Celibacy is always, shall we say, an affront to what man normally thinks. It is something that can be done, and is only credible, if there is a God and if celibacy is my doorway into the kingdom of God.

Distinction Matter - Subscribed Feeds

-

Site: RT - News

The Israeli Prime Minister has denounced as anti-Semitic the growing surge of pro-Palestine protests at American universities

Pro-Palestinian protests sweeping across university campuses in the US are anti-Semitic and must be stopped, Israeli Prime Minister Benjamin Netanyahu has said, claiming that mobs have been attacking Jewish students and faculty members.

His comments come after US police arrested more than 80 protesters on Wednesday in a crackdown on the pro-Palestine demonstrations taking place at some 21 universities in states like Massachusetts, California and New York, among others.

The students have been demanding that the US government cease all funding for the Israeli military and “stop giving them any more money to continue this genocide,” referring to the ongoing Israeli offensive against Hamas militants in Gaza.

In a video published on his X account on Wednesday, Netanyahu said that the protests on America’s college campuses are “horrific” and claimed that “anti-Semitic mobs have taken over leading universities” and are calling for “the annihilation of Israel.”

Read more Dozens arrested at pro-Palestine protests in US (VIDEO)

Dozens arrested at pro-Palestine protests in US (VIDEO)

“This is reminiscent of what happened in German universities in the 1930s. It’s unconscionable. It has to be stopped. It has to be condemned and condemned unequivocally,” the prime minister said, in an apparent reference to the Nazi Student League, which persecuted German students and university faculty members who were not of Aryan descent or were considered political opponents of the Nazi regime.

The Israeli leader also slammed what he called the “shameful” response of some university presidents to the protests. “More has to be done,” Netanyahu urged, saying there has been an “exponential rise of antisemitism throughout America and throughout Western societies.”

The Israeli leader also claimed the student protesters “want to kill Jews wherever they are” and are chanting slogans like “Death to the Jews.”

Earlier this week, Rabbi Elie Buechler urged Jewish students of New York’s prestigious Columbia University to stay home, claiming they were no longer safe amid ongoing pro-Palestinian protests. That was after a group of Jewish counter-protesters on Sunday got into an altercation with demonstrators from a Gaza Solidarity Encampment on university grounds.

READ MORE: Rabbi tells Jews to leave prestigious American university

The White House has denounced any “calls for violence and physical intimidation targeting Jewish students and the Jewish community.”

Activists, however, have denied that the protests are anti-Semitic and say many Jewish students and organizations are involved in organizing the demonstrations. Hundreds of Columbia faculty members staged a walkout on Monday to criticize the university leadership and to express their solidarity with the protesters, after the university president called police to the campus.

History professor Christopher Brown branded the move as “unprecedented, unjustified, disproportionate, divisive and dangerous.”

A surge of demonstrations followed the deadly attack on Israel by the Palestinian armed group Hamas last October. The students are protesting Israel’s relentless retaliatory bombardment of Gaza, which has caused unprecedented destruction in the enclave and has left more than 34,000 dead, according to the Palestinian Health Ministry.

-

Site: RT - News

Environmentalist diehards reportedly manipulated experts’ conclusions to fit their own agenda

Top-ranking German government officials from the Ministry of Economic Affairs intentionally falsified experts’ reports to make it look like nuclear power was no longer viable in the country, Cicero magazine reported on Thursday.

Citing internal documents and e-mails it obtained via a court order, the media outlet claims that long-time Green Party proponents of a nuclear phase-out in high positions swept reports under the rug, or altered them, if they ran counter to their ideological convictions.

Following the disaster at Japan’s Fukushima nuclear power plant in March 2011, Germany’s parliament voted in favor of shutting down all similar facilities in the country. In April 2023, Germany’s last three operational nuclear power plants were taken offline.

In the article, Cicero claims that Patrick Graichen and Stefan Tidow, then-undersecretaries at the Economy and Environment ministries respectively, played a key role in the effort to portray the prolongation of German nuclear power plants’ operational life as dangerous.

Read more Germany spending billions to replace nuclear power

Germany spending billions to replace nuclear power

The two allegedly conspired to prevent their respective bosses from getting acquainted with any technical reports that refuted this assumption. According to the article, these documents dated March 2022 clearly pointed out that with starkly diminishing Russian gas imports, an “extension of the nuclear power plants’ operational life” could have alleviated the dire situation in Germany’s energy sector and prevented prices from skyrocketing in the coming winter.

However, the Green higher-ups, unhappy with this conclusion, allegedly rewrote the document, ramming home the message that any prolongation of the remaining nuclear power plants’ operation “is not tenable on technical-security grounds.”

Cicero claims that Economy Minister Robert Habeck most likely only saw the reworked version of the report, and not the original.

Faced with the threat of looming energy deficits, on October 17, Chancellor Olaf Scholz ordered the remaining three nuclear power plants to remain operational throughout the winter, despite warnings coming out of the Economy and Environment ministries. However, as Cicero notes, the overall trend toward the total phasing out of nuclear power-generation has remained unchanged.

READ MORE: German industry ‘moving abroad’ – Bild

With energy prices on the rise, Germany’s prized industrial sector has found itself increasingly at a disadvantage, with one in three manufacturers considering moving production overseas as a result, Bild reported in February.

-

Site: RT - News

Environmentalist diehards reportedly manipulated experts’ conclusions to fit their own agenda

Top-ranking German government officials from the Ministry of Economic Affairs intentionally falsified experts’ reports to make it look like nuclear power was no longer viable in the country, Cicero magazine reported on Thursday.

Citing internal documents and e-mails it obtained via a court order, the media outlet claims that long-time Green Party proponents of a nuclear phase-out in high positions swept reports under the rug, or altered them, if they ran counter to their ideological convictions.

Following the disaster at Japan’s Fukushima nuclear power plant in March 2011, Germany’s parliament voted in favor of shutting down all similar facilities in the country. In April 2023, Germany’s last three operational nuclear power plants were taken offline.

In the article, Cicero claims that Patrick Graichen and Stefan Tidow, then-undersecretaries at the Economy and Environment ministries respectively, played a key role in the effort to portray the prolongation of German nuclear power plants’ operational life as dangerous.

Read more Germany spending billions to replace nuclear power

Germany spending billions to replace nuclear power

The two allegedly conspired to prevent their respective bosses from getting acquainted with any technical reports that refuted this assumption. According to the article, these documents dated March 2022 clearly pointed out that with starkly diminishing Russian gas imports, an “extension of the nuclear power plants’ operational life” could have alleviated the dire situation in Germany’s energy sector and prevented prices from skyrocketing in the coming winter.

However, the Green higher-ups, unhappy with this conclusion, allegedly rewrote the document, ramming home the message that any prolongation of the remaining nuclear power plants’ operation “is not tenable on technical-security grounds.”

Cicero claims that Economy Minister Robert Habeck most likely only saw the reworked version of the report, and not the original.

Faced with the threat of looming energy deficits, on October 17, Chancellor Olaf Scholz ordered the remaining three nuclear power plants to remain operational throughout the winter, despite warnings coming out of the Economy and Environment ministries. However, as Cicero notes, the overall trend toward the total phasing out of nuclear power-generation has remained unchanged.

READ MORE: German industry ‘moving abroad’ – Bild

With energy prices on the rise, Germany’s prized industrial sector has found itself increasingly at a disadvantage, with one in three manufacturers considering moving production overseas as a result, Bild reported in February.

-

Site: RT - News

Environmentalist diehards reportedly manipulated experts’ conclusions to fit their own agenda

Top-ranking German government officials from the Ministry of Economic Affairs intentionally falsified experts’ reports to make it look like nuclear power was no longer viable in the country, Cicero magazine reported on Thursday.

Citing internal documents and e-mails it obtained via a court order, the media outlet claims that long-time Green Party proponents of a nuclear phase-out in high positions swept reports under the rug, or altered them, if they ran counter to their ideological convictions.

Following the disaster at Japan’s Fukushima nuclear power plant in March 2011, Germany’s parliament voted in favor of shutting down all similar facilities in the country. In April 2023, Germany’s last three operational nuclear power plants were taken offline.

In the article, Cicero claims that Patrick Graichen and Stefan Tidow, then-undersecretaries at the Economy and Environment ministries respectively, played a key role in the effort to portray the prolongation of German nuclear power plants’ operational life as dangerous.

Read more Germany spending billions to replace nuclear power

Germany spending billions to replace nuclear power

The two allegedly conspired to prevent their respective bosses from getting acquainted with any technical reports that refuted this assumption. According to the article, these documents dated March 2022 clearly pointed out that with starkly diminishing Russian gas imports, an “extension of the nuclear power plants’ operational life” could have alleviated the dire situation in Germany’s energy sector and prevented prices from skyrocketing in the coming winter.

However, the Green higher-ups, unhappy with this conclusion, allegedly rewrote the document, ramming home the message that any prolongation of the remaining nuclear power plants’ operation “is not tenable on technical-security grounds.”

Cicero claims that Economy Minister Robert Habeck most likely only saw the reworked version of the report, and not the original.

Faced with the threat of looming energy deficits, on October 17, Chancellor Olaf Scholz ordered the remaining three nuclear power plants to remain operational throughout the winter, despite warnings coming out of the Economy and Environment ministries. However, as Cicero notes, the overall trend toward the total phasing out of nuclear power-generation has remained unchanged.

READ MORE: German industry ‘moving abroad’ – Bild

With energy prices on the rise, Germany’s prized industrial sector has found itself increasingly at a disadvantage, with one in three manufacturers considering moving production overseas as a result, Bild reported in February.

-

Site: RT - News

Environmentalist diehards reportedly manipulated experts’ conclusions to fit their own agenda

Top-ranking German government officials from the Ministry of Economic Affairs intentionally falsified experts’ reports to make it look like nuclear power was no longer viable in the country, Cicero magazine reported on Thursday.

Citing internal documents and e-mails it obtained via a court order, the media outlet claims that long-time Green Party proponents of a nuclear phase-out in high positions swept reports under the rug, or altered them, if they ran counter to their ideological convictions.

