It is sad that there are what you might call professional Catholics who make a living on their Catholicism, but in whom the spring of faith flows only faintly, in a few scattered drops. We must really make an effort to change this.

Distinction Matter - Subscribed Feeds

-

Site: LES FEMMES - THE TRUTH

-

Site: Zero HedgeThe Final Nail In The Coffin Of Synchronized Central Bank ActionsTyler Durden Fri, 04/12/2024 - 11:20

By Elwin de Groot, head of macro strategy at Rabobank

And now the end [to monetary tightening] is near … And so I face that final curtain …

My friend I'll say it clear … I'll state my case, of which I'm certain [– Christine Lagarde]

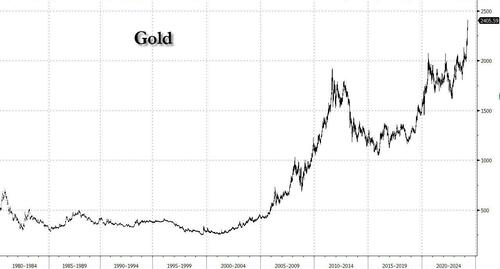

As we head into the weekend and gold prices just reached their highest level ever and the euro has slipped below 1.07 for the first time since November last year (perhaps also as some market participants worry about an imminent attack on Israel by Iran or its proxies), we may conclude that this week has proved to be the final nail in the coffin of synchronized central bank policy actions.

Not so long ago ‘June’ appeared to be the month for the two major global central banks. But in the last few weeks the Fed got it’s ‘itchy fingers’ slapped by stronger-than-expected labor market and sticky (services) CPI data. It is now fairly clear that ‘June’ is no longer the month of truth for the Fed, as our own Philip Marey explained earlier this week in his post Fed-minutes comment – we have moved the goalpost for the Fed to September. The Fed’s Collins said yesterday at an event in New York that recent data had eased concerns about “an imminent need” to adjust interest rates. Well, that’s one way to say it! WSJ’s Nick Timiraos put it more starkly, noting that that “Fed Rate Cuts Are Now a Matter of If, Not When”, which kind of captures the sentiment.

But over to Europe then, where the ECB yesterday gave some strong hints that a June cut is forthcoming. Although persistent price pressures in services remain somewhat of a concern, this doesn’t appear to be in the way of a first cut at the next policy meeting. As we explain here, the Council seems to have made up its mind now that i) the data (in the form of a weak economy and disinflationary forces) have continued to move in the right direction and that ii) a few cuts (let’s start with one) would still keep policy sufficiently restrictive so as to not derail the disinflation process. Despite its mantra of ‘data dependence’ and inflation not having reached its target yet, the Council seems pretty convinced that a cut would be appropriate. “We will not wait for everything to be 2% before we cut”, captures the idea that ECB is now more concerned of falling behind the curve at some point than making an policy error by easing too quickly and sustaining the stickiness services inflation and/or tightness in the labor market. But by emphasizing its data dependence and that it is not pre-committing to any kind of easing trajectory, it probably believes that it can keep the risk of that second scenario materializing at an acceptable level.

But what of course stands out from this development is that the ECB has increasing confidence that it can go its own (European) way. Some observers, including ourselves, note it is a great opportunity for the ECB to demonstrate its ‘independence’, by taking the lead instead of being influenced by what is happening in the US. This shouldn’t be an issue if there is a more fundamental gap opening up between the Eurozone and the US that -indeed- warrants an independent and divergent policy stance. The biggest risk is actually when this perceived gap is not ‘structural’ but sufficiently persistent to push both central banks in different directions when actually that is not really warranted.

A weakening of the Euro on the back of this divergence could of course warrant a slower easing cycle on the part of the ECB at some point. But, to be fair, any model will tell you that you need a pretty significant drop in the euro before this has a material impact on inflation. As a rule of thumb, a 1% drop in EUR/USD – associated with a 0.5% drop in the effective exchange rate – would raise domestic inflation by 0.05% in the first year and 0.15% after three years. Conversely, one could even argue that higher US rates could spill over to Europe dampening the effectiveness of ECB easing and thus warranting even a slightly faster cutting cycle.

But the biggest risk, arguably, is that the ECB simply has it wrong on fundamental grounds. That (global) inflationary forces are more persistent (or will return with a vengeance) and that the recent US inflation data are a harbinger of global trends rather than some statistical aberration. On that note, it is interesting to point out that Ms. Lagarde yesterday clearly did not want to be drawn too much into a comparative analysis between Europe and the US, although she noted that the ‘nature’ of US inflation was different from the perspective of fiscal stimulus and investment (more of both in the US). While that may be true, we would also argue that most of the disinflation so far has come from (global) ‘supply-driven’ factors: lower energy prices, lower tradable goods inflation and (more recently) lower food prices. Not services inflation! And there is obviously a parallel with the US data, albeit, perhaps, on a different level and persistence. So although the ECB is increasingly confident that it can diverge from the Fed – since its domestic data and trends take precedence over global developments – it is actually on the domestic inflation front where that divergence is the least convincing!

Turning briefly to another ‘front’, namely the geopolitical, we also observe a hardening stance from all the parties involved, but in Europe this comes with, well, European characteristics. This week we saw both the release of a 700+ European Commission report on ‘state-induced distortions in China’s economy’, a report that will likely open the door to far more EU trade actions against China, and subsidies to counteract it. This immediately drew a stinging rebuke from China, which “strongly opposes the European Commission’s subjective, one-sided and erroneous assessment of China’s socialist market economy to create an excuse for its discriminatory anti-dumping practices”, the Ministry of Commerce said, according to Xinhua news. A German Kiel Institute report released recently notes that “[…] even according to a very conservative estimate, counting only the more easily quantifiable subsidy instruments, industrial subsidies add up to about Euro 221 bn or 1.73% of Chinese GDP in 2019.” This contrasts with some 0.4-0.7% in most other economies with which it compares China.

That said, we should also mention the recent visit by German Chancellor Scholz to China and now also Italian PM Meloni planning to visit Beijing to strengthen economic/trade ties after ditching Italy’s support for China’s Belt and Road initiative.

Meanwhile, the Commission also published a discussion paper on the economic impact of defense spending, arguably, to stimulate and support the discussion of how to do this in the most effective way. It notes that “[…] the literature on the existence of a causal relationship between defence spending and economic growth is not unanimous. Although favourable impacts are more frequently reported in advanced economies than in less developed ones, the outcomes are dependent on the time horizon and on the methodology used.”

More signs of the hardening stance came via German defense minister Boris Pistorius, who warned yesterday that Europe should prepare for a Russian attack as he compared Russia invasion of Ukraine to Hitler’s annexation of Czechoslovak territory in 1938. Last week Pistorius called for easing Germany’s debt rules.

It’s hard to summarize all this into a single sentence. Is it strategic ambiguity? Perhaps, but it is definitely the European Way…

-

Site: Mises InstituteSimon Guenzl joins Bob to push back on Dave Smith's recent appearance, where Dave had made the case against open borders.

-

Site: Zero Hedge16 GOP Attorneys General Challenge Garland's Comments On Voting LawsTyler Durden Fri, 04/12/2024 - 10:20

Authored by Matt McGregor via The Epoch Times (emphasis ours),

A group of Republican state attorneys general are pushing back against U.S. Attorney General Merrick Garland’s comments made in March at a church in Selma, Alabama, where he discussed using the Department of Justice (DOJ) to interfere in state voting laws.

Attorney General Merrick Garland testifies before the House Judiciary Committee in Congress in Washington on Sept. 20, 2023. (Madalina Vasiliu/The Epoch Times)

Attorney General Merrick Garland testifies before the House Judiciary Committee in Congress in Washington on Sept. 20, 2023. (Madalina Vasiliu/The Epoch Times)

Indiana Attorney General Todd Rokita, in a letter supported by 15 other GOP prosecutors, including Ken Paxton in Texas and Liz Murrill in Louisiana, stated that Mr. Garland’s comments are “concerning.”

“In your speech, you claimed that democracy is under attack by ‘discriminatory, burdensome, and unnecessary restrictions on access to the ballot,’” Mr. Rokita wrote. “In response to these allegations, you announced that you ‘double[d] the number of lawyers in the civil rights division’ and ‘launched the Justice Department’s Election Threats Task Force,’ signaling your intent to intrude on our states’ authority.”

Mr. Rokita called this a “weaponization of the DOJ” fueled by Mr. Garland’s personal views, which he called a “serious threat to the principles of federalism and separation of powers, but also to democracy and the rule of law.”

In the letter, Mr. Rokita said the U.S. Constitution is clear in its direction to leave state elections up to the elected representatives of those states.

“Any subversion of these clear mandates would be undermining our Constitution and law and order,” he wrote. “And we think your remarks undermine these principles in a few ways.”

Mr. Garland told the audience at the Tabernacle Baptist Church that his DOJ is challenging state laws that he said are placing unneeded restrictions on black voters. He said black voters are disenfranchised by these restrictions on mail-in voting, the use of drop boxes, and voter ID.

