the Fed has painted itself into a corner on that.

The Fed’s Running out of Time

Beginning at the FOMC meeting on March 20, the Fed promoted the narrative that there would be three rate cuts before the end of the year. If they don’t cut in May, June, July or September (for reasons noted above) and there are no meetings in August or October, then the Fed would have at most two rate cuts this year, in November and December.

In short, the Fed is running out of meetings in which to conduct three rate cuts and may have to settle for two.

The Fed’s reckless promise and the dictates of the calendar are what are driving the stock market. The stock market’s fixated on the Fed, but the Fed doesn’t know what they’re doing. That’s a recipe for volatility and a sharp reversal of the first-quarter gains.

So why doesn’t the Fed just get on with it and start cutting rates in May? They could make an announcement and hire a band to play “Happy Days Are Here Again.”

The Fed thought they had won the battle when inflation dropped from 9.1% (CPI year-over-year) in June 2022 to 3.0% in June 2023. Nice job, Fed. It was when that June 2023 reading came out in July 2023 that the Fed put in one last rate hike, and then stopped dead. Since then, it’s been a countdown to rate cuts.

The problem is that inflation isn’t done. From the 3.0% in June 2023, inflation rose to 3.7% in August, and 3.7% again in September 2023. Inflation fluctuated between 3.1% and 3.4% until recently. March inflation came in at 3.5%, a full 0.3 percentage points higher than in February.

Oil’s up 24% in 4 Months

That’s not all that’s going up. The price of oil was $68.50 per barrel last Dec. 12 and is over $83.00 per barrel today. That’s about a 21% increase in just four months.

That oil price shock hasn’t worked its way through the supply chain yet. It has resulted in some price increases, but more are in the pipeline. This oil price spike will keep inflation at current levels or higher in the months ahead. The Fed is looking for signs that inflation is coming down but they’re not going to get them, as shown in the latest inflation report.

The price of one gallon of regular gasoline (regular, national average) was $3.64 as of yesterday, April 22. It was $3.57 on April 4, $3.55 on April 3, $3.54 on March 28, $3.52 on March 4 and $3.51 on April 4, 2023.

Put differently, gas prices are higher than they were last week, last month and last year.

That’s a bad sign for Biden politically, but it’s a worse sign for the Fed in terms of inflation. That gas price rise isn’t over because the wholesale price of oil is still on the rise. And oil prices affect far more than the price of gas at the pump.

Higher oil prices mean higher transportation costs whether by truck, train, plane or ship since all goods have to be transported to market. That means the price of everything is going up.

Other factors driving inflation from the supply side include the Key Bridge collapse in Baltimore, the closing of the Red Sea/Suez Canal shipping route and continued fallout from Ukraine war sanctions. Some of these supply side constraints may be deflationary in the long run, but they are definitely inflationary in the short run.

Running on Fed Happy Talk

The stock market has been running on Fed Happy Talk. That situation may end abruptly on June 12 if the Fed doesn’t cut rates and signals that rate cuts are not to be expected in the near future and perhaps not before the end of the year.

By then, we may be facing one of the worst economic outcomes possible: recession + inflation = stagflation.

Anyone under the age of 60 probably has no acquaintance with stagflation.

The U.S. last experienced this in 1977–1981. I remember that period well. It was great for leveraged holders of hard assets such as gold and real estate.

It was a nightmare for holders of stocks. (The long-term bull market in stocks did not start until August 1982.)

Investors might keep that winning hard asset portfolio allocation in mind as events unfold between now and June.

-

Site: Zero HedgeHarvey Weinstein Conviction Overturned On AppealTyler Durden Thu, 04/25/2024 - 09:17

A New York Court of Appeals has overturned Harvey Weinstein's 2020 conviction on felony sex crime charges, for which he was sentenced to 23 years in prison.

In a 4-3 decision, the court found that the trial judge in the disgraced mogul's case had made a critical error, allowing prosecutors to call a series of women as witnesses who said that Weinstein had assaulted them, but whose accusations weren't part of the charges against him, the NYT reports.