Following the disaster at Japan’s Fukushima nuclear power plant in March 2011, Germany’s parliament voted in favor of shutting down all similar facilities in the country. In April 2023, Germany’s last three operational nuclear power plants were taken offline.

In the article, Cicero claims that Patrick Graichen and Stefan Tidow, then-undersecretaries at the Economy and Environment ministries respectively, played a key role in the effort to portray the prolongation of German nuclear power plants’ operational life as dangerous.

Read more Germany spending billions to replace nuclear power

Germany spending billions to replace nuclear power

The two allegedly conspired to prevent their respective bosses from getting acquainted with any technical reports that refuted this assumption. According to the article, these documents dated March 2022 clearly pointed out that with starkly diminishing Russian gas imports, an “extension of the nuclear power plants’ operational life” could have alleviated the dire situation in Germany’s energy sector and prevented prices from skyrocketing in the coming winter.

However, the Green higher-ups, unhappy with this conclusion, allegedly rewrote the document, ramming home the message that any prolongation of the remaining nuclear power plants’ operation “is not tenable on technical-security grounds.”

Cicero claims that Economy Minister Robert Habeck most likely only saw the reworked version of the report, and not the original.

Faced with the threat of looming energy deficits, on October 17, Chancellor Olaf Scholz ordered the remaining three nuclear power plants to remain operational throughout the winter, despite warnings coming out of the Economy and Environment ministries. However, as Cicero notes, the overall trend toward the total phasing out of nuclear power-generation has remained unchanged.

READ MORE: German industry ‘moving abroad’ – Bild

With energy prices on the rise, Germany’s prized industrial sector has found itself increasingly at a disadvantage, with one in three manufacturers considering moving production overseas as a result, Bild reported in February.

-

Site: LifeNews

Myth: Abortion is 14 times safer than childbirth.

Fact: Studies from countries with better data show that a woman is at least three times as likely to die from any cause following abortion than after childbirth.

The false claim that abortion is 14 times safer than childbirth arose from a 2012 journal article by two vocal abortion advocates, Elizabeth Raymond and David Grimes (henceforth “R&G”).[1] Despite being debunked in the dozen years since,[2] it continues to be repeated by pro-abortion media advocates. Following are numerous reasons this statement is false and not data-driven.

1. This comparison is made using four disparate numbers, none of which can be calculated accurately (abortion-related deaths, legal abortions, maternal deaths, and live births).

Different denominators are being compared: Abortion-related deaths are compared to 100,000 legal abortions, whereas all maternal deaths are compared to 100,000 live births. The relevance of these facts to the R&G myth will be clarified below.

2. Even the former director of the Center for Disease Control and Prevention (CDC), Dr. Julie Louise Gerberding, demonstrated that a comparison between the two statistics is inappropriate. In 2004, she wrote that maternal mortality ratios and abortion mortality rates “are conceptually different and are used by CDC for different public health purposes.”[3]

3. The number of legal abortions in the U.S. is unknown.

- The estimated number of legally induced abortions is voluntarily provided by local and state health departments to the CDC. In 2020, the CDC documented 620,327 abortions.[4]

- The number of abortions is also estimated by the Guttmacher Institute, which directly surveys abortion providers, but a large disparity is seen between the two sources. In 2020, the Guttmacher Institute documented 930,160 abortions,[5] nearly 50% more abortions than the CDC reported.

- &G used Guttmacher-derived legal abortion numbers for their denominator rather than CDC numbers (even though they used CDC numbers for abortion-related deaths), allowing the larger numbers in the denominator to dilute the numerator.

4. Abortion-related deaths are undercounted. (See CLI paper “Handbook of Maternal Mortality” for extensive discussion.)

- The CDC relies primarily upon death certificate documentation or deaths that happen to come to its attention in order to detect abortion-related deaths, but there are many reasons that these deaths may not be documented.

- Due to private payment for most abortions and women’s tendency to hide an abortion history, a prior abortion is often not known by the certifier.[6]

- Abortion complication reporting is not required by federal law and ideologically driven individuals may misrepresent, hide, or fail to report abortion-related deaths.[7]

- Deaths from mental health causes (suicide, homicide, accidents due to high risk-taking behavior, substance and alcohol abuse and overdose) are rarely documented as abortion-related on death certificates,[8] even though several meta-analyses have documented increased risks of mental health complications such as anxiety, depression, substance and alcohol abuse, and self-harm following abortion compared to childbirth.[9]

REACH PRO-LIFE PEOPLE WORLDWIDE! Advertise with LifeNews to reach hundreds of thousands of pro-life readers every week. Contact us today.

5. The total number of pregnancies in the U.S. is unknown because early pregnancy losses are not recorded.

- Thus, the CDC uses the denominator of 100,000 live births because this is measured by mandatory birth certificates. This becomes a “maternal mortality ratio,” not “maternal mortality rate,” because the denominator does not include all the “at-risk” individuals (those who have experienced a pregnancy).

- This causes maternal deaths that are associated with early pregnancy events (miscarriages, ectopic pregnancies, gestational trophoblastic disease, and induced abortions) to be represented in the numerator but not the denominator, artificially inflating the numerator. Only 2/3 of maternal deaths are associated with a live birth or fetal death (beyond 20 weeks of gestation).[10]

- It should also be noted that an abortion-related death is counted in both

6. Maternal mortality data is also inaccurate.[11]

- There are several disparate maternal mortality reporting systems in the U.S. using different methods of data collection and different temporal definitions.

- CDC’s National Vital Statistics System (NVSS) determines pregnancy-related deaths based on death certificate ICD-O coding during or within six weeks of a pregnancy.[12]

- CDC’s Pregnancy Mortality Surveillance System (PMSS) determines pregnancy-related death based on death certificate documentation of pregnancy within one year and review of the woman’s medical records to determine “pregnancy-relatedness” – that is, whether it was caused or exacerbated by the pregnancy or its management.[13]

- Not surprisingly, given differing data sources and timelines, there is little correlation between the statistics reported by NVSS and PMSS.[14]

- Using death certificates as the initial source of detecting pregnancy-associated deaths does not cast a broad enough net, because at least 38-50% of all U.S. maternal deaths are not documented on death certificates.[15]

- In order to improve detection of pregnancy-associated deaths, the CDC recommended adding a “pregnancy check-box” to death certificates, but this was variably implemented by the states over a prolonged period, leading to non-comparable statistics for over a decade. Although more maternal deaths were detected, false positives were also noted to be frequent, leading to continued data deficiencies.[16]

- Additionally, Maternal Mortality Review Committees (MMRC) have convened at local, state, regional, and federal levels to comprehensively review reported maternal deaths. Although these multidisciplinary committees will likely provide better quality data, the most recent collaborative report from 2019 only included the analysis of 36 such committees (failing to include data from 14 states and the District of Columbia), so a complete analysis of U.S. data from all states remains elusive.[17]

7. Higher quality data can be obtained from records-linkage studies since all abortions can be detected (usually through single-payer insurance coverage in European countries) and compared to all subsequent deaths within one year in reproductive aged women. R&G chose not to include international data and ignored the one U.S. study using this methodology. These better-quality studies demonstrate far more deaths in the year following abortion than childbirth, providing strong evidence that abortion is not safer than childbirth.

- A records-linkage study of California Medicaid recipients found that a woman was 62% more likely to die from any cause in the years following abortion compared to childbirth, 82% more likely to die in an accident, and 154% more likely to commit suicide.[18]

- A number of large studies from Finland found that the maternal mortality rate following abortion was 3-4 times the maternal mortality rate following birth.[19] The rate of suicide following abortion was six times the rate following birth, the rate of accidental death was five times the rate following birth, and the rate of homicide was over ten times the rate following birth.[20]

- The Finnish data demonstrate the inherent unreliability of utilizing death certificate documentation to detect maternal deaths. Despite meticulous record-keeping in that country, death certificate documentation alone detects only 26% of deaths after a live birth or stillbirth, 12% of deaths following miscarriage or ectopic pregnancy, and just 1-6% of deaths following induced abortion.[21]

- Additionally, two international Systematic Reviews comparing all available studies were available at the time R&G published their paper but were not referenced by these researchers.[22]

- A 2017 meta-analysis of available records-linkage studies documented the increased risk of death after abortion compared to birth. One study included in the meta-analysis documented a dose-effect, as each additional abortion increased a woman’s risk of dying by around 50%.[23]

- A records-linkage study using Danish data from 1980-2004 revealed that after a first-trimester induced abortion, a woman had twice the likelihood of death within 180 days, and a 331% increased likelihood of death within 180 days for second-/third-trimester abortion compared to childbirth.[24]

8. In the politically polarized climate following the Supreme Court’s decision in Dobbs v. Jackson Women’s Health, reversing Roe v. Wade and allowing legislatures to regulate abortion, some have falsely stated that doctors may not be able to provide quality care for obstetric complications, even though all states with pro-life protections allow an exception if abortion is necessary in life-threatening emergencies. (See CLI articles, “Abortion Policy Allows Physicians to Intervene to Protect a Mother’s Life” and “Pro-Life Laws Protect Mom and Baby: Pregnant Women’s Lives are Protected in All States” for more discussion.)

9. Allegations have arisen that state limits on abortion will increase maternal mortality. Fortunately, there are many reasons to expect abortion restrictions to decrease, rather than increase, maternal mortality. (See CLI articles “Twelve Reasons Women’s Health and Maternal Mortality Will Not Worsen, and May Improve, in States with Abortion Limits” and “Response to Media Allegations that Abortion Restrictions Cause Maternal Mortality and Female Suicides” for more discussion.)

[1] Raymond EG, Grimes DA. The comparative safety of legal induced abortion and childbirth in the United States. Obstet Gynecol 2012;119:215–219.

[2] Calhoun B. Systematic Review: The maternal mortality myth in the context of legalized abortion. The Linacre Quarterly. 2013;80(3):264-276; Reardon DC, et al. Deaths associated with abortion compared to childbirth-A review of new and old data and the medical and legal implications. The Journal of Contemporary Health Law and Policy. 2004;20(2):279-327.