“That is why we are working to block the adoption of discriminatory redistricting plans that dilute the vote of Black voters and other voters of color,” Mr. Garland said. “We are holding accountable jurisdictions that fail to provide accessible vote centers for voters with disabilities. We are defending the ability of private individuals—not just the government—to bring lawsuits under the key provisions of the Voting Rights Act and the Civil Rights Act of 1964.”

Voter Fraud: ‘Very Real’

Mr. Rokita addressed Mr. Garland’s statement on voter ID laws, stating that contrary to Mr. Garland’s claiming they are discriminatory, they prohibit voter fraud, which he called “very real,” and referenced several occurrences.

“With these repeated instances of voter fraud, the DOJ should be championing these laws and encouraging enforcement of them,” Mr. Rokita said. “Individuals are required to use an ID to prove identity when driving a car, boarding an airline, buying cigarettes, or purchasing alcohol, and none of these identification requirements are considered ‘discriminatory’ or ‘burdensome.’ Requiring an ID to vote in an election is no different.”

He then called out Mr. Garland’s claim that states imposed “unnecessary restrictions” on mail-in voting and drop boxes.

“Numerous security risks exist with mail-in voting and drop boxes, and these methods of voting have led to the proliferation of election fraud,” he said, citing multiple instances.

He then referenced Mr. Garland’s comment in which he said the Voting Rights Act (VRA) has been weakened by legislation.

“This statement is factually incorrect,” he said. “When the VRA was enacted in 1965, a limited number of jurisdictions required federal oversight over its state election laws to combat discrimination. The original intent of the VRA was to ensure that the rights of Americans were not infringed upon at the ballot box based on their race.”

The law justifiably singled out states that were restricting the right to vote but had always meant to be “temporary legislation.”

“The Voting Rights Act is not under attack,” Mr. Rokita said. “Election security measures passed by state governments do not ‘make voting more difficult,’ nor are they dismantling the right to vote. Instead, common sense election laws strengthen our electoral process to ensure free and fair elections are conducted among the states; especially since voter fraud does exist.”

However, the right to vote is under attack by progressive elected officials, he said, who are allowing illegal aliens to vote in elections.

“In some cases, courts found these laws unconstitutional, and rightly so,” he said.

State attorney generals must defend their laws, he said, most importantly during a time when the Biden administration’s border policy has made them vulnerable to intrusions and violations of sovereignty.

“Finally, as you mention, the Department of Justice is ‘fighting back’ against these commonsense election security measures passed by the states in numerous ways,” he said.

The expansion of federal attorneys in the DOJ’s Voting Section of the Civil Rights Division and the election task force suggests a federal interference that goes against what a constitutional republic is supposed to be about, he wrote.

“The DOJ’s expansion serves as a direct attack on the states’ role in regulating elections,” he said. “Instead of working with the states to secure elections, you suggest weaponizing the DOJ through the civil rights division to undermine anything that you subjectively believe is a ‘threat [to] democracy.’”

Mr. Rokita said Mr. Garland is only concerned with using the DOJ to build up the vote of the Democratic party.

“And by using the justice system in this way, you diminish any democratic principles you claim to defend,” he said.

The Epoch Times contacted the DOJ for comment.

-

Site: Zero HedgeUMich Inflation Expectations Jump Higher At Start Of April, Sentiment Sinks But Democrats HappyTyler Durden Fri, 04/12/2024 - 10:08

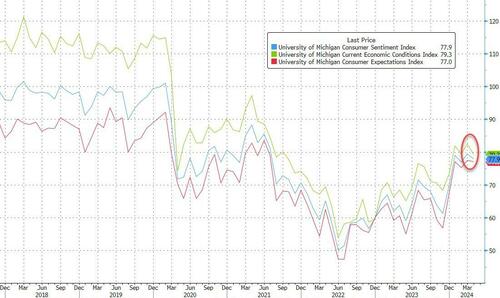

CPI is resurgent, PPI's trend is no longer lower, and this morning we saw import and export prices rising (or not falling) at their fastest pace in a year...

Source: Bloomberg

We say all that because this morning, we are told by UMich that in preliminary April data, Americans' expectations for inflation jumped higher...

Source: Bloomberg

“These increases in inflation expectations are modest enough that consumers do not appear worried that high inflation will come roaring back,’’ Joanne Hsu, director of the survey, said in a statement.

However, “while consumers are fully aware that inflation has come down substantially since 2022, they are not satisfied by the current pace of disinflation.”

The headline UMich sentiment index declined, led by a drop in 'current conditions'...

Source: Bloomberg

"Expectations over personal finances, business conditions, and labor markets have all been stable over the last four months," according to UMich.

"However, a slight uptick in inflation expectations in April reflects some frustration that the inflation slowdown may have stalled."

Democrats appear the most confident, with their sentiment pushing to its highest since June 2021. This as both Republicans and Independents saw confidence decline...

Source: Bloomberg

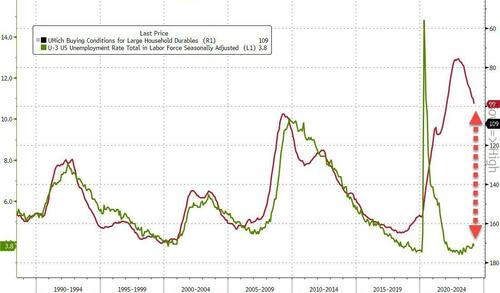

Finally, it appears all those illegal immigrants that are stuffing the payrolls prints are not buying large household durables...

Source: Bloomberg

Overall, UMich notes, that consumers are reserving judgment about the economy in light of the upcoming election, which, in the view of many consumers, could have a substantial impact on the trajectory of the economy.

-

Site: Mises InstituteWhile politicians and bureaucrats always claim to work in the "public interest," the rewards they gain for making bad economic decisions are more important to them than any satisfaction they get from supposedly "serving the people."

-

Site: Steyn OnlineCanada - the first hermaphrodite member of the G7...

-

Site: AsiaNews.itIn a statement, the National United Christian Forum calls on Christians to vote in the upcoming general election (19 April-1 June). Expressing a preference is not only "a symbol" but also a "powerful tool for growth and good governance" to build a 'society that is inclusive and which uplifts all the members.'

-

Site: Zero HedgeHow Taxpayers Will Heavily Subsidize Democrat Boots On The Ground This ElectionTyler Durden Fri, 04/12/2024 - 09:50

Authored by Ben Weingarten via RealClear Wire,

Progressives are using legal loopholes and the power of the federal government to maximize Democrat votes in the 2024 election at taxpayers’ expense, RealClearInvestigations has found.

The methods include voter registration and mobilization campaigns by ostensibly nonpartisan charities that target Democrats using demographic data as proxies, and the Biden administration’s unprecedented demand that every federal agency “consider ways to expand citizens’ opportunities to register to vote and to obtain information about, and participate in, the electoral process.”

A dizzying array of overwhelmingly “democracy-focused” entities with ties to the Democratic Party operating as charities and funded with hundreds of millions of dollars from major liberal “dark money” vehicles are engaged in a sprawling campaign to register the voters, deliver them the ballots, and figuratively and sometimes literally harvest the votes necessary to defeat Donald Trump.

These efforts, now buttressed by the federal government, amplify and extend what Time magazine described as a “well-funded cabal of powerful people ranging across industries and ideologies,” who had worked behind the scenes in 2020 “to influence perceptions, change rules and laws, steer media coverage and control the flow of information” to defeat Trump and other Republicans. The “shadow campaigners,” Time declared, “were not rigging the election; they were fortifying it.”

Heading into 2024, “there is not a ‘shadow’ campaign,” said Mike Howell, executive director of the Heritage Foundation’s Oversight Project. “There is an overt assault on President Trump and those who wish to vote for him occurring at every level of government and with the support of all major institutions.”

By contrast, Republican Party stalwarts lament that no comparable effort exists on their side. The GOP’s turnout and messaging efforts seek to thread a difficult needle by encouraging early and absentee voting and ballot-harvesting – pandemic-era measures that Trump and supporters blame for his 2020 electoral defeat – while the party simultaneously fights the mainly blue-state laws that made the practices possible. The party’s position is further complicated by its standard-bearer’s warnings of a rigged election bigger than in 2020, which some speculate could turn off moderate swing voters.

Electioneering 'Super-Weapons'

The IRS permits tax-exempt nonprofit groups to engage in voter registration and get-out-the-vote drives so long as they do not “refer to any candidate or political party” nor conduct their activities “in a biased manner that favors (or opposes) one or more candidates prohibited.”

These entities have become magnets for funds not only from wealthy donors, who can contribute without traditional campaign finance limits – and get a tax break to boot – but also abundantly endowed private foundations that are prohibited from engaging in partisan activities.

In recent years, dozens of progressive-oriented 501(c)(3)s, now pulling in upwards of $500 million annually, have engaged in purportedly neutral efforts to impact elections, according to Hayden Ludwig, director of Policy Research at the election integrity-focused advocacy group, Restoration of America.

In practice, critics like Ludwig argue, left-leaning charities flout the law by registering and mobilizing demographics that tend to vote disproportionately Democratic behind a veil of non-partisan democracy promotion.

During the 2020 election, for example, the Voter Participation Center solicited millions of ballot applications in swing states – many of them prefilled for respondents. This nonprofit, like its peers, is clear that it isn’t targeting just any voters, but what it and progressive activists have dubbed a “New American Majority” of “young people, people of color and unmarried women.”