In 2020, Lauren Young and two other women, Dawn Dunning and Tarale Wulff, testified about their encounters with Weinstein under a state law that allows testimony about “prior bad acts” to demonstrate a pattern of behavior. But the court in its decision on Thursday said that “under our system of justice, the accused has a right to be held to account only for the crime charged.”

...

Citing that decision and others it identified as errors, the appeals court determined that Mr. Weinstein, who as a movie producer had been one of the most powerful men in Hollywood, had not received a fair trial. The four judges in the majority wrote that Mr. Weinstein was not tried solely on the crimes he was charged with, but instead for much of his past behavior. -NYT

The decision was determined by one vote on a majority female panel of judges, who in February held a searching public debate over the fairness of the original trial.

Weinstein was convicted of raping aspiring actress Jessica Mann at a DoubleTree hotel in 2013 when she was 27-years-old, and forcing oral sex on former production assistant Mimi Haleyi, then 28, at his apartment in 2006.

Now, Manhattan DA Alvin Bragg, who's currently prosecuting former President Donald Trump, will have to decide whether to seek a retrial of Weinstein - who remains in an upstate prison in Rome, NY at the moment. It's unclear how the decision will affect his future. In 2022, he was convicted by a California court of raping a woman in a Beverly Hills hotel and sentenced to 16 years in prison. The jury found Weinstein guilty of rape, forcible oral copulation, and sexual penetration by foreign object involving a woman known as Jane Doe 1.

The 2022 jury acquitted Weinstein of a sexual battery charge made by a massage therapist who treated him at a hotel in 2010, and was unable to reach a decision on two allegations, including rape, involving Jennifer Siebel Newsom, the wife of California’s Democratic governor Gavin Newsom. She was known as Jane Doe 4 in the trial, and had testified to being raped by Weinstein in a hotel room in 2005.

Weinstein was convicted of sexually abusing over 100 women - and was convicted of assaulting two of them in the New York case.

"That is unfair to survivors," said actress Ashley Judd, the first actress to come forward with allegations against Weinstein, the NYT's Jodi Kantor reports. "We still live in our truth. And we know what happened."

-

Site: Ron Paul Institute - Featured Articles

A recent op-ed in the Los Angeles Times demonstrates what is a warped interpretation of the term “patriotism.” The op-ed is about former football player Pat Tillman, who was killed in Afghanistan twenty years ago. It’s written by Bill Dwyre, a former sports editor for the Times.

Dwyre reminds us that Tillman was motivated to join the military after the 9/11 attacks. He gave up a $3.6 million football contract to join the U.S. military and was hoping to be sent to Afghanistan to fight the terrorists.

Dwyre writes, “It was a can’t-miss story of patriotism. Americans applauded from the safety and comfort of our homes and communities.” (Since he uses the pronoun “our,” presumably Dwyre fell into the “safety and comfort” group rather than the “patriot” group.)

Unfortunately, however, Dwyre doesn’t explain why Tillman’s act was one of “can’t miss” patriotism. Apparently for him it’s a self-evident truth.

No declaration of war

The U.S. Constitution is the supreme law of the land. It is the higher law that we the people impose on government officials. We are expected to obey their laws, and they punish us when we fail to do so. By the same token, they are supposed to obey our law, the Constitution.

The Constitution requires a congressional declaration of war as a prerequisite to a president’s waging war against any other nation-state. If a president and his army wage war without a congressional declaration of war, they are acting in violation of the law.

It is undisputed that President Bush did not secure a congressional declaration of war from Congress before he ordered his military to invade Afghanistan. That made their war illegal under our form of government.

How can participating in an illegal war be considered “patriotic”? Dwyre doesn’t explain that.

The U.S. was the aggressor under Nuremberg

Moreover, the common perception is that Bush invaded Afghanistan because the Taliban regime, which was governing the country, had been complicit in the 9/11 attacks by having knowingly harbored Osama bin Laden, who U.S. officials suspected had orchestrated the attacks.

Not so. Bush initiated his war because the Taliban regime refused to comply with his unconditional demand to deliver bin Laden into the hands of the Pentagon and the CIA. Yet, there was no extradition treaty between Afghanistan and the United States and, therefore, Afghanistan was operating within its rights under international law to refuse Bush’s unconditional extradition demand.