[3] Letter from Julie Louise Gerberding to Walter Weber, July 20, 2004. http://afterabortion.org/pdf/CDCResponsetoWeberReAbortionStats-Gerberding%20Reply.pdf.

[4] Kortsmit K, Nguyen AT, Mandel MG, et al. Abortion Surveillance — United States, 2020. MMWR Surveill Summ 2022; 71(No. SS-10):1–27. DOI: http://dx.doi.org/10.15585/mmwr.ss7110a1.

[5] Jones RK, Kirstein M, Philbin J. Abortion Incidence and Service Availability in the United States, 2020. Nov 2022. Perspectives on Sexual and Reproductive Health 54(4):128-141. Available at https://onlinelibrary.wiley.com/doi/10.1363/psrh.12215.

[6] Desai S, Lindberg LD, Maddow-Zimet I, Kost K. The Impact of Abortion Underreporting on Pregnancy Data and Related Research. Matern Child Health J. 2021;25(8):1187-1192. doi:10.1007/s10995-021-03157-9; Udry JR, Gaughan M, Schwingl PJ, van den Berg BJ. A medical record linkage analysis of abortion underreporting. Fam Plann Perspect. 1996;28(5):228-231.

[7] Grossman D, Perritt J, Grady D. The Impending Crisis of Access to Safe Abortion Care in the US. JAMA Intern Med. 2022;182(8):793-795. doi:10.1001/jamainternmed.2022.2893

[8] Gissler M, Kauppila R, Meriläinen J, Toukomaa H, Hemminki E. Pregnancy-associated deaths in Finland 1987-1994–definition problems and benefits of record linkage. Acta Obstet Gynecol Scand. 1997;76(7):651-657. doi:10.3109/00016349709024605; Walker D, Campero L, Espinoza H, et al. Deaths from complications of unsafe abortion: misclassified second trimester deaths. Reprod Health Matters. 2004;12(24 Suppl):27-38. doi:10.1016/s0968-8080(04)24019-8

[9] Coleman PK. Abortion and mental health: quantitative synthesis and analysis of research published 1995-2009. Br J Psychiatry, 2011;199:180-186; Fergusson DM, Horwood LJ, and Boden JM. Does abortion reduce the mental health risks of unwanted or unintended pregnancy? A re-appraisal of the evidence. Aus NZ J Psych, 2013;47(9):819-827; Fergusson DM, Horwood LJ, Boden JM. Abortion and mental health disorders: evidence from a 30-year longitudinal study. Br J Psychiatry. 2008;193(6):444-451; Sullins DP. Abortion, substance abuse and mental health in early adulthood: Thirteen-year longitudinal evidence from the United States. Sage Open Medicine. 2016;4:1-11; Sullins DP. Affective and Substance Abuse Disorders Following Abortion by Pregnancy Intention in the United States: A Longitudinal Cohort Study. Medicina (B Aires) [Internet]. 2019;55(11):1–21.

[10] Horon IL. Underreporting of maternal deaths on death certificates and the magnitude of the problem of maternal mortality. Am J Public Health 2005;95:478-482

[11] M.F. MacDorman, et al., “Recent Increases in the U.S. Maternal Mortality Rate: Disentangling Trends from Measurement Issues,” Obstetrics & Gynecology 128:3 (2016): 447-455; Horon IL. Underreporting of maternal deaths on death certificates and the magnitude of the problem of maternal mortality. Am J Public Health 2005;95:478-482; Deneux-Tharaux C, Berg C, Bouvier-Colle MH, et al. Underreporting of pregnancy-related mortality in the United States and Europe. Obstet Gynecol 2005;106(4):684-692; Joseph KS, Lisonkova S, Boutin A, et al. Maternal mortality in the United States: are the high and rising rates due to changes in obstetrical factors, maternal medical conditions, or maternal mortality surveillance? Am J Obstet Gynecol. doi:10.1016/j.ajog.2023.12.038

[12] Hoyert DL. Maternal mortality rates in the United States, 2021. NCHS Health E-Stats. 2023. doi:10.15620/cdc:124678

[13] Pregnancy Mortality Surveillance System. Centers for Disease Control and Prevention. Updated March 23, 2023. Accessed April 3, 2024. https://www.cdc.gov/reproductivehealth/maternal-mortality/pregnancy-mortality-surveillance-system.htm

[14] MacKay A, Berg CJ, Duran C, et al. An assessment of pregnancy-related mortality in the United States. Pediatric & Perinatal Epidemiology 2005;19:206–214; Hoyert DL. Maternal Mortality and Related Concepts. Vital & Health Statistics. Series 3, Analytical and Epidemiological Studies. 2007;33:1-13. Available at https://europepmc.org/article/med/17460868, accessed August 9, 2022.

[15] Horon IL, Cheng D, Chang J, et al. Underreporting of Maternal Deaths on Death Certificates and the Magnitude of the Problem of Maternal Mortality. AJ of Public Health. 2005;95:478-82; Dye TD, Gordon H. Retrospective maternal mortality case ascertainment in West Virginia, 1985 to 1989. Am J Obstet Gynecol. 1992;167(1)72-6.

[16] Hoyert DL, Minino AM. Maternal mortality in the United States: Changes in coding, publication, and data release, 2018. National Vital Statistics Reports; vol 69 no 2. Hyattsville, MD: National Center for Health Statistics. 2020; Joseph KS, Lisonkova S, Boutin A, et al. Maternal mortality in the United States: Are the high and rising rates due to changes in obstetrical factors, maternal medical conditions, or maternal mortality surveillance? Am J Obstet Gynecol. doi:10.1016/j.ajog.2023.12.038

[17] Trost SL, Beauregard J, Njie F, et al. Pregnancy-Related Deaths: Data from Maternal Mortality Review Committees in 36 US states, 2017-2019. Atlanta, GA: Centers for Disease Control and Prevention, US Department of Health and Human Services; 2022. Available at: https://www.cdc.gov/reproductivehealth/maternal-mortality/erase-mm/data-mmrc.html.

[18] Reardon DC, Ney PG, Scheuren FJ, Cougle JR, Coleman, PK, Strahan T. Deaths associated with pregnancy outcome: a record linkage study of low income women. Southern Medical Journal, 2002;95(8):834-841.

[19] Gissler M, Berg C, Bouvier-Colle MH, Buekens P. Pregnancy-associated mortality after birth, spontaneous abortion, or induced abortion in Finland, 1987-2000. Am J Obstet Gynecol. 2004;190(2):422-427. doi:10.1016/j.ajog.2003.08.044; Gissler M, Kauppila R, Meriläinen J, Toukomaa H, Hemminki E. Pregnancy-associated deaths in Finland 1987-1994—definition problems and benefits of record linkage. Acta Obstet Gynecol Scand. 1997;76(7):651-657. Doi:10.3109/00016349709024605.

[20] Gissler M, Hemminki E, Lönnqvist J. Suicides after pregnancy in Finland, 1987-94: register linkage study. BMJ. 1996;313(7070):1431-1434. doi:10.1136/bmj.313.7070.1431; Gissler M, Berg C, Bouvier-Colle MH, Buekens P. Injury deaths, suicides and homicides associated with pregnancy, Finland 1987-2000. Eur J Public Health. 2005;15(5):459-463. doi:10.1093/eurpub/cki042; Gissler M, Kauppila R, Meriläinen J, Toukomaa H, Hemminki E. Pregnancy-associated deaths in Finland 1987-1994–definition problems and benefits of record linkage. Acta Obstet Gynecol Scand. 1997;76(7):651-657. doi:10.3109/00016349709024605

[21] Reardon DC, Thorp JM. Pregnancy associated death in record linkage studies relative to delivery, termination of pregnancy, and natural losses: A systematic review with a narrative synthesis and meta-analysis. SAGE Open Med. 2017;5:2050312117740490. Published 2017 Nov 13. doi:10.1177/2050312117740490

[22] Reardon DC, Strahan TW, Thorp JM, Shuping MW. Deaths associated with abortion compared to childbirth: a review of new and old data and the medical and legal implications. The Journal of Contemporary Health Law & Policy 2004; 20(2):279-327; Shadigian EM; Bauer ST. Pregnancy-Associated Death: A Qualitative Systematic Review of Homicide and Suicide. Obstetrical & Gynecological Survey. 2005. 60:183-190.

[23] Reardon D, Thorp J. Pregnancy associated death in record linkage studies relative to delivery, termination of pregnancy, and natural losses: A systematic review with a narrative synthesis and meta-analysis. Sage Open Medicine. 2017;5:1-17.

[24] Reardon DC, Coleman PK. Short and long term mortality rates associated with first pregnancy outcome: Population register based study for Denmark 1980-2004. Med Sci Monit 2012;18(9):71-76; Coleman PK, Reardon DC, Calhoun BC. Reproductive History Patterns and Long-Term Mortality Rates: A Danish population-based record linkage study. Eur J of Public Health. 2013;23(4):569-574.

LifeNews Note: Ingrid Skop, M.D., F.A.C.O.G., is Vice President and Director of Medical Affairs for the Charlotte Lozier Institute.

The post Studies Confirm Women are Three Times More Likely to Die Following Abortion Than Childbirth appeared first on LifeNews.com.

-

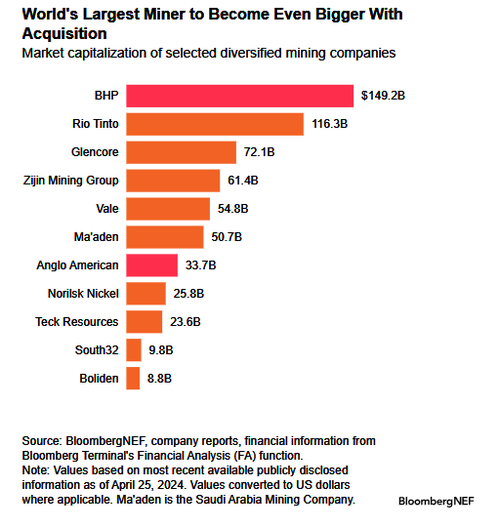

Site: Zero HedgeAnglo American Does Not Find BHP's $39 Billion Takeover Bid 'Attractive': ReportTyler Durden Thu, 04/25/2024 - 12:55

Update (1255ET):

Speaking on condition of anonymity, two sources close to top Anglo American investors told Reuters that BHP Group's proposed all-share deal, valued at £31.1 billion ($38.9 billion), is not attractive.