Tom Lopach, a longtime Democratic Party operative and the center’s president and CEO, told RCI in a statement: “We do the work that state election officials typically do not do – seeking out underrepresented voting-eligible Americans Tom Lopach … This is difficult but necessary work that brings democracy to eligible Americans’ doorsteps.”

In 2020, Facebook founder Mark Zuckerberg and his wife Priscilla Chan showed how supposedly neutral efforts can have a partisan impact when they funneled some $400 million through two progressive-led but purportedly nonpartisan nonprofits into election offices across the country.

That money disproportionately went to jurisdictions that Joe Biden won in the pivotal battleground states that delivered his victory, often flowing to left-leaning nonprofits to whom election offices outsourced the administration of sometimes critical functions.

In April 2022, a primary conduit of these so-called “Zuckerbucks,” the Center for Tech and Civic Life, announced the launch of a successor to the 2020 effort – the U.S. Alliance for Election Excellence, a five-year $80 million program “to envision, support, and celebrate excellence in U.S. election administration.”

“The left has assembled an impressive ‘election-industrial’ complex of non-profit organizations that is constantly working towards goals like ‘promoting participation’ targeting ‘underrepresented minorities,’” said Jason Snead, executive director of the conservative Honest Elections Project. Such terms, Snead says, “are code for identifying and mobilizing liberal voters.”

Election experts view such activities as potentially decisive.

“‘Nonpartisan’ and ‘charitable’ voter registration and get-out-the-vote groups” are the Democratic Party’s “electioneering super-weapon[s],” said Parker Thayer, an analyst with the conservative-oriented Capital Research Center in Washington, D.C.

'Everybody Votes' – But for Whom?

Of these, Thayer sees the Everybody Votes Campaign as of paramount importance.

Born of a plan “commissioned by [Hillary] Clinton campaign chairman John Podesta, funded by the Democratic Party’s biggest donors, and coordinated with cut-throat Democratic consultants,” Thayer writes in an extensive analysis of the group’s efforts, “the Everybody Votes campaign [has] used the guise of civic-minded charity to selectively register millions of ‘non-white’ swing-state voters in the hopes of getting out the Democratic vote.”

It does so by funding and training over 50 community groups to register voters to close “the voter registration gap in communities of color,” which it attributes to “modern forms of Jim Crow laws,” such as voter ID requirements, the group’s executive director, Nellie Sires, said in a January 2024 interview.

From 2016-2021, the Everybody Votes Campaign, doing business as three entities, collected over $190 million from major Democratic Party donors, unions, and environmental activists. Some of the largest donors include the League of Conservation Voters Education Fund; the New Venture and Hopewell Funds, managed by for-profit consulting firm Arabella Advisors; and the George Soros-funded Foundation to Promote Open Society – all 501(c)(3) public charities or private foundations forbidden from supporting “voter education or registration activities with evidence of bias.”

The Everybody Votes Campaign distributed the funds to a slew of left-leaning state-based voter registration organizations largely in eight pivotal states from 2016 to 2019 – Arizona, Colorado, Florida, Georgia, Ohio, North Carolina, Virginia, and Nevada – and then to Pennsylvania, Michigan, and Wisconsin in 2021.

According to Thayer’s analysis, the Everybody Votes Campaign’s voter registration push “would have provided Democrats more votes than the total margins of victory in Arizona, Georgia, Nevada, and Pennsylvania,” securing Joe Biden’s victory in the 2020 election.

'4 to 10 Times More Cost-Effective'

One notable backer of the Everybody Votes Campaign is Mind the Gap, a “Moneyball-style” Silicon Valley Democratic Super PAC founded by Stanford law professor Barbara Fried, and connected to the political activities of her convicted crypto-fraudster son, Sam Bankman-Fried.

The analytics-focused outfit prepared a confidential strategy memo leaked in advance of the 2020 election, noting that “501(c)(3) voter registration focused on underrepresented groups in the electorate” would be the “single most effective tactic for ensuring Democratic victories” – “4 to 10 times more cost-effective” on after-tax basis at “garnering additional Democratic votes” relative to alternatives like “broadcast media and digital buys.”

Mind the Gap recommended that donors contribute to three organizations: the Voter Participation Center and its sister organization, the Center for Voter Information for mail-based registration efforts, and Everybody Votes for site-based registration efforts.

The largest grant recipient, receiving $24 million during the 2016-21 period, was State Voices, which describes itself as a “nonpartisan network of 25 state-based coalitions … that collectively partner with over 1,200 organizations” consisting of “advocates, organizers, and activists … work[ing] together to fight for a healthy democracy and political power for Black, Indigenous, Latinx, Asian American and Pacific Islander (AAPI), and all people of color (BIPOC).”

Another top recipient, raking in over $10 million, was the Voter Participation Center.

According to the Capital Research Center, the Everybody Votes Campaign would collect and spend over $50 million in connection with the 2022 midterm elections – the most recent period for which financials are available. All told, since its founding in 2015, the Campaign says, its network has registered 5.1 million voters, of whom 76% are people of color; 56% are women; and 47% are under the age of 35.

Last November, the news outlet Puck reported on a secret memo circulated by Mind the Gap regarding its plans for 2024. “Our strategy early in the 2024 presidential race will be to massively scale high-performing voter registration and mobilization programs,” the memo read. The PAC again specifically directed donors to the Everybody Votes Campaign, which did not respond to requests for comment.

Lopach, who has worked in Democratic Party politics his entire career, bristled at RCI’s questions regarding critics’ claims of a partisan bent to its work. “The presumptions baked into the questions … emailed to us are inaccurate and reveal the reporter’s own biases,” he responded, while emphasizing the organization’s targeting of “underrepresented voting-eligible Americans.”

Thayer has dubbed Everybody Votes the “largest and most corrupt ‘charitable’ voter registration drive in American history.”

Of such organizations’ claims of nonpartisanship, Howell told RCI: “If they were truly interested in an informed participatory constitutional Republic, they would have an even-handed approach to registering voters.”

“Call me when they show up to a NASCAR race, Daughters of the American Revolution event, or a gun show,” Howell added. “Then we can pretend for a minute that these are beyond just facial efforts to appear somewhat neutral.”

Challenges for GOP

But NASCAR races have not been hubs for GOP-led voter registration efforts either. Restoration of America’s Ludwig estimates that the right may spend as little as 1% of what the left spends on voter registration efforts.

A recent memo from the Sentinel Action Fund, a super PAC that aims to elect conservatives, noted that in the 2022 election cycle, while $8.9 billion was spent on federal elections, there were zero large independent expenditure organizations on the right focused on get-out-the-vote efforts or “ballot chasing.”

Republican Party vehicles and conservative outfits like grassroots-oriented Turning Point Action, a 501(c)(4), are engaged in such efforts in the 2024 cycle, but the scale and sophistication of their political counterparts’ efforts would appear unrivaled at this point.

Election experts attribute this gap to several factors beyond the GOP’s focus on other tactics to win elections, or ineffectiveness. They note that Democratic voters tend to be more concentrated in urban areas and college campuses, making it easier to run efficient registration drives. As regards early and absentee voting and ballot harvesting, it is not clear if these efforts will substantially grow the pool of Republican voters versus merely enabling the party to “bank” votes earlier.

With respect to the use of 501(c)(3)s to conduct such activities, Ludwig said some conservatives may still be fearful of running afoul of the IRS – through exploiting tax laws to pursue efforts perceived to be partisan effectively on the taxpayers’ dime – in the wake of its targeting of Tea Party groups for extreme scrutiny during the Obama years.

‘Bidenbucks’: ‘Zuckerbucks’ on Steroids

Since the 2020 election, Democrats have opened a second apparent electioneering front that Republicans could not match even if they wanted to: The rise of so-called “Bidenbucks,” which uses the “unlimited funding, resources, and reach” of the federal government and agency offices located nationwide,” to turn out favored voters, according to Stewart Whitson, legal director of the conservative Foundation for Government Accountability.

In March 2021, President Biden introduced Executive Order 14019. The directive on “promoting access to voting” orders every federal agency, more than 600 in all, to register and mobilize voters – particularly “people of color” and others the White House says face “challenges to exercise their fundamental right to vote.” It further directs the agencies to collaborate with ostensibly nonpartisan nonprofits in pursuit of its goals.

As RCI has previously reported, EO 14019 appears to have been designed by left-leaning think tank Demos and implemented in consultation and sometimes coordination with a slew of progressive, labor, and identity-focused groups with the goal of generating up to 3.5 million new or updated voter registrations annually.

The ACLU and Demos have reportedly helped execute the order. RCI additionally found that at least two recipients of grants under the Everybody Votes Campaign, the NAACP and UnidosUS – formerly the National Council of Raza – were also listed on an email as participants in a July 2021 listening session on the executive order convened by the White House and agency officials.

Whitson, whose organization unearthed that email in its fight to expose details about the order, emphasized that “[U]nlike 2020 wherein the shadow campaign was conducted by private citizens seeking to influence government election operations from the outside, the threat we face in 2024 is being launched from within the government itself.”