Nonetheless, knowing that the Pentagon and the CIA would torture bin Laden into confessing to the crime, Afghanistan offered to deliver him to an independent nation for a fair trial. In making the offer, Afghanistan sought the same amount of proof that would be required in a normal extradition hearing. The U.S. government refused the offer, perhaps because it was unable to provide such proof.

Therefore, given that Afghanistan had the authority under international law to refuse Bush’s extradition demand, that makes Bush’s invasion illegal under the war-of-aggression provision of the Nuremberg War Crimes Tribunal.

How can participation in an unconstitutional and illegal war be considered “patriotic”? Unfortunately, Dwyre fails to explain.

If one assumes that the 9/11 attackers were the ones who did the attacking (as compared to the attacks being an “inside job,” as some believe), it’s worth pointing out that they were motivated by the death and destruction that the U.S. government’s foreign policy had wreaked in the Middle East. But of course, a real “patriot” does not bring up that discomforting fact and instead blindly supports the government’s claim that the terrorists attacked us out of hatred for our “freedom and values.”

Tillman’s opposition to the Iraq War

One of the fascinating aspects of Dwyre’s op-ed glorifying Tillman’s patriotism is what he leaves out of the op-ed. Tillman was an outspoken opponent of Bush’s invasion and war of aggression against Iraq. Dwyre doesn’t even mention that, which is revealing.

Keep in mind, after all, that Bush’s war on Iraq was also waged without a congressional declaration of war, making it illegal under our form of government. Bush’s claim that he was waging to war to enforce UN resolutions falls flat because only the UN can enforce its resolutions. The fact is that the U.S. war on Iraq was an even clearer case of a war of aggression under the Nuremberg principles than the U.S. war on Afghanistan.

Despite Tillman’s fierce objections to the U.S. war on Iraq, the U.S. military nonetheless ordered him to “serve” in Iraq, which he did. Keep in mind though that every U.S. soldier takes an oath to support and defend the Constitution and is under a legal and moral obligation to refuse to obey unlawful orders. Tillman chose to obey the unlawful order to deploy to Iraq.

U.S. government lies

After his “service” in Iraq, Tillman was deployed to Afghanistan, where he continued to speak out against the U.S. war on Iraq. It was there that he was killed. As Dwyre points out, the U.S. military initially lied about his death, claiming falsely that he was killed by enemy fire. In fact, what actually happened is that he was killed by his own men in what was described as “friendly fire.”

In 2006, Tillman’s brother, Kevin Tillman, wrote a scathing op-ed on truthdig.com, in which he echoed his brother Pat’s view of the Iraq war: “Somehow American leadership, whose only credit is lying to its people and illegally invading a nation, has been allowed to steal the courage, virtue and honor of its soldiers on the ground.”

Why would’t Dwyre mention Pat Tillman’s (and his brother’s) fierce opposition to the U.S. war on Iraq in his op-ed? My hunch is that it’s because he considers opposition to U.S. wars to be unpatriotic and, therefore, Tillman’s apparent lack of “patriotism” with respect to Iraq doesn’t fit conveniently within his patriotism narrative. Under Dwyre’s warped interpretation of patriotism, apparently it’s only those who blindly support the U.S. national-security state’s foreign wars and its interventionist foreign policy who should be considered “patriots.” Apparently, those who reject such wars and choose instead to remain in the “safety and comfort” of their homes instead of fighting them should be considered non-patriots.

Reprinted with permission from Future of Freedom Foundation.

-

Site: LifeNews

Catholics and pro-life groups denounced President Biden for making the Sign of the Cross in support of abortion.

On Tuesday, Biden attended a campaign rally in Tampa, FL, where he snidely made the sign of the cross while Florida Democratic Party Chairwoman Nikki Fried slammed her state’s legislation protecting unborn babies.

Outraged on behalf of their faith, and concerned for the soul of their president, CatholicVote was among the first to point out Biden’s blatant hypocrisy.

“Biden’s decision to make the Sign of the Cross in support of abortion extremism is a despicable charade that attempts to co-opt a sacred practice in support of his new abortion religion.” CatholicVote President Brian Burch posted to X (formerly Twitter).