One source said the offer did not address the complexities of demerging the Anglo American Platinum and Kumba Iron Ore businesses in South Africa.

Reuters expects Anglo's board to respond in the coming days. BHP has until May 22 to submit a binding bid.

A successful takeover would give BHP control of about 10% of the world's copper mining supply. There are talks of dwindling supply and soaring demand in the coming years because of electrification trends, such as the proliferation of generative AI data centers, electric vehicles, and onshoring manufacturing.

* * *

The world's largest global diversified miner, BHP Group, is making a monster bet on surging future copper demand with the proposed takeover of Anglo American Plc. The bet is based on the thesis that the world's power grids need a major overhaul and that the electrification of the economy will unleash new demand for base metals. This also comes as market observers have warned about an impending shortfall of global copper mining supply.

According to Bloomberg, BHP proposed an all-share deal valued at £31.1 billion ($38.9 billion). The transaction depends on Anglo spinning off its South African iron ore and platinum businesses to its shareholders. The offer is conditional and non-binding at £25.08 a share, or about a 14% premium to Anglo's closing share price on Wednesday.

Anglo shares in London jumped 13% to £24.89, giving the company a market capitalization of about £30.5 billion.

BHP's proposed acquisition of Anglo would dwarf its 2023 takeover of Australian copper producer OZ Minerals. The top miner believes copper demand will double over the next three decades.

Copper is a critical base metal for infrastructure and renewable energy. BHP bets that the world's power grids must be upgraded as fossil fuel demand slides and the global economy's electrification ramps up.

If the deal closes, BHP will become the world's biggest copper producer (controlling roughly 10% of the global copper mining supply), which comes as some market observers are warning about supply shortfalls.

About a year ago, billionaire mining investor Robert Friedland explained to Bloomberg TV in an interview that copper prices are set to soar because the mining industry is failing to increase supply ahead of 'accelerating demand.' He warned:

"We're heading for a train wreck here."

Friedland is the founder of Ivanhoe Mines Ltd. He continued, "My fear is that when push finally comes to shove," copper prices might explode ten times.

Jefferies' commodity desk recently warned, "Disruptions have significantly increased, and a market deficit is now increasingly likely. We could be at the foothills of the next copper cycle."

BofA recently warned, "The copper supply crisis is here."

Let's not forget about our note titled "The Next AI Trade," which explains the investment opportunities in upgrading the nation's grid as generative AI data centers increase power demand.

And Jefferies is on it: "Copper Demand in Data Centers."

Back to BHP, the company said in a statement to London Stock Exchange that the takeover would increase its "exposure to future-facing commodities through Anglo American's world-class copper assets" as well as "complementing BHP's iron ore and metallurgical coal portfolios."

Jefferies analysts commented on the proposed takeover, indicating BHP might face competition in its pursuit of Anglo.

"Our analysis suggests that Anglo consists of an undervalued portfolio of multiple tier 1 assets several of which are in low-risk jurisdictions (Australia, Chile, Peru and Brazil)," Jefferies said.

Jefferies Christopher LaFemina said:

"We would be surprised if this is BHP's final offer," adding, "We estimate that a price of at least £28/sh would be necessary for serious discussions to take place, and a takeout price of well above £30 per share would be the outcome if other bidders were to get involved."

A successful takeover would mark the first mega mining deal in more than a decade and signify the importance of critical metals and their use in upgrading the world's power grid.

-

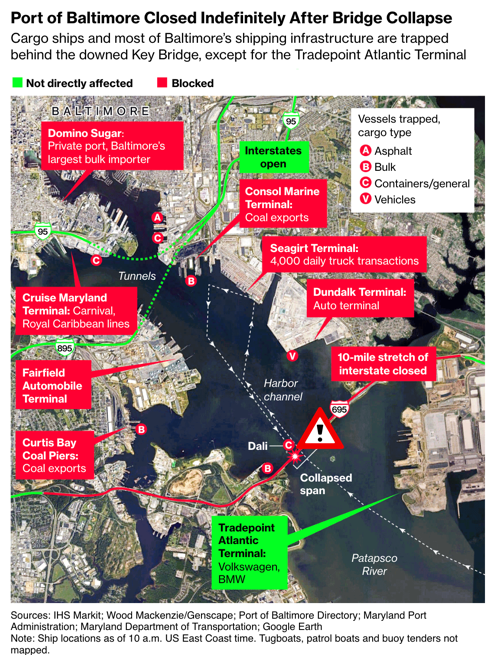

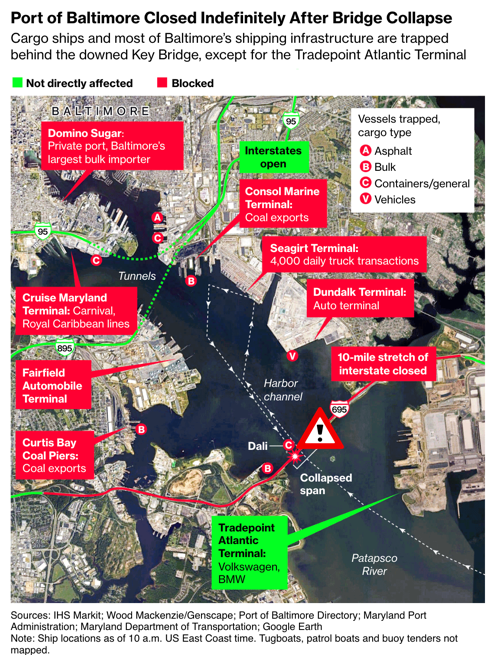

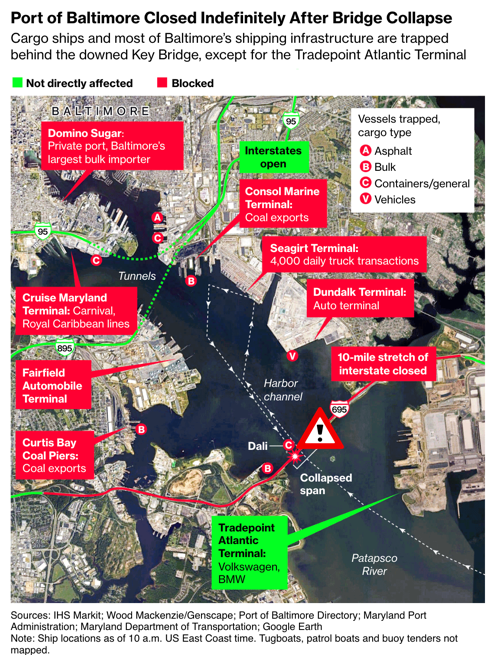

Site: Zero Hedge"None Of This Should've Happened": Baltimore Takes Container Ship Owner & Manager To Court Over Bridge CollapseTyler Durden Thu, 04/25/2024 - 12:45

Baltimore City filed a lawsuit against the owner and operator of the container ship that crashed into the Francis Scott Key Bridge last month, causing it to collapse.

Attorneys for Baltimore's mayor and City Council claim the bridge collapse was caused by "negligence of the vessel's crew and shoreside management," according to the Washington Post.

In the early morning hours of March 26, the Dali, a 213-million-pound container ship owned by Grace Ocean Private Limited and managed by Synergy Marine PTE LTD., lost power and slammed into one of the main pillars of the 1.6-mile long Key Bridge, instantly crumpling the bridge and blocking the only shipping channel in and out of the Port of Baltimore.

Source: Bloomberg

Source: Bloomberg

"The Dali slammed into the bridge, causing the bridge's immediate collapse, killing at least six individuals, destroying Baltimore property, and bringing the region's primary economic engine to a grinding halt," the city said in court filings.

"None of this should have happened," the attorneys said, adding, "Reporting has indicated that, even before leaving port, alarms showing an inconsistent power supply on the Dali had sounded. The Dali left port anyway, despite its clearly unseaworthy condition."

Earlier this month, Grace Ocean and Synergy Marine submitted a request in federal court to cap their potential liability at $43.6 million. Baltimore on Monday requested that the court dismiss the companies' petition to limit liability.

The court filing also called the crew of the Dali "incompetent" and lacked proper skill or training, adding they were "inattentive to their duties" and "failed to comply with local navigation customs."

The source of the "inconsistent power supply" has yet to be identified, and the Federal Bureau of Investigation and the US Coast Guard have launched a criminal investigation into the crash.

Meanwhile, the city of Baltimore failed to install fender systems to prevent ships from crashing into the bridge. These fenders could have prevented the collapse.

Why did the city, county, or whoever manages the bridge fail to install fender systems? Were progressive lawmakers in the city and state too distracted with their socialist agenda to focus on upgrading critical infrastructure?

-

Site: Zero Hedge"None Of This Should've Happened": Baltimore Takes Container Ship Owner & Manager To Court Over Bridge CollapseTyler Durden Thu, 04/25/2024 - 12:45

Baltimore City filed a lawsuit against the owner and operator of the container ship that crashed into the Francis Scott Key Bridge last month, causing it to collapse.

Attorneys for Baltimore's mayor and City Council claim the bridge collapse was caused by "negligence of the vessel's crew and shoreside management," according to the Washington Post.

In the early morning hours of March 26, the Dali, a 213-million-pound container ship owned by Grace Ocean Private Limited and managed by Synergy Marine PTE LTD., lost power and slammed into one of the main pillars of the 1.6-mile long Key Bridge, instantly crumpling the bridge and blocking the only shipping channel in and out of the Port of Baltimore.