Facing both congressional scrutiny and litigation, the administration has closely guarded the strategic plans agencies were to develop to carry out the order, how they are implementing them, to what end, and with whom.

Perfunctory press releases, reports from groups supportive of the order, and documents slowly ferreted out via FOIA requests and litigation, however, demonstrate that relevant agencies have sought to drive voter registration via public housing authorities, child nutrition programs, and voluntary tax preparation clinics.

In August 2023, U.S. Citizenship and Immigration Services issued updated guidance calling for the agency to register voters at naturalization ceremonies.

More recently, the Department of Education did the same, blessing the use of federal work-study funds to pay students for “supporting broad-based get-out-the-vote activities, voter registration,” and other activities. Scott Walter, president of the Capital Research Center, recently told the Epoch Times that the Department had previously threatened schools “that you better be registering students or you could lose your federal funds.”

When asked by RCI to respond to Walter’s claim, the Department of Education would not. Over two dozen Pennsylvania state legislators challenged the order via a lawsuit in January. Citing alleged unlawful attempts by several agencies to register Keystone state voters, the lawmakers asserted:

"By engaging in a targeted voter registration effort of this magnitude, focused specifically on these agencies and the groups of potential voters they interact with, leveraging the resources and reach of the federal government, this effort appears to be a taxpayer-funded get-out-the-vote effort designed to benefit the current President’s political party."

Echoing this view, Whitson’s Foundation for Government Accountability submitted an amicus brief noting that “all of the federal agencies FGA has identified as taking active steps to carry out EO 14019 have one thing in common: They provide government welfare benefits and other services to groups of voters the vast majority of which have historically voted Democrat.”

The plaintiffs alleged the executive order violated both Pennsylvania law limiting voter registration efforts to non-federal actors, and constitutional provisions reserving election laws to the states. On March 26, a district court dismissed the case, claiming the plaintiffs lacked standing. Whitson told RCI that others would likely lodge similar lawsuits, building on the Pennsylvania legislators’ case in the wake of the dismissal. Days later, The Federalist reported that the plaintiffs intended to appeal their case to the U.S. Supreme Court. A White House spokesperson did not reply to RCI’s inquiries regarding the executive order.

Opposition and Circumvention

Republicans have had more success opposing the use of Zuckerbucks and other private monies used to finance public elections. More than two dozen states would move to ban or restrict such grants in response to the activities observed during the 2020 election.

Most recently, Wisconsin, where some of the most controversial Zuckerbucks-related efforts took place, was added to that list when, on April 2, voters approved a constitutional amendment barring the private funding of elections.

Despite this crackdown and the feds seemingly stepping into the breach, efforts to privately finance election administration persist. The U.S. Alliance for Election Excellence bills itself as an initiative to bolster “woefully unsupported” election offices to “revitalize American democracy.”

The organization says it services jurisdictions – 11 listed on its website, ranging across states from Arizona to California and Wisconsin – with “training, mentorship, and resources.” Alliance officials did not respond to RCI’s inquiry about whether it would be terminating the relationship with the city of Madison, Wisconsin., in light of the passage of the recent ballot measure that would seem to have barred it. Nor did it respond to RCI’s other inquiries in connection with this article.

Most of these partnerships were initiated with jurisdictions in states that have not banned Zuckerbucks, though it has sought to circumvent such prohibitions in Georgia and Utah. The stated goal of the Alliance for Election Excellence is to support voters via measures like assisting participating centers in “redesigning” forms to make them more intuitive and purchasing infrastructure “to improve election security and accessibility.”

Alliance launch partners include entities such as:

- The Center for Civic Design, which works with election offices “using research, design, accessibility, and plain language to remove barriers in the voter journey and invite participation in democracy;”

- The Elections Group, to “implement new programs or improve processes for voters and stakeholders”; and

- The Center for Secure and Modern Elections to “modernize the voting system, making elections more efficient and secure.”

Critics argue this seemingly more modest effort is, in reality, an ambitious Zuckerbucks rebrand.

Snead’s Honest Elections Project published a report in April 2023, based in part on documents received from FOIA requests, indicating “that the Alliance is a reinvention of CTCL’s scheme to use private funding to strongarm election policy nationwide.”

Among other takeaways, it found that:

- The Alliance offers services that touch every aspect of election administration, ranging from “legal” and “political” consultation to public relations, guidance, and assistance with recruitment and training.

- The Alliance is gathering detailed information on the inner workings of participating election offices and developing “improvement plans” to reshape the way they operate.

The report shows that many of the alliance’s launch partners, starting with the Center for Tech and Civic Life and the Center for Civic Design, are funded by major Democrat-tied, so-called “dark money” groups such as the Democracy Fund and Arabella Advisors’ New Venture Fund and Hopewell Fund.

The Democracy Fund is led by Democrat tech billionaire Pierre Omidyar, which has granted some $275 million to like-minded organizations from publications like Mother Jones and ProPublica to the Voter Registration Project since its founding.

The District of Columbia recently closed a criminal investigation into Arabella, whose fund network reportedly spent nearly $1.2 billion in 2020 alone, after probing it over allegations its funds were pursuing political ends in violation of their tax-exempt statuses. The Center for Secure and Modern Elections, the Honest Elections Project says, pushes “left-wing priorities like automatic voter registration” and is run by the New Venture Fund. The Elections Group’s CEO and co-founder, Jennifer Morrell, previously served as a consultant at the Democracy Fund.

The Capital Research Center’s Walter uses a football analogy to explain why he sees these efforts as untoward. He told RCI:

"Election offices are the refs in elections; the parties are teams trying to score. You’d be puzzled if you heard Super Bowl refs say they’re trying to boost points scored. You’d be outraged if you learned those refs had received money and training from people who previously worked for one team’s offensive coaching staff. That’s what left-wing political operatives, using left-wing money, are doing, and it’s clearly unfair."

Non-Trump Lawfare

Democrat-aligned groups continue to engage in litigation, like that brought by chief election lawyer Marc Elias, aimed at loosening election laws to their benefit. Snead told RCI, “There are more than 70 active lawsuits right now targeting voter ID laws, anti-ballot harvesting laws, signature verification, drop box regulations, and more.”

After securing victory in a lawsuit requiring signature verification for mail voting in Pennsylvania, the RNC touted its engagement as well in 81 election integrity cases this cycle. Swing-state Wisconsin is another major battleground for such efforts.

There, Elias’ legal team has challenged witness signature requirements and bans on election clerks filling address information on mail-in ballots. It and others are also working to overturn a state Supreme Court decision finding drop boxes illegal. The Badger State’s now liberal-majority Supreme Court announced in March it would take up the case.

Cutting against these efforts are not only the state’s citizen-approved Zuckerbucks ban, but another Badger-passed April 2 ballot measure amending the state’s constitution to prohibit those other than “an election official designated by law” from carrying out election-related tasks.

Watchdogs like Howell are concerned that left-leaning electioneers and lawfare forces collectively are pursuing an “election ‘dis-integrity’ strategy … to greatly expand the universe of ballots while limiting any ability to ensure that they are fairly cast and counted.”

“It’s a basic recipe for fraud.”

Elias says those seeking to combat such efforts are engaged in “voter suppression and election subversion.”

Democrats also have the federal government working on their side on the litigation front – and in ways extending beyond the veritable lawfare barrage the Biden Justice Department has leveled at Donald Trump.

Speaking in Selma, Ala., on the 59th anniversary of Bloody Sunday, the 1965 police assault on civil rights marchers, Attorney General Merrick Garland declared that “the right to vote is still under attack.”

Garland vowed the Department of Justice was punching back, including “challenging efforts by states and jurisdictions to implement discriminatory, burdensome, and unnecessary restrictions on access to the ballot, including those related to mail-in voting, the use of drop boxes, and voter ID requirements.”

-

Site: The Orthosphere

“The happiness of others, therefore, has a depressing effect, their unhappiness an elevating effect upon our self-esteem.”

Friedrich Paulsen, A System of Ethics (1899)

Commenter Club Schadenfreude objects to Kristor addressing him as Club Schadenfreude, but his objection is not my concern here. I am, rather, concerned with the meaning of schadenfreude, and perhaps with the significance of operating a club by that name.

Schadenfreude is, of course, a German word that denotes the pleasure a man takes in another man’s misfortune. Not in the misfortune of an enemy, I hasten to add, for that is mere malice. Schadenfreude is the pleasure he takes in the misfortune of a stranger, and perhaps more particularly the pleasure he takes in the misfortune of a friend. Schadenfreude is, in other words, a perversion of compassion, and it is a pleasure with which very few of us are altogether unacquainted.

Ethicists generally recognize schadenfreude as the twin of envy, envy being unhappiness occasioned by another’s happiness, schadenfreude happiness occasioned by another’s unhappiness.

“These are well-known phenomena: they are never entirely wanting in man. The pessimistic philosophers love to dwell upon this truly partie honteuse of human nature.”*

The French phrase means “shameful part,” and like the shameful parts of the human anatomy, envy and schadenfreude are sentiments we take care to conceal. We take care to conceal them because they are dishonorable sentiments, envy entailing an admission of weakness, schadenfreude being pity without the mask.