“His gesture openly mocks the Christian belief in the sanctity of life,” Burch added. “There is no divine support for destroying the lives of innocent children, and he should know better.”

Please follow LifeNews.com on Gab for the latest pro-life news and info, free from social media censorship.

“Absolutely vile,” Bishop Joseph Strickland posted. “Pray for the soul of our president, he is a feeble old man, he needs to prepare to meet his maker…”

International pro-life organization 40 Days for Life called the president’s actions “shameful.”

The organization’s president Shawn Carney also reacted to Biden’s gesture writing, “The sign of the cross at the abortion rally is cringe but makes sense when you make it your golden calf.”

The Daily Signal’s Mary Margaret Olohan wrote “Biden blesses himself in apparent horror at [Republican Florida Gov.] Ron DeSantis protecting unborn babies from abortion.”

Catholic attorney and former Trump administration official Roger Severino replied to Olohan’s post stating, “The sign of the cross is sacred, not a political prop, especially not in support of abortion.”

Catholic pro-life advocate Anna Lulis was quick to spell out the hypocrisy she saw: “No Catholic should ever invoke God to excuse and promote killing innocent children in the womb.”

Students for Life America President Kristan Hawkins called upon her fellow Catholics to point out the lies.

Finally, Abby Johnson, a former Planned Parenthood director turned vocal pro-life speaker, stated that Biden “mocked God” through this action.

LifeNews Note: Joshua Mercer writes for CatholicVote, where this column originally appeared.

The post Biden Doing Sign of the Cross at Abortion Event Confirms He’s No “Devout Catholic” appeared first on LifeNews.com.

-

Site: Ron Paul Institute - Featured Articles

In the last days of East Germany, when government officials detected that their power was unraveling, they ratcheted up enforcement of the nation’s reporting laws. The reporting laws made it a felony to know of a crime and fail to report it. It was also a crime to tell the person of whose crime you learned that you had done so. There was no right to privacy and there was no freedom of speech.

This Orwellian tangle resulted, of course, in many false reports of crimes. It also resulted in many prosecutions for failing to report crimes or for warning others that they were being spied upon. As of this past weekend, we in America are headed to the same authoritarian place. Thanks to legislation that fell one vote short of demise in each house of Congress last weekend, America in 2024 will soon resemble East Germany in the late 1980s, where nearly everyone was a spy and no one could talk about it.

Here is the backstory.

The quintessential American right is the right to be left alone. Justice Louis Brandeis called it the most comprehensive of rights and the right most valued by civilized persons. It presumes that you can think as you wish and say what you think and read what you want and publish what you say, that you can exclude whomever you wish — including the government — from your property and from your thoughts; and that you can do all this without a government permission slip or fear of government reprisal.

This natural right is also protected in the Fourth Amendment to the Constitution, which requires a warrant issued by a judge based upon probable cause of crime before the government can invade your property or spy on you.

The warrant requirement serves three purposes.

The first is to force the government to stay in the lane of crime solving, rather than crime predicting.

This concern was initially manifest in 1765 when the British government entered colonial homes with warrants issued by secret courts in London based on governmental need, not probable cause, ostensibly looking to see if the colonists had purchased government stamps as the Stamp Act required. The true goal of these forced entries was to search for revolutionary materials in order to help the government predict who might be planning the revolution that came in 11 years.

The second purpose of the warrant requirement is to prevent fishing expeditions, hence the Fourth Amendment also requires that the warrants specifically describe the place to be searched and the person or thing to be seized.

The third and most fundamental purpose of the warrant requirement is to reduce to writing the right to privacy. All persons — even the federal spies themselves, now about 100,000 in number — want privacy. The Framers knew this and believed they had guaranteed it in the Fourth Amendment.

They were wrong.

After the abuses of the right to privacy orchestrated by President Richard Nixon and carried out by the CIA and the FBI during the Watergate era, Congress enacted the Foreign Intelligence Surveillance Act, which established a secret court to do to Americans what the British had done to the colonists — issue broad general warrants, based on whatever the government wanted and not specifying the place to be searched or the person or thing to be seized. Much of the intelligence community gave only lip service to FISA and used high-tech means to spy on all persons in the U.S. all the time.