Source: Bloomberg

Source: Bloomberg

"The Dali slammed into the bridge, causing the bridge's immediate collapse, killing at least six individuals, destroying Baltimore property, and bringing the region's primary economic engine to a grinding halt," the city said in court filings.

"None of this should have happened," the attorneys said, adding, "Reporting has indicated that, even before leaving port, alarms showing an inconsistent power supply on the Dali had sounded. The Dali left port anyway, despite its clearly unseaworthy condition."

Earlier this month, Grace Ocean and Synergy Marine submitted a request in federal court to cap their potential liability at $43.6 million. Baltimore on Monday requested that the court dismiss the companies' petition to limit liability.

The court filing also called the crew of the Dali "incompetent" and lacked proper skill or training, adding they were "inattentive to their duties" and "failed to comply with local navigation customs."

The source of the "inconsistent power supply" has yet to be identified, and the Federal Bureau of Investigation and the US Coast Guard have launched a criminal investigation into the crash.

Meanwhile, the city of Baltimore failed to install fender systems to prevent ships from crashing into the bridge. These fenders could have prevented the collapse.

Why did the city, county, or whoever manages the bridge fail to install fender systems? Were progressive lawmakers in the city and state too distracted with their socialist agenda to focus on upgrading critical infrastructure?

-

Site: Zero Hedge"None Of This Should've Happened": Baltimore Takes Container Ship Owner & Manager To Court Over Bridge CollapseTyler Durden Thu, 04/25/2024 - 12:45

Baltimore City filed a lawsuit against the owner and operator of the container ship that crashed into the Francis Scott Key Bridge last month, causing it to collapse.

Attorneys for Baltimore's mayor and City Council claim the bridge collapse was caused by "negligence of the vessel's crew and shoreside management," according to the Washington Post.

In the early morning hours of March 26, the Dali, a 213-million-pound container ship owned by Grace Ocean Private Limited and managed by Synergy Marine PTE LTD., lost power and slammed into one of the main pillars of the 1.6-mile long Key Bridge, instantly crumpling the bridge and blocking the only shipping channel in and out of the Port of Baltimore.

Source: Bloomberg

Source: Bloomberg

"The Dali slammed into the bridge, causing the bridge's immediate collapse, killing at least six individuals, destroying Baltimore property, and bringing the region's primary economic engine to a grinding halt," the city said in court filings.

"None of this should have happened," the attorneys said, adding, "Reporting has indicated that, even before leaving port, alarms showing an inconsistent power supply on the Dali had sounded. The Dali left port anyway, despite its clearly unseaworthy condition."

Earlier this month, Grace Ocean and Synergy Marine submitted a request in federal court to cap their potential liability at $43.6 million. Baltimore on Monday requested that the court dismiss the companies' petition to limit liability.

The court filing also called the crew of the Dali "incompetent" and lacked proper skill or training, adding they were "inattentive to their duties" and "failed to comply with local navigation customs."

The source of the "inconsistent power supply" has yet to be identified, and the Federal Bureau of Investigation and the US Coast Guard have launched a criminal investigation into the crash.

Meanwhile, the city of Baltimore failed to install fender systems to prevent ships from crashing into the bridge. These fenders could have prevented the collapse.

Why did the city, county, or whoever manages the bridge fail to install fender systems? Were progressive lawmakers in the city and state too distracted with their socialist agenda to focus on upgrading critical infrastructure?

-

Site: RT - News

Americans are having far fewer babies for a large number of reasons

Women in the US are having children at the lowest rate since record-keeping began, the National Center for Health Statistics has revealed. Only 3.59 million births were recorded in the country in 2023, the lowest since the 3.4 million figure recorded in 1979, a report by the NCHS has noted. The US population was 225 million at the time, compared to almost 335 million now.

The general fertility rate fell 3% from the year before to 54.4 births per 1,000 women of childbearing age (defined as 15–44). The total fertility rate was just 1.61, down 2% from 2022. The US birth rate has been below the replacement level of 2.1 since 2007.

Unplanned pregnancies – mostly among teenagers – have fallen by 2% from the previous year, representing a 68% decline from 2007 levels. Birth rates for the 20-24 age bracket have dropped by almost 50% since 2007 as well. The only demographic that saw an increase in birth rates was Hispanic women, with a modest 1% gain from 2022.

The NCHS is a unit of the Centers for Disease Control and Prevention (CDC). It relies on birth certificates to provide a snapshot of US population trends and does not look at the underlying factors, said Brady Hamilton, the lead author of the report.

Read more Researchers raise alarm over Russian demographics – media

Researchers raise alarm over Russian demographics – media

Karen Guzzo, a demographer at the University of North Carolina at Chapel Hill, has pointed to research that shows young Americans are delaying family formation for financial reasons. Among the factors Americans have cited for waiting or not having children at all are economic strain, work instability, political polarization, student loans, healthcare cost and accessibility, climate change and global conflicts, Guzzo told the Wall Street Journal.

US birth rates rose slightly right before the 2008 financial crisis, but have declined by 11% overall since 2000. Guzzo has pointed to “unstable work hours” and lack of paid leave in the “gig economy” that has arisen since the Great Recession.

Demographers such as Guzzo have argued that Americans need paid family leave and other benefits to promote the standard of living for young families. US surveys have persistently shown frustration with the “skyrocketing” cost of healthcare and childcare as well.

Birth rates in many wealthy nations with arguably better social support have been declining as well, however, which demographers have commonly attributed to “uncertainty” and “economic instability.” Meanwhile, the countries with the highest birth rates in the world in 2023 were all in sub-Saharan Africa: Niger (6.73), Angola (5.76) and the Democratic Republic of the Congo (5.56).

-

Site: RT - News

Americans are having far fewer babies for a large number of reasons

Women in the US are having children at the lowest rate since record-keeping began, the National Center for Health Statistics has revealed. Only 3.59 million births were recorded in the country in 2023, the lowest since the 3.4 million figure recorded in 1979, a report by the NCHS has noted. The US population was 225 million at the time, compared to almost 335 million now.

The general fertility rate fell 3% from the year before to 54.4 births per 1,000 women of childbearing age (defined as 15–44). The total fertility rate was just 1.61, down 2% from 2022. The US birth rate has been below the replacement level of 2.1 since 2007.

Unplanned pregnancies – mostly among teenagers – have fallen by 2% from the previous year, representing a 68% decline from 2007 levels. Birth rates for the 20-24 age bracket have dropped by almost 50% since 2007 as well. The only demographic that saw an increase in birth rates was Hispanic women, with a modest 1% gain from 2022.

The NCHS is a unit of the Centers for Disease Control and Prevention (CDC). It relies on birth certificates to provide a snapshot of US population trends and does not look at the underlying factors, said Brady Hamilton, the lead author of the report.

Read more Researchers raise alarm over Russian demographics – media

Researchers raise alarm over Russian demographics – media

Karen Guzzo, a demographer at the University of North Carolina at Chapel Hill, has pointed to research that shows young Americans are delaying family formation for financial reasons. Among the factors Americans have cited for waiting or not having children at all are economic strain, work instability, political polarization, student loans, healthcare cost and accessibility, climate change and global conflicts, Guzzo told the Wall Street Journal.

US birth rates rose slightly right before the 2008 financial crisis, but have declined by 11% overall since 2000. Guzzo has pointed to “unstable work hours” and lack of paid leave in the “gig economy” that has arisen since the Great Recession.

Demographers such as Guzzo have argued that Americans need paid family leave and other benefits to promote the standard of living for young families. US surveys have persistently shown frustration with the “skyrocketing” cost of healthcare and childcare as well.

Birth rates in many wealthy nations with arguably better social support have been declining as well, however, which demographers have commonly attributed to “uncertainty” and “economic instability.” Meanwhile, the countries with the highest birth rates in the world in 2023 were all in sub-Saharan Africa: Niger (6.73), Angola (5.76) and the Democratic Republic of the Congo (5.56).

-

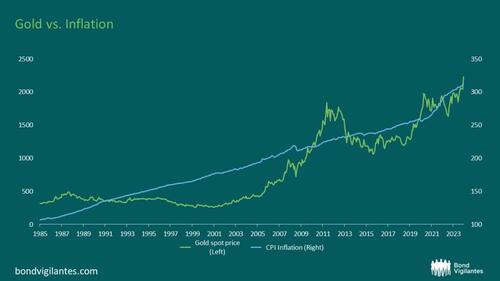

Site: Zero HedgeGold Prices: Beyond Inflation And Real YieldsTyler Durden Thu, 04/25/2024 - 12:25

Authored Robert Burrows via BondVigilantes.com,

Renowned for its role as a hedge against economic uncertainty and inflation, gold has long captivated investors. One key factor influencing gold’s price is the relationship between real yields and inflation. Over the long term, gold has protected one against the pernicious effects of inflation and remains a powerful diversifier within an investment portfolio:

Source: M&G, Bloomberg, 23 April 2024

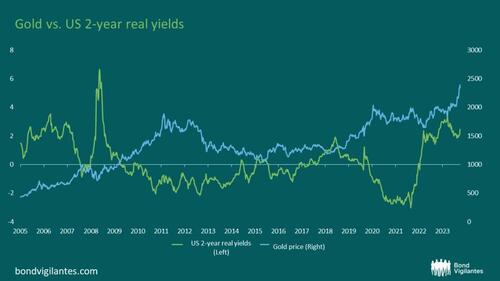

Real yields, also known as inflation-adjusted yields, represent the return on an investment after accounting for inflation. They are calculated by subtracting the inflation rate from the nominal yield of a financial instrument, such as a government bond. Real yields provide a more accurate measure of an investor’s purchasing power and the true return on their investment. Historically, gold prices have exhibited an inverse correlation with real yields. When real yields are low or negative, indicating that inflation-adjusted returns on fixed-income investments are meagre or eroded by inflation, investors seek alternative stores of value, such as gold. Conversely, when real yields are high, offering attractive returns relative to inflation, the opportunity cost of holding gold increases, leading to downward pressure on the gold price.