We see that pity is not all it is cracked up to be when we reflect that pity is much more agreeable to give than to receive. The reason for this is not hard to discover. When I express pity for my friend’s misfortune, I am secretly gratified by the reflection that my circumstances are, by comparison, quite comfortable. When I pity a friend, I am in fact praising myself.

This relation is reversed in envy because, when I praise a friend, I implicitly confess that I am, by comparison, pitiful. Envy is thus wounded self-esteem. Schadenfreude on the other hand is self-esteem petted, stroked, and exquisitely gratified. It is, as I just said, pity without the mask. As Lucretius says in his great atheist poem On the Nature of Things (c. 75 B.C.).

“’Tis sweet, when down the mighty main, the winds

Roll up its waste of waters, from the land

To watch another’s laboring anguish far,

Not that we joyously delight that man

Should be thus smitten, but because ’tis sweet

To mark what evils we ourselves be spared.”**Schadenfreude is not, as is sometimes said, malicious pleasure. It is the pleasure of marking, by observation or report, the suffering of evils from which I have myself been spared. As Lucretius goes on to say:

“ ’Tis sweet, again, to view the mighty strife

Of armies embattled yonder o’er the plains,

Ourselves no sharers in the peril . . .”**Schadenfreude is, to wrap this up, a psychological trick with which my ego assures me I am special. I am (naturally but dishonorably) gratified by the misfortunes of strangers and friends, not because I hate those strangers and friend so bitterly, but because I love myself so tenderly. It is owing to self-love, as my epigraph puts it, that news of their good fortune has “a depressing effect” on my self-esteem, whereas my self-esteem is by reports of their misery most decidedly elevated.

This may be evidence, I cannot forebear to mention, of Adam’s sin.

*) Friedrich Paulsen, A System of Ethics, Frank Thilly ed., Fourth ed. (New York: Charles Scribner, 1899), p. 593.

**) Book 2, William Ellery Leonard trans. -

Site: Zero HedgeCentral Banks Are Buying The Gold TopTyler Durden Fri, 04/12/2024 - 09:15

In investing, “Buy low, sell high” is among the most well-known sayings, and generally, it’s good advice. But with gold still holding near its historic all-time highs, central banks led by China are bucking the classic adage and smash-buying more, buying the top to fortify themselves against a global monetary and financial blow-up.

Last month marked the 17th in a row that the People’s Bank of China (PBOC) continued stacking gold. Notably, the bank typically reports lower numbers than its actual buying volume and is now also introducing a digital yuan to facilitate cross-border gold settlements.

The People's Bank of China announced its gold reserve data for March, with an additional 160,000 ounces of gold reserves added, bringing the total reserves to 72.74 million ounces. pic.twitter.com/Ngalymi8nd

— Bai, Xiaojun (@oriental_ghost) April 8, 2024Russia is also doubling its reserves of gold and foreign currencies on its de-dollarization path, further detaching Russia from the petrodollar empire as it reacts to wartime sanctions from the US and EU. There are other blips on the de-dollarization map as well: though much smaller than Russia and China, Zimbabwe has a new gold-backed currency that lets them dump the USD for trade with China and other countries.

Chinese citizens are trying to divest as well, but from their economy — Chinese buying has become so blistering that gold ETFs have gone haywire, with China repeatedly halting trading as ETFs rocket upward at a gobsmackingly-high premium against physical bullion. It has become increasingly difficult for the Chinese to invest outside of China, due to attempts by the regime to keep investments within the country. Citizens are trying to make moves to protect themselves against their perceptions of domestic economic uncertainty.

Meanwhile, expectations that the Fed and other Western central banks will be cutting rates this year amidst continuing wars in Ukraine and the Middle East provide further rocket fuel for the gold price, with central bank buying helping it hold its new levels despite whatever else seems to be going on in global markets.

A Year of Central Bank Buying: Gold vs USD April 2023 – April 2024

Source: Bloomberg

While shorter-term corrections are always to be expected, the macro factors support the view that, despite its awe-inspiring path upward in the past few months, the rally for gold hasn’t finished. While inflation isn’t contained, the Fed is expected to stay the course with planned 2024 rate cuts that will make dollar weakness even worse. This can only mean higher prices for gold against USD.

Reacting to warnings from Bloomerberg about ballooning debt and the powder keg of inflationary pressure, Peter Schiff said:

“We have a much bigger problem than they acknowledge — that’s why the price of gold is at a record high, that’s why it’s going to keep going up.”

With the overstretched and over-indebted American empire increasingly in a state of potentially terminal decline, BRICS countries are stacking hard assets with the hopes of overtaking the West as the next economic superpowers in the coming decades. While they have fiat currencies of their own, none have anything resembling the world reserve currency status enjoyed by the USD. Buying the top even as gold continues upward tells a story of their future visions of US dollar chaos.

Besides, if you expect the dollar to fail, as dominant fiat currencies historically have, then “the top” doesn’t matter — if the bottom for fiat is zero, then there’s no meaningful top for hard assets like gold in fiat terms. And just as you didn’t want to be the last schmo holding seashells when no sane person would give you even the tiniest sliver of gold in exchange, it’s wise of central banks to avoid being the last ones trying to trade worthless paper for gold that, when fiat is functionally dead, will be infinitely more valuable.

Because when you zoom out far enough, the exchange price of fiat currencies always reverts to its true value of zero.