When the courageous Edward Snowden, who had been both a CIA and an NSA agent, revealed the warrantless spying, instead of curtailing it, Congress made it lawful; unconstitutional, but lawful.

The infamous Section 702 of FISA expressly authorizes the feds to spy on foreign persons and those with whom they communicate, inside the U.S. and elsewhere, without warrants. That means that if a foreign person communicates with an American, the feds can spy on the American as well, without a warrant. The FISA Court has interpreted 702 to permit the feds to spy on communications with foreigners — even innocuous communications, like family chatter, ordinary commercial transactions, or academic or medical consults — and the Americans with whom they speak to the third degree.

Hence, if you email your cousin in Europe, the feds can warrantlessly capture all the fiber-optic traffic you generate, as well as all the traffic of all persons in the U.S. to whom you communicate, as well as all the traffic generated by all persons to whom they communicate. If you do the math, you will see that these numbers of victims — Americans spied upon without suspicion, probable cause or warrants — can quickly reach into the hundreds of millions.

The new Section 702 is worse for freedom than its predecessor. Though shortened to two years before sunsetting — these sunsets are a joke as they never happen — the new 702 requires that any person in the U.S. who installs, maintains or repairs any fiber-optic system must assist the feds in using that system to spy on the person’s own customers. It also prohibits that person from speaking about this. What happened to the freedom of speech?

It gets worse. The new Section 702 exempts members of Congress from the thou shalt not tell. So, if you or I or a member of the Supreme Court is spied upon by our cable installer, he cannot tell anyone. But if your representatives in Congress are spied upon, the cable installer and the spies will inform them. What kind of a democracy is this? And if the cable installer does tell you or refuses to spy upon you, the terrors of East Germany will come down upon him.

Why do we permit Congress with a whimper to legislate away the freedom of speech and the right to privacy? Why do we repose the Constitution for safekeeping into the hands of those determined to kill it? Is it any wonder that cynicism about the government is so pervasive in the land?

To learn more about Judge Andrew Napolitano, visit https://JudgeNap.com.

COPYRIGHT 2024 ANDREW P. NAPOLITANO

DISTRIBUTED BY CREATORS.COM

-

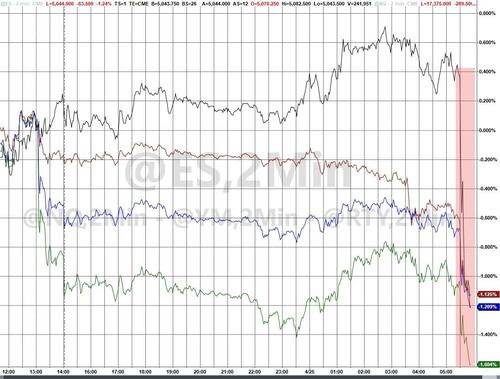

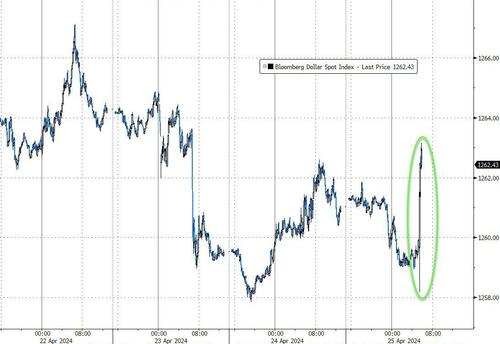

Site: Zero Hedge'Stagflationary' GDP Data Sparks Market Turmoil, Rate-Cut Hopes CrushedTyler Durden Thu, 04/25/2024 - 09:00

...and the market is very unhappy about it.

Olu Sonola, head of US economic research for Fitch Ratings:

“The hot inflation print is the real story in this report. If growth continues to slowly decelerate, but inflation strongly takes off again in the wrong direction, the expectation of a Fed interest rate cut in 2024 is starting to look increasingly more out of reach.”

Rate-cut expectations have dropped back near cycle lows (for 2024 and 2025)...