The below chart demonstrates this general trend:

Source: M&G, Bloomberg, 23 April 2024

While the trend is not perfect, the following chart demonstrates that correlations have been negative for the bulk of the time:

Source: M&G, Bloomberg, 23 April 2024

So why is gold going up? If these correlations hold and real yields are moving higher, the gold price should be trending lower. There is something else at play. Investors will generally point to global instability, with geopolitical concerns being obvious. The other would be the challenging fiscal backdrop of many major economies, which I have written about. These concerns are well founded; however, they do not seem to be showing up in other risk assets.

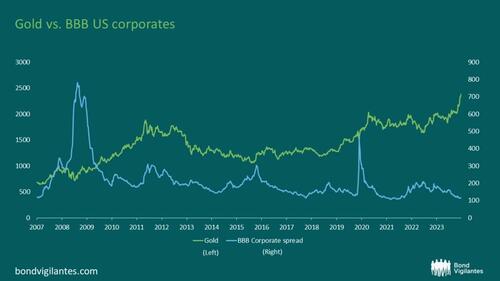

BBB US corporates are trading at their all-time tights, so there is nothing to see here:

Source: M&G, Bloomberg, 23 April 2024

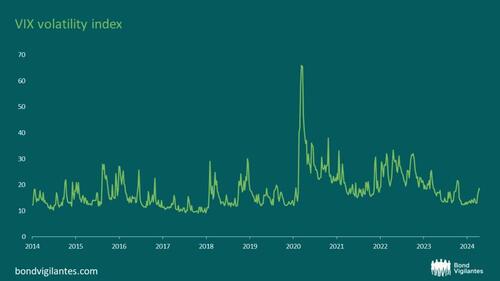

Volatility is not exploding, as shown by the volatility index VIX:

Source: M&G, Bloomberg, 23 April 2024

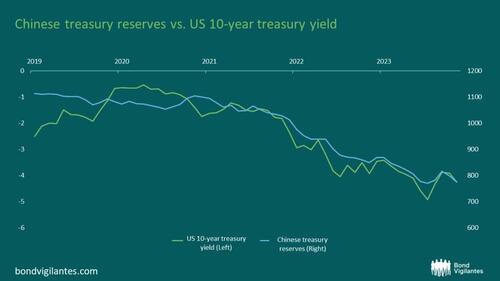

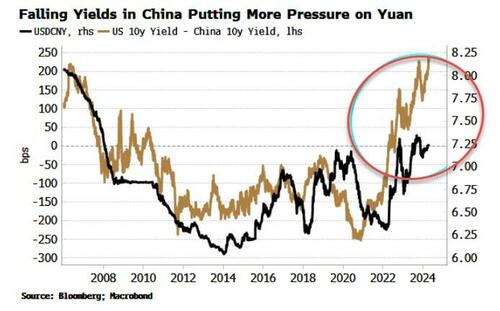

A quick look at China shows some interesting developments. We know why interest rates have gone up: to combat inflation. However, yields may still be pressured higher due to countries selling down their treasury reserves. China, for example, has been reducing its treasury reserves for some years. This is not the sole reason for higher yields but will be a contributory factor. The below chart shows Chinese treasury reserves falling plotted against the 10-year treasury yield (inverted):

Source: M&G, Bloomberg, 23 April 2024

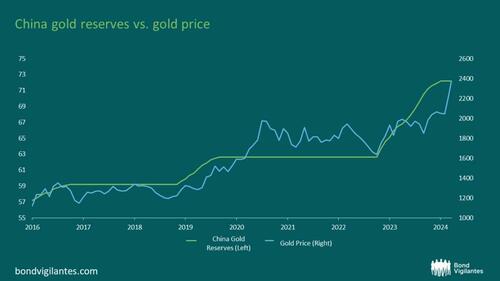

Where are these funds going? Bolstering gold reserves it would seem...

Source: M&G, Bloomberg, 23 April 2024

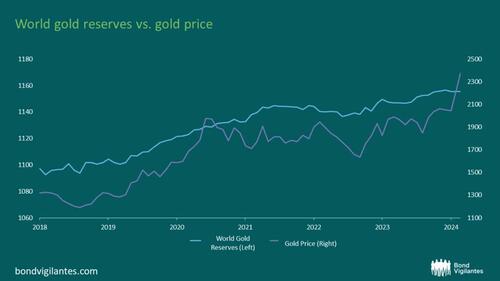

..., and China is not alone in this thinking:

Source: M&G, Bloomberg, 23 April 2024

We have witnessed many responses with the onset of the war in Ukraine, one of which is sanctions. The sanctions have attempted to lock out a country from its reserves. The West’s freezing of Russia’s gold and forex reserves in response to the conflict appears to have triggered this shift. More recently, there have been threats to confiscate Russian reserves and use these funds to support Ukraine’s efforts. This will undoubtedly make other countries somewhat nervous, especially those not 100% aligned with the West’s worldview.

Clearly, the Gold price is influenced by a multitude of factors, and one cannot point to any one single issue. However, it doesn’t seem as though gold is currently being bought for its safe-haven appeal at this stage. Where would the gold price be if the Fed starts cutting and the geopolitics worsen?

-

Site: Zero HedgeGold Prices: Beyond Inflation And Real YieldsTyler Durden Thu, 04/25/2024 - 12:25

Authored Robert Burrows via BondVigilantes.com,

Renowned for its role as a hedge against economic uncertainty and inflation, gold has long captivated investors. One key factor influencing gold’s price is the relationship between real yields and inflation. Over the long term, gold has protected one against the pernicious effects of inflation and remains a powerful diversifier within an investment portfolio:

Source: M&G, Bloomberg, 23 April 2024

Real yields, also known as inflation-adjusted yields, represent the return on an investment after accounting for inflation. They are calculated by subtracting the inflation rate from the nominal yield of a financial instrument, such as a government bond. Real yields provide a more accurate measure of an investor’s purchasing power and the true return on their investment. Historically, gold prices have exhibited an inverse correlation with real yields. When real yields are low or negative, indicating that inflation-adjusted returns on fixed-income investments are meagre or eroded by inflation, investors seek alternative stores of value, such as gold. Conversely, when real yields are high, offering attractive returns relative to inflation, the opportunity cost of holding gold increases, leading to downward pressure on the gold price.

The below chart demonstrates this general trend:

Source: M&G, Bloomberg, 23 April 2024

While the trend is not perfect, the following chart demonstrates that correlations have been negative for the bulk of the time:

Source: M&G, Bloomberg, 23 April 2024

So why is gold going up? If these correlations hold and real yields are moving higher, the gold price should be trending lower. There is something else at play. Investors will generally point to global instability, with geopolitical concerns being obvious. The other would be the challenging fiscal backdrop of many major economies, which I have written about. These concerns are well founded; however, they do not seem to be showing up in other risk assets.

BBB US corporates are trading at their all-time tights, so there is nothing to see here:

Source: M&G, Bloomberg, 23 April 2024

Volatility is not exploding, as shown by the volatility index VIX:

Source: M&G, Bloomberg, 23 April 2024

A quick look at China shows some interesting developments. We know why interest rates have gone up: to combat inflation. However, yields may still be pressured higher due to countries selling down their treasury reserves. China, for example, has been reducing its treasury reserves for some years. This is not the sole reason for higher yields but will be a contributory factor. The below chart shows Chinese treasury reserves falling plotted against the 10-year treasury yield (inverted):

Source: M&G, Bloomberg, 23 April 2024

Where are these funds going? Bolstering gold reserves it would seem...

Source: M&G, Bloomberg, 23 April 2024

..., and China is not alone in this thinking:

Source: M&G, Bloomberg, 23 April 2024

We have witnessed many responses with the onset of the war in Ukraine, one of which is sanctions. The sanctions have attempted to lock out a country from its reserves. The West’s freezing of Russia’s gold and forex reserves in response to the conflict appears to have triggered this shift. More recently, there have been threats to confiscate Russian reserves and use these funds to support Ukraine’s efforts. This will undoubtedly make other countries somewhat nervous, especially those not 100% aligned with the West’s worldview.

Clearly, the Gold price is influenced by a multitude of factors, and one cannot point to any one single issue. However, it doesn’t seem as though gold is currently being bought for its safe-haven appeal at this stage. Where would the gold price be if the Fed starts cutting and the geopolitics worsen?

-

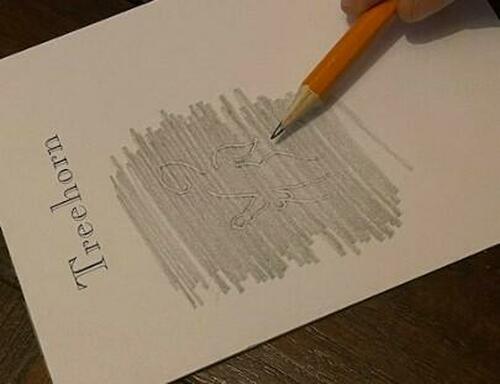

Site: Zero HedgeThe Infamous 'Buy Bitcoin' Pad Just Sold For More Than $1 Million At AuctionTyler Durden Thu, 04/25/2024 - 12:05

$1.027 million...or about 16 bitcoin.

That's what the infamous 'Buy Bitcoin' scribble drawing on a yellow legal pad, once held up at a televised Congressional testimony behind Federal Reserve Chair Janet Yellen, just sold for at auction, according to Bloomberg.

The report notes that the sign quickly became iconic in the crypto community, symbolizing the industry's revival. Bitcoin's price soared from about $2,300 to a peak of nearly $74,000 in March, boosted by major financial firms like Fidelity and BlackRock.

As retail interest came around, early Bitcoin memorabilia like the pad regained popularity. NFTs...well, not so much.

An anonymous buyer secured the item with a bid of 16 Bitcoin on the auction site Scare City, the report notes, although a temporary glitch suggested a mistaken bid of $6.4 million before correction.

Give them a break. After all, not everyone is on the bitcoin to USD conversion standard just yet...

But if the price of the pad is any indicator, interest in the crypto remains hot.