-

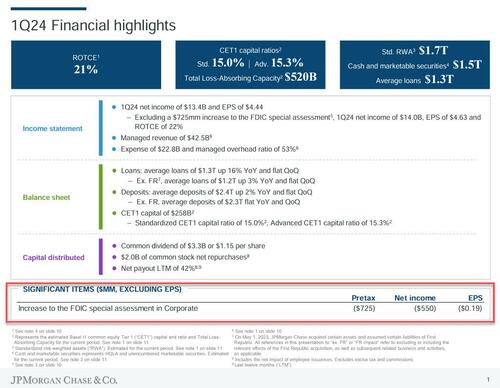

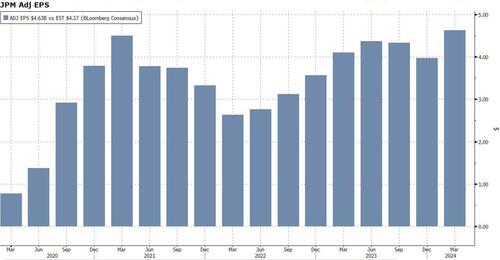

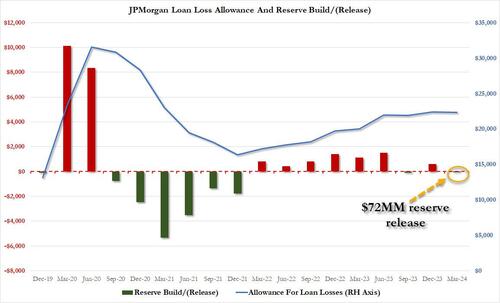

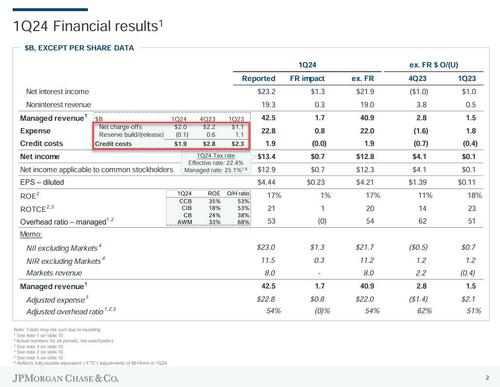

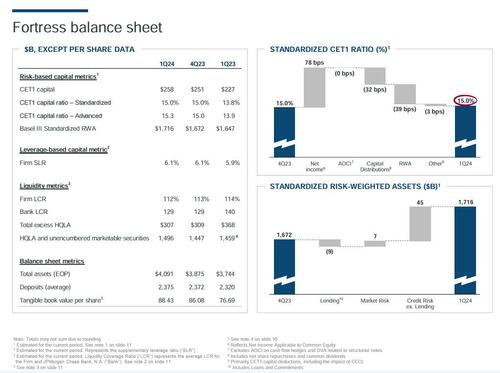

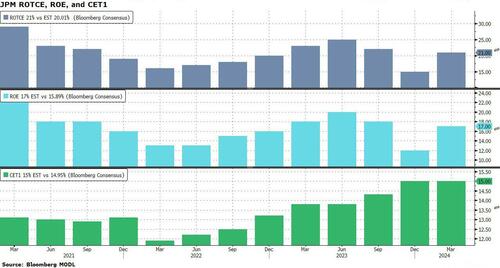

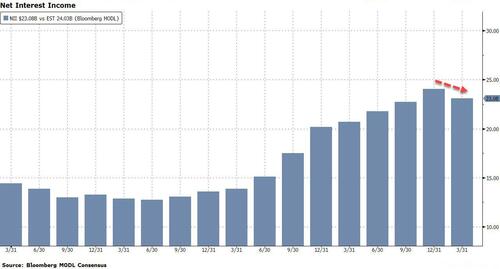

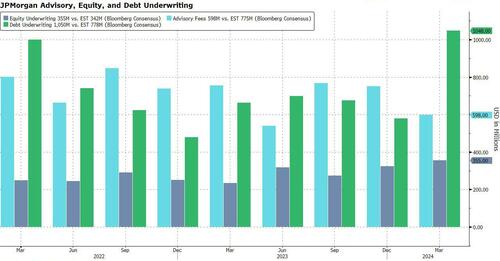

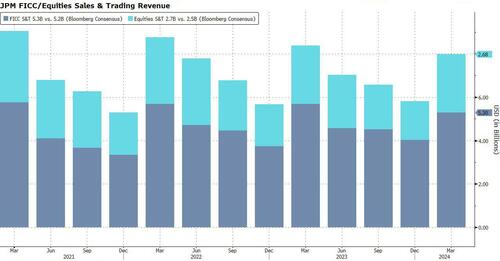

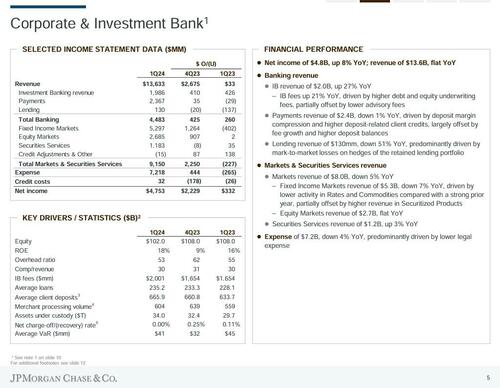

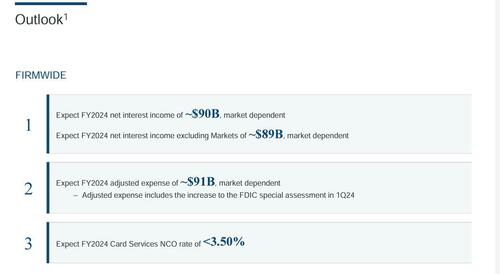

Site: Zero HedgeFutures Tumble On Disappointing JPM Earnings, Surging Geopolitical RisksTyler Durden Fri, 04/12/2024 - 09:01

Futures are tumbling this morning, hit by disappointing earnings and outllook from the largest US bank, JPMorgan whose stock is down around 3% in a soggy launch to Q1 earnings season, while growing fears of an imminent conflict between Israel and Iran have sent oil surging and futures sliding. As of 8:45am, S&P futures are down 0.7%, at session lows with Nasdaq also dumping after reports China has asked its telecom carriers to start phasing out foreign chips. The drop comes as we see safe having flows move capital into TSYs with bond yields sliding up to 10bps this morning. That said, the USD is higher again with the euro and cable sliding sharply. Commodities are mixed: oil and gold rally amid Middle East tension; base metals are lower amid lower-than-expected China exports (-7.5% vs. -1.9% survey vs. 5.6% prior), while the gold explosion documented last night continues, with gold futures trading just above $2,400 and spot trading just below. Today, the main focus will be banks earnings (C, JPM, WFC). We will also receive Univ. of Mich. Sentiment data.

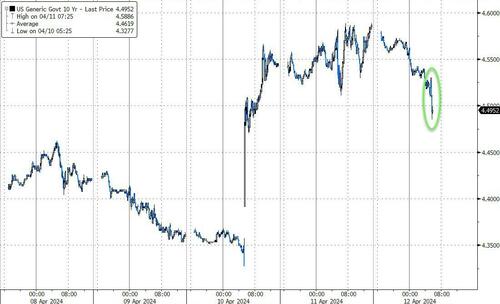

Bonds are bid also, 10Y -9bps...

In premarket trading, MegaCap tech are mostly lower: GOOG -45bp, TSLA -1.1%, while semis are lower amid headlines on China cutting American chip makers out of its telecoms systems (AMD -1.8%, INTC -1.7%, MU -94bp). Here are the most notable European movers:

- Applied Digital shares drop 11% after the data-center developer reported third-quarter adjusted diluted loss per share that was more than analysts had expected. The company also missed on revenue.

- Corteva shares slip 1.4% after a downgrade to neutral at JPMorgan, which says the agricultural products firm “has its work cut out” for it to reach its earnings guidance for 2024 amid falling crop chemicals prices.

- Coupang shares rise 4.4% after the e-commerce company said it would raise its monthly fee for “Wow” membership for new clients by 58%, starting on Saturday, according to emailed statement.

- DocuSign (DOCU US) shares gain 0.6% as UBS lifts its rating on the e-signature company to neutral from sell, with the stock now approaching fair value.

- Gitlab (GTLB US) shares climb after an upgrade to outperform at Raymond James, which sees the application software company ultimately exceeding $750 million in revenue for fiscal year 2025.

- Globe Life (GL US) shares are up 12%. The life insurance company said it intends to explore “all means of legal recourse against the parties responsible” after a short-seller report from Fuzzy Panda Research.

- Intel and AMD shares fall after the Wall Street Journal reported that China has asked its telecom carriers to start phasing out foreign chips.

The biggest highlight in premarket trading, however, was JPMorgan which dropped as much as 4.4% in premarket after its outlook for full-year net interest income missed expectations. Citigroup Inc. gained after its first-quarter profit topped estimates. Contracts for the S&P 500 fell 0.4%, while those on the Nasdaq 100 slid 0.5% after tech stocks jumped 1.7% Thursday. BlackRock rose in premarket after the world’s largest money manager reported a record $10.5 trillion in client assets. Wells Fargo shares retraced a slump after a miss on NII in its first-quarter report. State Street Corp. gained after its earnings beat estimates.

Separately, attention is also focused on the growing conflict between Iran and Israel where moments ago we got the following flashing red headline which hammered futures to session lows:

- *ISRAEL BRACING FOR POTENTIAL DIRECT ATTACK FROM IRAN IN DAYS

While there is nothing new there, we have heard that several times in the past few days, today the market is extra sensitive and it is sending oil surging, with WTI above $86 and Brent well into the $90.

European stocks were on course for their best day this month, with mining and energy shares leading gains amid a rally in oil and metals, however the gains have fizzled as geopol concerns emerge. The Stoxx 600 is up 0.6% after rising 1% earlier.

Earlier in the session, Asian equities slipped Friday with Hong Kong and South Korea leading the losses, as the region lacks positive momentum following a recent rebound. The MSCI Asia Pacific Index dropped as much as 0.2% in its third straight day of declines, the longest falling streak since early February. Chinese technology stocks including Alibaba and Tencent, as well as South Korea’s Samsung Electronics, were among the biggest contributors to the drop.Hong Kong markets underperformed, with the Hang Seng China Enterprises Index retreating after entering a so-called technical bull market earlier this week. Sentiment has turned cautious after Chinese price data released Thursday underscored deflationary pressures, putting a dampener on budding optimism that the economy is recovering.

In FX, the Bloomberg Dollar Index rises 0.4% while the euro sank to the weakest level against the dollar in five months as prospects grow that the European Central Bank will start cutting rates in June, well before the Federal Reserve can begin easing because of stubborn US inflation. Markets are pricing three rate cuts in the euro zone this year and fewer than two by the Fed. The Swedish krona is the worst performer among the G-10 currencies, falling 0.8% versus the greenback after CPI rose less than expected in March.

Treasuries rise after a steep two-day fall, with US 10-year yields dropping 8bps to 4.50% after surging 22 basis points in the previous two sessions. Data Thursday showed US producer prices in March increased less than forecast, sparking relief after consumer-price growth exceeded forecasts the previous day. German 10-year yields fall 9bps after ECB’s Stournaras said it is time for the ECB to diverge from the Fed. The 10-year Treasury yield dropped seven basis points. Strategists at Bank of America Corp. said a rare rally in both tech stocks and commodities, combined with a jump in bond yields, has echoes of periods when bubbles are forming. The unusual price moves are consistent with bets that interest rates will stay higher for longer while economic growth remains strong — a so-called no-landing scenario.

While that narrative is “correctly in vogue,” there’s also a risk of higher inflation and an increased cost of capital, the strategists led by Michael Hartnett wrote. The price action is “typical of bubbly markets,” according to Hartnett, who makes a comparison with the pre-tech bubble period of 1999.

In commodities, WTI rises 2% to trade near $87 a barrel; spot gold rises 0.9% having earlier topped $2,400/oz for the first time while copper rises 2.3% to the highest since June 2022. Iron ore headed for its best week in two years on speculation that China’s economy may be on the mend, buoying the outlook for demand. A rally in industrial metals strengthened, with zinc rising to a one-year high on increased risks to supply.

To the day ahead now, and the Bank of England will release the Bernanke review on forecasting. Central bank speakers include the BoE’s Greene, the ECB’s Elderson, and the Fed’s Collins, Schmid, Bostic and Daly. Data releases include the UK GDP reading for February, and in the US there’s the University of Michigan’s preliminary consumer sentiment index for April. Finally, earnings releases include JPMorgan, Citigroup, Wells Fargo and BlackRock.