Source: Bloomberg

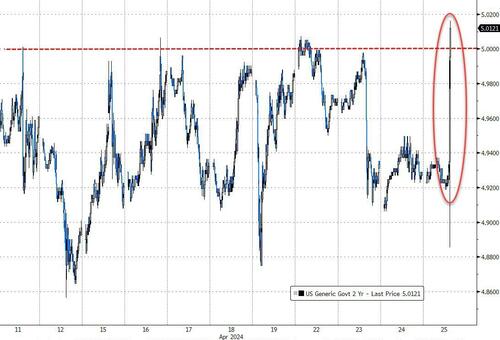

Treasury yields are soaring, led by the short-end...

Source: Bloomberg

With 2Y back above 5.00% (will it hold)...

Source: Bloomberg

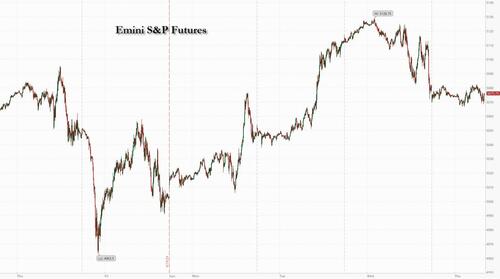

Stocks are getting spanked...

Commodities are less anxious with oil sliding a little, gold rallying modestly even with the dollar rising...

Source: Bloomberg

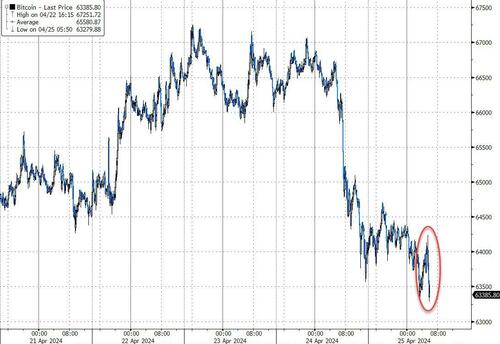

Crypto is heading lower...

Source: Bloomberg

What time is the Biden press conference to confirm there will be rate-cuts this year?

-

Site: Zero HedgeInitial & Continuing Jobless Claims Continue To Ignore RealityTyler Durden Thu, 04/25/2024 - 08:39

In the real world labor market, 2024 has been a shitshow of layoffs...

1. Everybuddy: 100% of workforce

2. Wisense: 100% of workforce

3. CodeSee: 100% of workforce

4. Twig: 100% of workforce

5. Twitch: 35% of workforce

6. Roomba: 31% of workforce

7. Bumble: 30% of workforce

8. Farfetch: 25% of workforce

9. Away: 25% of workforce

10. Hasbro: 20% of workforce

11. LA Times: 20% of workforce

12. Wint Wealth: 20% of workforce

13. Finder: 17% of workforce

14. Spotify: 17% of workforce

15. Buzzfeed: 16% of workforce

16. Levi's: 15% of workforce

17. Xerox: 15% of workforce

18. Qualtrics: 14% of workforce

19. Wayfair: 13% of workforce

20. Duolingo: 10% of workforce

21. Rivian: 10% of workforce

22. Washington Post: 10% of workforce

23. Snap: 10% of workforce

24. eBay: 9% of workforce

25. Sony Interactive: 8% of workforce

26. Expedia: 8% of workforce

27. Business Insider: 8% of workforce

28. Instacart: 7% of workforce

29. Paypal: 7% of workforce

30. Okta: 7% of workforce

31. Charles Schwab: 6% of workforce

32. Docusign: 6% of workforce

33. Riskified: 6% of workforce

34. EA: 5% of workforce

35. Motional: 5% of workforce

36. Mozilla: 5% of workforce

37. Vacasa: 5% of workforce

38. CISCO: 5% of workforce

39. UPS: 2% of workforce

40. Nike: 2% of workforce

41. Blackrock: 3% of workforce

42. Paramount: 3% of workforce

43. Citigroup: 20,000 employees

44. ThyssenKrupp: 5,000 employees

45. Best Buy: 3,500 employees

46. Barry Callebaut: 2,500 employees

47. Outback Steakhouse: 1,000