“The page with the sign drawing was removed from the notepad shortly after the hearing. It has since been reattached with clear archival wire,” the item's description read at the auction.

Christian Langalis, a 22-year-old intern at the Cato Institute, created the sign during a 2017 House Financial Service Committee hearing featuring Janet Yellen. After being televised, Langalis was escorted out. The auctioned item, described as "Ink Drawing on Legal Pad," also includes his notes from the session.

-

Site: Zero HedgeThe Infamous 'Buy Bitcoin' Pad Just Sold For More Than $1 Million At AuctionTyler Durden Thu, 04/25/2024 - 12:05

$1.027 million...or about 16 bitcoin.

That's what the infamous 'Buy Bitcoin' scribble drawing on a yellow legal pad, once held up at a televised Congressional testimony behind Federal Reserve Chair Janet Yellen, just sold for at auction, according to Bloomberg.

The report notes that the sign quickly became iconic in the crypto community, symbolizing the industry's revival. Bitcoin's price soared from about $2,300 to a peak of nearly $74,000 in March, boosted by major financial firms like Fidelity and BlackRock.

As retail interest came around, early Bitcoin memorabilia like the pad regained popularity. NFTs...well, not so much.

An anonymous buyer secured the item with a bid of 16 Bitcoin on the auction site Scare City, the report notes, although a temporary glitch suggested a mistaken bid of $6.4 million before correction.

Give them a break. After all, not everyone is on the bitcoin to USD conversion standard just yet...

But if the price of the pad is any indicator, interest in the crypto remains hot.

“The page with the sign drawing was removed from the notepad shortly after the hearing. It has since been reattached with clear archival wire,” the item's description read at the auction.

Christian Langalis, a 22-year-old intern at the Cato Institute, created the sign during a 2017 House Financial Service Committee hearing featuring Janet Yellen. After being televised, Langalis was escorted out. The auctioned item, described as "Ink Drawing on Legal Pad," also includes his notes from the session.

-

Site: Zero HedgeThe Infamous 'Buy Bitcoin' Pad Just Sold For More Than $1 Million At AuctionTyler Durden Thu, 04/25/2024 - 12:05

$1.027 million...or about 16 bitcoin.

That's what the infamous 'Buy Bitcoin' scribble drawing on a yellow legal pad, once held up at a televised Congressional testimony behind Federal Reserve Chair Janet Yellen, just sold for at auction, according to Bloomberg.

The report notes that the sign quickly became iconic in the crypto community, symbolizing the industry's revival. Bitcoin's price soared from about $2,300 to a peak of nearly $74,000 in March, boosted by major financial firms like Fidelity and BlackRock.

As retail interest came around, early Bitcoin memorabilia like the pad regained popularity. NFTs...well, not so much.

An anonymous buyer secured the item with a bid of 16 Bitcoin on the auction site Scare City, the report notes, although a temporary glitch suggested a mistaken bid of $6.4 million before correction.

Give them a break. After all, not everyone is on the bitcoin to USD conversion standard just yet...

But if the price of the pad is any indicator, interest in the crypto remains hot.

“The page with the sign drawing was removed from the notepad shortly after the hearing. It has since been reattached with clear archival wire,” the item's description read at the auction.

Christian Langalis, a 22-year-old intern at the Cato Institute, created the sign during a 2017 House Financial Service Committee hearing featuring Janet Yellen. After being televised, Langalis was escorted out. The auctioned item, described as "Ink Drawing on Legal Pad," also includes his notes from the session.

-

Site: Zero HedgeThe Infamous 'Buy Bitcoin' Pad Just Sold For More Than $1 Million At AuctionTyler Durden Thu, 04/25/2024 - 12:05

$1.027 million...or about 16 bitcoin.

That's what the infamous 'Buy Bitcoin' scribble drawing on a yellow legal pad, once held up at a televised Congressional testimony behind Federal Reserve Chair Janet Yellen, just sold for at auction, according to Bloomberg.

The report notes that the sign quickly became iconic in the crypto community, symbolizing the industry's revival. Bitcoin's price soared from about $2,300 to a peak of nearly $74,000 in March, boosted by major financial firms like Fidelity and BlackRock.

As retail interest came around, early Bitcoin memorabilia like the pad regained popularity. NFTs...well, not so much.

An anonymous buyer secured the item with a bid of 16 Bitcoin on the auction site Scare City, the report notes, although a temporary glitch suggested a mistaken bid of $6.4 million before correction.

Give them a break. After all, not everyone is on the bitcoin to USD conversion standard just yet...

But if the price of the pad is any indicator, interest in the crypto remains hot.

“The page with the sign drawing was removed from the notepad shortly after the hearing. It has since been reattached with clear archival wire,” the item's description read at the auction.

Christian Langalis, a 22-year-old intern at the Cato Institute, created the sign during a 2017 House Financial Service Committee hearing featuring Janet Yellen. After being televised, Langalis was escorted out. The auctioned item, described as "Ink Drawing on Legal Pad," also includes his notes from the session.

-

Site: LifeNews

Kansas Democrat Gov Laura Kelly claims she’s pro-choice on abortion, but she just vetoed a bill to help women with the choice of adoption instead of abortion.

Kelly line-item vetoed the proposed “Pregnancy Compassion Awareness Program,” which would renew allocation of $2 million in grant funding to provide and enhance resources for women who want to make the choice to parent or place their child for adoption. The line-item veto confirms that Kelly specifically targeted the program for elimination.

That makes it clear Governor Kelly isn’t just pro-choice, she is certifiably pro-abortion.

“Four times this legislative session, Gov. Coercion Kelly has proved her abortion extremism,” said Jeanne Gawdun, Kansans for Life Director of Government Relations, in an email to LifeNews.

“First, she vetoed protections for women who are coerced into abortions and shot down transparency in state statistics reporting; then she blocked financial relief to families hoping to adopt. Now she wants to remove resources for women facing unexpected pregnancies. It’s clear the only ‘choice’ the Kelly/Toland Administration supports is abortion.”

Kansans for Life urges legislators to stand with Kansas women and families by overriding Gov. Kelly’s extreme, out-of-touch, veto.

As LifeNews.com reported last week, Kelly’s abortion extremism was on full display as she vetoed life-affirming tax policies in House Bill 2465. That’s legislation that, had she signed it, would have promoted adoption in Kansas. The Democrat governor used her veto pen to block existing resources giving financial relief to families longing to adopt children and support to organizations that assist moms who want to choose life for their babies.

HB 2465 would establish adoption savings accounts and increase tax credits for adoptive families, eliminate the sales tax burden for pregnancy resource centers, and create tax credits for donors to those organizations.

Instead, Governor Kelly made it more financially difficult for families to provide loving homes for adoptive children.

ACTION ALERT: Contact Governor Laura Kelly to complain.

The post Kansas Gov Laura Kelly Vetoes Bill to Help Pregnant Women Choose Adoption appeared first on LifeNews.com.

-

Site: RT - News

The values system dominating the West has “brought chaos,” the Hungarian prime minister believes

Western liberal hegemony has failed and must be destroyed, Hungarian Prime Minister Viktor Orban stated on Thursday, suggesting it could end as soon as this year.

Addressing the Conservative Political Action Conference (CPAC Hungary) in Budapest, Orban criticized the existing “world order based on progressive liberal hegemony,” saying it has spawned numerous figureheads who are “not fit to be leaders,” with even “beauty pageants” knowing more about peace then they do.

He accused liberal politicians of building “hegemonic ideological control to which everyone must submit” instead of actual governing, while turning “state bodies into tools of oppression.” Such forces are a dangerous enemy whose time is coming to an end, Orban claimed.

“The progressive liberals sense the danger, the end of this era also means their end,” the prime minister argued. Their dominance could be overcome as soon as this year, Orban predicted, citing the upcoming EU Parliament and US presidential elections.

“The proponents of the old world are sitting in Brussels, and although it is not my business to interfere in American politics, I fear that they are also sitting in Washington. This is what we are doing this year. This year, we will try to drive them out,” the Hungarian prime minister said.

This year, God willing, we can end the inglorious era of the Western civilization. We can end the world order built on progressive liberal hegemony. The progressive liberal world spirit has failed. It gave the world war, chaos, unrest and destroyed economies.

The emerging world order will be based on true sovereignty, with countries driven by their actual national interests rather than a global ideology, according to Orban.

READ MORE: EU leadership must go – member state’s PM

“Let the era of sovereignty come, let’s get back towards peace and security. Let’s make America great again, let’s make Europe great again,” he concluded.

-

Site: RT - News

The values system dominating the West has “brought chaos,” the Hungarian prime minister believes

Western liberal hegemony has failed and must be destroyed, Hungarian Prime Minister Viktor Orban stated on Thursday, suggesting it could end as soon as this year.

Addressing the Conservative Political Action Conference (CPAC Hungary) in Budapest, Orban criticized the existing “world order based on progressive liberal hegemony,” saying it has spawned numerous figureheads who are “not fit to be leaders,” with even “beauty pageants” knowing more about peace then they do.

He accused liberal politicians of building “hegemonic ideological control to which everyone must submit” instead of actual governing, while turning “state bodies into tools of oppression.” Such forces are a dangerous enemy whose time is coming to an end, Orban claimed.

“The progressive liberals sense the danger, the end of this era also means their end,” the prime minister argued. Their dominance could be overcome as soon as this year, Orban predicted, citing the upcoming EU Parliament and US presidential elections.

“The proponents of the old world are sitting in Brussels, and although it is not my business to interfere in American politics, I fear that they are also sitting in Washington. This is what we are doing this year. This year, we will try to drive them out,” the Hungarian prime minister said.

This year, God willing, we can end the inglorious era of the Western civilization. We can end the world order built on progressive liberal hegemony. The progressive liberal world spirit has failed. It gave the world war, chaos, unrest and destroyed economies.

The emerging world order will be based on true sovereignty, with countries driven by their actual national interests rather than a global ideology, according to Orban.

READ MORE: EU leadership must go – member state’s PM

“Let the era of sovereignty come, let’s get back towards peace and security. Let’s make America great again, let’s make Europe great again,” he concluded.