Market Snapshot

- S&P 500 futures down 0.7% at 5,207

- STOXX Europe 600 up 1.2% to 510.39

- MXAP down 0.5% to 175.54

- MXAPJ down 1.0% to 536.11

- Nikkei up 0.2% to 39,523.55

- Topix up 0.5% to 2,759.64

- Hang Seng Index down 2.2% to 16,721.69

- Shanghai Composite down 0.5% to 3,019.47

- Sensex down 0.9% to 74,399.41

- Australia S&P/ASX 200 down 0.3% to 7,788.08

- Kospi down 0.9% to 2,681.82

- Brent Futures up 1.2% to $91.36/bbl

- Gold spot up 1.0% to $2,396.87

- US Dollar Index up 0.35% to 105.65

- German 10Y yield little changed at 2.38%

- Euro down 0.4% to $1.0678

Top Overnight News

- China posts weak trade numbers for Mar, with exports slumping 7.5% Y/Y (vs. the Street -1.9%) while imports dip 1.9% (vs. the Street +1%). RTRS

- China’s push to replace foreign technology is now focused on cutting American chip makers out of the country’s telecoms systems. Officials earlier this year directed the nation’s largest telecom carriers to phase out foreign processors that are core to their networks by 2027, a move that would hit American chip giants Intel and Advanced Micro Devices. WSJ

- Japan’s finance minister reiterated his readiness to act on excessive FX moves as the yen held near a 34-year low. Intervention will probably happen outside Tokyo trading hours to weed out overseas speculators. BBG

- Israel is preparing for a direct attack from Iran on southern or northern Israel as soon as Friday or Saturday, according to a person familiar with the matter. A person briefed by the Iranian leadership, however, said that while plans to attack are being discussed, no final decision has been made. WSJ

- The IEA trimmed its forecast for 2024 oil demand growth on Friday, citing lower than expected consumption in OECD countries and a slump in factory activity. The Paris-based energy watchdog lowered its growth outlook for this year by 130,000 barrels per day (bpd) to 1.2 million bpd, adding that the release of pent-up demand by top oil importer China after easing COVID-19 curbs had run its course. RTRS

- The US has proposed raising tens of billions of euros in debt for Ukraine secured against the future profits generated by Russian state assets that have been frozen by western countries. The G7 group of nations has been split on what to do with €260bn worth of Russian assets put on hold by the west since Moscow launched its full-scale invasion of Ukraine in February 2022. FT

- Big bank earnings kick off with net interest income in focus as fewer rate cuts are expected. JPMorgan is attracting most speculation over whether it will raise NII guidance — which analysts argue is conservative at $90 billion. Adjustments for Wells Fargo and Citi will also be scrutinized. BBG

- Roaring equity markets and the popularity of a new spot bitcoin exchange traded fund powered BlackRock to record assets under management of $10.5tn and net income of $1.57bn that was up 36 per cent year on year. FT

- KKR, one of the pioneers of the $15tn private capital industry, is hastening plans to sell large investments or take them public after higher interest rates caused a two-year slowdown in takeovers and initial public offerings. FT

- Sweden’s underlying inflation rate fell more than expected in March, fueling expectations for the Riksbank to start cutting interest rates ahead of major peers next month. A closely followed measure that strips out energy costs and the effect of interest-rate changes increased 2.9% from a year ago, a 26-month low, according to a statement from Statistics Sweden. That was less than the 3.2% expected by economists surveyed by Bloomberg as well as the 3.3% that the Riksbank projected. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed despite the gains on Wall St where softer-than-expected PPI eased some inflationary fears, while participants in the region were also cautious as they awaited the latest Chinese trade data. ASX 200 marginally declined as weakness in consumer-related sectors overshadowed the gains in gold miners. Nikkei 225 was underpinned on the back of a weaker currency and despite the selling pressure in Fast Retailing. Hang Seng and Shanghai Comp. were somewhat varied with underperformance in Hong Kong amid broad selling after the local benchmark index pulled back from the 17,000 level, while the mainland struggled for direction leading into the Chinese trade data.

Top Asian News

- US Senate Banking Committee Chair Brown urged for President Biden to permanently ban EVs produced by Chinese companies, according to a letter cited by Reuters.

- Japanese Finance Minister Suzuki said a weak yen has pros and cons, as well as noted that a weak yen could push up import prices and have a negative impact on consumers and firms. Suzuki reiterated that rapid FX moves are undesirable and that he is closely watching FX moves with a high sense of urgency, while he also repeated it is desirable for FX to move stably reflecting fundamentals and he won't rule out any steps to respond to disorderly FX moves.

- Bank of Korea kept its base rate unchanged at 3.50%, as expected, with the decision made unanimously, while it stated that it is premature to be confident that inflation will converge on the target level and it will maintain a restrictive policy stance for a sufficient period. BoK said it would monitor various factors including inflation slowdown, as well as financial stability and economic growth risks but noted the growth forecast is to be consistent with its earlier forecast or could be higher. BoK Governor Rhee said one in seven board members said the door for a rate cut should be open for the next three months and all 7 members said it is hard to predict policy decisions for H2. Furthermore, Rhee said the board is open to a rate cut if CPI slows in H2 although rate cuts might be difficult this year should inflation remain sticky and they have not signalled for a rate cut.

- Monetary Authority of Singapore maintained the width, centre and slope of the SGD NEER policy band, as expected. MAS said current monetary policy settings remain appropriate, while it added that the Singapore economy is expected to strengthen and that prospects for the Singapore economy should improve over the course of 2024.

- Chinese Cabinet issues guidelines to strengthen the supervision and prevent risks to promote development of its capital market; China to tighten supervision of stock market to control risks.

- Chinese Cabinet issues guidelines to strengthen the supervision and prevent risks to promote development of its capital market; China to tighten supervision of stock market to control risks.

- China March Trade (USD): Balance 58.55bln (exp. 70.2bln); Exports -7.5% Y/Y (exp. -2.3%); Imports -1.9% Y/Y (exp. -2.3%).

- China's Securities Regulator is proposing stricted differentiated regulatory requirements for high-frequency trading, plans to moderately increase requirements of operating income, net profit for Co's listed on Chinext.

European bourses, Stoxx600 (+1.1%), jumped higher at the open and continued to make session highs as the morning progressed, though upward momentum has slowed in recent trade as we await US bank earnings. European sectors are firmer across the board; Once again Basic Resources and Energy top the pile, lifted by gains in the commodities complex. Optimised Personal Care is found at the foot of the pile. US Equity Futures (ES U/C, NQ -0.1%, RTY U/C) are trading on either side of the unchanged mark, seemingly taking a breather following strong Stateside performance in the prior session; Intel (-1.8%) and AMD (-1.9%) pressured in the pre-market on China-related reports via the WSJ.

Top European News

- ECB's Kazaks says they will cut in June if nothing surprising occurs, via TV3; data will be clearer by then. Wage growth remains strong but inflation has decreased. The time for a cut is approaching.

- ECB's Stournaras says now is the time to diverge from the Fed; reiterates call for four rate cuts this year; there is a risk inflation will undershoot 2%.

- Riksbank's Breman says inflation has fallen from high levels but the risk of setbacks remains. Key factor is that household inflation expectations remain at a high level. Today's inflation figure shows we have a positive ground for inflation stabilising at 2%. Believe that household inflation expectations will also fall in the future as price increases slow; Co. pricing behaviour will be key.

- Goldman Sachs expects the ECB to cut rates four times this year in June, July, September & December

FX

- USD is stronger vs. most peers as Wednesday's CPI report has prompted a reassessment of the Fed's position vs. other major central banks in the easing cycle. Interim resistance comes via the 13th Nov high at 105.95 but broader focus is on a breach of 106 to the upside.

- EUR's descent vs. the Greenback has continued into today's session as emphasis on potential diverging Fed/ECB paths guides price action. EUR/USD hit a new YTD at 1.0676.

- GBP initially defended the 1.25 mark, before succumbing to the broader Dollar strength; An in-line UK GDP release has been vastly overshadowed by a broad reassessment of the relative BoE/Fed paths. GBP entered 2024 on the front foot amid expectations it would lag the Fed and ECB in cutting rates.

- JPY is holding up better than peers vs. the USD. Albeit, it has been a pretty painful week for the JPY following Wednesday's US CPI print which launched the pair from a 151 handle to 153+.

- Antipodeans are both softer vs. the USD to similar degrees amid light newsflow for both currencies. AUD/USD is below its 50 and 200DMAs at 0.6543 but holding above the weekly low at 0.6498.

- PBoC set USD/CNY mid-point at 7.0967 vs exp. 7.2365 (prev. 7.0968).

Fixed Income

- USTs off lows with newsflow light into a number of Fed speakers. USTs have bounced by around 10 ticks from today's 108-00+ base, but remain much closer to the week's trough of 107-27+ than the 109-26+ peak.

- Bunds are bid as markets digest the ECB's read-between-the-lines guidance towards a June cut with sources and ECB speakers since outlining this more explicitly, guidance which contrasts with hawkish Fed re-pricing. Bunds have been lifted back towards this week's 132.86 peak, currently 132.44, whilst the German 10yr yield sits comfortably below 2.40%.

- Gilts gapped higher by around 30 ticks given the above EGB action, and remained near session highs at around 97.87. A slightly stronger UK GDP print will give the BoE scope to continue to traverse the Table Mountain; Bernanke forecast review due shortly.

Commodities

- Crude is firmer on the session, given the heightened geopolitical environment and despite the firmer Dollar. Brent June trades within a USD 90.04-64/bbl parameter thus far.

- Precious metals are surging across the board despite the rise in the Dollar with the geopolitical landscape underpinning the havens ahead of weekend risk and a potential Iranian offensive against Israel; XAU tested USD 2,400/oz to the upside at fresh ATHs.

- Base metals are also soaring despite the stronger Dollar and downbeat headline Chinese trade data, with the internals revealing a Y/Y increase in copper imports.

- Shanghai Gold Exchange will raise margin requirements for some gold futures contracts to 9% from 8% effective from the settlement on April 15th and will raise daily trading limits for some gold futures contracts to 8% from 7%.

- MMG 's (1208 HK) Las Bambas copper mine in Peru and protestors reached a deal on lifting the road blockade near the mine, according to sources cited by Reuters.

- Japanese aluminium premiums for April-June shipments at USD 145-148/T, +61-64%, via Reuters citing sources.

- IEA OMR: World oil demand growth forecast -130k BPD to 1.2mln BPD; 2025 demand growth seen at 1.1mln due to sub-par economic outlook; China's 2023 post-COVID release of pent-up demand has effectively run its course. Sustained output curbs by the OPEC+ alliance mean that non-OPEC+ producers, led by the Americas, will continue to drive world oil supply growth through 2025. Robust production from non-OPEC+ coupled with a projected slowdown in demand growth will lower the call on OPEC+ crude by roughly 300 kb/d in 2025.

Geopolitics: Middle East

- "The (Israeli) army and the Mossad approved plans to target the heart of Iran if Israel (is) bombed from inside Iranian territory", via Al Jazeera citing Yedioth Ahronoth.

- Hamas sources: "The organization's leadership informed the mediators that it is not interested in further discussions about the deal, as long as there is no progress in its demands...", according to journalist Kais citing Hezbollah-affiliated press.

- "US official to Al-Arabiya: We will participate in the response if Iran escalates with an appropriate response", according to Al Arabiya

- Israel is prepared for an Iranian strike from its territory in the next 48 hours, according to WSJ. Israeli army said Iran is preparing its proxies in the region to attack them, according to Al Arabiya.

- Israeli Defence Minister Gallant told US Defense Secretary Austin that a direct Iranian attack on Israeli territory would compel Israel to respond in an appropriate way against Iran, according to Axios.

- Iran reportedly signalled to Washington it will respond to Israel's attack on its Syrian embassy in a way that aims to avoid major escalation and it will not act hastily, according to Reuters citing Iranian sources. Furthermore, a source familiar with US intelligence was not aware of the message conveyed but said Iran has been very clear its response would be controlled and non-escalatory, and planned to use regional proxies to launch a number of attacks on Israel.

- US President Biden's administration officials judge that Iran is planning a larger-than-usual aerial attack on Israel in the coming days which will likely feature a mix of missiles and drone strikes, according to two US officials cited by Politico.

- US official said the US expects an attack by Iran against Israel which they think will be calibrated to be bigger than usual but not so big it would draw the US into war, while US officials have also been in touch with regional partners to discuss efforts to manage and ultimately reduce further risks of escalation.

- US said it had restricted its employees in Israel and their family members from personal travel outside the greater Tel Aviv, Jerusalem and Be'er Sheva areas amid Iran's threats of retaliation against Israel.

- US State Department senior official said a robust conversation with Iraq is likely to lead to a second US-Iraq joint security cooperation dialogue later this year.

Geopolitics: Other

- US President Biden warned that any attack on Philippine vessels in the South China Sea would invoke their mutual defence treaty.

- China's top legislator Zhao Leji and North Korean counterpart discussed promoting exchange and cooperation in all fields, according to KCNA.

- Four drones shot down overnight near Russia's Novoshakhtinsk in a town in near proximity to an oil refinery

US Event Calendar

- 08:30: March Import Price Index MoM, est. 0.3%, prior 0.3%

- 08:30: March Import Price Index ex Petroleu, est. 0.1%, prior 0.2%

- 08:30: March Import Price Index YoY, est. 0.3%, prior -0.8%

- 08:30: March Export Price Index YoY, est. -1.2%, prior -1.8%

- 08:30: March Export Price Index MoM, est. 0.3%, prior 0.8%

- 10:00: April U. of Mich. 5-10 Yr Inflation, est. 2.8%, prior 2.8%

- 10:00: April U. of Mich. Expectations, est. 78.0, prior 77.4

- 10:00: April U. of Mich. Current Conditions, est. 81.3, prior 82.5

- 10:00: April U. of Mich. 1 Yr Inflation, est. 2.9%, prior 2.9%

- 10:00: April U. of Mich. Sentiment, est. 79.0, prior 79.4

Central Bank Speakers

- 09:00: Fed’s Collins Appears on Bloomberg TV

- 13:00: Fed’s Schmid Gives Speech on Economic Outlook

- 14:30: Fed’s Bostic Gives Speech on Housing

- 15:30: Fed’s Daly Participates in Fireside Chat

DB's Jim Reid concludes the overnight wrap

It’s been a volatile 24 hours in markets, with bonds continuing to struggle thanks to concerns about inflation, whilst equities saw a tech-led rebound that meant the NASDAQ (+1.68%) closed at an all-time high. To be fair, front-end yields did stabilise after Wednesday’s dramatic selloff, as the US PPI release was softer than many feared, and the ECB added to the signals that they might cut rates at the next meeting. But ultimately, the big picture is that inflation is still proving more resilient than expected, whilst the chance of a Fed rate cut in H1 is seen as increasingly remote. Alongside that, several geopolitical concerns remain in the background, and gold prices (+1.65%) closed at a record high yesterday of $2,372/oz.

With that in mind, yesterday brought another bond selloff on both sides of the Atlantic, and 10yr yields across several countries hit their highest level since late-2023. In the US, the 10yr yield was up +4.3bps to 4.59%, which is its highest level since November, although overnight there’s been a -1.6bps pullback to 4.57%. This was driven by a fresh rise in real yields, with the 10yr real yield (+4.8bps) also up to a post-November high of 2.18%. Meanwhile at the front end, yesterday saw a modest decline in the 2yr yield (-1.2bps) to 4.96%, but that comes in the context of a +23bps increase the previous day, leaving it up by more than +20bps relative to its pre-CPI levels.

That pullback in front-end yields was in large part down to the PPI inflation print for March, with the 2yr yield having momentarily traded at 5% immediately before the release. That showed headline PPI at +0.2% on a monthly basis (vs. +0.3% expected), which meant the year-on-year measure rose to +2.1% (vs. +2.2% expected). Although it was only slightly beneath expectations, monthly moves in PPI components that feed into core PCE inflation came in on the weaker side, including airfares (-1.8%) and healthcare services (0.0%). So a big relief to investors after the upside surprise in CPI the previous day. It also meant futures raised the chance the Fed would still cut rates by July, which moved up from a 50% to a 56% chance after yesterday’s session, with a further rise this morning to 58%.

When it came to Fed officials themselves, their remarks yesterday signalled they weren’t in a hurry to cut rates. For instance, New York Fed President Williams said “There’s no clear need to adjust policy in the very near term”. Meanwhile, Boston Fed President Collins said that the recent data “implies that less easing of policy this year than previously thought may be warranted.” And Richmond Fed President Barkin said that “We’re not yet where we want to be” when it came to inflation.

In light of recent developments, DB’s US economists have now materially adjusted their Fed view for this year. They now only expect one rate cut at the December FOMC meeting, followed by modest further reductions in 2025. Beyond that, they expect the Fed to guide the policy rate back towards a neutral level, that is likely just below 4% by the end of 2026. And although a rate cut in July is still possible, their view is that it would need a string of more favourable inflation prints than they forecast, as well as some softening in the labour market and tightening in financial conditions. See the report here for more details on their latest forecast.

Speaking of central banks, we had the latest ECB decision earlier in the day, who left their deposit rate at 4% as expected. However, their statement suggested that they were moving closer to rate cuts, as it said “If the Governing Council’s updated assessment of the inflation outlook, the dynamics of underlying inflation and the strength of monetary policy transmission were to further increase its confidence that inflation is converging to the target in a sustained manner, it would be appropriate to reduce the current level of monetary policy restriction.” So a clear signpost that rate cuts could be near, and investors raised the chance of a cut by the June meeting from 82% to 87% by the close. Our European economists see the ECB as having a clear but conditional baseline of a June cut, while keeping its options open beyond this. They note that Lagarde’s expression of a “dialling down cycle” may be more consistent with gradual rate cuts. See their reaction note here for more.

The ECB’s decision helped to bring down 2yr yields on German (-0.4bps) and French (-0.6bps) government bonds. However, at the long end it was a different story, and yields moved noticeably higher across the continent, including on 10yr bunds (+2.8bps), OATs (+3.6bps) and BTPs (+6.8bps). Meanwhile for gilts, the 10yr yield (+5.5bps) closed at a post-November high of 4.20%. That came as investors continued to dial back the chance of a Bank of England rate cut by June, with overnight index swaps lowering the probability from 56% to 41% by the close. That followed comments from the BoE’s Greene in the FT we mentioned yesterday, who said that UK rate cuts “should still be a way off”.