-

Site: RT - News

The values system dominating the West has “brought chaos,” the Hungarian prime minister believes

Western liberal hegemony has failed and must be destroyed, Hungarian Prime Minister Viktor Orban stated on Thursday, suggesting it could end as soon as this year.

Addressing the Conservative Political Action Conference (CPAC Hungary) in Budapest, Orban criticized the existing “world order based on progressive liberal hegemony,” saying it has spawned numerous figureheads who are “not fit to be leaders,” with even “beauty pageants” knowing more about peace then they do.

He accused liberal politicians of building “hegemonic ideological control to which everyone must submit” instead of actual governing, while turning “state bodies into tools of oppression.” Such forces are a dangerous enemy whose time is coming to an end, Orban claimed.

“The progressive liberals sense the danger, the end of this era also means their end,” the prime minister argued. Their dominance could be overcome as soon as this year, Orban predicted, citing the upcoming EU Parliament and US presidential elections.

“The proponents of the old world are sitting in Brussels, and although it is not my business to interfere in American politics, I fear that they are also sitting in Washington. This is what we are doing this year. This year, we will try to drive them out,” the Hungarian prime minister said.

This year, God willing, we can end the inglorious era of the Western civilization. We can end the world order built on progressive liberal hegemony. The progressive liberal world spirit has failed. It gave the world war, chaos, unrest and destroyed economies.

The emerging world order will be based on true sovereignty, with countries driven by their actual national interests rather than a global ideology, according to Orban.

READ MORE: EU leadership must go – member state’s PM

“Let the era of sovereignty come, let’s get back towards peace and security. Let’s make America great again, let’s make Europe great again,” he concluded.

-

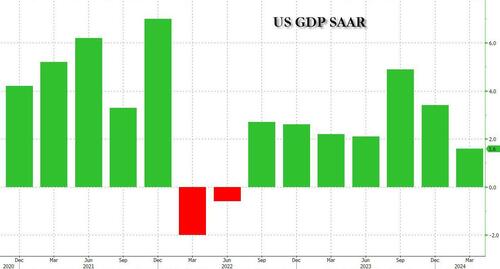

Site: Zero HedgeStagflation Shock: GDP Stuns With Lowest Print In 2 Years, Below Lowest Estimates, As PCE Comes In Red HotTyler Durden Thu, 04/25/2024 - 11:51

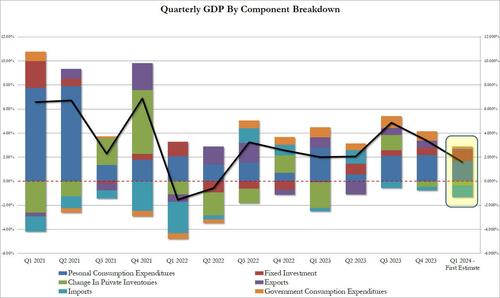

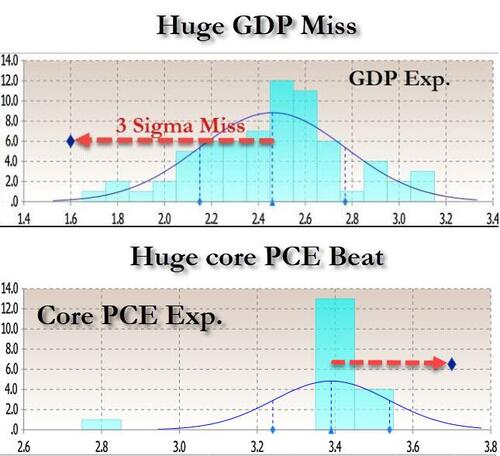

If the Biden admin was to have any hopes of the Fed cutting rates and monetary easing ahead of the election, the tires would need to start falling off the US economy right... about... now... Which is why we didn't find it at all surprising that moments ago the Biden Bureau of Economic Analysis reported that in Q1, US GDP unexpectedly collapsed to just 1.6%, down more than 50% from the Q4 print of 3.4%, the lowest print since Q2 2022 when the US underwent a brief technical recession (one which the NBER never admitted of course), and a huge miss to the 2.5% estimate.

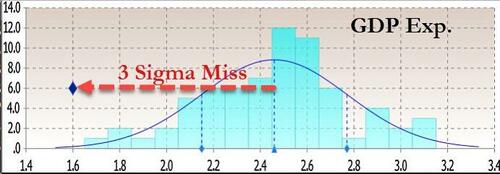

Almost as if on purpose, the GDP printed below the lowest estimate (that of SMBC Nikko) which was at 1.7% (the highest forecast was 3.1% from Goldman Sachs which was off by the usual 50%), and was a 3-sigma miss to the median estimate of 2.5%.

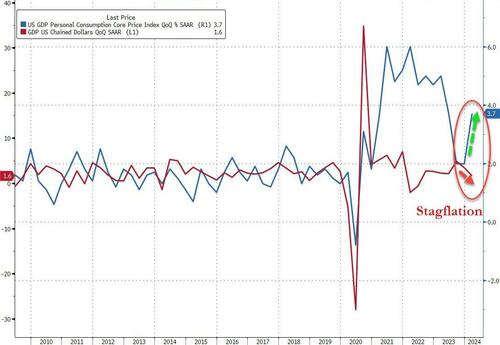

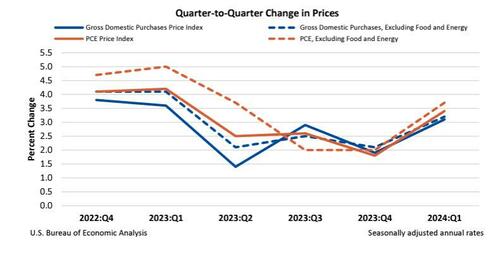

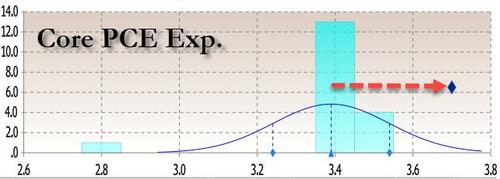

But while a collapse in the US economy is just what the "soft landers" wanted, the huge GDP miss was just half the story because at the same time, the BEA reported that the GDP Deflator (price index) came in at 3.1%, hotter than the 3.0% expected and almost double the 1.6% in Q4. Worse, the all important core PCE for Q1 soared from 2.0% to 3.7%, blowing away estimates of 3.4% (we will get a more accurate core PCE print tomorrow for the month of March) and suggesting that the US is about to not only not pass go, and overshoot soft-landing island completely, but crash-land straight into a stagflationary recession...

... unless the Fed does something, although what it can do - with inflation rising and growth slowing - is anyone's guess.

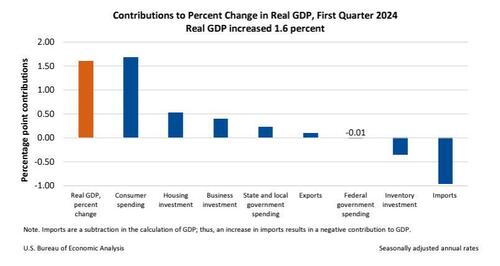

Taking a closer look at the absolute data, the BEA said that the increase in the first quarter primarily reflected increases in consumer spending and housing investment that were partly offset by a decrease in inventory investment. Imports, which are a subtraction in the calculation of GDP, increased.

- The increase in consumer spending reflected an increase in services that was partly offset by a decrease in goods. Within services, the leading contributors to the increase were health care as well as financial services and insurance. Within goods, the leading contributors to the decrease were motor vehicles and parts as well as gasoline and other energy goods.

- The increase in housing investment was led by brokers’ commissions and other ownership transfer costs as well as new single-family housing construction.

- The decrease in inventory investment was led by decreases in wholesale trade and manufacturing.

Compared to Q4, the deceleration in GDP in Q1 reflected decelerations in consumer spending, exports, and state and local government spending and a downturn in federal government spending. These movements were partly offset by an acceleration in housing investment. Imports accelerated.

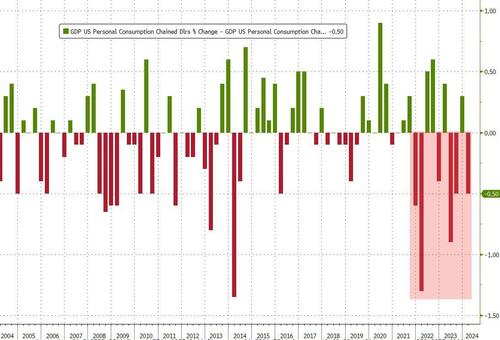

Digger deeper into the data, we find that it was once again the slowdown in consumption that was the biggest culprit, with Personal Consumption rising 2.5%, a big drop from the 3.3% in Q4 and below the 3.0% expected. Taking a step back we find that consumption has now missed on 6 of the past 10 prints.

As discussed extensively here, while the consumption missed, it was still positive, and reflects the latest drop in the savings rate, to 3.6% in the first quarter from 4% in the fourth quarter of last year, as consumers continue to drain their bank accounts and max out their credit cards. Economists have been wondering how long that can go on, but so far it shows no signs of abating. The (until recently) relentless rise in equity prices may be playing a role here.

In terms of actual components we find the following picture:

- Personal Consumption added 1.68% to the bottom line GDP print, or more than 100% of it. This was down notably from 2.20% in Q4.

- Fixed Investment rose modestly, to 0.91% of the bottom line contribution, up from 0.61% in Q4.

- The Change in Private inventories continued to detract from GDP for the 2nd quarter in a row, reducing the bottom line GDP print by 0.35%, a modest improvement from the -0.47% in Q4.

- Net trade was a big delta, and after contributing 0.25% to the Q4 3.4% GDP print, in Q1 it subtracted 0.86% from the actual print.

- Finally, government continues to be a contribution but in Q1 it added just 0.21%, a big drop from the 0.79% in Q4 and the lowest since Q2 2022 when it reduced GDP by 0.29%.

And visually: